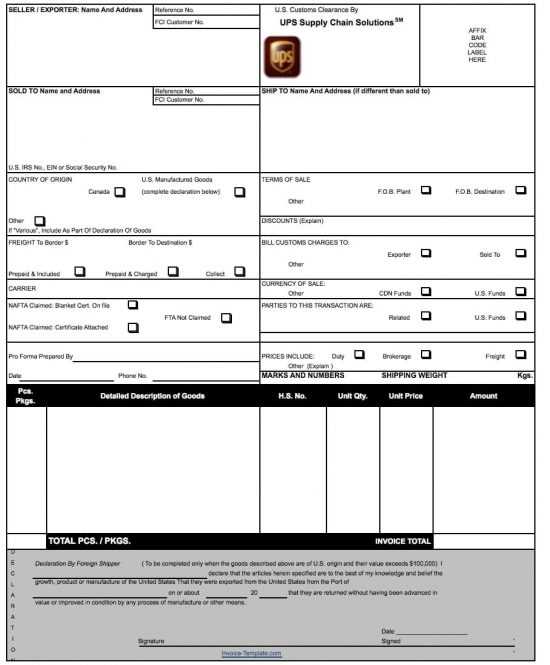

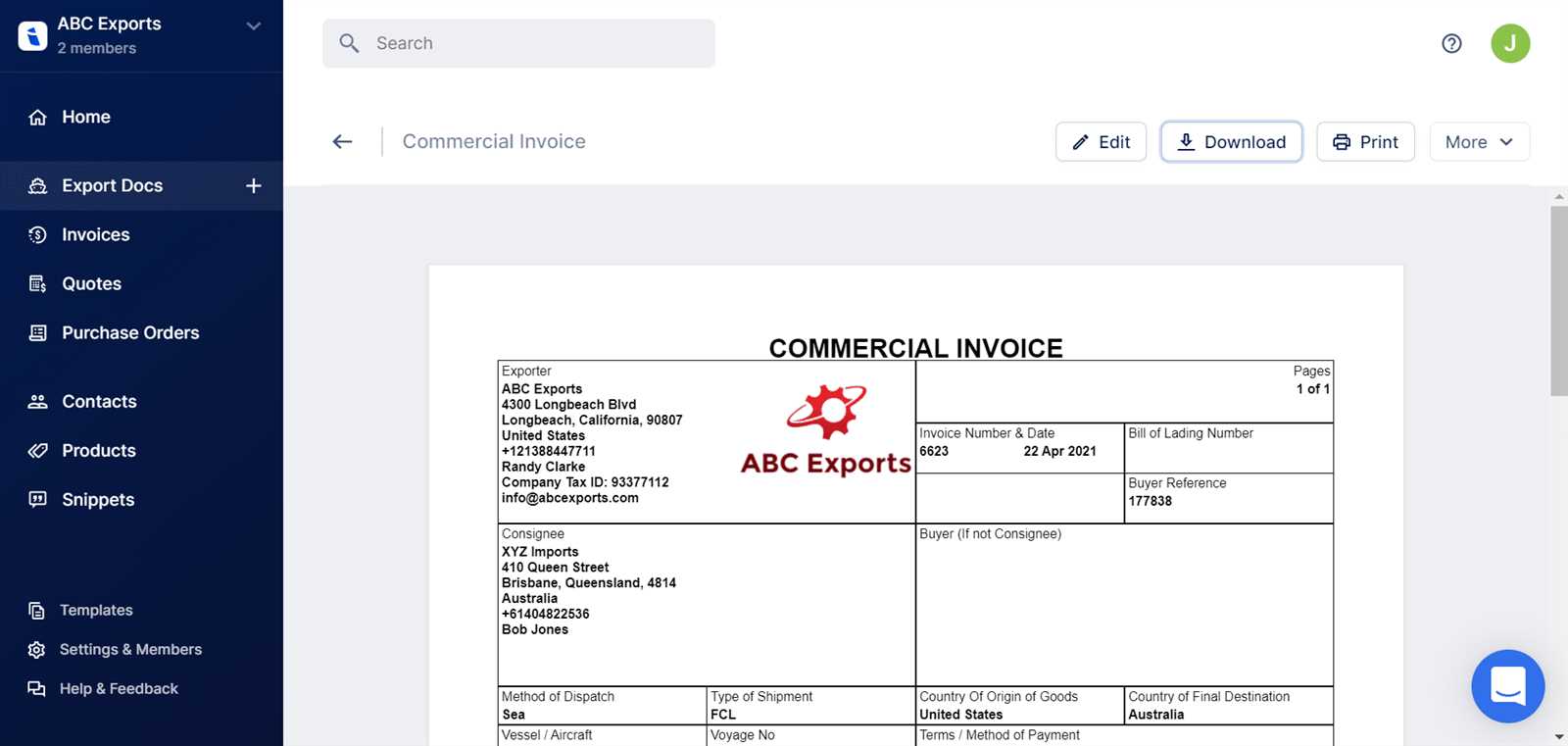

International Shipping Commercial Invoice Template in Excel Format

When engaging in cross-border trade, businesses must ensure that all the necessary paperwork is in order to comply with legal requirements and facilitate smooth transactions. One of the most crucial documents in this process is a detailed record of the goods being transported, including their value, description, and the terms of the sale. Having an organized approach to this documentation is essential for both legal compliance and the timely processing of shipments.

Streamlining this documentation process with a digital tool can save time and reduce errors. A well-structured spreadsheet allows companies to customize fields, easily update information, and ensure consistency across multiple shipments. Whether you’re handling small or large-scale deliveries, using a digital format for your records can simplify your workflow and enhance efficiency.

Creating a clear, accurate record in a standardized format provides greater clarity for all parties involved, including customs authorities, transport providers, and clients. By utilizing a template that is easy to modify and maintain, you can ensure your documents are always up to date and meet all necessary guidelines.

Understanding Global Trade Documentation

When goods are transferred across borders, proper documentation is vital to ensure smooth transactions, compliance with regulations, and efficient processing by various authorities. Each document serves a specific purpose, providing essential information about the merchandise, the parties involved, and the agreed terms. Understanding these documents is crucial for businesses to avoid delays, legal issues, or financial losses.

Key Documents for Cross-Border Transactions

The primary documents required for global trade typically include a record of the goods’ description, value, and origin, as well as the payment terms and transport details. These records are used by customs officials, carriers, and financial institutions to assess duties, taxes, and compliance with local laws. It is important to understand that these documents are not only used for shipping but also play a role in protecting the interests of both buyers and sellers.

Importance of Accuracy and Detail

Accuracy in documentation ensures that all parties involved are clear on the transaction’s specifics. Misunderstandings or errors can lead to costly delays or disputes. Ensuring that the descriptions of the goods match those in the sales agreements, providing correct tax and payment details, and listing all relevant dates and terms are key factors in creating reliable records. Furthermore, these documents need to be in compliance with both local and international regulations to facilitate smooth clearance through customs.

Clear and well-organized records help businesses track the movement of their products, manage inventory more effectively, and provide transparency to customers and partners. This level of detail ensures that each transaction can be traced back without confusion, minimizing the risk of mistakes or oversights that could affect the business’s reputation or financial stability.

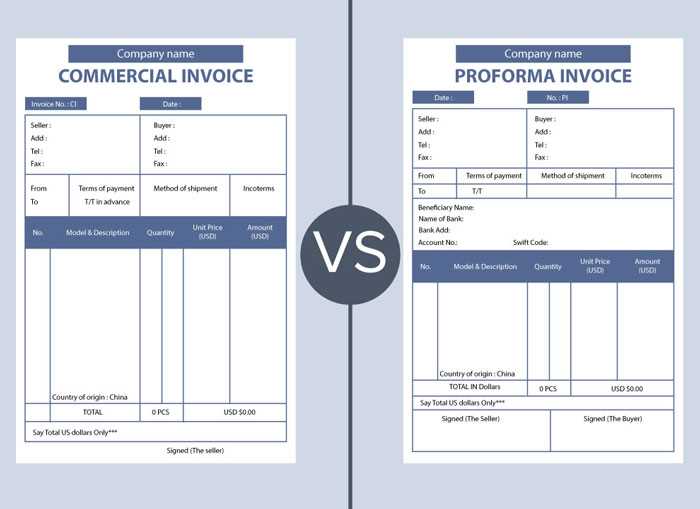

What is a Commercial Invoice?

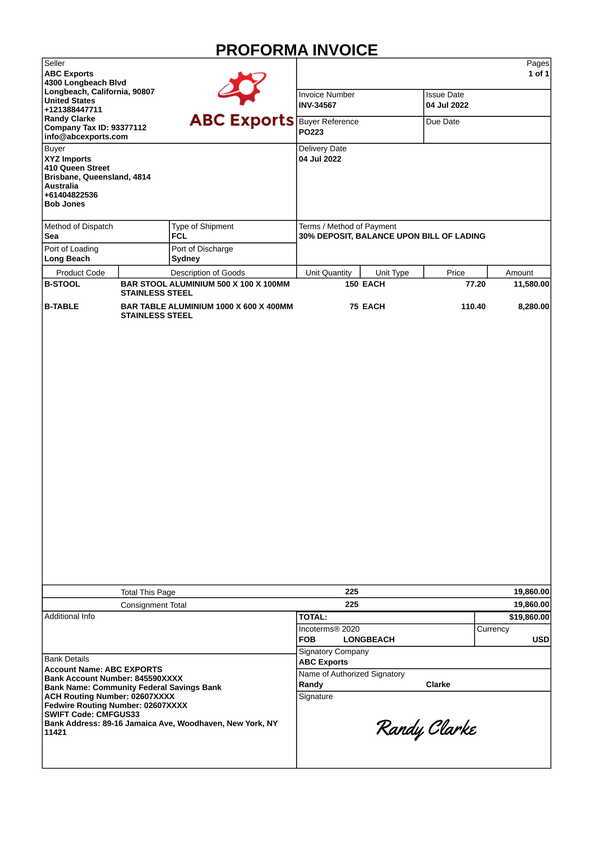

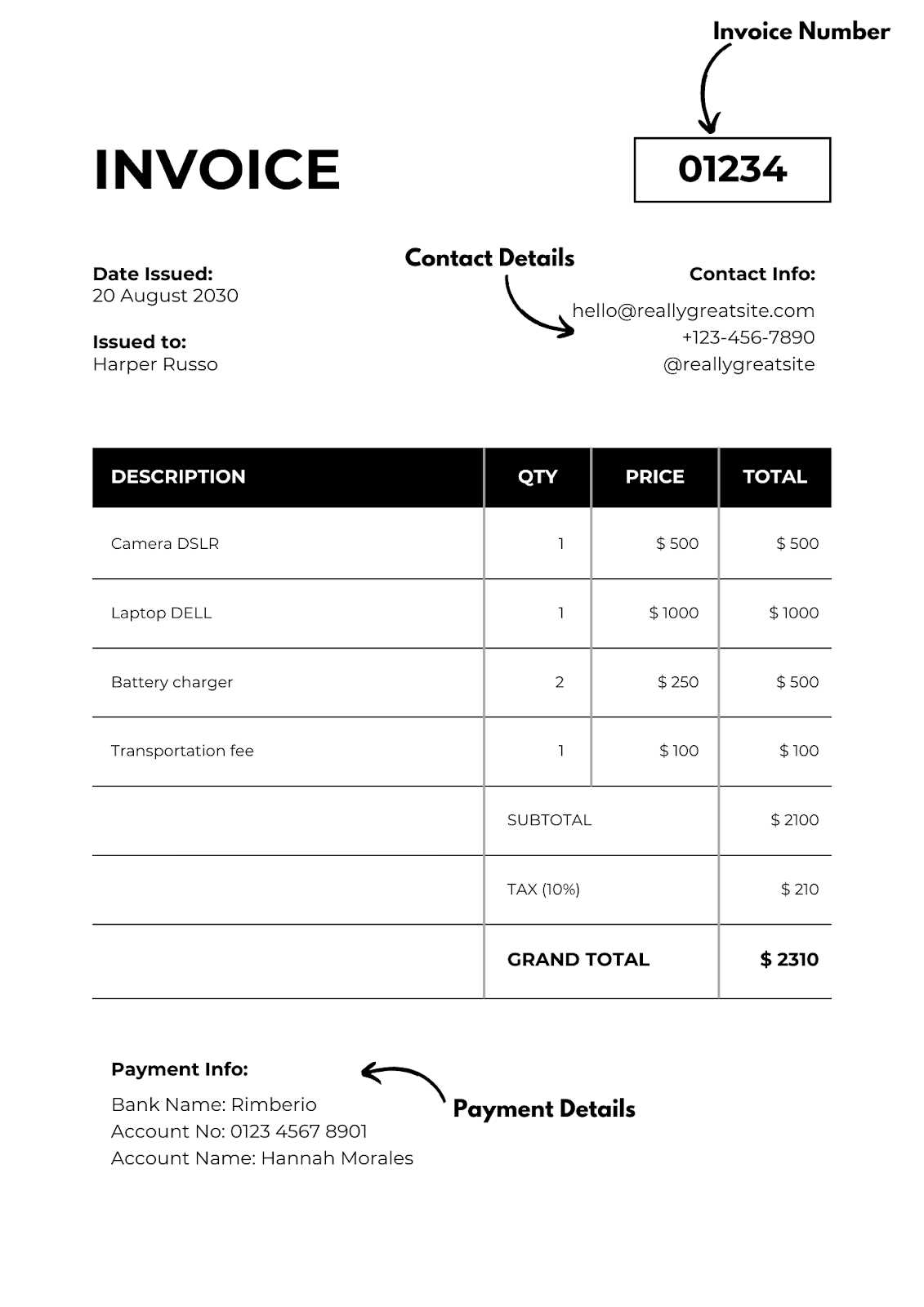

A key document in global transactions, this essential record outlines the details of the goods being exchanged, including their value, description, quantity, and the terms of the sale. It acts as a formal agreement between the seller and buyer, summarizing the commercial aspects of the transaction. This document is critical for clearing goods through customs and ensuring both parties understand their responsibilities.

Typically, this document includes important information such as the buyer and seller’s contact details, payment terms, delivery instructions, and a detailed list of the products being sold. It provides a transparent breakdown of the costs, including any additional charges like taxes or shipping fees. In essence, it helps avoid misunderstandings by clearly defining what is being exchanged and under what conditions.

Accurate and comprehensive records are necessary for the smooth processing of goods and services, helping to prevent delays or issues with customs clearance. This document also serves as proof of the transaction for accounting and tax purposes, ensuring that both parties have a clear understanding of the financial details of the deal.

Importance of Commercial Invoices for Exporters

For businesses involved in cross-border trade, providing accurate and detailed records is essential to ensure smooth transactions and compliance with regulations. These records are not just about documenting the products but also about proving the legitimacy of the transaction and facilitating payment. They are fundamental for the successful export of goods, ensuring that all legal and financial requirements are met efficiently.

Facilitating Customs Clearance

A properly completed document is required by customs authorities to assess duties, taxes, and verify the legitimacy of the goods being transported. Without it, goods could be delayed, held up at borders, or even rejected. This document provides the necessary details about the value, origin, and quantity of the products, allowing for quick and smooth clearance through customs. For exporters, having a well-prepared record is a critical step in ensuring that products reach their destination without unnecessary delays.

Ensuring Financial Transparency

For exporters, this document serves as proof of the sale, making it an important tool for invoicing and payment collection. It outlines the agreed-upon price, payment terms, and additional charges, such as shipping or handling fees. By ensuring that both buyer and seller are clear on the financial terms, these records minimize the risk of disputes or payment delays. Furthermore, they are essential for accounting purposes, allowing businesses to track income and manage financial reporting accurately.

How Excel Templates Simplify Shipping Records

Managing the paperwork for cross-border transactions can often be time-consuming and prone to errors. Using a digital record format can help streamline the process, offering a more organized, efficient way to handle product details, prices, and other critical information. These digital tools not only reduce human error but also make updating and tracking records far more manageable.

One of the main advantages of using a spreadsheet for documenting trade transactions is the ability to create standardized, customizable formats. This means businesses can quickly input data, perform calculations, and generate reports without needing to create records from scratch each time. A well-organized sheet allows users to track goods, monitor expenses, and ensure accurate entries across multiple transactions.

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Product A | Electronic Device | 50 | $100 | $5000 |

| Product B | Home Appliance | 30 | $200 | $6000 |

| Product C | Clothing | 100 | $20 | $2000 |

This kind of structured system also enables businesses to efficiently calculate totals, taxes, and other related costs, ensuring greater financial accuracy. The simplicity of digital records allows for quick modifications, updates, and sharing, making it easier to manage large volumes of data while maintaining consistency and clarity.

Key Components of a Shipping Invoice

A well-prepared document for international transactions includes several essential elements that ensure clarity and accuracy. These components help both the seller and buyer stay aligned on the specifics of the trade, as well as assist customs authorities in verifying the details of the goods being exchanged. Each section of the document serves a specific purpose, providing critical information that protects both parties and guarantees the successful transfer of goods.

Product Details and Descriptions

One of the most important sections of the document is the list of goods being sold. This section should include clear descriptions of each product, specifying the type, model, and key features. Accurate product identification helps avoid confusion during customs clearance and ensures that both the buyer and the authorities are aware of what is being imported. Additionally, each item should be accompanied by the corresponding quantity and the unit of measurement (such as weight or volume) to provide a complete understanding of the trade.

Financial Information and Terms

Another crucial component is the financial breakdown. This section outlines the agreed-upon pricing for each product, as well as the total cost. It should also include additional fees, such as taxes, handling charges, or transport costs, to ensure there are no hidden costs. The payment terms, including the method and deadline for payment, are vital to avoid any misunderstandings. Finally, if applicable, the document should list any discounts or promotional offers that were part of the agreement.

Customizing Your Excel Invoice Template

Adapting a digital record to suit your specific business needs can greatly improve the efficiency and accuracy of your transaction documentation. Customizing your document allows you to create a layout that fits your product range, financial structure, and preferred reporting style. By tailoring it to your requirements, you ensure that every detail is captured in a clear and organized way, making it easier to track, manage, and update.

When personalizing your digital record, there are several key elements to consider:

- Branding: Add your company logo, contact information, and any other branding elements to maintain a professional appearance.

- Fields: Adjust or add specific fields based on your needs, such as discount rates, custom tax rates, or shipping information.

- Formulas: Use formulas to automate calculations for totals, taxes, and shipping costs to reduce manual input and the risk of errors.

- Currency and Language: Modify the document to reflect your preferred currency, measurement units, and language preferences to suit your clients and partners.

Additionally, consider creating multiple versions for different types of transactions. For instance, you might want to have a version for wholesale orders, another for retail sales, or a specific one for returns and refunds. By making these adjustments, you enhance the flexibility of your document while ensuring consistency across all your records.

Customizing a digital record can help streamline your business operations, reduce errors, and ensure that you maintain a professional and consistent approach in every transaction.

How to Add Product Details in Excel

Accurately documenting product information is essential for maintaining clear records and ensuring smooth transactions. When using a digital document for this purpose, organizing the product details in a structured and consistent manner can simplify the entire process. By adding the right fields and making use of automated features, you can create a comprehensive record that is both efficient and easy to understand.

To start, each product should be listed in its own row with separate columns for different types of information. The following key details are typically needed:

- Product Name: Clearly state the name of the product to avoid any confusion.

- Description: Include a brief description or model number to help identify the item accurately.

- Quantity: List the number of units being sold or transferred, ensuring it reflects the actual amount.

- Unit Price: Enter the cost per unit to calculate the total value of the goods.

- Total Value: Multiply the unit price by the quantity to obtain the total value for each item.

Customizing these columns based on your specific products or industry needs can further enhance the clarity of your document. You may also include additional columns for items such as serial numbers, manufacturing dates, or SKU codes, depending on what is relevant for your business.

Once all the product details are added, the data can be easily modified, sorted, or filtered. Using built-in functions such as automatic totals and conditional formatting can help manage large inventories and ensure that all the necessary details are visible at a glance.

Incorporating Shipping Costs into the Template

Including all relevant expenses in your digital documentation ensures that the final amount accurately reflects the total cost of a transaction. One of the key elements to account for is the cost of delivering the goods. Whether you are dealing with local or overseas shipments, incorporating these costs into your records helps prevent confusion and ensures transparency for both the seller and the buyer.

To properly account for these costs, it’s important to separate them from the product prices and show them clearly in the document. This allows you to add any additional fees such as packaging, handling, and transport charges without obscuring the value of the goods themselves.

How to Add Shipping Costs

Typically, shipping expenses are calculated based on factors like weight, distance, and method of transport. Once you determine the cost, you can add a section in your document that outlines these charges. It’s helpful to break down the costs by category so the buyer can see exactly what they are being charged for.

| Item | Description | Cost |

|---|---|---|

| Transport Fee | Cost of moving goods by sea | $150 |

| Packaging | Materials and labor for packing | $25 |

| Insurance | Coverage for damaged or lost goods | $10 |

Automating Calculations for Accuracy

By using formulas in your digital record, you can automate the calculation of these fees. For example, once you input the transport cost, packaging, and other charges, the system can automatically add them to the total amount due. This reduces the chances of errors and saves time when processing multiple orders.

Incorporating these costs in a clear and detailed way helps to provide a complete and professional record, ensuring that both parties are fully informed of all expenses involved in the transaction.

Using Currency and Tax Information in Invoices

Accurate currency and tax details are crucial for any financial record, especially when dealing with cross-border transactions. Including this information ensures that both the seller and buyer are on the same page regarding the total cost, and it helps to avoid any potential confusion or disputes. Properly displaying the applicable taxes and using the correct currency also ensures compliance with local laws and regulations.

Displaying the Correct Currency

When dealing with multiple regions, it is essential to indicate the currency in which the transaction is being conducted. Using the correct currency symbol or code makes it clear to both parties what the financial terms are. For example, a sale from the United States might be listed in USD ($), while a transaction from the European Union could be in EUR (€). It’s important to set the currency at the beginning of the document to avoid misunderstandings, especially in cases where exchange rates may impact the final price.

Including Taxes and Other Fees

Tax rates vary significantly between countries, and depending on the nature of the goods and the location of both the buyer and the seller, different taxes may apply. For example, Value Added Tax (VAT) is common in many European countries, while other regions may have sales tax or import duties. It is important to clearly show these tax rates and include a separate line for them to ensure transparency. By itemizing taxes, customs duties, or other fees, both parties understand exactly what portion of the total cost is related to government-imposed charges.

To further streamline the process, businesses can use automated formulas in digital records to calculate taxes based on the region and type of goods. This reduces errors and ensures that the proper amounts are applied consistently across all transactions.

Why Accuracy is Crucial in Invoices

In business transactions, precision in documenting financial and product details is essential to ensure smooth operations and avoid costly mistakes. Accurate records provide clarity for both the seller and the buyer, reducing the risk of confusion, disputes, or delays. When errors are introduced into the documentation process, they can lead to significant challenges that may impact payment schedules, legal compliance, and overall customer satisfaction.

Impact of Errors on Payment and Delivery

One of the main reasons for prioritizing accuracy is its direct effect on payment processing and delivery timelines. If the recorded amount, tax, or product details are incorrect, it can lead to:

- Delayed payments: Miscalculations or missing charges can result in the buyer not paying the correct amount, delaying the settlement process.

- Delivery issues: Incorrect information can confuse the carrier, potentially leading to misdirected or lost shipments.

- Legal complications: Discrepancies in records may violate local regulations or agreements, leading to potential legal consequences.

Building Trust and Credibility

Accurate records not only prevent financial and operational setbacks but also help build trust between business partners. By ensuring that all details are correct, businesses demonstrate professionalism and reliability, which is critical for maintaining strong customer relationships. Additionally, consistent accuracy in transactions fosters a sense of confidence that can lead to repeat business and positive word-of-mouth.

Ultimately, ensuring precision in every aspect of transaction documentation is fundamental for a smooth and successful business operation. Even minor errors can snowball into major problems, so it is important to adopt best practices to guarantee correctness every time.

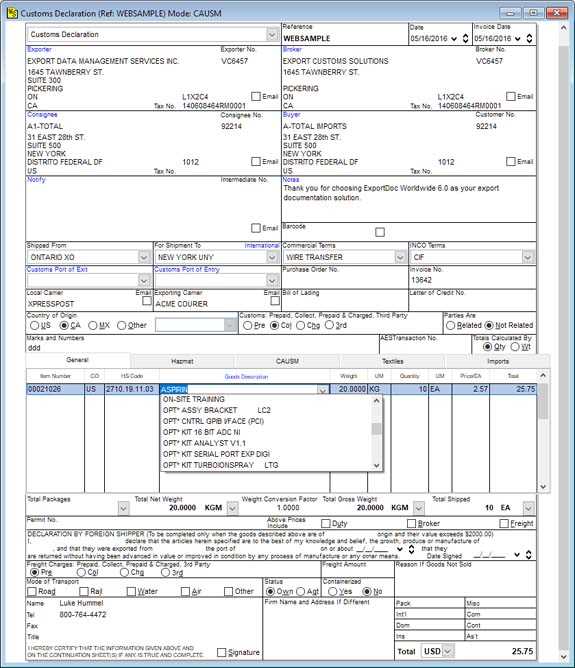

Shipping Invoice Format Standards for Global Trade

When engaging in global commerce, maintaining a consistent and clear format for transactional documents is essential to ensure smooth processing and compliance with various regulatory requirements. Adhering to internationally recognized standards not only helps businesses maintain efficiency but also facilitates quick customs clearance and minimizes the risk of delays or errors. A standardized document ensures that all critical information is included, clearly presented, and easily understood by all parties involved.

Essential Elements for Compliance

To ensure smooth processing, certain components must be included in any document used for cross-border transactions. Here are the key elements that should be consistently incorporated:

- Seller and Buyer Details: Always include full contact information for both the seller and buyer, including names, addresses, and contact numbers.

- Transaction Reference Number: A unique number or code that helps to identify and track the transaction.

- Description of Goods: A detailed description of the products or services being exchanged, including quantities, weights, and dimensions where applicable.

- Price Information: Clear breakdowns of costs, including unit prices, total values, and applicable taxes or duties.

- Terms of Payment: Specify when and how payment will be made, including any terms for early payment or discounts.

- Shipping and Delivery Information: Provide information about the delivery method, destination, and delivery terms (e.g., Incoterms like FOB, CIF).

- Currency and Tax Information: Include the currency used for the transaction and any taxes or fees applied to the goods.

Adhering to Global Standards

Different regions and countries may have specific requirements for the format or information required in these records. However, there are general guidelines accepted by many international organizations that can help streamline the process. For instance, the use of Incoterms (International Commercial Terms) is common to define the responsibilities of buyers and sellers in regards to shipping costs, insurance, and risk. Many countries also require specific documentation formats or details for customs clearance, which should be accounted for when designing a transactional document.

By following these globally recognized standards, businesses can ensure that their documentation is clear, accurate, and compliant with international laws. This not only helps avoid legal issues but also makes the entire transaction process more efficient and transparent for all parties involved.

How to Handle Multiple Shipments in One Invoice

When a business is involved in sending goods in separate batches or across multiple dates, it’s important to accurately document all the shipments under a single record. Consolidating multiple shipments into one comprehensive document helps streamline accounting, improves tracking, and makes the process clearer for both the seller and the buyer. Properly structuring the document ensures that each batch or consignment is easily identifiable and its associated costs are correctly attributed.

Breaking Down Each Shipment

To manage multiple consignments within a single document, start by clearly separating the details of each shipment. This can be done by creating a distinct section for every batch or individual shipment. Here’s how you can organize the information:

- Shipment Number: Assign a unique number to each shipment or batch for easy identification.

- Product Details: Include the product description, quantities, and unit prices for each consignment separately.

- Shipment Date: Note the specific date for each shipment to clearly differentiate between different batches.

- Shipping Costs: If the shipping costs differ for each batch, break them down individually. This ensures transparency and clarity.

Calculating Totals and Final Amount

After listing the individual shipments, it’s important to calculate the total value of all consignments together. The final cost should be a sum of the product prices, shipping fees, taxes, and any additional charges. By clearly showing how the total is calculated, you allow for full transparency and prevent any confusion. It’s also a good idea to include a separate line item for the overall total, ensuring that all individual costs are properly accounted for in the grand total.

Handling multiple consignments in one document ensures better organization and easier communication between parties. By breaking down each shipment’s details and showing the total cost in a clear manner, businesses can avoid errors and ensure smooth, efficient transactions.

Managing Payment Terms in Excel Templates

Establishing clear and detailed payment terms is a critical aspect of any transaction. By specifying the conditions under which payments are expected, both parties can avoid misunderstandings and ensure smooth financial exchanges. In digital documents, these terms can be easily tracked and updated, providing a transparent and efficient way to manage payment expectations. With the right structure, payment terms can be automatically calculated, making the entire process more streamlined and reducing the chance for errors.

Managing payment terms effectively in your document involves detailing the agreed-upon conditions, such as due dates, discounts for early payments, and penalties for late payments. This clarity ensures that both parties know exactly when payments are due and the consequences of missing those deadlines.

| Payment Term | Description | Example |

|---|---|---|

| Net 30 | Full payment is due within 30 days from the date of the document | $500 due by 30/11/2024 |

| Discount for Early Payment | 5% discount if paid within 10 days | $475 if paid by 10/11/2024 |

| Late Payment Penalty | Late payments incur an additional 2% per month | $510 after 30/11/2024 |

By including these payment terms clearly within the document, businesses can automate calculations and keep track of when payments are due, ensuring everything is settled promptly. You can also set up automatic reminders or alerts for upcoming payment deadlines, further improving cash flow management and reducing administrative burden.

Customizing payment terms according to your business’s needs and incorporating them directly into your records can help ensure that all parties are aligned and that the financial aspects of each transaction are handled efficiently and professionally.

Tracking and Organizing Shipping Data Efficiently

Effective management of transactional data is vital for any business handling the movement of goods. Organizing relevant information in a structured and systematic way ensures that businesses can track deliveries, monitor expenses, and manage customer expectations. An efficient approach to handling records not only saves time but also helps avoid errors, delays, and miscommunication. By utilizing digital tools and well-organized formats, it becomes easier to maintain accurate records and stay on top of the logistics process.

Organizing Key Shipment Information

To ensure smooth operations, it’s important to maintain organized records for each transaction. This can be done by categorizing the data based on relevant criteria such as delivery date, destination, and product details. Creating an easy-to-navigate layout allows businesses to track shipments in real time, ensuring quick retrieval of information when needed. Here are some key details that should be systematically tracked:

| Shipment Reference | Item Description | Quantity | Delivery Date | Status |

|---|---|---|---|---|

| #12345 | Electronics | 50 units | 15/11/2024 | Shipped |

| #12346 | Furniture | 20 units | 17/11/2024 | In Transit |

| #12347 | Textiles | 100 units | 18/11/2024 | Delivered |

Automating the Tracking Process

Utilizing automated systems or software to track this information can further enhance efficiency. By setting up formulas and linking different sections of data, businesses can easily track delivery status, calculate total costs, and automatically update records. Automated notifications can also alert you when shipments are delayed or when delivery has been completed, ensuring that no transaction slips through the cracks.

By implementing a well-organized system for tracking, businesses can streamline their operations, reduce human errors, and improve overall customer satisfaction by providing timely and accurate updates on their purchases.

Common Mistakes to Avoid in Shipping Invoices

When preparing transactional documents, accuracy is essential. Mistakes in documenting the details of a sale can lead to confusion, delays, and even financial loss. By being aware of common errors, businesses can ensure smooth processing and prevent unnecessary complications. Here are some of the most frequent mistakes made when preparing transactional records, and how to avoid them.

1. Missing or Incorrect Information

One of the most common mistakes is failing to include crucial details or listing incorrect information. This can create confusion for both the seller and the buyer, and delay processing or payment. Common errors include:

- Incomplete Product Descriptions: Not specifying the exact nature or specifications of the goods can lead to misunderstandings about the transaction.

- Incorrect Quantity or Price: Double-checking these details is essential to prevent discrepancies that can result in payment delays.

- Missing Contact Information: Ensure that the seller’s and buyer’s full contact information, including addresses and phone numbers, is clearly listed.

2. Failing to Include Tax and Duty Information

Taxes and duties are a crucial part of any transaction, especially for cross-border deals. Failing to properly

How to Generate Professional Invoices in Excel

Creating well-organized and professional transactional records is essential for maintaining a smooth business operation. With the right tools and techniques, you can easily generate detailed documents that reflect your company’s standards and provide clarity for your clients. By structuring the document in an efficient way, you can ensure all necessary details are included and minimize the risk of errors. Below, we will discuss how to generate these documents with precision using simple tools that are easy to set up and customize.

Step 1: Set Up the Basic Structure

The first step is to organize your document with clear headings and sections. This allows you to separate essential details such as company information, product descriptions, and payment terms. Here’s a simple structure to follow:

| Section | Details |

|---|---|

| Header | Include your company name, logo, and contact information |

| Recipient’s Information | Client’s name, address, phone number, and email |

| Transaction Date | The date the goods or services were provided |

| Product/Service Details | Clear descriptions of each item or service provided, including quantities and unit prices |

| Payment Terms | Specify when the payment is due, and if any discounts or late fees apply |

Step 2: Add Product or Service Information

Accurate product descriptions, quantities, and unit prices are essential for clarity and transparency. Ensure that each item is listed with its correct price and amount. For example:

| Item | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Product A | 2 | $50 | $100 |

| Service B | 1 | $150 | $150 |

Step 3: Calculate the Total Amount

After listing all the products or services, it’s time to calculate the total amount due. This should include the subtotal (sum of all items), any applicable taxes or fees, and the final total. Excel allows you to automate these calculations with formulas, making the process quick and accurate. For

Benefits of Using Excel for Shipping Documentation

Managing records for transactions involving goods and services can be complex, especially when dealing with multiple shipments, customs requirements, and varying payment terms. Using a digital tool that allows for easy organization, calculation, and tracking simplifies the entire process. A spreadsheet application is one of the most efficient solutions for handling these tasks, offering a combination of flexibility, automation, and accessibility that helps businesses stay organized and efficient.

Here are some key benefits of using spreadsheets for managing shipping-related documents:

1. Easy Customization: A spreadsheet can be easily customized to meet the unique needs of each transaction, allowing users to add or remove fields, adjust layouts, and modify calculation formulas. This flexibility makes it easy to create personalized records without needing specialized software or complex systems.

2. Automated Calculations: One of the major advantages is the ability to set up automatic calculations for totals, taxes, discounts, and shipping costs. With built-in functions and formulas, businesses can eliminate manual errors and reduce the time spent on repetitive tasks, ensuring that all figures are accurate and up-to-date.

3. Centralized Data Management: Storing all shipping-related records in one place makes it easier to track progress, monitor trends, and retrieve past documents. Having a central location for all transaction data streamlines the process of managing orders, payments, and deliveries, which is especially useful when handling large volumes of information.

4. Improved Accuracy and Consistency: By using predefined fields and formulas, businesses can ensure that the same data is consistently entered across multiple records, reducing the chances of discrepancies or omissions. This consistency improves the overall accuracy of the records and prevents mistakes that could affect shipments or financial reporting.

5. Easy Sharing and Collaboration: Documents stored in a spreadsheet format can easily be shared with team members, clients, or third-party service providers. This facilitates collaboration and ensures that all parties have access to the most up-to-date information, allowing for smoother communication and faster resolution of any issues.

6. Cost-Effective: Unlike specialized software, spreadsheet applications are often already available on most computers or can be obtained at a low cost. This makes them an ideal solution for businesses of all sizes looking to streamline their documentation without incurring significant expenses.

By utilizing the power of spreadsheets for managing shipping documentation, businesses can enhance efficiency, improve accuracy, and reduce the risk of errors, all while saving valuable time and resources.