Download International Commercial Invoice Template PDF for Global Trade

When engaging in cross-border transactions, proper paperwork is vital for ensuring smooth and efficient operations. The correct forms help businesses meet legal and regulatory requirements, avoid costly errors, and maintain a professional image. Having the right structure and content in your documents simplifies communication with clients, suppliers, and customs authorities around the world.

One of the most important documents in international business exchanges is a detailed account of the goods or services being exchanged. This document serves as proof of the transaction, ensuring transparency and safeguarding both parties’ interests. By using a standardized approach to create these documents, businesses can ensure consistency and reliability in their international dealings.

In this guide, we will explore the key elements of these essential forms, highlighting the importance of accuracy, customization options, and practical tips for optimizing your workflow. With the right resources, creating and managing these documents becomes a streamlined process, helping to focus on growing your business without the worry of administrative hiccups.

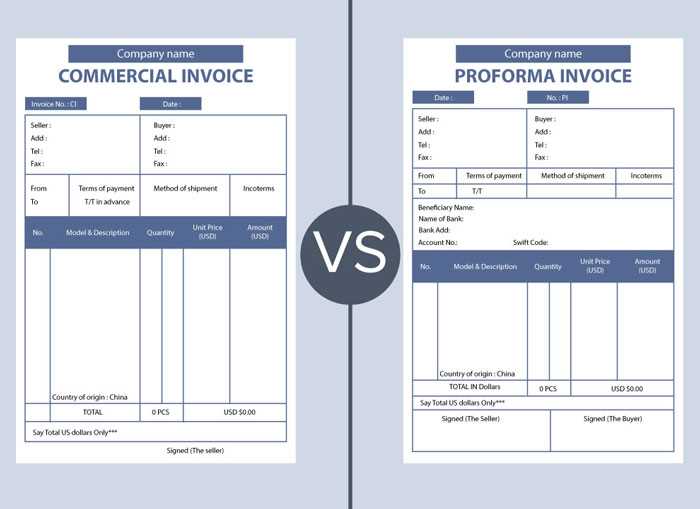

What is an International Commercial Invoice?

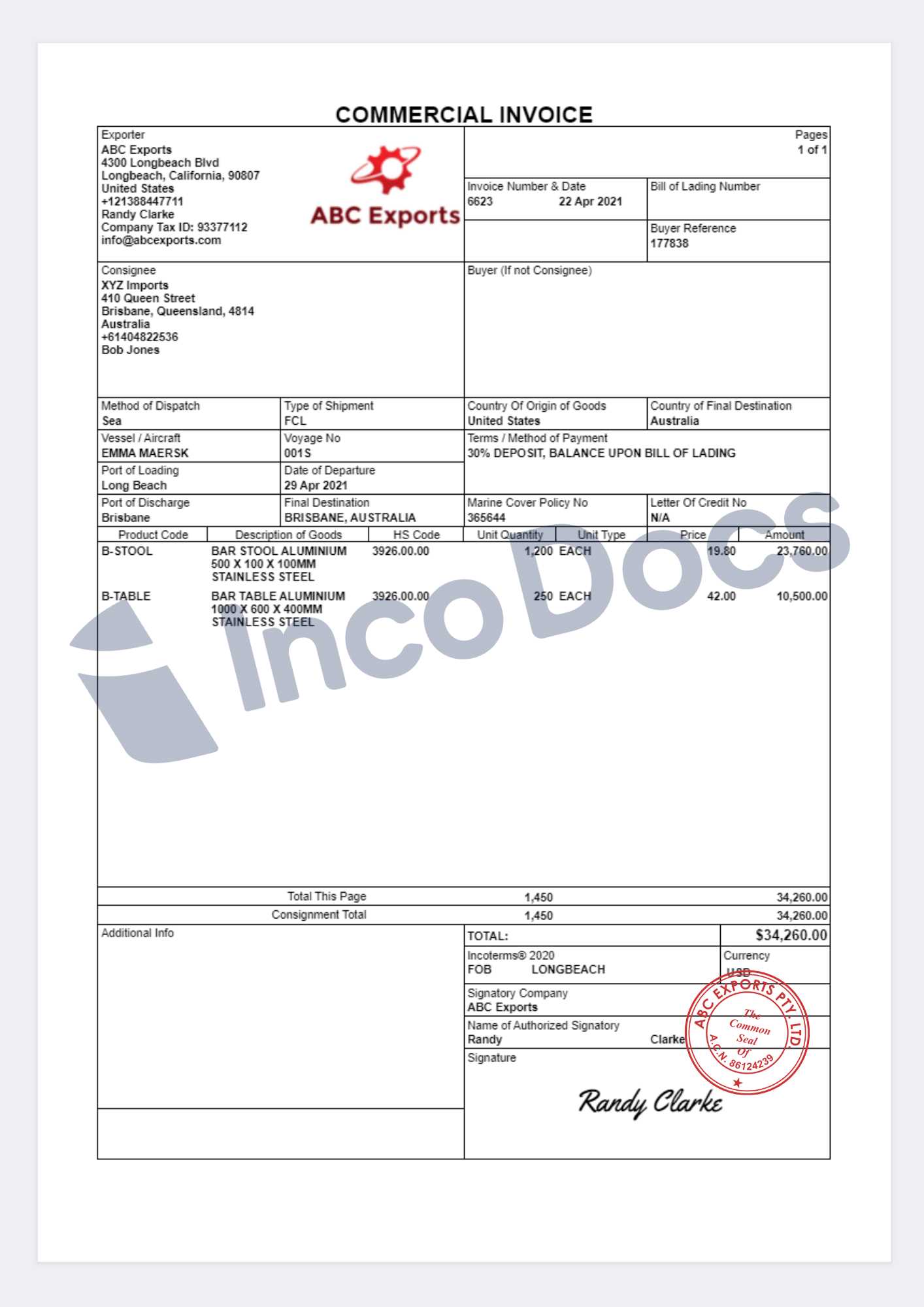

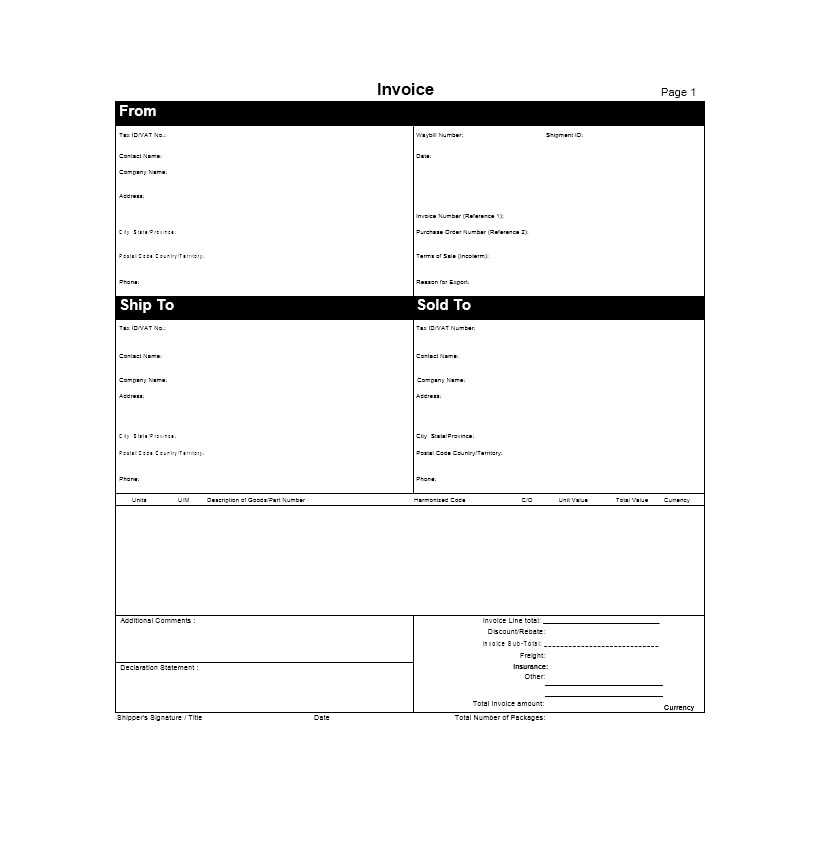

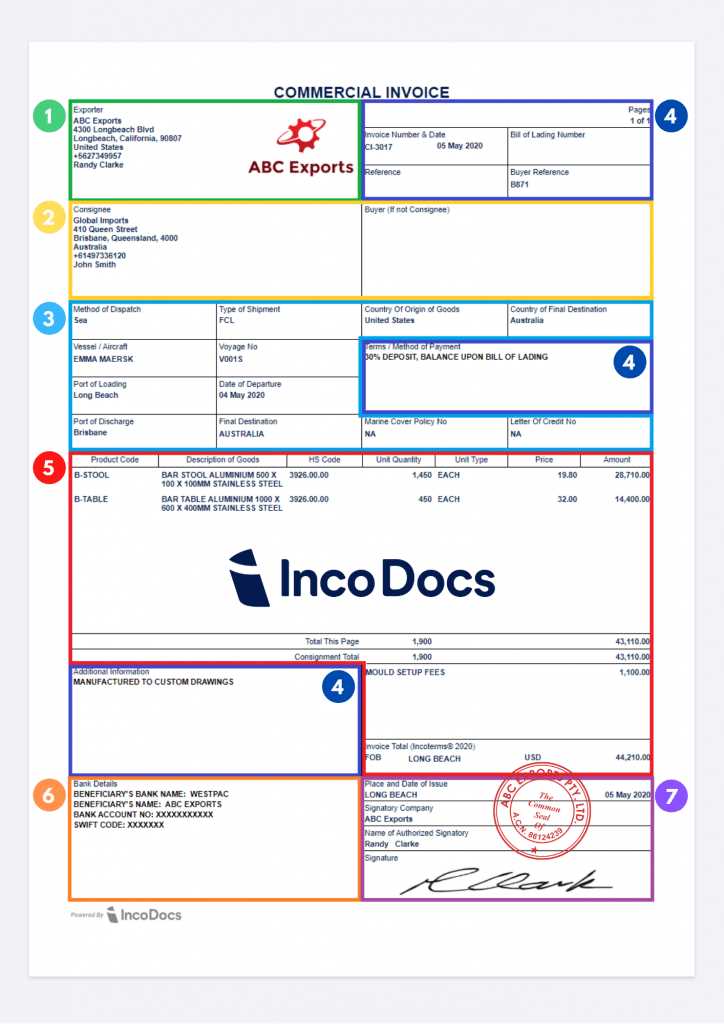

In the world of global trade, proper documentation is essential for both buyers and sellers. One of the most crucial forms used in international business transactions is a document that records the details of the goods or services exchanged. This form serves as a formal agreement between parties, providing vital information such as product descriptions, pricing, and terms of sale. It also acts as a key document for customs clearance and tax purposes, ensuring that the transaction complies with both local and international regulations.

This document includes various essential details that help prevent misunderstandings between the trading parties and facilitate smooth customs processing. While the specifics may vary by country, the general structure remains quite similar, helping to standardize international transactions and reduce errors in paperwork.

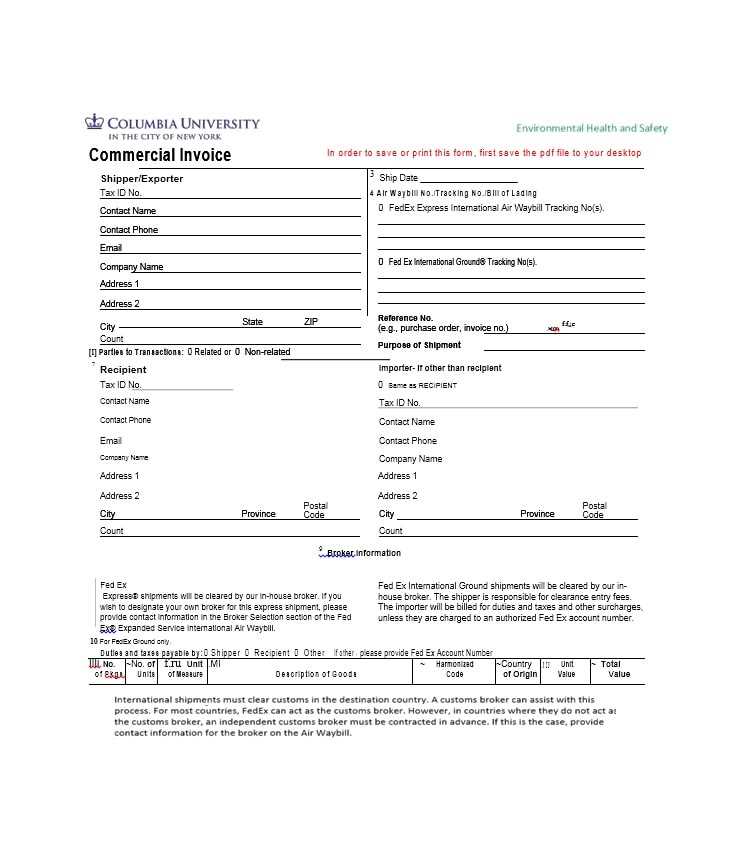

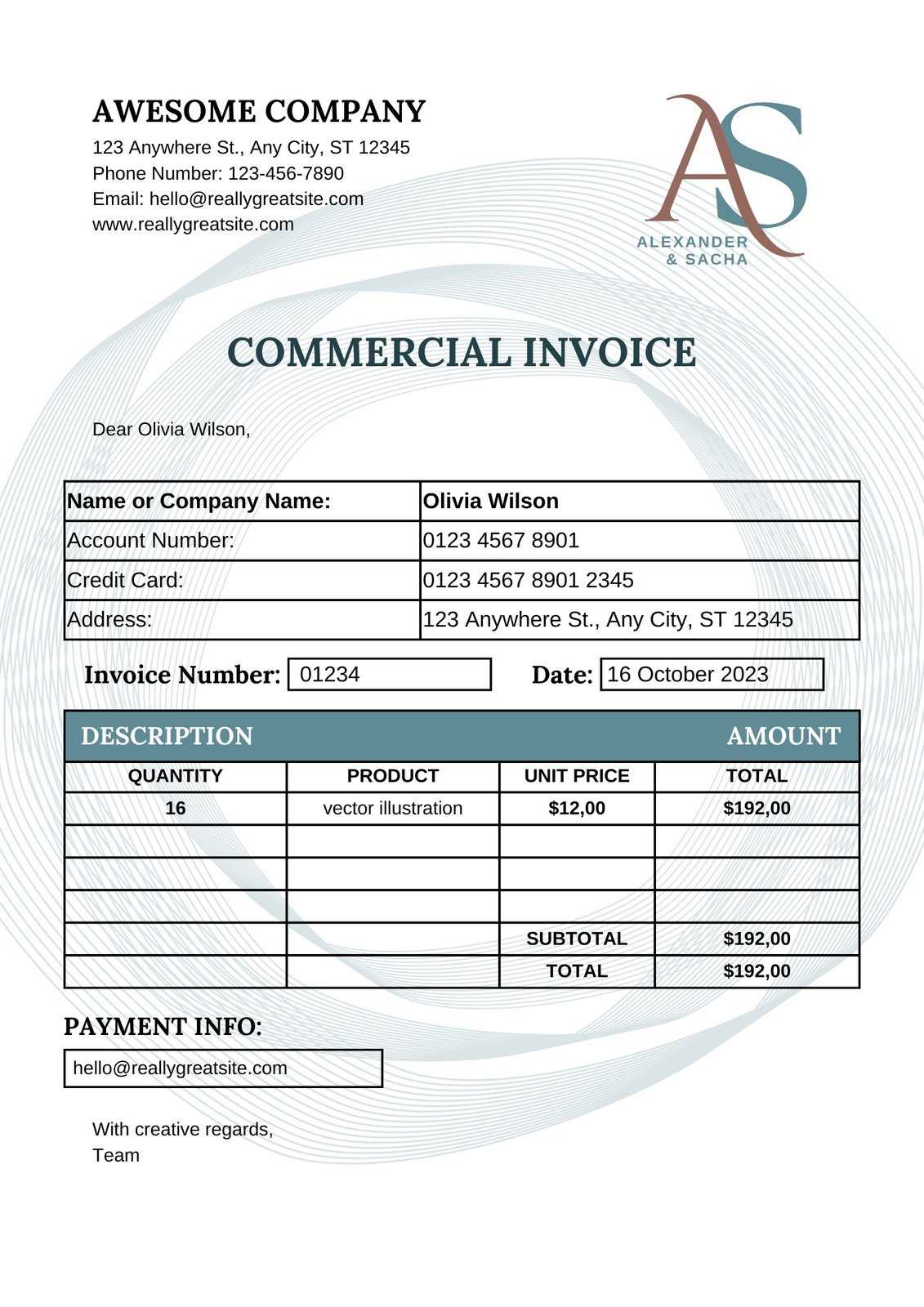

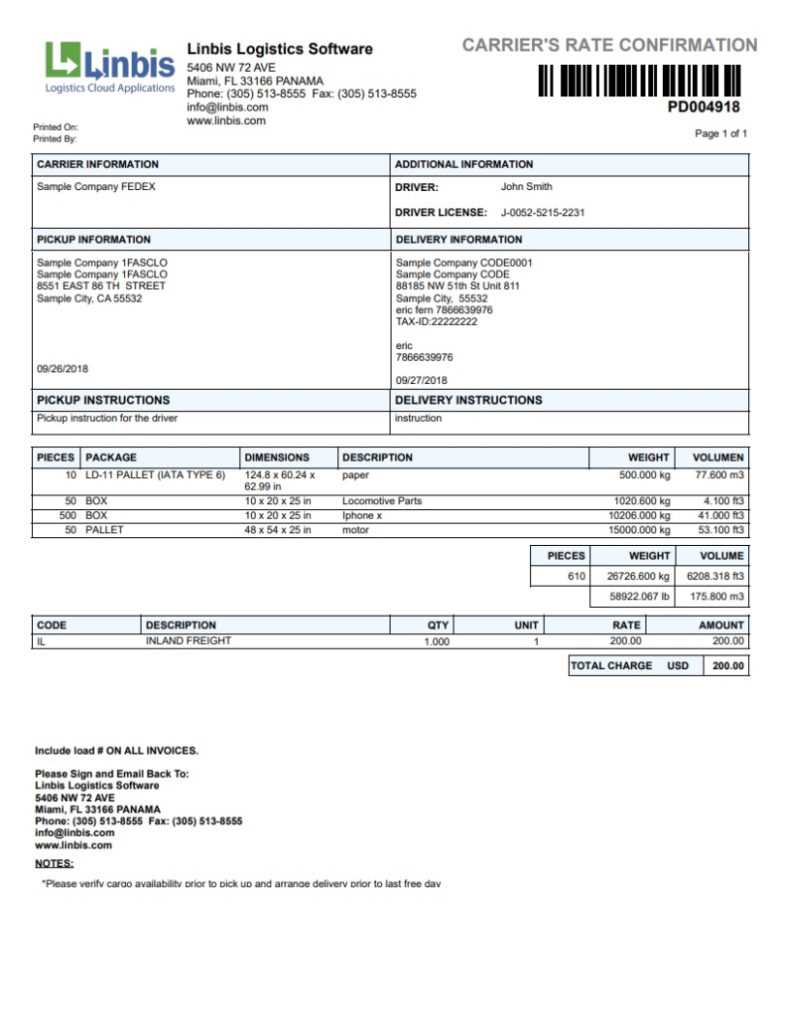

Below is an example of some key details typically found in such a document:

| Detail | Description | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Seller Information | Name, address, and

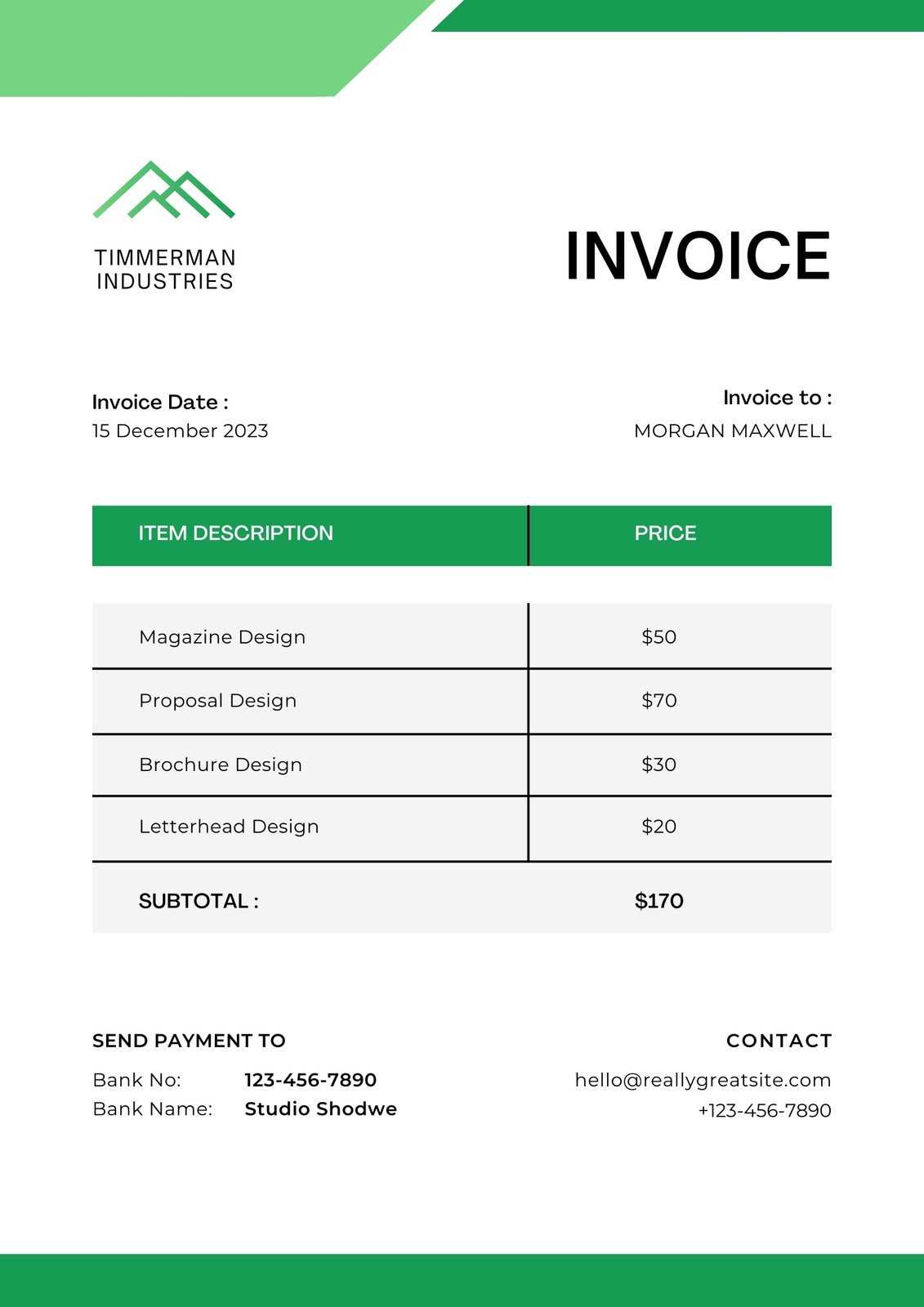

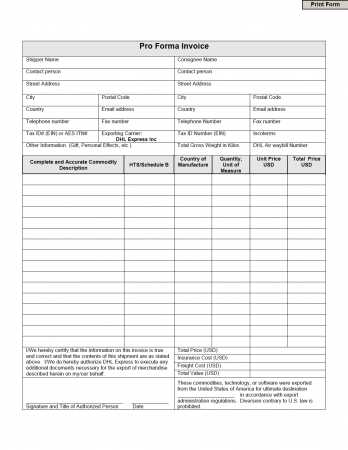

Key Elements of a Commercial InvoiceFor businesses involved in global trade, it’s crucial to include all necessary details in transactional documents to ensure smooth processing and avoid disputes. A well-structured document should contain specific pieces of information that cover the essential aspects of the transaction. Each section plays a role in confirming the accuracy of the sale, facilitating customs clearance, and protecting both the buyer and seller legally. Basic Information

Itemized Information

|