Installment Payment Invoice Template for Simple Billing

When dealing with clients or customers, offering flexible ways to settle debts over time is a common practice. By breaking down larger amounts into manageable installments, businesses can improve cash flow while providing their clients with more accessible options for clearing outstanding balances. This approach is particularly useful for services or products that require higher upfront costs or longer-term engagements.

To facilitate this process smoothly, businesses often rely on structured documents that outline the terms of these payments, including the amounts, due dates, and other important conditions. These documents help ensure clarity and avoid misunderstandings, creating a professional and organized framework for ongoing transactions.

Creating a well-organized and easy-to-use form can simplify both the billing process and client communication. A properly structured document is not only helpful for tracking outstanding sums but also for maintaining transparency between all parties involved. Clear terms lead to fewer disputes and better overall customer relationships.

Understanding Flexible Billing Documents

When clients opt to pay over time, businesses need a clear, organized way to outline the details of these arrangements. Such documents serve as a formal agreement between both parties, ensuring that the terms of the deal are easily understood and agreed upon. This structured approach helps maintain professionalism and transparency throughout the duration of the transaction.

These documents typically include essential information such as:

- Total amount due: The full cost of goods or services provided.

- Installment schedule: A breakdown of when payments are due and the amount for each installment.

- Interest rates: If applicable, the rate at which interest is charged over the payment period.

- Payment methods: Accepted methods for submitting each payment.

- Late fees: The penalties for missing a scheduled payment.

Having a well-detailed document helps both the business and the customer stay on track with their financial commitments. It also reduces the likelihood of confusion or disputes, as both parties have a mutual understanding of their responsibilities.

Such a document is essential for establishing clear expectations and ensuring that all terms are agreed upon in advance. When created properly, it can improve the efficiency of the payment process and foster stronger customer relationships.

What is a Flexible Billing Document

A flexible billing document is a tool used by businesses to outline the terms under which a customer can divide their total obligation into smaller, manageable amounts. It acts as a formal agreement that specifies how much is owed, how much is due at each stage, and when these amounts should be paid. This structure helps both the seller and the buyer keep track of outstanding balances and ensures that the payment process is transparent and organized.

Key Features of a Flexible Billing Document

These documents typically include several important elements to ensure clarity and fairness throughout the payment process. The key components include:

- Total balance: The complete amount the customer is required to pay for the goods or services provided.

- Scheduled due dates: Clear indications of when each payment is due, whether it is weekly, monthly, or otherwise.

- Payment amounts: Specific amounts due for each individual installment.

- Interest or fees: Any additional charges, if applicable, for spreading payments over time.

- Late fees: Penalties for missing payment deadlines, ensuring timely compliance.

Why Use a Flexible Billing Document

Having a clear and structured document helps both businesses and customers understand their financial commitments. It creates a professional, formal record of the terms agreed upon and reduces the risk of miscommunication. Furthermore, it allows businesses to maintain steady cash flow while offering customers a more accessible way to settle larger amounts over time.

Why Use Flexible Billing Documents

Businesses use flexible billing documents to create a clear structure for clients who prefer to divide their total debt into smaller, more manageable portions. This approach benefits both the company and the customer by offering a clear record of financial obligations and due dates, while also making larger purchases more accessible. Having this formalized process in place promotes trust, reduces misunderstandings, and ensures smoother transactions for both parties.

Advantages for Businesses

For companies, offering the option to pay over time can improve cash flow and attract more customers, especially for higher-priced goods or services. By outlining the terms clearly, businesses reduce the risk of late payments or non-payment. Additionally, these documents help maintain consistency and professionalism in billing practices.

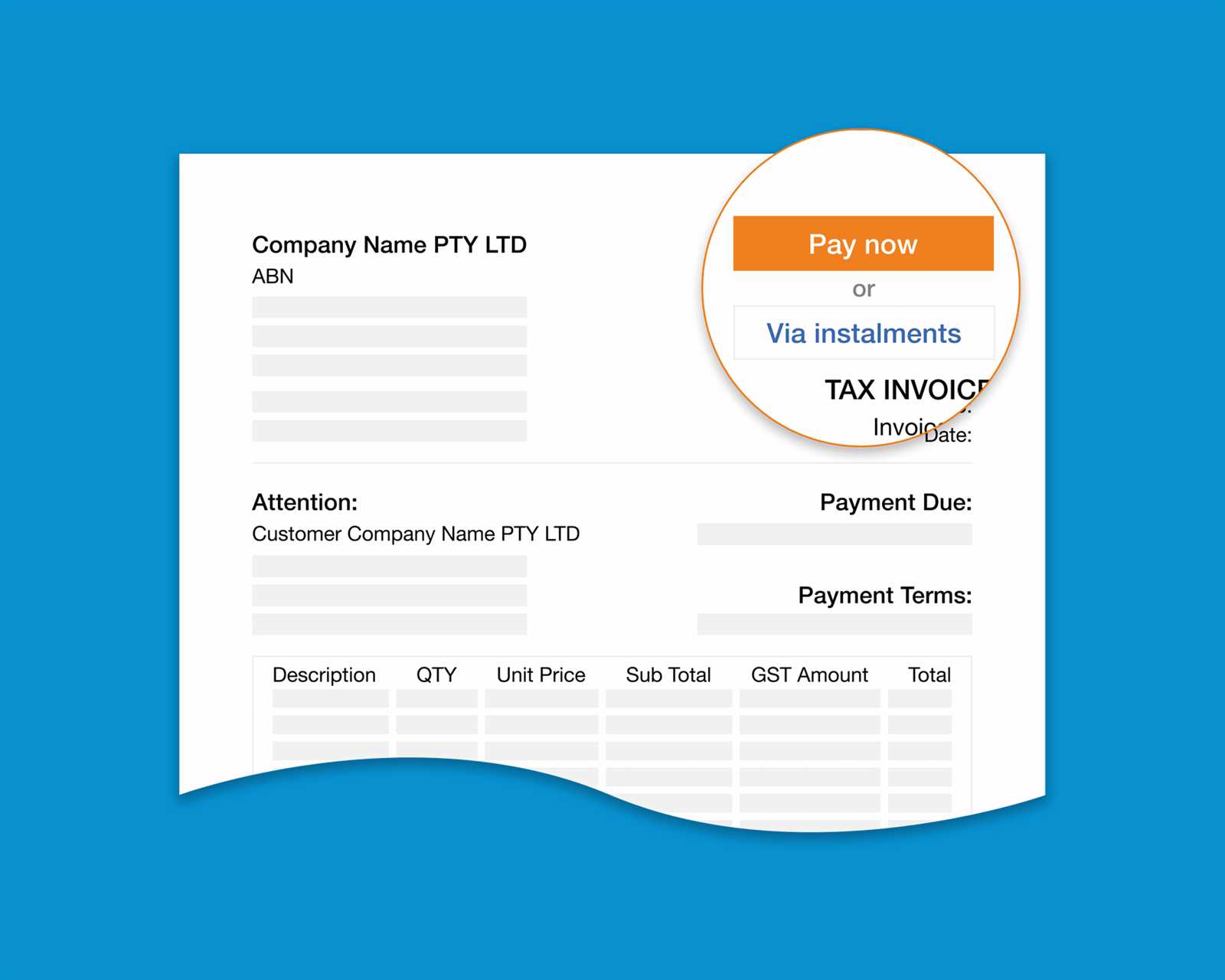

Advantages for Customers

For clients, breaking down the total cost into smaller portions makes it easier to manage their finances without committing to a large, lump-sum payment upfront. It also provides them with a clear understanding of when and how much they need to pay, making the process more predictable and stress-free.

Key Benefits Overview

| Benefit | For Businesses | For Customers |

|---|---|---|

| Improved Cash Flow | Ensures timely revenue from scheduled payments | Allows more flexibility in managing personal finances |

| Clear Financial Record | Reduces confusion and disputes | Provides clarity on amounts due and due dates |

| Customer Attraction | Encourages customers to make larger purchases | Offers an easier way to pay for big-ticket items |

| Professionalism | Maintains a structured and reliable process | Boosts confidence in the transaction |

Benefits of Offering Payment Plans

Providing customers with the option to pay over time can bring significant advantages to businesses. By offering flexible ways to manage large purchases, companies can attract a broader range of clients while maintaining healthy cash flow. These arrangements not only benefit customers by making it easier for them to afford products and services, but also help businesses maintain stronger financial relationships with their clientele.

Some of the key benefits include:

- Increased Sales: Offering the ability to pay in smaller amounts can make high-priced products or services more accessible, encouraging more customers to make a purchase.

- Improved Customer Satisfaction: Customers appreciate the flexibility to divide their financial commitments into manageable amounts, making the buying process less stressful.

- Reduced Cart Abandonment: By providing an option to break up payments, businesses can reduce the likelihood of customers abandoning their purchase due to the high upfront cost.

- Strengthened Customer Loyalty: Customers who feel that they can manage their expenses more easily are more likely to return for future purchases and become repeat clients.

- Better Cash Flow Management: These arrangements help businesses predict future income, as scheduled payments offer a steady stream of revenue over time.

- Competitive Advantage: Offering flexible options can set a business apart from competitors who require full upfront payment, potentially attracting new clients.

Overall, offering the option to pay in multiple stages creates a more customer-friendly approach, leading to higher sales, customer retention, and a stronger business reputation.

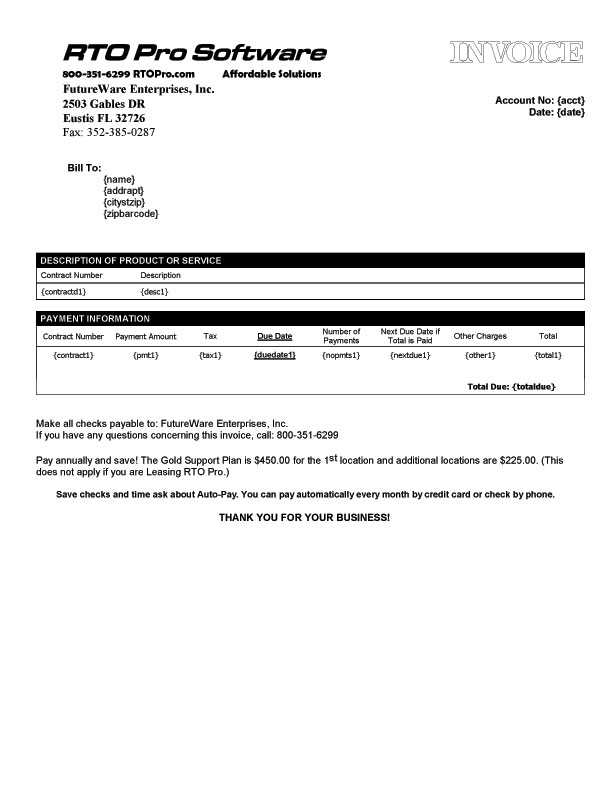

Essential Elements of the Document

For a structured and professional financial agreement, certain key elements must be included in the document to ensure that both the business and the customer understand the terms clearly. A well-designed document should be comprehensive and easy to follow, outlining all necessary details to avoid confusion and ensure smooth transactions. The following components are essential to making this process transparent and effective for all parties involved.

Here are the critical elements that should be present:

- Customer Information: The document should include the name and contact details of both the business and the client to clearly identify both parties involved in the agreement.

- Total Amount: A breakdown of the total cost for goods or services provided is essential to avoid any ambiguity regarding the amount due.

- Schedule of Amounts Due: Clear, precise dates and amounts for each scheduled sum must be outlined to ensure that both parties understand the timeline and obligations.

- Interest and Fees: Any interest charges or additional fees for deferred payments should be clearly stated so that customers are aware of any extra costs they may incur.

- Late Payment Terms: The document should specify any penalties or fees that will be charged for missed or late payments, along with the due dates for each installment.

- Accepted Methods of Payment: The form should outline the methods through which the customer can settle their amounts, whether by bank transfer, credit card, or other options.

- Signatures: A signature line for both parties is necessary to formalize the agreement and acknowledge the acceptance of the terms outlined in the document.

Including these essential details ensures clarity and accountability for both the business and the customer, fostering trust and transparency throughout the financial agreement.

How to Customize Your Billing Document

Customizing your financial agreement form allows you to tailor the document to fit your business needs and provide clear, professional communication with your clients. By adjusting key sections, such as payment schedules, due dates, and terms, you can ensure that your clients have all the necessary information and that the process runs smoothly. Here are a few steps to personalize your document effectively.

Choose the Right Structure

Begin by selecting a format that suits your business type and customer base. Decide whether you need a simple, straightforward layout or something more detailed with sections for product descriptions, taxes, or discounts. The structure should align with the complexity of the transaction, ensuring that both parties can easily understand the terms.

Adjust Key Details

Once the format is selected, customize the specific elements that are unique to your transaction:

- Customer Information: Add fields for client details, including name, address, and contact information.

- Amount Breakdown: Clearly outline the total cost, as well as any separate charges, taxes, or additional fees.

- Due Dates and Schedules: Modify the payment schedule to reflect the agreed-upon dates and amounts for each installment.

- Terms and Conditions: Edit or include any special terms, such as interest rates, late fees, or discount offers.

Customizing these sections not only makes the document clearer but also ensures that it reflects your specific business practices and agreements with clients.

Choosing the Right Payment Terms

Setting the right conditions for how your clients will settle their financial obligations is essential for maintaining smooth business operations. The terms should be clear, fair, and aligned with both your business objectives and the needs of your customers. By defining appropriate timelines, amounts, and any applicable fees or discounts, you can ensure that both parties understand the expectations and the process runs without issues.

Here are some factors to consider when determining the right conditions for your agreements:

- Flexibility: Offer options that allow customers to manage their finances effectively. For example, provide the possibility of longer or shorter timeframes depending on the transaction size.

- Clear Deadlines: Establish firm dates for when each amount is due. This helps avoid confusion and ensures that both parties know exactly when payments are expected.

- Late Fees: Specify if there are any penalties for missed deadlines. This can encourage timely payments and protect your business from delayed cash flow.

- Discounts for Early Settlement: Consider offering a discount for early payments, which can incentivize clients to settle their balance ahead of schedule.

- Transparency: Make sure the terms are easy to understand and free of hidden fees or ambiguous language. Transparency builds trust with customers and minimizes the risk of disputes.

By carefully considering these elements, you can create terms that benefit both your business and your clients, fostering a professional relationship and encouraging timely, hassle-free transactions.

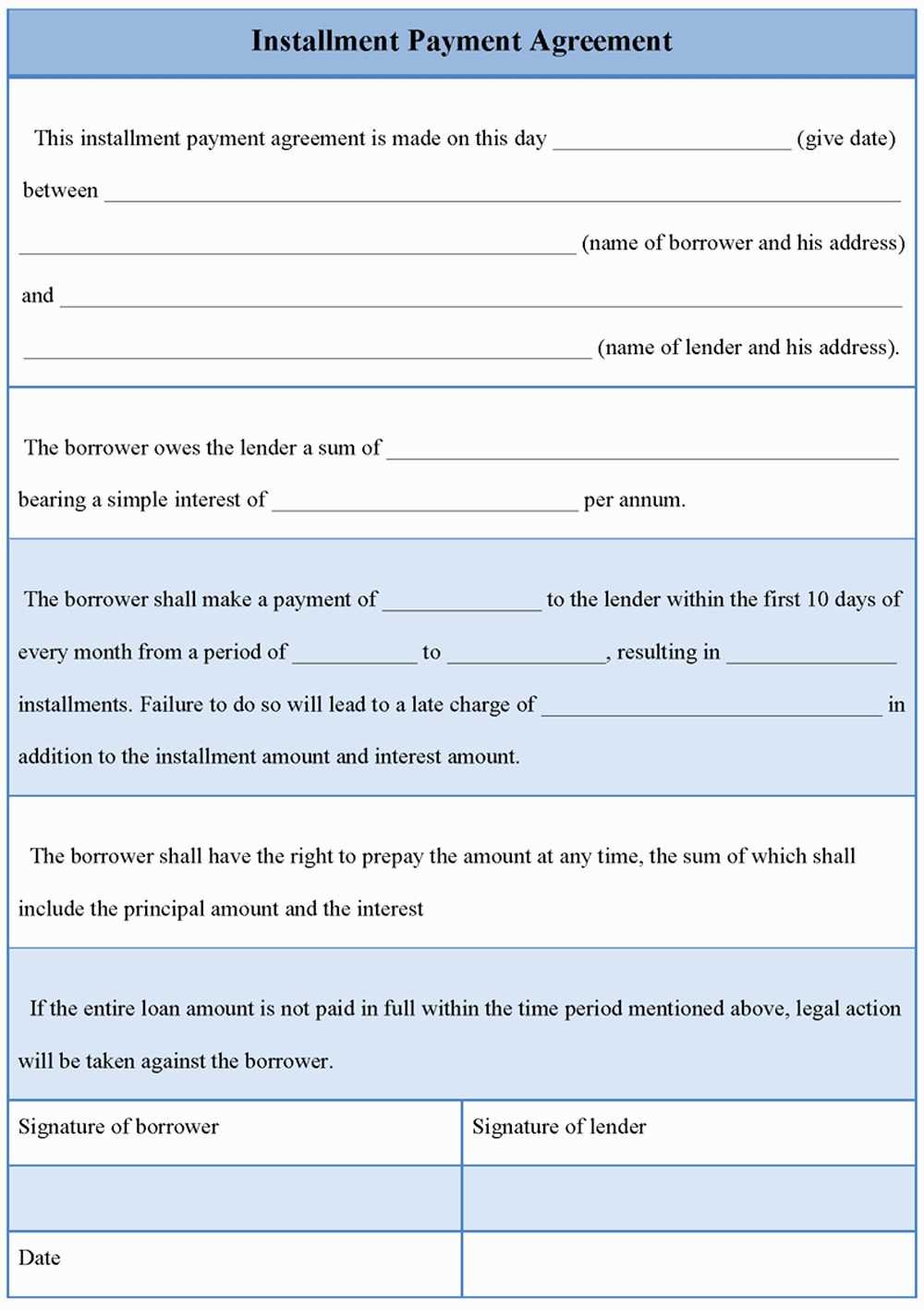

Legal Considerations for Billing in Installments

When offering the option to pay in multiple phases, businesses must be mindful of various legal factors to ensure compliance and avoid disputes. Properly outlining terms and ensuring that both parties understand their rights and obligations is critical to maintaining a transparent and fair transaction. It is important to take into account local laws, consumer rights, and any applicable regulations that could affect the structure of these financial agreements.

Key legal factors to consider include:

- Clear and Transparent Terms: All terms should be clearly stated in writing, including the total cost, due dates, and any potential penalties for late or missed payments. This helps avoid misunderstandings and ensures that both parties are fully aware of their obligations.

- Consumer Protection Laws: Many jurisdictions have laws that protect consumers from unfair practices, such as high-interest rates or unclear terms. Make sure that the terms of your agreement comply with these laws to avoid legal challenges.

- Late Fees and Penalties: If you include late fees or penalties for missed payments, they should be reasonable and clearly communicated. Excessive charges can lead to legal issues or complaints from customers.

- Disclosure of Additional Charges: If there are any additional fees, such as service charges or interest, these must be disclosed upfront and explained in detail. Hidden charges can lead to accusations of deceptive practices.

- Data Protection: When collecting personal or financial data from customers, ensure that all information is handled securely and in accordance with data protection regulations, such as GDPR in the European Union or CCPA in California.

- Legal Recourse: Include a clause in your agreement that outlines the legal options available in the event of non-payment or breach of terms, such as mediation, arbitration, or legal action, depending on the severity of the case.

By addressing these legal aspects, businesses can minimize the risk of disputes and ensure that their financial arrangements are both fair and legally sound, fostering a trustworthy relationship with clients.

Common Mistakes in Billing Agreements

When managing financial agreements that involve multiple payments, it’s crucial to avoid common pitfalls that can lead to confusion, delayed payments, or even legal disputes. Small mistakes can have a significant impact on the clarity and effectiveness of the arrangement. Understanding these frequent errors can help businesses create more efficient and transparent financial documents.

Here are some of the most common mistakes to avoid:

- Unclear Payment Schedule: One of the most frequent errors is failing to provide clear, precise dates for each payment. Vague or inconsistent timelines can lead to confusion and delays.

- Lack of Detailed Cost Breakdown: Not breaking down the total amount into smaller components (such as product cost, taxes, and fees) can leave customers uncertain about what they are being charged for.

- Inconsistent Terms: Failing to maintain consistency in terms, such as interest rates, due dates, and penalties for late payments, can cause misunderstandings. Ensure that all terms are stated in a uniform manner across the entire document.

- Not Accounting for Late Fees: Many agreements fail to specify the penalties or fees associated with missed payments. This can lead to missed opportunities for businesses to recover their losses and incentivize timely payments.

- Failure to Address Early Payment Discounts: Offering discounts for early payments is a valuable incentive, but if this option isn’t clearly stated, customers may not take advantage of it.

- Omitting Customer Contact Information: Leaving out essential customer details, such as contact information, can complicate communication and lead to confusion if issues arise.

- Not Having a Sign-Off Section: Not including a section for signatures from both parties can result in a lack of formal agreement, leaving room for potential disputes.

By being aware of these common mistakes, businesses can create more effective and professional financial agreements, helping to ensure smoother transactions and stronger relationships with clients.

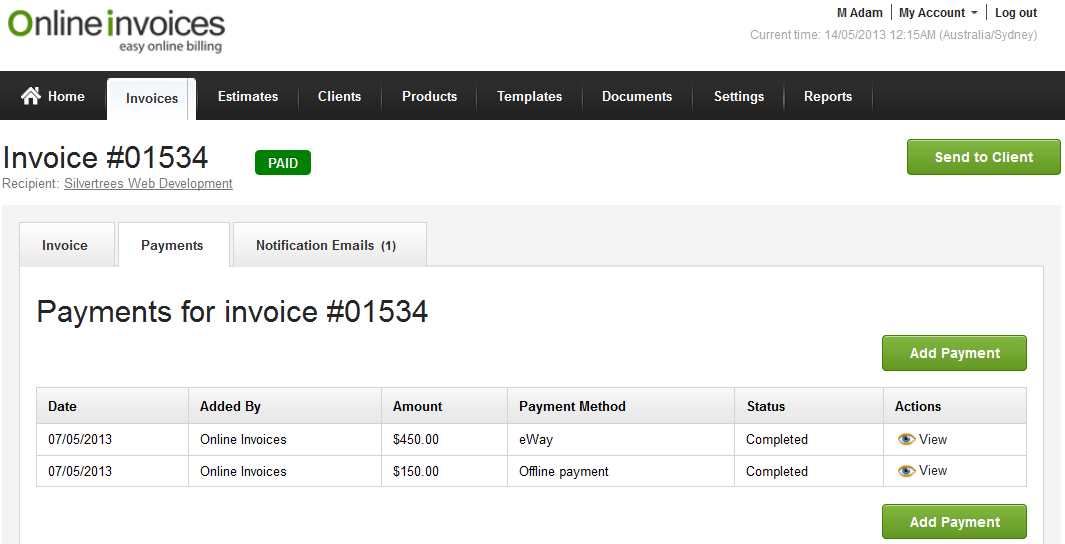

How to Track Payment Schedules

Effectively monitoring financial agreements with multiple due dates is crucial for ensuring timely settlements and maintaining a smooth cash flow. By keeping track of each scheduled contribution, businesses can reduce the risk of missed or delayed amounts. Proper tracking methods also help maintain transparency with clients and provide a clear record for future reference.

Here are some strategies to effectively track multiple contributions over time:

- Use a Payment Schedule Log: Maintain a log where each transaction is recorded, including the date, amount due, and status of the transaction (paid or pending). This log can be kept manually or digitally for easier access.

- Set Reminders: Utilize reminders or notifications for upcoming due dates. This ensures that both you and your client are aware of upcoming deadlines and helps avoid any late fees or confusion.

- Automated Systems: Implement automated software or platforms that track and remind you of upcoming amounts and dates. This eliminates the need for manual entry and minimizes human error.

- Keep Detailed Records: Always keep a clear record of each transaction and its corresponding status. This should include a date stamp for each entry to track when the transaction occurred and if any amounts remain outstanding.

The following table provides an example of a payment schedule log that can be used to track contributions effectively:

| Due Date | Amount Due | Status | Payment Date |

|---|---|---|---|

| January 15, 2024 | $500 | Paid | January 14, 2024 |

| February 15, 2024 | $500 | Pending | N/A |

| March 15, 2024 | $500 | Pending | N/A |

By organizing your tracking methods and using efficient systems, you can ensure timely transactions and reduce any confusion or delays in fulfilling the agreed-upon amounts.

Design Tips for Professional Billing Documents

Creating a well-structured and visually appealing billing document is essential for conveying professionalism and ensuring that all relevant details are clear to the recipient. A clean design not only enhances readability but also fosters trust and encourages prompt action from clients. The design should reflect your business’s identity while making it easy for customers to understand their financial obligations.

Here are some key design tips to consider when creating billing documents:

- Keep It Simple: Avoid cluttering the document with unnecessary information. Focus on the key details such as the total amount, due date, and payment schedule. A minimalist design will help your client focus on the important points.

- Use Clear Sections: Organize the document into distinct sections, such as personal details, billing breakdown, terms, and due dates. This allows for easy navigation and ensures that all necessary information is readily accessible.

- Incorporate Branding: Incorporate your company’s logo, color scheme, and fonts to create a cohesive design that reflects your brand. This will help maintain consistency across your communications and make your document instantly recognizable.

- Readable Fonts: Use easy-to-read fonts for the body text. Avoid overly decorative fonts that can make the document difficult to read. A clean, professional font like Arial, Calibri, or Times New Roman is ideal.

- Use Grid Layouts: A grid layout helps align all elements, creating a balanced and organized look. This ensures that text, numbers, and logos are properly aligned and that the document looks polished.

- Highlight Key Information: Use bold or larger fonts for important sections, such as the total amount due or payment deadlines. This will draw attention to the most critical elements and make them stand out.

- Leave Ample White Space: Don’t crowd the document with text. Make use of white space to make the content more breathable, helping your client focus on one piece of information at a time.

By following these tips, you can create a billing document that is both professional and easy to understand, making it easier for clients to process and fulfill their obligations promptly.

Free vs Paid Billing Documents

When it comes to choosing a design for your financial documents, you have two primary options: free or paid solutions. Each option has its own set of benefits and drawbacks, depending on your business needs and the level of customization you require. The choice between free and paid resources ultimately comes down to factors such as functionality, design flexibility, and additional features.

Here’s a breakdown of the key differences between free and paid solutions:

- Cost: Free options come at no monetary cost, making them an attractive choice for businesses on a budget. However, they often come with limitations that might require upgrading to a paid version later on.

- Customization: Paid options typically offer more flexibility in terms of design and layout. You can fully tailor the document to match your brand, whereas free options often come with pre-set designs and limited customization features.

- Features: Paid designs often come with advanced features such as automated calculations, integration with accounting software, and customer management tools. Free resources tend to have more basic functionality with fewer options for adding extra elements.

- Ease of Use: Free resources are often straightforward and simple to use, making them ideal for businesses just starting out. However, paid solutions typically offer a more polished, user-friendly experience with added support and assistance.

- Support: When using paid solutions, you’re more likely to receive customer support if you encounter any issues. Free resources may lack adequate support or only offer limited help, which can be a challenge when problems arise.

- Updates and Security: Paid options are regularly updated with new features and security patches, ensuring that your documents are up to date and protected. Free versions may not offer the same level of ongoing support or security.

Ultimately, your decision will depend on your business needs and whether the additional investment in a paid solution will provide you with the necessary tools and capabilities to streamline your operations. If you’re just starting out and need basic functionality, free options may suffice. However, if you’re looking for advanced features and long-term flexibility, paid resources could be the better choice.

How to Send Billing Documents Effectively

Sending financial documents to clients in a timely and efficient manner is crucial to ensuring smooth business operations. Clear communication and proper handling of these documents can help prevent confusion, encourage timely responses, and maintain a professional relationship with your customers. The process of sending these documents involves not just the document itself, but also the method, timing, and follow-up actions.

Here are some best practices to help you send your billing documents effectively:

- Choose the Right Delivery Method: Depending on your clients’ preferences, choose between email, postal service, or online platforms for sending your documents. Email is typically the fastest method, but ensure that it is secure and professional.

- Ensure Clear Formatting: Make sure the document is easy to read and understand. Use clear headings, bullet points, and highlight key details like due dates and amounts due. This makes it easier for the client to quickly find the necessary information.

- Send in a Professional Format: Always send the document in a professional format such as PDF to maintain its integrity. PDFs are widely accepted and can be viewed easily across different devices.

- Include All Relevant Information: Ensure that the document contains all necessary details like your business name, client information, due dates, and specific terms and conditions. Missing information could lead to confusion or delays.

- Set a Clear Due Date: Clearly state the due date for the transaction. This avoids any uncertainty and helps the recipient plan ahead. Remind them of payment terms and any potential late fees for overdue submissions.

- Provide Payment Instructions: Make sure to include clear instructions on how clients can complete the transaction. Offer multiple options for ease of payment, such as bank transfers, online payments, or other methods your business accepts.

- Automate Reminders: Set up automated reminders for clients who have not yet responded or made the necessary payments. This helps keep the process on track and reduces the likelihood of late payments.

- Maintain a Professional Tone: Always keep the tone of the communication respectful and professional. Polite, concise, and courteous language fosters positive relationships and reflects well on your business.

By following these steps, you can ensure that your billing documents are sent efficiently and effectively, reducing confusion and promoting prompt responses from your clients. A well-executed process reflects positively on your business and helps to build trust and reliability with customers.

Automating Billing Systems

Automating the billing process can significantly improve efficiency, reduce errors, and enhance customer satisfaction. By leveraging technology, businesses can ensure that financial documents are sent promptly, that clients are billed according to the agreed terms, and that the entire process operates smoothly with minimal manual intervention. Automated systems streamline the workflow, helping businesses stay organized and meet deadlines without having to keep track of every detail manually.

Key benefits of automating billing systems include:

- Improved Efficiency: Automation eliminates the need for repetitive manual tasks, reducing time spent on creating and sending financial documents. Once set up, these systems can process transactions automatically, saving both time and resources.

- Accuracy and Consistency: By automating the process, you minimize the chances of human error, ensuring that all amounts, due dates, and other details are accurately reflected in each document.

- Timely Billing: With automation, businesses can schedule when documents are sent, ensuring that invoices or statements are delivered promptly, on time, and as per the agreed-upon schedule.

- Cost Savings: Automating billing processes reduces the need for paper, postage, and manual labor, all of which can lead to significant cost savings over time.

- Increased Cash Flow: Automated systems can send reminders for overdue documents, ensuring that payments are collected promptly, which ultimately improves cash flow and reduces the risk of late payments.

- Customization and Flexibility: Modern automation tools offer customization options, allowing you to tailor your documents to suit your business needs. This flexibility ensures that everything from layout to the inclusion of specific payment terms can be adjusted automatically based on your preferences.

Automation of your billing process not only saves time but also ensures a consistent and error-free experience for both your business and your clients. Integrating automated systems into your workflow is a crucial step toward scaling your operations while maintaining high levels of professionalism and reliability.

Managing Late Payments with Templates

Handling delayed financial obligations efficiently is essential for maintaining cash flow and ensuring that business operations continue smoothly. One of the most effective methods to deal with overdue accounts is to use automated structures that can track and manage outstanding amounts. These structured documents help remind clients of their overdue balances and provide clear instructions for completing the necessary steps to settle them.

Creating Effective Follow-Up Documents

When clients miss deadlines, a well-crafted follow-up document is crucial for maintaining professionalism while ensuring that the payment process moves forward. These documents should clearly outline the outstanding amount, any applicable late fees, and the updated due date. By maintaining a polite but firm tone, businesses can communicate the urgency of the situation without damaging client relationships.

Features to Include in Follow-Up Documents

Effective overdue reminders should contain the following elements:

| Feature | Explanation |

|---|---|

| Clear Payment Details | List the exact amount due, the original due date, and any overdue charges, so the client has all necessary information to process the balance. |

| Updated Due Date | Provide a new due date or an installment schedule to encourage swift action on the outstanding balance. |

| Late Fee Information | Clearly state any additional charges that will be applied if the debt remains unpaid beyond the new due date. |

| Payment Methods | Include multiple payment options to make it easier for the client to settle their account. |

| Contact Information | Ensure that clients have access to customer service contact details for questions or concerns regarding the overdue balance. |

By utilizing these detailed documents, businesses can enhance their collection efforts, reduce the risk of further delays, and keep clients engaged with the payment process. Ensuring the right tone and clarity in follow-up communications helps balance firmness with customer care, ultimately promoting prompt payments and maintaining professional relationships.

Integrating Invoice Templates with Accounting Tools

Incorporating structured financial documents into your accounting system can streamline the process of tracking and managing business finances. By connecting these documents to accounting software, businesses can automate many tasks, reduce errors, and enhance financial reporting. Integration ensures that all billing data is synchronized with accounting records, which ultimately leads to better accuracy and time-saving efficiency.

To make the most of this integration, consider the following steps:

- Choose Compatible Software: Ensure that your billing structure is compatible with the accounting tool you use. Popular software options often provide pre-built integrations or customizable connectors.

- Automate Data Entry: With integration, the billing information is automatically transferred to your accounting platform, minimizing manual data entry and the potential for human errors.

- Track Outstanding Balances: Integrating your records with accounting systems helps you easily monitor overdue amounts, generate reminders, and update payment status in real-time.

- Enhance Financial Reporting: Automated integration between the billing and accounting systems ensures all your financial data is up-to-date, making it easier to create accurate reports and gain valuable insights into business performance.

- Improve Client Communication: Integration ensures that all financial documents remain consistent, and you can send the right reminders and statements without discrepancies or delays.

By aligning your structured billing process with accounting tools, you ensure a more efficient, organized, and error-free system for managing finances. This setup enables businesses to focus more on growth and less on administrative tasks, while ensuring that all financial data is correctly tracked and accounted for.

Best Practices for Payment Scheduling

Effectively managing the timing of client dues is key to maintaining cash flow and fostering strong business relationships. Setting clear and manageable schedules for financial obligations ensures that both parties are on the same page and that the process remains organized and predictable. Below are best practices that can help create a reliable and smooth billing cycle.

1. Establish Clear Terms

Defining the terms of the financial agreement upfront is crucial. Whether you choose to set fixed due dates or offer flexible arrangements, both parties should agree to the terms before any work begins or goods are delivered. This helps avoid confusion and ensures there are no surprises later on.

2. Offer Flexible Options

While setting a rigid timeline for dues can be beneficial in some cases, offering flexibility may improve customer satisfaction. Allowing clients to choose from different scheduling options–such as weekly, bi-weekly, or monthly due dates–can make it easier for them to manage their financial obligations.

3. Automate Reminders

To avoid delays, set up automatic reminders that notify clients of upcoming due dates. These can be sent via email, SMS, or through your business portal. Timely reminders help ensure that customers are aware of their obligations and allow them to prepare accordingly.

4. Break Down Large Amounts

If you’re dealing with a large amount due, consider breaking it down into smaller, more manageable portions. This not only makes it easier for clients to pay but can also reduce the likelihood of late payments, as the client is more likely to meet smaller deadlines.

5. Be Transparent

Transparency in how your billing schedule is set up and any associated terms is essential. Clearly communicate when payments are due, what happens in the case of late payments, and the process for adjusting the schedule if necessary. This builds trust and reduces misunderstandings.

By following these best practices, businesses can ensure that their financial expectations are clear, manageable, and met on time. Proper scheduling fosters positive relationships and provides the necessary structure for business growth and client satisfaction.