Installment Invoice Template for Efficient Payment Tracking

Efficiently organizing payment schedules is essential for both businesses and customers. A structured approach ensures clear communication and reduces the chances of confusion or missed payments. For companies that offer payment plans, having the right tools to document and manage each transaction is crucial for maintaining financial stability and trust with clients.

Using a pre-designed structure to outline payment details not only simplifies the process but also ensures consistency across all transactions. It allows businesses to clearly communicate the amount due, the payment frequency, and any terms regarding late fees or adjustments. Whether you’re offering services or products with deferred payments, an organized system can save time and help avoid misunderstandings.

In this guide, we will explore how creating a clear and straightforward billing system can streamline your workflow. By leveraging an efficient structure, you can easily track payments and maintain smooth financial operations. This method will also make it easier for clients to understand their obligations, ensuring both parties stay on the same page throughout the payment period.

Installment Invoice Template Overview

Managing deferred payment schedules requires a clear and standardized approach to ensure both parties are aligned on the terms and amounts. A well-organized document can serve as a comprehensive record, helping businesses keep track of amounts owed and when payments are due. It provides clarity on how funds should be distributed over time and helps reduce the chances of late payments or disputes.

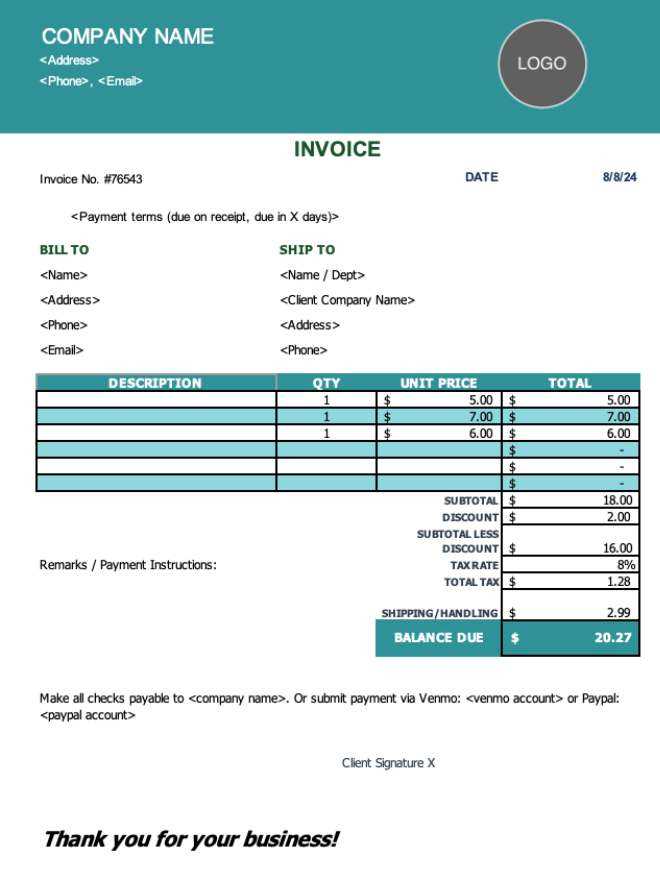

Such a document typically includes key details like the total amount due, the frequency of payments, and specific terms around due dates. Additionally, it may outline penalties for missed payments or other important conditions that need to be communicated. By using a pre-formatted structure, businesses can simplify the billing process and maintain professionalism while ensuring clients are fully aware of their obligations.

With the right system in place, businesses can easily manage recurring payments and ensure transparency throughout the transaction period. This approach benefits both the service provider and the customer, fostering better communication and a smoother payment experience.

What is an Installment Invoice

A payment arrangement that divides a total amount into smaller, manageable sums over a set period is a common practice for both businesses and customers. This approach allows buyers to pay for products or services in stages, rather than settling the full amount upfront. Such arrangements are typically used for higher-value transactions or when customers prefer to spread out their financial commitments.

In these cases, the document that formalizes the agreement will detail the total cost, the payment schedule, and any applicable terms for late fees or adjustments. It serves as a clear record of what is owed, when each payment is due, and how the balance is being gradually reduced. This type of arrangement helps ensure transparency and avoids confusion between the buyer and the seller.

Having a structured document to outline these terms not only facilitates easier tracking but also ensures that both parties are clear on expectations. It reduces the risk of miscommunication and helps maintain a smooth transaction flow throughout the duration of the agreement.

Benefits of Using an Installment Invoice

Utilizing a structured payment plan document offers numerous advantages for businesses and customers alike. It helps both parties manage financial expectations, ensuring that payments are made on time and according to the agreed terms. With clear documentation in place, businesses can maintain a steady cash flow while customers benefit from the ability to spread out their financial commitments over time.

One of the primary benefits is improved transparency. When all terms, amounts, and deadlines are clearly outlined, both the buyer and seller have a clear understanding of the payment arrangement. This reduces the risk of misunderstandings or disputes, ensuring that everyone involved is aware of their obligations.

Another advantage is the ability to track payments efficiently. A detailed record helps businesses monitor progress and follow up on any missed payments in a timely manner. It also makes financial planning easier, as businesses can predict incoming payments and manage their cash flow accordingly. Additionally, customers are less likely to feel burdened by large upfront costs, which can encourage more sales and build stronger customer relationships.

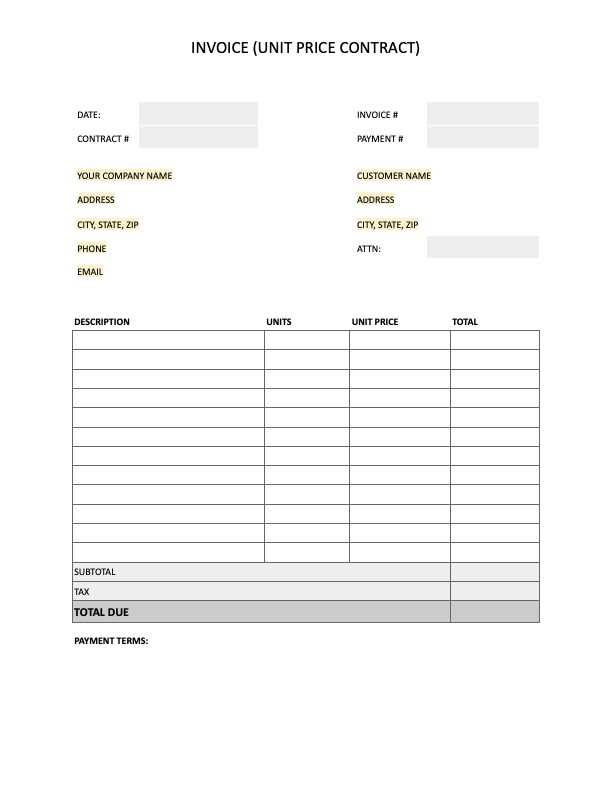

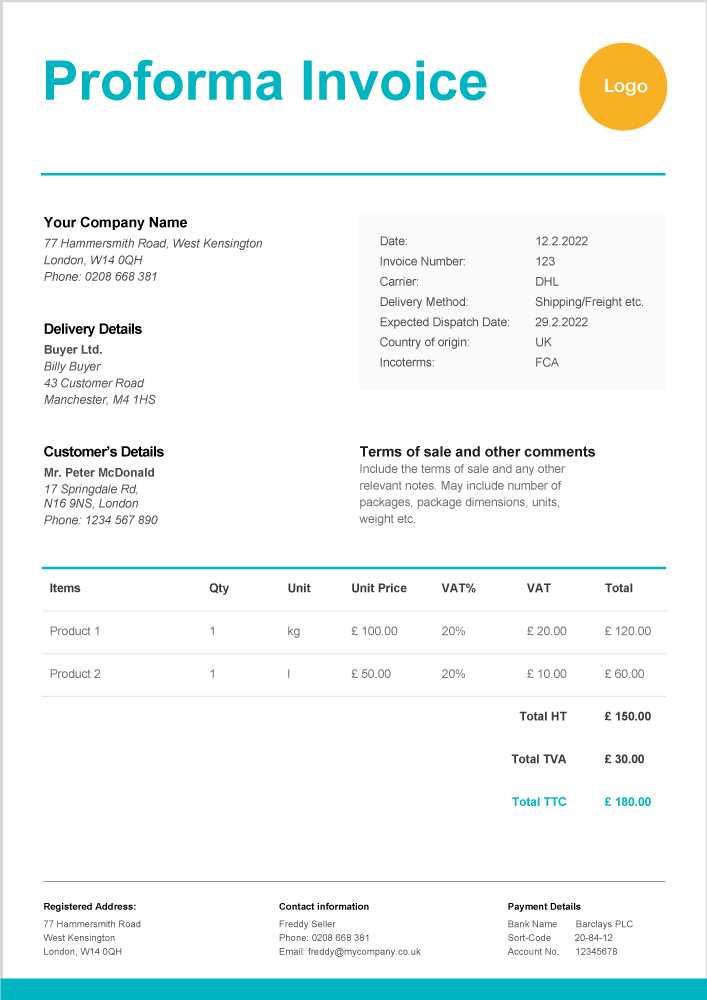

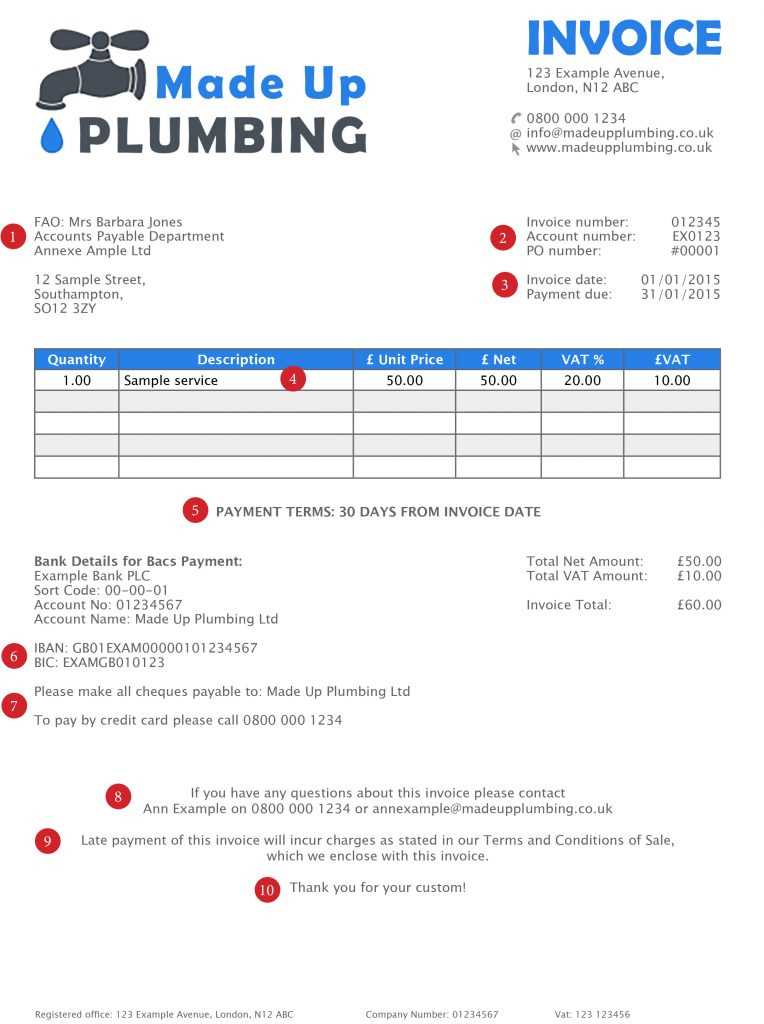

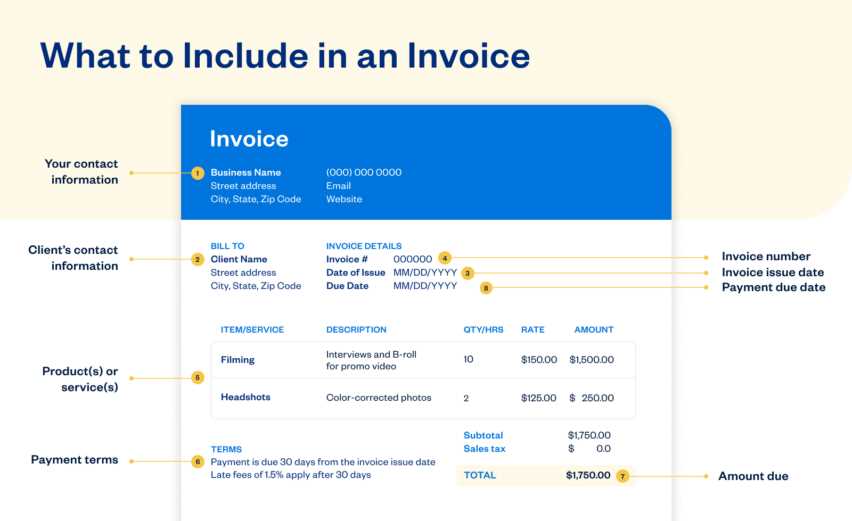

Key Elements of an Invoice Template

When creating a document that outlines payment terms and schedules, certain details are essential for clarity and effective communication. These components ensure that both the seller and the buyer understand the agreement, reducing the chance of errors or disputes. A well-structured record should include specific information to guarantee transparency and proper tracking of payments.

Essential Information for Both Parties

The most important details to include are the names and contact information of both the seller and the buyer. This establishes clear identification and helps both parties easily reference the document in the future. Along with the parties’ information, the total amount due and the agreed-upon payment schedule must be clearly outlined. This can include the number of payments, amounts, and due dates for each installment.

Terms and Conditions

Terms regarding late fees, payment methods, and any penalties for missed payments should also be included in the document. These terms protect both parties and ensure that there is no ambiguity about the consequences of non-payment. Additionally, providing a unique reference number for the document will make it easier to track and manage, especially for businesses handling multiple agreements at once.

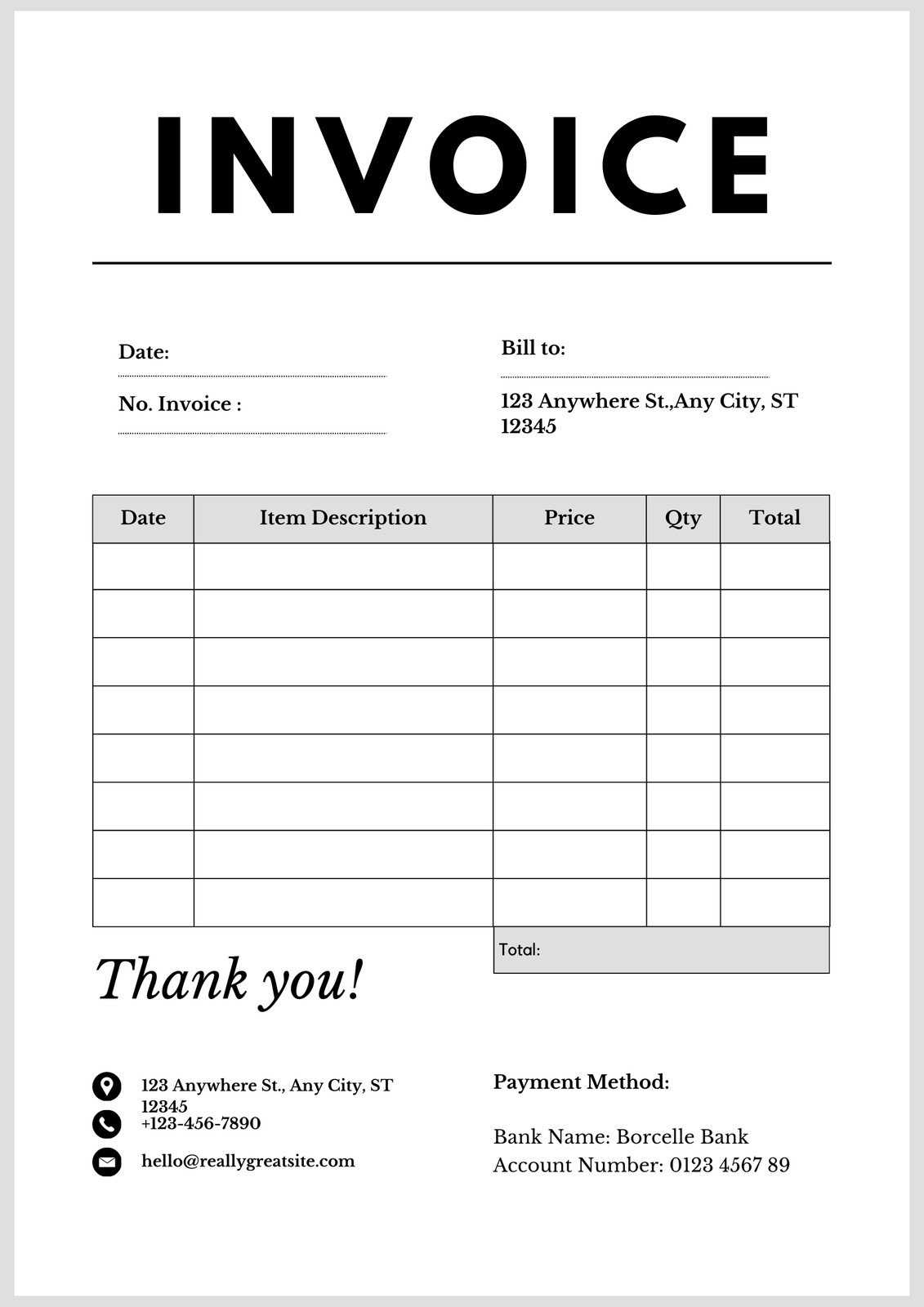

How to Create an Installment Invoice

Creating a document to outline payment plans is a straightforward process that can be done with minimal effort if you follow a clear structure. The goal is to provide a clear and professional outline of payment expectations, ensuring both parties are fully aware of the terms and schedule. Here’s a step-by-step guide to help you create an effective payment arrangement record:

- Include the Basics: Start by adding the names, addresses, and contact details for both the buyer and the seller. This ensures that the document is properly attributed and easy to reference.

- List the Total Amount Due: Specify the full cost of the product or service being provided, so there is no ambiguity about the amount being paid.

- Set the Payment Plan: Break down the total amount into smaller, manageable payments. Clearly define the amount due for each installment and specify the due dates.

- Outline Payment Methods: Indicate which payment methods are acceptable, whether it’s bank transfer, credit card, or another method. This ensures clarity on how transactions will be processed.

- Specify Late Fees or Penalties: If there are penalties for missed or delayed payments, make sure to clearly outline them. This helps prevent misunderstandings and encourages timely payments.

- Provide Reference Numbers: Assign a unique reference number to the document to make it easy to track and refer to in the future.

By following these steps, you’ll ensure that your document is professional, clear, and legally sound. This structure will help both you and your clients stay organized and maintain a smooth financial relationship.

Customizing Your Installment Invoice

Adapting your payment plan document to suit your specific needs is essential for making sure that both the buyer and the seller are on the same page. Customization allows you to reflect the nature of your transaction, ensure clear communication, and include any necessary details specific to the agreement. Tailoring this record can help improve both the professional presentation and clarity of the financial terms.

When customizing, consider adjusting the following aspects:

| Element | Customization Tips |

|---|---|

| Payment Amount | Adjust the amount due for each installment based on the total cost and the agreed-upon payment frequency. Ensure this matches your client’s financial capabilities. |

| Due Dates | Customize the due dates to align with the client’s payment cycle. Offering flexible terms can encourage prompt payments. |

| Late Fees | Clearly outline any late fees or penalties for missed payments. You can adjust the penalty rate based on the agreement terms. |

| Payment Methods | List the specific payment methods you accept, whether online, check, or bank transfer. This ensures the buyer knows how to pay. |

| Personalized Branding | Include your company’s logo, name, and other branding elements to make the document more professional and consistent with your business identity. |

By customizing these sections, you ensure the document aligns with your unique business practices and client expectations. A well-tailored agreement not only enhances professionalism but also contributes to a smooth, mutually beneficial financial transaction.

Common Mistakes to Avoid in Invoices

When creating a payment plan document, it’s crucial to be mindful of common errors that can lead to confusion or disputes between the buyer and the seller. These mistakes can cause delays, misunderstandings, and even affect cash flow. Ensuring accuracy and clarity in the payment details will help both parties stay on track and avoid unnecessary issues.

Missing Key Payment Information

One of the most frequent mistakes is leaving out important details such as the payment amounts, due dates, or the total amount owed. If the breakdown of payments is unclear or incomplete, the buyer may not understand their obligations, leading to delays or confusion. Always ensure that each installment is clearly listed, along with the due dates and payment methods.

Ambiguous Terms and Conditions

Another common error is failing to specify clear terms regarding late fees, penalties, or any special conditions attached to the payment arrangement. Without these details, it becomes difficult to enforce the agreement if a payment is missed or delayed. Always include a section outlining the consequences of non-payment, and be specific about how fees will be applied or how adjustments will be handled.

Avoiding these mistakes will ensure that both you and your clients have a shared understanding of the terms, making the payment process smoother and reducing the risk of complications.

Best Tools for Invoice Creation

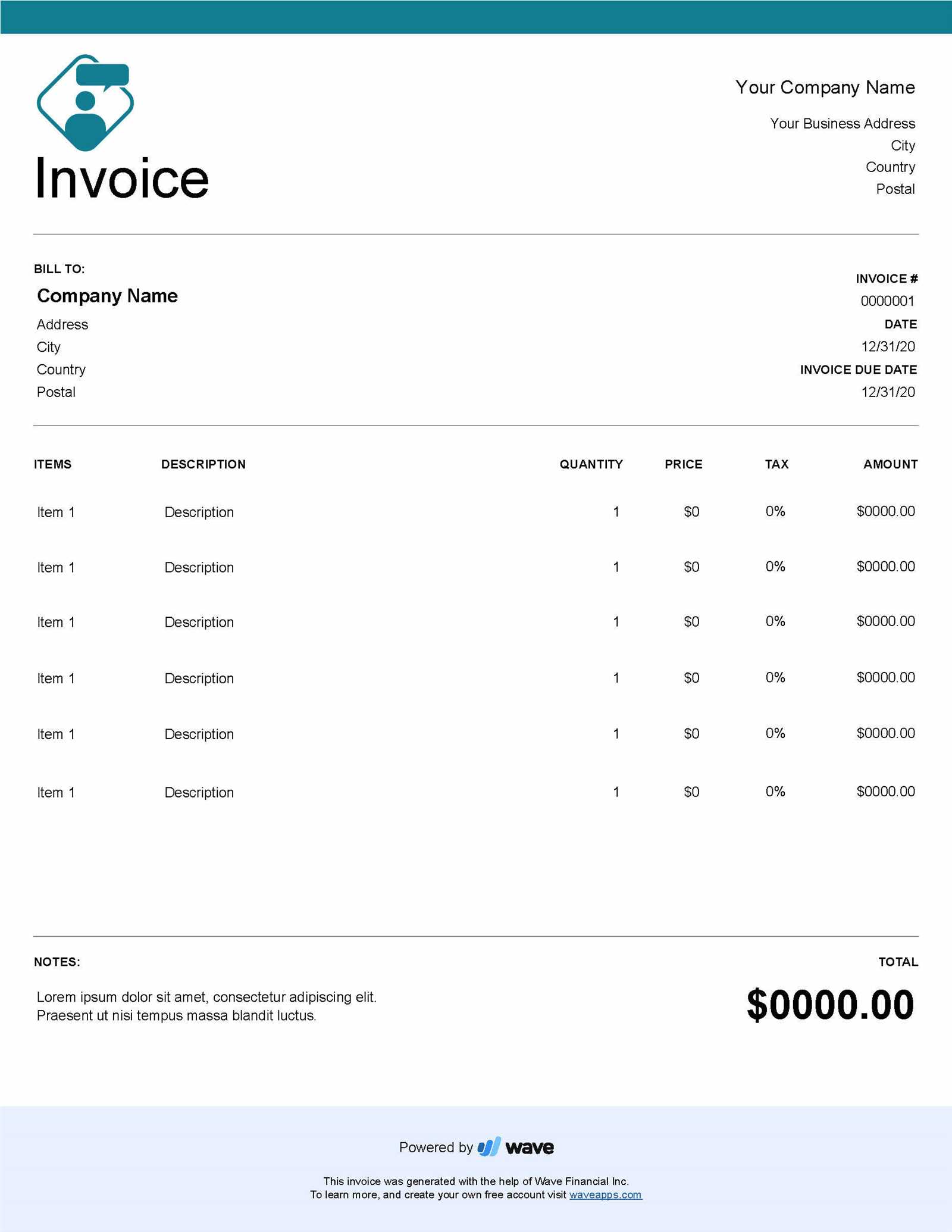

Creating professional and accurate payment documents is much easier with the right tools. There are several software options and online platforms that streamline the process, allowing businesses to quickly generate structured payment agreements. These tools offer customizable features to ensure that all necessary details are included and can be tailored to suit different business needs.

Many of these platforms come with pre-designed templates, automated calculations, and the ability to track payments, making the entire process more efficient. Whether you are a freelancer, small business owner, or part of a larger enterprise, using the best tools will save time and help maintain consistency in your financial records.

From simple document generators to more advanced accounting software, the right tool can enhance your workflow and ensure that your payment schedules are always clear and professional.

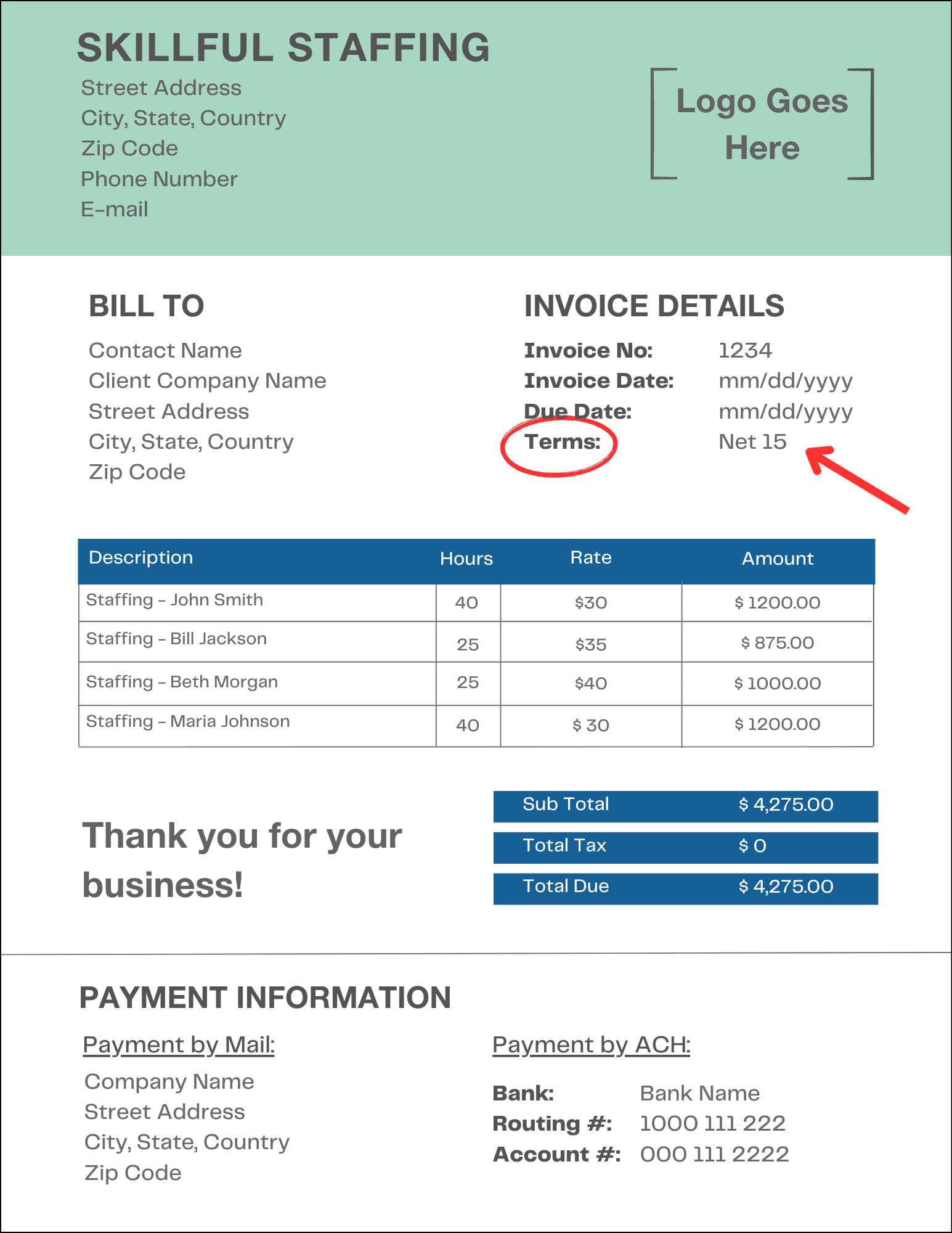

How to Set Payment Terms

Establishing clear payment terms is a crucial step in any financial agreement, ensuring both parties understand when and how payments will be made. Setting the right terms helps prevent confusion, delays, and disputes. It allows the buyer to plan their payments and gives the seller confidence that they will receive compensation on time.

When defining payment terms, consider the following:

- Payment Frequency: Determine how often payments will be made–whether it’s weekly, monthly, or according to a custom schedule. This ensures that both parties are aligned on the timing of each payment.

- Amount Per Payment: Clearly specify the amount due for each installment. Ensure that the buyer understands exactly what they are responsible for paying at each interval.

- Due Dates: Set precise due dates for each payment. Make sure the buyer has enough time to make the payment and understand any grace period that might be allowed.

- Late Fees: If there are penalties for missed payments, clearly state the terms for late fees or interest charges. This helps encourage timely payments and discourages delays.

- Payment Methods: Specify acceptable payment methods–such as bank transfer, credit card, or other payment platforms–to avoid any confusion about how the buyer should remit payment.

By clearly setting these terms upfront, you create a transparent and professional agreement that benefits both you and your client. Well-defined payment terms help manage expectations and ensure smooth transactions throughout the entire process.

Tracking Payments with Installment Invoices

Keeping track of payments is vital for any business that offers flexible payment plans. A well-organized system ensures that all transactions are recorded accurately and that both parties are aware of any outstanding amounts. Tracking payments allows businesses to monitor cash flow, send timely reminders, and follow up on overdue balances without confusion.

To effectively track payments, start by maintaining a clear record of each transaction. For each installment, note the payment amount, due date, and whether it was received on time. If a payment is missed or delayed, make sure to record the details and any follow-up actions taken, such as sending a reminder or discussing revised terms with the buyer.

Many businesses use software tools or accounting platforms to automate this process, reducing manual effort and minimizing the risk of errors. These tools can automatically update the payment status, send reminders, and even generate reports to provide an overview of outstanding balances. With automated systems, it becomes easier to stay on top of payment schedules and maintain organized records over time.

Whether you track payments manually or use digital tools, it’s essential to keep a consistent and accurate record. This ensures that you can resolve disputes quickly and maintain a professional relationship with your clients.

Legal Considerations for Installment Payments

When offering flexible payment arrangements, it is crucial to ensure that all terms are legally sound and protect both parties. A well-defined agreement helps prevent potential legal disputes by clarifying the rights and responsibilities of both the seller and the buyer. Understanding the legal aspects of these agreements can help businesses avoid costly mistakes and ensure that their payment plans are enforceable in court if necessary.

Key Legal Aspects to Include

Before entering into a payment agreement, consider the following legal elements to include in your document:

| Legal Element | Description |

|---|---|

| Payment Schedule | Clearly outline the dates and amounts for each payment. This ensures both parties are aware of their obligations and can prevent misunderstandings. |

| Late Fees and Penalties | Specify any late fees or interest charges for missed payments. This is essential for enforcing timely payments and protecting your business from financial loss. |

| Default Terms | Include provisions for what happens if the buyer defaults on the payment plan. This can include actions such as legal recourse or terminating the agreement. |

| Dispute Resolution | Define the process for resolving conflicts. This can include mediation, arbitration, or other methods to avoid costly litigation. |

Ensuring Enforceability

For the agreement to be legally binding, both parties must fully understand and accept the terms. It is often a good idea to have the contract reviewed by a legal professional to ensure compliance with local laws and regulations. Additionally, both parties should sign the document, and it should be dated to confirm that all terms were agreed upon at that specific time.

By addressing these le

Handling Late Payments in Installments

Late payments can disrupt cash flow and complicate financial planning, especially when dealing with agreements that are paid over time. It is important for businesses to have a clear strategy in place to handle missed or delayed payments to avoid financial strain and maintain healthy client relationships. A well-established approach ensures that both parties understand the consequences of late payments and can prevent issues from escalating.

When a payment is missed, it’s essential to take the following steps:

- Send a Reminder: A polite reminder is often the first step in resolving late payments. This can be done through email, a phone call, or an official letter. Ensure that you include the original payment terms and a new due date.

- Assess Late Fees: If your agreement includes late fees, apply them according to the terms outlined in the payment plan. Be sure to clearly communicate these fees to the buyer to emphasize the importance of timely payments.

- Offer Flexibility: In some cases, clients may need more time to make the payment. Consider offering an extended deadline or restructuring the payment plan to accommodate their needs, as long as it does not compromise your business’s financial health.

- Enforce Consequences: If the late payment persists, refer back to the terms of the agreement, which may include actions such as suspension of services or legal measures. Always ensure that these steps are clearly outlined in your initial agreement.

It’s important to address late payments promptly and professionally to maintain the integrity of the payment agreement and preserve the business relationship. Consistency in handling overdue payments is key to minimizing future delays and ensuring that both parties fulfill their commitments.

Automating Invoice Generation

Automating the creation of payment documents can save businesses time, reduce errors, and streamline the overall process. By using software or online tools, companies can quickly generate and send accurate payment plans to clients without needing to manually create each document. This automation not only increases efficiency but also ensures consistency in the format and terms of every agreement.

With automated systems, businesses can pre-set payment schedules, calculate amounts due, and even send reminders when payments are approaching or overdue. This reduces the need for manual tracking and minimizes the chances of missing important deadlines. Automation tools can also store historical data, making it easy to reference past transactions or agreements with clients.

Furthermore, many platforms allow for customization, enabling businesses to add their branding, adjust payment terms, and integrate with accounting systems. This level of flexibility ensures that automated documents are aligned with company policies while simplifying the entire process for both the seller and the buyer.

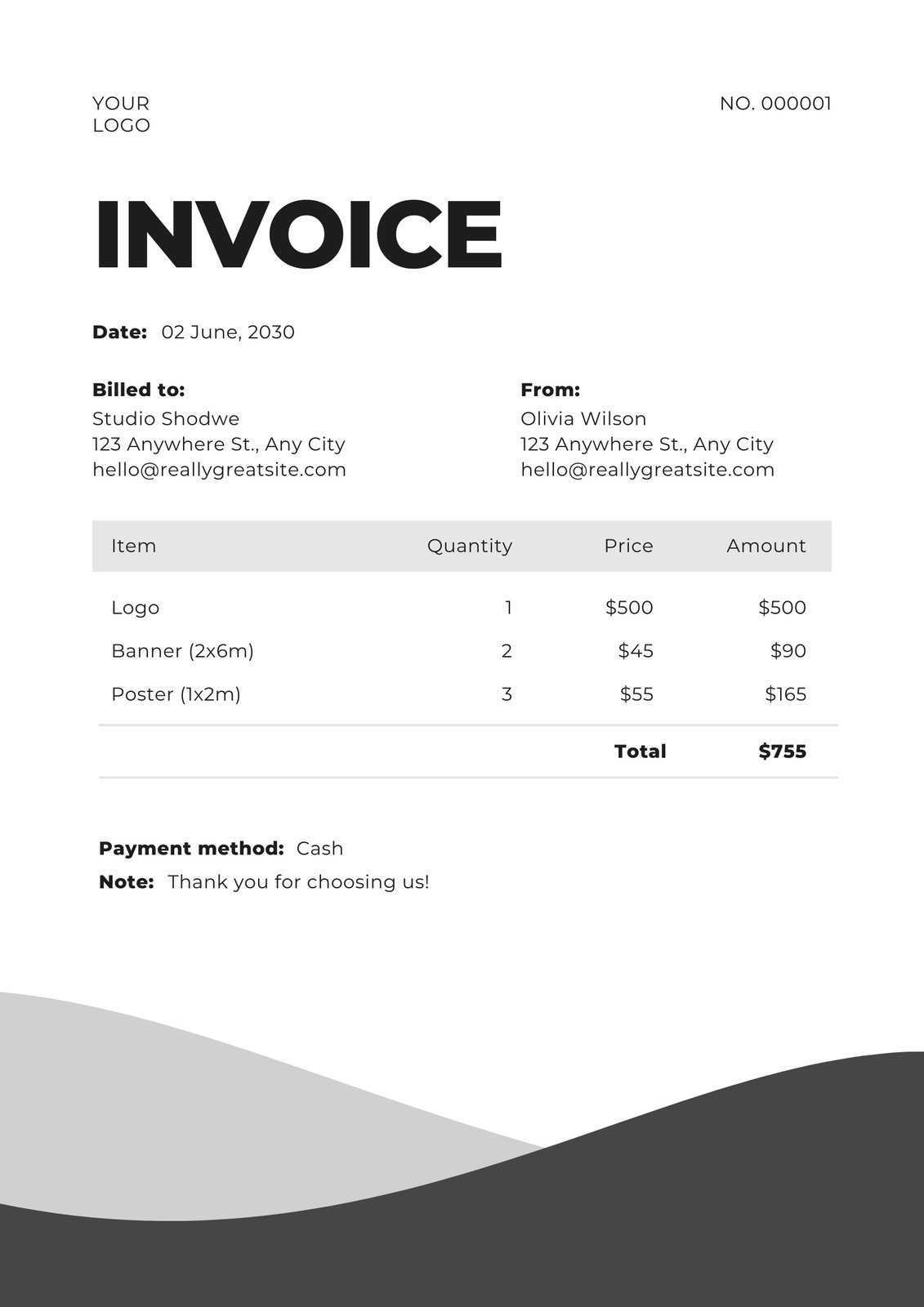

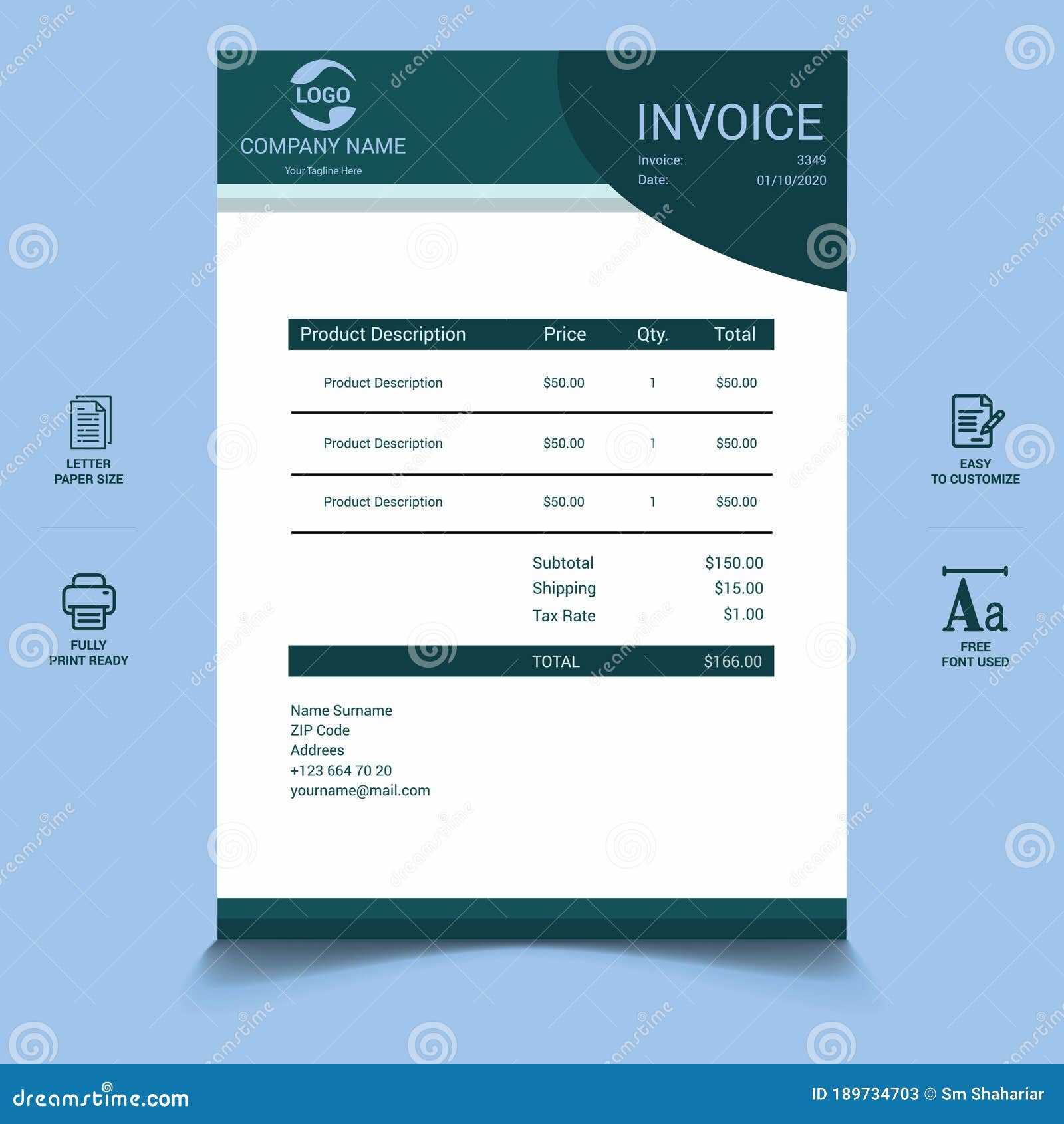

Using Templates for Consistency

Maintaining consistency in payment documentation is essential for building trust and professionalism in business relationships. Using pre-designed structures for payment plans ensures that every agreement follows the same format and includes all necessary information, reducing the chances of errors or omissions. With a consistent approach, businesses can streamline their financial processes, making it easier to manage multiple clients and agreements at once.

Benefits of Using Standardized Documents

By using standardized formats, businesses can achieve several key benefits:

| Benefit | Description |

|---|---|

| Efficiency | Pre-designed documents allow for faster creation of new payment plans, saving time on repetitive tasks and ensuring that all details are included. |

| Professionalism | A consistent structure enhances the appearance of the document, conveying a professional image to clients and fostering confidence in your business. |

| Accuracy | Standardized formats minimize the risk of missing or incorrect information, as all essential details are automatically included. |

| Scalability | As your business grows, using templates makes it easier to manage a larger volume of agreements without sacrificing quality or consistency. |

Customizing Templates to Fit Your Needs

While using a standard structure provides consistency, it is also important to have the flexibility to tailor documents to meet specific client needs. Many platforms allow you to easily adjust payment terms, add branding, and modify sections to better suit individual agreements. This customization ensures that each document remains professional while addressing the unique aspects of each transaction.

By using standardized formats, businesses can not only maintain consistency but also create a more efficient, professional, and scalable process for managing payment plans.

Sharing Your Installment Invoices Securely

When sending payment documents, ensuring their security is critical to protecting sensitive information and maintaining professional trust with clients. Whether it’s the payment amount, due dates, or personal details, keeping these documents secure minimizes the risk of unauthorized access and potential fraud. It’s important to use secure methods for sharing financial agreements to safeguard both your business and your client’s data.

Secure Methods for Sharing Payment Documents

There are several secure ways to share your payment documents with clients, each offering different levels of protection:

- Password-Protected Files: Encrypt your documents with a password before sharing. This adds a layer of protection in case the file is intercepted during transmission.

- Secure Email Services: Use email services that offer end-to-end encryption to ensure that the content of your message is visible only to the intended recipient.

- Document Management Systems: Platforms like Google Drive, Dropbox, or dedicated invoicing software offer secure cloud storage with controlled access, ensuring only authorized parties can view or download the documents.

- Secure Payment Platforms: If you’re sharing a payment schedule as part of a broader transaction, consider using trusted payment gateways that allow for secure document sharing along with payment processing.

Protecting Confidential Information

In addition to secure sharing methods, it’s essential to protect sensitive information within the document. Avoid including unnecessary personal details unless absolutely necessary. Use encrypted file formats like PDF, which can be locked or password-protected, and ensure that any links or attachments sent to the client are from trusted sources.

By prioritizing security when sharing payment agreements, you ensure both the safety of sensitive information and the trustworthiness of your business practices. This attention to detail strengthens your professional relationship and protects both parties from potential risks.

Free vs Paid Invoice Templates

When choosing a document format for payment agreements, businesses often face the decision between free and paid options. While both can serve the purpose, they come with distinct advantages and limitations. Understanding the key differences can help you determine which option best suits your needs, whether you are looking for basic functionality or more advanced features tailored to your business requirements.

Free templates are an appealing choice for businesses just starting out or those with a limited budget. These templates often come with essential fields such as payment amounts, due dates, and basic contact information. However, they may lack advanced customization options or premium features that can help enhance the professionalism and efficiency of the documents. Free options are ideal for those who need simple and quick solutions without extra frills.

On the other hand, paid templates offer a higher level of customization and flexibility. These options often include advanced features like automated calculations, integrations with accounting software, and enhanced design options that can help reinforce your brand. Paid solutions can also provide better customer support, security features, and regular updates, making them a more reliable choice for growing businesses that need more comprehensive tools.

Ultimately, the decision between free and paid templates depends on your specific needs, business size, and budget. While free options can be useful for basic document generation, investing in a paid option may offer long-term benefits in terms of efficiency, customization, and professional presentation.

Why Choose a Template for Installment Payments

Using a pre-designed structure for managing payment agreements can significantly simplify the process of creating professional and organized financial documents. Instead of starting from scratch each time, a standardized format allows businesses to quickly generate accurate and consistent records for every client. This approach saves time, reduces the chance of errors, and ensures that important details are always included.

Efficiency and Time-Saving

One of the primary reasons to use a pre-designed document for payment schedules is efficiency. With a consistent format already in place, businesses can create new records in minutes, without having to manually format each section or worry about missing key information. This is especially useful when dealing with multiple clients or complex payment plans, where keeping everything organized is critical for smooth operations.

Professionalism and Consistency

Another benefit of using a ready-made structure is the professional appearance it provides. Pre-designed documents often come with polished, clean layouts that align with industry standards. This consistency helps build trust with clients, as they can easily understand the terms and conditions of their payment agreement. Whether you’re sending a document to a new client or an established one, maintaining a professional and uniform format reinforces your business’s credibility.

By choosing to use a structured format for managing payment plans, businesses can save time, improve accuracy, and present a more professional image. These advantages make it easier to manage financial transactions while maintaining a high level of organization and client satisfaction.