Download and Customize Your Individual Invoice Template

Efficient billing is crucial for maintaining a smooth workflow in any business. Having a well-structured, clear, and easy-to-use document for requesting payments not only ensures timely transactions but also enhances the professionalism of your business. A reliable tool can save time and reduce errors, making the entire process more efficient.

Personalized payment requests are key to presenting a polished image to clients. By using a pre-designed framework, you can quickly generate the necessary paperwork without missing essential details. Customizing the layout and content allows you to reflect your brand while keeping the communication straightforward and formal.

Whether you’re an entrepreneur, freelancer, or part of a larger team, the right solution can make your financial dealings more organized. With clear payment terms and accurate figures, you avoid confusion and build trust with your clients. A simple but effective document management system is essential for smooth operations and financial transparency.

What is an Individual Invoice Template

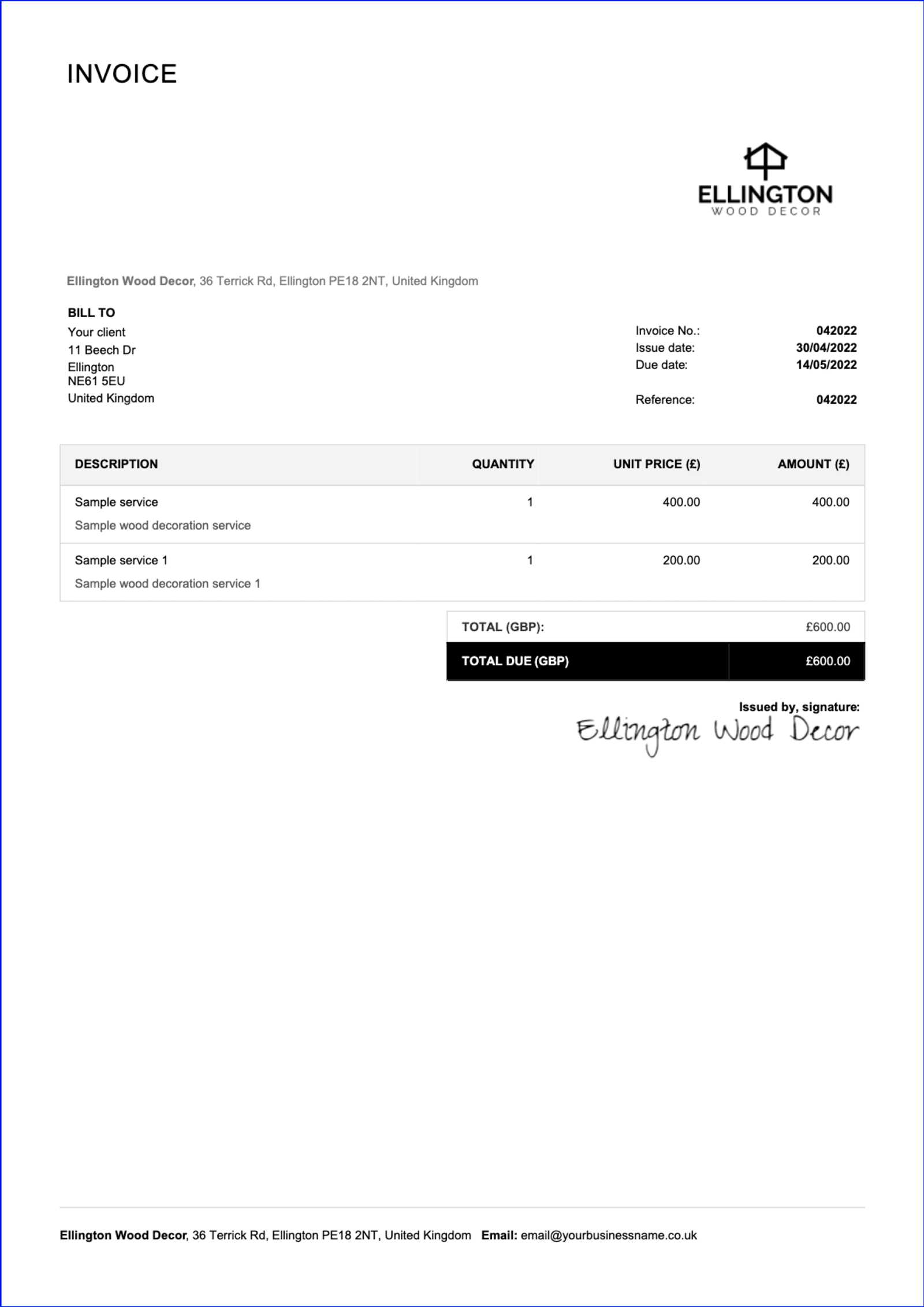

A billing document is a fundamental part of any transaction between businesses and their clients. It serves as a formal request for payment, detailing the products or services provided, the agreed price, and the terms of payment. Creating this document manually each time can be time-consuming and prone to errors, which is where a pre-designed format comes in handy.

Using a pre-formatted solution allows you to efficiently generate the required paperwork with consistency. These pre-built structures help eliminate the guesswork, ensuring all necessary components are included, while also providing flexibility for customization. Whether you are handling one-time or recurring payments, this tool simplifies the entire process.

Key Features of a Well-Structured Document

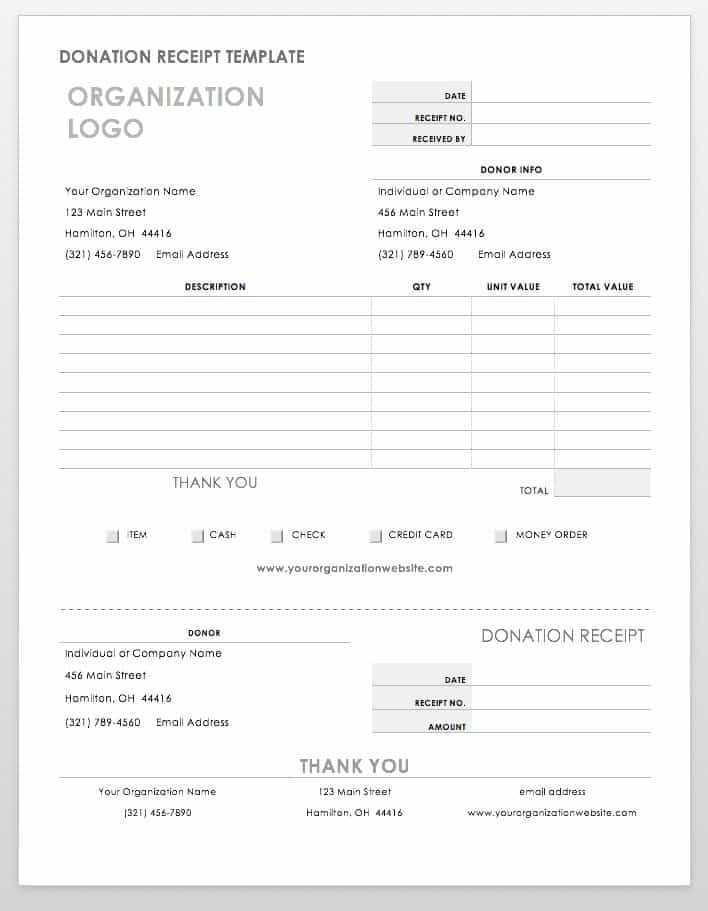

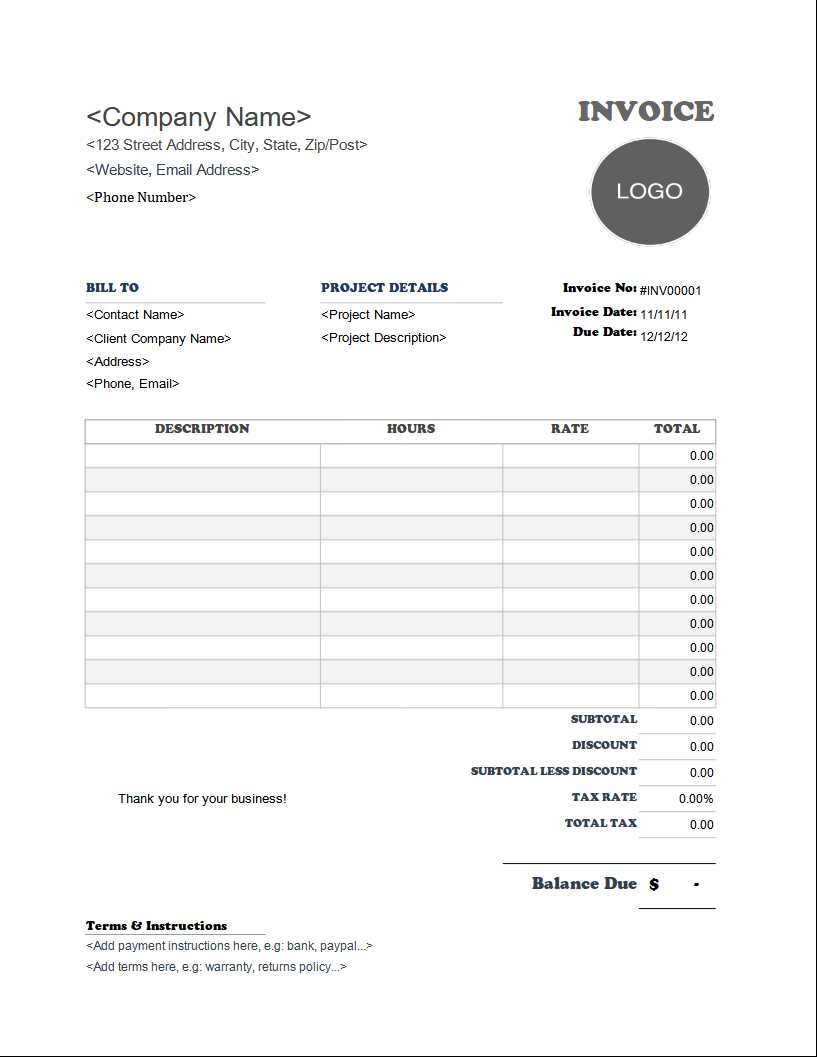

Such a document typically includes several essential components to ensure clarity and accuracy in the transaction. The structure is designed to help both the payer and the payee quickly understand the key details of the payment agreement. Below is an overview of the typical sections found in a well-organized document:

| Section | Description |

|---|---|

| Header | Contains the business’s name, logo, and contact information. |

| Client Information | Includes the recipient’s details, such as name, address, and contact info. |

| Services/Products | Lists the goods or services provided, along with their prices. |

| Total Amount | The sum due, including applicable taxes and fees. |

| Payment Terms | Details the due date, payment methods, and any late fees. |

Why Use a Pre-Formatted Document?

Using a pre-designed structure saves both time and effort. It ensures consistency across multiple billing documents and helps avoid missing any crucial information. Additionally, it improves professionalism and streamlines the entire billing process. Whether you are working with clients on a one-time basis or managing recurring projects, this type of

Benefits of Using Invoice Templates

Utilizing a pre-designed framework for creating billing documents offers numerous advantages for businesses of all sizes. These ready-to-use solutions streamline the payment request process, reduce errors, and enhance the professionalism of your communications with clients. By implementing a structured approach, you can focus more on your core business activities and less on administrative tasks.

Time Savings

One of the most significant benefits of using pre-designed documents is the amount of time saved. Rather than creating a new document from scratch for each transaction, a standardized format allows you to quickly fill in the necessary details. This efficiency frees up valuable time that can be spent on more important business tasks. Key time-saving advantages include:

- Faster document creation process.

- Minimal formatting adjustments needed.

- Reduced likelihood of forgetting essential details.

Consistency and Accuracy

Maintaining consistency across all billing documents ensures that your clients receive a professional and unified experience. Pre-designed formats help reduce human error and make sure that every piece of important information is included, such as payment terms, service descriptions, and tax calculations. The accuracy of these tools can help you avoid costly mistakes, such as incorrect amounts or missing payment details. Benefits of consistency and accuracy include:

- Uniformity across multiple documents.

- Accurate calculations, including taxes and discounts.

- Clear and professional presentation of business details.

By using a ready-made structure, businesses can ensure that all important information is included while saving time and reducing errors. Ultimately, this leads to smoother financial operations and more satisfied clients.

How to Customize Your Invoice Template

Personalizing your billing document is a crucial step in aligning it with your business brand and ensuring it meets your specific needs. Customization allows you to include unique information, adjust the layout, and ensure that your payment requests reflect your company’s identity. Tailoring these documents can make your transactions feel more professional and organized.

There are several key areas to focus on when customizing your payment request document:

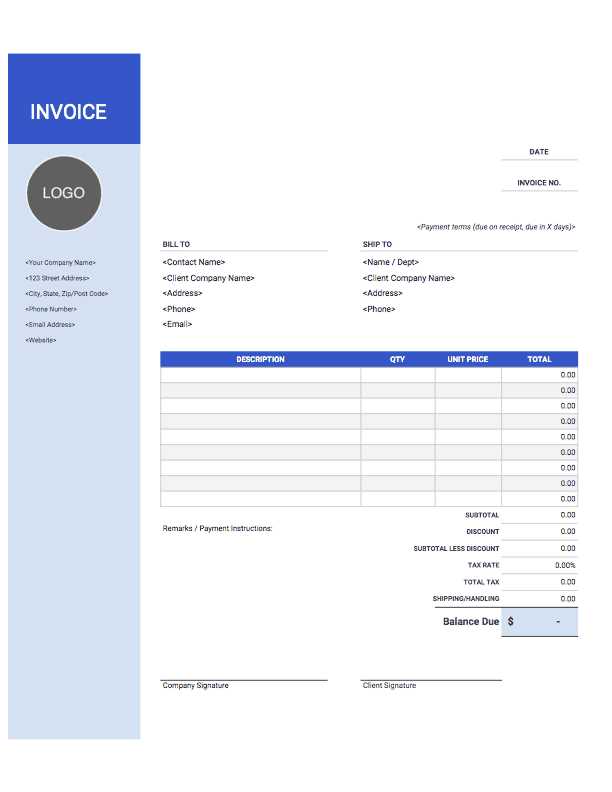

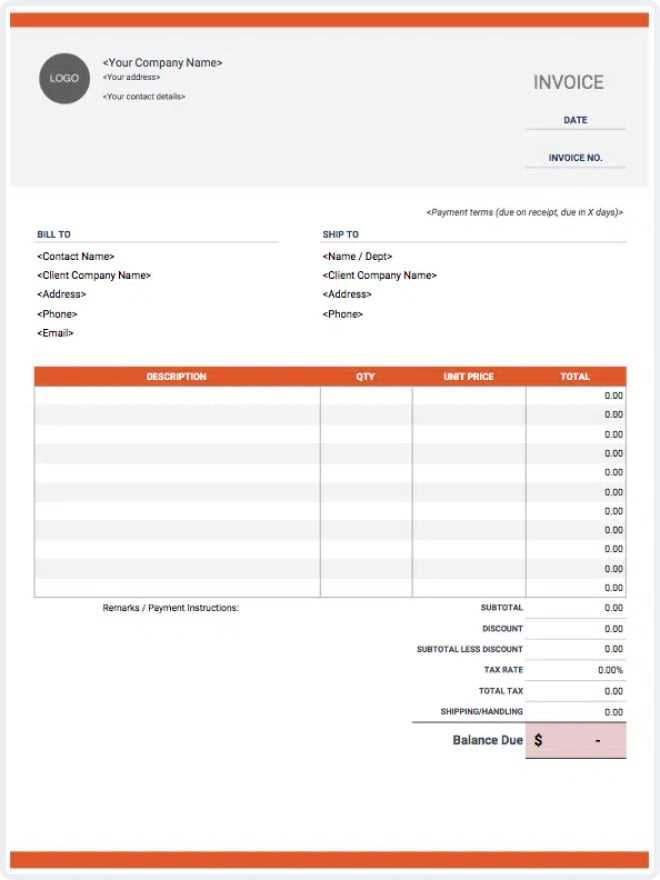

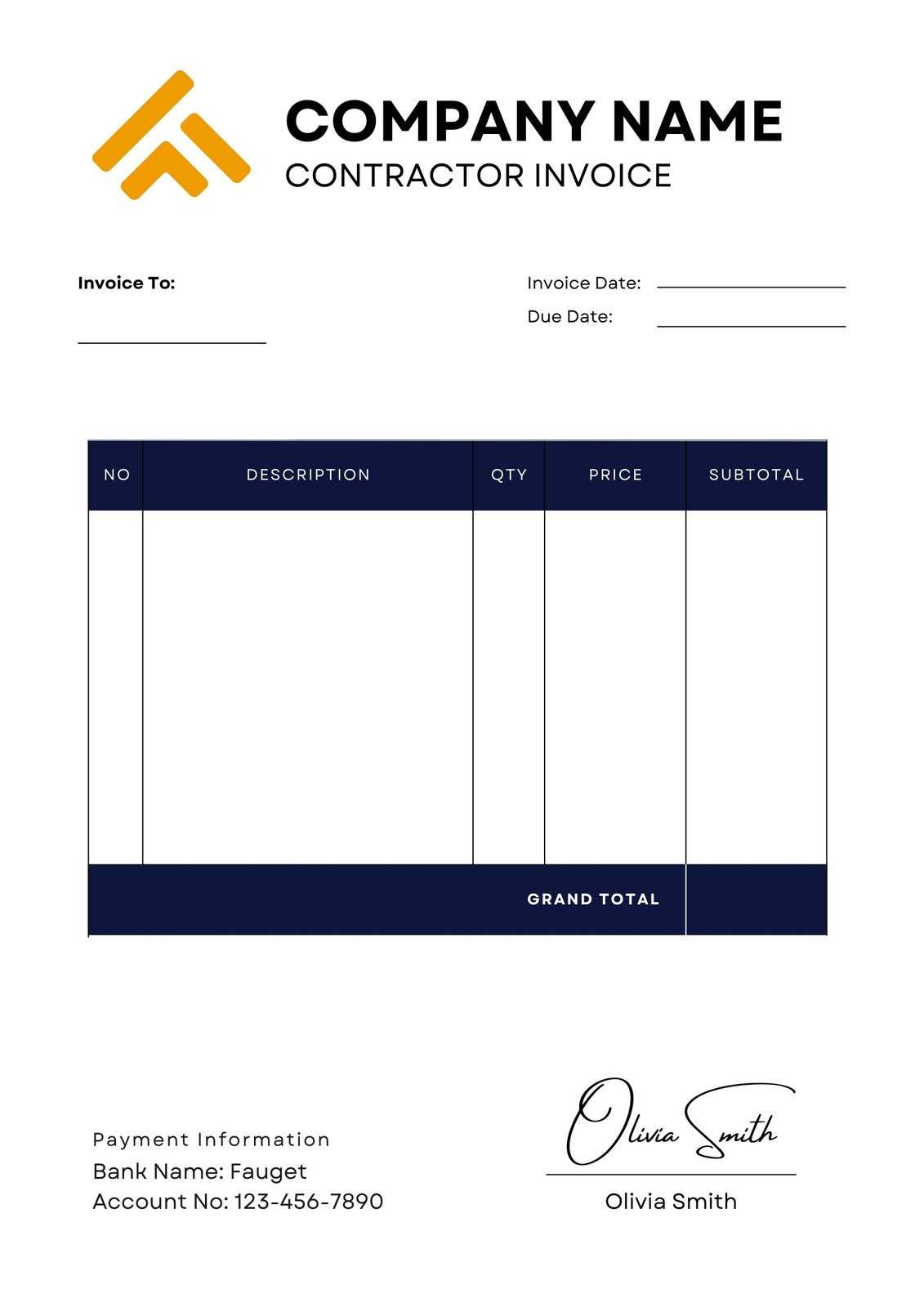

Modify the Layout and Design

The design of your document should reflect your brand’s style. This includes choosing colors, fonts, and the overall layout that resonates with your company’s image. Here are some design elements to consider:

- Incorporating your logo and business name.

- Choosing professional colors that align with your brand.

- Ensuring the layout is clean and easy to read.

Adjust Document Content

Once the layout is set, it’s important to focus on the content. Depending on your business, you may want to add or modify sections such as payment terms, discount offers, or special notes. Essential information to include might be:

- Client’s name and contact details.

- Product or service description with quantities and prices.

- Applicable taxes, discounts, or additional fees.

- Payment methods and due date.

By tailoring both the design and content, you ensure that the document is not only visually appealing but also perfectly suited to your business transactions. Customizing payment requests also helps maintain a professional relationship with your clients and improves the overall experience for both parties.

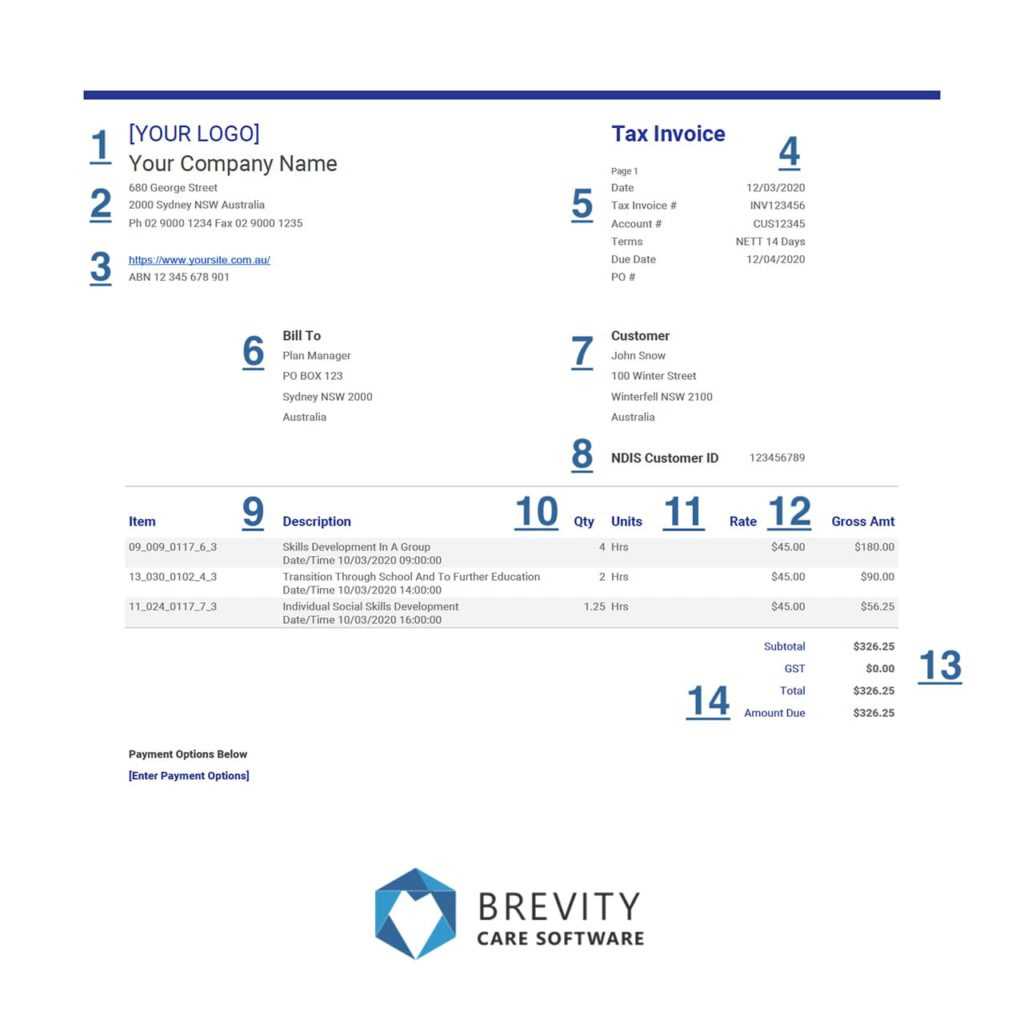

Essential Elements of an Invoice

A well-constructed billing document includes specific information that ensures clarity and accuracy for both the business and the client. These key components help avoid misunderstandings, ensure timely payments, and maintain professionalism throughout the transaction process. Whether you’re handling a one-time sale or a long-term contract, each of these elements is crucial for effective financial communication.

Below are the essential sections that should always be included in a properly structured payment request:

Key Information to Include

- Business Information: Your company’s name, logo, and contact details, including phone number and email address.

- Client Information: The client’s name, address, and contact details to ensure the document is directed to the correct recipient.

- Unique Identification Number: A reference number or code for easy tracking and organizing of documents.

Transaction Details

- Description of Products/Services: A clear list of items or services provided, including quantities, unit prices, and any applicable descriptions.

- Total Amount Due: The full amount owed, including taxes, discounts, and other charges.

- Payment Terms: Information on when the payment is due, accepted payment methods, and any late payment penalties.

- Due Date: The specific date by which the payment should be made to avoid penalties.

Including all of these elements ensures that the document is comprehensive, reduces the chance of errors, and provides both parties with the necessary details to proceed with the payment smoothly. The more complete and organized the document is, the easier it will be for clients to process their payments on time, maintaining a strong and professional relationship.

Choosing the Right Invoice Template Format

Finding the appropriate document structure for organizing payment details is essential for effective record-keeping and clear communication. Selecting a format that suits both the business’s needs and the preferences of clients can enhance professionalism and streamline the billing process.

Factors to Consider

Several aspects influence the choice of structure. Here are some key points to keep in mind when deciding on the best format:

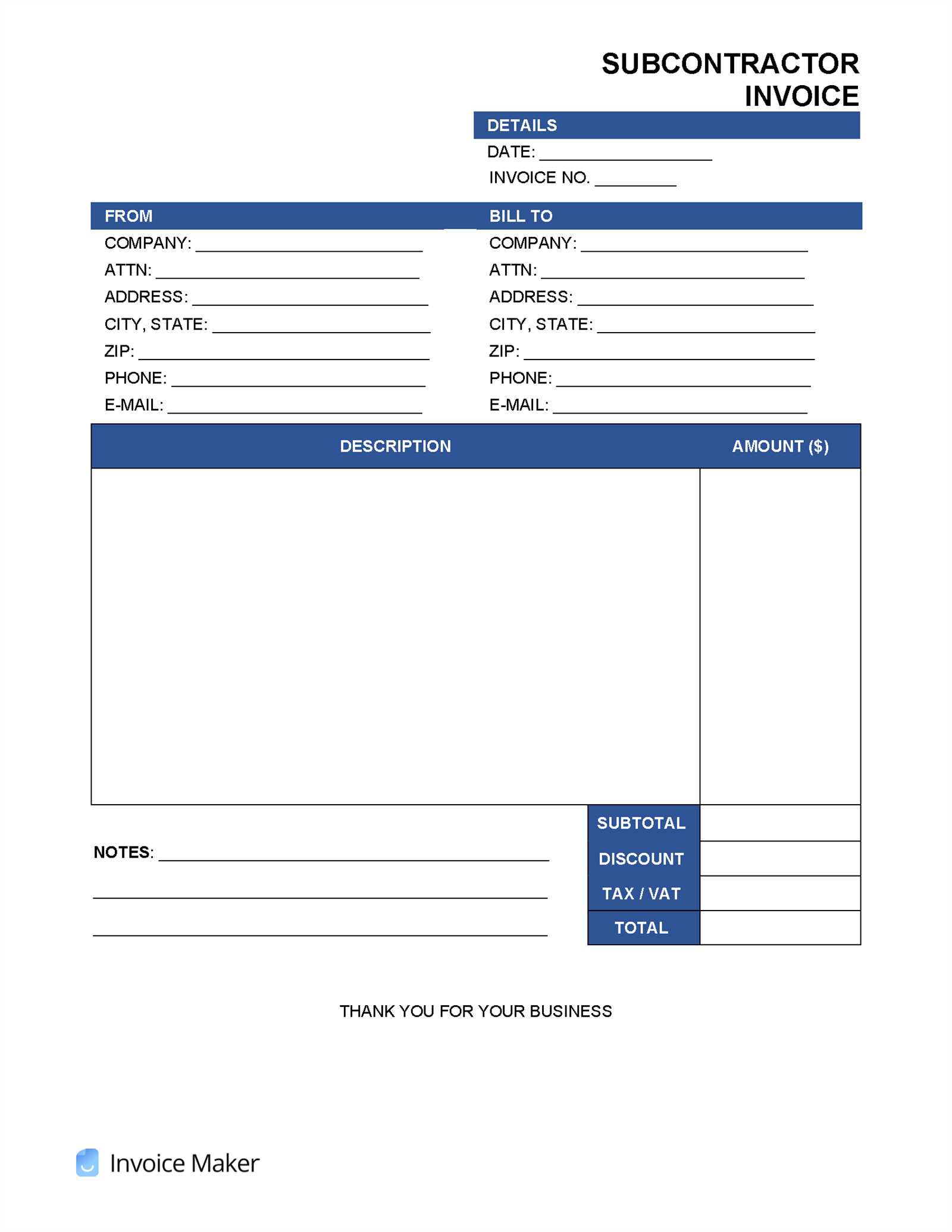

- Business Type: Different industries may require unique layouts. For instance, freelance services might benefit from simple, streamlined layouts, while companies with complex billing structures might need more detailed formats.

- Content Requirements: Ensure that the chosen format accommodates all necessary fields, such as item descriptions, quantities, and due dates.

- Client Preferences: Consider whethe

Free vs Paid Invoice Templates

Choosing between complimentary and premium document designs for billing can influence the efficiency and appearance of financial transactions. Each option has its advantages, depending on the specific needs and goals of the business.

Benefits of Free Options

Free formats are accessible and convenient for small businesses or individuals just starting out. These options often cover basic requirements, providing a simple layout that can be quickly implemented without additional costs.

Advantages of Paid Designs

Investing in a paid design can offer more customization, advanced features, and professional appeal. Paid options often include technical support, integration capabilities, and tailored layouts that help businesses stand out and better meet client expectations.

Ultimately, the choice depends on whether the business prioritizes affordability and simplicity or seeks enhanced functionality and unique style in its billing documents.

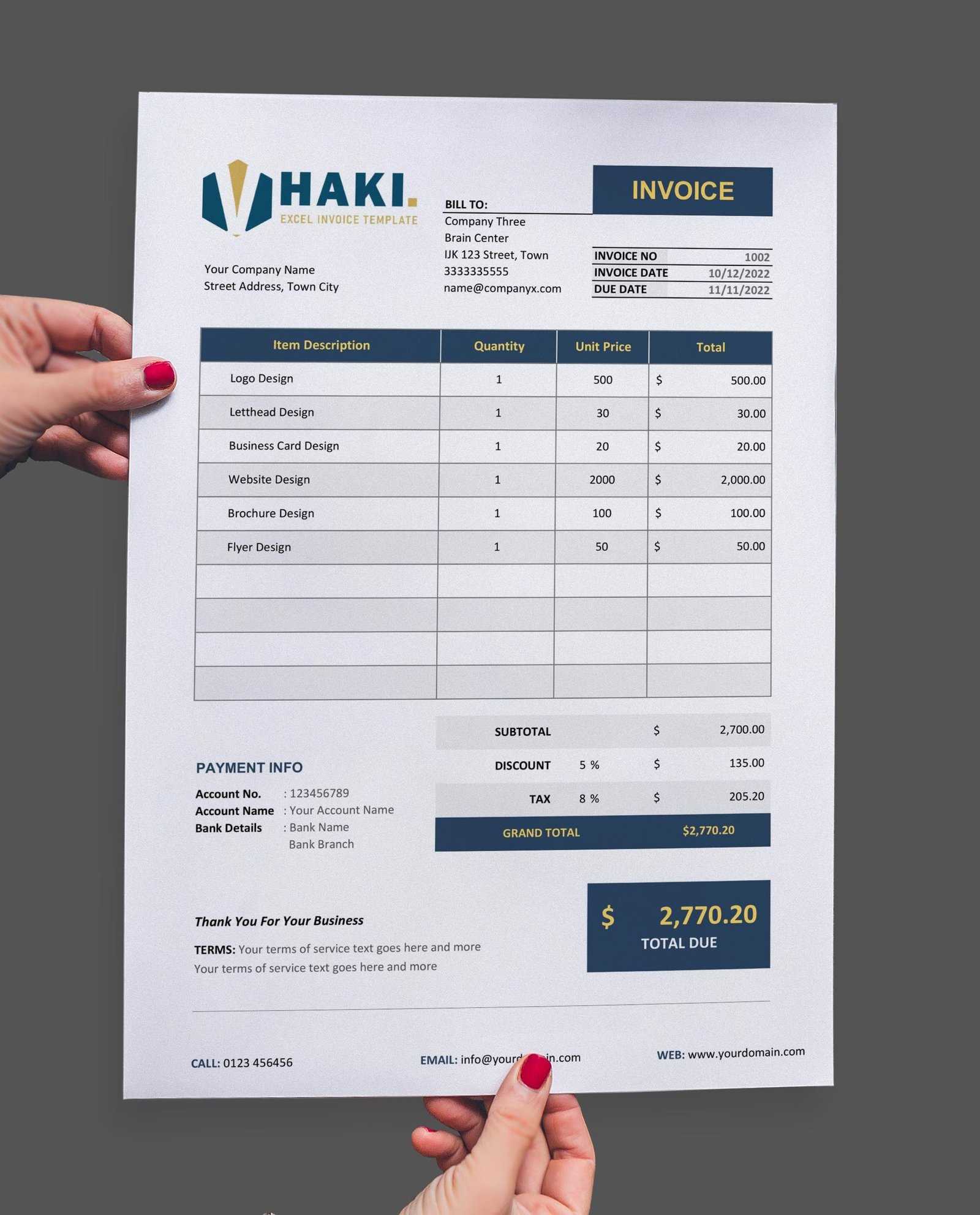

How to Add Taxes to Your Invoice

Incorporating taxes into a billing document is essential for accurate financial reporting and legal compliance. Including tax details ensures transparency and helps avoid potential issues with both clients and tax authorities.

Determine Applicable Tax Rates

The first step is to identify the relevant tax rate for your region or industry. This rate might vary based on the nature of the goods or services provided, so it’s crucial to verify current regulations to apply the correct percentage.

Calculate Tax on Total Amount

Once the rate is known, multiply it by the subtotal of the billed items or services. This will give the tax amount to be added. For example, if the subtotal is $500 and the tax rate is 10%, the tax to include would be $50.

Display Tax Clearly

Common Mistakes in Invoice Creation

Creating accurate billing documents is essential for smooth financial operations. However, certain common errors can lead to delays, misunderstandings, or even missed payments. Being aware of these mistakes can help ensure more effective and professional interactions with clients.

Missing Essential Details

One of the most frequent issues is omitting key information, such as the payment due date, contact details, or a clear breakdown of charges. Each item or service should be listed clearly with corresponding costs to avoid confusion.

Incorrect Calculations

Miscalculations, whether in the subtotal, taxes, or discounts, can lead to disputes and payment delays. Double-check all figures to confirm they are accurate, and use automated tools if possible to reduce manual errors.

Inconsistent Formatting

Inconsistent layouts or unclear formatting can make it hard f

How to Include Payment Terms on Invoices

Specifying payment terms on a billing document is essential for setting clear expectations with clients. Defining deadlines, methods, and conditions helps streamline the payment process and reduces the likelihood of misunderstandings or delays.

Key Elements of Payment Terms

Payment terms can vary based on the business model and client requirements. Here are some standard components to consider including:

Term Description Due Date Specifies the deadline by which payment should be made. Common options include “Net 30” (payment due in 30 days) or “Due upon receipt.” Accepted Payment Methods Indicates acceptable ways to pay, such Invoicing Best Practices for Freelancers

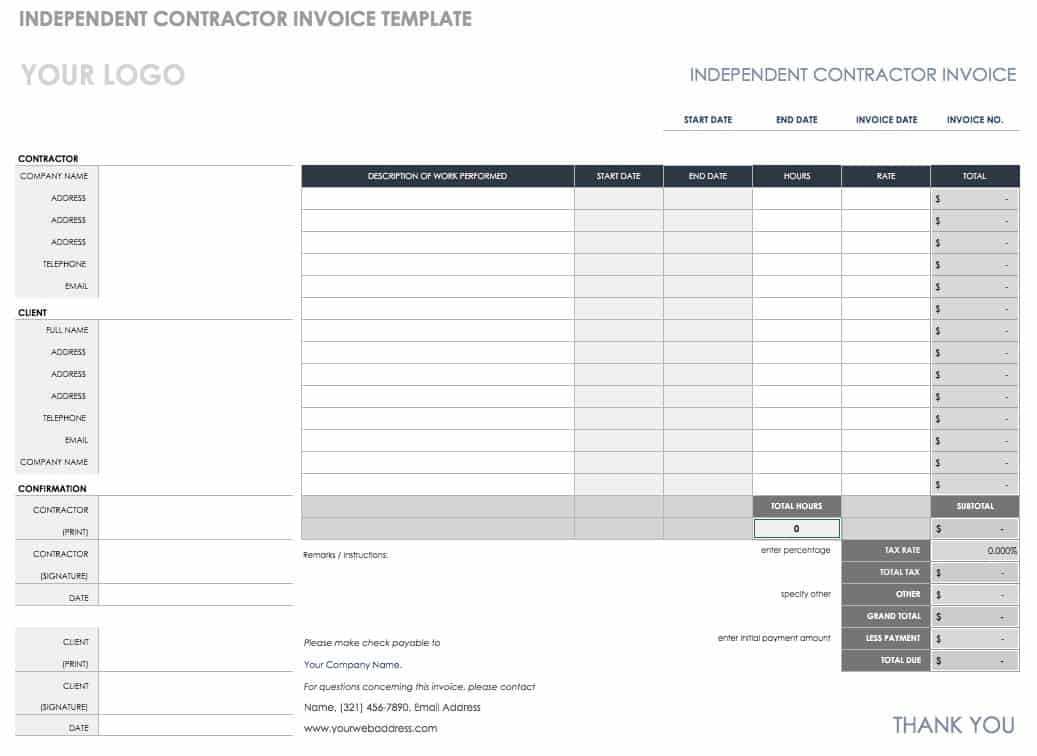

For freelancers, managing billing documents effectively is key to maintaining a steady cash flow and building professional client relationships. Implementing best practices in creating and sending these documents can help ensure timely payments and enhance overall credibility.

Be Clear and Specific

Detail each service provided, including descriptions and corresponding rates. Avoid vague terms; instead, clearly list tasks or deliverables to prevent misunderstandings. This clarity reassures clients and provides an accurate reference for future projects.

Set Defined Payment Terms

Establish and communicate payment deadlines and conditions upfront. Mention the due date and any potential fees for late payment, as well as accepted methods, such as bank transfer or online payment services. Clear terms help encourage prompt payment and reduce follow-up time.

Send Documents Promptly

Timely submission of billing documents reinforces your professionalism and increases the likelihood of swift payments. Aim to send them immediately upon project completion or by a specific recurring date if

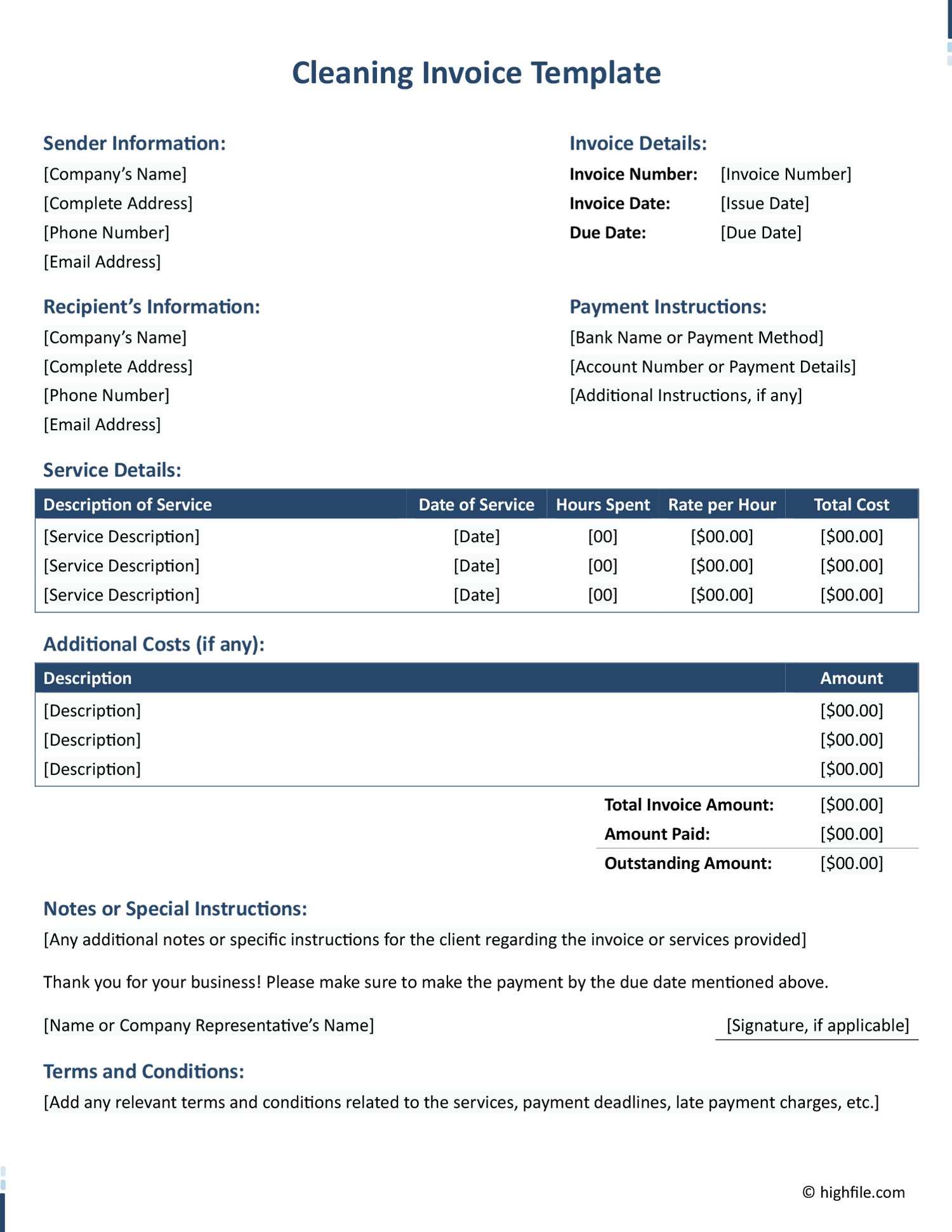

Invoice Templates for Small Businesses

Effective billing documents are essential for small businesses to maintain steady cash flow and establish trust with clients. By utilizing structured layouts, small business owners can streamline their payment processes and improve overall record-keeping. Different formats and details can suit various business needs, making it essential to select the right option for your operations.

Essential Elements for Small Business Billing

To create a document that is both clear and comprehensive, certain components are especially valuable. Here are some key items to consider:

Component Description Business Invoice Templates for Small Businesses

Effective billing documents are essential for small businesses to maintain steady cash flow and establish trust with clients. By utilizing structured layouts, small business owners can streamline their payment processes and improve overall record-keeping. Different formats and details can suit various business needs, making it essential to select the right option for your operations.

Essential Elements for Small Business Billing

To create a document that is both clear and comprehensive, certain components are especially valuable. Here are some key items to consider:

Component Description Business Information Includes the company name, address, contact details, and any applicable registration or tax ID numbers. This information helps verify the business’s credibility. Client Details Lists the client’s name, address, and contact information to ensure the document is directed to the correct person or department. Description of Services or Products Provides a detailed list of items or services rendered, including quantities, rates, and any applicable discounts. Total Amount Displays the final sum, incorporating any taxes, discounts, or other adjustments to the subtotal. Payment Instructions Specifies accepted payment methods, bank details, or online payment links to facilitate a smooth transaction. Choosing the Right Layout

Small businesses may benefit from flexible formats that can be customized to match their branding and meet client expectations. Selecting a straightforward, organized layout ensures clarity and helps build trust with clients through consistent, professional communication.

Can You Use a Template for Recurring Invoices?

For businesses with ongoing services or regular orders, re-using a consistent billing format can save time and simplify financial tracking. Creating a repeatable structure for these documents can help establish a smooth, predictable process for both clients and the business, reducing the time spent on administrative work.

Benefits of Using a Consistent Format for Recurring Billing

Adopting a standardized structure for regular billing has multiple advantages, especially for businesses with subscription-based or long-term service arrangements. Here are some key benefits:

Benefit Description Efficiency Streamlines the billing process by allowing for easy updates to dates and amounts, minimizing the time spent on administrative tasks. How to Personalize Your Invoice Template

Customizing your billing documents is an effective way to reinforce your brand identity and enhance professionalism. Adding unique elements helps ensure that clients can easily recognize your business, creating a more cohesive experience from service delivery to payment processing.

Adding Branding Elements

Incorporate your company’s logo, colors, and fonts to make your document stand out and reflect your brand. Choose colors that align with your business’s visual identity and include your logo at the top to ensure immediate brand recognition. Additionally, using a distinct font that remains clear and readable can give your documents a personalized touch.

Adjusting Layout for Specific Needs

To make your documents as effective as possible, consider arranging sections in a way that highlights key information, such as contact details, payment terms, and a summary of services. Organize these elements to prioritize clarity, ensuring clients can quickly review and understand the necessary informati

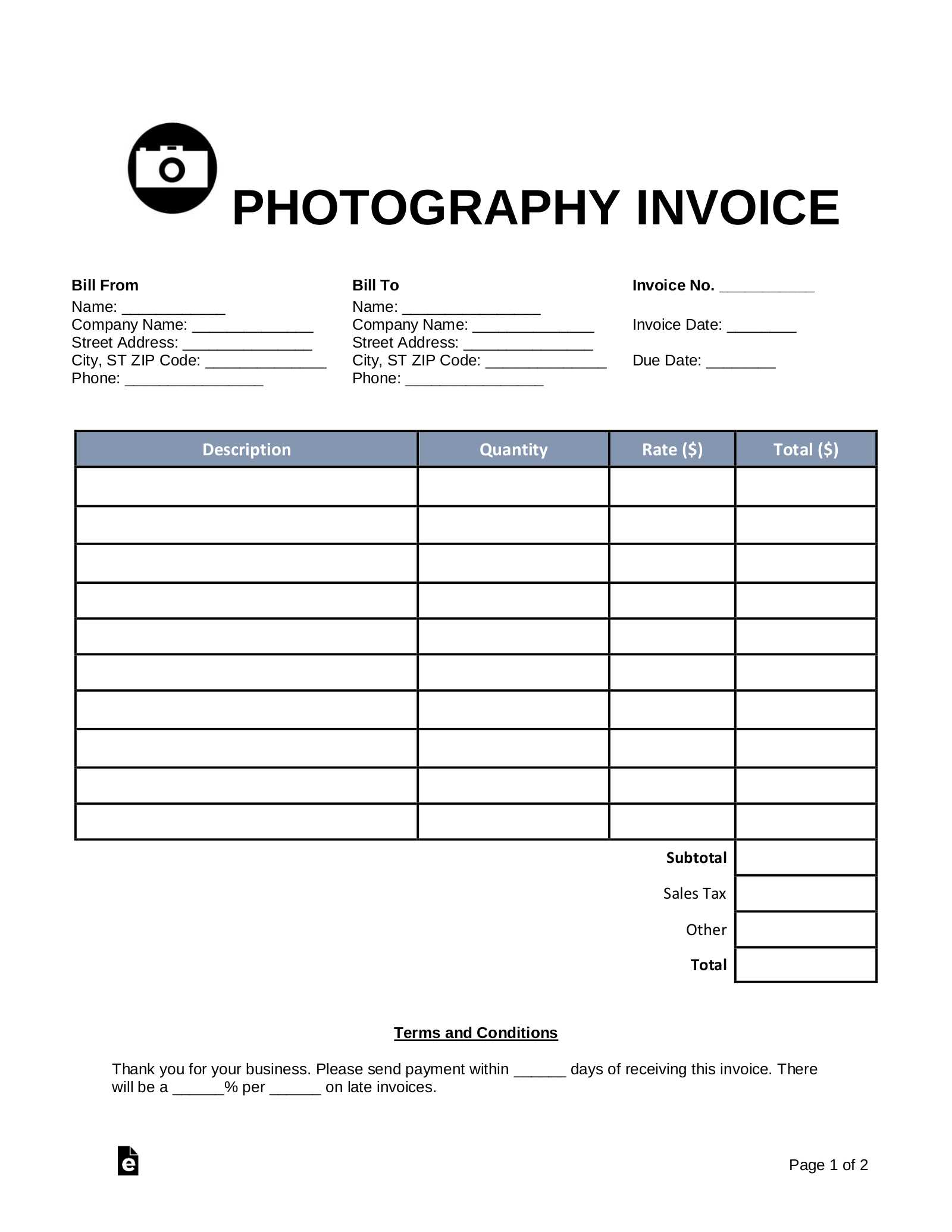

Top Invoice Templates for Different Industries

In various sectors, billing documents may require distinct layouts and details to meet specific industry standards. Tailoring your document to match industry expectations can simplify the process, ensure compliance, and provide a professional experience for your clients. Here are some of the most effective formats for different fields, each optimized for unique business needs.

Service-Based Businesses

For companies offering professional services, such as consulting, freelancing, or design work, clarity is key. A format that includes a detailed breakdown of services provided, hourly rates, and total hours worked helps clients understand exactly what they’re paying for. Organize line items clearly to ensure transparency, and include fields for additional notes to clarify project details or special instructions.

Product-Based Businesses

Retailers and manufacturers can benefit from a design that allows for comprehensive itemization of products. Fields should include product descriptions, quantities, unit prices, and totals for

How to Avoid Invoice Errors and Delays

Ensuring accuracy and timely processing of billing documents is crucial for smooth transactions and maintaining professional relationships. Even small errors can cause delays in payments, leading to frustration for both you and your clients. Here are some strategies to reduce mistakes and prevent holdups in the billing process.

Double-Check All Information

Always verify key details such as client names, payment amounts, and service descriptions. Mistakes in these areas are common but easily avoidable with a careful review. Additionally, ensure that the correct payment terms and due dates are clearly stated to prevent any confusion or misunderstandings.

Use Consistent Formats and Structures

Consistency in the way you present your documents can help minimize errors. Establishing a standardized format for all your billing documents ensures that you won’t miss any important information. Using a fixed structure also makes it easier for both you and your clients to quickly review and process the details.

By following these best practices, you can significantly reduce errors and delays, fostering positive client experiences and prompt payments.

How to Save Time with Templates

Utilizing pre-designed layouts for your financial documents can streamline the process, reduce repetitive tasks, and eliminate errors that come from starting from scratch each time. By using a structured design, you can quickly fill in the relevant information and focus on other aspects of your work. Here are a few ways to maximize efficiency using these tools.

Pre-fill Common Information

Many fields in your documents, such as business name, address, and contact details, remain the same for every transaction. With a pre-designed structure, you can save time by keeping this information already filled in. This minimizes the need for manual entry and ensures consistency across all documents.

Quick Adjustments and Customization

While a basic layout is already established, templates allow for easy adjustments and customization. For example, you can add or remove sections as needed for specific clients, services, or projects. This flexibility ensures that each document is tailored to meet the unique requirements of every transaction, without having to start over each time.

By saving time with these efficient structures, you can spend more of your energy on business growth and client relationships, rather than repetitive administrative tasks.