Top Independent Contractor Invoice Templates for Efficient Billing

For freelancers and self-employed professionals, managing payments efficiently is crucial to maintaining a successful business. One of the most important aspects of this process is creating clear, accurate documents to ensure timely compensation for services rendered. Having a structured system for billing not only promotes professionalism but also helps in avoiding misunderstandings with clients.

Designing a well-organized payment request is an essential skill. Whether you’re a designer, developer, consultant, or any other type of freelancer, using a consistent format for your billing can save time and improve your cash flow management. By using ready-made, customizable tools, you can streamline your workflow, reduce administrative burdens, and focus more on your work.

Effective invoicing goes beyond simply requesting payment–it’s about creating a document that reflects your professionalism, sets clear expectations for the client, and ensures you get paid promptly. Understanding how to craft a reliable payment request form will help you avoid common errors and build trust with your clients.

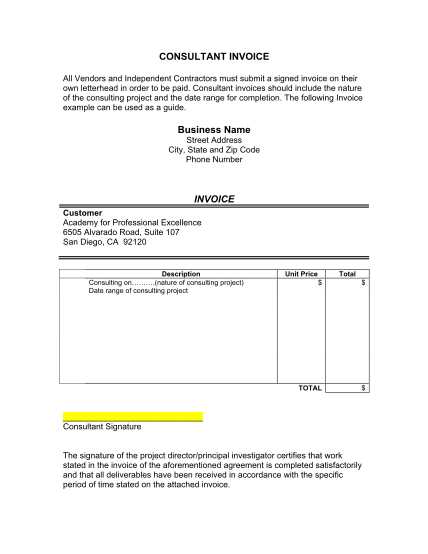

Independent Contractor Invoice Templates

When working as a freelancer or self-employed professional, having a structured and consistent way to request payment is essential. The process of billing clients should be simple, clear, and professional, ensuring both parties understand the terms and amounts involved. By utilizing pre-designed, customizable documents, you can streamline the payment process, save time, and reduce the chances of errors.

Why Use Customizable Billing Forms

Customizable billing documents allow you to tailor the content to fit your unique needs. Whether you’re providing a one-time service or recurring work, these documents help ensure all relevant details are included. With fields for service descriptions, payment terms, and client information, you can create a consistent format that reflects your professionalism and helps build trust with clients.

How Ready-Made Solutions Improve Efficiency

Ready-made billing forms are a powerful tool for freelancers who want to save time while maintaining a high level of organization. These solutions often come pre-filled with common sections, such as payment deadlines, itemized services, and tax calculations. By using such tools, you can quickly generate clear payment requests without reinventing the wheel each time. Additionally, these documents can be saved, edited, and reused for future projects, making them highly efficient for ongoing work.

Why You Need an Invoice Template

For freelancers and self-employed professionals, maintaining clear and accurate financial records is critical to ensure timely payments and avoid confusion with clients. One of the best ways to achieve this is by using a standardized document for all payment requests. This method not only streamlines your billing process but also guarantees that all necessary details are included and presented professionally every time you request compensation for your work.

Consistency and Professionalism

Using a standardized billing document provides consistency across all your transactions, helping to establish a professional image. A well-organized form shows your clients that you are serious about your business and ensures they know exactly what to expect when it comes to payment. It reflects your attention to detail and can foster trust with your clients.

Time and Effort Savings

Creating payment documents from scratch each time can be time-consuming and error-prone. By utilizing a pre-designed structure, you can focus on your core work while still providing your clients with a clear, itemized breakdown of services rendered. This not only saves you time but also reduces the chances of forgetting important details.

| Benefit | Description |

|---|---|

| Consistency | Using a standard format ensures all required information is included every time. |

| Time-Saving | Pre-designed documents allow quick and easy generation of billing forms. |

| Professionalism | A polished, uniform format boosts your credibility and enhances client relations. |

How to Create a Billing Document for Freelancers

Creating a professional payment request is an essential step for freelancers and self-employed professionals to ensure they get paid on time. A clear, well-organized document not only makes the payment process smoother but also helps in keeping accurate financial records. Whether you’re working on a one-time project or offering ongoing services, having a standard approach to generating these forms is key to maintaining professionalism and consistency.

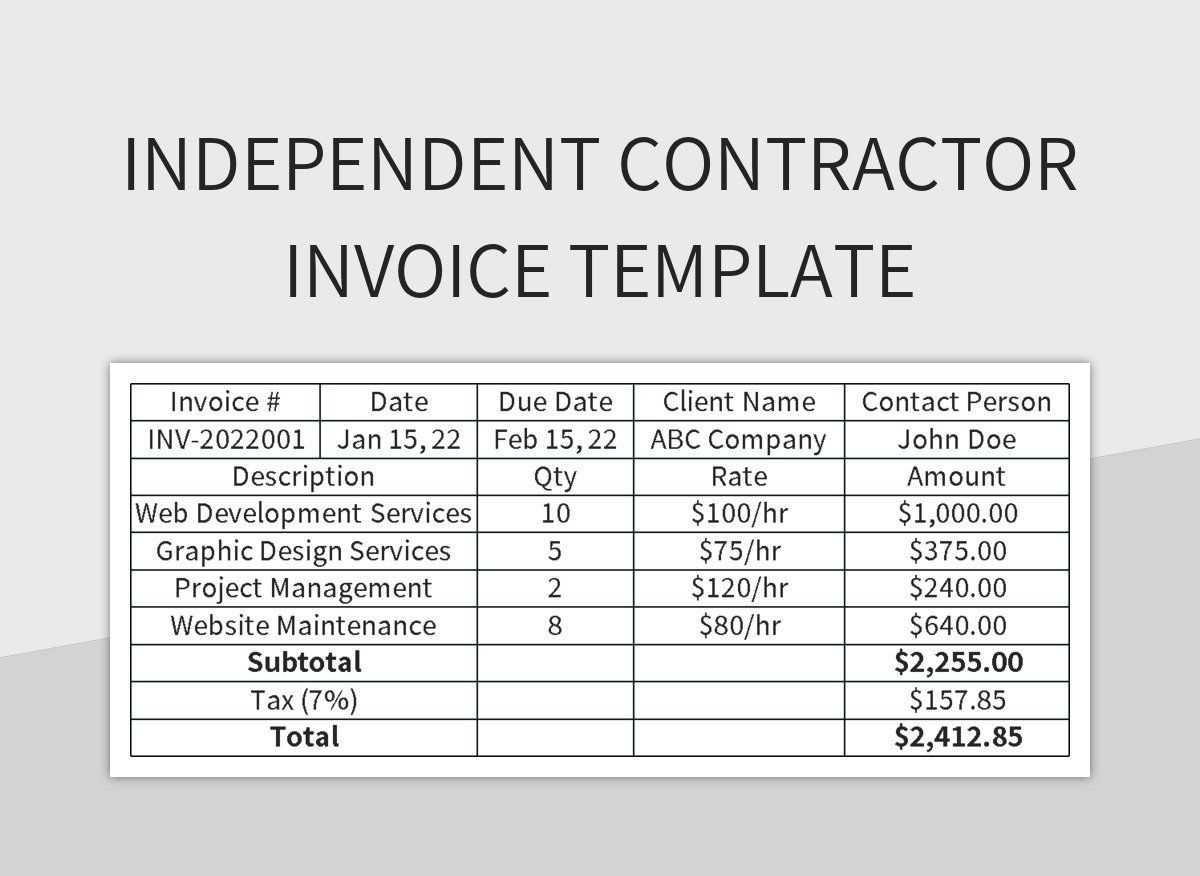

To create a comprehensive payment request, you’ll need to include several key components that ensure both you and your client understand the terms of the transaction. Start by clearly identifying the document with your name or business name, as well as the client’s details. Include a description of the services provided, the agreed-upon rates, and the total amount due. Don’t forget to specify the payment terms, such as deadlines and accepted payment methods.

Once these essential elements are in place, review the document for clarity and accuracy. A clean, error-free payment request helps build trust with clients and reduces the likelihood of payment delays or disputes. With the right structure, you can create a payment document that looks professional and is easy for clients to process quickly.

Key Elements of a Billing Document

When creating a payment request, certain elements must be included to ensure that both you and your client are clear on the terms and details of the transaction. A well-structured document provides a professional appearance, helps prevent disputes, and accelerates the payment process. Each section of the document plays a vital role in delivering all necessary information in an easy-to-understand format.

Essential Information to Include

At a minimum, your document should contain your name or business name, along with your client’s details. Clearly list the services rendered, along with the dates they were provided, and provide a breakdown of costs for each task or hour worked. It’s crucial to include payment terms such as the total amount due, the deadline for payment, and acceptable payment methods (e.g., bank transfer, credit card, etc.).

Additional Optional Sections

While the basic details are essential, there are additional sections that can enhance the clarity of your billing form. These may include late payment fees, discounts, or taxes if applicable. Including a unique reference number can also help with record-keeping and client organization. The more organized and detailed your document, the easier it will be for clients to process and make payments without delays.

Choosing the Right Document for Your Business

Selecting the right payment request form is crucial for freelancers and small business owners who want to maintain a professional appearance while ensuring accuracy and efficiency in their billing process. The ideal format should align with the type of work you do, the frequency of your projects, and the specific needs of your clients. A good document not only helps you get paid promptly but also builds trust and credibility with your clients.

When choosing a billing format, consider factors such as the complexity of your services, the payment terms you usually offer, and whether you need to itemize your work in detail. If your projects are short-term and straightforward, a simple, no-frills layout may suffice. However, if you often work on long-term or multi-phase projects, a more detailed form with sections for milestones, deadlines, and payment schedules might be more appropriate. Your choice of format should ensure that all the necessary details are clear and easy to follow, reducing the chances of misunderstandings or late payments.

Free vs Paid Billing Documents

When deciding how to manage your payment requests, one of the key choices you’ll face is whether to use a free or a paid document format. Both options come with their own set of benefits and limitations, and the right choice depends on your specific needs as a freelancer or small business owner. Understanding the differences between free and paid solutions can help you decide which will offer the best value for your business.

Free billing forms are often simple and easy to access, making them an appealing option for those just starting out or those with minimal billing needs. However, they may come with limitations, such as fewer customization options or a lack of advanced features. Paid versions, on the other hand, offer more advanced capabilities, but they usually come with a price tag.

Advantages of Free Options

- Cost-effective: No financial commitment required, ideal for those starting out.

- Simple to Use: Many free formats are user-friendly and quick to fill out.

- Basic Features: Enough for freelancers with straightforward payment requests.

Advantages of Paid Options

- More Customization: Allows you to tailor documents to fit your specific needs and branding.

- Advanced Features: Some paid options include automated calculations, tracking, and integrated payment gateways.

- Customer Support: Many paid services offer customer service, which can be helpful if you run into issues.

Ultimately, the choice between free and paid formats depends on your business size, the complexity of your services, and how much time you’re willing to invest in managing your billing process. If you have a simple operation with minimal invoicing needs, a free option may suffice. But if you deal with large projects or require more advanced features, paying for a premium document system could save you time and enhance your professionalism.

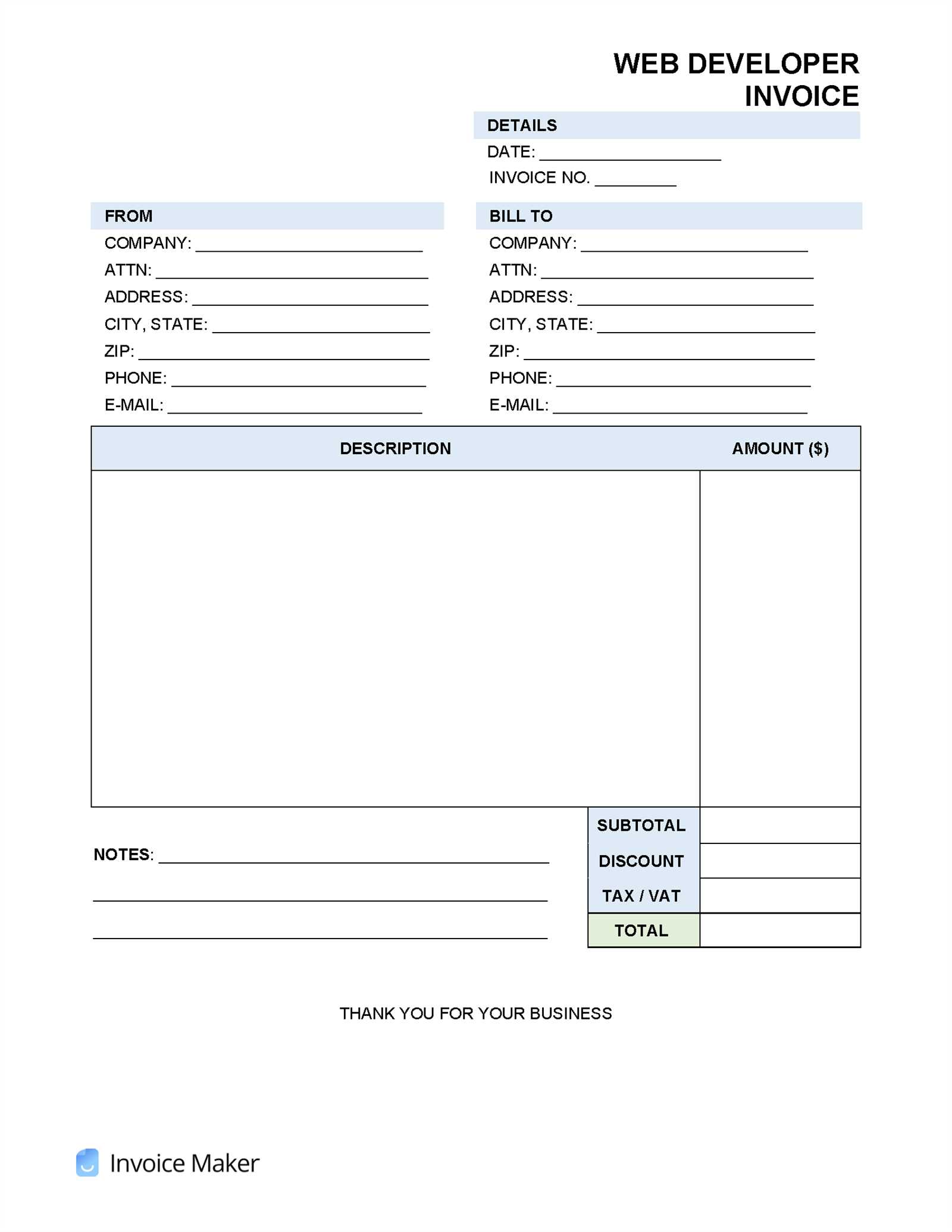

How to Customize Your Billing Document

Personalizing your payment request form is a key step in ensuring that it aligns with your brand and meets your specific business needs. Customization allows you to create a more professional and consistent experience for your clients, while also making the document easier to use for your specific services. Whether you’re adjusting the layout, adding your logo, or including additional fields, a customized billing document can reflect your unique style and streamline your workflow.

Basic Customizations to Consider

Start by adding your business name, logo, and contact details at the top of the document. This not only gives the form a personalized touch but also makes it easier for clients to get in touch with you. Next, adjust the layout to include fields relevant to your services, such as task descriptions, quantities, rates, and any applicable taxes. You might also want to include a unique reference number or a section for special notes that can provide additional context for the payment.

Advanced Customization Options

If you’re looking for more advanced customization, consider adding features like automatic calculations, a professional color scheme, or pre-set payment terms. Many paid document generation services offer these types of advanced features, making the process even more efficient and polished. Some tools allow you to set up recurring billing for clients with ongoing projects, while others can track payments and send reminders automatically. Tailoring these features to your business can save you valuable time and enhance your overall client experience.

Common Mistakes in Billing Documents

When creating a payment request, it’s easy to overlook some key details or make mistakes that can lead to delays or misunderstandings with clients. Even small errors in your billing document can affect your cash flow and damage professional relationships. Identifying and avoiding common pitfalls will ensure your payment requests are clear, professional, and processed without issues.

Frequent Errors to Watch For

One of the most common mistakes is failing to include the correct payment terms. Without clear terms, clients may not know when payments are due or what payment methods are acceptable. Another mistake is not itemizing services properly. If the client cannot easily see what they are being charged for, it may cause confusion or disputes. Additionally, forgetting to include contact information or a reference number can make it difficult for the client to process the payment correctly.

Other Common Mistakes

Some other frequent errors include incorrect calculations, missing tax details, or not having a clear description of the work completed. A poorly formatted document can also lead to mistakes, making it harder for the client to understand the charges or causing delays in processing the payment.

| Common Mistake | Impact |

|---|---|

| Missing Payment Terms | Delays in payment or confusion over due dates |

| Incorrect Calculations | Potential disputes or underpayment |

| Unclear Service Descriptions | Confusion, leading to payment disputes |

| Lack of Contact Information | Difficulty in processing payment or communication delays |

By avoiding these common mistakes and ensuring your payment requests are accurate, clear, and professional, you can help foster better client relationships and ensure timely compensation for your work.

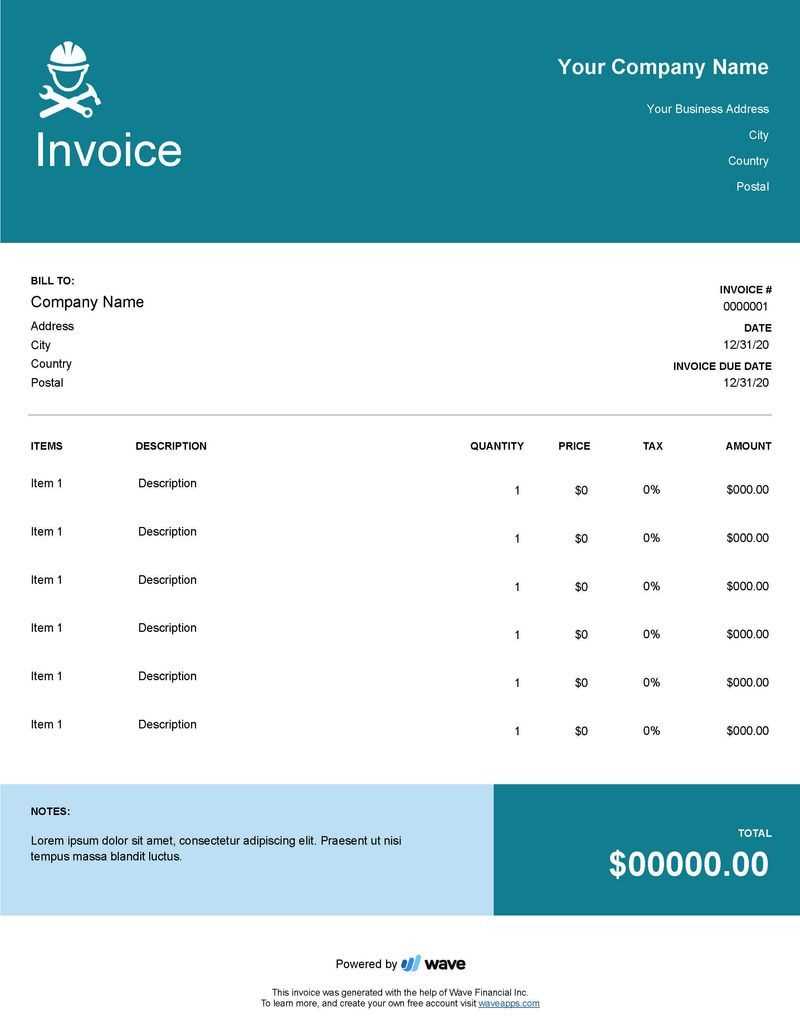

Best Tools for Generating Billing Documents

For freelancers and small business owners, using the right software or platform to create payment requests can save significant time and effort. The right tool can help you streamline your billing process, reduce errors, and ensure that your documents look professional every time. From simple document generators to more advanced systems with automated features, there are many options available to fit different needs and budgets.

Some tools offer basic functionality, allowing you to create and download a payment request quickly. Others provide more advanced features, such as recurring billing, payment tracking, and integration with accounting software. These features can be invaluable for businesses with ongoing projects or a large number of clients. Below are some of the best tools for generating professional, customizable billing documents.

Popular Tools for Freelancers

1. FreshBooks: This cloud-based tool offers a simple and intuitive way to create professional documents, track payments, and manage finances. It also includes options for time tracking and expense management, making it ideal for freelancers with a variety of needs.

2. QuickBooks: QuickBooks is a widely used accounting software that allows users to create detailed billing forms, track payments, and manage financial data. It’s perfect for those who want a more comprehensive solution for their business.

Free and Simple Options

3. Wave: Wave offers a free, easy-to-use solution for creating billing forms. With basic features like customizable fields, recurring billing, and payment tracking, it’s an excellent choice for those just starting out or with simple billing needs.

4. Invoice Generator: This free online tool allows users to quickly create and download a clean, professional payment request. It’s great for one-time projects or freelancers who need a fast, straightforward solution.

Choosing the right tool depends on the complexity of your business and the level of detail you need in your documents. Whether you choose a simple, free tool or a more feature-rich paid option, the right software can make your billing process smoother and more efficient.

Understanding Payment Terms for Billing Documents

When creating a payment request, it’s crucial to include clear and concise payment terms. These terms define the rules and expectations around how and when the client should settle the amount due. Properly stated payment terms can help ensure timely payments, prevent confusion, and establish professional standards between you and your client. Without clear terms, misunderstandings may arise, leading to delayed payments or disputes.

Common Payment Terms to Include

1. Due Date: This is the date by which the payment should be received. It’s important to specify whether the payment is due immediately upon receipt or within a certain period (e.g., 30 days). This gives the client clear expectations regarding when they need to make the payment.

2. Late Fees: If you plan to charge late fees for overdue payments, be sure to specify the amount or percentage that will be applied after the due date. This encourages timely payments and protects you from cash flow issues.

Understanding Payment Methods

Another important aspect of payment terms is specifying acceptable payment methods. Whether you accept bank transfers, checks, credit card payments, or online payment platforms, clearly listing the available options helps avoid confusion. Additionally, you may want to include any necessary account details or payment instructions to ensure the client can easily pay you.

By outlining these essential details in your payment request, you help establish professional boundaries and reduce the likelihood of payment-related issues. Clear terms ensure that both parties are on the same page, leading to smoother transactions and better client relationships.

Legal Considerations for Billing Documents

When creating a payment request, it’s important to understand the legal implications that come with it. These documents serve not only as a tool to request compensation but also as a formal record of the transaction between you and your client. Properly drafted billing documents can protect both parties in case of disputes, clarify terms, and ensure that payments are handled according to agreed-upon rules. Failing to include necessary legal elements can lead to misunderstandings or issues down the line.

Essential Legal Elements to Include

1. Clear Payment Terms: As mentioned previously, specifying clear payment terms is crucial. These terms should define the payment due date, acceptable methods of payment, and any penalties for late payment. It’s essential to outline these details to avoid ambiguity and ensure that both parties are aware of their responsibilities.

2. Jurisdiction and Governing Law: In case of a legal dispute, it’s beneficial to state the jurisdiction or region in which any legal matters will be handled. This ensures that both parties are aware of where potential legal proceedings would take place. Additionally, you may want to specify the governing law that applies to the agreement, helping clarify how legal disputes will be resolved.

Protecting Yourself with Detailed Descriptions

Another important consideration is providing a detailed breakdown of the services rendered. A clear, itemized list protects both you and your client by ensuring that both parties have a clear understanding of the work completed and the corresponding charges. This can serve as evidence in case of disputes, showing that the payment request aligns with the terms of the agreement.

By taking these legal factors into account when creating your payment documents, you help safeguard your business from potential issues. Proper documentation can ensure that your payment requests are legally sound, reducing the risk of misunderstandings and ensuring timely payments.

How to Organize Your Billing Records

Maintaining a well-organized system for tracking payment requests is essential for any business. It ensures that you can easily access past records, monitor outstanding payments, and stay on top of your financial status. A good organization system not only helps you keep track of what you’ve earned but also ensures that your records are ready for tax season or any potential audits. Whether you’re using software or a manual system, having a structured approach is key to efficient management.

The first step in organizing your billing records is to establish a consistent method for naming and storing each document. You should keep track of payment dates, amounts, and client details in a clear, structured way. This will help you quickly find the information you need and ensure that nothing is overlooked. There are several tools and techniques available for managing your records, ranging from digital file management systems to physical filing cabinets.

Organizing Your Records with a Table

One simple way to keep track of your records is by using a table that logs all relevant information for each transaction. This table should include key data such as the client name, the amount due, the due date, and whether the payment has been received. Here’s an example of how you might structure this table:

| Client Name | Amount Due | Due Date | Status |

|---|---|---|---|

| Client A | $500 | 2024-11-30 | Paid |

| Client B | $1,200 | 2024-12-15 | Pending |

| Client C | $750 | 2024-11-25 | Paid |

By using a table like this, you can easily track which payments are still outstanding and which have been successfully processed. Additionally, you can refer back to this table for any future reference, whether it’s for preparing your taxes or resolving any client issues.

Whether you choose to use a digital solution or a manual system, organizing your records is an important step in maintaining an efficient and professional billing process. A solid organization system not only helps with record-keeping but also ensures timely payments and keeps your business running smoothly.

Using Billing Documents for Tax Purposes

Properly managing payment requests is essential not only for maintaining professional relationships with clients but also for staying compliant with tax regulations. These documents serve as proof of income and can be used to calculate taxes owed, track deductions, and provide a clear record of business transactions. Ensuring that your payment requests are accurate and organized can help streamline the process when it comes time to file taxes.

When preparing for tax season, your billing records will be essential in reporting your earnings. These records provide a comprehensive overview of your income over the course of the year, allowing you to calculate the total amount earned from clients. Additionally, if you’re eligible for deductions, such as expenses for materials, travel, or business-related services, having detailed and well-organized records will make it easier to track these expenses and maximize your tax savings.

How Billing Documents Help With Tax Reporting

Each payment request acts as a record of a transaction, showing the amount billed, the client’s details, and the services provided. This information can be used to create an accurate report of your total income for the year. A well-structured payment record can also help if you ever need to provide documentation in case of an audit.

Using Documents to Track Business Expenses

In addition to income, these documents can also help you track expenses related to running your business. If your payment requests include itemized services or materials costs, this information can be used to verify deductions. For instance, if you need to claim the cost of tools or software used in your work, having these details on hand makes it easier to substantiate your claims.

| Document Type | Tax Use |

|---|---|

| Payment Request | Proof of income, total earnings |

| Itemized List of Services | Helps with reporting deductible expenses |

| Client Information | Used for verifying business transactions and payments |

By keeping a thorough record of your business transactions, including all payment requests and supporting details, you can ensure that you’re well-prepared for tax season. Proper organization will make the filing process smoother and can help avoid potential issues with tax authorities.

Time-Saving Tips for Billing Management

Managing payment requests efficiently is crucial for maintaining smooth business operations. The process of creating, tracking, and following up on these documents can be time-consuming, especially when done manually. However, with the right strategies and tools, you can streamline the entire process, saving valuable time while ensuring that your payment management system remains organized and effective. Below are some practical tips to help you manage your billing tasks more efficiently.

1. Automate Repetitive Tasks

Automation is one of the most effective ways to save time when managing billing documents. Many accounting platforms and tools allow you to automate recurring payments, reminders, and even document generation. By setting up recurring billing cycles and automatic payment reminders, you eliminate the need for manual follow-ups, ensuring that clients are always aware of upcoming payments. Automation also helps reduce the risk of human error and ensures consistency across your records.

2. Use Pre-Formatted Documents

Pre-designed forms can save a lot of time compared to creating new documents from scratch. Many online platforms offer customizable forms that allow you to add your details, adjust payment terms, and insert client information with just a few clicks. With the right setup, you can create professional-looking billing documents in minutes, rather than spending hours formatting each one manually.

3. Implement a Centralized System

Using a centralized document management system can drastically reduce the time spent looking for specific billing records. Whether it’s a cloud-based solution or a local software system, having all your billing documents stored in one accessible place makes it easier to track and manage them. You can quickly search for past documents, monitor payment statuses, and keep everything organized without having to sift through a cluttered file system.

4. Integrate with Accounting Software

Accounting software integration can be a game-changer when it comes to managing payment requests. By syncing your billing system with your accounting software, you can automatically update financial records, track payments, and generate reports. This integration ensures that everything is up to date without the need for double entry, saving you time and reducing the likelihood of mistakes.

5. Set Clear Payment Terms

Setting clear and consistent payment terms from the beginning helps avoid confusion and reduces the need for constant follow-ups. Make sure your terms are easy to understand and include payment due dates, accepted methods, and any late fees or penalties. By clearly outlining these expectations, you reduce the back-and-forth with clients and make the payment process more straightforward.

By adopting these time-saving strategies, you can significantly streamline your billing management process, freeing up time to focus on other aspects of your business. Efficiency in managing these documents not only improves cash flow but also enhances your professional image, making it easier to maintain good relationships with your clients.

How to Handle Late Payments

Dealing with overdue payments is a common challenge in business, and having a clear strategy to address it can help maintain your cash flow and professional relationships. Late payments can happen for a variety of reasons, but it’s important to handle them efficiently and professionally. A structured approach ensures that clients understand their obligations and that you can take the appropriate steps to follow up while minimizing disruption to your business.

1. Send Friendly Reminders

Often, late payments are simply a result of forgetfulness or miscommunication. It’s essential to first send a polite reminder to the client once the payment is overdue. A gentle follow-up email or call can resolve the issue without causing any tension. Be sure to include details of the due amount, the original payment date, and any agreed-upon terms. This reminder can act as a courteous nudge that prompts the client to take action.

2. Apply Late Fees or Penalties

If reminders don’t work, consider enforcing the terms outlined in your payment agreements. Many businesses include late fees or penalties for overdue payments. Charging a small fee after the due date can act as an incentive for clients to pay on time in the future. If you choose this route, ensure that the late fees were clearly communicated at the start of the business relationship and are mentioned in the agreement.

| Action | Recommended Timeline |

|---|---|

| First Reminder | 1-3 days after due date |

| Second Reminder with Late Fees | 7-10 days after due date |

| Final Notice Before Legal Action | 15-30 days after due date |

3. Offer Payment Plans

In some cases, clients may have difficulty paying the full amount at once. If this is the case, consider offering a payment plan or partial payment option. Providing this flexibility can help maintain a positive business relationship while ensuring you eventually receive payment. Be sure to outline the new terms in writing and set a clear schedule for when payments should be made.

By establishing a clear procedure for handling late payments, you can reduce the impact on your business. Setting expectations upfront, sending timely reminders, and using late fees when appropriate are all effective strategies to encourage on-time payments while preserving professionalism i

Benefits of Professional Billing Documents

Creating well-structured and professional payment requests is essential for businesses that aim to maintain a clear and efficient financial system. A professionally designed document not only reflects positively on your business but also helps establish trust with clients, ensuring that the payment process is smooth and transparent. By using high-quality, organized billing records, you can avoid confusion and foster strong, long-term client relationships.

One of the key advantages of professional payment requests is that they convey reliability and seriousness. When clients see a polished, consistent format, it signals that your business is organized and trustworthy. This impression can lead to quicker payments, as clients feel confident that their transactions will be handled efficiently and professionally.

Improved Client Relationships

Professional billing documents help set clear expectations from the beginning. When clients receive an itemized and clearly written payment request, they understand the work done, the amount due, and the due date. This transparency fosters trust and minimizes misunderstandings, which can often lead to payment delays or disputes. When clients can easily understand what they’re paying for, they’re more likely to follow through with timely payments.

Better Financial Management

Another benefit of using professional payment requests is that they simplify your financial tracking. With clear records of each transaction, you can easily monitor outstanding payments, track income, and prepare accurate financial reports. This is particularly helpful during tax season or when you need to assess your business’s financial health. Organized and professional billing records allow for more efficient bookkeeping, reducing the risk of errors and improving overall financial management.

In addition to these advantages, professional billing records also help with legal matters, should any arise. A well-documented transaction can serve as evidence in case of disputes, offering clear proof of the work completed and the agreed-upon terms. This can be especially important in protecting your business interests and avoiding legal complications.

In summary, using professional payment requests not only boosts your business’s credibility but also streamlines financial operations, improves client relations, and helps safeguard your business from potential disputes. A small investment in quality documentation can have significant long-term benefits for both your operations and reputation.