Independent Consultant Invoice Template for Easy Billing

For professionals working on a project-by-project basis, creating accurate and professional payment requests is a critical aspect of maintaining financial organization. Without the right tools, managing payments can become a tedious and time-consuming task. A well-structured document not only ensures prompt payments but also reinforces your professionalism with clients.

Designing a structured payment request form can save time and avoid confusion. It allows you to clearly present services rendered, the amount due, and the agreed-upon terms, which minimizes misunderstandings with clients. By using a clear and consistent format, you improve your chances of getting paid on time and reduce the need for follow-up communications.

With the right approach, you can easily tailor these documents to your specific needs, whether you’re handling small one-time projects or long-term collaborations. Streamlining this process will help you focus more on your work and less on administrative tasks.

Freelancer Payment Request Guide

For those working in a freelance capacity, creating a professional document to request payment is essential. This document helps ensure that both the service provider and the client are on the same page regarding the details of the work completed and the agreed-upon fees. A well-crafted payment request form not only serves as a formal agreement but also ensures smooth transactions, reducing the chances of misunderstandings.

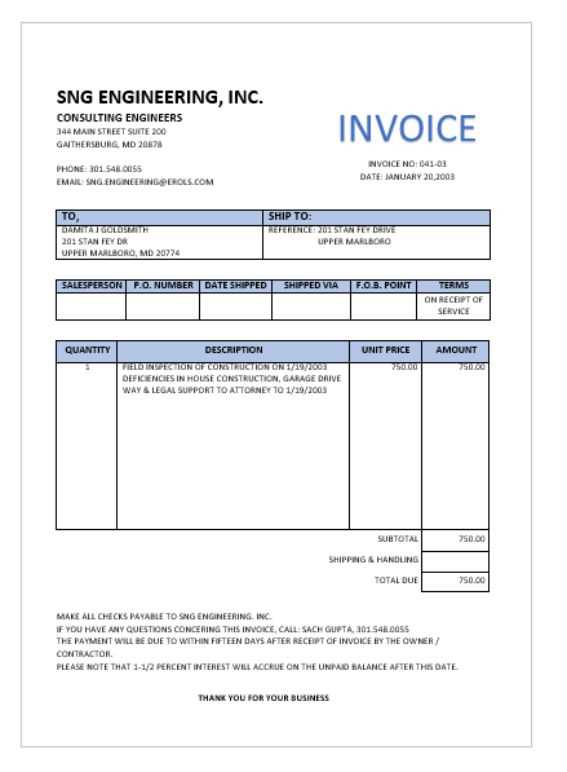

Designing a clear and effective payment request requires a few key elements. First, it should include basic information such as your name or business name, contact details, and the client’s information. It’s also essential to list the services provided, the amount due, and any applicable taxes. Setting clear payment terms, including the due date, is crucial for timely compensation.

By using a standard format that both you and your clients can rely on, you ensure that every billing process is efficient and professional. This approach not only helps in securing timely payments but also improves client trust and satisfaction.

Why You Need a Payment Request Document

When working on a freelance basis, maintaining a clear and consistent method for requesting payment is vital for financial stability. Without a structured approach, there’s a risk of missing important details or confusing clients about the amount due. A standardized document ensures both parties are aligned and that your request is professional and easy to understand.

Streamlining the Payment Process

Using a pre-designed form to request payment simplifies the entire process. It helps you save time by eliminating the need to create a new document for each client or project. With consistent formatting, clients can easily recognize the information they need, which can lead to quicker payments and fewer follow-up reminders.

Enhancing Professionalism

Presenting clients with a clear and polished payment request reinforces your credibility as a professional. By providing well-organized details such as your contact information, services rendered, and the payment due, you convey that you take your work seriously. This attention to detail can also help build stronger, long-term relationships with clients.

How to Create Your Own Payment Request

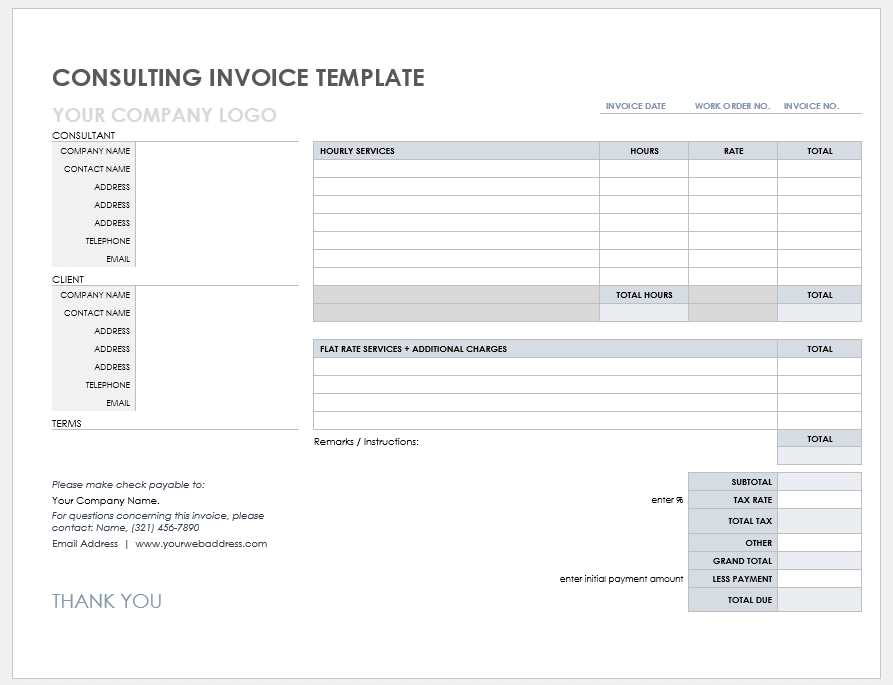

Creating your own payment request document is an essential skill for anyone working on a freelance basis. By designing your own form, you gain full control over the structure and content, ensuring that it fits your specific needs and professional style. While there are many pre-made options available, customizing your own allows for more flexibility and personalization in how you present your services.

Start with basic contact information. Include your name or business name, address, email, and phone number. Then, provide your client’s details to ensure there is no confusion about who is receiving the payment request. Make sure that both parties can easily reach each other if needed.

Next, list the services provided with clear descriptions and the corresponding charges. Be specific about the work done, whether it’s hourly or project-based, to avoid any misunderstandings. Clearly state the total amount due and any applicable taxes or discounts. Finally, include your payment terms, such as the due date and acceptable methods of payment. This information ensures the process is straightforward and professional.

Essential Elements of a Payment Request

For any payment request document to be effective, it must contain certain key details that make it clear, accurate, and professional. These elements ensure that the recipient understands exactly what is being requested, why, and by when. A well-organized request helps prevent confusion and accelerates the payment process.

Basic Contact Information

Always include your contact details as well as the client’s. This allows both parties to reach each other easily in case of any questions. Your name or business name, address, email, and phone number should be clearly visible at the top of the document, followed by the client’s corresponding information.

Details of the Work and Charges

Clearly itemize the services provided, including descriptions of each task and the corresponding rates. Whether you charge hourly, per project, or by another method, ensure that your charges are transparent. Be specific about the dates of service and any additional fees, such as taxes or expenses. This helps the client understand exactly what they are paying for and avoids any disputes down the line.

Choosing the Right Document Format for You

Selecting the right structure for your payment request is essential to ensure that it fits your needs, style, and business type. The format you choose should align with how you work and the level of professionalism you want to convey to your clients. A well-chosen format makes the process of creating and sending payment requests easier and more efficient.

Factors to Consider

When deciding on the most suitable format, consider the following:

- Type of work you do: If you handle multiple small projects, a simple layout may be sufficient. For larger, more complex tasks, a detailed, itemized structure might be necessary.

- Client preferences: Some clients may prefer a minimalist, straightforward format, while others might appreciate a more formal and comprehensive one.

- Branding: Your document should reflect your brand image. Customize the format to include your logo, colors, and any other elements that reinforce your business identity.

Where to Find the Right Format

There are various sources for finding a structure that works for you. Some options include:

- Online platforms: Many websites offer free or paid formats that can be customized to suit your needs.

- Software tools: Word processors and spreadsheet applications often have built-in formats that can be adjusted for different work styles.

- Creating your own: If you prefer full control, consider designing your own structure from scratch to ensure it matches your preferences and workflow.

By choosing the right structure, you’ll streamline your billing process and maintain a professional approach with every client.

Customizing Your Payment Request Document

Personalizing your payment request document is an important step in ensuring it reflects your unique business style and meets the needs of each client. By customizing the layout and content, you can enhance the professionalism of your documents and make them more aligned with your branding. Tailoring the document to your preferences also allows you to include specific information that may be unique to your type of work or business practices.

Here are some key elements you can customize:

| Section | Description | Customization Options |

|---|---|---|

| Header | Top portion containing your business details | Include your logo, business name, and contact information. Adjust fonts and colors to match your branding. |

| Itemized List of Services | Details of work done and charges | Customize descriptions of services, include hourly or project rates, and specify any discounts or additional fees. |

| Payment Terms | Conditions related to the payment process | Set payment due dates, specify late fees, and include accepted payment methods (e.g., bank transfer, credit card). |

| Footer | Additional information or thank-you note | Add a message of appreciation for the client’s business or any relevant legal disclaimers. |

By making these customizations, you not only enhance your document’s look but also create a clearer and more client-friendly experience. Personalization increases the likelihood of timely payments and reinforces your professional image with each client interaction.

Best Practices for Payment Request Formatting

When creating a document to request payment, how it is structured plays a crucial role in ensuring clarity and professionalism. Proper formatting not only makes it easier for your clients to understand the charges but also reflects your attention to detail and helps streamline the payment process. Following a few simple best practices can significantly improve the effectiveness of your document.

Key Elements to Focus On

Here are a few things to keep in mind when formatting your document:

- Consistency: Use a consistent font style and size throughout the document. This helps maintain a professional look and makes the content easy to read.

- Clarity: Ensure that each section is clearly labeled, with spaces between different parts of the document to avoid confusion. Sections such as the itemized list, payment terms, and client details should be easy to distinguish.

- Alignment: Make sure that your text and numbers are aligned correctly, especially when displaying amounts due. Align numerical values to the right for easier reading.

- Simplicity: Keep the design simple and clean. Avoid overly complex formatting that might distract from the key information.

Additional Tips for Professional Appearance

Consider these extra tips to enhance the appearance of your payment request:

- Use clear headings: Clearly defined headers such as “Service Details,” “Payment Due,” and “Client Information” help guide the reader through the document.

- Incorporate your branding: Adding your logo and using brand colors can help reinforce your business identity and make your request stand out.

- Ensure responsiveness: If you’re sending your document electronically, make sure it looks good on all devices. Keep file sizes reasonable and test the format before sending it out.

By following these formatting practices, you ensure that your payment requests are not only professional but also easy to understand, helping you get paid on time and maintain positive relationships with your clients.

How to Add Taxes to Your Payment Request

Including taxes in your payment request is an important step to ensure that you are compensated for the full amount of your services, in accordance with local regulations. Depending on where you operate and the type of work you do, taxes may be mandatory, and it’s essential to present them clearly to avoid any confusion with your clients.

First, determine the applicable tax rate for your business. This will depend on the location of your business and the client, as tax rates can vary by region and the type of service provided. Research local tax laws or consult with a tax professional to ensure you apply the correct percentage. Common tax types include sales tax, VAT (Value Added Tax), or GST (Goods and Services Tax), among others.

Next, calculate the tax amount based on the total amount due for the services rendered. For example, if the total is $1,000 and the tax rate is 10%, you will add $100 to the final amount. Make sure to include this amount in a separate line on your payment request to clearly distinguish it from the base amount.

Here’s an example of how to present taxes clearly:

| Description | Amount |

|---|---|

| Service Fee | $1,000 |

| Tax (10%) | $100 |

| Total Due | $1,100 |

By breaking down the tax amount and clearly showing the total, you help your clients understand the full cost and avoid any confusion when making the payment. Always ensure that the tax is calculated accurately and that it aligns with the requirements for your region or industry.

Setting Payment Terms and Due Dates

Establishing clear payment terms and due dates is essential for ensuring timely compensation and avoiding misunderstandings. By specifying when and how you expect to be paid, you set the right expectations for your clients and create a formal structure for financial transactions. Properly communicating these terms also helps build trust and professionalism in your business relationships.

Defining Payment Terms

Payment terms outline the rules and conditions under which payment is expected. Common terms include:

- Net 30: Payment is due 30 days from the date of the document.

- Net 15: Payment is due 15 days after the document date.

- Due on Receipt: Payment is expected as soon as the request is received.

- Installments: Payment is made in multiple installments, with the schedule defined upfront.

Clearly state the payment terms to avoid confusion and to ensure that both you and the client are aligned on expectations. It’s also a good idea to specify acceptable payment methods, such as bank transfer, credit card, or PayPal, to make the payment process as smooth as possible.

Setting a Due Date

Due dates specify the exact date by which the payment should be completed. It’s important to give your clients enough time to process the payment, but not so much that it delays your own cash flow. Consider factors like project complexity, client relationship, and industry standards when setting the due date.

If you’re working on a larger project, it might be useful to break the payment into milestones or phases, with each payment due upon the completion of specific tasks. This keeps the process transparent and provides assurance to both parties.

By defining payment terms and due dates clearly, you create a professional and organized approach to managing your financial transactions, which ultimately leads to faster and more reliable payments.

Tracking Payments and Late Fees

Tracking payments and enforcing late fees is an important part of managing your financial flow. Keeping a record of when payments are made, and whether they are on time, helps maintain your cash flow and ensures that clients are held accountable for agreed-upon terms. Additionally, late fees can serve as an incentive for clients to pay promptly and discourage delays.

To effectively track payments and calculate late fees, it’s essential to maintain accurate records of all transactions. A simple table format can be used to monitor which clients have paid, the amount they owe, and any overdue payments. If applicable, applying late fees should be done in a clear and transparent manner.

| Client Name | Amount Due | Payment Date | Due Date | Late Fee | Total Amount Due |

|---|---|---|---|---|---|

| Client A | $500 | 10/10/2024 | 09/30/2024 | $25 | $525 |

| Client B | $750 | 10/15/2024 | 10/05/2024 | $50 | $800 |

In the table above, you can see how overdue payments are tracked, along with the late fee applied and the total amount due. This method helps you stay organized and ensures that your clients are aware of their obligations. Be sure to clearly state late fee policies in advance to avoid misunderstandings, and keep a record of all communications regarding payment deadlines and fees.

Consistent tracking and the enforcement of late fees when applicable are key steps toward maintaining professional standards and ensuring prompt payments.

Common Mistakes to Avoid in Payment Requests

When creating a document to request payment, small errors can lead to confusion, delayed payments, or strained client relationships. Avoiding these common mistakes ensures that your documents are clear, professional, and efficient. By paying attention to the details, you can maintain a smooth transaction process and foster trust with your clients.

Key Errors to Watch For

- Missing or incorrect contact information: Ensure that both your contact details and the client’s are accurate. Incorrect information can cause delays or misdirect payments.

- Unclear descriptions of services: Avoid vague language when detailing what services were provided. Be specific about the work done, including dates, hours worked, and any materials used.

- Failure to apply taxes correctly: Not calculating or including the right tax amount can lead to confusion or disputes. Always ensure taxes are clearly listed and calculated according to the relevant rate.

- Not specifying payment terms: If you don’t set clear payment terms, clients may delay payments. Be explicit about due dates, late fees, and accepted payment methods.

- Omitting a due date: Leaving out a due date can create ambiguity about when payment is expected. Always include a specific deadline to avoid misunderstandings.

Formatting Issues

- Cluttered layout: A confusing or poorly organized document can make it difficult for clients to quickly understand what’s being requested. Use a clean, easy-to-read layout with clear section headings.

- Incorrect calculations: Simple math errors, such as incorrect totals or missing amounts, can undermine your professionalism. Double-check all calculations before sending the document.

- Lack of consistency: Inconsistent fonts, colors, or formatting can make your document appear unprofessional. Stick to a consistent style throughout.

By avoiding these common mistakes, you improve the likelihood of timely payments and reinforce your credibility with each transaction. A well-structured and error-free payment request reflects your professionalism and helps build long-term client relationships.

Free vs Paid Payment Request Formats

When choosing a structure for your payment request, one of the first decisions you’ll face is whether to use a free or paid version. Both options come with their own set of advantages and limitations, and selecting the right one depends on your business needs, budget, and the level of customization required. Understanding the differences can help you make an informed choice and ensure that your payment requests are both professional and efficient.

Advantages of Free Formats

- No cost: The most obvious benefit is that free options don’t require any upfront investment, making them ideal for new businesses or those on a tight budget.

- Simple and quick to use: Many free formats are straightforward and easy to fill out, allowing you to generate a payment request quickly without much customization.

- Basic features: Free structures often include the essential information needed for a payment request, such as amounts due, client details, and service descriptions.

Limitations of Free Formats

- Limited customization: Free options tend to offer fewer opportunities for personalization, such as adding your logo, branding colors, or unique payment terms.

- Less professional design: Many free formats may lack advanced design features or a polished appearance, potentially making your request look less professional.

- Basic functionality: Free versions might not include advanced features, such as automatic tax calculations, payment tracking, or integration with accounting software.

Advantages of Paid Formats

- More customization options: Paid formats typically allow for greater flexibility in design, including the ability to add logos, personalize colors, and adjust the layout to suit your branding.

- Advanced features: Paid versions often include additional features like automated tax calculations, payment reminders, integration with financial tools, and even multi-currency support.

- Professional design: Many paid formats are designed by professionals, ensuring that your request looks polished and aligns with industry standards.

Limitations of Paid Formats

- Cost: The most significant disadvantage is the upfront fee, which may not be justifiable for every business, especially small operations or those just starting out.

- Over-complication: Some paid formats may come with features you don’t need, making the process more complicated than necessary for simple tasks.

In summary, free formats can be an excellent starting point for businesses with limited resources, while paid formats offer more advanced features and customization options for those who need a more professional appearance or additional functionality. Your decision should align with your specific business needs, goals, and budget.

How to Protect Your Payment Request Information

When creating a document to request payment, it’s crucial to ensure that the sensitive information it contains is protected from unauthorized access or misuse. Whether you’re handling personal details, payment amounts, or client information, safeguarding this data helps maintain confidentiality and prevent fraud. Implementing security measures will protect both your business and your clients.

Secure Your Digital Documents

If you’re sending your payment requests electronically, it’s essential to use secure methods to protect your documents. Here are a few steps to take:

- Encrypt files: Use encryption to protect your payment requests when sending them via email or storing them digitally. Encryption ensures that only authorized recipients can open and view the document.

- Use strong passwords: If you’re sharing documents via cloud storage or other online platforms, make sure to use strong, unique passwords and enable two-factor authentication to further secure your files.

- Limit access: Only share payment requests with the necessary parties. Avoid sending sensitive information through unsecured channels or to unintended recipients.

Protect Physical Copies

For those who still maintain paper copies of their documents, it’s equally important to protect physical records. Consider the following precautions:

- Store documents securely: Keep physical payment requests in a locked file cabinet or safe, out of reach from unauthorized individuals.

- Shred old records: If you need to discard old payment requests, make sure to shred them to prevent sensitive information from being accessed by others.

By taking these simple but effective steps, you can significantly reduce the risk of exposing sensitive information in your payment requests, ensuring that your business remains secure and your clients’ privacy is respected.

Using Online Tools for Payment Requests

Online tools for creating and managing payment requests can save time, improve accuracy, and enhance the professionalism of your business operations. These platforms offer a variety of features that streamline the process of generating documents, tracking payments, and managing client communications. By leveraging these digital resources, you can make your financial transactions more efficient and secure.

Benefits of Online Tools

- Automation: Many online platforms automatically calculate totals, taxes, and due dates, minimizing human error and reducing the time spent on manual calculations.

- Customization: You can personalize the appearance of your payment requests with logos, branding, and specific terms, giving your documents a more professional look.

- Tracking and Reminders: Online tools can help you track the status of payments, send automatic reminders for overdue amounts, and maintain a clear record of transactions.

- Integration: Some tools integrate with accounting software or banking systems, allowing for seamless data transfer and easier financial management.

Popular Online Tools

- FreshBooks: A widely used tool for small businesses that offers simple invoicing features, time tracking, and project management capabilities.

- QuickBooks: Known for its comprehensive accounting features, QuickBooks also provides invoicing tools and allows businesses to manage their finances in one platform.

- Zoho Invoice: This free platform is ideal for small businesses, offering customizable payment requests, automatic reminders, and integration with payment gateways.

- PayPal Invoicing: A popular choice for freelancers and small businesses, PayPal offers easy-to-use invoicing tools with the added benefit of accepting payments directly through the platform.

Using online tools to generate and manage your payment requests not only saves time but also reduces the risk of errors and enhances the professionalism of your financial documents. These tools can help you focus more on your core business tasks while ensuring that your payment processes are smooth and efficient.

Creating Payment Requests for Different Clients

When generating a payment request for various clients, it’s important to tailor the document according to the specific needs and agreements of each individual client. Different clients may have varying expectations, requirements, and terms for payment. Understanding these differences will help you create accurate, professional, and clear payment requests, ensuring smooth transactions and positive relationships with your clients.

Considerations for Different Clients

- Frequency of Work: For clients with ongoing projects, consider creating recurring payment requests or installment plans. For one-time projects, a single payment request will suffice.

- Payment Terms: Some clients may prefer longer payment terms (e.g., net 30 or net 60), while others may request more immediate payment. Always confirm the terms before sending a request.

- Client Industry: Different industries may require specific information or documentation. For example, creative industries may need detailed breakdowns of hours worked, while corporate clients might prioritize contractual details or milestones.

- Location and Currency: If you’re working with international clients, make sure to include the correct currency and any applicable taxes or fees. Ensure that the payment request is formatted according to local regulations and expectations.

Customizing for Client Preferences

- Specific Details: Some clients may require specific line items or descriptions. Be sure to detail what was delivered, whether it’s services, products, or both.

- Professional Design: Clients in more formal industries may expect a polished, branded payment request, while others may be content with a simple and functional format.

- Payment Methods: Different clients may prefer various payment methods (bank transfer, credit card, or online platforms). Make sure to include the correct payment instructions for each client.

By customizing your payment request to each client’s preferences and agreements, you ensure a clear understanding of the transaction, reduce the risk of disputes, and improve the chances of receiving timely payments.

Automating the Payment Request Process

Streamlining the process of creating and sending payment requests can save valuable time, reduce human error, and ensure that no details are overlooked. Automation tools can handle repetitive tasks such as generating, sending, and tracking payment documents, allowing you to focus on your core business activities. By automating the process, you can improve efficiency, maintain consistency, and ensure timely follow-ups, ultimately enhancing cash flow.

Benefits of Automation

- Time-saving: Automation eliminates the need to manually create and send each payment request. With just a few clicks, the system can generate and dispatch documents, freeing up your time for other tasks.

- Consistency: Automated tools ensure that your payment requests are consistently formatted, include all necessary information, and are sent on time, reducing the chances of errors or missed deadlines.

- Improved Cash Flow: With automatic reminders and follow-ups, you can prompt clients to pay on time, reducing late payments and ensuring a steadier cash flow.

- Better Record-Keeping: Most automated platforms store all sent payment requests in a digital ledger, making it easier to track payments, generate reports, and manage finances.

How to Automate the Process

- Use invoicing software: Platforms like FreshBooks, QuickBooks, and Zoho offer automatic payment request generation, recurring billing options, and built-in payment tracking features.

- Set up payment reminders: Automate reminders for clients by setting up due dates and notifications for upcoming or overdue payments.

- Integrate with accounting systems: Link your payment request system with your accounting software to automatically sync data, reducing manual entries and improving accuracy.

By incorporating automation into your payment request system, you simplify the process, enhance client communication, and ultimately streamline your entire financial workflow. This allows you to focus more on growing your business while maintaining a professional approach to payment management.

Maintaining Professionalism in Your Payment Requests

When sending a payment request to clients, the presentation and content of the document play a significant role in establishing your credibility and maintaining a professional image. A well-crafted and organized request not only makes the process smoother but also reflects your attention to detail and commitment to professionalism. Ensuring your documents are clear, accurate, and consistent will help you build trust and maintain strong business relationships.

Key Elements of a Professional Payment Request

- Clear Formatting: A neat and easy-to-read layout is essential. Use simple fonts, adequate spacing, and a logical structure to make sure all information is easy to find.

- Accurate Information: Double-check all details, including client names, payment amounts, and dates. Accuracy reduces the chances of confusion and helps you avoid disputes later.

- Proper Branding: Including your company logo and using consistent branding throughout your payment requests reinforces your business identity and adds to the professionalism of the document.

- Polite and Professional Language: Use formal, respectful language in your communication. Avoid jargon or overly casual expressions, and ensure that your tone is courteous and clear.

Additional Tips for Professionalism

- Timely Delivery: Send your requests promptly, preferably as soon as the work is completed or according to the agreed terms. Delaying the request may give an impression of disorganization.

- Personalization: Tailor the request to the specific client, addressing them by name and including any relevant project or reference numbers. This adds a personal touch and shows attention to detail.

- Follow-Up Reminders: If a payment is overdue, follow up with a polite reminder. Keep your communications professional, reminding clients of the agreed payment terms without sounding aggressive.

Maintaining professionalism in your payment requests demonstrates that you value your clients and take your business seriously. By taking the time to create well-structured, accurate, and courteous documents, you ensure smoother transactions and long-term client trust.