Download Free Income Invoice Template for Simple and Efficient Billing

Managing financial transactions efficiently is crucial for any business. Having a well-structured document to track payments and keep records accurate can save you time and reduce errors. Whether you are a freelancer, small business owner, or a large enterprise, an organized billing method helps maintain smooth cash flow and ensures all parties are on the same page.

A good billing document provides a clear summary of the services rendered, payment terms, and amounts due. It not only serves as proof of the transaction but also aids in keeping your finances organized. By using a ready-made format, you can easily create a professional and consistent record every time.

In this guide, we’ll explore how you can simplify the billing process with customizable formats. These tools can help you generate clear and accurate statements with just a few details, ensuring that your clients or customers understand their obligations, and you get paid on time. Whether you’re looking to reduce your workload or improve your document design, the right solution can make a significant difference.

Income Invoice Template Overview

When managing financial transactions, having a well-organized document to detail the services or products provided is essential. Such a record ensures clarity between the service provider and the client, reducing misunderstandings and promoting timely payments. These records not only help track what has been delivered but also serve as an official reference for both parties involved.

Using a pre-designed document can significantly streamline this process. With a structure already in place, you can focus on the details of the transaction without worrying about formatting. This saves valuable time and guarantees consistency across all your records.

Why Use a Pre-Made Format?

Many professionals and businesses opt for using a pre-made format because it simplifies their workflow. These formats often come with essential fields already outlined, allowing you to fill in specific details such as client information, services rendered, payment terms, and amounts due. This reduces the chances of missing important data and ensures a professional presentation every time.

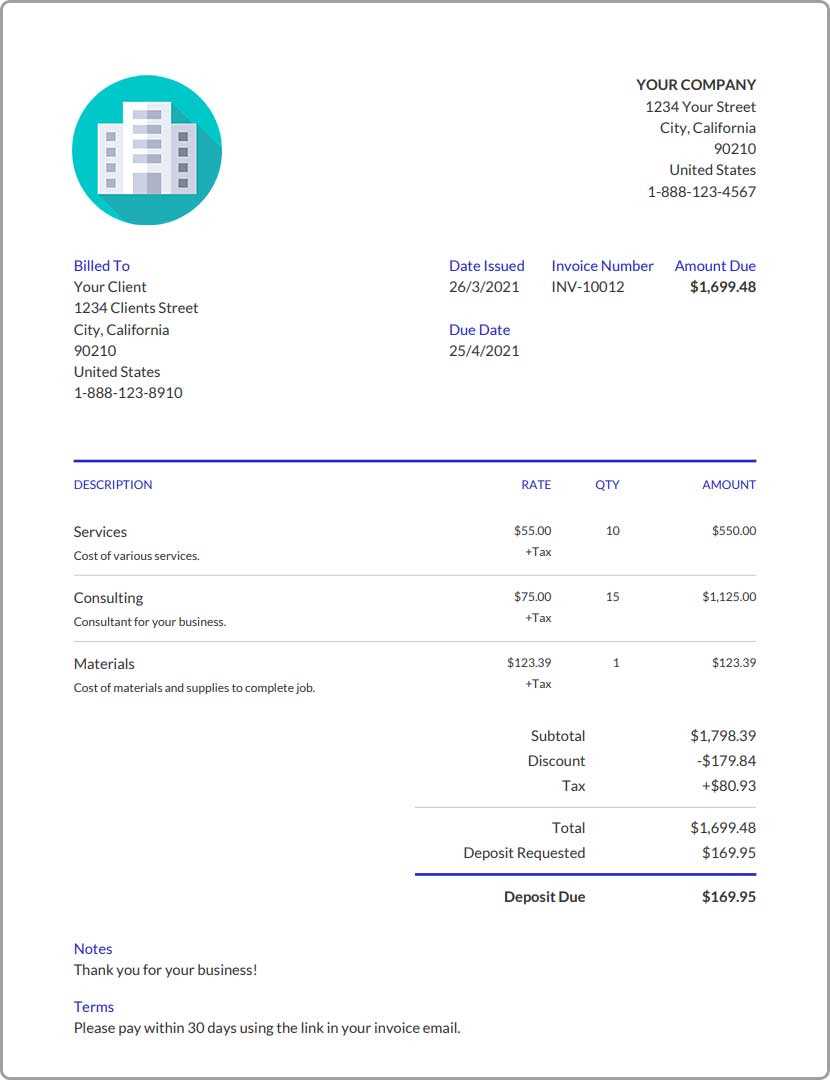

Key Features of a Professional Billing Document

A well-structured document typically includes several key elements: clear identification of both parties, a detailed list of services provided or goods sold, payment amounts, and terms of payment. Clarity in these areas is crucial for ensuring that the document serves its purpose. Additionally, an accurate format can help you stay organized, allowing you to track past payments and maintain records for future reference.

What is an Income Invoice?

An official record used to document a financial transaction between a service provider and a client is an essential part of the business process. It serves as a formal request for payment, detailing the products or services provided, the amount owed, and the terms of payment. This document is crucial for maintaining transparency and ensuring that both parties are clear on the terms of the deal.

Such a record typically includes a range of information, from the names and contact details of the buyer and seller to a breakdown of the charges. It also specifies any additional terms, such as payment deadlines, discounts, or late fees. Providing this clarity helps prevent any confusion and makes the transaction process smoother for everyone involved.

Whether it’s for a small freelance project or a larger business deal, this document acts as proof of the agreed-upon exchange. It helps both the service provider and the client track financial obligations, ensuring that payments are processed correctly and on time. Properly formatted records not only aid in payment collection but also provide a helpful tool for accounting and tax reporting purposes.

Benefits of Using an Invoice Template

Utilizing a pre-designed billing document offers numerous advantages that can improve the efficiency and accuracy of your financial processes. With a consistent structure in place, you can quickly generate professional records, save time, and avoid common errors that might occur when creating a document from scratch.

Here are some key benefits of using a pre-made billing format:

- Time Efficiency: A ready-to-use format speeds up the creation process, allowing you to focus on other important tasks.

- Consistency: Using the same structure for every transaction ensures that all your records are uniform, making it easier to track payments and manage financial reports.

- Reduced Errors: With predefined fields for essential information, the chances of forgetting important details are minimized, improving the accuracy of your billing records.

- Professional Appearance: A well-organized document enhances your business’s credibility and presents a polished image to clients, making it clear that you take your financial matters seriously.

- Customizability: Most pre-designed formats are easily customizable, allowing you to tailor the layout and details to match your specific business needs.

These advantages make using a ready-made billing document an effective way to simplify your administrative workload, stay organized, and maintain a smooth payment collection process.

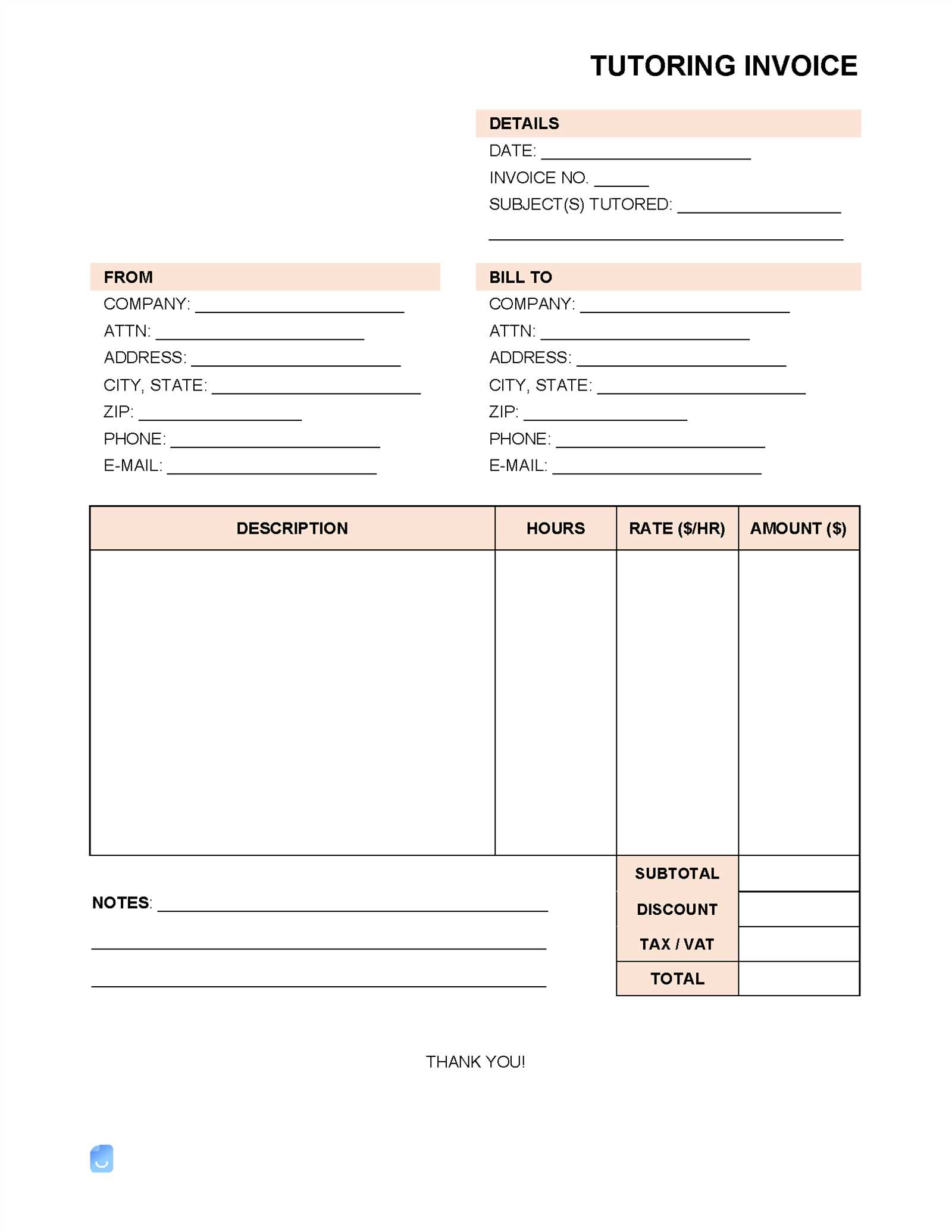

How to Customize Your Invoice Template

Customizing a billing document is a straightforward process that allows you to personalize the layout and details to match your business’s unique requirements. By adjusting specific elements, you can ensure the record reflects your branding, includes all necessary information, and meets the preferences of your clients.

To begin, focus on the following key areas when tailoring your document:

- Logo and Branding: Add your company logo, colors, and fonts to the top of the document. This gives the record a professional and branded appearance that aligns with your business identity.

- Contact Information: Ensure that your company’s contact details, including address, phone number, and email, are prominently displayed. This makes it easier for clients to reach you with any questions or concerns.

- Payment Terms: Clearly define payment terms such as due dates, late fees, and acceptable methods of payment. This helps set expectations and encourages prompt payments.

- Itemized List: Include a detailed breakdown of the goods or services provided, with individual prices and quantities. This helps clients understand exactly what they are being charged for.

- Customization of Fields: Depending on your business, you may want to add or remove specific fields. For example, you could include a discount section, tax rates, or a field for special instructions.

Once these elements are tailored to your needs, review the entire document to ensure that all details are accurate and complete. Proper customization enhances the document’s clarity and professionalism, making it a valuable tool for both your business and your clients.

Key Elements of an Income Invoice

To ensure clarity and proper documentation of a transaction, there are several essential components that should be included in any billing record. These elements help provide transparency, facilitate payment processing, and make the document legally sound. A well-structured billing record will include key details that both the sender and recipient can refer to for accurate tracking and future reference.

Some of the most important components of such a document include:

- Header Information: This includes your business name, address, and contact details, as well as the client’s information. Clear identification of both parties ensures there is no confusion regarding the transaction.

- Unique Identification Number: Assigning a unique reference number to each document helps to easily track and organize records for future use.

- Date of Issue: The date when the transaction occurs or when the document is generated is crucial for establishing payment terms and deadlines.

- Detailed List of Services or Products: An itemized breakdown of the goods or services provided, with quantities and unit prices, ensures both parties understand what has been delivered and what is being charged for.

- Payment Terms: Including payment due dates, accepted payment methods, and any late fees or discounts can help clarify expectations and ensure timely payments.

- Total Amount Due: A clear and accurate calculation of the amount due, taking into account all items, taxes, discounts, and additional fees, is essential for preventing misunderstandings.

- Footer Notes: Optional additional information, such as thank-you notes, refund policies, or instructions for payment, can be included at the bottom of the document to improve customer relations.

By ensuring that these key elements are present and correctly formatted, your billing records will be clear, professional, and ready to use for both legal and financial purposes.

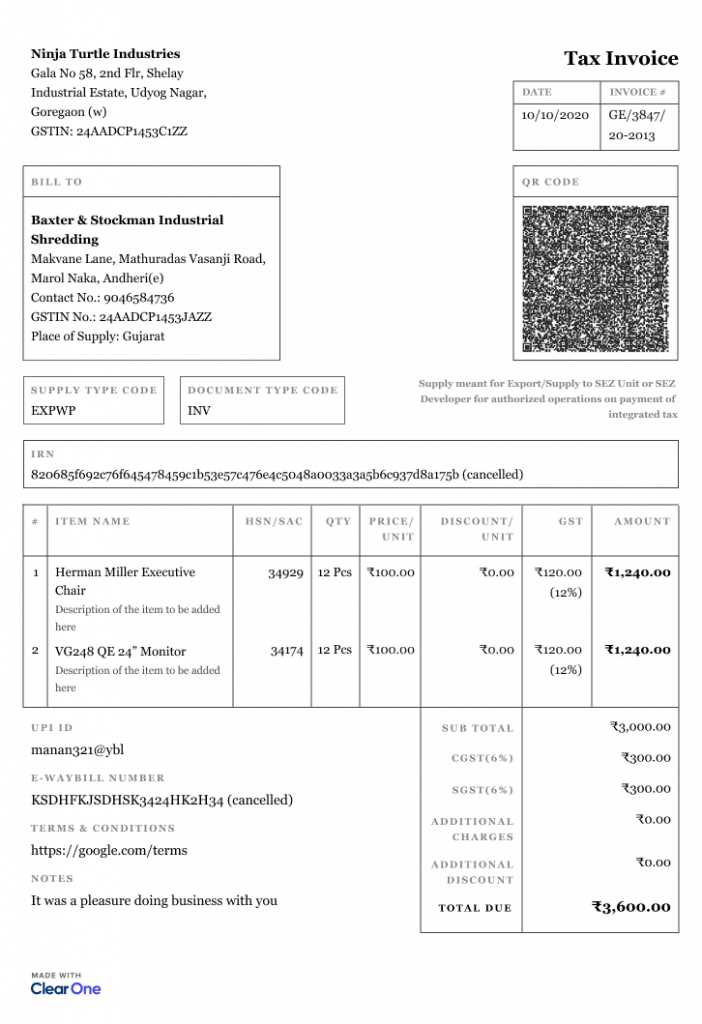

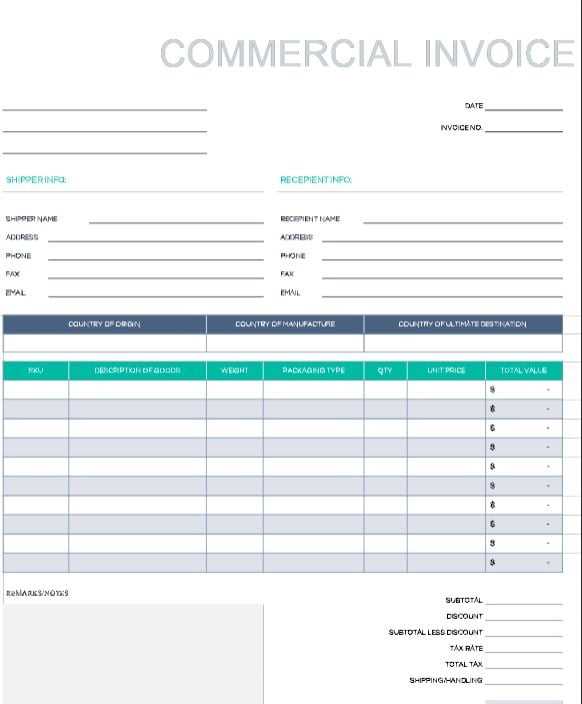

Choosing the Right Invoice Template

Selecting the right billing document format is crucial for ensuring that your records are both professional and functional. A well-chosen format will not only present your business in the best light but also make the payment process clearer for your clients. The right design should suit the specific needs of your business while remaining simple and easy to understand.

When choosing a format, consider the following factors:

- Business Type: The structure of your document should align with the nature of your business. A freelancer might need a simpler design, while a larger company may require more detailed elements, such as tax rates or shipping charges.

- Customization Options: Make sure the format allows for easy customization so you can include your logo, adjust fields, and adapt the document to fit each individual transaction.

- Clarity and Simplicity: A clean, straightforward layout with clear headings and well-organized sections ensures that the details are easy to understand. Avoid overcomplicating the design with unnecessary graphics or confusing layouts.

- Compatibility: Ensure the format is compatible with the software or platform you are using. Whether it’s Word, Excel, or a specialized accounting tool, choose a design that works seamlessly with your workflow.

- Legal and Tax Compliance: If you are dealing with specific legal or tax requirements, choose a document that includes all the necessary fields for proper record-keeping and compliance.

Ultimately, the goal is to select a format that simplifies the process of tracking payments, enhances communication with your clients, and reflects your business’s professionalism. A well-designed record helps you stay organized and ensures that your financial documents meet both your needs and those of your clients.

Free vs Paid Invoice Templates

When selecting a format for your billing records, you’ll often face the choice between free and paid options. Each comes with its own set of advantages and limitations, making it important to assess which one better suits your business needs. Free options may offer basic features, while paid ones tend to provide more advanced tools and customization options.

Here’s a breakdown of the key differences between free and paid formats:

- Cost: The most obvious difference is the price. Free formats are, well, free, making them a good option for small businesses or freelancers just starting out. Paid formats, however, typically require an investment, but this often comes with added value.

- Customization: Free formats usually have limited customization options. While they may allow you to add your business name and logo, they might not offer much flexibility beyond that. Paid formats, on the other hand, often provide extensive customization features, allowing you to tailor every aspect of the design to suit your branding and business needs.

- Features: Paid options often come with additional features, such as integrated payment gateways, tax calculation tools, or advanced reporting capabilities. Free formats may be basic and lack these added functionalities.

- Support: Free formats typically don’t include customer support, which can be an issue if you encounter difficulties or need help with customization. Paid options usually come with dedicated support, ensuring you have assistance when needed.

- Design and Professionalism: While free formats are generally functional, they may lack the polished look that a paid format can provide. Paid options often have more refined designs, which can enhance your business’s credibility and professionalism.

Ultimately, the decision depends on your specific requirements. If you need a simple solution with minimal customization, a free format may be enough. However, if you require advanced features, customization, and professional design, investing in a paid option could be the right choice for your business.

How to Create an Income Invoice from Scratch

Creating a custom billing document from scratch might seem like a daunting task, but with a clear structure and the right information, it can be straightforward. Starting from a blank page allows you to tailor every detail to suit your business’s needs and ensures that all necessary elements are included. Whether you are new to creating billing records or looking for a more personalized approach, following a simple step-by-step process can help you build an effective and professional document.

Step 1: Set Up the Header

Start by including your business name, logo, and contact information at the top of the document. This section should clearly identify your company and provide all the necessary details for clients to get in touch with you. Next, add the client’s information, including their name, company name (if applicable), and contact details. This ensures that both parties are properly identified in the record.

Step 2: Include Key Transaction Details

Once the header is set up, move on to the body of the document. Start by assigning a unique reference number to the document for easy tracking. Then, include the date when the transaction took place or when the document is being issued. Following this, provide a detailed list of the goods or services provided, including descriptions, quantities, unit prices, and any applicable taxes.

Finally, calculate the total amount due, clearly breaking down any discounts, additional fees, or taxes. Be sure to state the payment terms, such as the due date and any late fees if applicable. This structure helps ensure transparency and makes the payment process easier for both parties.

Once all the information is added, review the document for accuracy before sending it out. Creating your own billing record gives you full control over the details, but it’s essential to ensure everything is correct and professional before sharing it with your client.

Top Tools for Designing Invoices

Designing a professional billing document requires the right tools to ensure both functionality and aesthetics. There are a variety of software and online platforms that can help you create clear, accurate, and well-designed records. Whether you’re looking for simplicity or advanced features, the right tool can save you time, reduce errors, and give your documents a polished look.

Best Tools for Creating Billing Records

Here are some of the top tools available for designing billing documents, each offering unique features to suit different business needs:

| Tool | Key Features | Best For |

|---|---|---|

| FreshBooks | Customizable designs, automatic billing, expense tracking | Small businesses and freelancers |

| Canva | Drag-and-drop interface, professional templates, branding customization | Creative businesses looking for visual appeal |

| QuickBooks | Accounting integration, automated payment reminders, customizable formats | Businesses with complex financial needs |

| Microsoft Word | Simple design, easy to use, customizable fields | Businesses seeking a straightforward solution |

| Zoho Invoice | Multi-currency support, automatic tax calculations, time tracking | International businesses and remote workers |

Choosing the Right Tool for Your Business

The right tool for designing billing documents depends on your specific needs. If you’re looking for a simple, no-frills solution, tools like Microsoft Word or Canva can help you create professional documents quickly. For businesses with more complex accounting needs, platforms like QuickBooks and FreshBooks offer integration with other financial tools, helping to streamline the entire process. No matter which tool you choose, make sure it aligns with your workflow and provides the features that

How to Organize Income Invoices Efficiently

Efficient organization of your billing records is essential for managing your finances, ensuring timely payments, and keeping your business operations running smoothly. With a well-structured approach, you can quickly locate past transactions, track outstanding payments, and stay on top of your accounting tasks. Proper organization not only reduces stress but also improves accuracy in financial reporting.

Key Strategies for Organizing Billing Records

Here are some effective methods for keeping your billing documents well-organized:

- Use Digital Storage: Keep all your billing records in a digital format. Cloud-based storage services like Google Drive or Dropbox ensure that your documents are safely stored, easily accessible, and organized in a way that allows for quick retrieval.

- Create Folders by Client or Date: Organize documents by client name or by transaction date. This makes it easy to locate specific records when needed and helps maintain a logical filing system.

- Label and Categorize: Use clear naming conventions for your files. Include key details such as client name, transaction date, and amount. For example, “ClientName_TransactionDate_Amount” helps ensure that you can easily identify the document without opening it.

- Track Payment Status: Maintain a separate list or database to track the status of payments (paid, pending, overdue). You can use spreadsheet software like Excel or Google Sheets to create simple tables for this purpose.

- Back-Up Regularly: Regularly back up your documents to avoid losing important records. Utilize both cloud storage and external hard drives for extra security.

Tools for Streamlining Organization

To help streamline your organization, you can use various tools and software:

- Accounting Software: Platforms like QuickBooks, FreshBooks, and Xero automatically organize and categorize billing records, making it easier to track payments and generate financial reports.

- Spreadsheet Tools: Google Sheets or Microsoft Excel can be used to create custom tracking systems and spreadsheets to monitor the status of all transactions.

- Cloud Storage Services: Using cloud-based storage solutions like Dropbox, OneDrive, or Google Drive allows you to store and organize your documents i

Common Mistakes to Avoid in Invoices

When creating a billing document, even small errors can lead to confusion, delays, or disputes with clients. It’s essential to pay attention to every detail, ensuring that all the necessary information is correct and clearly presented. Avoiding common mistakes can help streamline the payment process and maintain a professional relationship with your clients.

Here are some common errors to watch out for when preparing billing records:

- Incorrect or Missing Contact Information: One of the most basic but often overlooked mistakes is failing to include accurate contact details. Make sure both your business’s and the client’s name, address, phone number, and email are clearly listed. Missing or wrong contact information can cause delays in payment and communication.

- Omitting or Miscalculating the Total Amount: Double-check your calculations before sending the document. Any miscalculation of the total amount due, taxes, or discounts can lead to confusion and disputes. Always ensure that the figures add up correctly and reflect what was agreed upon.

- Not Including Payment Terms: It’s crucial to specify payment terms clearly, such as the due date, accepted payment methods, and any late fees or discounts. Failing to include this information can result in delayed payments or misunderstandings about when and how payments should be made.

- Failure to Use a Unique Document Number: Without a unique reference number for each document, tracking payments becomes more difficult. A unique number helps both you and your clients easily identify and reference the specific transaction.

- Not Itemizing Products or Services: When you fail to provide a detailed list of the products or services rendered, clients may question what they are being charged for. Always include a clear breakdown with descriptions, quantities, and individual prices to avoid confusion.

- Unclear or Inconsistent Formatting: A poorly organized document can make it difficult for your client to understand the charges. Use a clean, professional layout with consistent fonts, spacing, and alignment. An easy-to-read document helps your clients process payments more

Best Practices for Invoice Management

Effective management of billing records is crucial to ensuring timely payments, maintaining a steady cash flow, and avoiding misunderstandings with clients. Adopting best practices in managing these documents not only helps streamline your processes but also improves accuracy and efficiency. Proper management involves keeping track of transactions, setting clear payment terms, and staying organized with follow-ups.

Here are some best practices for managing your billing documents efficiently:

- Keep Accurate Records: Always maintain a detailed and up-to-date record of all billing documents, including dates, amounts, and client information. This helps track the status of payments and provides a clear history of your business transactions.

- Implement a Consistent Numbering System: Use a unique reference number for each billing document to make tracking easier. A consistent numbering system helps with organization and simplifies locating specific transactions.

- Set Clear Payment Terms: Define the payment due date, accepted payment methods, and any late fees or discounts. Clearly stating these terms on every document helps avoid confusion and ensures that clients understand when and how payments should be made.

- Automate Reminders: Set up automated reminders for upcoming or overdue payments. Tools like accounting software or email reminders can help ensure that you follow up on outstanding balances without missing a beat.

- Monitor Cash Flow: Regularly review your billing records to monitor the flow of payments and identify any potential cash flow issues. Keeping an eye on payments helps you plan and adjust business operations as needed.

- Store Documents Securely: Store all billing records, whether digital or physical, in a secure location. Cloud-based storage systems or a well-organized physical filing system can protect your documents from being lost or damaged.

- Follow Up Promptly: If a payment is overdue, follow up with clients promptly and professionally. A polite reminder can often resolve payment delays before they become bigger issues.

- Regularly Reconcile Accounts: Periodically reconcile your financial records with your bank or payment accounts to ensure that all transactions have been recorded accurately. This helps catch any discrepancies early on and prevents financial confusion later.

By following these best practices, you ca

Legal Considerations for Income Invoices

When managing billing documents, it’s essential to understand the legal aspects involved to ensure compliance with tax laws, business regulations, and contractual agreements. These legal considerations not only help you avoid potential disputes but also safeguard your business against legal issues. Properly created and documented billing records serve as a proof of transaction and can be used in legal or financial matters if necessary.

Key Legal Aspects to Include

Here are some important legal elements to keep in mind when creating your billing records:

- Tax Information: Depending on your location and industry, you may be required to include specific tax details, such as VAT or sales tax. Ensure that your documents reflect the correct tax rates and amounts according to local laws. Failure to include tax information properly can lead to penalties or audits.

- Clear Payment Terms: Payment terms are not only a business practice but also a legal requirement. Clearly state the due date for payment, any penalties for late payments, and the accepted payment methods. This transparency helps avoid potential legal conflicts over unpaid amounts.

- Contractual Compliance: Ensure that the billing document aligns with the terms agreed upon in the contract or service agreement. If there are any deviations in pricing, scope, or timelines, you may risk legal challenges. Accurate representation of contract terms in billing is vital.

- Client Identification: Always ensure that both parties are correctly identified in the billing document, including full legal names, business names, and addresses. Clear identification helps prevent misunderstandings and proves the legitimacy of the transaction.

- Dispute Resolution Clauses: In some cases, it’s beneficial to include a clause that outlines the procedure for resolving disputes. This could include arbitration or legal action if payments are not made within the specified time frame.

Record Retention and Compliance

Keeping accurate records for the required time period is also a legal consideration. Tax authorities and other regulatory bodies often have specific requirements for how long you must retain business records, including billing documents. Failing to keep adequate records can result in penalties or a loss of important evidence should a dispute arise.

- Retention Period: The general rule is to keep records for at least 5-7 years, depending on your country’s tax regulations. However, it’s i

How to Track Payments with Invoices

Tracking payments is a crucial aspect of managing business finances. Ensuring that all payments are received on time, and accurately recorded, helps maintain cash flow and prevents financial discrepancies. Properly tracking payment statuses linked to billing records can also simplify accounting, tax reporting, and help you follow up on overdue balances efficiently.

Here are some strategies to help you track payments effectively:

Best Practices for Tracking Payments

- Use Unique Document Numbers: Assign a unique reference number to each billing record. This makes it easier to track and link payments to specific transactions, helping to avoid confusion and ensuring accurate payment tracking.

- Record Payment Status: Clearly indicate the payment status for each transaction. Mark documents as “Paid,” “Pending,” or “Overdue” to track where each payment stands. This visual clarity helps you stay organized and on top of your receivables.

- Set Up Payment Reminders: Use reminders for overdue payments or upcoming due dates. Automated reminders can help ensure clients pay on time without manual follow-ups, reducing the risk of late payments.

- Track Payment Methods: Keep track of how each payment was made–whether via bank transfer, credit card, cash, or other methods. This helps in reconciling accounts and provides a clear history of payment sources for your records.

- Maintain Detailed Records: Always include important payment details, such as the payment date, transaction amount, and any adjustments (discounts, late fees, etc.). Having all relevant information helps when cross-checking or addressing potential issues later.

Tools for Efficient Payment Tracking

There are several tools that can help automate and streamline the payment tracking process:

- Accounting Software: Platforms like QuickBooks, FreshBooks, and Xero can automatically track payments linked to billing documents. These tools can also generate reports, send payment reminders, and help reconcile payments with your bank accounts.

- Spreadsheet Programs: Tools like Google Sheets or Microsoft Excel are simple and effective for manually tracking payments. You can create custom tracking sheets that include columns for payment dates, amounts, client names, and payment status.

- Online Payment Systems: Services like PayPal, Stripe, or Square offer built-in payment tracking features. These pl

Tips for Improving Invoice Accuracy

Ensuring the accuracy of billing records is vital for maintaining good client relationships and smooth business operations. Mistakes in billing documents can lead to delayed payments, confusion, or even disputes with clients. By implementing strategies to improve the precision of your records, you can reduce the likelihood of errors and ensure timely payments.

Key Strategies for Accurate Billing

- Double-Check Details: Always verify the client’s information, such as name, address, and contact details. Incorrect or incomplete information can cause delivery or payment issues. Cross-check all data before finalizing the document.

- Be Clear with Descriptions: Provide clear and precise descriptions of the products or services provided. Avoid vague language and ensure that each item or service is itemized with quantities, rates, and specific details that leave no room for ambiguity.

- Review Dates and Amounts: Make sure that dates, due dates, and amounts are correct. Simple mistakes in pricing or the omission of taxes or discounts can lead to confusion and delay payments. Always double-check numbers before sending them to clients.

- Use Consistent Formats: Stick to a consistent format for all your billing documents. This includes using a clear layout with uniform fonts, headings, and numbering. A standardized format minimizes the chances of overlooking important details.

- Incorporate Automatic Calculations: If using digital tools, take advantage of automatic calculation features. Many accounting platforms and spreadsheets have built-in functions that calculate totals, taxes, and discounts, reducing the risk of manual errors.

- Ensure Proper Tax Rates: Ensure that the correct tax rates are applied according to your jurisdiction. Tax laws can vary depending on the location and type of transaction. Being meticulous about tax calculations ensures compliance and avoids legal issues.

Tools for Enhancing Accuracy

There are several tools available that can help improve the accuracy of your billing records:

- Accounting Software: Programs like QuickBooks or Xero are designed to streamline the process of creating accurate billing records. They include built-in features for tax calculations, automatic numbering, and templates that ensure consistency and accuracy.

- Spreadsheets: Using tools like Google Sheets or Excel allows you to set up custom formulas for automatic calculations, making it easier to track and adjust amounts as needed.

- Cloud-Based Billing Systems: Online services such as FreshBooks or Zoho offer automated invoicing with built-in checks to ensure that al

How to Send an Income Invoice

Sending billing records to clients in a professional and timely manner is essential to ensuring prompt payments and maintaining good business relationships. The process of sending these documents involves more than just creating and sending an email–it’s about ensuring that all relevant details are clear, the method of delivery is secure, and the recipient knows exactly what action to take. A proper approach not only ensures smoother transactions but also helps in avoiding misunderstandings and disputes.

Here are the steps to effectively send your billing records:

Steps to Send a Billing Record

- Choose the Right Delivery Method: You can send your billing documents either electronically or through physical mail. For electronic deliveries, email is the most common method, while physical copies might be used for clients who prefer hard copies. Ensure you choose the method most suitable for your client’s preference.

- Personalize the Message: Whether you’re sending an email or a physical document, always include a personalized message. Mention the amount due, the due date, and any important details that the client should be aware of. A polite tone helps maintain good relationships.

- Attach the Document Correctly: If you’re sending the billing record via email, ensure that the document is properly attached in a format that can be easily opened (e.g., PDF or Word). Also, make sure the document is named appropriately so that it’s easily identifiable by the client (e.g., “ClientName_Invoice_001.pdf”).

- Confirm the Email Address or Mailing Address: Double-check that you are sending the record to the correct contact information. A mistake in the recipient’s details can cause delays and confusion, so it’s important to verify this information before sending.

- Set a Clear Payment Due Date: Always include a clear payment due date on the document and in the accompanying message. This ensures that the client understands when the payment is expected, and it also establishes a timeline for any follow-up actions if the payment is late.

- Track the Delivery: If sending physical copies, consider using a trackable service to ensure the document reaches the client. For electronic delivery, it can be helpful to request a confirmation or read receipt for emails to verify that the document has been received.

Best Practices for Sending Billing Records

- Use Professional Language: Whether sending an email or a letter, always maintain a professional tone. This shows respect for the client and strengthe

Automating Income Invoice Generation

Automating the process of generating billing documents can save businesses a significant amount of time and effort. Instead of manually creating each record, automation tools can quickly generate accurate and consistent documents with minimal input. This not only reduces the chance of human error but also allows businesses to focus on more important tasks, such as client management and strategic growth.

By integrating automated systems, businesses can streamline their operations, reduce administrative workload, and ensure that billing documents are generated consistently and on time. Below are key benefits and methods for automating this process:

Advantages of Automation

- Time Efficiency: Automation reduces the need for repetitive manual tasks, allowing you to generate multiple records in a fraction of the time it would take to create them manually.

- Consistency: Using automation ensures that every document follows the same format, includes the same information, and is free from inconsistencies or errors that can arise from manual input.

- Improved Accuracy: Automation tools often come with built-in checks and validations, ensuring that all calculations (such as totals, taxes, and discounts) are correct and that no important information is missed.

- Seamless Integration: Automated systems can often integrate with accounting or customer relationship management (CRM) software, making it easier to pull up-to-date client data and track transactions in real-time.

- Faster Payments: By generating and sending billing records promptly, automation can help improve the chances of getting paid on time. The faster the process, the quicker clients can process payments.

How to Automate Billing Document Creation

Here are the steps to effectively automate the generation of your billing records:

- Choose the Right Software: Many platforms, such as QuickBooks, FreshBooks, and Zoho, offer automated billing features. These tools allow you to set up recurring billing, customize document templates, and automatically send out reminders and invoices.

- Integrate with Payment Systems: Integrating your billing system with payment processors (e.g., PayPal, Stripe) helps automate both the creation and tracking of transactions. Once a payment is made, the system can automatically mark the document as paid and update the status.

- Set Up Recurring Billing: For clients with regular payments, automation can handle r