Import Invoice Template for Efficient Business Transactions

When dealing with cross-border transactions, having a well-structured document to record and verify the details of the sale or purchase is essential. This document serves not only as a proof of transaction but also helps in managing tax obligations, customs procedures, and payment processing. Crafting an efficient and accurate record of each international trade deal ensures that your business operates smoothly and in compliance with global standards.

For any business involved in importing or exporting goods, ensuring that each trade is documented correctly is a key factor in maintaining transparency and avoiding costly mistakes. Having the right tools to create these documents can save valuable time and minimize errors. With a standardized approach, your business can easily handle multiple transactions while staying organized and compliant with regulations.

Optimizing the way these documents are created and managed not only streamlines internal processes but also establishes trust with suppliers, buyers, and customs authorities. A well-prepared document lays the groundwork for faster processing, fewer disputes, and more efficient operations overall.

Import Invoice Template: A Complete Overview

In international business, having a standardized document to track and confirm each transaction is crucial. This document serves as a formal record of goods or services exchanged between parties, providing necessary details for both parties involved, as well as for authorities such as customs and tax agencies. Ensuring that these records are clear, consistent, and legally compliant is essential for smooth operations and to avoid any legal or financial complications.

Creating such a document manually can be time-consuming and prone to errors. However, with a well-designed format, businesses can ensure that the essential information is captured accurately and uniformly every time. The right structure helps prevent misunderstandings between buyers, sellers, and regulators while improving workflow efficiency within the company.

From basic product descriptions to detailed shipping and payment terms, each section of this document plays a vital role. A complete guide to setting up this record ensures that all necessary elements are included, enabling businesses to conduct their transactions confidently and without delay. In this section, we will explore the key components that should be featured in any properly structured trade documentation.

Why Use an Import Invoice Template

Having a pre-designed structure for documenting trade transactions offers significant advantages for businesses involved in global commerce. A standardized approach ensures that all critical details are captured correctly and consistently, making it easier to manage and track international deals. Below are the key reasons why using such a structured format is beneficial:

- Consistency: A pre-formatted document helps maintain uniformity across all transactions, reducing the chances of missing important information.

- Time-saving: By using a ready-made design, businesses can fill in the required details quickly, rather than creating a new record from scratch each time.

- Compliance: Standardized documentation ensures that all legal and regulatory requirements are met, preventing errors and penalties from oversight.

- Accuracy: A well-organized structure guides users to input the correct information in the right format, reducing the risk of mistakes or omissions.

- Ease of Communication: Clear and consistent records help avoid misunderstandings between the buyer, seller, and any involved authorities, making the process smoother for all parties.

By adopting a uniform approach to creating these documents, companies can simplify their operations and reduce the time spent on administrative tasks. This leads to faster processing, better organization, and a more professional image in the global marketplace.

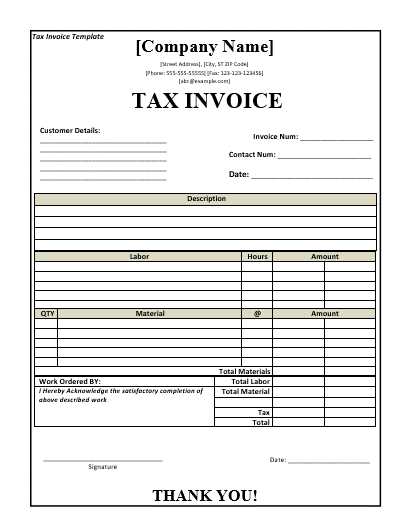

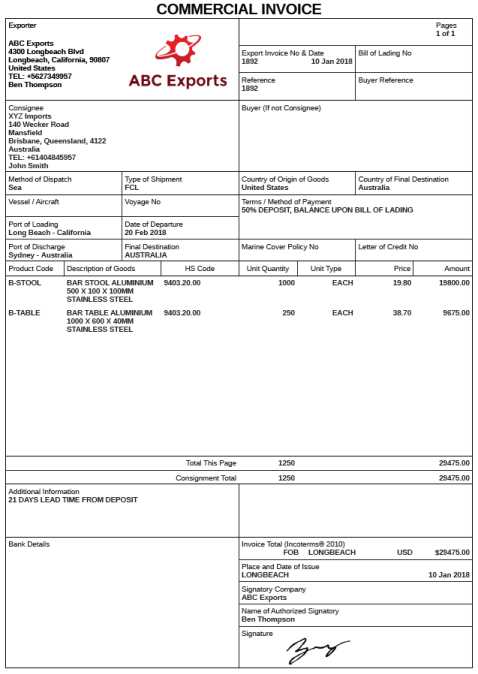

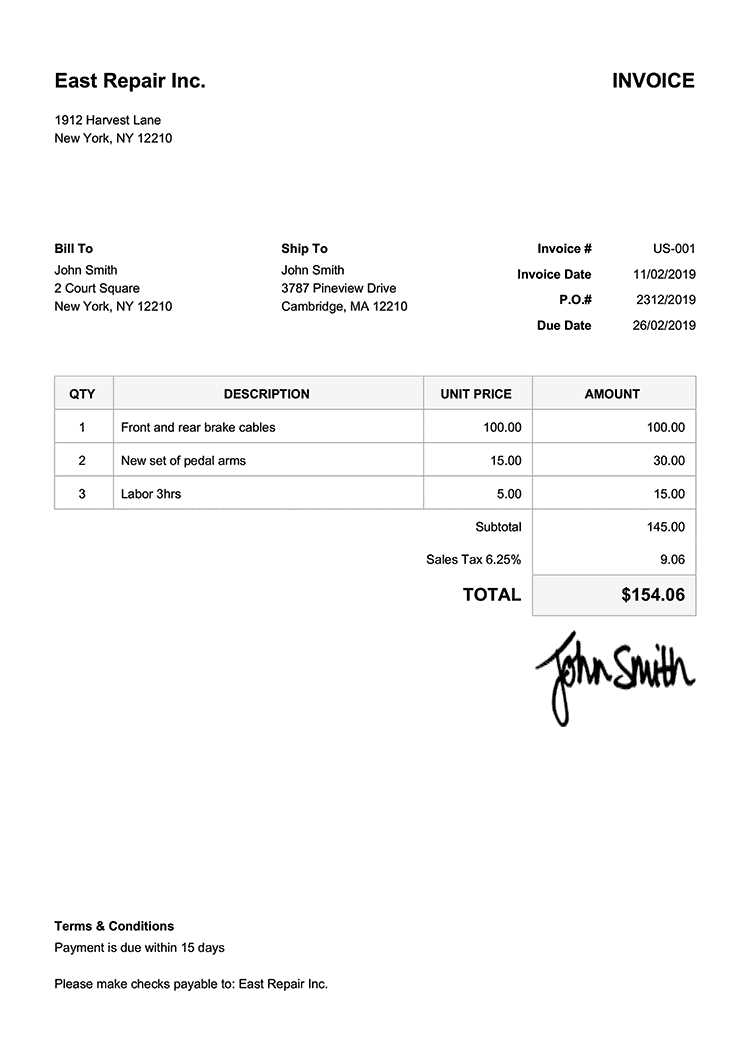

Key Elements of an Import Invoice

For any business involved in cross-border transactions, it is crucial to capture specific details in the document that records the exchange of goods or services. These key components ensure that all necessary information is included for legal, financial, and operational purposes. A well-organized document not only simplifies the transaction process but also minimizes the chance of disputes or misunderstandings between the involved parties.

Essential Information to Include

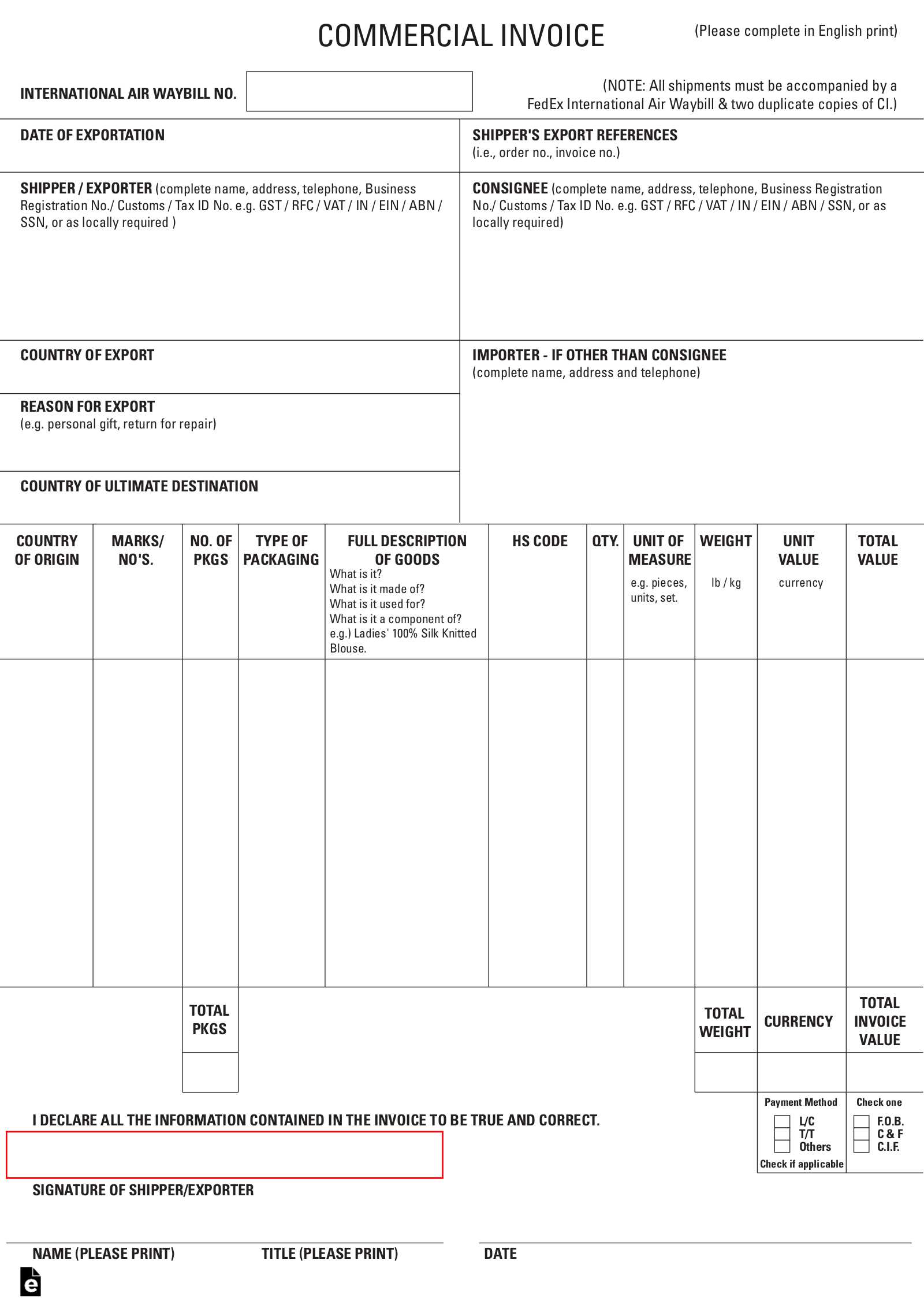

Several critical sections should be present in any formal trade document to ensure it is complete and valid:

- Transaction Date: This indicates when the deal occurred, providing a clear timeline for both parties.

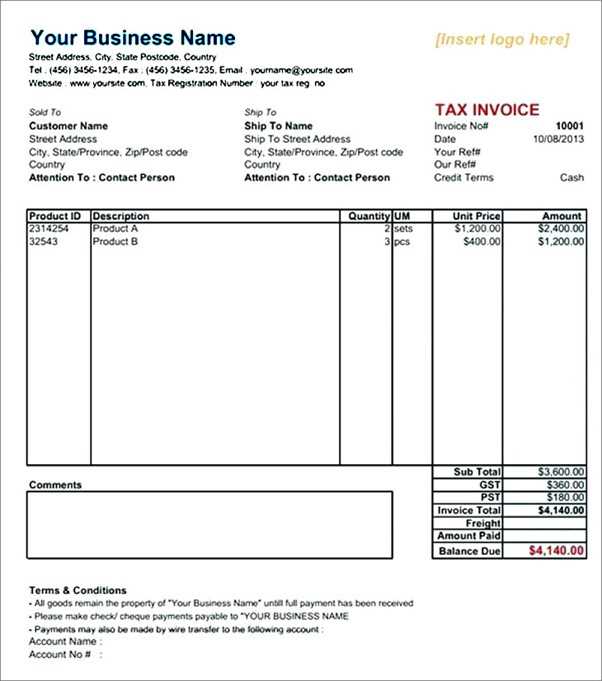

- Product or Service Description: A detailed list of what was purchased or sold, including quantity, unit price, and total value.

- Parties Involved: The names and contact details of the buyer and seller, along with any intermediaries, should be clearly stated.

- Payment Terms: Information regarding payment methods, due dates, and any associated conditions, such as discounts or penalties.

- Shipping Information: The destination, shipping method, and any relevant tracking or reference numbers to help track the goods during transit.

Additional Considerations

In addition to the core details, some documents may also require additional sections depending on the nature of the transaction or the country’s regulations:

- Tax Identification Numbers: Essential for taxation purposes, especially when dealing with international trade.

- Customs Information: Specific codes and documentation to ensure compliance with customs regulations.

- Currency Details: If applicable, the currency used in the transaction should be clearly mentioned to avoid any confusion during payment.

Including these key elements ensures that your document provides all the necessary information for accurate processing, helping to avoid delays or complications in the transaction process.

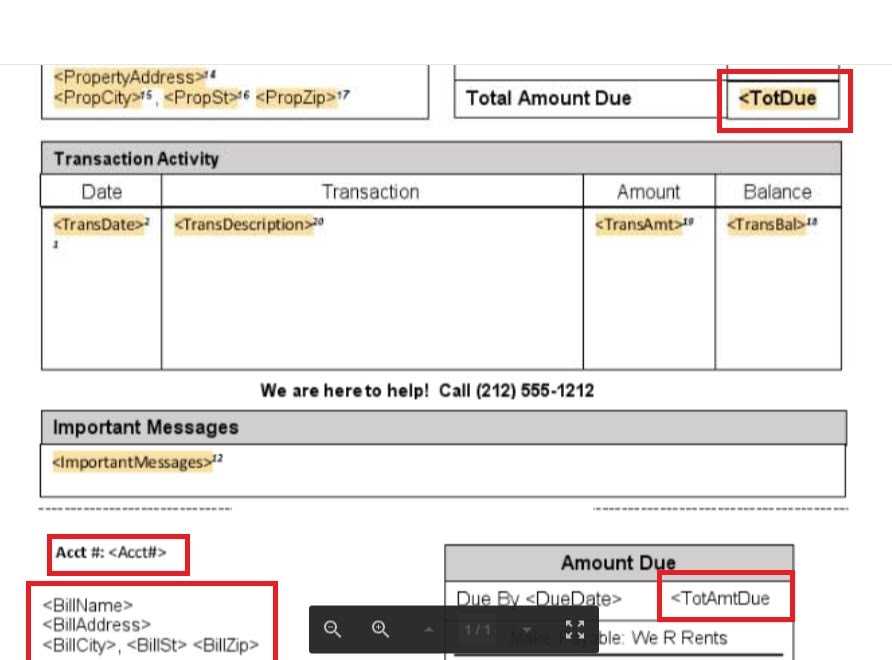

How to Customize Your Import Invoice

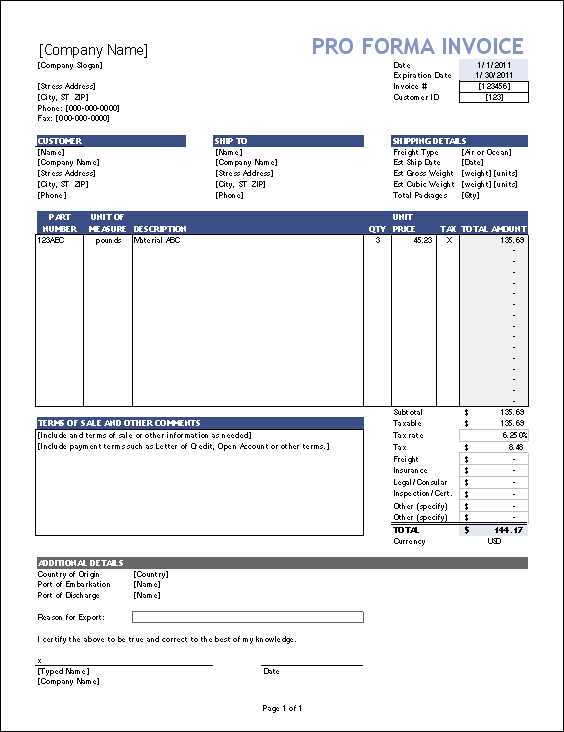

When creating a formal document for international transactions, tailoring the structure to meet your specific business needs is crucial. Customizing the layout and content allows you to focus on the most important details while maintaining a professional and organized presentation. By adjusting the design and sections of the record, you can make it more efficient and aligned with your company’s requirements and regulatory obligations.

Here are the key steps to effectively customize your trade documentation:

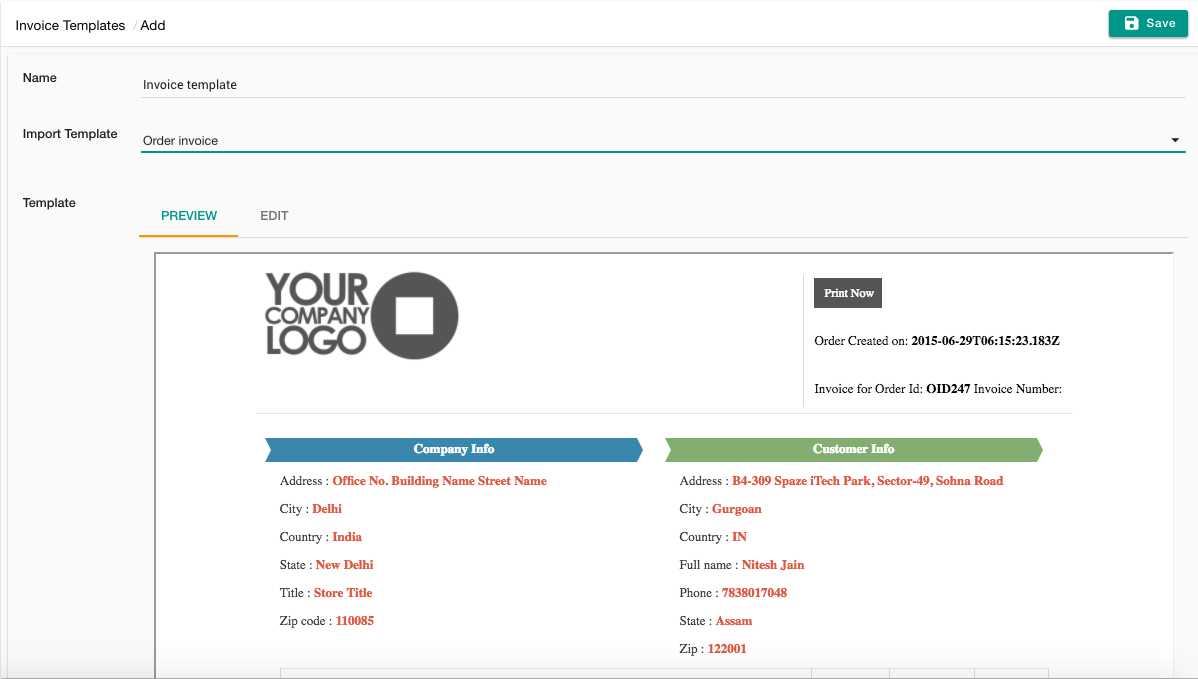

- Choose the Right Format: Depending on your business needs, select whether you prefer a simple or detailed format. For example, a smaller business may need fewer fields, while a larger enterprise might require more complex tracking systems.

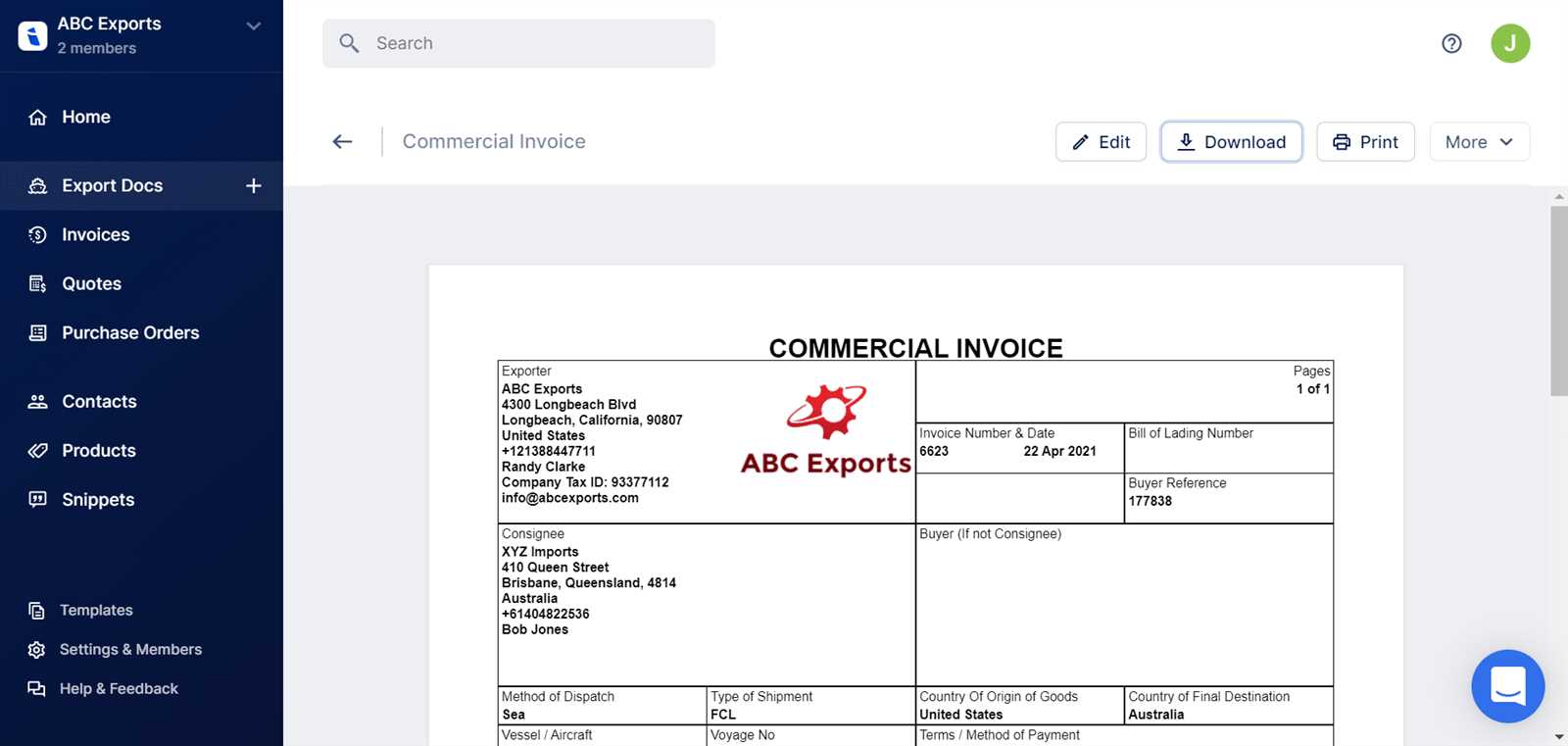

- Adjust Branding Elements: Include your company’s logo, contact details, and branding elements in the header to maintain a professional image and ensure that your document reflects your brand identity.

- Modify the Layout: Organize sections in a way that suits your workflow. You might want to prioritize payment terms, shipping details, or product information based on the nature of the transaction.

- Include Special Fields: Customize sections based on your specific needs. For example, you might add fields for regulatory codes, product specifications, or client purchase orders.

- Adjust Currency and Tax Information: If you deal with multiple currencies, ensure your document reflects the correct exchange rates and tax rates applicable to each transaction.

- Automate Calculations: Use formulas to automate calculations for totals, taxes, and discounts. This will save time and reduce the chances of errors.

Customizing these elements allows you to streamline the document creation process and ensure that it meets all business, legal, and regulatory requirements. The more personalized and organized the document is, the more efficient your transaction and record-keeping processes will become.

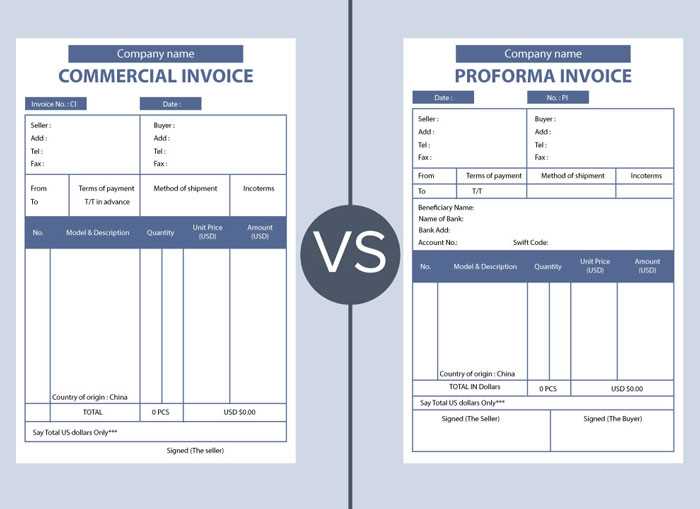

Choosing the Right Format for Import Invoices

Selecting the appropriate layout for trade documentation is crucial for ensuring clarity and efficiency in global transactions. The format determines how easily the necessary details are captured, processed, and reviewed. A well-structured document format not only improves internal workflows but also facilitates smoother interactions with clients, suppliers, and regulatory bodies.

There are several factors to consider when choosing the right layout for your trade records:

- Business Size and Complexity: Small businesses may benefit from a simple, easy-to-read design, while larger organizations may require a more complex format with additional sections to track inventory, payments, and taxes.

- Customization Flexibility: A format should allow for easy customization based on specific transaction needs, such as adding fields for unique product details or shipping conditions.

- Ease of Use: The layout should be user-friendly, allowing both internal teams and external partners to fill out and review the document quickly without confusion.

- Legal and Tax Requirements: Ensure the chosen design accommodates all legal and tax-related fields, such as identification numbers, customs information, and applicable taxes.

- Digital vs. Paper Format: Decide whether you need a digital template or a printable version. Digital formats are ideal for quick editing and sharing, while printed records may be necessary for physical filing and submission.

By carefully evaluating these factors and selecting a format that best fits your needs, you can improve the efficiency of your global business operations while ensuring compliance with relevant regulations.

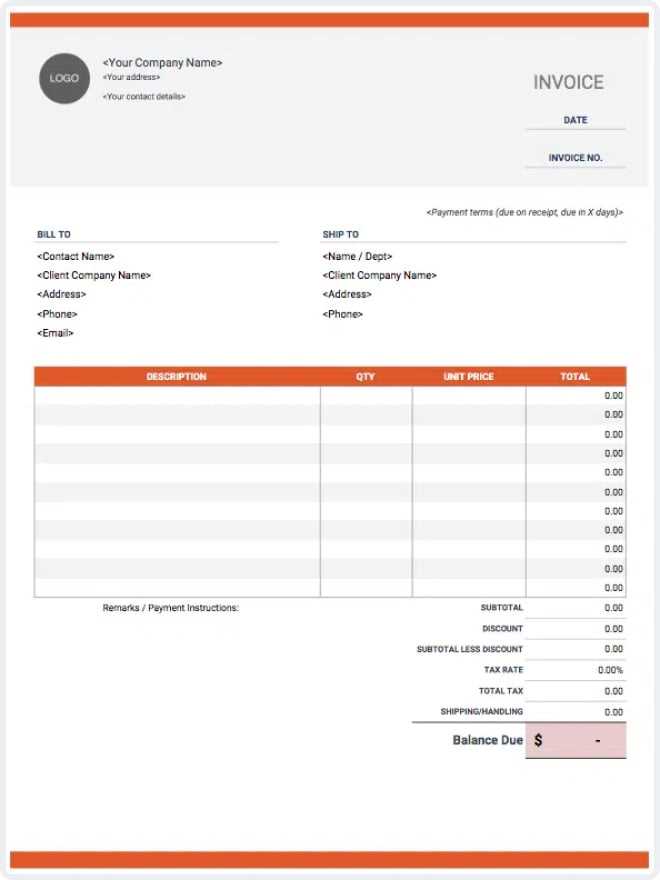

Top Features of a Good Invoice Template

A well-designed document for recording trade transactions should have certain essential features to ensure clarity, accuracy, and ease of use. These key elements not only help businesses maintain consistency but also improve the efficiency of processing and managing international transactions. The right format can significantly streamline workflows and reduce the risk of errors in critical business operations.

Here are the top features to look for in an effective document layout:

- Clear Structure: A good design should organize information logically, with sections clearly labeled for ease of reference, such as product descriptions, payment terms, and shipping details.

- Customizable Fields: Flexibility is essential. A well-structured format allows you to add or remove fields based on your specific transaction needs, such as additional taxes, shipping details, or product information.

- Automatic Calculations: Including fields that automatically calculate totals, discounts, or taxes saves time and minimizes human error, ensuring accuracy.

- Branding Options: The ability to add your company logo, contact details, and custom branding ensures that the document reflects your business identity and enhances professionalism.

- Legal Compliance: Ensure the design accommodates all necessary legal and regulatory fields, such as tax identification numbers, shipping documentation, and any specific requirements for international trade.

- Currency and Payment Information: Including fields for currency type, exchange rates, and clear payment terms allows for better financial tracking and avoids confusion when dealing with global transactions.

By incorporating these essential features, you can ensure that your trade documentation is both efficient and compliant, providing a smoother experience for both your team and international partners.

How Import Invoices Facilitate International Trade

In global commerce, clear and accurate documentation plays a crucial role in ensuring that transactions are processed efficiently and smoothly. These records act as a formal agreement between buyers and sellers, detailing the exchange of goods or services, payment terms, and shipping conditions. They are essential for managing cross-border transactions, helping businesses navigate the complexities of international regulations, customs procedures, and payment processing.

Role in Streamlining Cross-Border Transactions

Properly structured records facilitate smoother communication between all parties involved in international trade, including suppliers, buyers, and financial institutions. They help standardize the flow of information, reducing misunderstandings and potential disputes. Here are some of the key ways these documents aid in international transactions:

| Aspect | How It Helps International Trade |

|---|---|

| Legal Compliance | Ensures all necessary regulatory information is included, helping businesses comply with local and international laws. |

| Customs Clearance | Facilitates faster clearance at borders by providing required product details, taxes, and duties. |

| Payment Processing | Clearly outlines payment terms, reducing delays in payment and ensuring funds are transferred without issues. |

| Transparency | Provides clear information on pricing, quantities, and shipping, making the transaction transparent and reducing the chance of disputes. |

Benefits for Business Operations

For businesses engaged in international trade, using a standardized format to document transactions helps improve efficiency and maintain accuracy. This, in turn, reduces the likelihood of errors that can lead to financial loss or delays. By simplifying the documentation process, businesses can focus on scaling their operations and managing their partnerships more effectively.

Best Practices for Creating Import Invoices

Creating effective documentation for international transactions is essential for ensuring smooth business operations. A well-prepared document serves not only as a record of the transaction but also as a tool for managing payment terms, ensuring legal compliance, and facilitating customs clearance. Following best practices when drafting these documents helps to avoid common errors, streamline processes, and maintain strong business relationships.

Essential Guidelines for Efficient Documentation

There are several key practices that can help ensure the quality and accuracy of your trade records:

| Best Practice | Why It Matters |

|---|---|

| Be Thorough and Detailed | Ensure all relevant details, such as product descriptions, quantities, pricing, and shipping terms, are accurately recorded. This reduces the risk of misunderstandings or disputes. |

| Standardize the Format | Using a consistent format for all transactions ensures that key information is always in the same place, making it easier to review and process quickly. |

| Double-Check Calculations | Ensure all totals, taxes, and any additional fees are correctly calculated. Mistakes in financial details can lead to delays or payment issues. |

| Ensure Legal Compliance | Include all required legal and regulatory information, such as tax identification numbers, customs codes, and product certifications, to avoid complications with authorities. |

| Include Clear Payment Terms | Clearly state payment deadlines, methods, and any applicable discounts or penalties. This helps prevent payment delays and ensures smoother financial transactions. |

Additional Tips for Success

In addition to the key guidelines above, there are other strategies that can improve the effectiveness of your documentation process:

- Use Automation Tools: If possible, automate the process of generating these documents to minimize errors and increase efficiency.

- Maintain a Digital Archive: Keep an organized, easily accessible record of all documents for future reference and auditing purposes.

- Review Regularly: Regularly update your document format to stay compliant with evolving regulations and industry standards.

By following these best practices, businesses can ensure that their trade documents are clear, accurate, and compliant, making international transactions more efficient and reducing the risk of issues down the line.

How to Ensure Accuracy in Invoices

Ensuring that all information on trade documents is accurate is crucial for avoiding delays, errors, and potential disputes. An inaccurate record can lead to financial discrepancies, legal issues, and even strained business relationships. To prevent such complications, it is essential to follow certain steps that guarantee precision in every transaction.

Here are some effective strategies to ensure that your trade documentation is always accurate:

- Double-Check All Entries: Always verify the details before finalizing the document. This includes checking quantities, prices, and payment terms to ensure they match the agreement.

- Standardize Data Fields: Use a consistent format for key information, such as product descriptions, shipping details, and payment terms. This makes it easier to spot discrepancies or missing information.

- Automate Calculations: Where possible, use automated formulas to calculate totals, taxes, and discounts. This reduces the chances of human error in number crunching.

- Review Legal Requirements: Ensure that all required fields, such as tax IDs, registration numbers, and customs details, are correctly filled out and comply with local regulations.

- Cross-Reference Documents: Cross-check your trade record with related documents such as purchase orders, shipping receipts, and contracts to ensure consistency and accuracy across all paperwork.

By following these best practices, you can significantly reduce the likelihood of errors in your documents. Accurate records not only streamline your internal processes but also help maintain trust with your international partners.

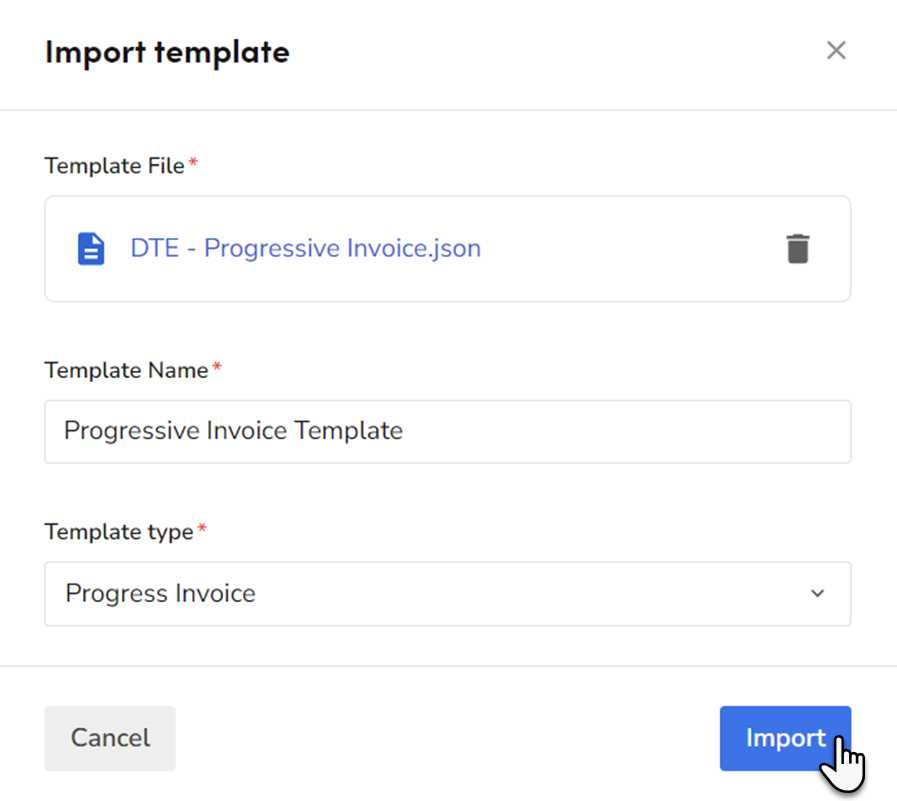

Integrating Import Invoices with Accounting Systems

Seamless integration between transaction documents and accounting systems is essential for efficient financial management. By linking your business records directly to accounting software, you can automate key processes like data entry, reporting, and tax calculation. This reduces manual effort, minimizes errors, and ensures that financial data is accurate and up to date across all platforms.

Integrating transaction records with accounting systems offers several key benefits:

- Automation of Data Entry: Automatically transferring details such as amounts, product descriptions, and payment terms into your accounting software eliminates the need for manual input and reduces the risk of errors.

- Improved Financial Tracking: Direct integration ensures that all records are instantly available in your accounting system, allowing for more efficient tracking of payments, expenses, and cash flow.

- Real-Time Updates: Any changes made to your trade records are immediately reflected in your financial system, providing accurate, real-time financial reports and helping to prevent discrepancies.

- Streamlined Tax Compliance: With integrated systems, tax information such as VAT or sales tax is automatically calculated, making it easier to comply with local and international tax regulations.

- Enhanced Reporting Capabilities: Accounting systems can generate detailed financial reports based on transaction data, helping you gain deeper insights into your business’s performance and identify areas for improvement.

To achieve a smooth integration, it is important to choose accounting software that supports import records or can be connected to third-party integration tools. Ensuring that both your accounting system and transaction documentation platform are compatible will make the process efficient and error-free.

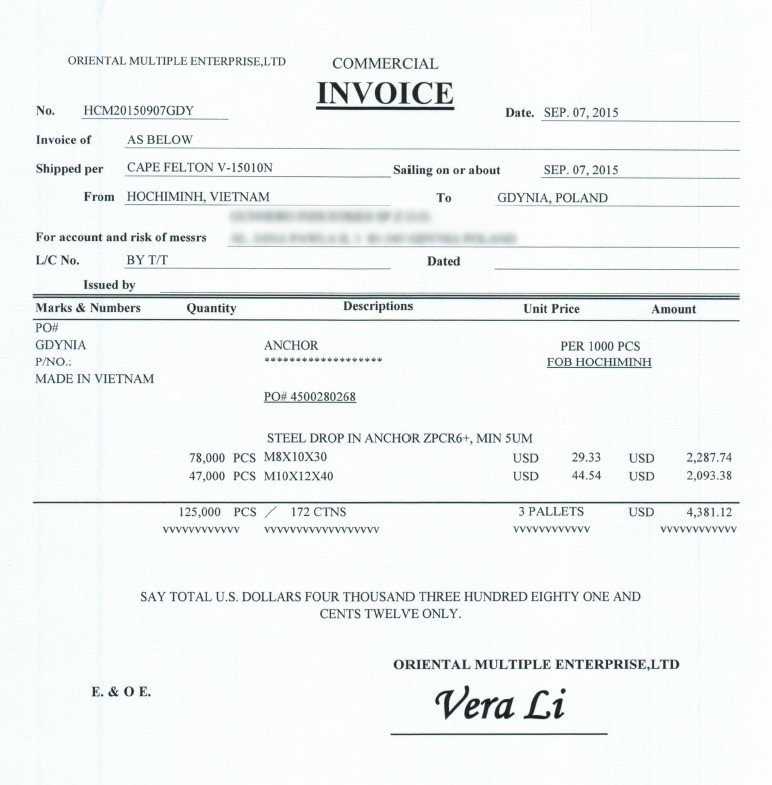

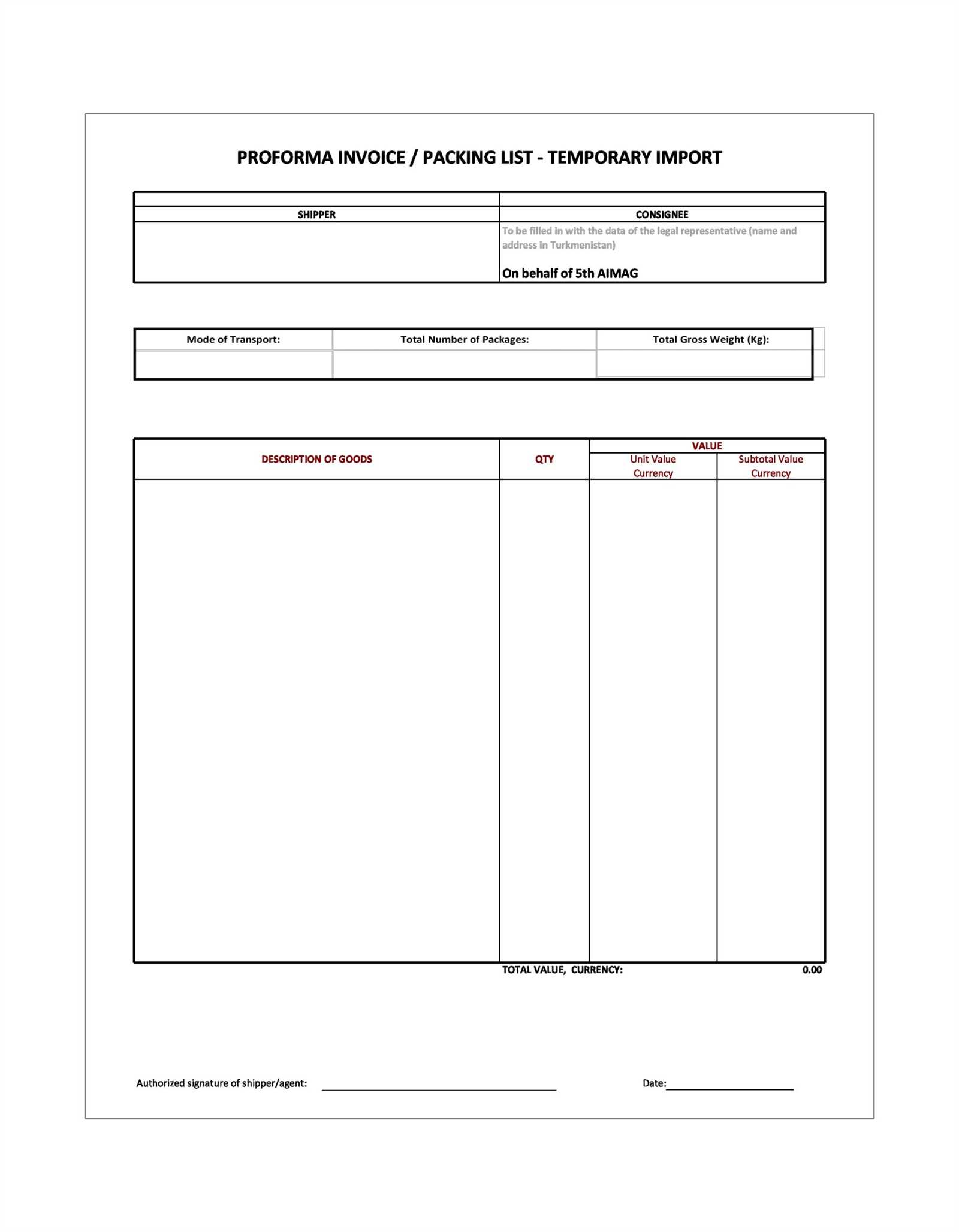

Legal Requirements for Import Invoices

When engaging in international trade, it is essential that business records comply with local and international laws to ensure smooth transactions and avoid potential legal complications. Each country has its own set of regulations governing what information must be included in trade documentation. These legal requirements help customs authorities, financial institutions, and tax agencies verify the legitimacy of transactions and assess duties, taxes, and other charges correctly.

Key Legal Requirements for Transaction Documentation

Below are some of the most important legal elements to consider when preparing trade documents for cross-border transactions:

| Legal Requirement | Description |

|---|---|

| Tax Identification Numbers | Both parties involved in the transaction, including the seller and the buyer, must provide their respective tax ID numbers for tax reporting and compliance purposes. |

| Customs Declarations | For international shipments, certain details, such as product classifications, value, and country of origin, must be included to meet customs clearance requirements. |

| Payment Terms | Clearly stating payment terms, such as currency, exchange rates, and deadlines, helps prevent misunderstandings between parties and ensures regulatory compliance in cross-border payments. |

| Goods Descriptions | Accurate and detailed descriptions of the goods being sold, including their quantity and value, are necessary for customs and tax purposes, helping to avoid delays or penalties. |

| Signature and Authorization | A valid signature from an authorized representative of the business is often required to confirm the accuracy and authenticity of the transaction record. |

Compliance Across Jurisdictions

Each country or region may have additional requirements for documentation in international trade, particularly when dealing with customs or specific product categories. It’s important to stay informed about the legal obligations in the countries you are trading with to avoid issues such as customs delays or fines. Businesses that frequently engage in global trade should consider consulting legal or customs experts to ensure compliance with all regulations.

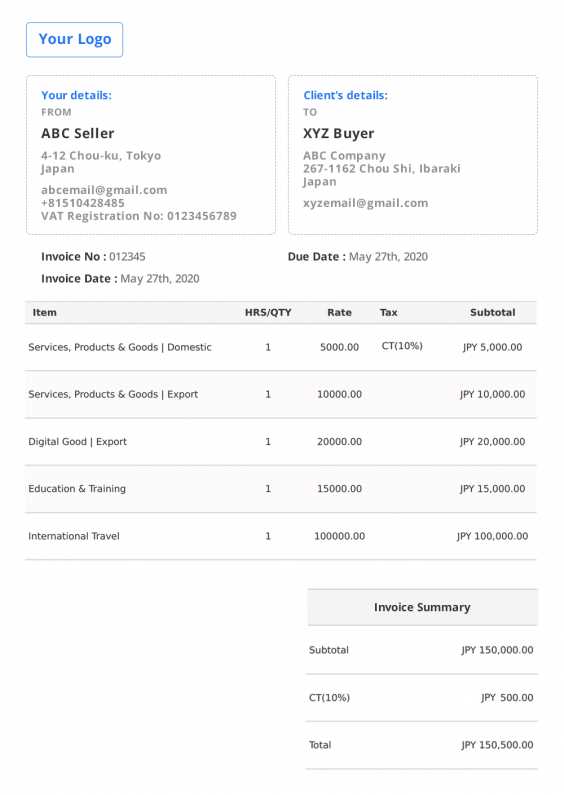

How to Handle Currency and Taxation in Invoices

When dealing with cross-border transactions, managing currency and taxation correctly is vital for both parties involved. Not only does it ensure compliance with local laws, but it also prevents potential financial discrepancies or misunderstandings. Clear currency conversions and accurate tax calculations help maintain transparency and ensure smooth financial operations between international businesses.

Here are some key considerations for handling currency and taxation in trade records:

| Aspect | How to Handle It |

|---|---|

| Currency Conversion | Clearly state the currency used in the transaction and ensure that exchange rates are accurately applied. If the transaction involves multiple currencies, specify the conversion rate and the source used for it. |

| Tax Rates | Specify the applicable tax rate (e.g., VAT, sales tax) and ensure it aligns with the tax laws of the buyer’s and seller’s countries. For international transactions, ensure that tax-exempt goods or services are clearly marked. |

| Tax Identification Numbers | Include both the seller’s and buyer’s tax IDs to ensure compliance with tax authorities. This information may be required for cross-border tax reporting or exemptions. |

| Currency Formatting | Use standardized currency symbols (e.g., $, €, £) and include the numeric value clearly formatted. In some cases, mention the currency code (e.g., USD, EUR) to avoid confusion. |

| Handling Multiple Taxes | If there are multiple taxes (such as local taxes, customs duties, or excise taxes), list each separately with its corresponding rate and amount to maintain transparency and clarity. |

By addressing currency and taxation details clearly, businesses can avoid potential misunderstandings with international partners and regulatory bodies. Properly handling these aspects helps maintain professionalism and ensures that all financial elements are accounted for in cross-border transactions.

Free vs Paid Import Invoice Templates

When creating trade records, businesses have the option to choose between free and paid solutions for documentation. Both types have their pros and cons, and selecting the right one largely depends on the needs of the business. Free options may be sufficient for smaller companies with simple transactions, while paid solutions often offer advanced features and greater customization for larger enterprises or those engaged in more complex international trade.

Advantages of Free Documentation Templates

Free trade documentation formats are widely available and can be a great starting point for small businesses or startups. Here are some of the benefits of using a free solution:

- Cost-Effective: As the name suggests, free options require no upfront payment, making them ideal for businesses with limited budgets.

- Quick and Simple: Many free solutions offer basic layouts that are easy to use, with minimal setup or customization required.

- Basic Compliance: Free documents often cover the essential legal and financial fields necessary for simple transactions, ensuring basic compliance with local laws.

Benefits of Paid Documentation Solutions

Paid options, on the other hand, offer additional features and customization that can be essential for larger businesses or those involved in more complex international transactions. Here are some advantages of paid solutions:

- Advanced Customization: Paid templates often offer more flexible design options, allowing businesses to add branding elements, tailor the format to specific needs, and include additional details relevant to the transaction.

- Automated Calculations: Many paid platforms include automated features such as tax calculations, currency conversions, and payment reminders, reducing the risk of human error.

- Integrated Solutions: Paid options can often integrate with accounting and inventory management systems, streamlining business processes and improving overall efficiency.

- Legal Compliance and Support: Paid solutions are more likely to be regularly updated to comply with the latest regulations, and they often come with customer support to address any legal or technical concerns.

Ultimately, the choice between free and paid solutions comes down to the complexity of your business needs. Small businesses or occasional traders may find free options adequate, while larger organizations or those with more intricate requirements may benefit from the enhanced features provided by paid services.

Tips for Organizing Your Import Invoices

Efficient organization of transaction records is key to maintaining smooth business operations, especially when handling international trade. Properly managing these documents not only ensures compliance with legal requirements but also helps streamline financial reporting, tax filing, and audit processes. Adopting effective organizational strategies can save time, reduce errors, and improve overall productivity.

Best Practices for Managing Trade Records

Here are some essential tips for keeping your business documentation well-organized:

- Use Digital Systems: Transitioning to a digital record-keeping system makes it easier to store, search, and retrieve documents. Cloud-based platforms offer added security and remote access, making it easier for teams to collaborate.

- Implement a Clear Filing System: Organize your documents by categories such as date, client, or product type. A well-structured folder system ensures you can quickly locate the right record when needed.

- Label Documents Consistently: Always use clear and consistent naming conventions for your files, such as including the transaction date or invoice number. This helps avoid confusion and ensures that documents are easy to track.

- Regularly Back Up Files: Keep regular backups of your electronic records, especially when dealing with important or sensitive trade documentation. This ensures you don’t lose valuable data in case of technical issues.

Advanced Organizational Techniques

For businesses handling a larger volume of transactions, consider these more advanced techniques for streamlining the process:

- Automate Data Entry: Utilize software that can automatically extract relevant details from received documents and enter them into your system. This reduces manual effort and helps eliminate errors.

- Set Up Alerts for Deadlines: Use project management tools or calendar reminders to track key dates, such as payment due dates or tax filing deadlines, ensuring you never miss an important milestone.

- Regular Audits: Periodically review your organization system to ensure it’s still working efficiently. Address any bottlenecks or inefficiencies that may be slowing down your document retrieval or processing.

By following these organizational practices, you can ensure that your trade documents are not only easy to access but also fully compliant with legal and financial standards, making your international operations smoother and more efficient.

Streamlining the Invoice Process for Efficiency

Efficient management of financial documentation is critical for the smooth operation of any business, especially when dealing with international trade. A streamlined process reduces errors, accelerates workflow, and ensures that payments are processed on time. By optimizing the creation, tracking, and management of transaction records, businesses can save both time and resources, while maintaining accuracy and compliance.

Key Steps for Optimizing the Process

Here are some important strategies for making your financial documentation process more efficient:

- Automate Record Creation: Leverage software solutions that can automatically generate transaction documents based on pre-set parameters. This eliminates the need for manual data entry and reduces the chances of human error.

- Use Standardized Formats: Adopt a consistent format for all your trade records to make it easier to track and compare documents. Standardization helps ensure that all necessary details are included, improving both speed and accuracy.

- Integrate with Accounting Systems: Link your documentation process to accounting software to automate the transfer of data. This integration ensures that all financial records are instantly updated and reduces duplication of effort.

- Set Up Automated Reminders: Use automated reminders for critical deadlines such as payment due dates or tax filing dates. This ensures you stay on top of important tasks without having to rely on manual tracking.

Advanced Solutions for Better Workflow

For larger organizations or businesses handling a higher volume of transactions, more advanced solutions can further enhance efficiency:

- Implement Digital Signatures: Replace traditional paper signatures with secure digital signatures to speed up document approval processes and ensure a higher level of security.

- Cloud-Based Storage: Store all your records in a cloud system to allow easy access from anywhere and ensure that documents are securely backed up in case of system failures.

- Use Data Validation Tools: Employ software that validates entered information in real-time, preventing errors before they become a problem and ensuring consistency in all records.

By incorporating these strategies, businesses can significantly reduce administrative overhead and improve the accuracy and timeliness of their transaction management. A well-optimized process not only helps ensure compliance with regulations but also contributes to better financial health and smoother international operations.