How to Use an Import Commercial Invoice Template for Your Shipments

When conducting global business transactions, accurate and organized paperwork is essential to ensure smooth operations. A well-prepared document is not only crucial for customs clearance but also serves as a clear record of the goods being transported, their value, and the terms of the sale. Inaccurate or incomplete forms can lead to delays, fines, or even the rejection of shipments. Thus, creating a standardized form for such purposes becomes an invaluable asset for both businesses and their clients.

The proper preparation of trade documentation involves understanding the required details and having a clear format that simplifies data entry. While the specifics may vary based on the region and type of goods, the fundamental structure remains largely the same. Businesses can benefit greatly from using pre-designed structures that ensure all necessary information is included, making the process more efficient and reducing the risk of errors.

Implementing a professional structure helps streamline transactions, supports compliance with international trade laws, and accelerates processing times for shipments. By utilizing a well-structured format, organizations can guarantee that all critical information is captured correctly and consistently every time, facilitating smoother global exchanges.

Import Commercial Invoice Template Overview

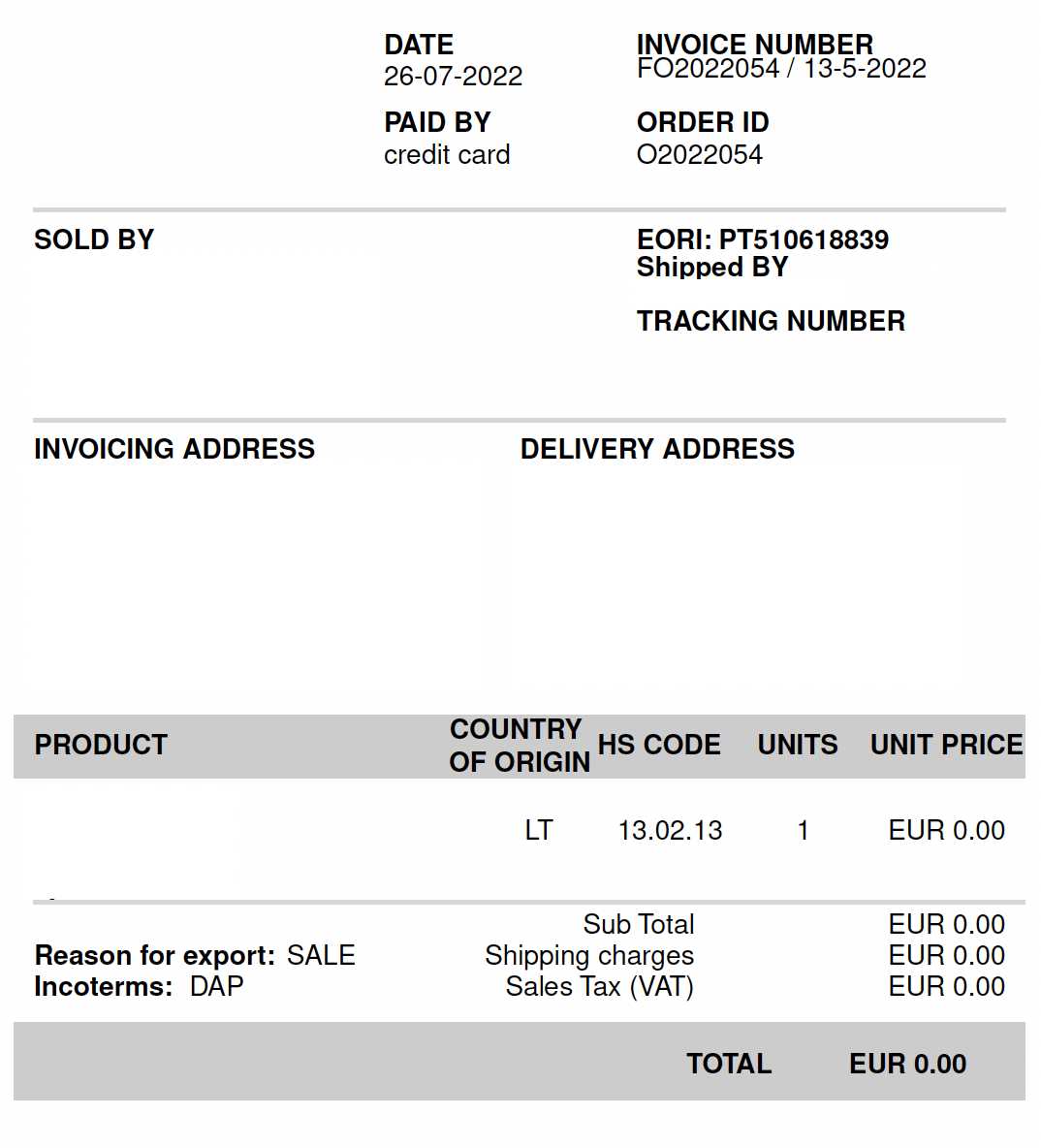

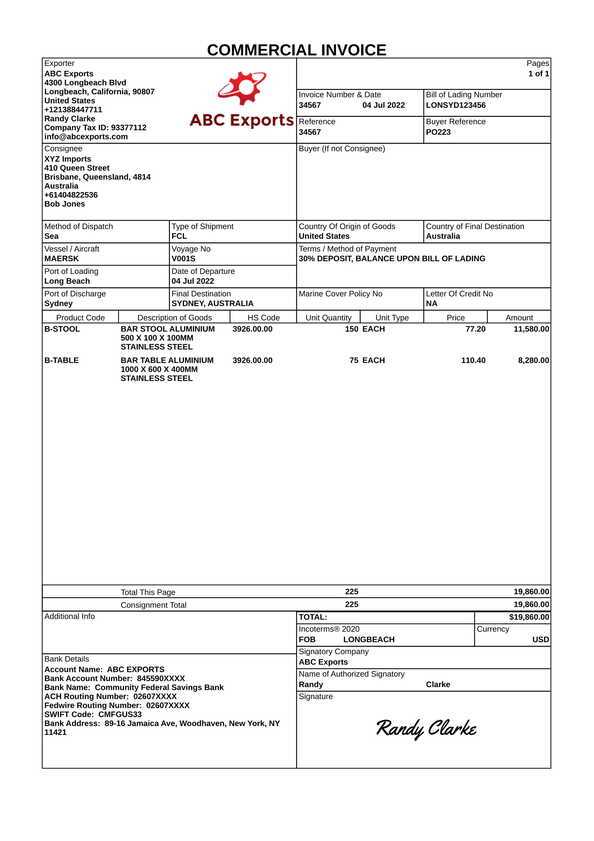

In international trade, proper documentation is essential for the smooth movement of goods across borders. A well-organized document that outlines the transaction details, such as the nature of the products, their value, and the agreed-upon terms, is required to comply with customs regulations. This standardized format is used to communicate the necessary information between businesses, customs authorities, and shipping companies, ensuring that all parties have a clear understanding of the shipment’s contents and value.

For businesses engaged in cross-border trade, using a pre-structured form to record these details can save time and reduce the likelihood of errors. Such a document is typically designed to capture essential information, including descriptions of the items, quantities, prices, and shipping terms. By following a standardized format, companies can ensure that all the necessary fields are completed accurately, helping avoid customs delays or penalties.

These standardized forms also help businesses maintain consistency across shipments, streamline their workflow, and improve overall efficiency. With a well-established format, companies can easily adapt to different customs requirements while minimizing the risk of non-compliance or misunderstandings. This approach ultimately makes international transactions smoother and more reliable for all involved parties.

What is an Import Commercial Invoice

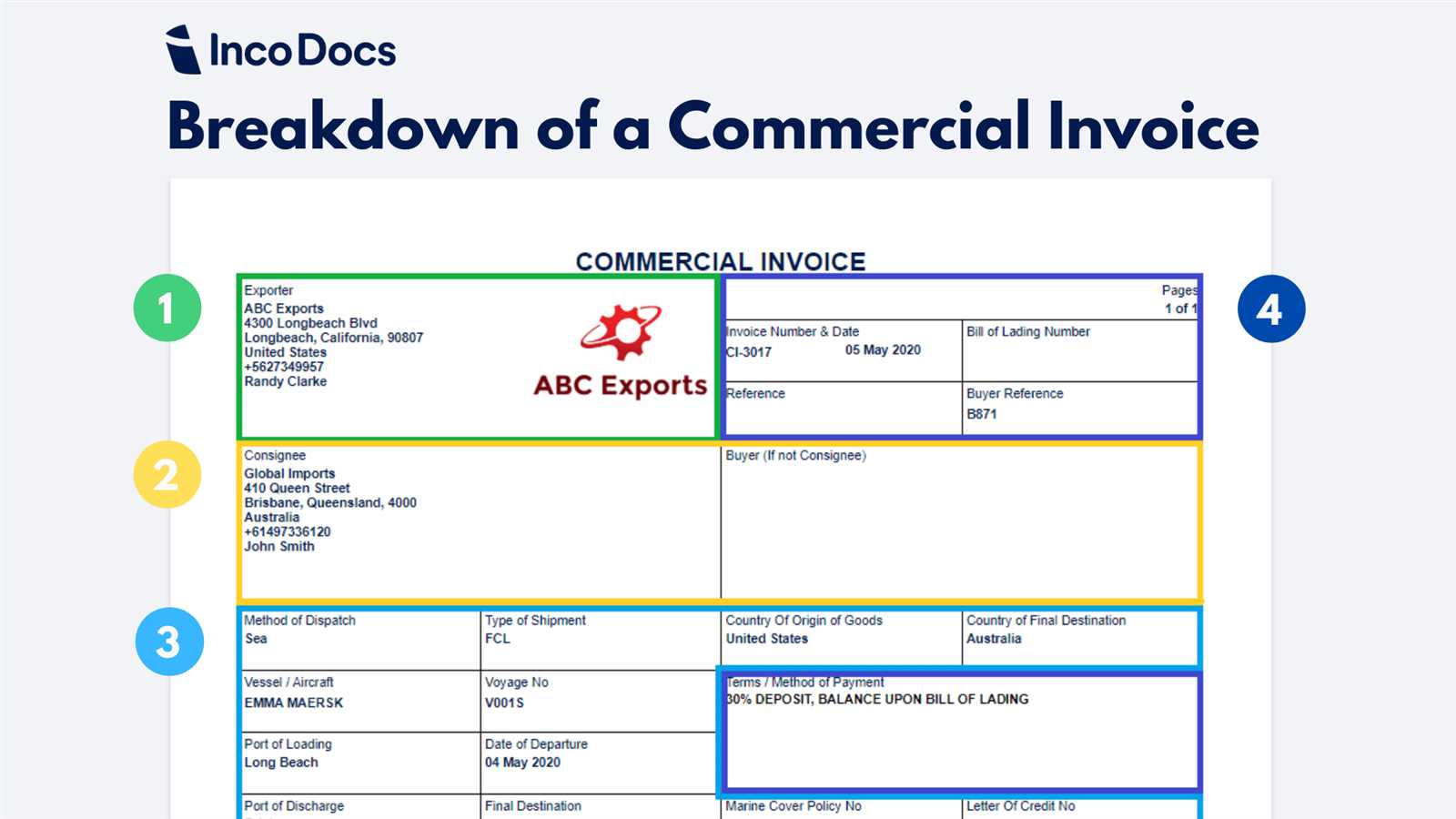

In international trade, a crucial document is used to provide a detailed summary of the transaction between the buyer and seller. This record serves multiple purposes, from facilitating customs clearance to ensuring that both parties agree on the terms of the exchange. It includes key information about the goods being shipped, their value, and the conditions under which the transaction takes place. Understanding this document is essential for businesses involved in global trade, as it ensures smooth and timely delivery of products across borders.

This document typically includes the following important details:

- Seller and Buyer Information: Names, addresses, and contact details of both parties involved in the transaction.

- Goods Description: A detailed breakdown of the items being shipped, including quantity, specifications, and any identifying features.

- Transaction Value: The price of the goods, along with any additional costs such as shipping or insurance.

- Shipping Terms: Agreements regarding how the goods will be delivered, including freight arrangements and responsibilities.

- Customs Information: Data required by customs authorities, such as the country of origin, Harmonized System codes, and other regulatory information.

By providing all of this information in a clear and standardized format, the document helps ensure that the goods are processed smoothly by customs, and it supports compliance with local and international trade regulations. It is not only essential for tracking and clearing shipments but also for ensuring that both the buyer and seller are protected throughout the transaction process.

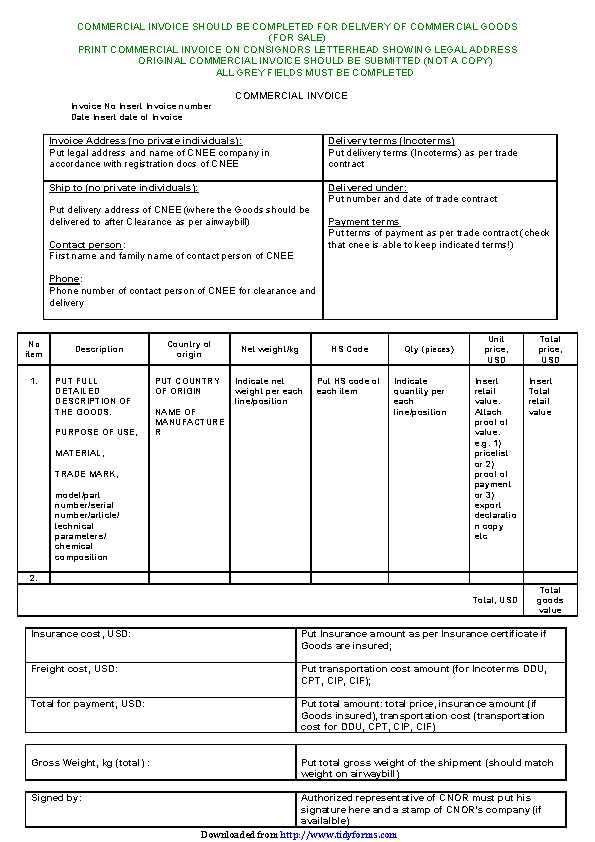

Key Elements of an Invoice Template

To ensure smooth and efficient transactions in international trade, a well-structured document is required to clearly outline all relevant details of a shipment. The layout of this document is designed to provide a clear understanding of the goods being exchanged, the terms of the transaction, and the parties involved. A complete and accurate document minimizes confusion, ensures compliance with customs regulations, and helps both buyers and sellers track their shipments without delay.

Essential Information for Accurate Documentation

The following elements are critical to include in this type of document:

- Seller and Buyer Details: The full names, addresses, and contact information of the buyer and seller to clearly identify the parties involved.

- Product Descriptions: A precise description of each item being shipped, including the quantity, unit price, and total value of the goods.

- Transaction Terms: This section outlines the conditions of the sale, such as the delivery method, payment terms, and any warranties or guarantees.

- Shipping Information: Includes the method of shipment, expected delivery dates, and any tracking numbers or reference codes.

- Customs and Regulatory Information: Details required for customs clearance, such as HS codes, country of origin, and relevant tax codes.

Formatting and Consistency

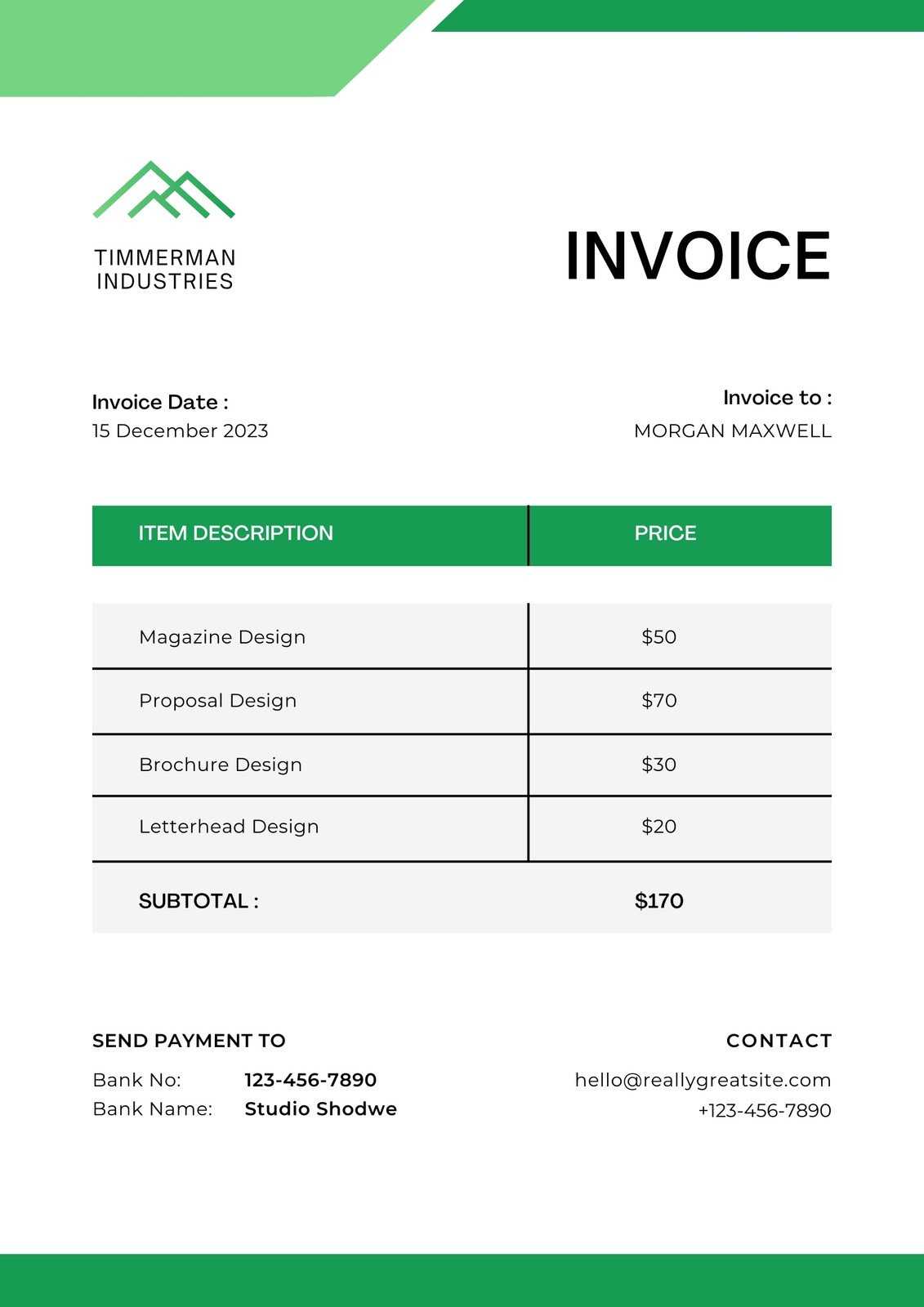

A clear and consistent format makes it easier to read and ensures that no vital information is missed. The layout should be simple but comprehensive, with clearly labeled sections for each required detail. Many businesses prefer using pre-designed formats that can be customized for each transaction, allowing for quick and accurate document preparation while maintaining consistency across all shipments.

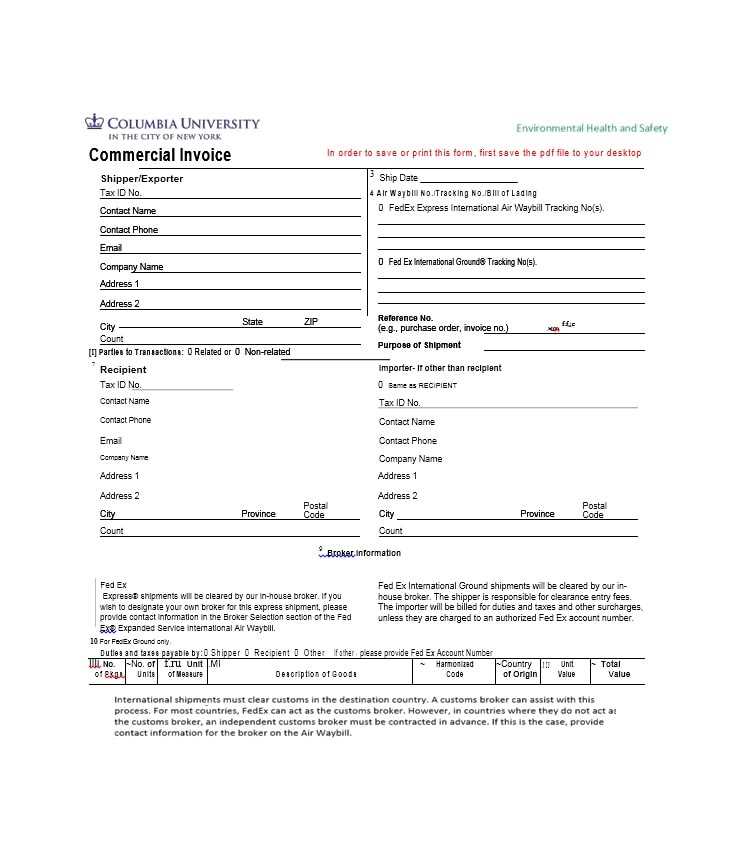

How to Customize Your Invoice

Adapting a standard document to meet the specific needs of each transaction can significantly streamline the process and ensure accuracy. Customizing the layout allows businesses to incorporate all necessary details while maintaining consistency. A flexible format can be tailored to reflect different types of goods, specific terms, or varying payment methods, making it easier to comply with international regulations and meet the preferences of clients.

Steps for Customization

To tailor the document to your specific business needs, consider the following steps:

- Adjust the Layout: Customize the structure of the document to suit your preferences or company branding, ensuring it’s easy to read and organized logically.

- Modify Field Names: Depending on your business or industry, you might want to rename certain sections or add additional fields for specific details (e.g., discounts, special instructions, etc.).

- Include Specific Shipping Information: Adapt the shipping section to reflect various delivery methods or international shipping requirements that may be relevant to your clients.

- Insert Legal or Tax Information: Add necessary compliance information like tax identification numbers or specific legal disclaimers required for cross-border transactions.

Example of a Customized Layout

Here is an example of how you might organize and customize the content:

| Field | Customized Content | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Seller Information | Company Name, Address, Phone, Email | |||||||||||||

| Buyer Information | Customer Name, Address, Contact Information | |||||||||||||

Product Description

Why an Accurate Invoice MattersEnsuring that all transaction details are properly documented is crucial for any business. Accurate records help to prevent disputes, streamline financial management, and maintain professional relationships. Whether dealing with suppliers, clients, or regulatory bodies, precision in these documents can save time, money, and effort in the long run. Here are some key reasons why accuracy is essential:

In short, an error-free record of transactions not only strengthens your business’s credibility but also lays the foundation for smooth, successful operations in the future. Common Mistakes in Invoice Preparation

Proper documentation is vital for maintaining smooth business operations, but errors in the creation of financial records are common. These mistakes can lead to confusion, delays, or even financial discrepancies. Recognizing and avoiding common pitfalls can help ensure that transactions are processed accurately and efficiently. Here are some frequent errors businesses make when preparing transaction documents:

|