Easy to Use Illustration Invoice Template for Artists and Designers

Managing payments for creative work can often be a challenging task, but having a structured way to request compensation can make the process smoother and more professional. Whether you’re a graphic designer, freelance artist, or another type of creative professional, sending clear and organized documents helps both you and your clients stay on the same page.

By using a well-crafted form to outline the details of your work, agreed-upon rates, and payment terms, you ensure that expectations are clearly defined from the start. Not only does this help avoid misunderstandings, but it also adds a layer of professionalism to your business operations. With the right document, you can reduce the chances of delayed payments and maintain a trustworthy relationship with your clients.

In this guide, we explore how to create and customize such documents to suit your unique needs, ensuring that you can handle billing with ease and confidence.

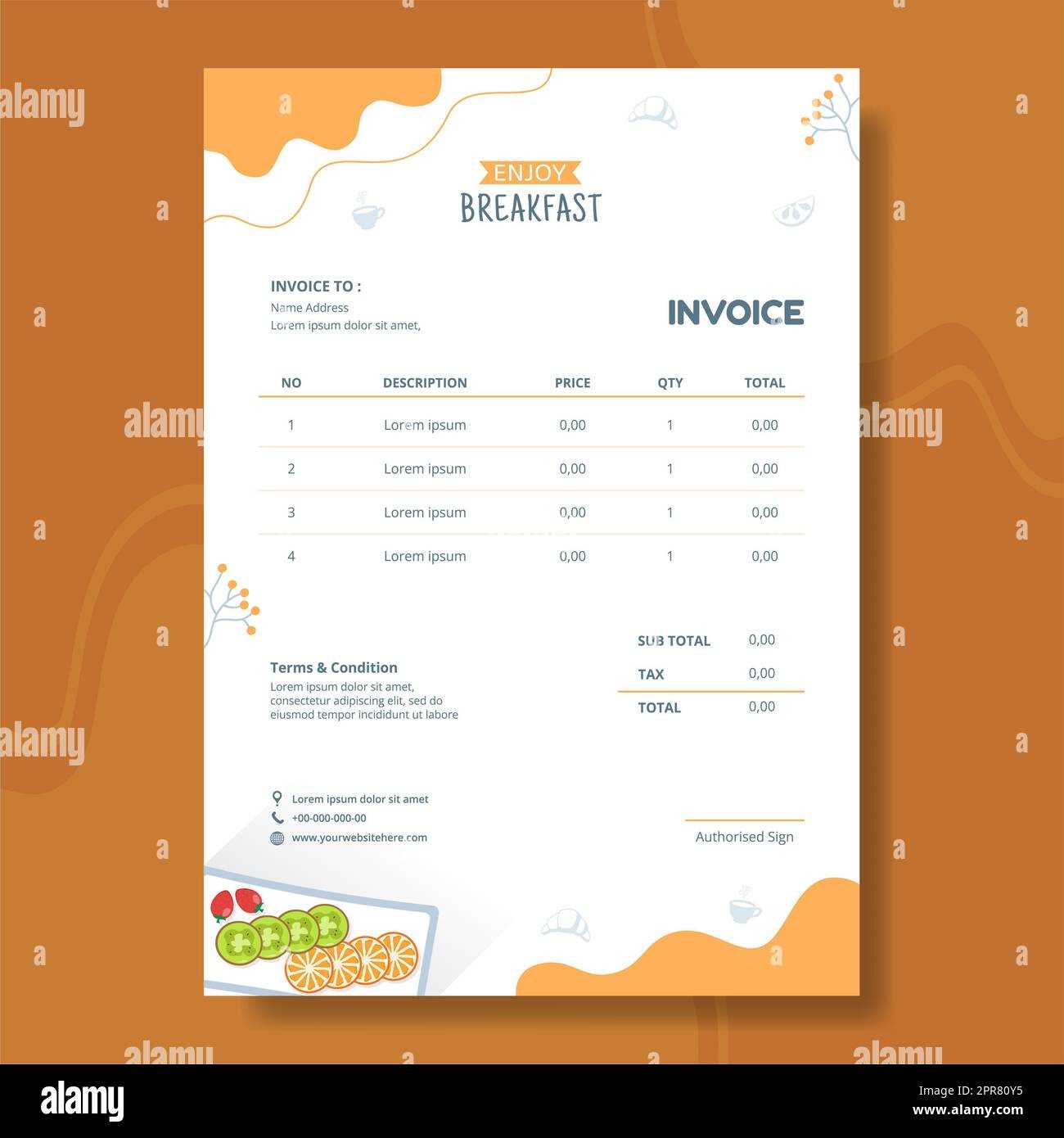

Illustration Invoice Template Overview

For any creative professional, having a standardized document to request payment is essential for smooth transactions. This form serves as a formal request that outlines the work completed, agreed-upon pricing, and the terms of payment, ensuring that both parties have a clear understanding of the financial aspects of the project.

By utilizing a well-structured document, you can quickly and efficiently generate requests that cover all necessary details without leaving room for confusion. A properly formatted document will include fields such as the client’s information, a description of the work provided, payment deadlines, and any additional terms or conditions specific to the project.

Having this kind of form not only saves time but also enhances professionalism and helps maintain strong relationships with clients. It serves as a record for both the service provider and the customer, ensuring transparency in financial transactions and providing legal protection if disputes arise.

Why Use an Invoice Template for Illustrators

For creatives, having a predefined document to request payment can streamline the billing process, making it more efficient and less time-consuming. Instead of creating a new form from scratch for each project, a standardized document ensures that all necessary details are included and formatted correctly, reducing the chance of errors or missed information.

Using such a document also helps to maintain a professional appearance when dealing with clients. It provides a clear and consistent structure, allowing clients to easily understand the work completed, pricing, and payment terms. This clarity fosters trust and helps establish a smooth working relationship, especially in long-term or repeat collaborations.

Additionally, by using a ready-made document, creatives can focus more on their craft rather than administrative tasks. This allows for quicker turnaround times and better overall project management, leading to a more organized and productive business environment.

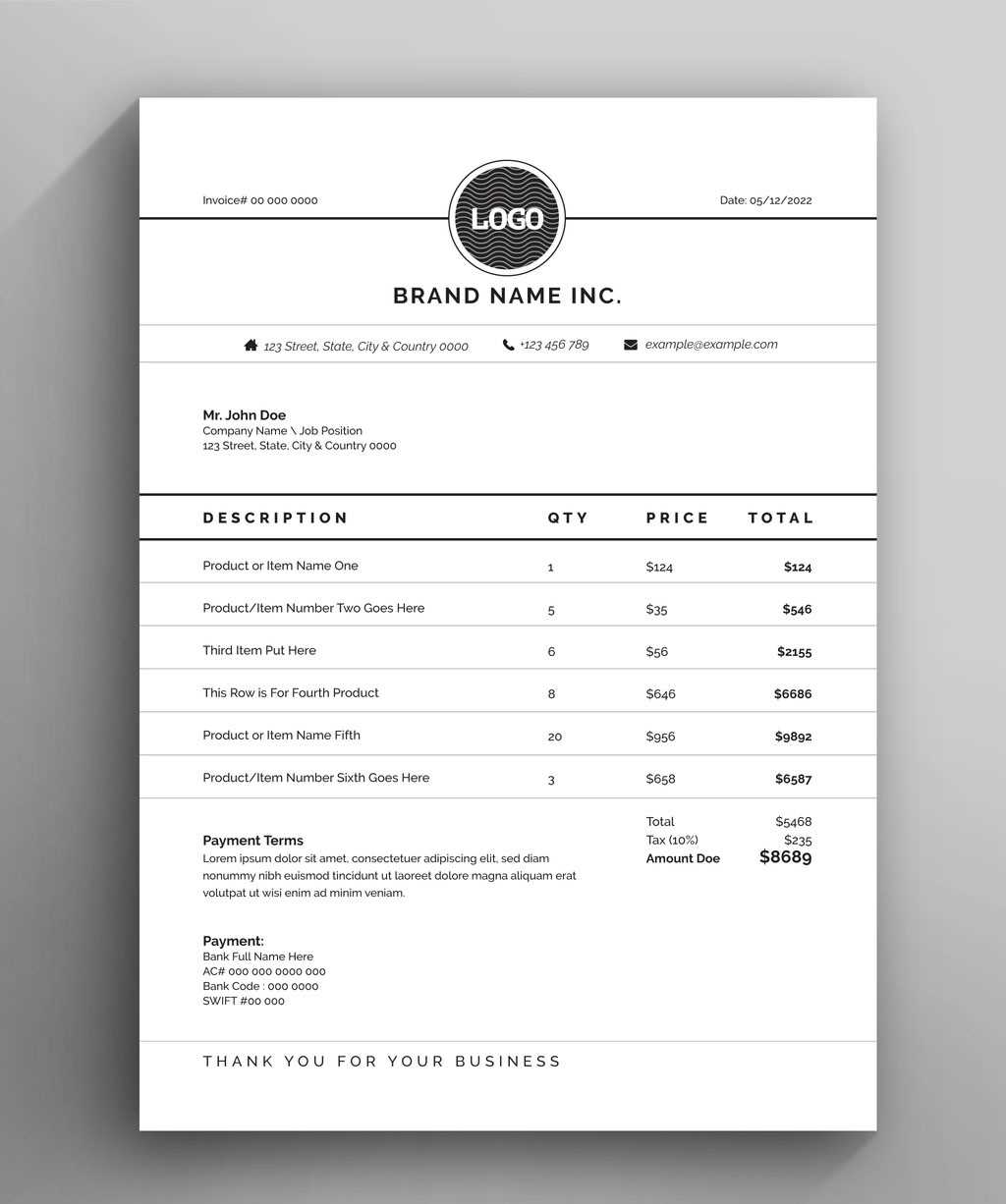

Key Features of an Effective Invoice

When it comes to requesting payment for creative work, a well-constructed document should include all the essential elements that make the transaction clear and professional. An effective form not only ensures timely payments but also establishes transparency and builds trust with clients. Here are the key features that make such a document efficient and reliable:

1. Clear Identification and Contact Information

- Your Name and Business Information: Include your name or business name, address, phone number, and email.

- Client’s Details: Ensure the client’s contact information is listed accurately, including their name, company (if applicable), and address.

- Unique Identification Number: Each document should have a unique reference number for easy tracking and future reference.

2. Detailed Description of Work

- Project Summary: Provide a clear description of the work completed, including specific tasks or services rendered.

- Quantity and Rate: List the number of hours worked or units provided and their corresponding rates.

- Breakdown of Costs: If applicable, break down any additional charges or fees for extra work or materials used.

3. Payment Terms and Deadlines

- Payment Method: Clearly indicate accepted payment methods, such as bank transfer, PayPal, or credit card.

- Due Date: Specify the payment due date to set clear expectations for the client.

- Late Fees: If necessary, include information on penalties for late payments.

4. Professional Presentation

- Consistent Layout: Use a clean, organized structure that makes the form easy to read and navigate.

- Branding: Incorporate your logo or personal branding to maintain a professional appearance and reinforce your identity.

These key features are crucial for creating a seamless, effective payment request process. By including these elements, you ensure that the transaction is transparent, professional, and clear for both parties involved.

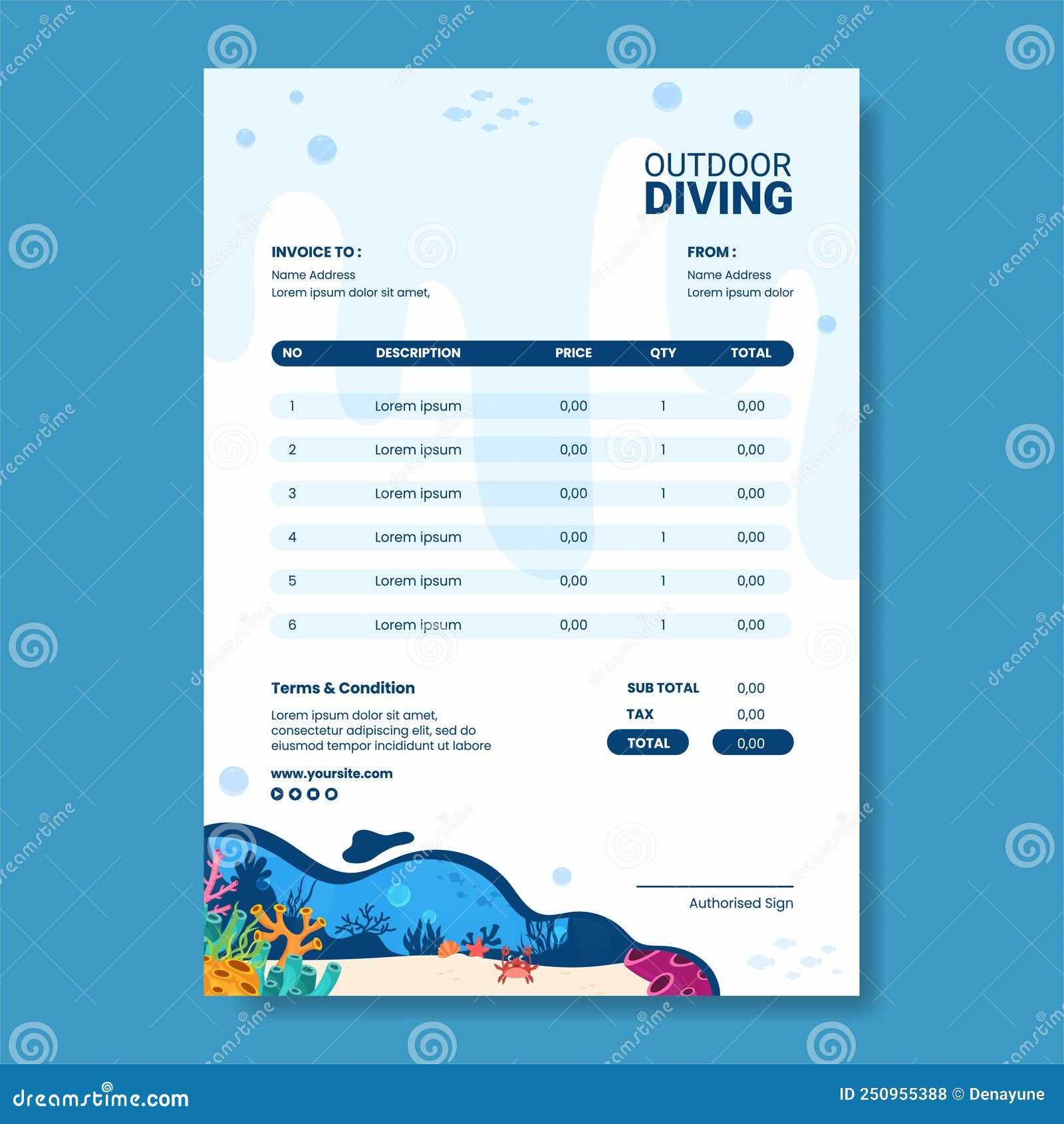

How to Customize Your Invoice Template

Customizing a document for billing purposes allows you to tailor it to your specific needs and style. This not only helps maintain a consistent look for your brand but also ensures that all necessary details are included in a way that best suits the nature of your work and your client’s preferences. Customization can involve adjusting the layout, adding specific terms, or even modifying the language used in the document.

Here are a few key steps to help you personalize your billing form:

1. Adjust the Layout

Begin by choosing a layout that matches your style. You can opt for a minimalist design or a more detailed format depending on the type of work you do. A well-organized layout should prioritize clarity, with each section easily distinguishable. The overall goal is to make the document easy to read and professional in appearance.

2. Include Your Branding

Incorporating your brand’s colors, logo, and font style gives the document a cohesive look that represents your business. Make sure to place your logo in a prominent position, such as at the top of the document, to increase brand visibility. This adds a personal touch while maintaining a professional standard.

3. Customize Fields and Sections

Tailor the fields to your specific needs. If you often work on projects that require deposits, make sure there is a field for prepayment amounts. Similarly, if you offer different pricing tiers, include a section to itemize these options. Be sure to add spaces for both your and your client’s contact information, and any other details that will help clarify the terms of the project.

4. Adjust Payment Terms and Deadlines

Modify the payment terms to reflect your specific conditions. Whether you require full payment upfront, a percentage deposit, or payment upon completion, make sure these terms are clearly stated. Similarly, if you work with international clients, consider adding payment options or notes about currency conversion fees.

5. Use Descriptive Language

While the structure is important, the wording of your document can make a difference. Use clear, professional language to describe your services and terms. Avoid jargon and be as precise as possible to prevent any misunderstandings. You may also want to include a short note or message thanking your client for their business.

By customizing your billing document, you create a more efficient and personal experience for both you and your clients, making it easier to track payments and maintain professionalism throughout your projects.

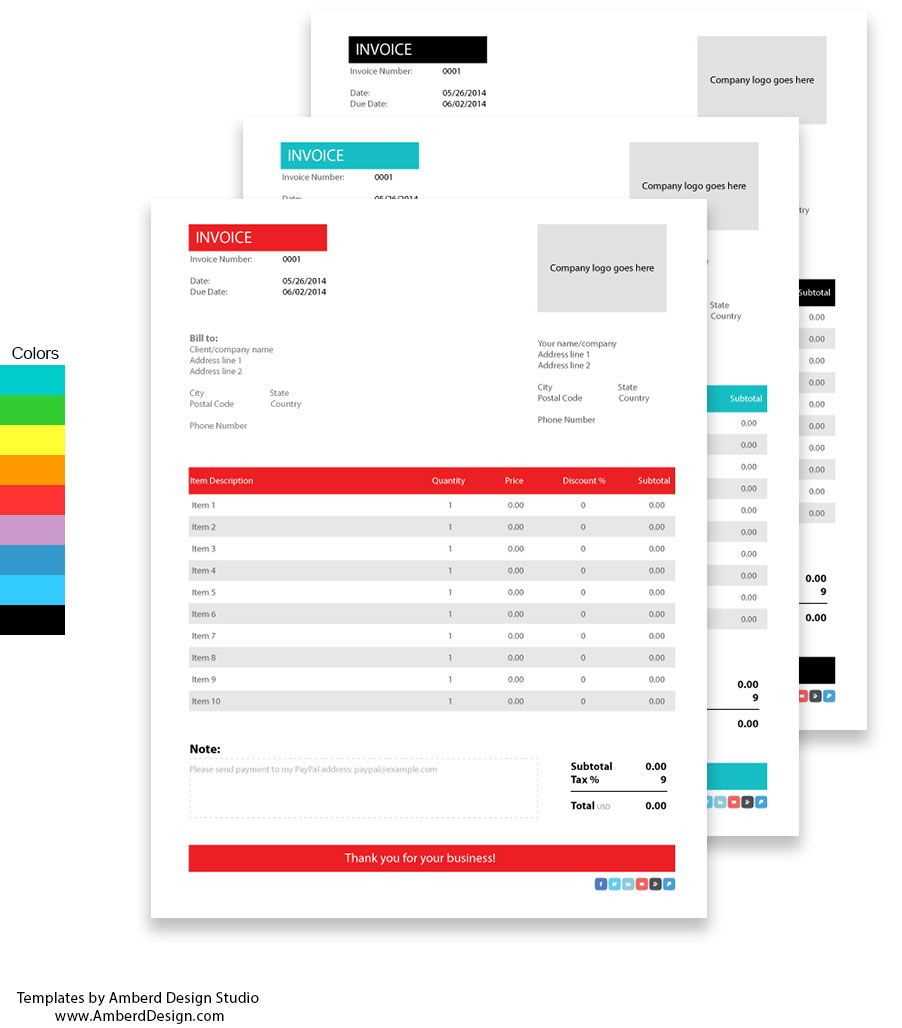

Free Illustration Invoice Templates Available

For creatives looking to simplify their billing process, there are numerous free resources available to download customizable forms. These ready-made documents are designed to make the payment process quicker and more efficient, allowing you to focus on your work rather than spending time on administrative tasks.

Many of these forms come in a variety of styles and formats, ensuring that you can find one that fits your specific needs. Whether you prefer a simple, minimalist design or a more detailed layout, there are plenty of options that provide all the necessary fields for outlining services, payment terms, and client details.

Here are some benefits of using free resources:

- Time-saving: These forms save you the effort of creating one from scratch, offering a ready-to-use solution.

- Easy to Customize: Most free documents are easy to edit, so you can quickly tailor them to your specific requirements.

- Professional Appearance: Free resources often feature clean, professional designs that enhance the overall presentation of your work.

By taking advantage of these free options, you can streamline your billing process and ensure a smooth, professional transaction with your clients.

Understanding the Essential Invoice Components

To create an effective payment request, it’s crucial to understand the key components that make up a professional document. Each section serves a specific purpose, ensuring both you and your client have all the necessary information for a smooth transaction. By including these critical elements, you not only improve clarity but also demonstrate professionalism.

1. Client and Business Information

- Your Details: Include your full name or business name, address, phone number, and email for contact purposes.

- Client Information: Ensure your client’s name, company (if applicable), and contact information are correctly listed to avoid confusion.

2. Clear Breakdown of Work and Costs

- Service Description: Clearly outline the work completed or products provided. Be specific to avoid any misunderstanding.

- Quantity and Rate: Detail the amount of work performed and the agreed rates. Include unit prices or hourly rates for transparency.

- Total Cost: List the total amount due for all services, including taxes or additional fees if applicable.

3. Payment Terms

- Due Date: Indicate when the payment is expected, whether it’s due immediately or by a specific deadline.

- Accepted Payment Methods: Specify the payment methods you accept (bank transfer, PayPal, etc.).

- Late Fees: If applicable, include information about penalties for late payments.

4. Professional Design and Structure

- Layout: A clean, easy-to-read format is key. Use sections and headings to organize information clearly.

- Branding: Add your logo or business branding to give the document a professional look and reinforce your identity.

By understanding and including these essential components, you ensure that your payment request is comprehensive, professional, and easy for your clients to understand, helping you maintain smooth financial transactions.

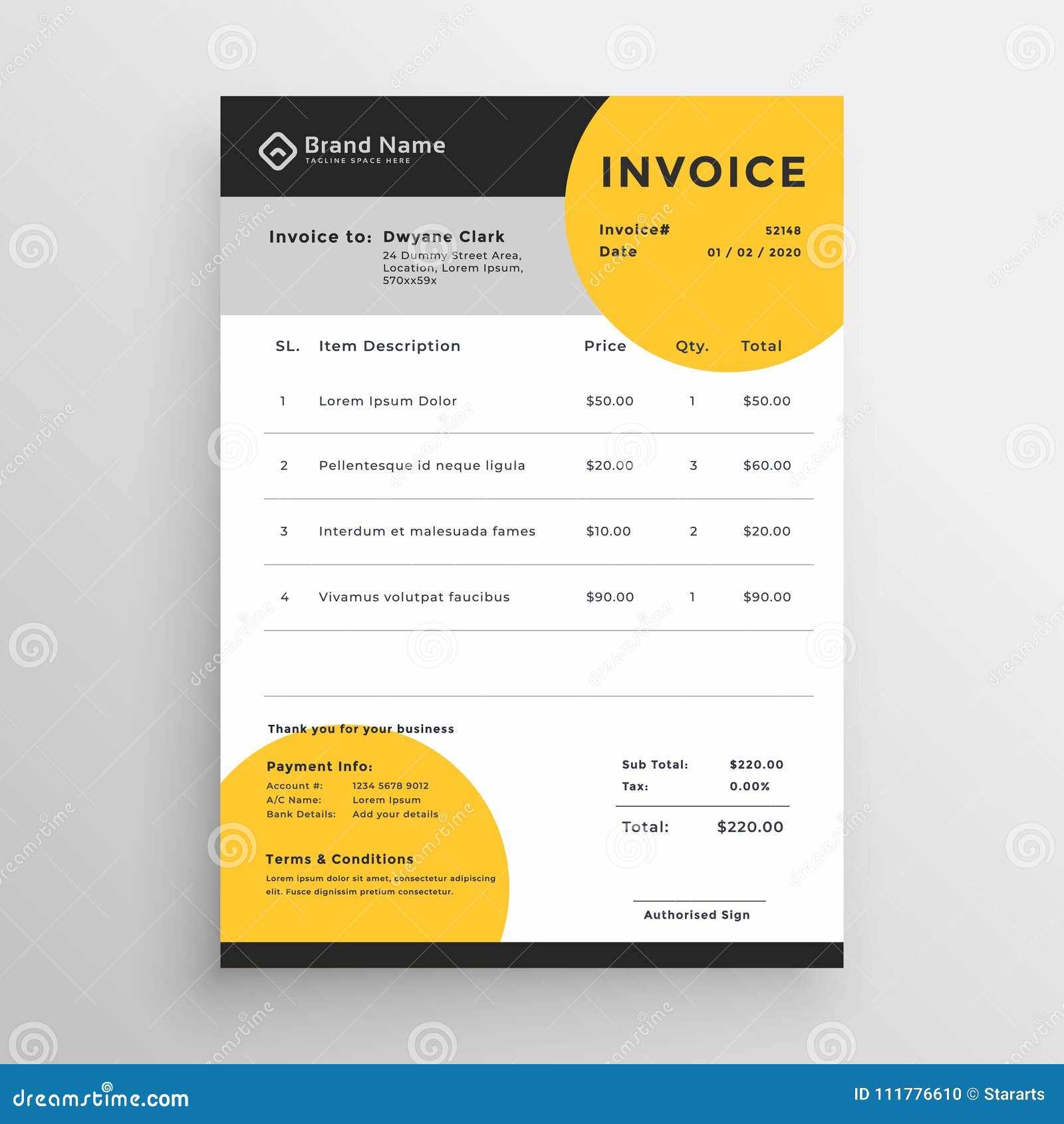

Creating Professional Invoices for Artwork

When it comes to selling your creative work, a professional payment request is essential for ensuring timely compensation and maintaining good relationships with clients. A well-crafted document not only communicates the value of your work but also sets clear expectations regarding payment terms and conditions. Creating a professional billing form helps you establish credibility and fosters trust with clients, making future transactions smoother.

To create a polished payment request for your artwork, start by clearly describing the work you’ve completed. Include details such as the project type, size, medium used, and any other relevant information that gives context to the pricing. Be sure to itemize the costs, whether you’re charging per piece, hour, or project, and include any applicable taxes or additional fees. This level of detail ensures that clients understand exactly what they’re paying for, which can help avoid disputes down the line.

Additionally, make sure the document is formatted professionally, using a clean layout that reflects your brand’s identity. Incorporate your logo and use a consistent color scheme or font style. A visually appealing, organized form not only enhances your professionalism but also leaves a lasting impression on your clients.

Lastly, always include clear payment terms, such as due dates, acceptable payment methods, and any late fees or penalties for overdue payments. By providing all the necessary information upfront, you reduce the likelihood of confusion and make the process of receiving payment as straightforward as possible.

Best Software for Invoice Generation

For creatives looking to streamline their billing process, using the right software can make generating payment requests quick, easy, and professional. With the right tools, you can create custom documents, track payments, and manage client information all in one place, helping you stay organized and focus more on your work.

There are several options available for generating these types of forms, each with unique features to suit different business needs. Some platforms offer simple, no-fuss solutions, while others provide more advanced customization, integrations with accounting systems, and automated reminders. Here are some of the best tools available:

1. FreshBooks

FreshBooks is a user-friendly accounting platform that allows you to easily create, send, and track payment requests. It offers a variety of customizable templates, making it simple to tailor the form to your brand. FreshBooks also provides features for tracking time, managing projects, and sending automatic payment reminders, helping you stay on top of all aspects of your business.

2. QuickBooks

QuickBooks is another popular accounting software known for its comprehensive features. With QuickBooks, you can generate professional payment requests, track expenses, and manage taxes–all in one platform. It integrates seamlessly with your bank account and offers a variety of templates for different business needs, making it an excellent choice for freelancers and small business owners.

3. Zoho Invoice

Zoho Invoice is an intuitive tool that offers a simple way to create and manage payment requests. It allows for extensive customization, from branding your documents with logos to setting up recurring billing for ongoing projects. Zoho Invoice also includes time tracking and expense management features, making it a great option for creatives who want a comprehensive solution.

4. Wave

Wave is a free accounting software that offers an easy-to-use invoicing system. It allows you to create customizable forms, send payment reminders, and track your income and expenses. While Wave offers fewer advanced features compared to some paid options, it is an excellent choice for freelancers or small businesses just starting out.

By choosing the right tool for your needs, you can simplify your billing process, reduce administrative work, and ensure that your payment requests are always professional and accurate.

Common Mistakes to Avoid on Invoices

When creating a billing document, it’s easy to overlook certain details that could lead to confusion or delays in payment. Even small errors can result in miscommunication with clients or complications in tracking payments. By being aware of common mistakes and addressing them in advance, you can ensure that your payment requests are clear, professional, and effective.

1. Missing or Incorrect Client Information

- Incorrect Client Details: Always double-check the client’s name, address, and contact information to avoid sending the document to the wrong party.

- Omitting Contact Information: Ensure that both your and your client’s contact information is clearly listed, making it easier for them to reach out if needed.

2. Lack of Clear Work Description

- Unclear Service Details: Avoid vague descriptions of the work provided. Be specific about the tasks completed, so the client understands exactly what they are paying for.

- Omitting Hours or Units: If you charge by the hour or unit, ensure these quantities are clearly noted alongside the corresponding rates.

3. Missing Payment Terms

- No Due Date: Always specify the payment deadline to avoid confusion about when the payment is expected.

- Unclear Payment Methods: Clearly state which payment methods are accepted, whether it’s a bank transfer, credit card, or PayPal.

4. Incorrect or Omitted Calculations

- Math Errors: Double-check all calculations to ensure that the totals and any applicable taxes are correct.

- Overlooked Fees: If there are additional fees, such as late charges or rush fees, make sure they are clearly listed and calculated correctly.

5. No Branding or Personalization

- Generic Documents: Failing to add your logo or business name makes your document appear unprofessional and can reduce its impact.

- Lack of Personal Touch: Include a polite thank you message or a brief note expressing your appreciation for the client’s business.

Avoiding these common mistakes will help you create clear, accurate, and professional payment requests that are more likely to be processed quickly and efficiently. By paying attention to detail, you can enhance your reputation and ensure smooth financial transactions with your clients.

Benefits of Using Digital Invoices

In the digital age, moving away from paper forms to electronic ones has become a game-changer for many businesses. Using digital payment requests not only makes the process faster and more efficient, but it also offers numerous advantages in terms of convenience, security, and environmental impact. By switching to digital formats, you can streamline your billing process and improve overall workflow.

1. Increased Efficiency

- Faster Processing: Digital forms can be generated, sent, and received almost instantly, speeding up the time it takes to request and receive payments.

- Automated Features: Many platforms offer automation tools such as recurring billing, automatic reminders, and tracking, reducing the need for manual follow-ups.

- Easy Customization: Digital documents can be quickly tailored for different clients, saving you time when making adjustments or creating new requests.

2. Enhanced Security and Organization

- Secure Transmission: Digital forms are sent via encrypted channels, offering a higher level of security compared to traditional mail.

- Better Record-Keeping: With digital copies, you can store and organize all your documents in one place, making it easy to track past payments and access records when needed.

- Reduced Risk of Errors: Automated calculations and predefined fields help eliminate mistakes in calculations and data entry, ensuring accuracy.

3. Cost-Effectiveness

- Lower Operational Costs: Digital forms reduce the need for printing, postage, and other overhead costs associated with physical paperwork.

- Environmentally Friendly: By going paperless, you help reduce waste and your environmental footprint, contributing to sustainability efforts.

By adopting digital payment requests, you not only save time and money but also gain a higher level of control over your billing process. These advantages make the shift to digital formats an easy choice for freelancers and businesses looking to optimize their operations.

Setting Payment Terms on Your Invoice

Clearly defined payment terms are essential to ensure smooth transactions and avoid misunderstandings with clients. By establishing clear expectations for when and how payments should be made, you can maintain professional relationships and reduce the risk of delayed or missed payments. Setting these terms at the outset provides both you and your client with a mutual understanding of the financial aspects of your work.

Common Payment Terms to Include

When outlining payment expectations, several standard terms are often used to cover various scenarios. Depending on your preferences and the nature of the project, you can modify these terms to suit your needs.

| Payment Term | Description |

|---|---|

| Due Upon Receipt | Payment is expected immediately upon the client receiving the billing document. |

| Net 30 | Payment is due 30 days from the date the document is issued. |

| Net 60 | Payment is due 60 days after the billing document is issued, often used for larger projects or corporate clients. |

| Deposit Required | A certain percentage of the total amount is due upfront before starting the work, with the remaining balance due upon completion. |

| Late Fee | An additional fee is charged if the payment is not received by the due date. The fee is usually a percentage of the total amount or a flat rate. |

Best Practices for Setting Payment Terms

- Be Clear and Specific: Make sure the payment terms are easy to understand and unambiguous, so there is no confusion.

- Offer Multiple Payment Options: Consider offering a variety of payment methods (bank transfer, credit card, PayPal, etc.) to accommodate client preferences.

- Set Expectations Early: Discuss payment terms with the client before starting any work to ensure mutual agreement on dea

How to Handle Late Payments in Invoices

Dealing with overdue payments is a common challenge for many businesses, especially for freelancers and creatives. Late payments can disrupt cash flow and create unnecessary stress. However, having clear policies in place and handling the situation professionally can help mitigate the impact of delays and maintain good relationships with clients.

It’s essential to approach late payments with tact and understanding, while still enforcing the terms of your agreement. The following steps can help ensure that overdue payments are handled effectively and professionally:

1. Review Payment Terms

- Check the Due Date: Ensure that the payment deadline has passed. Sometimes, clients may need a reminder about the agreed-upon terms.

- Verify the Details: Double-check the payment details on the document to make sure there are no errors that could delay the payment.

2. Send a Friendly Reminder

- Polite Follow-Up: If the payment is only slightly overdue, send a friendly reminder to the client, thanking them for their business and gently prompting them to settle the outstanding amount.

- Include Relevant Details: Make sure to include the payment amount, due date, and any other relevant information in the reminder to avoid confusion.

3. Establish a Clear Late Fee Policy

- Late Fee Clause: Make sure your payment terms include a late fee policy, such as an additional charge after a specific number of days past due. This can motivate clients to pay on time.

- Communicate Late Fees: If you have a late fee clause, remind the client about it if the payment is overdue. Politely mention that the fee will be applied if the payment isn’t received soon.

4. Offer Payment Plans if Necessary

- Flexible Options: If a client is facing financial difficulty, consider offering a payment plan to help them pay in installments. This can preserve your relationship with the client while ensuring you still receive compensation.

- Set Clear Deadlines: If you agree on a payment plan, make sure to set clear deadlines for each installment to avoid further delays.

5. Escalate When Necessary

- Final Notice: If reminders go unanswered, send a more formal “final notice” that states the consequences of continued non-payment, such as the suspension of services or legal action.

- Consider Legal Action: As a last resort, if a client continues to delay payment despite multiple reminders, you may need to seek legal advice or involve a collections agency.

Handling late payments effectively requires a balance of professionalism, flexibility, and assertiveness. By having clear terms in place and addressing overdue payments promptly, you can minimize their impact on your business while maintaining strong relationships with clients.

Tips for Organizing Your Invoice Records

Keeping track of your billing documents is crucial for maintaining accurate financial records and staying on top of payments. Well-organized records make it easier to track your income, manage taxes, and resolve any disputes that may arise. By setting up an efficient system for storing and organizing your payment requests, you can save time and reduce stress during tax season or when reviewing your financial history.

1. Create a Consistent Filing System

- Use Clear Categories: Organize your records by client, project, or date. This makes it easier to locate specific documents when needed.

- Label Files Effectively: Use descriptive filenames that include key details such as the client’s name, the project, and the date to ensure easy identification.

- Digital vs. Physical: Decide whether you want to keep your records in digital form, physical copies, or both. Digital files can be stored on your computer or in the cloud, making them easier to access and back up.

2. Regularly Update and Review Records

- Log Payments Promptly: As soon as a payment is received, update your records. This will help you keep an accurate, real-time track of your finances.

- Review Outstanding Balances: Regularly check your accounts to identify any overdue payments and send follow-ups to clients who have yet to settle their balances.

- Keep Backup Copies: For important documents, always keep backup copies in case of technical issues or accidental loss.

3. Use Accounting Software or Tools

- Automation Tools: Many accounting software tools allow you to automate record-keeping by creating digital payment requests, tracking payments, and generating reports.

- Integrations: Some tools integrate with your bank or payment platforms, so your payments are automatically logged, reducing manual data entry.

- Cloud Storage: Cloud-based accounting tools like QuickBooks or FreshBooks offer the convenience of storing your records securely online, making them accessible from any device.

4. Keep Records Organized for Tax Time

- Maintain Annual Reports: At the end of each year, generate a summary report of your earnings and expenses for easy reference during tax filing.

- Set Aside Tax-Related Documents: Organize documents related to taxes separately to ensure you have everything you need when preparing for tax season.

- Track Deductible Expenses: Keep records of any business-related expenses that might be deductible, such as software subscriptions or materials purchased for projects.

By implementing an organized system for managing your payment requests and records, you can reduce the time spent searching for documents and ensure that your financial tracking is both accurate and efficient. This level of organization can also help you make informed decisions about your business finances in the future.

Invoice Templates for International Clients

When working with clients from different countries, it’s essential to tailor your billing documents to meet international standards. This ensures that both you and your client are on the same page regarding payment terms, currency, and applicable taxes. A well-structured payment request can prevent misunderstandings and streamline the payment process, making it easier for your global clients to process their payments smoothly and on time.

Here are some important considerations when creating documents for clients outside your home country:

1. Currency and Exchange Rates

- Specify the Currency: Clearly state the currency in which the payment is expected. If you’re working with international clients, it’s essential to avoid confusion by specifying whether the amount is in USD, EUR, GBP, or another currency.

- Account for Exchange Rates: If the client will be paying in their local currency, be sure to include an exchange rate or allow for fluctuations in the final amount due. Be clear about how the exchange rate will be applied to avoid misunderstandings.

2. Language and Localization

- Use the Client’s Language: If possible, provide the document in the client’s preferred language. This shows professionalism and ensures clarity, especially if the client does not speak English fluently.

- Consider Local Formats: Date formats and numbering systems can vary between countries. Ensure that your document follows the conventions that are familiar to your client (e.g., DD/MM/YYYY vs. MM/DD/YYYY for dates).

3. Taxes and Duties

- Include Relevant Taxes: Depending on your client’s location, you may need to account for VAT, GST, or other local taxes. Make sure these taxes are clearly outlined in the document, including the tax rate and the total amount being charged.

- Clarify Who Pays Duties: Specify who is responsible for any additional duties, such as import taxes or banking fees, to avoid unexpected costs for either party.

4. Payment Methods for International Clients

- Offer Multiple Payment Options: International clients may prefer different payment methods based on their location. Be sure to provide a range of options, such as wire transfers, PayPal, or international credit cards, to accommodate their preferences.

- Provide Bank Details: If you’re accepting direct transfers, ensure that your bank details are accurate and include information such as your IBAN (International Bank Account Number) or SWIFT/BIC codes.

5. Delivery Time and Processing Delays

- Clarify Expected Timelines: International payments may take longer to process due to banking systems or cross-border regulations. Be sure to outline estimated payment timelines to manage expectations.

- Consider Processing Fees: Inform your client if there are any additional processing fees for international payments, such as wire transfer charges or conversion fees from currency exchanges.

By customizing your payment requests for international clients, you ensure a smoother process for both parties, making it easier to collect payments while building trust and professionalism in your global business relationships. Be sure to include all the necessary details to minimize confusion and provide a clear, professional experience for your clients, regardless of location.

How Invoices Impact Your Creative Business

Billing documents play a critical role in the financial health of any creative business. They not only formalize transactions but also help maintain a professional image, ensure timely payments, and keep your financial records organized. For creatives, who often work with various clients on different projects, clear and efficient billing is essential for smooth cash flow and long-term success.

In this section, we’ll explore how well-organized payment requests can influence the growth and stability of your creative business:

1. Ensuring Timely Payments

Clear and precise billing documents set the tone for when and how payments should be made. When your clients receive a detailed request, it encourages them to settle accounts promptly, minimizing the risk of overdue payments. By specifying payment terms–such as due dates or late fees–you establish clear expectations from the start, which leads to better cash flow management.

2. Building Professional Credibility

Sending professional billing documents can elevate the perception of your business. Whether you’re a freelancer or a small agency, providing well-structured documents shows that you take your work seriously. Clients are more likely to trust and continue working with businesses that maintain a high standard of professionalism in all aspects of their operations, including payment requests.

3. Tracking Earnings and Managing Finances

Properly organized payment records allow you to easily track income, monitor project profitability, and analyze trends over time. By keeping a record of all your earnings, you can quickly identify patterns, plan for tax filing, and make informed business decisions. This level of organization can also help when reviewing your financial performance and setting future pricing strategies.

4. Reducing Disputes and Misunderstandings

Detailed payment documents can prevent disputes by clearly outlining the agreed-upon services, prices, and terms. When everything is explicitly stated, both you and the client are on the same page about what has been delivered and what is expected in return. This reduces the chances of misunderstandings and strengthens client relationships.

5. Enhancing Business Growth and Reputation

As your creative business grows, efficient billing becomes even more crucial. A streamlined process for sending, tracking, and managing payment requests allows you to focus on delivering your work rather than worrying about missed payments or administrative tasks. By maintaining consistent professionalism in this area, you build a reputation for reliability, which can lead to repeat clients and new referrals.

In conclusion, well-executed billing practices are fundamental to the success of any creative business. They impact everything from cash flow and client trust to business reputation and growth. By ensuring that your billing process is clear, professional, and efficient, you lay the foundation for long-term success and sustainability in your creative endeavors.

Legal Considerations for Illustration Invoices

When managing payments for creative work, it’s important to be aware of the legal aspects that come into play. A well-structured billing document does more than request payment–it also serves as a legal agreement between you and your client. By including essential information and adhering to legal requirements, you ensure that both parties understand their rights and obligations, minimizing the risk of misunderstandings or disputes.

Here are some key legal considerations to keep in mind when preparing payment requests for your creative projects:

1. Clear Terms of Agreement

- Payment Terms: Clearly outline when the payment is due and any late fees or interest charges that may apply if the payment is not received on time. This helps protect you if the client fails to pay according to the agreed timeline.

- Service Details: Be sure to include a detailed description of the work delivered, including project milestones, revisions, and any additional work requested. This provides a legal basis for the payment request.

- Ownership Rights: Specify the terms of ownership or licensing for your creative work. Are the rights fully transferred to the client upon payment, or will you retain some rights to the work? These terms should be clear to avoid disputes over usage later on.

2. Tax and Compliance Requirements

- Tax Identification: Include your tax identification number (TIN) or VAT registration number if applicable. This is especially important for freelancers or small businesses working in jurisdictions that require such identification for tax purposes.

- Tax Rate and VAT: If you are required to charge VAT or other taxes, make sure to clearly indicate this on your billing document. Specify the rate applied and the total amount being charged for taxes.

- Cross-Border Considerations: If working with international clients, be aware of any specific tax laws or duties that apply when providing services or selling creative work across borders. This may include import/export duties, local tax rates, or withholding taxes.

3. Dispute Resolution and Legal Protections

- Dispute Clause: Include a clause in your agreement outlining how disputes will be handled, whether through mediation, arbitration, or legal action. This helps ensure that if a conflict arises, both parties know the process for resolving it.

- Jurisdiction: Specify the jurisdiction (the region or country) where any legal disputes will be settled. This is particularly important for international transactions, as it defines where any legal proceedings will take place.

- Liability Limitations: If necessary, include a limitation of liability clause to protect yourself from potential legal claims beyond the scope of your work, such as indirect or consequential damages.

4. Record Keeping and Documentation

- Retention of Records: Keep copies of all payment requests and communication with clients related to your work. These records may be needed in case of legal issues or disputes in the