Free HTML Invoice Template for Easy Customization

When it comes to managing your business finances, having a professional and customizable document for requesting payments is essential. Many entrepreneurs and small business owners look for efficient ways to create documents that reflect their brand and make the billing process seamless. Whether you’re a freelancer, a consultant, or a startup owner, finding an easy way to generate such documents can save time and help you stay organized.

By using pre-designed digital files, you can quickly create polished, consistent billing requests without needing any graphic design skills or expensive software. These files can be personalized with your business information, logos, and payment terms to suit your specific needs. The best part is that you don’t have to spend money on expensive programs or hire a designer to make them for you.

In this article, we will explore how to find and use customizable billing documents that can be easily adapted to your business model. We’ll guide you through the advantages of using these solutions, their customization options, and how you can implement them into your daily operations with minimal effort. Get ready to streamline your payment process and enhance your professional image with a few simple clicks.

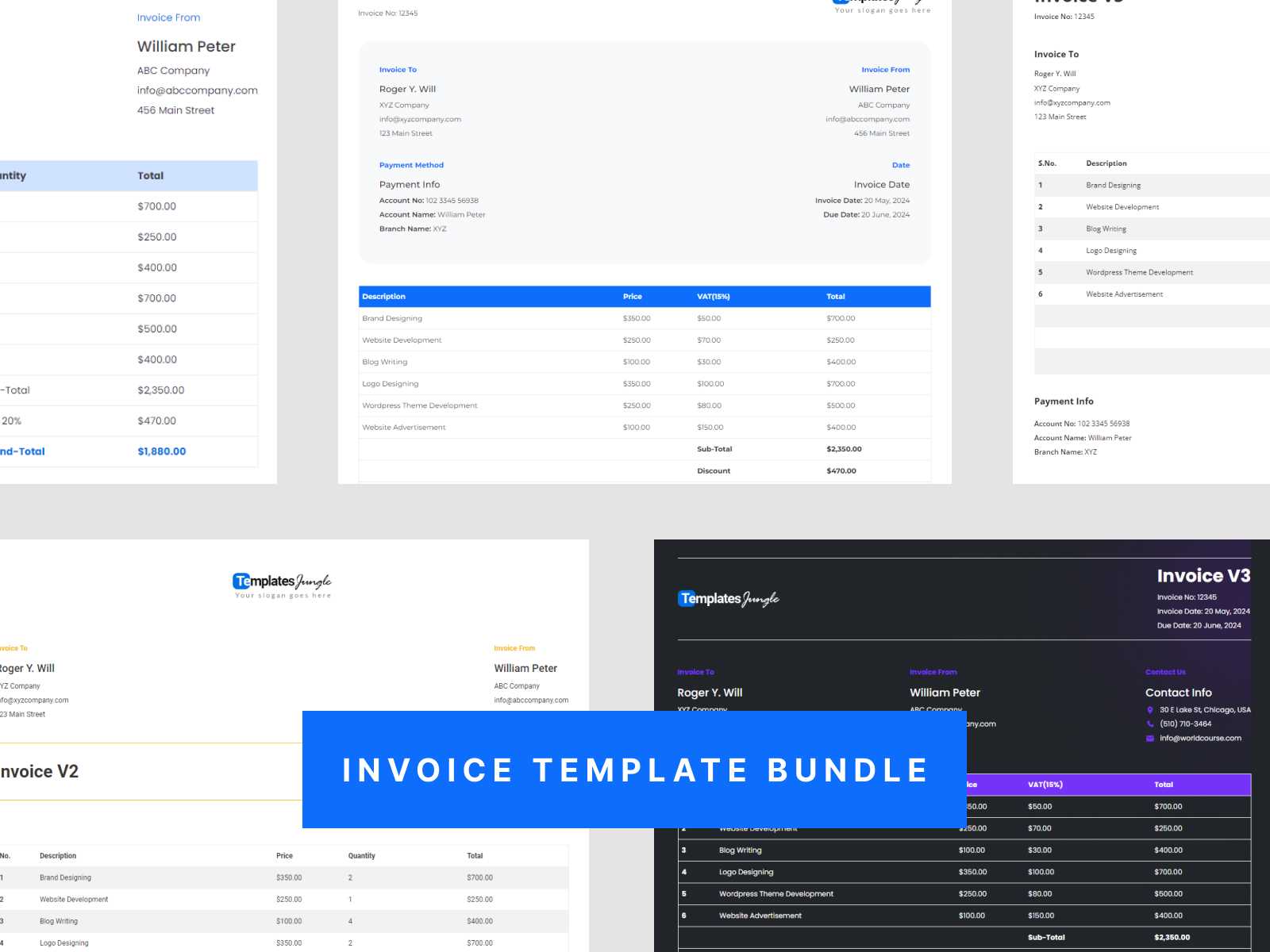

Free HTML Invoice Template Overview

In today’s fast-paced business world, having a quick and efficient way to create professional billing documents is essential for any entrepreneur or small business owner. Whether you’re a freelancer, a service provider, or a product-based business, the ability to generate payment requests that are well-designed and easily customizable can make a significant difference in how your clients perceive your professionalism. The good news is, there are readily available resources that allow you to create such documents without any technical knowledge or upfront cost.

Key Benefits of Using These Billing Documents

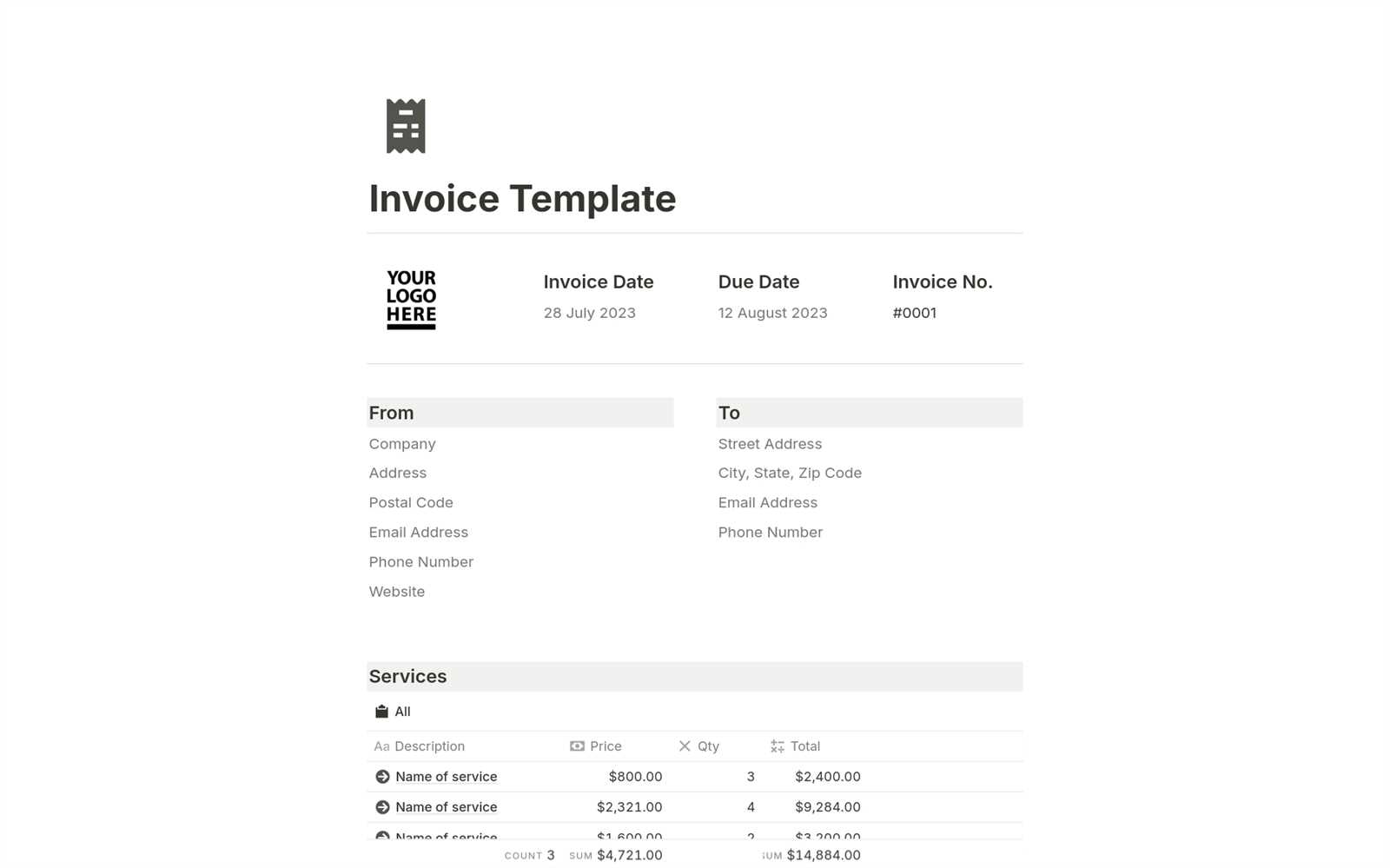

One of the primary advantages of using pre-made files for creating your billing documents is the ease of use. These solutions often come with simple structures that can be easily customized with your business details, such as your logo, payment terms, and contact information. This allows you to maintain a professional appearance while saving time and effort compared to creating custom designs from scratch.

How to Get Started with Customizable Billing Files

Getting started with these customizable resources is straightforward. Many websites offer a variety of options that are ready for download, often with multiple styles to choose from. Once you download the document, you can open it in any text or code editor and make quick changes. This flexibility makes it easy to tailor the document to meet your specific business needs, from adjusting payment terms to adding your branding elements.

Why Choose an HTML Invoice Template

When running a business, presenting professional payment requests is crucial to maintaining a positive relationship with clients. The ability to quickly generate polished, clear, and customizable documents can save time, reduce errors, and help streamline your workflow. By opting for digital documents that can be easily adapted, you gain both flexibility and efficiency in your billing process. Using structured files offers a number of key benefits that can simplify the entire process of requesting payments from your clients.

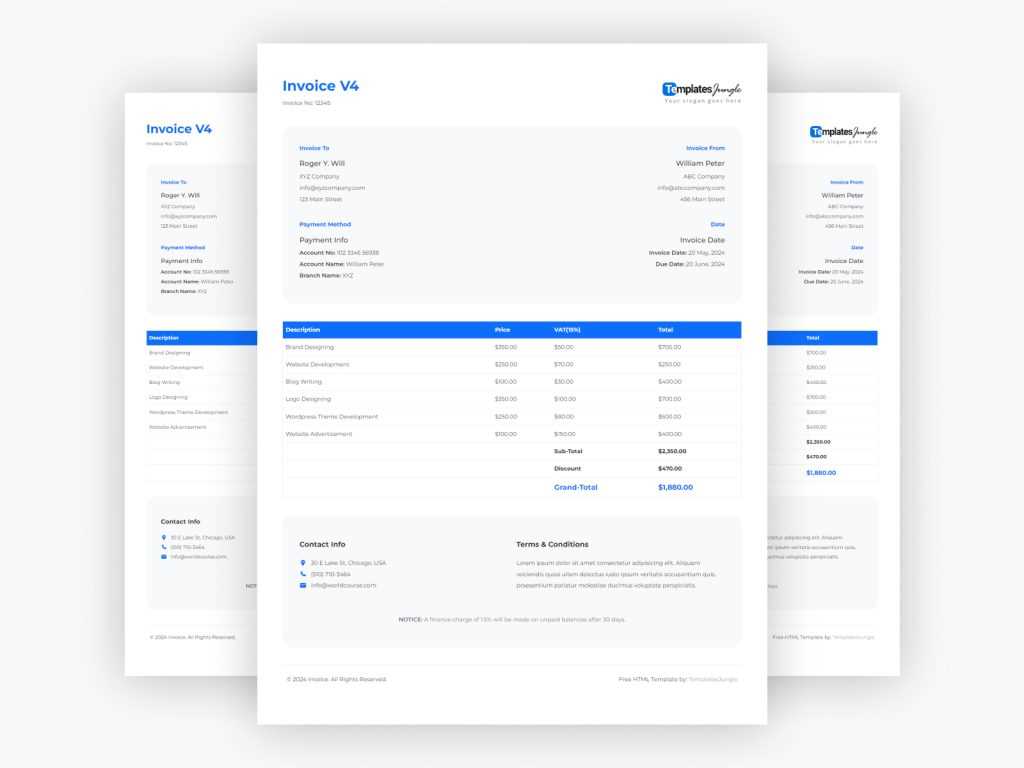

Customizability and Flexibility

One of the main reasons to choose a digital document solution is the level of customizability it offers. You can easily add your company logo, adjust the layout, and include specific payment terms tailored to your business needs. This level of flexibility means you can maintain a consistent and professional appearance across all your billing requests, while also making each document unique to your business.

Cost-Effectiveness and Accessibility

Another major advantage is that these solutions are often available at no cost, eliminating the need for expensive software or hiring a designer. Furthermore, you don’t need advanced technical skills to create professional documents, as many of these resources are simple to use and can be edited with basic text editors. The accessibility of such tools ensures that small businesses and startups can create high-quality payment requests without incurring additional expenses.

Benefits of Using HTML for Invoices

When creating billing documents, using a well-structured format can enhance both the appearance and functionality of your payment requests. Leveraging a simple, code-based format offers a range of advantages that help streamline the process of managing payments. The flexibility of this approach allows business owners to easily customize each document while maintaining a professional and consistent look for their clients. The overall ease of use and adaptability of this method makes it a top choice for many businesses looking to simplify their payment process.

Efficiency and Speed in Document Creation

One of the key benefits of using code-based formats is the speed at which you can create and modify your documents. Unlike traditional design tools that may require specialized software or knowledge, these files can be quickly edited and tailored to suit your specific needs. This enables you to generate billing documents in just a few minutes, saving valuable time that can be better spent on other aspects of your business.

Improved Compatibility and Accessibility

Another advantage of using code-based billing solutions is their cross-platform compatibility. Documents created in this format are easily accessible on various devices and can be opened by anyone with a basic web browser. This ensures that both you and your clients can view and interact with the document without worrying about software limitations. Additionally, such documents can be seamlessly integrated into existing systems, making them a practical choice for businesses of all sizes.

How to Customize HTML Invoice Templates

Customizing your billing documents is a crucial step to ensure they reflect your brand and provide clear, professional communication with your clients. By adjusting various elements of the structure, you can make the document uniquely yours while ensuring that all essential information is presented in a way that’s easy to understand. Fortunately, personalizing these files is a simple process that requires only basic editing skills.

Editing Text and Branding Elements

To get started, focus on editing the text content. This includes adding your business name, contact details, and payment terms. Make sure to include all relevant information, such as your client’s details, items or services provided, and payment instructions. Personalizing this information ensures that the document is tailored to each transaction. You can also enhance the document by inserting your company logo or adjusting the color scheme to match your branding, creating a cohesive look across all your business documents.

Modifying Layout and Structure

Another important step in customization is adjusting the layout and structure to meet your specific needs. You can change the arrangement of sections, add new ones (e.g., payment history, discount information, or additional notes), or even modify fonts and spacing to improve readability. Making these tweaks ensures that the document looks professional and suits the specific requirements of your business operations, while also improving the overall user experience for your clients.

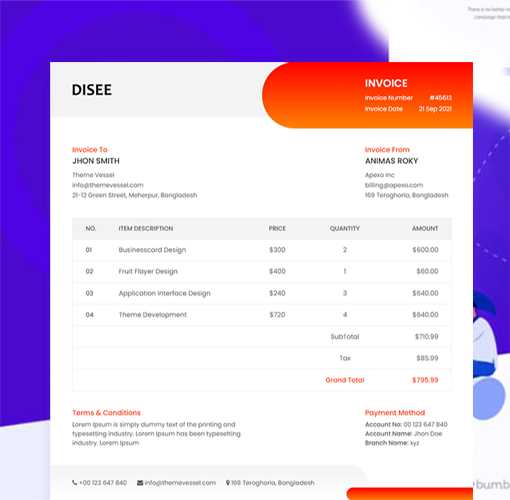

Best Practices for HTML Invoice Design

Creating a visually appealing and functional document for billing purposes requires attention to both design and structure. A well-organized layout ensures that all key information is easily accessible and clearly presented, while also making a strong, professional impression on your clients. By following a few simple best practices, you can ensure that your payment requests not only look great but are also effective in conveying important details without overwhelming the recipient.

Keep the Layout Clean and Organized

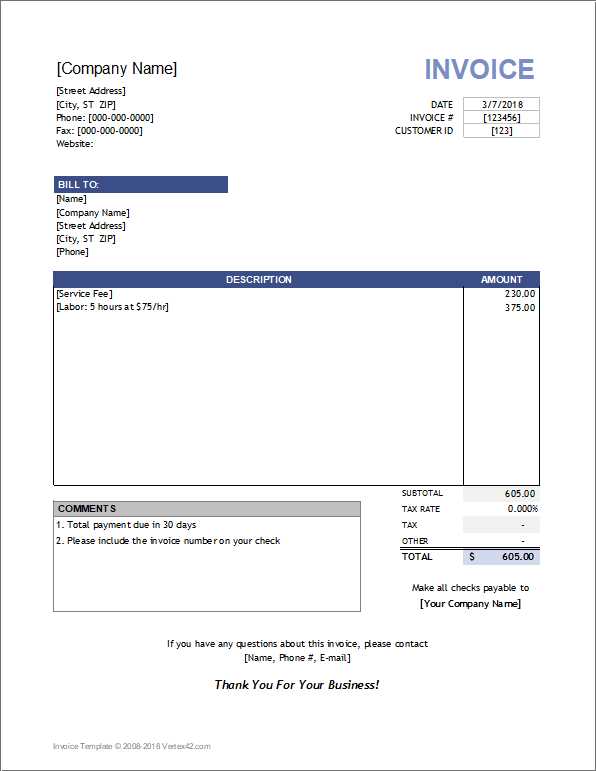

A clean and organized structure is essential for readability. Divide the document into clear sections, such as the sender’s details, recipient’s information, a list of products or services, and payment terms. Grouping related information together helps clients quickly find what they need, minimizing confusion. Here’s a simple example of how you can structure the content:

| Item | Description | Quantity | Price | Total |

|---|---|---|---|---|

| Web Design | Custom website design services | 1 | $500 | $500 |

| Hosting | Annual web hosting | 1 | $100 | $100 |

| Total Amount | $600 | |||

Use Clear and Readable Fonts

Ensure that the fonts you choose are easy to read and professional. Avoid overly decorative fonts that may make the document look cluttered. Stick to simple, web-safe fonts such as Arial, Helvetica, or Times New Roman. For headings and key information, use larger font sizes and bold text to draw attention to the most important details. Consistency in font usage throughout the document will also contribute to a more polished and uniform appearance.

Free Resources for HTML Invoice Templates

When creating professional payment requests, having access to high-quality, customizable digital documents can make a big difference. Fortunately, there are numerous online resources that offer downloadable documents at no cost. These resources provide a variety of designs and layouts, catering to different business needs. By using these platforms, you can quickly find a solution that suits your style and requirements without spending money on custom designs or software.

Top Websites for Downloading Billing Documents

Here are some of the best platforms where you can find a wide range of billing documents, ready for immediate download and customization:

- Invoice Generator – Offers simple, user-friendly templates that allow for quick customization and immediate downloading.

- Billdu – Features a range of templates designed for small businesses, with customization options to tailor the look and feel.

- Zoho Invoice – Provides an extensive collection of professionally designed templates, available in various formats, including for digital editing.

- Canva – While known for graphic design, Canva also offers customizable billing documents with a drag-and-drop interface.

- Invoicely – A straightforward platform offering customizable documents with options for businesses of all sizes.

Advantages of Using Online Resources

By utilizing these platforms, you gain several advantages:

- Cost-effective – Accessing templates from these websites comes at no charge, saving you money on software or hiring a designer.

- Easy customization – Most platforms offer an intuitive interface, allowing you to easily input your business details and adjust the design.

- Variety of styles – With so many templates to choose from, you can select a design that best fits your brand image and business needs.

- Quick turnaround – Many resources allow you to create and download a customized document in just a few minutes, speeding up your billing process.

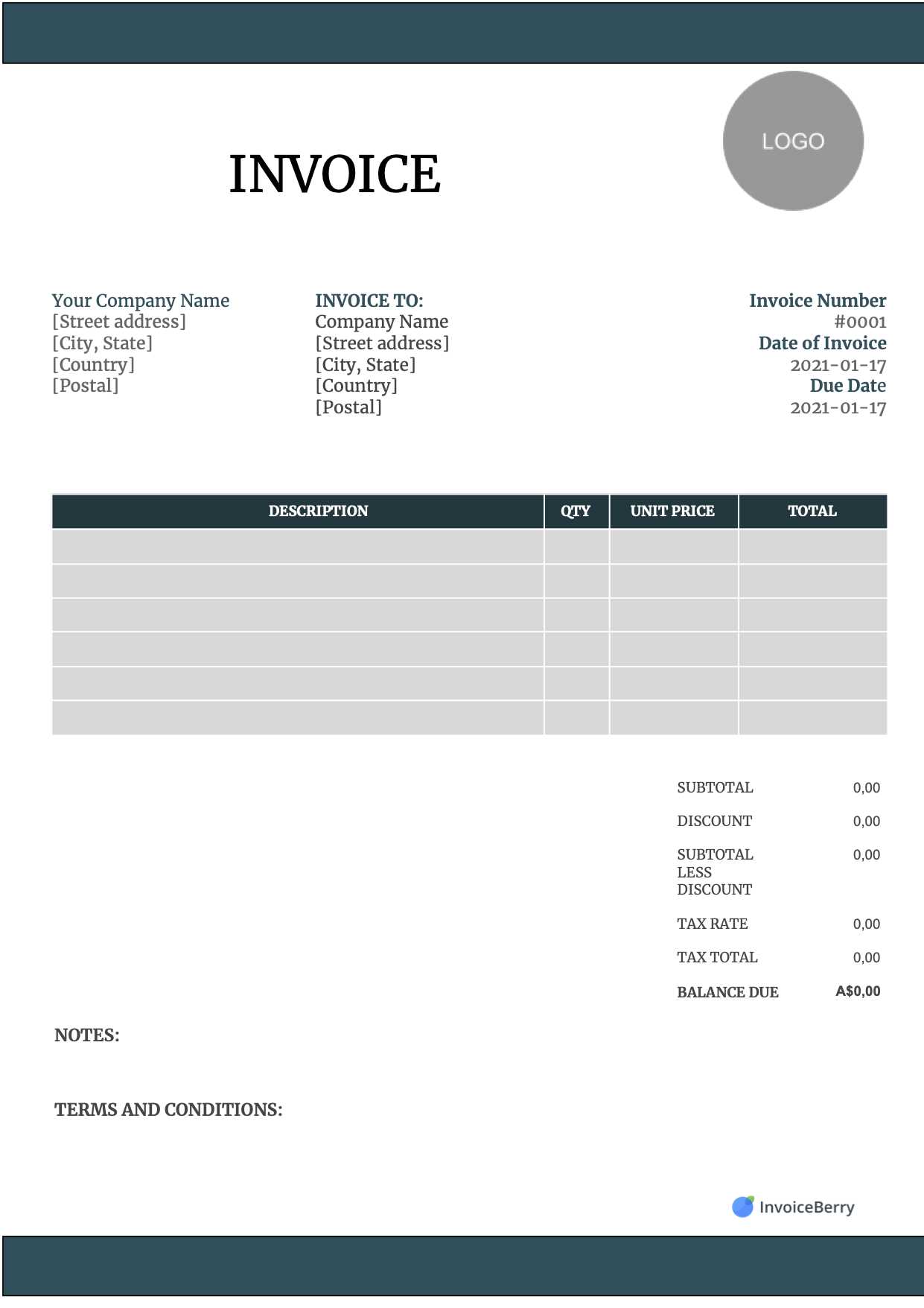

Key Features in a Quality Invoice Template

When choosing or designing a billing document, it’s important to focus on certain characteristics that ensure clarity, professionalism, and ease of use. A well-designed billing document not only provides the necessary details for your client to process payment but also reflects your business’s professionalism. A quality document should be clear, structured, and customizable, offering both functionality and aesthetic appeal. Below are the key features that make a document effective for your billing needs.

Essential Elements for a Professional Layout

There are several key sections that should be included in any billing document to ensure all necessary information is clearly communicated:

- Contact Information – Both your business and your client’s details should be prominently displayed at the top, making it easy for both parties to identify each other.

- Unique Identifier – An invoice number or unique reference is important for tracking purposes and ensures that the document can be easily referenced later.

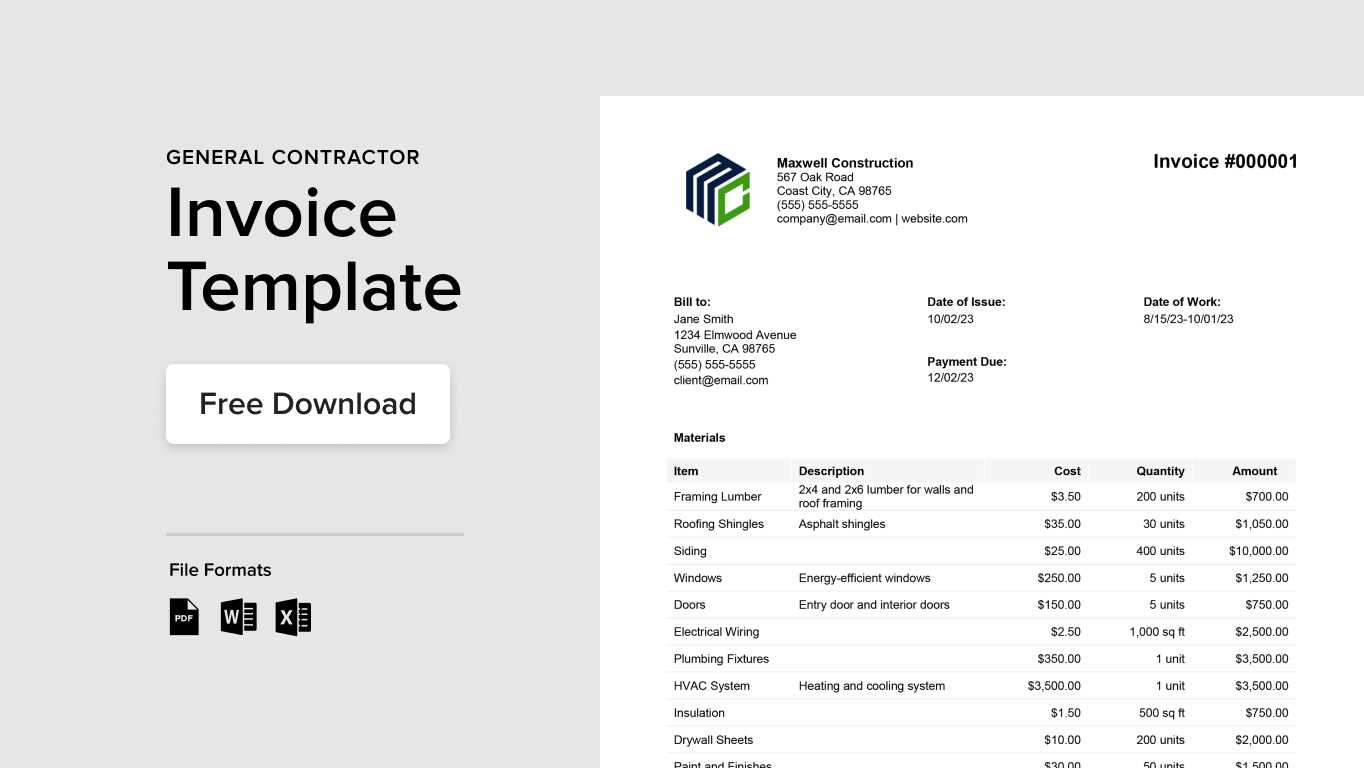

- Breakdown of Services/Products – List the items or services provided, along with a brief description, quantity, rate, and the corresponding total for each item.

- Payment Terms – Include information on payment deadlines, accepted methods, and any late payment penalties, if applicable.

- Total Amount Due – Clearly display the total amount owed at the bottom of the document, ensuring there is no confusion about the final sum.

Design and Customization Options

While the content of the document is crucial, the visual presentation is equally important. A clean, visually appealing layout can help your business make a lasting impression. Here are some additional features to consider:

- Branding – Include your company logo, color scheme, and any other elements that reflect your brand identity, making the document unique to your business.

- Clear Typography – Use readable fonts and adjust the size for headings and key information to ensure important details stand out.

- Space and Organization – The document should have sufficient white space to prevent it from looking cluttered, and information should be logically arranged for easy navigation.

- Printable Format – Ensure that the document is easy to print, with proper margins and alignment so that it appears professional both digitally and in print.

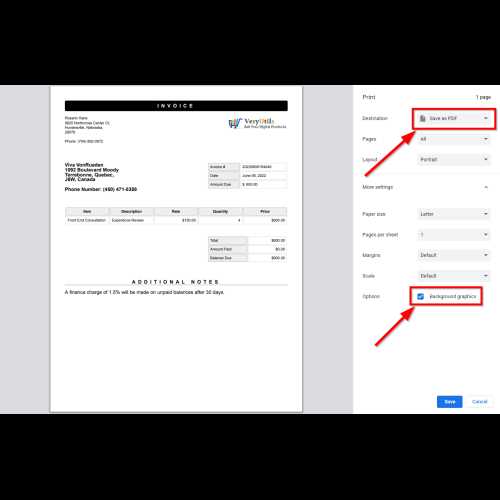

How to Download Free HTML Invoice Templates

Downloading a professional billing document for your business doesn’t have to be a complicated process. There are several platforms that offer ready-to-use, customizable documents at no cost, allowing you to generate professional payment requests in just a few clicks. Whether you’re looking for a simple design or something more detailed, the process is generally straightforward. Here’s how you can easily download and start using them for your business.

Steps to Download and Customize Your Document

Follow these steps to quickly find and download a customizable billing document:

- Choose a Reputable Website – Look for trusted platforms that offer reliable, high-quality documents. Some popular options include Canva, Zoho, and Invoicely, which offer a wide variety of customizable designs.

- Browse the Available Designs – Most platforms will have multiple options, often organized by style or industry. Take some time to review different designs and select one that suits your business needs.

- Download the Document – Once you’ve selected the document you like, click the download button. Many platforms will allow you to download the file in various formats, such as .HTML, .PDF, or .DOCX.

- Open and Customize – After downloading, open the file in your preferred editor (e.g., text editor or code editor) and customize the fields, such as adding your business details, client information, and payment terms.

- Save and Send – Once you’ve made the necessary changes, save the document and send it to your client via email or print it for physical delivery.

Where to Find Quality Resources

Here are some of the best platforms to explore when looking for downloadable business documents:

- Canva – Offers a variety of customizable designs with an easy drag-and-drop interface for quick edits.

- Zoho – Provides professional and industry-specific designs, easily editable with their online tools.

- Invoicely – A simple and intuitive platform for downloading customizable documents with easy customization options.

- Invoice Generator – A fast tool for creating and downloading documents with minimal effort.

Ensuring Compatibility with All Devices

In today’s digital world, it’s essential that the documents you send to clients can be easily accessed and viewed on a wide range of devices. Whether your clients are using smartphones, tablets, or desktop computers, your payment requests should look professional and function properly across all platforms. Ensuring compatibility across different devices not only improves the user experience but also increases the likelihood that your clients will view and process the document promptly.

Responsive Design for Optimal Viewing

One of the key ways to ensure your billing document is accessible on all devices is by using a responsive design. A responsive layout automatically adjusts to the screen size, ensuring the document appears properly whether viewed on a small mobile screen or a large desktop monitor. This approach eliminates the need for manual resizing and ensures that the text, images, and overall layout remain clear and easy to read.

Testing Across Multiple Platforms

Before sending out your documents, it’s a good practice to test how they display on different devices. Open your file on a smartphone, tablet, and desktop computer to check for any issues with formatting, readability, or image alignment. If you encounter any problems, consider adjusting the layout, font size, or margins to improve the document’s appearance. Some platforms also offer built-in tools to preview how your document will look across different screen sizes before finalizing it.

HTML Invoices vs PDF Invoices

When it comes to creating and sending billing documents, there are several formats available, each offering unique benefits. Two of the most commonly used formats are digital files and PDF files. Each of these options has its own strengths and weaknesses, depending on your specific needs and preferences. Understanding the differences between the two can help you choose the best format for your business and clients.

Advantages of Digital Documents

Digital documents that are based on web formats offer several key benefits:

- Easy to Customize – These documents are often editable directly in a browser or text editor, allowing for quick changes to information and design.

- Responsive Design – Web-based formats can automatically adjust their layout to fit various screen sizes, making them easy to view on mobile devices, tablets, or desktops.

- Interactive Features – Digital formats can include interactive elements, such as clickable links to your payment portals or embedded contact information.

- Immediate Delivery – Since they are generally created online, these documents can be sent directly via email or through a web interface, speeding up the delivery process.

Advantages of PDF Documents

On the other hand, PDF files also provide a number of benefits, especially when it comes to business communication:

- Universal Compatibility – PDFs can be opened on almost any device or operating system without losing formatting, ensuring consistency regardless of the recipient’s technology.

- Professional Appearance – PDFs maintain their appearance as intended, with fixed fonts, images, and layout, making them ideal for businesses that require a polished presentation.

- Secure and Reliable – PDFs can be password-protected or encrypted, providing an added layer of security for sensitive information.

- Offline Access – Unlike web-based files, PDFs can be downloaded and accessed offline, making them ideal for clients who may not have consistent internet access.

Which Format Is Right for You?

The best format for your business depends on several factors:

- If you prioritize ease of customization and fast, interactive communication, digital documents may be the better option.

- If you need a professional, secure, and universally accessible format that maintains its integrity across devices, PDFs are likely the better choice.

Ultimately, the decision will depend on your business’s specific needs, the preferences of your clients, and the level of customization and security required for each transaction.

How to Add Your Business Branding

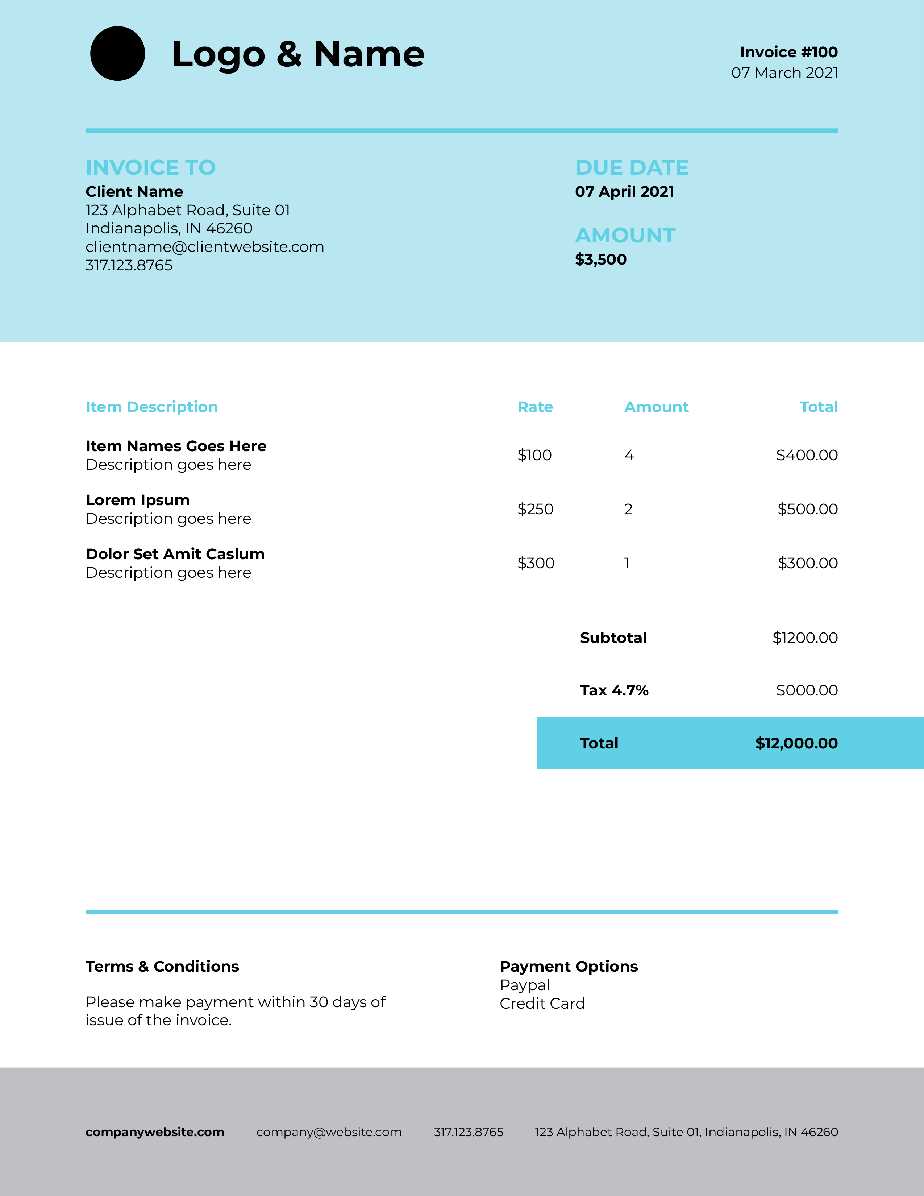

Incorporating your business’s unique identity into your documents is essential for creating a professional and cohesive look. Branding goes beyond just adding a logo; it includes the use of specific colors, fonts, and design elements that reflect your company’s style and values. By customizing your billing documents to align with your brand, you ensure consistency and strengthen your business’s presence in every communication with clients.

Incorporating Your Logo

Your company logo is the most obvious element of your branding, and it should always be prominently displayed at the top of your documents. Place it in a space that’s visible but not overwhelming, ensuring that it complements the overall design. You can add the logo as an image in the header or beside your company name for a clean, professional appearance.

Using Brand Colors and Fonts

To further enhance your branding, use your business’s color palette and font choices throughout the document. This adds a personal touch and ensures that all of your communications maintain visual consistency. Stick to one or two primary colors for headers, borders, or call-to-action sections, and use your brand’s fonts for titles and body text. If your branding guidelines are available, refer to them for consistency in usage.

Customizing the Layout and Design

Beyond colors and logos, the overall design of the document should reflect your business’s style. Whether you prefer a minimalist look or something more detailed, your billing documents should visually align with your brand’s tone. For example, if your brand emphasizes modernity and innovation, opt for sleek, clean lines and contemporary fonts. If your brand is more traditional, consider using classic fonts and a more structured layout. Customizing these design elements helps to create a strong, recognizable identity in every client interaction.

Common Mistakes in HTML Invoices

While creating professional billing documents, it’s easy to overlook certain details that can lead to confusion or even delays in payment. Simple errors in layout, content, or formatting can make the document difficult to understand or even seem unprofessional. By being aware of common mistakes, you can ensure that your billing documents are clear, accurate, and effective in encouraging timely payments.

Overloading with Information

One of the most frequent errors is including too much unnecessary information in the document. While it’s important to provide detailed descriptions of the products or services provided, overwhelming the recipient with excessive text can lead to confusion. Keep the content concise and focus on the most relevant details, such as the items or services rendered, payment terms, and the total amount due. Avoid including extraneous information that could clutter the layout.

Incorrect or Missing Contact Details

Another common mistake is forgetting to include accurate contact information. If your client needs to get in touch with you regarding the payment or document, they should be able to find your contact details easily. Always ensure that your business name, address, email, and phone number are clearly visible on the document. Additionally, verify that your client’s information is correct before sending the document.

Unclear Payment Terms

Payment terms are crucial, but they are often not presented in a way that is easy to understand. Be sure to clearly specify the due date, acceptable payment methods, and any late fees or penalties that apply. Avoid vague terms like “payment within a reasonable time” and provide clear, measurable deadlines, such as “payment due within 30 days of issue.” Ambiguity in this area can lead to confusion or delayed payments.

Poor Formatting and Alignment

Formatting mistakes can make your document appear unprofessional. For instance, misaligned text, inconsistent fonts, or tables that don’t fit properly on the page can leave a poor impression. Always use clean, consistent formatting, and ensure that the document looks well-organized. Make sure that text is legible, and use headings and sections to break up the content for easy navigation.

Missing or Inaccurate Pricing Information

Another mistake often made is incorrectly listing the prices or forgetting to include them altogether. Be sure that each item or service is clearly priced and that the totals add up correctly. Double-check your calculations and confirm that taxes, discounts, and shipping fees are included as needed. Errors in pricing not only confuse the client but may also result in payment delays.

By avoiding these common mistakes, you can create billing documents that are clear, accurate, and easy to process, leading to a smoother experience for both you and your clients.

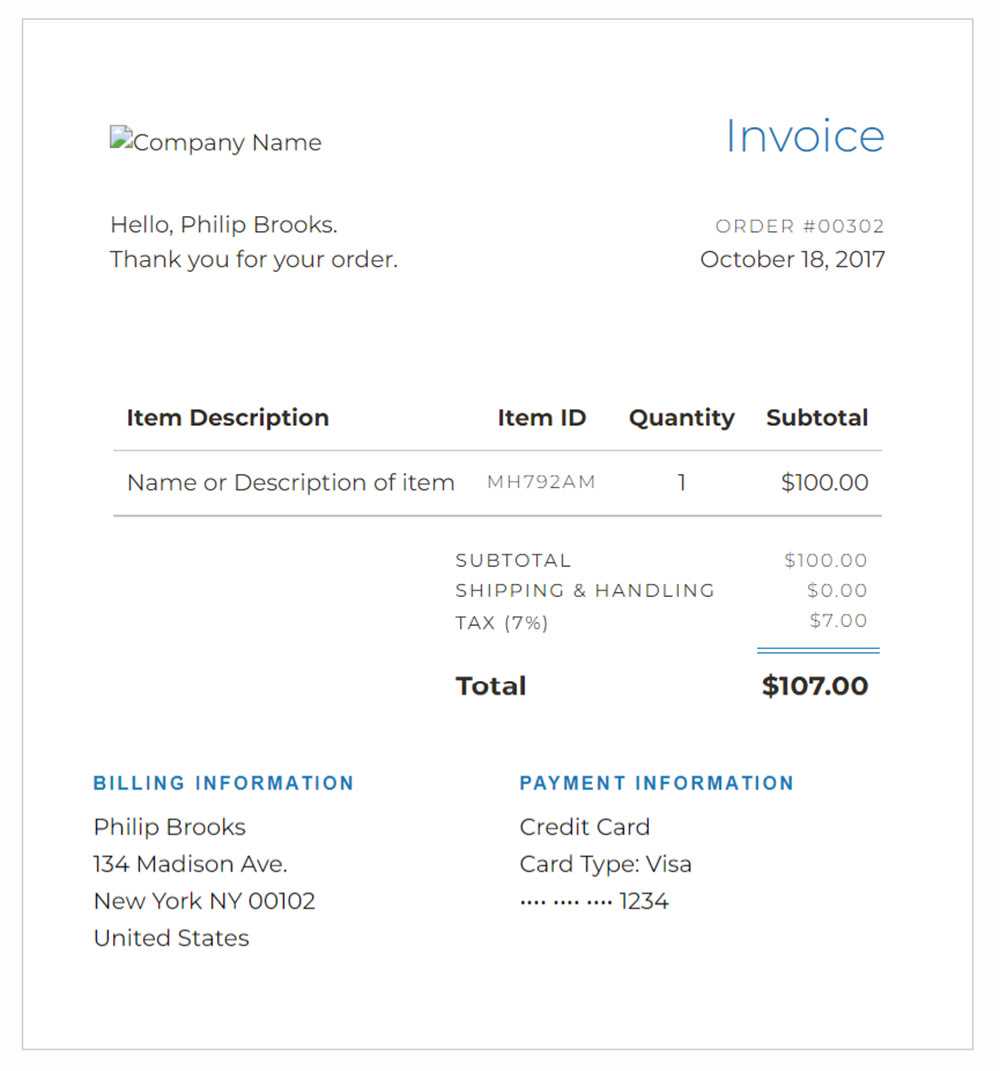

How to Integrate Payment Options

Including easy and secure payment options in your billing documents is essential for a smooth transaction process. Offering multiple payment methods increases the likelihood of timely payments and improves the overall customer experience. Whether you prefer to accept credit card payments, bank transfers, or online payment platforms, integrating these options effectively can streamline the payment process and help build trust with your clients.

Providing Multiple Payment Methods

Different clients have different preferences when it comes to paying for services or products. To accommodate these preferences, it’s important to provide a range of payment options. Here are some common methods to consider:

- Credit and Debit Cards – Include the option to pay via major credit or debit cards. Ensure your payment processing system is secure and easy to use.

- Bank Transfers – Provide your banking details for clients who prefer to transfer funds directly to your account. This option is often favored for larger payments.

- Online Payment Gateways – Use services like PayPal, Stripe, or Square, which allow clients to pay via their preferred online platforms. These services often come with built-in fraud protection and easy integration.

- Mobile Payment Solutions – Consider adding mobile payment options, such as Apple Pay, Google Pay, or other mobile wallets, for added convenience.

Adding Payment Links or Buttons

To make payments even more convenient, consider adding direct payment links or buttons within the document. For example, you can include a Pay Now button that directs the client to an online payment portal. This eliminates the need for manual entry of payment details and helps clients complete the payment quickly. Ensure that the link is clearly visible and functional on both desktop and mobile devices.

Including clear instructions for each payment method can also reduce confusion. Make sure clients understand how to complete the payment process, and offer support if they encounter issues.

Using HTML Invoices for Small Businesses

For small businesses, creating and managing payment documents is an essential part of maintaining healthy cash flow. A digital approach to generating and sending these documents can offer numerous advantages, especially when it comes to saving time and reducing administrative overhead. By using customizable and easily accessible formats, small business owners can ensure their billing process is efficient, professional, and scalable.

Benefits of Digital Documents for Small Businesses

There are several key advantages to using digital billing documents for small businesses:

- Cost-Effective – Digital documents eliminate the need for printing and mailing, saving on paper, ink, and postage costs.

- Customization – Small businesses can easily tailor their documents with their branding, including logos, colors, and specific payment terms, ensuring consistency across all communications.

- Quick Delivery – Sending documents via email or directly through online platforms ensures that clients receive them instantly, speeding up the payment process.

- Easy Record-Keeping – Storing digital documents is simple and space-efficient. They can be easily archived and retrieved for future reference, helping small business owners maintain organized financial records.

How Digital Documents Enhance Client Relationships

Using digital formats for payment documents can improve communication with clients. By sending clear, professional documents that are easy to read and navigate, small businesses can foster trust and credibility. Moreover, adding clickable payment links or offering multiple payment options within the document makes it easier for clients to pay on time, reducing friction in the payment process.

For small businesses looking to grow and expand, using digital documents not only streamlines operations but also helps establish a professional brand presence. By making billing efficient and user-friendly, businesses can focus more on their core activities while ensuring that the financial side runs smoothly.

Securing Your HTML Invoice Files

When dealing with sensitive financial information, it is crucial to take measures to protect the integrity and confidentiality of your documents. Securing digital payment requests is not only important for safeguarding client data but also for maintaining your business’s reputation and compliance with privacy regulations. Implementing proper security practices can help prevent unauthorized access, fraud, and data breaches.

Encryption and Password Protection

One of the most effective ways to secure your digital billing documents is through encryption. Encrypting the files ensures that only authorized individuals can access and read the content. Additionally, you can apply password protection to restrict access to the document, making it available only to the intended recipient. Always use strong passwords and avoid sharing them in unsecured ways, such as over email. For added security, consider setting up two-factor authentication for accessing sensitive files.

Use Secure Payment Gateways

When incorporating payment options within your digital documents, always use trusted and secure payment gateways. Reputable platforms such as PayPal, Stripe, or Square offer built-in security features that protect both you and your clients from fraud. These platforms ensure that financial transactions are encrypted and protected from cyber threats. Avoid embedding direct payment links that may not be secure, as these can expose sensitive data to potential breaches.

By securing your digital documents, you help build trust with your clients, ensuring that their personal and financial information remains protected. Implementing encryption, using secure payment systems, and following best practices for document handling are essential steps in safeguarding your business and clients from potential risks.

How to Test Your HTML Invoice Template

Before sending your billing documents to clients, it’s essential to test them to ensure that everything functions correctly and appears as expected. Testing helps identify potential issues, such as formatting problems, broken links, or errors in calculations. By thoroughly checking your document in various environments, you can ensure a seamless user experience and avoid costly mistakes.

Steps to Test Your Document

Follow these steps to effectively test your document and ensure its accuracy:

- Check for Formatting Issues – Open the document on different devices (desktop, tablet, smartphone) to make sure it displays correctly. Look for any alignment or font problems and ensure that all text is legible.

- Verify All Links and Buttons – Test any clickable elements, such as payment links or buttons. Ensure they direct to the correct page or platform and function as expected.

- Double-Check Calculations – If your document includes totals, taxes, or discounts, make sure the calculations are correct. Manually compare the values to verify accuracy.

- Test Compatibility with Email Clients – If you plan to send the document via email, test it in multiple email clients (Gmail, Outlook, etc.) to make sure it renders properly across platforms.

- Proofread the Content – Carefully review all text for spelling or grammatical errors. Check that client information is accurate and that the payment terms are clearly stated.

Tools for Testing and Validation

There are various tools available to help you test and validate your documents:

- Responsive Design Testers – Use online tools like BrowserStack or Responsinator to check how your document appears on different screen sizes and browsers.

- Online Validators – Tools such as W3C Markup Validation Service can help you identify any errors in your document’s code that might affect its appearance or functionality.

- Email Preview Services – Services like Litmus or Email on Acid allow you to preview how your document will appear in different email clients before sending it.

Testing your document before sending it out ensures that you deliver a professional and polished final product to your clients, reducing the risk of errors and increasing the chances of timely payments.

Why Free HTML Invoices Are Ideal for Startups

For startups, managing finances efficiently while keeping costs low is crucial during the early stages of growth. Opting for customizable, no-cost billing solutions can be a game-changer. These digital documents not only help streamline the invoicing process but also enable businesses to maintain a professional appearance without the need for expensive software or services. Here’s why such solutions are especially beneficial for new businesses.

Cost-Effectiveness

One of the most significant advantages of using no-cost digital billing solutions is the savings. Startups often operate with limited resources, and avoiding additional software subscriptions or paid tools allows funds to be allocated toward other critical aspects of the business. With a wide range of no-cost options available, startups can create professional-looking documents without the need for costly investments.

Customization and Flexibility

Even when using a no-cost solution, startups have the flexibility to fully customize their billing documents. These solutions often come with the ability to add branding elements, adjust layouts, and include personalized payment terms. This level of customization ensures that the final document reflects the business’s identity and meets specific needs, all without the need for a developer or graphic designer.

Quick Setup and Ease of Use

Most no-cost billing solutions are easy to set up and require little to no technical expertise. This allows entrepreneurs and small business owners to focus more on running their business rather than worrying about complicated software. Once set up, these solutions can be used quickly and efficiently to generate billing documents, helping streamline the payment process for clients.

Professional Appearance

While startups may not have large budgets, maintaining a professional image is key to building trust with clients. No-cost digital solutions offer templates that are well-designed and polished, allowing startups to create professional-looking documents that inspire confidence. The clean, consistent formatting and the ability to add business branding help establish credibility from the very start.

Scalability

As startups grow, their invoicing needs may become more complex. Fortunately, many no-cost solutions offer scalability. They can easily be adapted to accommodate additional features, such as multiple clients, bulk invoicing, or integration with other tools as the business expands. This adaptability ensures that the solution remains effective even as the business evolves.

In conclusion, utilizing no-cost digital billing solutions provides startups with an efficient, cost-effective way to manage client payments while maintaining a professional image. The flexibility, ease of use, and scalability of these tools make them an ideal choice for new businesses looking to streamline their financial processes without breaking the bank.