Free HTML Invoice Template Download for Easy and Professional Billing

In the fast-paced world of business, managing payments efficiently is crucial. Having the right tools to generate structured and clear financial statements can save you time and help maintain professionalism. Whether you’re a freelancer or running a small company, utilizing the right format for your documents is essential for smooth transactions with clients and partners.

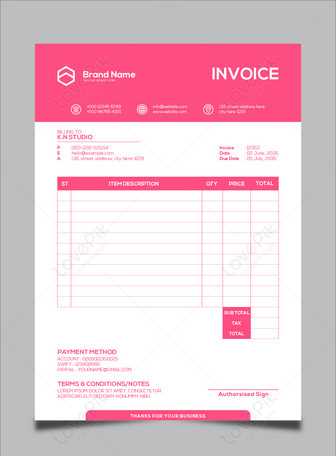

With customizable and user-friendly formats, you can craft professional-looking documents that clearly outline all necessary details, from payment amounts to due dates. These pre-designed options simplify the process, ensuring accuracy and consistency while maintaining a polished presentation.

By choosing the right solution, you can create organized, easy-to-read records that not only meet your business needs but also reflect your attention to detail. With a variety of styles and layouts available, you can select the one that best fits your company’s image and billing requirements, all without needing advanced design skills.

HTML Invoice Templates for Small Businesses

For small business owners, creating professional financial documents is crucial for maintaining clear communication with clients and ensuring smooth payment processes. Having access to simple yet effective formats can help you manage this task without needing specialized software or complex systems. These pre-built solutions offer flexibility and customization, making it easier to adapt them to your specific needs.

By choosing a suitable layout, small businesses can streamline their billing procedures, ensuring that all the necessary information is included while maintaining a polished appearance. Below are some key advantages of using structured formats for your business:

- Simplicity: Easy to customize with essential fields like amounts, due dates, and client details.

- Professionalism: Well-designed layouts ensure your documents look credible and organized.

- Time-saving: Pre-designed structures help you focus on content rather than formatting, reducing the time spent on each document.

- Consistency: Use the same design for all your billing statements to present a unified and cohesive brand image.

Small businesses can choose from various layouts that suit their industry, whether for freelancers, service providers, or product-based companies. These options allow easy adaptation, whether for one-time or recurring transactions.

Moreover, by using these adaptable structures, businesses can manage financial documentation efficiently while ensuring compliance with industry standards. The ability to edit and personalize fields helps create a clear record of services provided and payments due, which is crucial for both business operations and legal purposes.

Why Use Free Invoice Templates

Efficient financial documentation is essential for any business, and using structured formats for billing purposes can make a significant difference. These pre-designed solutions simplify the creation of essential business records, saving you time while ensuring accuracy and consistency. With a wide range of customizable layouts available, you can quickly create professional-looking documents without the need for extensive design or technical skills.

Cost-Effective Solution

One of the main advantages of using these readily available options is the cost-saving benefit. Small businesses, freelancers, or startups can avoid expensive software subscriptions and still access high-quality, professional formats. By opting for these solutions, you reduce overhead while ensuring your financial documents remain clear and organized.

Time-Saving and Easy to Use

With a structured approach, these solutions eliminate the need to start from scratch every time you need to send a billing document. The ease of customization allows you to add client details, payment terms, and services rendered quickly. This streamlined process helps you focus on growing your business rather than worrying about formatting issues.

Additionally, these pre-made designs often include all the essential fields required for accurate documentation. This reduces the chances of overlooking critical information and ensures that your records are complete and professional.

How to Download HTML Invoice Templates

Accessing professional billing formats online is simple and can save you a lot of time when creating business documents. With just a few clicks, you can obtain pre-designed layouts that are ready to be customized to your needs. The process typically involves finding a trusted source, selecting the right design, and saving the file for future use. Here’s how you can get started:

First, search for reliable platforms that offer a variety of design options. Many websites provide free access to structured documents in formats that are easy to edit and personalize. Once you’ve identified a suitable layout, most sites will offer a direct link to save the file to your computer, usually in a downloadable format such as .html or .zip.

After the file is saved, you can open it in any text editor to make adjustments. These designs are often flexible, allowing you to input your business details, client information, and specific payment terms. Once modified, your document is ready for use and can be shared electronically or printed for physical records.

Benefits of Customizable Invoice Templates

Having access to adaptable billing formats offers several advantages for businesses of all sizes. Customizable designs allow you to tailor your documents to suit your specific needs, ensuring accuracy and professionalism in every transaction. By using flexible layouts, you can easily incorporate your branding, payment terms, and client details, creating a consistent experience for your customers.

One of the key benefits of these adjustable solutions is the ability to save time. Instead of creating a new document from scratch each time, you can quickly update pre-made designs with the necessary information. This reduces the time spent on repetitive tasks and allows you to focus on more important business operations.

Another significant advantage is the level of professionalism these adaptable solutions provide. By customizing your billing documents, you can ensure that every detail aligns with your business’s image and meets industry standards. Whether you’re sending a one-time bill or recurring statements, a polished design creates a positive impression and enhances your credibility with clients.

Steps to Edit an HTML Invoice Template

Editing a pre-designed billing document is a straightforward process that allows you to customize the content according to your needs. Whether you’re adjusting client details, adding specific charges, or modifying the layout, this task can be completed in just a few simple steps. Here’s how to get started:

First, open the saved document in any text or code editor. If you’re not familiar with code, a basic editor like Notepad or TextEdit will work fine. The document will contain various sections, such as client information, payment terms, and service descriptions. Each of these can be easily modified to suit your current transaction.

Next, locate the placeholders within the layout. These are areas where text or figures need to be entered. Replace the existing content with your own business details, including your name, address, and contact information. Make sure to update the client’s information, payment deadlines, and any specific items or services provided.

Once you’ve updated the necessary fields, save the changes and preview the document. Check for any formatting issues and ensure that all details are accurate. If necessary, tweak the design elements such as font size, alignment, or spacing to ensure the final version looks polished and professional.

Top Features to Look for in Templates

When selecting a pre-designed billing format, there are several important aspects to consider to ensure that the final document meets your business needs. A well-constructed layout should be functional, easy to use, and adaptable to different types of transactions. Here are the key features to keep an eye out for when choosing a solution:

Customization Options

The ability to tailor the layout is essential. Look for formats that allow easy customization of various sections, such as:

- Client Information: Easily modify the fields for name, address, contact details, and more.

- Payment Terms: Customize payment deadlines, late fees, and discounts based on your business practices.

- Itemized Charges: Ensure you can adjust the list of services or products with descriptions, quantities, and prices.

Professional Design and Clarity

A clean, clear layout enhances the professionalism of your document and makes it easier for clients to understand. Key elements to look for include:

- Consistent Formatting: Fonts, colors, and spacing should be uniform, contributing to a neat and organized look.

- Readable Font Sizes: Ensure text is large enough to be legible but not overwhelming, making the document easy to scan.

- Clear Section Headers: Use headings to break down information, making it simple for clients to find relevant details quickly.

By choosing a solution that includes these features, you can create professional and well-organized billing documents that reflect your business’s standards and make transactions smoother for both you and your clients.

How HTML Templates Improve Your Billing

Using structured designs for creating business documents offers several advantages that streamline your billing process and improve overall efficiency. These pre-built formats simplify the task of generating clear and professional records, reducing the chances of errors and inconsistencies. By incorporating the right layout, you can ensure a smoother, more reliable transaction process for both you and your clients.

Here’s how these solutions can enhance your billing system:

- Time Efficiency: Pre-designed layouts save time by eliminating the need to create documents from scratch for each new transaction. You only need to input client-specific information and adjust payment terms as necessary.

- Consistency: Using the same design across all your documents ensures that your records are uniform, helping to establish a strong and professional brand image.

- Accuracy: Structured formats include all the necessary fields for essential details like amounts, dates, and services, which helps reduce the chances of omitting important information.

- Clear Communication: A well-organized document makes it easier for clients to understand the charges, due dates, and payment instructions, minimizing confusion and the need for follow-up clarifications.

With the right format, you can also easily adjust your documents for different types of transactions, whether they’re one-time payments or recurring charges. This flexibility helps your business maintain control over its financial documentation while keeping everything organized and professional.

Common Mistakes in Invoice Creation

Creating accurate and professional business documents is essential for maintaining smooth transactions with clients. However, many businesses make common mistakes that can lead to confusion, delays, or even disputes. Being aware of these errors can help ensure that your billing process runs more efficiently and helps build trust with your clients.

Common Errors in Financial Documents

Here are some frequent mistakes to watch out for when preparing your records:

- Missing Client Information: Failing to include important client details such as name, address, or contact information can lead to confusion and delay payments.

- Incorrect Payment Terms: Setting unclear or inconsistent payment deadlines, or failing to specify late fees, can create misunderstandings between you and your clients.

- Unclear Descriptions of Services or Products: Vague or incomplete descriptions can lead to disputes over charges and the work provided.

- Failure to Include Tax Information: Not including applicable taxes or tax identification numbers can cause issues with clients and regulatory authorities.

- Inconsistent Numbering: Not maintaining a consistent numbering system for your documents can lead to confusion and may impact your ability to track payments accurately.

Formatting and Design Issues

In addition to content errors, design and layout mistakes can also impact the effectiveness of your documents. Here are some common formatting problems:

- Poor Organization: Failing to clearly separate sections, like client details, itemized charges, and payment instructions, can make your document harder to read and understand.

- Unreadable Fonts or Sizes: Using hard-to-read fonts or sizes can frustrate clients and cause important information to be overlooked.

- Lack of Professional Appearance: A cluttered or overly complicated design may give the wrong impression, making your documents look unprofessional.

Avoiding these mistakes ensures that your business documents are clear, accurate, and professional, helping to create a smoother billing process and better relationships with your clients.

Best Free Invoice Templates for Entrepreneurs

As an entrepreneur, managing your business finances efficiently is key to success. Having the right structure for creating professional billing documents can save you time and ensure accurate transactions with clients. There are several high-quality options available that can help streamline this process, offering both simplicity and flexibility for entrepreneurs of all industries.

Top Layouts for Small Business Owners

Here are some of the best options for entrepreneurs looking for clear and effective billing solutions:

- Minimalistic Design: Clean and simple formats that focus on key details without unnecessary complexity. Perfect for freelancers or startups looking to maintain professionalism while avoiding clutter.

- Itemized Billing: Ideal for service-based businesses, this format allows you to list each service or product along with its cost. It helps clarify what the client is being charged for and ensures transparency.

- Recurring Billing Formats: Designed for businesses that offer subscription-based services or ongoing projects, these options allow you to easily set up repeated billing cycles.

- Modern and Professional Designs: Sleek, contemporary layouts with your branding elements, ensuring that every document you send reflects your company’s image and attention to detail.

Features to Consider

When selecting the best solution for your business, consider these important aspects:

- Customization: Choose formats that allow you to easily change client details, payment terms, and service descriptions.

- Mobile-Friendly: Some options are optimized for viewing on mobile devices, making it easier for clients to access your documents on the go.

- Tax and Discount Fields: Make sure the layout includes space for tax information, discounts, or additional charges, depending on your business requirements.

By selecting the right structure, entrepreneurs can improve their billing process, ensuring professional and timely payments, and ultimately enhancing client relationships.

How to Ensure Your Invoice is Professional

Creating polished and professional billing documents is crucial for maintaining a positive image with your clients. A well-designed record not only ensures clarity but also reflects the professionalism of your business. To achieve this, it’s important to focus on several key factors that will elevate your billing process and make your documents look credible and organized.

First, always ensure that your documents include all the necessary information. This includes your business name, contact details, and payment terms, as well as a clear breakdown of services or products provided. Be specific about the amounts charged and the due date for payment. This helps avoid any confusion and sets clear expectations for your clients.

Formatting is also essential for a professional appearance. Ensure that your layout is clean and organized, with well-defined sections for each part of the document, such as the client’s details, the list of items or services, and payment instructions. Consistent font sizes and alignment make the document easy to read and navigate. Avoid using too many different fonts or colors, as this can make the document look cluttered.

Incorporating your business branding into the design adds an extra touch of professionalism. By including your logo, business colors, and other branding elements, you reinforce your company’s identity and build trust with your clients. A well-branded document creates a sense of continuity and establishes your business as established and trustworthy.

Finally, always double-check the details. Errors such as incorrect dates, amounts, or client names can damage your reputation and delay payments. Proofread the document thoroughly before sending it out to ensure accuracy and professionalism at every step.

Understanding the HTML Invoice Structure

To create an effective and professional billing document, it’s essential to understand its basic structure. A well-organized layout ensures that all important information is included and easy to find. The structure typically follows a clear order, with sections dedicated to different pieces of information, such as client details, the services or products provided, and payment instructions.

At the core of any well-designed billing document are the key sections that help both you and your client understand the terms of the transaction. These sections generally include:

- Header Section: This area typically includes your business name, logo, and contact details. It sets the tone for the document and should be easy to locate.

- Client Information: Includes the client’s name, address, and contact details. This ensures the document is personalized and makes it clear who is being billed.

- Details of Goods or Services: A detailed breakdown of what was provided, including descriptions, quantities, and unit prices. This section is critical for transparency and ensures both parties are aligned on what has been delivered.

- Pricing and Total: This includes the individual prices for each item or service, any applicable discounts, taxes, and the final total amount due. Accurate pricing is essential to avoid misunderstandings.

- Payment Terms: Includes the due date, payment methods accepted, and any late fees or discounts for early payment. This helps set clear expectations for both parties regarding the payment process.

Proper alignment and spacing throughout the document are crucial for readability. Ensuring each section is clearly separated with adequate white space allows your client to quickly find relevant information. For example, using bold text for section titles or important dates helps draw attention to critical details.

By understanding the structure of your billing document, you can ensure that it is well-organized, professional, and easy for clients to understand. A clear, properly structured document not only reflects positively on your business but also makes the entire billing process more efficient.

How to Include Taxes in Your Invoice

Accurately calculating and presenting taxes on business documents is essential for compliance and clarity. When creating a financial record, including taxes in a clear and transparent manner ensures that both you and your clients are on the same page regarding the total amount due. Properly indicating taxes also helps prevent confusion or disputes and ensures you meet local tax requirements.

To include taxes correctly, follow these simple steps:

- Determine the Tax Rate: The first step is to identify the correct tax rate based on the location of your business and the client. This could include sales tax, value-added tax (VAT), or any other relevant tax type.

- Calculate the Tax Amount: Once you know the rate, apply it to the subtotal of your goods or services. For example, if your subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Clearly List Taxes: On your document, provide a separate line item for taxes. Label this section clearly, such as “Sales Tax” or “VAT,” followed by the percentage and the amount being charged. This makes it easy for your client to understand the breakdown of the total cost.

- Include Total Amount Due: After listing the tax amount, make sure to add it to the subtotal and show the final amount due at the bottom of the document. This will help your client quickly understand what they are expected to pay.

Example: If the subtotal is $500, the tax rate is 10%, and the tax amount is $50, the total would be $550. Be sure to clearly label each component of this calculation to avoid confusion.

By following these steps, you ensure that your billing documents are accurate, transparent, and compliant with local regulations. Properly including taxes not only shows professionalism but also helps build trust with your clients by providing clear, understandable pricing information.

Best Practices for Invoice Design

Creating a well-structured and aesthetically pleasing billing document is essential for making a positive impression on your clients. A professional design not only ensures clarity but also enhances the likelihood of timely payments. The key to effective document design is balancing functionality with simplicity, ensuring that all important details are easily accessible without overwhelming the reader.

Here are some best practices to follow when designing your business documents:

- Maintain a Clear Layout: Organize your content in a logical sequence, using distinct sections for each type of information. The most common sections include business details, client information, itemized charges, taxes, and total amount due.

- Use a Simple and Readable Font: Choose a font that is easy to read, such as Arial or Times New Roman. Stick to one or two font styles to avoid clutter and maintain a clean, professional look. Ensure the text size is large enough for comfortable reading.

- Incorporate Your Branding: Include your logo, company colors, and any other branding elements to give your document a unique identity. This not only helps with brand recognition but also adds to the overall professionalism of the document.

- Make Important Information Stand Out: Highlight critical details, such as the due date, total amount, and payment terms, using bold text or a larger font size. This ensures these elements are easy to find and catch your client’s attention immediately.

- Use Adequate White Space: Avoid crowding your document with too much text. Leave enough space between sections and lines of text to make the document visually appealing and easy to navigate.

- Be Consistent with Alignment: Ensure all text, numbers, and headings are properly aligned. Consistency in alignment helps with readability and gives the document a polished, organized look.

- Provide Detailed Descriptions: When listing products or services, be sure to include clear descriptions along with quantities, unit prices, and total costs. This not only adds transparency but also reduces the chance of disputes over what was delivered.

By following these best practices, you can create business documents that are not only visually appealing but also functional and effective in conveying essential information. A well-designed document reflects professionalism and helps ensure smooth financial transactions with your clients.

Legal Considerations for Invoices

When creating business documents to request payment, it’s crucial to ensure that they are legally compliant. These documents serve as formal records of transactions, and failing to meet legal requirements can lead to disputes, delays in payment, or even legal repercussions. Understanding the legal considerations involved can help protect your business and ensure that all necessary information is included to comply with relevant laws.

Here are some key legal factors to consider when preparing your documents:

- Include Your Business Details: Always include your business name, address, and contact information. Depending on your jurisdiction, you may also need to add your registration number or tax identification number to comply with local laws.

- Provide Accurate Client Information: Make sure that the client’s name, address, and contact details are correct. Incorrect client information can cause complications, particularly in case of legal disputes or audits.

- Specify Payment Terms: Clearly outline the payment due date, any penalties for late payments, and accepted payment methods. Be sure that these terms comply with any local or industry-specific regulations regarding payment deadlines and interest rates.

- Detail the Products or Services Provided: Be thorough in describing what was delivered, including the quantity, description, and price. This transparency helps avoid disputes and clarifies exactly what the client is paying for.

- Comply with Tax Regulations: Ensure that all applicable taxes are correctly calculated and included. Depending on your location, you may need to list the tax amount separately, include your tax ID, or apply the correct tax rates for different regions or types of goods/services.

- Issue Legal Documentation: In some cases, your business documents may need to be formally issued in a particular format or through a specific system. Make sure you understand any legal requirements for how to submit your documents to clients or regulatory bodies.

Keeping Accurate Records: Beyond the document itself, it’s important to keep records of all transactions for tax and audit purposes. This includes storing copies of each billing document and tracking payments to ensure accuracy in your financial reporting.

By addressing these legal considerations, you not only ensure that your billing documents are compliant but also build trust with your clients. A legally sound and transparent document can prevent misunderstandings and promote timely payments, safeguarding your business in the long run.

How to Automate Invoice Generation

Automating the billing process can save significant time and reduce the risk of errors. With the right tools, you can streamline the creation, customization, and delivery of billing documents, ensuring they are sent on time without the need for manual intervention. This automation helps businesses operate more efficiently, allowing you to focus on growth and customer satisfaction.

To automate the creation of your billing documents, consider the following steps:

- Choose the Right Software: Invest in accounting or billing software that supports automation. Many tools allow you to create recurring billing schedules, set up templates, and generate documents with minimal input from you.

- Integrate with Your Payment System: Link your billing system with your payment gateway or customer management software. This integration allows you to automatically generate documents based on transactions and ensures that payment information is accurate and up-to-date.

- Set Up Recurring Billing: For businesses that offer subscription-based services or ongoing projects, set up recurring billing to automatically generate and send documents on a regular schedule. You can define the frequency (e.g., weekly, monthly) and payment terms, reducing manual work.

- Customize with Client Data: Make sure the system can pull client-specific information from your database. This will ensure each document is personalized with accurate contact details, purchased services, and prices, eliminating the need for manual entry.

- Use Pre-Defined Templates: Save time by using pre-set layouts that automatically populate with the relevant details for each transaction. These templates can be customized to match your brand, ensuring that each document maintains a professional appearance.

- Automate Delivery: Set up automatic email notifications to send the documents directly to your clients. You can also automate reminders for overdue payments or upcoming due dates to help maintain smooth cash flow.

Benefits of Automating Billing: Automating your billing process can significantly improve efficiency, reduce human error, and increase consistency. It ensures timely delivery, helps you manage recurring payments easily, and provides you with real-time insights into your business’s financial status.

By leveraging automation, you can streamline your operations, save valuable time, and create a more professional experience for your clients.

Maintaining Invoice Records Efficiently

Efficient record-keeping is crucial for any business, not only for financial management but also for ensuring legal compliance and simplifying tax filing. Properly organized documents provide a clear history of transactions, facilitate quick access when needed, and ensure transparency in case of disputes. Maintaining an organized record system helps businesses stay on top of payments, track overdue balances, and avoid financial mismanagement.

Here are some best practices for managing your financial records effectively:

- Centralize All Documents: Store all your records in a single, secure location, whether it’s a physical filing system or a cloud-based digital platform. This makes retrieval quicker and ensures nothing is misplaced.

- Use Consistent Naming Conventions: Develop a consistent naming system for your records. For example, use the date and client name or unique reference numbers to easily identify documents. This practice can greatly improve searchability.

- Utilize Accounting Software: Invest in accounting or record-keeping software that allows you to store, track, and manage all your records in one place. These tools often provide automated features for tracking payments, creating reports, and generating reminders for overdue payments.

- Maintain Organized Categories: Classify your records by year, client, or payment status (paid, unpaid, overdue). This helps to stay organized and allows you to quickly filter records when needed.

- Regularly Backup Your Data: Ensure your records are backed up regularly, whether using a cloud service or external drives. Losing your financial data can lead to significant complications, especially if it involves tax filings or audits.

- Set a Review Schedule: Periodically review your records to ensure they are accurate and up-to-date. This helps to identify discrepancies early and avoid issues with outstanding balances or incorrect information.

Digital Record Management

Using digital systems offers numerous advantages in terms of speed, organization, and accessibility. Cloud-based software not only allows you to store records securely but also makes it easier to access them from anywhere. Additionally, many accounting platforms integrate with your financial accounts and automatically categorize transactions, saving time and minimizing the risk of human error.

Compliance and Legal Requirements

Staying compliant with local tax laws and regulations is another important reason to maintain accurate records. Proper documentation of every transaction can be critical in case of audits or legal disputes. Ensure that your record-keeping practices meet the specific requirements of your region, including retaining records for the appropriate number of years as mandat

Where to Find Reliable Template Sources

When looking for reliable sources to obtain customizable billing documents, it’s important to choose platforms and providers that offer high-quality, professional layouts. A well-designed document not only enhances your business’s credibility but also ensures that all necessary fields are included, reducing the chance of errors or omissions. The right source should offer a variety of options, so you can find a format that fits your brand’s style and specific needs.

Below is a table listing some trusted platforms where you can find quality resources for creating your own billing documents:

| Platform | Key Features | Pros |

|---|---|---|

| Canva | Customizable designs, user-friendly interface, templates for various industries | Easy drag-and-drop features, a wide selection of free and premium options |

| Microsoft Office Templates | Pre-designed templates for various document types, downloadable for Word and Excel | Simple to use, compatible with Microsoft Office programs |

| Zoho Invoice | Online billing tool, automatic calculations, customizable layout options | Cloud-based, real-time tracking, integrates with accounting software |

| Google Docs | Access to templates through Google Drive, collaboration features, free to use | Cloud-based access, easy sharing and collaboration |

| Template.net | Variety of professional designs for different industries and business needs | Wide selection of templates, both paid and free options available |

These platforms offer both free and paid options, so you can find resources that meet your specific requirements and budget. When selecting a source, look for options that provide flexibility in editing, as well as support for your business’s unique branding needs. Whether you prefer online tools or downloadable files, there’s a solution that can save you time and ensure professional results every time.