How to Write an Invoice Template for Professional Billing

When it comes to managing business transactions, having a clear and organized billing system is essential. A well-structured document for requesting payments not only ensures accuracy but also reflects professionalism and builds trust with clients. Knowing the key components and formatting options available can make this process much easier, whether you’re a freelancer or running a larger company.

In this guide, we’ll explore the necessary steps to craft a document that covers all the required details, from client information to payment terms. By the end, you’ll be able to create a polished, consistent form that suits your specific needs and helps streamline your financial operations.

Understanding the essentials of a payment request document is the first step towards simplifying your billing process. It’s crucial to incorporate clear instructions, proper legal language, and itemized services or goods. With these in place, your clients will have all the information they need to process their payments efficiently.

How to Write an Invoice Template

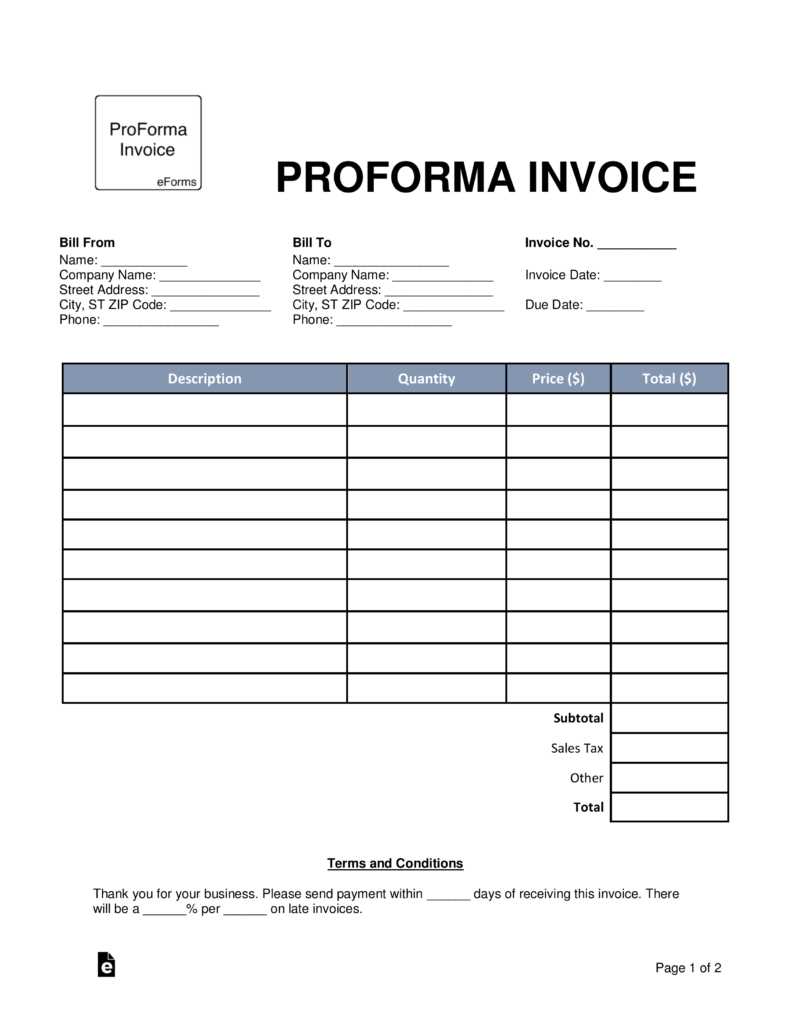

Creating a document for requesting payment requires a careful approach to ensure that all necessary information is included in an organized and clear format. The goal is to present details that allow both the provider and the client to understand the transaction completely, from the services rendered to the amount due. The structure of this document can vary depending on the specific business needs, but certain elements are essential for clarity and effectiveness.

Key Elements to Include

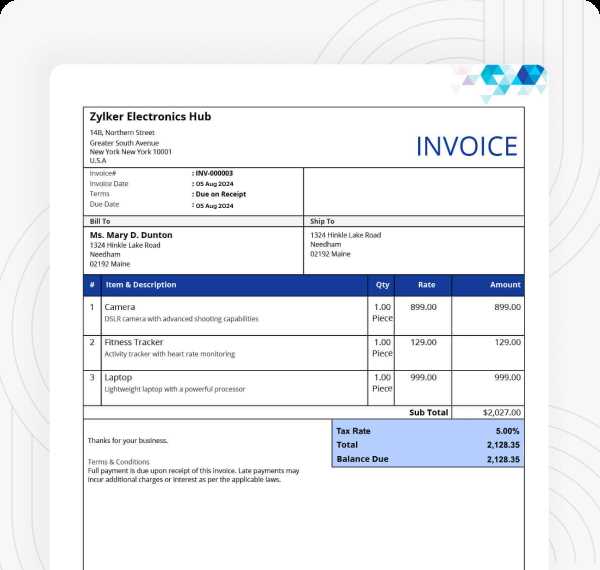

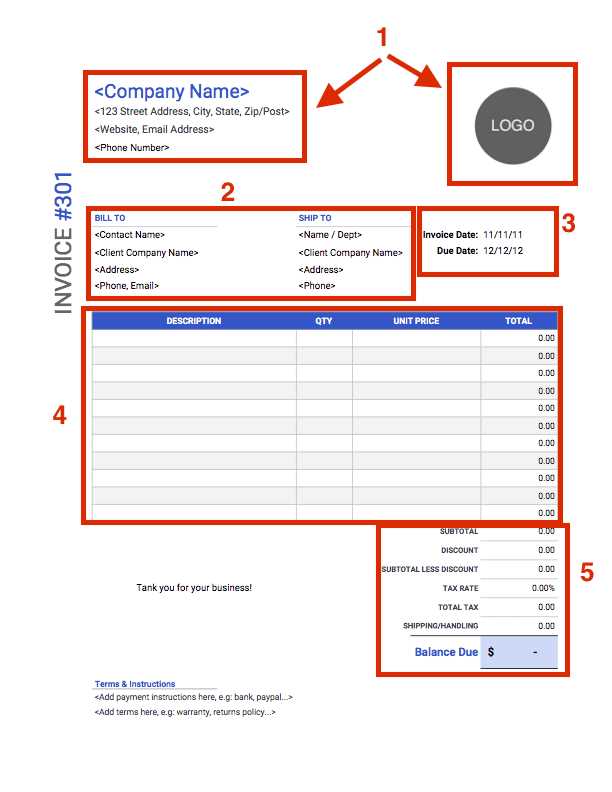

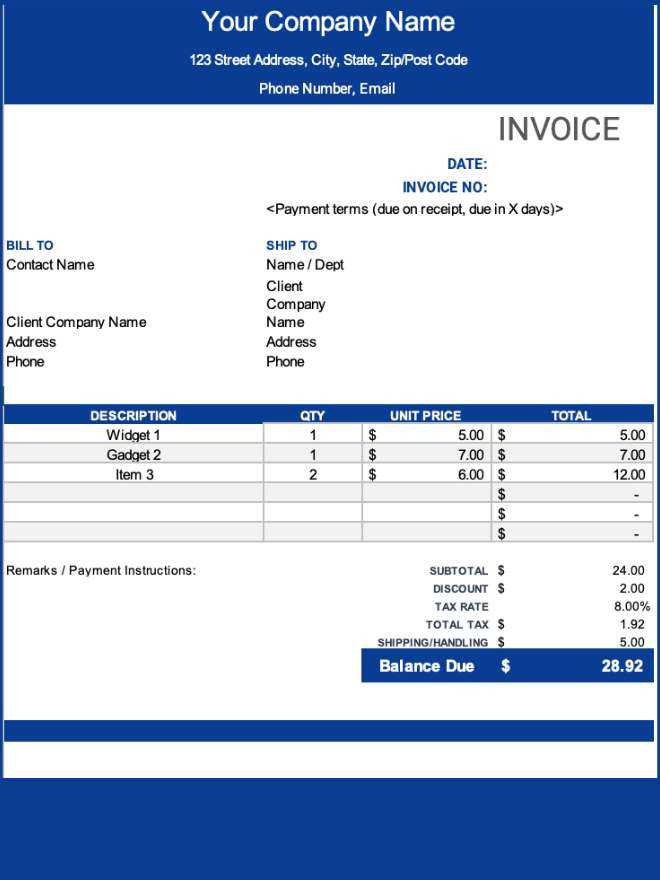

At its core, a billing request should include essential information such as the client’s contact details, a breakdown of the products or services provided, the payment amount, and the terms under which payment is due. It’s important to include clear item descriptions and the agreed-upon price for each item or service. Additionally, don’t forget to include your own business information to ensure that the client knows who to contact if there are any questions.

Formatting Your Document

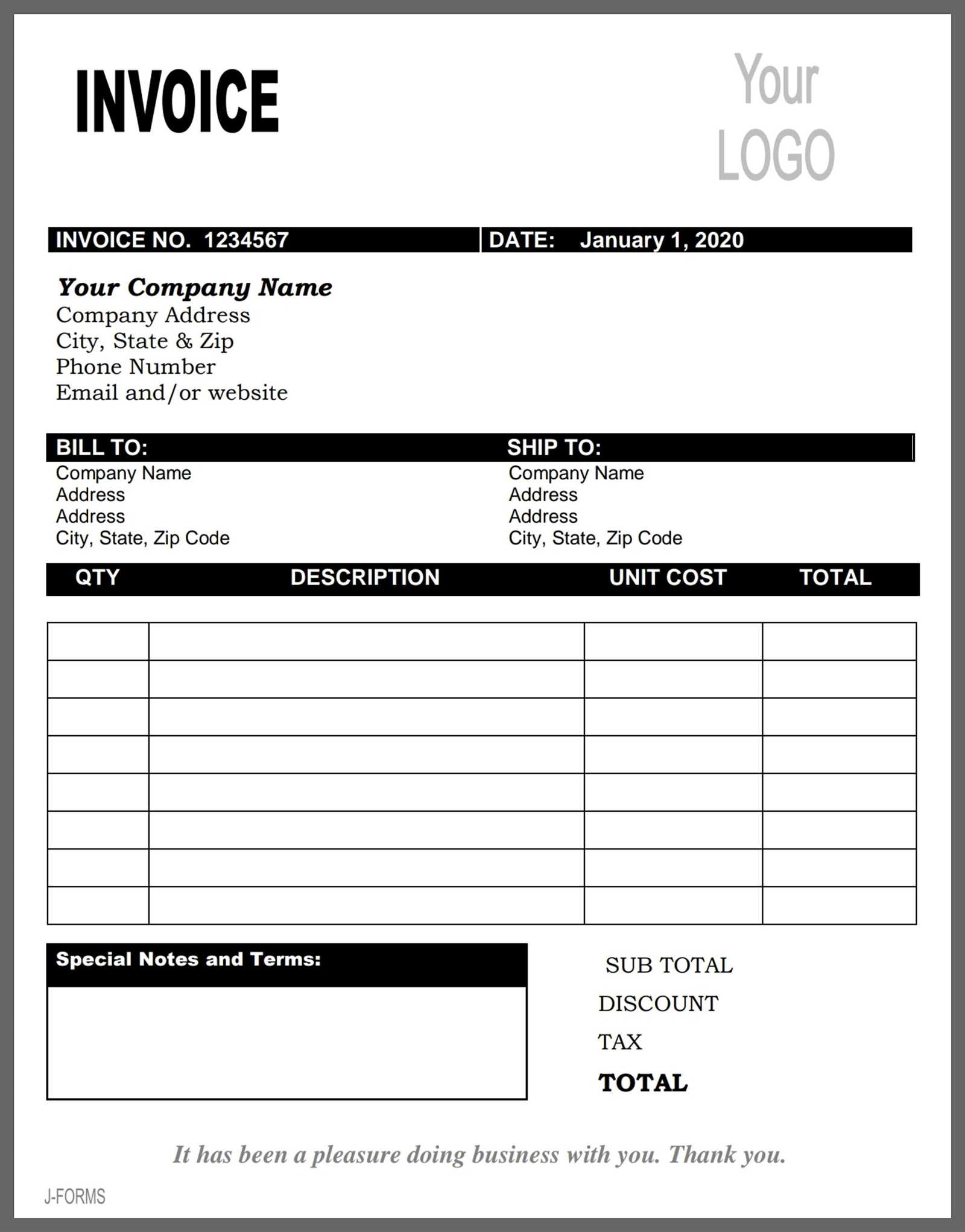

The layout of the document should be clean and easy to navigate. A well-organized request typically follows a logical flow, starting with header information such as your business name and the client’s name, followed by the details of the transaction. Ensure that there is sufficient space between sections, and use bold or italic fonts sparingly to highlight critical points such as the total amount due and payment terms. A professional appearance is key to maintaining trust with your clients.

Understanding the Basics of Invoices

At its core, a payment request document serves as an official record of a transaction between a provider and a client. This essential document ensures that both parties have a clear understanding of the agreement and the terms for completing the payment. It should include all necessary information to prevent misunderstandings and facilitate smooth processing of payments. Whether you’re a freelancer or a business owner, knowing the fundamentals of this document is critical to maintaining professionalism and organization in your financial dealings.

The primary components of a payment request include details such as the business and client information, a breakdown of the services or products provided, and the total amount owed. It’s important to structure this document in a way that’s easy to read and understand, ensuring that all key information is readily accessible.

| Component | Description |

|---|---|

| Business Information | Name, address, phone number, and email of the business issuing the request |

| Client Information | Name, address, and contact details of the recipient |

| Service/Item Description | A clear breakdown of the services provided or goods sold |

| Payment Terms | Due date, payment methods, and any additional terms such as late fees |

| Total Amount | The total amount due, including any taxes, fees, or discounts |

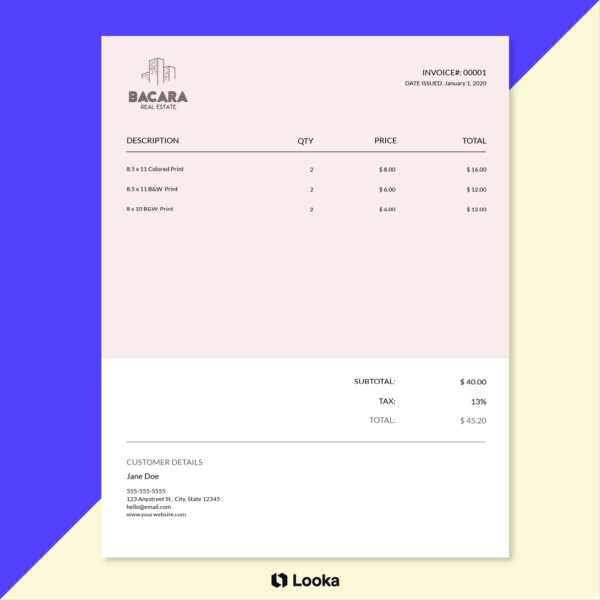

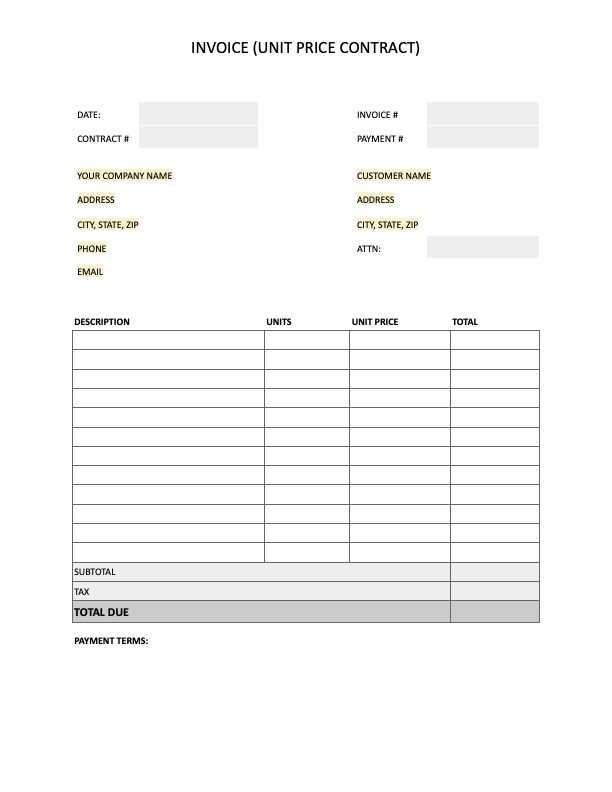

Choosing the Right Invoice Format

Selecting the right structure for a payment request document is crucial for ensuring that all necessary information is presented in a clear and organized manner. The format you choose can affect how easily your client processes the payment and can also impact the professional image of your business. Different formats may be more suitable depending on the complexity of the transaction or the industry you’re in. By understanding the various options available, you can choose the one that best meets your needs.

Types of Formats to Consider

There are several approaches to organizing a billing document. Some businesses may prefer a simple, straightforward design, while others might require a more detailed format with itemized descriptions. Depending on your business model, you may also choose between digital or paper versions, as each has its advantages. Digital formats, for instance, allow for easy updates and can be automatically generated, while printed versions might be preferred for personal interactions or specific industries.

Key Considerations When Choosing a Format

When deciding on the structure, consider factors such as the type of service or product you’re offering, the frequency of transactions, and the preferences of your clients. A straightforward format with clear, concise sections will often work best for most situations. However, for more complex agreements or larger invoices, you might need additional fields for tax information, discounts, or payment terms.

| Format Type | Advantages | Best For |

|---|---|---|

| Simple Layout | Quick to create, easy to read | Small businesses, freelancers |

| Itemized Layout | Clear breakdown of charges | Product-based businesses, large transactions |

| Digital Format | Easy to edit, can be automated | Freelancers, online businesses |

| Printed Format | Professional appearance, physical record | Businesses requiring physical documentation |

Essential Elements of an Invoice

When creating a document to request payment, certain components are critical to ensuring the transaction is clear, transparent, and professionally handled. These elements provide both the provider and recipient with the necessary details to avoid confusion and facilitate a smooth payment process. From basic contact information to a clear breakdown of the services or goods provided, each part serves a specific purpose in maintaining accuracy and professionalism.

While the structure of such a document may vary, there are several key components that should always be included. These ensure that the request is comprehensive and that both parties have the information needed to complete the transaction. Below are the essential parts that should be considered when crafting a payment request document:

| Component | Description |

|---|---|

| Provider’s Information | Includes business name, address, phone number, and email |

| Client’s Information | Details of the client or customer receiving the request |

| Unique Identifier | A specific reference number or code for tracking the request |

| Service or Product Description | A detailed list of the items or services provided, including quantities and rates |

| Payment Terms | Due date, payment methods, and any penalties for late payments |

| Total Amount Due | The final amount owed, including taxes, discounts, or additional fees |

How to Add Client Information

Including accurate and complete details about the recipient is crucial for any payment request. By providing the client’s information clearly, you ensure proper identification and communication throughout the transaction process. This step not only helps in the event of any follow-up but also adds a level of professionalism to the document.

Key Details to Include

When adding client information, make sure to include the following details:

- Client’s Name: Full legal name or business name if applicable.

- Contact Information: Phone number and email address for easy communication.

- Billing Address: The address where the request should be sent, which is important for both digital and physical communication.

- Tax ID or Registration Number: Required for businesses, especially for international transactions.

Tips for Accuracy and Consistency

Ensure that the information is accurate and consistent with the client’s official records. Double-check the spelling of names, addresses, and contact numbers. A small error in this section can lead to delays or confusion during the payment process. If you’re dealing with a business, be sure to include the name of the contact person responsible for payments to avoid miscommunication.

Creating a Clear Payment Due Date

Establishing a clear and unambiguous payment deadline is essential for ensuring timely transactions and preventing misunderstandings between you and your clients. A well-defined due date not only sets expectations but also encourages prompt payments, helping maintain cash flow and a professional relationship.

Key Considerations for Setting a Due Date

When specifying the due date, it’s important to consider several factors to ensure that it’s fair and practical for both parties:

- Reasonable Timeframe: Provide enough time for the client to review the charges, process the payment, and resolve any potential issues. Typically, payment terms range from 15 to 30 days.

- Business Calendar: Take into account holidays, weekends, and other non-working days when setting the deadline. It’s helpful to specify the exact date rather than simply stating “30 days” to avoid confusion.

- Clarity: State the due date clearly in the document, using a specific day and month, and avoid vague language like “End of the month” or “ASAP”.

Examples of Payment Due Date Formats

To make the deadline unmistakable, consider these ways of presenting it:

- Specific Date: “Payment due by December 15, 2024”

- Timeframe with Date: “Payment due within 30 days of issue date (December 15, 2024)”

- Custom Terms: “Payment due upon receipt” or “Due within 7 business days”

Choosing a clear format ensures there’s no room for ambiguity, and both you and your client are on the same page regarding when payment is expected.

Formatting Item Descriptions on Invoices

Providing clear and detailed descriptions of the products or services provided is essential for ensuring that both the client and the provider understand the transaction. When formatting these descriptions, clarity and precision are key to avoid any confusion and ensure transparency. A well-organized item list helps the client verify charges easily and ensures that all terms are understood before payment is made.

Each item should be described in enough detail to leave no ambiguity. This can include the type of service, quantity, rate, and any applicable additional costs. Depending on the complexity of the transaction, you may also want to include part numbers, delivery dates, or specific terms related to the items or services provided.

Best Practices for Item Descriptions

To ensure your descriptions are effective, follow these guidelines:

- Be Specific: Clearly define each product or service. For example, instead of just “Consulting,” write “Consulting services for website redesign (5 hours at $50 per hour).”

- Use Clear Language: Avoid jargon or overly technical terms that might confuse the client. Make sure your descriptions are easy to understand.

- Include Quantities and Rates: If applicable, mention how many units of a product or hours of service are provided, along with the agreed-upon rate for each.

- Highlight Discounts or Taxes: If there are any discounts or taxes applied to the charge, make them clearly visible so that the client can see how the final amount is calculated.

Example of Well-Formatted Item Descriptions

Here’s an example of how to format descriptions for clarity:

- Website Development Services: “Custom website design and development for a five-page website (40 hours at $75 per hour) – Total: $3,000”

- Software Subscription: “Annual software subscription for Project Management Tool (1 user license) – $150”

- Consulting: “Marketing strategy session, 2 hours of consulting at $100 per hour – $200”

Clear and concise descriptions not only make the billing process smoother, but they also enhance professionalism, which builds trust with clients.

How to Include Payment Terms

Clearly outlining the conditions under which payment is expected is essential for setting expectations between you and your client. By including well-defined payment terms, you help ensure that the transaction is completed smoothly and on time. These terms provide a framework for both parties to understand the timing, method, and possible penalties related to payment, reducing the chances of confusion or disputes.

Key Elements of Payment Terms

When establishing payment terms, consider the following details to make the expectations clear:

- Due Date: Specify the exact date by which payment should be made, or define a timeframe (e.g., “30 days from the date of issue”).

- Accepted Payment Methods: Clearly state which payment methods you accept, such as bank transfer, credit card, or online payment services.

- Late Fees: If applicable, mention any additional charges for overdue payments, such as a percentage of the total amount due after a certain period (e.g., “1.5% per month after 30 days”).

- Early Payment Discounts: Offer incentives for clients who pay ahead of schedule, such as “2% discount if paid within 10 days.”

- Partial Payments: If applicable, mention if partial payments are allowed and under what conditions.

Examples of Payment Terms

Here are a few examples of clear payment terms:

- Net 30: “Full payment is due within 30 days of the issue date.”

- Upon Receipt: “Payment due immediately upon receipt of this document.”

- Installments: “50% deposit required to begin work, with the remaining balance due upon completion.”

- Late Fee: “An additional 2% will be added for payments not received within 15 days of the due date.”

Setting clear payment conditions ensures that both you and your client have a mutual understanding of the expectations, making the process more efficient and professional for all parties involved.

Setting Up Tax Calculations in Invoices

Including tax calculations is a crucial part of any billing document, as it ensures that the final amount accurately reflects the applicable taxes. Depending on the location and nature of the transaction, taxes can vary, so it’s essential to apply the correct rates and clearly display them. Properly calculating and including taxes not only ensures compliance but also prevents discrepancies and helps maintain transparency with clients.

Types of Taxes to Consider

There are various types of taxes that may need to be added to a payment request, depending on your business type and location:

- Sales Tax: A tax applied to the sale of goods and services. The rate depends on the jurisdiction (state, country, or region).

- Value Added Tax (VAT): A consumption tax used in many countries, added at each stage of production and distribution.

- Service Tax: A tax on specific services provided by businesses, common in certain industries like hospitality or consultancy.

- Excise Tax: A tax on specific goods, often applied to luxury items, alcohol, tobacco, and fuel.

Steps to Accurately Apply Tax

When including taxes, follow these steps to ensure accuracy:

- Identify the Applicable Tax Rate: Research the tax rate that applies to your products or services in your jurisdiction. Ensure you’re using the correct percentage (e.g., 7%, 10%, etc.) for the specific location.

- Calculate Tax Amount: Multiply the taxable amount by the tax rate to find the tax due. For example, if the total charge is $100 and the tax rate is 10%, the tax amount will be $10.

- Show Tax Separately: Display the tax as a separate line item, clearly indicating the percentage and the total amount. This makes it easy for the client to see the exact tax amount applied.

- Include Tax ID or Registration Number: If required by your jurisdiction, include your business’s tax identification number for verification purposes.

By following these guidelines, you ensure that the tax is applied correctly and transparently, which reduces the likelihood of confusion and promotes trust with your clients.

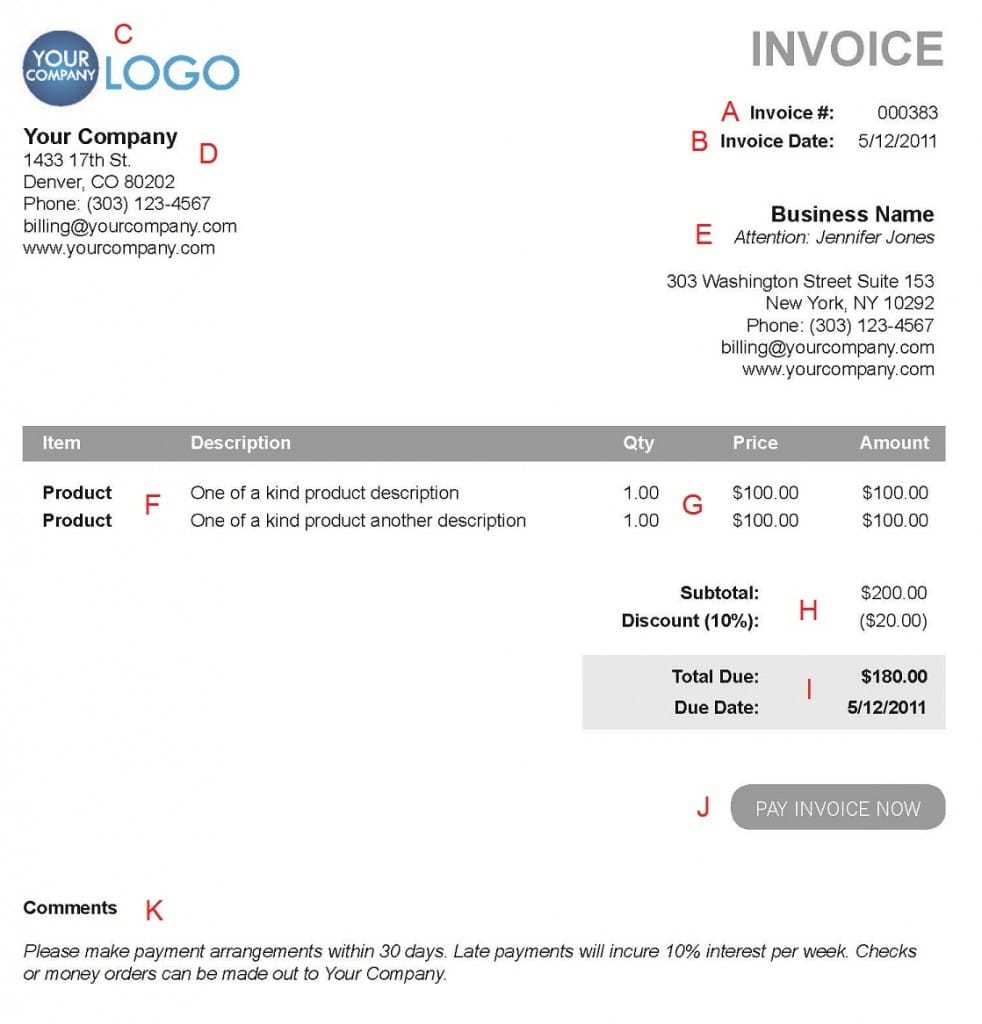

Including Discounts and Special Offers

Offering discounts or special promotions can be a powerful way to incentivize payments or reward loyal customers. Including such offers in your payment request documents not only shows appreciation but also enhances customer satisfaction. However, it is important to clearly outline the terms of any discounts or special rates to ensure both you and the client understand the conditions under which the offer applies.

Types of Discounts to Include

There are several types of discounts that businesses often apply to transactions:

- Percentage Discount: A reduction in price based on a percentage of the total amount, such as 10% off the overall bill.

- Flat Amount Discount: A specific dollar amount deducted from the total, for example, $50 off a service or product.

- Seasonal Discount: Offered during certain times of the year or for a limited period, such as “10% off for orders placed before December 31st.”

- Volume Discount: Applied when a client purchases a certain quantity of goods or services, e.g., “Buy 3, get 1 free” or “10% off for purchases over $500.”

How to Present Discounts Clearly

When including a discount or special offer, it’s essential to ensure the client understands exactly how the discount is applied. Here are some tips for presenting it clearly:

- State the Discount Terms: Clearly define how the discount can be redeemed, including any conditions such as minimum purchase amounts, specific dates, or payment methods required.

- Show the Original Price and Discount: Display both the original price and the discounted price to highlight the savings. For example: “Original Price: $200, Discount: 20%, Total After Discount: $160.”

- Include Expiration Dates: If applicable, specify an expiration date for the discount to encourage timely payment. For example: “Valid until [date].”

By clearly outlining discounts and special offers, you create a transparent and attractive billing document that encourages prompt payments and positive client relations.

Adding an Invoice Number for Tracking

Assigning a unique reference number to each billing document is essential for organization and tracking purposes. This number serves as an identifier for both the provider and the client, ensuring that each transaction is easily accessible for future reference, auditing, or follow-up communications. A well-structured numbering system can simplify record-keeping and help avoid confusion in case of multiple transactions or inquiries.

Why a Unique Number is Important

A reference number helps in various ways:

- Easy Identification: A unique number makes it simple to locate specific transactions, especially when dealing with large volumes of orders or payments.

- Improved Organization: Assigning a number to each document creates a chronological and systematic way to organize records.

- Efficient Tracking: It aids in tracking unpaid balances, pending payments, or completed transactions, especially when communicating with clients or accounting teams.

- Enhanced Professionalism: A consistent numbering system reflects well on your business practices, showing attention to detail and organizational skills.

Best Practices for Assigning a Number

Here are some best practices when creating and assigning a reference number:

- Use a Sequential Numbering System: Start with a simple numbering system, such as 001, 002, 003, and so on. This makes it easy to track and reference invoices in order of issue.

- Incorporate Dates: Consider adding the date or year as part of the number (e.g., 2024-001). This helps quickly identify when the document was created.

- Include Client or Project Codes: For businesses with multiple clients or projects, adding an identifier (e.g., CLT123-001) can further streamline organization.

- Keep It Simple: Avoid overly complex numbering systems that may confuse clients or create unnecessary complications in your records.

Including a clear and systematic reference number in your billing documents is essential for maintaining clarity and professionalism in your business transactions. This small but powerful detail ensures that you can easily manage and track payments while keeping your operations organized.

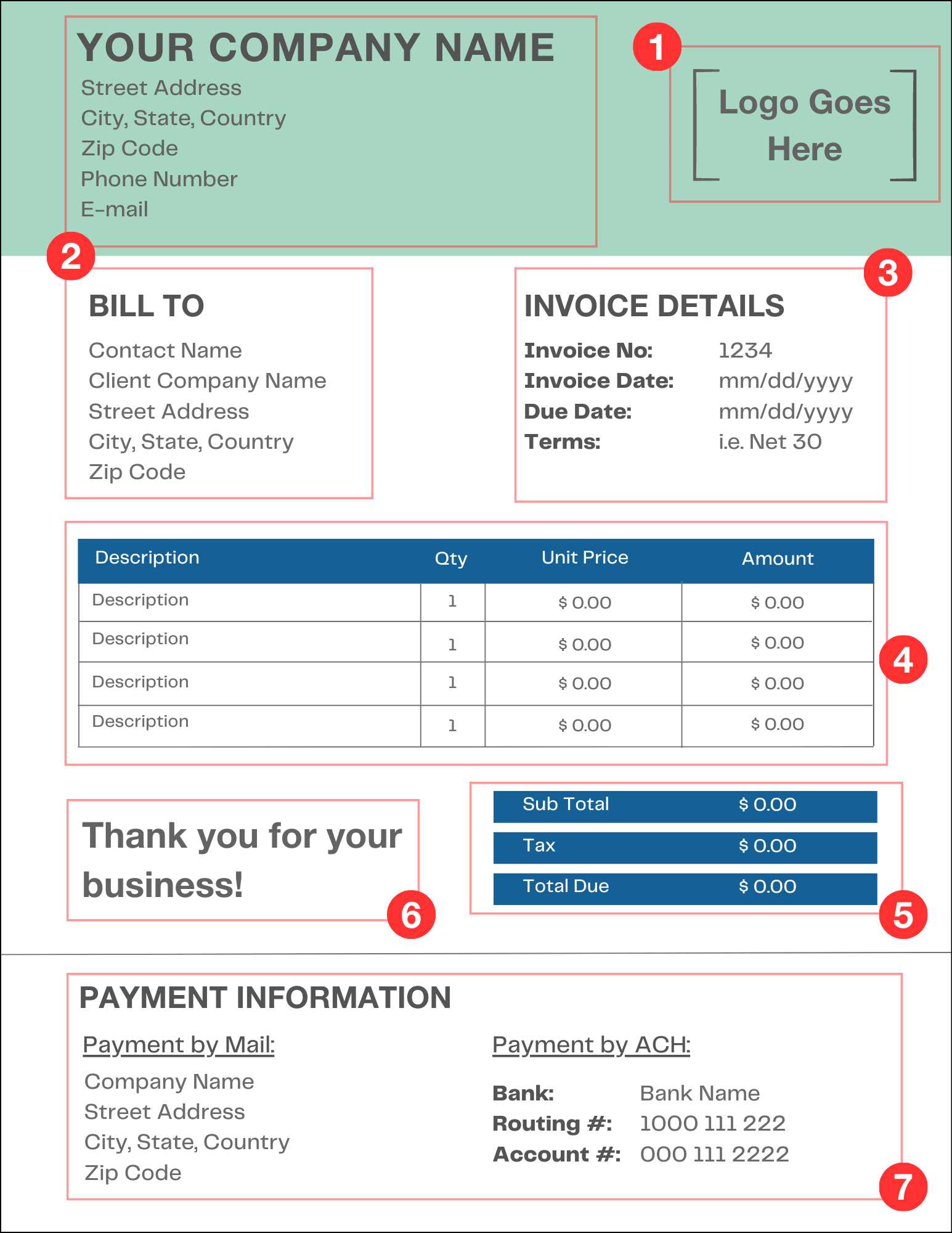

Customizing Invoice Templates for Your Brand

Customizing your billing documents is an excellent way to make them reflect your business identity and create a more professional and cohesive customer experience. By tailoring the appearance and content to suit your brand’s style, you ensure that your documents not only serve their functional purpose but also enhance brand recognition and trust with clients.

Key Elements to Personalize

When customizing your documents, focus on the following elements to make sure they align with your business’s branding:

- Logo and Brand Colors: Including your company’s logo and using brand-specific colors can make the document instantly recognizable and align it with your overall branding strategy.

- Font Style: Select fonts that match your business’s personality, whether it’s formal, modern, or casual. Ensure readability while maintaining a professional look.

- Business Contact Information: Ensure that your business name, address, phone number, email, and website are easily visible. This reinforces the professionalism of your company and makes it easy for clients to reach out if needed.

- Tagline or Slogan: If applicable, adding a business slogan or tagline can further reinforce your brand message and make your documents feel more personal.

- Payment Instructions: Customize the payment instructions section with your preferred methods, making it clear and easy for clients to make payments.

Examples of Personalization

Here are a few ways to personalize your documents to reflect your brand:

- Simple Branding: “Add your logo to the top left corner, use your primary brand color for headings, and ensure the font matches your website’s typography.”

- Complete Branding: “Incorporate your full brand identity by using your company’s visual elements throughout the document. This includes the logo, color scheme, fonts, and a custom footer with your social media links and business tagline.”

By adding these customized touches, your documents will look more polished and cohesive, helping reinforce your business identity with every transaction. Not only does this improve the overall client experience, but it also creates a lasting impression of your professionalism.

How to Add Your Company Details

Including your business information on a billing document is essential for establishing trust and ensuring that the client knows how to contact you if needed. Your details should be clearly visible and easy to find, as they serve not only as a point of reference for clients but also as a legal requirement in some regions. Properly presenting your company’s contact information and relevant business credentials helps maintain professionalism and ensures smooth communication throughout the payment process.

Key Information to Include

When adding your company’s details to a billing document, make sure to include the following essential elements:

- Business Name: The official name of your business as registered, ensuring it matches your legal documents.

- Business Address: Your physical address, which is necessary for legal and shipping purposes. If you operate online or have a virtual office, include the address of your primary operations.

- Phone Number: A contact number where clients can reach you for inquiries or support. Ensure it’s an active number that is monitored regularly.

- Email Address: An email address dedicated to business correspondence. It should be professional (e.g., [email protected]) and easy for clients to find.

- Website URL: A link to your company’s website, offering clients easy access to further information about your products, services, and terms.

- Tax Identification Number (TIN): If applicable, include your business’s tax ID or VAT number, as this may be required for legal and tax purposes, especially for international transactions.

Example of Company Details Layout

Here’s an example of how you can layout your business information in a billing document:

- Business Name: XYZ Consulting LLC

- Address: 123 Business Avenue, Suite 100, New York, NY 10001

- Phone: (123) 456-7890

- Email: [email protected]

- Website: www.xyzconsulting.com

- Tax ID: 12-3456789

By clearly displaying your company’s details, you enhance the professional appearance of your billing document and make it easier for clients to contact you if any questions or issues arise.

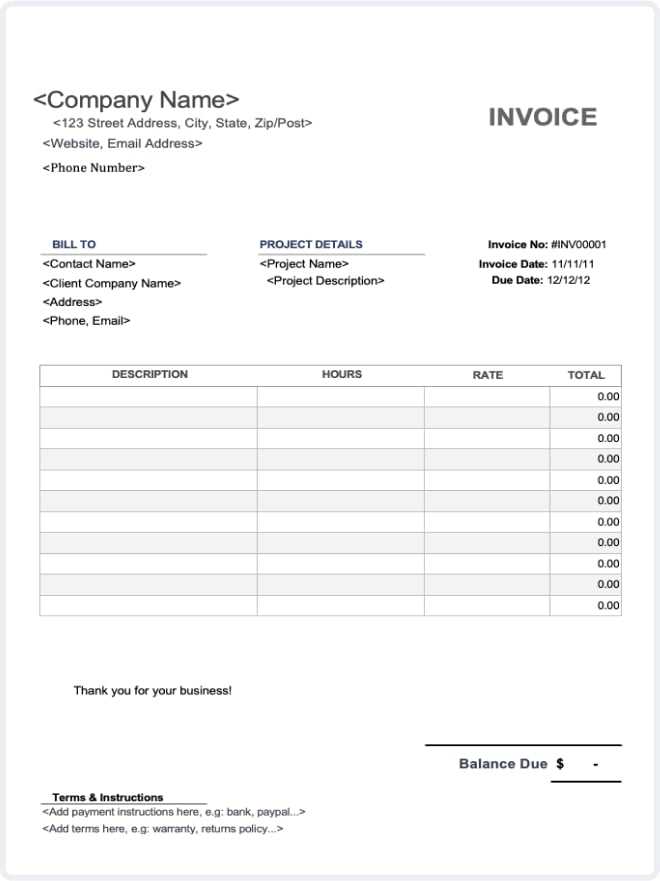

Creating Invoice Templates for Different Industries

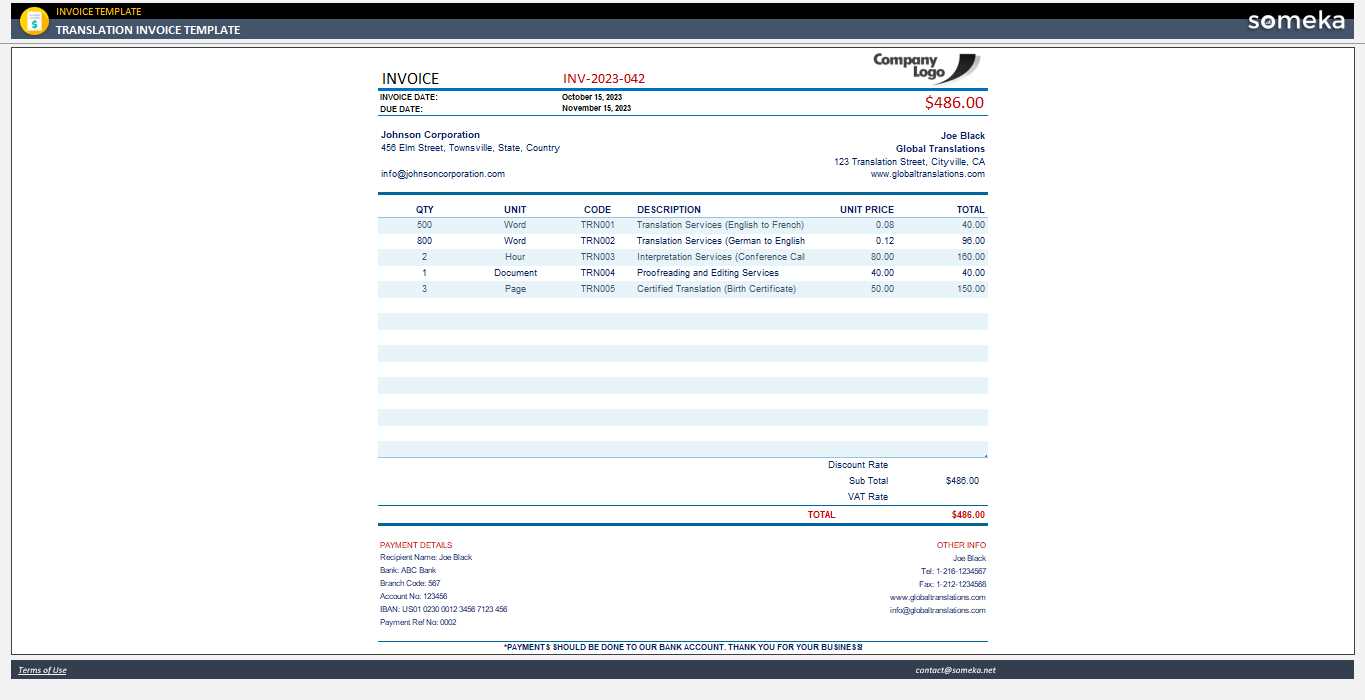

Each industry has its own specific needs when it comes to billing documents. Customizing your documents to align with industry standards can not only streamline the billing process but also improve communication with clients. By understanding the unique requirements of your sector, you can create documents that are both professional and functional, ensuring that all necessary information is included in a format that suits your business and your clients.

Adapting to Industry-Specific Needs

Different industries have varying needs and legal requirements that should be reflected in your billing documents. Here are a few examples of how documents can be tailored for specific sectors:

- Freelancers and Consultants: Freelancers and consultants often deal with projects of varying lengths and scopes. Including detailed project descriptions, hourly rates, and milestones can help clarify terms for both parties.

- Retail Businesses: For retail businesses, documents should focus on itemized product listings, quantities, unit prices, and discounts. A clear breakdown of taxes and shipping charges is also important.

- Construction and Contracting: In the construction industry, it’s crucial to include detailed descriptions of the work completed, materials used, labor charges, and terms of payment. Clients may also need to see references to specific contracts or project phases.

- Software and Technology Services: Companies in the tech sector might offer subscription-based services, licensing, or support contracts. It’s important to include billing cycles, subscription periods, and any special conditions regarding upgrades or renewals.

- Medical and Healthcare Providers: For healthcare providers, it’s important to include patient information, detailed descriptions of services or treatments, and insurance billing details. Privacy regulations, such as HIPAA in the U.S., may require special care when handling sensitive data.

Important Features to Include for Industry-Specific Templates

Regardless of the industry, certain features are essential for any billing document. These include:

- Clear Breakdown of Charges: Whether it’s products, services, or labor, clients should easily see how their total was calculated.

- Payment Terms: Specify due dates, late fees, and acceptable payment methods to ensure smooth transactions.

- Tax Information: Accurately applying relevant taxes (e.g., VAT, sales tax) is essential for compliance and clarity.

- Industry-Specific Legal Terms: Ensure that all legal clauses, such as warranties, liabilities, and contract terms, are clearly stated when necessary.

By creating billing documents that are customized to the specific needs of your industry, you help build trust with clients and ensure that you meet the particular requirements of your sector.

Using Online Tools to Create Invoices

Leveraging online tools for generating billing documents can save time, reduce errors, and streamline the entire process. These platforms offer user-friendly interfaces and customizable features that cater to various business needs, from freelancers to large enterprises. By using digital solutions, you can create and send documents quickly, track payments, and ensure compliance with tax regulations, all while enhancing the professionalism of your business communications.

Benefits of Online Tools for Billing

Here are some advantages of using online platforms to generate billing documents:

- Time Efficiency: Most online tools come with pre-built templates that allow you to quickly input details and generate a professional-looking document in minutes.

- Automation: Many platforms offer automation features, such as recurring billing for subscription-based services or automatic reminders for overdue payments.

- Customization: You can easily adjust the design and layout to fit your brand’s style, from logos and colors to specific content, ensuring consistency in all your communications.

- Cloud Storage: With cloud-based platforms, your documents are securely stored and accessible from anywhere, making it easier to manage and retrieve records when needed.

- Integration with Payment Systems: Online tools often integrate with popular payment gateways, allowing clients to pay directly from the document itself, streamlining the transaction process.

Popular Online Tools for Billing

There are several online platforms that offer excellent features for creating and managing billing documents. Below is a comparison of some commonly used tools:

| Tool | Key Features | Best For |

|---|---|---|

| FreshBooks | Customizable templates, time tracking, recurring billing, client management | Freelancers and small businesses |

| QuickBooks | Invoicing, expense tracking, financial reporting, tax calculations | Small to mid-sized businesses, accountants |

| Zoho Invoice | Multi-currency support, automated reminders, time tracking | Freelancers and service-based businesses |

| Wave | Free invoicing, receipt scanning, payment tracking | Startups, freelancers, and small businesses on a budget |

By choosing the right platform for your business needs, you can significantly improve the efficiency and accuracy of your billing process, while also enhancing your professional image. Whether you’re a freelancer just starting out or a larger business looking to streamline your operations, online tools offer powerful solutions for creating and managing billing documents.