How to Make Your Own Invoice Template

When managing a business, having a well-structured document for tracking transactions is essential. It serves not only as a record of sales or services provided but also as a professional representation of your business. By designing a personalized form, you can ensure that all necessary details are clearly presented and easy to understand.

From client information to payment terms, various elements must be included in this document to ensure clarity and transparency. With the right approach, you can create a functional tool that enhances both your workflow and client relations.

Building a document for financial dealings involves more than just adding text fields. It requires careful thought about what should be included, the layout, and how to present it in a way that is both professional and practical. Tailoring it to fit the unique needs of your business can help improve communication and payment processes.

Creating a Custom Billing Document

Designing a personalized billing document is a key step for any business looking to streamline its financial processes. With the right structure, it becomes a useful tool for tracking payments and keeping clear records. Whether you are providing services or selling products, having a clear and consistent document will help ensure that all essential information is included and easy to understand.

Follow these basic steps to create an effective document:

- Choose a layout: Decide whether you want a simple, minimalist design or a more detailed one with advanced features.

- Include necessary fields: Make sure to add all relevant details such as business name, client information, payment terms, and amounts.

- Ensure readability: Use clear fonts and an organized structure to make sure the document is easy to read and understand at a glance.

- Customize branding: Incorporate your business logo, colors, and fonts to make the document uniquely yours and align it with your brand identity.

- Include legal details: Add any necessary legal terms, such as payment conditions and tax information, to ensure compliance.

Once you have determined the key features, you can either use a digital tool or software to bring your design to life or create it manually using word processors or spreadsheet programs. The goal is to create a professional, clear, and functional document that meets all your business needs.

Understanding the Importance of Invoice Templates

Having a consistent and organized document for financial transactions plays a crucial role in managing business operations. It not only serves as a receipt of services rendered or goods sold but also as a key element for maintaining professionalism and clarity with clients. A well-designed billing record ensures that all necessary information is included and easily accessible for both parties.

Streamlining Financial Processes

A personalized billing record helps speed up the entire process from request to payment. By clearly outlining the cost, payment terms, and due dates, both the client and business owner can quickly understand the financial aspects of the transaction. This efficiency minimizes confusion and the chances of delays or disputes.

Building Professionalism and Trust

Utilizing a uniform document gives clients the impression that your business is organized and trustworthy. It reflects a level of professionalism that can enhance client relationships and encourage timely payments. This consistency builds trust and makes the payment process smoother for both parties.

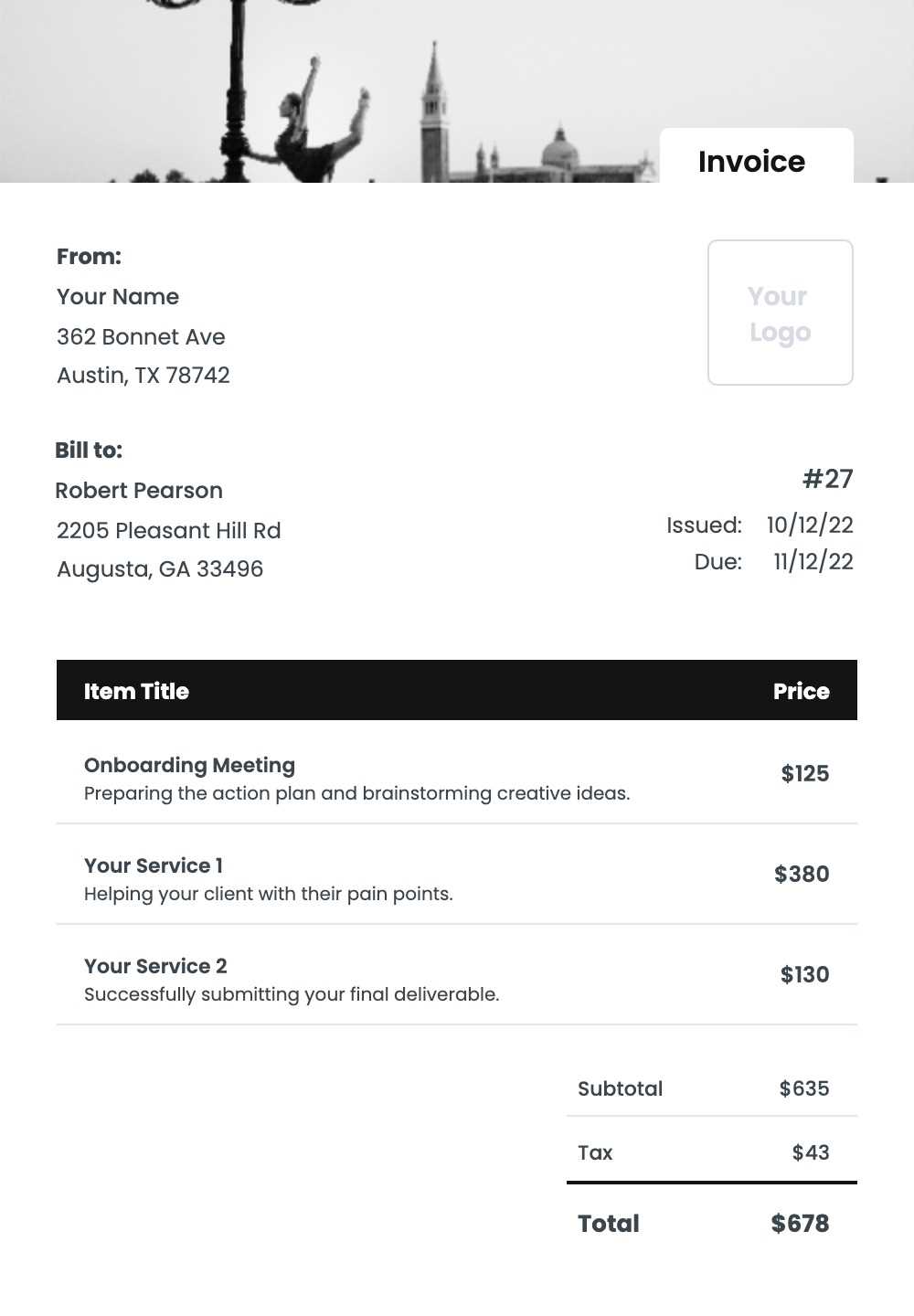

Key Components of an Invoice

Every financial document should include certain essential elements to ensure clarity and accuracy. These elements help both the business and the client understand the details of the transaction, ensuring that no important information is overlooked. A properly structured document enhances communication and minimizes the chances of confusion or disputes.

The most important parts to include are:

- Contact Information: Both the business and client’s names, addresses, and contact details must be clearly visible.

- Unique Identifier: Each document should have a specific number for tracking purposes, which helps avoid mistakes or misidentifications.

- Service or Product Details: A clear list of the services provided or goods sold, including quantities and descriptions.

- Payment Terms: Information regarding the payment due date, method, and any applicable penalties for late payments.

- Total Amount: The sum of the services or products provided, including any taxes or discounts.

Including these elements ensures that both parties can easily understand the terms of the agreement and that the document serves its intended purpose effectively.

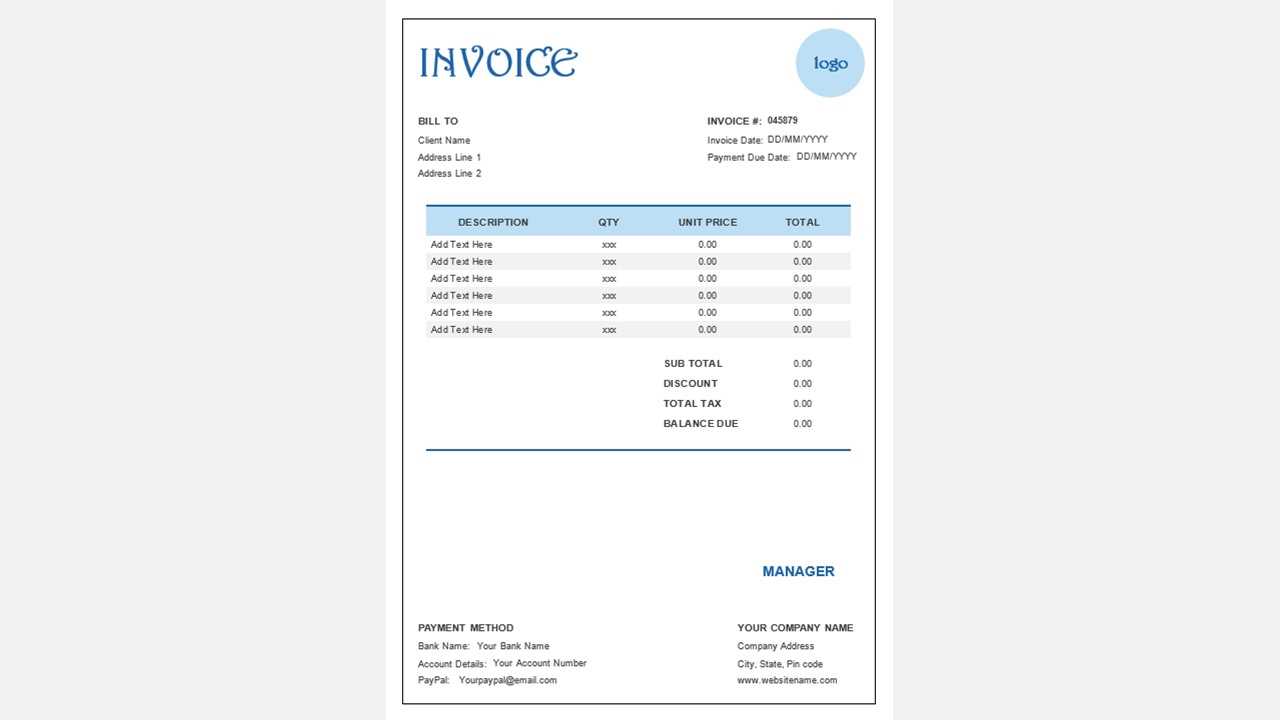

Choosing the Right Invoice Format

Selecting an appropriate structure for a billing document is essential for ensuring it meets both business and client needs. The format chosen affects how easily the document can be understood, processed, and filed. A well-organized layout contributes to smoother transactions and clearer communication.

Consider Your Business Needs

The type of business you run can influence the layout and elements needed in the financial record. Depending on whether you’re offering services, selling physical products, or both, the document might need different sections or levels of detail.

- For service-based businesses: A more detailed breakdown of services, hours worked, and rates might be necessary.

- For product-based businesses: Clear product descriptions, SKU numbers, and quantities should be emphasized.

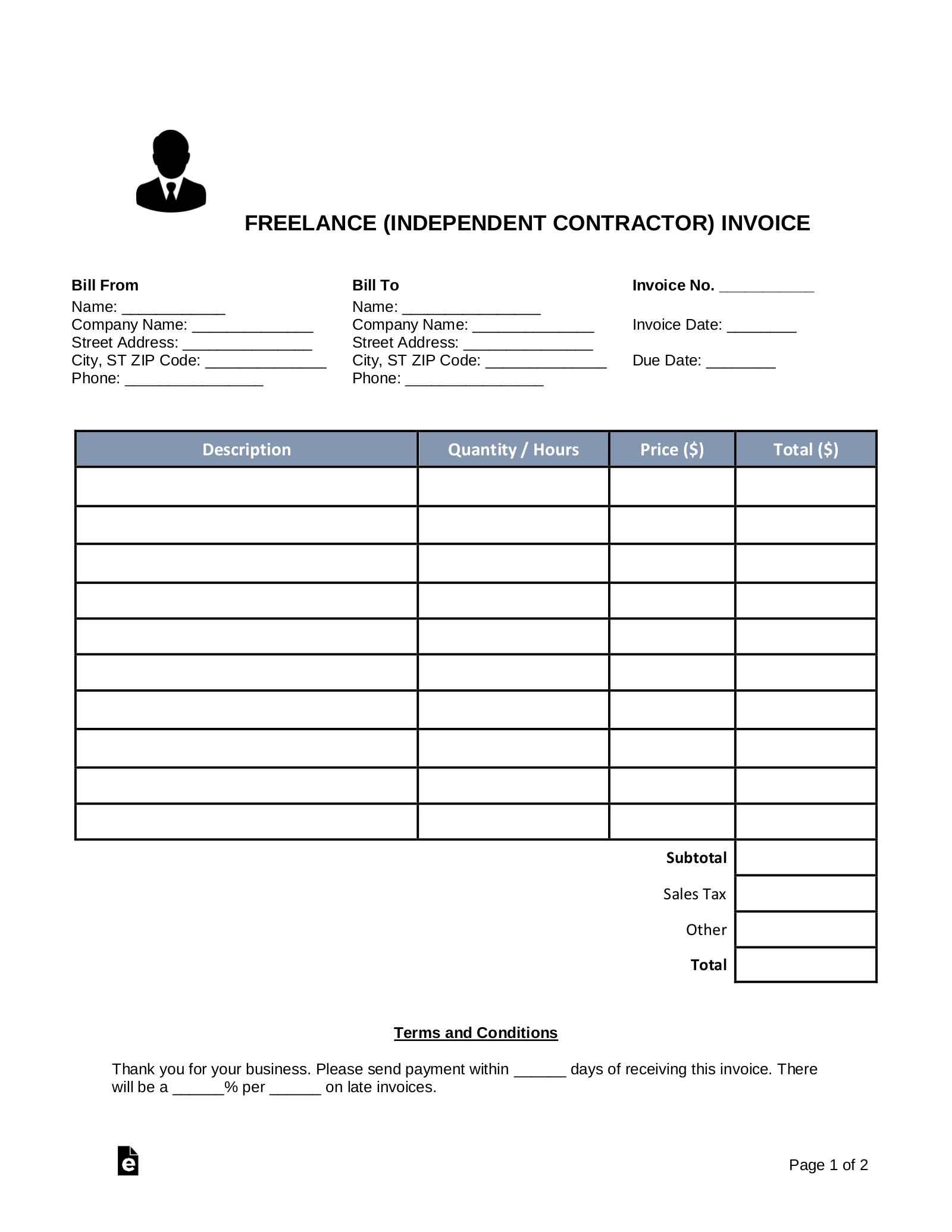

Choosing Between Digital and Printable Formats

Another factor to consider is whether to use a digital format or a traditional printed version. A digital format may be more convenient for quick edits and email delivery, while a printed format may be better for in-person transactions or physical records.

- Digital formats: Easily customizable and shareable, ideal for businesses that rely on email or online payments.

- Printable formats: Suitable for businesses that handle face-to-face transactions or prefer physical copies for record-keeping.

Free Tools for Creating Invoices

There are many online tools and software available that allow businesses to generate professional documents for financial transactions without any cost. These platforms offer customizable features that can help create documents quickly and easily, saving time and resources while ensuring accuracy.

Popular Online Platforms

Various online tools provide an intuitive interface for creating detailed financial documents. These platforms often allow for easy customization, letting users tailor the layout to fit their brand and business needs.

- Wave: A free accounting software with built-in options for generating customizable billing records and tracking payments.

- Invoice Generator: A straightforward tool for creating simple yet professional records, available for free use without requiring an account.

- Zoho Invoice: Provides a free version with essential features for creating customized financial documents, especially for small businesses.

Benefits of Free Tools

Using free software for document creation offers several advantages, including ease of use, no upfront costs, and the ability to generate documents quickly. Many tools also integrate with other business software, making them convenient for businesses of all sizes. Additionally, these platforms typically offer cloud storage, ensuring that all documents are securely saved and easily accessible at any time.

Design Tips for Professional Invoices

A well-structured layout and appealing design can make all the difference when it comes to creating a polished financial document. The visual appearance of the document not only reflects the professionalism of your business but also ensures that the information is clear and easy to navigate for both you and your client. By paying attention to key design elements, you can enhance the readability and overall effectiveness of the document.

Focus on Clarity and Simplicity

Keeping the design simple yet informative is essential for creating a clean and functional document. Overcrowding with too many elements can make it difficult to understand the key details. Focus on the essential information and leave plenty of white space for better readability.

- Use clear fonts: Choose legible fonts like Arial or Times New Roman to ensure the text is easy to read.

- Avoid clutter: Use minimalistic design with a clear separation between sections such as services/products and payment details.

- Proper alignment: Align text and numbers correctly to enhance organization and make the document look neat.

Incorporate Branding Elements

Incorporating your company’s logo, colors, and style into the document helps reinforce your brand identity. Consistent branding increases professionalism and makes the document instantly recognizable.

- Logo placement: Position your logo in a prominent place, typically at the top of the page, for brand visibility.

- Brand colors: Use your business’s color scheme to create a cohesive design that aligns with your other business materials.

- Custom fonts: If your business has a unique typeface, incorporate it to strengthen your brand’s identity.

Customizing Your Invoice Template

Personalizing a financial record can significantly improve its professionalism and make it more tailored to specific business needs. Customization ensures that the document not only looks cohesive with your brand but also includes all the relevant details in a format that works best for your business. With the right adjustments, the document becomes a useful tool for both you and your client.

Adding Essential Details

Ensure the document includes all necessary information, from contact details to payment terms. Personalizing each section allows for clear communication and reduces the chances of errors.

- Business and client information: Include your business name, logo, address, and contact information, along with the client’s details for reference.

- Payment terms: Clearly define the payment due date, accepted payment methods, and any late fees or discounts.

- Itemized list: Include specific details about the products or services provided, including quantities, unit prices, and total amounts.

Design and Layout Adjustments

Along with adding the required details, consider customizing the design to better fit your branding and style. Simple design changes can enhance the appearance and functionality of the document.

- Color scheme: Use colors that reflect your brand identity while maintaining clarity and readability.

- Font choices: Select professional fonts that are easy to read, and ensure consistency throughout the document.

- Section organization: Adjust the layout to highlight important sections such as due dates, itemized lists, and payment instructions.

How to Add Business Information

Including relevant business details in financial documents helps establish clear communication with your clients. This section provides essential information that identifies your company, ensuring that recipients know how to contact you and where to send payments. Adding your business information correctly helps maintain professionalism and builds trust with clients.

Key Business Details to Include

There are several key pieces of information that should always be included when representing your business in such documents. These details help ensure clarity and ease of communication.

| Business Element | Description |

|---|---|

| Business Name | Include your official company name, ensuring it’s clear and consistent with legal documents. |

| Address | Your physical business address helps clients know where to send payments or official correspondence. |

| Phone Number | Provide a contact number to make it easy for clients to reach you for inquiries or clarifications. |

| Email Address | An email address allows for quick communication regarding the transaction or other related matters. |

| Website | Including a website lets clients learn more about your business and the services you offer. |

Positioning the Business Information

Proper placement of business information ensures visibility and easy access for your clients. Typically, this information is placed at the top of the document, making it the first thing the recipient sees.

Including Payment Terms on Invoices

Clearly outlining payment conditions in business documents ensures both parties understand their obligations and reduces the risk of disputes. It is important to establish when and how payments should be made, as well as any potential penalties for late transactions. Including these terms helps maintain professionalism and fosters positive business relationships.

Key Payment Terms to Include

Payment terms define the expectations surrounding the timing and method of payment. Clear terms protect both the seller and buyer. Below are essential elements to include when outlining payment conditions.

| Payment Element | Description |

|---|---|

| Due Date | Specify the exact date the payment is due, so clients know when to submit their payment. |

| Accepted Payment Methods | List all the payment methods you accept (e.g., bank transfer, credit card, PayPal). |

| Late Payment Fees | Indicate any penalties or fees for overdue payments to encourage prompt settlement. |

| Discount for Early Payment | Offering a discount for early payment can incentivize clients to pay ahead of schedule. |

| Partial Payments | State if partial payments are acceptable and any terms related to them. |

Positioning Payment Terms

Payment conditions should be clearly visible to avoid confusion. It is advisable to place them near the bottom of the document, directly before the total amount due. This ensures that the recipient can easily review the details before completing the payment process.

Setting Up Tax and Discounts

Accurately reflecting taxes and discounts in business documents ensures clarity and compliance with legal requirements. Including these elements helps clients understand the final price and allows businesses to maintain transparency and avoid misunderstandings. Properly setting up these features can enhance professionalism and foster trust with clients.

Adding Taxes

Tax rates can vary based on location and the type of product or service offered. It’s important to specify the tax rate applied to the total amount before finalizing the payment request. Here’s how to properly set up tax calculations:

- Research local tax regulations to determine the correct rate.

- Include tax as a separate line item on the document.

- Ensure the tax is calculated based on the pre-discounted total, unless otherwise required.

- List the tax rate clearly next to the tax amount for transparency.

Incorporating Discounts

Discounts are often used as an incentive to encourage early payments or bulk purchases. Including them in business documents can increase customer satisfaction and drive sales. When applying discounts, consider the following:

- Specify the percentage or fixed amount of the discount.

- Indicate the terms under which the discount applies (e.g., for early payment or large order volumes).

- Clearly mention if the discount is applied before or after tax calculation.

- Provide the final discounted price in bold to highlight the benefit to the customer.

By properly setting up tax and discount features, businesses can ensure their pricing is both clear and competitive, contributing to positive customer experiences and compliance with tax regulations.

Adding a Unique Invoice Number

In any financial documentation, assigning a distinct identifier to each transaction is essential for keeping track of records and ensuring easy reference. This practice not only helps in organizing your accounts but also supports clear communication with clients and regulatory bodies. A well-structured numbering system contributes to the accuracy and professionalism of your business dealings.

Creating a Numbering System

Establishing a consistent method for generating unique identifiers is key. A well-organized numbering sequence can help streamline administrative tasks and avoid confusion. Consider the following tips for creating a numbering system:

- Use a chronological sequence, such as INV-001, INV-002, etc., for simplicity.

- Incorporate the year or month, e.g., 2024-001 or JAN24-001, for easier tracking by date.

- Consider including client identifiers if you handle multiple accounts (e.g., CLIENT001-001).

- Ensure that the system is scalable and can accommodate future transactions without overlap.

Benefits of a Unique Number

Assigning a specific number to each transaction brings several advantages:

- Organization: It helps you quickly locate and reference past transactions.

- Professionalism: Clients appreciate the clear identification of documents, fostering trust.

- Legal Compliance: Unique identifiers are often required for tax reporting and audit purposes.

- Efficiency: A consistent numbering system simplifies data entry and retrieval in your accounting software.

By incorporating a distinct identifier for each transaction, you not only enhance the organizational aspect of your business but also ensure smooth processes for both internal use and client interactions.

Formatting for Clarity and Readability

Ensuring that financial documents are easy to read and understand is crucial for maintaining professional relationships. Clear and well-structured layouts allow recipients to quickly find important details, such as amounts due, payment terms, and contact information. Proper formatting helps eliminate confusion and ensures that essential information is presented logically and cohesively.

Use of Clean Layouts

One of the key elements of readability is the use of an uncluttered design. A clean, well-organized layout not only enhances the visual appeal but also improves comprehension. Some tips for creating a clean layout include:

- Keep margins and spacing consistent to avoid overcrowding information.

- Group related sections together, such as contact information, services provided, and payment details.

- Use ample white space to separate sections, making it easier to follow the document.

Text Formatting for Readability

Text formatting is essential for guiding the reader’s eye to the most important information. Clear distinctions between sections and well-chosen font styles improve readability. Consider the following tips:

- Headings and Subheadings: Use bold or larger fonts for headings to help organize the content and break up the page into digestible parts.

- Fonts: Stick to easy-to-read fonts, such as Arial or Helvetica, and avoid overly decorative or complex typefaces.

- Contrast: Ensure there is good contrast between text and background colors for ease of reading.

- Bullet Points: Use bullet points or numbered lists to organize items, such as services rendered or payment methods.

By focusing on clear design principles and thoughtful text formatting, you can create a document that not only looks professional but also delivers essential details in a straightforward manner, enhancing the overall experience for the recipient.

Making Your Invoice Look Brand Consistent

Maintaining a consistent brand identity across all business communications is essential for building trust and recognition. A professional document should reflect the same visual style and tone as the rest of your marketing materials. Aligning these documents with your brand’s personality can enhance credibility and foster a sense of continuity for clients and partners.

Use Brand Colors and Fonts

Incorporating your brand’s colors and fonts is a simple way to ensure consistency. These elements are key visual markers that help reinforce your identity. To achieve this, consider the following:

- Colors: Use your primary brand colors for headings, borders, or accents within the document. Avoid using too many colors, as this can make the design feel cluttered.

- Fonts: Stick to the fonts used in your other branding materials. Keep the font choices simple to maintain clarity, and avoid using more than two font styles in a single document.

Incorporate Your Logo and Tagline

Adding your business logo and tagline to the document serves as a constant reminder of your brand’s presence. Position the logo at the top of the page or in the header section for easy recognition. Make sure the size is appropriate to maintain visual balance without overpowering the content. Additionally, if your brand has a tagline, consider placing it below the logo or in the footer to reinforce your message.

By aligning the visual elements with your brand’s established style guide, you not only create a professional appearance but also enhance the client’s perception of your business, ensuring your documents are easily identifiable and trustworthy.

How to Save and Store Invoices

Properly saving and organizing financial records is critical for smooth business operations. Keeping track of these documents ensures easy retrieval, compliance with regulations, and provides clarity in case of audits. Effective storage methods allow you to stay organized while also ensuring security and accessibility when needed.

Choose the Right Storage Method

Depending on preferences and business needs, there are several ways to store financial documents securely:

- Cloud Storage: Storing files online offers the advantage of access from anywhere, plus automatic backups. Popular platforms like Google Drive or Dropbox can be used to organize and save digital files securely.

- Local Storage: For those who prefer to keep files on their own devices, saving documents on a computer or external hard drive is another option. Ensure these are backed up regularly to avoid data loss.

- Paper Storage: While digital solutions are preferred, some may still opt for hard copies. A safe filing system with clearly labeled folders can ensure easy access to paper-based records.

Organize Files for Easy Access

Once stored, organization is key. Here are some tips to help:

- Label Files: Whether digital or physical, use clear, consistent file names. Include the date and client name for easier identification.

- Use Folders and Subfolders: Keep related documents grouped together. For digital files, create folders for each client, month, or financial year, and categorize them accordingly.

- Implement a Searchable System: For digital storage, ensure files are searchable using keywords or tags, making it easy to find them when needed.

By implementing a well-organized system for saving and storing these records, business owners can avoid clutter, reduce errors, and easily access past transactions whenever necessary.

How to Send Invoices to Clients

Effectively delivering financial documents to clients is an essential part of maintaining a smooth business relationship. Timely and accurate submission ensures that both parties have a record of the transaction and can proceed with payment or follow-up actions without delays. Choosing the right method and maintaining professionalism throughout the process is crucial.

There are several methods to send these records, each offering different benefits depending on the preferences of the client and business needs.

- Email: Sending files electronically via email is one of the most common methods. Attach the document as a PDF or another format and include a brief, polite message with payment instructions. Make sure the file name is clear and includes relevant details like the client name and date.

- Postal Mail: In cases where clients prefer physical copies, mailing hard copies remains an option. Ensure proper packaging to avoid damage during transit, and choose a reliable postal service with tracking for added security.

- Online Platforms: Many businesses now use dedicated invoicing platforms or accounting software to send documents. These platforms can automate the process, allow clients to view and pay directly through the system, and track payment status in real-time.

Regardless of the method chosen, it is important to provide clear instructions and contact information should any questions arise. Always confirm with clients that they have received the document, and follow up if payments are not received by the due date.

Legal Considerations When Creating Invoices

When preparing financial documents for clients, it is crucial to ensure that they comply with relevant legal requirements. Proper documentation not only helps maintain clear records but also ensures that businesses meet their tax obligations and avoid potential disputes. Understanding key legal elements is essential for avoiding costly mistakes.

Key Legal Elements to Include

- Business Details: Including your business name, contact information, and any relevant registration or license numbers is often required by law in many regions.

- Client Information: It’s important to list the full name or business name of the client and their contact details for accurate identification.

- Clear Payment Terms: Clearly state the agreed payment terms, including due date, late fees, and acceptable payment methods to avoid misunderstandings.

- Tax Information: Depending on your location and the nature of the transaction, you may need to include tax rates, tax identification numbers, and the total tax amount charged.

- Itemized Charges: A detailed list of services or products provided, along with corresponding prices, is essential for transparency and to fulfill any legal requirements.

Local and International Regulations

Different regions may have varying regulations for financial documentation. For instance, some countries require specific information on documents for tax purposes. International transactions may also require additional details such as currency information, export codes, and compliance with both local and international tax laws.

Incorporating these legal considerations when creating financial records helps ensure smooth operations and avoids complications with authorities or clients.

Updating Your Invoice Template Over Time

As business needs evolve, it’s important to periodically review and adjust financial documents to stay aligned with industry standards, legal changes, and personal requirements. Making regular updates ensures that the structure remains relevant and accurate, minimizing errors and improving efficiency. Regular revisions also help maintain a professional image and ensure compliance with new regulations.

Why Updates Are Necessary

- Regulatory Changes: Laws and tax rates can change, which might require updates to reflect current standards or tax obligations.

- Business Growth: As a business expands, additional information may be needed, such as multiple billing addresses, new services offered, or different payment terms.

- Branding Evolution: Modifications to the company’s branding or logo might necessitate design adjustments to keep documents visually aligned with the brand identity.

- Feedback Implementation: Input from clients or team members can highlight areas for improvement, such as layout changes or more streamlined sections.

When to Make Adjustments

- At the start of a new fiscal year to ensure compliance with tax laws and update pricing or payment terms.

- After implementing new services or products to include accurate descriptions and pricing.

- When you rebrand, to update logos, color schemes, and fonts to reflect the new brand image.

Keeping documents up-to-date with changing business conditions and legal requirements allows companies to maintain a professional appearance, streamline internal processes, and avoid potential mistakes in financial transactions.