How to Make an Invoice Template for Easy Billing

Establishing a well-structured billing document is a vital step for businesses and freelancers seeking to streamline their payment processes. A tailored approach to formatting and organizing a billing outline not only ensures a smooth transaction but also reflects professionalism and builds trust with clients. An efficient design helps prevent misunderstandings and promotes quicker payments, benefiting both parties involved.

Whether you’re just starting out or looking to improve an existing layout, crafting a customized billing form can greatly enhance the clarity of your financial records. Key components like personalized branding, clear itemization, and essential details like payment terms are crucial for a successful layout. Using flexible design tools, any professional can build a polished, functional format that suits specific business needs.

This guide will walk through each step of the process, from selecting a layout to finalizing every detail for easy use in any situation. By focusing on organization, clarity, and consistency, you’ll be able to set up a billing document that simplifies financial interactions and supports a professional image.

Creating a Professional Billing Format

Establishing a clear and organized document for billing is essential for efficient business operations and smooth client transactions. A structured layout allows you to present all necessary details, ensuring your payment requests are easy to understand and adhere to professional standards. By focusing on readability and including key information, you create a document that reinforces reliability and minimizes potential payment delays.

Selecting a Layout for Clarity

Choosing an effective layout is fundamental to organizing a well-designed billing document. Start by considering a simple structure that outlines essential sections clearly. This includes adding spaces for contact information, a list of services or products, pricing, and payment terms. A streamlined design helps clients easily locate the information they need, reducing confusion and improving transaction efficiency.

Incorporating Branding Elements

Adding personalized touches such as logos, colors, and fonts that reflect your brand can elevate the document’s presentation. Consistent branding not only enhances professionalism but also strengthens recognition with clients, reinforcing your business’s image. Use these elements sparingly to maintain a polished and professional appearance without overwhelming the layout.

Understanding the Purpose of Invoices

A structured billing document serves as more than just a payment request; it plays a crucial role in maintaining transparent financial transactions between businesses and clients. This formal record captures key details of the services or products provided, helping both parties clearly understand the transaction and terms involved. By specifying agreed-upon amounts and deadlines, it supports a smooth, professional interaction that benefits both sides.

Beyond facilitating payments, a well-organized billing document also aids in accurate bookkeeping and legal compliance. Keeping these records ensures that all transactions are documented for future reference, tax purposes, and financial audits. This accountability not only strengthens trust with clients but also simplifies business management, allowing for a clear overview of revenues and expenses.

Essential Components of a Professional Invoice

A well-crafted billing document requires specific elements to ensure clarity, professionalism, and ease of use. Including the right details is crucial for effective communication, as it provides all the necessary information for clients to understand the charges and make timely payments. A carefully structured document also helps avoid misunderstandings and supports seamless business interactions.

Key Information to Include

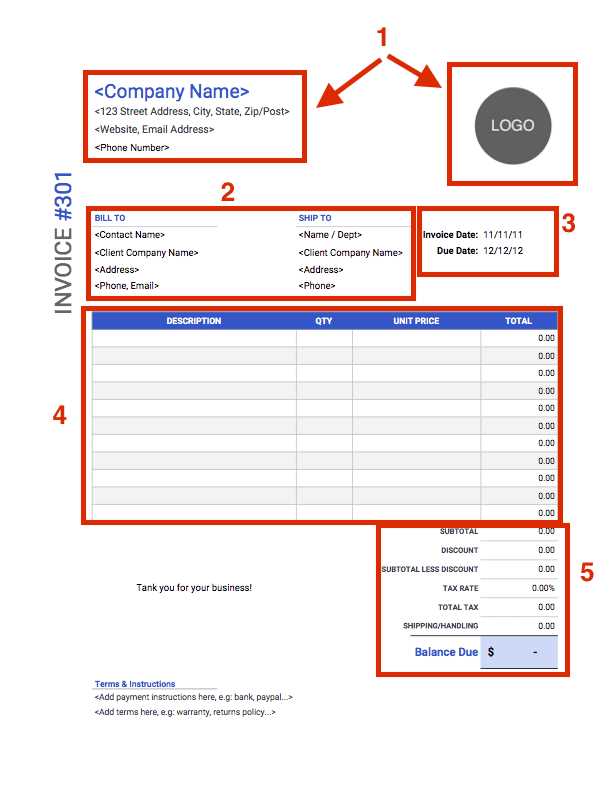

Each billing document should contain fundamental elements that clearly outline the transaction details. Here are the essential components to consider:

- Company and Client Details: Include your business name, address, and contact information, along with the client’s details. This identification helps verify the transaction and provides a point of contact if there are any questions.

- Document Number and Date: Assign a unique identifier and indicate the date to keep records organized and make future references straightforward.

- Description of Goods or Services: Clearly itemize what is being charged, including descriptions, quantities, and unit prices to give a full view of the transaction.

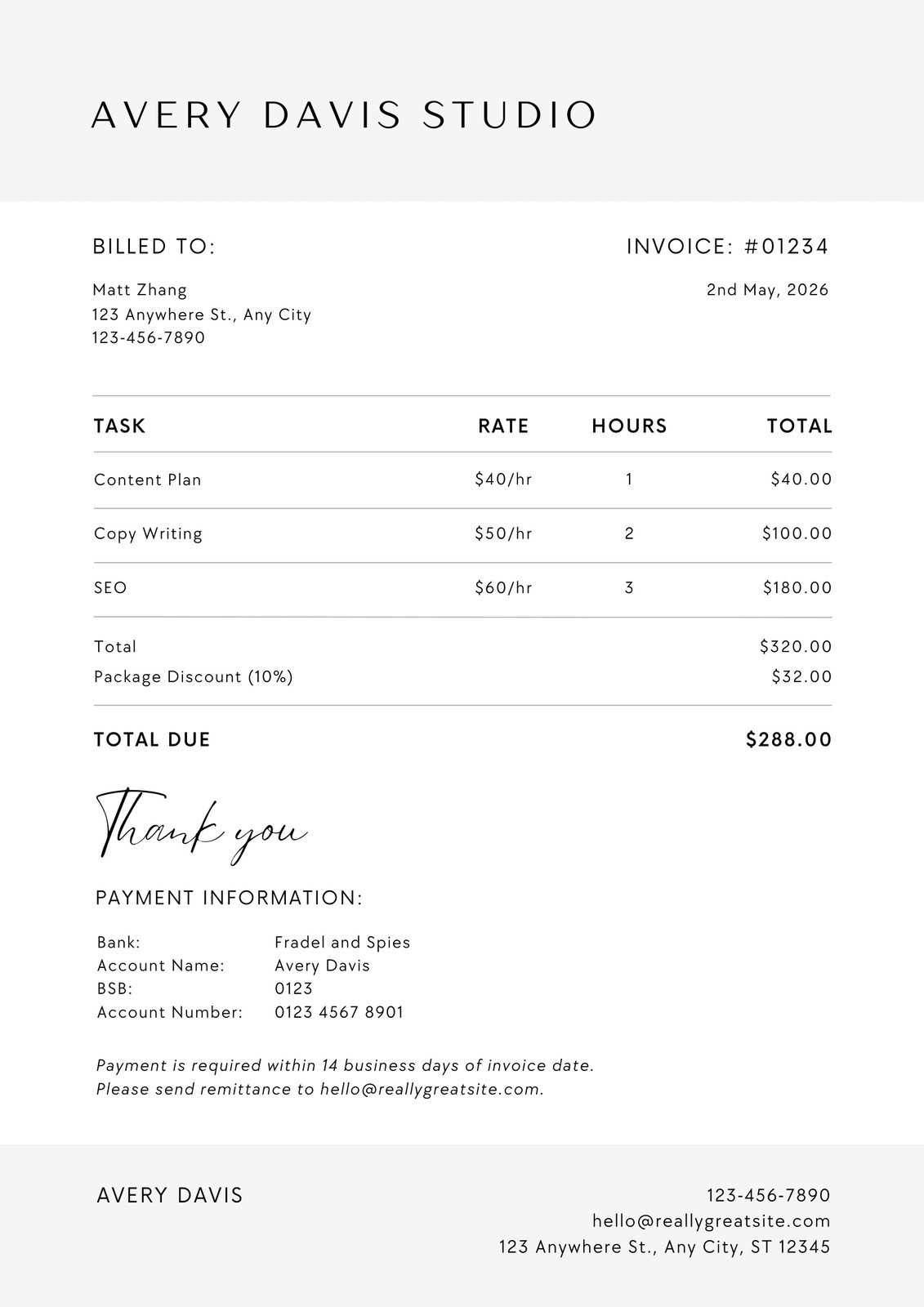

- Total Amount Due: Present a subtotal of all items, applicable taxes, discounts, and the final amount owed. This breakdown enhances transparency and minimizes payment disputes.

Additional Components for Clarity

- Payment Terms and Methods: Specify due dates and acceptable payment methods. Outlining terms ensures clients are aware of deadlines and any potential late fees.

- Tax Identification or Business Number: Depending on

Choosing the Right Format for Your Invoice

Selecting an appropriate structure for your billing document is crucial for creating a streamlined, effective payment process. The chosen layout should reflect your business style and cater to the specific needs of your clients. A thoughtfully selected format helps ensure all details are easy to find, understand, and process, contributing to a smooth transaction experience.

Evaluating Different Layout Options

When selecting a design, consider both traditional and modern options. Classic formats often include itemized lists with straightforward sections, making them ideal for clarity and professionalism. More modern layouts might incorporate elements like digital signatures or interactive fields, which can be useful for businesses aiming for a fully digital process. Assessing these options allows you to find a balance between usability and aesthetics, catering to your clients’ preferences and your branding goals.

Choosing Between Digital and Physical Formats

Digital formats, such as PDFs or online forms, offer convenience and ease of sharing, making them ideal for remote transactions. They also allow for interactive elements like clickable payment links, which can speed up the payment process. Physical formats, while less common in a digital world, may be suitable for clients who prefer tangible documents or for industries where hard copies are required. Selecting the format that aligns best with your business model and client preferences can improve the efficiency of your billing and payment procedures.

A well-chosen format not only meets practical needs but also conveys professionalism, setting the right tone for each transaction.

Design Tips for a Clear Layout

An organized, easy-to-read document layout is essential for effective billing. A well-thought-out design not only makes information accessible but also reflects a professional image to clients. With a few strategic design choices, you can create a document that is both visually appealing and functional, helping clients quickly understand and process each transaction.

- Keep Sections Distinct: Use clear headings and ample spacing to separate different parts, such as client information, service details, and payment terms. This enhances readability and helps clients find key details without confusion.

- Choose a Simple Font: Select a clean, professional font that is easy to read both on screen and in print. Avoid overly decorative fonts, which can detract from readability and make the document look unprofessional.

- Use Color Sparingly: Adding color can make the document look polished, but limit it to key elements like headers, section dividers, or your logo. Excessive color can be distracting and reduce the document’s professional appearance.

- Align Items Consistently: Maintain a consistent alignment for all text, lists, and tables. For example, align numbers to the right for easy comparison, and use left alignment for descriptive text. Consistency makes the layout appear organized and well-planned.

Implementing these design tips helps create a clear, structured document that leaves a positive impression and facilitates quick, accurate processing.

Selecting Colors and Fonts for Readability

Choosing the right colors and fonts plays a key role in ensuring that your document is both visually appealing and easy to read. The combination of typefaces and color schemes can significantly impact the user’s experience, making it easier or harder for them to absorb the information. Prioritizing readability and clarity while maintaining a professional look will help create an efficient and user-friendly document.

Fonts: Opt for fonts that are simple and legible, such as Arial, Helvetica, or Times New Roman. These fonts are universally recognized for their clarity. Avoid overly decorative fonts that can distract or make text difficult to read. Additionally, use a font size that is large enough for easy reading, typically between 10 to 12 points for body text, with larger sizes for headings.

Colors: Keep the color palette minimal and professional. Stick to dark colors for text, such as black or dark gray, on a white or light background. This combination ensures maximum contrast, making the content easy to read. Use color accents sparingly–perhaps for headers or section dividers–so they stand out without overwhelming the reader.

By carefully selecting fonts and colors, you can create a document that is not only aesthetically pleasing but also functional, making it easier for clients to read and understand the information presented.

Using Software to Create an Invoice Template

Using specialized software can streamline the process of creating professional billing documents. These tools offer a variety of features designed to simplify the task, from pre-made layouts to customizable options that suit different business needs. Whether you’re looking for basic functionality or advanced customization, software solutions can save time and ensure consistency in your documentation.

Programs like word processors, spreadsheet applications, or dedicated invoicing tools offer a range of templates and design options. Many of these platforms allow you to easily input client information, list services, and calculate totals automatically. Furthermore, most of these tools include features for saving and exporting your files in formats like PDF, ensuring your documents are accessible and easy to share with clients.

With the right software, creating professional documents becomes a fast, efficient, and error-free process, helping businesses maintain a high level of professionalism and organization in their transactions.

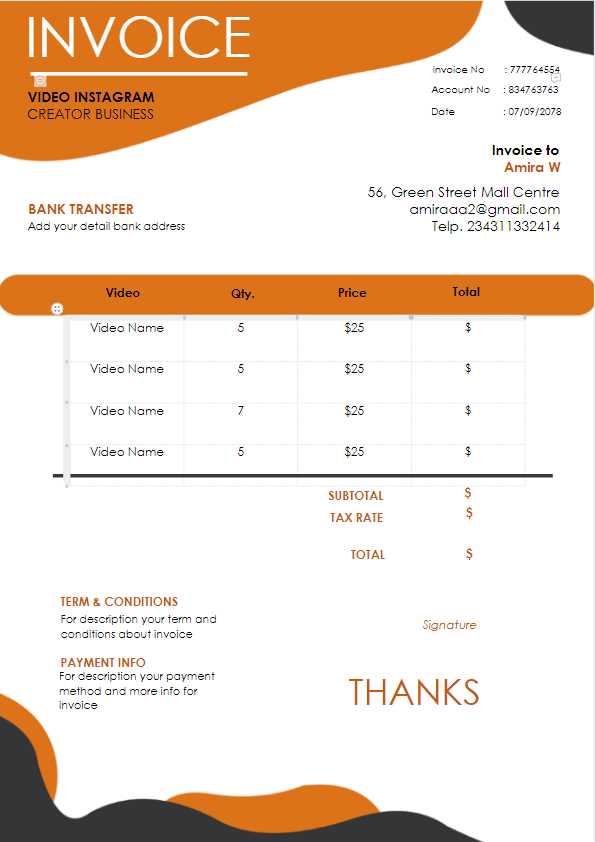

Customizing Templates for Your Brand

Personalizing your billing documents is an essential step in maintaining a strong brand identity. Customization allows you to align these documents with your business’s visual style, creating a cohesive experience for your clients. By incorporating elements such as logos, colors, and specific fonts, you can make each document feel uniquely yours and reinforce your professionalism.

Incorporating Brand Colors

Colors play a significant role in establishing your brand’s look and feel. Use your brand’s primary color palette to enhance the visual appeal of the document. This creates a sense of consistency across all communications and reinforces your company’s identity. Be sure to choose subtle shades for text and background to maintain readability while still incorporating your brand’s colors.

Adding Your Logo

Your logo is one of the most recognizable elements of your business. Placing it prominently at the top of the document adds a personal touch and enhances your brand’s visibility. Ensure the logo is clear and sized appropriately, so it doesn’t overpower the text or clutter the layout.

By customizing your billing documents, you not only create a more polished and professional appearance but also build stronger brand recognition and trust with your clients.

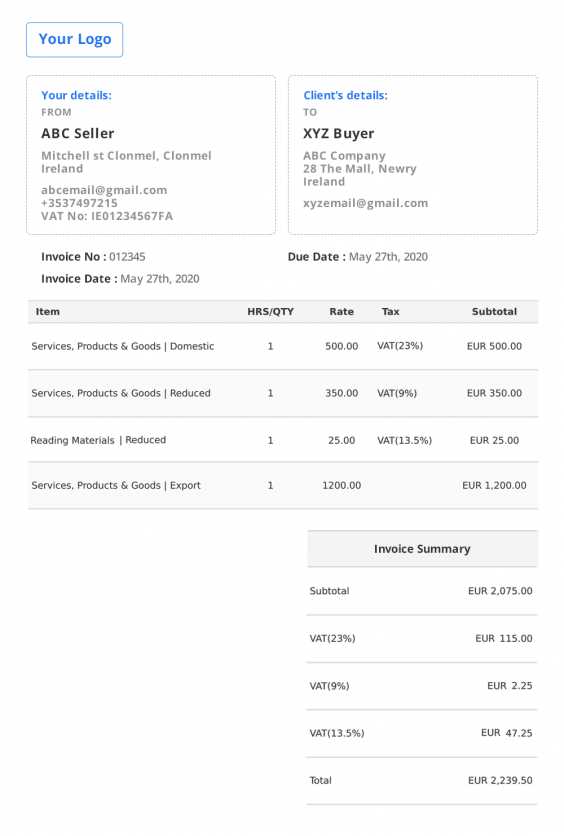

Adding Legal and Tax Information

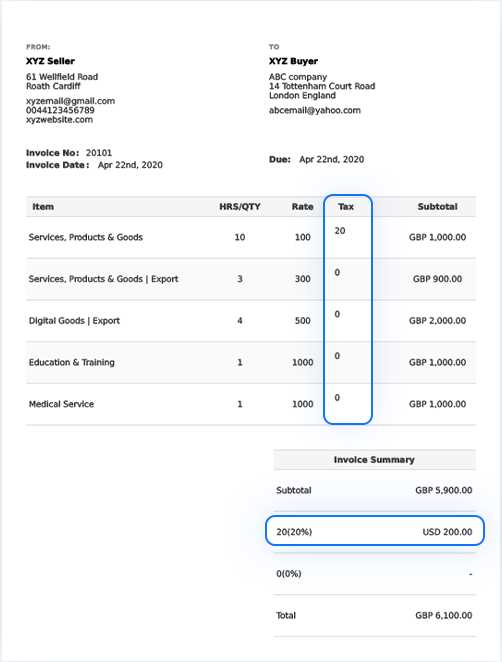

Including the correct legal and tax details in your billing documents is crucial for compliance and clarity. These essential elements ensure that both you and your clients have a clear understanding of the financial terms, including applicable taxes and regulatory requirements. Properly incorporating this information helps build trust and avoids potential legal issues.

Make sure to include relevant data such as your business registration number, tax identification number, and any other necessary legal references. Additionally, indicate the applicable tax rates for the products or services provided, along with a breakdown of the total amount due, including taxes. This transparency allows clients to verify the charges easily and ensures accurate record-keeping for both parties.

How to Organize Line Items Effectively

Efficiently structuring the list of products or services offered is essential for clarity and ease of understanding. Well-organized line items provide your clients with a clear breakdown of each charge, making it simple to assess the costs associated with each individual service or product. Proper categorization also helps prevent confusion and ensures transparency in the billing process.

Each item should be listed separately with a clear description, quantity, unit price, and total amount. It’s crucial to maintain a logical order, grouping similar items together where appropriate, and making sure the most important or highest charges are easy to spot. Additionally, offering a subtotal for each section, along with a final total at the bottom, ensures clients can quickly verify the overall cost and see any applicable discounts or taxes.

Best Practices for Payment Terms

Clearly defined payment conditions are essential for ensuring a smooth financial transaction between you and your clients. Establishing transparent terms helps both parties understand the expectations and avoid potential disputes. Well-drafted payment conditions can lead to faster processing of payments and build a stronger professional relationship.

Set Clear Deadlines

Always include a specific due date for payments to avoid confusion. Whether it’s “Net 30,” meaning payment is due within 30 days, or a more immediate term, providing a clear time frame ensures that both parties are on the same page. Additionally, consider offering early payment discounts to encourage prompt settlement.

Define Payment Methods

It’s important to specify acceptable methods of payment, such as bank transfers, credit cards, or digital payment systems. This provides your clients with clear options and helps avoid delays due to payment method confusion. Ensure that all payment methods are secure and easily accessible to your clients.

How to Automate Recurring Invoices

Automating repetitive billing tasks can save time and ensure timely payments. By setting up automatic processes, you can eliminate the need to manually create and send documents on a regular basis. This approach is particularly beneficial for businesses with subscription models or long-term clients, allowing for consistent cash flow and reduced administrative workload.

There are several ways to automate recurring billing, including using software or online platforms designed for this purpose. These tools allow you to schedule and customize billing cycles, track payments, and send reminders to clients.

Setting Up Automation with Software

Most accounting or invoicing software offers options for automating regular billing. Once you input the relevant client details and agreed-upon terms, the software can generate and send documents based on your preferred frequency (e.g., monthly, quarterly). Additionally, many tools allow you to store client payment information securely and set up automatic reminders for overdue payments.

Benefits of Automating Recurring Billing

Benefit Explanation Time-saving Automation frees up time by eliminating manual entry, allowing you to focus on other areas of your business. Consistency Automatic billing ensures that payments are collected on time, reducing the chance of missed or delayed payments. Reduced Errors Automated systems minimize the risk of human error in calculations or document generation. Client Convenience Clients will appreciate the predictable and timely nature of the billing process, improving customer satisfaction. Saving and Exporting Templates for Use

Once a document structure is created, it’s essential to ensure that it’s stored and accessible for future use. By saving the layout properly, you can reuse it efficiently without the need to recreate it each time. Exporting it into various formats adds flexibility, allowing it to be shared across different platforms or used with other software tools as needed.

Choosing the Right Format for Export

When saving or exporting your document layout, it’s important to select the appropriate file format to maintain compatibility with other systems or software. Common formats include PDF for secure sharing, Excel for easy data manipulation, or Word for text editing. Each format has its advantages depending on the intended use.

Steps for Saving and Exporting

Step Description 1. Finalize the Layout Ensure all sections and fields are filled correctly before saving. Double-check for any errors or inconsistencies. 2. Save the Document Store the file in a location where it can be easily retrieved. Naming it clearly will help avoid confusion later. 3. Export to Desired Format Choose a file type that suits the purpose, whether it’s for emailing, printing, or editing. 4. Test Accessibility Open the exported file on another device or software to confirm the layout is intact and functional. Tips for Testing Your Template Design

Before using your layout for real transactions, it’s essential to test its functionality and appearance to ensure it meets your expectations. Testing helps you identify potential issues, like misalignment, unclear sections, or problems with readability. This step allows for adjustments that can make the final version more effective and user-friendly.

Key Areas to Test

- Clarity of Information: Ensure that all fields are clearly labeled, and the content is easy to understand.

- Consistency: Check if the design elements, such as fonts, colors, and logos, remain consistent throughout.

- Layout and Alignment: Verify that all elements are aligned correctly and there are no overlapping or misplaced components.

- Responsiveness: Test the layout on different devices or screen sizes to ensure it adapts well.

Testing Methods

- Preview: Always preview your design on different screen sizes or print formats to ensure it looks correct in various environments.

- Use Real Data: Fill in the fields with actual data to see if everything fits and functions as expected.

- Peer Review: Have a colleague or friend review the layout to spot issues you may have missed.

- Run Through with Clients: If possible, ask a client to review the document for their feedback on usability and clarity.

Common Mistakes to Avoid in Invoices

Even minor errors in a financial document can lead to confusion, delays in payment, or even disputes. It’s crucial to carefully review every detail before finalizing the document to ensure all essential information is accurate and well-presented. Avoiding common mistakes can enhance professionalism and streamline payment processes.

Key Errors to Watch Out For

- Missing Contact Details: Failing to include your business name, address, and phone number can delay communication or raise concerns with clients.

- Incorrect Payment Terms: Misunderstanding or omitting the payment due date or terms can lead to payment delays.

- Omitting Item Descriptions: Leaving out descriptions of the products or services provided can lead to confusion or disputes over charges.

- Errors in Pricing: Incorrectly calculating totals, taxes, or discounts can cause financial discrepancies.

Other Mistakes to Avoid

- Inconsistent Formatting: Using different fonts, sizes, or misaligning information can make the document look unprofessional and hard to follow.

- Not Including a Unique Identifier: Every document should have a unique reference number to make tracking and organizing easier.

- Ignoring Legal Requirements: Not including necessary tax information or other required details can lead to compliance issues.

Updating Your Template Over Time

As your business grows and industry standards evolve, it’s important to revisit and revise financial documents periodically. Adjusting certain elements ensures your records remain professional, accurate, and compliant with current regulations. Regular updates also reflect changes in your branding, payment terms, or the services offered.

When to Review and Revise

- Changes in Business Information: Update contact details, business name, or tax registration number whenever necessary.

- Adjusting Payment Terms: Revise due dates, discounts, or interest rates based on your current business practices or client preferences.

- Adding New Services or Products: Include new offerings to ensure clarity and prevent omissions in future documents.

Tips for Keeping Your Records Up-to-Date

- Set Regular Reminders: Schedule periodic reviews to ensure nothing is overlooked, especially after major business changes.

- Solicit Client Feedback: Ask clients for feedback on the clarity and comprehensiveness of the documents to ensure it meets their expectations.

- Stay Informed of Legal Changes: Be aware of shifts in tax laws or other regulations that might require adjustments in the information provided.