How to Edit Invoice Template in Sage 100

Every business needs to maintain a professional and consistent appearance when communicating with clients. One of the most crucial elements of this is the design and structure of financial documents. Customizing these documents ensures that they reflect your brand and meet your specific business needs. With the right tools, you can easily personalize your documents to align with your company’s image.

For users of accounting solutions, modifying the layout and content of their financial statements can significantly improve both the functionality and aesthetics. Whether you need to add your logo, adjust the layout, or include specific information, the process is straightforward once you understand the available options. The ability to tailor these documents allows businesses to present information in a clear, professional, and branded manner.

In this guide, we will walk you through the necessary steps to personalize your financial documents within the software. We will cover essential tips and tools to help you get the most out of your customization options, ensuring that your paperwork is both efficient and visually appealing.

How to Edit Invoice Template in Sage 100

Modifying the layout and design of your financial documents is a crucial step in ensuring your business looks professional and maintains a consistent brand identity. By adjusting the structure and content, you can make your billing statements more relevant to your specific needs. This section will guide you through the necessary steps to make those customizations within the software, enabling you to present clear and well-organized documents to clients.

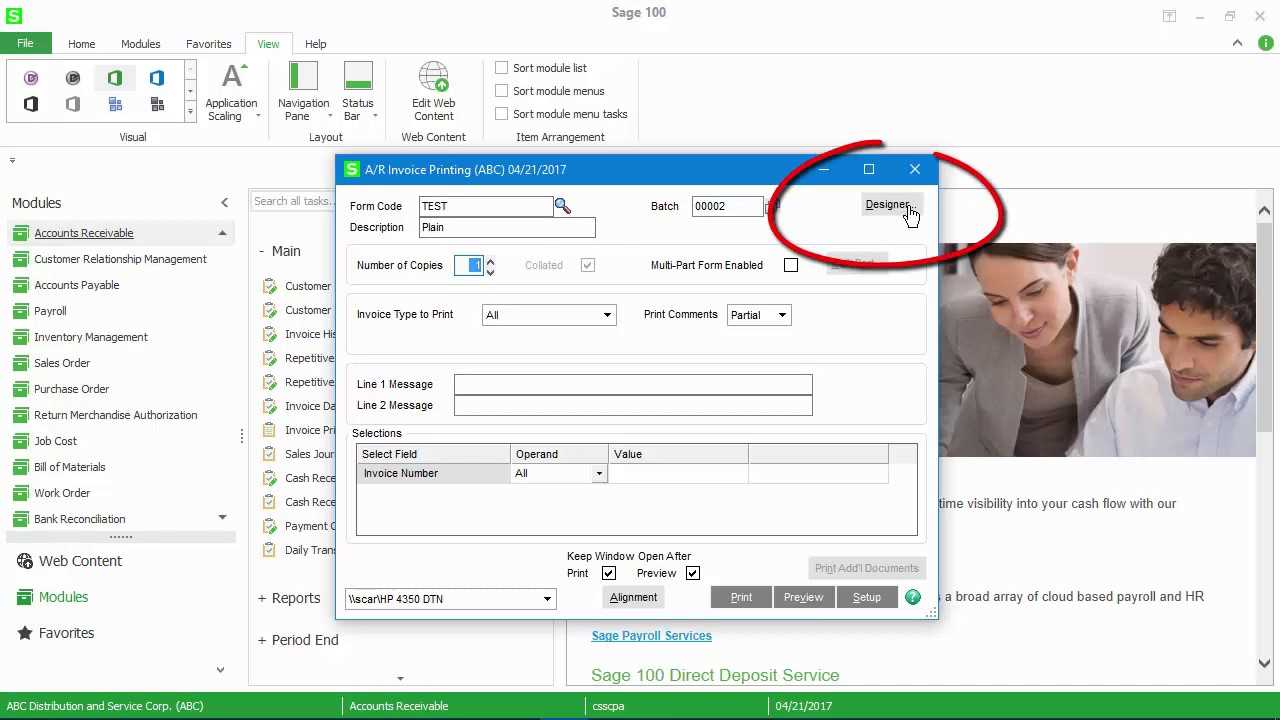

Accessing the Customization Options

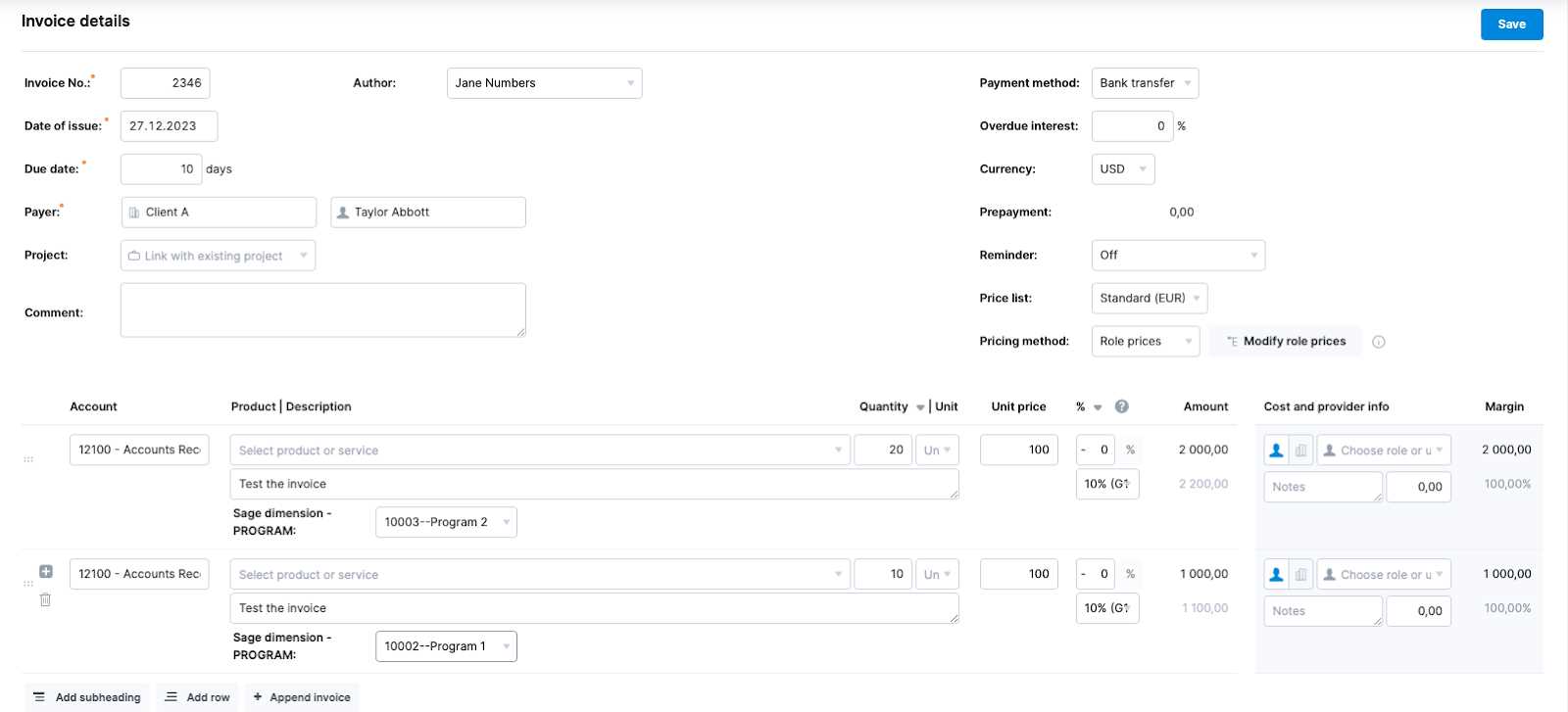

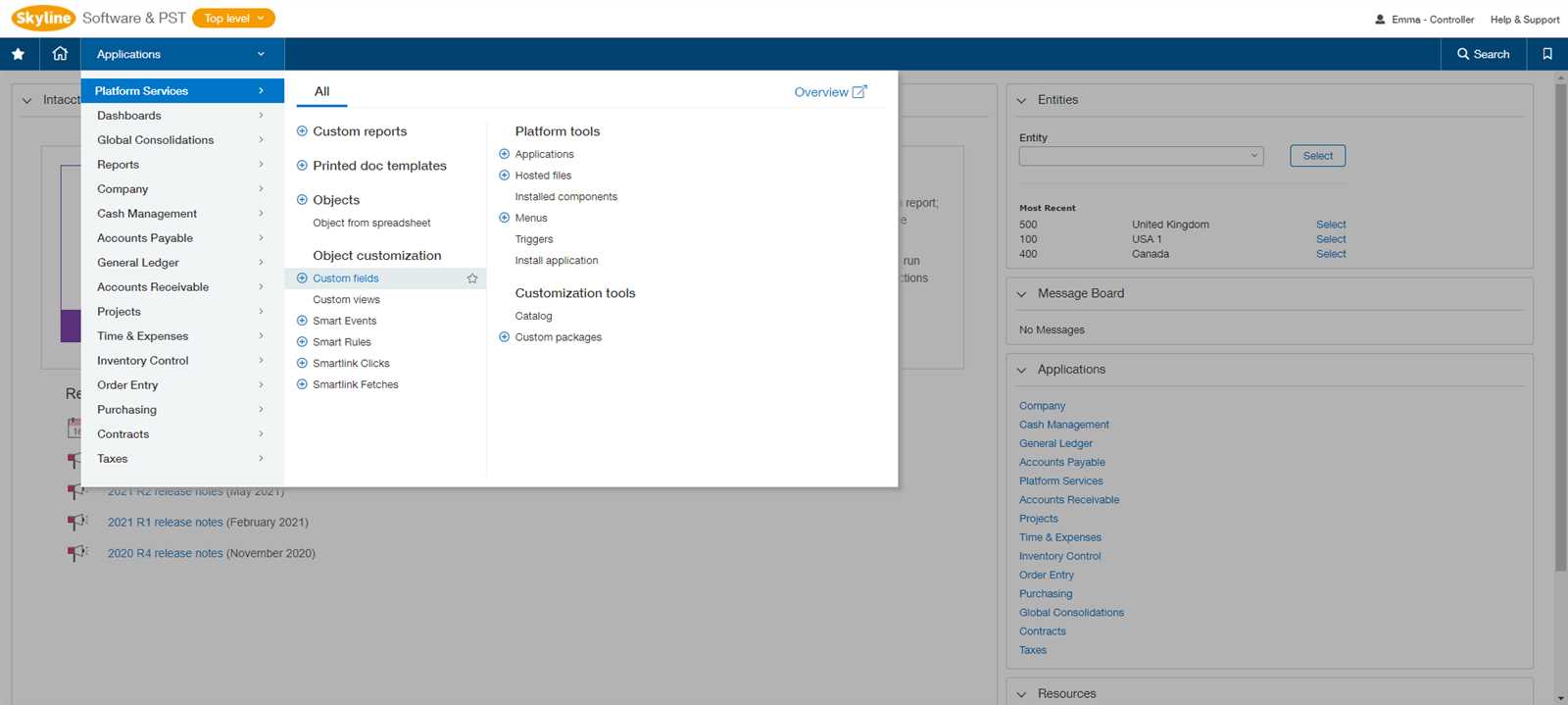

To begin making changes to your billing documents, the first step is to access the relevant settings within the accounting program. Navigate to the document configuration area where you can manage existing designs or create new ones. This feature allows you to manipulate elements such as text fields, layout, and data presentation to align with your preferences.

Steps to Personalize Your Document

Once you’ve accessed the customization settings, you will be able to adjust several elements that appear in your financial paperwork. These adjustments typically involve altering content fields, adjusting fonts, and modifying placement to ensure the document meets your business requirements. Below is a general overview of the most common elements that can be changed:

| Element | Customization Options |

|---|---|

| Logo | Add, resize, or reposition the company logo to fit your document design. |

| Text Fields | Modify the text for various fields such as dates, terms, and payment instructions. |

| Layout | Adjust the alignment of fields, such as amounts, item descriptions, or contact information. |

| Tax Information | Include or update tax-related fields and ensure accurate calculation and presentation. |

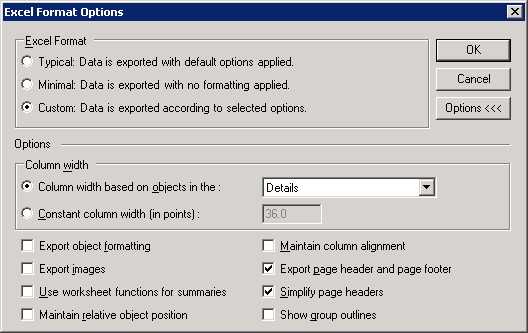

After making all necessary changes, you can save the new configuration, allowing it to be used for all future documents. Previewing the updated design is highly recommended to ensure everything appears as intended before sending out any finalized paperwork.

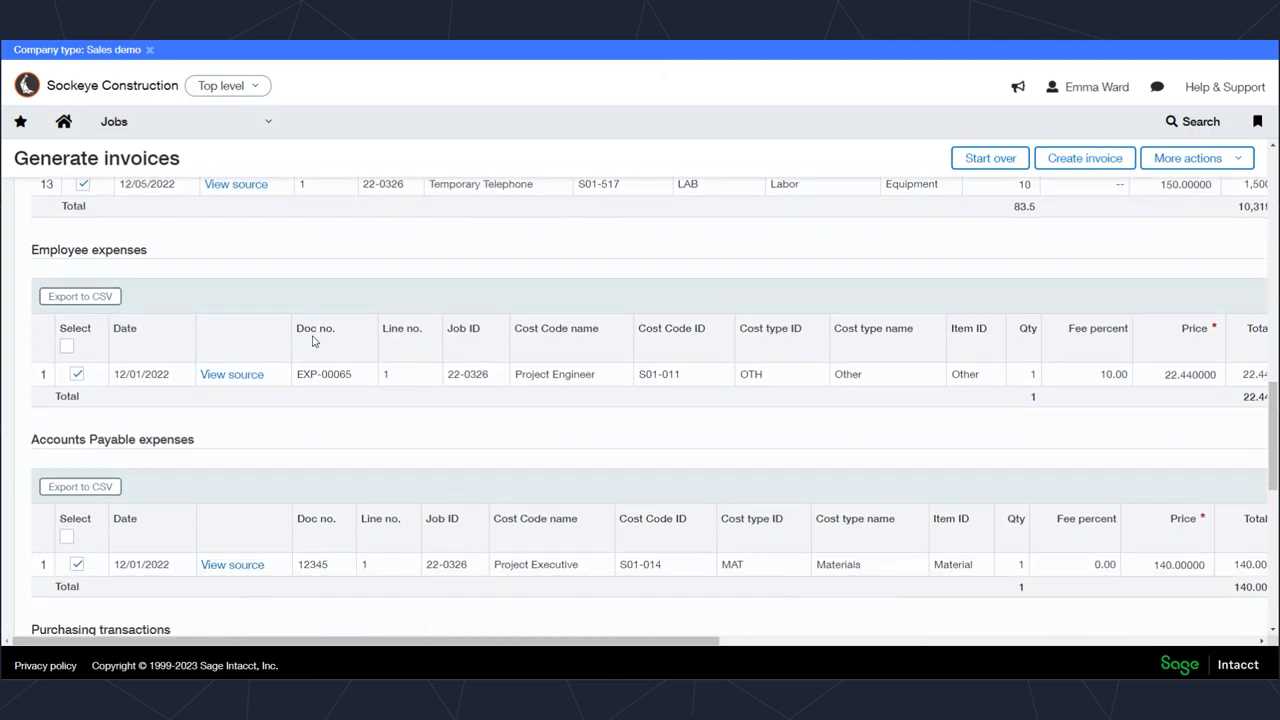

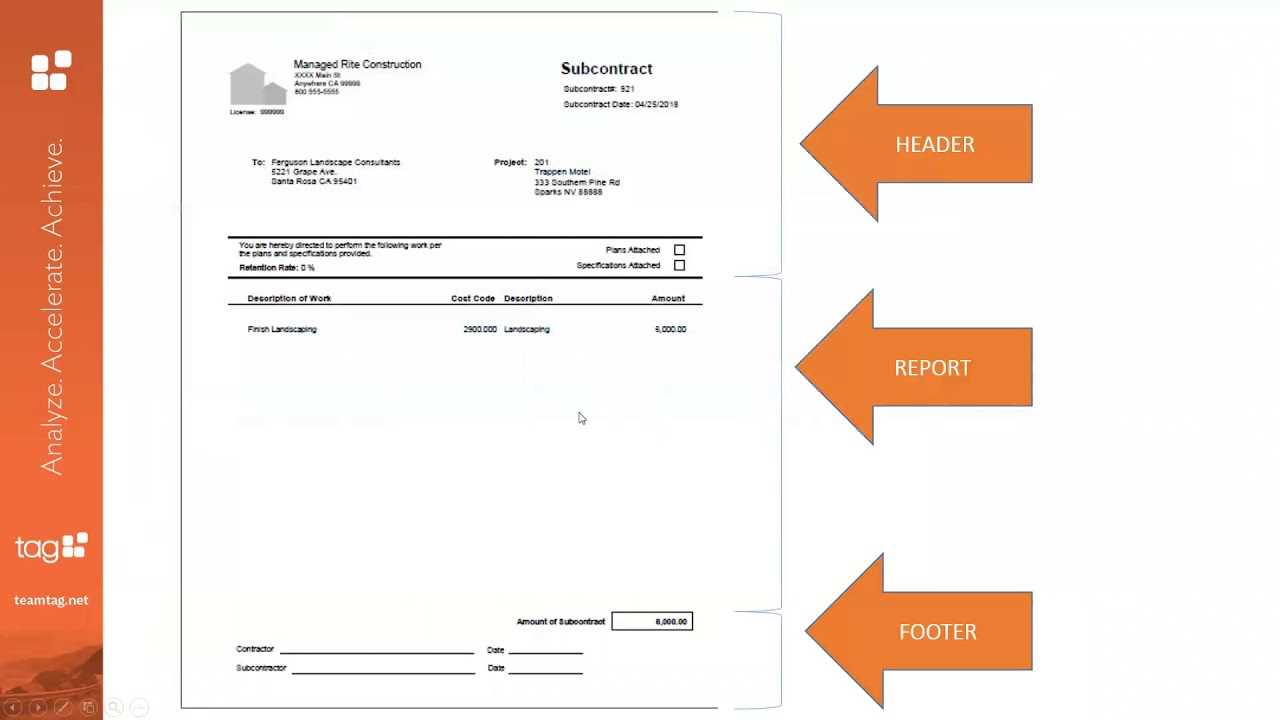

Understanding Sage 100 Invoice Customization

Customization options within accounting software allow businesses to tailor their financial documents to meet specific needs and branding requirements. Understanding how to modify the structure and content of these documents can enhance clarity, ensure professionalism, and provide greater flexibility in how information is presented to clients. The ability to adjust these elements ensures that each document reflects your company’s identity and meets your operational standards.

When it comes to configuring financial documents, there are several aspects you can control. This includes modifying basic layouts, adding custom fields, and ensuring that relevant business details are correctly displayed. Below are some of the key features that users can adjust when personalizing their billing statements:

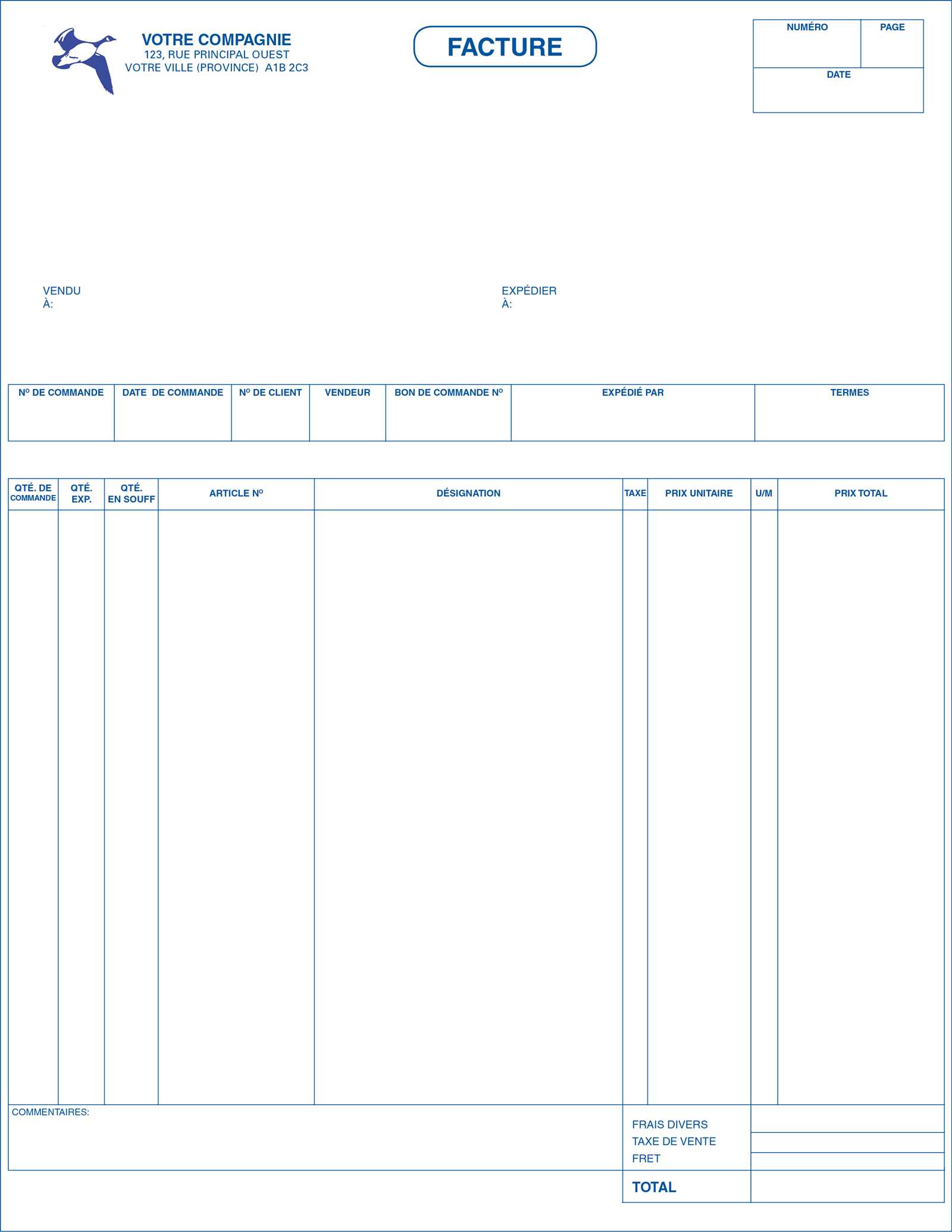

- Document Layout: Adjusting the overall structure of the document, including the placement of company details, item descriptions, and payment information.

- Field Customization: Editing the labels and content of various fields, such as client details, service descriptions, or total amounts due.

- Design Elements: Incorporating company logos, adjusting fonts, and selecting color schemes to match your brand’s visual identity.

- Legal and Tax Information: Ensuring that all necessary legal and tax-related details are present, including VAT or sales tax rates, and payment terms.

- Terms and Conditions: Adding standard terms, payment instructions, or other legal disclaimers to ensure transparency in your financial documents.

Once you understand the available customization options, you can begin adjusting these elements to create documents that align with your company’s needs. The software’s flexibility ensures that you can modify both the content and design of your financial statements with ease.

By taking advantage of these settings, businesses can ensure that every document sent to clients is not only clear and accurate but also reflects their unique brand identity and values. Customization options provide the necessary tools for streamlining the invoicing process, improving communication, and maintaining a professional image in all business transactions.

Why Customize Your Invoice Template

Personalizing your business documents is a key step in presenting a professional image to clients and improving your overall workflow. Customization allows you to tailor financial paperwork to reflect your company’s identity, ensuring it aligns with your brand, legal requirements, and specific operational needs. By adapting your documents, you can make them more functional, visually appealing, and easier for clients to understand.

Enhancing Brand Recognition

Customizing your business documents helps reinforce your brand identity by incorporating logos, color schemes, and consistent fonts. When clients receive paperwork that reflects your company’s visual elements, it fosters trust and professionalism. Customization ensures that every document, whether it’s a bill or a statement, feels uniquely yours, reinforcing your brand with each transaction.

Improving Accuracy and Clarity

By personalizing your documents, you can ensure that all the relevant details are included in a clear and easily readable format. Customization enables you to organize fields logically, highlight important information, and present payment terms in a straightforward way. This minimizes errors, reduces confusion, and helps streamline communication with clients.

| Benefits | Customization Impact |

|---|---|

| Brand Recognition | Incorporating logos, colors, and fonts that align with your company’s brand. |

| Legal Compliance | Ensuring all necessary legal details are included, such as tax rates or payment terms. |

| Improved Organization | Placing key information (like amounts, dates, and descriptions) in easily accessible locations. |

| Client Confidence | Providing professional, polished documents that foster trust and clarity with clients. |

In addition to improving client relationships, customized documents can also streamline internal processes. When you adjust the layout to suit your specific workflow, it becomes easier to track payments, generate reports, and manage records. Whether you’re dealing with tax reporting, legal compliance, or customer satisfaction, customized financial documents play an important role in business success.

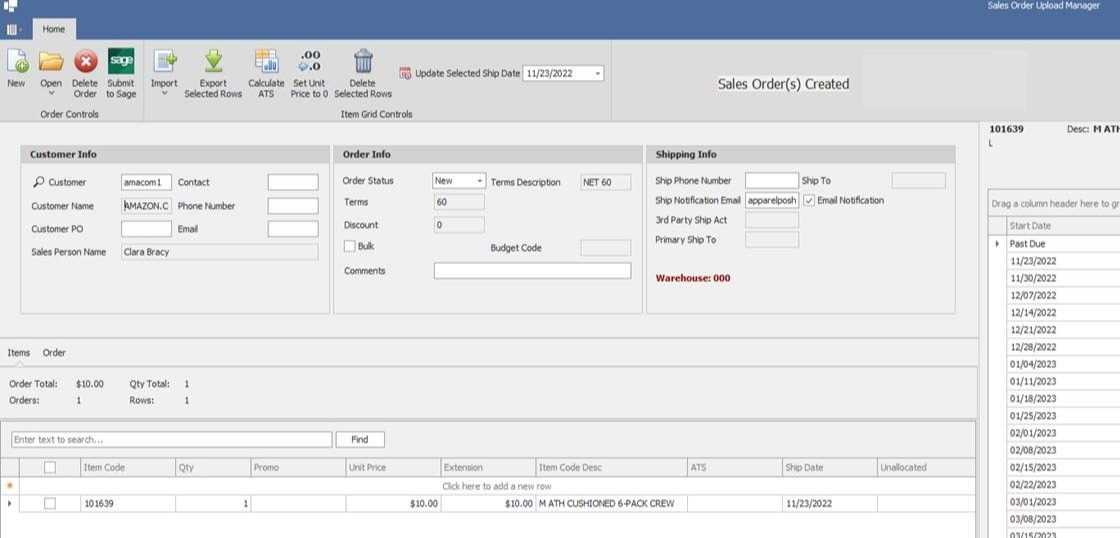

Accessing Invoice Template Settings

In order to customize your business documents, the first step is to locate the settings area where you can manage their design and content. These configuration options provide you with the tools needed to make necessary changes to how your financial paperwork looks and functions. Understanding where to find these settings is crucial for streamlining the customization process and ensuring that your documents reflect your company’s specific requirements.

To access these settings within your accounting software, follow these general steps:

- Open the main dashboard or home screen of your software.

- Navigate to the “Settings” or “Preferences” section. This is typically found in the main menu or under the “Administration” tab.

- Look for the section labeled “Document Management,” “Forms,” or “Layouts.” This is where you will find the settings related to document customization.

- Click on the appropriate option to open the customization panel for your documents.

- Once inside, you will see a list of available designs, and you can either select an existing layout or create a new one.

After accessing the settings area, you can begin customizing various aspects of your documents, including layout, text fields, and design elements. You’ll be able to make adjustments such as adding logos, modifying field placements, or adjusting legal disclaimers to suit your business needs.

Things to Keep in Mind

- Ensure that you have the necessary permissions to access and modify these settings.

- It’s recommended to back up your current design before making significant changes to avoid losing previous work.

- Always preview the document after changes to ensure that all adjustments appear as expected.

By following these steps, you will be able to access the customization tools and begin making adjustments to your business documents with ease.

Step-by-Step Guide to Editing Templates

Customizing your business documents allows you to create a professional and personalized look that reflects your company’s identity. By following a simple step-by-step process, you can easily make the necessary adjustments to the layout, fields, and design elements of your financial statements. This guide will walk you through the basic steps to help you modify your documents efficiently and effectively.

Accessing the Customization Area

The first step is to locate the section of your software where you can modify your documents. To do this:

- Log into your accounting system and navigate to the settings or administration panel.

- Look for an option labeled “Document Management” or something similar.

- Click on the option that allows you to manage forms or layouts.

Once you have accessed the customization area, you will be able to view the list of available document layouts and select the one you wish to modify.

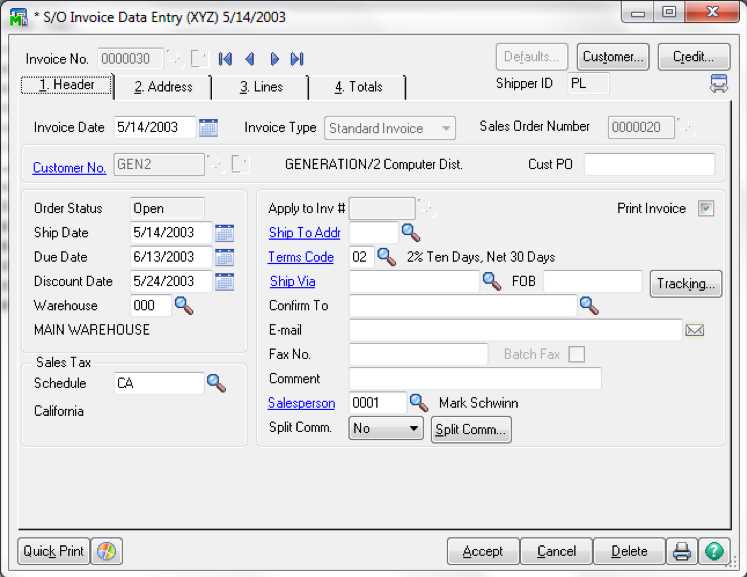

Making Changes to Your Documents

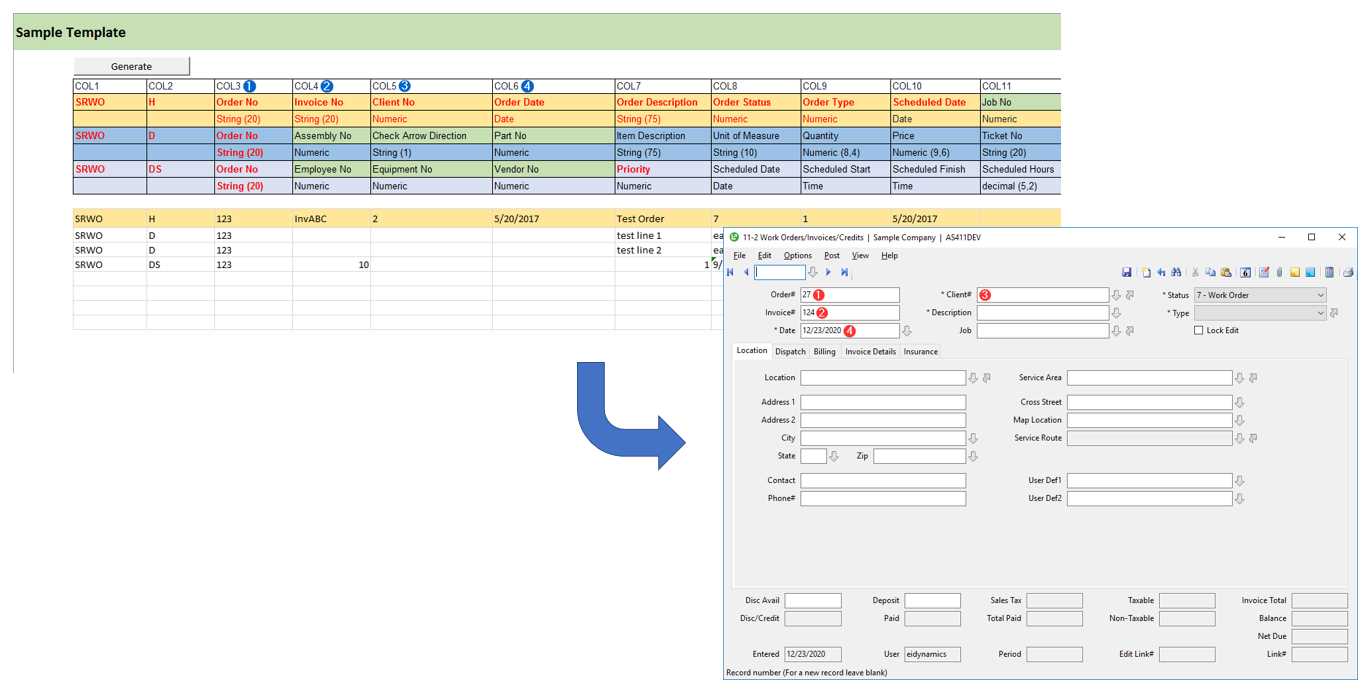

After selecting the document you want to modify, the next step is to make adjustments to its content and design. Here’s how you can modify different elements:

- Logo and Branding: Add or update your company logo, adjust the size, and ensure the color scheme matches your branding.

- Field Modifications: Change labels, rearrange fields, or add custom fields for additional information like tax rates or payment terms.

- Text and Content: Update text fields such as descriptions, payment instructions, or terms. You can also adjust fonts and styles to match your company’s identity.

- Legal and Tax Information: Make sure all relevant legal information is included, such as terms and conditions, tax calculations, or payment instructions.

Each element can be easily modified using the available tools in the software’s customization panel. Once you are satisfied with the changes, save the document layout to apply it to future transactions.

By following these steps, you can ensure that your financial documents are both professional and aligned with your business needs, improving communication and enhancing your client relationships.

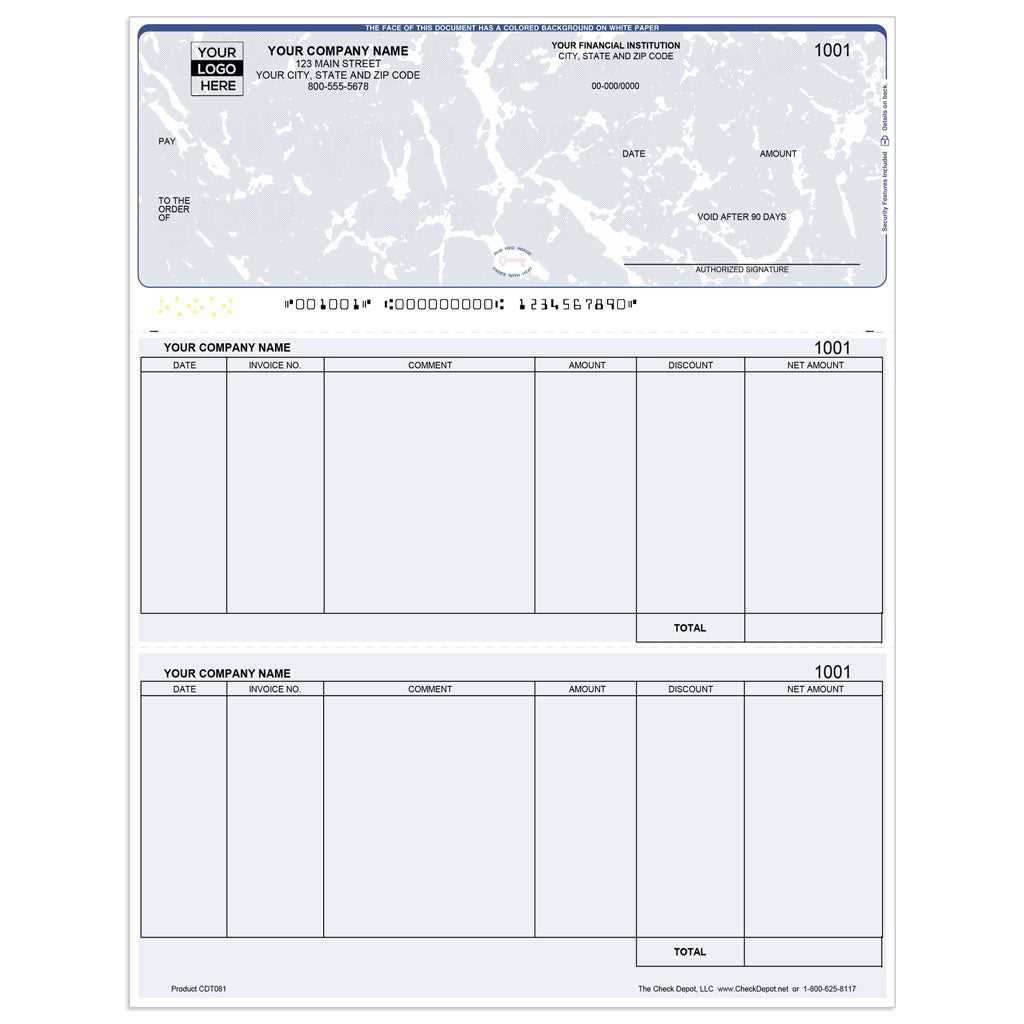

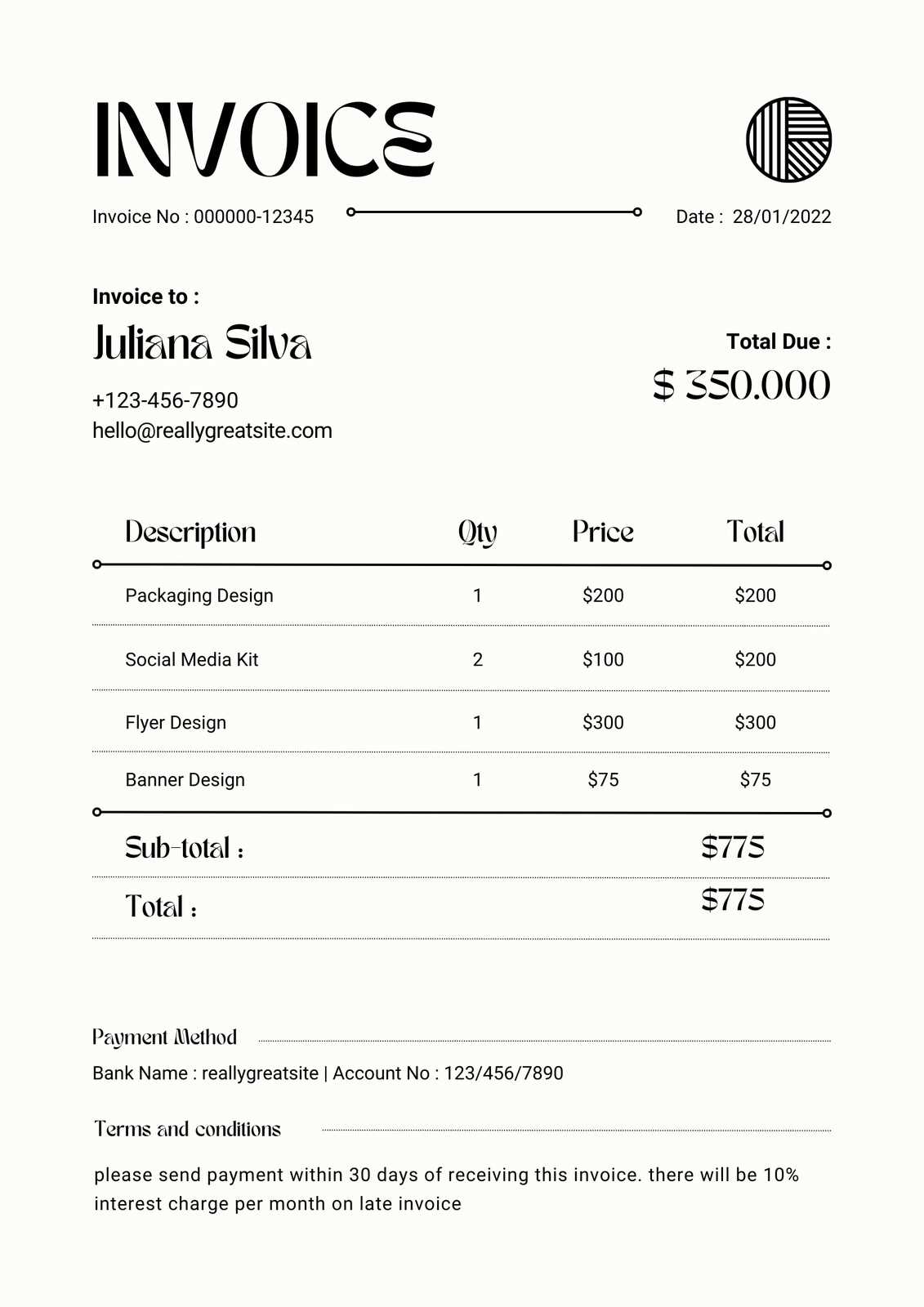

Choosing the Right Invoice Format

Selecting the right document layout for your business is essential for presenting clear, professional, and easy-to-understand financial statements. The format you choose should not only reflect your company’s branding but also ensure that all necessary details are easily accessible and well-organized. Understanding which format best suits your needs will streamline your workflow and improve the client experience.

There are several key factors to consider when choosing a layout for your business documents:

- Business Type: Different industries have varying requirements for financial statements. For example, a service-based business may require more detailed descriptions of services rendered, while a product-based business may focus on itemized product lists.

- Brand Identity: Choose a format that complements your company’s visual identity. This includes using your brand colors, fonts, and logo placement to ensure a consistent look across all communications.

- Clarity and Simplicity: Opt for a design that prioritizes clarity. Make sure the document is easy to read and that important information, such as amounts due, due dates, and client information, are clearly visible.

- Legal Requirements: Ensure the format includes all necessary legal and tax information. This may include your company’s registration number, tax ID, payment terms, and any other required disclaimers.

- Functionality: Choose a layout that allows for easy customization and future updates. The ability to add or remove fields, adjust text size, and include custom information will give you flexibility as your business grows.

Once you understand your business’s specific needs and requirements, you can begin exploring the available document formats. Some common layout options include:

- Basic Format: A simple, clean layout with essential fields for amounts, dates, and descriptions.

- Detailed Format: A more comprehensive design that includes additional fields for project details, payment breakdowns, and client-specific notes.

- Customized Format: A fully personalized layout that reflects your company’s unique branding and allows for customized fields tailored to your business operations.

By carefully considering these factors, you can sel

Modifying Fields on the Invoice

Adjusting the information displayed on your financial documents is essential to ensure clarity and accuracy. By modifying various fields, you can tailor the document to your specific business needs, adding or removing information as necessary. These modifications allow you to highlight important details, streamline the document’s layout, and ensure that all required information is included for both legal and operational purposes.

Key Fields to Modify

There are several important fields within your financial documents that can be adjusted to suit your business needs. Below are some of the most commonly modified fields:

- Company Information: This includes your business name, address, contact details, and tax ID. Ensuring that these details are always up-to-date is crucial for legal compliance and communication.

- Client Information: The client’s name, address, and contact details should be clearly listed. This helps avoid any confusion and ensures proper billing.

- Item Descriptions: Modify the descriptions of the products or services provided to the client. This ensures that each item is clearly described and priced correctly.

- Amounts: Adjust the pricing for each item, taxes, discounts, and total amounts due. Accurate calculations are essential for financial clarity.

- Payment Terms: Include or modify payment due dates, payment methods, and any applicable late fees or early payment discounts.

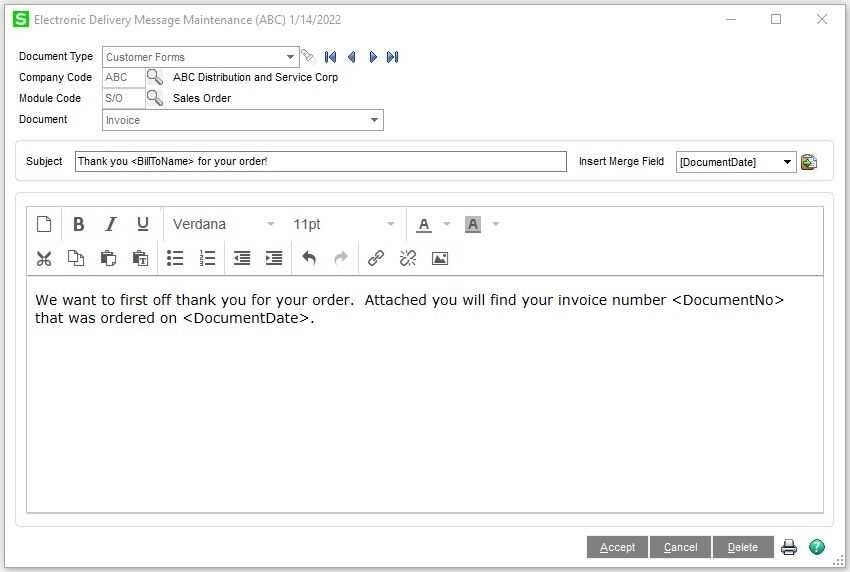

- Notes or Special Instructions: This field allows for custom text, such as thank you messages, terms of service, or project-specific details.

Steps to Modify Fields

Once you have identified the fields you need to modify, follow these general steps to make the necessary adjustments:

- Navigate to the section of your software where you can manage document layouts and forms.

- Select the document you wish to modify and choose the “Field Modification” or “Content Adjustment” option.

- Click on the specific field you want to modify. You can change the text, adjust the layout, or even add new fields as necessary.

- Make the necessary changes, such as updating text or adding custom fields for additional information.

- Save the changes and preview the document to ensure everything looks correct.

By carefully modifying the fields in your financial documents, you can ensure that all relevant information is displayed in a clear, organized, and professional manner, ultimately improving your client communication and streamlin

How to Add Company Logo

Incorporating your company logo into business documents adds a professional touch and reinforces your brand identity. A logo not only makes your documents instantly recognizable but also helps establish trust and credibility with clients. The process of adding your logo to financial paperwork is straightforward, and it can be done with just a few simple steps to ensure a polished appearance for all your communications.

Steps to Add Your Logo

To include your company’s logo, follow these simple steps:

- Open the document layout or design editor in your accounting system.

- Locate the section where you can add images or logos. This is usually found within the header or upper part of the document.

- Click the option to insert an image, and then select your company logo file from your computer.

- Resize and position the logo as needed. Ensure that it is placed in a prominent but non-distracting location, typically at the top left or right of the document.

- Save the changes to apply the logo to all future documents created with this layout.

Considerations for Logo Placement

When placing your logo, keep the following in mind to ensure a balanced and professional look:

- Size: Make sure your logo is large enough to be clear but not so large that it dominates the document.

- Position: Most businesses place their logo in the upper left or right corner of the document. This ensures visibility without cluttering the layout.

- File Type: Use high-quality image files such as PNG or JPEG. Transparent backgrounds often work best for seamless integration with various document designs.

- Brand Consistency: Ensure the logo is up-to-date and matches your company’s current branding (e.g., colors, fonts, etc.).

By adding your logo to financial documents, you reinforce your company’s identity and present a consistent, professional image across all client communications.

Setting Up Tax Information on Invoices

Properly configuring tax details on financial documents is crucial for both legal compliance and accurate billing. By setting up tax information correctly, you ensure that the correct rates are applied and that the amounts due reflect all necessary charges. This process helps avoid errors, improves transparency, and ensures your business meets local tax regulations.

Steps to Configure Tax Information

Follow these steps to set up the tax details on your documents:

- Open your accounting software and navigate to the settings or configuration section for document management.

- Locate the option for managing tax rates or tax settings. This is typically found under financial settings or document customization options.

- Input the appropriate tax rates based on your region or business requirements. This could include sales tax, VAT, or other relevant taxes.

- Assign tax rates to specific products or services, ensuring the correct tax is applied based on the items listed on your documents.

- Ensure that the tax information is displayed in a clear and accurate format on your documents, typically at the bottom or in the summary section.

Considerations When Setting Up Tax Information

When configuring tax details, keep the following points in mind:

- Tax Rates: Make sure to input the correct local tax rate(s) for the relevant regions where your business operates.

- Multiple Tax Rates: If applicable, ensure that different tax rates are set for different product categories or services.

- Exemptions: If certain items or services are exempt from tax, ensure those exceptions are correctly configured.

- Tax Breakdown: Clearly display the tax amount and rate on each document to maintain transparency with your clients.

By properly setting up tax information, you help avoid mistakes in billing, ensure that your business adheres to tax regulations, and provide clients with clear, detailed statements. This configuration also allows for easier auditing and tracking of tax-related data over time.

Adjusting Currency and Payment Terms

Accurate representation of currency and payment conditions is essential for ensuring smooth transactions between your business and clients. By adjusting these settings, you can accommodate different payment structures, currencies, and terms specific to each client or region. Proper setup helps avoid confusion, improves payment clarity, and ensures timely settlements.

Steps to Adjust Currency Settings

To adjust the currency used in your documents, follow these general steps:

- Access the settings or preferences section of your financial software.

- Navigate to the currency settings area, which may be under general settings or payment configuration.

- Select the default currency for your transactions or choose from a list of available options.

- If your business deals with multiple currencies, configure the software to automatically apply the correct currency based on the client’s location or preferences.

- Save your changes and verify that the selected currency is displayed correctly in the document preview.

Setting Payment Terms

In addition to currency, configuring the correct payment terms is important for maintaining a clear understanding of payment deadlines and conditions. This allows your clients to know when payments are due, what methods are accepted, and if any discounts or penalties apply. Here’s how to adjust payment terms:

- In the payment settings section, look for the option to set payment terms for your transactions.

- Choose from standard options like “Net 30,” “Net 60,” or “Due on Receipt,” or create custom terms based on your specific requirements.

- Include any discount options for early payment or late fees for overdue invoices.

- Ensure that the selected payment terms are clearly displayed on your documents so clients are aware of the conditions.

Currency and Payment Terms Example

| Currency | Payment Terms |

|---|---|

| USD | Net 30 |

| EUR | Due on Receipt |