How to Create Your Own Invoice Templates for Easy Billing

For any business or freelancer, having a structured and polished method of requesting payment is essential. A well-organized document not only ensures clarity but also builds credibility with clients. The process of drafting these documents can be simplified by setting up a reusable structure that meets all the necessary requirements.

By understanding the core components that must be included in such documents, you can develop a consistent format that is both effective and professional. From essential contact details to payment terms, every aspect of the document plays a role in securing timely payments and avoiding confusion.

Whether you’re using software like Excel, Word, or specialized platforms, setting up a suitable system that you can easily adapt to different projects will save time and help maintain consistency across all client interactions. With the right structure in place, sending clear and professional payment requests becomes an effortless task.

How to Create Your Own Invoice Templates

Establishing a clear and professional system for billing is an important step for anyone running a business. By designing a customized document that outlines all necessary details, you can streamline the payment process and maintain consistency across different clients and projects. A well-structured billing form helps prevent misunderstandings and ensures all critical information is included for swift payments.

The first step is identifying the key elements that need to be present. This usually includes basic details such as client information, payment terms, due dates, and service descriptions. Once these components are clear, it’s important to choose a format that is easy to update and flexible for various transactions.

After gathering the required information, you can begin building the layout of the document. Start by choosing a tool that suits your needs, whether it’s a simple word processor, a spreadsheet, or an online platform that offers pre-made structures. With the right design, the document becomes a reusable tool that helps maintain a professional appearance and avoids starting from scratch each time you need to bill a client.

Understanding the Importance of Invoice Templates

Having a standardized approach to generating payment requests is crucial for any business. A well-structured document helps ensure that all necessary information is included, minimizing errors and reducing delays in receiving payments. It also serves as a clear record for both the service provider and the client, making transactions more transparent and organized.

By using a consistent format, you not only make your billing process more efficient but also present a professional image to clients. A uniform document that looks polished and clear can help build trust and reinforce the perception of your business as reliable and organized.

Furthermore, a reusable structure saves time. Instead of recreating a billing form for each client, a customizable framework allows you to quickly adjust details for every new project. This automation reduces administrative workload, allowing you to focus on more important tasks while maintaining accuracy in your financial records.

Choosing the Right Software for Invoices

Selecting the appropriate tool for generating payment documents is a key step in ensuring efficiency and accuracy. The right software can simplify the process, automate repetitive tasks, and offer features that meet your specific needs. With various options available, it’s essential to find a solution that is both user-friendly and capable of producing professional-looking forms.

There are different types of programs to consider, ranging from basic word processors to specialized accounting software. A spreadsheet program, for example, offers flexibility and customization, while accounting tools might provide automated calculations and the ability to track payments directly within the platform. The choice ultimately depends on the complexity of your business and the level of automation you require.

In addition to functionality, it’s important to consider compatibility with other tools you may be using. Software that integrates with payment systems, cloud storage, or project management apps can enhance productivity and streamline your workflow. Whether you’re working on a single project or managing multiple clients, choosing the right software will save time and ensure that all details are handled professionally.

Designing a Professional Invoice Layout

Creating a clean, organized, and professional layout for payment requests is crucial for leaving a positive impression on clients. A well-designed document not only makes the billing process more efficient but also enhances credibility. The goal is to ensure clarity and ease of use while maintaining a polished and consistent appearance across all forms.

Key Elements of a Professional Design

A strong layout should highlight essential information in a logical order. This includes fields such as contact details, service descriptions, payment terms, and total amounts. Make sure that these components are clearly separated and easy to read. Use whitespace effectively to avoid clutter and guide the reader’s attention to important sections.

Choosing Fonts and Colors

The choice of fonts and colors can significantly impact the document’s overall professionalism. Stick to simple, readable fonts like Arial or Times New Roman, and use a color scheme that aligns with your brand. Avoid using too many fonts or colors, as this can make the document look chaotic. A minimalist approach will often create a more polished and formal appearance.

By paying attention to design details and ensuring the layout is both functional and visually appealing, you can present a document that reflects the quality of your services and strengthens client trust.

Key Elements to Include in Invoices

When issuing a payment request, certain details must be present to ensure clarity and transparency between the parties involved. These essential components serve to communicate the terms, goods, or services provided, along with the conditions for payment. Each item on the list plays a critical role in ensuring that the transaction is processed smoothly and in compliance with legal and financial requirements.

Basic Information

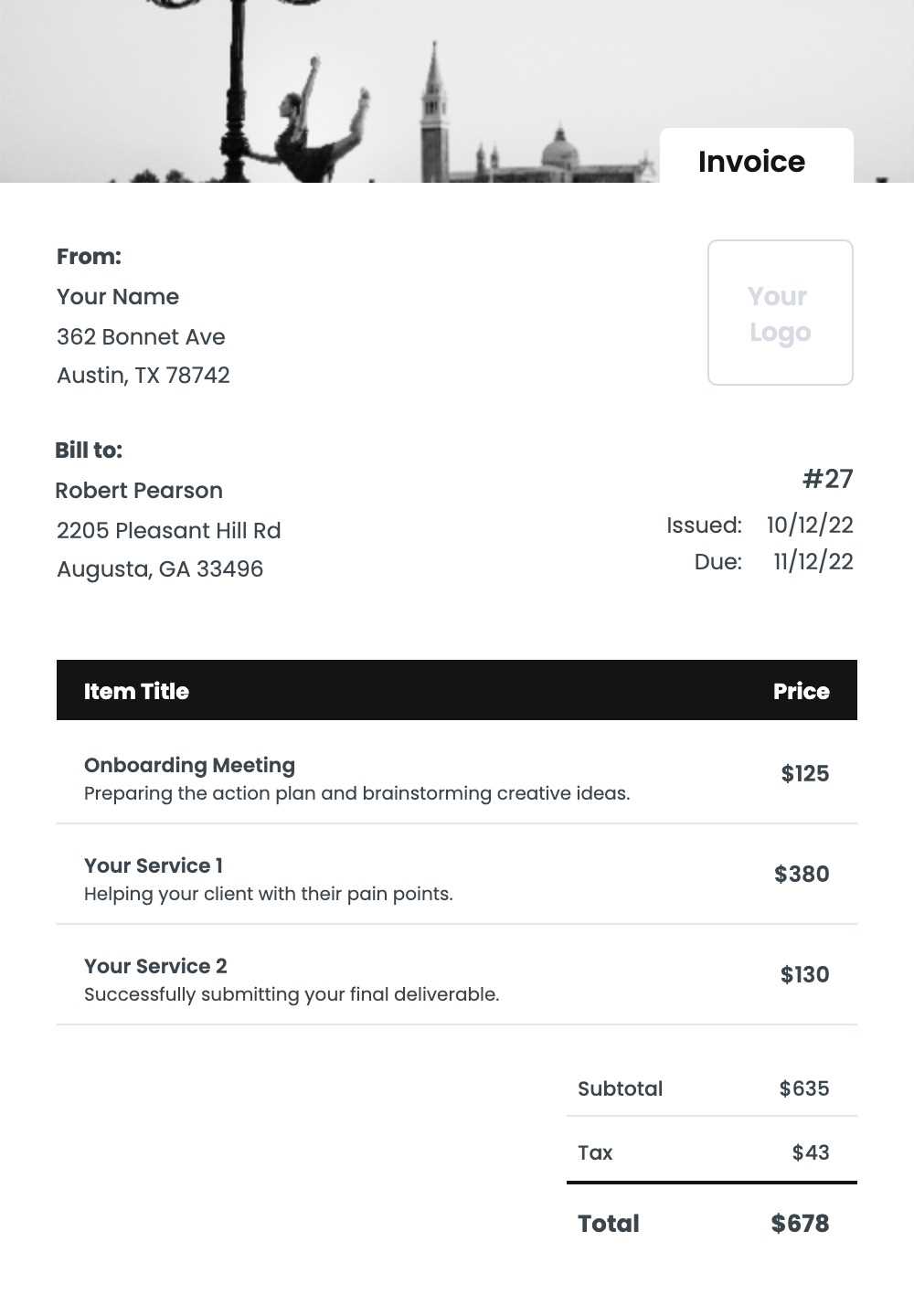

At the core of every financial document are key identifiers such as the name and contact information of both the sender and the recipient. This ensures that all parties are clearly identified, and there is no confusion about who is issuing or receiving the payment.

Transaction Details

This section outlines the specific products or services that have been delivered or completed, along with their corresponding prices. Descriptions of the goods or services should be clear and accurate to avoid any misunderstandings. Additionally, the dates of service or product delivery are crucial for determining payment due dates.

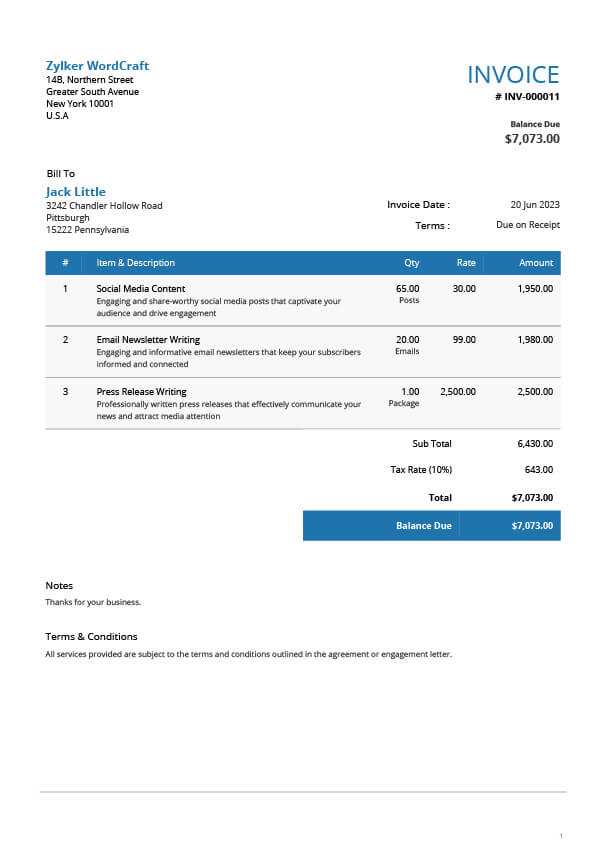

| Element | Description |

|---|---|

| Sender Information | Name, address, phone number, and email of the issuing party. |

| Recipient Information | Name, address, phone number, and email of the receiving party. |

| Invoice Number | Unique identifier for the document to ensure tracking and reference. |

| Itemized List | Detailed breakdown of goods or services with their prices and quantities. |

| Total Amount | The final amount due for payment, including applicable taxes and discounts. |

| Due Date | Indicates the deadline by which payment must be made. |

Adding Your Business Branding to Invoices

Incorporating business branding into official documents is an important step in establishing a professional image and ensuring consistency across all communications. The design elements you choose can enhance recognition and build trust with clients. By aligning your payment requests with your brand’s visual identity, you reinforce your business’s presence and make the process more personal and memorable.

Logo placement, color schemes, and font choices are all critical elements to consider. These details help convey your brand’s personality and create a unified experience for recipients. The more cohesive the design, the more professional and reliable your business will appear in the eyes of clients and partners.

Logo – Include your company’s logo at the top of the document to immediately identify it as coming from your business. Ensure the logo is clear and appropriately sized so that it stands out without overwhelming the layout.

Colors – Use the primary colors from your brand’s palette to maintain consistency. This can include header backgrounds, text highlights, or borders around sections. Keep the color contrast readable to ensure clarity.

Fonts – Choose fonts that reflect the style of your brand while maintaining readability. Select one or two fonts for headings and body text to avoid visual clutter.

Professionalism is key when adding these elements. A balance of branding with functional design ensures that the document remains clear and focused on the financial transaction while still reflecting your business’s identity.

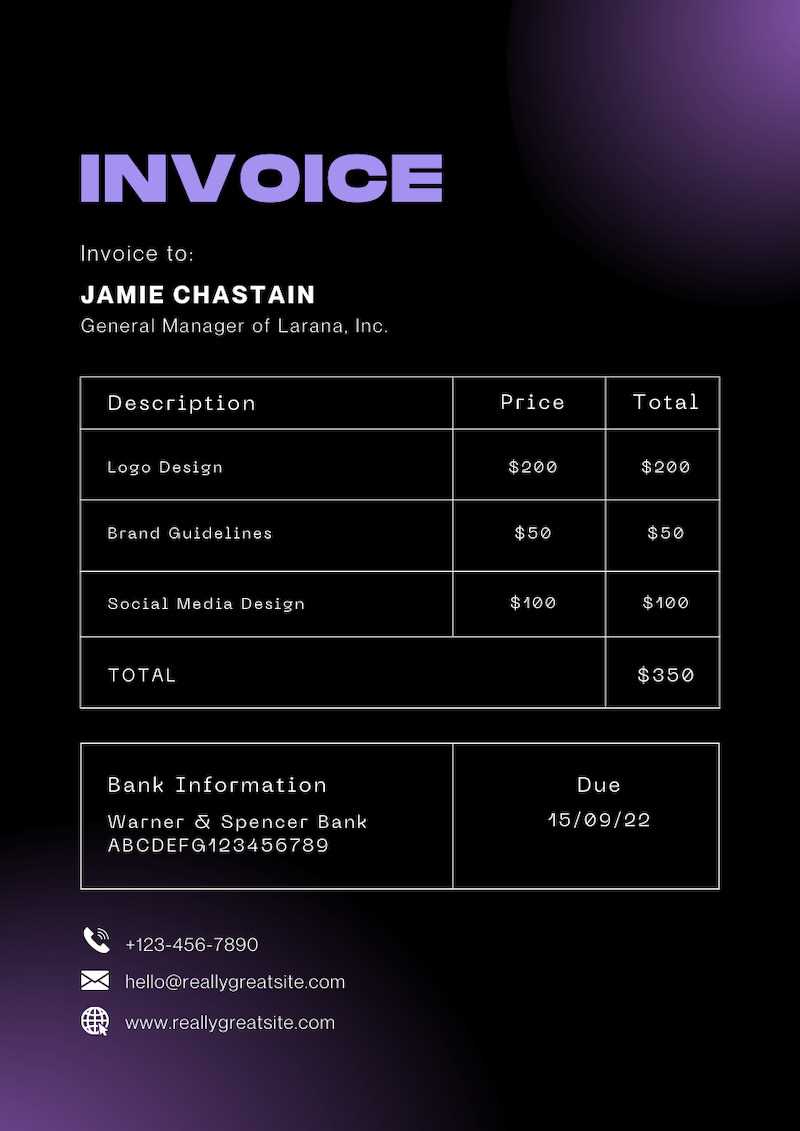

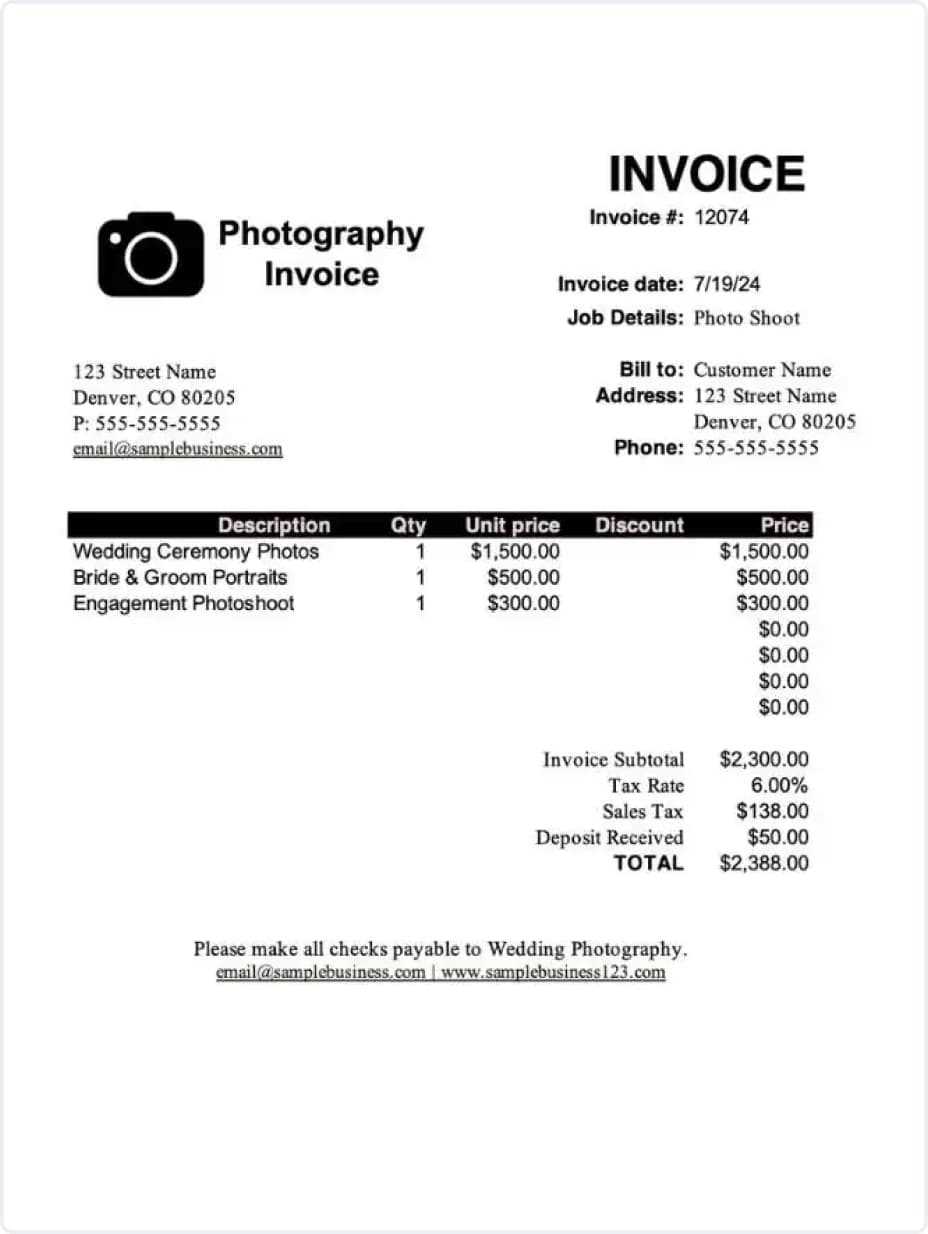

Customizing Invoice Templates for Your Industry

Tailoring payment request documents to suit the specific needs of your sector is crucial for maintaining professionalism and streamlining communication. Different industries have unique requirements regarding the information they need to include, the language they use, and the way transactions are structured. By adjusting the layout and content of the document, you can ensure it aligns with the standards and expectations of your business field.

Here are some common customizations for various sectors:

- Freelancers & Consultants: Include detailed descriptions of services provided, hourly rates, and project milestones. You may also need to incorporate payment terms specific to your working agreements.

- Retail & E-commerce: Focus on itemized lists of products, SKU numbers, and quantities. The format should be simple and easy to process for both the buyer and your accounting system.

- Construction & Trades: Incorporate a breakdown of labor costs, materials, and project phases. Add fields for worksite address and subcontractor details if applicable.

- Legal & Accounting Services: Include a section for billable hours, a description of legal or accounting tasks, and references to contracts or agreements. Clients may require references to specific case numbers or project titles.

- Hospitality & Events: Use sections for deposits, event dates, services rendered, and venue details. Include any special terms for cancellations or additional fees.

By customizing the content and structure based on the sector, businesses can improve communication and ensure they meet industry-specific needs while presenting a polished and professional document. Adjusting terminology, itemization, and payment terms can create a more efficient workflow and reduce misunderstandings with clients.

How to Choose the Right Invoice Format

Selecting an appropriate layout for billing documents is essential for both clarity and efficiency. The format you choose should cater to the specific needs of your business while being easy for clients to understand. A well-structured design helps avoid confusion, ensures all necessary details are included, and facilitates timely payments. Several factors influence the decision, from the complexity of the service provided to the type of client you’re working with.

Consider the Type of Business

The nature of your products or services will play a significant role in determining the best format. For businesses offering a single product or service, a simpler layout with fewer details may be sufficient. However, if your business deals with multiple items or complex services, a more detailed and structured layout will be necessary to avoid any ambiguity.

Client Expectations and Industry Standards

It’s also important to consider the preferences of your clients and the standard practices in your industry. Some clients may prefer a minimalist approach, while others might require detailed breakdowns of each charge. Researching common formats within your industry can help you select a layout that aligns with expectations and enhances professionalism.

Using Excel to Create Simple Invoices

Microsoft Excel is a versatile tool that can be used to generate straightforward payment requests quickly and efficiently. Its grid structure and formula capabilities make it an ideal option for businesses that need a simple, customizable solution. By leveraging Excel’s basic features, you can easily create clear and professional documents without the need for specialized software.

Here’s a step-by-step guide to using Excel for building a basic payment request:

- Set Up the Layout: Start with a blank worksheet and divide the document into clear sections such as sender information, recipient details, transaction description, and totals. Use borders to separate these sections for better organization.

- Include Essential Details: In the first section, add your business name, address, and contact information, followed by the recipient’s details. Leave space for the unique reference number and the date of issue.

- List Products or Services: Create columns for the description of items, quantity, unit price, and total cost. This makes it easy to calculate totals and track each charge.

- Apply Simple Formulas: Use basic Excel functions to calculate totals automatically. For example, use the SUM function to total up costs, and multiply quantity by unit price to get item subtotals.

- Formatting for Clarity: Make the document visually appealing and easy to read by adjusting font sizes, bolding key information (like totals), and using background shading for headings.

Excel offers a simple yet effective way to produce functional payment documents. With minimal effort, businesses can customize the layout, use formulas to streamline calculations, and create professional-looking documents that meet their needs.

Creating Invoices in Google Docs

Google Docs provides a user-friendly platform for generating professional payment requests without the need for specialized software. Its cloud-based nature makes it accessible from any device, while its simple design tools allow users to create clean and clear documents. By utilizing the features within Docs, you can customize layouts and content, making it an ideal option for businesses that require flexibility and convenience.

To begin, start with a blank document or choose from pre-existing styles in the Google Docs template gallery. From there, you can insert your business details, the client’s information, and any necessary transaction descriptions. With basic formatting tools such as bold, italics, and underline, you can emphasize key areas like totals or payment terms.

Google Docs also offers the ability to include tables, which are helpful for listing items, quantities, prices, and total costs. This makes organizing information straightforward and clear for both you and your clients. Additionally, the cloud-based nature of Google Docs means that all documents are automatically saved and can be shared or downloaded in various formats, such as PDF, making the billing process efficient and secure.

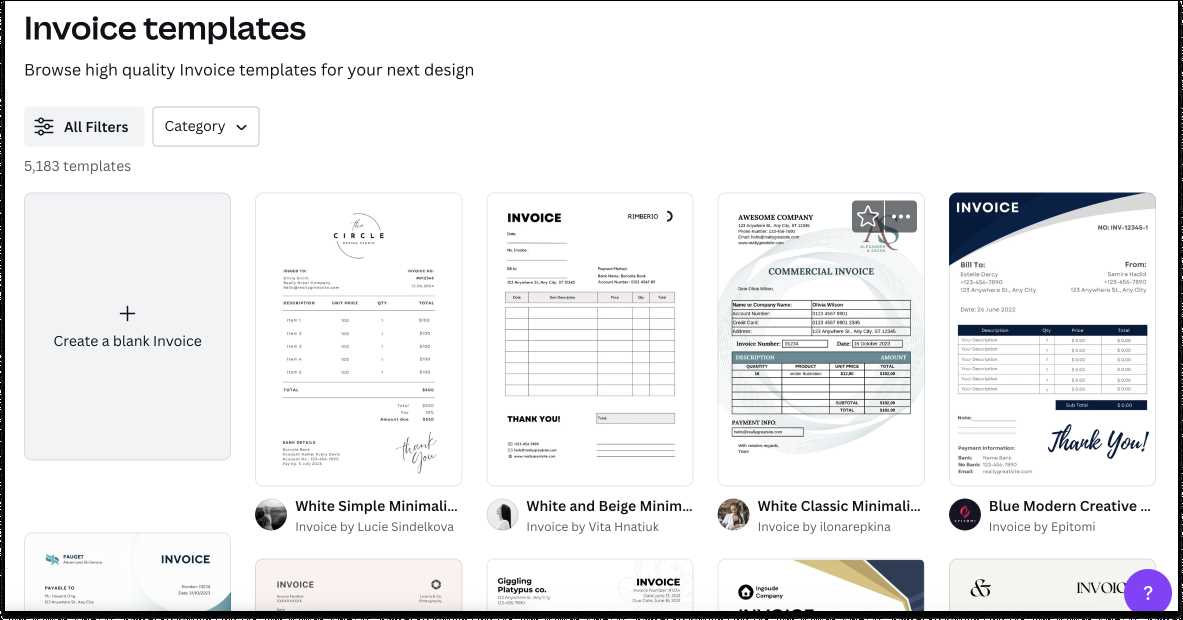

Designing Invoices with Online Tools

There are numerous online platforms available that simplify the process of designing professional billing documents. These tools often feature user-friendly interfaces with drag-and-drop functionality, pre-made layouts, and customizable design options. They are perfect for businesses that need quick, visually appealing documents without advanced design skills or software. Online tools also streamline the process of generating invoices, making it faster and easier to maintain consistency across your documents.

Here are some popular online platforms to consider when designing payment requests:

- Canva: Known for its intuitive design features, Canva offers a wide selection of customizable invoice layouts. You can adjust fonts, colors, and logo placement, ensuring that the final document aligns with your brand’s visual identity.

- Zoho Invoice: Zoho allows users to create invoices with a variety of templates. It also integrates with accounting features, making it a great option for businesses that need more than just design capabilities.

- Invoice Generator: This platform is ideal for quick and straightforward payment requests. With a minimal interface, you can input relevant details and generate a professional document in minutes.

- FreshBooks: A popular choice for small businesses and freelancers, FreshBooks offers customizable billing formats with built-in features for tracking payments and managing client accounts.

Using these online tools, you can design aesthetically pleasing and functional documents while reducing the time spent on formatting. Many platforms also offer cloud storage options, making it easy to save, share, and track your billing records from any location.

How to Automate Invoice Generation

Automating the creation of payment requests can save significant time and reduce human error. By leveraging software and tools that streamline this process, businesses can ensure accuracy, consistency, and efficiency in managing financial transactions. Automation removes the need for manual entry, allowing invoices to be generated based on predefined data, such as product purchases, service hours, or contract terms. This leads to faster processing and improved cash flow management.

Using Accounting Software

One of the most common methods to automate the generation of billing documents is through accounting platforms. These tools are equipped with features that allow users to set up recurring transactions, apply taxes, and generate detailed reports. Many accounting programs also integrate with payment systems, ensuring that all transactions are logged and invoicing is done automatically after each sale or service completion. Popular examples include:

- QuickBooks: A comprehensive accounting tool that allows users to automate billing based on customer records and transactions.

- Xero: Known for its simple interface, Xero offers automatic invoice generation based on subscription models, project completion, and payment reminders.

- FreshBooks: This platform automates invoicing, recurring billing, and integrates with bank accounts for seamless transaction tracking.

Integrating with CRMs and eCommerce Platforms

For businesses that operate online, integrating invoice generation with Customer Relationship Management (CRM) software or eCommerce platforms can be a game-changer. These tools can automatically create payment documents once a transaction is completed, sending them directly to the client. Popular integrations include:

- Shopify: Automatically generates invoices after a purchase is made, with customizable templates that match your branding.

- HubSpot: CRM software that integrates with invoicing systems to trigger automatic document creation based on sales activity.

- Stripe: For subscription-based services, Stripe automates invoicing and payment tracking, ensuring clients are billed according to the agreed terms.

By implementing automated solutions, businesses can significantly reduce administrative overhead, prevent mistakes, and improve the overall efficiency of financial operations.

Ensuring Accuracy in Your Invoices

Maintaining precision in billing documents is crucial for fostering trust with clients and avoiding costly mistakes. Every detail, from item descriptions to payment terms, must be accurate and clear to ensure that both parties are in agreement and no confusion arises. By implementing thorough checks and using reliable systems, businesses can minimize errors and streamline the payment process.

Key Areas to Double-Check

Here are the most critical areas to review before sending a financial document to ensure all information is correct:

- Client Information: Verify that the recipient’s name, address, and contact details are accurate and up-to-date to avoid misdirected communications.

- Product/Service Details: Double-check item descriptions, quantities, unit prices, and total amounts to confirm they align with the transaction or contract terms.

- Payment Terms: Ensure that payment deadlines, discounts, and late fees are clearly stated and reflect the agreement with the client.

- Tax Calculations: Accurately apply the correct tax rate and ensure that the final amounts, including taxes, are properly calculated.

- Invoice Number: Make sure each document has a unique identifier to maintain proper tracking and avoid duplication.

Implementing Systems to Reduce Errors

Incorporating automated tools and software can help reduce human error and ensure consistency across all financial documents:

- Automated Calculations: Use formulas to automatically calculate totals, taxes, and discounts to avoid manual mistakes.

- Templates: Develop standardized formats that can be reused for each transaction, ensuring that essential information is consistently included.

- Accounting Software: Utilize accounting platforms that integrate directly with your sales or project management tools to ensure real-time accuracy and avoid discrepancies.

By carefully reviewing each component and using automated tools, businesses can improve the accuracy of their documents, ensuring that clients receive the correct information and payments are processed without delay.

How to Set Up Payment Terms on Invoices

Establishing clear expectations regarding payment is crucial in any business transaction. By outlining specific conditions, both parties can avoid confusion and ensure smooth financial exchanges. These conditions typically specify when payments are due, possible penalties for late payments, and any discounts for early settlements. Including these terms helps to maintain professionalism and fosters a trustworthy relationship with clients.

To begin, it is essential to define a precise due date for the payment. Common choices are a fixed number of days after the service or product delivery, such as “Net 30” (payment due within 30 days). You may also opt for a specific date, like the 15th of the month following the service.

Additionally, consider adding late payment fees as an incentive for clients to pay promptly. A typical penalty might be a percentage of the outstanding balance after a certain period, such as 1.5% per month. However, make sure that these penalties are clearly communicated and legally enforceable to avoid misunderstandings.

Some businesses may offer early payment discounts as a way to encourage quicker payments. A discount, such as 2% off the total amount if paid within 10 days, is a popular approach. This strategy not only accelerates cash flow but can also strengthen client relationships.

Finally, make sure that all payment terms are consistent and prominently displayed. Clarity is key to avoiding disputes. If possible, include a summary of payment conditions at the top of the document, and reiterate them within the body to ensure they are easily understood and agreed upon.

Best Practices for Invoice Numbering

Implementing a structured and consistent system for numbering documents is essential for smooth tracking and organization. A well-organized numbering sequence not only enhances administrative efficiency but also ensures clarity in communication with clients and stakeholders. Proper numbering helps businesses maintain accurate records, avoid duplication, and adhere to legal or accounting requirements.

Key Considerations for a Solid Numbering System

- Sequential order: Always use a continuous, ascending order for each document. This makes it easy to follow a chronological sequence and prevents confusion in record-keeping.

- Unique identifiers: Include an element that makes each number distinct. This could be a date, client code, or a project identifier, ensuring there are no duplicates in the system.

- Avoid gaps: Ensure that the numbering sequence doesn’t skip any numbers. Gaps can cause confusion and signal potential errors or missed transactions.

Popular Numbering Formats

- Simple sequential numbering: This is the most common approach, where each document is assigned a unique, progressively increasing number (e.g., 001, 002, 003, etc.).

- Date-based numbering: Some businesses prefer incorporating the date into the number for quick identification. For instance, 2024-001, 2024-002, etc., ties the number directly to the year of issue.

- Client-specific numbering: If dealing with multiple clients, adding a client identifier to the number (e.g., 001-ABC, 002-XYZ) can help organize and sort documents by client.

By following these practices, businesses can ensure that their records are accurate, traceable, and professionally presented.

Saving and Organizing Your Invoice Templates

Efficient storage and organization of essential business documents are key to ensuring quick access and smooth workflow. When working with billing or payment documents, having a well-organized system for saving and categorizing files can save valuable time, prevent errors, and ensure compliance with record-keeping regulations.

Effective File Naming and Storage

- Clear naming conventions: Adopt a consistent naming system that includes key details, such as the document type, date, and client name. For example, “Invoice_2024_ABC_Corp” can make it easier to locate and identify files later on.

- Use cloud storage: Storing documents in the cloud provides easy access from anywhere, ensuring that files are safe and retrievable even if physical devices are damaged or lost.

- Backup systems: Regular backups are essential to avoid the loss of critical documents. Consider setting up automatic backups for added peace of mind.

Organizing and Categorizing Files

- Folder structure: Organize files in clearly labeled folders by client, year, or project. This hierarchy allows for quick retrieval and prevents clutter.

- Version control: When updating documents, ensure that older versions are archived or marked clearly. This prevents confusion between outdated and current versions.

- Search functionality: Make use of software or cloud platforms with powerful search features that allow you to quickly locate specific files based on keywords, client names, or dates.

By following these practices, businesses can maintain an efficient filing system that makes document retrieval straightforward, while reducing the risk of errors and improving overall efficiency.

How to Modify Templates for Future Use

Adapting and updating document formats for repeated use can significantly streamline processes and ensure consistency. Customizing existing files allows businesses to save time and maintain accuracy by tailoring them to evolving needs. Regular modifications help ensure that documents remain relevant and compliant with any new regulations or client requirements.

Steps to Update and Customize Documents

- Assess changing requirements: Regularly review the current content and structure to determine if any new information or adjustments are needed. This could include updated payment terms, tax rates, or additional sections based on client needs.

- Incorporate client-specific details: If necessary, add placeholders for custom client information that might change with each use, such as project names, service descriptions, or unique pricing terms.

- Update legal or compliance information: Ensure that any new regulations, taxes, or legal requirements are reflected in the document. This might include adjusting for new tax laws or incorporating updated payment policies.

Best Practices for Future Modifications

- Maintain a version history: When making changes, keep track of previous versions. This will allow easy access to older formats and help identify what changes were made over time.

- Test before use: After making modifications, run a test by applying the updated format to a sample transaction or client. Ensure that the document displays correctly and all fields are functional.

- Automate repetitive tasks: If possible, incorporate tools that allow automatic population of common fields, such as client names or dates. This saves time and reduces the chance of manual errors.

By making these adjustments and consistently reviewing the format, businesses can ensure that their documents remain professional, accurate, and adaptable to any situation or requirement.

Common Mistakes to Avoid When Creating Invoices

Even with the best intentions, mistakes in billing documents can lead to confusion, delayed payments, or disputes. Avoiding common errors ensures that documents are clear, professional, and legally sound. By paying attention to detail, businesses can prevent costly oversights and ensure a smooth transaction process.

Frequent Errors to Watch Out For

- Incorrect or missing contact information: Failing to include accurate business or client details, such as addresses, phone numbers, and email addresses, can delay communication or lead to misunderstandings.

- Omitting payment terms: Not specifying the due date or payment conditions clearly can result in confusion. Always state when the payment is due and outline any late fees or early payment discounts.

- Errors in pricing or calculations: Double-check all amounts and calculations. Even a small mistake, such as adding an incorrect tax rate or discount, can create confusion and damage trust.

- Unclear descriptions of products or services: Vague or incomplete descriptions may leave clients unsure about what they are being charged for. Be specific about the items or services provided and their respective costs.

- Missing or incorrect tax information: Ensure that taxes are calculated correctly and that the appropriate tax rate is applied based on location and the type of service or product provided. Failing to account for tax can lead to legal issues.

Additional Points to Consider

- Failure to number documents sequentially: Skipping numbers or not following a logical sequence can cause confusion and make it harder to track payments.

- Not keeping copies: Always save a copy of each document for your own records. This helps track payments, resolve disputes, and keep accurate financial records.

- Using generic or outdated formats: Templates that don’t reflect your current branding or business needs can appear unprofessional. Regularly update formats to ensure they align with your company’s image and meet the latest requirements.

By avoiding these common mistakes, businesses can ensure a smoother and more professional billing process, enhancing both customer relationships and overall efficiency.