How to Create a Template Invoice for Your Business

In any business, maintaining a structured and clear system for financial transactions is essential. One of the most important aspects of this process is ensuring that the details of services or products provided are accurately presented to clients. A well-organized document helps avoid confusion and ensures timely payments, benefiting both the business and the customer.

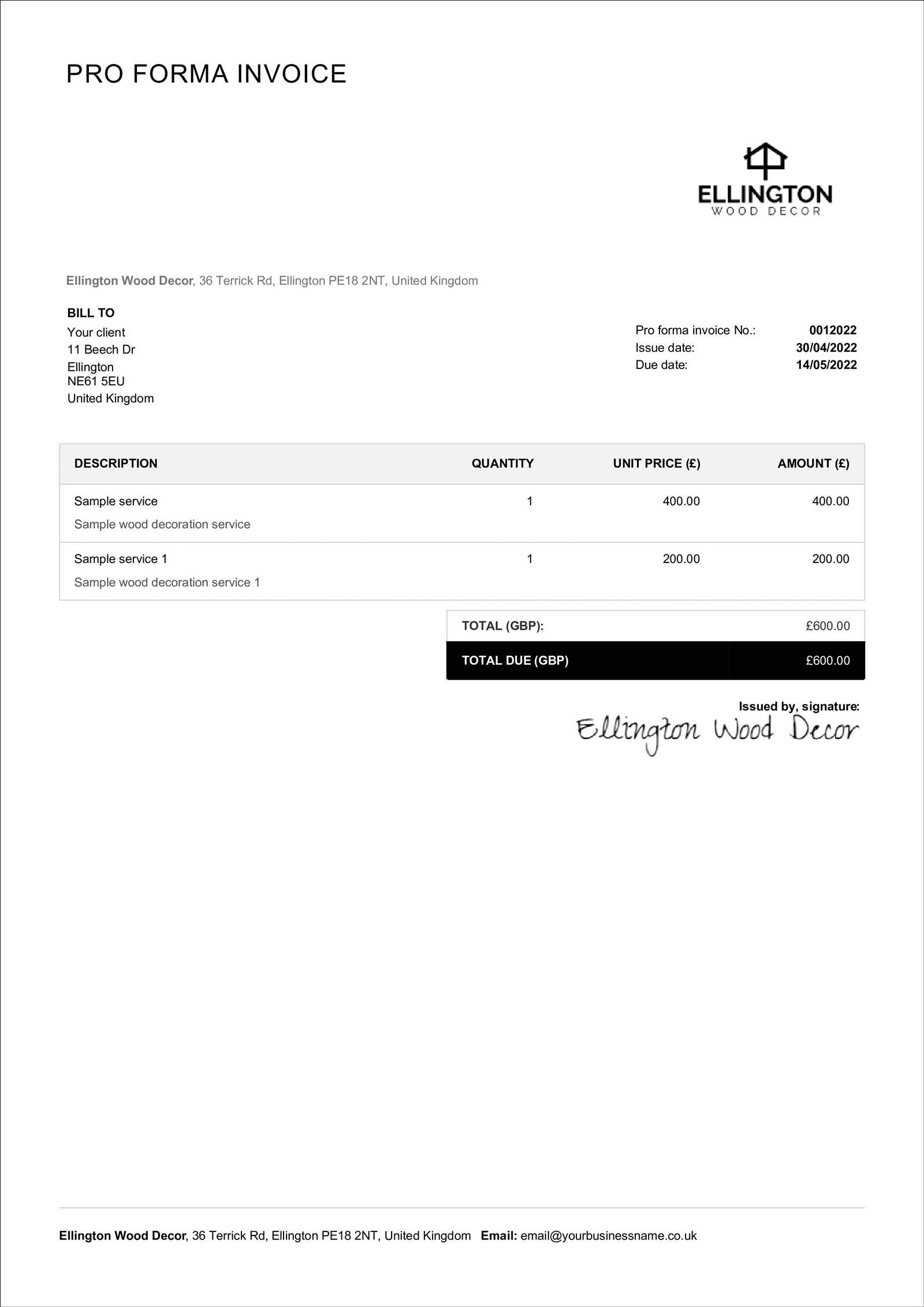

Designing a reliable and efficient billing form is crucial for professionals across all industries. This document should include all the necessary information, from pricing to payment terms, while reflecting the business’s branding. By setting up a standardized format, businesses can streamline their invoicing process, reduce errors, and maintain consistency in every financial interaction.

Whether you’re working independently or running a large organization, mastering the craft of building these essential documents will lead to smoother transactions and a more professional image. In this guide, we’ll explore the key components and best practices for assembling an effective billing document that suits your needs.

How to Create a Template Invoice

Establishing a consistent format for billing documents is a key step in ensuring smooth financial transactions. A well-structured document allows businesses to easily track payments, manage client relationships, and reduce errors. The goal is to create a flexible design that can be reused for different clients, while still maintaining a professional appearance and clear communication.

Essential Sections to Include

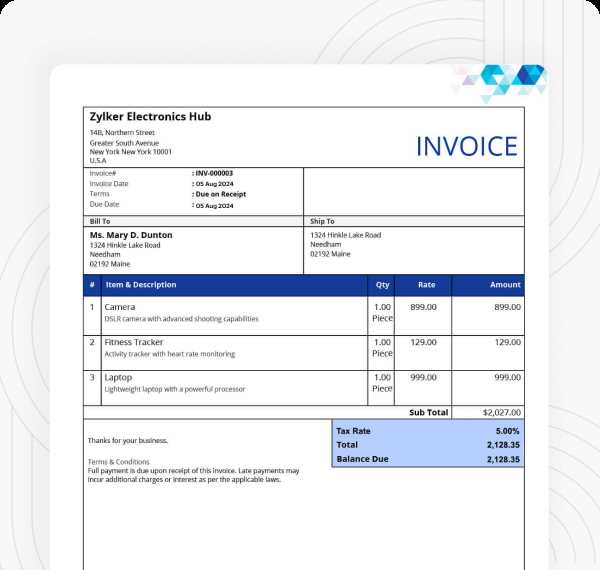

Every effective billing document should feature several core sections. Begin with your business information, such as the name, address, and contact details, followed by the client’s corresponding data. A unique reference number helps differentiate each document, making it easier to track and reference in the future. Next, include a list of services or products provided, with clear descriptions and corresponding costs. This transparency fosters trust and avoids disputes over pricing.

Setting Payment Terms and Conditions

To avoid confusion and late payments, be sure to include detailed payment terms on each document. Specify the due date and any penalties for late payments. You may also want to outline acceptable payment methods, whether it’s through bank transfer, credit card, or another option. Clarity in these terms will ensure both you and the client are aligned on expectations and obligations.

Understanding the Importance of Invoice Templates

Having a standardized format for billing documents is crucial for any business. It ensures consistency, reduces the risk of errors, and helps maintain a professional image. By using a reliable structure, businesses can efficiently manage transactions and ensure that every detail is communicated clearly to clients. This consistency not only enhances workflow but also builds trust with customers, making them more likely to pay on time.

Additionally, a well-organized document saves time. Instead of creating new billing forms from scratch for each transaction, a reusable structure allows for quicker generation of financial records. This becomes especially valuable when dealing with a high volume of transactions, as it streamlines the process and minimizes administrative overhead. Efficiency in managing these documents is key to smoother operations.

Another benefit of using a consistent format is its role in branding. A personalized layout with your business logo, colors, and fonts reinforces your identity and adds a touch of professionalism to every document. This attention to detail can have a positive impact on how your clients perceive your business, contributing to stronger relationships and better communication.

Key Elements of an Effective Invoice

An effective billing document should be clear, concise, and professional, containing all the necessary information to avoid confusion or delays in payment. The goal is to present a well-organized summary of the transaction, ensuring that the recipient understands the amount due, the services or products provided, and the payment terms. Several key elements must be included to achieve this level of clarity and efficiency.

Essential Information to Include

First and foremost, a professional document must contain your business details, such as your company name, address, and contact information. The client’s details should also be included to ensure proper identification. A unique reference number is crucial for tracking purposes, especially if multiple transactions are involved. It is also important to state the issue date and due date clearly to set expectations for payment timelines.

Breaking Down Costs and Payment Terms

Clearly itemizing the services or products rendered helps the client understand what they are paying for. Provide a detailed list with accurate descriptions and associated costs. Including any taxes, discounts, or additional charges is also essential to avoid confusion. Lastly, specify payment terms–including the accepted methods and any late fees for overdue payments. This transparency in both the charges and terms builds trust and ensures a smooth transaction process.

Choosing the Right Software for Invoice Creation

Selecting the right software is essential for generating accurate and professional billing documents. With the right tools, you can save time, reduce errors, and easily customize your forms to meet the unique needs of your business. The choice of software depends on various factors, including your budget, the complexity of your needs, and how often you need to generate financial records.

Factors to Consider When Selecting Software

When choosing the right solution, several key considerations should guide your decision-making process. Here are some important aspects to keep in mind:

| Feature | What to Look For |

|---|---|

| Ease of Use | Choose software that is user-friendly and does not require technical expertise to navigate. |

| Customization | Look for options that allow you to easily modify layouts, add logos, and personalize fields to suit your business. |

| Integration | The software should integrate with accounting tools, payment processors, or other business software you already use. |

| Cost | Ensure the pricing is within your budget, and look for features that match your requirements without overpaying for unnecessary tools. |

| Automation | Automated features like recurring billing and reminders can save time and reduce manual errors. |

Popular Software Options

Many solutions on the market offer a wide range of features for creating professional documents. Some popular options include cloud-based tools, which allow ac

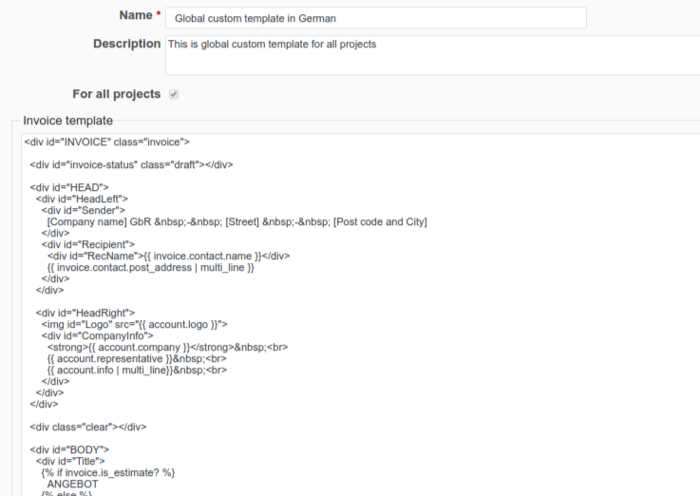

Customizing Your Invoice Template Layout

Designing a professional document to reflect your brand and streamline your billing process involves careful arrangement of elements. Tailoring the overall structure allows you to present key details clearly and consistently, ensuring your communication with clients remains polished and effective. Customizing the layout not only enhances readability but also reinforces the credibility of your business.

Understanding Layout Structure

The first step in adapting the structure is deciding on the essential sections. Each layout has a distinct set of components, but common elements include client information, services or products listed, totals, and payment terms. Adjusting the positioning and size of these sections can improve the flow and make important details stand out.

Incorporating Branding Elements

To align with your company’s identity, incorporate branding elements such as logos, colors, and fonts. These visual cues make your documents more recognizable and foster trust. Consistency in style will further strengthen your brand’s presence across all communication materials.

Finally, ensure there is a balance between design and functionality. A layout should be easy to navigate, with each section clearly separated and easy to read. Small adjustments can lead to a big impact on how clients perceive your professionalism and organization.

How to Add Your Business Information

Including key details about your company is essential for maintaining transparency and establishing trust with clients. These elements provide clarity regarding the source of the document and ensure that your recipients have all the necessary contact information should they need to reach you. Properly displaying your business data makes your documents look professional and ensures smooth communication.

Essential Contact Details

Start by including your full business name, physical address, phone number, and email address. These are the primary means of contact and should be placed in a prominent location, typically at the top or header of the document. Make sure the information is accurate and up to date to avoid any confusion.

Additional Identification Information

In addition to the basic contact details, it’s important to include any relevant identification numbers, such as a tax ID or registration number, especially for legal or regulatory purposes. These identifiers lend credibility to your business and can be crucial for clients who require them for their own records. Ensuring this information is clearly displayed helps in avoiding delays or issues in the transaction process.

Including Payment Terms and Due Dates

Clarifying payment expectations is crucial for both you and your client to avoid misunderstandings. Specifying when and how payments should be made ensures that both parties are on the same page regarding deadlines and methods of settlement. Clear payment guidelines not only facilitate smoother transactions but also enhance professional relationships.

Payment Deadlines

One of the most important aspects is specifying the due date. This should be presented in a clear and visible spot on the document to avoid confusion. Common formats for payment deadlines include:

- Due upon receipt

- Net 15 (payment due within 15 days from the date of the document)

- Net 30 (payment due within 30 days from the date of the document)

- Due on a specific date (e.g., “Due by December 1st”)

Payment Methods and Conditions

Alongside the due date, it’s also important to outline the accepted methods of payment. These could include:

- Bank transfers

- Credit or debit cards

- Online payment platforms (e.g., PayPal, Stripe)

- Checks or money orders

If there are any discounts for early payment or penalties for late payment, be sure to specify these terms clearly. For instance, you might include an early payment discount of 2% if paid within 10 days or a late fee of 1.5% per month after the due date. Providing these details up front can encourage timely payments and ensure all terms are understood from the start.

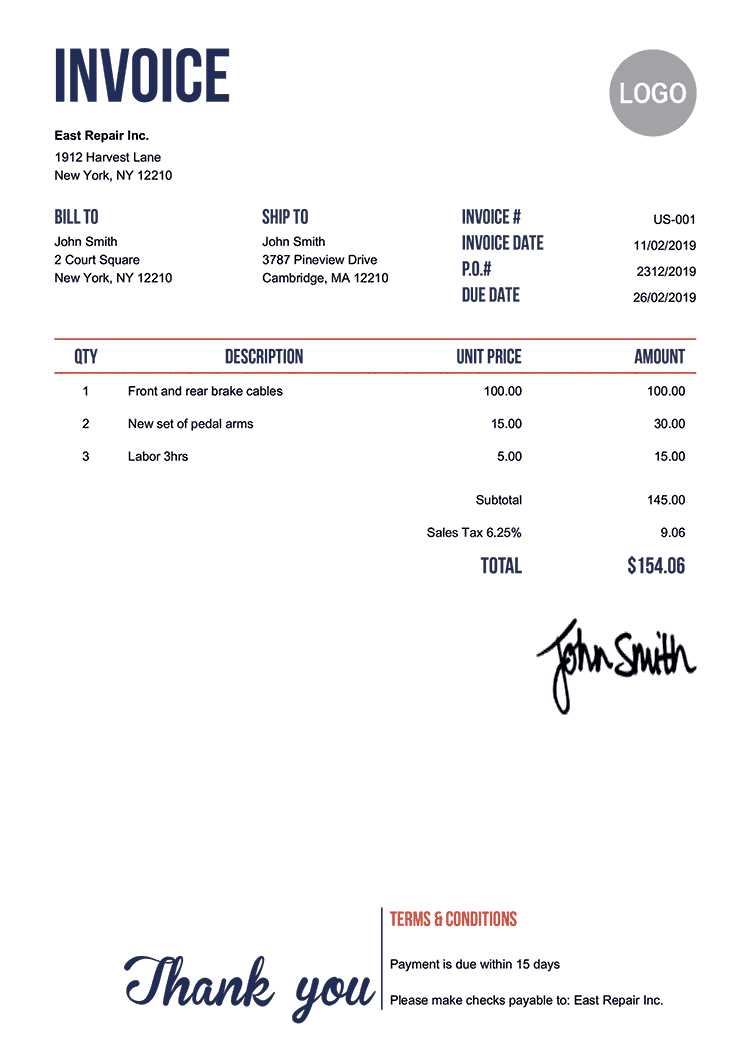

Adding Itemized Lists and Descriptions

Breaking down products or services in a detailed manner is essential for transparency and clarity. An itemized list allows your client to see exactly what they are paying for, ensuring there are no ambiguities. Each item or service should be accompanied by a brief description to provide context and justify the charges. This approach helps in building trust and reduces the likelihood of disputes over the charges.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Website Design – Initial Consultation | 1 | $150.00 | $150.00 |

| Website Design – Homepage Layout | 1 | $500.00 | $500.00 |

| SEO Optimization | 1 | $200.00 | $200.00 |

Each row in the table should represent a specific product, service, or task, accompanied by the corresponding quantity, unit price, and total amount. If necessary, you can also add a short description of each item to explain the scope of work or the features included. This makes the charges more transparent and helps clients understand exactly what they are being billed for.

Setting Up Tax and Discount Fields

Incorporating tax and discount information into your document ensures that clients are aware of any additional charges or reductions applied to the total amount. Properly setting up these fields helps maintain transparency in financial transactions and ensures that the correct amount is paid. It’s important to clearly outline these adjustments to avoid confusion and guarantee compliance with local tax laws.

Applying Taxes

When adding tax information, start by specifying the applicable tax rate. Depending on your location, this could be a state, regional, or national sales tax. Display the tax as a separate line item to make it clear and distinguishable from the main charges. For example, if the tax rate is 10%, you would calculate and list it accordingly:

- Subtotal: $500.00

- Sales Tax (10%): $50.00

- Total: $550.00

Including the specific percentage or amount ensures that the client knows exactly what portion of the total price is attributed to tax. Ensure accuracy in your calculations to avoid discrepancies during payment.

Adding Discounts

Discounts are often used as incentives or promotional offers. Clearly displaying any reductions can make clients feel appreciated and encourage prompt payments. Discounts can be listed either as a percentage or a fixed amount, depending on the terms agreed upon. For instance, a 10% discount on a $200 subtotal would be calculated as follows:

- Subtotal: $200.00

- Discount (10%): -$20.00

- Total: $180.00

If you offer early payment discounts, be sure to specify the time frame within which the discount applies. Transparency in both tax and discount fields helps build trust and fosters positive business relationships.

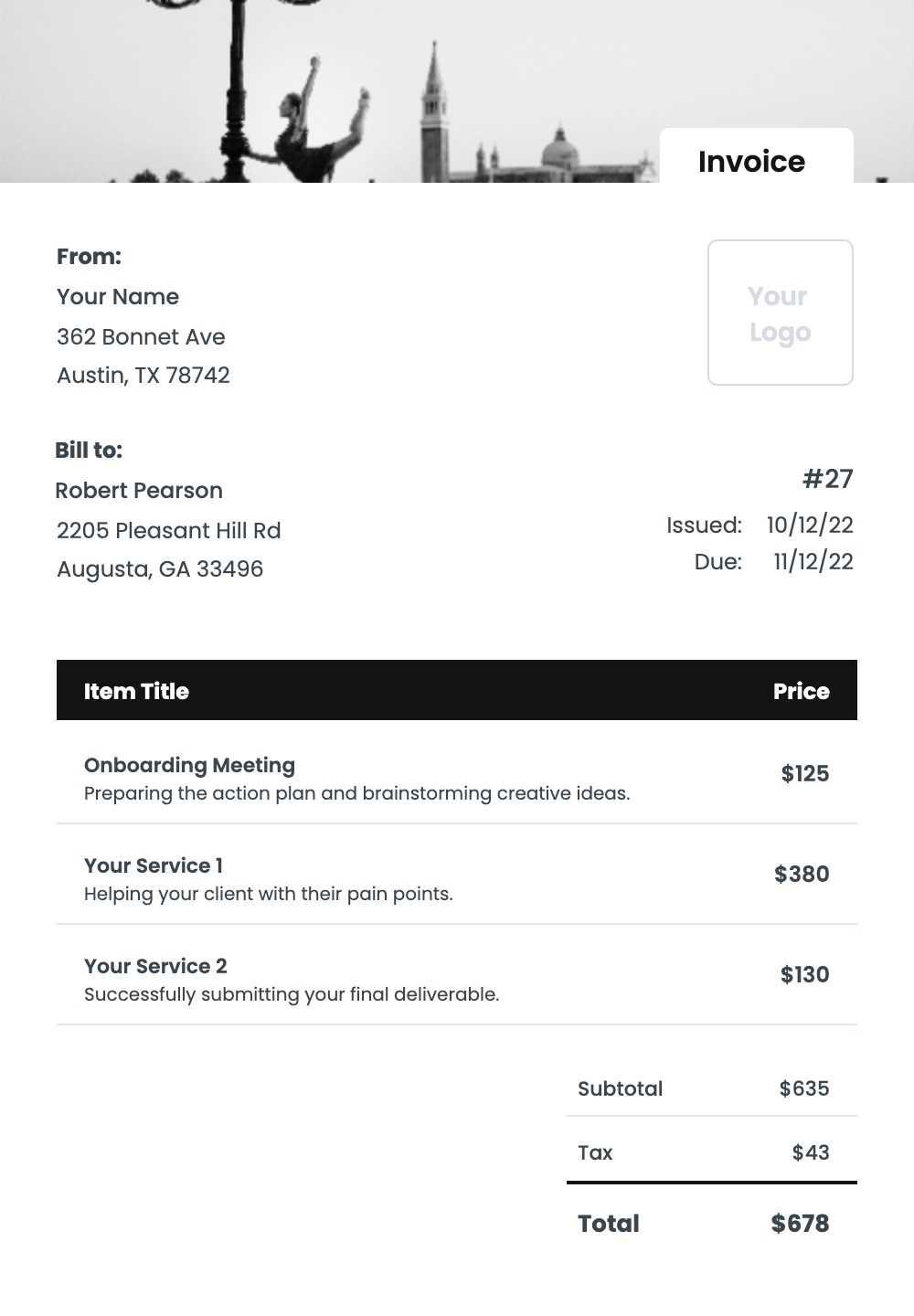

Incorporating Your Logo and Branding

Incorporating visual elements of your brand, such as your logo and color scheme, into business documents is essential for creating a professional and cohesive image. These branding elements not only make your documents more visually appealing but also help reinforce your identity with clients. Including consistent branding establishes trust and makes your communications easily recognizable, which can enhance your overall reputation.

Placing Your Logo

Your logo should be placed in a prominent position, typically at the top of the document, where it can be easily seen. This allows clients to immediately associate the document with your business. The logo should be clear and of high quality to ensure it maintains its integrity when printed or viewed on various devices. A well-placed logo not only strengthens brand identity but also adds a level of professionalism to your correspondence.

Using Consistent Colors and Fonts

To maintain a cohesive look, make sure the colors and fonts you use align with your brand’s visual guidelines. The primary colors of your logo should be incorporated into headings, borders, or other sections of the document. Similarly, the fonts should be consistent with those used in other materials, such as your website or business cards. Using the same style throughout creates a unified and polished appearance that enhances brand recognition and credibility.

How to Format Currency and Pricing

Accurate and consistent presentation of monetary amounts is crucial for clarity and professionalism. Whether you’re listing individual item costs, taxes, or the final total, ensuring that numbers are formatted correctly helps avoid confusion and promotes transparency. Proper currency formatting also contributes to the document’s overall polished look, making it easier for clients to understand the breakdown of charges.

Standard Currency Formatting

When presenting prices, always use the appropriate currency symbol and ensure that decimal points are placed consistently. For example, if you’re working with US dollars, the format should be:

- $100.00

- $25.50

- $5.00

For international currencies, ensure that you are using the correct symbols and separators for the respective regions. The Euro, for example, is typically displayed as:

- €100.00

- €25.50

It’s important to keep the formatting uniform throughout the document to avoid any confusion. Additionally, do not omit zeroes after decimal points, even for round numbers (e.g., $100.00 instead of $100).

Itemizing Prices and Discounts

For clarity, break down prices for each item or service separately, as well as any applicable taxes, discounts, and other adjustments. Each item should be listed with its unit price, quantity, and total price. If discounts are applied, display the original price next to the discounted amount to clearly show the reduction. For instance:

- Website Development – $500.00

- SEO Optimization – $150.00

- Discount (10%) – $65.00

- Subtotal – $585.00

- Sales Tax (8%) – $46.80

- Total – $631.80

Such formatting makes it easier for clients to review and understand each charge and discount applied, helping to prevent disp

Creating a Professional Footer Section

A well-designed footer serves as the finishing touch for any official document. It not only provides additional space for essential information but also enhances the overall appearance and professionalism of the page. A clean, structured footer can include contact details, legal disclaimers, and payment instructions, helping ensure that your recipient has all the necessary details in one place.

Key Information to Include

The footer should include critical information that is helpful but not distracting from the main content. Common elements in the footer section may include:

- Your business’s full name and contact details (phone, email, website)

- Tax identification number or business registration number

- Payment terms or bank account details for wire transfers

- Legal disclaimers or terms and conditions

- Thank you note or message to the client

Design Considerations

While functionality is key, the footer should also match the overall design and tone of the document. Keep the footer simple, with clean lines and legible text. Make sure the font size is smaller than the main content but still readable. Avoid overcrowding the space; instead, focus on providing essential information that can help the recipient feel confident and informed.

A well-placed footer adds credibility and provides clients with easy access to important details, ensuring your document appears polished and complete.

Ensuring Invoice Template Compatibility

Ensuring that your billing document works seamlessly across different platforms and devices is essential for accessibility and ease of use. Compatibility guarantees that your recipient can view and interact with the document without issues, regardless of the software or system they are using. This consideration is crucial for maintaining professionalism and avoiding delays in processing.

One important aspect is ensuring the document format is widely supported. PDF files, for example, are universally accessible and preserve the layout, fonts, and graphics as intended. If you are using a different format, such as Excel or Word, be aware that some clients may not have the necessary software to open or view the file properly.

Additionally, test the document on various devices–such as desktops, tablets, and smartphones–to verify that it displays correctly. This ensures that your layout, text alignment, and any images remain intact across different screen sizes and resolutions.

Lastly, check that your document is free from any complex elements that may not be rendered properly in certain programs or versions. Keeping things simple and consistent will avoid potential problems and make sure your communication remains clear and professional across all platforms.

How to Save and Reuse Invoice Templates

Storing and reapplying standardized documents can greatly streamline your business operations. By saving a pre-designed layout, you can avoid recreating the same structure for each new transaction. Instead of manually entering information every time, you can efficiently populate the form with specific details, saving both time and effort.

To achieve this, it is important to use a reliable file format that preserves the design elements, ensuring that all parts remain consistent. Many prefer formats like PDF or Word, which maintain formatting across different devices. Once saved, these files can be easily accessed and edited as needed, reducing redundancy.

Moreover, organizing these files in a well-structured folder system allows for quicker retrieval. Keeping templates named clearly and categorizing them based on client or service type can further enhance accessibility. By incorporating automation tools, you can even set up reminders to ensure these forms are populated and sent out on time.

Printing and Sending Your Invoice

Once the document is finalized, it’s time to deliver it to the recipient. The process involves either printing a physical copy for mailing or sending a digital version via email. Both methods offer distinct advantages, depending on the preferences of your client and the nature of the transaction.

Printing and Mailing

If a hard copy is preferred, ensure the document is printed clearly with all necessary details. Choose a professional layout that enhances readability and presents your information in an organized manner. After printing, include any required additional documents or instructions, and mail the package to the recipient’s address. Always keep a record of the sent copy for future reference.

Sending Digitally

For a faster and more efficient approach, emailing the document is often the best choice. Convert the file into a universally accessible format, such as PDF, to preserve the structure and formatting. Attach the file to your email and include a brief, polite message outlining the contents. Be sure to follow up if you don’t receive confirmation of receipt within a reasonable time frame.

Common Mistakes to Avoid in Invoice Creation

When preparing a billing document, it’s easy to overlook small details that could lead to confusion or delays in payment. Even minor errors can result in disputes or a lack of professionalism, which might harm client relationships. Being aware of these pitfalls and taking steps to avoid them ensures smoother transactions and clearer communication.

Omitting Important Details

One of the most common errors is failing to include all necessary information. Missing details like the service description, correct pricing, payment terms, or contact information can delay processing. It’s essential to provide a comprehensive breakdown so the recipient can quickly understand the charges and terms.

Incorrect Dates and References

Another frequent mistake is using inaccurate or outdated dates. Always double-check that the document includes the correct issue date and payment due date. Additionally, reference numbers or purchase order IDs should be correct, as this helps the recipient match the billing statement with their records, avoiding confusion.

Updating and Modifying Your Invoice Template

Over time, you may find that adjustments are necessary to keep your billing documents aligned with changes in your business practices, client needs, or legal requirements. Regularly reviewing and refining these forms ensures that they remain accurate, professional, and effective for all future transactions.

Adjusting to New Business Requirements

As your business grows or evolves, certain details on your forms may need to be updated. This can include altering payment terms, adding new services, or changing tax rates. Regular modifications are necessary to reflect any shifts in your offerings or pricing structures.

Ensuring Legal and Financial Compliance

Changes in tax laws or industry regulations may require updates to the information presented in your documents. It’s essential to stay informed about any legal changes that might impact how you present charges, taxes, or other mandatory details.

| Section | Suggested Update |

|---|---|

| Contact Information | Ensure all phone numbers, emails, and addresses are up-to-date. |

| Service Descriptions | Modify service names or descriptions if offerings change. |

| Payment Terms | Adjust payment schedules or due dates as business terms evolve. |

| Tax Rates | Update tax percentages or rules in accordance with local regulations. |