How to Create a Business Invoice Template for Efficient Billing

Creating an efficient and clear document for requesting payment is essential for maintaining a smooth financial workflow. It ensures both parties understand the agreed terms and helps avoid misunderstandings. A well-designed record of services or products provided can also contribute to the professionalism of your operations, leaving a positive impression on clients.

In this guide, we’ll explore the crucial elements that go into building a structured and functional payment request form. Whether you’re just starting out or looking to improve your existing processes, knowing how to design and customize such a document can significantly streamline your billing cycle. With the right approach, you can ensure accuracy, transparency, and consistency with each transaction.

How to Create a Business Invoice Template

Designing an efficient document for requesting payments involves a few key steps that ensure clarity, accuracy, and professionalism. This process not only helps you maintain a well-organized system but also improves communication with clients by setting clear expectations. A thoughtfully designed document can facilitate faster processing and reduce the risk of errors in financial transactions.

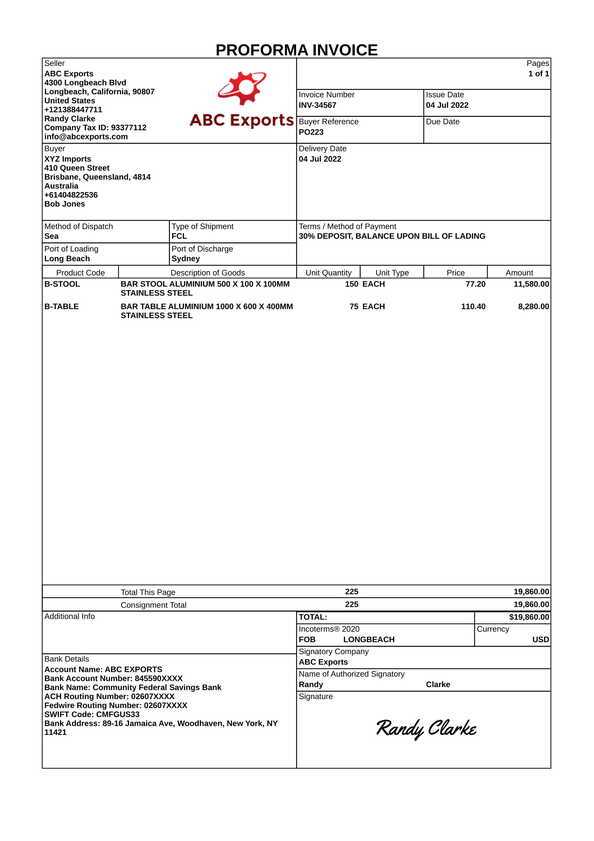

Essential Elements to Include

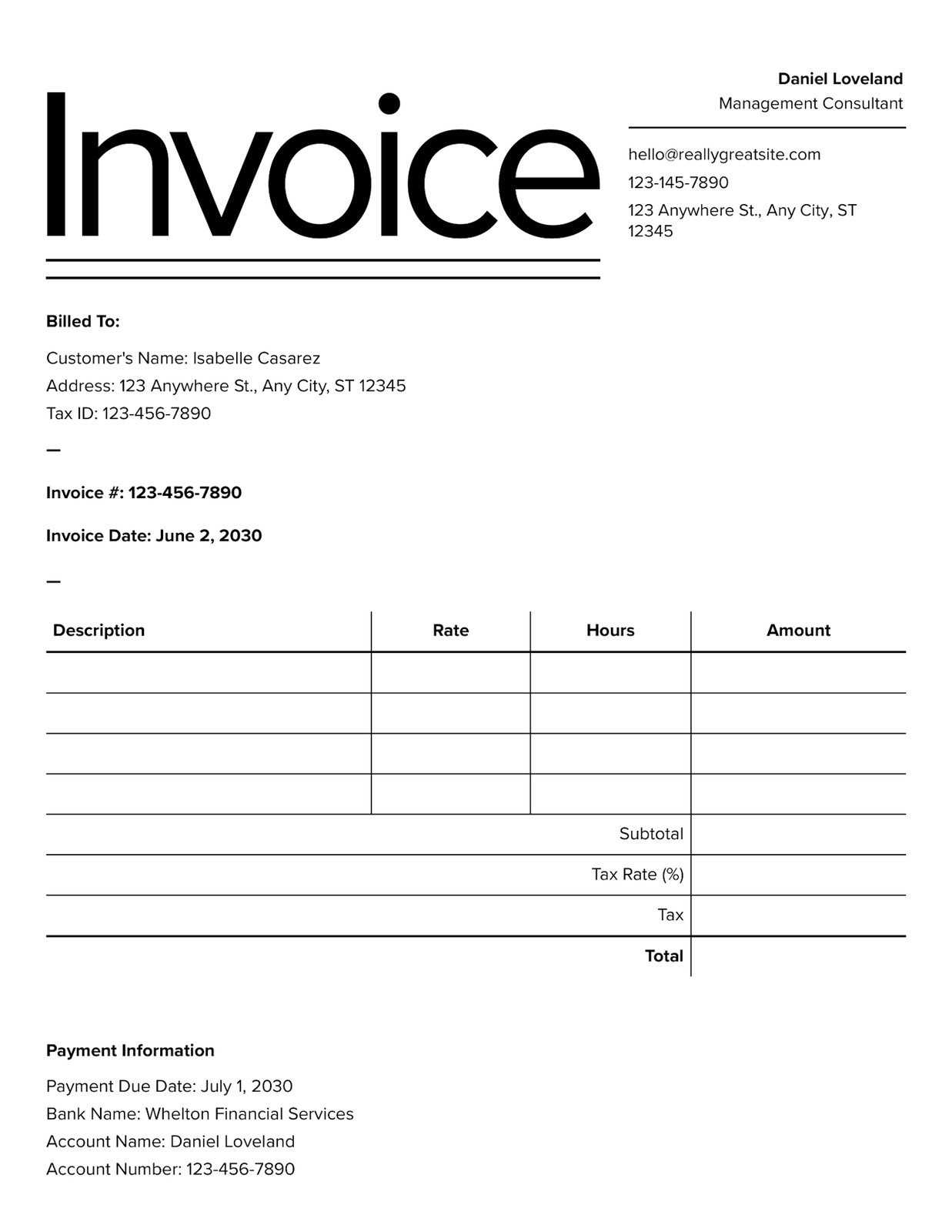

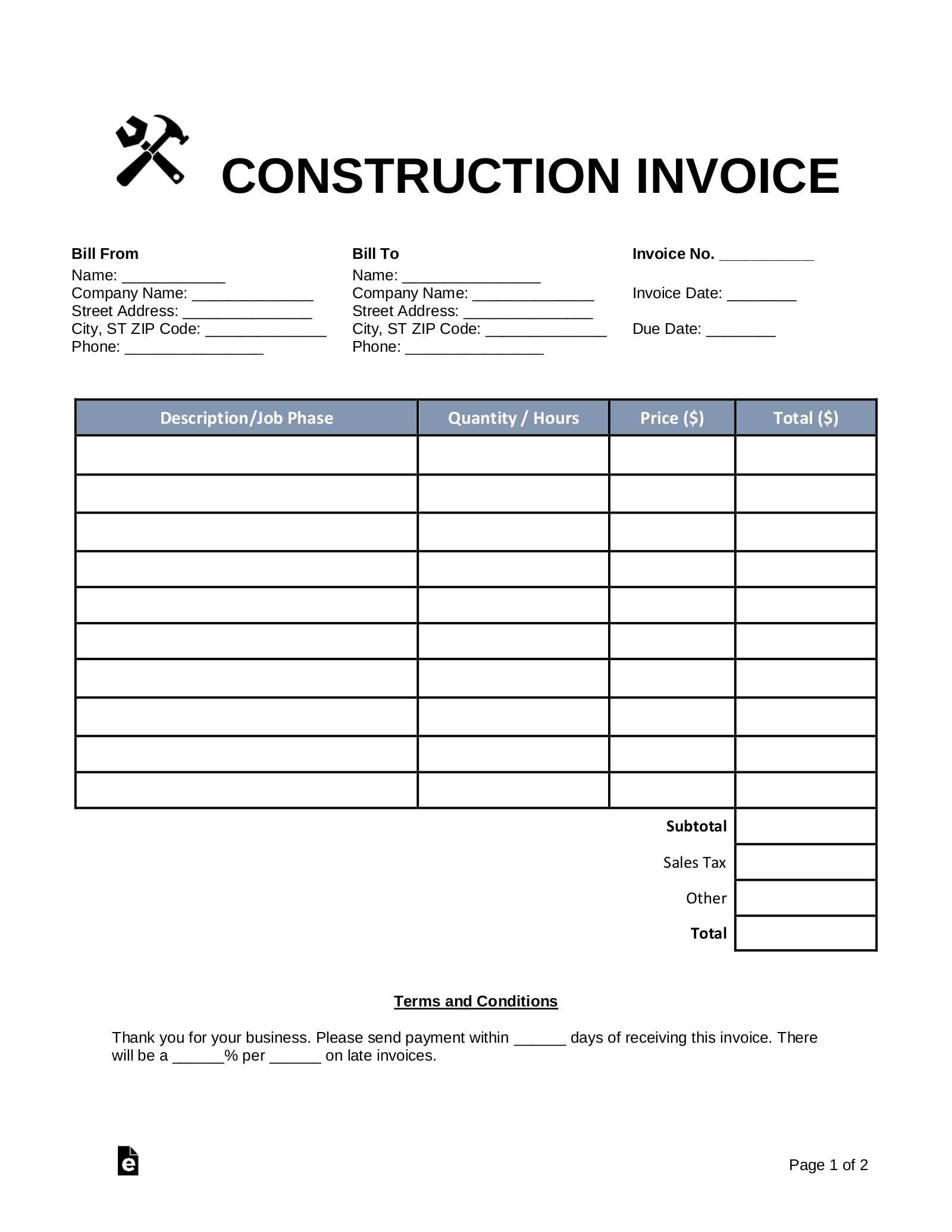

The first step is to focus on the core components that make up the document. This includes fields for your company name, contact information, as well as the client’s details. Clear breakdowns of products or services, prices, payment terms, and any applicable taxes should be outlined in a way that’s easy to follow. Consistency across all fields will enhance the professionalism and readability of your document.

Customization and Personalization Tips

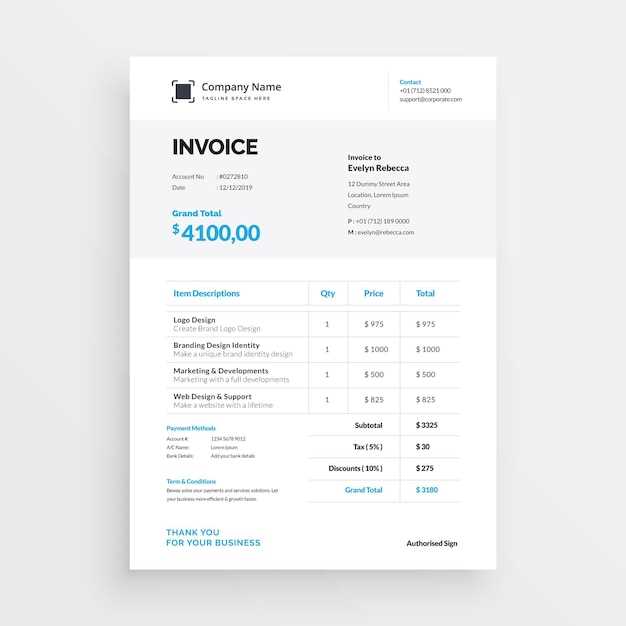

Once the basic structure is in place, consider personalizing the document to align with your brand. You can add your company logo, adjust the color scheme to match your branding, and ensure the design reflects the nature of your services. A unique yet simple design can help make the document stand out while still remaining functional and easy to understand.

Understanding the Importance of Invoice Templates

Having a standardized format for requesting payments is crucial in any operation. It ensures that all relevant details are included, minimizing the chances of confusion or mistakes. A well-structured document serves not only as a record of transaction but also as a professional tool that strengthens your brand’s image and establishes clear expectations with clients.

Key Benefits of Using a Structured Document

Implementing a consistent format for billing purposes provides several advantages, both for you and your clients:

- Consistency: A unified approach makes it easier for clients to understand the payment terms and helps you stay organized.

- Professionalism: A clean and well-organized document adds to your company’s credibility and fosters trust.

- Efficiency: A set format saves time during the billing process and reduces the need for manual entry or corrections.

- Legal Protection: Proper documentation ensures that you have all the necessary information in case of any disputes.

Streamlining Financial Processes

When creating a standardized form for payments, you also set the foundation for streamlining your financial operations. With a template, you can quickly adjust the details, update prices, and send invoices with little effort. This leads to faster payments, fewer mistakes, and more time to focus on growing your business.

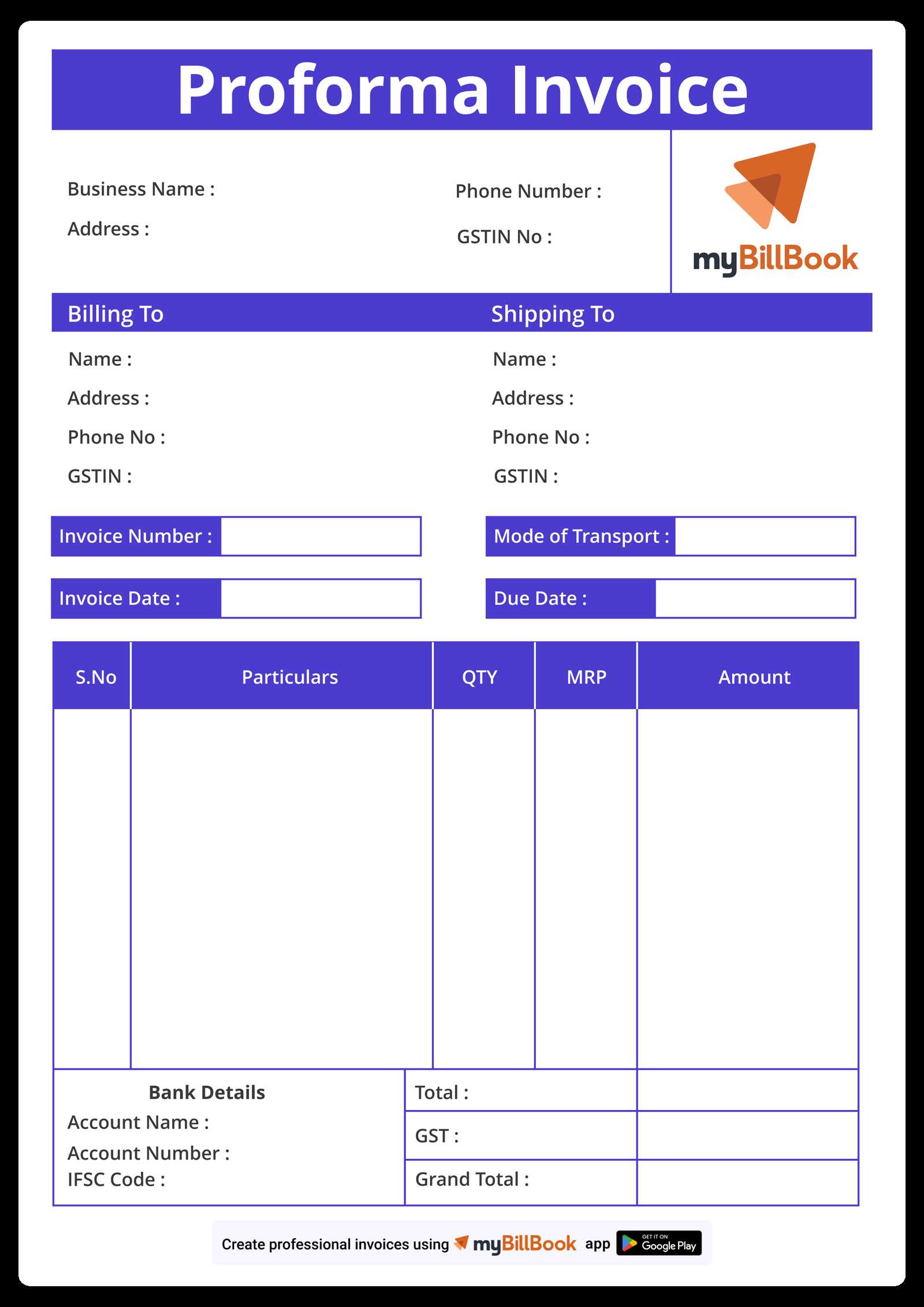

Key Components of an Invoice

To ensure that a payment request is clear and effective, it’s important to include all the necessary details. Each section of the document plays a crucial role in conveying the right information to both parties. By structuring it properly, you can avoid confusion, speed up the payment process, and maintain a professional image.

Basic Information to Include

There are several essential fields that must be filled out in every payment request. These elements ensure that both you and your client have a clear understanding of the transaction:

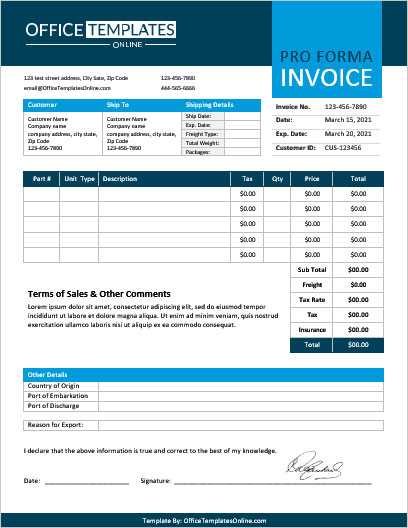

- Sender’s Details: Include your company’s name, address, and contact information. This helps the client know who is sending the request.

- Recipient’s Information: Clearly list the client’s name, business name (if applicable), and address.

- Document Number: A unique reference number is crucial for tracking and organizing requests. This is especially important for accounting purposes.

- Issue Date: Indicating when the payment request was created helps set clear timelines for payment deadlines.

Transaction Details

In addition to contact and identification information, it’s essential to break down the items or services being billed. This section should be clear and easy to follow:

- Description of Goods or Services: Provide a detailed list of what was provided, including quantities, unit prices, and any relevant descriptions.

- Payment Terms: Specify the due date, and if applicable, outline any discounts, penalties, or late fees.

- Total Amount Due: Clearly state the total cost, including applicable taxes and additional fees.

Choosing the Right Invoice Software

Selecting the right tool for generating payment requests is an essential step toward improving efficiency and accuracy in financial operations. A reliable software solution can automate key processes, reduce manual errors, and save valuable time. With a range of options available, it’s important to choose one that aligns with your needs and streamlines your billing workflow.

Factors to Consider When Selecting Software

When evaluating different software options, consider the following key factors:

- Ease of Use: The software should have an intuitive interface that allows you to generate and send requests without a steep learning curve.

- Customization Options: Look for tools that allow you to personalize documents with your logo, color scheme, and any specific layout preferences.

- Integration with Accounting Tools: It’s beneficial if the software can sync with other financial or accounting platforms you already use for a more seamless workflow.

- Payment Tracking and Reminders: Choose a solution that can automatically track payments and send reminders for overdue amounts, saving you the effort of manual follow-ups.

- Cost and Scalability: Ensure the software fits within your budget and can scale as your needs grow, whether you need more users, advanced features, or additional documents.

Popular Invoice Software Options

Here are some popular tools to consider when selecting the right solution for your payment processing needs:

- QuickBooks: A comprehensive accounting software that offers invoicing capabilities, expense tracking, and seamless integration with banking systems.

- FreshBooks: A user-friendly option with great customization features and automated payment reminders.

- Zoho Invoice: A versatile and affordable solution with excellent reporting features and integrations with other Zoho apps.

- Wave: A free, easy-to-use software that offers invoicing, payment processing, and basic accounting features.

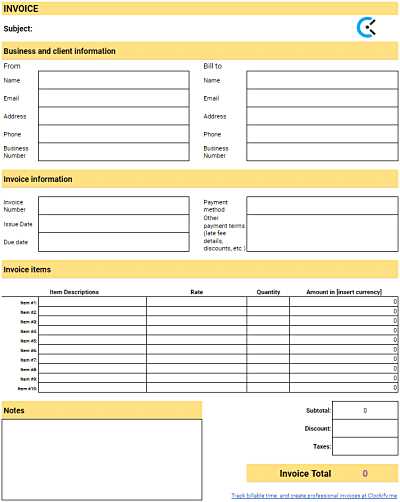

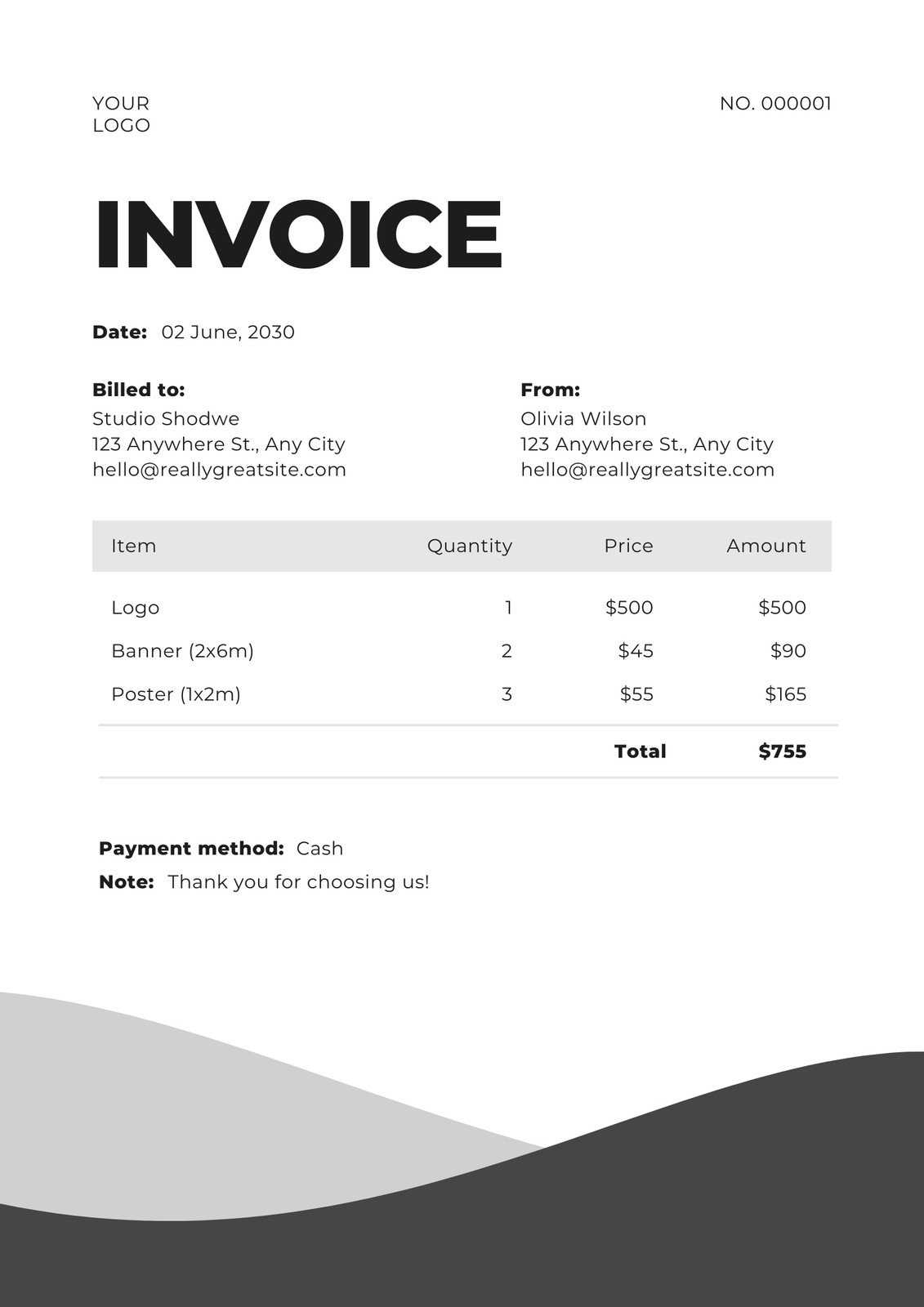

Designing a Simple Invoice Layout

A clear and clean layout is essential for making your payment request easy to read and understand. A well-organized document helps clients quickly locate key information such as pricing, payment terms, and contact details. By focusing on simplicity, you ensure that your document looks professional while remaining functional.

Essential Design Principles

When designing the layout of your request form, consider the following principles to enhance readability and visual appeal:

- Clear Structure: Divide the document into distinct sections–header, body, and footer–to make it easier to navigate.

- Use of White Space: Ensure enough spacing between different sections and lines of text. This prevents the form from feeling cluttered and makes it easier to focus on important details.

- Consistent Font Styles: Use easy-to-read fonts and maintain consistency throughout the document. Stick to one or two font types to avoid visual distractions.

- Logical Information Flow: Arrange the details in a sequence that makes sense, such as listing client details first, followed by the services provided, and then the payment information.

Best Practices for Layout Elements

In addition to general design principles, here are some tips for organizing the key components of your document:

- Header: Include your company’s name and logo at the top, followed by the client’s information. This provides immediate context.

- Service or Product Breakdown: Use a simple table format to list each item or service, along with the quantity, price, and total cost. This allows the client to easily review what they are being charged for.

- Total Section: Clearly display the total amount due, including taxes and fees, in a bold or highlighted area for emphasis.

- Footer: Add any relevant payment terms, instructions, or contact details in the footer section to keep the document clean while providing important info at the bottom.

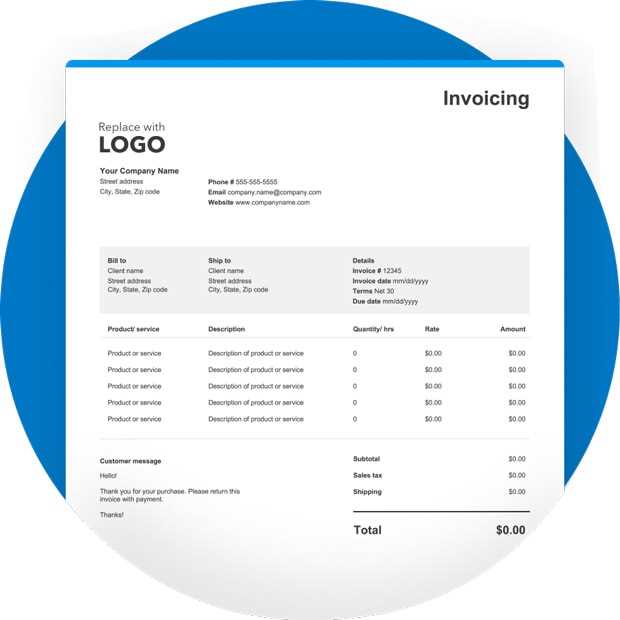

Adding Business Details to Your Invoice

Including your company’s essential information on a payment request is key to ensuring transparency and establishing trust. It not only helps the recipient identify the sender but also provides the necessary contact details for any follow-up. By properly displaying these elements, you make it easy for clients to get in touch and settle payments without confusion.

What Information to Include

Your contact information should be clearly visible, typically at the top of the document, so clients can easily reference it if they need to ask questions or resolve issues. The following details are crucial:

- Company Name: Your full legal or trade name should be prominent and easy to spot.

- Address: Include your physical address or the address of your main office. This helps clarify the location of your business.

- Phone Number: Providing a contact number makes it easier for clients to reach you quickly.

- Email Address: An email address ensures that clients can communicate efficiently, especially for non-urgent inquiries.

- Website: If applicable, include your website URL for clients who may need more information about your services or business.

- Tax Identification Number: If relevant in your region, include your business’s tax ID number to comply with legal requirements.

Formatting for Clarity

To keep your details clear and professional, avoid cluttering the header of the document with excessive information. Use a clean, easy-to-read layout that separates these details from the rest of the content. For instance, listing your company name and logo at the top left corner, followed by contact information in smaller text beneath it, is a simple yet effective approach. This helps clients quickly find the information they need without distraction.

How to Include Client Information

Correctly capturing and displaying the recipient’s details in a payment request is essential for smooth communication and accurate processing. Having the right client information ensures that the document reaches the intended party and can help resolve any issues that may arise during the payment process.

What Client Details to Include

To make sure that all necessary information is provided, include the following key elements:

- Client’s Full Name or Company Name: Clearly state the name of the person or company you are billing. This helps avoid any confusion about who the request is intended for.

- Billing Address: Including the client’s physical address ensures that you can follow up or send a physical copy of the document if needed.

- Email Address: An email address allows you to send the payment request directly to the client and helps with future communication.

- Phone Number: Providing a contact number can expedite communication in case there are any issues or queries related to the payment.

Formatting Client Information

Make sure to place the client’s details in a prominent section of the document, typically beneath the header or next to your business information. Using a clear, organized layout, such as placing the name, address, and contact information in separate lines or boxes, will help prevent confusion. This structured approach will also make it easier for your client to verify their details quickly before processing the payment.

Setting Payment Terms and Conditions

Clearly defining payment expectations is crucial for avoiding misunderstandings and ensuring that both parties are on the same page. Specifying the payment deadline, any applicable fees, and acceptable methods of payment can help smooth the transaction process and encourage timely settlement.

Key Elements to Define

To set clear terms, consider the following elements:

- Due Date: Clearly state when the payment is expected. This can be a fixed date or a specific number of days after the document is issued (e.g., “Due within 30 days”).

- Late Fees: If applicable, specify any charges that will be added for overdue payments. This could be a flat fee or a percentage of the total amount.

- Accepted Payment Methods: List the ways in which the payment can be made, such as bank transfer, credit card, or online payment platforms like PayPal.

- Discounts for Early Payment: If you offer any incentives for early settlement, make sure to clearly state the terms (e.g., “5% discount if paid within 10 days”).

Formatting Terms for Clarity

These conditions should be easy to find and clearly separated from other sections of the document. Place them in a designated area, typically at the bottom or in the footer, with enough space to highlight them. Using bullet points or a concise paragraph format will help your client quickly understand the expectations and avoid any confusion regarding payment obligations.

Incorporating Tax Information on Invoices

Including accurate tax details in your payment request is crucial for both legal compliance and clarity. Properly calculating and displaying taxes ensures that your clients understand the full cost of the transaction and helps avoid future disputes. It’s important to list any applicable taxes separately to maintain transparency.

When adding tax information, ensure that the following elements are clear:

| Tax Description | Tax Rate | Amount |

|---|---|---|

| Sales Tax | 5% | $10.00 |

| VAT | 20% | $40.00 |

| Total Tax | $50.00 |

Including Tax Breakdown

For full transparency, it’s helpful to break down the tax calculations. This means listing each tax type separately (e.g., VAT, sales tax, etc.) and clearly indicating the rate and amount being charged for each. This not only helps your client understand the calculation but also ensures compliance with tax regulations.

Formatting and Placement

Place tax information in a prominent section of the document, typically after the subtotal but before the total amount due. This ensures that clients can clearly see the impact of taxes on the final cost. A simple table format works well to keep the details organized and easy to read.

Using Invoice Numbers for Organization

Assigning unique reference numbers to each payment request is an essential step in keeping financial records organized and easily accessible. These numbers help distinguish one document from another, making it easier to track payments, manage client interactions, and maintain accurate accounting records. By adopting a consistent numbering system, you can improve both internal and external communication regarding financial transactions.

Why Invoice Numbers Matter

Invoice numbers provide a clear and systematic way to track all issued payment requests. The use of sequential or customized numbering not only helps in sorting and finding specific documents but also ensures that there are no duplicates or errors in your records. Here are some key reasons why they are important:

- Tracking: With unique identifiers, it’s easier to track payments and identify which documents have been paid or remain outstanding.

- Organization: Invoice numbers help you categorize and organize your financial documents, making it easier to manage your business’s accounting system.

- Legal Compliance: Having a clear and sequential numbering system helps ensure compliance with financial regulations, especially during audits.

Best Practices for Numbering

When assigning invoice numbers, consider these best practices:

- Sequential Numbers: Start with a simple sequence, such as INV001, INV002, and so on. This is easy to follow and ensures no gaps in your numbering.

- Yearly or Monthly Prefix: If you manage a large volume of documents, consider adding a year or month prefix (e.g., 2024-001 or JAN-001) to make it easier to identify when the request was issued.

- Avoid Gaps: Always ensure there are no skipped numbers, as gaps can create confusion or raise concerns about missing documents.

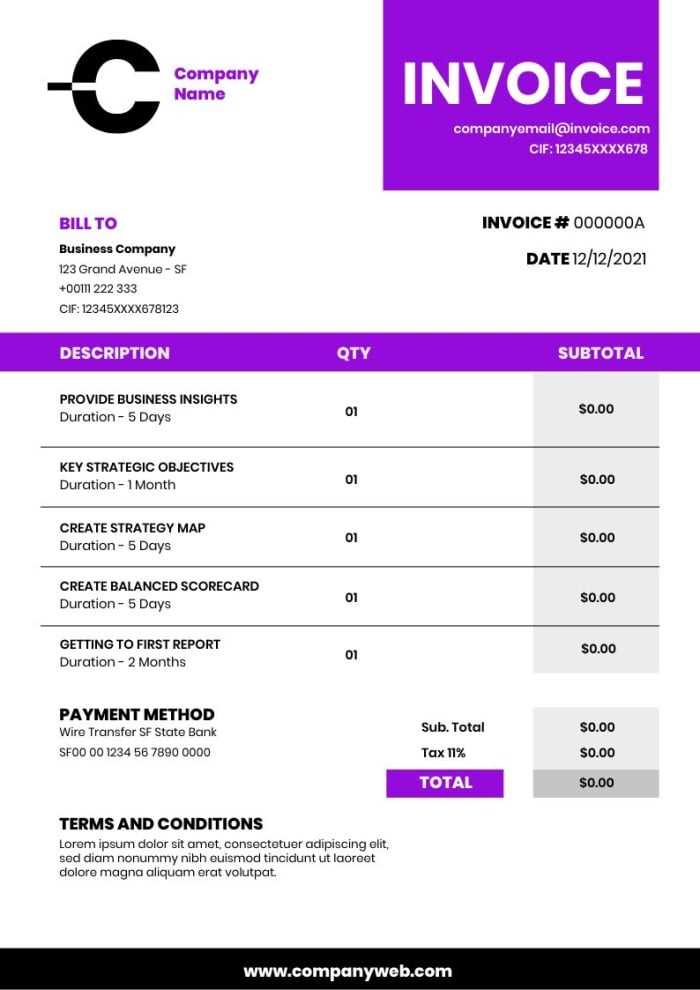

Customizing Your Invoice Template for Branding

Personalizing your payment request document not only helps reinforce your brand’s identity but also presents a professional image to clients. By incorporating your company’s unique design elements, you make the document stand out and reflect your business values. Customization ensures consistency across all client-facing communications, strengthening your brand’s recognition and credibility.

Key Elements to Customize

To align your payment request with your brand, focus on these key design elements:

- Logo: Including your company logo at the top of the document helps establish your identity and increases brand visibility.

- Color Scheme: Use your company’s official colors for headings, borders, and accents to create a cohesive and branded look.

- Font Style: Choose fonts that match your brand’s personality. Ensure they are readable but also reflect your company’s tone–whether modern, professional, or creative.

- Tagline or Slogan: Adding a company tagline or slogan subtly reinforces your brand messaging and leaves a lasting impression.

Using a Table for a Structured Layout

A clear, structured layout is essential for maintaining professionalism. A simple table can help organize the content in a way that is both visually appealing and easy to follow:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service A | 1 | $100.00 | $100.00 |

| Service B | 2 | $50.00 | $100.00 |

| Total | $200.00 |

This table format helps to organize important transaction details, making the document easy for your clients to read while providing a clean, professional look that aligns with your branding.

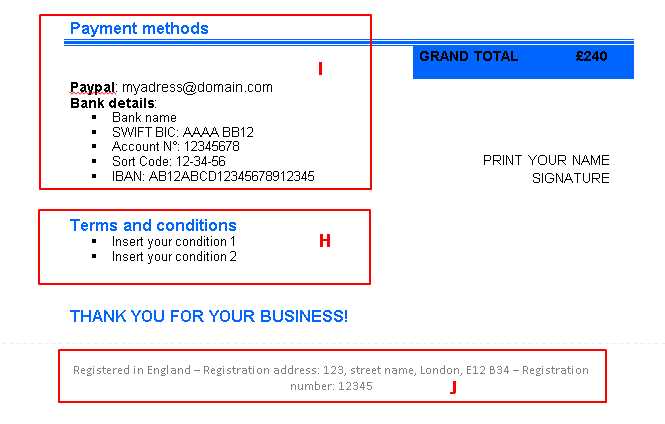

Creating a Professional Invoice Footer

The footer of a payment request is just as important as the rest of the document. It serves as the final section that wraps up the transaction details and provides any additional necessary information. A well-crafted footer adds professionalism to the document and can include essential items like payment instructions, legal disclaimers, and contact information.

Essential Components for the Footer

To ensure your footer is complete and functional, consider including the following elements:

- Payment Instructions: Clearly outline the preferred methods of payment, such as bank details, online payment links, or payment service platforms.

- Contact Information: Include your phone number, email, or other communication channels for any questions or support regarding the payment.

- Terms and Conditions: Briefly state any important terms, such as late fees, refund policies, or warranty information, that are relevant to the transaction.

- Legal Information: If required by law, include tax ID numbers, business registration details, or any other legally necessary information.

Designing the Footer for Readability

Although the footer contains essential information, it’s important not to overcrowd it. Keep the layout simple and organized. Use smaller font sizes than the rest of the document, but make sure the text is still legible. Consider separating different sections within the footer with lines or spaces to enhance readability. A clean and concise footer leaves a positive impression and allows clients to easily access the key details they need for completing the transaction.

How to Format Your Invoice for Clarity

Proper formatting is key to ensuring that your payment request is both professional and easy to understand. By organizing the document in a clear and logical manner, you can avoid confusion, improve communication with clients, and ensure that all relevant details are easy to locate. A well-structured document helps the client quickly verify the transaction details, leading to faster payments and fewer disputes.

Tips for Clear Layout

Follow these formatting best practices to keep your payment request clear and concise:

- Use Headers and Subheaders: Organize information with distinct sections using bold or larger fonts for headers. This will help clients quickly navigate through the content.

- Include Adequate Spacing: Ensure there’s enough white space between sections. A crowded document can be overwhelming and hard to read.

- Align Information Properly: Align text and numbers neatly. For example, prices should be right-aligned, while descriptions and terms can be left-aligned.

- Keep Fonts Simple: Choose clear, readable fonts (e.g., Arial, Times New Roman) and avoid using too many different font styles or sizes.

- Use Tables for Itemization: For listing services or products, use tables to break down the details, such as quantity, unit price, and total. This enhances readability and clarity.

Including a Summary Section

A summary at the end of the document, including subtotal, taxes, discounts, and total amount due, can help clients quickly check the full amount they owe. This section should be distinct from the rest of the document, either by bolding the totals or placing them in a separate box, so they stand out clearly.

By keeping these tips in mind, you can ensure that your payment request is not only clear and organized but also reflects your professionalism and attention to detail.

Common Mistakes to Avoid in Invoices

Even small errors in a payment request can lead to confusion, delays in payment, or even legal issues. It’s important to ensure that every detail is accurate and well-organized. By understanding and avoiding common mistakes, you can improve the effectiveness of your documents and enhance client relationships.

Key Errors to Watch Out For

- Incorrect or Missing Details: Failing to include important information such as the recipient’s name, correct payment terms, or your contact details can lead to confusion and delays. Always double-check the accuracy of these fields.

- Ambiguous Payment Terms: Vague or unclear payment instructions can cause misunderstanding. Clearly state the payment due date, accepted methods, and any applicable penalties for late payments.

- Forgetting Tax Information: Omitting taxes or incorrectly calculating them is a common mistake that can create problems for both you and your client. Ensure all applicable taxes are clearly listed with the correct rates.

- Wrong or Missing Invoice Number: Skipping an invoice number or reusing a number can cause confusion and make it difficult to track payments. Always use a unique and sequential numbering system.

- Inconsistent Formatting: A lack of structure can make the document harder to read. Use tables, bold headers, and bullet points to organize information clearly. A messy document can create a negative impression of your professionalism.

Double-Check Before Sending

Taking a few minutes to review the payment request before sending it can help catch these common mistakes. A quick final check for typos, accurate details, and organized layout can save you time and prevent costly errors. In addition, using accounting software or digital tools can help automate some of these processes, reducing the likelihood of mistakes.

Automating Invoice Creation for Efficiency

Automating the process of generating payment requests can significantly improve productivity and reduce human error. By using software or tools designed for this purpose, you can streamline your workflow, minimize the time spent on manual tasks, and ensure consistent, accurate documents every time. Automation allows you to focus more on your core business activities while ensuring that financial transactions are handled efficiently and professionally.

With the right automation system in place, key details such as client information, transaction amounts, and payment terms can be pre-filled based on existing data, eliminating the need for repetitive entry. This not only speeds up the process but also ensures consistency and accuracy in every document issued.

Many invoicing platforms offer templates, recurring billing options, and integration with accounting software to further simplify the process. By automating, you can also track payments in real-time, sending reminders for overdue amounts and improving cash flow management.

Saving and Exporting Your Invoice Template

Once you’ve designed and customized your payment request document, the next step is to save and export it for future use. Properly saving your document ensures that it can be accessed, edited, and reused whenever necessary. Exporting it in the right format is equally important for sharing it with clients or integrating it into your accounting system.

Steps to Save Your Document

After finalizing your design, follow these steps to save your document properly:

- Save a Master Copy: Always keep a master version of your document that you can edit. This will allow you to make any necessary updates without starting from scratch each time.

- Use Descriptive File Names: Name your file with a clear and descriptive title (e.g., “Payment_Request_CompanyName”) so you can quickly identify it later.

- Store It in a Safe Location: Use a folder or cloud storage service where you can easily retrieve your document. Regular backups will also help protect your files from accidental loss.

Choosing the Right Format for Export

Exporting your document in a commonly used format ensures compatibility across different platforms and makes it easier to share with clients. Some of the most popular formats include:

- PDF: This format preserves the layout and formatting across different devices and ensures that no changes can be made to the content after it’s sent.

- Word or Google Docs: If you need to make frequent edits, saving the document in a Word or Google Docs format allows for easy updates and customization.

- Excel: For a detailed, itemized breakdown, an Excel file may be ideal as it allows for automatic calculations and adjustments.

By saving and exporting your payment request properly, you ensure that your documents remain accessible, editable, and professional, streamlining your financial workflows for greater efficiency.