How to Create a Free Invoice Template

When running a business, one of the key tasks is organizing financial transactions in a professional and clear manner. For many entrepreneurs and small business owners, finding a simple yet effective way to create documents for payment requests can save time and ensure consistency. There are numerous methods available, from advanced software to manual options, but the right approach depends on the nature of the work and personal preferences.

Building a document that suits your needs doesn’t require expensive tools or complicated software. With just a few basic elements, you can design an efficient structure that looks polished and communicates all necessary information. Customizing such a document ensures that it aligns with your brand, while also remaining straightforward for your clients to understand.

In this guide, we will explore simple steps to generate the perfect financial request document without the hassle of costly services or complex designs. Whether you’re looking for flexibility or consistency, you’ll find various options to help streamline your billing process, allowing you to focus more on what matters most–growing your business.

How to Design a Free Invoice Template

Creating a clear and professional document for billing clients is an essential task for any business. A well-structured document ensures that all necessary information is communicated effectively, minimizing confusion and errors. Designing this kind of document is not as complex as it may seem. By focusing on key elements and utilizing available tools, you can create a polished and functional layout that serves your needs perfectly.

Start by considering the main details that need to be included in your document. Essential components like your contact information, the client’s details, a description of services or products, payment terms, and total amounts must be clearly presented. By organizing these elements in a logical and visually appealing way, you ensure that your billing requests are easy to read and understand.

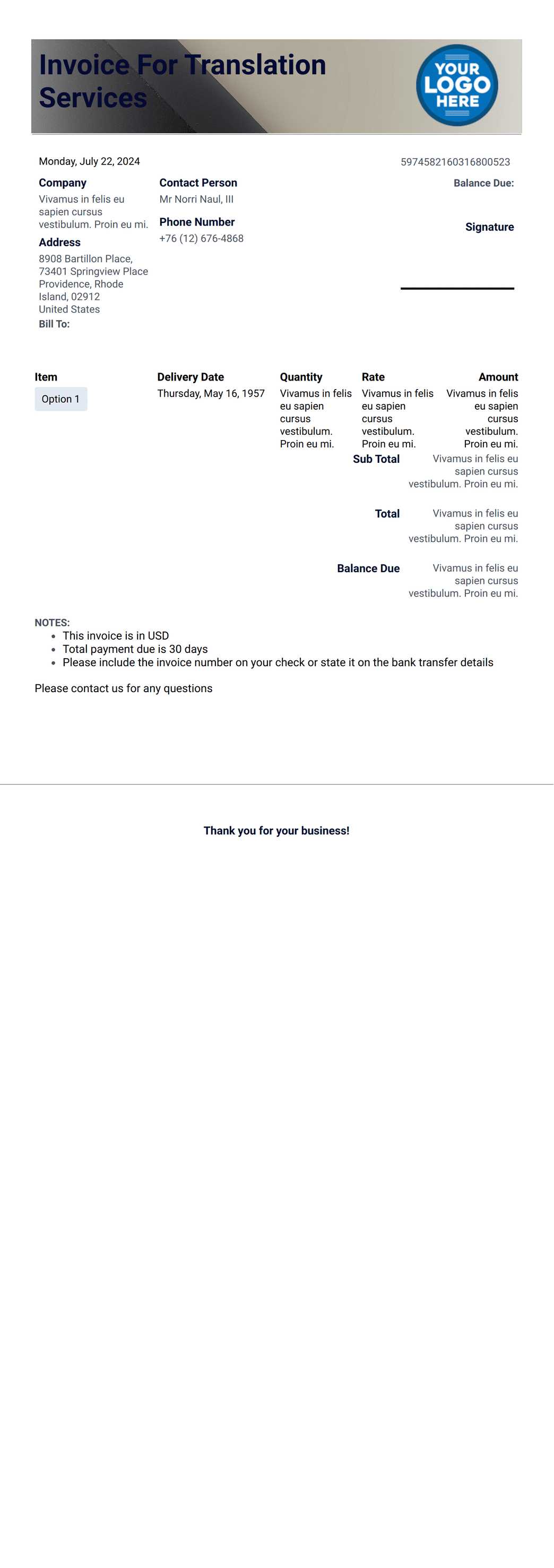

Another important aspect is customizing the design to reflect your brand identity. Using your company logo, specific fonts, and color schemes can give the document a professional touch. Fortunately, many online tools and platforms offer customizable formats that allow you to quickly adjust these elements without any design experience.

Once you’ve organized the layout and design, make sure to save your document in a format that is easily shareable and compatible with common software. PDF is often the best choice, as it ensures that the document looks the same across all devices. With these simple steps, you’ll have a functional and visually appealing document that can be used time and again for your business transactions.

Choosing the Right Format for Invoices

Selecting the appropriate structure for billing documents is crucial to ensure clarity and professionalism. The format you choose directly impacts how easy it is for your clients to understand the charges and terms outlined. A well-organized layout allows the client to quickly identify key details such as the amount due, payment methods, and deadlines, reducing the chance of errors or confusion.

Consider whether you prefer a simple or detailed design. For businesses that deal with straightforward transactions, a minimalist approach may be best. In contrast, more complex services or products might require a detailed format that includes breakdowns of costs, taxes, and additional fees. Regardless of the complexity, always prioritize legibility and consistency across the document.

Another important factor to keep in mind is compatibility. Choose a format that can be easily shared and opened by your clients, regardless of their device or operating system. Commonly used formats like PDF or Word documents ensure that your billing details remain intact and accessible. Additionally, these formats allow for easy printing, which some clients may prefer for their records.

Ultimately, the right format depends on your business needs and the preferences of your clients. Ensure that whatever structure you choose, it aligns with your brand’s image and facilitates smooth communication. A well-designed billing document will help you maintain professional relationships and encourage timely payments.

Benefits of Using a Free Invoice Template

Utilizing a pre-designed document for billing can bring numerous advantages to any business. With a ready-made format, you save time on creation, avoid mistakes, and ensure consistency across all transactions. Instead of starting from scratch each time, a structured layout offers a streamlined process that allows you to focus more on your core business activities.

Time and Cost Efficiency

One of the main benefits of using a pre-built structure is the time it saves. Instead of designing documents from the ground up, you can quickly input the necessary details, and the format is ready for use. This can significantly reduce the amount of time spent on administrative tasks. Additionally, opting for a ready-made solution eliminates the need to invest in expensive software or hire external professionals, making it a cost-effective choice for small business owners or freelancers.

Consistency and Professionalism

Having a standardized design ensures that all your billing documents have a consistent look and feel. This consistency reinforces your brand’s image and adds a level of professionalism to every transaction. Clients will receive clear, easy-to-read documents that include all the necessary details, which can improve your credibility and reduce misunderstandings regarding payments.

Overall, using a ready-made solution for billing documents is an excellent way to streamline your workflow, maintain professionalism, and reduce administrative costs. By focusing on the content rather than the design, you ensure a faster, more reliable process for both you and your clients.

Top Tools for Creating Invoices

There are many online resources available to help you quickly design and generate professional billing documents. Whether you prefer a simple tool or a feature-rich platform, the right tool can make the process much easier and more efficient. Below are some of the most popular options, each offering unique features to suit different business needs.

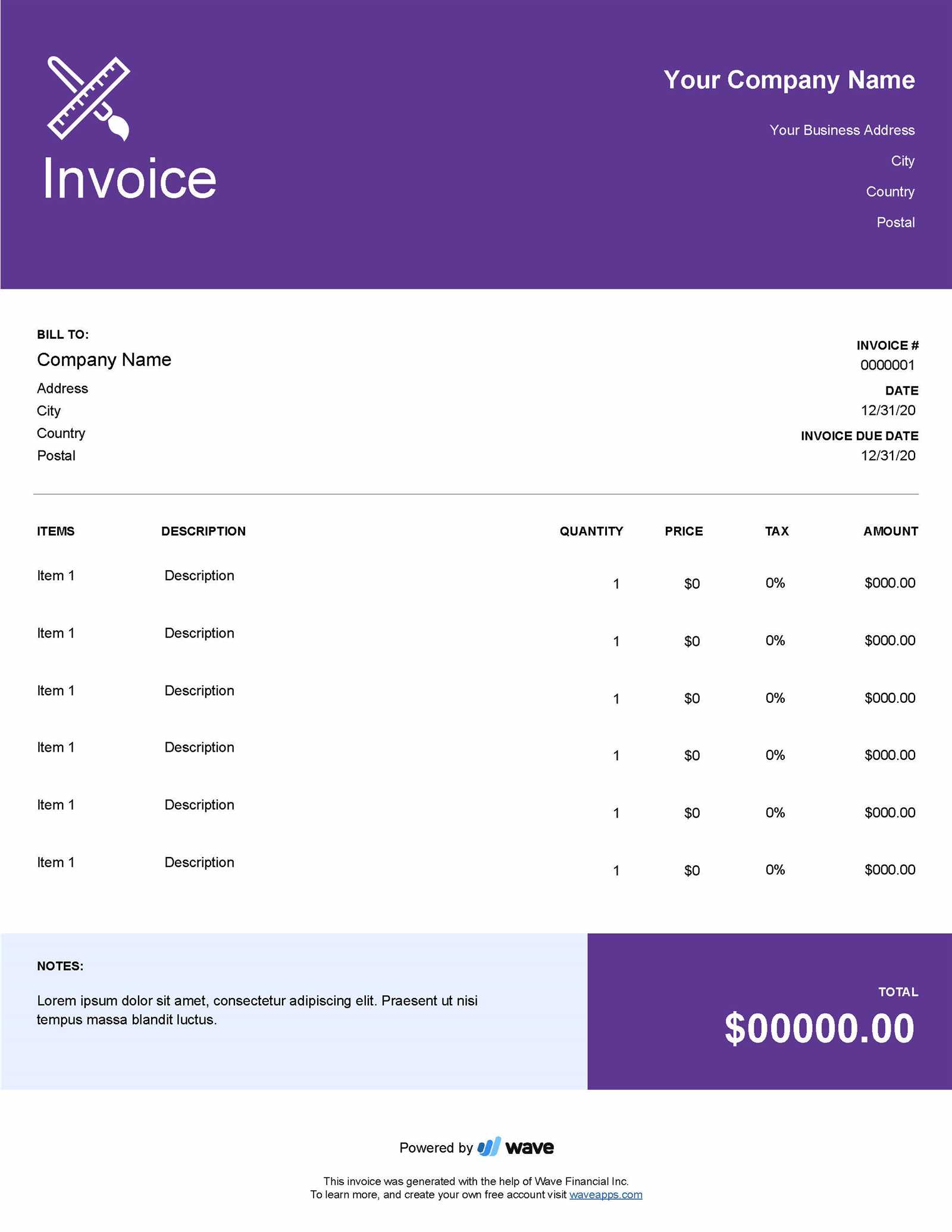

- Wave – A versatile platform that offers a free suite of accounting and billing tools. It allows you to easily create, customize, and send documents without any cost.

- Zoho Invoice – A comprehensive solution with a user-friendly interface, allowing you to design and track payments seamlessly. It includes automated reminders and customizable layouts.

- Canva – Known for its simple drag-and-drop design tools, Canva lets you create visually appealing documents with various templates that can be easily personalized.

- PayPal Invoicing – An excellent choice for businesses already using PayPal, this tool allows for fast and straightforward billing with integrated payment processing.

- Microsoft Word or Google Docs – Ideal for those who prefer manual customization, these tools allow for easy creation of documents with basic design features and are perfect for basic needs.

Each of these platforms has its own strengths, so it’s important to choose the one that best fits your business model and desired level of customization. Whether you need an all-in-one tool or something simple and free, these options can help streamline your billing process and keep everything organized.

Customizing Your Invoice Template for Branding

Personalizing your billing document is an important step in reinforcing your company’s identity. By adding elements of your brand to the design, you ensure that the document reflects your business values and stands out in the client’s mind. Customizing these details creates a cohesive experience for your clients, making the transaction feel more professional and aligned with your brand.

Start by incorporating your company’s logo at the top of the document. This simple addition immediately signals professionalism and establishes a visual connection between the billing document and your business. Next, consider using your brand’s colors for headings, borders, or background elements. This helps create consistency across all of your business materials, from websites to physical marketing assets.

The fonts you choose can also enhance your brand’s voice. If your business uses a specific font in its marketing materials, incorporate it into the billing document to keep the look uniform. Additionally, ensure the text is clear and easy to read, as readability is key in any business transaction. Lastly, include contact details in a well-structured way–your phone number, email address, and website URL–so clients can easily reach out if necessary.

By following these simple steps, you can ensure that your billing documents not only look professional but also reflect the essence of your business, creating a stronger and more consistent brand identity.

Essential Elements of an Invoice

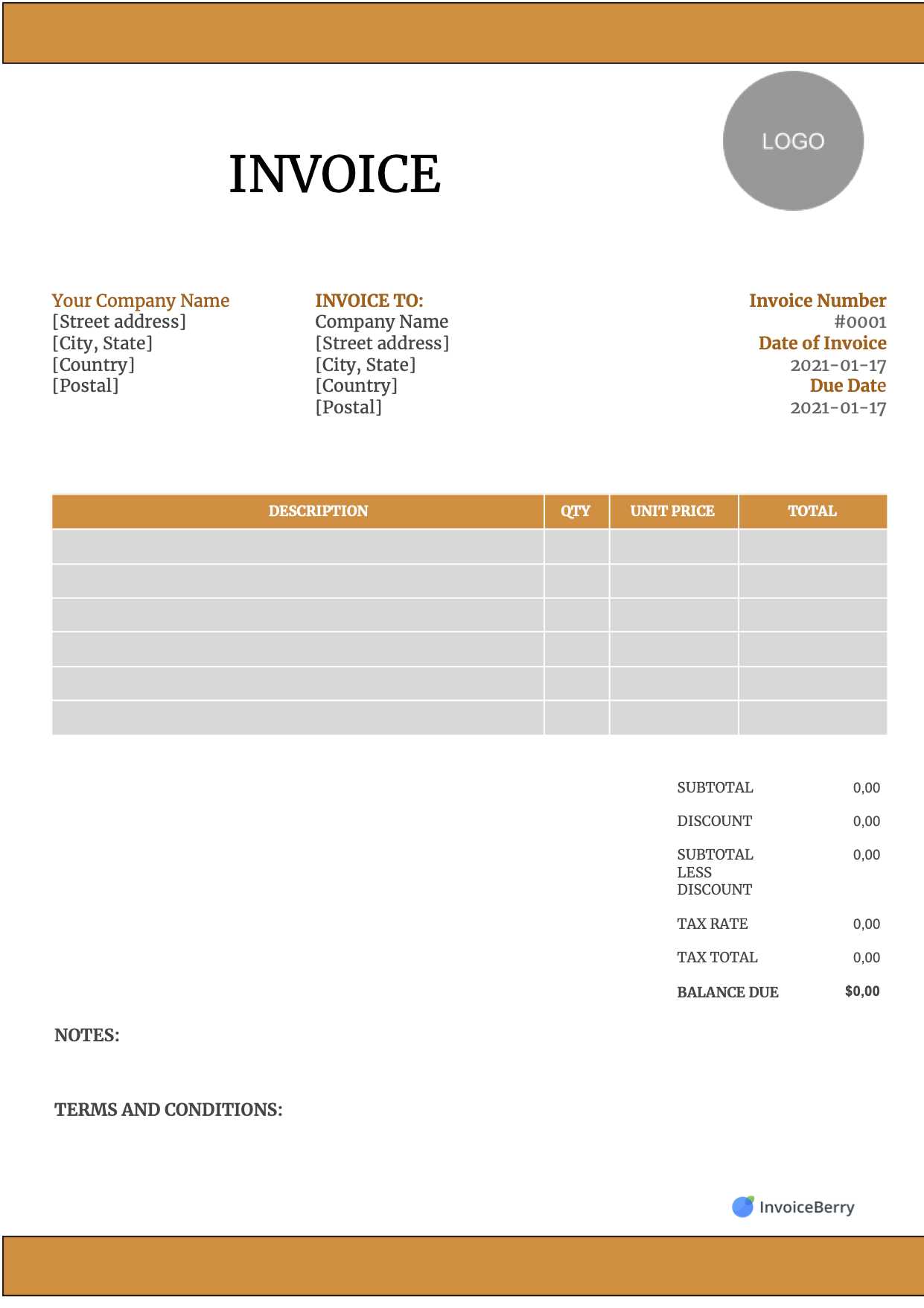

A well-constructed billing document is more than just a request for payment; it must clearly convey all the necessary information to avoid confusion and ensure smooth transactions. There are several key components that should always be included to make the document complete, transparent, and easy for your clients to understand.

Key Information to Include

At a minimum, every billing document should contain your company’s name, address, and contact details. These elements ensure that the client can easily identify the source of the charge and reach out if needed. Similarly, including the client’s name and contact information makes the document personalized and avoids any mix-ups between clients. A unique document number is also essential for tracking purposes and avoiding any potential confusion with previous or future transactions.

Details of Services or Products

Clearly listing the services or goods provided is crucial for transparency. Each item should be accompanied by a brief description, quantity, unit price, and total cost. This breakdown ensures the client understands exactly what they are paying for, preventing disputes over charges. Additionally, including any relevant dates, such as the service period or delivery date, adds clarity to the document.

Finally, don’t forget to specify the payment terms, including the total amount due, accepted payment methods, and any applicable taxes. Setting clear expectations regarding due dates and late fees ensures that both parties are on the same page, making it easier to manage payments and avoid delays.

How to Add Tax Information to an Invoice

Including tax details in your billing documents is essential for compliance and transparency. Properly displaying tax information not only helps your clients understand the breakdown of charges but also ensures that your business adheres to local tax regulations. There are several key steps to follow when adding tax information, making sure it is both accurate and clear.

Identifying the Correct Tax Rate

The first step is to identify which tax rate applies to your transaction. This can vary depending on your location, the nature of the goods or services provided, and whether your client is located in a different tax jurisdiction. In many cases, this will be a standard sales tax rate, but some products or services may qualify for special rates or exemptions. It’s important to research and apply the correct tax rate to avoid any legal issues or errors in billing.

Presenting the Tax Details Clearly

Once the correct rate has been determined, the next step is to display the tax amount clearly in the billing document. This can be done by adding a line item specifically for tax charges, showing both the percentage and the amount. You should also include the subtotal before tax, followed by the total amount after tax. This breakdown allows the client to see exactly how much they are paying for the product or service and the tax applied. Additionally

Creating a Professional Invoice in Minutes

Generating a polished billing document doesn’t need to be a time-consuming task. With the right tools and a clear structure, you can produce professional-looking requests quickly and efficiently. The key is to focus on the essential elements and use a streamlined approach that minimizes effort without sacrificing quality.

Using Pre-Built Designs

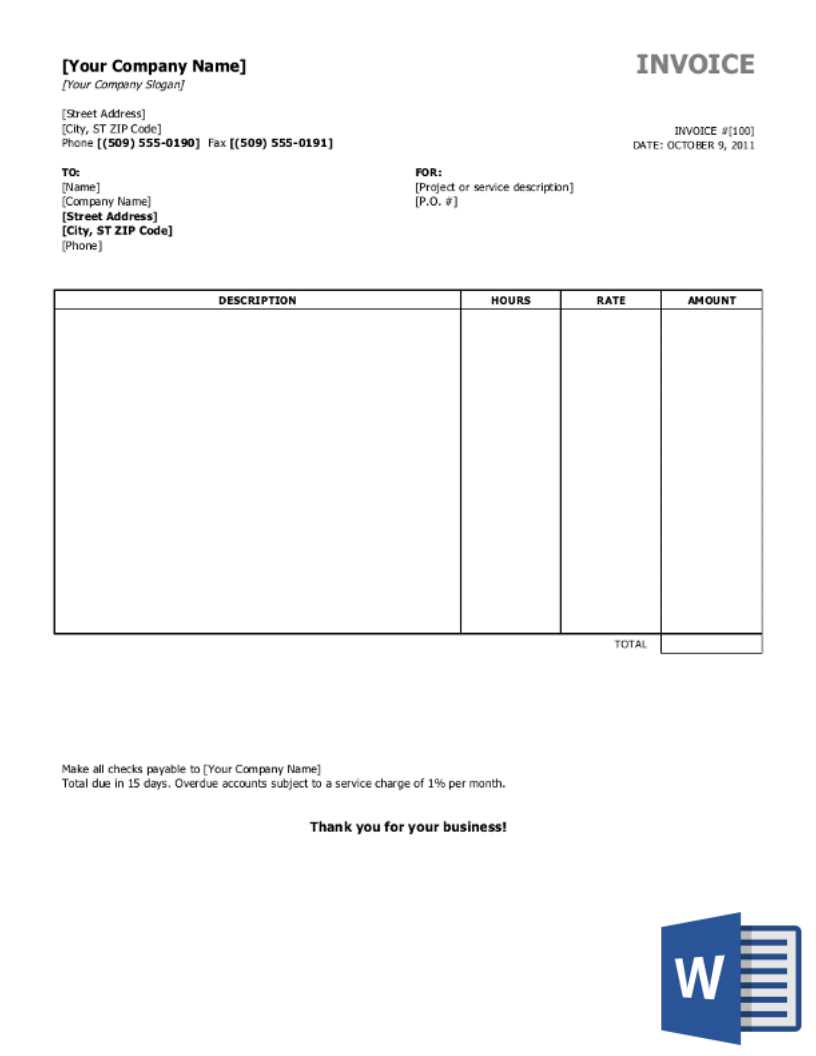

One of the fastest ways to generate a clean and professional document is to use pre-designed layouts. Many online platforms offer ready-made formats where you only need to input the necessary information, such as service descriptions, payment amounts, and contact details. These templates are customizable, so you can adjust them to fit your branding without having to start from scratch.

Keep It Simple and Clear

To create a professional document in minutes, it’s important to avoid clutter. Focus on clarity by organizing the key components, such as company details, client information, services provided, and total amounts, in a simple and logical layout. Keep the design minimalistic but consistent with your brand, using your company logo and colors. With these elements in place, you’ll have a professional and efficient billing document ready to send in no time.

Free Invoice Template Options You Should Know

There are several resources available that offer downloadable and customizable formats for generating billing documents at no cost. These tools are designed to make the process simple, whether you’re just starting your business or managing a large number of transactions. Knowing which options are available can save time and help you maintain a professional appearance without the need for complex software or expensive subscriptions.

Online Platforms with Customizable Designs

Many websites provide a variety of ready-to-use formats that can be easily customized with your details. These online platforms often feature a range of styles, from minimalist layouts to more detailed designs, allowing you to pick one that suits your brand. The best part is that these platforms typically allow you to download the document in multiple formats, such as PDF or Word, ensuring compatibility with different systems.

Spreadsheets for Easy Customization

For those who prefer a more hands-on approach, using spreadsheet software like Google Sheets or Microsoft Excel is an excellent alternative. Both platforms offer pre-built spreadsheets designed for billing purposes, with fields for inputting prices, taxes, and other necessary details. These formats provide the flexibility to easily adjust formulas and calculations, making them ideal for businesses that require frequent updates or changes to pricing.

By taking advantage of these accessible options, you can create professional and effective billing documents that meet your needs without any financial investment. Whether you choose a simple online platform or a spreadsheet-based format, these resources ensure that you can focus on your business, not on creating paperwork.

How to Include Payment Terms on Invoices

Clearly stating payment terms in your billing document is crucial for setting expectations and ensuring timely payments. Defining payment conditions can help avoid misunderstandings and foster professional relationships with your clients. Including this information upfront ensures that both parties are aware of the agreed-upon terms, such as due dates, late fees, and available payment methods.

Specify Due Dates and Deadlines

One of the most important aspects to include is the payment deadline. This should be clearly stated in the document, typically near the total amount due. You can use terms like “Due upon receipt,” “Due within 30 days,” or specify an exact date to make the expectation clear. This will prevent any confusion about when the payment should be made and help keep your cash flow on track.

Late Fees and Early Payment Discounts

It is also wise to mention any penalties for late payments or discounts for early settlement. If your business has a policy for charging interest on overdue amounts, ensure that this is clearly outlined, specifying the interest rate or flat fee that will be applied. Similarly, if you offer a discount for clients who pay early, include the percentage or amount and the timeframe in which this offer is valid. These incentives can encourage clients to pay on time and help maintain a smooth billing cycle.

Including these details in your document helps manage expectations and reduces the chance of disputes. With clearly defined payment terms, both you and your clients will be on the same page regarding when and how payments are to be made.

How to Create an Invoice in Google Docs

Google Docs offers a simple and accessible way to generate professional billing documents without needing specialized software. Whether you need to send a quick request for payment or create a detailed breakdown of services, this platform provides the tools to customize your document to suit your business needs. Using Google Docs allows you to create and edit billing forms quickly, store them securely in the cloud, and share them with clients in real time.

Start with a Blank Document or Pre-Built Layout

The first step is to open a new document in Google Docs. You can either start with a completely blank document or use a pre-designed layout available within Google Docs or from third-party sources. Starting from scratch gives you full control over the design, but using an existing layout can save time and offer a more professional look. If you choose a pre-built option, make sure to modify it with your business details, such as your company name, logo, and payment terms.

Include Essential Details

Next, input all the necessary information. This includes your company’s contact information, the client’s details, a description of the goods or services provided, the price for each item, and the total amount due. It’s essential to also include payment terms such as due dates, accepted payment methods, and any applicable taxes or discounts. Organize the document clearly, using headings, bullet points, or tables to ensure that the information is easy to read and understand.

Once you’ve completed your document, you can save and share it in different formats, such as PDF or Word, ensuring that it remains accessible and professional for your clients.

Making Your Invoice Mobile-Friendly

In today’s digital world, many people view documents on their mobile devices, including billing statements. Ensuring that your document is easy to read and navigate on smaller screens is essential for maintaining a professional image. A mobile-friendly layout allows your clients to quickly access and understand the details of their payment, improving their experience and reducing the chances of mistakes or delays.

Key Considerations for Mobile Optimization

- Simplify Layout: Avoid clutter and keep the design straightforward. Use clear headings and well-organized sections to ensure easy navigation on mobile screens.

- Use Large Fonts: Small text can be difficult to read on mobile devices. Choose larger fonts for key information like the total amount due and payment due dates to enhance visibility.

- Limit Horizontal Scrolling: Ensure that your document fits within the screen width, eliminating the need for horizontal scrolling. Use single-column layouts to maintain readability.

- Optimize Images: If you’re including logos or images, make sure they are optimized for mobile by resizing them appropriately. Large images can cause the document to load slowly or display incorrectly.

Testing Your Document

Before sending out your billing document, it’s important to test how it appears on different devices. Open the document on a mobile phone and check for readability. Make adjustments as necessary, ensuring that everything from text to images appears clear and well-spaced. You can also ask a colleague or client to review the document on their device to get feedback on its mobile-friendliness.

By following these simple steps, you can ensure that your billing documents are accessible and easy to read, no matter how your clients access them.

How to Save and Share Your Invoice

Once your billing document is ready, it’s important to save and share it in a way that’s both secure and accessible for your clients. Choosing the right format and sharing method ensures that your client can easily access and pay the amount due without complications. Whether you need to send the document via email, share it through a cloud platform, or print it for physical delivery, there are various options to consider.

Saving the Document in the Right Format

The first step is to save your document in a format that is easy to view and doesn’t alter its layout when opened. The most commonly used formats are:

- PDF: This is the most popular format for billing documents because it preserves the layout and design, ensuring that the document looks the same across different devices and platforms.

- Word or Google Docs: If you need to make further edits or want to share the document in a more editable format, saving it as a Word file or in Google Docs is a good choice.

Sharing the Document with Clients

Once saved, you can send the document to your client using various methods depending on their preference:

- Email: Attach the saved document to an email for quick delivery. Be sure to include a clear subject line and a brief message that explains the purpose of the document.

- Cloud Storage: Upload the document to a cloud storage service like Google Drive, Dropbox, or OneDrive. Then, share the link with your client, allowing them to view or download it securely.

- Printing and Mailing: If you need to send a physical copy, print the document and mail it to the client. Make sure to keep a copy for your records.

By following these steps, you can ensure that your billing documents are properly saved and easily shared with your clients, reducing the risk of errors and delays.

Why Keep Invoices Organized and Updated

Maintaining accurate records of all billing documents is crucial for any business. Not only does it help with financial tracking and ensuring timely payments, but it also plays a key role in legal and tax compliance. Keeping your documents well-organized and up-to-date ensures smooth operations and helps avoid costly mistakes that could affect your cash flow or business reputation.

Benefits of Keeping Records Organized

Organizing your billing records offers a range of benefits, including:

- Faster Payment Tracking: With an organized system, you can easily track outstanding balances and follow up on overdue payments promptly.

- Efficient Financial Planning: Accurate records help you forecast revenue, plan for taxes, and manage cash flow effectively.

- Compliance with Tax Laws: Having a clear record of all transactions ensures that you can report your income correctly and are prepared for audits if needed.

Keeping Documents Updated

Along with organization, keeping your documents current is equally important. Each new billing document should reflect any changes in pricing, payment terms, or services. Failing to update your records can lead to confusion with clients and financial discrepancies that are difficult to resolve later. Additionally, updating your billing documents ensures that you are charging the correct amounts and applying the right tax rates.

Below is an example of how keeping your billing records organized can help track payments and ensure no detail is overlooked:

| Document Number | Date Issued | Amount Due | Status |

|---|---|---|---|

| #001 | 2024-10-01 | $500 | Paid |

| #002 | 2024-10-05 | $300 | Pending |

| #003 | 2024-10-10 | $700 | Overdue |