House Cleaning Invoice Templates for Quick and Easy Billing

Managing finances and client interactions is crucial for any business, especially when it comes to providing services. Clear and organized documentation plays a vital role in ensuring timely payments and maintaining professional relationships. Having a well-structured billing document helps streamline the payment process and reduces the risk of confusion.

For service providers, using a predefined structure for documenting charges can save valuable time and effort. Whether you are offering residential assistance or commercial services, creating a consistent format for your charges is essential. By customizing your billing paperwork to fit your specific needs, you can ensure accuracy and professionalism in every transaction.

With the right format, you can also track services delivered and amounts due, offering a transparent overview for both parties. These structured documents contribute to improving overall business operations and make it easier to manage financial records. Efficiency and clarity are key when it comes to managing your business’s finances.

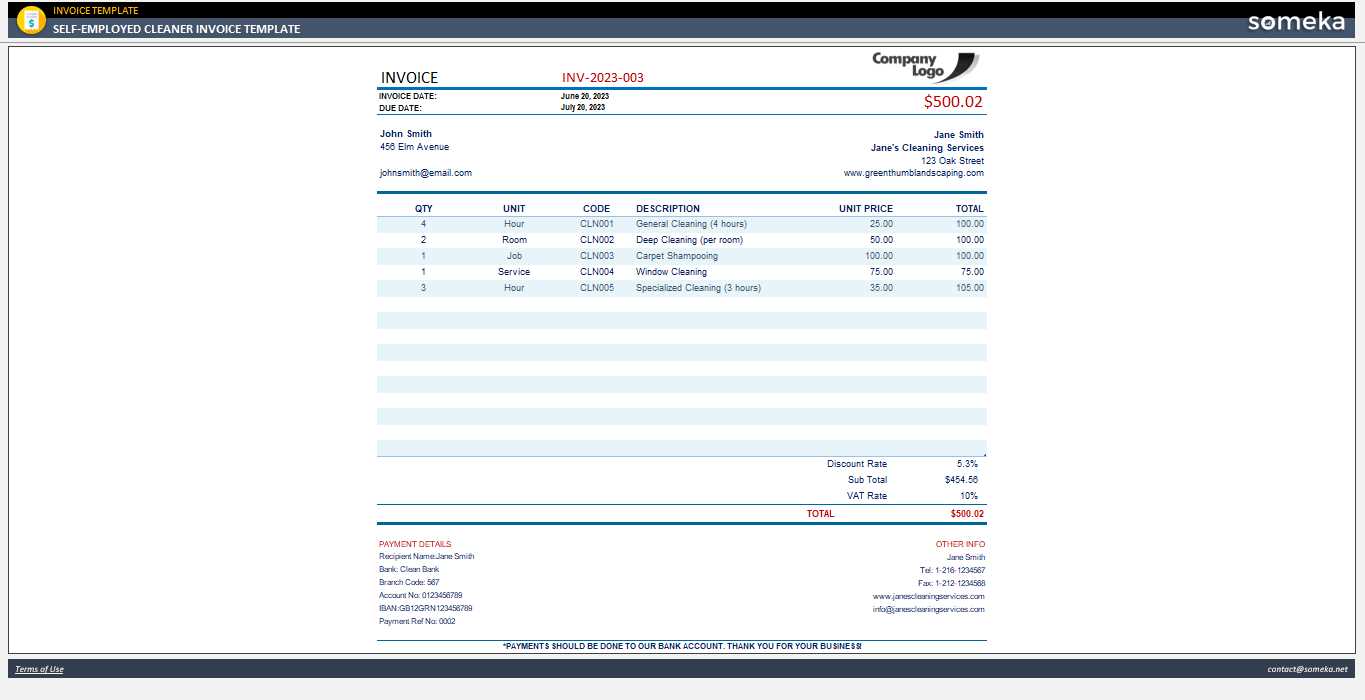

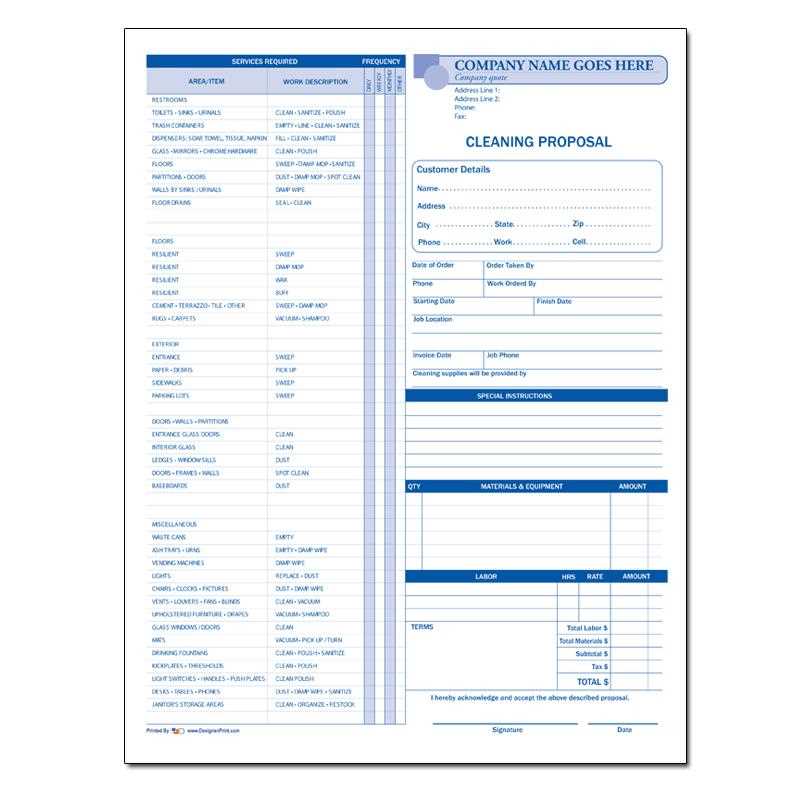

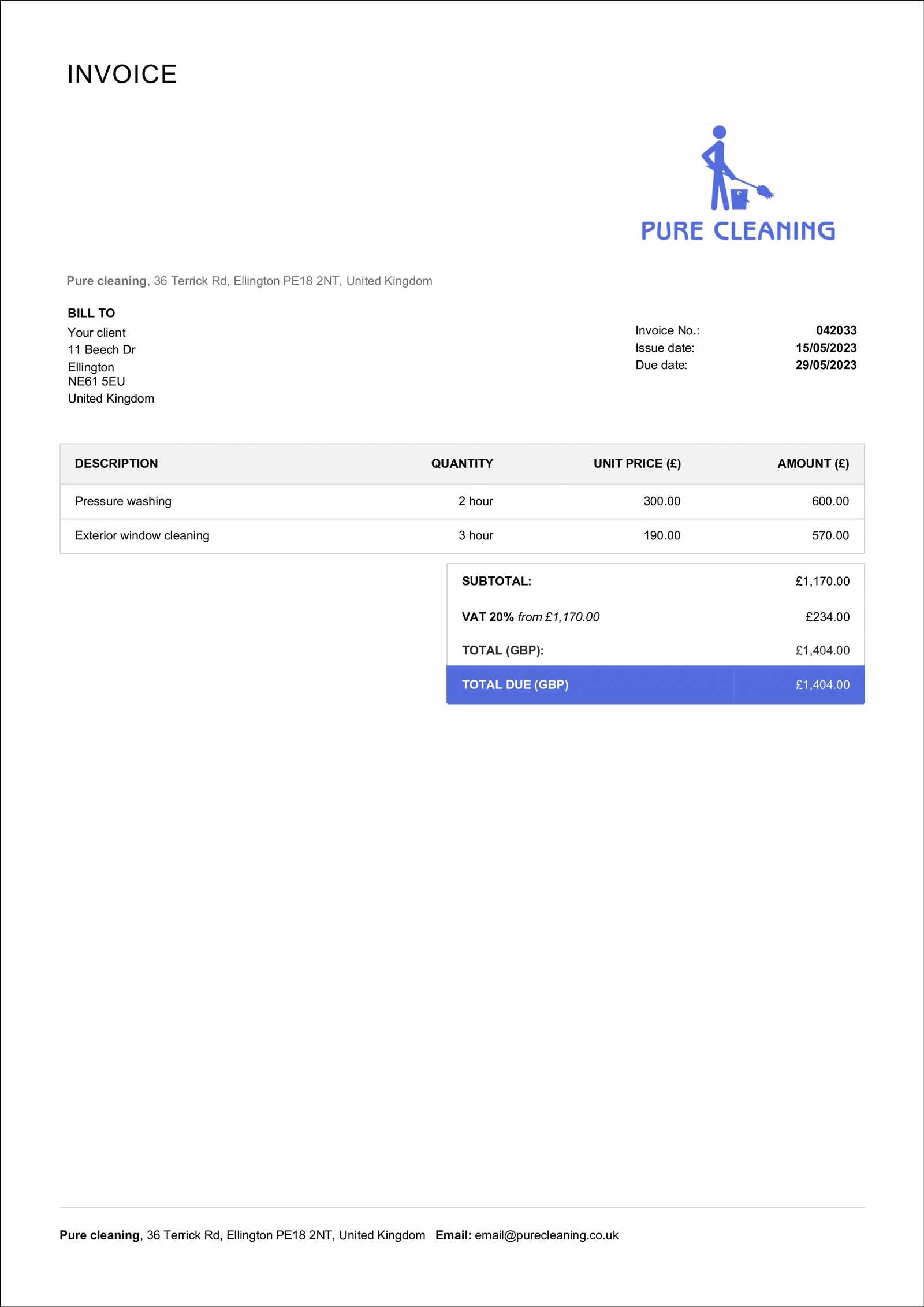

Service Billing Document Formats

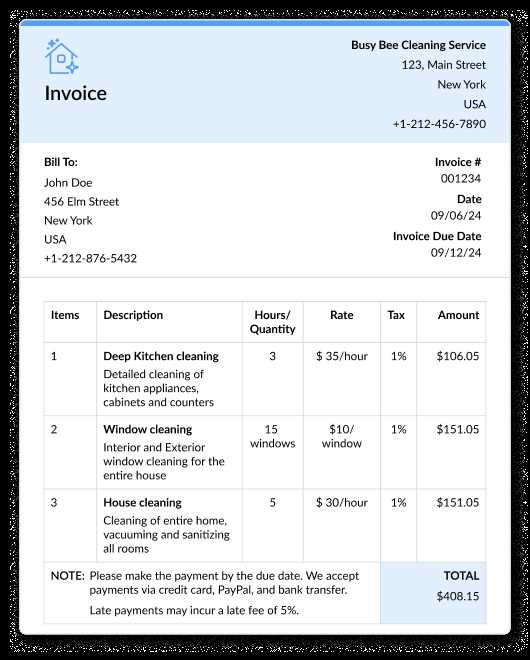

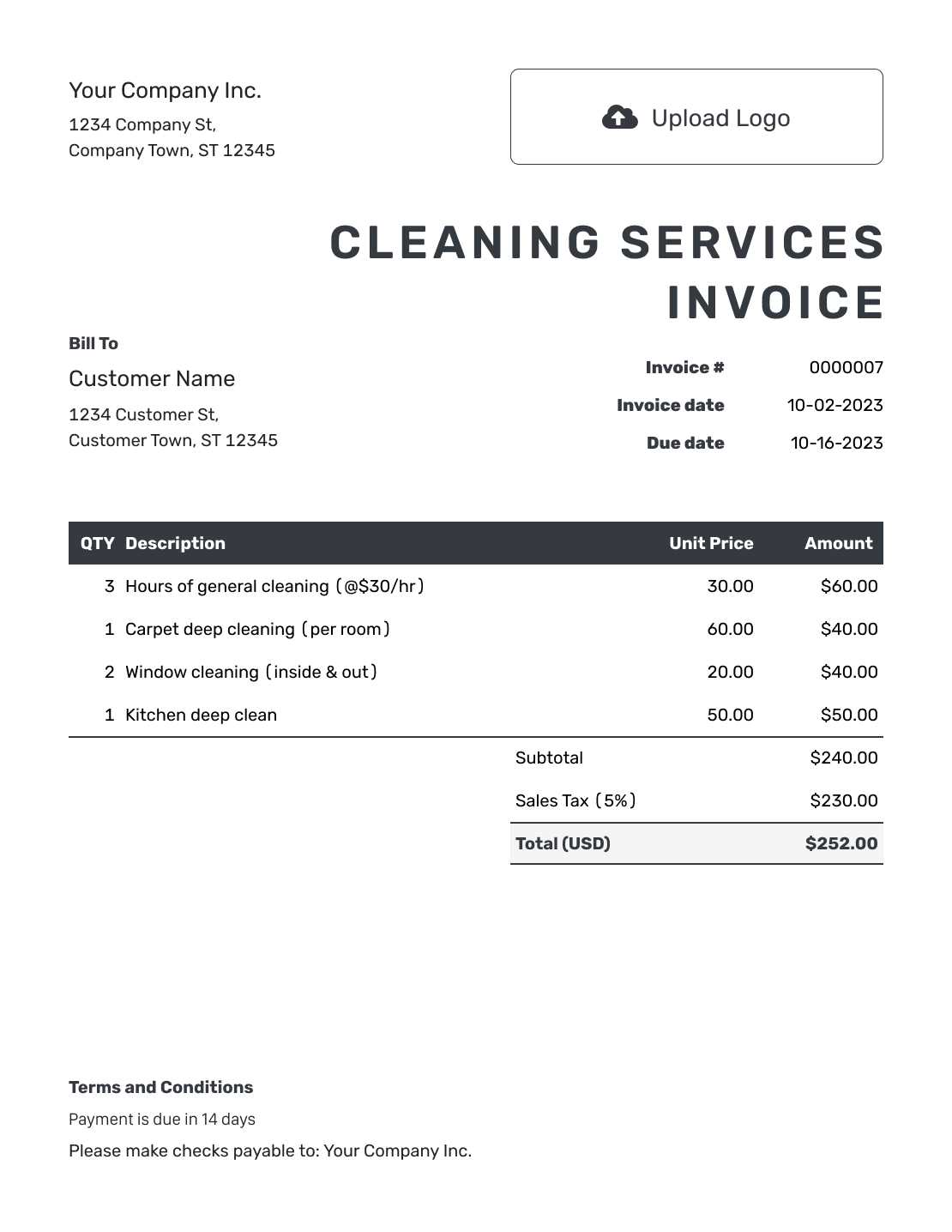

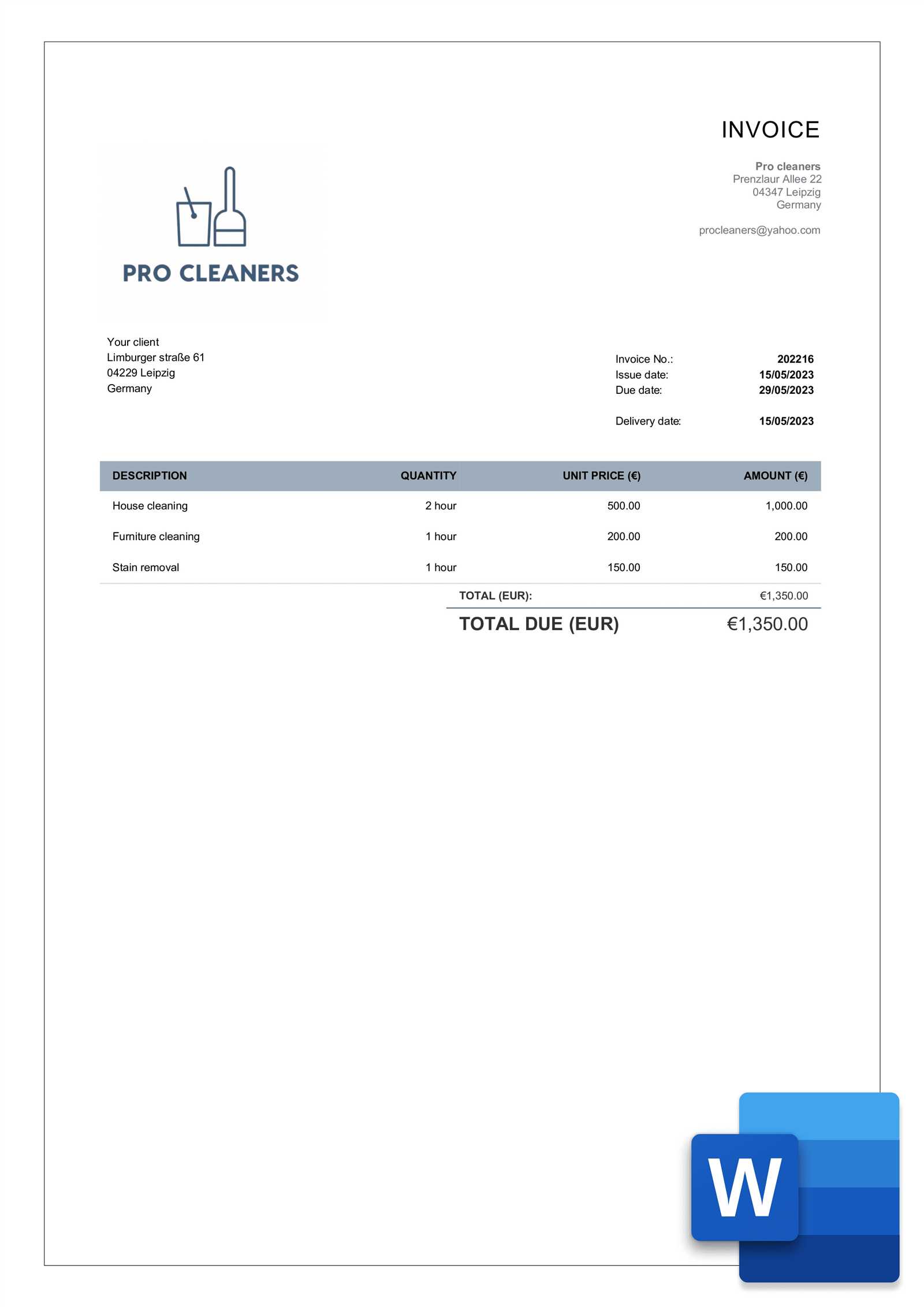

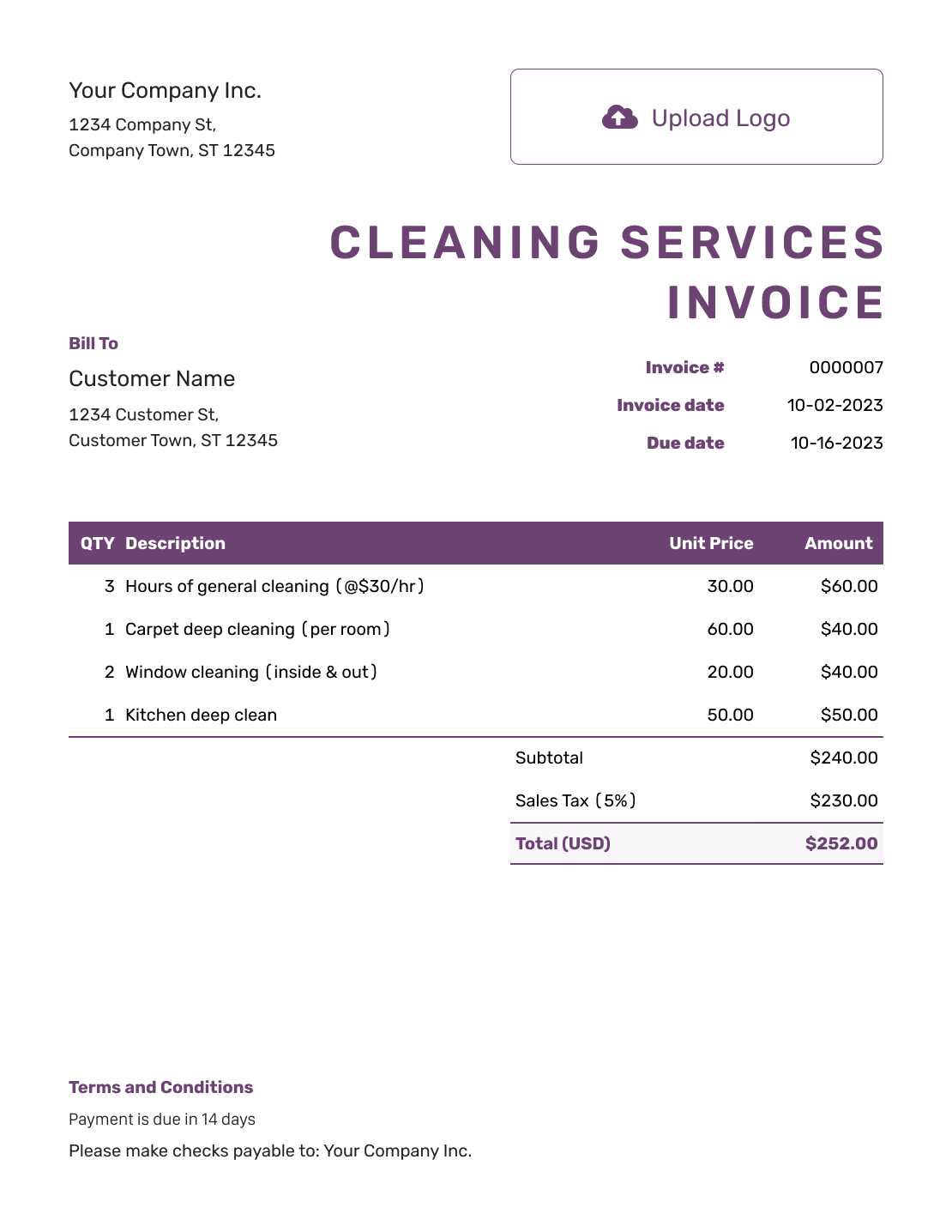

For any service-oriented business, creating a standardized way to present charges is essential. A structured document allows providers to detail the services offered and the corresponding fees, ensuring clarity for both the client and the service provider. This method simplifies financial transactions, promotes professionalism, and minimizes misunderstandings.

By using pre-built structures, service providers can streamline their billing process, reducing the time spent on drafting individual documents for each client. The ability to easily adjust specific details while maintaining a consistent layout is a key advantage. Customization is possible, allowing providers to reflect the nature of the services, client preferences, and payment terms.

These tools also help ensure that all necessary information is included, such as service dates, time spent, pricing, and payment instructions. Having a reliable format ensures a smooth workflow and contributes to a positive customer experience. A professional approach to billing not only enhances the business’s image but also supports better financial management.

Benefits of Using Templates for Billing Documents

Utilizing pre-designed formats for billing offers numerous advantages, especially for service-based businesses. These structured documents save time, ensure consistency, and minimize the risk of errors, ultimately contributing to a smoother financial workflow. The ability to easily customize and reuse these formats simplifies the billing process and enhances professionalism.

- Time Efficiency: Pre-made structures allow for quick adjustments, saving valuable time that would otherwise be spent creating a new document for each transaction.

- Consistency: Using the same format for every transaction ensures a uniform presentation, helping to maintain a professional image.

- Accuracy: A predefined structure reduces the likelihood of missing critical details, ensuring that all necessary information is included in every document.

- Customization: Formats can be easily tailored to suit specific needs, from service descriptions to payment terms, offering flexibility while maintaining consistency.

- Client Satisfaction: Clear and organized billing enhances client trust and communication, leading to better customer relationships and more timely payments.

By adopting structured billing documents, businesses can improve their financial operations and create a more efficient, professional process. It not only helps to meet client expectations but also streamlines internal record-keeping, leading to better overall management.

How to Customize Service Billing Documents

Customizing billing documents is an essential step in making sure that the details of services provided are clearly communicated and aligned with your business needs. A flexible structure allows you to adjust specific elements such as service descriptions, pricing, and terms to suit each client’s preferences and requirements. By tailoring the layout, you can ensure that every transaction is professional and transparent.

Here are some key elements to consider when customizing your billing documents:

| Section | Customization Options |

|---|---|

| Client Information | Include client name, address, and contact details. Add company logos or branding for a more personalized touch. |

| Service Descriptions | List the specific tasks performed, such as time spent, areas covered, or any special services provided. |

| Pricing | Adjust rates for individual services, add discounts, or include taxes and additional fees based on the job. |

| Payment Terms | Specify due dates, accepted payment methods, and any late payment penalties or early payment discounts. |

| Additional Notes | Include any special instructions, terms, or agreements made with the client regarding the service. |

By adjusting these sections, you create a document that meets both your business standards and your client’s expectations. Customization ensures accuracy and prevents potential misunderstandings, making your billing process more efficient and client-friendly.

Essential Information for Service Billing Documents

For a service-based business, ensuring that all necessary details are included in the billing document is critical to avoid confusion and ensure a smooth transaction process. A well-structured record provides both the client and the provider with all the relevant information, helping to maintain transparency and professionalism.

- Client Information: Include the full name, address, and contact details of the customer to ensure the document is easily traceable and personalized.

- Service Description: Clearly outline the tasks performed, including any specific areas covered or additional requests made by the client.

- Date of Service: Mention the exact date (or range of dates) when the work was carried out to avoid disputes regarding timing.

- Pricing Details: List the cost of each service provided, including any extra fees, taxes, or discounts that may apply.

- Payment Terms: Include the total amount due, payment methods accepted, and the deadline for payment to avoid any ambiguity about financial obligations.

- Company Information: Add your business name, logo, address, and contact details to make the document official and easily recognizable.

Including all of these details in your billing document ensures that both parties are on the same page, which helps to reduce misunderstandings and promotes quicker payment processing. A comprehensive document also improves the overall experience for your client, contributing to stronger business relationships.

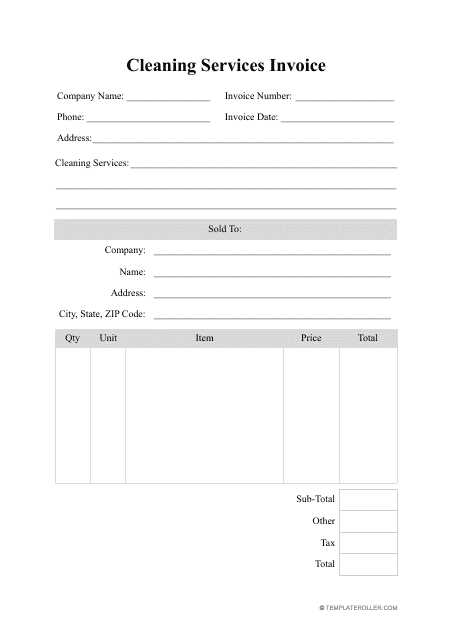

Free vs Paid Service Billing Formats

When choosing a structure for documenting charges, businesses are often faced with the decision between free and paid options. Both types offer unique advantages and limitations, and the choice ultimately depends on the specific needs and goals of the service provider. While free options might suffice for simple operations, paid solutions often come with added features that can streamline processes and enhance professionalism.

Free formats typically provide basic layouts that are easy to customize for smaller businesses or those just starting out. They can be useful for businesses that only need a simple way to document charges and aren’t looking for advanced features. However, these free structures may lack advanced functionality, such as automatic calculations, or the ability to easily manage recurring clients.

Paid solutions, on the other hand, often come with enhanced features such as advanced customization, integrated payment tracking, and automated billing. These can save time and reduce errors, especially for businesses with a larger client base or those that offer multiple service packages. Moreover, paid options frequently provide professional-grade designs that help convey a more polished image to clients.

In the end, the choice between free and paid options depends on the scale of your operations and the specific requirements of your business. Free formats are suitable for those with limited needs, while paid options offer more flexibility and can better accommodate growing businesses seeking efficiency and a professional presentation.

Creating Professional Billing Documents for Clients

Presenting a polished and well-organized document for your clients is crucial for building trust and ensuring timely payments. A professional format helps convey the value of your services and reflects positively on your business. When creating such a document, attention to detail and consistency are key to maintaining a high standard of professionalism.

Key Elements for Professional Documents

- Clear Service Description: Accurately describe the tasks performed and any additional requests, ensuring the client knows exactly what they are being charged for.

- Legible and Structured Layout: Use a clean, easy-to-read layout with distinct sections for different pieces of information, such as client details, services, and payment terms.

- Client Contact Information: Include the client’s full name, address, and phone number, making the document personalized and traceable.

- Business Branding: Add your business name, logo, and contact details to maintain a consistent brand presence and reinforce professionalism.

- Payment Terms: Clearly state the total amount due, due date, and accepted payment methods to avoid any confusion regarding financial matters.

Tips for Enhancing Professionalism

- Keep It Simple: Avoid cluttering the document with excessive details or complex language. Simple, clear, and concise information makes for a more effective document.

- Consistency: Use the same format and style for every document, ensuring that each one reflects the same professional standard.

- Proofread: Double-check the document for any errors in pricing, dates, or client details to avoid confusion or mistakes that could harm your credibility.

By focusing on these elements, you can ensure that your billing documents not only look professional but also foster positive client relationships and contribute to the efficient management of your business finances.

Steps to Make a Billing Document Format

Creating a customized format for documenting services and payments is an essential task for any business. A well-structured format helps streamline the billing process and ensures that clients receive all necessary information in a clear and professional manner. Below are the steps to create an efficient and effective document for your business.

- Step 1: Choose the Layout – Select a layout that suits your business needs. A simple, clean design is typically best, with clearly defined sections for each piece of information.

- Step 2: Add Business Information – Include your business name, logo, address, and contact details at the top of the document. This reinforces your brand identity and provides clients with easy access to your contact information.

- Step 3: Include Client Details – Clearly display the client’s full name, address, phone number, and email. This ensures the document is personalized and traceable.

- Step 4: List Services Provided – Describe the services rendered, including any additional requests or customizations. Break down the tasks in detail to avoid confusion and make pricing transparent.

- Step 5: Specify Pricing – Outline the cost of each individual service or task, including any discounts, taxes, or additional charges. This breakdown helps ensure clarity and accuracy.

- Step 6: Add Payment Terms – Clearly state the total amount due, payment methods accepted, and the due date for payment. Be explicit about late fees or any other important terms.

- Step 7: Customize for Future Use – Save the format as a reusable document that can be easily adjusted for future clients. This step will save you time with future transactions.

By following these steps, you can create a detailed and professional billing document format that will help manage client transactions effectively and efficiently, maintaining a consistent and organized workflow.

Common Mistakes in Service Billing Documents

Even the most experienced service providers can sometimes overlook key details when preparing their billing documents. Small errors or omissions can lead to confusion, delayed payments, and misunderstandings with clients. Being aware of common mistakes and actively avoiding them can help ensure that your billing process runs smoothly and professionally.

- Missing Client Information: Failing to include the client’s full name, address, or contact details can make the document look unprofessional and complicate follow-up communication.

- Vague Service Descriptions: Not clearly outlining the services provided can lead to confusion about what exactly is being charged. Be specific about the tasks completed to avoid potential disputes.

- Inaccurate Pricing: Errors in pricing, whether it’s incorrect rates or missing charges, can cause frustration for both the service provider and the client. Always double-check pricing and ensure that it matches what was agreed upon.

- Omitting Payment Terms: Failing to clearly state the total amount due, payment methods, or deadlines can delay payments and result in misunderstandings. Always be clear about when payment is expected and how it should be made.

- Lack of Professional Branding: Without your business name, logo, or contact information prominently displayed, the document may appear informal and less trustworthy. Professional branding reinforces your business identity and helps clients recognize your services.

- Not Including Dates: Not specifying the date(s) the services were rendered can create confusion about the timeline of work completed. Always include service dates to make your records clear and precise.

By being mindful of these common mistakes and taking the time to review your billing documents carefully, you can create a smoother, more professional experience for your clients. This attention to detail not only improves efficiency but also fosters stronger, more positive relationships with your customers.

How to Automate Billing for Service Providers

Automating the process of creating and sending payment documents can save time and reduce errors for service providers. By using the right tools and setting up automated workflows, businesses can streamline their financial operations and focus more on delivering quality services. The following steps outline how to automate the billing process effectively.

- Step 1: Choose the Right Software – Select software or an online platform that offers automation features specifically tailored to your business needs. Look for tools that allow you to set up recurring payments, generate bills, and manage client information all in one place.

- Step 2: Set Up Client Profiles – Input client details into the chosen system, including contact information, service preferences, and payment history. This makes it easier to automatically generate accurate documents without needing to re-enter information each time.

- Step 3: Automate Payment Calculations – Use the software’s automatic calculation features to add up charges for services based on predefined rates or time worked. Ensure the system can handle additional fees like taxes, travel charges, or special requests.

- Step 4: Create Recurring Billing Cycles – For clients with regular or subscription-based services, set up automated recurring billing. This way, you don’t have to manually create documents every time; the system will generate and send them automatically on the agreed schedule.

- Step 5: Integrate Payment Processing – Link your automated system with payment processors such as credit card services or digital wallets. This enables clients to pay directly from the generated document, streamlining the payment process and reducing administrative work.

- Step 6: Monitor and Adjust – Regularly review the automation system to ensure everything runs smoothly. Make adjustments if there are any changes to pricing, services, or client preferences. This ensures your automation remains relevant and accurate.

By following these steps, service providers can significantly reduce the time spent on billing, while also improving accuracy and efficiency in their financial processes. Automation also helps maintain a consistent cash flow and reduces the likelihood of human error, ultimately benefiting both the provider and the client.

Legal Considerations in Document Creation

When preparing billing documents for services rendered, it’s essential to be aware of the legal requirements and guidelines that ensure compliance with local laws. Failing to include the necessary legal elements in these documents can lead to disputes, delayed payments, or even legal challenges. Understanding the key considerations can help businesses avoid complications and maintain professionalism.

Mandatory Information

There are certain details that must be included in every billing document to ensure it is legally sound. These details not only protect both the service provider and the client but also ensure the document is recognized by legal authorities if needed. Essential information includes:

- Business Identification: Clearly state the business name, registration number, and tax identification number, if applicable. This identifies the service provider legally and allows the client to verify your business status.

- Client Details: Include the client’s full name or business name, address, and contact details to establish the identity of the party responsible for payment.

- Service Descriptions: Accurately describe the services performed, including any specifics related to the work, to avoid confusion about what is being charged for.

- Payment Terms: Clearly outline payment expectations, including due dates, late fees, and acceptable payment methods. This helps prevent misunderstandings or delayed payments.

Compliance with Local Laws

Depending on the jurisdiction, there may be additional legal requirements for service-related documents. These can vary significantly from country to country or even within regions. Common considerations include:

- Tax Rates: Ensure that the applicable tax rates are reflected in the final amount. This could include sales tax, VAT, or other service-specific taxes depending on your location.

- Language and Currency: In some areas, documents may need to be issued in the official language of the region, or the currency must be specified based on local standards.

- Retention Period: Many jurisdictions require businesses to retain financial documents for a certain number of years for tax or auditing purposes. Ensure your system complies with these retention requirements.

By incorporating these legal elements into your billing documents, you can ensure that your business is compliant with local laws, avoid potential disputes, and create a more professional relationship with your clients.

Best Software for Service Billing Documents

Using the right software for managing financial documents can drastically simplify the billing process for service providers. The ideal software solution should allow for easy creation, customization, and management of payment documents while offering features that save time and improve accuracy. Below are some of the best options available for businesses looking to streamline their financial operations.

- FreshBooks – Known for its user-friendly interface, FreshBooks is an excellent option for small businesses and service providers. It offers easy invoicing, time tracking, and client management tools, along with automation for recurring payments and reminders.

- QuickBooks – QuickBooks is a highly popular accounting software that also provides comprehensive billing solutions. It allows for detailed customization of payment documents, tax calculations, and integrates well with bank accounts to streamline financial processes.

- Zoho Invoice – Zoho Invoice offers a free version that can be ideal for businesses with a smaller client base. It includes automation for recurring bills, multi-currency support, and customizable document formats, along with time-tracking and expense management features.

- Wave – This is a free software option for small businesses that offers invoicing, accounting, and receipt scanning features. Wave allows users to create professional-looking documents, send them directly to clients, and accept online payments.

- Bill.com – Bill.com is focused on automating the payment process, allowing businesses to send, track, and receive payments quickly. It’s a good option for those who need to manage multiple clients and handle large volumes of transactions.

Each of these platforms offers different features, so it’s important to assess your business’s specific needs, such as whether you need advanced reporting, mobile access, or integration with other tools. By selecting the right software, service providers can automate the billing process, reduce errors, and ensure a more efficient financial workflow.

How to Handle Multiple Clients’ Billing Documents

Managing several clients and their respective billing statements can quickly become overwhelming, especially for service providers handling large volumes of work. However, with the right strategies and tools in place, organizing and tracking these documents becomes much easier. This section explores the best methods for efficiently managing multiple client transactions and ensuring timely payments.

Effective Organization Techniques

One of the first steps in managing a large number of financial records is setting up a system that allows you to track and organize each document effectively. Consider these approaches:

- Client Segmentation: Organize clients into categories based on their service frequency, payment terms, or region. This segmentation will help you quickly identify which clients require attention and manage their payments accordingly.

- Use of Software: Utilizing invoicing or accounting software can streamline the process. These platforms often offer features like automated reminders, payment tracking, and easy document generation for multiple clients.

- Unique Reference Numbers: Assign unique reference numbers to each document or transaction. This system helps you track payments and follow up on overdue balances with ease.

Automating and Tracking Payments

Automation is a key factor in managing a high volume of clients. Below are some practical strategies to automate processes and improve payment tracking:

- Recurring Billing: For clients with regular, fixed payments, set up recurring billing cycles. This ensures that payments are automatically generated and sent out, reducing the risk of missed payments.

- Automated Reminders: Use automated reminders for clients whose payments are due. Software tools can send reminders at scheduled intervals, prompting clients to pay before deadlines.

- Integrated Payment Systems: Ensure your payment systems are integrated with your billing software. This allows clients to pay online easily and ensures you can track payments in real-time.

By implementing these strategies, businesses can effectively handle multiple client financial documents, reduce errors, and maintain healthy cash flow without getting bogged down in manual processes.

Tips for Clear Document Formatting

Creating clear and professional financial documents is essential for smooth transactions and ensuring that both parties understand the terms and amounts involved. A well-organized layout not only reduces the chances of confusion but also promotes timely payments. Below are some useful tips to enhance the clarity of your financial documents.

Maintain a Clean and Simple Layout

One of the most important aspects of document presentation is simplicity. Avoid cluttered designs and focus on clarity by following these guidelines:

- Use Clear Headings: Organize sections with distinct headings such as “Client Information,” “Services Rendered,” and “Amount Due” to make the document easy to navigate.

- Keep Fonts Readable: Choose simple, professional fonts like Arial or Times New Roman and avoid using too many different font styles or sizes, which can distract the reader.

- Utilize White Space: Ensure that there is enough white space around each section. This makes the document look more organized and easier to read.

Include All Essential Information

It’s crucial to include all necessary details to avoid confusion and disputes. Here’s what should be included:

| Information | Description |

|---|---|

| Client Name | Ensure that the client’s name and contact details are clearly listed at the top of the document. |

| Service Details | Provide a concise breakdown of the services provided, including the dates and hours worked if applicable. |

| Payment Terms | Clearly state the payment methods accepted, due dates, and any penalties for late payments. |

| Amount Due | Present the total amount clearly, breaking down costs if needed for transparency. |

Double-Check for Accuracy

Before sending out any financial documents, make sure to double-check all information for accuracy. Simple errors in numbers, client details, or payment instructions can lead to misunderstandings or delays in payment.

By following these tips, you can create documents that are not only easy to understand but also reflect professionalism and care, helping you build stronger relationships with your clients.

Tracking Payments with Document Templates

Effective tracking of payments is crucial for maintaining a smooth cash flow and ensuring that you are compensated for your work. With the right system in place, it’s easier to monitor the status of payments, avoid delays, and stay organized. Using well-structured documents can significantly enhance your ability to track financial transactions with your clients.

Establish a Payment Tracking System

To stay on top of your financial records, it’s essential to implement a system that allows you to track the status of each transaction. Here are some effective practices to consider:

- Mark Payment Status: Clearly indicate whether a payment is pending, completed, or overdue. You can use checkboxes or color-coded indicators to make this visually easy to track.

- Include Payment Deadlines: Always specify the due date for each payment. This not only helps clients understand when to pay but also serves as a reference for follow-ups.

- List Partial Payments: If clients make partial payments, ensure these are reflected accurately in your documents to avoid confusion.

Automate Payment Updates

By automating the process, you can reduce the risk of errors and improve efficiency. Many software tools and platforms offer features like automatic payment updates and reminders. Here’s how automation can help:

- Automatic Reminders: Set up automated reminders for clients who have not paid by the due date. This helps reduce the need for manual follow-ups and encourages timely payments.

- Payment Integration: Use platforms that integrate payment systems directly with your documents, allowing you to mark payments as completed automatically once received.

With a clear system in place and the right tools, tracking payments becomes more straightforward, giving you peace of mind and more time to focus on providing excellent service to your clients.

How to Send Invoices Efficiently

Sending payment requests efficiently ensures that your clients receive their documents on time and reduces the chances of delayed payments. With the right approach and tools, you can streamline the process, minimize errors, and keep track of sent documents effectively.

Choose the Right Method

The method you choose to send documents plays a significant role in ensuring timely payment. Here are the most common methods and their benefits:

- Email: One of the fastest and most commonly used ways to send documents. Attach the document as a PDF and ensure the email includes all relevant details such as the payment deadline and instructions.

- Online Payment Platforms: Many platforms provide built-in tools for creating and sending documents directly to clients, offering added features such as automated payment reminders.

- Postal Mail: If your clients prefer hard copies or operate in areas with limited internet access, sending a physical document may be necessary. Ensure that all details are clear and legible to avoid confusion.

Organize Your Document System

Keeping a well-organized system for your sent documents is crucial for tracking progress and avoiding missed payments. Consider the following tips:

- Use a Folder System: Create a dedicated folder for each client or project. This allows you to quickly find and reference past transactions, payment statuses, and communication records.

- Label Documents Clearly: Include the client name, date, and any other specific identifiers in the document file name to make it easier to locate later.

- Track Sent Documents: Utilize software or a manual log to track which documents have been sent, when they were sent, and when payments are due.

Automate and Schedule Sending

If you’re dealing with multiple clients or recurring projects, automating the process can save you significant time. Many accounting or invoicing software tools allow you to set up automatic document sending. This can include:

- Scheduled Email Delivery: Pre-set your documents to be sent on a specific date and time, ensuring timely delivery even when you’re not available.

- Automatic Payment Reminders: After sending, automated reminders can be configured to follow up with clients who haven’t made payments by the due date.

By leveraging automation and organizing your sending process, you can enhance your workflow and ensure that clients receive their documents promptly, helping to maintain a smooth financial operation.

Improving Client Communication Through Invoices

Effective communication with clients is essential for building trust and ensuring smooth business transactions. One often overlooked but vital aspect of communication is the clarity and detail in the documents you send for services rendered. These documents not only serve as a record but also provide a powerful tool to enhance client relationships.

By providing clear and detailed records, clients can quickly understand the charges, payment terms, and services offered. This transparency helps prevent confusion, fosters professionalism, and builds credibility. Here are several ways to enhance communication through well-prepared documents:

- Detailed Breakdown of Charges: Including a clear breakdown of each service or item helps clients easily identify what they are being charged for. This reduces misunderstandings and clarifies any complex fees or charges.

- Clear Payment Terms: By stating payment due dates, accepted payment methods, and late fees, you can avoid any ambiguity and ensure that both parties are on the same page regarding financial expectations.

- Professional Tone and Design: A clean, professional-looking document reflects well on your business and can make a positive impression. It also helps to use a polite and clear tone throughout the document, ensuring that the communication is respectful and transparent.

- Personalized Client Information: Including personalized details such as the client’s name, address, and previous transactions not only adds a personal touch but also demonstrates attention to detail and organization.

Furthermore, regularly following up on the documents sent, and keeping clients informed about their payment status through reminders or updates, helps maintain a positive relationship. By integrating these communication practices into your business model, you are more likely to foster long-term partnerships and reduce payment delays.