Hourly Work Invoice Template for Simple and Effective Billing

Managing payments and ensuring clarity in transactions is essential for independent professionals and contractors. A well-organized billing system not only streamlines the financial process but also builds trust with clients. Having a clear and structured document for detailing services rendered, time spent, and agreed rates is crucial for maintaining transparency and avoiding misunderstandings.

Using a carefully designed document for client billing can simplify your accounting tasks. With the right format, you can easily track hours, calculate fees, and present professional statements to clients. This method helps avoid errors and ensures both parties are on the same page when it comes to payment expectations.

In this guide, we’ll explore how to create a comprehensive and easy-to-use document that ensures accuracy in every transaction. By focusing on essential components and offering customization options, you’ll have the tools needed to manage your earnings efficiently and maintain a professional relationship with your clients.

Hourly Work Invoice Template Guide

Creating an organized document for tracking services provided is essential for professionals who charge based on time. This tool helps streamline the billing process by clearly outlining the hours spent and the corresponding rates. With a structured approach, both you and your client can ensure all details are correct, avoiding potential disputes.

In this guide, we will walk you through the key components necessary for building an efficient document that is easy to understand and simple to customize. By following a few best practices, you can ensure your statements are accurate, professional, and effective in securing timely payments.

Key Components of a Professional Billing Document

To ensure clarity and accuracy, each entry should include details such as the total time worked, the specific services rendered, and the agreed-upon rates. Additionally, it’s important to clearly state payment terms, including the due date and preferred methods of payment. This information ensures transparency and helps maintain a positive client relationship.

Customization and Personalization

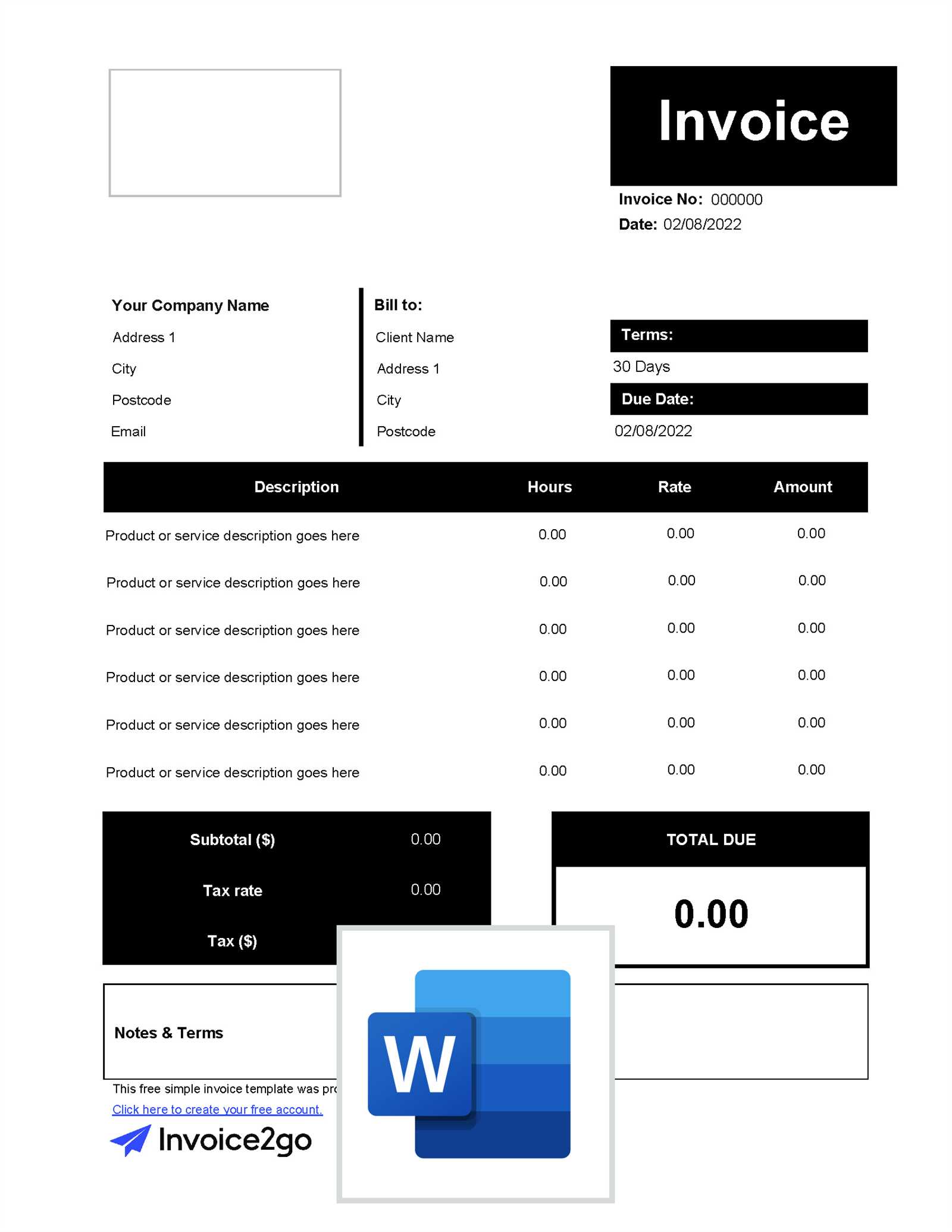

Personalizing your document according to your business needs can make it stand out and create a more professional impression. You can customize sections such as the header with your business name, logo, or contact details. It’s also important to offer flexibility in how you calculate fees and present the final amount, allowing for clear, understandable figures for your clients.

Why Use an Hourly Work Invoice

Using a structured document to bill clients for time-based services offers numerous advantages for both freelancers and contractors. This approach ensures that both parties are clear about the work performed and the compensation due. By providing a transparent breakdown of hours spent, it fosters trust and reduces the likelihood of disputes over payments.

One of the main benefits of utilizing such a system is the clarity it brings to financial transactions. Clients can see exactly how their money is being spent, and service providers can easily justify the time spent on each task. This level of detail can be especially useful for complex projects where multiple hours or stages of work are involved.

Additionally, using a detailed document for each transaction helps professionals stay organized. It serves as a record of completed tasks and can be used for future reference, either for client reviews or for managing taxes and financial records. By relying on an efficient system, service providers can save time on administrative tasks and focus on what they do best.

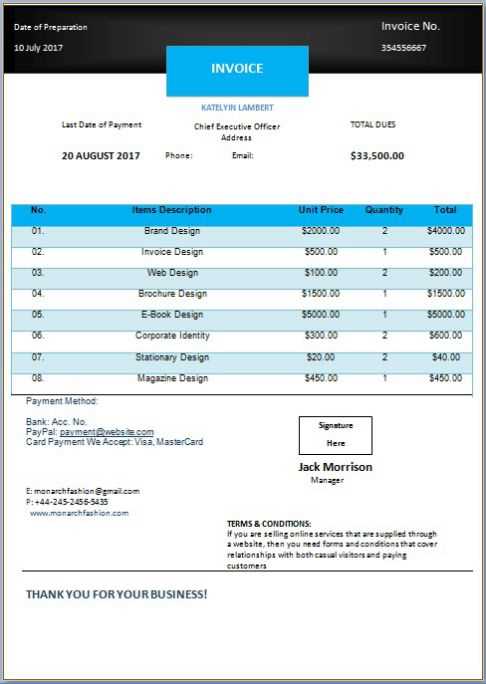

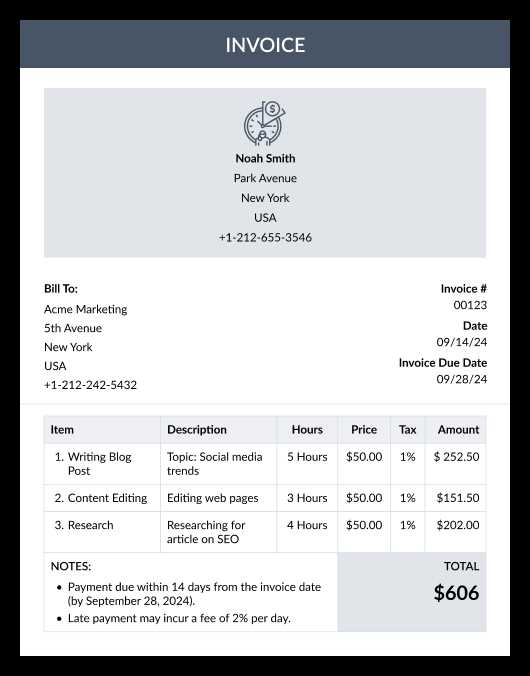

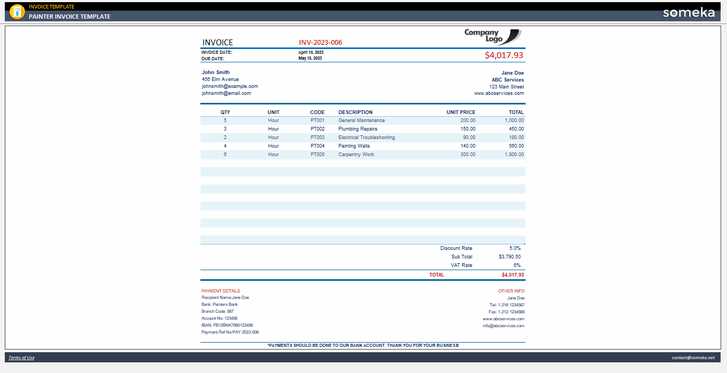

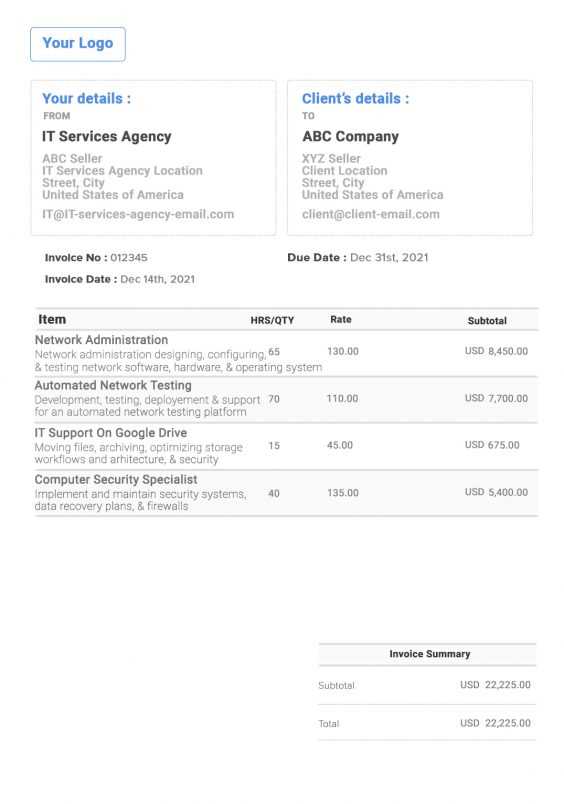

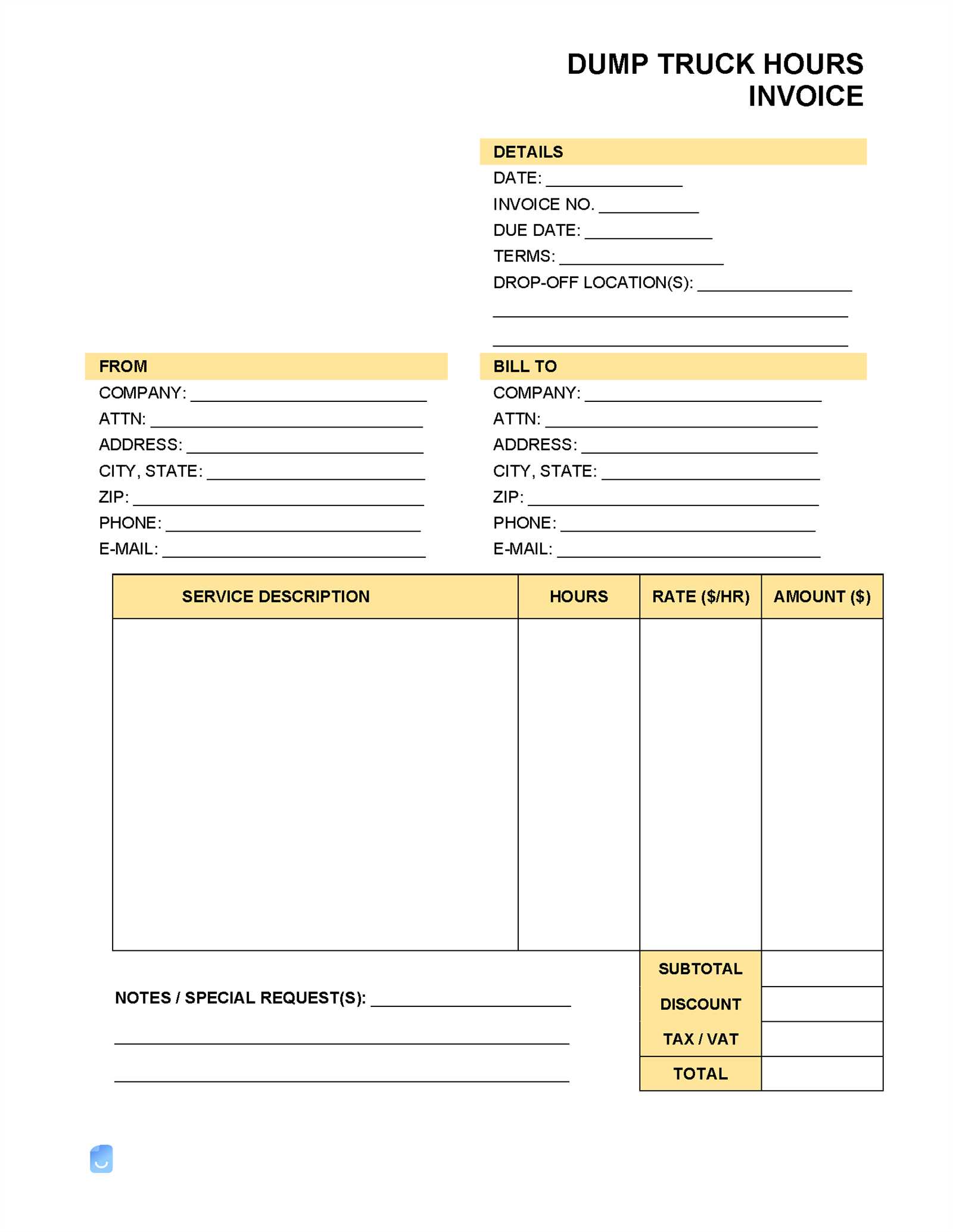

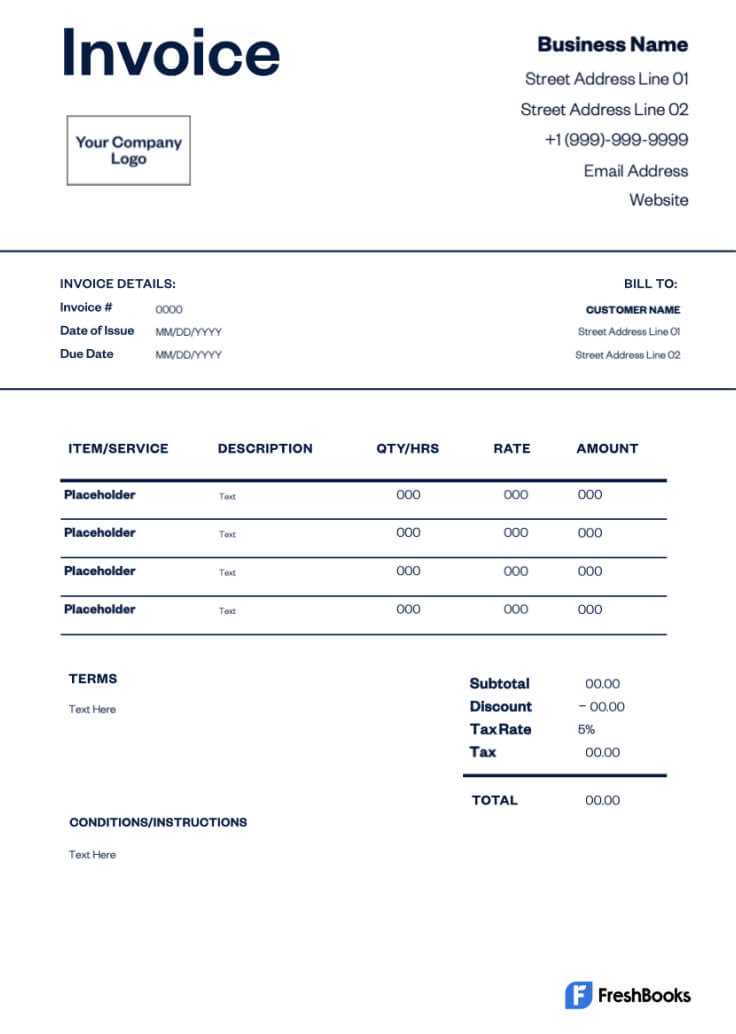

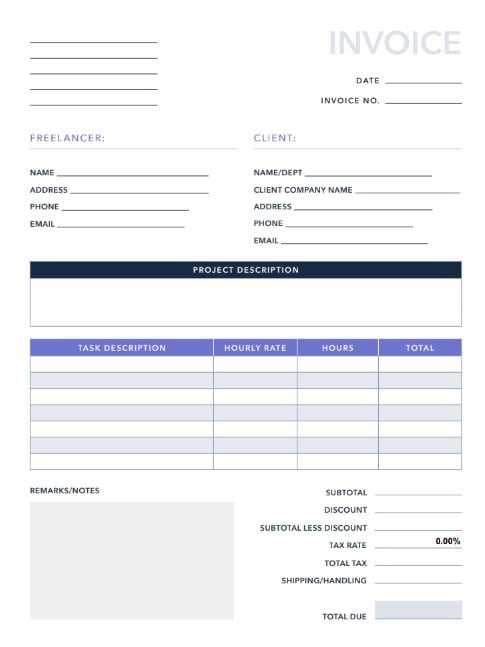

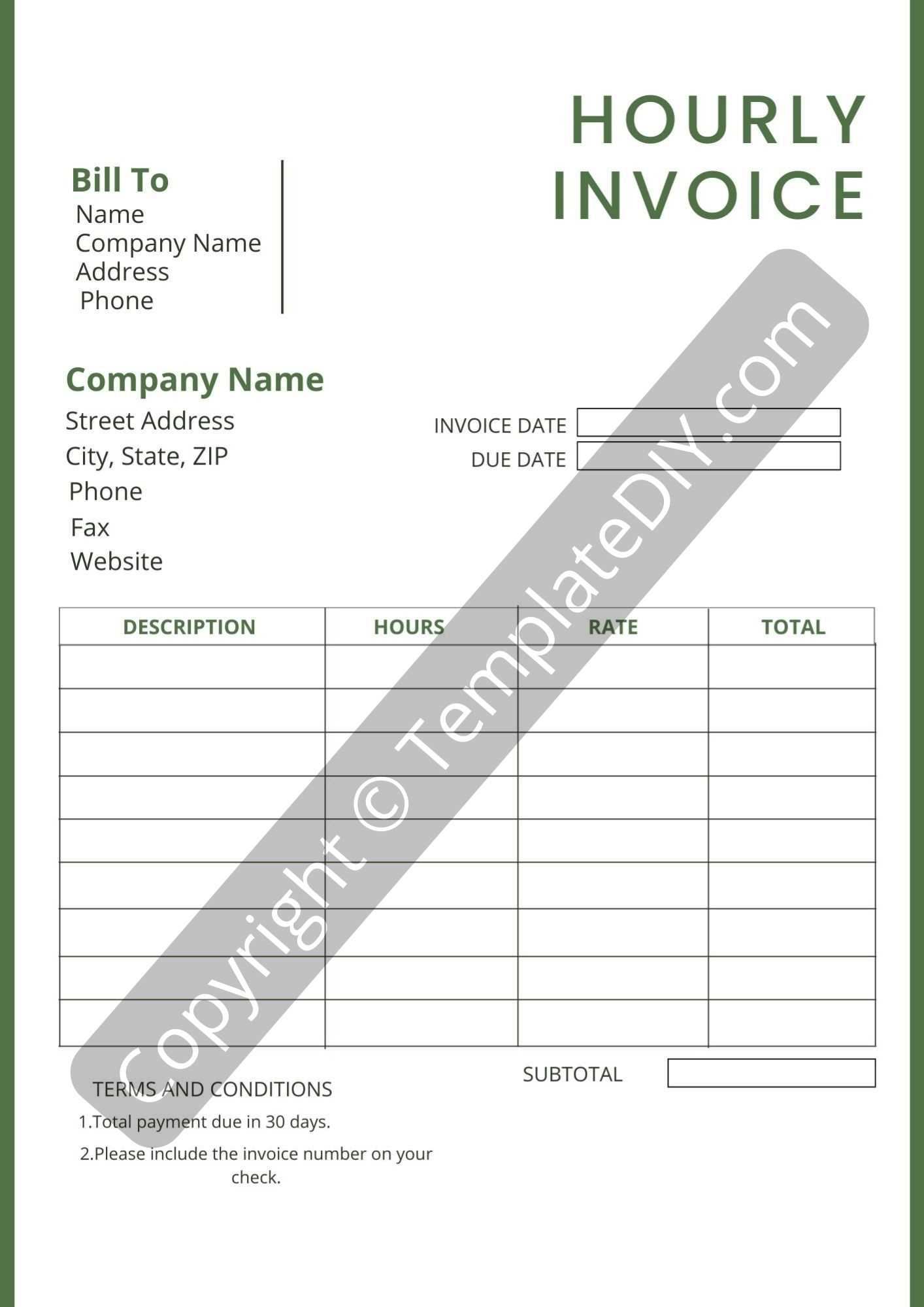

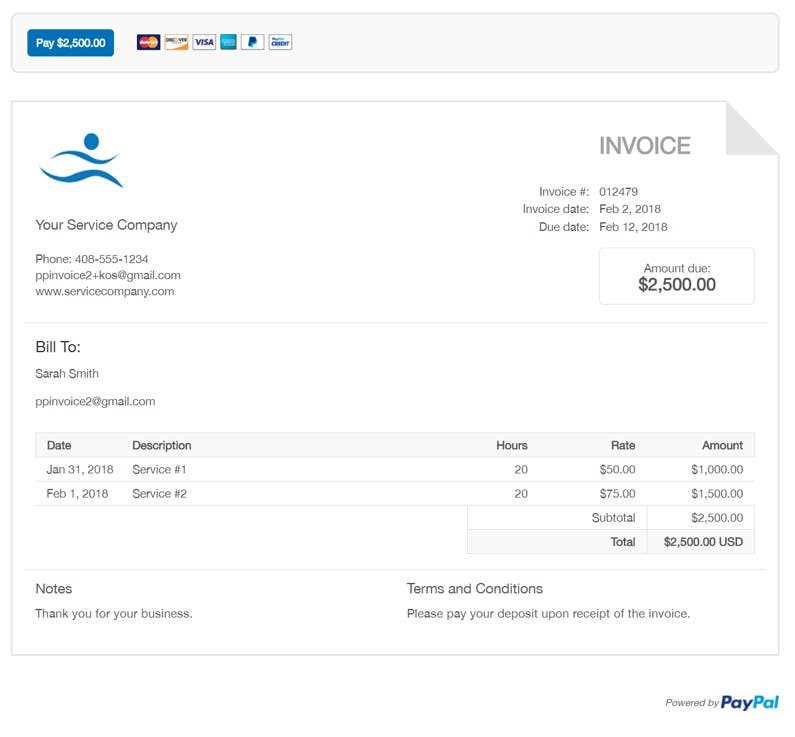

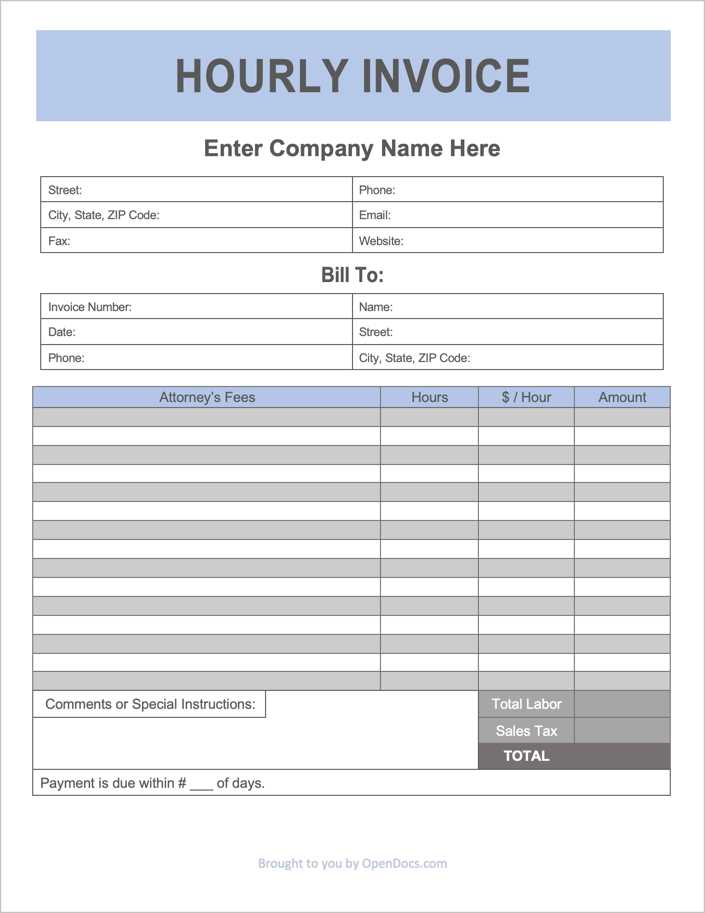

Essential Elements of an Invoice

A well-structured billing document includes several key components that ensure clarity and accuracy for both the service provider and the client. These elements are crucial for transparent communication and smooth transactions. Each section of the document serves a specific purpose, making it easier to track payments and avoid misunderstandings.

The following are the essential elements that should be included in every billing document:

- Contact Information: Include the names, addresses, and contact details of both the service provider and the client to ensure there is no confusion regarding the parties involved.

- Service Description: Provide a detailed description of the tasks completed, specifying the nature of the work and any relevant milestones or deliverables.

- Hours Worked and Rate: Clearly indicate the time spent on each task and the agreed-upon rate for the service. This is essential for accurate calculations.

- Total Amount Due: The total amount should be easily identifiable, showing a breakdown of the charges along with any taxes or discounts applied.

- Payment Terms: Specify the due date for payment, accepted methods, and any late fees or penalties for overdue payments.

- Invoice Number and Date: A unique invoice number helps track records efficiently, while the date of issue ensures both parties are on the same page regarding payment deadlines.

Incorporating these elements not only makes the document more professional but also ensures that both the service provider and the client have a clear understanding of the terms of the transaction.

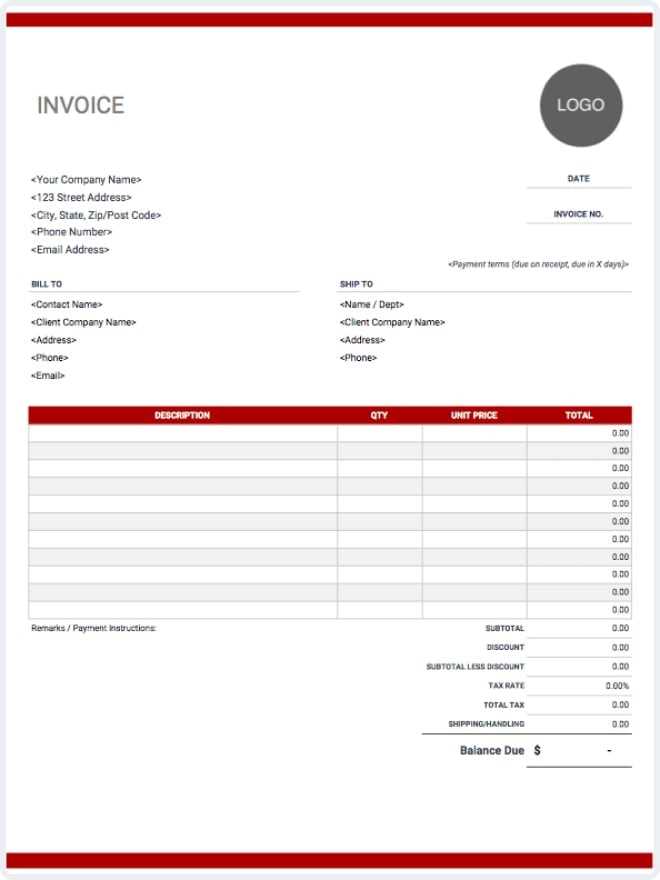

How to Customize Your Invoice Template

Customizing your billing document is an important step in making it fit your business needs and enhancing its professionalism. By personalizing the design and content, you can ensure that the document reflects your brand identity while meeting your specific billing requirements. A well-tailored document not only looks more polished but also improves communication with your clients.

To begin customizing, you can start by adding your company logo, name, and contact details at the top of the document. This helps establish your business identity right away. You can also adjust the layout to suit your preferred style, ensuring it is both clear and easy to read.

Next, consider adjusting the fields to match the services you offer. For example, if you provide different types of services or have varied pricing structures, make sure your document includes all necessary categories for clear itemization. You might also want to add sections for any discounts, taxes, or additional fees specific to your business practices.

Finally, make sure the payment terms reflect your preferences, such as your standard due date, late payment fees, and accepted payment methods. By making these customizations, you ensure that the document works for you and your clients, enhancing efficiency and minimizing confusion.

Best Practices for Accurate Billing

Maintaining accuracy in your billing process is essential for ensuring that you are compensated fairly while avoiding confusion with your clients. By following a few best practices, you can minimize errors and create clear, professional financial documents. These practices also help in building trust with clients and promoting timely payments.

One of the most important aspects of accurate billing is ensuring that the time spent and services rendered are clearly recorded. This involves keeping detailed logs of your activities and ensuring that every charge is justified. Below are some key practices to follow for accuracy:

| Best Practice | Description |

|---|---|

| Track Time Consistently | Keep a real-time record of hours spent on each task to avoid errors and omissions when it comes time to bill. |

| Use Clear Descriptions | Describe the services provided in detail, breaking down tasks where necessary to give clients a full understanding of the charges. |

| Verify the Rate | Double-check the rates applied to each service or hour worked to ensure they align with the agreed-upon terms. |

| Review Before Sending | Always review the final document before sending it to your client, checking for any discrepancies or missing details. |

| Be Transparent with Fees | Ensure all additional costs, such as taxes or late fees, are clearly listed and explained to avoid surprises. |

By following these best practices, you can ensure that your billing process is efficient, transparent, and error-free, leading to smoother transactions and happier clients.

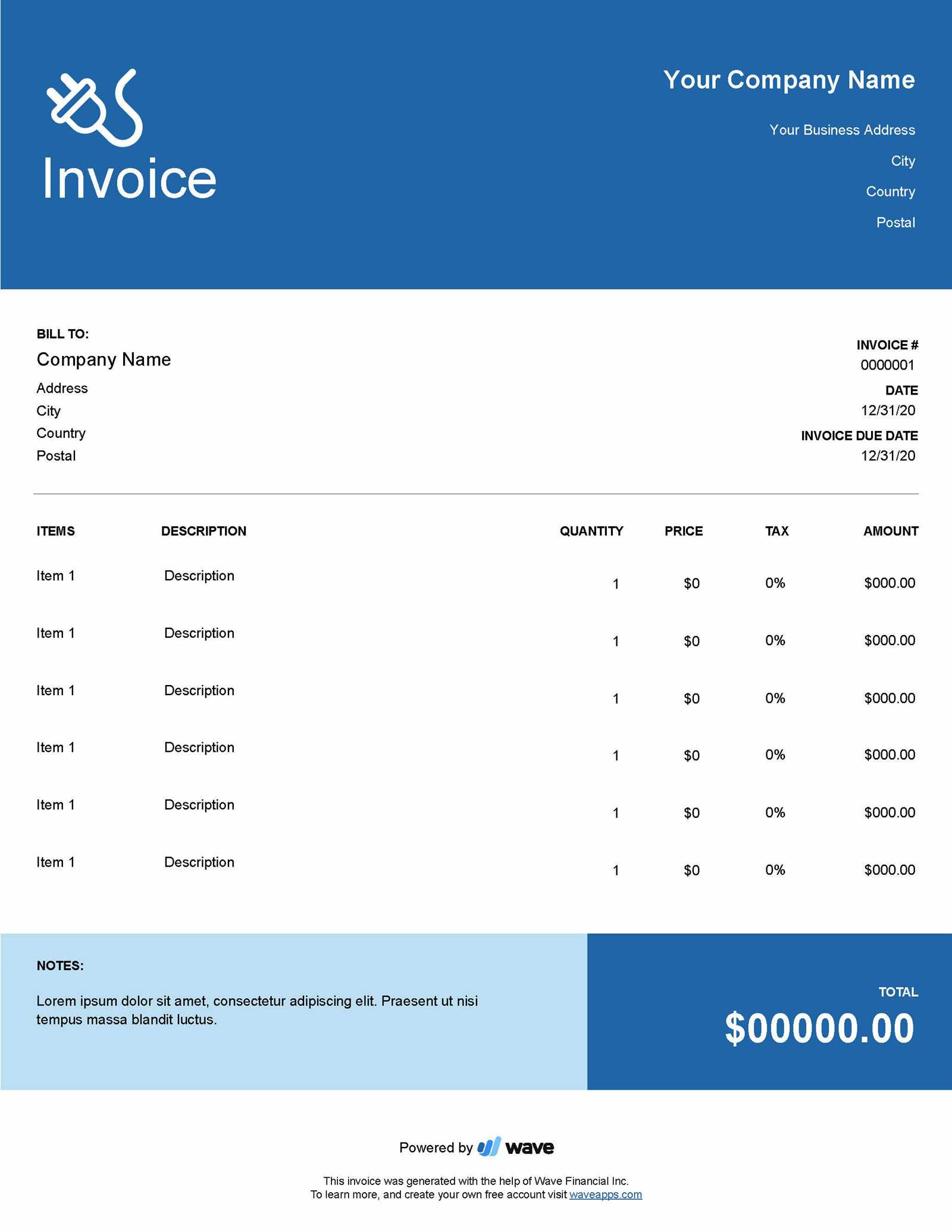

Benefits of Using Invoice Templates

Utilizing pre-designed documents for billing offers numerous advantages that can streamline the entire payment process. These ready-made formats save time and effort, ensuring that every detail is accounted for and consistently presented. By adopting such solutions, businesses can maintain professionalism, improve efficiency, and reduce the chance of errors in financial transactions.

Time-Saving and Efficiency

One of the primary benefits of using ready-made billing documents is the significant time saved. Instead of creating a new document from scratch each time, you can simply fill in the necessary details, allowing you to focus more on providing services rather than administrative tasks. This efficiency not only speeds up the billing process but also helps avoid mistakes caused by rushing to format or calculate charges.

Consistency and Professionalism

Pre-designed billing solutions provide a consistent format that ensures all necessary details are included and presented in a clear, professional manner. This consistency enhances your brand’s credibility and makes it easier for clients to understand charges. A polished and uniform approach to billing can also strengthen client relationships, showing that you take your business seriously and are committed to transparent communication.

How to Calculate Hourly Rates

Setting an appropriate rate for the services you provide is crucial for ensuring you are compensated fairly. Calculating the right amount involves considering various factors, such as your skill level, market demand, and business expenses. By understanding the components that make up your rate, you can confidently charge clients while maintaining a competitive edge in your industry.

Factors to Consider When Setting Your Rate

Several factors come into play when determining how much to charge per hour. The most common considerations include:

- Experience and Expertise: The more experience and specialized skills you have, the higher your rate can be. Professionals with niche expertise often command higher fees.

- Market Rates: Research the going rates in your industry and region. Pricing too high may scare away potential clients, while pricing too low can undervalue your services.

- Operating Costs: Factor in any business expenses such as software, equipment, or overhead costs. Your hourly rate should cover these expenses and allow for a profit margin.

- Project Complexity: Some tasks require more effort or specialized knowledge. You should charge more for complex or high-demand services than for routine tasks.

Steps to Calculate Your Rate

Follow these steps to determine an appropriate rate for your services:

- Estimate your desired annual income based on your financial goals.

- Calculate your annual operating expenses, including business overhead, tools, and taxes.

- Divide your total annual income goal by the number of billable hours you expect to work each year. This will give you a base hourly rate.

- Adjust your rate according to the factors mentioned earlier, such as experience or project complexity.

By following these steps and regularly revisiting your rate as your business evolves, you can ensure your pricing remains competitive and sustainable over time.

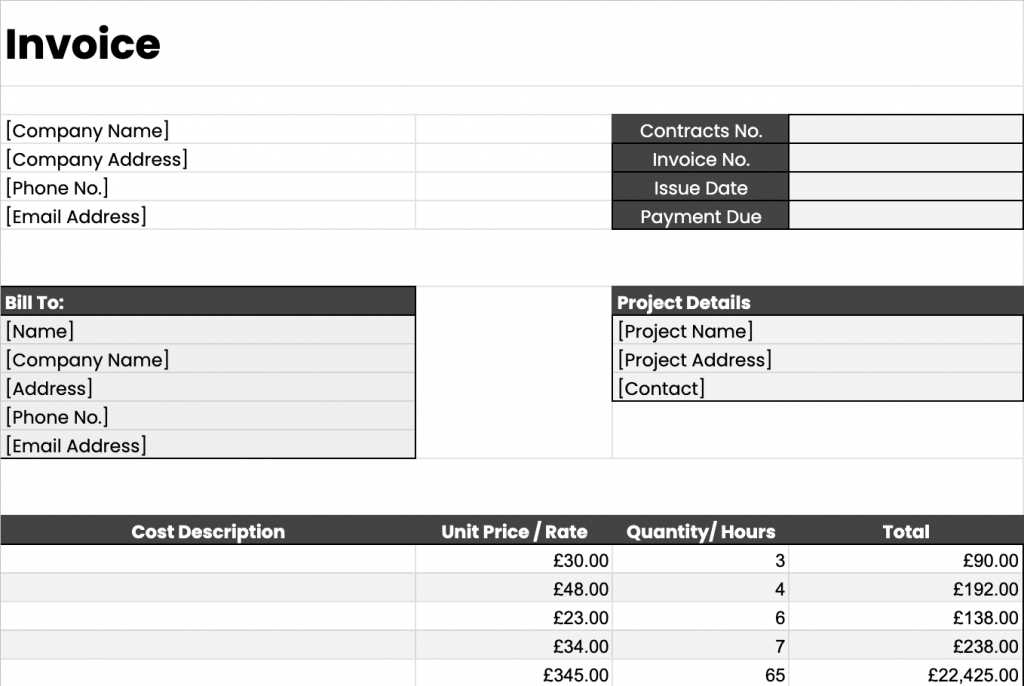

Setting Clear Payment Terms in Invoices

Clear payment terms are essential for smooth transactions between service providers and clients. By specifying the conditions under which payments are due, you create a transparent agreement that helps avoid confusion and ensures that both parties know what to expect. Clear terms not only protect your financial interests but also help maintain a positive relationship with clients.

When setting payment terms, consider including details such as the due date, accepted payment methods, late fees, and any discounts for early payments. This information ensures that the client is aware of their responsibilities and the consequences of delayed payments. Below are some key components to include:

| Payment Term | Details |

|---|---|

| Due Date | Clearly state when the payment is due, whether it’s within 30 days, upon completion, or another specified time frame. |

| Accepted Payment Methods | List the methods you accept for payment, such as bank transfer, credit card, PayPal, or checks. |

| Late Payment Fees | Specify any penalties or interest charges for overdue payments to encourage timely settlement. |

| Discount for Early Payment | If you offer discounts for early payments, mention the percentage and the time frame in which clients must pay to qualify for the discount. |

By establishing and communicating these payment terms clearly, you ensure that your clients understand their obligations, reducing the likelihood of delayed payments and fostering smoother financial transactions.

Designing an Invoice for Professional Appeal

Creating a visually appealing and well-structured billing document is essential for making a positive impression on your clients. A professional design not only enhances the clarity of the information presented but also strengthens your brand identity. By incorporating key design elements and a clean layout, you can ensure that your document is both functional and aesthetically pleasing.

Key Design Elements for a Professional Look

There are several important design features to consider when creating a document that stands out and communicates professionalism:

- Logo and Branding: Include your company logo and brand colors to make your document instantly recognizable and consistent with your overall business identity.

- Clear Typography: Use simple, legible fonts that enhance readability. Avoid overly decorative fonts that could detract from the document’s clarity.

- Clean Layout: Keep the layout simple and organized, with enough white space to make the document easy to read. Sections should be clearly defined to ensure that the client can quickly locate important information.

- Consistent Alignment: Align text and numbers in a way that maintains balance and order, whether it’s for item descriptions, pricing, or contact information.

Using a Table to Organize Information

A table is a great way to organize details such as services rendered, time spent, and costs. This allows clients to easily digest the information and quickly verify the charges. Below is an example of how a table can be used to present key information in a clear, professional format:

| Description | Hours | Rate | Total |

|---|---|---|---|

| Consultation on Project Scope | 3 | $75 | $225 |

| Design and Development | 12 | $100 | $1,200 |

| Total | $1,425 |

By using a well-designed table, you provide a clear breakdown of charges, which improves transparency and helps build trust with your clients. A polished, easy-to-read document not only reflects your professionalism but also makes the billing process more efficient for both you and your clients.

Common Mistakes to Avoid in Invoices

Even small mistakes in billing documents can lead to confusion, delays, or missed payments. It’s essential to ensure that every detail is correct and clearly presented to maintain a professional image and avoid unnecessary issues with clients. Understanding the most common errors will help you streamline your billing process and ensure accuracy in every transaction.

Below are some frequent mistakes that can cause problems when creating your billing documents:

| Mistake | Impact | How to Avoid |

|---|---|---|

| Missing Client Information | Leads to confusion about the client’s identity, affecting communication and payment tracking. | Always double-check that the client’s name, address, and contact details are included and correct. |

| Unclear Service Descriptions | Clients may question the validity of charges if the services aren’t clearly outlined. | Be as specific as possible in describing the services you provided, including dates and key details. |

| Incorrect Payment Amount | Errors in pricing or calculations can cause disputes or delays in payment. | Double-check your math, ensure rates and hours are correct, and provide a clear breakdown of charges. |

| Omitting Payment Terms | Clients may not know when to pay or which methods to use, leading to delays. | Clearly state payment terms, including due dates, acceptable payment methods, and any penalties for late payments. |

| Not Including an Invoice Number | Without a unique identifier, tracking payments or referring to a specific document can become difficult. | Assign a unique number to every billing document for easy tracking and future reference. |

By avoiding these common mistakes, you can improve the accuracy of your documents and build stronger, more transparent relationships with your clients. Ensuring that every detail is correct reduces confusion and fosters trust, ultimately leading to smoother transactions and timely payments.

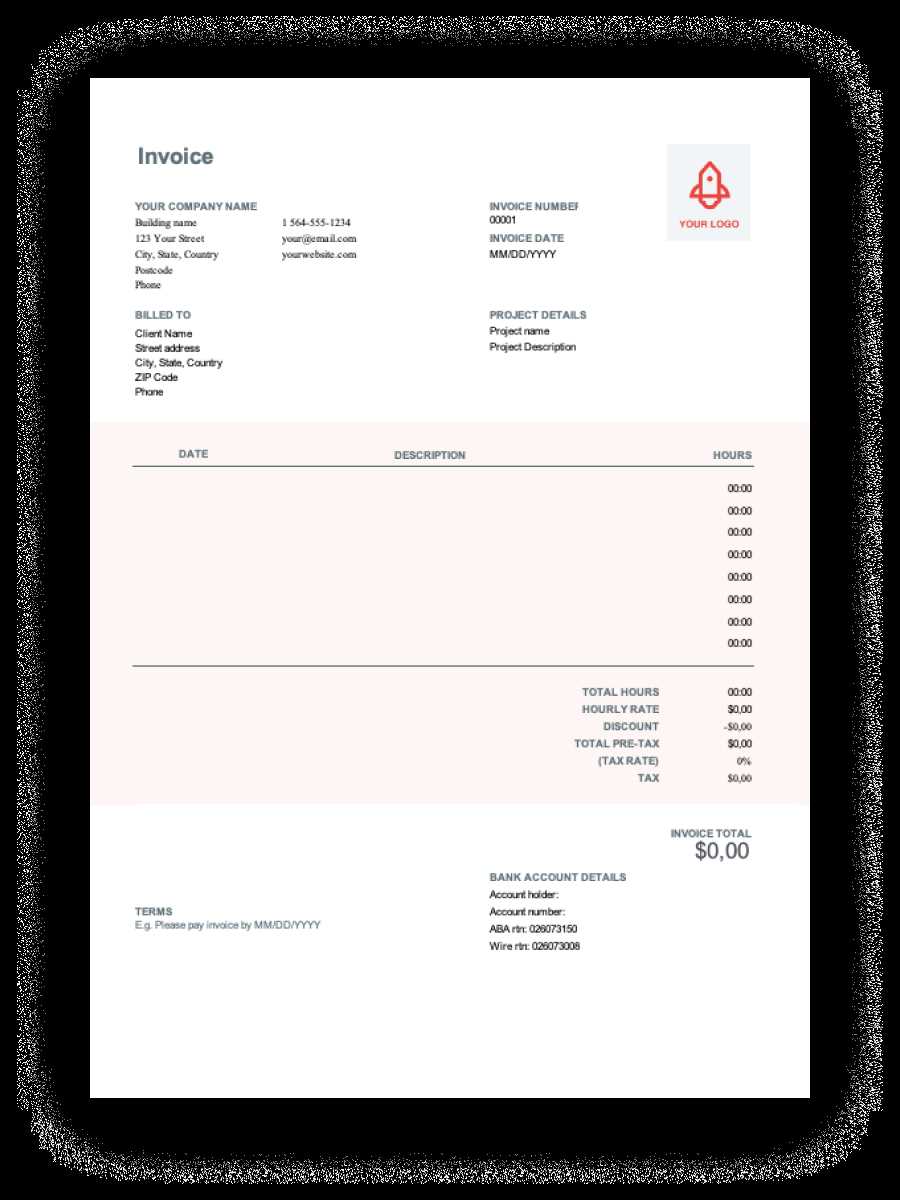

How to Track Hours for Invoicing

Accurately tracking the time spent on various tasks is crucial for ensuring that you are paid correctly and fairly. Without a reliable system to record your hours, it’s easy to overlook important details or make mistakes that could lead to undercharging or overcharging. Establishing a consistent method for logging time will not only help you avoid errors but also improve transparency and trust with your clients.

Methods for Tracking Time

There are several methods you can use to track the hours spent on each task or project. Below are a few common techniques that can help you stay organized and precise:

- Manual Logs: Write down your start and end times for each task in a notebook or digital document. While this method is simple, it requires diligence and regular updates.

- Time-Tracking Software: Use dedicated tools or apps designed for time tracking. These programs allow you to start and stop a timer for each task, providing a more accurate and automated way to track your hours.

- Spreadsheet Records: Create a spreadsheet where you can log your hours, tasks, and any relevant notes. This method can help you keep a detailed record and generate summaries for billing.

Best Practices for Accurate Time Tracking

Whichever method you choose, there are best practices to follow to ensure accuracy:

| Practice | Details |

|---|---|

| Track Immediately | Record your time as soon as a task is completed to avoid forgetting details or miscalculating hours. |

| Be Specific | Note exactly what was done during each time block to make it easier to justify charges later. |

| Include Breaks | Account for any breaks or interruptions, and make sure these aren’t included in your billable time. |

| Review Regularly | At the end of each day or week, review your time logs to ensure that all hours are accounted for and correct. |

By following these best practices and choosing an appropriate tracking method, you can ensure that your time is accurately logged and that your billing process runs smoothly. This attention to detail will help you maintain client satisfaction and ensure that you are compensated for every hour spent on a project.

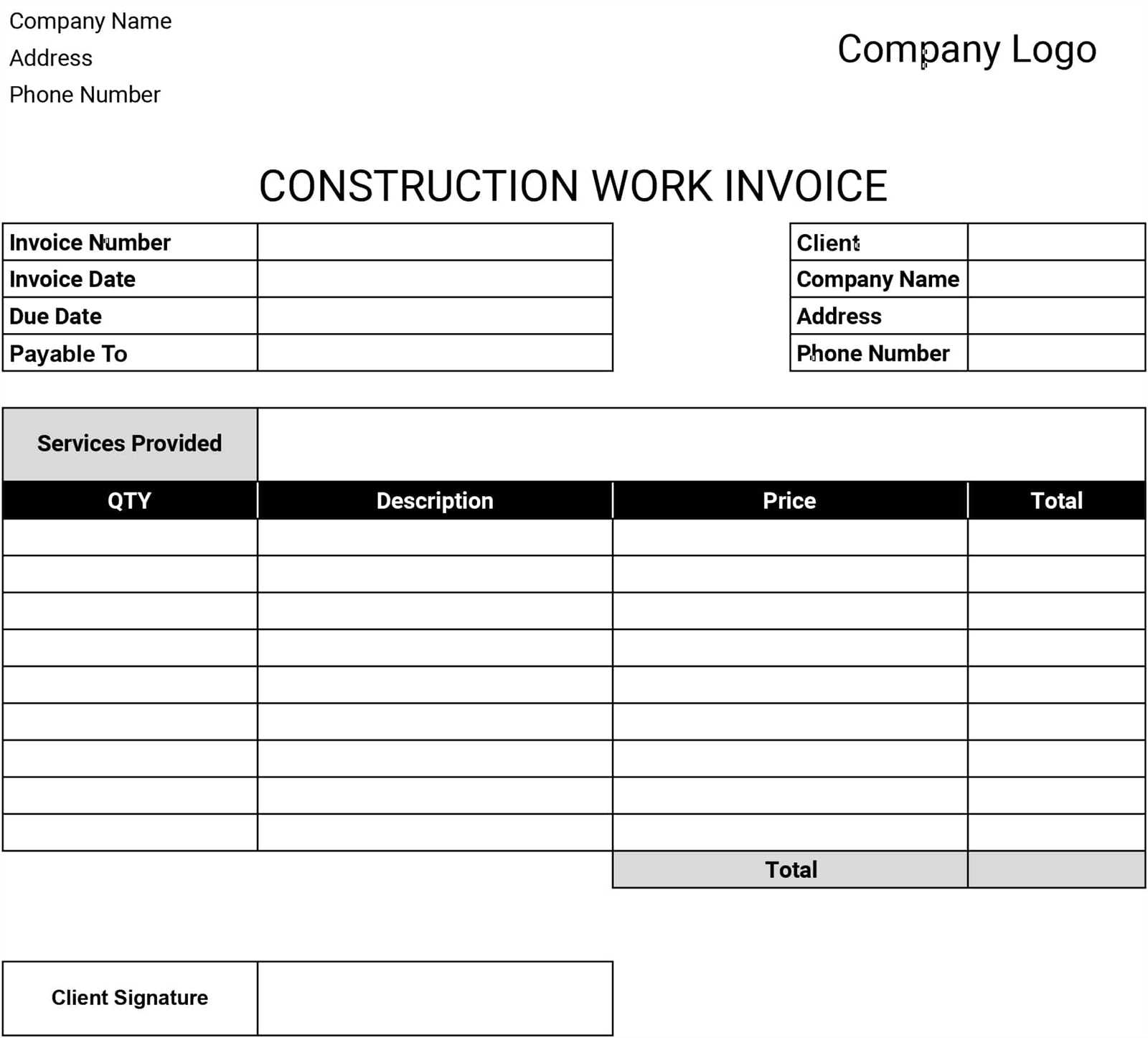

Legal Requirements for Billing Invoices

When creating a financial document to request payment, it’s essential to understand the legal requirements that apply to such documents in your country or region. Failing to include necessary information could lead to disputes, legal issues, or delays in payment. By ensuring your documents meet legal standards, you protect both yourself and your clients while maintaining transparency and professionalism.

Key Legal Elements to Include

There are several key pieces of information that should always be included to ensure compliance with legal standards. These elements provide both you and your client with clarity on the terms of the transaction and the details of the payment process:

- Legal Business Name: Your official business name should be clearly displayed on the document, as recognized by government authorities or your legal registration.

- Client’s Details: Include the full name or business name, address, and contact information of the client being billed.

- Unique Document Number: Each financial document should have a unique identifier to help with record keeping and tracking payments.

- Date of Issue: The date the billing document is issued must be clearly stated. This will help determine payment terms and deadlines.

- Payment Terms: Indicate the due date for payment and any late fees or penalties that may apply if the payment is delayed.

- Breakdown of Services or Goods: Clearly describe what is being charged, including the rate or price, quantity, and any applicable taxes or discounts.

- Tax Information: Depending on your location, include any applicable tax identification numbers (such as VAT) and ensure tax rates are correctly applied.

Compliance with Local Tax Laws

Legal requirements often vary depending on the jurisdiction. Be sure to research the specific regulations that apply in your area, especially regarding tax collection and reporting. Some areas may require certain types of businesses to charge sales tax, while others may have specific reporting obligations for freelancers or contractors. Here are some tips to ensure compliance:

- Consult with a tax professional to ensure your charges and tax calculations align with local laws.

- Keep accurate records of all transactions and document any sales tax collected, as these may need to be reported periodically to tax authorities.

- Ensure that all payments are clearly itemized to reflect the appropriate tax amounts and any applicable exemptions.

By including these key details in your billing documents and ensuring compliance with relevant legal requirements, you not only safeguard your business but also foster a transparent, trustworthy relationship with your clients. Following these legal standards will help ensure timely payments and avoid unnecessary disputes or legal issues.

How to Format Your Invoice Correctly

Proper formatting of your billing document is essential for clarity, professionalism, and ease of use. A well-organized layout helps ensure that all necessary information is easy to find, making it more likely that your clients will understand the charges and settle payments promptly. Correct formatting not only enhances readability but also reinforces your business’s professionalism.

Here are the key steps to correctly format a financial document, ensuring that it is clear, accurate, and well-received:

- Start with Your Business Information: At the top of the document, include your business name, logo (if applicable), address, contact details, and any tax identification numbers. This establishes your brand identity and provides clients with the information they need to reach you.

- Include Client’s Information: Clearly list your client’s name, company (if applicable), address, and any other relevant contact details. This ensures that the document is correctly assigned to the right party.

- Assign a Unique Identifier: Each document should have a unique number for easy reference. This helps both you and your client keep track of payments and allows you to organize your records more efficiently.

- Provide a Date: Clearly indicate the date the document is issued, as well as the payment due date. This helps to define the payment terms and avoid confusion about when payment should be made.

- Break Down the Charges: List the specific services or products provided, the time spent or quantities delivered, the rate or price for each item, and the total for each line item. Use a table format for clarity and easy reading.

- Include Payment Terms: Clearly state the payment deadline, any late fees, and accepted payment methods. This ensures that both parties are on the same page regarding when and how payment should be made.

- Tax and Additional Charges: If applicable, include any sales tax or other charges that apply. Be sure to specify the tax rate and total tax amount to ensure transparency.

By following these guidelines and ensuring that all critical information is easily accessible, you create a document that will not only help facilitate timely payments but also reflect positively on your business. A properly formatted financial document reduces the chance of confusion, delays, or disputes, fostering smoother interactions with your clients.

Digital vs Paper Invoices: Pros and Cons

When it comes to billing, businesses have two primary options for sending payment requests: digital documents and traditional paper-based ones. Both approaches have their advantages and disadvantages depending on factors such as speed, cost, and the client’s preferences. Understanding these pros and cons can help you choose the best method for your needs and streamline your billing process.

Pros and Cons of Digital Documents

Digital billing documents are becoming increasingly popular due to their convenience and efficiency. Here’s a look at the key advantages and drawbacks:

| Pros | Cons |

|---|---|

| Speed: Digital documents can be sent instantly via email or through billing software, which speeds up the billing cycle. | Technical Issues: Digital documents may not be received due to technical issues, such as incorrect email addresses or server problems. |

| Cost-Effective: No printing, paper, or postage costs involved, making it a more affordable option in the long run. | Security Concerns: Digital documents are susceptible to cyber threats, such as hacking or phishing attacks, if not properly secured. |

| Environmentally Friendly: Reduces paper waste and is a more eco-conscious choice. | Dependence on Technology: Both you and your clients must have access to the necessary technology to send and receive digital documents. |

| Easy Tracking and Storage: You can store, search, and manage digital files with ease, making record-keeping more organized. | Less Personal Touch: Some clients may feel that a physical document is more personal or professional than a digital one. |

Pros and Cons of Paper Documents

While digital documents offer many benefits, some businesses still prefer to send paper bills for various reasons. Below are the pros and cons of using paper-based billing:

| Pros | Cons |

|---|---|

| Physical Proof: Paper documents provide a physical record that some clients may prefer for reference or compliance reasons. | Higher Costs: Printing, paper, and postage fees can add up, especially if you send a large number of documents. |

| No Technology Needed: Clients who are less tech-savvy or don’t have access to email can still receive and process paper documents. | Slower Processing: Mailing takes longe

Creating a Template for Recurring Clients

For businesses that work with clients on an ongoing basis, creating a reusable structure for billing can save both time and effort. A well-designed billing document can ensure consistency, reduce the likelihood of errors, and streamline your invoicing process. By designing a format that caters specifically to repeat clients, you can focus more on providing value and less on administrative tasks. Key Elements for Recurring BillingWhen crafting a billing structure for repeat clients, there are several important elements to consider that will make the process smoother for both you and your clients:

How to Automate the Process

For recurring clients, it’s possible to automate much of the billing process to reduce the administrative burden. Here’s how:

By creating a structured approach to recurring billing, you can simplify the invoicing process, build stronger relationships with your clients, and maintain a more predictable cash flow for your business. How to Send and Follow Up on InvoicesSending billing documents and following up with clients is a critical step in ensuring timely payments and maintaining positive business relationships. Whether you’re sending your first request for payment or dealing with long-term clients, the way you approach both the delivery and follow-up process can make a significant difference in how quickly and smoothly you receive payments. Effective communication and clear instructions can help avoid delays and misunderstandings. Sending the Payment Request

When sending a payment request, the process should be clear, professional, and straightforward to ensure that the client understands the charges and the payment terms. Here’s a simple guide on how to send your documents:

Following Up on PaymentsAfter sending the payment request, it’s essential to follow up in a professional and courteous manner if the payment is not made on time. Here’s how you can handle follow-ups effectively:

Remember, timely follow-ups are crucial for maintaining cash flow and fostering good client relationships. By sending Tools to Generate Billing Documents

For businesses that need to create payment requests for services provided, using the right tools can save time, reduce errors, and help maintain professionalism. A range of online platforms and software tools are available to simplify the process, allowing you to create custom billing documents quickly and efficiently. These tools often offer templates, automatic calculations, and other features to streamline the entire process. Popular Tools for Generating Payment Requests

Here are some of the most popular tools that can assist you in generating professional payment requests:

Features to Look for in Billing ToolsWhen choosing the right tool for generating your billing documents, look for features that match your specific business needs:

By using these tools, businesses can generate billing documents with ease, ensure accuracy, and keep the payment process organized. Whether you prefer a quick online generator or a comprehensive accounting system, the right tool can save you time and improve your overall efficiency. Ensuring Timely Payments from Clients

One of the key challenges for businesses, especially small enterprises and freelancers, is ensuring that clients make payments on time. Late payments can disrupt cash flow and hinder growth. To avoid these issues, it’s essential to implement strategies that encourage prompt payments, maintain clear communication, and streamline the billing process. Key Strategies for Timely PaymentsHere are some effective strategies you can use to ensure clients pay on time:

Maintaining Positive Relationships Despite Payment Issues

While it’s important to ensure timely payments, it’s also vital to maintain positive relationships with clients, even if delays occur. Here are a few tips for handling payment delays without jeopardizing client trust:

By setting clear terms, offering flexible payment options, and communicating proactively, businesses can significantly improve the chances of receiving payments on time and maintain healthy cash flow. |