Hotel Invoice Template in Excel for Easy Billing and Customization

Managing billing for your business can often be time-consuming and prone to errors. The process becomes even more challenging when dealing with various services, pricing structures, and customer details. To streamline this, a well-organized, easy-to-update document can make all the difference. By using a customizable structure, businesses can ensure accurate calculations and professional presentation every time.

Automation and flexibility are key when it comes to simplifying financial tasks. With the right tools, you can quickly create documents that reflect the specifics of each transaction, from room charges to additional services. The ability to update rates or add new fields as needed helps maintain consistency, while reducing the chance for mistakes.

In this article, we’ll explore how to create and customize a professional billing document that meets your specific needs, saving you time and effort. With a simple, yet powerful solution, you’ll be able to manage client transactions with ease and accuracy.

Hotel Invoice Template in Excel

When managing customer charges and payments, it’s crucial to have a system that ensures both clarity and accuracy. A digital solution that offers flexibility in formatting, calculation, and customization can significantly improve the billing process for any accommodation-based business. By using an adaptable framework, businesses can easily reflect all relevant details, from stay duration to additional services provided.

Why Choose a Digital Format for Billing

Opting for a digital method to handle financial documents offers numerous benefits:

- Efficiency: Automatically calculate totals, taxes, and discounts without manual intervention.

- Customization: Easily adjust the format to suit the specific needs of your business.

- Record Keeping: Store and access past documents with ease, improving organization and transparency.

Key Features of a Good Billing Document

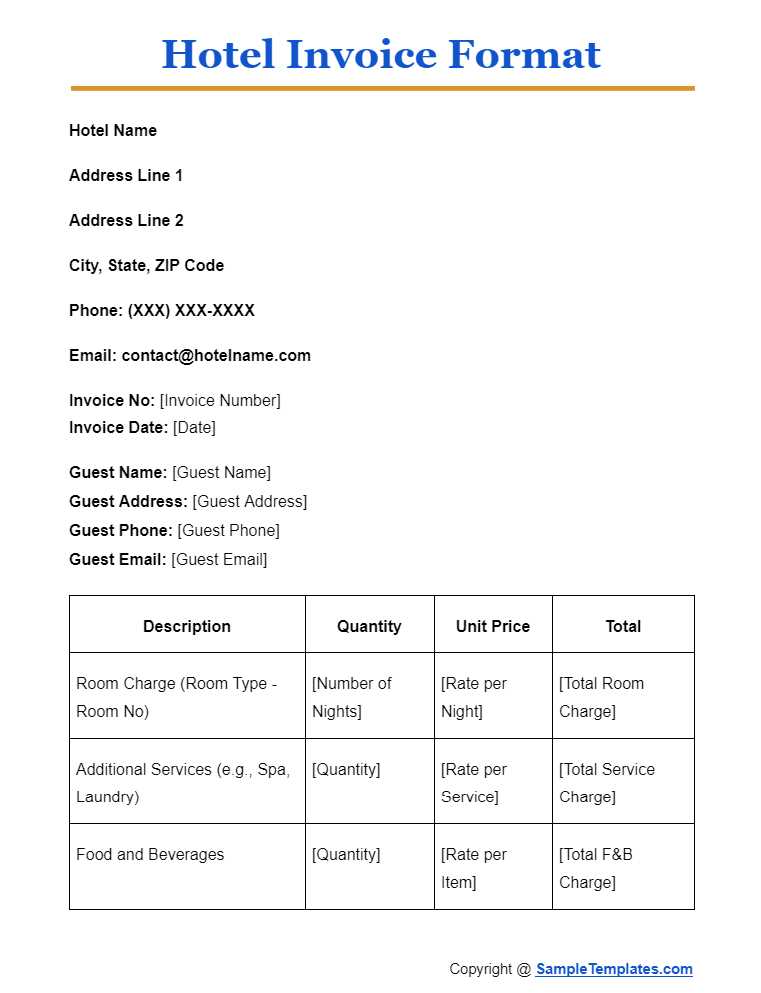

A well-designed document should include essential fields to ensure smooth transactions and easy reference:

- Client Information: Name, address, and contact details for each customer.

- Service Details: List of rooms or services provided with respective charges.

- Additional Costs: Charges for extra services such as parking, meals, or amenities.

- Payment Status: Clearly display whether the payment is pending, completed, or overdue.

- Dates of Stay: Check-in and check-out dates for accurate billing.

By incorporating these elements into your digital documents, you can streamline your business operations while maintaining a professional image with every transaction.

Why Use an Excel Invoice Template

Choosing the right solution for creating and managing financial documents can greatly impact the efficiency and accuracy of your billing process. A digital tool that allows for easy customization and automatic calculations can save valuable time and reduce human error. This method is especially useful for businesses with frequent transactions, helping to maintain consistency across all billing records.

Advantages of Using a Spreadsheet for Billing

- Automation: Calculations such as totals, taxes, and discounts can be automatically applied, eliminating the need for manual computation and reducing mistakes.

- Customizable Design: Easily adjust the layout and fields to meet your business’s specific needs, whether it’s adding additional services or adjusting pricing structures.

- Ease of Use: Most people are familiar with basic spreadsheet software, making it easy to adapt without requiring advanced technical skills.

- Efficient Record Keeping: You can store and access all financial documents digitally, improving organization and making it easier to retrieve past records when needed.

- Cost-Effective: Using readily available spreadsheet software avoids the need for expensive invoicing software or third-party services.

How It Helps Maintain Professionalism

Using a digital solution helps create a polished and professional appearance, enhancing your business’s credibility. By maintaining consistent formatting across all billing documents, you ensure that your records are clear, easy to read, and free of errors, which is key to building trust with your clients.

How to Create a Hotel Invoice in Excel

Creating a professional billing document for your business doesn’t have to be complicated. With a simple digital tool, you can easily set up a system that calculates totals, tracks payments, and generates clear, organized records. By following a few basic steps, you can quickly produce a custom document that fits your business needs and ensures accurate billing every time.

Step-by-Step Guide to Building Your Document

To start, follow these simple instructions to create your billing form:

- Open Your Spreadsheet Software: Start a new blank document to begin designing your structure.

- Set Up Header Information: Add the necessary business details like the name, address, and contact information. You can also include a title such as “Billing Statement” or “Transaction Record” at the top.

- Insert Fields for Customer Information: Create rows for customer name, address, and any other relevant details you need to track.

- List Charges: Create a table with rows for the services provided, such as room type, quantity, and rate. You can also include columns for additional charges, like meals or parking.

- Include Calculation Fields: Set up formulas for automatically calculating totals, tax, and any applicable discounts.

- Final Summary: Add a section at the bottom for the overall total, payment status, and any due dates.

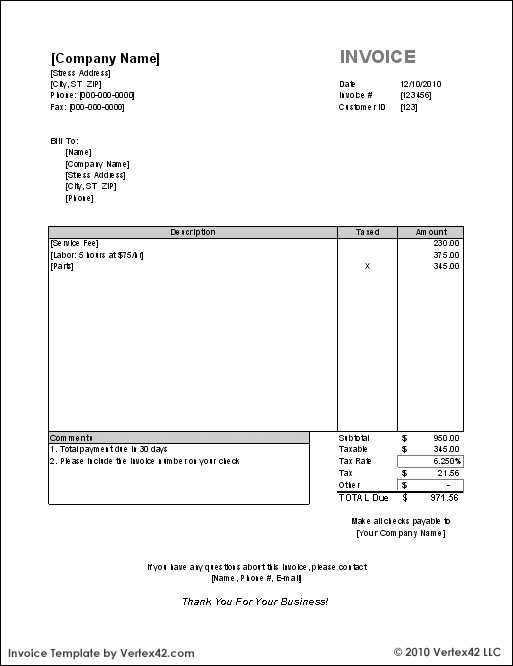

Example of a Basic Layout

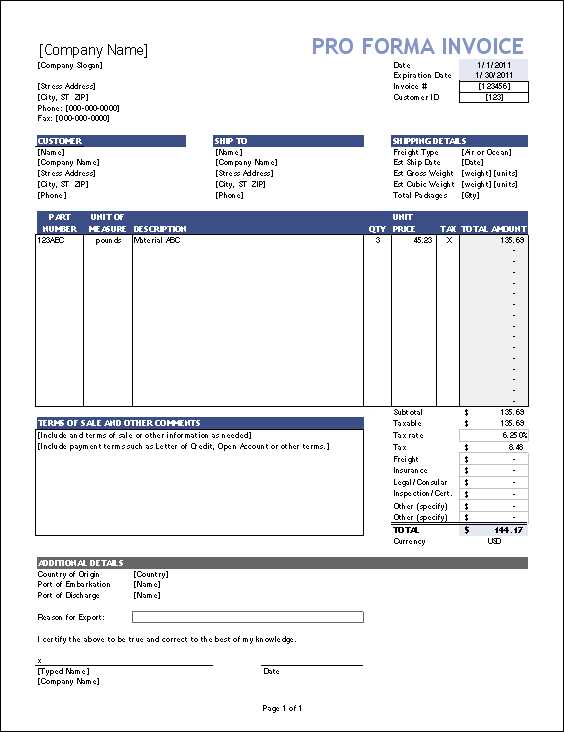

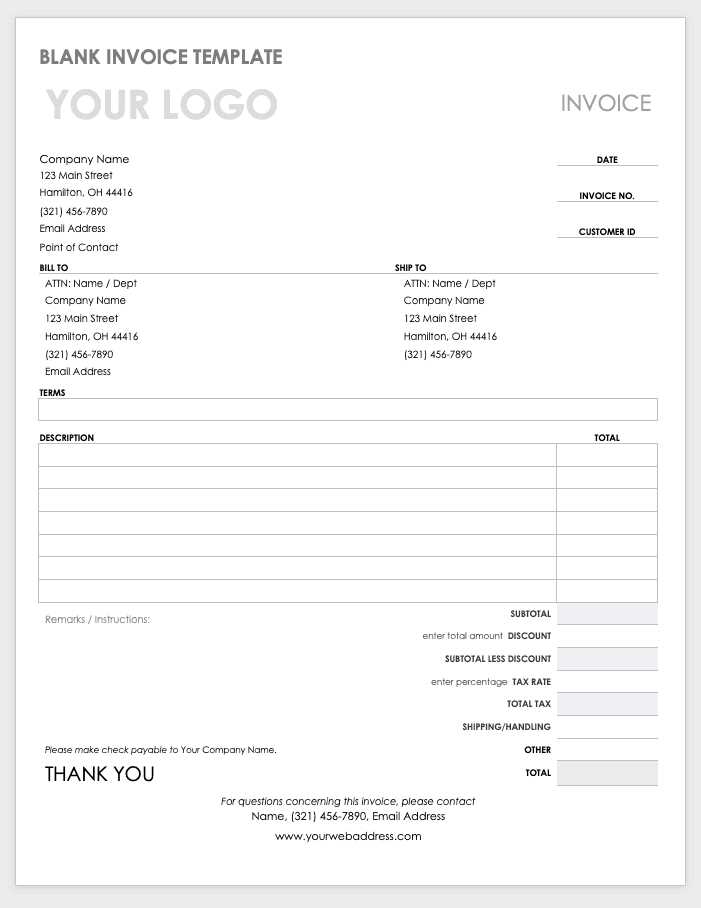

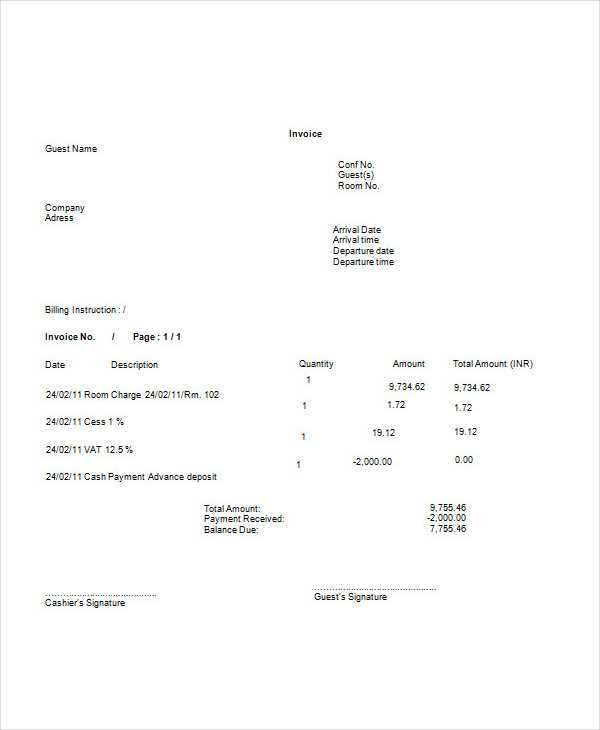

Here is an example of a simple layout for your billing document:

| Service | Quantity | Rate | Total |

|---|---|---|---|

| Standard Room | 1 | $100 | $100 |

| Parking | 1 | $10 | $10 |

| Total | $110 |

This simple structure can be expanded with more rows or columns depending on the complexity of your pricing. Once completed, you can save and share the document with clients or store it for future reference.

Essential Features of an Excel Invoice

A well-constructed financial document serves not only to summarize the transaction but also to ensure clarity and accuracy in billing. The key to an effective solution lies in including all necessary details while maintaining a simple, user-friendly design. A well-organized structure helps avoid confusion and supports smooth financial operations for both businesses and clients.

Core Components to Include

To make sure your document meets all the needs of your business and your clients, consider including these essential elements:

- Business Information: Include your business name, address, and contact details at the top for easy identification.

- Customer Details: Make space to add the customer’s name, contact information, and billing address.

- Services Provided: Clearly list each service provided along with the respective charge, including room rates, additional amenities, or special requests.

- Quantities and Rates: Ensure there are columns for the quantity of services used and the rate per unit to calculate totals automatically.

- Taxes and Discounts: Provide areas to apply taxes or any applicable discounts, helping to break down the total amount clearly.

- Payment Status: Include fields to note the payment status, such as whether the amount has been paid, is due, or partially paid.

Why These Features Matter

Each of these features plays a crucial role in ensuring your billing documents are clear, professional, and accurate. With all details in place, both your business and your clients will have a clear understanding of the charges and the payment process. This reduces errors, prevents misunderstandings, and helps maintain transparency in all financial transactions.

Benefits of Customizing Hotel Invoices

Tailoring financial documents to fit the specific needs of your business can enhance both efficiency and professionalism. By adjusting the layout and content to match the unique aspects of your operations, you can ensure that all necessary details are accurately captured, while also creating a more branded experience for your clients. Customization provides the flexibility to reflect your business model, pricing structure, and customer service philosophy.

Improved Professional Appearance

A personalized billing document can elevate the perception of your business. By incorporating your branding–such as logos, color schemes, and fonts–into each transaction record, you present a polished, consistent image. This attention to detail builds trust with clients and reinforces your business’s professionalism.

Increased Efficiency and Accuracy

Customizing your financial documents allows you to streamline the billing process. By creating specific fields for your unique services and products, you can ensure that all charges are clearly itemized and easily calculated. This reduces the chances of mistakes or omissions and speeds up the overall workflow, saving time for both your staff and clients.

Additionally, customization makes it easier to adjust your documents when you need to update pricing, add new services, or apply specific discounts, all while maintaining consistency across your records.

Steps to Download an Invoice Template

Finding and downloading a suitable billing document for your business is a quick and easy way to streamline your financial processes. By choosing a pre-designed solution, you can save time and avoid the hassle of creating a structure from scratch. Downloading a ready-made form allows you to focus on customizing it to suit your specific needs, rather than dealing with the initial setup.

Where to Find a Billing Document

There are numerous online resources that offer free or paid templates for financial documents. Look for trusted websites, including software providers or business tool platforms, which specialize in providing pre-built solutions. Some key points to keep in mind when searching:

- Reputable Sources: Choose trusted platforms that offer professional, high-quality forms.

- File Formats: Ensure that the downloaded document is compatible with the software you use (e.g., spreadsheet format or PDF).

- Customization Options: Look for solutions that allow you to modify fields, add logos, and change prices as needed.

How to Download the Document

Follow these simple steps to download and set up your financial document:

- Choose the Desired Form: Browse through available templates and select one that best fits your business requirements.

- Download the File: Click the download link or button on the website to save the document to your computer.

- Open and Review: Open the downloaded file in your preferred software to review the format and structure.

- Customize the Form: Adjust the content, such as business details, service descriptions, and pricing, to reflect your own offerings.

- Save and Use: Once you’re satisfied with the customization, save the document and begin using it for transactions.

By following these simple steps, you can quickly obtain a functional and customizable billing document, ready to meet your business’s needs.

How to Add Your Hotel Details

Including your business information in a billing document is crucial for maintaining professionalism and ensuring clarity. The goal is to provide all necessary contact and legal details in a clear and organized manner. By adding these details properly, you create a document that not only serves its purpose but also reinforces your brand identity and makes communication smoother with clients.

To add your business information, start by identifying the key details that need to appear on every document you issue. These may include your business name, contact information, and any relevant registration or tax numbers. Placing this information at the top of the document makes it easy for clients to find and ensures consistency across all records.

Here’s how you can do it:

- Business Name: Add the full name of your business at the top of the document. Make sure it’s prominent and easy to read.

- Address: Include your physical location, including street address, city, and zip code. This helps clients recognize where you’re located.

- Contact Information: List a phone number, email address, and any other ways customers can reach you for queries or follow-ups.

- Tax Identification Number: If required by law, include your tax ID number or VAT number to ensure that the document complies with legal standards.

- Website or Social Media Links: You can also add links to your website or social media profiles for easy access to more information about your services.

Once all the details are added, review the document to make sure everything is correct. This simple step helps maintain transparency and ensures your clients have all the information they need in case of questions or follow-up.

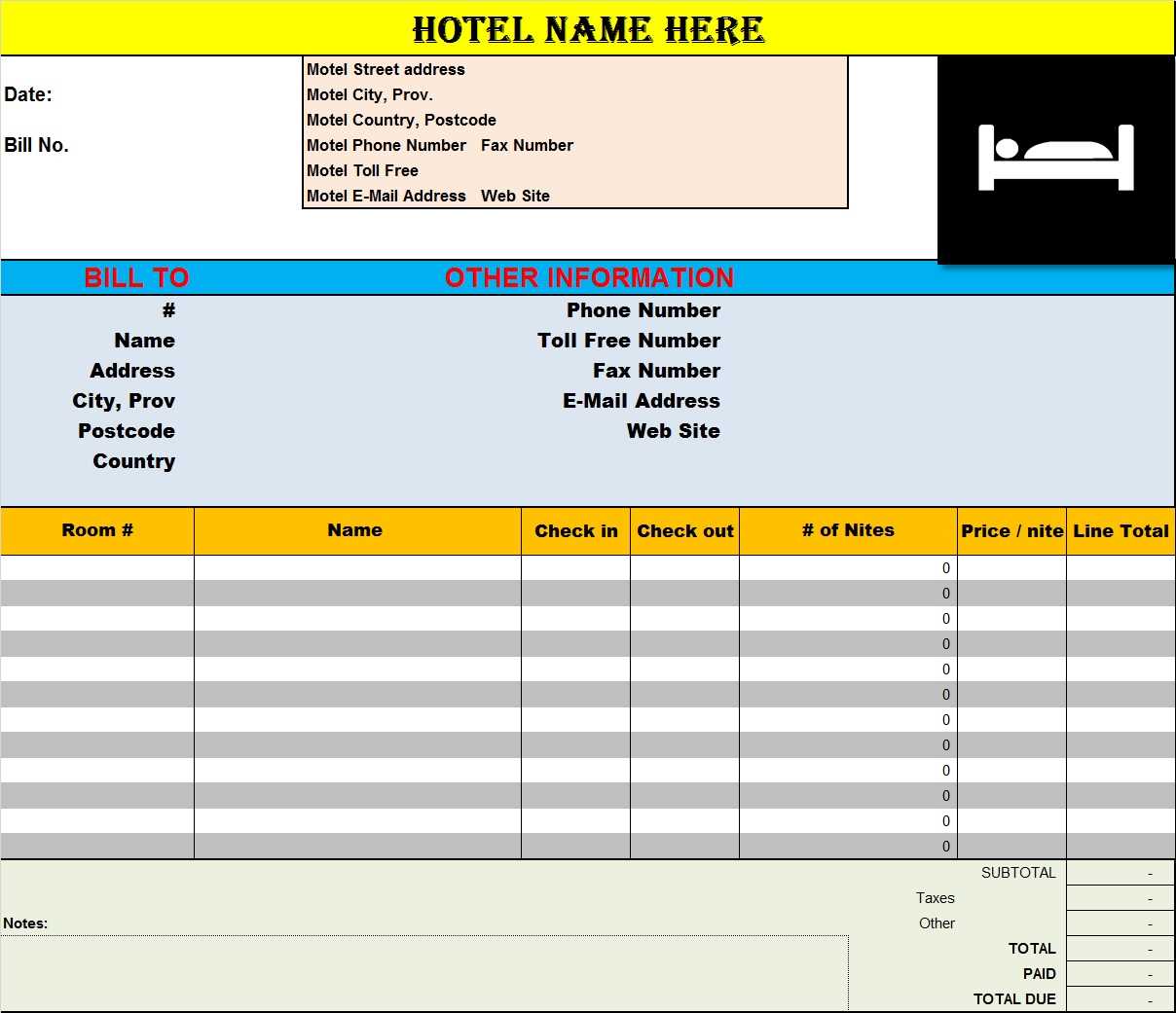

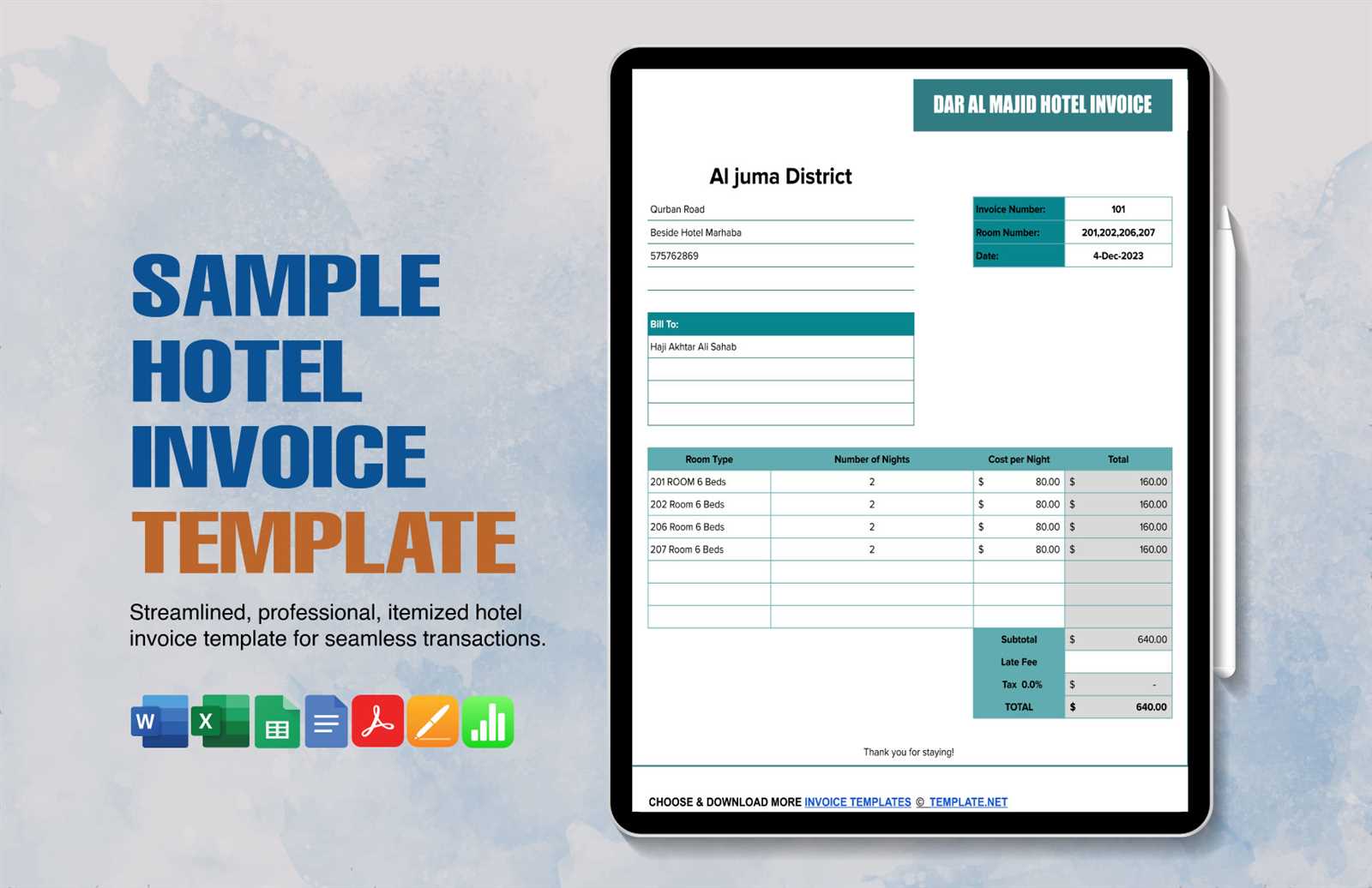

Calculating Room Charges Automatically in Excel

Automating the calculation of charges in your financial documents can save significant time and reduce the risk of errors. By using formulas, you can easily calculate totals based on room rates, the length of stay, and any additional services provided. This allows for quick and accurate billing, ensuring that clients are charged appropriately and that your records are always consistent.

To set up automatic calculations for room charges, follow these simple steps:

Steps to Set Up Automated Room Charge Calculations

- Input Room Rate: Start by entering the price for each room type in a dedicated column. This could be a fixed price per night or vary depending on the room category.

- Enter Length of Stay: In another column, input the number of nights the client stayed. This is a key factor in calculating the total cost.

- Use Formulas: Multiply the room rate by the number of nights to calculate the total charge for the stay. You can use a simple multiplication formula, such as =room_rate * nights_stayed.

- Include Additional Services: If applicable, list any extra services, like meals, parking, or amenities, and use a similar formula to calculate their costs.

- Summing Up Charges: Add up all the individual charges (room rate + additional services) to get the final total. Use a sum formula, like =SUM(cell_range), to automatically calculate the total amount due.

Example of Formula Setup

Here’s an example of how the formula setup might look in your document:

- Room Rate (per night): $100

- Number of Nights: 3

- Total Room Charge Formula: =100 * 3 = $300

- Additional Services (e.g., Parking): $20

- Total Due Formula: =SUM(300, 20) = $320

By automating these calculations, you minimize the need for manual input and ensure your billing documents are error-free. This approach also streamlines the billing process, allowing you to handle more clients with less effort and in less time.

How to Track Payments and Due Dates

Effectively managing payment records and due dates is crucial for maintaining financial stability and ensuring timely collections. By tracking this information in your billing system, you can stay on top of outstanding balances, avoid delays, and improve cash flow management. It’s essential to have a clear method for monitoring payments and identifying upcoming due dates, especially when dealing with multiple clients or transactions.

Steps to Track Payments

Here’s how you can easily track payments and due dates in your financial records:

- Payment Status Column: Add a column labeled “Payment Status” to indicate whether the payment has been made, is pending, or partially completed. This allows for quick reference and ensures you can easily follow up on outstanding balances.

- Payment Date Column: Include a column for the payment date to record when the payment was made. This helps in keeping track of the transaction history and ensures accuracy in your records.

- Amount Paid: Add a section where you can input the amount received. This can be especially useful for partial payments, helping to avoid confusion regarding outstanding balances.

Managing Due Dates

To keep track of when payments are due, you can use the following techniques:

- Due Date Column: Include a field where the expected payment due date is clearly listed. This gives you a quick overview of when payments should be made and helps prioritize follow-up actions.

- Payment Reminders: Set up automatic reminders or alerts, if using digital tools, to notify you of upcoming due dates. This ensures you never miss a payment deadline.

- Late Payment Tracking: Add a column that tracks whether payments are overdue. This allows you to easily identify clients who have missed deadlines and need follow-up.

By including these elements in your records, you can efficiently track payments, ensure timely collections, and reduce the risk of missed or delayed transactions.

Design Tips for a Professional Invoice

Creating a well-designed billing document not only improves its clarity but also strengthens the perception of your business. A professional design makes the information easier to understand and more visually appealing, helping to build trust and credibility with your clients. By following a few key design principles, you can create a document that reflects your brand and enhances the overall client experience.

Key Design Elements for Professional Billing Documents

- Branding: Incorporate your business logo, colors, and fonts to maintain brand consistency. This will make your document feel cohesive with your other marketing materials and strengthen your brand presence.

- Clear Layout: Use a clean, well-structured layout with plenty of white space. Avoid overcrowding the page with too much text or unnecessary elements, which can make the document feel cluttered.

- Easy-to-Read Fonts: Choose simple, easy-to-read fonts like Arial or Times New Roman. Avoid decorative fonts that can be difficult to read, especially when printed or viewed on smaller screens.

- Logical Flow: Arrange the information in a logical order. Place important details like your business name, contact info, and transaction summary at the top. Follow with the list of services and charges, then the total amount due.

- Highlight Important Information: Make the total amount due stand out by using bold text or a larger font size. This helps ensure clients immediately see the most critical information.

Additional Tips for Enhancing the Design

- Use Grids and Tables: Organize charges and services in clearly defined rows and columns. This helps the reader quickly navigate through the details and understand the breakdown of costs.

- Include Payment Instructions: Make it easy for clients to pay by clearly outlining your payment methods, due dates, and any late fees in a separate section.

- Consistent Alignment: Align all text and numbers neatly, particularly in tables. This ensures everything is easy to read and visually balanced.

- Leave Room for Notes: Allow space for any additional information or special instructions, such as thank-you messages or return policies, to personalize the document.

By following these design tips, you can create a professional billing document that enhances the client experience, builds trust, and reflects your attention to detail.

How to Add Taxes and Discounts

Including taxes and discounts in your billing records is essential for accurate financial reporting and clear communication with your clients. These elements help break down the total cost in a transparent manner, making it easier for both parties to understand the final amount due. Adding these adjustments can also enhance professionalism and show attention to detail in your billing process.

To accurately reflect taxes and discounts, follow these steps:

Adding Taxes

Taxes are usually a percentage of the subtotal amount. Depending on your location or the nature of the service, different tax rates may apply. Here’s how to add taxes:

- Determine the Tax Rate: Identify the tax percentage that applies to the transaction (e.g., 5%, 10%, etc.).

- Calculate the Tax Amount: Multiply the subtotal by the tax rate to get the tax amount. For example, if the subtotal is $100 and the tax rate is 10%, the tax will be $10.

- Display the Tax: Clearly list the tax amount in a separate line on the document to show transparency.

Adding Discounts

Discounts can be applied either as a flat amount or as a percentage. Here’s how you can apply them:

- Determine the Discount Type: Decide whether the discount will be a fixed amount (e.g., $20 off) or a percentage (e.g., 10% off).

- Apply the Discount: If it’s a flat discount, simply subtract the amount from the subtotal. For a percentage discount, multiply the subtotal by the discount rate and subtract it from the total. For example, a 10% discount on a $100 bill will reduce the total by $10.

- Show the Discount: Clearly list any discounts applied, showing both the original price and the reduced amount for transparency.

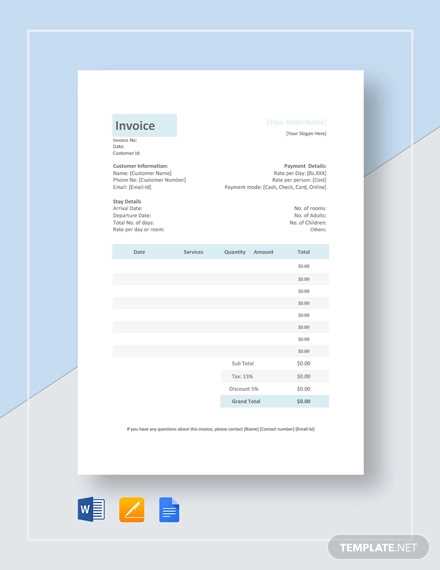

Example Calculation

| Description | Amount |

|---|---|

| Subtotal | $100.00 |

| Tax (10%) | $10.00 |

| Discount (10%) | -$10.00 |

| Total | $100.00 |

By adding taxes and discounts clearly and correctly, you ensure your billing process is b

Managing Multiple Reservations with One Template

Handling multiple bookings efficiently is essential when managing a busy schedule. Instead of creating separate documents for each reservation, you can use a single document to track all transactions, simplifying your process and ensuring consistency across all records. By organizing the information properly, you can manage numerous clients or reservations without losing track of the details or missing important data.

Organizing Multiple Reservations in One Document

To effectively manage several bookings in a single record, it’s important to structure the document in a way that keeps each reservation separate, while still allowing you to see the overall picture. Here’s how to do it:

- Use a New Row for Each Reservation: Allocate a separate row for each client or reservation. This keeps data clear and easy to navigate while providing space for all relevant information.

- Include Key Details: For each reservation, ensure that essential information is included, such as the client’s name, stay dates, services used, and total charges.

- Utilize Filters: If you’re using a spreadsheet, apply filters to easily sort and find specific reservations. Filters can help you quickly identify upcoming stays, cancellations, or special requests.

- Column for Payment Status: Add a column to track the payment status of each reservation (e.g., paid, pending, or partially paid). This makes it easy to follow up on outstanding amounts.

Tracking Additional Information

To further streamline the process, you can add additional columns or sections to capture extra details, such as:

- Special Requests: A column where you can note any specific requests made by clients, like room preferences, early check-in, or extra services.

- Discounts and Offers: If applicable, include a column for any discounts, promotions, or special offers applied to a reservation.

- Payment History: Track partial payments or deposits made by clients, so you have a clear record of what has been paid and what is still due.

By organizing the inf

Why Excel Is Ideal for Hotel Invoices

When it comes to managing billing records, using a software program that combines flexibility, ease of use, and powerful features is essential. Spreadsheets offer a practical solution for creating, organizing, and customizing documents, making them particularly useful for businesses that require frequent and detailed financial transactions. The ability to quickly calculate totals, track payments, and make adjustments is invaluable in maintaining accurate financial records.

Here are several reasons why a spreadsheet program is the best choice for managing billing details in the hospitality industry:

- Ease of Use: The user-friendly interface makes it simple to create and customize financial documents without the need for advanced technical knowledge.

- Customization: You can easily modify the layout, design, and content to fit your business needs, whether you want to adjust fields, add new categories, or personalize your documents with your branding.

- Automated Calculations: Built-in formulas allow for automatic calculations, eliminating the need for manual math and ensuring that totals are accurate every time.

- Data Management: A spreadsheet allows you to manage large amounts of data efficiently, organizing multiple transactions in one place, tracking payments, and monitoring due dates.

- Versatility: You can use the software for a variety of tasks beyond billing, such as tracking inventory, managing customer data, or generating reports, all within the same document.

- Accessibility: With cloud-based options, you can access your records from anywhere, collaborate with team members in real time, and share documents easily with clients or colleagues.

By using a spreadsheet program, you not only save time but also ensure greater accuracy and efficiency in your billing process. The ability to easily adapt and expand your documents as needed makes it an ideal choice for businesses that require dynamic, reliable, and professional financial records.

How to Save and Share Your Invoice

Once you’ve completed your billing document, it’s important to save it in the right format and share it with your clients or colleagues in a way that is both secure and accessible. Whether you need to send it via email or store it for future reference, understanding how to properly save and share your document ensures smooth transactions and better organization.

Saving Your Document

When saving your financial record, it’s important to choose a format that preserves the layout and ensures the document can be opened without issues. Here are the most common saving options:

- Save as PDF: Saving your document as a PDF is often the best option, as it ensures the layout remains intact and can be easily opened on any device. This format is universally accepted and ensures your document looks professional.

- Save in a Cloud Storage: Using cloud storage solutions like Google Drive or Dropbox allows you to access your files from any location and share them easily. You can also keep them safe with automatic backups.

- Save as a Spreadsheet: If you need to make future changes or updates to the document, saving it as a spreadsheet (such as .xlsx) is ideal. This allows for easy editing and adjustments as needed.

Sharing Your Document

After saving your document, sharing it with clients or colleagues can be done quickly and efficiently. Here’s how:

- Email Attachment: The most common way to share a document is by attaching it to an email. If you’ve saved it as a PDF or spreadsheet, simply attach the file and send it to the recipient’s email address.

- Cloud Sharing: If you’ve saved the document to a cloud storage platform, you can generate a shareable link and send it to the recipient. This allows for easy access and ensures that they always receive the most up-to-date version of the document.

- Direct File Transfer: If you’re working closely with someone or need to share the file quickly, consider using direct file transfer methods such as file-sharing apps or platforms that allow for secure transfers.

By following these steps, you can ensure that your document is saved and shared in the most efficient and professional manner, allowing for seamless communication and record-keeping.

Best Practices for Hotel Billing Records

Maintaining accurate and well-organized billing records is essential for any business that provides accommodation or services. Proper record-keeping not only ensures compliance with financial regulations but also helps improve customer trust and streamline internal operations. By following a few best practices, you can ensure that your billing process is efficient, transparent, and error-free.

Key Practices for Accurate Billing Records

- Keep Consistent Formats: Standardize the layout and format of your records for easy reference. This makes it simpler to find specific details and ensures consistency across all documents.

- Detail Every Charge: Always list each charge separately, including room rates, additional services, taxes, and discounts. This transparency helps avoid confusion and allows clients to easily understand their charges.

- Track Payments and Balances: Regularly update payment statuses to avoid confusion. Include sections for partial payments, deposits, and outstanding balances to keep the financial records clear.

- Maintain Accurate Dates: Always record the date of the transaction and the payment due date. This helps in tracking overdue balances and ensures timely follow-ups on outstanding amounts.

- Store Records Securely: Keep your billing records secure, whether digitally or in physical form. Use password protection for digital files and ensure proper storage and access control for physical documents.

- Regularly Update Data: Ensure your records are regularly updated to reflect any changes, such as amendments to services, client requests, or additional charges. Timely updates prevent discrepancies and confusion.

How to Ensure Accuracy and Avoid Errors

- Double-Check Calculations: Always double-check the math, including totals and taxes, to ensure accuracy. Automated calculations can help minimize errors but should still be reviewed for mistakes.

- Use Clear Descriptions: Ensure that each item or service is clearly described. This avoids misunderstandings and provides clarity to the client regarding the charges.

- Implement a Review Process: Establish a review system where another team member verifies the records before they are finalized and sent. This second set of eyes can help catch any potential mistakes.

- Use Templates for Consistency: Consider using pre-designed formats to help streamline the creation of billing documents. Templates can reduce errors and ensure uniformity in each transaction.

By adopting these best practices, you can manage your billing records efficiently, reduce errors, and provide a better experience for your clients. Proper record-keeping not only aids in smooth daily operations but also ensures transparency and fosters trust with your customers.

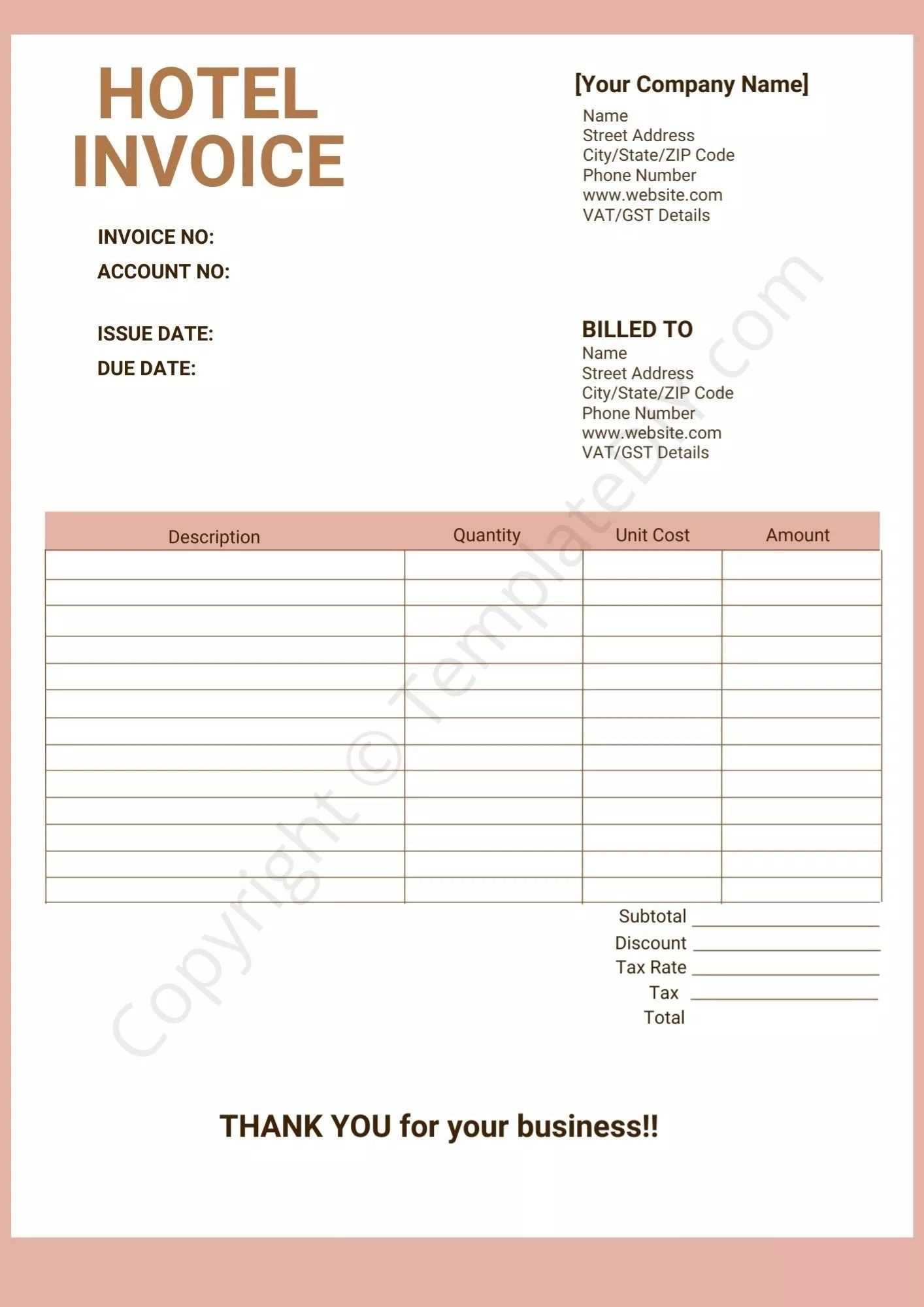

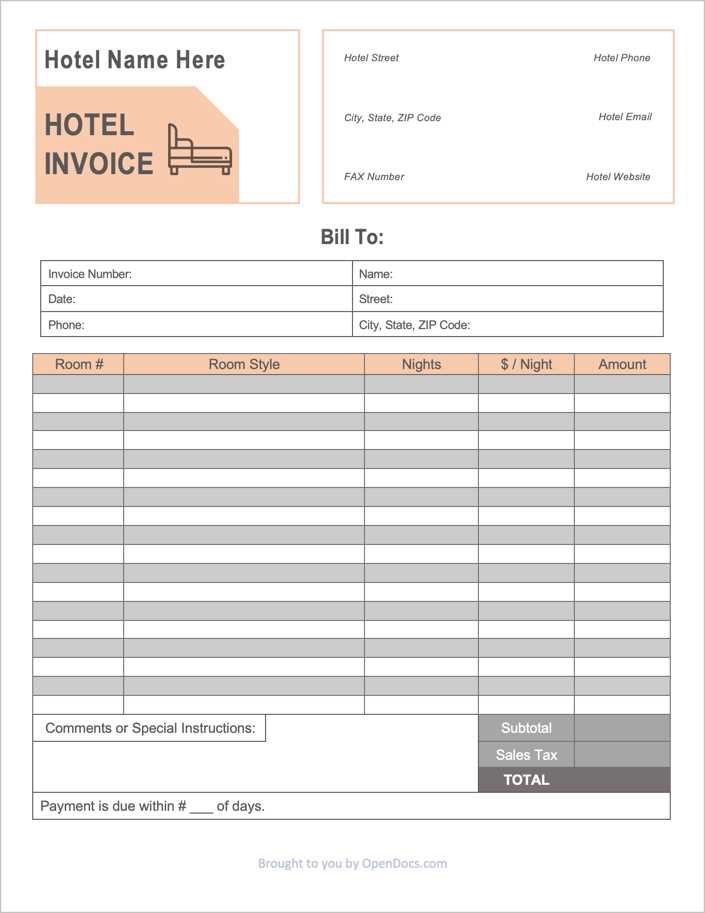

Free Hotel Invoice Templates for Excel

For businesses in the accommodation industry, having a ready-made document format that can be easily customized for each transaction is crucial. Free billing document designs are available online, making it easy for any business to quickly generate accurate and professional-looking financial records. These free options offer a simple solution for those looking to streamline their billing processes without having to design a document from scratch.

Here are some benefits of using free pre-designed billing documents:

- Cost-Effective: As these options are free, you don’t need to invest in expensive software or hire a designer to create your billing records. All you need to do is download and customize the document according to your needs.

- Quick Setup: Ready-made formats save time by eliminating the need for manual document setup. Simply download the design and begin entering the relevant details.

- Customizable: While the basic structure is provided, you can easily adjust the design and content to reflect your branding, add services, or change any other details to match your business operations.

- Easy to Use: These formats are designed to be user-friendly, making it easy for anyone, even with minimal technical skills, to create and manage their financial records.

Many free billing designs come in various styles, allowing you to select one that fits the look and feel of your business. Some templates even include predefined fields for services, taxes, and payments, making it even easier to track all financial transactions in one place.

By using a free, customizable billing document, you can save both time and effort, while ensuring that your financial records are clear, accurate, and professional. Explore the various free options available and choose the one that works best for your business needs.