Hotel Invoice Format in Word Template

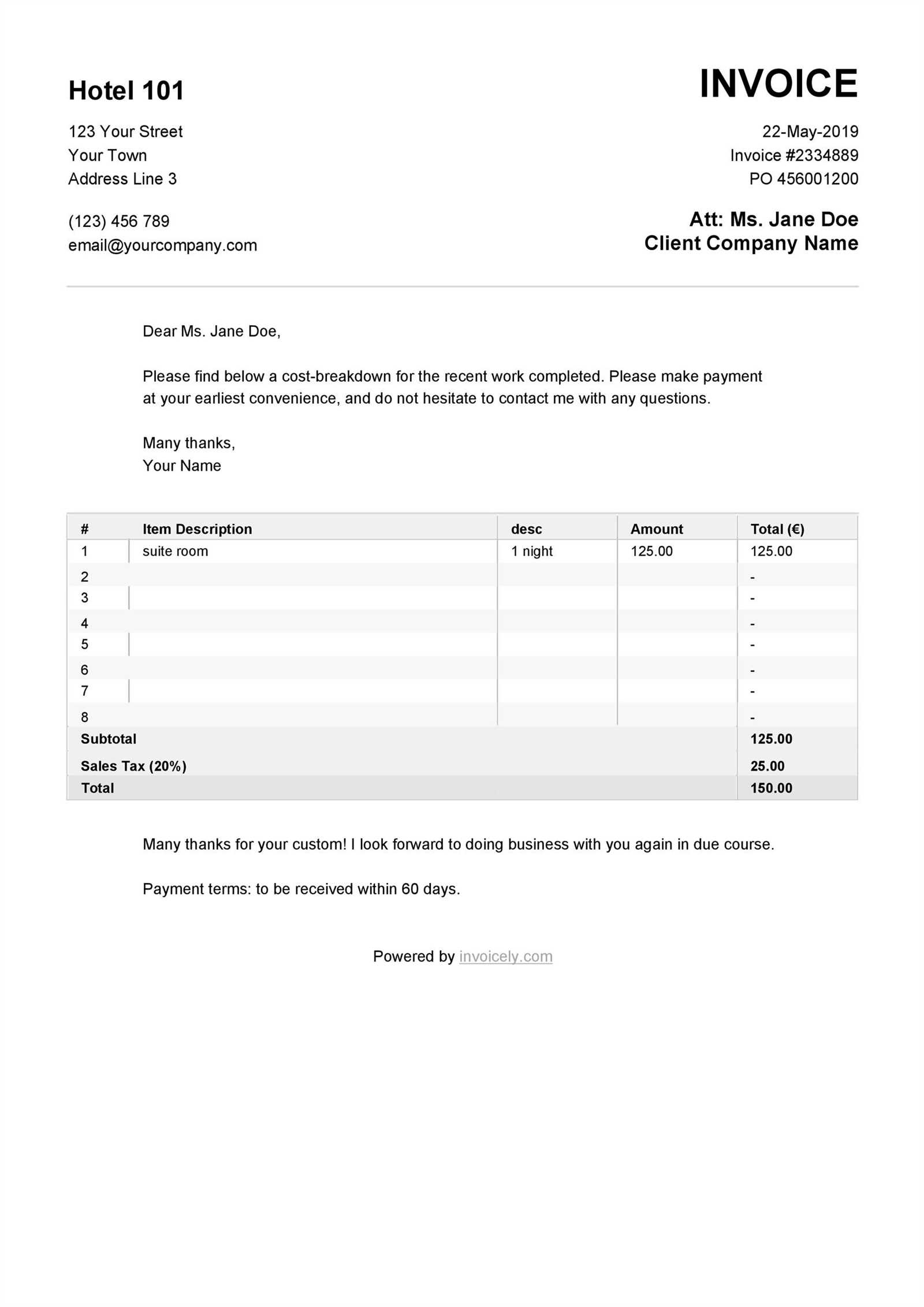

Efficient billing is essential for businesses offering accommodation services. Having a clear and professional document to request payment from customers helps ensure smooth transactions and maintains a positive relationship. Whether for a single night or an extended stay, a structured approach to documenting charges is crucial for accuracy and transparency.

Utilizing a ready-made document design allows for consistent presentation and reduces the time spent on creating such materials from scratch. With the right layout, it becomes easier to include necessary details such as services rendered, charges, taxes, and payment terms, while providing a polished look to the final statement.

Customization options further enhance the usefulness of these documents, allowing businesses to tailor them to their specific needs and branding. The result is a seamless experience for both the service provider and the client, fostering trust and professionalism.

Hotel Invoice Format in Word Template

Organizing a detailed and professional billing document is crucial for ensuring clarity and accuracy in financial transactions. A well-structured layout provides essential sections to list services, rates, and terms, making it easier for customers to understand the breakdown of costs and payment instructions. This type of structured document simplifies record-keeping and fosters trust with clients.

Key Components of a Billing Document

- Contact Information: Clearly display the business name, address, and contact details to provide a point of reference for any inquiries or follow-up communication.

- Client Details: Include sections to record customer details, such as name and contact information, ensuring proper identification for future records.

- Description of Services: List all services or items provided, specifying dates, quantities, and any relevant details to give a

Hotel Invoice Format in Word Template

Organizing a detailed and professional billing document is crucial for ensuring clarity and accuracy in financial transactions. A well-structured layout provides essential sections to list services, rates, and terms, making it easier for customers to understand the breakdown of costs and payment instructions. This type of structured document simplifies record-keeping and fosters trust with clients.

Key Components of a Billing Document

- Contact Information: Clearly display the business name, address, and contact details to provide a point of reference for any inquiries or follow-up communication.

- Client Details: Include sections to record customer details, such as name and contact information, ensuring proper identification for future records.

- Description of Services: List all services or items provided, specifying dates, quantities, and any relevant details to give a complete overview of the transaction.

- Pricing and Calculations: Present individual rates, taxes, discounts, and the total amount due in an organized manner, allowing the recipient to understand each component of the charge.

- Payment Terms: Clearly outline the due date, accepted payment methods, and any applicable terms for late fees or discounts for early payment.

Steps to Customize the Document

- Open a Pre-Designed Layout: Begin with a ready-to-use structure that includes all necessary sections. This allows for a faster setup and ensures a polished final document.

- Update with Business Branding: Add a company logo, adjust font styles, and use brand colors to make the document look consistent with other company materials.

- Fill in Default Information: Insert standard business details, such as address and contact information, which saves time for future use.

- Save as a Custom Template: Once the structure and style are set, save it for repeated use, which helps maintain consistency and professionalism across all issued documents.

By following these steps, businesses can ensure they have a streamlined and effective document, ready to use whenever needed, enhancing both efficiency and customer satisfaction.

Why Use a Word Template for Invoices

Creating organized and professional billing documents can be a time-consuming task, especially when managing multiple clients. Using a pre-designed layout simplifies this process by providing a ready-to-use structure that ensures all essential details are included and formatted consistently. This approach streamlines document creation, making it faster and easier to produce well-organized statements for clients.

Consistency and Professionalism

A structured layout offers a consistent look across all documents, which helps maintain a high standard of presentation. Clients appreciate receiving clear and professional statements, as they are easier to review and understand. This consistency reflects positively on the business, showing attention to detail and dedication to high-quality service.

Time-Saving and Customizable

Using a pre-set structure saves time by eliminating the need to start from scratch each time a new statement is created. These designs are often customizable, allowing businesses to add unique branding elements, adjust layouts, and save personalized versions. This flexibility is especially useful for businesses that frequently handle different types of charges or special requests.

Key Elements of a Hotel Invoice

A comprehensive billing document should include all critical details to ensure transparency and avoid any potential misunderstandings. A clear layout with organized sections allows both the business and the client to easily understand the charges, payment terms, and contact information. These essential components are fundamental to any professional billing process.

Business and Client Information

At the top of the document, it is important to include basic details about both the business and the client. This typically involves the business’s name, address, and contact details, alongside the client’s full name and address. These details provide an official record and help identify the transaction for future reference.

Description of Services and Charges

An itemized list of provided services is essential, as it outlines each specific charge and helps clarify the total amount due. This section often incl

How to Customize Hotel Invoices in Word

Personalizing a billing document enhances its professionalism and aligns it with the brand’s identity. Customizing these documents allows businesses to adjust layouts, add branding elements, and include specific details to fit their unique requirements. Here’s a step-by-step guide on tailoring a billing layout to ensure it meets both practical and aesthetic needs.

- Choose a Basic Layout: Start with a structured design that contains all essential sections. This provides a foundation, making it easier to focus on personalization without needing to build from scratch.

- Add Business Branding: Incorporate your company’s logo, color scheme, and preferred font styles. Adding these branding elements ensures that each document reflects your business identity, which contributes to a cohesive, professional appearance.

- Adjust Section Layouts: Modify the placement and size of different sections, such as headers, client details, and service descriptions. These adjustments can improve

Benefits of Using Professional Invoice Templates

Opting for a structured, expertly crafted layout for billing documents offers a range of advantages that enhance both efficiency and professionalism. These pre-designed resources not only simplify the creation process but also ensure that all essential details are presented in an organized and clear manner.

Time-Saving Efficiency: One major benefit of using a pre-made layout is the reduction in time spent on preparing each document. Instead of creating new files from scratch, businesses can quickly fill in essential details, allowing for faster turnaround and more time to focus on other important tasks.

Consistency and Professionalism: A uniform structure across all billing documents helps maintain a professional appearance, which clients appreciate and recognize. Consistent presentation builds trust, as clients know what to expect with each statement they receive.

Customizable for Specific Needs: Pre-designed layouts can be adjusted to fit a business’s unique requirements,

Best Practices for Hotel Billing Procedures

Effective billing is a crucial component of smooth financial operations. By adhering to best practices, businesses can ensure transparency, minimize errors, and enhance customer satisfaction. Proper procedures not only streamline operations but also improve relationships with clients by providing clear, concise documentation of services rendered.

Ensure Accuracy and Clarity

One of the most important aspects of billing is the accuracy of the details. Always double-check that the services and amounts are correctly listed, with clear descriptions and correct pricing. Ensuring that the document is easy to read and understand minimizes confusion and the potential for disputes.

Implement Timely and Consistent Billing

Sending out statements in a timely manner is essential for maintaining smooth financial transactions. Consistency is key–ensure that all clients receive their documents promptly, following a predictable schedule. This not only helps clients stay informed but also strengthens trust in the business’s operations.

By following these best practices, businesses can create a more efficient and professional process that enhances client relationships while ensuring financial accuracy and clarity in all transactions.

Essential Information to Include in Invoices

For a billing document to be both clear and effective, it must include several key details. These elements ensure that both the business and the client understand the charges, terms, and expectations. Whether for a product or service, a comprehensive document helps maintain transparency and prevents misunderstandings.

Key details include the client’s contact information, a unique reference number, and a breakdown of services or products provided. Additionally, including payment terms, dates, and any applicable taxes helps clarify the total amount due and the timeline for payment. These elements not only improve the professionalism of the document but also ensure it meets legal and business standards.

In conclusion, an effective document includes all necessary data to avoid confusion and guarantee that both parties are on the same page regarding the transaction, fostering a smooth and efficient business process.

How to Save Time with Invoice Templates

Streamlining the process of creating billing documents can significantly reduce the amount of time spent on administrative tasks. By utilizing a structured, pre-designed layout, businesses can quickly generate accurate and professional statements without starting from scratch each time. This not only enhances productivity but also ensures consistency in every document.

Eliminate the Need for Repetition

Using pre-structured layouts eliminates the need to manually input repetitive details like company information, payment terms, and standard charges. Once the layout is set, these details are automatically included in every document, allowing businesses to focus on customizing client-specific data.

Increase Efficiency with Quick Edits

With a ready-made structure, any necessary changes can be made in minutes. Customizing dates, amounts, and services is fast and straightforward, ensuring that each document is tailored to the client’s specific needs without significant time investment.

In conclusion, leveraging pre-designed structures for billing documents helps businesses save valuable time, increase efficiency, and maintain consistency in their operations, ultimately contributing to smoother financial management.

Hotel Invoice Format in Word Template Customizing Fonts and Layouts in Word

Personalizing the appearance of a billing document can elevate its professionalism and make it more readable for clients. Adjusting the text style, size, and the overall layout of the document ensures that it aligns with your brand’s identity and is visually appealing. This customization also allows for better clarity and structure, enhancing the user experience.

Choosing the Right Font Style

Font selection plays a key role in the document’s readability. By selecting clear and professional fonts, you can ensure that the document is easy to read and visually balanced. Some tips for choosing fonts include:

- Use simple, legible fonts like Arial or Times New Roman.

- Ensure font size is readable (generally between 10pt and 12pt for body text).

- Avoid using too many different fonts to maintain consistency.

Enhancing Layout for Better Organization

The structure of the document should make it easy to navigate and understand. A well-organized layout can highlight important information like charges, dates, and contact details, making the content accessible at a glance. Key layout adjustments might include:

- Aligning text to ensure consistency.

- Using bullet points or tables to organize key details.

- Adding ample spacing to make the document easier to scan.

By customizing these elements, businesses can create documents that not only look professional but also communicate information more effectively, resulting in a better client experience.

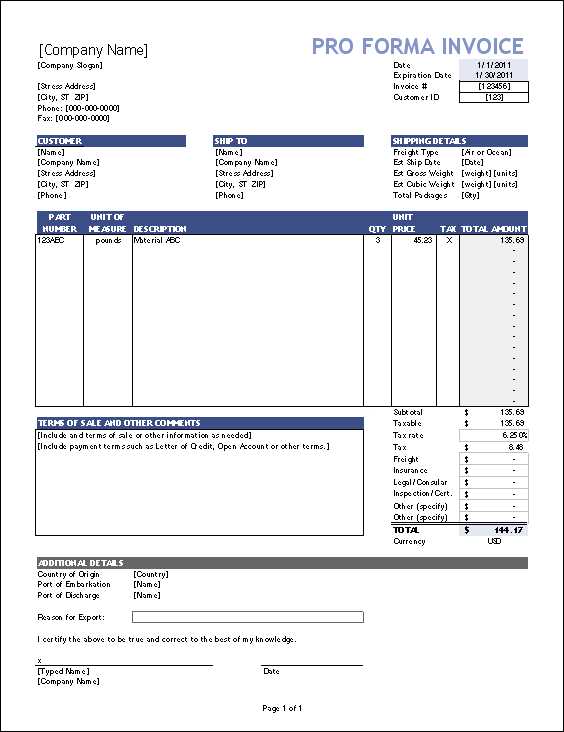

Handling Multiple Charges on a Single Invoice

When multiple fees or services are included in a single document, it’s important to present them clearly and in an organized manner. Properly categorizing each charge ensures that customers understand exactly what they are being billed for and can make payments efficiently. Providing transparency not only helps avoid confusion but also builds trust with clients.

Organizing Charges by Category

Breaking down charges into clear categories or sections is essential for keeping the document organized. Each charge should be listed with its corresponding description and amount. This could include:

- Room rates or accommodation fees

- Additional services (e.g., meals, amenities)

- Taxes and other applicable fees

Using Itemized Lists

Itemized lists are an effective way to present multiple charges in a clear and digestible format. This approach allows clients to easily identify each cost and verify its accuracy. Ensure that:

- Each item is listed with a detailed description.

- The total for each section is clearly indicated.

- A summary of all charges is presented at the end of the document.

By following these practices, you can ensure that all charges are clearly communicated, reducing the likelihood of disputes and improving the overall client experience.

Automating Invoice Generation in Word

Automating the creation of billing documents can significantly save time and reduce human error. By using built-in tools and features, businesses can streamline the process of generating these documents, ensuring that they are accurate and consistent. Automating this process not only speeds up daily operations but also minimizes the risk of discrepancies in calculations or formatting issues.

One effective way to automate the generation of billing records is through the use of predefined structures. These structures allow for automatic population of client details, charges, dates, and other necessary information. With the right setup, the process of generating such documents becomes faster and more efficient.

Using Tables for Structured Data

Tables are a great way to present data clearly and organize the necessary components of each charge. By structuring the information into rows and columns, it is easier to both input and view essential details. Below is an example layout of a typical structured data table used in this process:

Description Quantity Price per Unit Total Accommodation Fee 3 nights $100 $300 Meals 2 days $20 $40 Service Charge 1 $15 $15 By automating these components, such documents can be created effortlessly, saving time and reducing administrative workload.

Adding Taxes and Discounts to Billing Statements

Including taxes and discounts is a crucial part of the billing process. These adjustments ensure that the final amount reflects the correct charges, in line with local regulations and promotional offers. By adding these components properly, businesses can maintain transparency with their customers and avoid discrepancies.

When calculating taxes, it’s important to know the applicable rate based on the location or service provided. Discounts, on the other hand, can be applied based on special offers or loyalty programs, which can also help attract repeat business. Ensuring that these adjustments are applied correctly is essential for maintaining a fair and accurate pricing structure.

Calculating and Applying Taxes

Taxes are typically calculated as a percentage of the total charges. The exact rate will vary depending on the type of service and the jurisdiction. For example, if the subtotal for services is $300, and the applicable tax rate is 10%, the tax would be calculated as follows:

- Subtotal: $300

- Tax Rate: 10%

- Tax Amount: $30

- Total with Tax: $330

Make sure to clearly indicate the tax amount and its rate on the statement to maintain clarity for the client.

Applying Discounts

Discounts can be applied in various forms: flat amount reductions, percentage-based deductions, or loyalty program benefits. Here’s an example of how a discount is applied:

- Original Total: $500

- Discount Rate: 15%

- Discount Amount: $75

- Total After Discount: $425

Discounts should be clearly marked on the statement to show the customer how the final amount was determined. This ensures both transparency and customer satisfaction.

Common Mistakes to Avoid in Billing

Proper documentation is essential for any business transaction, and even small errors can cause confusion and delays in payment. While preparing statements, it’s important to ensure accuracy in every detail, from the amounts charged to the correct identification of both the customer and the services provided. Mistakes in this process can lead to customer dissatisfaction, disputes, and even legal complications.

Here are some common mistakes that businesses should be mindful of when preparing their statements.

Omitting Key Details

One of the most common errors is leaving out important information. Every record should include the following:

- Business and customer contact details

- Clear description of services provided

- The correct payment terms and due date

Forgetting these details can make it difficult for customers to understand the charges and lead to unnecessary back-and-forth communication. Always ensure that all relevant fields are filled in thoroughly and correctly.

Incorrect Calculations

Another frequent mistake is errors in adding up the charges. Whether it’s a miscalculation of service totals, taxes, or discounts, inaccuracies can lead to significant confusion and potential financial loss. Double-checking the figures and ensuring proper tax rates or discounts are applied is vital for avoiding these mistakes.

Failure to Include Terms and Conditions

Not clearly outlining the terms of the transaction, such as payment deadlines or late fees, is a mistake that can cause misunderstandings. Including these details helps set clear expectations and ensures that both parties are on the same page regarding the payment process.

Not Following Up

Lastly, some businesses fail to follow up with clients on overdue payments. Timely reminders help ensure that payments are made promptly, reducing the chance of non-payment and helping to maintain healthy cash flow.

Avoiding these common mistakes is essential for maintaining professionalism and fostering strong customer relationships. Ensuring that each statement is accurate and clear will not only help your business run smoothly but also enhance customer trust.

Legal Requirements for Billing

When generating billing statements, businesses must adhere to specific legal obligations to ensure compliance with tax regulations and consumer protection laws. Failing to meet these requirements can result in penalties, disputes, or even legal action. It is crucial to be aware of the necessary information and practices to include when preparing any financial document.

Here are key legal aspects to consider when preparing such documents:

Mandatory Information

The following details must always be included in any billing statement:

- Full business details: This includes the legal name of the business, address, and tax identification number.

- Customer information: Ensure that the customer’s full name and contact details are clearly stated.

- Description of services or goods: Each charge should be itemized with a brief but clear description of the product or service provided.

- Tax information: Include applicable taxes with the correct tax rate and total amount charged.

- Total amount due: Clearly state the amount owed and provide information on payment terms.

Tax Compliance

Depending on the location and the nature of the transaction, tax laws vary. It is essential to apply the correct sales tax, VAT, or other relevant taxes. Businesses should regularly review the current tax regulations to ensure that they are charging the appropriate amounts, especially if tax rates change seasonally or annually.

Payment Terms and Deadlines

Clear terms regarding the due date for payments, late fees, and acceptable payment methods must be included. These terms ensure transparency and help avoid misunderstandings. Clearly state whether there are penalties for delayed payments, including interest rates or other charges that may apply.

Consumer Protection Laws

In some regions, businesses are required to provide specific information related to consumer rights, refunds, and dispute resolution procedures. Always ensure compliance with local regulations to protect both the business and the customer from potential legal conflicts.

By following these legal guidelines, businesses can avoid legal issues, ensure smooth transactions, and maintain trust with their clients.

Ensuring Accuracy in Billing Calculations

Accurate calculations in financial documents are essential to avoid errors that could lead to disputes or delayed payments. The precision of the amounts, taxes, discounts, and totals directly impacts the professionalism and credibility of the business. To maintain accuracy, it is important to implement clear processes and checks throughout the calculation process.

Key Areas to Focus on for Accuracy

Here are important aspects to ensure precise billing calculations:

- Unit Prices: Always verify the individual unit price for each service or product provided. Any change in price should be updated before finalizing the statement.

- Quantity and Amounts: Ensure the correct quantity of items or services is listed. Multiply the unit price by the quantity to obtain the total for each item or service.

- Discounts and Offers: If applicable, apply any discounts before calculating taxes. Ensure that percentage-based discounts are correctly calculated and deducted.

- Tax Calculations: Apply the right tax rate based on local regulations. Always check the applicable tax rate and ensure that the correct amount is added to the total.

- Subtotals: Double-check the subtotal amounts to confirm the sum of the charges before taxes and discounts are applied.

Using Tools for Automation

To reduce human error, consider using software or automated systems for generating financial documents. These tools can help with accurate calculations by automatically applying formulas for taxes, discounts, and totals, ensuring consistency and minimizing mistakes.

Final Review and Verification

Before finalizing the statement, always review the document thoroughly. Verify that all calculations are correct and that no details are omitted. A final check of all totals, taxes, and other calculations ensures that everything matches and avoids any future misunderstandings.

By paying attention to these steps, businesses can improve accuracy, minimize errors, and maintain trust with their clients through clear and reliable financial statements.

How to Store and Track Billing Documents Efficiently

Properly storing and tracking financial documents is crucial for any business, ensuring that records are accessible, well-organized, and easy to retrieve when needed. Efficient management of these records can streamline administrative tasks, simplify auditing processes, and improve overall financial control. Establishing a reliable system for storage and tracking is essential for maintaining order and compliance.

Best Practices for Storing Billing Records

To optimize the storage process, it is important to establish clear guidelines and use the right tools. Here are some tips for managing your records effectively:

- Digital Storage: Using cloud storage solutions or dedicated software ensures that all documents are securely stored and can be easily accessed from any location. This is particularly beneficial for remote teams or businesses with multiple locations.

- Paperless Organization: By scanning physical records and converting them into digital files, you can reduce paper clutter and make document retrieval faster and more efficient.

- File Naming Conventions: Standardize file names to include relevant information, such as dates, customer names, and document types. This helps you quickly identify files and ensures consistency in your record-keeping system.

- Backups: Regularly back up digital files to prevent data loss. Cloud storage services often offer automatic backup features, but it’s also important to keep offline backups in case of unexpected issues.

Tracking and Monitoring Financial Records

Tracking billing documents requires a systematic approach to ensure accuracy and organization. Consider implementing the following strategies:

- Spreadsheet Tracking: Using spreadsheets to track issued documents allows you to monitor their status, such as whether they are paid, pending, or overdue. Including columns for key information, such as dates and amounts, will give you a comprehensive overview.

- Automated Systems: Leveraging software that automatically tracks document status and generates reminders for unpaid accounts can significantly reduce the manual effort required.

- Barcode or QR Code Scanning: For physical documents, assigning unique barcodes or QR codes can simplify the tracking process. Scanning these codes allows for quick updates and retrieval in the database.

Using a Tracking Table for Better Overview

Document ID Client Name Issue Date Amount Status INV-001 Client A 2024-09-01 $150 Paid INV-002 Client B 2024-09-10 $200 Pending INV-003 Client C 2024-09-15 $180 Overdue By incorporating these practices and using the right tools, businesses can ensure that their financial documents are securely stored and easily accessible for tracking, auditing, and reporting purposes. This efficient management system not only saves time but also helps in maintaining better financial