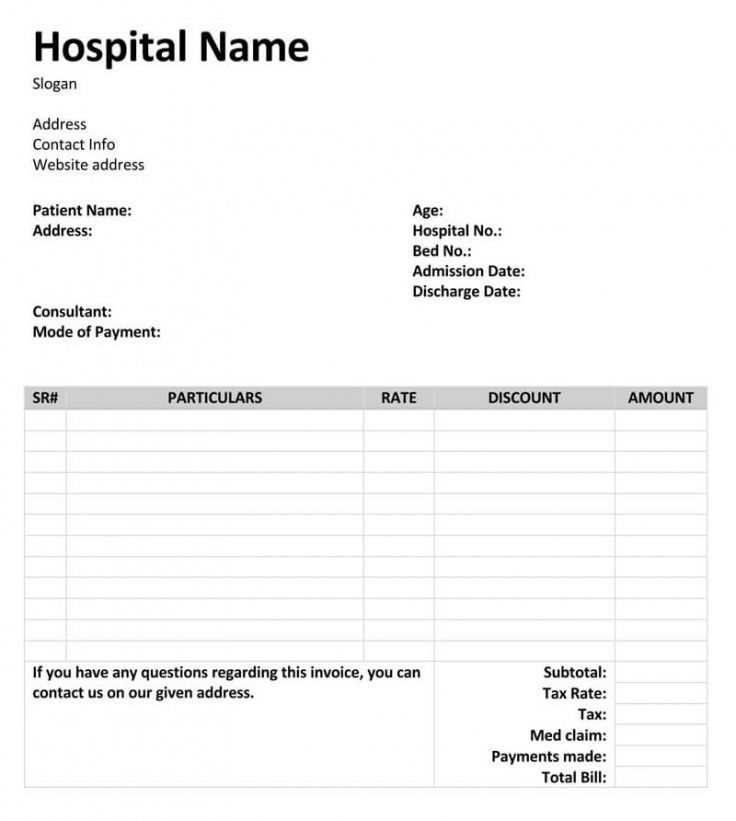

Hospital Invoice Template for Efficient Billing and Payment Tracking

Managing financial records in healthcare settings can be a complex task, requiring precision and organization. Proper documentation is essential for accurate tracking of services provided and payments received, ensuring both clarity and efficiency. A structured approach to financial paperwork helps medical practices maintain smooth operations and avoid costly errors.

Utilizing a well-organized billing structure allows healthcare providers to maintain consistency in how charges are presented to patients and insurers. By standardizing these records, it becomes easier to track outstanding payments, manage reimbursements, and ensure compliance with industry standards. A carefully designed billing document can also reduce confusion and speed up the payment process.

In this article, we’ll explore how to create and customize a professional billing document that meets your practice’s needs. Whether you’re working with insurance companies or directly with patients, the right format can help streamline your financial workflow and improve overall business efficiency.

Hospital Invoice Template Overview

Efficient financial documentation plays a crucial role in the smooth operation of any healthcare facility. A well-organized billing document serves as the primary tool for tracking services rendered, managing patient payments, and ensuring compliance with industry standards. The right structure helps reduce administrative errors and provides a clear record for both patients and insurance providers.

In essence, this tool is designed to streamline the billing process, making it easier to itemize charges, specify payment terms, and clarify any additional fees. The format is flexible enough to accommodate the unique needs of various healthcare practices, from small clinics to large medical centers. By standardizing this important document, medical professionals can ensure that all necessary information is communicated effectively and consistently.

In the following sections, we will delve deeper into the key elements of an efficient financial record, offering insights on how to create, customize, and optimize it for your practice. Whether you’re a healthcare provider or a billing specialist, understanding the structure of this vital document will significantly enhance your financial management process.

Why Use a Hospital Invoice Template

Using a standardized billing structure is essential for any healthcare practice aiming to streamline financial operations. With such a system in place, managing payments becomes less error-prone and more efficient, ensuring that both patients and healthcare providers are on the same page. A consistent approach to billing helps to minimize misunderstandings and reduces the administrative workload significantly.

Key Benefits of a Structured Billing System

- Improved Accuracy: A predefined format ensures that no important details are overlooked, reducing mistakes in billing.

- Faster Processing: Standardized forms help speed up the payment cycle, as both patients and insurance companies can quickly review the charges.

- Better Record-Keeping: Having a consistent method of documenting charges makes it easier to track payments and follow up on outstanding amounts.

- Compliance and Transparency: With all necessary details included, this approach helps maintain transparency and meets regulatory standards.

How It Helps Healthcare Providers

- Time Efficiency: Providers can focus more on patient care instead of spending excessive time on billing tasks.

- Consistent Communication: A clear, uniform format makes it easier to communicate with patients about their financial responsibilities.

- Improved Cash Flow: Faster and more accurate payments contribute to healthier cash flow management.

By incorporating such a system into your practice, you not only simplify financial workflows but also enhance overall patient satisfaction, making it an indispensable tool for modern healthcare operations.

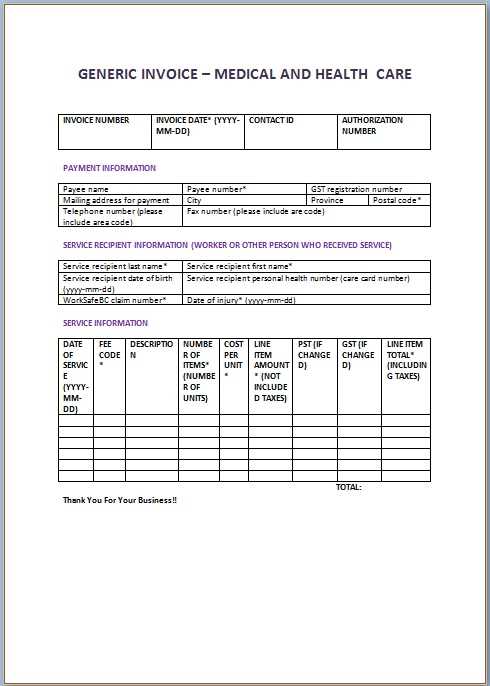

Key Features of an Effective Template

An effective billing document should be more than just a simple list of charges; it must be designed to capture all necessary information clearly and accurately. The key to an efficient billing system lies in its ability to reduce errors, streamline processes, and provide all relevant details in a concise format. A well-structured document ensures that both the healthcare provider and the patient or insurance company have a clear understanding of the services rendered and the corresponding costs.

Essential Elements for Clarity and Precision

- Detailed Itemization: Every service, procedure, and item should be listed with clear descriptions, quantities, and corresponding costs to avoid confusion.

- Clear Payment Terms: Payment due dates, accepted methods, and late fees must be easily identifiable to ensure timely processing.

- Accurate Contact Information: Both the provider’s and the patient’s contact details should be included, facilitating easy communication regarding payments or discrepancies.

- Identification Numbers: Including unique identifiers like patient IDs or reference numbers helps keep records organized and easy to track.

Design and Usability Considerations

- Easy-to-Follow Layout: A logical, well-organized structure with clearly marked sections improves readability and reduces the chance of overlooking important details.

- Professional Appearance: A clean, professional design reflects the credibility of the healthcare provider and enhances trust with patients and insurers.

- Customizable Options: The document should be flexible enough to be tailored to specific services or specialties while maintaining consistency in format.

By integrating these features, a billing document can significantly improve financial management and communication, reducing the risk of errors and facilitating smooth transactions.

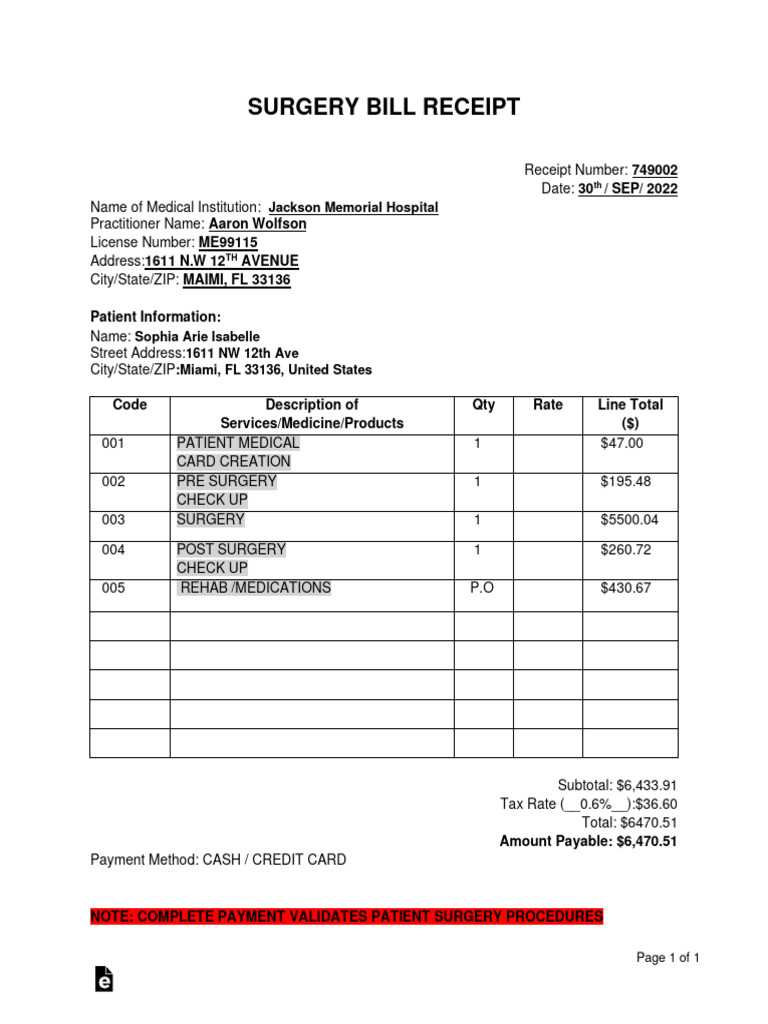

How to Create a Hospital Invoice

Creating a clear and effective billing document requires attention to detail and organization. It is essential to structure the document so that it clearly reflects the services rendered, costs associated, and payment expectations. By following a straightforward process, you can ensure that all the necessary information is included, reducing the chance of misunderstandings or delayed payments.

To start, you need to gather all relevant details such as patient information, the services provided, and the associated costs. Once this data is collected, it is important to format the document in a way that is easy to read and understand. Here are the key steps to follow:

- Step 1: Include header information such as the practice’s name, address, and contact details, along with the patient’s name, contact information, and a unique identifier (e.g., patient ID).

- Step 2: List all services provided, including procedures, consultations, tests, and medications. Be sure to itemize each charge with clear descriptions and quantities where applicable.

- Step 3: Add pricing for each item or service. Ensure that the costs are accurate and reflect the agreed-upon fees or insurance coverage.

- Step 4: Clearly specify payment terms, including the total amount due, due date, and accepted payment methods.

- Step 5: Include any additional information such as tax rates, discount options, or payment plans if applicable.

Once the document is structured with all the relevant details, review it for accuracy. Ensure that all charges are accounted for, and there are no discrepancies in the information provided. A well-organized document will help reduce confusion and facilitate smoother financial transactions for both healthcare providers and patients.

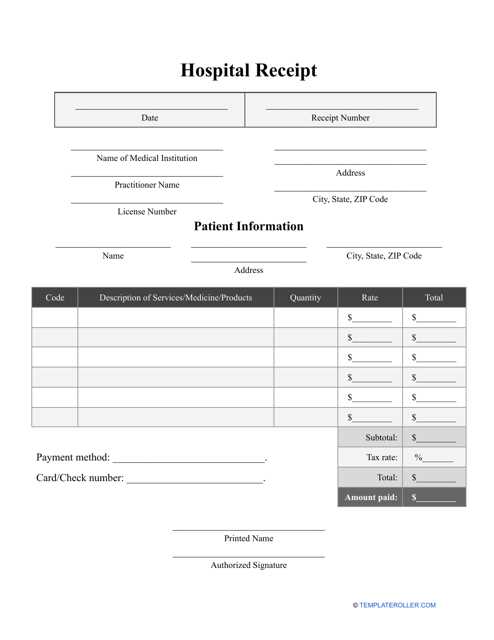

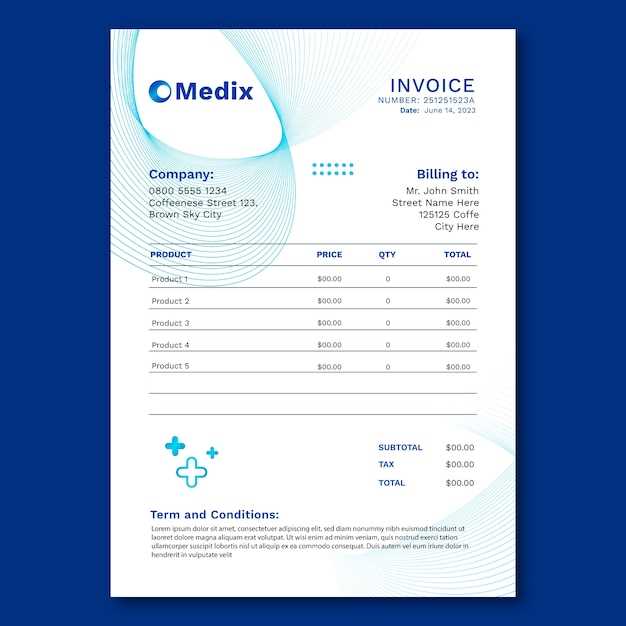

Choosing the Right Invoice Format

Selecting the right format for your billing documents is crucial for efficiency and clarity. The format should not only reflect the nature of the services provided but also ensure that all necessary information is communicated in a straightforward manner. An appropriate format makes it easier to track payments, manage records, and reduce errors in financial transactions.

Factors to Consider When Choosing a Format

- Clarity and Readability: The layout should be simple and organized, with clear sections for each piece of information. A format that is too cluttered or difficult to read can lead to confusion and delays.

- Customization Options: It is important that the format can be adapted to meet the specific needs of your practice. Different services, specialties, or insurance policies may require different levels of detail.

- Compliance and Standardization: The chosen format should comply with local regulations or insurance requirements. A standardized layout can also streamline communication with insurers and patients.

Choosing Between Digital and Paper Formats

- Digital Formats: These allow for faster processing and easier storage. Digital records can be emailed directly to patients or insurers, and they can be easily updated and tracked for errors.

- Paper Formats: Although less efficient than digital methods, printed forms are still widely used in many healthcare environments, especially when patients prefer hard copies or if electronic records are not feasible.

The right format will depend on your practice’s specific needs and workflow. Whether you choose a digital or paper version, ensure that it is organized, easy to use, and adaptable to various financial situations.

Customizing Your Hospital Invoice Template

Adapting your billing document to fit the specific needs of your practice is essential for maintaining both professionalism and accuracy. Customization ensures that the document aligns with your services, reflects your brand, and meets legal or insurance requirements. A tailored document not only improves the overall appearance but also enhances functionality, making it easier to track and manage financial information.

When customizing your billing form, several key elements should be considered to ensure it serves both your operational and aesthetic needs:

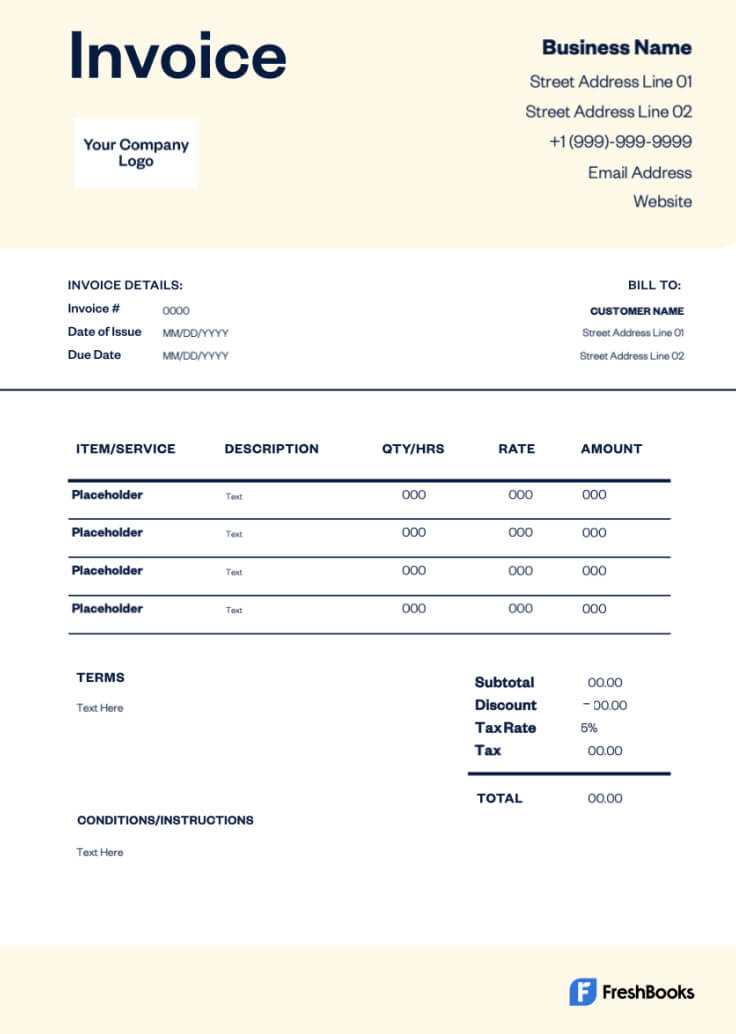

- Branding and Identity: Include your practice’s logo, address, and contact details at the top. Using your brand colors or font style helps make the document look professional and consistent with your other materials.

- Service Descriptions: Customize the layout to clearly reflect the range of services you provide. If your practice offers specialized treatments, you may want to add specific categories or fields to describe those services in detail.

- Payment Terms and Instructions: Clearly define the payment terms, including methods accepted, due dates, and any late fees. Customize fields to accommodate payment options that are specific to your practice, such as installment plans or insurance billing codes.

- Tax and Discount Fields: If applicable, include customizable sections for taxes, discounts, or adjustments. This ensures that all financial variables are accurately reflected in the final amount.

Customizing your billing document also includes adjusting for legal and regulatory requirements. Depending on your location and the type of services offered, there may be mandatory fields or specific details required by law, such as license numbers, insurance billing codes, or tax identification numbers. Be sure to review these before finalizing any changes.

In addition to layout and content, consider the format of the document itself. For example, if you’re working digitally, you might want to use editable fields that can be filled out quickly, or if you’re using physical copies, you may want to structure the layout for easier printing and mailing.

By personalizing your billing documents, you ensure not only a professional presentation but also an efficient financial workflow, helping you focus more on patient care while minimizing administrative hassle.

Essential Information to Include in Invoices

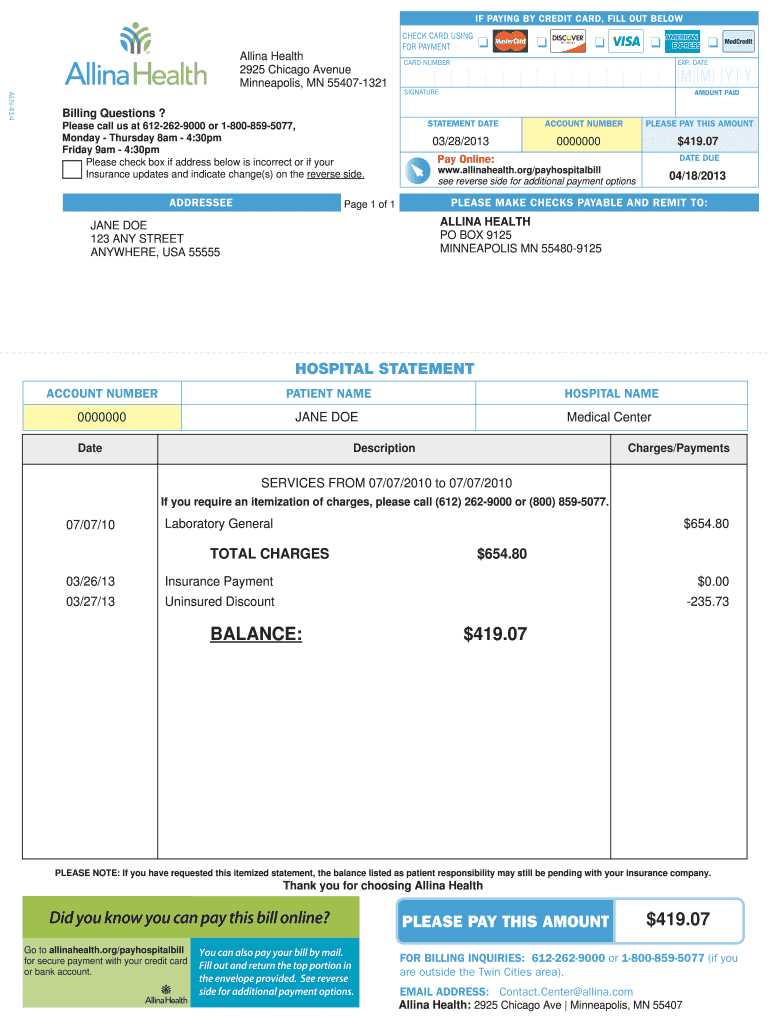

For any billing document to be effective, it must contain all the necessary details that ensure both parties–the provider and the recipient–understand the charges, terms, and payment expectations. Missing or incomplete information can lead to confusion, delayed payments, or even disputes. A well-structured document provides clarity and transparency, helping to maintain a smooth financial process.

The following elements are essential for creating a comprehensive and professional billing document:

- Provider Information: Always include the full name, address, and contact details of the healthcare provider. This makes it easy for the recipient to identify the source of the charges and reach out if needed.

- Patient Information: Clearly list the patient’s name, address, and any unique identifiers, such as a patient ID number. This ensures that the billing document is properly associated with the right person and can be easily cross-referenced in records.

- List of Services Provided: Each service, treatment, or procedure should be clearly described, with quantities, unit costs, and total amounts. Detailed descriptions reduce ambiguity and ensure that the recipient knows exactly what they are being charged for.

- Payment Terms: Clearly state the total amount due, the payment due date, and acceptable payment methods. If applicable, include any discounts, late fees, or installment options to make payment expectations clear.

- Billing Reference Number: Assign a unique identifier or reference number to each document. This helps both parties track the transaction in their records and can simplify any future inquiries or adjustments.

- Tax Information: If applicable, include the tax rate and any additional charges, such as VAT or service tax, that are required by law. This ensures compliance and provides clarity regarding the final payment amount.

- Insurance Details (if applicable): For insurance-related transactions, include relevant policy numbers, claim numbers, and any coverage details to help facilitate reimbursement processes.

By including these key details, you ensure that the billing process is clear, transparent, and efficient, minimizing the risk of errors or misunderstandings between providers and patients or insurers.

Understanding Payment Terms in Invoices

Clear payment terms are essential for ensuring timely and accurate payments. Without well-defined terms, confusion can arise, leading to delays or disputes. Payment terms specify how, when, and under what conditions payment should be made, providing both parties with a clear understanding of their financial responsibilities. Whether dealing with insurance companies, patients, or other entities, clear terms facilitate smoother transactions and help maintain positive relationships.

Some of the most common payment terms to include in your billing document are:

- Due Date: Clearly indicate when the payment is expected. This helps the recipient understand the timeline for settling the balance and avoid late fees.

- Accepted Payment Methods: Specify the forms of payment you accept, such as credit cards, bank transfers, checks, or digital payment platforms. This prevents confusion and allows for a faster, more efficient transaction.

- Late Fees: If applicable, outline any penalties for late payments. This encourages timely payments and makes it clear what will happen if the deadline is missed.

- Early Payment Discounts: Offering a discount for early payment can be a helpful incentive to encourage prompt settlement. Specify any conditions for receiving such discounts.

- Installment Options: If your practice allows payment plans, outline the terms of the installments, including frequency, amounts, and due dates.

Incorporating clear, precise payment terms not only helps in managing cash flow but also sets proper expectations, minimizing misunderstandings and ensuring that both parties are aligned on the financial aspects of the transaction.

Common Mistakes in Billing Documents

Even the most well-intentioned financial documents can contain errors that lead to confusion, delayed payments, and even disputes. These mistakes can range from simple oversights to more significant miscalculations, but regardless of their severity, they can complicate the payment process. Being aware of these common pitfalls is essential for ensuring that your billing records are accurate, clear, and professional.

Here are some of the most frequent mistakes that can occur when creating financial documents for healthcare services:

- Incorrect Patient Information: Failing to accurately capture the patient’s name, contact details, or unique identifiers can lead to confusion and miscommunication. Always double-check that all details are correct.

- Missing Service Descriptions: Omitting detailed descriptions of the services provided can cause uncertainty regarding charges. Ensure that each service is clearly listed, along with any necessary explanations or codes for insurance claims.

- Calculation Errors: Mistakes in adding up the totals, tax rates, or applying discounts can result in incorrect amounts being requested for payment. Always double-check your figures and consider using automated tools to minimize human error.

- Unclear Payment Terms: If payment deadlines, methods, or conditions (such as late fees) are not clearly stated, it can lead to delays or misunderstandings. Be explicit about payment expectations to avoid confusion.

- Failure to Include Legal or Regulatory Details: Depending on the location and type of services, certain legal or regulatory information may be required. Missing these details can lead to complications, especially when dealing with insurance reimbursements.

- Inadequate Formatting: A cluttered, hard-to-read format can make it difficult for the recipient to understand the charges or process the document efficiently. Always use a clean, well-organized layout that prioritizes clarity.

Avoiding these common mistakes ensures that your financial documents are both accurate and professional, helping to streamline the billing process and improve cash flow management.

How to Track Payments Efficiently

Efficiently tracking payments is vital for maintaining healthy cash flow and ensuring that all financial transactions are recorded accurately. Whether dealing with insurance companies, patients, or other entities, having a clear system in place helps prevent errors, missed payments, or confusion. By keeping accurate records and monitoring outstanding balances regularly, you can streamline the payment process and maintain a stable financial environment.

Key Methods for Tracking Payments

There are several effective methods for tracking payments that can help reduce administrative workload and ensure timely follow-ups. A structured approach involves organizing financial data in a way that is easy to review and update.

| Method | Description | Benefits |

|---|---|---|

| Manual Record-Keeping | Using physical ledgers or spreadsheets to track each payment and outstanding balance. | Cost-effective for small practices; simple to implement and customize. |

| Accounting Software | Utilizing automated tools to track payments, generate reports, and send reminders. | Efficient for large volumes; reduces errors and provides real-time data. |

| Cloud-Based Solutions | Using cloud platforms that allow access to payment data from anywhere, with automated updates. | Accessible from any device; easy collaboration and integration with other systems. |

Best Practices for Tracking Payments

- Regular Reconciliation: Frequently review and reconcile your records to ensure all payments are correctly logged and matched with the corresponding services.

- Automated Reminders: Set up automated payment reminders for clients or insurance companies to prompt timely payments and reduce outstanding balances.

- Clear Reporting: Use clear and concise reports that highlight outstanding payments, payment due dates, and any discrepancies for quick resolution.

By adopting these methods, you can improve the accuracy of your financial records and speed up the payment process, ultimately improving your practice’s financial health.

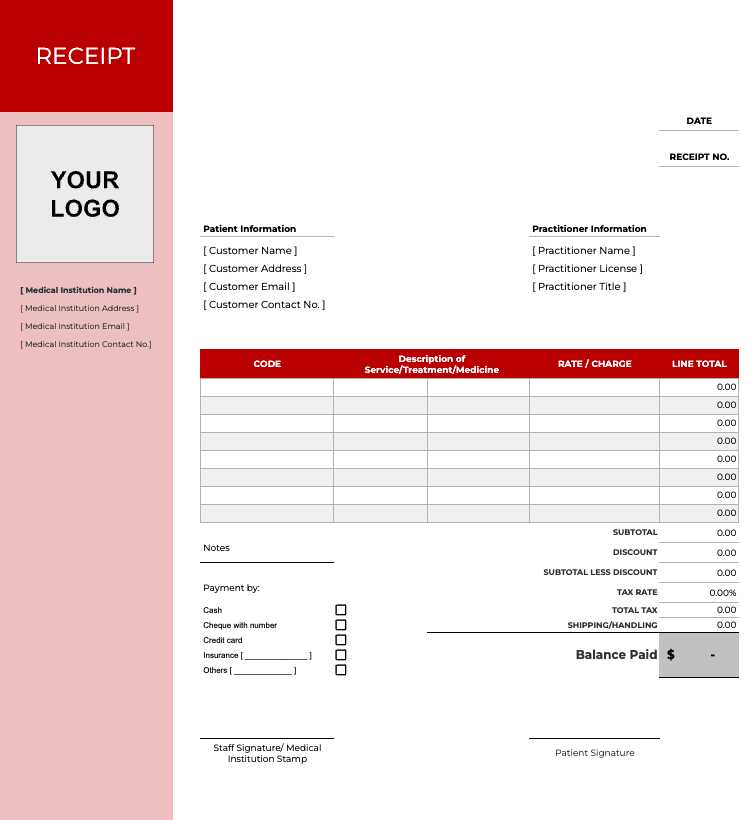

Benefits of Using Digital Invoices

Switching from paper-based billing to digital methods offers a wide range of advantages, improving both the efficiency of financial operations and the overall customer experience. Digital records streamline the billing process, reduce administrative work, and enhance accuracy. These systems not only save time but also contribute to better organization, faster payment processing, and increased security.

Key Advantages of Digital Billing Documents

Using digital tools to generate and manage billing records offers significant benefits for healthcare providers and businesses of all sizes. The ability to quickly create, send, and track payments through electronic means simplifies many aspects of financial management.

| Benefit | Description | Impact |

|---|---|---|

| Speed and Efficiency | Digital records can be created, sent, and processed much faster than paper alternatives. | Reduces delays in payment processing, improving cash flow. |

| Cost Savings | Digital billing eliminates the need for paper, printing, and postage. | Significant cost reductions on materials and administrative tasks. |

| Accuracy | Automated calculations and error-checking features minimize human errors in bill creation. | Increases accuracy and reduces disputes or payment issues. |

| Environmentally Friendly | Using electronic records reduces paper waste and supports sustainability efforts. | Helps businesses reduce their environmental impact. |

Improved Organization and Security

Digital systems offer greater organization and security for financial records. With cloud-based tools and encrypted files, sensitive data is better protected from unauthorized access or loss. Digital records are also easier to organize and retrieve, enabling faster and more efficient audits or reviews. Tracking payments becomes more transparent, allowing for clearer follow-ups on outstanding balances and more effective reconciliation.

Overall, adopting digital billing solutions improves operational efficiency, reduces costs, and ensures smoother financial transactions. These benefits make the switch to digital an attractive option for any practice looking to modernize its financial processes.

Legal Requirements for Hospital Billing

When managing financial records for healthcare services, it’s essential to adhere to various legal and regulatory standards. Proper documentation ensures compliance with federal, state, and local laws, helping to avoid legal disputes or penalties. Additionally, meeting these requirements protects both the service provider and the patient, ensuring transparency and fairness in financial transactions.

Different jurisdictions may have specific laws and guidelines governing billing practices, but there are several common requirements that apply broadly. Understanding these key aspects is crucial for maintaining compliance and avoiding errors that could lead to financial or legal complications.

- Clear Itemization of Services: Billing documents must clearly list all services provided, including descriptions and corresponding costs. This helps ensure transparency and avoids disputes regarding charges.

- Tax Identification Numbers: Many regions require the inclusion of the service provider’s tax identification number (TIN) or employer identification number (EIN) on all billing documents for proper tracking and reporting.

- Payment Terms and Deadlines: Clearly outline payment expectations, including due dates and accepted methods. Failure to communicate payment terms properly can result in legal issues related to late fees or non-payment.

- Patient Consent and Acknowledgment: In some cases, patients are required to sign consent forms acknowledging their responsibility for payment. This ensures that both parties are in agreement about the financial aspects of the service.

- Insurance Information: For insurance-covered services, billing must include relevant policy numbers, claim codes, and other pertinent details to ensure the provider is reimbursed correctly. Failing to include these details can delay payment or cause claim rejections.

- Compliance with Privacy Regulations: It’s essential to follow data privacy laws such as HIPAA in the U.S., ensuring that all personal health information (PHI) is protected when included in financial documents.

- Use of Standardized Codes: Certain billing documents must include standardized codes for services (e.g., ICD codes for diagnoses, CPT codes for procedures). These codes help ensure accuracy and are often required for insurance reimbursement.

By ensuring that billing documents comply with these legal requirements, healthcare providers can streamline the billing process, avoid legal disputes, and maintain good relationships with both patients and insurance providers. Regular audits and staying updated on local regulations are essential to maintaining compliance over time.

Billing Document for Insurance Claims

When submitting a billing document for insurance claims, it’s crucial to include all the necessary information that insurers require for proper processing and reimbursement. A well-structured document ensures that the healthcare provider receives payment quickly and accurately, and it minimizes the chances of claim rejections or delays. Accurate and complete records help to establish the legitimacy of the charges and facilitate smoother communication between the provider and the insurer.

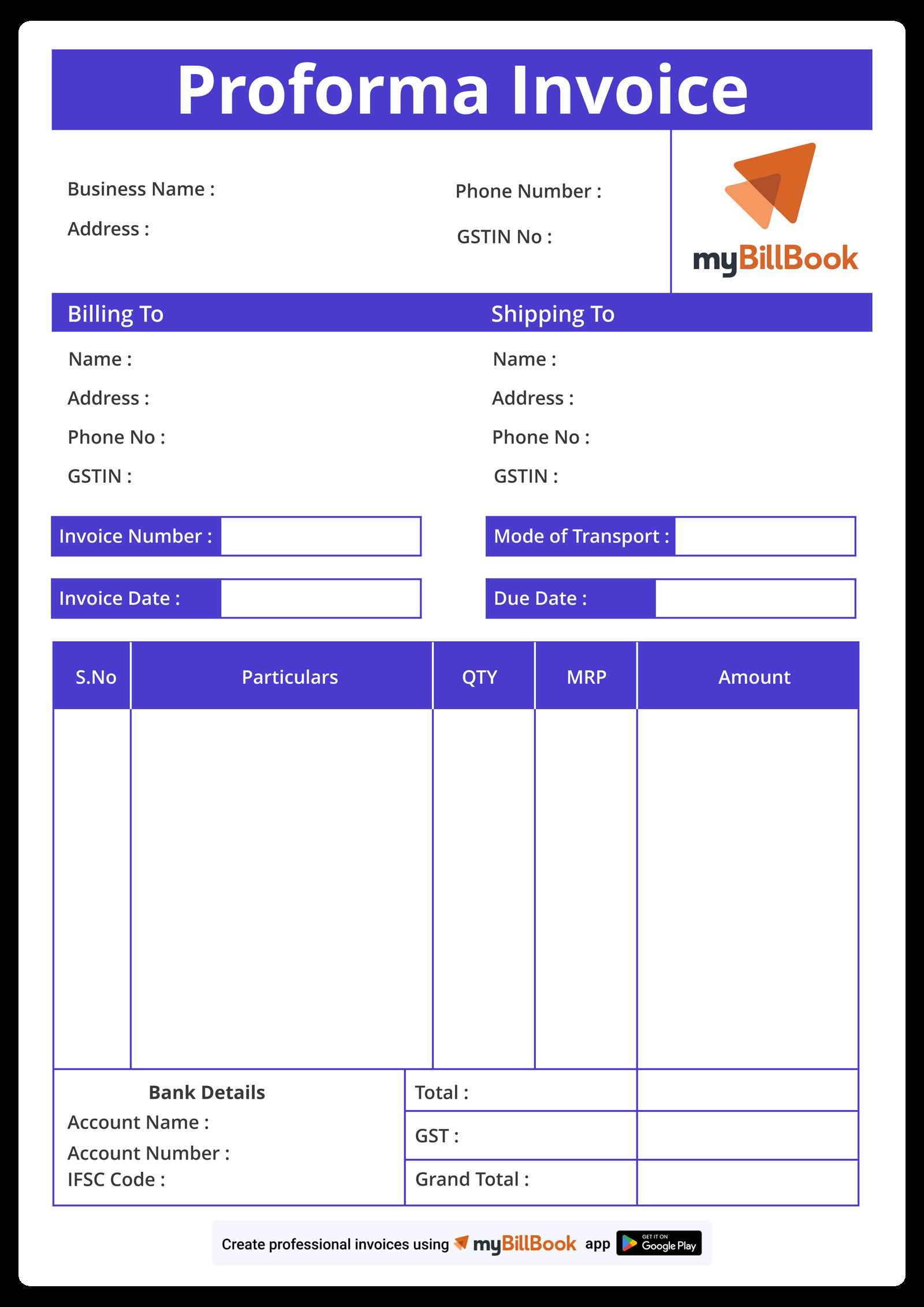

To ensure a successful claim process, the following key elements should be included in your financial record when submitting it for insurance reimbursement:

- Patient Information: Include full details of the patient, such as name, date of birth, insurance policy number, and any relevant identifiers, to ensure proper matching of the claim.

- Provider Information: Clearly list the healthcare provider’s name, contact details, and tax identification number (TIN) to verify the legitimacy of the charge and facilitate the payment process.

- Service Details: Break down the services rendered, including specific treatments, diagnoses, procedures, and the corresponding codes (such as ICD and CPT). These codes are essential for the insurer to process the claim correctly.

- Dates of Service: List the exact dates when the services were provided. Insurance companies often require specific timelines to determine coverage eligibility and payment schedules.

- Charge Breakdown: Include a detailed list of each service or procedure, along with the cost for each, ensuring that the charges are clear and accurate to avoid confusion or denials.

- Payment Information: State any payments already made by the patient or other parties, such as copayments or prior insurance payments, to show the remaining balance due from the insurance company.

- Diagnosis and Procedure Codes: Ensure that all medical codes, such as ICD-10 for diagnoses and CPT for procedures, are included correctly. These are essential for reimbursement and are used by insurance companies to verify the medical necessity of the services.

By ensuring that your billing document includes all the necessary details and complies with insurance requirements, you can reduce the chances of errors and speed up the reimbursement process. Accurate and comprehensive documentation not only benefits the provider but also enhances the relationship between the healthcare provider and the insurance company.

Automating Billing Generation for Healthcare Providers

Automating the process of generating financial documents can significantly improve efficiency, reduce human error, and streamline workflows for healthcare organizations. By implementing automated systems, providers can generate accurate billing records quickly, without the need for manual input. This not only saves time but also enhances consistency and reduces the risk of mistakes in patient billing and insurance claims.

Benefits of Automation in Billing

Automating billing processes offers several advantages that help healthcare organizations manage their financial operations more effectively:

- Time-Saving: Automation eliminates the need for manual data entry, allowing administrative staff to focus on more strategic tasks.

- Accuracy: Automated systems minimize human errors, ensuring that all charges, codes, and patient information are correct and consistent.

- Faster Billing: Automated tools can generate and send billing documents instantly, speeding up the overall payment cycle and improving cash flow.

- Compliance: Many automated systems are designed to ensure compliance with healthcare regulations, reducing the risk of legal issues or claims rejections.

- Reporting and Analytics: Automation allows for easy tracking and analysis of payment data, helping healthcare providers make informed financial decisions.

Key Features of Automated Billing Systems

When selecting an automation tool, it is important to look for key features that will optimize your billing process:

- Integration with Electronic Health Records (EHR): Automated systems that integrate with EHRs ensure that patient information and service details are automatically transferred into billing documents.

- Automated Payment Reminders: Automated tools can send reminders to patients or insurance companies when payments are due, reducing delays and improving collection rates.

- Customizable Billing Templates: Many automated systems allow providers to customize billing documents to reflect specific services or organizational needs, ensuring that all necessary information is included.

- Insurance Claim Integration: Automated systems often integrate with insurance claim platforms, enabling the seamless submission of claims for reimbursement and reducing the chances of errors or denials.

By adopting automation for billing generation, healthcare organizations can enhance operational efficiency, improve payment cycles, and reduce administrative costs. The shift to automated systems not only improves accuracy but also ensures that healthcare providers can focus more on patient care rather than manual paperwork.

Improving Payment Recovery with Billing Documents

Effective payment recovery relies on clear and consistent communication with patients and insurers. By utilizing structured and well-organized financial documents, providers can streamline the payment collection process, reduce outstanding balances, and improve cash flow. A well-designed billing document not only ensures that all necessary information is included but also facilitates quicker responses and resolutions from the payer.

How Structured Financial Documents Improve Payment Recovery

Using consistent formats for billing can have a significant impact on the efficiency of payment recovery. By clearly outlining charges, due dates, and payment methods, healthcare providers can set clear expectations with patients and insurance companies, making the payment process more transparent and manageable. Here are several ways structured documents enhance payment recovery:

- Clarity and Transparency: A detailed, easy-to-read document helps patients and insurers understand exactly what they owe and why, reducing confusion and disputes over charges.

- Consistency: Consistently using the same format ensures that both patients and payers become familiar with the billing structure, making it easier for them to process payments quickly.

- Accurate Payment Tracking: Clear records make it easier to track what has been paid, what remains outstanding, and whether there are any discrepancies that need to be addressed.

- Timely Follow-Up: By using standardized formats, automated reminders and follow-up communications can be sent promptly, increasing the likelihood of timely payments.

Strategies for Enhancing Payment Collection with Structured Documents

Incorporating key strategies into your billing documents can further improve the recovery process:

- Highlight Payment Terms: Clearly state payment due dates, late fees, and accepted payment methods to set expectations upfront.

- Offer Payment Plans: For larger balances, consider offering flexible payment options that can be outlined in the document to facilitate easier settlement of outstanding amounts.

- Use Electronic Billing: Sending electronic copies of financial documents speeds up the process and allows patients or insurers to pay instantly using online payment portals.

- Include Insurance Information: Make sure to include relevant insurance claim codes and policy details in your documents, ensuring faster claim processing and fewer delays in reimbursement.

By utilizing well-structured billing documents and implementing these strategies, healthcare providers can improve their payment recovery process. Clear communication, efficient tracking, and timely follow-up are essential for reducing outstanding balances and ensuring consistent cash flow.

Billing Document Software Options

When it comes to creating and managing billing records, choosing the right software can make a significant difference in the efficiency and accuracy of the process. Various software options are available that help streamline document creation, automate calculations, and ensure compliance with industry regulations. By leveraging specialized tools, healthcare providers can improve workflow, reduce errors, and expedite the payment cycle.

Below are some of the most popular software solutions for managing billing documents:

Top Software Options for Efficient Billing

- QuickBooks: QuickBooks is a versatile accounting software that includes invoicing capabilities, allowing users to easily create and customize billing records. It is particularly useful for small to medium-sized healthcare providers looking for a user-friendly solution.

- FreshBooks: Known for its intuitive interface, FreshBooks simplifies the billing process by automating invoicing and payment reminders. It is a great choice for practices that want a simple, cloud-based solution with time-tracking features.

- Zoho Invoice: Zoho Invoice offers robust features for creating detailed billing documents, including multi-currency support, customizable templates, and integration with other Zoho tools. It’s ideal for larger organizations with diverse billing needs.

- Medisoft: Specifically designed for healthcare providers, Medisoft helps create accurate billing records while ensuring compliance with medical coding standards. It integrates with electronic health records (EHR) systems for seamless information transfer.

- Square Invoices: Square offers a straightforward, easy-to-use platform for creating professional billing documents. Its cloud-based service also allows for real-time payment tracking and integration with Square’s point-of-sale system.

Features to Consider When Choosing Software

When selecting billing software, it’s important to look for specific features that can enhance the efficiency of your billing process:

- Customization Options: Ensure that the software allows you to customize billing templates to reflect your specific needs, such as adding relevant service codes or payment terms.

- Integration with EHR Systems: For smoother workflows, choose software that integrates with your practice’s electronic health record system to automatically populate billing documents with accurate patient and service data.

- Automated Payment Reminders: Look for software that can send automatic reminders to patients or insurers for unpaid balances, reducing the need for manual follow-up.

- Compliance Features: Make sure the software complies with industry standards and regulations, such as HIPAA, to protect sensitive patient information and ensure accurate medical coding.

- Reporting and Analytics: Some software options offer robust reporting tools to track payments, identify trends, and manage accounts receivable effectively.

Choosing the right billing software is essential for simplifying financial operations and improving the overall billing experience. By selecting a solution that aligns with your needs, you can enhance efficiency, reduce administrative overhead, and improve payment cycles.

Tips for Managing Billing Records

Managing billing records efficiently is crucial for ensuring timely payments and maintaining a smooth financial workflow. Healthcare providers face unique challenges when it comes to billing, such as navigating complex insurance claims, handling patient payments, and staying compliant with regulations. By following best practices and using the right tools, organizations can streamline their billing processes, reduce errors, and improve revenue cycle management.

Best Practices for Effective Billing Management

Here are some essential tips to help you manage your billing records more efficiently:

- Standardize Billing Processes: Establish clear and consistent procedures for generating and processing financial documents. Standardization reduces errors and ensures that each step in the billing cycle is completed accurately and on time.

- Stay Up-to-Date with Codes: Ensure that your team is well-versed in the latest medical codes, such as ICD-10 and CPT, to accurately describe services and diagnoses. Incorrect or outdated codes can delay payments and lead to claim denials.

- Automate Recurring Tasks: Leverage technology to automate tasks like billing, follow-up reminders, and payment tracking. Automation saves time and reduces the chance of human error, leading to faster payment recovery.

- Verify Insurance Information Early: Confirm patient insurance details before providing services. This minimizes the chances of billing issues later on and ensures that claims are sent to the correct insurer without delay.

- Provide Transparent Communication: Clearly communicate payment expectations to patients upfront. This includes outlining payment terms, due dates, and insurance coverage details. Transparency helps avoid misunderstandings and improves collections.

Improving Collection Rates

Improving payment recovery is essential for the financial health of any healthcare organization. Here are some strategies to enhance collections:

- Offer Payment Plans: For large bills, consider offering flexible payment plans to help patients manage their balances. This increases the likelihood of receiving full payment over time, rather than having the debt go unpaid.

- Send Timely Reminders: Use automated systems to send payment reminders before and after the due date. Regular reminders help keep payments top of mind for patients and insurers

Best Practices for Billing Documentation

Proper documentation is a fundamental aspect of managing financial records. Accurate and well-structured billing documents help ensure that payments are processed efficiently, reduce errors, and avoid disputes. By adhering to best practices, healthcare providers can streamline their operations, maintain transparency, and foster positive relationships with patients and insurers.

Essential Guidelines for Effective Billing Documentation

Here are some key practices to ensure your billing records are complete, accurate, and easily understandable:

- Use Clear and Consistent Language: Ensure that the terminology used in your billing documents is clear and consistent. Avoid jargon or abbreviations that may confuse the reader. This is especially important when dealing with insurance companies or patients who may not be familiar with specific terms.

- Include All Relevant Details: Make sure that each document contains all the necessary information, such as patient details, service dates, itemized charges, payment terms, and insurance information. This reduces the likelihood of disputes and delays in payment.

- Ensure Accuracy in Charges: Double-check all charges, service codes, and patient details before sending out a document. Accurate documentation prevents errors, reduces the risk of rejected claims, and ensures prompt payment.

- Organize Records Logically: Keep your billing documents well-organized and structured. This includes grouping similar charges, using headers, and numbering items for easy reference. Organized documentation makes it easier for both patients and insurers to understand and verify the charges.

- Set Clear Payment Terms: Clearly outline payment due dates, accepted payment methods, and any late fees or penalties. Clear terms set expectations upfront and help avoid confusion or delays in the payment process.

Additional Considerations for Billing Documentation

To further enhance the effectiveness of your billing records, consider these additional tips:

- Provide Contact Information: Always include a contact number or email address for patients or insurers to reach out in case of any questions or issues with the document. Having clear communication channels helps resolve any concerns quickly.

- Incorporate Digital Tools: Use digital billing software that allows for easy customization, storage, and retrieval of billing documents. Digital records can be securely stored, are easily accessible, and can be updated with real-time changes.

- Maintain Compliance: Ensure your billing documents adhere to industry regulations and standards, such as privacy laws and billing codes. Non-compliance can lead to legal issues or delays in reimbursement.

- Keep Records for Auditing: Retain billing records for a sufficient period in case of audits or disputes. Organized and accessible documentation simplifies the audit process and helps avoid penalties or fines.

By following these best practices, healthcare providers can ensure that their billing records are accurate, professional, and effective in facilitating timely payments. Proper documentation not only improves operational efficiency but also enhances the overall experience for patients and