Download Free Health Care Invoice Template for Medical Billing

Managing financial transactions in the medical field can be complex, but using the right tools can make the process smoother and more organized. A well-structured document for requesting payments not only helps maintain a clear record but also ensures timely reimbursements from patients and insurance providers.

Professionals in the medical industry benefit greatly from using customizable documents to itemize services rendered, track outstanding balances, and comply with regulations. With these documents, practitioners can present accurate charges to patients, streamline the payment process, and reduce errors that could lead to delays or disputes.

In this guide, we explore the essential features of effective billing documents and how they contribute to better financial management. We also offer practical tips for creating and customizing these documents, allowing medical professionals to save time and improve their overall efficiency.

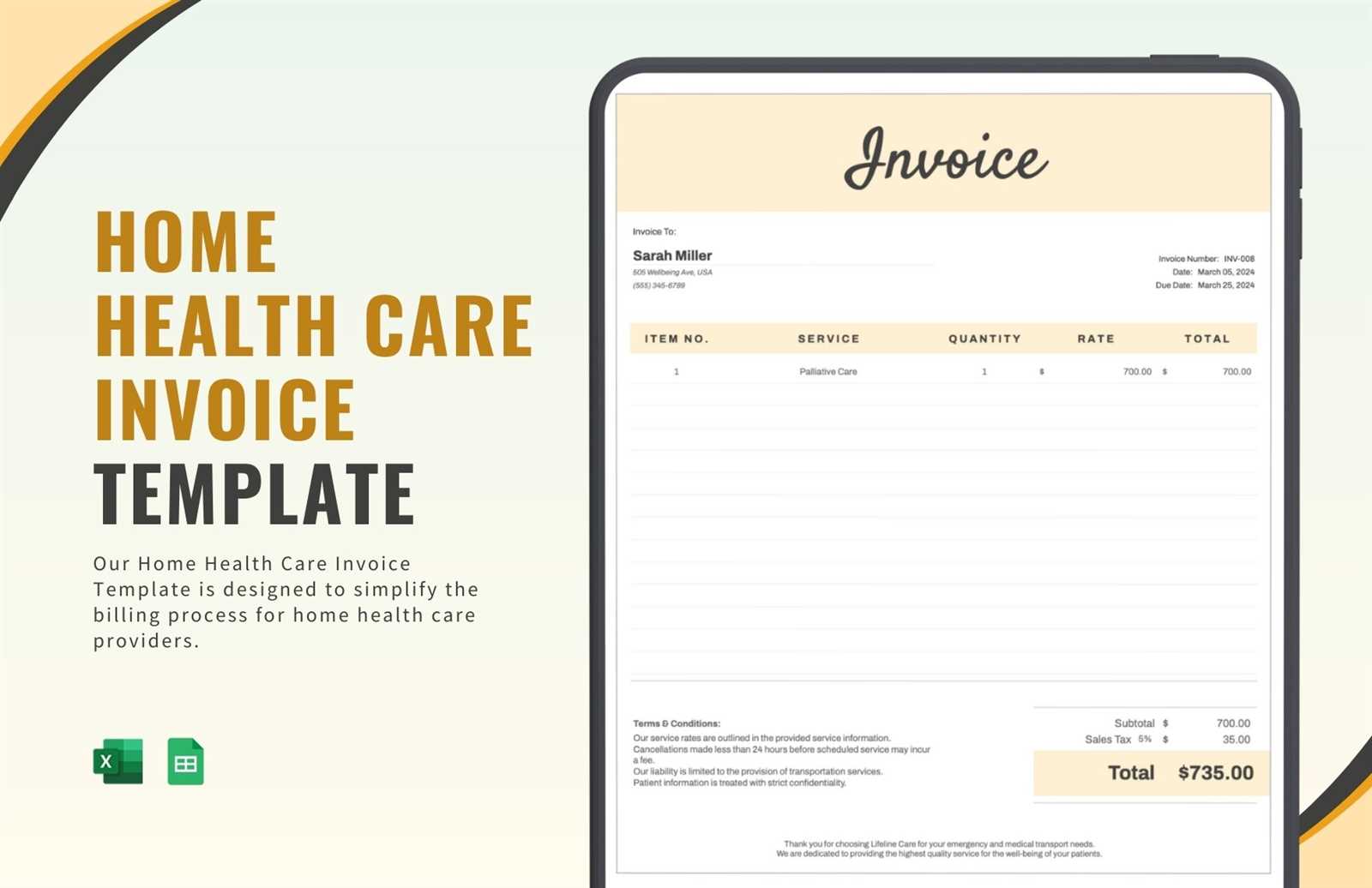

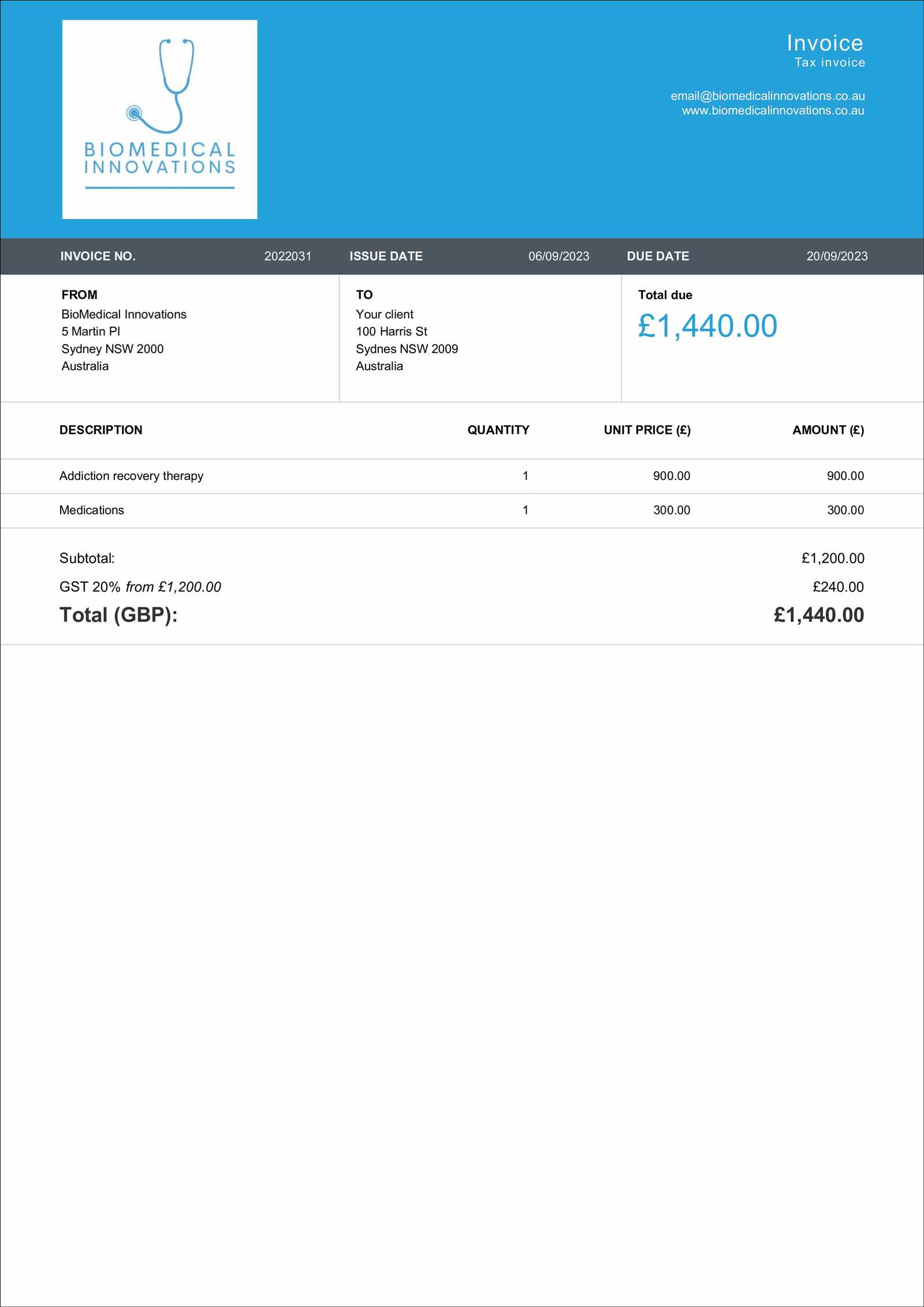

Health Care Invoice Template Overview

In any medical practice, keeping track of payments and services rendered is critical for maintaining smooth financial operations. Professionals in the healthcare industry rely on standardized documents to ensure accuracy, transparency, and compliance with industry regulations. These essential tools simplify the billing process, helping practitioners avoid errors and expedite payments from both patients and insurance providers.

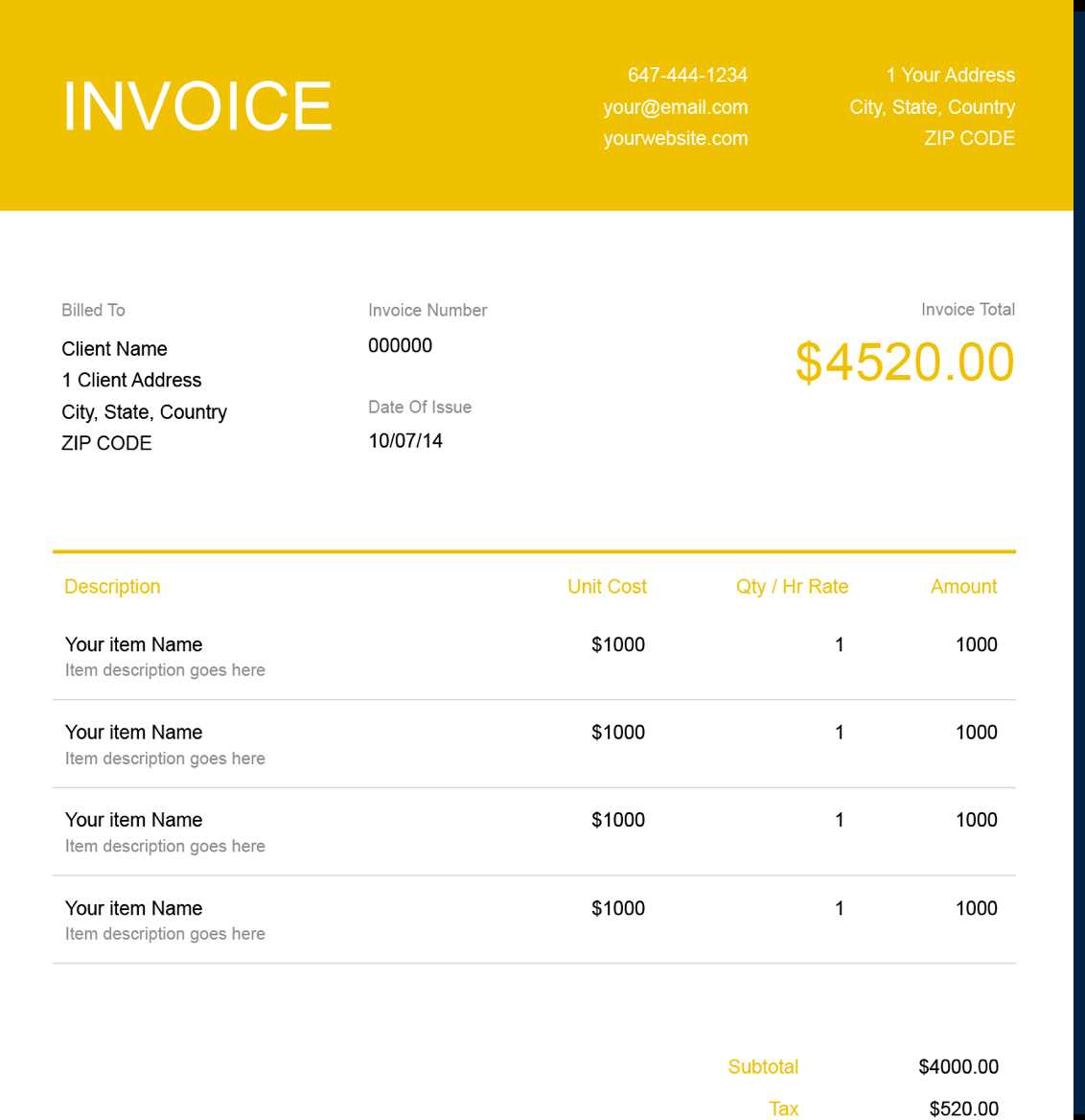

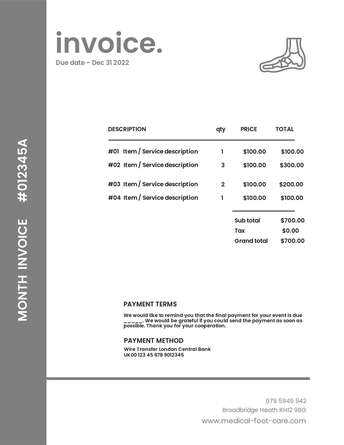

These documents typically feature a clean, easy-to-read layout that includes necessary details such as service descriptions, charges, and payment terms. Customization options are available to suit various practices, from general clinics to specialized medical services. This flexibility allows medical professionals to create a document that reflects their unique services and needs while still adhering to best practices for billing.

Key Features of a Billing Document

The most effective billing documents share several common characteristics. Here are some of the key elements that should be included:

| Feature | Description |

|---|---|

| Service Description | Clear explanation of treatments, consultations, or procedures provided. |

| Charges | Detailed breakdown of costs for each service rendered. |

| Payment Terms | Indicates the due date and any payment plans or discounts available. |

| Patient Information | Includes the patient’s name, address, and insurance details (if applicable). |

| Practitioner Information | Details of the service provider, such as name, license number, and contact information. |

Benefits of Using a Structured Document

Using a well-organized document provides numerous benefits, including increased efficiency in handling finances, reduced administrative workload, and a better overall experience for patients. It also ensures that all parties involved have a clear understanding of the charges and payment requirements, leading to fewer disputes and quicker reimbursements.

Why You Need a Medical Invoice

Accurate financial documentation is essential in any medical practice, as it ensures smooth transactions between healthcare providers and patients. Having a well-structured document for requesting payment is crucial not only for tracking services provided but also for managing the revenue cycle. Without proper records, there can be confusion, delays, and disputes, which can impact the financial health of a practice.

These payment requests serve several important functions that streamline both the administrative and financial aspects of running a medical practice. Below are some of the key reasons why this type of documentation is vital:

- Clear Payment Tracking: A detailed document helps track payments, making it easier to follow up on unpaid balances and identify discrepancies in billing.

- Improved Professionalism: Using a consistent, formalized approach to requesting payment presents a professional image to patients and third-party payers, enhancing trust and transparency.

- Compliance with Regulations: Medical billing must adhere to specific standards set by healthcare regulations. Proper documentation ensures compliance with these rules, reducing the risk of audits or fines.

- Faster Payments: Providing patients with clear, understandable charges and payment instructions encourages quicker payment processing, whether directly or through insurance claims.

- Accurate Record Keeping: Detailed billing records help maintain an accurate history of services provided, which is crucial for future references or any disputes that may arise.

In summary, using well-organized payment requests not only enhances operational efficiency but also ensures legal compliance and promotes positive patient-provider relationships.

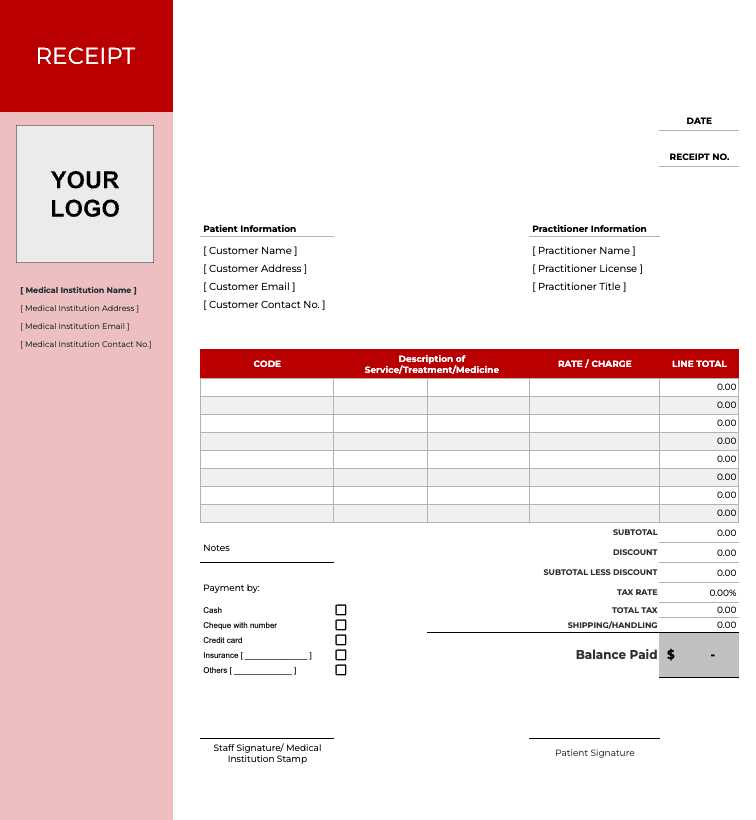

How to Create a Health Care Invoice

Creating a structured and accurate document for requesting payment is essential for any medical practice. This document should clearly outline the services provided, the associated costs, and the terms of payment. A well-crafted payment request helps ensure timely reimbursements and reduces the chances of disputes or errors. Below are the steps to create a professional and effective payment request.

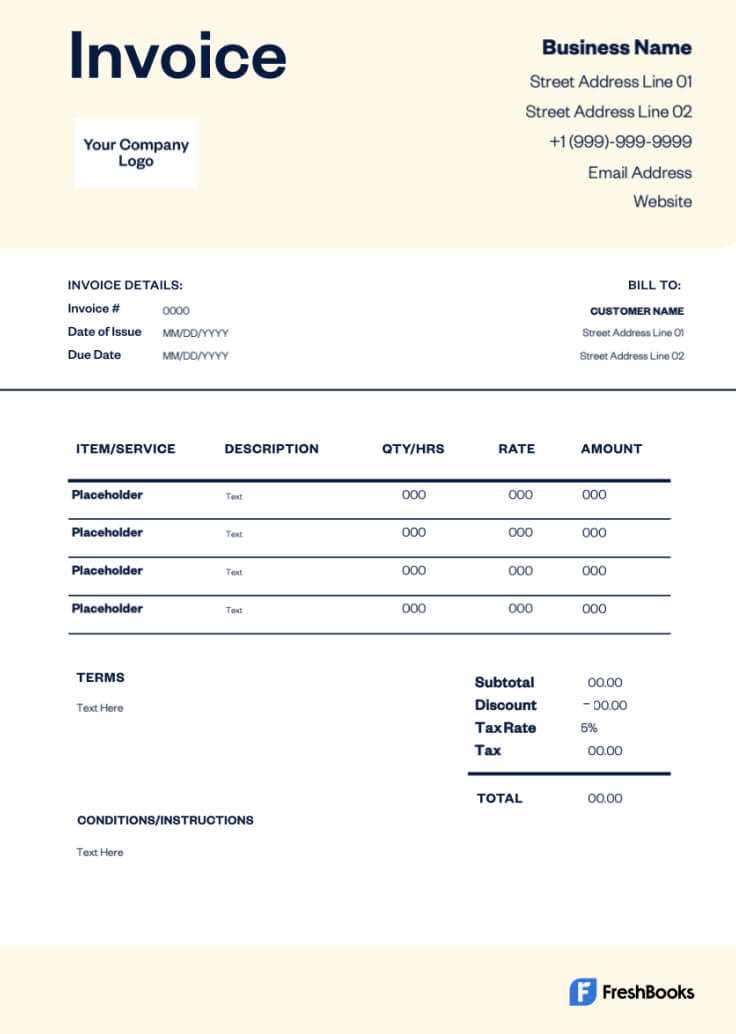

Step 1: Include Basic Information

Start by adding the essential details that identify both the patient and the service provider. This information forms the foundation of your document and helps maintain clear records for both parties.

- Patient Information: Name, address, contact details, and insurance information if applicable.

- Provider Information: Name, practice name, address, contact number, and any relevant licensing details.

- Document Number: Unique identification for the document to easily track it in your system.

- Issue Date: The date when the payment request was issued.

Step 2: List Services and Costs

Next, provide a detailed breakdown of the services rendered. Be as specific as possible and include the date of service, a description of the treatment or procedure, the quantity, and the cost per unit. This clarity helps prevent confusion and ensures the patient understands exactly what they are being billed for.

- Service Description: A clear explanation of each treatment or procedure.

- Quantity: The number of services rendered (if applicable).

- Unit Price: The cost per service or item.

- Total Cost: The total amount for each line item (quantity × unit price).

Step 3: Add Payment Terms and Instructions

Clearly outline how the payment should be made, the due date, and any payment plans or discounts offered. Including payment instructions helps guide the patient through the process and ensures both parties are on the same page.

- Due Date: Specify the date by which payment should be made.

- Payment Methods: Indicate the accepted payment methods (credit card, check, online payment, etc.).

- Late Fees: Mention any penalties or interest that may apply if the payment is not received on time.

By following these steps, you can create a well-organized and professional document that facilitates clear communication, accurate record-keeping, and prompt payments.

Benefits of Using Invoice Templates

Using a pre-designed format for billing can greatly streamline the process of requesting payment, saving time and reducing errors. By leveraging standardized documents, professionals can ensure consistency and accuracy in their financial transactions. This approach not only improves efficiency but also enhances the overall experience for both service providers and patients.

Time Savings and Efficiency

One of the primary advantages of using a ready-made document is the time it saves. Instead of creating a new request from scratch for each patient, a pre-formatted document can be quickly customized with the necessary details. This significantly reduces administrative workload, allowing healthcare providers to focus more on patient care rather than paperwork.

- Pre-filled Fields: Many templates come with pre-filled sections that only require minor adjustments, such as the patient’s name or the date of service.

- Faster Processing: With fewer steps involved in creating a document, you can submit payment requests more quickly, speeding up reimbursement timelines.

Consistency and Professionalism

Using a standardized format also ensures that each request for payment is uniform, which helps maintain a professional image. Patients and insurance providers will receive clear, well-organized documents, which builds trust and fosters a more transparent relationship. Consistency in billing can also reduce misunderstandings and disputes over charges.

- Uniform Appearance: A consistent layout ensures that all required details are included every time, reducing the risk of missing important information.

- Clarity for Patients: When documents follow a clear, logical structure, patients are more likely to understand their charges and payment terms.

Overall, using a structured, pre-designed format for payment requests provides significant advantages in terms of time, accuracy, and professionalism, helping medical providers run their practices more smoothly and efficiently.

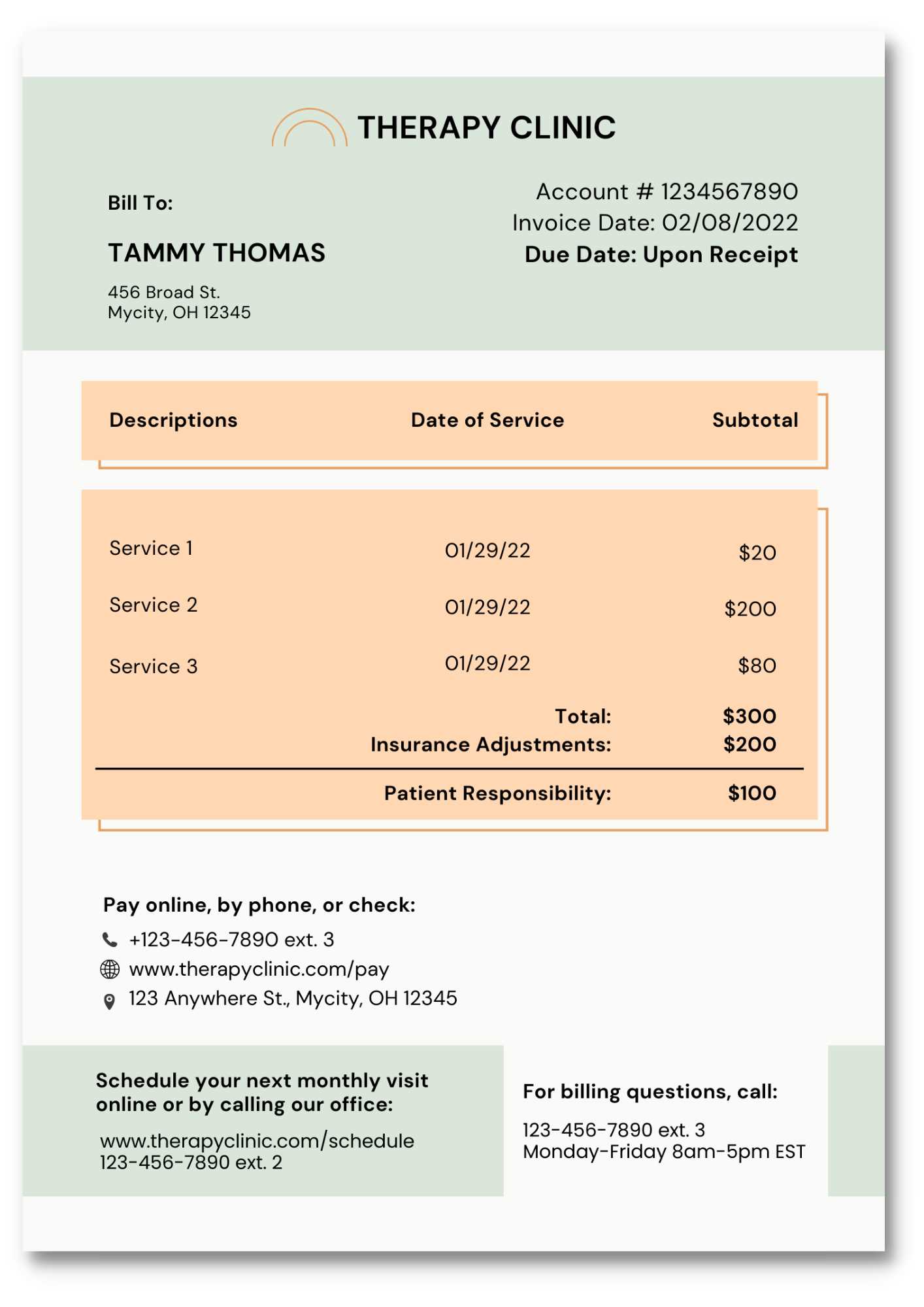

Key Components of a Health Care Invoice

To ensure accurate billing and smooth financial transactions, it is essential to include specific information in every payment request. A well-structured document provides clarity and transparency, helping both the service provider and the patient understand the charges, terms, and payment process. Below are the key components that should be included in any billing document for medical services.

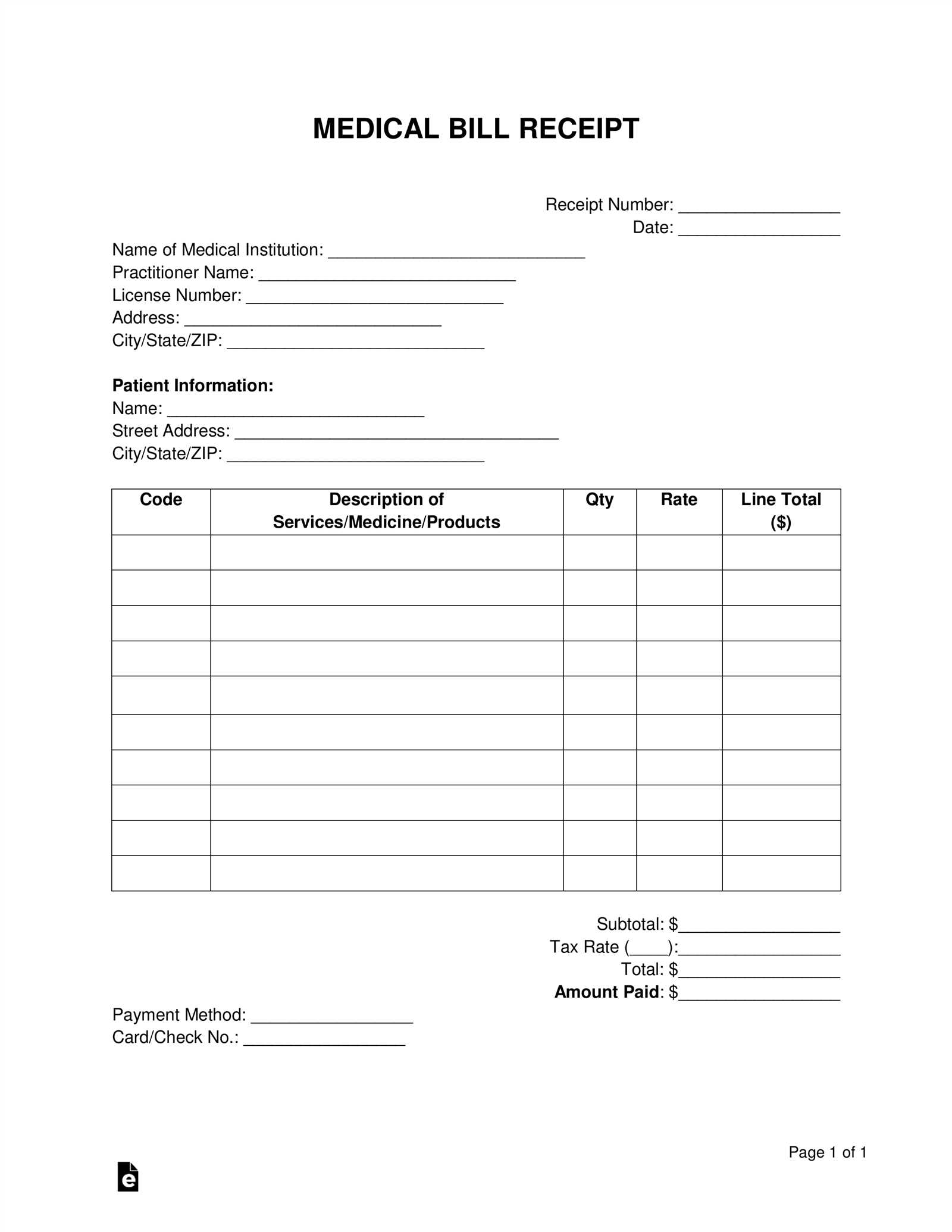

- Patient Information: This section should include the patient’s full name, contact details, and insurance information (if applicable). It is vital for identifying the individual receiving the services and ensuring the correct billing party.

- Provider Information: The name, contact details, and licensing information of the medical professional or clinic providing the services should be clearly stated. This establishes the legitimacy of the document and provides a point of contact for any questions or concerns.

- Unique Document Number: Each request for payment should have a unique identifier to make it easier to track in your system. This helps avoid confusion and ensures that all documents are properly recorded.

- Dates of Service: The exact dates when medical services were provided should be listed to avoid any ambiguity and to give both parties a clear timeline of when treatments or consultations took place.

- Detailed Description of Services: A breakdown of the treatments, procedures, or consultations performed should be included. Each service should be clearly described, and the corresponding fees should be listed alongside each item.

- Pricing Information: The cost of each service rendered, including the quantity and unit price, should be specified. This makes it easy to verify charges and helps ensure that both parties are clear on what is being billed.

- Total Amount Due: The final amount owed, including any applicable taxes, should be clearly calculated and stated. If there are any discounts, payment plans, or partial payments, these should also be indicated.

- Payment Terms and Due Date: The document should clearly outline the payment deadline, the accepted payment methods, and any late fees or penalties for overdue payments. This section helps set expectations and encourages timely payment.

Including these essential components ensures that the billing document is comprehensive, easy to understand, and legally compliant, which ultimately supports a more efficient and transparent financial process.

Customizing Your Health Care Invoice Template

Customizing your billing document is essential for aligning it with the specific needs of your medical practice. A personalized approach ensures that the payment requests you send reflect your unique services, branding, and professional standards. By tailoring the format, you can streamline your workflow, maintain consistency, and create a professional image that instills confidence in your patients.

Here are some key areas to focus on when customizing your billing document:

- Branding and Design: Including your practice’s logo, colors, and font styles creates a professional and cohesive look. This not only reinforces your brand identity but also adds an element of trust and familiarity for your patients.

- Service Descriptions: Tailor the descriptions of treatments, consultations, and procedures to accurately reflect the services you provide. You can include specific details or use terminology that your patients will easily understand.

- Payment Terms: Adjust the payment conditions to suit your business model. You may want to offer flexible payment options, such as installment plans, or include details about late fees, discounts for early payments, or promotional offers for specific services.

- Additional Information: Consider including extra fields for patient-specific details, such as referral information, the doctor’s name, or notes about pre-authorized insurance coverage. Customizing these fields helps ensure all relevant information is captured for each case.

- Legal and Compliance Statements: If necessary, add statements related to insurance claims, disclaimers about payment responsibilities, or terms of service that comply with local regulations and industry standards.

With these adjustments, your payment requests will be more than just functional–they will align with your practice’s identity and help you maintain clear communication with your patients, ensuring a smoother financial process for all involved.

Common Mistakes to Avoid in Medical Invoices

Creating accurate payment requests is crucial for maintaining smooth financial operations in a medical practice. However, several common mistakes can lead to confusion, delays, and even disputes over charges. By being aware of these errors and taking steps to avoid them, you can ensure that your billing process is as efficient and error-free as possible.

Here are some of the most common mistakes to watch out for:

- Missing or Incorrect Patient Information: One of the most common errors is failing to include or incorrectly entering patient details such as their name, address, or insurance information. Incorrect details can cause delays in processing payments and may lead to reimbursement issues with insurance companies.

- Vague Service Descriptions: A lack of clarity in describing the services provided can lead to misunderstandings. Be specific about the procedures, consultations, or treatments given, and avoid using abbreviations or technical jargon that may confuse the patient.

- Incorrect Billing Amounts: Errors in calculating the cost of services or applying the wrong fees can create confusion and cause disputes. Always double-check the prices, quantities, and any applicable taxes before finalizing the document.

- Missing Payment Terms: Failing to clearly specify the due date, payment methods, or late fees can result in delays or missed payments. Clearly stating payment expectations helps prevent misunderstandings and encourages timely payment.

- Omitting Relevant Dates: Not including the date of service or the date the payment request was issued can create confusion and make it harder to track payments. Always ensure that these dates are clearly marked on the document.

- Not Including a Unique Identifier: Each payment request should have a unique document number for easy tracking. Without this, it becomes difficult to reference past transactions, which can lead to problems with record-keeping and follow-ups.

- Failure to Account for Insurance Coverage: If the patient has insurance coverage, failing to properly account for it on the document can lead to delayed payments. Be sure to include relevant insurance details and note the amount covered and the patient’s responsibility.

By avoiding these common mistakes, you can ensure that your billing process runs smoothly, reduce the risk of disputes, and ultimately improve cash flow in your medical practice.

Legal Considerations for Health Care Invoices

When creating payment requests for medical services, it’s crucial to consider the legal and regulatory requirements that apply. Failing to comply with applicable laws can lead to financial penalties, disputes, and damage to your practice’s reputation. Being aware of the legal considerations helps ensure that your financial documents are both compliant and clear, reducing potential risks in the billing process.

Compliance with Industry Regulations

Medical billing is governed by various laws and regulations that ensure transparency and fairness in financial transactions. These include:

- HIPAA Compliance: The Health Insurance Portability and Accountability Act (HIPAA) ensures the privacy and confidentiality of patient information. When handling personal data on payment requests, it is essential to comply with HIPAA regulations to avoid breaches of patient confidentiality.

- Medicare and Medicaid Requirements: For practices that accept government insurance, there are strict billing requirements. Make sure the document includes the correct codes, descriptions, and payment terms according to Medicare or Medicaid guidelines to avoid billing fraud or overpayments.

- State Laws: Each state may have specific rules regarding medical billing practices. These laws might include restrictions on late fees, payment terms, and how services are documented. Always check your state’s regulations to ensure compliance.

Key Legal Elements to Include

In addition to compliance with broader regulations, certain legal elements should be included in every payment request:

- Clear Payment Terms: The document should clearly state payment deadlines, accepted methods of payment, and any late fee policies. This helps prevent confusion and protects your practice legally if payments are delayed.

- Patient Consent: Ensure that patients have signed any necessary consent forms, especially for services covered by insurance or third-party payers. This provides legal protection in case of billing disputes.

- Accurate Billing Codes: When billing insurance companies, be sure to include the correct medical codes (CPT, ICD, etc.) for services provided. Incorrect codes can lead to rejected claims or delaye

Best Practices for Medical Billing

Effective billing is essential for maintaining a healthy cash flow in any medical practice. By following best practices, providers can ensure timely payments, minimize errors, and avoid disputes with patients and insurance companies. Implementing a clear, consistent approach not only streamlines the financial process but also helps build trust and transparency between practitioners and patients.

Below are some key practices to follow for efficient and accurate medical billing:

- Ensure Accurate Patient Information: Before issuing a payment request, double-check that all patient details–such as name, insurance information, and contact details–are accurate. This helps prevent delays due to incorrect or missing data, especially when dealing with insurance claims.

- Use Clear and Detailed Descriptions: Always provide precise descriptions of the services rendered, including the type of procedure or treatment, the date of service, and any applicable codes. This clarity reduces confusion and improves the likelihood of timely payment, especially from insurance providers.

- Verify Insurance Coverage: Before providing any services, ensure that you have the patient’s current insurance details and verify their coverage. This can help prevent surprises later on and ensure that both parties know what costs will be covered and what the patient is responsible for paying.

- Submit Claims Promptly: Delaying the submission of payment requests can lead to slower reimbursements and potential penalties. Ensure that claims are sent out as soon as possible, ideally within a few days of providing the service.

- Follow Up on Unpaid Claims: If payments are not received within the agreed-upon timeframe, don’t hesitate to follow up. Establish a system for tracking outstanding payments and routinely check on the status of pending claims. A proactive approach can help prevent outstanding balances from becoming unmanageable.

- Keep Detailed Records: Maintain thorough documentation of all services, payments, and communications related to billing. This not only helps ensure accuracy but also provides a safeguard in case of disputes or audits.

- Offer Multiple Payment Options: Make it as easy as possible for patients to pay by offering a variety of payment methods, such as credit/debit cards, checks, or online payment platforms. The more convenient the payment process, the more likely it is that patients will settle their bills promptly.

By adhering to these best practices, medical professionals can streamline their billing processes, reduce the risk of errors, and improve financial outcomes for their practices. Efficiency, transparency, and communication are key to fostering positive relationships with patients and ensuring the financial stability of any healthcare provider.

Free Health Care Invoice Templates Online

For those looking to streamline their billing processes without investing in expensive software, free online resources offer an excellent solution. These customizable billing documents are easy to use, helping medical providers save time while ensuring accuracy and professionalism in their financial communications. Whether you’re a solo practitioner or managing a large practice, free billing documents can meet your needs with minimal effort and cost.

Here are some key benefits of using free online resources for creating payment requests:

- Cost-Effective: Free resources allow medical professionals to access high-quality, pre-designed formats without incurring additional costs. This is especially useful for smaller practices or independent practitioners.

- Customizable: Many free billing resources are fully customizable, allowing you to adjust the document to fit your branding, service descriptions, and payment terms.

- Easy to Use: With user-friendly interfaces, most online resources require little to no technical knowledge, making it easy for anyone to create a professional-looking payment request in minutes.

- Save Time: Ready-made documents allow you to quickly input the relevant patient and service details, helping you issue billing statements more efficiently.

Here’s an example of what you can find in some free online resources:

Component Description Service Date The date when the services were provided. Provider Details Information about the medical professional or clinic, including name and contact details. Patient Information Personal information about the patient receiving the services, such as name and insurance details. Service Descriptions A list of treatments or services rendered, along with associated costs. Total Amount The total amount due for the services rendered, including taxes and fees. Payment Terms Information about payment due dates, accepted payment methods, and any late fees or disc How to Track Payments with Invoices

Efficiently tracking payments is crucial for maintaining a healthy cash flow and ensuring that financial records are accurate. By using well-structured billing documents, providers can monitor outstanding balances, manage payment schedules, and prevent missed or delayed payments. Establishing a clear system for tracking payments helps reduce administrative burdens and improves financial transparency.

Key Steps to Track Payments

To effectively manage your payment records, follow these steps:

- Assign a Unique Identifier: Every billing document should have a unique reference number. This helps you easily track each transaction and prevents confusion when managing multiple requests for payment.

- Include Clear Payment Terms: Clearly outline payment deadlines, methods, and any applicable penalties for late payments. This sets expectations for both the provider and the patient, reducing the chance of misunderstandings.

- Track Partial Payments: If a patient makes a partial payment, record it accurately on the document and ensure the remaining balance is clearly visible. This will help you keep track of outstanding amounts and follow up accordingly.

- Monitor Payment Dates: Always mark the payment due date and record the date the payment was received. This will help you stay on top of late payments and manage your accounts receivable efficiently.

Using Digital Tools for Tracking

Many digital solutions are available to help automate the process of tracking payments and outstanding balances. By integrating billing systems with accounting software, you can:

- Automate Reminders: Set automatic reminders for overdue payments, helping ensure timely follow-ups with patients.

- Generate Reports: Easily generate reports showing outstanding amounts, payment statuses, and payment histories for each patient.

- Maintain Accurate Records: Digital tracking systems can help maintain a central database of all transactions, reducing errors associated with manual record-keeping.

By adopting a methodical approach to tracking payments, medical professionals can ensure that billing processes remain organized, timely, and accurate. Proper tracking not only improves financial management but also strengthens relationships with patients by providing clarity on payment expectations.

Medical Invoice Formatting Tips

Creating clear and professional billing documents is essential for any medical practice. Proper formatting not only ensures that the request for payment is easy to understand, but it also helps maintain a consistent, trustworthy image. By following specific formatting guidelines, you can improve readability, reduce errors, and encourage timely payments from patients or insurers.

Key Formatting Tips

When creating your payment documents, consider the following formatting tips:

- Use Clear Headings: Include bold, easy-to-read headings for each section of the document, such as “Patient Information,” “Services Provided,” and “Total Amount Due.” This helps the recipient quickly find the information they need.

- Ensure Consistent Font and Size: Use a clean, professional font (such as Arial or Times New Roman) and maintain a consistent size throughout the document. Typically, font size 12 is ideal for body text, while headings can be slightly larger for emphasis.

- Include Adequate White Space: Don’t overcrowd the document with too much text or too many details. Proper spacing between sections and around the text improves readability and makes the document look more organized.

- Use Tables for Service Listings: When listing treatments, procedures, or services, organize them in a table format. This allows for easy comparison of costs, making it clear which services were provided and at what price.

- Highlight Important Information: Use bold or underlined text to draw attention to critical information such as the total amount due, payment due date, and payment instructions. This helps avoid confusion and ensures key details stand out.

- Include Footer for Additional Information: In the footer of the document, include important legal disclaimers, contact details, or payment instructions. This is a good place to mention accepted payment methods or any other relevant terms.

Visual Appeal and Branding

In addition to functionality, the visual appeal of the document plays a role in projecting professionalism. To strengthen your brand identity, consider the following:

- Add Your Logo: Place your practice’s logo at th

Choosing the Right Invoice Software

Selecting the right software to handle billing and payment requests is a crucial decision for any practice. The right solution can save time, reduce errors, and enhance the overall efficiency of financial operations. Whether you are a small practitioner or managing a larger facility, choosing software that aligns with your needs and workflows can make a significant difference in how you manage finances.

When evaluating invoice management software, consider the following factors to ensure you choose the best option for your practice:

Factors to Consider

Feature Why It’s Important Ease of Use The software should have a user-friendly interface so that staff with varying levels of technical expertise can use it without difficulty. Customization Options Choose software that allows you to customize billing documents, add your practice’s branding, and tailor the fields to match your services. Payment Tracking Look for features that help you track payments, monitor overdue balances, and send automatic reminders to patients or insurers. Integration with Other Tools Ensure that the software integrates smoothly with your accounting software, electronic health records (EHR) system, or scheduling tools to streamline workflows. Security Choose software that offers strong encryption and security features to protect sensitive patient and financial information. Customer Support Opt for software that offers reliable customer support in case you encounter any technical issues or need assistance with setup and use. Types of Invoice Software

There are several types of software available depending on your needs and the size of your practice. Some common options include:

- Cloud-Based Solutions: These are accessible from anywhere with an internet connection and often provide real-time updates, making them ideal for practices with multiple locations or remote work setups.

- Desktop Applications: These are installed directly on your computer and typically provide more robust features but may not be as accessible or flexible as cloud-based solutions.

- Integrated Software: Some practice management software comes with built-in billing functionality, which is convenient if you need everything in one place, from scheduling to billing.

By carefully evaluating your practice’s unique needs and considering the features listed above, you can make an informed decision on which software will best support your billing and financial processes. The right

How to Handle Unpaid Medical Invoices

Unpaid bills can pose a significant challenge for medical practices, disrupting cash flow and creating unnecessary administrative burdens. However, managing overdue payments is an inevitable part of any business. By establishing clear procedures and taking proactive steps, practices can improve their chances of collecting outstanding amounts while maintaining professional relationships with patients.

Below are some strategies to help handle overdue payments effectively:

Steps to Take When Payments are Overdue

- Send Timely Reminders: As soon as a payment becomes overdue, send a polite reminder to the patient or insurance company. Make sure the reminder includes the original payment details and any updated information about the amount due.

- Follow Up with a Phone Call: If the payment reminder doesn’t result in a response, consider following up with a phone call. This allows you to clarify any confusion and address potential concerns that might be delaying payment.

- Offer Payment Plans: Some patients may be unable to pay the full amount at once. Offering flexible payment plans can make it easier for them to pay off their balance over time, while ensuring you receive the funds you are owed.

- Provide Multiple Payment Options: Offer various payment methods to make it easier for patients to settle their bills. This can include online payments, credit cards, checks, or even mobile payment systems.

- Implement Late Fees: If a payment remains unpaid after a certain period, consider implementing a late fee. Be sure to inform patients of this policy upfront and include it in your billing terms.

Escalating the Collection Process

If standard reminders and payment plans do not lead to payment, there are more formal options to consider:

- Hire a Collection Agency: As a last resort, you may need to engage a professional collections agency to pursue the debt. Collection agencies have the expertise and resources to recover outstanding amounts, although they usually charge a fee for their services.

- Legal Action: In extreme cases, legal action may

Integrating Billing Documents with Your Accounting System

Efficient financial management requires seamless integration between billing processes and accounting systems. By syncing payment requests with accounting software, you can ensure that all financial data is consistently updated and easily accessible. This integration minimizes errors, reduces manual data entry, and provides real-time insights into the financial health of your practice.

Here are the key benefits and steps for integrating your billing documents with your accounting system:

Benefits of Integration

- Improved Accuracy: Automatically transferring data between billing documents and your accounting system reduces the risk of human error, ensuring all transactions are recorded correctly.

- Time Savings: Integration eliminates the need to manually input data into both systems, allowing your team to focus on more important tasks and improving overall efficiency.

- Real-Time Updates: With integrated systems, payment information is updated instantly, giving you a current view of outstanding balances, paid amounts, and financial projections.

- Streamlined Reporting: Financial reports can be generated quickly without having to pull data from multiple sources. Integration provides a holistic view of your revenue, expenses, and cash flow.

Steps to Integrate Billing and Accounting Systems

Integrating your payment processing and accounting systems is a relatively straightforward process if you follow these steps:

- Choose Compatible Software: Ensure that both your billing software and accounting system are compatible or designed to work together. Many modern accounting platforms offer built-in integration with popular billing solutions.

- Set Up Automatic Data Syncing: Configure the systems to automatically sync data. This can include patient payment details, payment dates, balances, and invoice numbers. The automatic sync will keep both systems up-to-date in real time.

- Map Data Fields: Make sure that all relevant fields from your billing documents are correctly mapped to the corresponding fields in your accounting software. This includes linking payment amounts, service codes, and patient information.

- Test the Integration: Before going live with the integration, run tests to verify that data flows correctly between the systems. This ensures that all payments are accurately recorded, and no important details are lost.

- Train Your Team: Ensure that your team is trained on how to use the integrated system. They should understand how to access the integrated data and handle any discrepancies that may arise.

Maintaining Accurate Billing Records

Accurate financial records are crucial for any practice, ensuring that all transactions are properly documented and tracked. Maintaining organized and precise billing records not only facilitates smooth operations but also helps in managing cash flow, preparing tax returns, and handling audits. Proper documentation ensures that every service provided is accounted for, payments are correctly recorded, and any discrepancies are easily identified and resolved.

To ensure your billing records remain accurate and up-to-date, consider following these best practices:

Best Practices for Accurate Record-Keeping

- Regularly Update Records: Consistently update billing entries as soon as services are rendered or payments are received. This minimizes the risk of errors or omissions.

- Double-Check Information: Before finalizing any billing document, carefully review all information for accuracy. Verify patient details, service descriptions, and amounts before sending out payment requests.

- Use Organized Systems: Implement a clear system for categorizing and storing billing documents. Whether you use physical or electronic records, make sure that each entry is easily accessible and properly filed by date, patient, or service type.

- Track Payments and Adjustments: Monitor incoming payments and apply adjustments where necessary. Ensure that overpayments, discounts, or write-offs are clearly noted to avoid confusion later on.

- Reconcile Financial Statements: Regularly reconcile billing records with financial statements to ensure that payments and charges match. This practice helps identify any discrepancies early and ensures the accuracy of your financial data.

Technology for Maintaining Accurate Records

Utilizing modern software tools can greatly enhance your ability to maintain precise billing records:

- Accounting Software: Invest in a reliable accounting system that integrates with your billing process. This software can automatically update records, track payments, and generate reports, reducing the likelihood of manual errors.

- Cloud Storage: Use cloud-based storage to keep electronic copies of all billing documents. Cloud solutions allow for secure, easy access to records from anywhere, ensuring that they are always up-to-date and backed up.

- Automated Billing Systems: Automate recurring charges and reminders to reduce the risk of forgotten billing cycles. Automated systems can help ensure consistency and accuracy in your financial documentation.

By adopting these practices and utilizing the right tools, you can ensure your billing records are accurate, secure, and easy to manage. Maintaining precise records not only supports day-to-day operations but also strengthens your practice’s financia