Free Handyman Invoice Template in Word Format for Easy Billing

Creating clear and professional payment requests is essential for maintaining a smooth business operation. For service providers, having a consistent and easy-to-use method for documenting work performed and costs is critical. A well-structured billing document not only ensures proper compensation but also helps establish trust with clients. Whether you’re just starting or looking to improve your current approach, having a reliable solution can make all the difference.

By using a ready-made format, you can save time and avoid the stress of formatting from scratch. These documents are designed to be simple, customizable, and provide all the necessary information that clients need to process payments quickly. With the right setup, you can enhance the professionalism of your business and focus more on what truly matters: delivering quality service.

In this guide, we’ll explore how such documents can be tailored to meet your specific needs, helping you stay organized and efficient. From basic details to payment terms, you’ll discover how to use these tools to streamline your operations and improve cash flow.

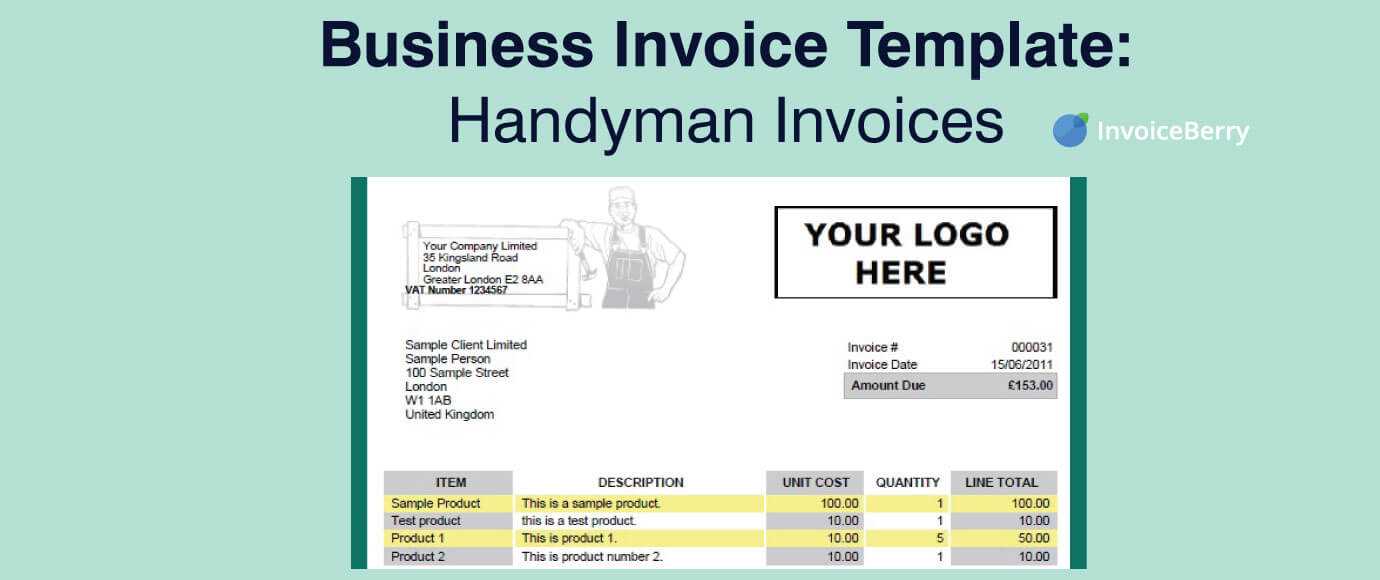

Handyman Invoice Template Word Overview

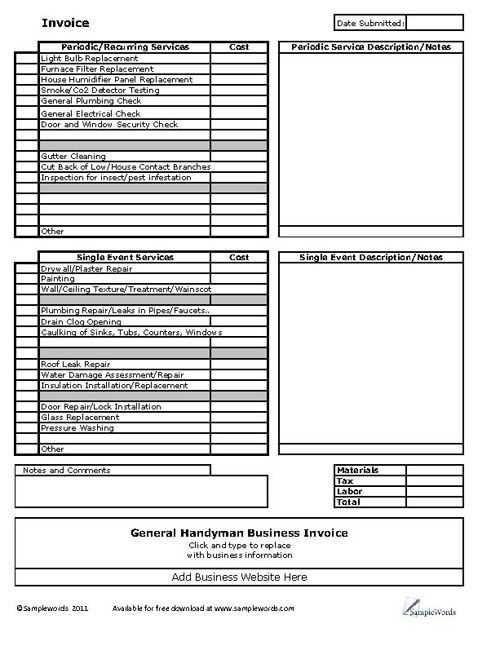

For professionals offering repair and maintenance services, having an efficient system for billing clients is essential. A well-organized billing document simplifies the process of tracking completed tasks, expenses, and due payments. It ensures that both the service provider and the client are on the same page regarding the services rendered and the amount due. Utilizing a pre-made structure can make this process quicker and more efficient, reducing administrative tasks and preventing errors.

Such billing structures are often customizable, allowing you to add specific details related to each project. These formats typically include fields for work descriptions, labor costs, materials used, and any applicable taxes or discounts. With a few adjustments, you can tailor the document to suit your business needs, creating a professional and clear payment request every time.

In addition to simplicity and customization, this solution ensures consistency in your billing approach, which helps maintain professionalism and streamline client interactions. Whether you are new to the business or have been providing services for years, this approach to invoicing will save time and enhance your workflow.

Benefits of Using Invoice Templates

Using pre-designed documents for billing brings numerous advantages, especially for professionals who need to ensure their payment requests are accurate and timely. These ready-to-use formats eliminate the need for creating new documents from scratch every time a job is completed, allowing for faster processing and greater efficiency. By streamlining the billing process, service providers can focus on delivering quality work while maintaining a professional image.

Time Savings

One of the most significant benefits is the amount of time saved. Instead of manually formatting a new document for each client, a structured template allows you to simply input the relevant details and send it. This efficiency reduces the time spent on administrative tasks, which can be especially helpful for busy professionals managing multiple jobs.

Consistency and Professionalism

Another key advantage is consistency. Using the same format for all your billing documents ensures that the information presented is clear and standardized. This professional approach can improve how clients perceive your business and help foster trust. A consistent presentation also reduces the chance of errors or omissions in important details.

- Clarity: Pre-made formats are designed to include all necessary fields, minimizing the risk of missing key details.

- Customization: Easily editable fields allow for adjustments to suit individual project needs while maintaining structure.

- Accuracy: Using a template reduces the chances of human error in calculations or formatting.

- Speed: The time it takes to create a billing document is drastically reduced, which improves cash flow.

With these benefits in mind, it’s easy to see why using a pre-made structure is a smart choice for anyone looking to streamline their payment process and maintain a high level of professionalism in their business.

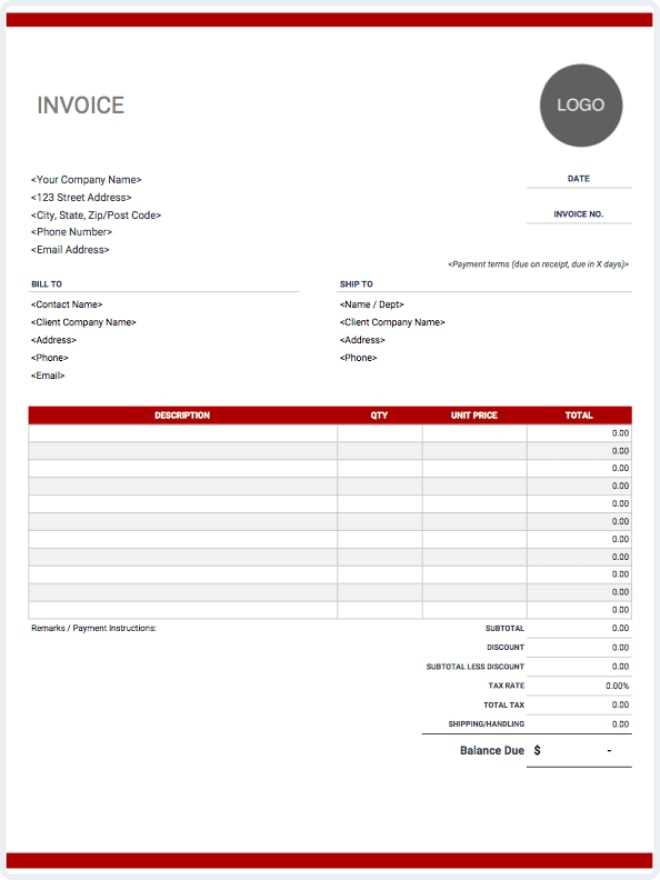

How to Customize Your Invoice

Personalizing your billing documents is an important step in ensuring they accurately reflect the services provided and the terms agreed upon with clients. A customizable format allows you to make adjustments that suit the specifics of each job, from the types of tasks completed to the costs involved. By tailoring these documents, you can present a clear, professional, and precise payment request every time.

Customizing your document typically involves adding your business details, modifying the structure to fit the nature of your services, and ensuring the payment terms are clearly outlined. Most pre-made structures are designed to be flexible, allowing for easy updates without sacrificing consistency or clarity.

- Business Information: Ensure your company name, contact details, and logo are prominently displayed for brand consistency and easy communication.

- Project Description: Modify the description fields to reflect the specific tasks you performed, ensuring that the client understands the scope of work completed.

- Pricing Adjustments: You can adjust hourly rates, material costs, or even apply discounts where necessary, depending on the project specifics.

- Payment Terms: Clarify the due date, payment methods, and any late fees or discounts to avoid confusion and expedite payment processing.

Customizing these aspects not only ensures accuracy but also enhances the professionalism of your payment requests, ultimately improving client relationships and encouraging timely payments.

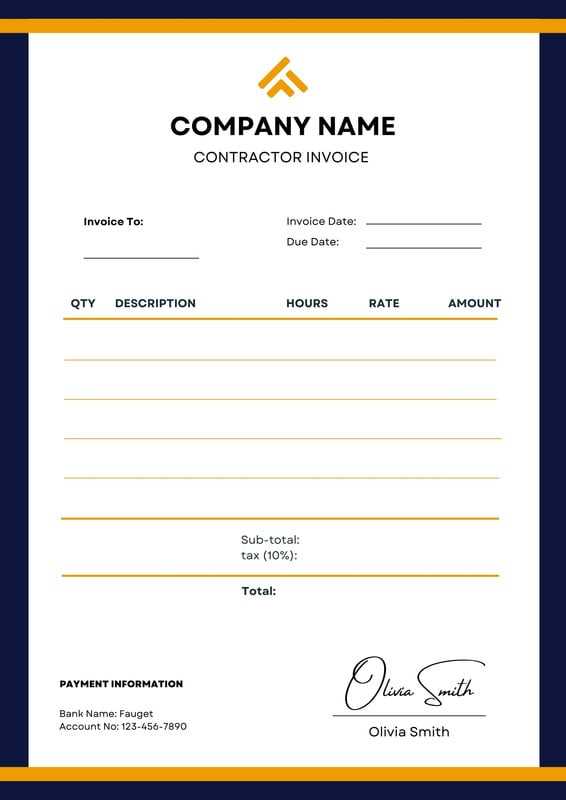

Top Features of Handyman Invoices

When creating payment documents, it’s essential to ensure that they are comprehensive, clear, and easy for both the service provider and client to understand. A well-designed billing document includes specific features that not only make the process smoother but also ensure all necessary information is captured. These features help streamline communication and reduce the likelihood of misunderstandings between both parties.

The top elements to look for in a payment request format include sections for clear task descriptions, itemized costs, and easy-to-understand payment terms. A great document will also offer flexibility for customization, allowing the service provider to adjust the layout or add additional details as needed.

- Detailed Service Descriptions: Each task performed should be clearly listed, including any materials used and the time spent, so that clients can easily understand the breakdown of charges.

- Accurate Pricing Breakdown: Clear itemization of costs for labor, materials, and additional charges ensures transparency and helps avoid disputes.

- Business Branding: Including your business name, logo, and contact information helps reinforce your brand identity and makes the document look more professional.

- Payment Instructions: Clearly defined payment terms, including due dates, accepted payment methods, and penalties for late payments, ensure both parties are on the same page regarding expectations.

- Tax and Discount Information: The ability to add taxes or discounts ensures that all relevant charges are accounted for, making it easy for clients to calculate the total amount due.

These features not only simplify the process but also add a level of professionalism that helps foster trust with clients, ensuring that payments are made promptly and accurately.

Choosing the Right Format for Your Invoice

Selecting the correct structure for your billing document is crucial to ensure clarity, professionalism, and ease of use. The right layout can help you communicate the details of your services clearly while making it easy for clients to process their payments. When deciding on a format, it’s important to consider the complexity of the job, the amount of information you need to include, and how frequently you issue such requests.

Factors to Consider When Choosing a Format

The format you choose should be easy to customize, yet comprehensive enough to include all necessary details. Depending on your business needs, you may opt for a simple, clean design or a more detailed version that includes various sections for materials, labor, and additional fees. Ultimately, the goal is to select a structure that suits both your preferences and those of your clients.

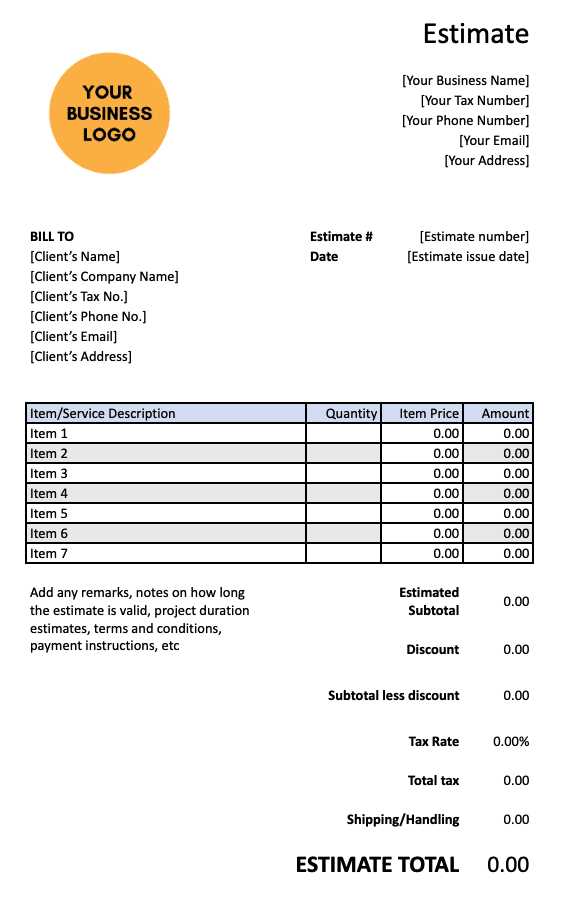

Popular Formats for Billing Documents

There are a variety of formats available, each offering unique advantages based on your business needs. The most common formats include simple layouts with just the basics or more complex designs with itemized lists and detailed sections for payment terms. Here’s a quick comparison of the most popular options:

| Format Type | Best For | Key Features |

|---|---|---|

| Basic Layout | Simple jobs with minimal details | Short descriptions, fewer items, fast payment processing |

| Itemized Breakdown | Complex projects with varied costs | Detailed descriptions, costs for materials and labor, taxes and discounts |

| Customizable Layout | Businesses needing flexibility | Highly adaptable fields, multiple sections for client-specific needs |

Choosing the right structure for your billing documents depends on the level of detail required for each job and how you prefer to communicate with your clients. No matter the format, always ensure it is clear and easy to understand, with all essential information presented logically and professionally.

Steps to Create a Professional Invoice

Creating a polished and clear payment request is essential for maintaining professionalism and ensuring timely payments. A well-crafted billing document provides all the necessary details in an organized manner, making it easy for clients to review and process payments. Following a structured approach can help you create consistent, accurate documents every time, fostering trust and improving client relationships.

Key Steps in Building a Payment Request

When crafting a payment document, there are several important elements that need to be included. Each section should be clear, concise, and easy to understand to avoid any confusion or delays in payment.

- Include Your Business Information: Start by adding your business name, address, phone number, and email at the top of the document. This ensures that clients know who the payment is being made to and how they can contact you if needed.

- Add Client Details: Include the client’s name, address, and contact information. This helps to personalize the document and ensures that the payment is directed to the right person or company.

- List Services or Products Provided: Provide a clear and detailed list of the tasks completed or materials provided. Include descriptions, quantities, and individual prices to give the client a complete breakdown of the charges.

- Calculate Total Costs: Sum up the costs for each item or service, including any applicable taxes or additional fees. Make sure the calculations are accurate to avoid disputes.

- Set Payment Terms: Clearly state the payment due date, acceptable methods of payment, and any late fees or discounts for early payment. This ensures that both you and the client are aligned on when and how payment will be made.

Finalizing the Document

Once all the necessary information is included, take a moment to review the document for accuracy. Double-check the calculations, spelling, and any other details that could cause confusion. When everything is accurate and professionally presented, save or print the document for distribution.

- Proofread: Always proofread the document for any errors or missing information before sending it to the client.

- Maintain a Record: Keep a copy of each document for your own records, which can be helpful for tracking payments and taxes.

By following these steps, you can create a detailed and professional payment request that will help maintain clear communication with clients and streamline the payment process.

Free vs Paid Handyman Invoice Templates

When choosing a structure for your billing documents, you’ll encounter both free and paid options, each offering unique advantages depending on your needs. While free solutions may seem attractive due to their zero cost, paid options often provide additional features and customization that can improve both the functionality and presentation of your payment requests. Understanding the differences between the two can help you make an informed decision about which one best suits your business.

Free billing documents can be an excellent choice for those just starting out or with simple needs. They often come with basic fields and easy customization options that allow you to get up and running quickly. However, they may have limitations in terms of design flexibility, features, or support. Paid options, on the other hand, typically offer more advanced tools, enhanced customization, and better support, making them ideal for businesses looking for a more professional, long-term solution.

Advantages of Free Options

Free billing solutions can be sufficient for small businesses or independent contractors with straightforward billing needs. Here are some benefits:

- No Cost: The most obvious advantage is that they are free to use, making them an appealing option for those just starting or with a limited budget.

- Easy to Access: Free formats are readily available online and can be downloaded quickly without any complex setup or registration.

- Simplicity: Often, free formats are simpler, which can be beneficial if your services are not overly complex or varied.

Benefits of Paid Options

Although paid formats require an upfront investment, they can offer significant advantages that may justify the cost, especially for businesses looking to maintain a professional image. Consider the following benefits:

- Advanced Features: Paid versions often come with additional features such as automatic tax calculations, multi-currency support, and payment tracking.

- Customization: Paid formats tend to offer greater flexibility, allowing you to add or remove sections, adjust layouts, and personalize the design to fit your brand identity.

- Better Support: Many paid services offer customer support, providing assistance in case of technical issues or if you need help customizing the format.

- Professional Appearance: Paid options usually offer higher-quality designs, which can make your payment requests appear more polished and trustworthy.

Ultimately, the choice between free and paid formats comes down to the complexity of your business needs and how much you’re willing to invest in your administrative processes. If you need something simple and quick, a free format may be sufficient. However, if you want to present a more professional image and have access to additional features, a paid solution may be the better choice in the long run.

Best Software for Editing Invoice Templates

When it comes to creating and modifying billing documents, having the right software can make a significant difference in both the ease and efficiency of the process. Choosing a reliable editing tool allows you to customize your payment requests, ensuring they are accurate, professional, and tailored to your specific needs. Some software offers additional features such as automatic calculations, branding options, and compatibility with different file formats, providing a more comprehensive solution for managing business finances.

Top Tools for Editing Payment Documents

There are several software options available that can help you modify, personalize, and streamline your billing process. Here are some of the best tools that offer both ease of use and advanced functionality:

- Microsoft Excel: Known for its powerful data manipulation features, Excel is a versatile option for creating and editing payment requests. With its built-in formulas and templates, you can easily calculate totals, taxes, and discounts while keeping everything organized.

- Google Sheets: A free, cloud-based alternative to Excel, Google Sheets offers many of the same features with the added benefit of being accessible from anywhere. Its collaborative features also allow you to share documents with clients or team members for quick feedback.

- Zoho Invoice: Specifically designed for creating billing documents, Zoho Invoice offers an intuitive interface with customizable templates, automatic tax calculations, and options for branding. It also integrates with other tools, allowing for seamless business management.

- FreshBooks: This popular accounting software is not only useful for invoicing but also offers additional features like time tracking, expense management, and reporting. FreshBooks makes it easy to generate and customize payment documents while automating many aspects of the billing process.

- Canva: While primarily a graphic design tool, Canva provides customizable, visually appealing templates that can be used for creating professional-looking billing documents. Its drag-and-drop interface makes it easy to design unique, branded forms without any prior design experience.

Factors to Consider When Choosing Software

When selecting the best software for your needs, it’s important to consider the following factors:

- Ease of Use: The software

How to Calculate Costs on Invoices

Accurate cost calculation is a crucial part of preparing any payment request. Whether you’re billing for labor, materials, or both, ensuring that all costs are accounted for and clearly outlined helps to prevent disputes and ensures timely payments. Properly calculating the charges also provides transparency to clients, showing them exactly what they are paying for. Understanding how to correctly calculate these costs can streamline your billing process and maintain a professional image.

Steps to Calculate Labor Costs

When billing for time spent on a project, it’s important to clearly define your hourly or flat-rate fees. Here’s how to calculate labor costs effectively:

- Determine Your Hourly Rate: Set a clear hourly rate based on your expertise, industry standards, and the complexity of the task. If you charge a flat rate for specific jobs, ensure it’s clearly stated upfront.

- Track Time Spent: Keep accurate records of the time spent on each task or project. You can use time-tracking software or log hours manually to ensure no time is overlooked.

- Calculate Labor Costs: Multiply the hours worked by your hourly rate. For example, if you worked 5 hours at $50 per hour, the labor cost would be $250.

Calculating Material Costs

In addition to labor, you may need to charge for materials used during the project. Here’s how to include material costs in your payment request:

- List All Materials: Itemize all the materials used, including quantities and unit costs. Be specific about each material to avoid confusion.

- Include Additional Fees: If you incurred any delivery charges or other fees related to acquiring materials, be sure to add them.

- Calculate Total Material Costs: Multiply the quantity of each material by its unit cost. For example, if you used 10 units of material at $20 each, the total material cost would be $200.

Once you have calculated both labor and material costs, add them together to determine the total charge for the project. Don’t forget to include any applicable taxes, discounts, or additional charges that may apply.

Additional Considerations

There are several other factors to consider when calculating costs:

- Tax Rates: Depending on your location and the type of service, you may need to add sales tax or VAT to the total cost.

- Discounts: If you offer

Why Accuracy Matters in Invoices

Ensuring accuracy in billing documents is essential for maintaining a professional reputation and smooth business operations. Incorrect information, whether it’s related to the amount due, the services provided, or the payment terms, can lead to confusion, delays, and even disputes with clients. By getting the details right from the outset, you can avoid unnecessary complications, improve client satisfaction, and expedite the payment process.

Accurate billing documents not only reflect your professionalism but also build trust with your clients. When customers see that your charges are clear and correct, they are more likely to pay promptly and return for future services. Furthermore, having accurate records helps you manage your business finances more effectively and simplifies the process of tax reporting and audits.

Common Mistakes to Avoid

There are several common errors that can affect the accuracy of your payment documents. It’s important to be vigilant about these mistakes:

Error Impact Solution Incorrect Total Calculation Leads to overcharging or undercharging, which can damage client trust. Double-check calculations and consider using automated tools to avoid mistakes. Missing Client Information Delays payment and can cause confusion about who is being billed. Ensure all relevant client details are accurately entered. Unclear Payment Terms Confuses clients about due dates or payment methods, causing delays. Clearly outline payment terms, including due dates and accepted payment methods. Overlooked Taxes or Discounts Can lead to discrepancies in the amount billed, creating issues with clients. Make sure all taxes and discounts are applied correctly and clearly stated. By avoiding these errors and taking care to ensure every detail is correct, you can create accurate, professional payment requests that foster trust and improve cash flow for your business.

Common Mistakes to Avoid in Invoices

Creating a payment document requires attention to detail to ensure accuracy and professionalism. Even minor errors can lead to confusion, delays in payment, and a negative experience for your clients. By being aware of common mistakes, you can take proactive steps to avoid them and ensure that your billing process runs smoothly and efficiently.

Below are some of the most frequent mistakes made when preparing payment requests and tips on how to avoid them:

- Incorrect Contact Information: Failing to include the correct details for both your business and your client can lead to confusion or missed payments. Always double-check that names, addresses, and contact numbers are accurate.

- Missing or Inaccurate Dates: Leaving out the date of issue or due date can create uncertainty around when payments are expected. Ensure that both the issue and due dates are clearly stated, and that they align with your payment terms.

- Unclear Item Descriptions: Vague descriptions of the work performed or materials used can cause misunderstandings about what is being charged. Always provide clear, detailed descriptions for each service or product, including quantities and unit costs.

- Errors in Calculations: Mistakes in summing up the charges or applying taxes can lead to incorrect amounts being billed. Double-check your calculations, and consider using an automated tool to avoid human error.

- Overlooking Taxes or Discounts: If you fail to include applicable taxes or forget to apply discounts, it could affect the overall accuracy of the document. Be sure to factor in taxes, discounts, or any other adjustments and clearly show them on the document.

- Omitting Payment Terms: Not specifying your payment terms–such as due date, late fees, and accepted payment methods–can lead to confusion. Clearly define these terms so that both you and your client are aligned on expectations.

- Using Generic or Unprofessional Formats: Using a basic or unprofessional-looking layout can undermine the credibility of your business. Choose a clean, easy-to-read design that reflects your brand identity.

Avoiding these common mistakes will help ensure that your payment requests are professional, clear, and accurate, reducing the likelihood of delays and misunderstandings. It’s essential to take the time to carefully review each document before sending it to clients, as this can ultimately save you time and effort in the long run.

How to Add Taxes and Discounts

Adding taxes and discounts to your billing documents is an essential part of ensuring that both you and your clients are clear on the final amount due. Properly calculating and displaying these adjustments can help avoid confusion, foster transparency, and ensure that you’re complying with local tax regulations. Whether you need to include sales tax or offer a discount for early payment, knowing how to apply these changes correctly is crucial for maintaining accuracy.

Adding Taxes to Your Payment Documents

Taxes are a common addition to billing requests, and it’s important to calculate them based on the applicable rates for your location and type of service. Here’s how to add taxes to your billing documents:

- Identify the Tax Rate: Research the applicable sales tax rate for your location or industry. This could be a standard sales tax rate or a specific rate for services or products. Some locations have different rates based on the nature of the work.

- Apply the Tax to the Subtotal: Calculate the tax by multiplying the subtotal (the total amount before tax) by the tax rate. For example, if the subtotal is $500 and the tax rate is 8%, the tax amount would be $40, bringing the total to $540.

- Show the Tax Breakdown: Clearly display the tax amount separately from the subtotal and total amount due. This helps the client understand how the tax was calculated.

Applying Discounts to Your Billing Documents

Discounts are a great way to incentivize early payments or reward loyal customers. Here’s how to add discounts correctly:

- Determine the Discount Type: Decide whether the discount will be a flat amount or a percentage of the total. For example, a 10% discount on a $200 bill would reduce the total by $20.

- Apply the Discount Before Tax: It’s generally best to apply the discount to the subtotal before adding taxes. This ensures that the tax is calculated on the correct amount.

- Clearly Display the Discount: Clearly indicate the discount on the document, specifying the discount percentage or amount and how it affects the total. For example, if you apply a $20 discount to a $200 bill, show it as “$200 – $20 discount = $180 before tax.”

By following these steps to apply taxes and discounts, you can ensure that your payment documents are both accurate and easy to understand, promoting a smoother transaction process and better client relationships.

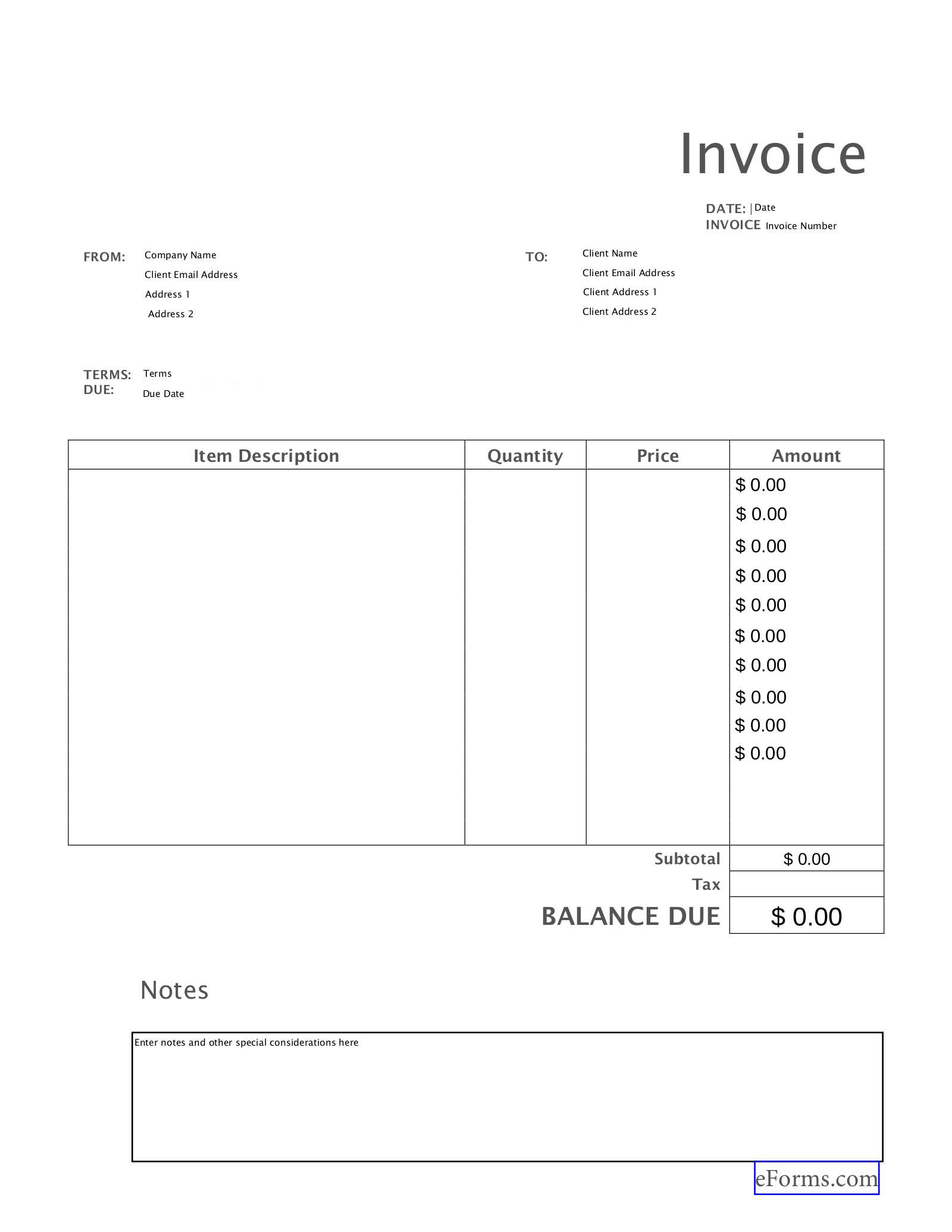

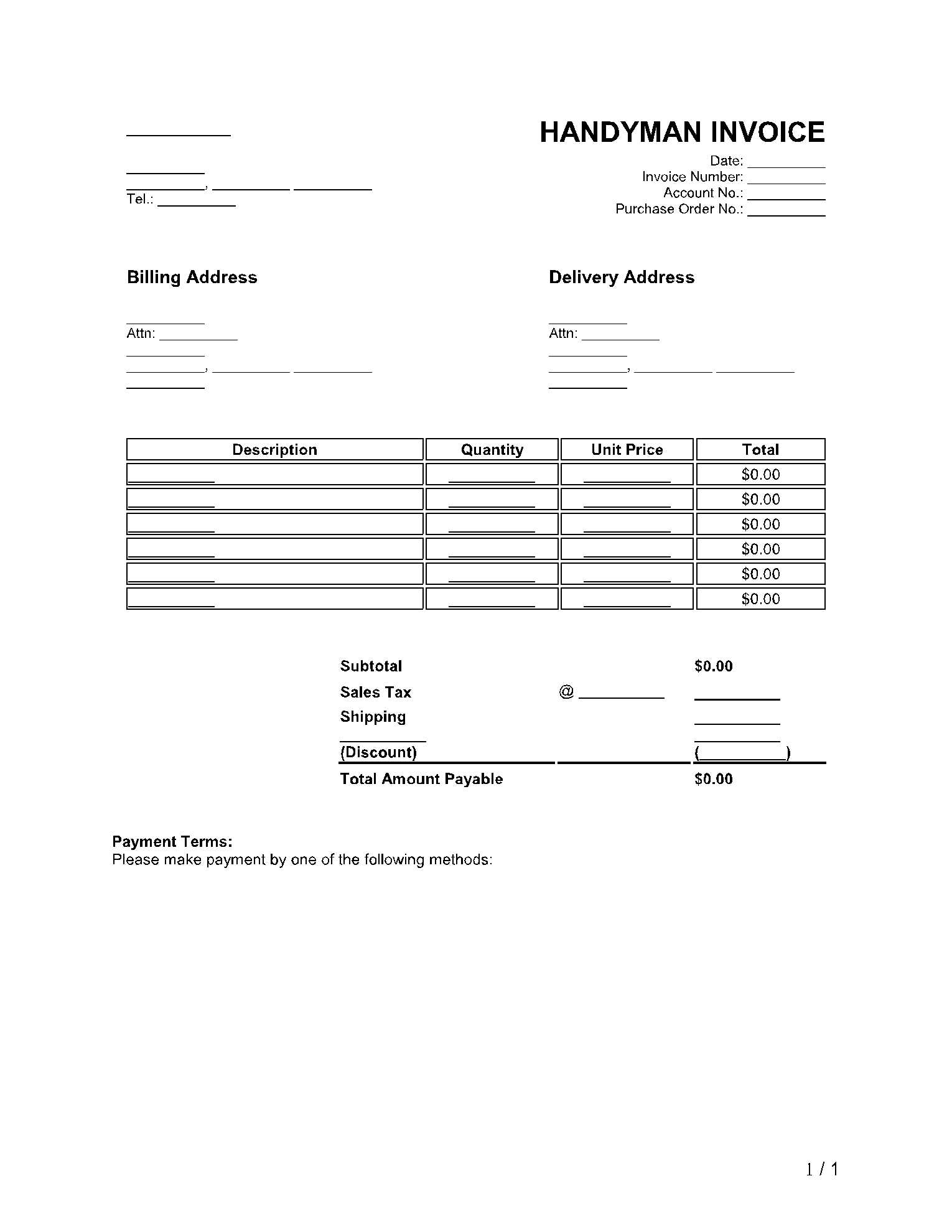

What to Include in an Invoice

When creating a billing document, it’s important to include all the necessary details that will ensure clarity, professionalism, and accuracy. A well-structured payment request not only helps your client understand what they are being charged for but also reduces the chance of errors or disputes. To avoid confusion and streamline the payment process, make sure your billing documents are complete and easy to read by including the following key elements.

- Business Information: Include your business name, address, phone number, and email address. This helps your client identify who the payment request is from and makes it easy for them to contact you if needed.

- Client Information: Clearly list the client’s name, address, and contact details. This ensures the payment request is directed to the correct party and provides a reference in case of any issues.

- Unique Identification Number: Assign a unique reference number to each document. This helps both you and your client track the transaction and provides a useful reference for future inquiries.

- Issue Date and Due Date: Clearly indicate when the document was created and when the payment is due. This ensures that both parties are on the same page regarding the payment timeline.

- Description of Services or Products: Provide a detailed list of all services performed or goods supplied. Be specific about what was delivered, including quantities, unit costs, and any relevant information to clarify what is being billed.

- Subtotal: Before adding taxes or discounts, list the subtotal for the goods or services provided. This amount reflects the total cost for the work or products delivered, without any adjustments.

- Taxes and Additional Charges: Specify the applicable tax rates and any other additional fees, such as delivery charges or special requests. Be transparent about these costs, as they can affect the final amount due.

- Discounts (if applicable): If you are offering any discounts, include the amount or percentage of the discount and show how it impacts the total. This ensures that the client understands the reduction in price.

- Total Amount Due: Clearly display the total amount that the client owes, including taxes, discounts, and any additional charges. This should be the final, payable amount.

- Payment Instructions: Specify the preferred methods of payment, such as bank transfer, credit card, or online payment systems. Provide any necessary details, such as account numbers or payment links, to make it easy for your client to pay.

By including these essential elements in your payment request, you ensure that the document is comprehensive, accurate, and easy for your client to process. This will not only help prevent misunderstandings but also enhance your professionalism and facilitate timely payments.

Tips for Faster Invoice Payment

Receiving prompt payment is essential for maintaining a healthy cash flow in any business. However, delays in receiving payments can disrupt your operations and cause unnecessary stress. By taking a few simple steps to streamline the billing process, you can encourage your clients to pay on time and ensure that your payments are processed efficiently.

Clear and Transparent Billing

One of the most effective ways to encourage faster payments is by making your payment requests clear, detailed, and transparent. Clients are more likely to pay quickly when they understand exactly what they are being charged for and can easily identify the details of the transaction.

- Include Detailed Descriptions: Ensure that all services and products are listed clearly, with detailed descriptions, quantities, and unit costs. This eliminates any confusion and allows the client to see exactly what they are paying for.

- Double-Check Accuracy: Make sure that all calculations are correct, and that there are no mistakes in the amounts, taxes, or discounts. Errors can cause delays and mistrust, which may lead to payment postponement.

- Set Clear Payment Terms: Clearly define your payment terms, such as due dates, accepted payment methods, and late fees if applicable. A client who understands the expectations is more likely to pay on time.

Streamlining the Payment Process

Making the payment process as convenient as possible for your clients can encourage them to pay qui

Tracking Payments with Invoices

Effectively tracking payments is crucial for managing your cash flow and ensuring that you are paid on time for the services or products provided. By using a structured approach to monitor payments, you can avoid late payment issues, manage outstanding amounts, and keep your financial records in order. This process helps ensure that you are not only paid promptly but also that your clients’ payment history is clearly documented.

One of the most reliable ways to track payments is through a system of organized records that includes clear payment details. By maintaining an up-to-date log of all transactions, you can easily monitor when payments are made, which are overdue, and which clients may need follow-up reminders.

Key Elements to Track

To successfully track payments, ensure that your payment requests include the following elements:

- Unique Reference Number: Assign a unique number to each payment request, allowing you to easily identify and cross-reference transactions.

- Payment Due Date: Clearly state when payment is due to help track whether payments are on time or overdue.

- Payment Status: Include a space to mark whether payment has been received or is still pending.

- Amount Paid: Keep a record of how much has been paid, ensuring that partial payments are also accurately tracked.

- Payment Method: Note how the payment was made (e.g., bank transfer, credit card, cash), providing a complete transaction history.

Organizing Payment Records

Proper organization of payment records will allow you to track outstanding balances and follow up with clients when necessary. You can use various tools to keep track of your payments, from spreadsheets to accounting software. Here is a simple example of how a payment tracking table might look:

Invoice Number Client Name Amount Due Amount Paid Payment Date Status #001 John Doe $500 $500 10/10/2024 Paid #002 Jane Smith $300 $150 How to Protect Your Invoice Data

When managing financial records, including payment requests and transaction details, it’s crucial to ensure that your data remains secure. Protecting sensitive information helps prevent fraud, unauthorized access, and data breaches, which can harm your business and client relationships. By adopting effective security practices, you can safeguard your financial documents from malicious attacks and unauthorized alterations.

Best Practices for Data Protection

Implementing these practices will help secure your billing documents and maintain the integrity of your financial data:

- Use Strong Passwords: Always protect your documents with strong, unique passwords. Avoid using easily guessable phrases and include a mix of upper and lowercase letters, numbers, and special characters.

- Encrypt Sensitive Files: Use encryption tools to protect your billing records from unauthorized access. Encryption ensures that even if someone gains access to your files, they will not be able to read or alter the data without the decryption key.

- Limit Access: Restrict access to your financial documents to authorized personnel only. Implement role-based access controls to ensure that only individuals who need the information for their job can view or edit the records.

- Secure Cloud Storage: If you store your financial data in the cloud, ensure that you use a secure cloud provider that offers strong encryption and multi-factor authentication (MFA) to protect your documents from unauthorized access.

- Back Up Your Data: Regularly back up your billing records to secure locations, either in the cloud or on physical drives. This ensures that in case of a system failure or data loss, you can restore your documents without losing valuable information.

Monitoring and Updating Security Measures

Staying vigilant and updating your security measures regularly is key to keeping your data safe. Cyber threats evolve constantly, so it’s important to stay proactive about protecting your financial documents:

- Keep Software Up to Date: Ensure that the software you use to create, store, and manage your payment requests is updated regularly. Software updates often include security patches that address vulnerabilities that could be exploited by attackers.

- Monitor for Suspicious Activity: Regularly check for any unusual or unauthorized access to your financial records. Set up alerts to notify you if someone tries to access your documents without permission.

- Educate Your Team: If you work with a team, ensure that everyone is educated about the importance of data security. Regularly train staff on best practices and how to identify potential threats such as phishing emails an

Legal Aspects of Handyman Invoices

When running a business that involves providing services or products to clients, it’s important to be aware of the legal aspects related to payment requests. Understanding these legalities ensures that you comply with local laws and protects both you and your clients from potential disputes. Properly constructed payment requests can also serve as legal evidence in case of a disagreement over payment or service delivery.

Essential Legal Information to Include

To ensure that your payment records are legally valid, certain pieces of information must be included. These elements not only make the document more professional but also provide clarity in case legal action is required.

- Business Information: Always include your full business name, address, contact details, and relevant business registration numbers. This identifies your company as the legal entity and establishes credibility.

- Client Information: The payment request should clearly list the client’s name, address, and contact details. This ensures that there is no ambiguity about who is responsible for the payment.

- Clear Payment Terms: Outline the payment terms clearly, including due dates, late fees, and acceptable methods of payment. These terms set expectations and can be referenced in the case of non-payment.

- Detailed Descriptions of Goods or Services: It’s important to provide a thorough description of the services or products provided. A well-detailed list helps prevent misunderstandings and strengthens the legality of the document.

- Tax Identification Numbers: Including your business tax ID or VAT number may be necessary depending on your region. This ensures that your payment requests meet local tax regulations.

Legal Requirements and Compliance

In addition to the details mentioned above, there are legal requirements that vary depending on your location. These may include tax regulations, consumer protection laws, and industry-specific guidelines. Failing to comply with these regulations can lead to penalties or disputes that could harm your business reputation.

- Tax Compliance: Ensure that your payment requests comply with local tax regulations, including the correct application of sales tax, VAT, or other applicable taxes. Always check the current tax laws in your jurisdiction to avoid costly mistakes.

- Consumer Protection Laws: Some regions have specific laws that protect consumers in business transactions. These laws may dictate how long you have to provide services, what constitutes an unfair term, or how disputes should be handled. Make sure your payment requests are aligned with these regulations.

- Contractual Obligations: In many cases, the agreement between you and your client is not just based on a verbal promise but on a legally binding contract. Your payment request may serve as evidence of this agreement. Always ensure your terms are clear and legally enforceable.

By incorporating these legal considerations into your payment requests, you protect your business, avoid potential legal pitfalls, and build trust with your clients. Keeping up-to-date with changes in the law and ensuring your records comply with