Handyman Invoice Template Excel for Quick and Easy Billing

For professionals offering repair or maintenance services, managing financial transactions efficiently is crucial. One of the key elements of this process is the creation of clear, accurate, and organized documents to request payment for completed work. By using digital tools, service providers can streamline this task, saving time and ensuring consistency.

With the right approach, you can easily create customizable documents that track services rendered, itemize costs, and calculate totals automatically. This method helps maintain transparency and simplifies the payment process for both parties involved. The ability to adjust these documents for different jobs or customers further enhances convenience and professionalism.

Maximizing productivity and minimizing errors are essential goals for any business. By adopting a systematic approach to generating financial records, service providers can focus more on their core activities, knowing that their documentation is accurate and reliable. Furthermore, such tools can support better record-keeping and tax preparation.

Handyman Invoice Template Excel Overview

For service providers, generating clear and professional documents to request payment is an essential part of managing a business. These records help ensure both parties are on the same page regarding the work performed and the corresponding costs. Using a digital solution allows for quick customization, accuracy, and consistency across all payment requests.

Streamlining Payment Requests

The process of creating a document for billing doesn’t need to be complex. With the right setup, one can quickly input job details, calculate totals, and apply any necessary taxes. The simplicity of such a tool allows service providers to focus more on their work and less on administrative tasks, while still maintaining a high level of professionalism.

Customization and Flexibility

Being able to adjust these documents to suit various jobs and clients adds flexibility to the billing process. Whether it’s adjusting prices, adding line items, or applying discounts, a well-designed system can handle different scenarios, making it easy to tailor each request to the specifics of the service provided.

Efficiency is a key benefit when using these digital tools. By automating calculations and reducing the need for manual entry, service providers can reduce errors and improve the speed of transaction processing. This is especially important for those managing multiple jobs or customers on a regular basis.

How to Use a Handyman Invoice Template

Creating a professional billing record for services rendered is a straightforward task when using the right digital tools. These tools allow you to input job details, calculate amounts, and generate accurate payment requests with minimal effort. Once the system is set up, you can quickly adapt it for different projects and clients, ensuring consistency and accuracy in all your financial transactions.

Setting Up the Document

The first step is to set up a new document or open an existing one designed for this purpose. Most systems provide fields for essential information, such as the client’s details, job description, pricing, and payment terms. It’s important to ensure that these fields are properly filled out before sending the document to the client. Some systems allow for automatic population of fields based on previously saved data, making it even easier to create new records.

Customizing for Specific Jobs

Every project is different, so customization is key. You can easily adjust line items, pricing, and any discounts or extra charges that may apply. These tools allow you to quickly calculate totals and taxes, making the whole process more efficient. Additionally, you can adjust the layout to reflect your business branding, which helps maintain a professional appearance.

Once everything is set, the document can be saved and shared digitally with your clients. By using these tools, you save time, reduce errors, and ensure your billing process is as smooth as possible.

Customizing Your Excel Invoice Template

Adapting your billing document to reflect specific business needs is a simple but important task. Customization ensures that your financial records are both professional and tailored to each project or client. With the right digital tools, you can adjust various aspects of the document, from layout and design to the content of individual fields, to make sure every detail is accurate and relevant.

Adjusting Layout and Design

One of the first customization options is modifying the document’s layout. This allows you to organize the information in a way that makes sense for your business while maintaining a clear, professional appearance. Common adjustments include:

- Changing column widths to fit data.

- Adding or removing rows for additional details.

- Incorporating your logo or business branding.

- Customizing fonts and colors for better readability.

Modifying Fields and Pricing Details

Another important customization is adjusting the fields to reflect the type of services you provide and the payment terms you offer. For example, you may want to add sections for hourly rates, material costs, or discounts. You can also modify the formulas used to calculate totals, taxes, and other financial details, ensuring everything is automatically updated based on the inputs you provide.

By customizing these aspects, you create a document that not only looks professional but also aligns with your business practices, making billing and financial tracking more efficient.

Benefits of Using Excel for Invoices

Using digital spreadsheets for billing offers several advantages, especially for small business owners and service providers. The flexibility and functionality of these tools make managing financial records easier, more accurate, and less time-consuming. By leveraging the power of spreadsheets, you can streamline the process of generating and tracking payment requests, ensuring consistency and reducing the chances of errors.

Key Advantages of Spreadsheets

There are numerous reasons why spreadsheets are a popular choice for creating payment requests:

- Automation: Automatic calculations for totals, taxes, and discounts reduce manual input and potential errors.

- Customization: You can tailor the layout, fields, and formulas to meet your business needs, making it easy to adjust for different types of services.

- Cost-Effective: Unlike specialized software, spreadsheets are often included in office software packages, making them an affordable option.

- Data Organization: Easily store and access historical records, track payments, and generate reports for financial analysis.

Increased Efficiency and Accuracy

With pre-set formulas and customizable options, digital spreadsheets allow for quick data entry and accurate calculations. This reduces the amount of time spent on creating and reviewing payment requests, enabling you to focus more on your work while ensuring that all figures are correct. Additionally, using such tools can improve the overall professionalism of your documents, helping to build trust with clients.

Free Handyman Invoice Templates for Excel

Many professionals looking for a simple and cost-effective way to manage their payment requests can benefit from free, customizable billing documents. These pre-designed files provide an easy way to quickly create detailed records without the need for expensive software. With these free tools, you can streamline your workflow, maintain consistency in your documents, and avoid starting from scratch each time you need to generate a new record.

Where to Find Free Templates

There are numerous sources online offering free downloadable documents specifically designed for service providers. These documents come with a variety of features and layouts, allowing you to choose one that best suits your needs. Some popular places to find free templates include:

- Online template libraries and marketplaces.

- Office software providers offering free downloads.

- Websites dedicated to small business resources and productivity tools.

Features of Free Billing Documents

While free options may have some limitations compared to paid tools, they often include essential features such as:

- Pre-set formulas for quick calculations.

- Customizable fields for job details, pricing, and taxes.

- Professional layouts that are easy to modify and personalize.

Cost-effective and convenient, these free documents can help save time and reduce the cost of managing your finances. Whether you’re just starting out or looking to simplify your current processes, free downloadable files provide an accessible way to keep your billing organized and efficient.

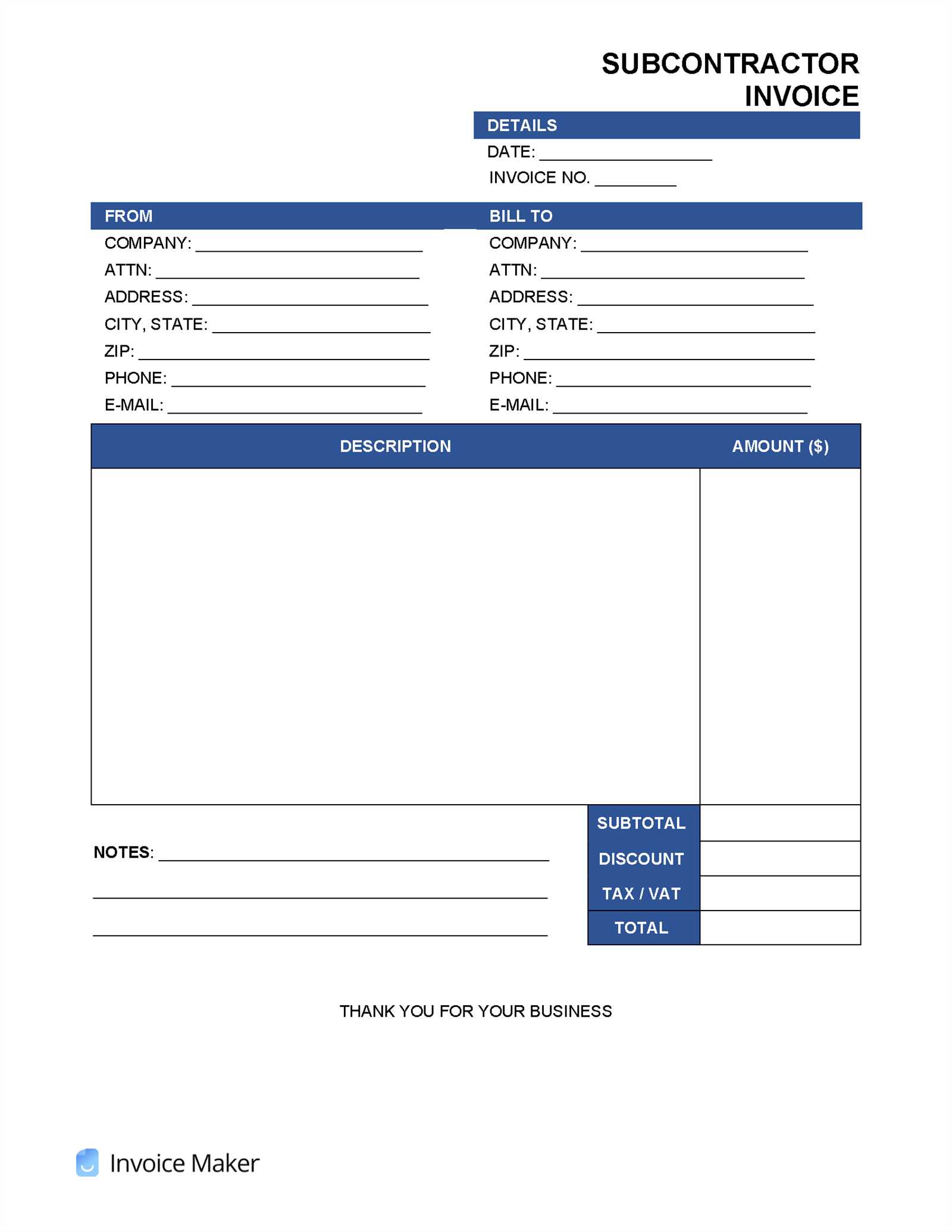

Key Features of an Invoice Template

When creating professional documents to request payment, certain features are essential to ensure clarity, accuracy, and ease of use. These key elements help ensure that the details of the transaction are clear, the calculations are correct, and the document maintains a polished, professional appearance. A well-designed document should be easy to customize, track payments, and facilitate smooth communication with clients.

Essential Elements to Include

A well-structured document typically includes several crucial sections that provide all the necessary information for both the service provider and the client. Key features include:

- Contact Information: Fields for your business name, address, and contact details, as well as the client’s information.

- Detailed Service Description: A clear breakdown of the services rendered, including dates, labor, and materials used.

- Pricing and Totals: A clear list of rates, quantities, and costs, followed by an accurate total and applicable taxes.

- Payment Terms: Information on payment methods, due dates, and any late fees or discounts offered.

Customization and Flexibility

One of the main advantages of using a digital system is the ability to easily customize the document to fit the specifics of each job. From adding or removing line items to adjusting rates or applying discounts, flexibility allows you to tailor each document to suit the unique aspects of every service provided. This ensures that the record reflects the correct details and maintains accuracy in billing.

Efficiency is another key benefit. With the right setup, the document can automatically calculate totals, taxes, and other variables, saving you time and reducing the chances of errors. This level of automation makes managing your financial records more efficient and reliable.

Common Mistakes to Avoid in Invoices

When generating payment requests, it’s essential to avoid common mistakes that can cause confusion or delays in receiving payment. These errors can undermine professionalism, lead to misunderstandings, or even result in non-payment. By being mindful of these potential pitfalls, you can create clear, accurate, and efficient records that will facilitate smooth transactions with clients.

Common Errors to Watch Out For

Here are some frequent mistakes to avoid when creating billing documents:

- Missing Contact Information: Ensure that both your contact details and the client’s are clearly displayed, making it easy for them to reach out if needed.

- Inaccurate Pricing: Double-check that your rates, quantities, and totals are correct. Even small errors in pricing can lead to confusion and disputes.

- Omitting Payment Terms: Always include payment terms such as due dates, accepted payment methods, and late fees to avoid delays in payment.

- Forgetting to Include Taxes: Be sure to correctly calculate and include applicable taxes to avoid issues with your client or tax authorities.

- Lack of Clear Descriptions: Provide detailed descriptions of the services or products provided. Vague descriptions can lead to misunderstandings about what was actually delivered.

Improper Formatting and Layout

Formatting mistakes can also detract from the clarity of your document. Avoid using hard-to-read fonts, unclear structures, or inconsistent layouts. A clean, organized presentation will make it easier for clients to review and process the payment request. It’s also important to ensure that the document can be easily opened and viewed on various devices.

By avoiding these common mistakes, you can

How to Add Tax to Billing Documents

Including tax in payment requests is a critical step to ensure compliance with local regulations and to maintain transparency with your clients. By correctly calculating and displaying tax, you ensure that both you and the client are clear on the total amount due. While the process may vary depending on your location and tax rate, adding tax to a financial record is straightforward once you know the required steps.

Steps to Calculate and Add Tax

Here’s a simple guide to adding tax to your billing documents:

- Identify the Tax Rate: Find out the applicable tax rate for your services. This could be a sales tax, value-added tax (VAT), or any other form of tax depending on your region.

- Calculate the Tax Amount: Multiply the total amount of services or goods provided by the tax rate. For example, if your total amount is $100 and the tax rate is 10%, the tax amount would be $10.

- Add the Tax to the Total: After calculating the tax, add it to the total amount. In the example above, your final total would be $110 ($100 + $10).

Displaying Tax Information Clearly

It’s important to show the tax amount and the final total in a clear and organized manner. Include a separate line for tax, specifying the rate and the amount charged. This helps ensure that the client can easily see how much tax is being added and understand the breakdown of the total amount due.

Transparency and accuracy in tax calculation are key for building trust with clients and avoiding misunderstandings or potential legal issues. By following these simple steps, you can ensure that your billing documents are fully compliant and clear.

Tracking Payments with Billing Documents

Efficiently tracking payments is essential for maintaining cash flow and ensuring that all transactions are properly accounted for. Whether you are managing a small business or a freelance service, keeping track of which payments have been made and which are still pending is crucial. A well-organized document can help you monitor outstanding amounts and avoid potential payment delays.

How to Track Payments

By incorporating a payment tracking system into your billing records, you can easily stay on top of your finances. Here are some effective ways to track payments:

- Payment Status Column: Add a column to your record to mark the payment status, such as “Paid,” “Unpaid,” or “Partial Payment.” This simple addition allows you to quickly assess the payment situation for each transaction.

- Payment Date: Include a field for the payment date to note when the client has settled their bill. This will help you track payment periods and keep an accurate financial timeline.

- Outstanding Amount: Track any remaining balance by calculating the difference between the total amount and what has already been paid. This will help you identify what is still owed.

Organizing Payment Information

In addition to payment status and dates, organizing the records in a systematic way is essential for effective tracking. Using separate sections for each project or client will help you stay organized and minimize confusion. Here are some tips:

- Group by Client or Project: Organize your records by client name or project number to make it easy to locate payment information when needed.

- Use Filtering Tools: Leverage sorting and filtering functions available in most spreadsheet software to easily search for unpaid balances or payment histories.

By keeping an accurate record of payments and implementing a clear system for tracking, you ensure that financial management remains smooth and efficient, and you minimize the risk of missing payments or overlooking important details.

Using Formulas for Billing Documents

One of the most powerful features of a spreadsheet for financial documentation is the ability to use formulas to automate calculations. By incorporating formulas into your records, you can easily compute totals, apply taxes, and track balances with minimal manual input. This not only saves time but also reduces the risk of human error, ensuring that your financial records are both accurate and efficient.

Common Formulas for Billing Documents

Here are a few basic formulas that can streamline your payment records:

- Sum Formula: Use the

SUM()function to calculate the total cost of goods or services. For example, if you have a list of item prices in cells A2 to A10, the formula=SUM(A2:A10)will give you the total amount. - Tax Calculation: To calculate tax, use a formula like

=A2*0.10, where A2 is the total amount before tax and 0.10 represents the 10% tax rate. This will give you the tax amount that can be added to the final total. - Balance Due: To track remaining balances, use

=A2-B2, where A2 is the total amount and B2 is the amount paid. This will show you the outstanding balance for the client.

How to Automate Complex Calculations

For more complex calculations, such as applying multiple discounts or calculating payment deadlines, you can use conditional formulas like IF() or VLOOKUP(). These can help you manage varied pricing structures, customer-specific discounts, or payment terms that depend on specific conditions. With the help of formulas, you can create a more dynamic and adaptable financial system that can handle a wide range of situations.

By mastering these simple yet powerful formulas, you can greatly improve the efficiency and accuracy of your financial documents, ultimately making your business operations more streamlined and professional.

How to Save and Share Billing Documents

After creating a financial record, it’s essential to save and share it in a way that ensures security and accessibility. Whether you need to send a document to a client or store it for future reference, using the right methods will help maintain an organized and professional workflow. Proper storage options and sharing techniques also ensure that your records remain intact and easily retrievable when needed.

Saving Your Billing Documents

There are several ways to save your financial records, depending on your needs and preferences:

- Save Locally: Store your files on your computer or external hard drive in a well-organized folder system. This method gives you full control over the files but may require backup to prevent data loss.

- Cloud Storage: Using cloud-based platforms like Google Drive, Dropbox, or OneDrive allows you to store your documents online. Cloud storage makes it easy to access your files from anywhere and share them quickly with clients or colleagues.

- File Formats: Save your documents in widely-used formats like PDF or CSV to ensure compatibility across devices and software. PDF is ideal for sharing finalized records as it preserves formatting, while CSV is better for keeping raw data in a spreadsheet format.

Sharing Your Billing Documents

Sharing your billing documents efficiently helps ensure prompt payments and clear communication. Here are some common methods:

- Email: Send your financial documents directly via email. Attach the file in a PDF or Excel format, and make sure to include a brief message explaining the contents of the document.

- Secure File Sharing: For sensitive documents, use secure file-sharing services that encrypt your files, ensuring privacy. These platforms may require authentication, adding an extra layer of security.

- Shared Cloud Folders: If you regularly need to share documents with multiple people, create a shared folder on a cloud service. This allows multiple users to access, edit, and update the document in real-time, ensuring everyone has the latest version.

By using efficient saving and sharing techniques, you can improve the management of your financial records while ensuring they remain secure and accessible whenever you need them.

Setting Up Invoice Templates in Excel

Creating a detailed and professional document for billing purposes can streamline your workflow and enhance client satisfaction. With the right tools, you can efficiently track payments, calculate totals, and maintain a consistent approach to documenting your services. Setting up a structured sheet can save time and reduce errors when generating billing statements for clients.

To get started, follow these basic steps:

- Choose a Layout – Decide on the format of your document. A clean, easy-to-read design with clear sections is essential for professionalism.

- Include Important Information – Your document should have fields for your company details, customer information, a unique reference number, itemized charges, and payment instructions.

- Set Up Formulas – Use built-in calculation functions to automatically sum totals, apply taxes, or add discounts. This reduces manual errors and ensures consistency.

- Ensure Customization – Tailor the document to your business needs. For example, you might want to include specific service descriptions or create different layouts for various types of work.

Once set up, this document can be saved and reused for future projects, streamlining your business processes and keeping things organized for your clients and you.

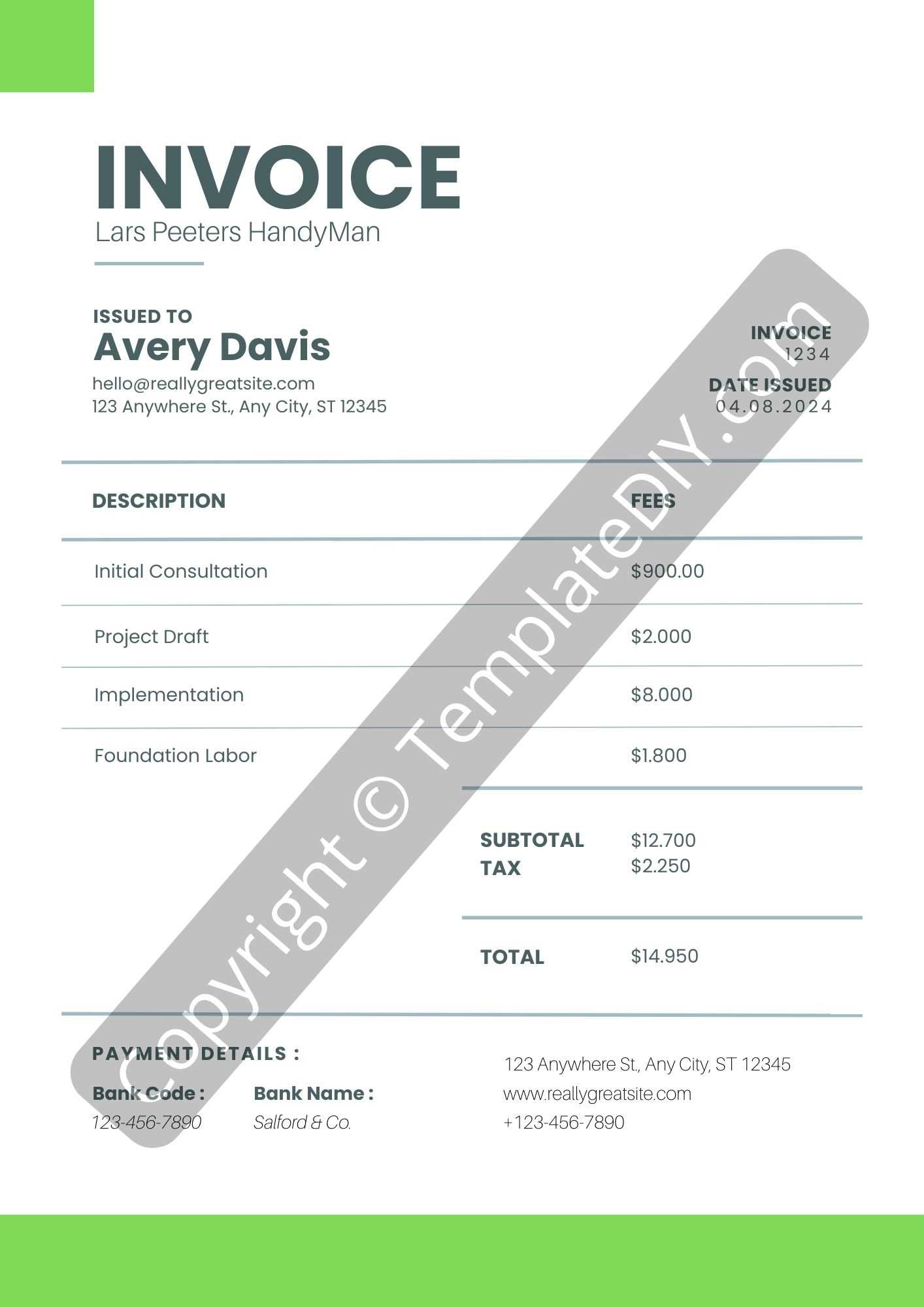

Design Tips for Professional Invoices

A well-designed billing statement not only communicates the details of a transaction clearly but also reinforces your brand’s image and professionalism. It is important to strike the right balance between functionality and aesthetics to ensure your clients receive a polished and organized document. Here are key tips for creating visually appealing and effective billing documents.

- Keep It Simple – A clean, uncluttered design is crucial. Avoid using excessive colors or complicated fonts. Stick to a minimalist approach with easy-to-read typography.

- Brand Consistency – Incorporate your business logo, brand colors, and font style to maintain consistency across all client communications. This helps to build trust and recognition.

- Clear Structure – Divide the document into distinct sections such as services provided, cost breakdown, and payment details. Each section should be easily identifiable for better readability.

- Use Columns for Itemized Lists – When listing charges, use columns for quantity, description, unit price, and total. This helps clients quickly understand what they are being charged for.

- Professional Fonts – Opt for standard, professional fonts like Arial or Times New Roman. Ensure that the font size is large enough for easy reading, but not so large that it overcrowds the document.

- Include Payment Instructions – Make sure to clearly state how and where clients can make payments, including any applicable terms or deadlines. Providing multiple payment options is a plus.

By following these design principles, you can ensure that your documents are not only functional but also leave a lasting, positive impression on your clients.

Integrating Invoice Templates with Accounting Tools

Connecting your billing statements with accounting software can significantly improve efficiency and accuracy in managing financial records. By automating data entry and syncing documents with your accounting system, you can reduce manual errors and save valuable time. This integration ensures that all financial data is consistently updated across platforms, providing a clear overview of your business’s financial health.

Benefits of Integration

When your billing statements are seamlessly integrated with accounting tools, you can:

- Automate Data Entry – Eliminate the need for manually entering payment information, reducing the risk of errors.

- Ensure Consistency – Syncing information ensures that records are up to date and accurate across both your billing and accounting systems.

- Streamline Financial Reporting – Quickly generate reports and track outstanding balances without switching between multiple platforms.

Steps to Integrate

To connect your documents with accounting tools, follow these basic steps:

- Choose Compatible Software – Select an accounting program that supports integration with your billing platform.

- Link the Systems – Use available APIs or integration features to connect your financial records with your accounting software.

- Automate the Flow – Set up automatic data transfer between the platforms for a more seamless experience.

Integrating your billing processes with accounting tools can greatly enhance your workflow and ensure your financial data remains accurate and organized.

Legal Considerations for Handyman Invoices

When preparing billing statements for services rendered, it is essential to be mindful of the legal requirements that govern such documents. Properly structured statements not only ensure clear communication with clients but also protect your business interests and comply with relevant regulations. Adhering to legal guidelines is crucial to avoid disputes, ensure timely payments, and maintain professional standards.

- Include Essential Information – Each document should contain key details such as the service provider’s name, business address, and registration number (if applicable), as well as the client’s information and service description.

- Clearly Define Payment Terms – Specify the agreed-upon terms, including payment due dates, accepted payment methods, and any late fees or penalties for overdue payments.

- Comply with Tax Regulations – Ensure that the document includes any applicable tax rates and that the amounts are properly calculated and displayed. This is important for both business owners and clients, as tax compliance is a legal obligation.

- State Legal Jurisdiction – If disputes arise, it is important to define the legal jurisdiction in which any issues will be resolved. This is especially useful for protecting your business if legal action becomes necessary.

By ensuring that your billing statements meet all legal standards, you safeguard both your business and your clients, fostering a professional and transparent relationship.