Download Free Gym Invoice Template for Easy Billing and Payment Management

For businesses that offer fitness services, maintaining a clear and efficient payment process is crucial. Proper documentation not only helps track transactions but also ensures smooth operations for both the service provider and clients. A well-organized record system simplifies payment tracking, minimizes errors, and enhances professionalism.

One of the most effective ways to manage payments is through customized forms that capture all necessary details. These documents allow for quick and easy recording of services rendered, amounts due, and payment status. The flexibility of such tools enables businesses to adapt to various client needs and service structures.

Whether you’re managing a personal training studio or a large fitness facility, having the right tools for financial organization is essential. In this guide, we’ll explore how to optimize your billing process and make it more efficient, helping your business thrive while ensuring clients remain satisfied with their experience.

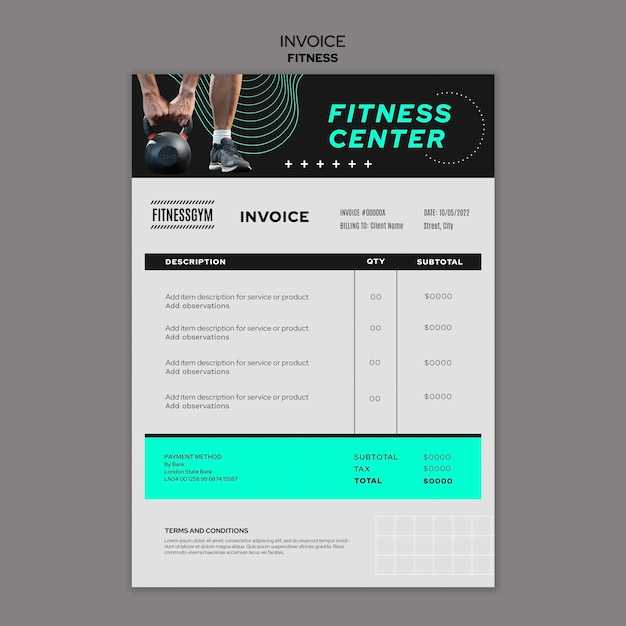

Why Use a Fitness Billing Document

Having a standardized form to record payment details can significantly improve the efficiency of any fitness-related business. It allows owners and managers to track services rendered, payments received, and outstanding balances in a clear and organized manner. This approach reduces the chances of errors and ensures that both customers and service providers are on the same page regarding financial transactions.

Streamlined Financial Management

By using a pre-designed document, businesses can eliminate the need for manual calculations and reduce administrative workload. The structure of such a tool helps maintain consistency across all transactions, ensuring that every client receives the same level of service and clarity in billing. Efficiency is key when managing multiple clients or members, and having a uniform system in place ensures smooth operations.

Professional Appearance and Client Trust

Providing clients with a clean, well-organized receipt or statement not only boosts credibility but also helps in building trust. A formal approach to billing shows that you value their business and are committed to providing transparent services. Professional documents enhance the customer experience and reflect positively on your business’s reputation.

How Fitness Billing Documents Improve Payment Tracking

Having a structured document for recording payments allows businesses to effectively track financial transactions. With a clear format, business owners can easily identify completed, pending, or overdue payments, reducing confusion and increasing financial control. This organized system helps ensure that no payments are missed and allows for accurate financial reporting.

Key Benefits of Using a Structured Payment Record

- Clear Overview of Transactions: A standardized format provides a snapshot of all payments, making it easy to identify which clients have settled their dues and which still have pending balances.

- Reduction of Errors: With automated calculations and pre-defined fields, there is less room for human error, ensuring that all amounts are correct.

- Easy Tracking of Payment History: A well-organized system keeps a detailed history of every transaction, making it easier to track long-term client relationships and ensure consistency in payments.

How Organized Records Benefit Clients and Providers

- Transparency: Clients can clearly see what services they are being charged for, promoting trust and reducing disputes.

- Efficient Follow-ups: If a payment is overdue, the business can quickly identify which clients need reminders or additional communication.

- Financial Planning: For business owners, having accurate records helps in budgeting and financial forecasting, allowing better decision-making in the long run.

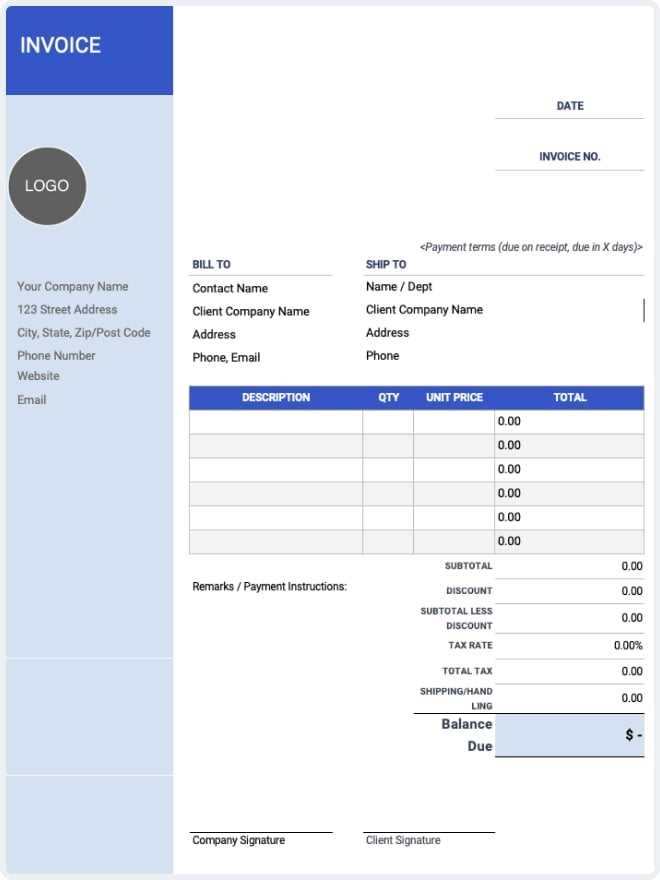

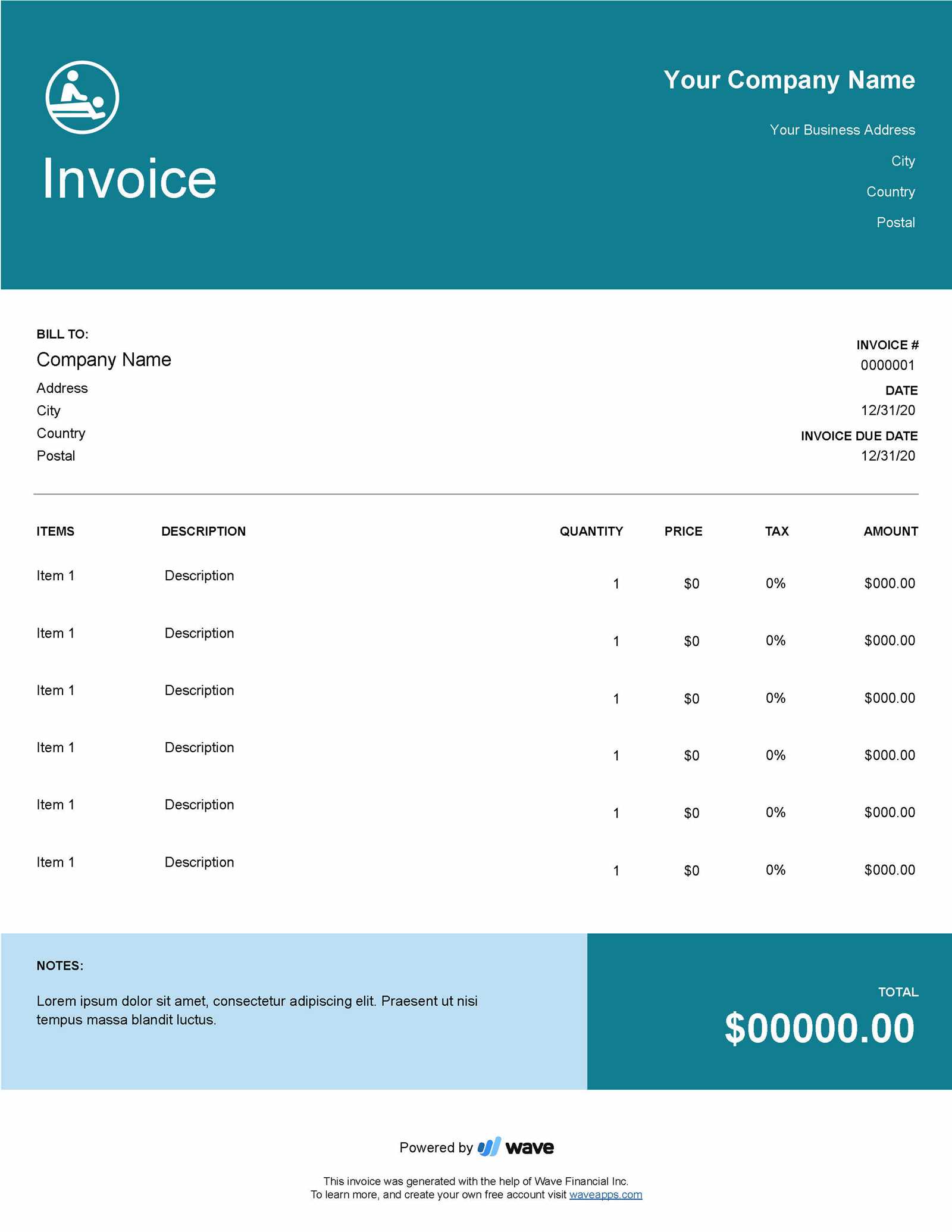

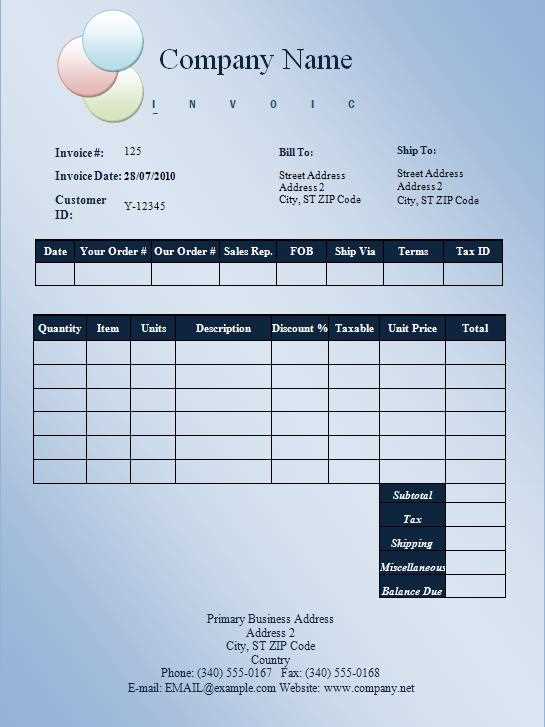

Essential Elements of a Fitness Billing Document

To ensure accurate and professional financial records, every billing document should include certain key elements. These components not only help clarify payment details but also make it easier to track and manage client transactions. A well-structured document promotes transparency, reduces confusion, and ensures that both the service provider and the client are on the same page regarding the payment process.

Key Components of a Payment Record

- Business Information: Include the name, address, and contact details of the service provider or business. This helps clients quickly identify who issued the document and reach out if needed.

- Client Information: Clearly state the name and contact details of the client being billed. This is crucial for keeping accurate records and avoiding mistakes with multiple clients.

- Unique Document Number: Every document should have a unique identifier, which helps in organizing and tracking payments, especially when dealing with a large volume of transactions.

- Description of Services: Provide a detailed list of the services provided, including dates, duration, and any other relevant information. This ensures clarity for both the client and the business.

- Amounts Due: Break down the total amount into separate line items. Include applicable taxes, discounts, or additional fees to give a clear picture of the final balance.

- Payment Terms: Clearly outline the payment due date and any terms related to late payments, such as interest charges or penalties.

Why These Elements Matter

- Clarity and Transparency: Including all relevant details ensures that clients fully understand what they are being charged for, reducing potential misunderstandings or disputes.

- Efficient Record-Keeping: Having a consistent structure with all necessary information makes it easier for businesses to track payments and maintain organized financial records.

- No Cost: Free options allow businesses to save money, which can be crucial for small or new enterprises that are looking to minimize expenses.

- Basic Features: Free documents typically cover essential elements such as service descriptions, amounts due, and client details, which may be all a small business needs.

- Quick Setup: With minimal customization required, free solutions can be set up quickly, allowing businesses to start managing payments right away.

- Advanced Customization: Paid options often provide more flexibility to tailor the layout, add branding, and include additional features like automatic calculations or integration with payment platforms.

- Professional Appearance: Premium options tend to offer more polished, visually appealing designs that reflect well on your business and help build client trust.

- Enhanced Functionality: Many paid solutions include extra tools for tracking overdue payments, generating reports, or managing recurring billing, which can help streamline your financial processes.

- Customer Support: With paid services, businesses often have access to customer support in case of technical issues or questions about the document’s functionality.

- Instant Delivery: With digital documents, you can instantly send billing records to clients via email or text, eliminating the need for postal services or face-to-face handovers.

- Accessibility: Digital documents can be accessed from anywhere, allowing business owners to manage transactions remotely and clients to view their records at their convenience.

- Environmentally Friendly: By going paperless, businesses contribute to sustainability efforts, reducing paper waste and minimizing their environmental footprint.

- Security: Digital records are less prone to being lost or damaged compared to paper documents. Additionally, encryption and password protection can be used to secure sensitive financial information.

- Automation: Digital solutions often include built-in tools for calculating totals, taxes, and applying discounts, reducing the time spent on manual calculations and minimizing human error.

- Cost Reduction: Going digital eliminates the need for paper, printing, and postage costs, resulting in long-term savings for the business.

- Easy Tracking and Record-Keeping: Digital systems allow for organized and searchable records, making it easy to track payments, generate reports, and maintain accurate financial histories.

- Include clear headings for client details, services rendered, amounts due, and payment terms.

- Use standardized language to describe services and charges, avoiding ambiguity that could cause confusion.

- Assign a unique reference number to each document for easy tracking and identification.

- Automated calculations for totals, taxes, and discounts ensure accuracy.

- Recurring billing features are useful for businesses offering membership or subscription-based services.

- Payment reminders can be set up automatically to notify clients of due payments or overdue balances.

- Track paymen

Integrating Payment Systems with Fitness Billing Documents

Seamlessly connecting payment systems with financial records is essential for streamlining transactions and improving cash flow. Integration allows businesses to automate the payment process, ensuring accuracy and minimizing manual work. By linking digital payment gateways directly to billing records, businesses can offer clients easy and secure payment options while maintaining up-to-date financial documentation.

Key Benefits of Integration

- Efficiency: Automating payments reduces the time spent on manual data entry and minimizes human error. Payment details are automatically updated in the system, ensuring that no payments are missed or incorrectly recorded.

- Convenience for Clients: Offering a range of integrated payment methods, such as credit cards, bank transfers, or digital wallets, provides clients with flexible options and enhances their experience.

- Real-Time Payment Tracking: Integration enables real-time updates, so businesses can instantly track whether a payment has been completed, allowing for faster follow-ups if needed.

- Security: Linking secure payment platforms directly to billing records ensures that sensitive client data is protected and minimizes the risk of fraud or unauthorized access.

Steps to Integrate Payment Systems

- Select a Payment Gateway: Choose a payment processing platform that suits your business model. Common options include PayPal, Stripe, or Square, which offer easy integration with various billing systems.

- Connect to Your Billing Software: Most modern financial software allows you to integrate with payment gateways. Look for features like automated payment logging and payment confirmation notifications.

- Customize Payment Options: Tailor the payment options to your business needs, such as setting up recurring payments for memberships or adding one-time payment features for individual sessions or packages.

- Test the Integration: Before fully implementing the system, test the integration to ensure that payments are correctly processed and that the system updates billing re

How to Handle Late Payments with Billing Documents

Late payments can disrupt cash flow and create unnecessary administrative challenges for fitness businesses. Managing overdue payments in a professional and efficient manner is essential to maintaining financial stability. By establishing clear payment terms and implementing a structured follow-up process, you can handle late payments with minimal stress and protect your business from the impact of delayed funds.

1. Set Clear Payment Terms from the Start

One of the most effective ways to reduce late payments is to set clear expectations upfront. When clients understand the payment schedule, due dates, and potential late fees, they are more likely to pay on time. Be sure to include detailed payment terms in every billing document, highlighting due dates, accepted payment methods, and any penalties for late payments.

- Due Date: Clearly state when the payment is due, such as “Payment due within 30 days of service.”

- Late Fees: Specify any penalties for overdue payments (e.g., “Late fee of 5% applied after 30 days”).

- Payment Methods: List all accepted payment methods, ensuring that clients know how to settle their balance easily.

2. Send Friendly Payment Reminders

If a payment becomes overdue, sending a friendly reminder can often resolve the issue without much trouble. Reminders should be polite and professional, providing clients with all the necessary information to complete the payment. You can set up automated reminders or manually send them via email or text.

- First Reminder: A gentle reminder sent a few days after the due date, politely reminding the client that the payment is past due.

- Second Reminder: A more direct reminder, reiterating the importance of timely payment and outlining late fees, if applicable.

- Final Notice: If payments are still not receive

Automating Fitness Billing for Efficiency

Automating financial documentation processes can significantly improve the efficiency of your business operations. By reducing the time spent on manual data entry, calculation errors, and follow-ups, you can streamline your billing system, save valuable time, and ensure a smoother workflow. Automation can also enhance client satisfaction by providing quick, accurate billing statements and reducing the chances of human error.

Key Benefits of Automation

Benefit Description Time-Saving Automated systems handle repetitive tasks such as generating documents and calculating totals, freeing up your time for more important business activities. Accuracy Automation reduces the risk of human error, ensuring that totals, taxes, and discounts are calculated correctly every time. Consistency With automation, all documents are created in a uniform format, ensuring consistency and professionalism across all client communications. Quick Updates Payments, adjustments, and changes are instantly reflected in your system, helping you keep track of financial transactions in real time. How to Automate Your Billing Process

- Use Billing Software: Invest in software that integrates with your business operations, such as CRM systems or payment platforms, to automatically generate financial documents for each transaction.

- Set Up Recurring Billing: For membership or subscription-based services, set up recurring billing cycles that automatically charge clients at regular inte

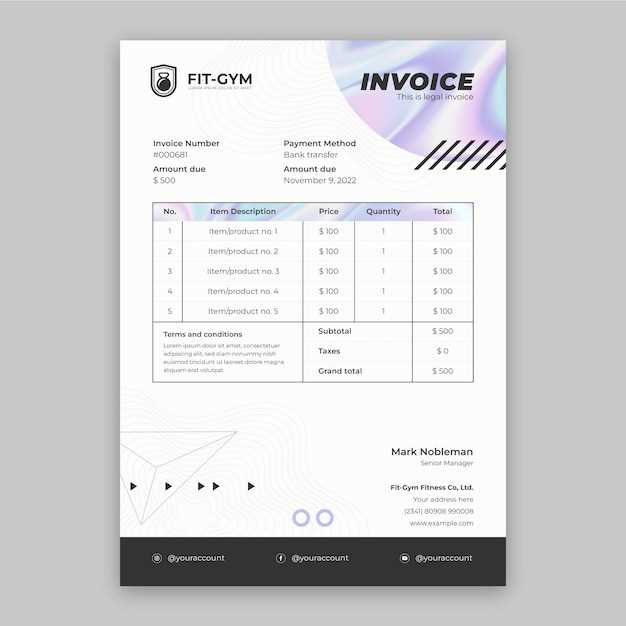

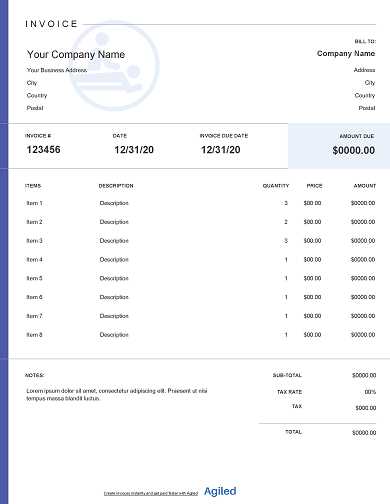

Design Tips for Professional Fitness Billing Documents

Creating professional and visually appealing financial records is key to making a strong impression on clients. A well-designed document not only reflects the quality of your business but also makes it easier for clients to understand and process their payments. By focusing on clarity, organization, and consistency, you can ensure that your billing documents appear polished and professional, reinforcing your brand’s reputation for quality service.

1. Keep the Layout Simple and Clear

Clarity is the most important aspect of any financial document. A clean, well-organized layout helps clients quickly understand the charges, due dates, and payment instructions. Avoid cluttering the document with unnecessary elements or excessive text. Instead, focus on providing key information in a straightforward manner.

- Use headings and subheadings to separate sections like client details, services, charges, and payment information.

- Break down charges clearly, using bullet points or tables to display each service and its associated cost.

- Maintain consistent font sizes for readability, ensuring that key details stand out, such as the total amount due and payment deadlines.

2. Brand Consistency and Visual Appeal

Your billing document is a reflection of your business, so make sure it aligns with your brand’s visual identity. Using consistent colors, fonts, and logos can help reinforce your brand’s image while creating a professional look. A cohesive design enhances the client’s perception of your business and makes the document feel more personal.

- Include your logo at the top of the document to create a branded header that clients immediately recognize.

- Use brand colors sparingly to highlight important sections, such as totals or payment due dates, without overwhelming the design.

- Choose professional fonts that are easy to read and maintain consistency with your marketing materials

Legal Requirements for Fitness Billing Documents

When it comes to creating financial records for your business, it is important to ensure that all legal requirements are met. These requirements help protect both your business and your clients by ensuring that transactions are properly documented and transparent. Adhering to the necessary legal guidelines not only ensures compliance but also boosts the professionalism and reliability of your business.

Key Legal Elements to Include

- Business Information: Your business name, address, and contact details should be clearly displayed on the document. This helps verify the legitimacy of your company.

- Tax Identification Number (TIN): Including your TIN is essential for tax purposes and allows both parties to comply with local tax laws.

- Client Information: The full name and contact details of the client should be listed, providing clarity on who is being billed and allowing for easier tracking.

- Unique Reference Number: Assigning a unique reference number to each document is necessary for record-keeping and ensures that both you and your client can track the transaction.

- Clear Breakdown of Charges: Each service provided, along with its cost, must be itemized. This transparency is essential for both legal compliance and customer satisfaction.

Additional Compliance Considerations

- VAT/GST Information: Depending on your location and business type, you may be required to include details about any applicable value-added tax (VAT) or goods and services tax (GST) on your documents.

- Payment Terms and Deadlines: Clearly outline the payment terms, including when payment is due and any late fees that may apply. This ensures that both parties are aware of the financial expectations.

How Fitness Billing Documents Help with Tax Filing

Accurate and organized financial records are essential when it comes time to file taxes. Properly documented transactions provide clarity and transparency, making it easier to report income, deduct expenses, and comply with tax regulations. By ensuring that every transaction is properly recorded, businesses can simplify the process of tax filing and avoid costly errors or audits.

1. Clear Documentation of Income

One of the key roles of financial records is to track income accurately. Every payment received should be documented, providing a clear record of the business’s earnings. By maintaining well-organized documents, you ensure that all income is properly reported to tax authorities.

- Itemized Records: A detailed breakdown of each service or product purchased ensures that the total income can be easily tracked, and no payments are overlooked.

- Tracking Payment Methods: Documenting whether payments were made via credit card, cash, or another method can help you account for all forms of revenue.

2. Simplified Expense Tracking

Financial documents can also play a crucial role in tracking business expenses, which are important for tax deductions. Many businesses incur operational costs that can be deducted from taxable income, and having a clear record of these expenses helps maximize tax benefits.

- Service Costs: Documenting expenses like equipment maintenance, utility bills, and staff payments ensures that you can deduct these costs during tax season.

- Consistent Records: Regularly updating your financial documentation helps track ongoing expenses, ensuring nothing is missed when filing taxes.

By maintaining accurate financial records and organizing your receipts, transactions, and expenses, you create a solid foundation for tax filing. Well-documented business activities simplify tax reporting, reduce the chances of mistakes, and can even help with future audits. This proactive approach not only ensures compliance but can also reduce the stress associated with tax season.

Tracking Fitness Membership Payments with Billing Documents

Tracking membership payments effectively is critical for ensuring smooth cash flow and accurate financial records. For businesses offering subscription-based services, it’s essential to have a reliable system in place to monitor payments, track due dates, and identify any outstanding balances. Using well-structured billing documents can streamline this process, making it easier to stay on top of financial obligations while maintaining clear communication with clients.

1. Record All Payment Details Clearly

Each payment for membership should be recorded accurately to prevent any discrepancies. This includes documenting the amount, the payment method, and the date of transaction. Detailed records help not only in tracking payments but also in resolving any future disputes or clarifications that might arise between the business and the client.

- Subscription Plan: Include information about the membership type (e.g., monthly, annual) and the agreed payment schedule to avoid confusion.

- Payment Amount: Clearly state the payment amount for each transaction, especially if there are different rates for services or if discounts are applied.

- Payment Method: Specify whether payments were made by credit card, direct debit, or cash for easy tracking of how revenue is generated.

2. Automate Recurring Payments for Seamless Tracking

For businesses with clients on recurring payment plans, automating billing can help reduce administrative workload and improve payment tracking accuracy. Automated systems ensure that payments are processed on time and that invoices are generated and sent to clients without the need for manual input.

- Recurring Payment Setup: Set up automated billing cycles (e.g., monthly or yearly) to ensure that membership renewals are processed without delay.

- Automatic Reminders: Use automated notifications to remind clients of upcoming payments or outstanding balances, helping to reduce late payments and ensure timely renewals.

- Tracking and Reporting: Automated systems can generate real-time reports, offering insights into payment status, overdue amounts, and active memberships.

By utilizing these tracking methods, businesses can

How to Send and Follow Up on Fitness Billing Documents

Effective communication is key when it comes to managing financial records and ensuring timely payments. Sending billing statements promptly and following up on outstanding payments are essential steps in maintaining a steady cash flow and healthy business operations. A well-structured approach to sending and tracking financial documents helps reduce confusion, build trust with clients, and ensure that payments are received on time.

1. Sending Payment Requests

Sending a billing statement should be clear, professional, and timely. When preparing to send a payment request, make sure all the necessary details are included and that the client knows exactly what is expected of them.

- Choose the Right Method: Decide whether to send the document via email, postal mail, or an online payment platform. Digital methods are usually faster and more convenient for both parties.

- Include Essential Details: Ensure that the document contains all relevant information, such as the client’s name, the amount due, due date, and a breakdown of services rendered. The clearer the information, the less likely clients will be confused or question the charges.

- Be Prompt: Send the billing document as soon as possible after the service is provided or when the payment is due. Timely billing fosters professionalism and encourages quicker payments.

2. Following Up on Outstanding Payments

If payments are not received by the due date, it’s important to follow up promptly. A polite and professional approach can help maintain client relationships while ensuring that outstanding balances are addressed. Here are some tips for effective follow-up:

- Send a Friendly Reminder: Contact clients a few days before the due date with a gentle reminder. This shows that you are organized and helps avoid late payments.

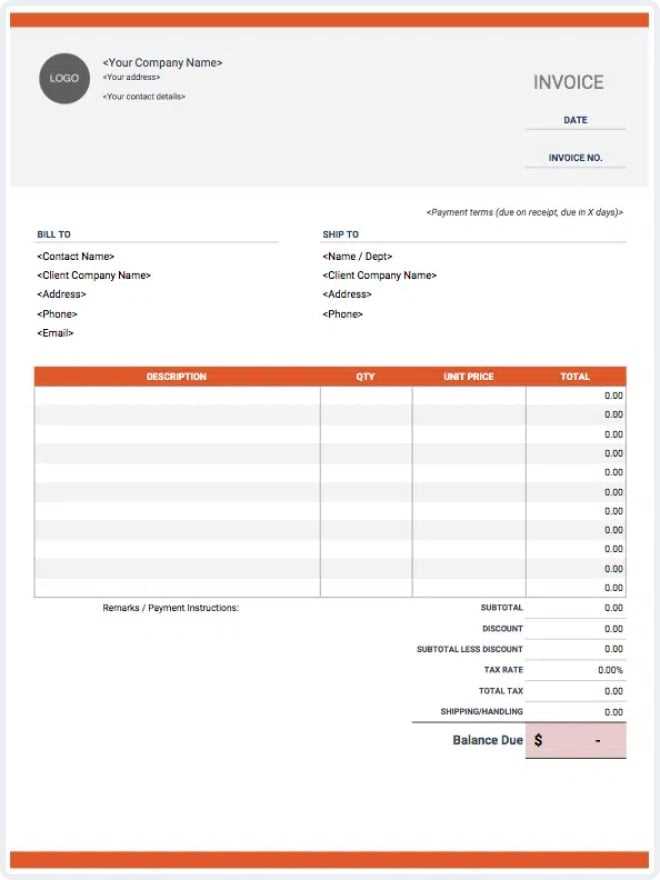

Customizing Your Fitness Billing Document

Personalizing your financial records can help reflect your brand’s identity while ensuring that all the necessary details are included for effective communication. Customizing these documents not only makes them more professional but also allows you to tailor the layout and information to fit your specific needs, creating a more seamless experience for both your business and your clients.

Key Elements to Personalize

There are several aspects of the document that can be customized to suit your business style and client preferences:

| Element | Description |

|---|---|

| Branding | Incorporate your business logo, color scheme, and any branding elements to make the document look professional and aligned with your business identity. |

| Client Details | Ensure that the client’s information is formatted correctly, and you may choose to add additional fields such as membership status or specific packages used. |

| Service Descriptions | Provide a more detailed breakdown of services offered, whether it’s personal training sessions, group classes, or other fitness programs. |

| Payment Instructions | Customize the payment instructions with your preferred methods, such as bank transfer, credit card, or digital payment options, along with any account details. |

| Additional Information | Include any notes or terms specific to your business, such as cancellation policies, membership renewal dates, or promotional discounts. |

Why Customization Matters

Personalizing your financial documentation adds a professional touch and allows you to keep track of all relevant information in a format that works best for your operations. Custom elements help to ensure consistency across all your records, while also making it easier to maintain clear communication with clients. Tailoring your records to your specific needs not only reflects positively on your business but also improves efficiency in your administrative processes.

Free vs Paid Fitness Billing Documents

When selecting a structured document for managing financial transactions, businesses have the option of choosing between free and paid options. Both come with their own set of advantages and limitations, so understanding the differences is important for choosing the best fit for your needs. While free options may be sufficient for small businesses or those just starting out, paid solutions often offer more advanced features and customization.

Benefits of Free Solutions

Advantages of Paid Solutions

Ultimately, the choice between free and paid options depends on the scale and complexity of your business. If you are looking for basic functionality without extra cost, free documents might be sufficient. However, for businesses that require more flexibility, automation, and a professional edge, investing in a paid option may be worth the cost in the long run.

Benefits of Using Digital Fitness Billing Documents

Switching to electronic records for financial transactions offers a range of advantages for fitness businesses. Digital solutions provide greater convenience, efficiency, and security compared to traditional paper-based methods. By adopting online tools, businesses can streamline their operations, reduce the risk of errors, and enhance the client experience.

Key Advantages of Digital Solutions

Efficiency and Cost Savings

Overall, transitioning to digital records not only makes billing more efficient but also improves client satisfaction through convenience and professionalism. Whether you’re managing a small studio or a large fitness center, using digital solutions can optimize your financial workflow and enhance the overall business experience.

How to Create a Fitness Billing Document from Scratch

Creating a financial record from the ground up requires attention to detail and a clear understanding of the essential components. While pre-made options are available, building a custom document tailored to your business’s needs can offer more control over the structure and design. By following a step-by-step approach, you can create a professional and organized billing record that ensures accuracy and client satisfaction.

Step 1: Include Your Business Information

Start by adding your business details at the top of the document. This should include your business name, address, phone number, and email address. If you have a logo, include it as well for a more professional appearance. This ensures that your clients know who issued the document and have the necessary information to contact you if needed.

Step 2: Add Client Information

Next, include the client’s information. This should consist of their full name, address, and any other relevant details, such as membership type or plan. Having this information clearly stated on the document helps prevent confusion and ensures that payments are accurately matched to the correct client.

Make sure to assign a unique identifier to each transaction. This can be a reference number or an order ID, which will help you track the payment history and prevent duplicate records.

Step 3: List Services Rendered

Clearly outline the services provided, including descriptions, dates, and the cost of each service. If applicable, break down the pricing to show individual charges (e.g., per session or package) and any additional fees such as taxes or surcharges. This transparency helps clients understand the charges and avoid any confusion.

Step 4: Include Payment Information

After listing the services, indicate the total amount due. Make sure to include payment terms, such as the due date and acceptable payment methods (e.g., credit card, bank transfer, online payment). You may also want to specify any late fees or penalties for overdue payments.

Common Mistakes in Fitness Billing Documents

When managing financial records for a fitness business, it’s easy to overlook certain details that can lead to errors or confusion. Mistakes in your billing documents can cause delays, misunderstandings, or even affect client trust. Recognizing common issues and knowing how to avoid them can improve the efficiency of your billing process and ensure smoother transactions.

Common Errors to Avoid

| Error | Impact | How to Avoid |

|---|---|---|

| Incorrect Client Information | Incorrect names, addresses, or contact details can lead to missed payments or confusion about who owes what. | Double-check all client details before finalizing any document. Ensure consistency with your client database. |

| Missing or Incorrect Charges | Omitting charges or listing wrong amounts can result in undercharging or disputes over pricing. | Always break down each service with accurate pricing and verify totals before sending. |

| Failure to Include Payment Terms | Clients may not be aware of due dates, late fees, or payment methods, causing delays or confusion. | Clearly state payment terms, including the due date and any applicable penalties for late payments. |

| Lack of Unique Reference Number | Without a unique identifier, it’s harder to track payments and resolve any issues with past transactions. | Always assign a unique reference or transaction number to each document for easy identification. |

| Not Including Tax or Additional Fees | Excluding taxes or additional charges like service fees can lead to incorrect totals and tax-related problems. | Ensure all taxes and fees are clearly listed, with itemized breakdowns for

Best Practices for Fitness Billing ManagementEffective management of financial records is crucial for the smooth operation of any fitness-related business. Keeping track of transactions, ensuring timely payments, and maintaining an organized system can reduce errors and improve cash flow. By following best practices for managing billing documents, businesses can enhance their professionalism, improve client relationships, and streamline their administrative processes. 1. Stay Consistent with DocumentationConsistency is key when creating financial records. A standardized format for all billing documents ensures that important information is never overlooked, and it helps clients easily understand the charges they’re being billed for. Keep the layout simple but informative, and use the same structure across all documents to maintain clarity. 2. Automate Where PossibleManual billing processes are time-consuming and prone to error. Automating certain aspects of your financial record management can save time and reduce mistakes. Many software solutions offer automatic calculations, tax inclusion, and customizable templates that streamline the billing process. 3. Maintain a Clear Payment Tracking SystemA reliable payment tracking system ensures that you can quickly identify which clients have paid and which still owe. This helps in following up on overdue payments and reduces the risk of missed or forgotten transactions. |