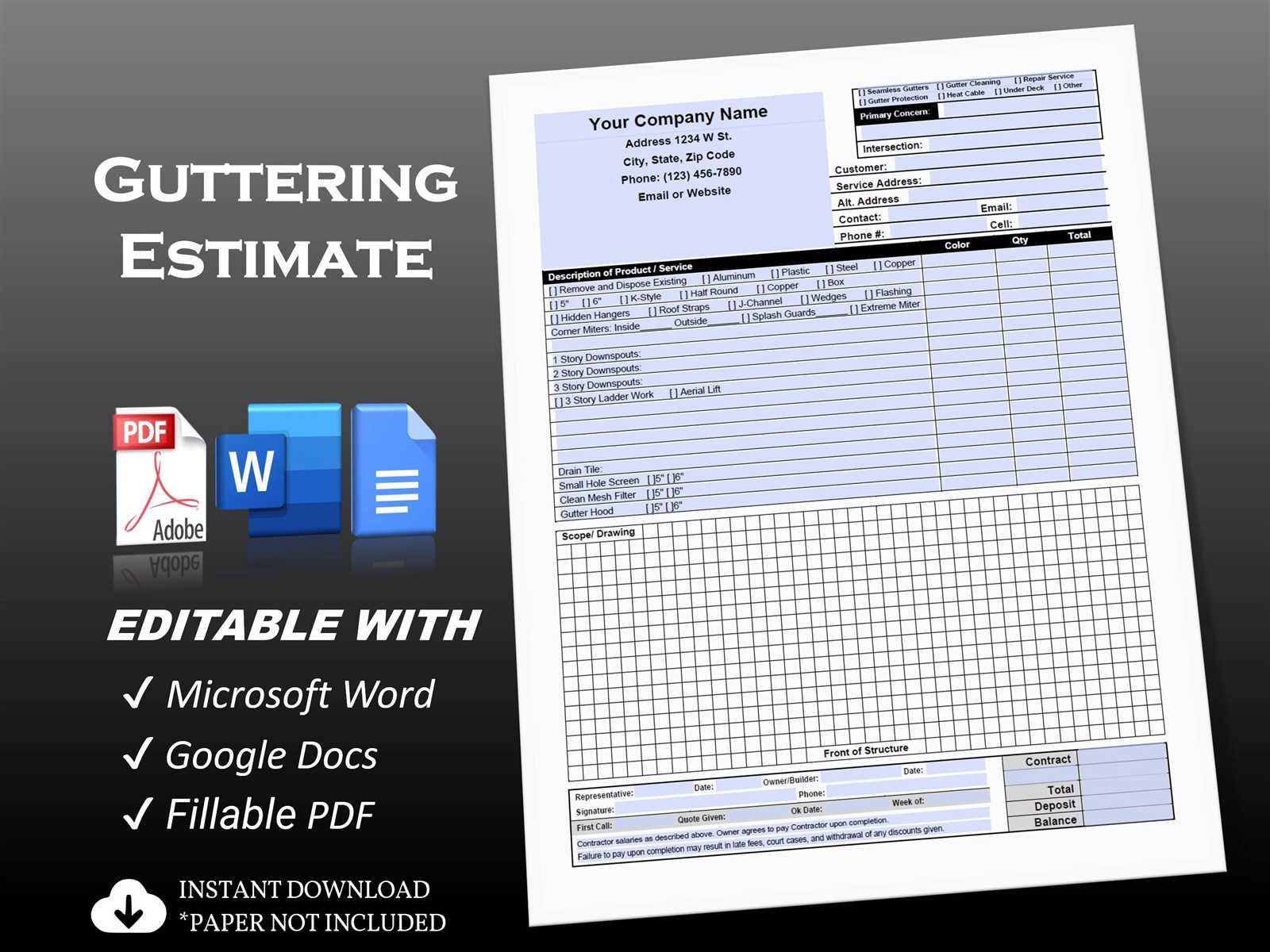

Gutter Invoice Template for Easy Billing and Professional Invoicing

In any service-oriented business, ensuring smooth financial transactions is crucial for maintaining good client relationships and securing steady cash flow. One key element to achieving this is having a streamlined way of presenting charges and payments. A well-organized document that clearly outlines the work done, pricing, and payment terms can significantly improve your operational efficiency.

For businesses offering home maintenance or similar services, creating professional and accurate billing documents is essential. These records not only help in managing finances but also serve as a clear reference for both you and your clients, avoiding misunderstandings. A customized billing solution can save time, reduce errors, and help maintain a positive image with your customers.

With the right tools, you can easily craft and personalize these documents, making sure every important detail is included, from service descriptions to payment deadlines. Whether you’re a freelancer or part of a larger team, having a reliable system for generating such records is a game-changer for smooth operations.

Billing Document Overview

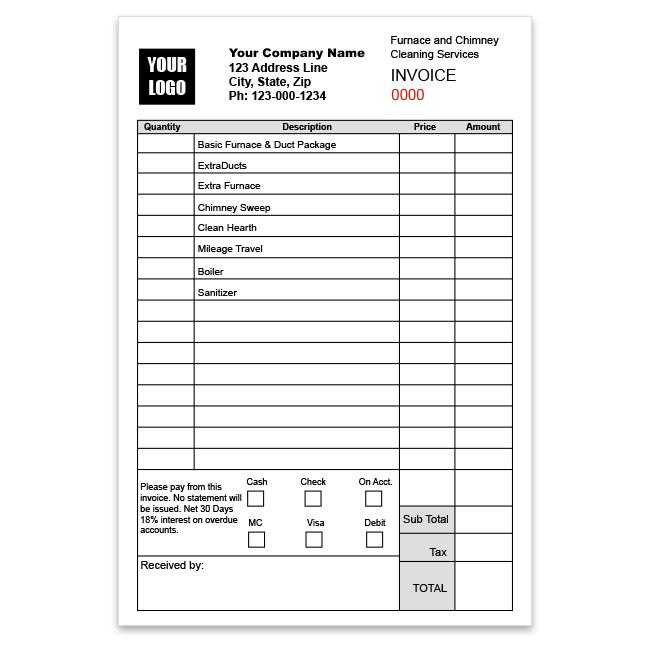

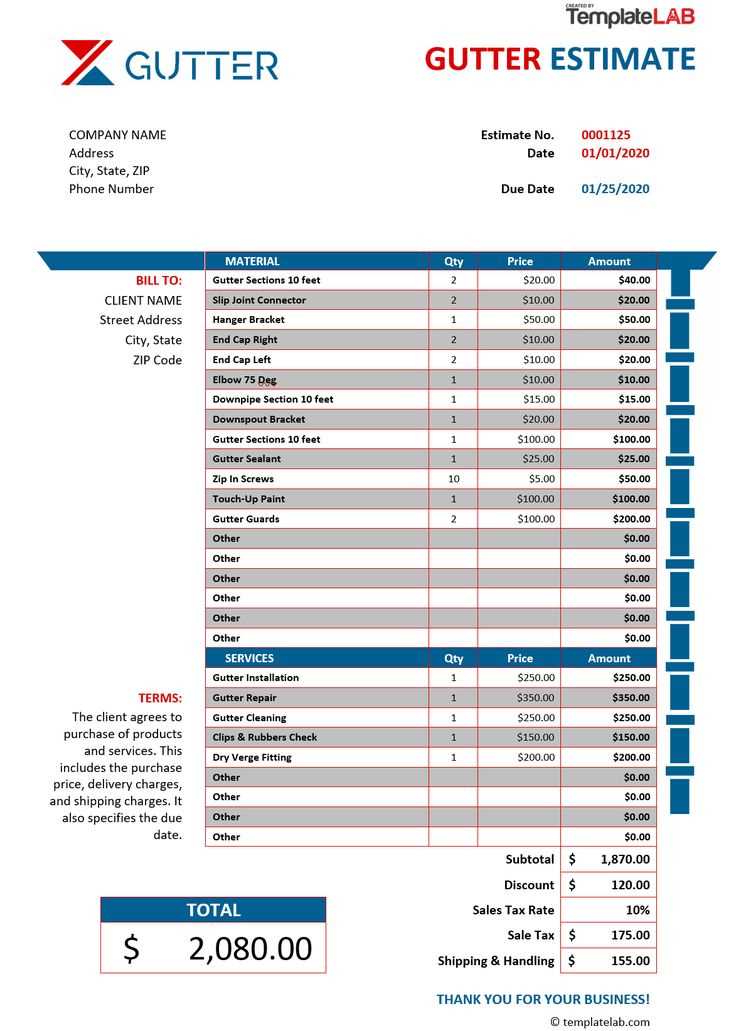

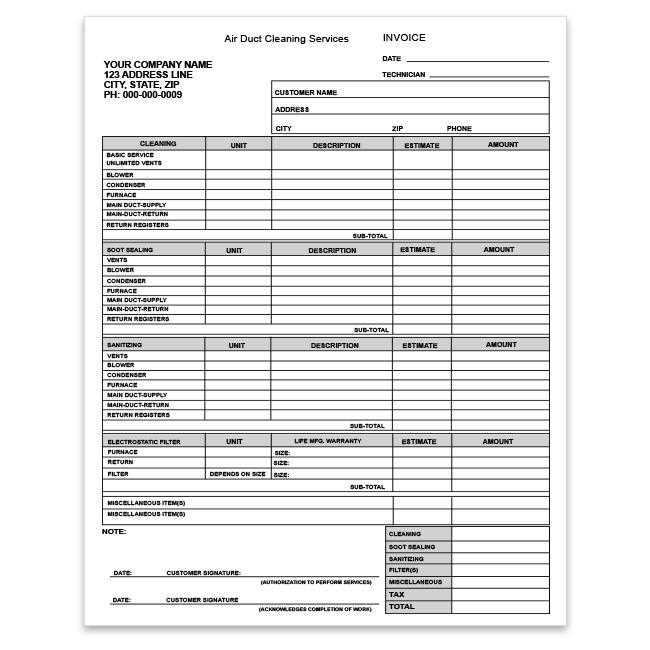

Creating accurate and professional billing records is essential for any business, especially those that provide specialized services. These documents are used to outline the charges for completed work, specify payment terms, and ensure both the service provider and the client are on the same page regarding financial expectations. A well-designed billing document can help streamline the entire process, from service delivery to payment collection, minimizing confusion and delays.

For businesses focused on home repairs or installations, a tailored billing document is particularly important. It should include specific details related to the job performed, such as materials used, labor costs, and any additional fees. A clear and structured document can not only facilitate smooth financial transactions but also improve the overall client experience, reflecting professionalism and reliability.

By using a pre-structured format that can be easily adapted to each unique job, businesses can save time, reduce administrative errors, and focus on delivering high-quality services. This approach ensures that each bill is consistent and accurate, helping to build trust with customers and secure timely payments.

Why You Need a Billing Document Format

In any business, especially those that involve offering hands-on services, having a consistent and clear way of documenting financial transactions is essential. A structured record that clearly displays the charges for work completed not only simplifies the payment process but also builds trust with clients. Using a pre-designed structure ensures that all necessary information is included and presented in a professional manner, reducing the chances of errors or misunderstandings.

Benefits of Using a Structured Format

Implementing a standard format for every transaction provides several advantages. First, it saves time by removing the need to create a new document from scratch for each job. Second, it ensures consistency, which helps in maintaining professionalism and making the process easier for clients to understand. Third, it minimizes the risk of missing critical details, such as tax information or payment terms.

How a Standard Format Helps Your Business

By using a standardized record system, you can focus on delivering quality services rather than spending time on administrative tasks. It also streamlines payment processing, making it easier for clients to pay promptly and reducing the likelihood of overdue payments. Consistency in your financial documents can enhance your business’s reputation and lead to more repeat clients.

| Benefit | Explanation |

|---|---|

| Time-saving | A pre-designed structure reduces the need to create documents from scratch. |

| Consistency | All documents will look uniform, creating a professional impression. |

| Accuracy | Important information, like pricing and payment terms, is included every time. |

| Efficiency | Streamlines payment collection and ensures timely transactions. |

Benefits of Using a Structured Billing Document

Having a clear and professional financial record for every service completed offers several advantages. Not only does it ensure both parties are aligned on the work done and the charges applied, but it also helps streamline your business operations. A well-organized financial document can improve efficiency, reduce misunderstandings, and enhance your reputation with clients.

Improved Professionalism

Using a standardized format for all your transactions conveys professionalism and attention to detail. Clients are more likely to trust a business that provides clear, organized financial documents. It shows that you value transparency and are serious about your operations.

- Clients can easily understand charges and services rendered.

- Demonstrates that your business is organized and trustworthy.

- Creates a consistent brand image for your company.

Streamlined Financial Process

When you use a pre-defined format, managing finances becomes much simpler. Instead of creating records from scratch, you can quickly generate accurate documents that include all necessary information. This reduces the chance of missing important details and makes it easier to track payments and balances.

- Speeds up the process of generating payment requests.

- Reduces errors in calculations and payment terms.

- Helps you maintain accurate records for tax purposes.

By implementing a structured system, you not only simplify your financial tracking but also enhance client communication and satisfaction. A reliable system ensures timely payments and smoother overall transactions, allowing you to focus on providing quality service.

Key Elements of a Billing Document

To ensure that financial records are clear, professional, and complete, certain key components must be included in every document. These elements help both the service provider and the client understand the terms of payment, the services rendered, and any additional charges. Without these crucial details, the document may lead to confusion, delayed payments, or disputes.

The first essential element is the contact information for both parties. It’s important to clearly list the service provider’s name, business name, and contact details, as well as the client’s information. This ensures that all communication regarding the transaction can be easily referenced.

Another important section is the service description. This should clearly outline the work performed, including any materials used and labor hours, with sufficient detail to avoid ambiguity. It’s critical that both parties can quickly identify what they are being charged for.

Payment terms are also necessary. This includes the total amount due, any applicable taxes, the payment due date, and accepted payment methods. Clear payment terms help avoid misunderstandings and ensure timely payments.

Additionally, including a unique reference number or transaction ID can assist in tracking and organizing records for future reference. This makes it easier to locate specific documents for any future queries or audits.

Finally, a professional design helps in conveying trustworthiness. Using a clean, structured layout for the document makes it more legible and easier to understand, improving client satisfaction.

How to Create a Billing Document

Creating a clear and accurate financial document is an essential task for any business that offers services. A well-structured record helps ensure that both the service provider and the client understand the charges and terms. By following a simple process, you can quickly create a professional document that accurately represents the work completed and the amount due.

Steps to Create a Billing Document

- Include Contact Information

- Provide your business name, address, phone number, and email address.

- Include the client’s name, address, and contact details for clarity.

- Describe the Services Rendered

- Clearly list each service provided, with a description of the work done.

- Include any materials used, along with labor charges if applicable.

- Specify Payment Terms

- State the total amount due, including any taxes or additional fees.

- Indicate the payment deadline and accepted methods of payment.

- Assign a Unique Reference Number

- Generate a unique number or code for each transaction to ensure easy tracking.

- This will help you organize and retrieve documents in the future.

Finalizing the Document

Once all the necessary information is included, review the document for accuracy. Make sure that all details are correct, including client information, service descriptions, and payment amounts. Once everything is verified, you can either print or email the document to the client, depending on your preferred method of communication.

By following these simple steps, you can create a well-organized and professional document that will help ensure smooth financial transactions and maintain clear communication with your clients.

Customizing Your Billing Document

To make your financial records stand out and align with your business needs, it’s important to customize the structure you use for all transactions. Personalizing these documents allows you to maintain brand consistency, ensure clarity for clients, and make sure that all relevant details are included. Customization can be done easily to match the specific services you provide and the way you interact with clients.

Essential Customization Options

When adapting your billing document, focus on several key areas to enhance professionalism and ensure the document serves your business goals.

- Branding Elements

- Add your company logo, color scheme, and font choices to make the document reflect your business identity.

- Ensure that your business name and contact details are prominently displayed at the top.

- Service Categories

- Customize the sections for listing services to suit the type of work you perform.

- Include specific descriptions, quantities, and unit prices for each service rendered.

- Payment Terms and Methods

- Adjust the payment terms to include information on discounts, late fees, or installment options.

- Specify available payment methods such as credit card, bank transfer, or check.

Additional Features for Personalization

For further customization, consider adding a personalized message or a thank-you note at the bottom of the document. This small touch can make a big difference in client relations, leaving a lasting positive impression. You can also include a section for notes or special instructions to cover any additional agreements or customized work.

- Client-specific Adjustments: If necessary, tailor each document with unique terms or services to meet the individual needs of your clients.

- Flexibility: Keep the layout and sections flexible to allow easy edits for future jobs, ensuring every document is accurate and specific to the task at hand.

Customizing your billing records can greatly improve your communication with clients, ensure accuracy, and enhance your business’s professional appearance.

Common Mistakes in Billing Documents

Even with a well-structured format, mistakes in financial documents can happen. These errors can lead to confusion, delayed payments, or even disputes with clients. Identifying and avoiding common pitfalls will help ensure your records are clear, professional, and effective in collecting payments promptly.

Typical Errors to Avoid

Here are some of the most frequent mistakes businesses make when creating financial documents for clients:

- Missing Contact Information

- Omitting or incorrectly listing contact details for either party can create confusion and make it difficult for clients to reach out if needed.

- Always double-check the accuracy of both your and your client’s contact information.

- Unclear Service Descriptions

- Being vague about what services were provided can lead to misunderstandings regarding the charges.

- Provide clear, detailed descriptions of each task or item, along with any relevant quantities and rates.

- Incorrect Pricing

- Entering the wrong pricing or failing to calculate totals correctly is a common mistake that can result in lost revenue or client disputes.

- Double-check all calculations, including taxes, discounts, and additional fees, to ensure they are accurate.

- Omitting Payment Terms

- Failure to clearly state payment terms, such as the due date or penalties for late payments, can create confusion about when payment is expected.

- Be specific about the payment methods, deadlines, and any other relevant terms to avoid delays or misunderstandings.

How to Avoid These Mistakes

To prevent errors, always review your financial records before sending them out. Consider using an automated tool or pre-designed format that ensures all fields are filled out correctly. Additionally, keep a checklist to verify that each essential element is included and accurate before finalizing the document.

- Review Details: Always check contact information, service descriptions, and pricing before submitting the document.

- Use Templates: Leverage pre-made layouts that guide you through the necessary sections, reducing the likelihood of missing key elements.

- Seek Feedback: Having a colleague or team member review your documents can catch errors you might overlook.

By taking extra care and following best practices, you can ensure that your financial records are error-free, leading to smoother transactions and stronger

How to Format Billing Documents Properly

Properly formatting your financial documents is key to ensuring they are professional, easy to read, and clear to clients. A well-structured layout not only helps clients quickly understand the charges but also reflects positively on your business. Following a logical format improves clarity, reduces errors, and ensures all necessary information is included in the document.

Essential Formatting Guidelines

Here are some important steps to follow when formatting your billing documents:

- Use a Clear Header

- Start with your company name, logo, and contact details at the top of the document.

- Include the client’s name and contact information below your business details to clearly distinguish the recipient.

- Provide a Unique Reference Number

- Include a unique identifier for each document to track and organize records easily.

- Ensure the reference number is placed prominently near the top of the page.

- List Services Clearly

- Each service or item should be listed in a separate row, with a brief description, quantity, rate, and total cost.

- Organize services by type, grouping similar tasks together to maintain clarity.

- Specify Payment Terms

- Ensure that the payment due date, accepted methods of payment, and any additional charges are clearly stated.

- If applicable, include any late fees or discount offers.

Additional Formatting Tips

To enhance the readability and professionalism of your financial documents, consider the following tips:

- Keep It Simple: Use a clean, straightforward layout without excessive decoration or clutter. White space makes the document easier to read.

- Use Consistent Fonts: Stick to one or two easy-to-read fonts. Ensure that the font size is legible and consistent throughout the document.

- Organize Financial Information: Ensure totals, taxes, and discounts are clearly displayed at the bottom of the document, with a final amount due prominently highlighted.

- Check Alignment: Proper alignment of text, columns, and numbers is essential for a professional appearance and to avoid confusion.

By following these formatting guidelines, you can create clear and professional records that make it easier for both you and your clients to understand the financial terms of each transaction.

Legal Requirements for Billing Documents

When creating financial documents for your services, it’s important to understand the legal requirements that must be met to ensure compliance with local tax laws and business regulations. These requirements help establish a clear record of transactions, ensure that both you and your clients are protected, and facilitate tax reporting. While the specifics can vary by region or country, there are several key elements that should always be included in a proper billing document.

One of the primary legal considerations is the inclusion of essential details that provide proof of the transaction. These details typically include the names and addresses of both the service provider and the client, as well as the date the services were rendered and the date of the document itself. Furthermore, accurate and complete information regarding the services provided, including descriptions, rates, and quantities, is crucial for transparency and avoiding future disputes.

Additional Legal Elements that should be incorporated into your financial documents include:

- Tax Information: If applicable, include tax identification numbers, VAT (value-added tax) numbers, and a clear breakdown of taxes charged. This is particularly important for businesses that operate internationally or in regions with specific tax laws.

- Clear Payment Terms: Specify when the payment is due, the acceptable payment methods, and any penalties for late payment. Clear terms help avoid misunderstandings and provide a legal framework for enforcing payment.

- Business Registration Details: Depending on your location, you may need to include your business registration number or license information on the document to demonstrate that you are a legally registered entity.

- Refund or Return Policies: In some cases, you may need to include a statement about the business’s refund or return policy, particularly if the transaction involves goods or specific services that have return conditions.

Understanding and adhering to these legal requirements not only helps ensure compliance but also provides you with protection in the event of a dispute. By maintaining well-documented, legally compliant financial records, you build trust with clients and strengthen the legitimacy of your business.

Automating Your Billing Process

Automating your financial documentation process can save you significant time and effort, especially when dealing with recurring tasks like generating and sending payment requests. By leveraging modern tools and software, you can streamline the process, reduce human error, and ensure consistency across all your transactions. Automation also allows you to focus more on delivering quality services rather than getting bogged down in administrative work.

There are a variety of software tools available today that can help automate the creation and management of financial records. These tools can help you generate documents with pre-filled details, track payments, and even send reminders when payments are due. Additionally, automating the process allows you to quickly generate professional and accurate records without manually inputting data for each client.

Benefits of Automating Your Process

| Benefit | Explanation |

|---|---|

| Time Savings | Automation eliminates the need to manually create each document, allowing you to focus on more important tasks. |

| Consistency | With automation, you ensure that all your records follow the same format and include all necessary information. |

| Accuracy | By reducing human input, automation minimizes the risk of errors in calculations, client details, or payment terms. |

| Tracking and Reporting | Automated systems can easily track payments, create reports, and remind clients about outstanding balances. |

How to Get Started with Automation

To begin automating your financial document creation process, follow these steps:

- Choose the Right Software: There are many options available, ranging from simple invoice generators to comprehensive accounting software that integrates with your payment systems.

- Set Up Templates: Customize your automated records to include all the necessary fields such as client details, services, payment terms, and tax calculations.

- Integrate with Your Payment System: Connect your automation tool to your payment gateway to track payments and issue receipts or reminders automatically.

- Schedule Reminders: Set up automated reminders for clients to ensure timely payments and reduce late fees.

By automating your billing process, you can increase efficiency, reduce administrative workload, and improve your overall client experience. With the right tools in place, financial document management becomes a streamlined, hassle-free process.

How to Include Taxes in Your Billing Document

Incorporating taxes into your financial records is an essential step to ensure compliance with local laws and provide clear transparency for both you and your clients. Whether you are charging sales tax, VAT, or other forms of tax, it’s important to show these calculations clearly to avoid confusion or disputes later on. Properly displaying tax information not only ensures legal compliance but also builds trust with your clients.

The process of including taxes starts with determining the appropriate tax rate based on your location and the services or products you are providing. After that, it’s crucial to list the tax amount separately, so clients can see exactly how it impacts the total cost. Here are some key steps to help you integrate tax details effectively:

Steps to Include Taxes

- Identify the Tax Rate: Research the correct tax rate for your business based on your location and the nature of the service provided. This rate can vary depending on the country, state, or region.

- Apply the Tax Rate: Once you have the correct rate, multiply the cost of services or products by the tax rate to calculate the total tax due.

- Separate the Tax Amount: List the tax amount as a separate line item on the document to ensure the client can clearly see the breakdown of the total cost. For example, list the “Subtotal” and then add a line for the “Tax” amount before showing the “Total Due.”

- Show Total Cost: Add the tax amount to the subtotal to display the final total due from the client.

Example of Tax Breakdown

| Description | Amount |

|---|---|

| Service A | $500.00 |

| Service B | $300.00 |

| Subtotal | $800.00 |

| Sales Tax (8%) | $64.00 |

| Total Due | $864.00 |

By clearly itemizing taxes in this manner, you provide a transparent and professional document that makes it easier for clients to understand the breakdown of costs and reduces the likelihood of confusion. It’s also important to keep in mind that tax laws may vary by region, so always stay updated on local tax regulations to ensure your documents are accurate and compliant.

Tracking Payments with Billing Documents

Properly tracking payments is crucial for maintaining accurate financial records and ensuring smooth cash flow. Whether you are managing a small business or handling a large number of clients, keeping track of outstanding balances and payments made can save you time and prevent misunderstandings. By integrating payment tracking into your billing system, you can easily monitor which transactions are complete and which are pending.

There are several key elements to include in your financial records to track payments effectively. These include recording the payment status, payment date, and the method of payment used. Additionally, you should have a clear process for following up with clients whose payments are overdue. Below is an example of how payment tracking might be structured in your records:

Payment Tracking Example

| Client Name | Amount Due | Payment Date | Payment Status | Payment Method |

|---|---|---|---|---|

| John Doe | $500.00 | 10/10/2024 | Paid | Credit Card |

| Jane Smith | $300.00 | Pending | Unpaid | Bank Transfer |

| Robert Brown | $700.00 | 10/15/2024 | Paid | Check |

In this example, payment statuses such as “Paid” and “Unpaid” are clearly marked, allowing you to quickly identify which transactions still require action. Additionally, the payment method used is noted, making it easier to reconcile payments with your financial accounts.

To further streamline the process, consider using digital tools or software that automate payment tracking. These tools can automatically update the payment status when a transaction is completed, reducing the chances of missing or incorrect entries. Furthermore, automated reminders can be sent to clients whose payments are overdue, helping to keep the payment process on track.

By keeping a detailed record of payments and updating your billing documents regularly, you can maintain a clear overview of your business’s financial health and ensure prompt payment collection from your clients.

Best Tools for Billing Document Creation

Choosing the right tools for creating professional billing documents can greatly improve your workflow, ensuring that your financial records are accurate, consistent, and easy to manage. Whether you’re a small business owner or an independent contractor, having access to efficient and reliable tools is crucial for streamlining your administrative tasks. These tools can help you design, send, and track payments for your records, all while saving time and reducing errors.

There are a variety of options available to help you create and customize billing documents. Some tools offer pre-designed formats, while others allow for complete customization. Depending on your needs, you might want a tool that integrates with your accounting software, automates reminders, or simply helps you generate professional-looking documents quickly. Below are some of the best tools to consider:

Top Tools for Efficient Billing Management

- QuickBooks: QuickBooks is a well-known accounting software that offers customizable financial document creation. With features for invoicing, tracking payments, and managing taxes, it’s an all-in-one solution for small businesses.

- FreshBooks: FreshBooks is ideal for freelancers and small businesses. It simplifies the process of creating professional-looking records, managing expenses, and tracking time spent on client work.

- Zoho Books: Zoho Books is a versatile tool for businesses of all sizes. It allows for the creation of professional documents, automates payment reminders, and integrates seamlessly with other Zoho applications.

- Wave: Wave is a free software that offers a straightforward solution for invoicing and accounting. It’s a great option for small businesses looking for a simple yet effective tool to manage billing and payments.

- Microsoft Word/Excel: For those who prefer a more hands-on approach, Microsoft Word and Excel provide customizable templates that can be tailored to your specific needs. These tools are easy to use and offer flexibility for creating basic records.

How to Choose the Right Tool

When selecting a tool for creating your financial documents, consider the following factors:

- Ease of Use: The tool should be user-friendly, even for beginners. Look for tools with drag-and-drop features or simple templates.

- Customization Options: If you want to add your company logo, change fonts, or modify the layout, ensure the tool allows for customization.

- Integration with Accounting Software: For more advanced features, select a tool that integrates with your existing accounting or financial management software.

- Cost: Some tools offer free versions, while others have premium plans with more features. Choose one that fits your budget and needs.

By selecting the right tool for creating your billing documents, you can streamline your operations, improve accuracy, and maintain professionalism with your clients.

How to Send Billing Documents to Clients

Sending billing documents to clients is a critical step in the payment process. It’s essential to ensure that the document reaches your clients in a timely and professional manner to avoid delays in payment. With the right approach, you can streamline communication, maintain a professional image, and make it easy for your clients to settle their balances.

There are various ways to send billing documents, ranging from traditional methods like postal mail to digital solutions that offer faster and more efficient delivery. Regardless of the method you choose, it’s important to ensure that the document is clear, easy to understand, and includes all necessary payment details.

Methods of Sending Billing Documents

- Email: Sending documents via email is the most common and efficient method. You can attach the document as a PDF file and send it directly to the client’s email address. This method allows you to track delivery and follow up if needed.

- Postal Mail: While less common today, mailing physical documents is still an option, especially for clients who prefer hard copies. Ensure you use reliable postal services to guarantee timely delivery.

- Online Platforms: Many businesses use platforms like PayPal, Stripe, or accounting software like QuickBooks or FreshBooks to send digital documents directly to clients. These platforms often allow clients to pay directly from the document, making the payment process seamless.

- Client Portals: Some businesses set up secure client portals where clients can access and download their billing documents. This method adds an extra layer of security and can be useful for managing multiple clients.

Best Practices for Sending Billing Documents

When sending billing documents, follow these best practices to ensure professionalism and avoid confusion:

- Double-Check the Document: Before sending, ensure all the details are correct, including the amount due, payment terms, and client information.

- Clear Subject Line: When emailing the document, use a clear subject line, such as “Billing Statement for [Service Name] – [Client Name]” to make it easy for the client to recognize the purpose of the email.

- Include Payment Instructions: Always provide clear instructions on how the client can pay. If applicable, include payment links or account details.

- Track Delivery: Use tracking features when sending documents via email or online platforms to monitor whether the client has received the document.

By following these guidelines, you can ensure that your billing documents are sent securely and professionally, making the payment process smoother for both you and your clients.

Storing and Organizing Billing Documents

Efficient storage and organization of financial records are essential for any business. Properly managing your documents ensures that you can quickly retrieve them when needed, maintain compliance with tax regulations, and streamline your accounting processes. Whether you’re keeping digital or physical records, the key is to establish a system that is both secure and easy to navigate.

With the increasing shift towards digital tools, many businesses now store and organize their billing documents electronically. Digital storage offers many advantages, such as easy retrieval, backup options, and the ability to share documents with clients or colleagues. However, some businesses still prefer physical copies or use a combination of both methods. Regardless of the storage method, it’s important to set clear practices to keep everything in order.

Methods for Storing and Organizing Documents

- Cloud Storage: Using cloud-based storage solutions like Google Drive, Dropbox, or OneDrive is a popular and efficient way to store your financial records. Cloud storage allows you to access your documents from anywhere and ensures they are securely backed up.

- Accounting Software: Many businesses use accounting software like QuickBooks, FreshBooks, or Xero, which automatically stores billing records and organizes them by client, date, or project. These tools often include search functions and reporting features for easy access to specific records.

- Physical Filing Systems: For businesses that still prefer physical records, it’s important to have a well-organized filing system. Use labeled folders or filing cabinets to store documents by date, client, or project type. Ensure the storage area is secure and protected from damage.

- Automated Document Management Systems: Automated systems like DocuSign or Adobe Sign can help manage both the storage and the signing process of documents. These tools often integrate with cloud storage solutions, offering a seamless way to store and organize electronic copies of your documents.

Best Practices for Organizing Financial Records

- Consistency: Establish a consistent naming convention and categorization system for your documents. This makes it easier to search and find specific files when needed.

- Security: Whether you store documents digitally or physically, ensure that they are kept secure. Use password protection for digital files and locked filing cabinets for physical records to prevent unauthorized access.

- Regular Backups: Regularly back up your digital files to ensure you don’t lose important records. Consider using automated backup systems for added security.

- Compliance: Keep in mind any legal or tax requirements for record retention. Depending on your location and industry, you may be required to keep certain documents for a specified number of years.

By adopting the right storage and organization methods, you can impro

Free vs Paid Billing Document Options

When it comes to creating professional documents for your business, you have the option of choosing between free and paid solutions. Each option comes with its own set of benefits and drawbacks, depending on the needs of your business and your desired level of customization. Understanding the key differences between free and paid tools can help you make an informed decision about which option is best suited for your requirements.

Free solutions are often appealing due to their zero cost, making them ideal for small businesses or startups with limited budgets. However, these tools might come with limitations in terms of design flexibility, features, and support. On the other hand, paid solutions typically offer more advanced features, greater customization, and customer support, but they often come with a subscription or one-time fee.

Benefits of Free Solutions

- No Cost: Free tools require no financial investment, which makes them an excellent choice for businesses just starting out or those with tight budgets.

- Basic Functionality: Free options often include basic templates that can be easily customized with your company’s details, offering simple but effective solutions for small-scale operations.

- Ease of Use: Many free tools are user-friendly and don’t require extensive experience, making them accessible to entrepreneurs without a technical background.

- Quick Access: Free tools can often be accessed instantly without any subscription process, allowing you to create documents as needed without delay.

Benefits of Paid Solutions

- Advanced Features: Paid tools generally offer additional features such as advanced customization options, better design flexibility, and integration with accounting software or payment platforms.

- Professional Designs: These solutions often include high-quality, polished designs that can make your billing documents look more professional and well-branded.

- Customer Support: With paid options, you often gain access to customer support services, which can be crucial if you run into issues or need assistance with advanced features.

- Automation and Integration: Paid solutions may include automation tools for reminders, recurring billing, or integration with your financial software to streamline your workflow.

Ultimately, the decision between free and paid options depends on your business’s specific needs. If you’re just starting out and need a simple solution, a free tool may be sufficient. However, as your business grows and you need more advanced features and support, a paid option might be worth the investment for greater efficiency and professionalism.

Improving Client Relationships with Billing Documents

Effective communication with clients extends beyond the services you provide; it also involves how you manage administrative tasks, such as sending billing documents. By ensuring that your documents are clear, professional, and delivered on time, you can create a positive experience that strengthens your relationship with clients. A well-structured financial document can build trust, demonstrate transparency, and contribute to smoother business transactions.

While billing documents are often seen as simple transactional tools, they present an opportunity to engage with your clients in a meaningful way. By including personalized messages, offering flexible payment options, and ensuring your records are easily understandable, you can enhance client satisfaction and foster long-term partnerships. Clear communication through your financial documents can also help avoid misunderstandings and disputes.

Key Ways Billing Documents Can Strengthen Client Relationships

- Clarity and Transparency: Clear, concise billing documents that break down services and costs help avoid confusion and build trust. Clients appreciate transparency, knowing exactly what they’re paying for.

- Professionalism: A well-designed billing document reflects your business’s professionalism. It reassures clients that you pay attention to detail, not only in the services you provide but also in how you manage financial transactions.

- Timeliness: Sending your financial records promptly shows respect for your client’s time and helps them budget and plan their own finances. Consistency in sending timely documents contributes to a reliable business image.

- Personalization: Including personalized notes, such as thanking your clients for their business or offering discounts for prompt payment, can make a positive impact. It shows clients that you value their partnership beyond just the monetary transaction.

How Timely Payments Can Enhance Client Loyalty

Clients are more likely to remain loyal to businesses that provide efficient and hassle-free billing experiences. Offering clear payment terms, multiple payment options, and automated reminders can reduce late payments, preventing unnecessary tension in client relationships. Additionally, being flexible in terms of payment plans, where applicable, demonstrates understanding and can foster a more collaborative relationship.

Ultimately, the way you handle billing plays a significant role in shaping the client’s overall experience. By making your financial documents a tool for building trust and providing a positive, professional impression, you can improve the quality of your relationships with clients and promote long-term success.