Gst Tax Invoice Template for Your Business

In every business transaction, it’s crucial to maintain accurate and organized records of sales and purchases. Properly formatted billing documents are an essential part of this process, ensuring that all necessary details are included and easily accessible for both the business and its clients. These documents play a significant role in financial management, tax reporting, and legal compliance.

Understanding how to create effective billing forms can help streamline your operations and avoid common errors that could result in financial discrepancies. By utilizing well-structured forms, businesses can minimize the risk of mistakes, improve the efficiency of their accounting processes, and ensure that they meet the regulatory standards required by authorities.

This guide provides a detailed look at creating and customizing billing forms, covering essential elements, best practices, and tips for tailoring them to suit your specific needs. Whether you’re managing a small business or working in a larger enterprise, mastering the art of crafting clear and precise billing documents is key to smooth and successful transactions.

Complete Guide to GST Tax Invoices

In any business, properly documenting financial transactions is essential. These records not only ensure clarity and transparency but also assist in regulatory compliance. When managing payments and receipts, it’s important to create well-organized documents that contain all the required information for both the business and its clients. This section covers everything you need to know about crafting such records, from essential components to formatting guidelines.

Key Components of a Proper Billing Document

When preparing a financial record, certain details must be included to ensure that the document is complete and legally compliant. These elements include:

- Seller’s Information: Business name, address, and contact details.

- Buyer’s Information: Customer name, address, and contact details.

- Unique Document Number: A serial number to differentiate each document.

- Date of Transaction: The specific date when the goods or services were exchanged.

- Description of Goods or Services: A clear breakdown of what was provided.

- Total Amount: The total cost, including any applicable fees.

Benefits of Using Well-Structured Documents

Utilizing properly formatted records provides numerous advantages for both businesses and clients:

- Legal Protection: Ensures that all transactions are documented and can be referenced in case of disputes.

- Improved Financial Management: Helps businesses track income and expenses accurately.

- Tax Compliance: Ensures that all necessary details are available for reporting to the relevant authorities.

- Enhanced Professionalism: Clear and organized documentation builds trust with customers.

What is a GST Tax Invoice?

A formal document used in business transactions plays a crucial role in keeping track of the exchange of goods and services between a seller and a buyer. This document provides a detailed account of the transaction, ensuring both parties have a clear record for future reference. It includes essential information such as the items or services provided, the cost, and the applicable charges.

This type of document is not just a receipt; it serves as an official record that can be used for financial reporting, legal purposes, and compliance with local regulations. It outlines the specifics of the transaction, such as the seller’s and buyer’s details, the date of exchange, the payment terms, and any applicable fees. Without this level of documentation, businesses could face difficulties in managing finances or adhering to legal requirements.

In many cases, these records are required for businesses to apply certain benefits or obligations, including reporting to relevant authorities or reclaiming overpaid amounts. Additionally, the document must meet specific standards set by governing bodies, making it a key part of any company’s financial operations.

Importance of GST Compliance for Businesses

Adhering to regulatory requirements is a cornerstone of any successful business. For companies operating in regions with specific financial reporting laws, compliance with these regulations is essential not only for legal reasons but also for maintaining smooth operations. When businesses ensure they meet these standards, they minimize the risk of penalties and safeguard their reputation in the marketplace.

Ensuring Legal Protection and Avoiding Penalties

One of the primary reasons for compliance is to avoid potential fines or legal issues. Governments impose strict guidelines on how businesses should record and report transactions, and failing to comply with these rules can result in significant financial penalties. Regular audits and the proper documentation of sales and purchases help businesses stay on the right side of the law.

Building Trust and Professionalism

For businesses, transparency and trust are critical to establishing strong customer relationships. When companies follow all required procedures and provide clear, accurate records, it enhances their credibility and encourages clients to do business with them. Moreover, businesses that adhere to established standards are seen as more reliable, leading to long-term success and repeat customers.

How to Create a GST Tax Invoice

Creating a detailed financial record is a straightforward process, but it requires attention to key information to ensure accuracy and compliance with regulations. Whether you’re generating a document for goods sold or services rendered, it’s important to include all relevant details in a clear, organized format. By following a few simple steps, businesses can produce professional and legally sound records that are both efficient and effective.

Essential Information to Include

The foundation of any well-structured financial record is the information it contains. To ensure that your document meets all necessary criteria, make sure to include the following details:

- Business Details: Include the name, address, and contact information of both the seller and the buyer.

- Transaction Date: The date when the transaction occurred.

- Unique Document Number: Assign a unique number for each document to avoid confusion.

- Goods or Services Provided: A clear description of what was sold or rendered.

- Cost Breakdown: A detailed list of amounts, including any applicable fees or charges.

- Total Amount: The overall amount due, including all applicable costs and charges.

Formatting Your Document

Once the essential details are included, the next step is to format the document in a professional manner. A well-organized layout will ensure clarity and make it easier for both parties to review the record. Follow these formatting tips:

- Use a Clear Heading: Start with a prominent title that clearly identifies the document.

- Organize by Sections: Break down the document into sections such as ‘Seller Information’, ‘Buyer Information’, ‘Transaction Details’, and ‘Payment Summary’.

- Double Check for Accuracy: Ensure that all amounts and details are correct before finalizing the document.

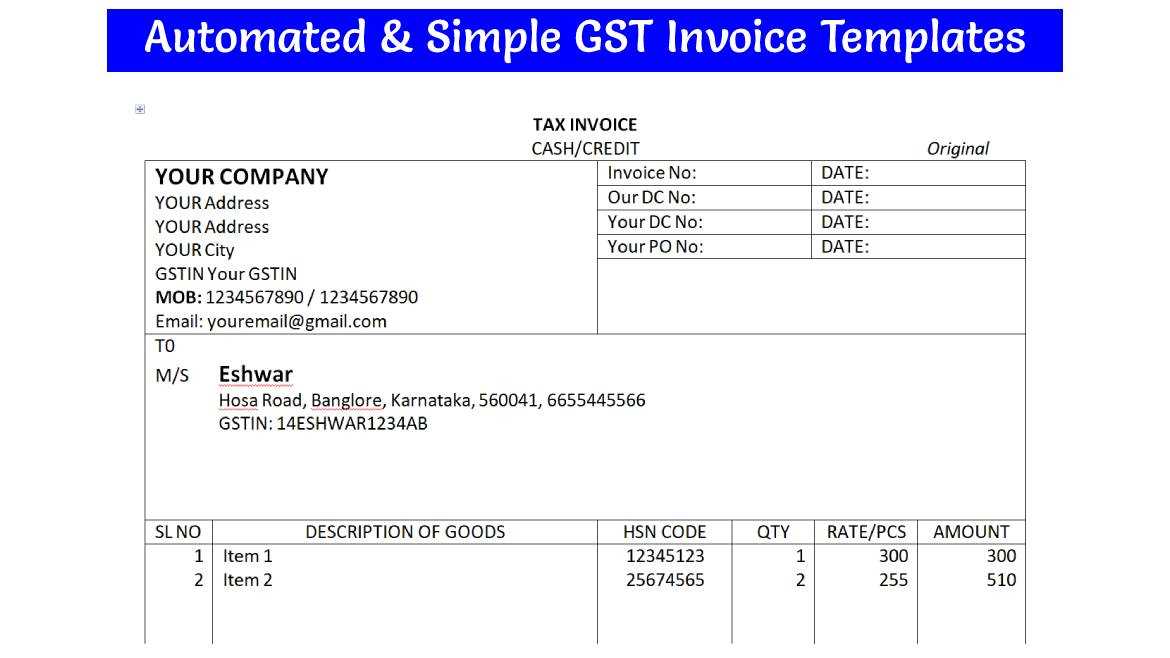

Key Information to Include in GST Invoice

When creating a formal document for a business transaction, it’s crucial to ensure that all necessary information is included. This not only helps in maintaining accurate records but also ensures that the transaction is legally valid. Including the right details in your financial documentation is essential for both tracking payments and ensuring compliance with regulations.

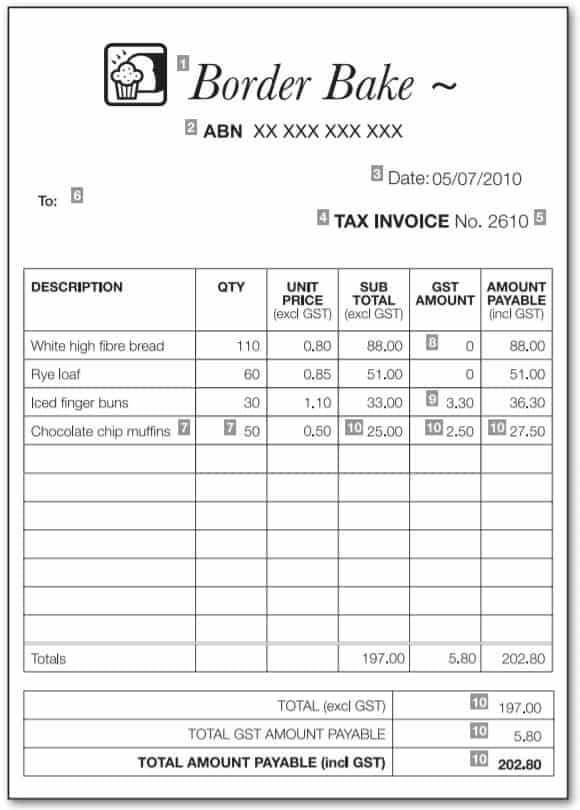

The following table outlines the key components that should be included in every document:

| Component | Description |

|---|---|

| Seller Information | Details such as the business name, address, and contact information of the seller. |

| Buyer Information | Details of the buyer, including name, address, and contact information. |

| Document Number | A unique identifier for each document, ensuring it can be easily tracked. |

| Transaction Date | The date when the goods or services were provided. |

| Items or Services | A detailed description of the goods or services sold, including quantities and individual prices. |

| Total Amount | The final amount payable, including any additional charges or fees. |

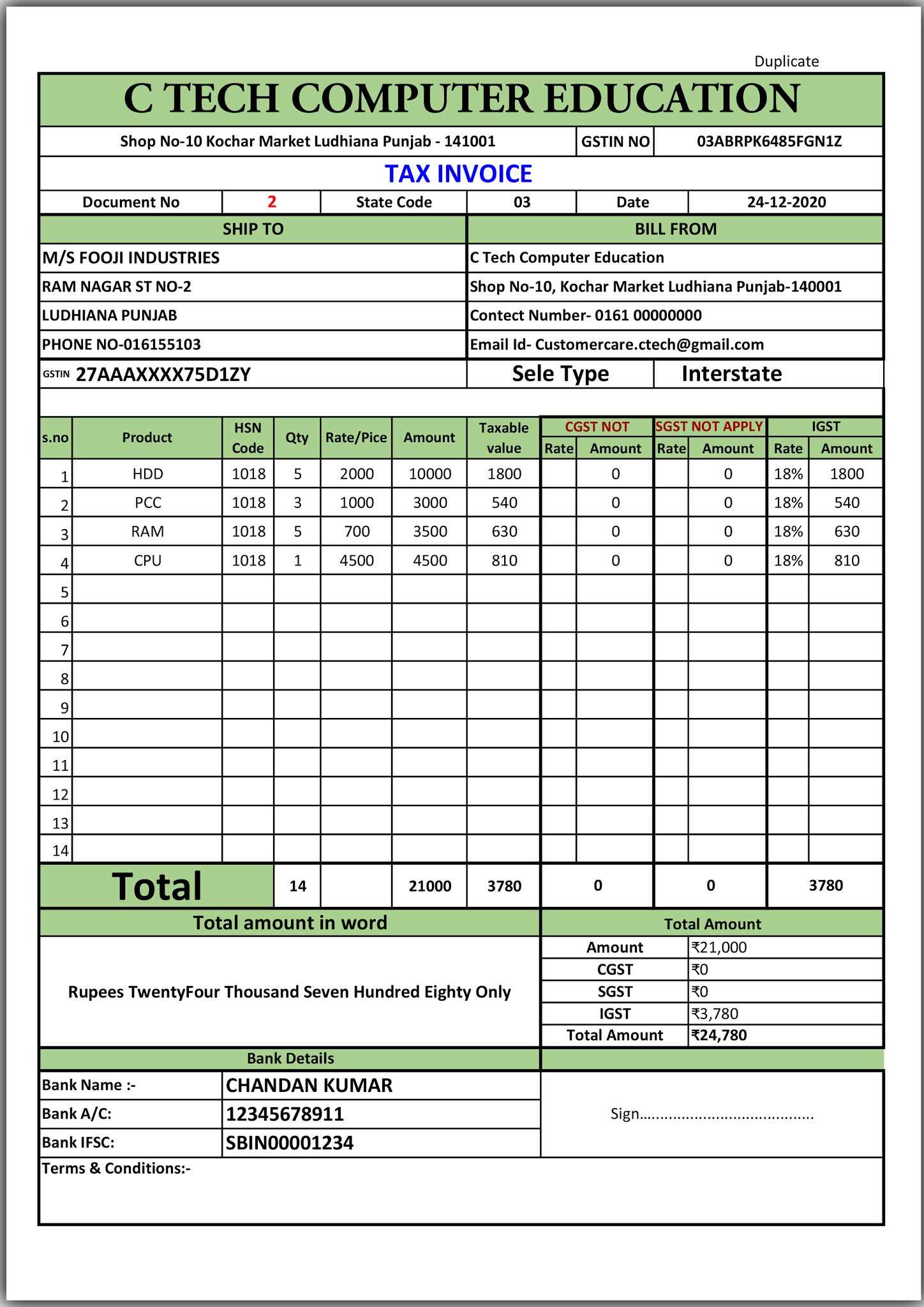

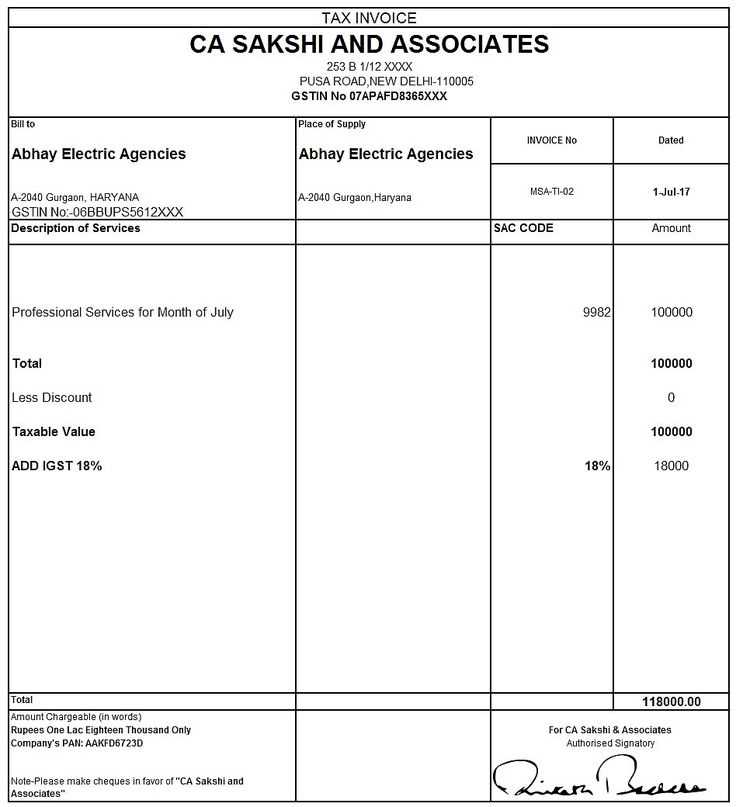

Understanding GST Tax Rates and Invoices

Understanding the applicable rates and charges in business transactions is essential for both businesses and customers. When selling products or services, businesses must apply the correct rates to ensure compliance with the relevant financial laws. This section explains the different types of rates that apply and how they are reflected in formal records of transactions.

Types of Rates to Apply

There are typically several categories of rates that a business may need to use, depending on the product or service provided. The most common rates include:

- Standard Rate: The most commonly applied rate on most goods and services.

- Reduced Rate: A lower rate that applies to certain goods and services, often essential items.

- Zero Rate: Goods and services that are exempt from charges but still require documentation.

- Exempt Items: Products or services that do not incur any charges but need to be clearly stated in records.

How Rates Are Reflected in Financial Records

When creating a formal document for any transaction, it’s important to clearly state the rate applied to each product or service. This not only helps in proper documentation but also ensures transparency for the customer. Key points to include are:

- Rate Applied: Clearly list the percentage or amount of the charge applied to the transaction.

- Breakdown of Charges: Itemize the individual charges to show how the total amount was calculated.

- Total Amount: Provide a summary of the total due after applying the correct rates.

Customizing Your GST Invoice Template

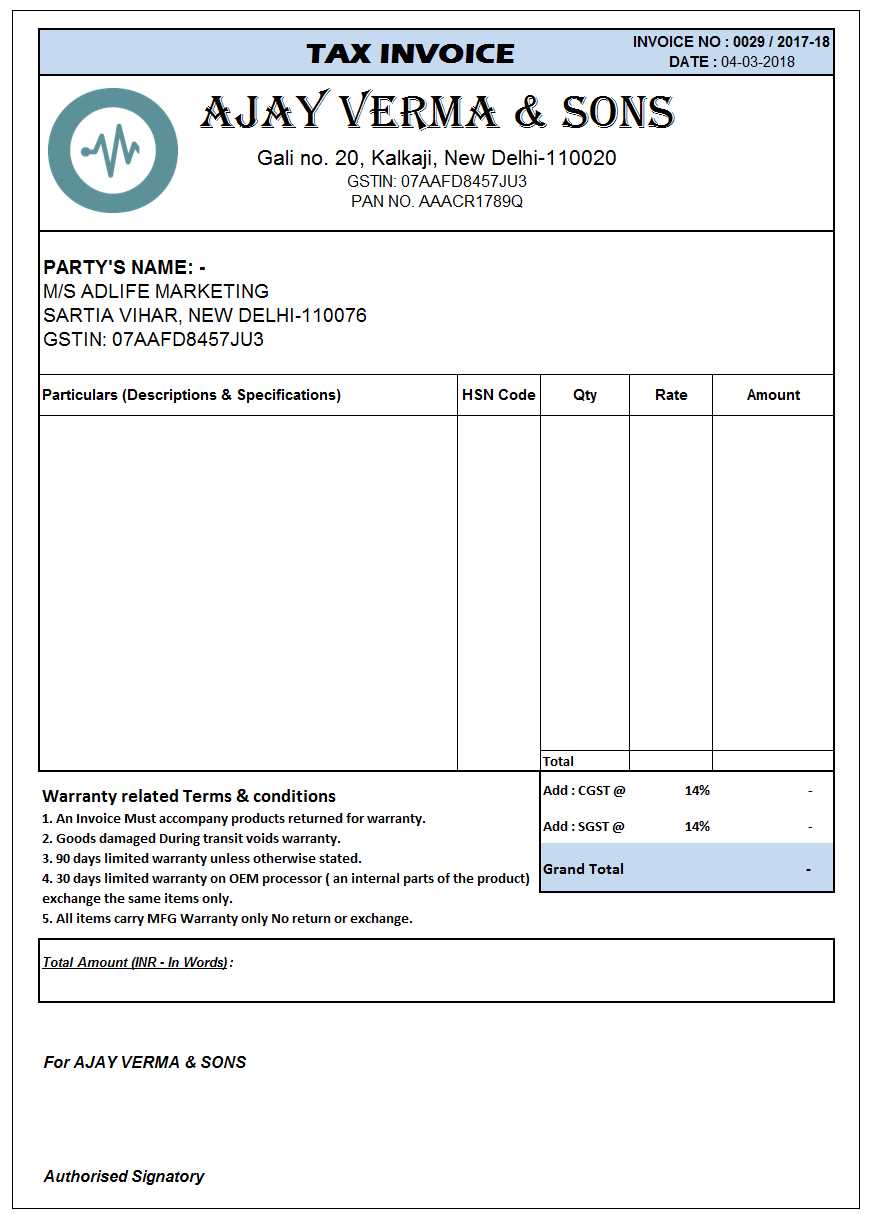

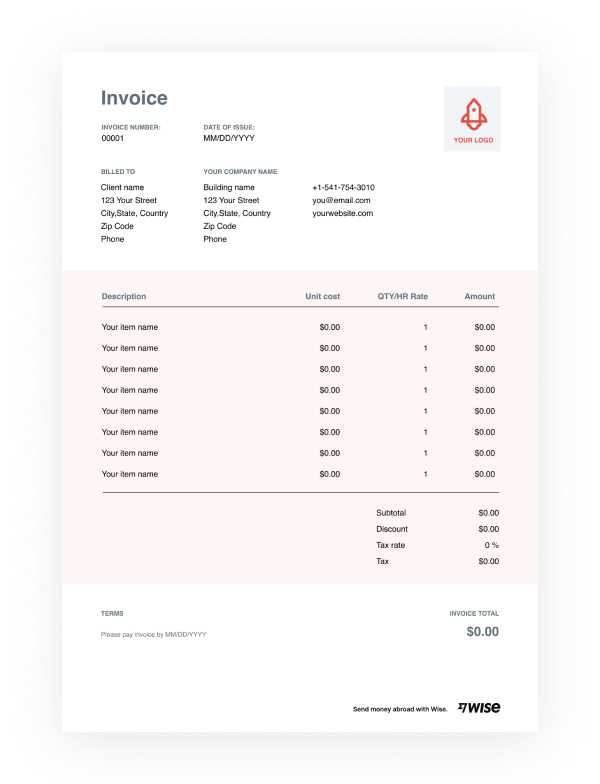

Creating a personalized document for your business transactions allows you to ensure that all necessary information is clearly presented while aligning with your company’s branding. Customizing the layout, design, and details in your financial records not only enhances professionalism but also improves clarity for both your business and clients. This section explores how to customize these documents to suit your specific needs.

Design and Layout Considerations

When customizing your formal business records, it’s essential to focus on clarity and ease of use. A well-structured layout ensures that all key information stands out, making it easy to reference and understand. Consider the following elements:

- Header: Include your business logo, name, and contact information at the top for easy identification.

- Document Number: Assign a unique identifier to each document for proper tracking and organization.

- Clear Sections: Organize the document into clear sections such as ‘Seller Information’, ‘Buyer Information’, and ‘Transaction Details’.

- Bold Important Information: Make key details like the total amount or payment terms stand out to avoid confusion.

Including Customizable Fields

One of the main benefits of customizing your documents is the ability to add fields that are unique to your business or specific transaction. These customizable fields can include:

- Discounts: Apply discounts or promotional offers directly in the document for clear communication.

- Additional Notes: Include any special terms or conditions relevant to the transaction.

- Payment Instructions: Specify how the buyer should make payment, including bank details or other payment methods.

Common Mistakes in GST Invoicing

Even experienced businesses can occasionally make errors when preparing formal transaction records. These mistakes can lead to discrepancies, delays in payments, or legal issues. Being aware of the most common pitfalls helps ensure that your documents are accurate, professional, and compliant with regulations. Below are some of the most frequently encountered mistakes and how to avoid them.

Missing or Incorrect Information

One of the most common issues businesses face is leaving out essential details or providing incorrect information. This can lead to confusion and even disputes. To avoid this, ensure the following:

- Business Details: Make sure both your company’s and the client’s contact information are accurate and complete.

- Transaction Date: Double-check the date to avoid discrepancies in the timing of payments.

- Unique Document Number: Ensure each document has a distinct identifier to avoid duplication.

Incorrect Application of Rates

Applying the wrong rates or failing to include them can result in financial complications or legal penalties. It’s essential to verify that the correct rates are used for different products and services. Common mistakes include:

- Using the Wrong Rate: Ensure the correct rate is applied based on the product type or service provided.

- Missing Discounts or Additional Charges: If discounts or extra charges apply, they must be properly reflected in the total amount.

- Failure to Apply Exemptions: Certain goods and services may be exempt, and this should be clearly stated in your records.

GST Invoices for Small Businesses

For small businesses, preparing accurate financial documents is critical for maintaining proper records and ensuring legal compliance. These records not only help in tracking sales and payments but also play a vital role in managing cash flow, taxes, and overall business operations. Understanding how to generate and manage these essential documents is especially important for businesses that are just starting out or operating on a smaller scale.

Small businesses need to pay particular attention to the structure of their financial records. Unlike larger enterprises that may have dedicated departments for these tasks, small business owners often handle the paperwork themselves. This means they must be aware of the key elements that should be included in each document to avoid errors and ensure smooth operations. By keeping the records well-organized and compliant with the necessary regulations, small business owners can focus more on growing their business and building relationships with clients.

Digital vs. Paper GST Invoices

In today’s business environment, companies have the option to choose between digital and paper records for tracking and documenting transactions. Both methods have their own advantages and challenges, depending on the business size, industry, and specific needs. This section compares the benefits and drawbacks of digital and paper-based documentation to help businesses decide which method works best for them.

While digital records offer convenience and speed, paper documents provide a traditional method that some businesses still prefer for its tangible nature. Understanding the differences between these two options is essential for ensuring efficient and compliant operations.

| Aspect | Digital Records | Paper Records |

|---|---|---|

| Storage | Stored electronically, easy to back up and access remotely. | Physical storage is required, which can take up space and be prone to damage. |

| Access Speed | Quick to access, especially when using software or cloud-based systems. | Slower to access as they require manual retrieval and organization. |

| Cost | Minimal ongoing costs after initial setup, often free for basic digital solutions. | Costs associated with paper, printing, and physical storage space. |

| Environmental Impact | More eco-friendly, reduces paper waste. | Higher environmental impact due to paper consumption and waste. |

| Compliance and Security | Can be easily encrypted and backed up, ensuring data security and regulatory compliance. | Vulnerable to damage (e.g., fire, water) and difficult to protect from unauthorized access. |

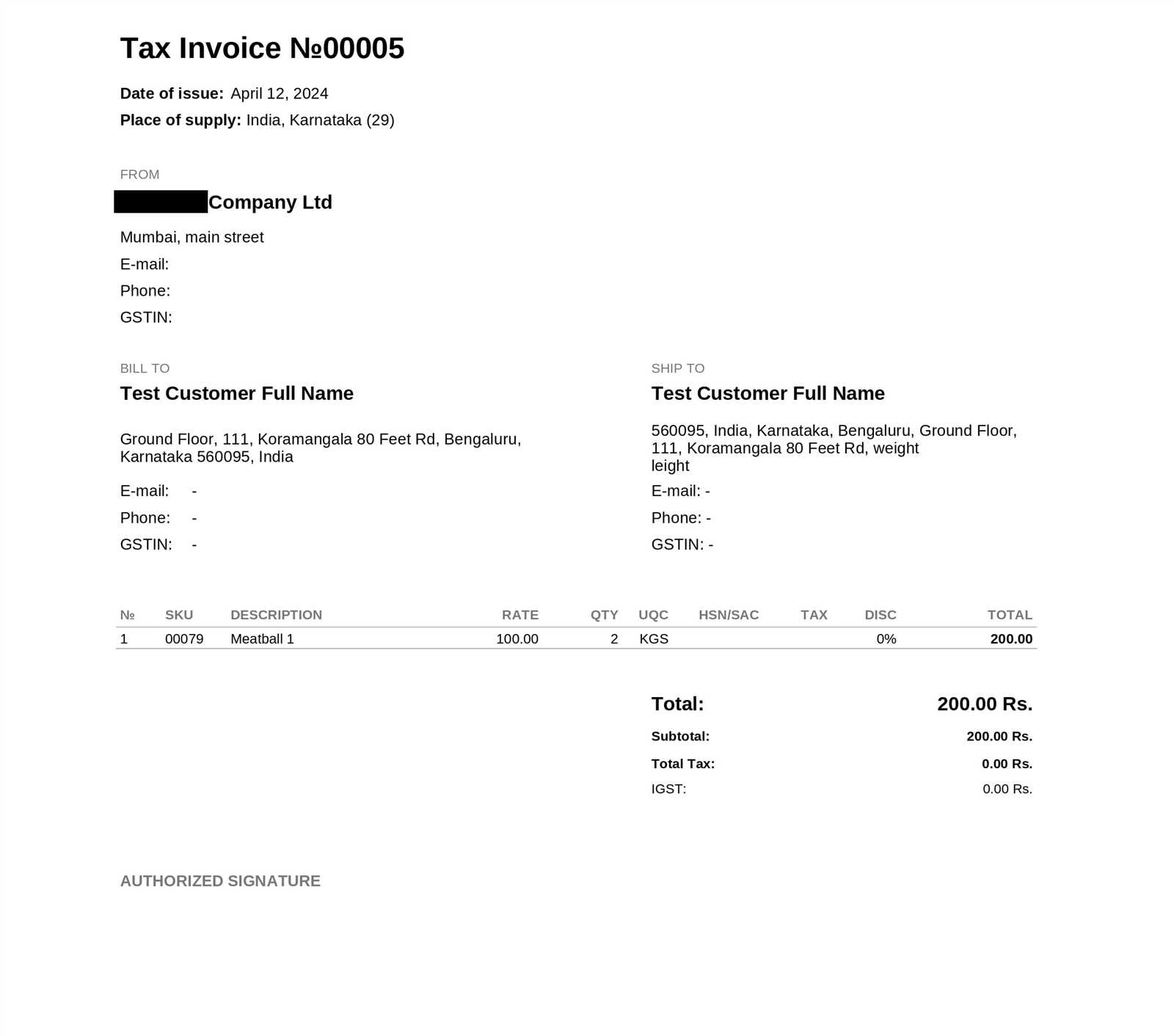

GST Invoice Requirements for Service Providers

Service providers, like other businesses, must adhere to specific guidelines when documenting their transactions. Properly structuring these formal records ensures compliance with regulations and provides clarity for both parties involved. Whether offering consulting, maintenance, or other services, ensuring that all required details are included is essential for maintaining transparent and accurate financial records.

Unlike product-based businesses, service providers face unique challenges when it comes to documenting their work. The nature of services–often intangible and ongoing–means that details such as the scope of work, service duration, and payment terms must be clearly outlined. The following key elements should always be included in service-related financial documents:

- Service Description: Clearly outline the type of service provided, including any relevant details about the scope or nature of the work.

- Payment Terms: Specify the agreed-upon payment schedule, including due dates, installment amounts, and any applicable discounts or penalties for late payment.

- Client Information: Include the full details of the client, such as their name, address, and contact information.

- Date of Service: Clearly indicate the date when the service was rendered or completed, particularly for ongoing services.

- Amount and Pricing: Provide a detailed breakdown of the charges for services rendered, including any applicable fees or charges.

How to Track GST Invoices for Tax Filing

Properly tracking formal transaction records is essential for businesses to stay organized and compliant, especially when it comes time for tax filing. By ensuring that each transaction is documented correctly, businesses can accurately report their income and expenses. This process becomes more streamlined when a clear tracking system is in place. Below, we’ll explore effective methods for organizing and tracking your financial documents to make tax filing easier.

Establish a Record-Keeping System

The first step in tracking your financial documents is to create a system for record-keeping. This system should categorize your transactions and be easy to reference during filing periods. Options for record-keeping include physical files, spreadsheets, or specialized software. Here’s what should be included in your record-keeping system:

- Chronological Order: Arrange documents by date to easily locate transactions for a specific period.

- Document Classification: Sort records by type–whether they are sales, purchases, or returns–to simplify reference and filing.

- Digital Backups: Ensure all physical records are scanned and backed up digitally to avoid loss or damage.

Use Software Tools for Automation

Many businesses now use software solutions to automate record tracking. These tools can streamline the entire process, from capturing transaction data to generating reports. Some software features include:

- Real-Time Data Entry: Automatically input sales and purchases into the system to reduce errors and time spent manually entering data.

- Tax Calculation: Tools can automatically calculate applicable rates and assist in tracking deductions for accurate reporting.

- Reporting Functions: Software can generate reports based on the information gathered, helping businesses compile the necessary details for tax filing.

| Method | Advantages | Challenges | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Physical Records | Simple, no technical skills required | Space-consuming, susceptible to damage or loss | ||||||||||||||||||||||

| Spreadsheets | Easy to use and manage, customizable | Prone to human error, requires manual data entry | ||||||||||||||||||||||

| Software Solutions | Automates data entry, tracks transactions in real-time | May involve setup costs, requires ong

GST Invoice Template for RetailersFor retailers, accurately documenting sales transactions is crucial for both compliance and record-keeping. A well-structured record helps ensure that all necessary details are captured, making it easier to track purchases, sales, and overall financial performance. Retailers can streamline their processes by adopting a format that clearly presents all relevant transaction information. When designing a record for retail transactions, the key is to include comprehensive information that covers the sale details, client information, and payment terms. This ensures transparency and facilitates easy access to data when needed, especially during audits or reporting. Below are the essential elements that should be present in a sales record for retailers:

Additionally, using an organized approach to maintaining these records helps ensure that retailers can quickly retrieve information when needed for financial audits or reporting. Implementing digital solutions or manual record books can be effective, as long as they maintain consistency and accuracy. Integrating GST Invoices into Accounting SystemsEfficiently incorporating transaction records into an accounting system is crucial for businesses aiming to streamline their financial management. By seamlessly integrating sales and purchase documentation into the accounting software, companies can automate data entry, reduce errors, and improve overall reporting accuracy. This process not only simplifies the workflow but also enhances compliance and ensures that financial statements are up to date. The key to successful integration lies in choosing the right software and ensuring that all necessary fields are mapped correctly from the transaction document to the accounting system. This allows for automated updates to sales ledgers, customer balances, and financial statements, saving time and reducing the risk of mistakes.

By integrating sales and purchase documentation into your accounting system, businesses can not only ensure accuracy and efficiency but also gain valuable insights into their financial performance. With automation in place, companies can focus on growing their business while staying compliant with financial regulations. Frequently Asked Questions about GST InvoicesMany businesses have questions about how to properly document and manage sales transactions. Understanding the requirements and best practices can help ensure compliance and smooth operations. Below, we answer some of the most commonly asked questions to clarify the process and make it easier to manage financial records. What Information Should Be Included in a Transaction Record?A complete transaction record should include the following details:

How Long Should Transaction Records Be Kept?It’s important to keep records for the legal duration required by the tax authority, usually 5-7 years. This helps ensure compliance and provides a reference in case of audits. Additionally, having these records readily available can simplify annual accounting and help avoid penalties. Can Digital Records Be Used Instead of Paper?

Yes, digital records are increasingly accepted and often recommended due to their ease of management and storage. Many businesses use accounting software to generate and store electronic copies of transaction records, which can be easily retrieved when needed. By understanding these common questions and implementing best practices, businesses can improve their financial record-keeping and ensure they remain compliant with regulations. Best Practices for GST InvoicingProperly documenting transactions is essential for businesses to maintain clear records, ensure compliance, and avoid costly mistakes. Following best practices can streamline the process, minimize errors, and help you stay organized when managing your financial transactions. Here, we discuss some key tips to follow when issuing transaction records for your business. Essential Elements to IncludeFor a smooth and efficient process, ensure that every transaction record includes the following critical details:

Utilizing Technology for EfficiencyUsing accounting software can significantly reduce human error and increase efficiency. By automating the creation and storage of records, businesses can save time and ensure accuracy. Additionally, digital records are easier to track and can be easily accessed for reporting or audit purposes. Many software programs also allow integration with other business management tools, providing a more holistic approach to financial documentation. Adopting these best practices will not only improve your record-keeping process but also help you avoid common mistakes that can lead to financial discrepancies. Whether you are managing a small business or a large enterprise, staying organized and compliant is key to long-term success. |