GST Invoice Templates for Efficient and Accurate Billing

Accurate and professional billing is a crucial part of managing any business, ensuring smooth transactions and compliance with tax regulations. Having the right system in place can help businesses maintain transparency and avoid costly errors. A well-structured document plays a vital role in delivering clear and consistent records for all financial exchanges.

When it comes to creating these records, having a customizable structure can save time and enhance efficiency. The right design not only simplifies the process but also ensures that all necessary details are included, making it easier for both businesses and clients to understand. This approach improves overall business operations and strengthens customer trust.

Using a digital format for generating such documents can also offer greater flexibility. With the ability to easily edit, update, and track past transactions, businesses can ensure that all information is up-to-date and accurately reflects the services or goods provided. Modern solutions allow for easy integration with financial tools, streamlining the entire process and reducing manual work.

GST Invoice Templates for Business Success

For any business, maintaining organized and accurate records is essential for long-term success. Having a structured system for documenting transactions ensures smooth financial management, enhances customer trust, and simplifies the tracking of payments and taxes. With the right tools in place, businesses can easily stay compliant with regulations while boosting overall efficiency.

Professional-looking documents that are easy to customize can help companies save valuable time. By creating consistent formats that include all required details, businesses can streamline their billing process, reducing the chances of errors and improving cash flow management. These solutions provide flexibility, enabling business owners to focus on growth while ensuring all financial records are kept up to date.

Automating the process further enhances efficiency. Digital solutions allow for quick modifications and the ability to generate multiple documents at once, making it easier to manage large volumes of transactions. By choosing the right approach, businesses not only simplify their operations but also ensure greater accuracy in financial reporting, which is key to long-term success.

Understanding GST Invoices and Their Importance

Proper documentation of financial transactions is crucial for businesses to ensure transparency and compliance with legal regulations. Having a clear and organized method for recording each exchange helps maintain accurate records, avoid disputes, and make the tax process simpler. These records are essential not only for internal use but also for external audits and customer relations.

The Role of Detailed Records in Business

Accurate records are the foundation of good financial practices. They help businesses monitor cash flow, track sales and purchases, and verify tax liabilities. A well-maintained system also provides clear evidence of business activity, which is important during audits or for resolving discrepancies. Proper documentation can even enhance customer trust by presenting a professional image and fostering a sense of reliability.

Legal Compliance and Efficiency

Complying with legal tax requirements is a major reason for implementing a structured system. Correctly formatted records ensure that businesses follow the appropriate tax laws and regulations. This not only avoids penalties but also simplifies reporting and payment processes. In the long run, businesses that consistently maintain precise financial documentation can save time and resources, creating a more efficient workflow.

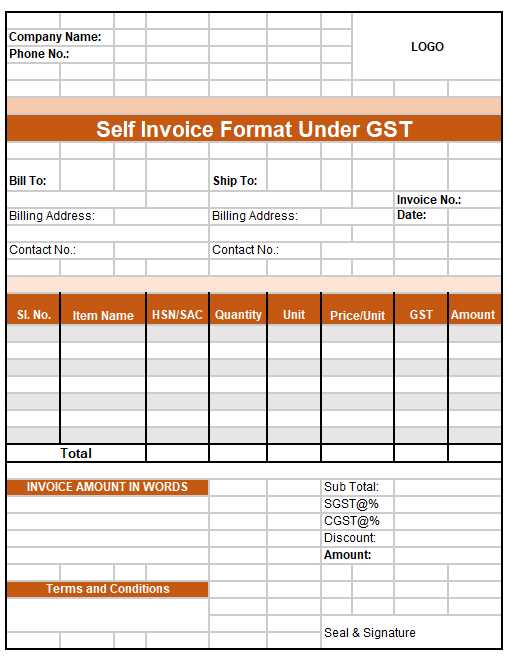

How to Create a GST Invoice Template

Designing a professional and functional document for recording transactions is an essential step for any business. A well-organized structure ensures that all necessary information is clearly presented, making it easy for both businesses and clients to understand the terms of the exchange. By following a few key steps, you can create an effective document format that meets legal requirements and enhances your workflow.

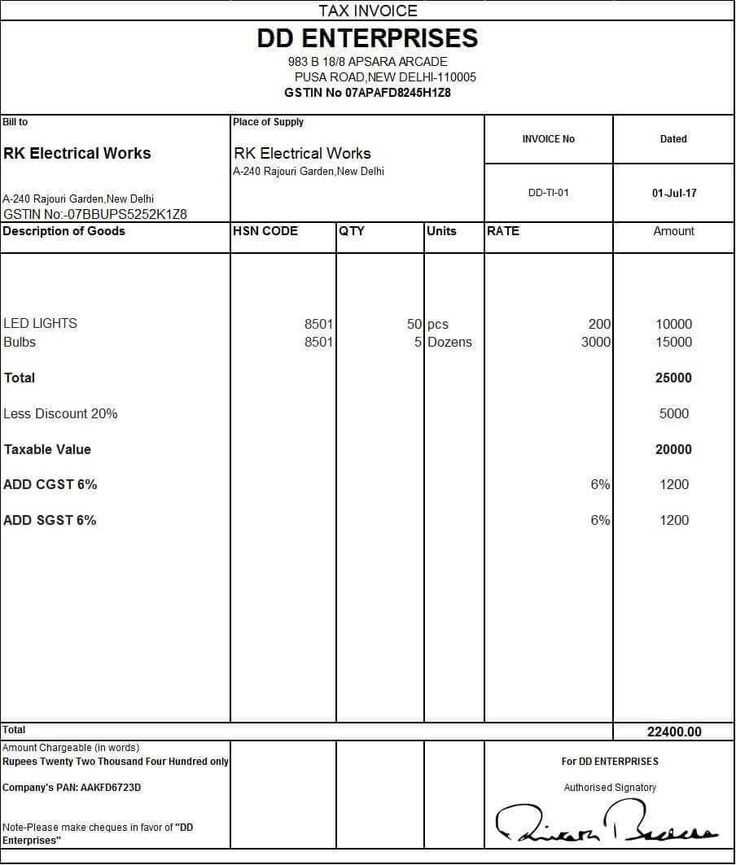

To start, here are the essential components that should be included in your document format:

- Header Information – Include your business name, address, and contact details for easy identification.

- Client Details – Make sure to add the client’s name, address, and other relevant information.

- Document Date – This helps keep track of when the transaction occurred.

- Description of Goods/Services – Clearly list the products or services provided, along with their quantities and rates.

- Payment Terms – Specify the payment due date and any other important financial terms.

- Tax Details – Include the applicable tax rates and the total tax amount for clarity.

Once you have these components, consider the following tips:

- Choose a Clean Layout – Ensure the design is simple, organized, and easy to read. Avoid unnecessary clutter that could confuse the recipient.

- Use Consistent Formatting – Maintain consistent font styles, sizes, and spacing throughout the document.

- Incorporate a Payment Reminder – A gentle reminder for due payments can help ensure timely transactions.

- Consider Digital Tools – Using software or online services can simplify the process by automating certain sections, such as dates and tax calculations.

By following these steps, businesses can create a document that not only ensures accuracy and professionalism but also helps streamline their financial management process.

Key Components of a GST Invoice

When creating a document for recording business transactions, certain essential elements must be included to ensure accuracy and compliance with tax regulations. These components not only provide clarity for both parties involved but also ensure that all necessary details are captured to avoid confusion or errors during audits. By structuring the document properly, businesses can streamline their accounting process and enhance customer trust.

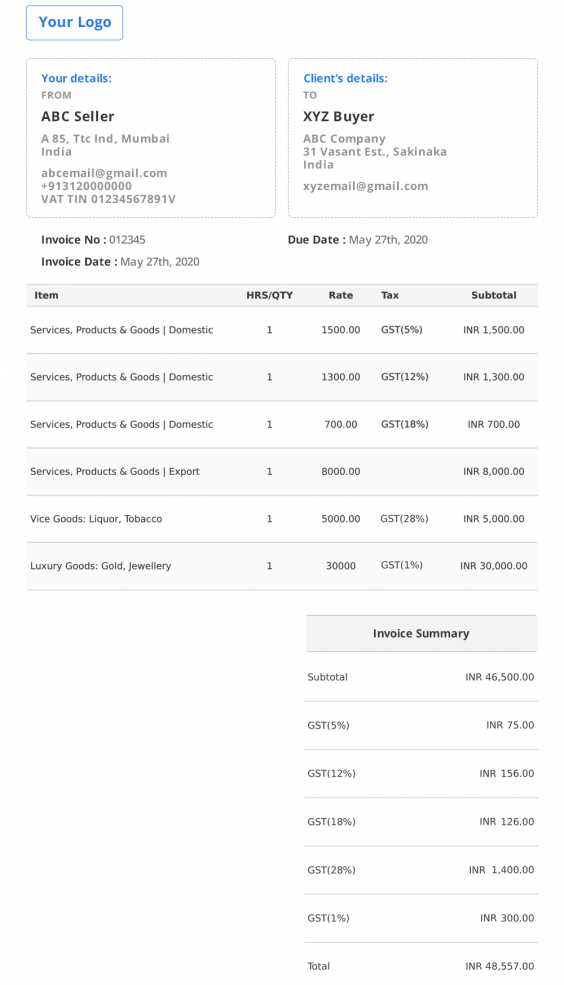

The following key elements should always be present in your business transaction document:

- Business Information – Include the name, address, and contact details of your business for easy identification.

- Client Information – Ensure the recipient’s details, such as their name, address, and contact information, are clearly stated.

- Document Number – Assign a unique reference number to each document for easy tracking and record-keeping.

- Date of Issue – Specify the date when the transaction occurred or when the document was generated.

- Description of Goods/Services – Provide clear and detailed information on the products or services supplied, including quantities and pricing.

- Tax Breakdown – Clearly outline the applicable tax rate and the total tax amount for transparency.

- Total Amount – Indicate the final total amount due, including the cost of goods/services and any applicable taxes.

- Payment Terms – Include information about payment due dates and any other financial terms agreed upon by both parties.

Incorporating these components into your document ensures that it is not only legally compliant but also clear and professional, minimizing any potential confusion or disputes.

Choosing the Right GST Invoice Format

When selecting a format for documenting transactions, it’s important to consider how well the layout supports both your business needs and legal requirements. The right structure not only ensures clarity but also streamlines processes, making it easier to manage financial records, track payments, and comply with tax regulations. A well-chosen format can save time, reduce errors, and foster professional relationships with clients.

Factors to Consider When Selecting a Format

Before deciding on the ideal format, businesses should take into account the following factors:

- Clarity and Simplicity – The format should be easy to understand and provide all necessary details without unnecessary complexity.

- Customization Options – Choose a format that allows easy customization to fit specific business needs, such as adjusting tax rates or adding extra sections.

- Legal Requirements – Ensure the structure complies with local laws and regulations, providing all the required information like business details, tax amounts, and transaction descriptions.

- Automation and Integration – A digital format that integrates with accounting software can simplify the process and reduce the need for manual input.

Benefits of Choosing the Right Format

By selecting the correct layout, businesses can streamline their operations and improve efficiency:

- Improved Accuracy – A clear structure minimizes mistakes by automatically populating key details.

- Time Efficiency – Reduces the time spent creating and reviewing documents, allowing more focus on core business activities.

- Professionalism – A well-organized format enhances the business’s image, making it look more trustworthy and reliable to clients.

Choosing the right format for your documentation ensures that it is both functional and professional, helping to build a smooth and efficient workflow while maintaining compliance with regulations.

Benefits of Using GST Invoice Templates

Utilizing pre-designed structures for transaction documentation offers businesses numerous advantages. These structured formats provide a consistent and professional way to record all necessary details, reducing errors and saving time. By automating the process, businesses can maintain accurate records, streamline financial management, and improve client relationships.

The benefits of using a well-designed format include:

| Benefit | Description |

|---|---|

| Time-Saving | Pre-designed structures eliminate the need to start from scratch, saving time in document creation. |

| Consistency | Using a standardized format ensures that all documents follow the same layout, reducing the chance of missing key details. |

| Accuracy | Automated fields help ensure correct calculations and prevent human errors, maintaining financial precision. |

| Professionalism | A clean, well-organized document enhances your business image and demonstrates attention to detail. |

| Compliance | Structured formats often include all legal requirements, ensuring compliance with local laws and tax regulations. |

| Easy Customization | These formats can be tailored to your business’s specific needs, including adding custom fields or adjusting layouts. |

By using a pre-designed format, businesses can streamline their operations, reduce manual work, and improve the overall efficiency of managing financial records, leading to smoother operations and enhanced client interactions.

Free GST Invoice Templates for Small Businesses

For small businesses, managing financial documents can be time-consuming and overwhelming, especially when dealing with tax-related details. Access to cost-free, pre-designed formats can simplify this process, offering an easy way to stay organized and ensure compliance. These ready-made structures allow businesses to focus on growth while minimizing administrative burdens.

Why Free Templates Are a Great Option for Small Businesses

Small businesses often operate with limited resources and tight budgets. Free options provide a significant advantage, offering essential functionality without additional costs. These formats are usually easy to use, customizable to fit your specific needs, and help maintain consistency across all your financial records.

- No Cost – Using free formats eliminates the need for purchasing expensive software or hiring professionals for document creation.

- Time Efficiency – Pre-designed layouts reduce the time spent manually creating each document from scratch, allowing business owners to focus on core activities.

- Easy to Customize – Free formats can be tailored to suit specific business requirements, such as adjusting tax rates or adding extra fields.

- Simple to Use – These formats are user-friendly and require minimal effort to understand, making them accessible for individuals with little to no experience in document design.

Where to Find Free GST Document Formats

Many online platforms offer free downloadable options that can be customized and used right away. These resources are often updated to reflect the latest tax regulations, ensuring that your business stays compliant with any changes. Look for websites that specialize in business resources or accounting tools, as they typically offer reliable, up-to-date materials for free.

By utilizing free formats, small businesses can streamline their financial documentation process, saving both time and money while staying organized and compliant with tax requirements.

Customizing Your GST Invoice Template

Tailoring your financial documentation to suit your business needs is an important step in maintaining consistency and professionalism. Customizing pre-designed formats allows you to reflect your brand identity, ensure accuracy, and meet the specific requirements of your industry. This section will guide you through the process of personalizing your structure to align with your preferences.

Here are some key elements you can modify to create a more personalized document:

- Logo and Branding – Adding your company logo and selecting colors that align with your brand enhances the professional appearance of your records.

- Company Information – Ensure your business details, such as name, address, contact information, and tax ID, are included and updated in every document.

- Custom Fields – Add or remove fields to match your specific service offerings, such as special discounts, service descriptions, or custom payment terms.

- Tax Rates – Adjust the tax rates to fit your local requirements, ensuring that all calculations reflect the current rates accurately.

- Payment Instructions – Customize the payment terms and methods section to reflect your preferred ways of receiving payment, such as bank transfer details or online payment links.

By customizing the structure, businesses can ensure all necessary details are present, while also creating a document that aligns with their brand identity and regulatory requirements. This approach makes it easier to manage financial records and ensures consistency across all business communications.

How to Add GST Details Correctly

Ensuring that tax-related information is added accurately to your financial documents is crucial for both compliance and transparency. Correctly including the necessary tax details helps maintain clarity for both your business and your clients. This section will guide you through the essential steps to ensure that tax details are correctly incorporated into your documents.

Essential Information to Include

When adding tax details, it’s important to include the following components:

- Tax Registration Number – Make sure to include your business’s tax registration number (or GSTIN) to confirm that you’re compliant with tax regulations.

- Tax Rate Applied – Clearly specify the tax rate applied to your products or services. This should be consistent with the applicable rate for your region or industry.

- Tax Amount – The tax amount for each item or service should be calculated and listed separately, ensuring that the total is accurate.

- Exemptions or Special Rates – If certain products or services are exempt from tax or fall under special tax categories, be sure to note these exemptions on your documents.

Tips for Accurate Tax Details

- Double-check Calculations – Always verify that the tax calculations are correct and reflect the current tax rates to avoid any discrepancies.

- Update for Changes – Ensure that your tax details are updated in case of any tax law changes or updates in rates.

- Clear Breakdown – Provide a clear breakdown of the tax amount in relation to the product or service to avoid confusion for your clients.

Adding accurate tax information ensures that your documents remain compliant with legal requirements while also making it easier for your clients to understand the charges. By following these steps, you can create clear and professional records that support the financial integrity of your business.

Integrating GST Templates with Accounting Software

Integrating your financial documents with accounting software streamlines the process of tracking and managing transactions. This integration allows for seamless data flow between your financial records and accounting systems, reducing the need for manual entries and minimizing the chances of errors. In this section, we will explore how you can connect your records to accounting software to improve efficiency and accuracy in your business operations.

Steps to Integration

Follow these key steps to integrate your financial documents with your accounting software:

- Choose Compatible Software – Ensure that the accounting software you use supports integration with the format of your financial records.

- Set Up Data Sync – Configure the software to automatically sync with your documents, so data is transferred without manual input.

- Customize Fields – Customize the fields in your financial records to match those used by the accounting software for smooth data transfer.

- Test the Integration – Before fully relying on the integration, perform test runs to ensure that the data is correctly transferred and calculations are accurate.

Benefits of Integration

- Improved Accuracy – Automation reduces the risk of human errors in data entry, ensuring that all financial information is accurate and up-to-date.

- Time Savings – With automatic data entry, your team can focus on other tasks, significantly reducing the time spent on manual input.

- Easy Financial Tracking – Integration provides a clear, consolidated view of your financial records, making it easier to track expenses, taxes, and income.

By integrating your financial documents with accounting software, you create a more efficient and reliable system for managing your business finances. This process not only saves time but also improves accuracy, helping you make informed decisions for business growth.

Common Mistakes in GST Invoices

When preparing financial documents for business transactions, it’s crucial to avoid errors that could lead to confusion or even legal issues. These mistakes can occur at various stages, from data entry to submission. Understanding and addressing these common errors will ensure that your business remains compliant with regulations and maintains accurate records. In this section, we highlight the most frequent mistakes made during document creation and how to prevent them.

Frequent Errors in Document Preparation

Here are some of the most common mistakes businesses make when creating their financial records:

- Incorrect Tax Rate – One of the most common errors is applying the wrong tax rate. Always ensure that you are using the current applicable rate for the type of transaction.

- Missing Information – Omitting essential details such as business identification numbers, addresses, or transaction descriptions can lead to incomplete records and compliance issues.

- Wrong Calculation of Tax – Calculating the tax incorrectly can result in overcharging or undercharging customers, which may lead to disputes or penalties.

- Failure to Include Discounts – When providing discounts, make sure they are accurately reflected in the financial document. Failing to account for discounts can result in discrepancies in the total amount.

How to Avoid These Mistakes

To prevent these common errors, consider the following steps:

- Double-Check Information – Always verify that all details are correct before submitting any document. This includes tax rates, business numbers, and customer information.

- Use Automated Tools – Automated systems can help calculate taxes and fill in required fields, minimizing the risk of human error.

- Train Staff Properly – Ensure that your team is well-trained in the process of creating financial records and understands the importance of accuracy.

- Review Regulations Regularly – Stay updated with any changes in tax laws or business regulations to ensure your documents are always compliant.

By avoiding these common mistakes, you can ensure that your business remains on track with its financial recordkeeping and complies with legal requirements, saving time and reducing stress in the long run.

Legal Requirements for GST Invoices

In any business transaction, it is crucial to comply with the legal standards set forth by authorities. Proper documentation ensures transparency and helps avoid potential legal complications. In this section, we will outline the essential legal criteria for creating financial records that meet regulatory requirements. Adhering to these standards is not just important for tax purposes but also for maintaining trust and credibility in business operations.

Essential Information to Include

When preparing financial records for a transaction, the following details are legally required to ensure accuracy and compliance:

- Business Identification Number – Each business must include its official registration or tax identification number to identify itself in any transaction.

- Transaction Date – The date when the transaction occurs is necessary for accurate recordkeeping and tax calculation.

- Complete Business Address – The address of both the buyer and the seller must be clearly stated to ensure the legitimacy of the transaction.

- Details of Products or Services – Clear descriptions of the goods or services provided are essential for legal verification and transparency.

- Amount and Tax Breakdown – The total amount and applicable tax rates must be clearly outlined for proper tax calculations.

- Payment Terms – Including payment methods and due dates helps establish clear contractual obligations between both parties.

Compliance with Regulatory Authorities

In addition to the basic details, businesses must ensure their financial records are compliant with relevant laws and regulations. The following practices are vital for maintaining compliance:

- Adherence to Tax Laws – Businesses must stay updated with local tax regulations and ensure that all applicable taxes are included in the transaction records.

- Retention of Records – It is legally required to retain these documents for a specific period, depending on the jurisdiction, to comply with auditing and review processes.

- Electronic vs. Physical Copies – Many regions allow both digital and physical versions of records, but they must meet the same legal standards for authenticity and accessibility.

By ensuring your financial records meet these legal requirements, your business can avoid unnecessary penalties, audits, or disputes while maintaining a solid reputation in the marketplace.

How to Automate GST Invoices

Automating business records can significantly improve efficiency and reduce the risk of errors in the documentation process. By utilizing the right tools and technologies, businesses can streamline their transactions, ensure compliance, and save time. In this section, we will explore how to automate the creation and management of financial records, ensuring accuracy and consistency without manual intervention.

Steps to Automate Financial Record Creation

To successfully automate your business records, follow these essential steps:

- Choose Automation Software: Select software that integrates seamlessly with your accounting system and allows for customization according to your business needs.

- Set Up Business Details: Input your business’s essential details such as tax ID, address, and contact information. This allows the system to automatically populate the necessary fields in each document.

- Configure Tax Rates: Predefine the applicable tax rates for your region or business type, ensuring all calculations are accurate.

- Integrate Payment Methods: Link your payment methods to the system for automatic updating of payment statuses and transactions.

- Automate Record Generation: Set up the system to automatically generate records based on the provided parameters, including the date, products, amounts, and taxes.

Benefits of Automation

Automating the process of record generation offers numerous advantages:

- Reduced Errors: Automation minimizes human errors by ensuring calculations and data entry are consistent.

- Time Efficiency: With automation, the time spent manually preparing records is reduced, allowing businesses to focus on growth and strategy.

- Faster Processing: The time between a transaction and the creation of accurate records is significantly shortened, improving cash flow and reducing delays.

- Compliance Assurance: Automation helps maintain up-to-date compliance with local regulations, as the software can be set to automatically apply the latest rules and tax rates.

Example of an Automated Record

Here’s a simple example of how automation might look for a typical transaction:

| Transaction Date | Product/Service Description | Amount | Tax Rate | Total |

|---|---|---|---|---|

| 2024-11-07 | Office Supplies | $100 | 10% | $110 |

| 2024-11-07 | Consulting Service | $500 | 10% | $550 |

By automating your financial records, you can ensure greater accuracy, save time, and improve business processes, contributing to overall business success.

Top Online Tools for GST Invoices

In today’s digital era, managing business records has become more efficient thanks to various online tools. These platforms allow entrepreneurs and businesses to quickly generate, track, and manage financial documentation, ensuring compliance and accuracy with minimal effort. Below are some of the top online tools that can help simplify the process of creating business-related documents.

Best Tools for Managing Financial Documentation

- QuickBooks Online: A widely recognized tool for managing business finances, QuickBooks Online offers easy customization of financial records, automatic calculations, and seamless integration with other financial tools.

- Zoho Books: Zoho Books provides a comprehensive suite of features for tracking expenses, managing payments, and generating professional documents for businesses of all sizes.

- FreshBooks: Known for its user-friendly interface, FreshBooks helps small businesses create financial records, track time, and manage projects–all in one place.

- Wave: A free and easy-to-use platform for small business owners, Wave offers tools for generating financial records, invoicing, and bookkeeping.

- Invoicely: Invoicely is an intuitive online tool that allows users to create professional documents, track payments, and manage business finances effortlessly.

- Bill.com: Ideal for businesses with a high volume of transactions, Bill.com automates and streamlines financial workflows, providing easy document creation and payment management.

Features to Look for in Online Tools

When selecting an online tool for managing business documentation, consider the following features:

- Customization: The ability to tailor the documents to fit your business’s specific needs is crucial for ensuring that all the required details are included.

- Automation: Look for tools that automate repetitive tasks, such as adding tax rates or calculating totals, to save time and reduce errors.

- Integration: Choose a tool that integrates seamlessly with your existing accounting and financial software to streamline your workflow.

- User-Friendly Interface: The tool should be easy to navigate and should not require extensive training to use.

- Cloud-Based Access: A cloud-based platform allows you to access your records from anywhere, making it more convenient for businesses on the go.

Using these online tools can significantly improve the efficiency and accuracy of your business documentation processes, making it easier to maintain compliance and manage financial transactions.

Designing a Professional GST Invoice

Creating professional business documents is essential for establishing credibility and ensuring clear communication with clients. A well-designed record not only reflects the professionalism of the business but also ensures that all necessary details are included for accuracy and compliance. Below are key considerations when designing a professional business document that can meet these standards.

Key Elements of a Professional Document

A business document should include specific details to ensure it serves its purpose effectively. The essential components typically include:

- Business Information: Include the business name, address, and contact information to ensure your clients can easily reach you if needed.

- Client Information: The document should have space for the recipient’s name, address, and contact details for clear identification of the transaction parties.

- Unique Identification Number: Each document should feature a unique number for tracking purposes, which is crucial for record-keeping and reference.

- Itemized List: Include a clear breakdown of products or services offered, including quantities, rates, and any applicable charges.

- Tax Information: Ensure that tax details are accurately included, such as rates, totals, and applicable deductions.

- Payment Terms: Define the payment terms, including due dates and accepted methods of payment.

Design Tips for Clarity and Professionalism

The layout and design play an important role in making sure the document is easy to read and professionally presented. Consider the following design tips:

- Clear and Simple Layout: Use a clean, well-organized layout with sections clearly labeled for easy navigation. Avoid cluttering the document with unnecessary elements.

- Consistent Font and Branding: Use a uniform font and colors that reflect your brand identity. This ensures that your documents remain professional and consistent with other business communications.

- Readable Font Size: Choose a font size that is large enough to be easily readable but not so large that it takes up excessive space.

- Alignment and Spacing: Properly align text and use adequate spacing between sections to enhance readability.

By focusing on both the content and design, you can create a professional document that not only meets legal and operational requirements but also strengthens your brand’s image and facilitates smooth communication with clients.

Tracking Payments Using GST Invoices

Accurate tracking of payments is crucial for any business to maintain financial health and streamline accounting processes. By using a proper document that records each transaction, businesses can keep track of amounts due, payments received, and any outstanding balances. Effective tracking not only ensures that the business can manage cash flow but also supports transparency and helps in reconciling accounts with ease.

Key Strategies for Payment Tracking

To efficiently track payments, businesses should include specific information in the document for clarity and reference. Some key strategies include:

- Unique Identification Number: Assigning a unique reference number to each document helps track payments associated with that specific transaction. This makes it easier to identify when payments were made and whether they have been fully settled.

- Payment Terms and Due Dates: Clearly stating payment terms and due dates allows both parties to understand the expectations and timing for payment. This helps in tracking whether payments are made on time or if they are overdue.

- Itemized Breakdown of Charges: Providing a detailed list of products or services allows for clear tracking of what each payment is for, preventing confusion about what has been paid for and what remains outstanding.

- Partial Payment Tracking: If a payment is made in installments, it’s essential to track each partial payment. Including columns or sections to mark received payments ensures accurate record-keeping.

Benefits of Payment Tracking

By incorporating these tracking elements, businesses gain several advantages:

- Improved Cash Flow Management: Having a clear view of payments helps businesses predict future cash flows and plan accordingly, reducing financial uncertainty.

- Reduced Risk of Errors: Clear and consistent tracking minimizes the chances of human error in accounting and payment reconciliation.

- Enhanced Client Relations: Transparency in payments builds trust with clients by providing them with an easy way to understand their outstanding balances and payment history.

Tracking payments effectively not only ensures smooth financial operations but also provides better control over business finances, improving overall efficiency.

How to Manage GST Compliance with Templates

Managing compliance with tax regulations is crucial for businesses to avoid penalties and ensure smooth operations. One of the key aspects of this is ensuring that financial documents accurately reflect the required information as per the local tax laws. By utilizing structured formats for these documents, businesses can ensure that they meet regulatory requirements while simplifying the process of record-keeping and reporting.

Key Steps to Ensure Compliance

To effectively manage tax compliance, businesses should focus on the following key aspects when preparing their financial documents:

- Include Required Information: Make sure that each document contains essential details such as transaction dates, tax identification numbers, total amounts, and applicable tax rates. This ensures that the business is adhering to legal requirements.

- Maintain Consistency: Consistently using a standard format for each transaction document helps in avoiding discrepancies. It also streamlines the process when dealing with audits or tax filing.

- Use Automated Solutions: Implementing software tools that automate the process of creating financial records can reduce human errors and ensure that all required fields are included correctly every time.

Benefits of Compliance Management

Effective management of tax compliance offers several advantages to businesses:

- Reduced Risk of Penalties: By maintaining accurate and compliant documents, businesses can avoid costly penalties for non-compliance or errors in their financial records.

- Improved Financial Transparency: Keeping organized and well-structured records allows businesses to maintain transparency in their financial dealings, which is crucial for stakeholders and auditors.

- Streamlined Tax Reporting: With the right system in place, businesses can easily generate reports that adhere to regulatory standards, simplifying the filing process and saving time.

By adopting a systematic approach to creating and managing these essential documents, businesses can stay on top of compliance requirements while ensuring operational efficiency.

Adapting GST Templates for Different Industries

Each industry has its own specific requirements when it comes to financial documentation, and adapting these records to meet those needs is essential for ensuring accuracy and compliance. Whether it’s the healthcare sector, retail, or manufacturing, adjusting the format and content of business documents can help streamline processes, ensure compliance with regulations, and improve overall efficiency.

Industry-Specific Requirements

Different industries often have unique needs when it comes to documenting transactions and taxes. Here are some key adjustments businesses should consider:

- Retail Industry: Retail businesses need to capture detailed product information, including prices, taxes, and discounts. A simplified yet comprehensive layout that highlights the product details and tax rates is essential for smooth operations and accurate tax reporting.

- Healthcare Sector: Healthcare providers often deal with complex billing scenarios. Detailed information about services, patient data, and applicable tax rates must be clear, ensuring transparency for both patients and tax authorities.

- Manufacturing and Construction: For businesses in manufacturing or construction, multiple items and services may be involved in a single transaction. Properly categorizing materials, labor costs, and taxes is essential for compliance and accurate reporting.

Key Features for Adaptation

To customize financial documents for different industries, consider these key features:

| Feature | Retail | Healthcare | Manufacturing |

|---|---|---|---|

| Itemized Details | Product details, including discounts and taxes | Medical services, procedures, and patient charges | Material costs, labor costs, and equipment used |

| Tax Breakdown | Clear tax breakdown for each product or service | Specific tax rates for medical services | Separate tax calculations for materials and services |

| Customization Options | Discounts, offers, and promotional codes | Insurance claims and patient payment options | Multiple services bundled together with detailed cost breakdowns |

By making these adjustments, businesses can ensure that their financial documentation aligns with industry-specific regulations, providing clarity, accuracy, and ease of use for both internal teams and external auditors or tax authorities.