GST Invoice Template in Excel for Accurate and Efficient Billing

Managing financial transactions can be a complex and time-consuming task for any business. To streamline this process, many turn to digital solutions that allow for quick calculations and precise record-keeping. A well-organized system can significantly reduce errors and save valuable time when issuing receipts or processing payments.

Using a customizable document format to generate payment records ensures accuracy and consistency across all your financial dealings. With the right tools, it’s easy to add taxes, discounts, and other variables, making the entire process more efficient. Whether you’re dealing with one or multiple tax rates, an automated solution can handle these details seamlessly.

In this article, we will explore how you can create a simple yet powerful structure that adapts to your specific needs. We will focus on practical steps, key features, and ways to make the most of software options that cater to both small and large businesses.

GST Invoice Template in Excel

For businesses looking to simplify their billing process, a structured digital document can significantly improve efficiency. By using a customizable sheet, companies can easily manage sales records, apply taxes, and track payments. This method helps avoid manual errors and ensures consistency across all financial transactions. It also provides a professional approach to handling business correspondence, which is essential for maintaining clear financial communication with clients.

Why Use a Spreadsheet for Billing

Spreadsheets provide an excellent platform for creating automated records with the flexibility to adapt to changing requirements. These digital tools offer features like automatic calculations, which reduce the time spent on manual entries. Additionally, they allow easy modification of tax rates and the ability to generate reports, making it ideal for small and medium-sized businesses.

Key Elements of a Billing Document

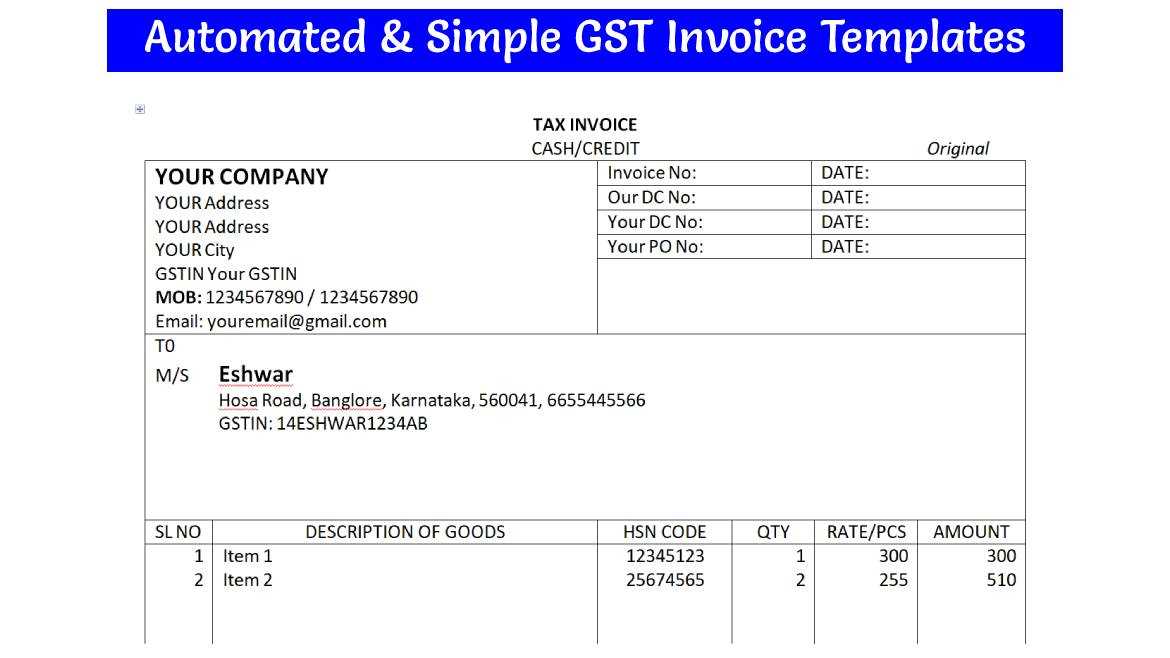

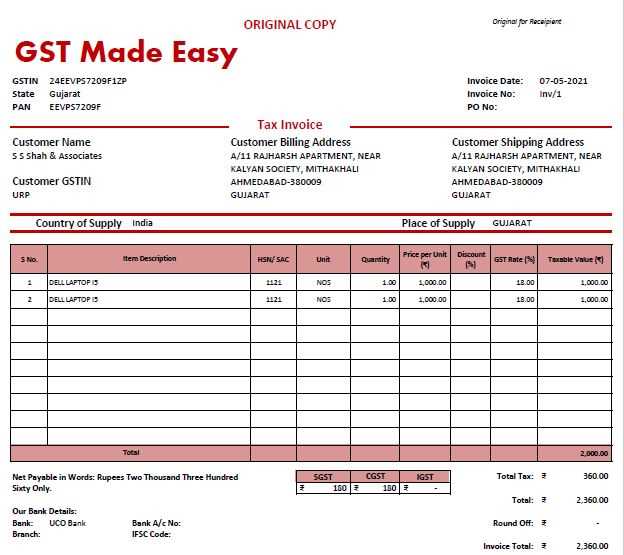

A properly structured document typically includes fields for customer details, item descriptions, pricing, and tax calculations. With a customized sheet, you can set up formulas to compute taxes and totals, ensuring all numbers are accurate and up-to-date. Below is an example of what such a document might look like:

| Item Description | Quantity | Unit Price | Tax Rate | Total |

|---|---|---|---|---|

| Product A | 2 | $50.00 | 10% | $110.00 |

| Service B | 1 | $150.00 | 10% | $165.00 |

| Subtotal | $275.00 | |||

| Total Amount Due | $302.50 | |||

This example shows how easily the spreadsheet can calculate totals, including taxes, based on the input data. By adapting the layout and formulas to your business needs, you can create a comprehensive record-keeping system that is both efficient and accurate.

How to Create a GST Invoice Template

Creating a digital document for managing business transactions can significantly improve the efficiency of your billing system. By setting up a structured format, you can streamline the process of generating records, apply applicable taxes, and ensure consistent accuracy with every transaction. A customizable layout allows you to adjust the fields as per your specific business needs, making it easier to handle varying sales volumes and tax rates.

Step-by-Step Process

To create a practical billing document, start by setting up essential fields that are crucial for every transaction. These typically include customer details, product or service descriptions, quantity, price per unit, and applicable taxes. Using an organized format ensures that you can quickly input data, and the calculations are done automatically to prevent errors.

Adding Tax Calculations

One of the most important features of this digital document is the ability to automatically calculate taxes. By inputting the tax rate and linking it to the total amount, you can avoid manual calculations that can lead to mistakes. This function is especially useful for businesses operating in regions with multiple tax rates. Setting up simple formulas in the document will calculate the total amount due, including taxes, making the entire process more efficient and reliable.

Key Features of GST Invoice Templates

A well-structured billing system offers several key features that make the process of managing sales and tax calculations simpler and more efficient. These features help ensure that all necessary information is captured accurately, and that the document remains organized and professional. Below are some of the core functionalities that make a billing document effective for business operations.

Core Elements for Efficient Billing

When creating a billing document, there are several essential fields and features to include in order to facilitate accurate calculations and clear communication. These elements help organize information in a structured way and prevent errors in your financial records:

- Customer Information: Name, address, and contact details.

- Product or Service Details: Clear description of what is being sold or provided.

- Tax Calculation: Automatically applied based on the set rate.

- Itemized Pricing: Breakdown of the quantity, price per unit, and total cost for each item.

- Total Amount Due: Final amount after taxes and discounts have been applied.

Automation and Customization

One of the most valuable features of a digital document is the ability to automate repetitive tasks. By setting up formulas to calculate totals, taxes, and other relevant values, businesses can reduce human error and save time. Moreover, the document can be easily customized to match your branding and business requirements. You can adjust field sizes, fonts, colors, and layouts to make the document fit your company’s identity.

- Auto-Calculation: Automatically sum totals and apply taxes.

- Customizable Fields: Adjust the layout to suit your business model.

- Multiple Tax Rates: Include different rates for various products or services.

- Invoice Numbering: Automatically generate unique identifiers for each record.

By incorporating these features into your document, you can enhance the accuracy, efficiency, and professionalism of your business transactions.

Benefits of Using Excel for Invoices

Utilizing a digital document to manage financial transactions offers numerous advantages for businesses. Among various tools, spreadsheets stand out for their flexibility, ease of use, and powerful features that can be tailored to meet specific needs. They provide an effective platform for managing sales, calculating taxes, and maintaining accurate records without the complexities of specialized software.

Flexibility and Customization

One of the major benefits of using spreadsheets for managing financial records is the high level of customization they offer. You can adjust the layout, design, and fields based on your business requirements. Whether you need to add extra rows for multiple items, include special discount fields, or modify tax calculations, spreadsheets allow for easy customization without the need for complex tools or coding.

- Easy Customization: Adapt the layout to suit your branding or specific business needs.

- Flexible Fields: Add or remove fields as necessary to reflect various transaction types.

- Simple Updates: Quickly modify tax rates, item prices, and other variables across multiple records.

Automation and Accuracy

Spreadsheets significantly reduce the chances of manual errors through automation. With built-in formulas, businesses can automatically calculate totals, taxes, and other values. This automation ensures that calculations are consistent, saving time and preventing costly mistakes. Additionally, you can set up rules to trigger alerts for incomplete or incorrect entries, helping maintain accurate records.

- Automatic Calculations: Reduce human error by automating totals, taxes, and final amounts.

- Built-in Functions: Use advanced formulas for precise calculations and data analysis.

- Consistent Results: Ensure the same calculation method is applied to every record, enhancing reliability.

Overall, spreadsheets provide a user-friendly, customizable, and efficient way to handle financial transactions, allowing businesses to stay organized and accurate while saving valuable time.

Customizing Your GST Invoice Template

When creating a document for business transactions, it’s essential to ensure that it aligns with both legal requirements and your company’s branding. Customizing your document allows you to incorporate specific details that make it unique and professional, while also adhering to regulatory standards. By modifying the structure, layout, and content, you can create a document that reflects your business’s identity and ensures clarity for your clients.

Layout and Design play a crucial role in ensuring the document is both readable and visually appealing. Adjust the placement of key elements, such as business information, product descriptions, and amounts due. Ensure that the design maintains a balance between formality and ease of understanding.

Branding is another important aspect. Customize colors, fonts, and logos to align with your company’s visual identity. A well-branded document not only conveys professionalism but also enhances recognition and trust with your clients.

Legal Compliance should always be a priority when adapting your document. Ensure that all mandatory fields are clearly marked and easily accessible, such as tax numbers, payment terms, and total amounts. Customize any additional sections according to local regulations to ensure your document meets the legal standards required in your jurisdiction.

Finally, remember that every business is different. By tailoring the content to your specific needs, you ensure that your document not only serves its functional purpose but also strengthens your relationship with clients through a clear, customized presentation.

How to Calculate GST in Excel

When managing business finances, it’s important to accurately calculate tax amounts to ensure compliance with tax regulations. Using a spreadsheet application, you can automate this process, making it easier to handle large volumes of transactions. By applying simple formulas, you can quickly calculate the required tax for each item or total amount, reducing errors and saving time.

Step-by-Step Process

To calculate the tax for a given amount, first determine the tax rate applicable to the product or service. In your document, list the prices of the items in one column. In the next column, input the tax rate as a percentage. Then, use a basic multiplication formula to find the tax amount. For example, if the price is in cell A2 and the tax rate is in cell B2, the formula in cell C2 will be: =A2*B2. This will calculate the tax for that specific item.

Calculating Total Amount Including Tax

Once the tax amount is calculated, you can find the total cost, including the tax. Add a new column for the total amount. The formula to calculate the total would be: =A2+C2, where A2 is the price and C2 is the tax. This will give you the final amount to be paid, including both the base price and the additional charge.

Common Mistakes in GST Invoices

Accurate financial documentation is essential for any business, yet many often make simple errors that can lead to complications with tax authorities or confusion for clients. These mistakes can range from minor formatting issues to more significant oversights that impact the accuracy of tax calculations and payments. Understanding these common pitfalls can help businesses avoid costly mistakes and streamline their accounting processes.

Missing or Incorrect Tax Identification Numbers

One of the most frequent errors is failing to include the correct tax identification numbers or mistakenly using the wrong ones. Each business and transaction requires specific identifiers to ensure that the document is recognized as legitimate by tax authorities. Double-check that your tax number is correct and that it appears clearly on the document to avoid any delays or complications.

Incorrect Tax Calculations

Another common mistake is incorrect tax calculations. This can happen when the tax rate is applied incorrectly, or when the base price is miscalculated. To ensure accuracy, it’s important to always double-check that the tax rate matches the applicable local or national rate, and that the formulas used to calculate the tax are correct. Even small discrepancies can lead to financial discrepancies or legal issues down the line.

Top Excel Functions for Invoicing

When managing business transactions, using the right functions in a spreadsheet application can greatly simplify calculations and improve efficiency. With the proper formulas, you can automate complex tasks such as calculating totals, applying discounts, and determining tax amounts. This reduces manual errors and saves valuable time, allowing you to focus on more strategic aspects of your business.

SUM Function

The SUM function is one of the most essential tools for anyone creating business documents. It allows you to quickly add up multiple numbers, such as the prices of items or the total tax. To use it, simply input the formula =SUM(A1:A5) to add up values in cells A1 to A5. This function is invaluable when calculating totals across a range of items or services.

IF Function

The IF function enables you to apply conditional logic to your calculations. For example, you can use it to automatically apply a discount if a certain condition is met, such as a minimum purchase amount. The basic formula looks like this: =IF(A1>100, A1*0.9, A1), which applies a 10% discount if the amount in cell A1 is greater than 100. This flexibility is crucial for businesses with varying pricing structures or special offers.

Tracking GST Payments in Excel

Managing payments and ensuring accurate record-keeping is vital for businesses, especially when it comes to financial obligations like taxes. Keeping track of what has been paid and what is still due can be a challenging task, but with the right approach, it becomes much easier. Using a spreadsheet to record payments provides clarity and allows you to monitor outstanding amounts, payment dates, and transaction statuses efficiently.

To streamline tracking, you can create a simple table that includes the necessary details about each payment. Here’s an example of how to structure your payment tracking sheet:

| Transaction Date | Amount Due | Amount Paid | Payment Status | Balance Due |

|---|---|---|---|---|

| 2024-10-01 | $500.00 | $500.00 | Paid | $0.00 |

| 2024-10-15 | $300.00 | $150.00 | Partial Payment | $150.00 |

| 2024-10-20 | $200.00 | $0.00 | Unpaid | $200.00 |

In this table, you can easily track the status of each payment, including the amount paid, remaining balance, and payment date. By updating this sheet regularly, you’ll always have a clear overview of your financial obligations and ensure that no payments are overlooked.

Using Excel to Organize GST Records

Efficient management of financial records is crucial for businesses to stay organized and compliant with tax laws. A well-structured document can help track all relevant transactions, making it easier to calculate obligations and submit reports. Using a spreadsheet to organize these records ensures accuracy, reduces manual effort, and enables quick access to important information.

Setting Up Your Record Keeping System

To organize your tax-related records effectively, start by creating a layout that captures essential details for each transaction. You can structure your spreadsheet into various sections, such as:

- Date of Transaction: The date the transaction occurred.

- Client/Customer Name: The name of the buyer or recipient.

- Product/Service Description: A brief description of the items or services sold.

- Total Amount: The total value of the transaction before tax.

- Tax Amount: The amount of tax applied to the transaction.

- Amount Paid: The payment amount received from the client.

- Payment Status: Whether the payment has been made, is pending, or partially paid.

Using Formulas to Automate Calculations

Automating calculations can save significant time and reduce errors. For example, you can use formulas to automatically calculate tax amounts based on the transaction total or apply payment status based on the amount paid. Here are some useful formulas:

- Calculating Tax: =Total Amount * Tax Rate

- Calculating Balance Due: =Total Amount – Amount Paid

- Calculating Total Revenue: =SUM(Total Amount)

By setting up your records with these elements and formulas, you’ll be able to efficiently manage and track all relevant tax-related data.

How to Add Multiple GST Rates

In many business transactions, different products or services may be subject to varying tax rates. Handling these rates can be complex, but with the right approach, it can be easily managed in a financial tracking system. By setting up your document to accommodate multiple tax rates, you can automate calculations for different categories and ensure that the correct rate is applied to each transaction.

Setting Up Multiple Tax Categories

To add multiple tax rates, you first need to create distinct categories for each rate in your document. This can be done by listing the tax rates and their corresponding values in separate columns. For example, you could set up columns for different tax percentages such as 5%, 12%, and 18%. Each product or service will then have its own applicable tax rate based on its category.

- Column A: Product/Service Description

- Column B: Base Price

- Column C: Applicable Tax Rate

- Column D: Tax Amount

- Column E: Total Amount

Using Formulas to Calculate Multiple Rates

Once the tax rates are set up, you can use simple formulas to calculate the tax for each item based on its rate. For instance, if the base price is in column B and the applicable rate is in column C, you can use the formula =B2*C2 to calculate the tax for the item in row 2. To calculate the total amount including the tax, the formula would be =B2+D2, where D2 is the calculated tax amount.

This way, each item will automatically calculate its own tax based on the rate applied, helping you manage multiple tax rates with ease and accuracy.

Setting Up Invoice Numbering in Excel

Consistent and sequential numbering of financial documents is essential for organization and record-keeping. It helps to track transactions, avoid duplicates, and ensures compliance with accounting standards. By automating the numbering system, you can create a smooth and error-free process that generates unique identifiers for each transaction automatically.

Creating Sequential Numbers

To set up a sequential numbering system, you can use a simple formula in your spreadsheet. Start by entering the number “1” in the first row where the number should appear. Then, in the cell below, use the formula =A1+1 (assuming the first number is in cell A1). This formula will automatically increment the number by one for each subsequent row.

If you want to start numbering from a specific point, such as 1001, simply enter “1001” in the first cell and use the same formula =A1+1 in the next cell. This will continue generating sequential numbers starting from 1001.

Adding Prefixes or Suffixes

For better organization, you may want to add a prefix or suffix to the number. For example, you could add the year or month to each number. In this case, you can combine text with the number using the CONCATENATE function or the newer TEXTJOIN function. For instance, the formula =“INV-”&TEXT(A1,“0000”) will create invoice numbers like “INV-0001”, “INV-0002”, etc.

This method allows you to create a customized numbering format that fits your business needs while maintaining order and clarity in your records.

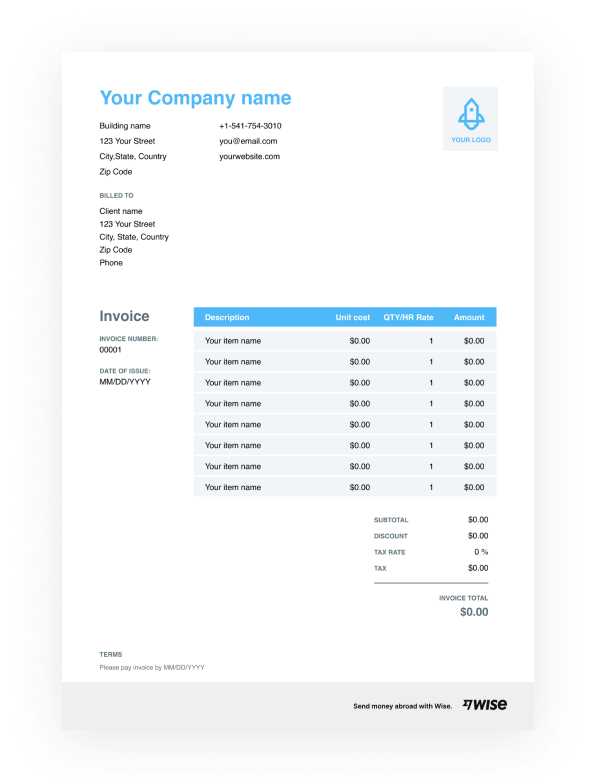

Creating a Professional Invoice Design

A well-designed document not only serves its functional purpose but also reinforces your brand identity and builds trust with your clients. A professional design enhances clarity, improves readability, and reflects the credibility of your business. By paying attention to layout, typography, and overall visual presentation, you can create a document that is both practical and visually appealing.

Key Elements of a Professional Design

To achieve a polished look, consider incorporating the following elements into your design:

- Branding: Include your company’s logo, color scheme, and font choices to maintain consistency with your overall brand identity.

- Clear Structure: Organize the content logically, with easily identifiable sections such as contact information, payment details, and item descriptions.

- Whitespace: Allow for sufficient spacing between sections to prevent clutter and enhance readability.

- Fonts: Use professional fonts that are easy to read, such as Arial, Helvetica, or Times New Roman. Ensure that font sizes are consistent and that headings stand out.

- Alignment: Align text and numbers properly to ensure everything looks neat. This is particularly important for financial figures and payment terms.

Layout and Formatting Tips

To further refine your design, follow these layout and formatting guidelines:

- Header Section: Place your company logo and contact details at the top, making it easy for clients to identify who issued the document.

- Table for Items/Services: Use a clear table to list the products or services, their quantities, rates, and totals. Ensure that the columns are properly aligned for quick reference.

- Footer: Include a footer with your company’s legal information, payment terms, and any other relevant details.

- Color Scheme: Stick to a minimal color palette to avoid distraction. Use one or two colors that complement your branding.

By carefully considering these design elements, you can create a professional document that not only communicates the necessary information but also leaves a lasting impression on your clients.

Importing and Exporting Invoice Data

Efficient management of financial documents often requires transferring data between different systems or software. The ability to seamlessly import and export financial records allows businesses to save time, reduce errors, and maintain consistency in their accounting practices. This process involves moving data from external sources into your system or vice versa, facilitating smooth communication with other platforms or stakeholders.

Importing Data into Your System

Importing records involves bringing in data from external sources, such as other software, databases, or manual entries. By using appropriate file formats like CSV, XML, or JSON, businesses can quickly update their financial systems with accurate, up-to-date information. Importing saves time by eliminating the need for manual data entry and ensures that the system is always working with the most recent data available.

Exporting Data for Sharing or Analysis

Exporting data enables sharing financial information with other software, clients, or authorities. By extracting data into a compatible format, businesses can easily transfer records for analysis, reporting, or collaboration. Exporting also allows companies to back up critical information or share it with external partners in a structured, accessible way. Formats like CSV, PDF, or Excel are commonly used for these purposes, ensuring compatibility with most platforms and tools.

Automation Tips for GST Invoicing

In today’s fast-paced business environment, automating routine tasks can save significant time and reduce errors. Streamlining processes related to tax documentation, calculations, and record-keeping is essential for businesses aiming to enhance efficiency and ensure accuracy. Leveraging automation tools for financial reporting can provide a smoother workflow and make compliance easier to manage.

1. Use Pre-Built Functions for Calculations

- Automating tax calculations can eliminate the chances of manual errors, ensuring you comply with current rates without effort.

- Utilize built-in formulas or create custom ones to automatically calculate totals, taxes, and discounts based on predefined criteria.

- Link your calculation fields to dynamic data to ensure the correct figures are always displayed, reducing manual entry.

2. Implement Auto-Population of Data Fields

- Take advantage of software that can automatically fill in repetitive data, such as business details, customer information, and product descriptions.

- Set up dropdown lists and predefined text to speed up the creation process and avoid inconsistencies.

- Ensure that contact and transactional data sync across different platforms to reduce redundant data entry and maintain consistency.

By incorporating automation into your tax-related paperwork, you’ll not only streamline daily operations but also free up valuable time to focus on other business-critical activities. Keep exploring different tools and integrations that fit your operational needs to maintain both accuracy and productivity in your financial processes.

Best Practices for GST Invoice Management

Effective management of financial records is crucial for maintaining accuracy and compliance in business operations. By adopting best practices for handling documentation, companies can streamline their processes, reduce errors, and ensure timely submissions. A well-organized system not only improves efficiency but also minimizes the risk of penalties due to overlooked details or incorrect entries.

1. Maintain Consistent and Organized Recordkeeping

- Ensure all financial documents are categorized and stored systematically, whether digitally or physically, for easy retrieval when needed.

- Develop a standardized format for all records to reduce confusion and prevent missing data.

- Regularly update and back up records to avoid data loss, especially in case of system failures.

2. Implement Regular Reviews and Reconciliations

- Establish a schedule for periodic reviews of your financial documents to ensure they are accurate and up to date.

- Reconcile transactions with your accounting system regularly to avoid discrepancies between actual and recorded figures.

- Promptly address any discrepancies or errors to avoid long-term complications and ensure that all records align with tax requirements.

By following these best practices, businesses can manage their documentation more effectively, ensuring compliance while reducing administrative burdens. A proactive approach not only keeps operations running smoothly but also strengthens the trust and reliability of financial operations within the organization.