Ground Rent Invoice Template for Efficient Billing

Managing payments for leased properties can be a complex task, especially when it involves keeping track of regular fees. A well-structured document can simplify the entire process, ensuring that both the recipient and the payer are clear on the terms and amounts due. Having the right framework in place not only saves time but also helps maintain transparency and professionalism in all transactions.

By utilizing a standardized form, property owners and managers can streamline their billing practices, reducing errors and disputes. This system helps ensure that every charge is documented clearly, with the necessary details included, such as due dates and payment instructions. Using a consistent format offers both parties peace of mind and helps in maintaining accurate records for future reference.

Creating a well-organized structure for managing these payments is crucial for a smooth financial operation. Customizable documents can be tailored to suit specific needs while still maintaining essential components that ensure compliance and clarity. Whether you’re managing a single property or multiple units, having the right tools in place can make all the difference.

Ground Rent Invoice Template Overview

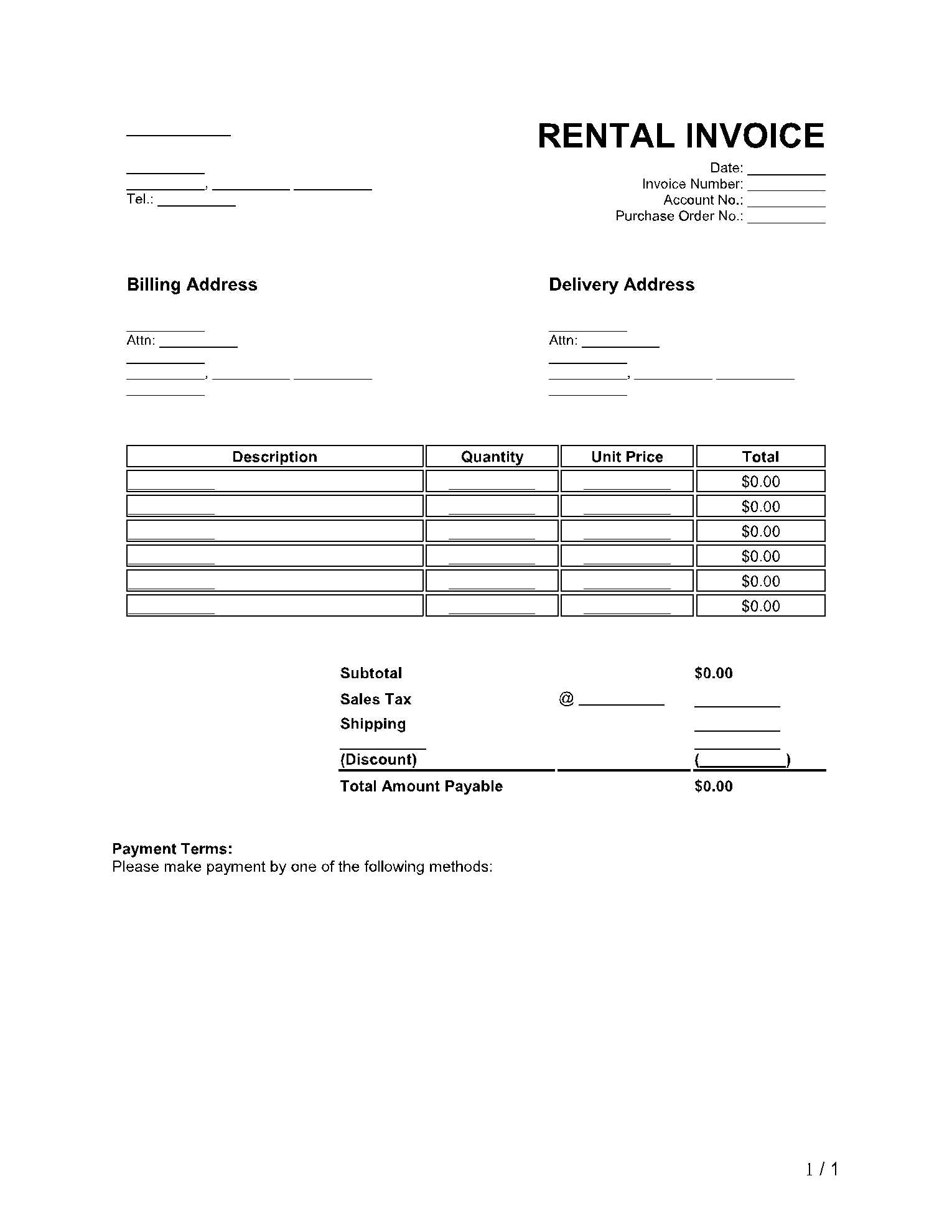

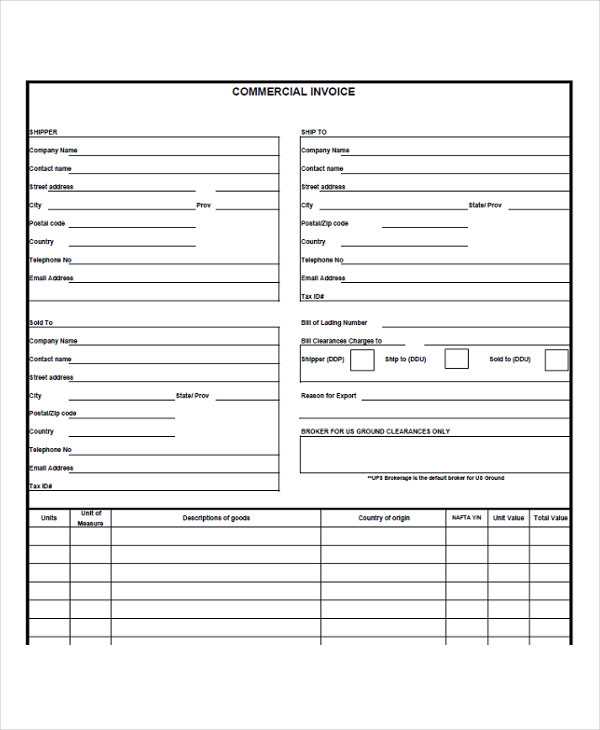

Proper documentation for property-related payments is essential for smooth transactions between landlords and tenants. A well-structured document that outlines the financial obligations helps ensure clarity and minimizes the risk of confusion or disputes. Such documents should include key information such as the payment amount, due date, and contact details, providing a transparent record for both parties involved.

Creating an effective document for payment requests can save time and reduce errors. The format should be clear, easy to understand, and customizable to fit different property arrangements. By incorporating consistent elements in every document, it becomes easier to track payments and ensure that all financial matters are handled professionally.

| Section | Description |

|---|---|

| Property Information | Details about the property involved in the agreement, including address and type of lease. |

| Amount Due | The total sum that needs to be paid by the tenant for the specified period. |

| Payment Terms | Specifics regarding when and how the payment should be made. |

| Due Date | The deadline by which the payment must be received to avoid penalties. |

| Late Fee Information | Information regarding any additional charges for overdue payments. |

Understanding Ground Rent Invoices

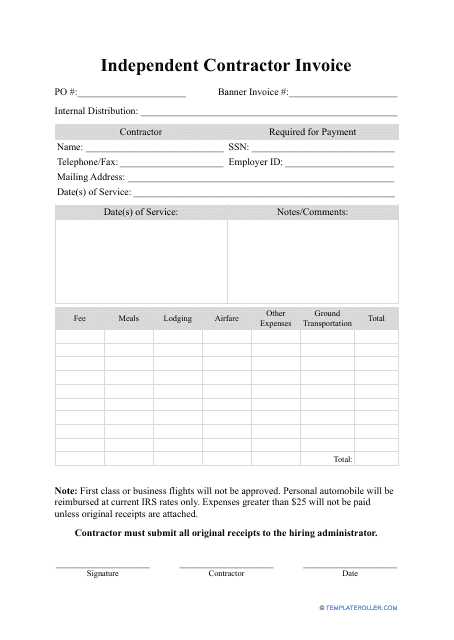

Managing financial transactions for leased properties involves clear documentation that outlines the amounts owed and the terms for payment. A well-constructed document for such purposes serves as a record for both parties, ensuring that there is no ambiguity regarding the amount due, payment deadlines, and any applicable fees. Understanding the components of this document is key to ensuring smooth and effective management of property-related finances.

Key Components of a Payment Request

- Payment Amount: The sum that the tenant is required to pay for the specific period covered by the agreement.

- Due Date: The deadline for when the payment must be received to avoid penalties.

- Payment Methods: The various ways the payment can be made, such as bank transfer, check, or online payment.

- Late Fees: Additional charges that apply if the payment is made after the due date.

Why Accurate Documentation Matters

- Helps avoid misunderstandings between the property manager and tenant.

- Provides a clear legal record in case of disputes.

- Ensures timely payments, contributing to smooth property management.

Why Use a Ground Rent Invoice Template

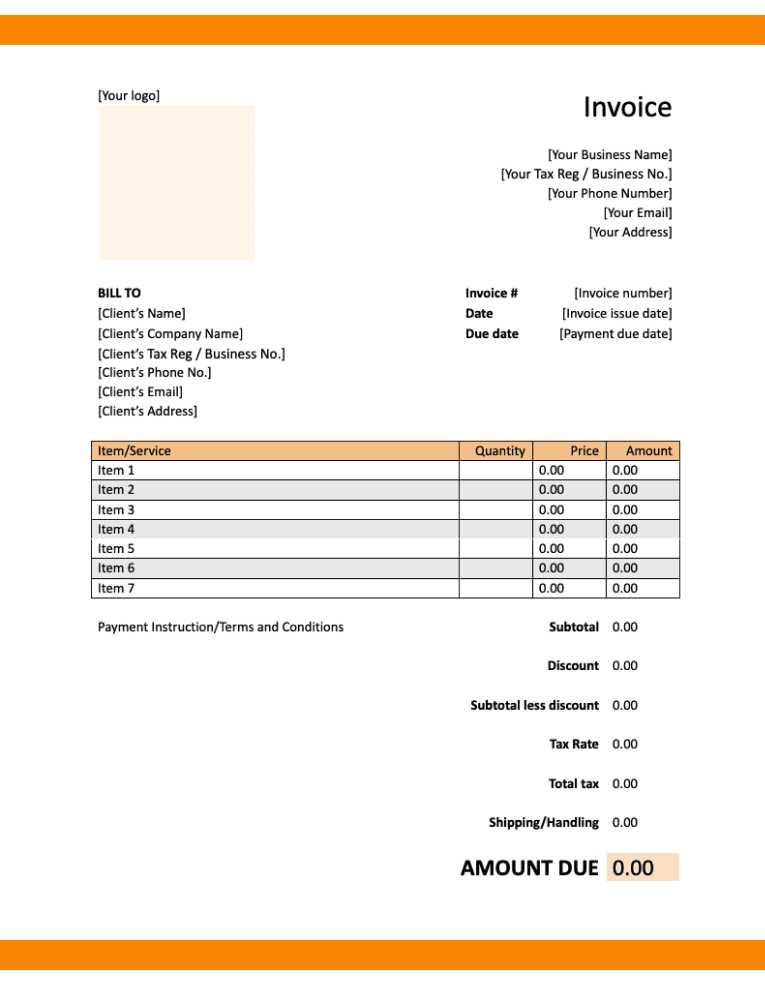

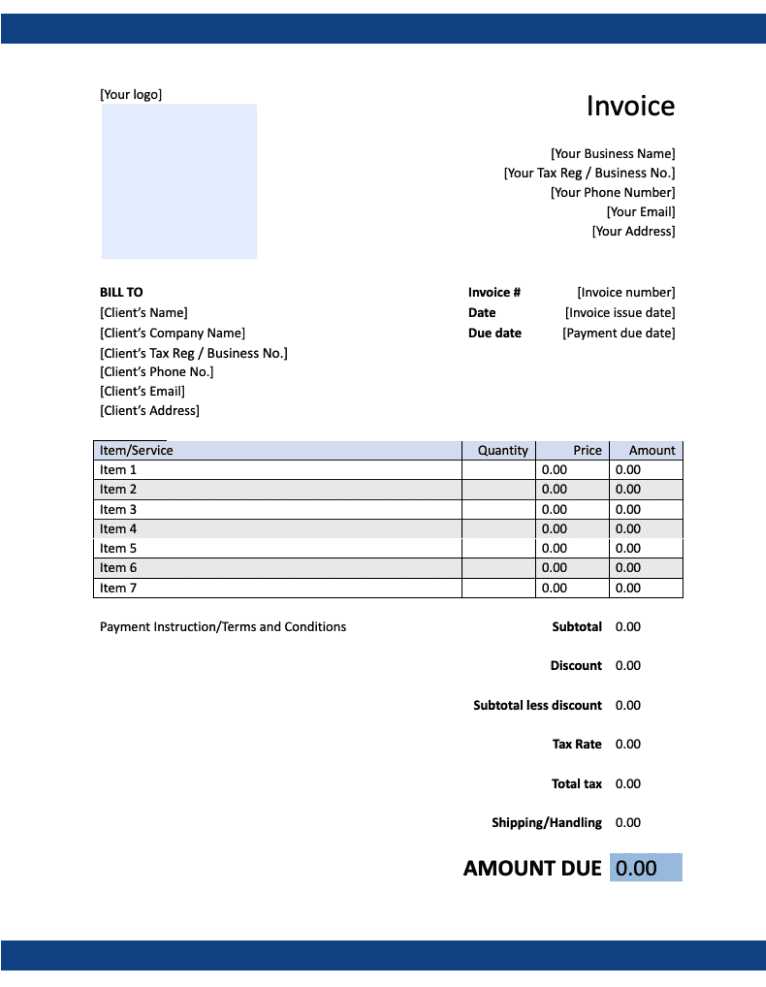

Utilizing a pre-structured document for payment requests offers numerous advantages for both property managers and tenants. By standardizing the process, you ensure consistency, reduce the chances of errors, and streamline the entire billing procedure. This makes managing multiple properties or leases simpler and more efficient, allowing for clearer communication and improved financial record-keeping.

Here are some key reasons why such a system is beneficial:

| Benefit | Explanation | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Consistency | Using a structured document ensures all relevant details are included every time, avoiding omissions or mistakes. | ||||||||||||

| Time-Saving | Customizing and reusing an established form reduces the time spent creating new documents from scratch. | ||||||||||||

| Professional Appearance | A polished document demonstrates professionalism and helps build trust with tenants. | ||||||||||||

| Clear Communication | All necessary payment details are provided in a transparent manner, reducing confusion or disputes. | ||||||||||||

| Legal Protection | A standardized form serves as an official record, offe

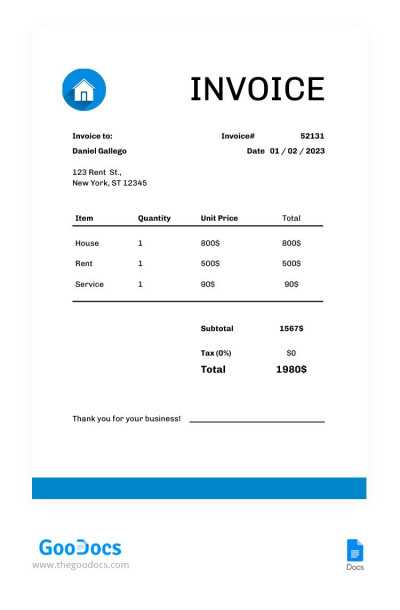

How to Customize the TemplateAdapting a payment request document to fit specific needs ensures that it aligns with the unique terms of each agreement. Customizing this document involves adjusting key fields, such as the amount due, property details, and payment instructions. This flexibility allows you to tailor the form for different types of properties, lease terms, or payment schedules, making it a versatile tool for property managers. Essential Customization Elements

Example Customization Table

Essential Elements of Ground Rent InvoicesA well-crafted payment request document should include several key components to ensure clarity and accuracy. These elements not only provide the necessary details for both the payer and recipient but also contribute to the document’s legal standing. Including the right information ensures smooth transactions and minimizes the risk of disputes or misunderstandings. Key Information to Include

Additional Information for Clarity

Formatting Tips for Professional InvoicesCreating a clear and professional-looking document for payment requests not only ensures that the details are easily understood, but also builds trust with the recipient. Proper formatting makes it easier for tenants or clients to locate key information, while enhancing the overall appearance of the document. A well-organized layout can also prevent misunderstandings and help establish credibility. Best Practices for Document Layout

Visual Enhancements for Readability

Calculating Ground Rent Charges Accurately

Ensuring that payment amounts are calculated correctly is essential for maintaining transparent and fair financial transactions. Whether based on an annual fee, property value, or another metric, the calculation process should be clear, consistent, and easy to verify. Properly calculating the charges helps prevent disputes and ensures that both the property owner and tenant understand their financial responsibilities. Methods of Calculation

Important Factors to Consider

Including Payment Terms in Your InvoiceClear and well-defined payment terms are essential for both parties involved in a financial agreement. By specifying when and how payments are expected, you eliminate confusion and set clear expectations. Payment terms help the recipient understand their responsibilities and avoid delays, while also protecting the issuer’s interests by establishing a framework for timely payments. Key elements to include in the payment section of your document include:

Including these key payment terms ensures that both parties are aware of the agreed-upon conditions and fosters a smooth, predictable financial relationship. Best Practices for Sending Ground Rent InvoicesEffectively managing the distribution of payment requests is crucial for maintaining timely financial transactions. Sending out clear, professional, and timely documents ensures that recipients are aware of their obligations and helps to prevent delays in payments. Following best practices in this area not only fosters a positive relationship between property owners and tenants but also promotes smoother cash flow management. Here are some essential practices to follow when sending payment requests:

By following these practices, property owners can ensure smoother transactions and maintain professional and timely relationships with tenants or clients. Common Mistakes to Avoid in InvoicesEven a small mistake in a payment document can lead to confusion or delayed payments. It’s important to avoid common errors that can undermine the professionalism of the document and cause misunderstandings between the parties involved. By being aware of these mistakes and taking steps to prevent them, you can ensure smoother transactions and more efficient financial management. Here are some frequent mistakes to avoid:

By being mindful of these common mistakes, you can ensure that your payment documents are accurate, professional, and easily understood, helping to foster trust and prompt payments. Digital vs Paper Ground Rent Invoices

When deciding how to send payment requests, it’s important to weigh the pros and cons of digital versus traditional paper formats. Each method has its own benefits depending on the specific needs of the sender and the recipient. Understanding the advantages of each option can help determine the most efficient and effective way to handle financial transactions. Benefits of Digital Formats

Benefits of Paper Formats

Ultimately, the choice between digital and paper formats depends on factors like convenience, recipient preferences, and the nature of the transaction. Both methods are viable, and understanding their strengths can help streamline your financial processes. Legal Requirements for Ground Rent InvoicesWhen it comes to sending payment requests, it’s essential to ensure that the document complies with the legal regulations governing such transactions. Depending on the jurisdiction and type of agreement, certain information must be included to protect both parties involved and ensure the document holds up in legal matters. Understanding these legal requirements is crucial to avoid disputes and ensure that the request is enforceable. Key elements that are typically required by law include:

Ensuring that these elements are included in your payment request can help avoid misunderstandings and provide a clear record that protects both parties in case of a dispute. Always consult with a legal professional to make sure your documents meet local legal requirements and are properly formatted to be enforceable. How to Track Ground Rent PaymentsMonitoring payments is an essential part of managing financial obligations. Whether you are the recipient or the payer, keeping an accurate record of transactions ensures transparency and helps prevent any potential disputes. There are various methods to track payments, each suited to different needs and preferences. Here are some effective ways to track payments:

By utilizing these methods, you can ensure that payments are tracked accurately and that all parties are aware of their financial standing. Proper tracking not only helps with record-keeping but also aids in maintaining healthy financial practices and avoiding late payment issues. Handling Late Payments with the TemplateDealing with delayed payments is a common challenge in any business transaction. When payments are overdue, it’s crucial to have a clear strategy in place to handle the situation professionally. By utilizing a structured document for payment requests, you can efficiently manage late payments and minimize disruptions to your cash flow. Here are some strategies to handle overdue payments using a structured document:

Having a well-structured document that outlines these conditions makes it easier to manage late payments, reduces misunderstandings, and maintains a professional relationship with clients. It’s important to clearly communicate the consequences of overdue payments, while also providing sufficient time for the payer to settle the debt. A balanced approach ensures fairness for both parties involved. How to Handle Disputes Over Rent

Disagreements regarding payments can arise in any financial arrangement, and it is essential to approach such disputes with professionalism and clarity. Whether it involves a misunderstanding about the terms, the amount due, or the time frame, handling these issues effectively is crucial to maintaining a good relationship with the payer while protecting your financial interests. Here are some steps to resolve conflicts related to payments:

Approaching disputes with a calm and systematic approach can help resolve issues efficiently. By keeping detailed records, maintaining open communication, and exploring all options for resolution, you can ensure that disagreements are settled fairly, minimizing the impact on both parties. Templates for Different Types of PropertiesWhen managing properties, it’s important to tailor the financial documents to the specific type of property being dealt with. Different properties may require different formats or pieces of information, depending on the agreements in place. Understanding these distinctions helps ensure that all parties are clear about the terms and payments involved. Below are the various approaches to consider when creating documents for different property types. Residential PropertiesFor residential properties, the payment schedules and terms tend to be more straightforward, but it is still essential to include all relevant details. Common elements for these documents include:

Commercial PropertiesCommercial properties often involve more complex arrangements, with longer-term contracts and possibly varying fees. These documents should include more detailed clauses such as:

By understanding the requirements of each property type, you can create documents that reflect the specific needs of both the property owner and the tenant. Customizing these documents accordingly ensures clarity and avoids misunderstandings down the line. Benefits of Using a Ground Rent Invoice TemplateUtilizing a structured document for managing payments offers several advantages for both property owners and tenants. These well-organized financial documents ensure consistency, improve efficiency, and help avoid potential errors. Below are the key benefits of using a standardized approach for payment documentation.

Incorporating a structured approach into financial management is essential for maintaining smooth business operations. By using a pre-designed format, property managers and landlords can improve the experience for all parties involved while keeping everything organized and efficient. Where to Find Free Ground Rent TemplatesFinding suitable and cost-effective resources for managing payment documentation is essential for both property owners and managers. Many online platforms offer free, customizable options for creating these documents. These resources provide easy-to-use formats that ensure accurate and professional payment records. Online Platforms Offering Free Resources

How to Use These Resources Effectively

By exploring these options, you can access a wide range of free resources that simplify the creation of essential documents, making it easier to manage payments and maintain professional relationships with tenants or clients. |