Grocery Store Invoice Template for Simplified Billing

Managing transactions and keeping accurate records is crucial for any retail business. The ability to provide clear and professional documentation for each purchase ensures smooth operations and helps maintain trust with customers. With the right tools, this process can be both simple and effective, streamlining day-to-day tasks and reducing errors.

Utilizing a well-organized format for receipts and payment records allows businesses to track sales, monitor payments, and handle taxes with ease. A good system also makes it easier to integrate discounts, refunds, or other adjustments as necessary, providing flexibility while maintaining accuracy.

Customizable solutions give retailers the freedom to adjust designs and structures according to their needs, making it possible to reflect unique business requirements while adhering to legal standards. Whether you’re looking to save time, reduce administrative work, or enhance your customer service, an efficient billing method can be a game-changer for your business.

Grocery Store Invoice Template Overview

For any business, providing clear and organized documentation for customer purchases is essential. This documentation helps maintain a professional image while ensuring that all transactions are accurately recorded. Whether for internal records, customer reference, or accounting purposes, a well-structured record form is an important part of day-to-day operations.

Why Accurate Billing is Important

Clear records are not only a legal requirement but also a vital aspect of efficient financial management. They provide a straightforward way to track sales, manage payments, and handle returns or refunds. Accurate documentation also ensures that your financial statements are correct and complete, which is crucial when it comes to taxes or audits.

Customization and Flexibility

Having a flexible format that can be customized to suit your specific needs is a key benefit. It allows for easy adjustments to reflect discounts, promotions, and payment terms. Additionally, personalization options give you the opportunity to include your branding, making each document an extension of your business identity.

Why You Need an Invoice Template

In any business, providing clear and consistent documentation for each transaction is essential. Without a structured approach, managing sales and payments can become disorganized, leading to mistakes and confusion. Having a ready-to-use format for recording purchases simplifies this process, ensuring accuracy and professionalism.

Here are some key reasons why having a standardized record format is crucial:

- Consistency: A uniform method for documenting transactions ensures all records follow the same format, reducing errors and making the process more efficient.

- Time-saving: Using a pre-designed format speeds up the billing process, allowing staff to focus on other important tasks.

- Professional appearance: Clear, organized documentation creates a positive impression on customers, making your business appear reliable and trustworthy.

- Tax compliance: Well-structured records make it easier to track sales, taxes, and deductions, helping you stay compliant with financial regulations.

By adopting a standardized format, businesses can streamline their operations and maintain high levels of accuracy, ultimately contributing to smoother financial management.

Benefits of Using a Customizable Template

Having a flexible and adaptable format for recording transactions offers several advantages for businesses. The ability to tailor each document to your specific needs allows for greater control and efficiency. Customizable solutions help businesses align their documentation process with their unique operational requirements while ensuring accuracy and professionalism.

Some of the key benefits include:

- Personalization: Customize elements like logos, color schemes, and contact information to reflect your brand identity, providing a cohesive look for your business communications.

- Adaptability: Easily adjust the layout to include additional fields, such as discounts, loyalty points, or special offers, giving you flexibility to meet evolving customer needs.

- Improved Efficiency: Automating certain sections, like item listings or totals, can save time and reduce the chances of manual errors during the documentation process.

- Consistency: By using a standardized yet customizable format, every transaction maintains a professional appearance and ensures all necessary information is included each time.

- Legal Compliance: A customizable format allows you to easily integrate tax rates, payment terms, and other legal requirements, helping you stay compliant with regulations.

Ultimately, a customizable solution enhances both the efficiency and professionalism of your business operations, making it easier to manage transactions and maintain accurate records.

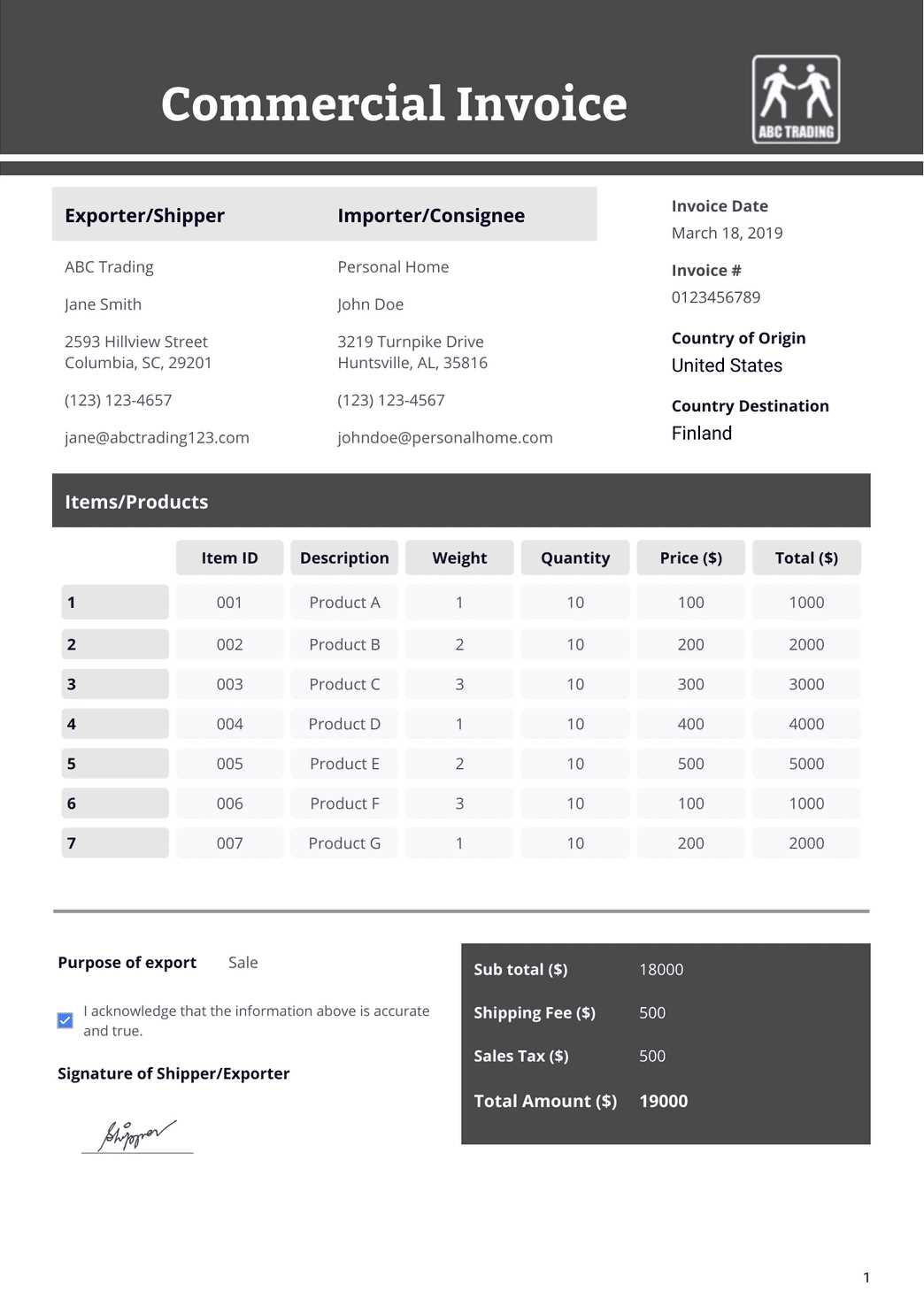

How to Create an Effective Invoice

Creating clear and accurate documentation for transactions is a fundamental task in any business. An effective record should contain all necessary details, ensuring both the seller and the customer understand the terms of the sale. A well-structured document not only helps with financial tracking but also serves as a professional communication tool.

To craft a successful document, consider the following key steps:

- Include Essential Details: Every document should have the date of transaction, itemized list of products or services, quantities, prices, and total amount due.

- Specify Payment Terms: Clearly state the payment deadline and accepted methods, ensuring both parties are aware of expectations.

- Provide Contact Information: Include your business’s name, address, and contact details, making it easy for customers to reach out for any questions or concerns.

- Organize the Layout: A clean and organized format makes the document easy to read. Use headings, sections, and proper spacing to guide the reader through the information.

- Include Legal Information: Add any necessary legal disclaimers or tax information to ensure compliance with relevant regulations.

By focusing on these critical elements, you can create effective documents that are both functional and professional, improving communication and ensuring smooth financial operations.

Key Elements of a Grocery Invoice

When creating a document to record sales, it’s important to include all the necessary details that ensure transparency and accuracy. An effective record not only provides a clear breakdown of the transaction but also helps both the business and the customer keep track of payments, products, and terms. There are several key components that should be consistently present to make sure the documentation is complete and useful.

The most essential elements to include are:

- Transaction Date: Clearly specify the date of the purchase to ensure proper tracking and reference for both parties.

- Unique Identification Number: Assign a unique number to each record to easily track and reference the sale in your system.

- Itemized List of Products: Include a detailed list of purchased goods or services, including quantities, descriptions, and unit prices. This ensures clarity for the customer and helps avoid misunderstandings.

- Total Amount Due: Clearly display the total cost of the transaction, including any taxes or additional charges, so the customer understands the final amount.

- Payment Terms: Specify the due date for payment, accepted methods (e.g., cash, credit), and any discounts or penalties for early or late payments.

- Business Information: Include your business’s name, address, contact details, and any applicable tax identification numbers to ensure transparency and legal compliance.

Including these key elements in your records helps streamline your billing process, ensures customer satisfaction, and keeps your business in compliance with financial regulations.

Choosing the Right Template for Your Store

Selecting the appropriate format for documenting transactions is an important decision for any business. The right layout can streamline the billing process, improve organization, and ensure clarity for both customers and staff. It’s essential to find a solution that aligns with your business needs while maintaining a professional appearance.

Consider Your Business Needs

Every business has unique requirements, so it’s important to choose a format that fits your specific needs. Consider factors such as:

- Size and Volume of Transactions: If your business handles many small transactions, a simple, easy-to-fill-out structure may be more appropriate. For larger, more complex sales, a detailed layout may be needed.

- Branding and Customization: Make sure the format you choose allows room for customization, such as adding your logo, brand colors, and contact information.

- Flexibility for Additions: Look for a solution that can easily accommodate discounts, returns, or other special conditions that may apply to certain transactions.

Ease of Use and Integration

Opt for a design that is user-friendly and integrates easily with your existing systems. An intuitive layout minimizes errors and saves time, while smooth integration with your accounting or sales software can automate many aspects of the process, reducing manual work and improving accuracy.

Choosing the right format not only enhances the efficiency of your business operations but also ensures that you present a consistent and professional image to your customers.

Common Mistakes to Avoid in Invoices

When preparing transaction records, it’s easy to overlook important details that can lead to confusion, errors, or even legal issues. Avoiding common mistakes in documentation ensures smooth business operations, accurate financial tracking, and positive customer relations. Here are some frequent errors that should be avoided to maintain professionalism and accuracy.

Incomplete or Missing Information

One of the most common mistakes is failing to include all necessary details. Without complete information, both parties may face confusion regarding payment terms, items purchased, or amounts owed. Always ensure the following elements are present:

- Clear transaction date

- Accurate product descriptions and quantities

- Total amount due, including taxes and discounts

- Payment terms and deadlines

Incorrect Calculation and Tax Errors

Another issue is incorrect math or miscalculating taxes. This can cause disputes and delay payments. Ensure you double-check all figures, including subtotal amounts, discounts, taxes, and the final total. It’s also crucial to stay updated with the correct tax rates for your region or industry to avoid compliance issues.

By paying attention to these common errors and taking the time to review each document carefully, you can improve the efficiency and professionalism of your transaction records, ultimately fostering better customer relationships and ensuring smooth financial processes.

How to Add Discounts to Your Invoice

Offering discounts is a great way to attract customers and encourage repeat business. However, it’s important to clearly indicate any discounts applied to your transaction records to avoid confusion and ensure accuracy. Properly documenting discounts helps both the seller and the buyer keep track of the original price and the discounted amount.

Here are some steps to effectively apply discounts to your transaction records:

- Specify the Discount Type: Clearly state if the discount is a percentage or a fixed amount. This helps the customer understand how the discount was calculated.

- Show the Original Price: Display the full price of each item before the discount is applied. This ensures transparency and helps customers see the value they are receiving.

- Deduct the Discount Amount: After showing the original price, subtract the discount to reflect the new total. Ensure that the discount is clearly noted as a separate line item to avoid any misunderstandings.

- Indicate Terms and Conditions: If applicable, note any conditions for the discount, such as a minimum purchase requirement, expiration date, or specific eligibility criteria. This prevents confusion and sets clear expectations.

By following these guidelines, you can ensure that discounts are communicated clearly and accurately, making your records both transparent and professional. This not only helps in maintaining good customer relations but also streamlines the billing process.

Setting Payment Terms in the Template

Establishing clear payment terms is a critical aspect of any business transaction. By setting expectations up front, both the buyer and the seller can avoid misunderstandings and ensure that payments are made on time. Defining payment terms within your transaction records helps create a professional image while protecting your business’s cash flow.

Here are some key considerations when setting payment terms:

- Payment Deadline: Clearly state when the payment is due. Common terms include “due upon receipt,” “net 30,” or “due within 15 days.” This helps manage expectations regarding the time frame for payments.

- Accepted Payment Methods: Specify the forms of payment you accept, whether it’s cash, credit card, bank transfer, or another method. This eliminates confusion and helps your customers choose the most convenient option for them.

- Late Fees or Penalties: If applicable, include any fees for late payments. Be sure to outline when the penalty will be applied and the amount or percentage that will be charged. This incentivizes timely payments and helps mitigate the risk of delayed cash flow.

- Discounts for Early Payment: Consider offering a small discount for early payments, such as 2% off if paid within 10 days. This encourages customers to pay promptly and helps maintain a steady cash flow.

By clearly defining these terms, you can ensure a smooth payment process and strengthen your business relationships. Setting payment expectations not only protects your financial interests but also builds trust with your customers by being transparent about your requirements.

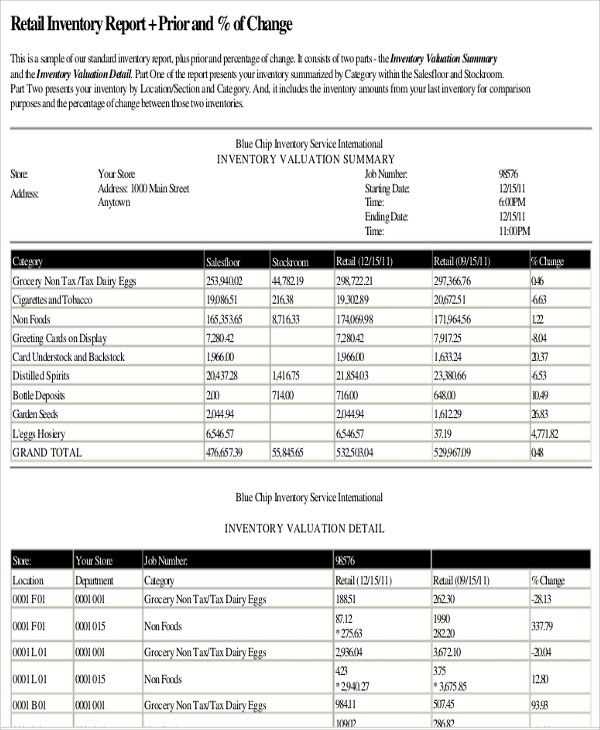

Tracking Sales with Invoice Templates

Efficiently tracking sales is essential for maintaining accurate records and ensuring that your business remains financially organized. Proper documentation not only helps with monitoring cash flow but also provides valuable insights into sales patterns, inventory management, and customer preferences. By utilizing well-organized forms for each transaction, businesses can easily track sales over time and analyze performance.

Organizing Sales Data

Using a structured format allows for easy recording and retrieval of important sales data. Key information such as product details, quantities sold, and transaction totals are vital for generating accurate reports. Regular tracking of this data enables you to assess your business’s growth and pinpoint areas for improvement.

| Product | Quantity Sold | Unit Price | Total Sale |

|---|---|---|---|

| Item A | 50 | $10.00 | $500.00 |

| Item B | 30 | $15.00 | $450.00 |

| Item C | 20 | $25.00 | $500.00 |

Analyzing Sales Trends

Tracking sales through these forms can provide insights into customer behavior and inventory turnover. By organizing this data over time, you can detect trends such as which products are most popular, seasonal shifts in demand, and overall sales growth. This information is crucial for strategic planning and decision-making.

In conclusion, keeping detailed records using a clear structure not only simplifies sales tracking but also helps in making informed decisions for business development and future growth.

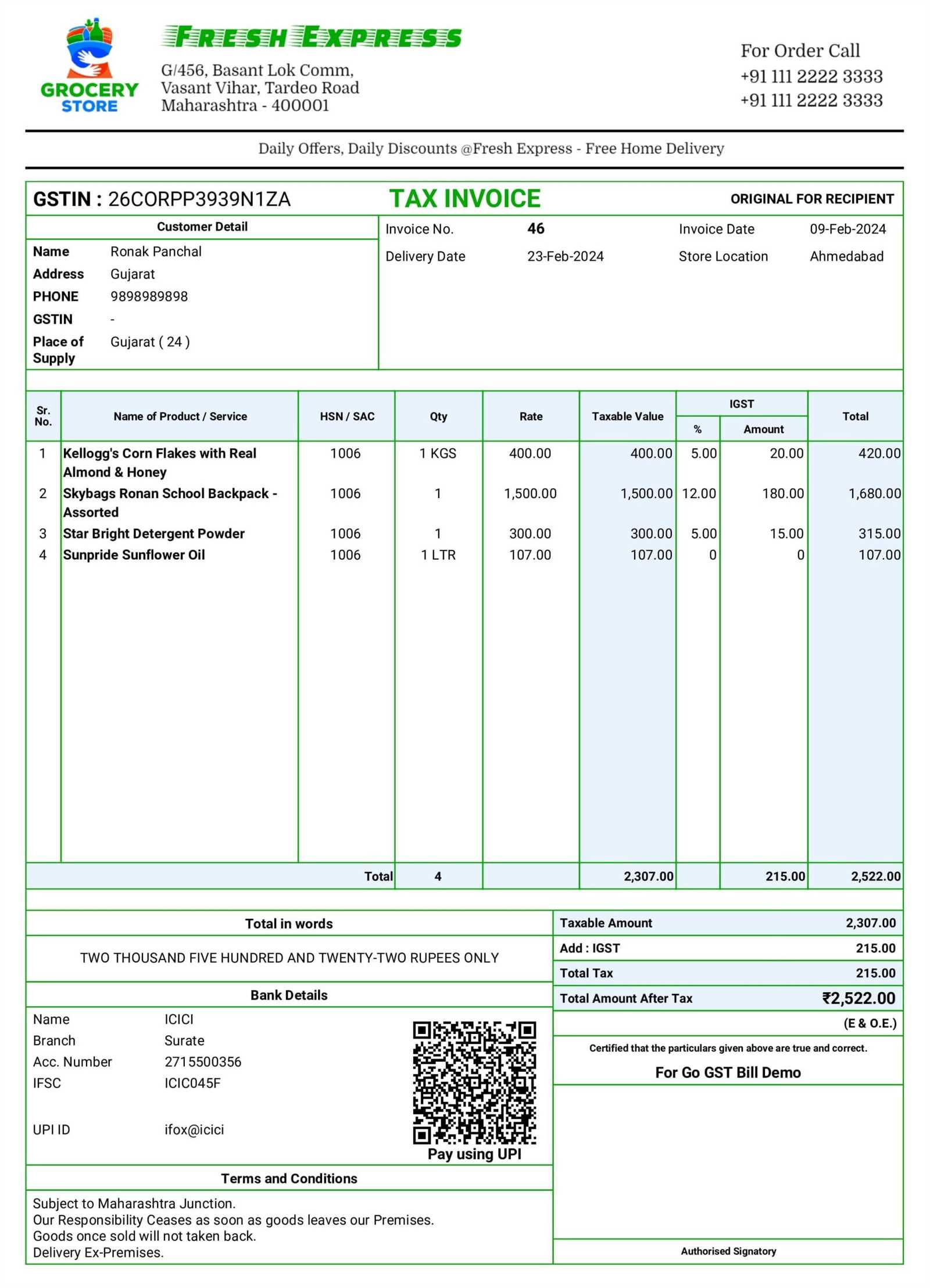

How to Integrate Taxes in Your Invoice

Including taxes in your transaction records is crucial for both legal compliance and clear communication with customers. When taxes are calculated and displayed accurately, it ensures transparency and helps avoid confusion during payment. Understanding how to properly integrate tax charges can also assist in staying compliant with local tax regulations.

Steps to Include Taxes Correctly

To accurately reflect taxes in your transaction documents, follow these steps:

- Determine the Correct Tax Rate: Research the applicable tax rate for your region or product category. Tax rates can vary by location, and it’s important to apply the correct one to avoid errors.

- Calculate the Taxable Amount: Before applying the tax, ensure that you’re only charging tax on the taxable items. Some goods or services may be exempt from taxation, so make sure to adjust your calculations accordingly.

- Display Tax Information Clearly: Make sure the tax amount is shown separately from the item prices and the total. This helps customers see the breakdown of the final amount and understand the specific tax charges they are paying.

- Show Total Amount with Tax: After calculating the tax, add it to the subtotal to give the customer a clear total amount due, including tax charges.

Example of Tax Calculation

Here’s a simplified example of how tax should appear in your transaction document:

- Item Total: $100.00

- Sales Tax (5%): $5.00

- Total Amount Due: $105.00

By clearly indicating the tax breakdown in your transaction records, you help foster trust with customers and ensure that your business remains compliant with tax regulations. Properly integrating taxes can also streamline your accounting processes, making it easier to report income and tax obligations.

Design Tips for a Professional Look

A clean, well-organized design can make a big difference in how your transaction records are perceived. When customers receive documents that are visually appealing and easy to understand, it not only builds trust but also enhances your professional image. A simple, structured layout with thoughtful design choices can make your business stand out and create a lasting impression.

Key Design Elements to Consider

To create a visually appealing and professional look, here are a few design tips:

- Use Clear and Readable Fonts: Opt for professional, easy-to-read fonts. Stick to standard fonts like Arial, Times New Roman, or Helvetica to ensure clarity. Avoid using too many different font styles or sizes, which can make the document look cluttered.

- Maintain Consistent Branding: Incorporate your business’s logo and color scheme to maintain brand consistency. This reinforces your business identity and helps make your records easily recognizable.

- Focus on Spacing and Alignment: Proper alignment and generous white space improve readability and ensure the document doesn’t appear crowded. Make sure text, numbers, and headings are neatly aligned and spaced to create a balanced and clean layout.

- Highlight Important Information: Use bold text or larger font sizes for key details like totals, dates, and payment terms. This ensures that critical information stands out and can be easily located.

Example of a Simple Layout

Below is an example layout with a clean, professional look:

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Item A | 2 | $20.00 | $40.00 |

| Item B | 1 | $15.00 | $15.00 |

| Total | $55.00 |

Incorporating these design tips will help create a document that looks polished and professional, leaving a positive impression on your customers and contributing to smooth business operations. A well-designed document not only reflects the quality of your products or services but also shows that you value organization and detail in all aspects of your business.

Incorporating Branding into Your Invoices

Adding your brand identity to official documents is an essential step in reinforcing your business presence and professionalism. Customizing transaction records with your logo, color scheme, and unique design elements helps create consistency across all your communication materials, giving customers a cohesive experience. By integrating your branding into these documents, you not only enhance your professional image but also remind your customers of your business’s values and commitment to quality.

Here are a few ways to incorporate your branding into transaction records:

- Logo Placement: Position your business logo at the top of the document, making it the first thing your customers see. This establishes your brand’s visual presence right away and makes the document feel personalized.

- Use of Brand Colors: Apply your business’s primary colors in headings, borders, and text accents. Consistent color usage ties the document to your brand and makes it more visually cohesive.

- Custom Fonts and Typography: Choose fonts that align with your brand’s personality. Whether you prefer a modern sans-serif or a more traditional serif font, consistent typography helps solidify your branding and ensures your document is easily readable.

- Design Elements: Incorporate subtle design touches, such as custom borders, background patterns, or icons, to elevate the document’s look and feel while maintaining a clean, professional appearance.

By thoughtfully integrating your brand into official documents, you create a stronger connection with your customers and reinforce your business identity. This attention to detail not only enhances the look of your documents but also builds trust and recognition, making your transactions more memorable and professional.

How to Automate Your Invoicing Process

Streamlining your billing process through automation not only saves time but also reduces human error and ensures consistency. By setting up automated systems, you can efficiently handle tasks such as generating, sending, and tracking payments, freeing up valuable time to focus on other aspects of your business. Automation allows for faster processing, improves accuracy, and ensures that no transaction is overlooked.

Steps to Automate Your Billing Process

Follow these steps to automate your billing system:

- Choose the Right Software: Select a platform or software that fits your business needs. There are many tools available that offer features like automatic bill creation, payment reminders, and reports.

- Set Up Recurring Billing: For businesses with regular customers, automating recurring charges ensures that payments are processed on time without manual intervention.

- Integrate Payment Gateways: Link your payment system to your billing software to allow for seamless, secure transactions. This integration ensures that payments are tracked and recorded in real-time.

- Automate Payment Reminders: Set up automatic reminders for overdue payments, reducing the need for follow-up communication and minimizing late payments.

- Generate Reports Automatically: Use automated reporting features to track your financials without having to manually compile data. This ensures you have up-to-date insights on revenue, outstanding balances, and more.

Benefits of Automation

- Time Efficiency: Automating manual tasks such as data entry and follow-ups saves significant time, allowing you to focus on growing your business.

- Accuracy: Reducing human error in calculations or data entry leads to more accurate records and minimizes costly mistakes.

- Consistency: Automated systems provide consistent processes, ensuring all documents are sent on time and follow the same format.

- Improved Cash Flow: Timely billing and payment reminders increase the likelihood of getting paid faster, improving cash flow for your business.

By implementing automation in your billing processes, you can enhance efficiency, reduce errors, and ensure timely payments, all of which contribute to a smoother and more professional business operation.

Invoice Template vs. Manual Billing

When it comes to processing payments and documenting transactions, businesses have the option of using ready-made billing documents or relying on manual methods. Both approaches have their pros and cons, but the choice largely depends on the specific needs of the business and the volume of transactions. While manual billing provides flexibility, using a pre-designed document can streamline the entire process and reduce the potential for errors.

Manual Billing involves creating each billing record from scratch, often using pen and paper or digital tools like spreadsheets. This method offers complete control, allowing businesses to tailor each record to the specific transaction details. However, it can be time-consuming, especially for businesses with high transaction volumes. Additionally, it increases the likelihood of human errors in calculations or data entry, which can lead to delays or confusion.

Pre-Designed Billing Documents offer a more structured approach, where most fields are automatically populated, reducing the time spent on creating each document. These forms ensure consistency across all records, which minimizes mistakes and simplifies the accounting process. The use of software or online platforms also enables businesses to integrate payment tracking, send automated reminders, and generate reports quickly, improving overall efficiency. However, they may not always provide the same level of customization as manual methods.

Advantages of Using Pre-Designed Forms

- Consistency: Pre-designed forms ensure that every document follows the same format, which promotes professionalism and avoids discrepancies.

- Time Efficiency: By reducing the time spent on creating each record, businesses can focus on other tasks, increasing productivity.

- Error Reduction: With fields that are auto-filled or calculated, the chances of human errors, such as miscalculating totals or entering incorrect information, are minimized.

- Streamlined Processes: Automated features, such as payment tracking and reminders, help businesses manage finances more effectively.

Challenges of Manual Billing

- Time-Consuming: Creating individual records for each transaction is labor-intensive and can slow down operations.

- Higher Risk of Errors: Manual calculations and data entry can lead to mistakes that impact financial reporting or customer relationships.

- Inconsistent Records: Without a standardized format, each bill may look different, which can cause confusion or a lack of professionalism.

- Limited Automation: Manual methods do not provide built-in features for payment tracking, reminders, or automatic reporting, which can result in inefficiencies.

Ultimately, choosing between using a pre-designed document or sticking with manual methods depends on the size and complexity of the business. For larger operations, automated solutions are typically more efficient, while small businesses may find manual billing sufficient fo

Maintaining Legal Compliance with Invoices

Ensuring that financial records are accurate and comply with legal requirements is essential for every business. Proper documentation not only helps with organizing transactions but also protects the business in the event of audits or disputes. Legal compliance in financial records typically involves adhering to tax regulations, ensuring transparency in transactions, and keeping clear records that meet local laws and international standards.

Tax Requirements play a significant role in compliance. Businesses must ensure that the correct tax rates are applied to every transaction, which may vary depending on the product or service provided, as well as the location of the transaction. Failure to apply taxes correctly can lead to fines, penalties, and legal issues with tax authorities.

Clear and Transparent Information is another critical aspect. All essential details, such as the names of both the buyer and seller, the date of the transaction, the payment terms, and a breakdown of goods or services provided, should be clearly outlined. Accurate documentation helps avoid misunderstandings or disputes and provides a solid foundation for resolving any potential legal issues.

Key Legal Aspects to Include

- Accurate Tax Rates: Always apply the correct sales tax rate, depending on the product and location, to comply with tax laws.

- Clear Transaction Details: Ensure that the name of the business, customer information, and list of items or services provided are clearly listed and correctly spelled.

- Legal Terms and Conditions: Include payment terms, refund policies, and any relevant legal disclaimers that protect both parties.

- Record Retention: Keep all records for the required period as dictated by local laws to avoid penalties for non-compliance.

Consequences of Non-Compliance

- Fines and Penalties: Businesses may incur significant fines if they fail to comply with tax and financial reporting requirements.

- Loss of Reputation: Non-compliance can damage a business’s credibility and reputation, leading to a loss of trust from clients or customers.

- Legal Disputes: Lack of proper documentation can result in costly legal battles in case of discrepancies or conflicts with clients or suppliers.

By ensuring that each document is complete, accurate, and legally sound, businesses not only stay on the right side of the law but also foster trust with their customers and avoid unnecessary legal trouble.