Great Invoice Templates to Streamline Your Billing Process

Managing billing can often be a time-consuming and repetitive task, especially for small businesses and freelancers. However, using well-structured documents for financial transactions can simplify the process significantly. These ready-made solutions help save time and ensure accuracy, providing a professional touch to every financial interaction.

With the right tools, you can quickly generate clear, organized statements that reflect the quality of your service or product. Whether you’re handling one-time projects or ongoing work, having a reliable method for tracking payments and agreements can streamline your workflow. These resources allow for customization, making it easy to adapt to your unique needs and branding.

Effective billing documents are not just about numbers; they also play a vital role in building trust and professionalism. With the right structure and design, they ensure both clarity and transparency for clients, helping to avoid misunderstandings and delays. Whether you’re just starting or looking to refine your approach, using the proper tools can make all the difference.

Great Invoice Templates for Small Businesses

For small business owners, maintaining accurate records and ensuring timely payments can often be a challenge. One of the most important tools to streamline this process is a structured and easy-to-use document for tracking transactions. By utilizing well-designed formats, small businesses can keep their financial dealings organized and professional, which in turn helps build trust with clients and ensures timely payment.

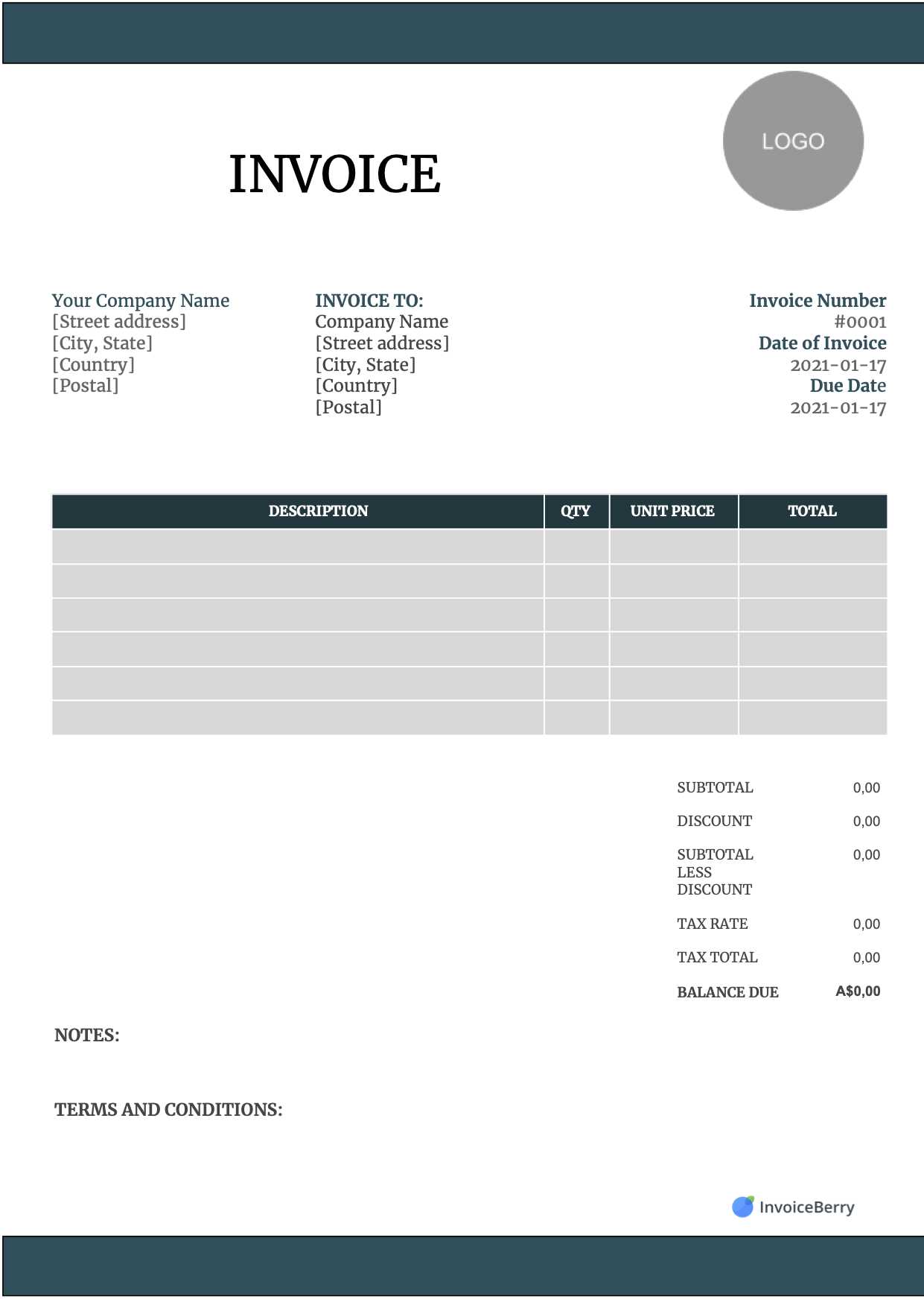

These documents offer a simple yet effective way to present essential details such as services rendered, payment terms, and due dates. With customizable elements, they can reflect the unique branding and specific requirements of each business, making them an essential part of daily operations.

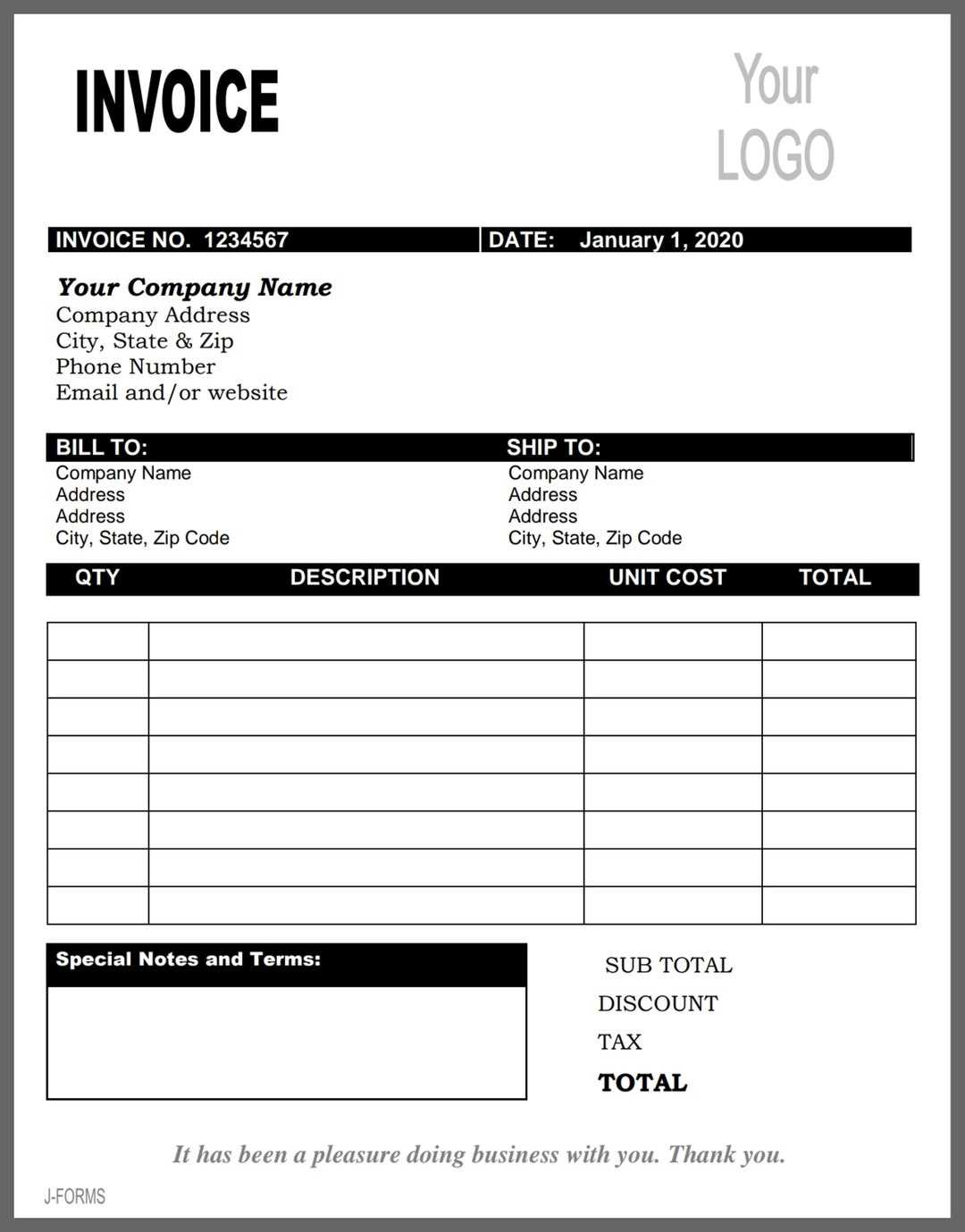

Here is an overview of key features small businesses should look for when selecting the right document for their needs:

| Feature | Description | Benefit | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Clear Payment Terms | Specify due dates and late fees clearly | Helps clients understand expectations and avoid delays | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Customizable Fields | Allow for personal branding and specific service details | Enhances professionalism and tailors documents to business needs | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Simple Layout | Easy to read and navigate | Ensures clients quickly understand the details of the payment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trackable Numbers | Include unique reference codes for each document | Helps businesses keep a record of all transactions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benefit | How It Helps | Impact on Your Business |

|---|---|---|

| Consistency | Standardizes documents across transactions | Improves brand image and ensures uniformity in communication |

| Speed | Quick to fill in and send to clients | Reduces time spent on administrative tasks, boosting productivity |

| Accuracy | Prevents missing key information and reduces errors | Ensures financial details are clear, avoiding confusion and delays |

| Professionalism | Design reflects the business’s branding | Enhances credibility and builds trust with clients |

Ultimately, usin

Benefits of Customizable Invoice Designs

One of the key advantages of using editable billing formats is the ability to personalize them to meet the specific needs of your business. Customizable designs provide flexibility, allowing you to tailor the layout, style, and content to suit your brand identity and the nature of your services. This not only enhances the appearance of your financial documents but also helps you maintain consistency across all communications with clients.

By having the freedom to adjust various elements, such as fonts, colors, and logos, businesses can ensure their documents reflect their unique brand image. This customization feature plays a crucial role in creating a professional and cohesive look that sets your business apart from competitors.

- Brand Recognition: Personalized designs help clients easily recognize your business, reinforcing your brand identity.

- Flexibility: Modify layouts and sections to include the most relevant information for each client or transaction.

- Professional Appearance: A well-tailored format makes your documents look polished and credible, boosting client confidence.

- Client Preferences: Adapt your designs to meet specific client needs, whether it’s adding custom fields or unique payment terms.

- Consistency: Create a uniform appearance for all billing communications, ensuring that each document aligns with your business image.

Moreover, customizable billing formats can save time by allowing you to quickly generate documents without repeatedly adjusting the same details. Once the design is set up, you can easily reuse it, making the process efficient and less prone to errors.

In summary, the ability to customize your financial documents offers a host of benefits, including better brand visibility, greater flexibility, and enhanced professionalism. It also helps streamline the billing process, ultimately improving your business’s efficiency and client satisfaction.

How to Choose the Right Template

Selecting the appropriate document layout is essential for ensuring that your financial communications are both efficient and professional. The right design will not only simplify the billing process but also reflect your brand’s identity and make it easier for clients to understand the details of the transaction. When choosing a format, it’s important to consider factors such as your industry, the complexity of the services offered, and the specific information you need to include.

Here are some key points to consider when selecting the right layout:

| Consideration | Why It Matters | What to Look For | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Industry Needs | Different sectors require different levels of detail | Look for a format with fields specific to your industry (e.g., hourly rates, service descriptions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Design Flexibility | Ability to customize your document ensures it fits your brand | Choose a layout that allows for logo placement, color adjustments, and font customization | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ease of Use | Simplicity ensures quick and efficient creation of each document | Select a clean, user-friendly layout with clear sections and fields | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Details and Fields | Specific details may be necessary based on the type of transaction | Ensure the format includes space for service descriptions, taxes, payment terms, etc. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aspect | Basic Layout | Comprehensive Layout |

|---|---|---|

| Content | Contains only essential details such as dates, amounts, and a brief description. | Includes additional information such as itemized lists, taxes, terms, and notes. |

| Use Case | Ideal for smaller transactions or ongoing services where the exchange is clear and simple. | Better suited for larger projects or when detailed breakdowns are required for clarity. |

| Time Investment | Quick to fill out and process, making it efficient for both parties. | Requires more time to complete due to the inclusion of multiple sections. |

| Clarity | Straightforward and easy to understand, but may lack detailed context. | Provides in-depth understanding, minimizing the chance for confusion, but may overwhelm with excessive details. |

Free Invoice Templates for Quick Billing

For businesses and freelancers, efficient billing is crucial to maintaining cash flow and professionalism. Having a ready-to-use, no-cost billing document can significantly speed up the process of requesting payment. These ready-made solutions help to ensure accuracy, consistency, and a polished appearance without the need for custom designs or complicated software. By choosing a free option, small business owners can focus on their work rather than spending valuable time on paperwork.

Benefits of Using Free Billing Solutions

Utilizing a free, pre-designed format can save time and resources. With a few clicks, you can customize the document to reflect your business’s unique needs while maintaining a clean and professional look. These options often come with simple yet effective layouts that can be filled out in moments, making them ideal for quick turnarounds and daily transactions.

Key Features to Look For

| Feature | Basic Version | Advanced Version |

|---|---|---|

| Customization | Allows you to add your business name, client details, and amounts. | Includes fields for discounts, taxes, and specific payment terms. |

| Ease of Use | Simple, minimal setup for fast processing. | Requires more detailed input but provides more options for complex transactions. |

| Design | Basic design that gets the job done. | More polished with additional design elements, like logos or color schemes. |

| Availability | Accessible online with immediate download options. | May require sign-ups or subscriptions for access to premium features. |

Best Invoice Templates for Freelancers

Freelancers often juggle multiple clients and projects, which means having an efficient and professional way to request payments is essential. A well-structured billing document not only helps in keeping track of earnings but also ensures timely payments and fosters trust with clients. The right design can streamline the process, making it faster and easier to manage finances without the need for complicated software.

Features to Look For

When selecting the best solution for billing, freelancers should prioritize simplicity, flexibility, and clarity. Key features like customizable fields, easy-to-fill sections, and a clean layout can enhance the user experience. The document should also be easy to update and adapt, especially when dealing with different types of services, rates, or payment schedules.

Top Choices for Freelancers

| Option | Advantages | Best For |

|---|---|---|

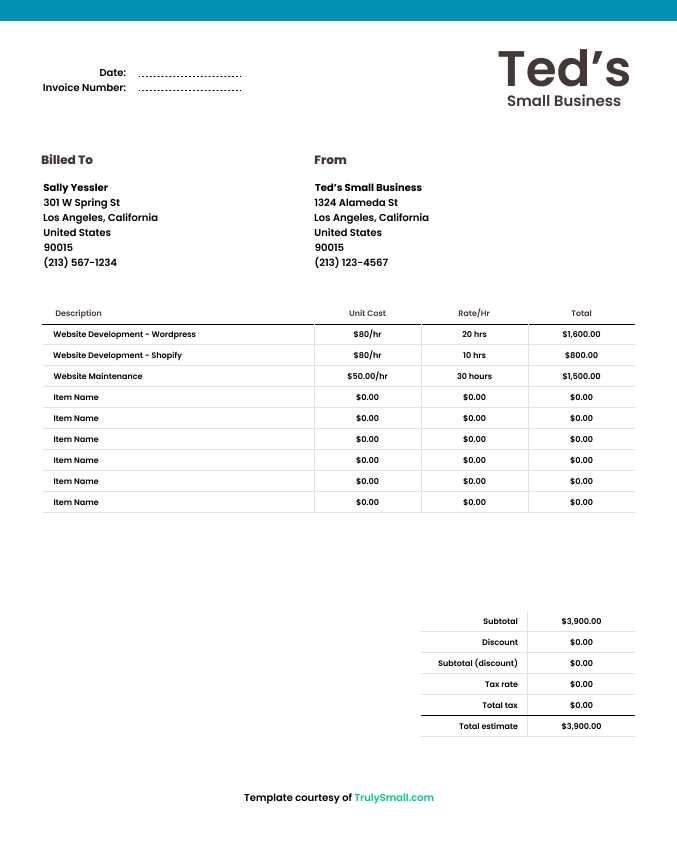

| Minimal Design | Quick to fill out, clear layout, ideal for small jobs or regular work. | Freelancers with frequent but simple tasks. |

| Detailed Breakdown | Includes itemized services, taxes, and payment terms for larger projects. | Freelancers working on long-term projects or with complex pricing. |

| Branding Focused | Allows for customization of colors and logos to match your business identity. | Freelancers seeking a more professional look for high-value clients. |

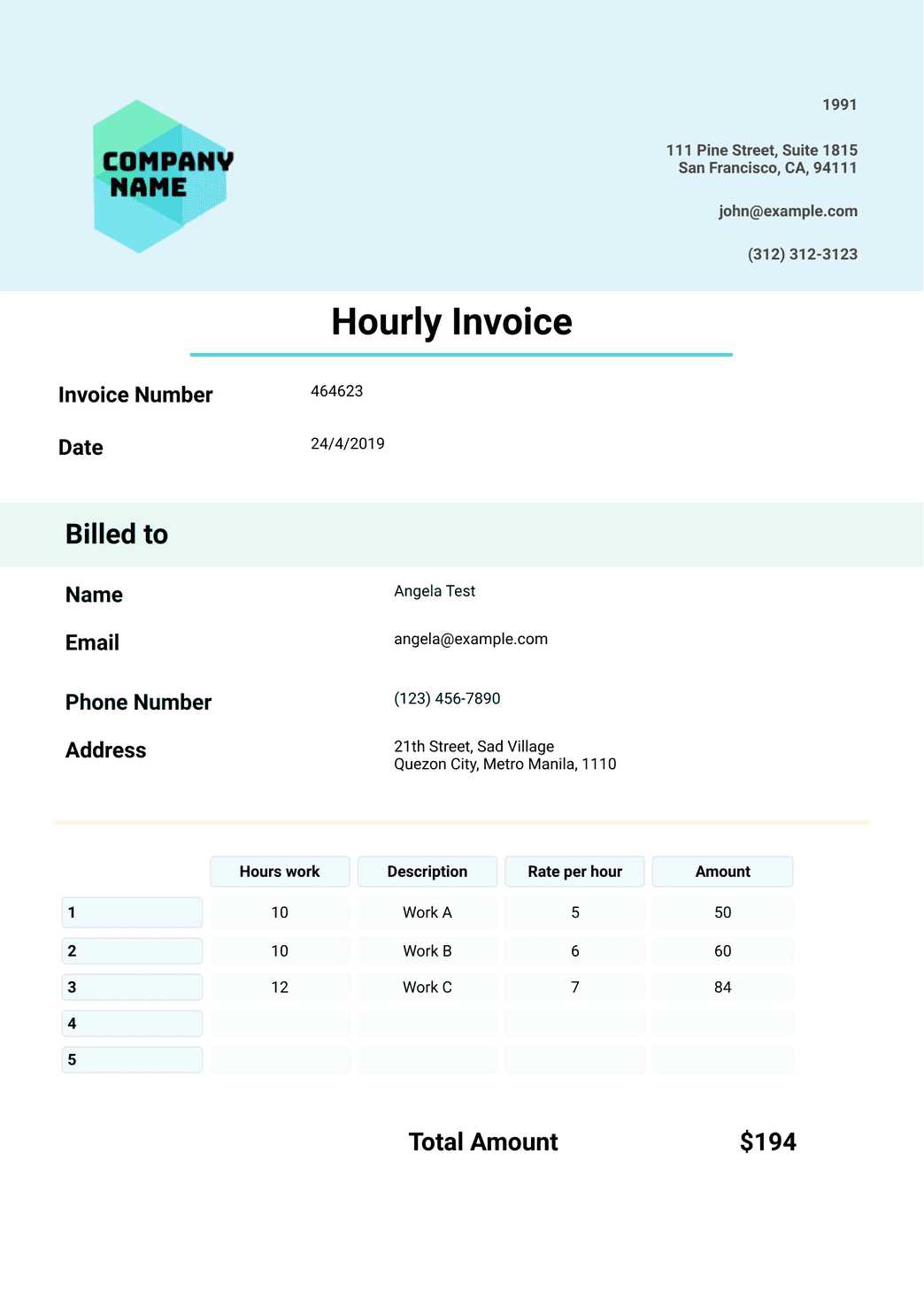

| Time Tracking | Integrated time tracking fields for hourly rates and detailed hours worked. | Freelancers offering hourly-based services. |

How to Personalize Your Invoice

Customizing a billing document can make a significant difference in the way clients perceive your professionalism and attention to detail. By adding personalized elements, you not only enhance the visual appeal but also ensure that the document reflects your brand and creates a more personal connection with your clients. Personalization goes beyond adding a logo–it’s about tailoring the content and design to align with your unique business identity and the specific needs of each client.

Here are several ways to customize your billing statement:

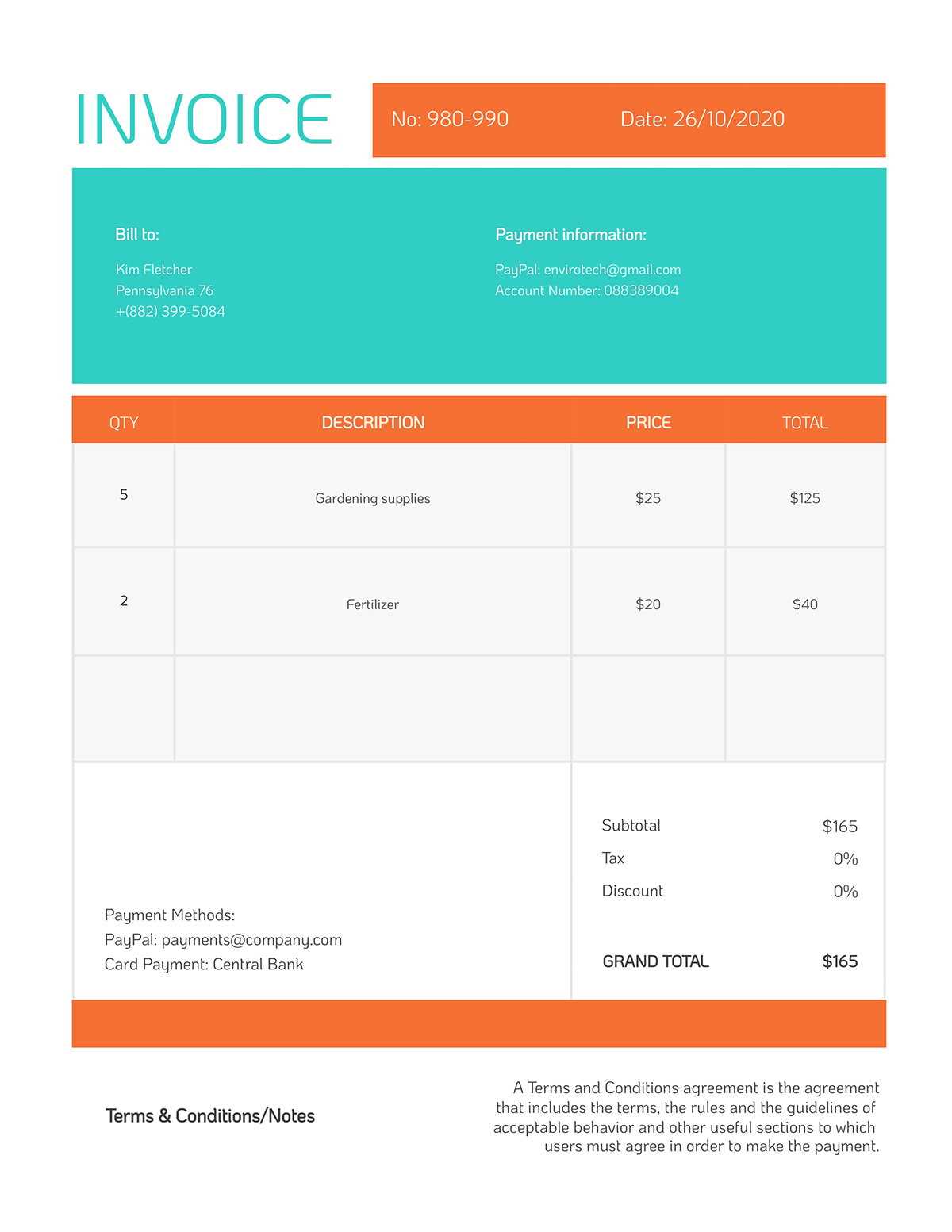

- Branding Elements: Include your company logo, business name, and contact details at the top of the document. This helps establish your brand identity and makes your document easily recognizable.

- Custom Colors: Choose a color scheme that matches your brand’s style guide. Soft tones for a more professional appearance or bold colors for a creative flair can leave a lasting impression.

- Personalized Message: Add a brief thank-you note or a personalized message to show appreciation to your client. A simple, courteous message can build better client relationships.

- Unique Payment Terms: Adjust payment terms to reflect your specific agreements with the client. This can include late fees, early payment discounts, or specific instructions based on the project.

- Project Descriptions: Provide detailed descriptions of the services rendered, emphasizing unique aspects of your work. This gives clarity and reinforces the value of your services.

By customizing these aspects, you create a more tailored and professional experience for your clients, increasing the likelihood of prompt payments and repeat business.

Essential Elements in Every Invoice

Whether you’re running a small business or working as a freelancer, having a properly structured billing document is crucial for ensuring clear communication and smooth financial transactions. Certain elements must always be included to guarantee that the document serves its purpose–providing all necessary details for clients to process payments promptly and accurately. Missing key information can lead to confusion, delays, or disputes, making it essential to include all the right components every time.

Key Details to Include

Every well-crafted billing document should have the following essential components:

| Element | Explanation | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contact Information | Include your name or business name, address, phone number, and email address, as well as the client’s contact details. | ||||||||||||

| Unique Reference Number | A unique identifier for each document, such as a number or code, which helps both parties track the transaction. | ||||||||||||

| Issue Date and Due Date | The date the document is issued and the date by which the payment is due. This sets clear expectations for the client. | ||||||||||||

| Description of Services or Products | A detailed breakdown of what the client is being billed for, including the quantity, rate, and any additional information necessary for clarity. | ||||||||||||

| Total Amount | The total amount owed, including applicable taxes, discounts, or other adjustments, clearly stated at

Time-Saving Features in Invoice TemplatesManaging financial documentation can be time-consuming, especially when you have multiple clients and projects. However, utilizing the right features in your billing documents can significantly reduce the time spent on administrative tasks. With streamlined processes and automation, you can focus more on your core work while ensuring that your billing is accurate and professional. Key elements designed for efficiency can simplify the task, allowing you to generate and send out requests for payment quickly and with minimal effort. Efficient Tools for Faster Billing

The following features help to speed up the creation and processing of your billing documents:

Additional Time-Saving FeaturesHere are a few more elements that can save you valuable time:

|