Government Invoice Template Free Download and Easy Customization

When working with public sector clients, it’s essential to ensure that all financial transactions are documented accurately and in line with official standards. A well-structured document not only helps you get paid on time but also avoids delays caused by errors or missing information. The format of these documents plays a crucial role in meeting regulatory requirements and simplifying the approval process.

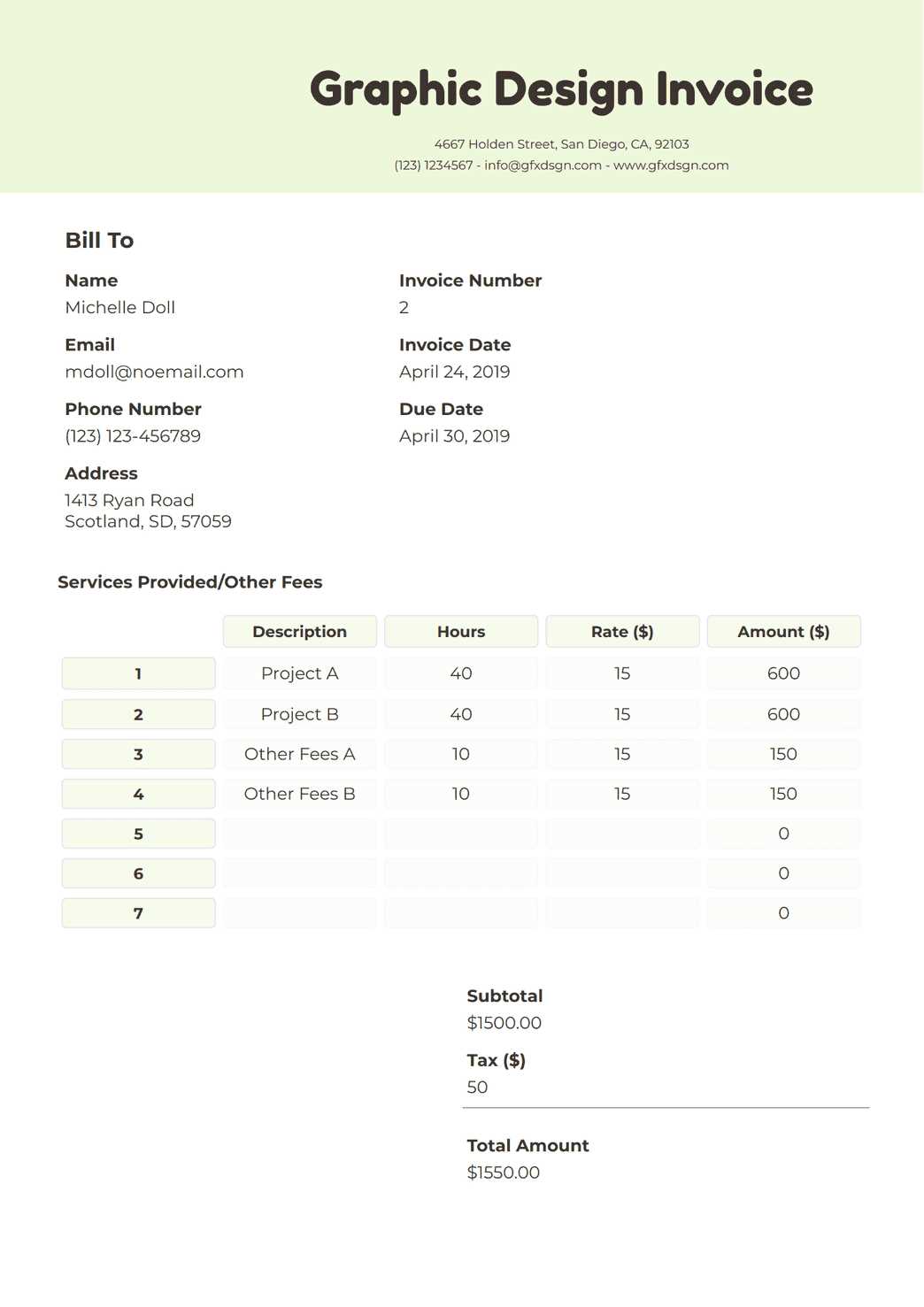

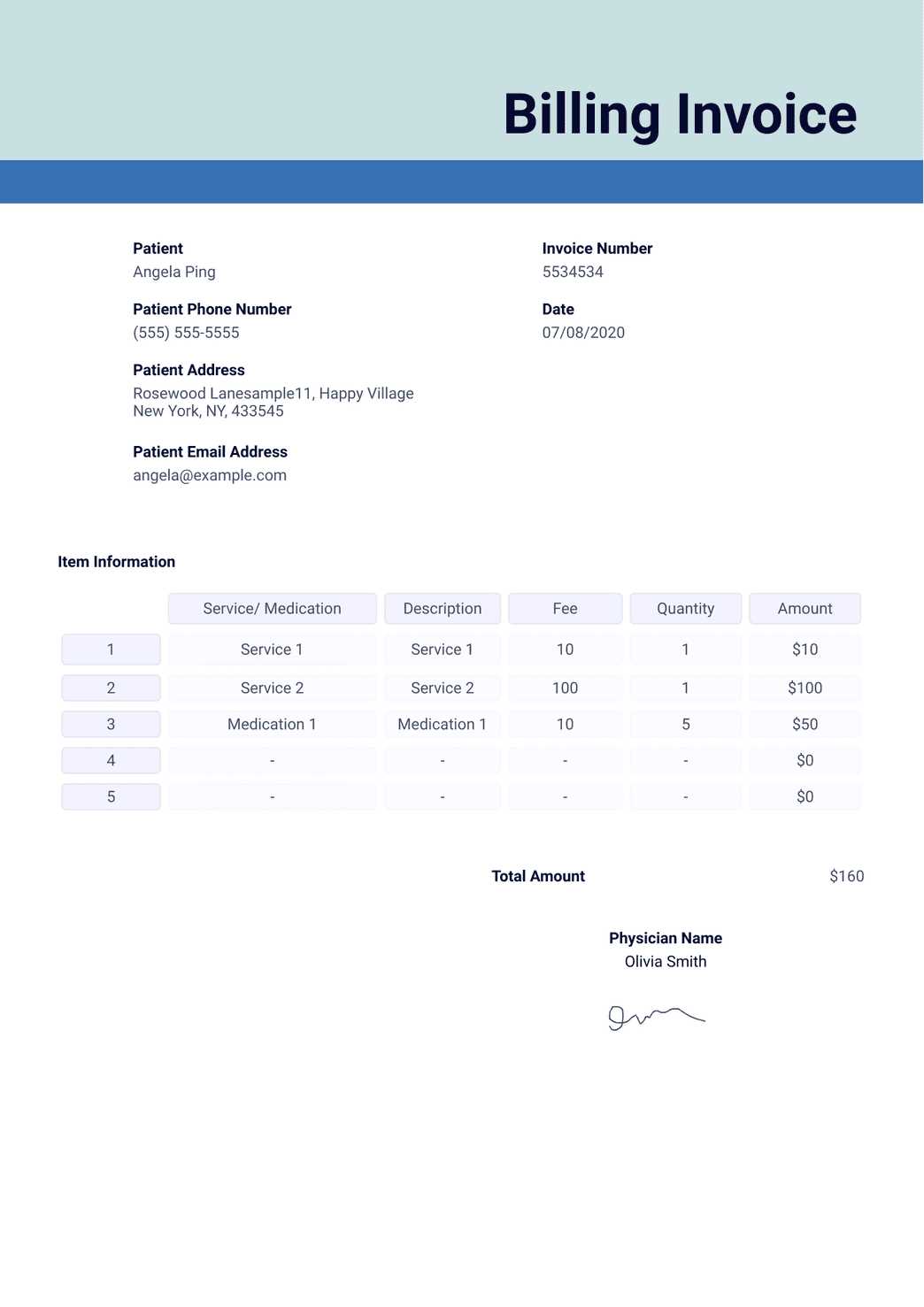

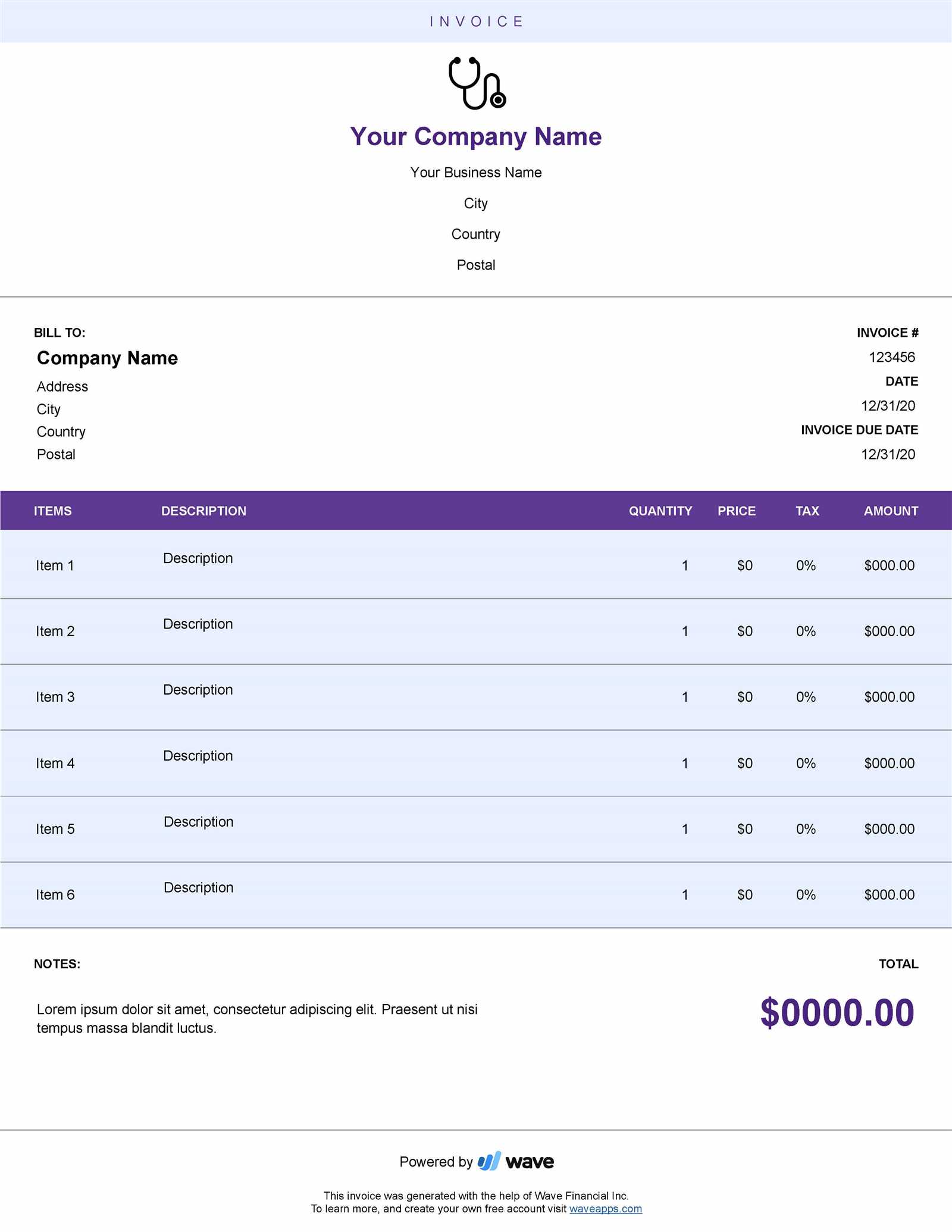

Customizable templates allow for easy creation of these documents, ensuring consistency in every submission. Whether you are providing services or delivering products, having a clear and precise document can make the process smoother for both parties involved. These forms are designed to include all necessary details, from payment terms to descriptions of work completed, ensuring that everything is accounted for.

In this guide, we’ll explore the best practices for preparing these important records, including key elements to include, common mistakes to avoid, and how to tailor them for specific requirements. By following the right approach, you can streamline your billing process and reduce the chance of misunderstandings with government entities.

Government Invoice Template Guide

Creating a clear and professional billing document for public sector work requires attention to detail and a deep understanding of required formats. These records are essential for ensuring that all services provided are accurately tracked, approved, and paid for. In order to meet the expectations of public entities, your document should adhere to specific guidelines and include all necessary information to facilitate quick processing.

The key to an effective document lies in structuring it correctly. A well-designed format ensures that all required details, such as service descriptions, payment terms, and contact information, are present and easy to locate. It’s crucial to customize your document for each project while keeping within the boundaries of required standards. This will not only speed up approval but also minimize the risk of errors or rejections.

In this section, we’ll provide a comprehensive overview of how to create the perfect billing record for public sector clients. From essential sections to include to tips on customization, this guide will help you prepare clear, concise, and compliant documentation for any public contract.

Understanding Government Invoice Requirements

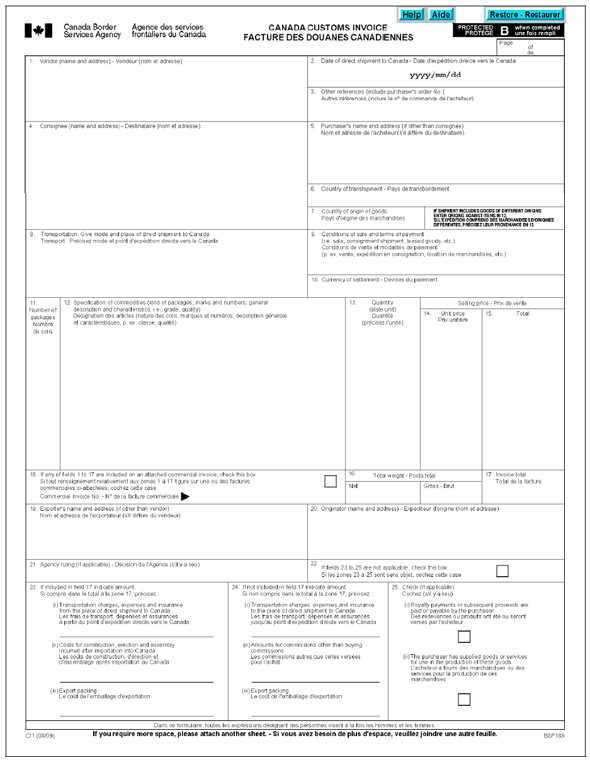

When working with public sector clients, it’s important to meet specific requirements for financial documentation. These records must be clear, accurate, and formatted according to certain guidelines to ensure smooth processing. Public entities typically have strict standards for how such documents should be structured, what information must be included, and the timelines for submission and payment.

Key Information to Include

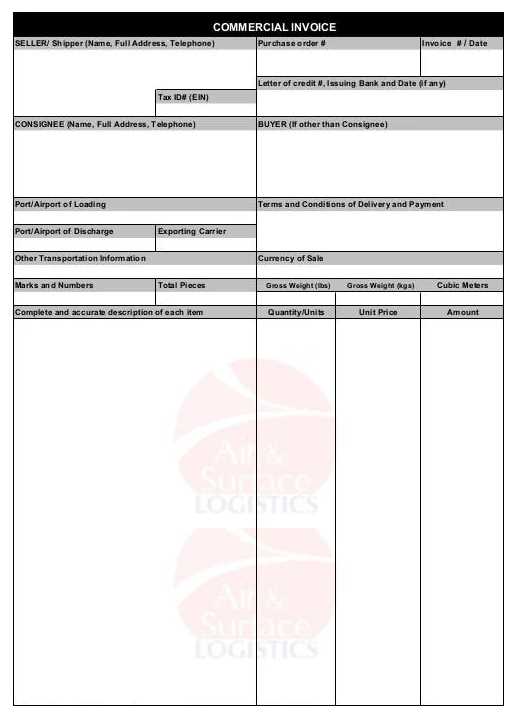

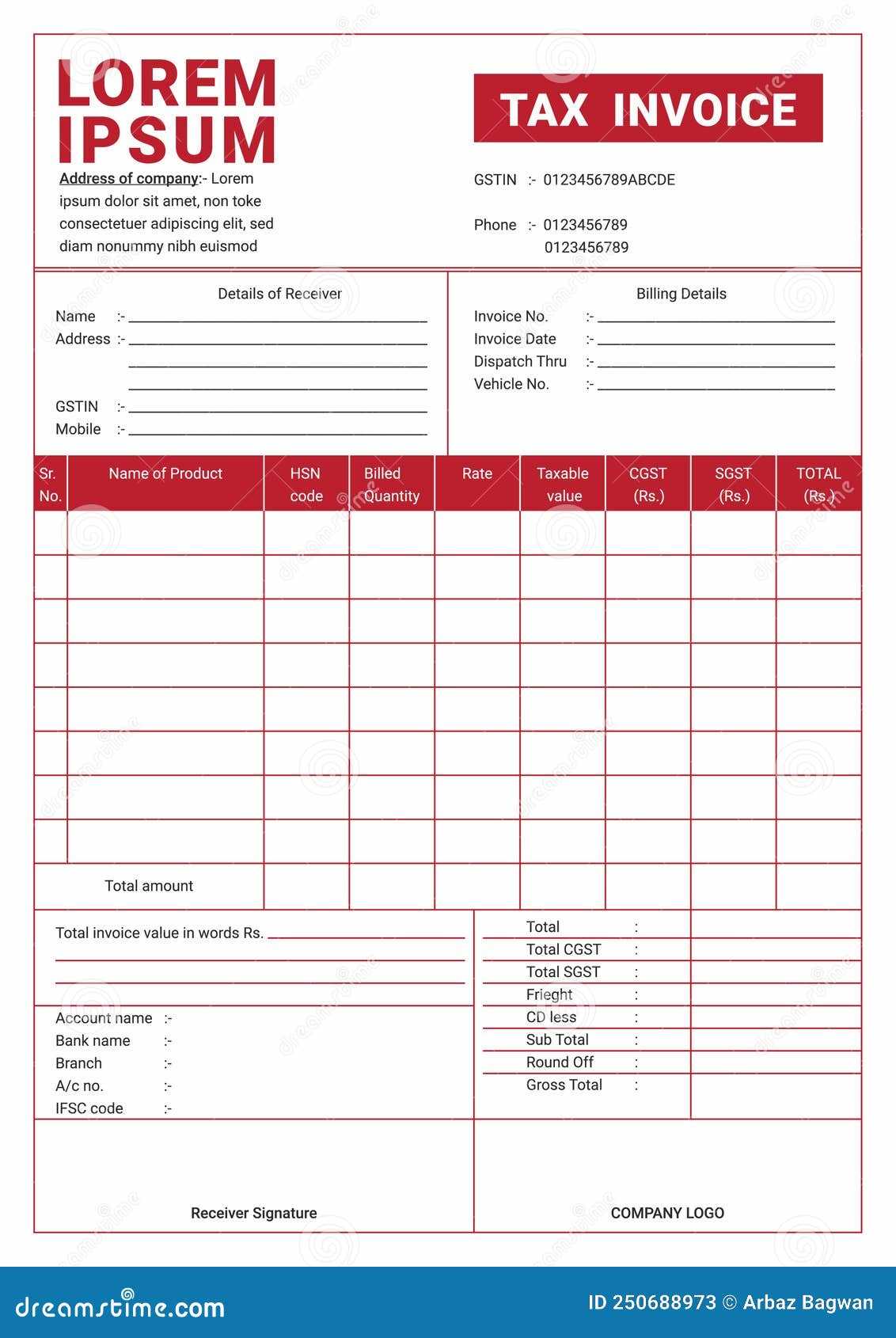

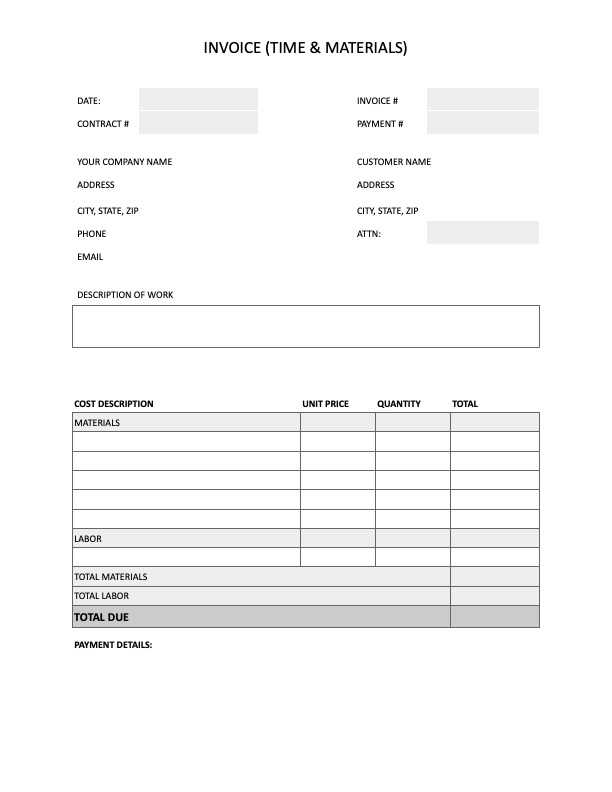

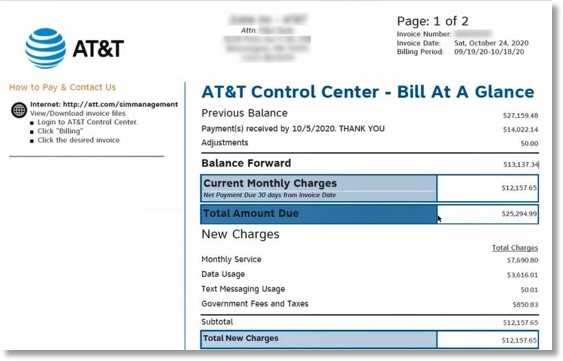

A properly structured record will include essential elements such as the project description, a breakdown of services rendered or goods delivered, and any relevant contract numbers. Additionally, payment terms, tax identification numbers, and the total amount due should be clearly stated. Including these details ensures the document complies with the public entity’s requirements and helps avoid delays in approval.

Compliance and Accuracy

One of the most critical aspects of creating these documents is ensuring compliance with legal and regulatory standards. Accuracy is key, as errors or missing information can lead to payment delays or rejections. It’s essential to review the document thoroughly before submission and ensure that all required fields are filled out properly. Public organizations often have automated systems for processing, so clarity and precision are vital.

Key Elements of a Government Invoice

When creating a document for public sector payments, it’s essential to include all the necessary information that allows for accurate and efficient processing. These records must be comprehensive and structured in a way that meets the specific needs of the public organization. Key elements, such as identification numbers, service descriptions, and payment terms, should be presented clearly to ensure that all parties involved can quickly understand the details.

Essential Information to Include

The document should begin with your business information, including your name, contact details, and tax identification number. Along with this, the recipient’s details, such as the public entity’s name and address, should be listed. This ensures proper identification of both parties involved in the transaction.

Breakdown of Services and Payment Terms

Clearly outlining the services provided or goods delivered is crucial. This section should include a detailed description of each item, along with quantities, unit prices, and total costs. Additionally, specifying the payment terms, including the due date, accepted payment methods, and any late fees, will help avoid confusion and ensure timely settlement.

Why Use a Government Invoice Template

Using a standardized format for financial documentation with public organizations offers several benefits. It not only streamlines the creation process but also ensures that all required elements are consistently included. This can reduce errors, improve efficiency, and enhance the chances of timely approval and payment. By adopting a structured approach, businesses can meet the specific needs of public sector clients without the hassle of reinventing the wheel each time a new document is needed.

Benefits of a Standardized Format

- Consistency: A pre-designed structure ensures all necessary fields are included, reducing the risk of missing information.

- Time-saving: Reusing a format means less time spent on formatting and more time on focusing on your work.

- Compliance: Using a compliant structure ensures you meet public sector standards and avoid delays caused by incorrect or incomplete submissions.

Improving Accuracy and Efficiency

- Minimized Errors: A structured approach minimizes the likelihood of making mistakes in the document’s details.

- Faster Approvals: Clear, correctly formatted documents are processed more quickly, improving cash flow.

- Professionalism: Well-prepared documents enhance your reputation with public sector clients and demonstrate your attention to detail.

How to Customize Your Invoice Template

Customizing your billing document is essential to ensure it reflects your business’s needs while adhering to the specific requirements of public sector clients. By adjusting the format, you can include relevant details, create a professional layout, and ensure that the information is presented clearly and concisely. Customization also allows you to tailor the document for different projects or clients, making it versatile and effective in various situations.

Key Fields to Modify

To personalize your document, begin by adjusting key fields such as your business name, contact information, and tax identification number. You should also include relevant contract or reference numbers, if applicable. Additionally, the section that details the services provided should be tailored to each project, with specific descriptions, quantities, and costs that align with the agreement.

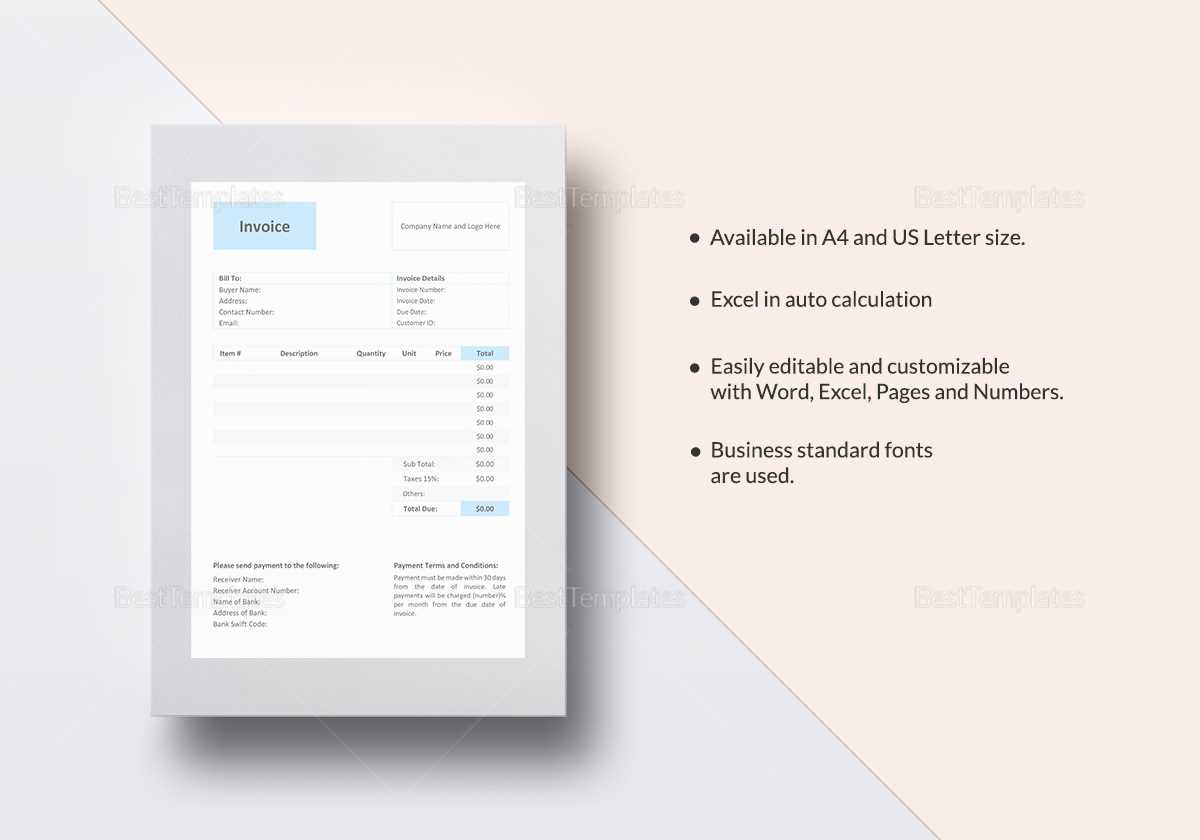

Design and Layout Customization

In addition to the information contained within the document, the layout is equally important. A clean, well-organized design enhances readability and ensures that all important details stand out. You can adjust fonts, headers, and spacing to suit your branding or preferences. Some businesses also include their logo or a header with their contact information to give the document a more professional appearance.

Free Templates for Government Invoices

There are numerous resources available online that offer free, ready-to-use forms for preparing billing documents for public sector transactions. These free resources are designed to meet the necessary standards, helping businesses save time and effort while ensuring compliance. Using pre-built formats ensures that all required information is included, and eliminates the need to start from scratch with every new submission.

Many of these resources come in various formats, such as Word, Excel, or PDF, allowing you to choose the one that best suits your needs. These documents are typically customizable, so you can easily add specific details such as the description of services, payment terms, and relevant contact information. Whether you need a simple format or one with advanced features, you can find an option that suits your business’s requirements.

Benefits of Using Free Resources:

- Cost-effective: You can access high-quality formats without having to pay for expensive software or services.

- Time-saving: Pre-made documents save you from having to design a new one every time you need to send a billing statement.

- Easy Customization: Most free resources allow you to quickly adjust the layout and information to suit your needs.

Legal Considerations for Government Invoices

When preparing financial documentation for public sector entities, it’s important to understand the legal aspects that govern the process. These records must comply with specific regulations to ensure they are recognized as valid and can be processed without delay. Missing or incorrect information can result in rejections, penalties, or even legal issues. It’s essential to ensure that the document adheres to local, state, or national standards, depending on the nature of the contract.

Compliance with Regulatory Standards

Each jurisdiction may have its own set of rules regarding the structure and content of billing documents. Public organizations often require particular fields, such as tax identification numbers, project codes, or terms of payment, to be included. Failing to meet these standards can lead to payment delays or the refusal to process the document altogether. Understanding the specific regulations governing these transactions is critical to ensuring compliance.

Record Keeping and Transparency

For legal and auditing purposes, it’s important to maintain accurate records of all submitted documents. This transparency is essential not only for regulatory compliance but also for protecting both parties in case of disputes. By keeping a well-organized and complete archive of these financial records, businesses can avoid complications should any issues arise with the public entity in the future.

Common Mistakes to Avoid in Invoices

When preparing billing documents for public sector transactions, it’s crucial to ensure every detail is accurate and complete. Even small errors can cause delays in payment or lead to the rejection of the document. Understanding the common mistakes people make can help you avoid costly issues and streamline the approval process. Below are some of the most frequent errors that should be avoided.

Frequent Errors to Watch Out For

- Missing or Incorrect Contact Information: Ensure that both your and the recipient’s contact details are correct and up to date. Mistakes here can delay communication and approval.

- Incorrect Project or Reference Numbers: Always double-check contract or purchase order numbers. These help the public entity track and validate the transaction.

- Omitting Payment Terms: Clearly state payment terms, including due dates, methods of payment, and any late fees. Missing payment terms can lead to confusion and delays.

- Unclear Descriptions of Services: Be as detailed as possible when describing services or products provided. Vague descriptions can lead to questions and possible rejections.

- Math Errors: Always double-check totals and calculations. Simple errors in amounts or taxes can cause the entire document to be flagged for correction.

How to Prevent These Mistakes

- Review Before Submission: Always carefully proofread your documents to ensure all fields are filled out correctly and consistently.

- Use Reliable Software: Utilizing invoicing software or reliable templates can help minimize human error and ensure consistency.

- Verify All Information: Double-check the recipient’s details, contract terms, and all numerical data to avoid errors before submission.

How to Format Government Invoices Properly

Proper formatting is essential when creating financial documents for public sector transactions. A well-organized document ensures that all required information is easily accessible, which helps speed up the approval and payment process. It also reduces the likelihood of errors or confusion that could lead to delays. The right format will include all necessary details in a clear, structured manner, making it easier for the public entity to process your submission efficiently.

Key Formatting Elements

To format your document correctly, start by including a header with your business name, address, and contact information. This should be followed by the recipient’s details, including their name, address, and any relevant reference numbers, such as a contract or purchase order number. This ensures that the document is easily identifiable and linked to the appropriate project or contract.

Next, ensure that the itemized list of services or goods provided is presented clearly. Each service should be listed with a brief description, followed by quantities, unit prices, and total amounts. A clean table format works well for this section, ensuring that all amounts and calculations are easy to read. Don’t forget to include payment terms at the end, such as the due date and any penalties for late payment.

Maintaining Consistency

Maintaining consistency throughout the document is crucial for readability and professionalism. Use a simple, easy-to-read font and ensure that all headings and sections are clearly marked. Align text and numbers properly, and avoid excessive use of colors or graphics, which may detract from the clarity of the document. A well-structured, simple design is the most effective for ensuring that your submission meets public sector standards.

Top Tools for Creating Government Invoices

When creating billing documents for public sector transactions, using the right tools can significantly improve the accuracy and efficiency of the process. These tools not only help ensure that all required information is included but also streamline the formatting and customization, making it easier to produce professional, compliant documents. With the right software, businesses can create, track, and manage their records with minimal effort, reducing the chances of errors and delays.

Best Software for Document Creation

Several tools are specifically designed to help businesses create detailed and accurate financial records. Some popular options include:

- Microsoft Excel: A widely-used spreadsheet tool that allows for easy customization of document formats, with built-in functions to calculate totals and taxes.

- Google Sheets: A free, cloud-based alternative to Excel, offering similar functionality with the added benefit of easy sharing and collaboration.

- FreshBooks: An invoicing and accounting software that provides templates and easy tracking of transactions, ideal for service-based businesses.

- Zoho Invoice: A user-friendly tool with customizable formats and automated reminders, helping businesses manage their financial documentation more efficiently.

Additional Tools for Customization and Compliance

For those looking to further enhance their documentation, the following tools provide additional customization options and help ensure compliance:

- Canva: A graphic design tool that allows businesses to create visually appealing and professional-looking billing documents with ease.

- QuickBooks: An accounting software with invoicing capabilities, helping businesses track payments, manage client records, and generate reports.

How to Submit Your Government Invoice

Submitting your billing document to public sector entities requires careful attention to the required process and format. Different organizations may have their own submission methods, ranging from email submissions to online portals or even physical mailing. Knowing how and where to send your document ensures that it reaches the right department and is processed in a timely manner, helping you avoid unnecessary delays in payment.

Typically, submitting your document involves ensuring that all required information is present, including any reference numbers, project details, and payment terms. Some public organizations may also have specific file formats or guidelines that must be followed. Familiarizing yourself with these requirements can save you time and effort when it comes to processing payments.

Methods of Submission

- Email Submissions: Many public sector organizations accept electronic documents via email. Ensure that your document is in a widely accepted format, such as PDF or Word, and that it’s attached correctly.

- Online Portals: Some entities have dedicated online portals for submitting billing records. You may need to create an account and follow the submission steps outlined by the organization.

- Physical Mail: In some cases, documents may need to be sent via mail. If this is the case, ensure the document is printed clearly and includes all necessary paperwork, such as contracts or supporting documentation.

Ensuring Successful Submission

- Follow Submission Guidelines: Always adhere to any specific instructions regarding format, content, and method of submission. This will reduce the chances of your document being rejected or delayed.

- Confirm Receipt: If possible, request a confirmation of receipt, especially for online or email submissions. This provides peace of mind and allows you to follow up if there are any issues.

- Track the Status: Some public sector agencies provide a way to track the status of your submission. Regularly check the status to ensure the document is being processed and that payment is on track.

Best Practices for Invoice Compliance

Ensuring that your billing documents meet all regulatory and contractual requirements is crucial for timely payment and avoiding disputes. Compliance is not just about including necessary information but also about formatting the document correctly and following the specific guidelines set by the receiving entity. By adhering to best practices, you can minimize errors and streamline the approval process, ensuring that your financial records are processed smoothly and efficiently.

Key Elements for Compliance

To ensure your document is compliant, there are several key elements that must be included. These elements are typically outlined by the public sector organization or governing body involved. Below is a table summarizing some of the most important components to consider when preparing your billing records:

| Element | Description |

|---|---|

| Business Information | Include your company name, address, tax identification number, and contact details. |

| Recipient Details | Clearly list the public sector entity’s name, address, and any relevant reference numbers or project codes. |

| Detailed Descriptions | Provide clear and detailed descriptions of the goods or services provided, including quantities, unit prices, and total amounts. |

| Payment Terms | Specify payment due dates, methods, and any applicable late fees or discounts. |

| Tax Information | Ensure that tax rates, calculations, and totals are clearly stated, following local laws. |

Common Compliance Pitfalls to Avoid

- Missing or Incorrect Information: Double-check that all required fields are complete and accurate before submitting.

- Failure to Meet Submission Deadlines: Ensure that your document is submitted on time to avoid payment delays or penalties.

- Non-Compliance with Formatting Guidelines: Follow the specified document format, whether it be a particular file type or layout, to avoid rejection.

- Inaccurate Calculations: Verify all calculations, including totals, taxes, and discounts, to ensure they align with the terms of the agreement.

How to Track Government Payments

Keeping track of payments for transactions with public sector entities is crucial for maintaining proper cash flow and financial records. Timely and accurate tracking helps you stay on top of pending payments, ensure that your documents have been processed, and follow up when necessary. By using a systematic approach, businesses can avoid delays, resolve issues quickly, and keep financial operations running smoothly.

Steps to Track Payments Effectively

To monitor payments efficiently, follow these essential steps:

- Record Payment Details: Immediately document the details of the transaction, including the amount, due date, and any reference numbers associated with the payment.

- Use Accounting Software: Accounting tools like QuickBooks or Xero can help track payments automatically. These programs can sync with your bank accounts, alert you to incoming funds, and help manage your financial records more easily.

- Monitor Payment Status: Regularly check with the public sector entity or portal to see if your payment has been processed. Many organizations offer online portals that provide real-time status updates on outstanding payments.

- Follow Up When Necessary: If a payment is overdue, don’t hesitate to follow up with the organization. Ensure you have all necessary documentation and reference numbers to make the follow-up process more efficient.

Helpful Tools for Tracking Payments

- Bank Statements: Regularly check your bank account for incoming payments, especially if your transactions are conducted through electronic transfers or checks.

- Online Portals: Many public sector organizations provide portals where you can track the status of payments and confirm when funds have been released.

- Payment Tracking Software: Tools like Zoho Books or FreshBooks offer payment tracking features, allowing businesses to set reminders for due dates and track outstanding amounts with ease.

Tips for Efficient Invoice Management

Managing financial records efficiently is essential for any business, especially when dealing with transactions involving public sector entities. Effective management ensures timely payments, reduces the risk of errors, and helps maintain an organized and transparent financial system. By implementing best practices and utilizing the right tools, you can streamline your processes, saving both time and resources.

Best Practices for Managing Financial Documents

- Automate Where Possible: Use accounting software to automate routine tasks like sending payment reminders, tracking due dates, and generating reports. This minimizes manual effort and reduces the chance of missing important deadlines.

- Keep Detailed Records: Always maintain a clear record of all transactions, including the date, amount, and any related reference numbers. This helps you track payments and resolve disputes efficiently if they arise.

- Organize by Category: Group your records by project, client, or type of service. This will make it easier to find specific documents when needed and allows for better reporting and analysis.

- Set Up a Clear Filing System: Whether physical or digital, have a system in place that allows for easy access to all your financial records. Organizing by date, client, or category can help you quickly retrieve any document you need.

Tools to Enhance Invoice Management

- Accounting Software: Tools like QuickBooks, FreshBooks, or Zoho Books offer comprehensive features for managing and tracking financial documents, from creating records to monitoring payment statuses.

- Cloud Storage: Use cloud services like Google Drive or Dropbox to securely store digital copies of all records, ensuring they’re easily accessible from anywhere and protected against data loss.

- Document Management Systems: Specialized software for managing documents can streamline workflows, make document retrieval faster, and enhance collaboration among teams handling financial records.

Improving Invoice Approval Times

Speeding up the approval process for financial documents can have a significant impact on your cash flow and operational efficiency. Delays in processing can lead to missed payment deadlines, late fees, or strained relationships with clients and public sector entities. By optimizing how documents are prepared and submitted, businesses can help reduce bottlenecks and ensure faster approval and payment.

Strategies for Faster Approvals

- Ensure Accuracy and Completeness: Double-check all details before submission to avoid any errors or omissions that could cause delays. Ensure that the document is complete with all necessary information, such as payment terms, reference numbers, and descriptions of goods or services.

- Follow Submission Guidelines: Every organization may have specific requirements for document submission. Adhering strictly to these guidelines–such as the correct format or required fields–can prevent your document from being returned for revision.

- Submit Electronically: Whenever possible, submit documents through online portals or email. Electronic submissions are processed more quickly than physical mail and often have automatic acknowledgment features, which helps you track the document’s status.

- Use Clear and Professional Formatting: A well-organized document with a clean layout makes it easier for approvers to review and process. Use standard formats that are easy to read and ensure that all calculations and totals are clearly presented.

- Establish Strong Communication Channels: Maintain open communication with the approving agency to clarify any questions or concerns quickly. Prompt responses to inquiries can help expedite the approval process.

Technology to Streamline the Process

- Automated Approval Systems: Many organizations now use software that automates the approval workflow. By integrating automated systems, you can reduce the time spent waiting for approvals, as well as eliminate the potential for human error in the process.

- Online Tracking Tools: Use tracking systems that allow you to monitor the status of your submission in real-time. This helps identify any delays early and allows you to take corrective action promptly.

- Electronic Signatures: Implement electronic signature solutions to speed up the approval of documents, reducing the need for manual signatures and eliminating delays associated with paperwork handling.

Payment Terms Explained

Understanding payment terms is essential for ensuring smooth financial transactions between businesses and public sector entities. These terms define the conditions under which payments are made, including deadlines, methods, and any applicable discounts or penalties. Clear and well-defined terms help both parties avoid confusion and ensure that payments are processed on time, contributing to better cash flow management.

Key Payment Terms to Know

- Net 30/45/60: This common term specifies the number of days the payer has to settle the payment after receiving the billing document. For example, “Net 30” means the payment is due within 30 days of the invoice date.

- Due on Receipt: Payments are expected immediately upon receipt of the billing document. This term is often used for urgent transactions or when a business relationship requires quick turnaround.

- Early Payment Discount: Some agreements offer a discount if the payment is made before a certain date. For example, “2/10 Net 30” means a 2% discount is available if the payment is made within 10 days, with the full amount due in 30 days.

- Late Payment Fees: If payment is not made by the agreed-upon due date, a late fee may be applied. This fee can be a flat amount or a percentage of the outstanding amount, and it serves as an incentive for timely payments.

How to Set Payment Terms

- Clarify Expectations Early: Ensure both parties understand and agree on payment terms before any work begins. This prevents misunderstandings and provides a clear basis for any follow-up if payments are delayed.

- Be Transparent About Fees: If there are any late fees or discounts, be sure to outline these terms clearly in the agreement or billing document to avoid confusion later.

- Consider Payment Method Preferences: Specify the methods through which payments will be made (e.g., bank transfer, credit card, check). This ensures that the receiving entity is able to process the payment in a timely manner.