Find the Best Good Invoice Template for Your Business Needs

Managing financial transactions efficiently is key to any business. A well-organized, clear, and professional billing system not only ensures smooth payments but also helps maintain trust with clients. Properly formatted documents streamline the process, saving time and reducing the risk of mistakes.

Choosing the right structure for these documents is crucial. Whether you are a freelancer, a small business owner, or managing a larger company, having a reliable format for requesting payments can make all the difference. The right approach can enhance your reputation and ensure that you are paid on time.

In this section, we will explore various ways to create professional-looking documents for billing purposes. From basic design elements to specific details that must be included, you’ll learn how to choose a format that works best for your needs and improves overall efficiency.

Effective Billing Document Overview

When it comes to requesting payments, a well-organized document is essential for clear communication and smooth transactions. A professional structure ensures all necessary details are presented in an easy-to-understand manner. By using a standardized approach, businesses can avoid confusion and speed up the payment process.

Key Components of a Billing Document

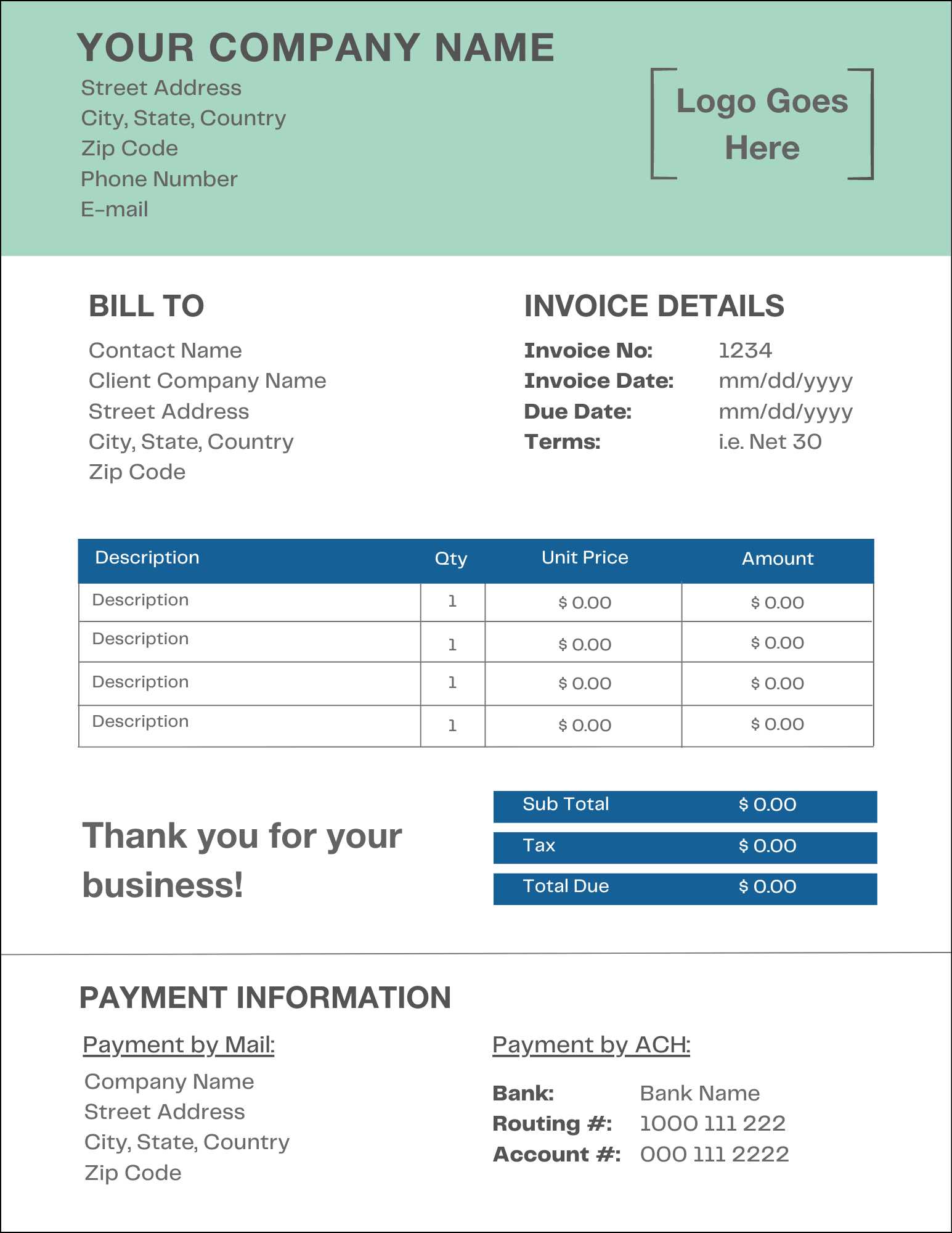

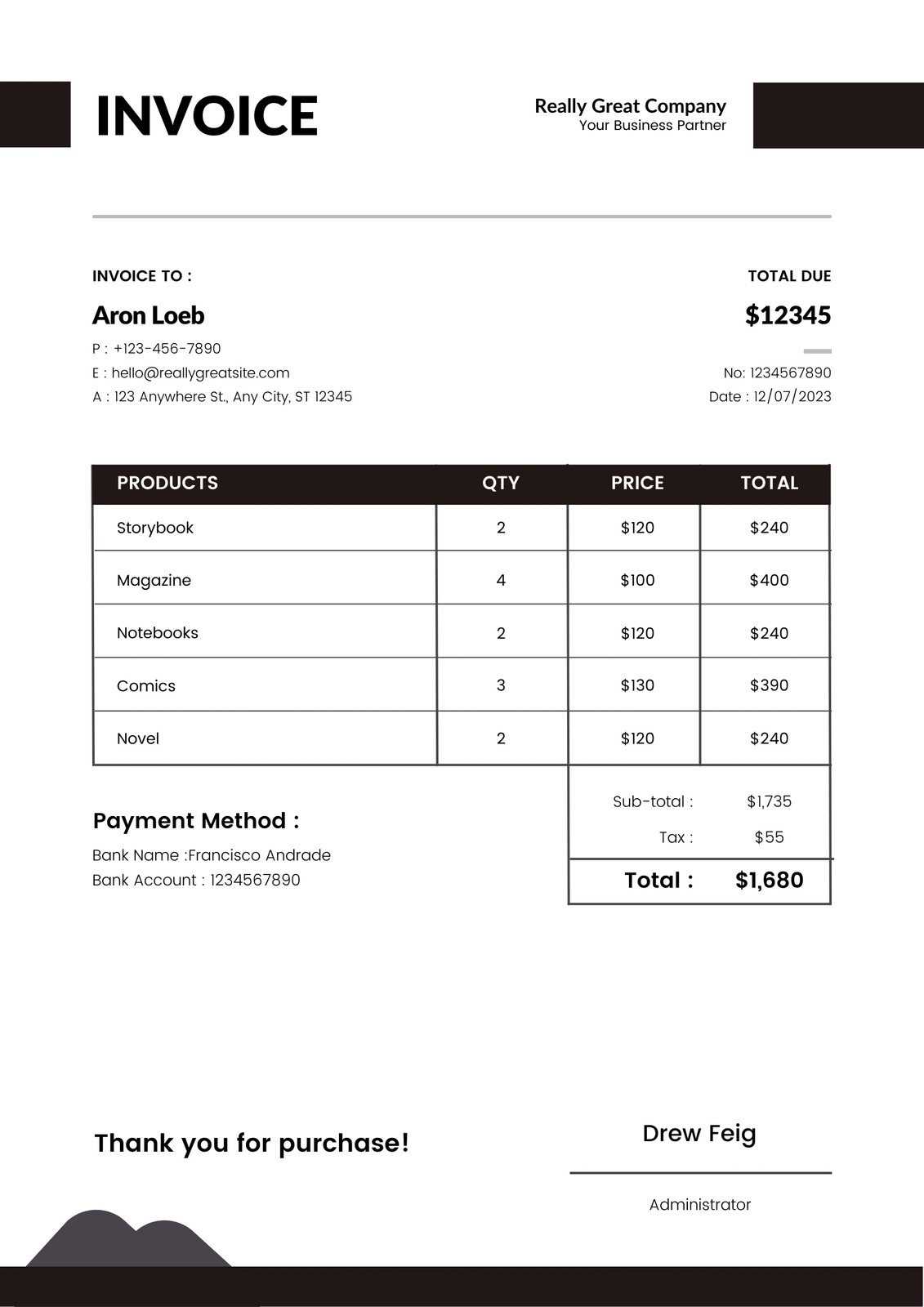

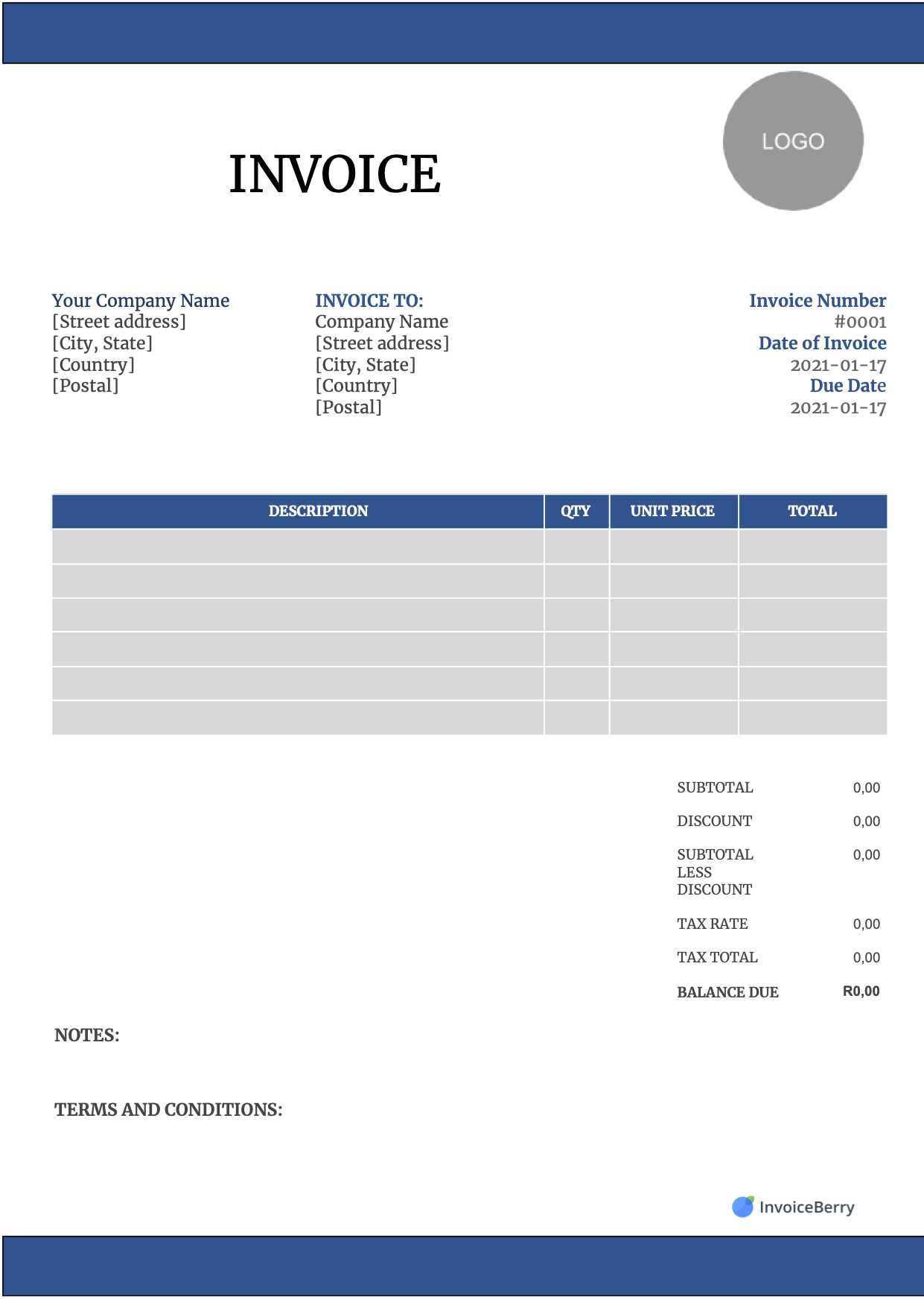

There are several crucial elements that every payment request should include to be considered complete and professional. A properly structured document should clearly outline the transaction and provide all necessary details for the client to process the payment without delays. The most important components are:

- Business details: Contact information and tax identification numbers

- Recipient details: The client’s name, address, and contact information

- Itemized list: A breakdown of services or products provided, including costs

- Payment terms: Due dates, late fees, and preferred payment methods

- Unique reference number: To keep track of payments and avoid confusion

Why a Standardized Format Matters

Using a consistent structure for all payment requests benefits both businesses and their clients. A familiar format speeds up the process, ensuring that every party understands exactly what is expected. Additionally, this approach reduces errors and helps with record-keeping. Whether you’re handling one-off projects or ongoing services, a reliable document format improves efficiency and professionalism.

Why a Professional Billing Document Matters

Having a well-structured request for payment is more than just a formality. It plays a key role in ensuring smooth transactions, maintaining professionalism, and building trust with clients. The clarity and accuracy of these documents directly influence the efficiency of the payment process, reducing misunderstandings and delays.

Impact on Business Operations

A properly formatted billing document not only provides the necessary details for clients but also reflects the business’s reliability and attention to detail. When customers receive clear, accurate, and professional documents, they are more likely to process payments promptly, which improves cash flow and reduces the risk of late payments. In addition, well-organized records make accounting and auditing tasks much easier for business owners.

Key Advantages of a Well-Formatted Payment Request

| Advantage | Description |

|---|---|

| Improved Clarity | Clear breakdown of services or products helps the client understand exactly what they are paying for. |

| Timely Payments | Easy-to-follow documents reduce confusion and increase the likelihood of prompt payment. |

| Professional Image | Well-designed documents reflect positively on the business, demonstrating professionalism and reliability. |

| Reduced Disputes | By outlining clear terms and details, disputes regarding charges or payment terms are less likely to arise. |

In short, the way you present your billing requests can significantly impact your business’s reputation, cash flow, and overall efficiency. A streamlined, professional approach makes the payment process simpler for everyone involved, ensuring smoother operations and stronger client relationships.

Key Features of an Ideal Billing Document Structure

A well-constructed billing document is more than just a record of transactions. It is a tool that ensures accurate communication between the business and the client, helping to avoid confusion and delays. The ideal structure should include several essential components that make it clear, easy to use, and professional in appearance.

When designing an effective payment request format, it is important to include certain key elements that make the document both functional and easy to read. These features not only help streamline the payment process but also establish trust and professionalism with clients. The following table highlights the most important aspects to consider:

| Feature | Description |

|---|---|

| Clear Contact Information | Both your business and the client’s contact details should be easy to find, ensuring smooth communication. |

| Itemized Breakdown | A detailed list of goods or services provided, including quantities, unit prices, and any applicable taxes or discounts. |

| Unique Reference Number | A distinct identifier for each request that allows for easy tracking and reference in case of future inquiries. |

| Clear Payment Terms | Include due dates, payment methods, and any applicable late fees or discounts for early payments. |

| Professional Layout | A clean, organized design with clear headings and logical flow ensures that all relevant information is easy to locate and understand. |

Incorporating these key features ensures that each document is not only functional but also contributes to building a professional image. By adhering to these principles, you can enhance the client experience, avoid disputes, and maintain an efficient billing process.

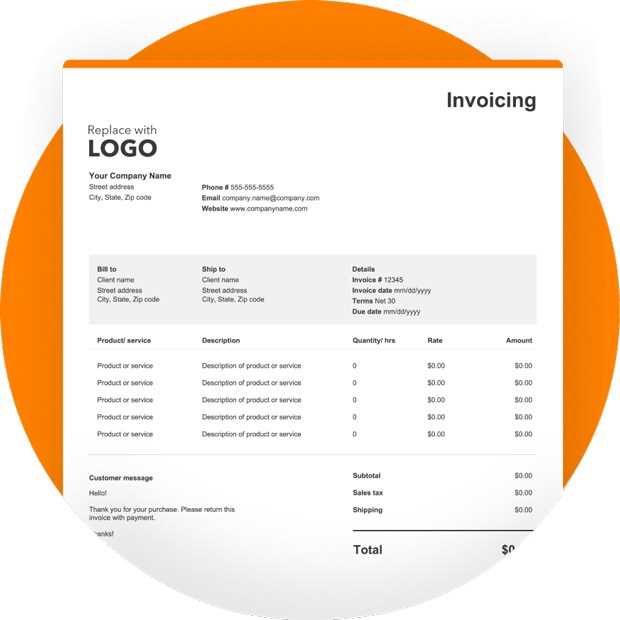

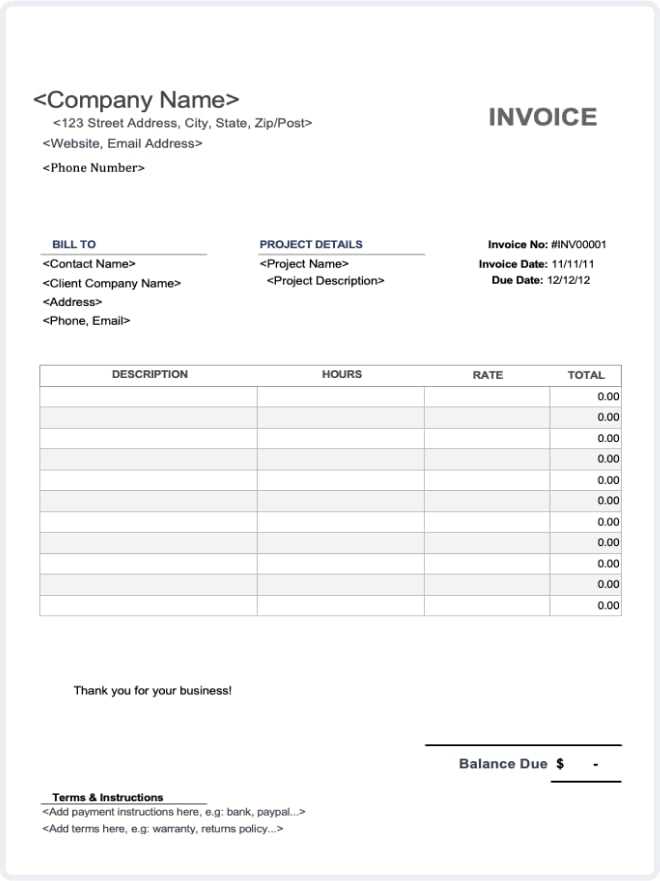

How to Choose the Right Billing Document Format

Selecting the right structure for your payment requests is essential for ensuring clarity, professionalism, and efficiency. The format you choose will impact how easily clients can understand and process the details of the transaction. A well-chosen structure can improve payment speed, reduce confusion, and establish trust with your customers.

When deciding on the best format, consider the nature of your business, the type of services or products offered, and the preferences of your clients. A format that works well for one industry or client may not suit another. Customization is key, and understanding the essential components of a document can guide you toward a choice that benefits both parties.

Factors to Consider When Choosing a Format

Here are some factors that can help you select the most appropriate layout for your payment request:

- Business Type: A simple structure might work for freelancers, while larger companies may need more detailed layouts with multiple line items and payment terms.

- Client Preferences: Some clients may have specific format requirements, such as particular sections or custom designs. Be sure to inquire about these before deciding.

- Frequency of Transactions: Regular billing (e.g., subscriptions) may benefit from automated, easy-to-complete formats, whereas one-time services may require a more detailed document.

- Legal Requirements: Some industries may have specific regulations regarding the content and format of billing documents. Make sure your choice complies with these standards.

Where to Find Formats That Work for You

Once you’ve identified the key components and requirements for your business, the next step is to find a structure that suits your needs. You can find a variety of pre-made formats available online, ranging from simple to complex designs. However, it’s important to evaluate each option based on the features that will help your business communicate clearly and efficiently with clients.

In summary, selecting the right structure involves understanding your business needs and the expectations of your clients. A clear and professional format is an investment in the smooth running of your financial transactions.

Common Mistakes in Billing Document Design

While creating a payment request may seem straightforward, there are several common pitfalls that can make the document confusing, unprofessional, or even legally problematic. These mistakes can result in delayed payments, client dissatisfaction, or financial errors. Recognizing and avoiding these issues is essential for ensuring smooth transactions and maintaining a professional image.

From missing information to poor formatting, the design of your request for payment should be clear, organized, and accurate. Even small errors can lead to confusion and hinder prompt payment. The following are some of the most frequent mistakes that businesses make when creating their billing documents:

1. Missing Essential Information

Omitting key details can cause significant delays in the payment process. Always ensure that your document includes:

- Complete contact details for both your business and t

Customizing Your Billing Document Structure

Adapting your payment request format to match your business needs can enhance both its functionality and professionalism. Customization allows you to tailor the design and layout to reflect your brand, making the document more personal and aligned with your business identity. By adjusting key elements, you ensure that the format works efficiently for both your clients and your operations.

Customizing your request for payment can involve modifying various components such as colors, fonts, or sections to better suit the nature of your products or services. Additionally, personalization helps clients feel more comfortable and confident in their dealings with your business. Below are some of the key areas where customization can make a significant impact:

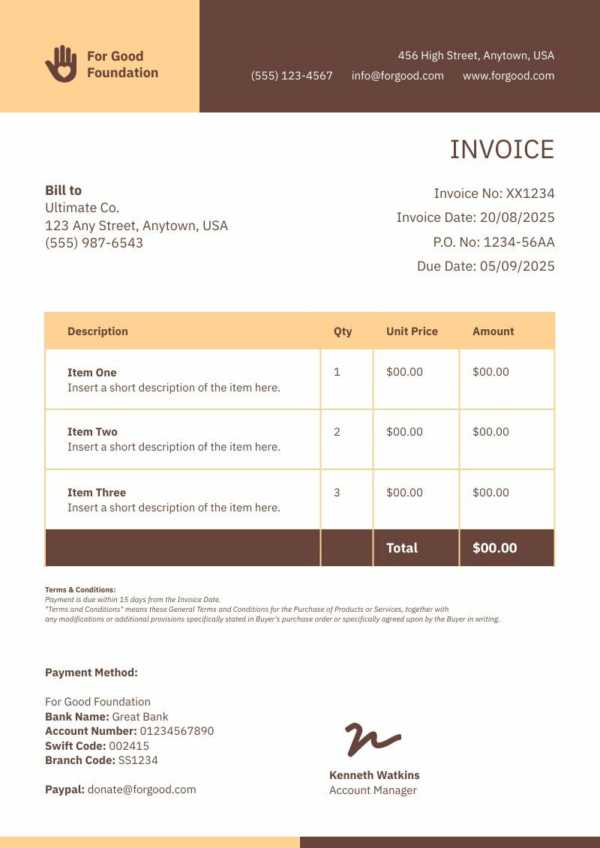

Branding Your Billing Document

Adding your company’s logo, brand colors, and fonts can instantly make the document feel more cohesive and professional. This helps clients quickly recognize the origin of the document and adds a touch of personalization. Key areas for branding include:

- Logo Placement: Place your company logo at the top or in the header for immediate recognition.

- Color Scheme: Use your business’s primary colors for headings, borders, or accents to keep the look consistent with your branding.

- Font Style: Choose a clean, legible font that reflects your business’s tone, whether formal or casual.

Including Custom Sections for Specific Needs

Every business has unique requirements, and your billing document should reflect that. For instance, if you offer subscription-based services or have specific discount structures, including custom sections can help clarify the terms for your clients. Consider adding:

- Subscription Details: If you provide recurring services, add a section to outline subscription plans and renewal dates.

- Discount or Promo Codes: Include fields for any discounts, coupon codes, or special offers that apply to the transaction.

- Additional Notes: A customizable text field allows you to add personalized messages, payment instructions, or project-specific terms.

By personalizing the format of your payment requests, you not only reinforce your brand identity but also create a smoother experience for your clients. Customization ensures that the document is both functional and aligned with your business practices.

Essential Elements of a Professional Billing Document

A well-crafted request for payment not only serves as a record of the transaction but also reflects the professionalism of your business. To ensure clarity, reduce misunderstandings, and maintain a positive image with clients, it’s crucial to include the right elements in the structure. These components help establish the transaction’s legitimacy and ensure smooth payment processing.

Every professional document should include certain key details to make it clear and comprehensive. The following sections outline the essential elements that should be present in any effective billing document:

1. Business and Client Information

The document must clearly identify both the business and the client. This ensures that both parties can easily reference and verify the transaction. Key information includes:

- Business Name and Contact Details: Include your company’s name, address, phone number, email, and website (if applicable).

- Client’s Name and Contact Information: Ensure that the recipient’s name, address, phone number, and email are accurately listed.

- Tax Identification Number: If required by law, include your business’s tax ID or VAT number.

2. Itemized List of Products or Services

Providing a clear breakdown of the goods or services rendered is essential. This list should include:

- Descriptions of Goods or Services: A brief, clear description of each item or service provided.

- Quantities and Unit Prices: Specify the amount of each product or service and its corresponding price.

- Subtotal for Each Item: Show the cost for each individual item before any taxes or discounts.

3. Clear Payment Terms

To avoid confusion and ensure timely payment, it’s important to clearly outline payment terms. Include:

- Due Date: Clearly state when the payment is due to avoid any misunderstandings.

- Accepted Payment Methods: Specify the payment methods you accept (bank transfer, credit card, PayPal, etc.).

- Late Payment Penalties: If applicable, include any late fees or penalties for overdue payments.

4. Total Amount and Taxes

The final section of the document should include the total amount due, with a clear breakdown of any taxes or additional charges. Be sure to include:

- Subtotal: The sum of all products or services before taxes and discounts.

- Taxes: Specify any applicable taxes, such as VAT or sales tax, along with the rate.

- Total Amount Due: The final amount, including taxes and any discounts or adjustments.

5. Unique Reference Number

Assigning a unique reference number to each document helps both you and the client track the payment. This reference number should be easily distinguishable and sequential for easier record-keeping.

Including these essential elements in your payment reques

Free vs Paid Billing Document Formats

When choosing the right format for your payment requests, one of the first decisions you’ll face is whether to use a free or paid option. Both choices have their advantages and drawbacks, and the right option largely depends on your business needs, budget, and the level of customization required. Understanding the differences between the two can help you make an informed decision that aligns with your goals.

Advantages of Free Billing Formats

Free document formats are readily available online and can be an excellent choice for small businesses or freelancers just starting out. They provide basic functionality and allow for quick setup without any financial investment. Some of the main benefits of free formats include:

- No cost: Free formats are accessible without any upfront costs, making them ideal for businesses with limited budgets.

- Ease of use: Many free formats are simple and easy to fill out, requiring minimal time to get started.

- Basic functionality: Free options often include all the essential elements needed to create a simple, professional-looking document.

Disadvantages of Free Billing Formats

While free formats can be a good starting point, they may lack some advanced features that paid versions offer. Some of the limitations include:

- Limited customization: Free formats often have rigid designs and limited options for personalization, which may not align with your brand identity.

- Less professional design: The design quality may not be as polished or visually appealing as paid options, which could impact your business’s professional image.

- Lack of advanced features: Free formats may not include features like recurring billing, automatic calculations, or integration with accounting software.

Benefits of Paid Billing Formats

Paid formats offer additional features and customization options that can provide more value, especially for growing businesses. Some of the benefits of paid options include:

- Custom branding: Paid formats allow for greater design flexibility, enabling you to incorporate your company’s logo, colors, and fonts to match your brand identity.

- Advanced features: Many paid formats include features like automated calculations, customizable fields, recurring billing, and integration with accounting tools or payment gateways.

- Better customer support: With paid formats, you often receive access to customer support to assist with any issues or customization needs.

Choosing the Right Option for Your Business

The choice between free and paid formats depends on your specific business requ

Where to Find Quality Billing Document Formats

Finding a reliable and professional format for your payment requests is crucial for maintaining a smooth and efficient business operation. With the growing demand for customizable, easy-to-use solutions, there are a variety of sources where you can access high-quality documents. Whether you’re looking for free options or prefer a more tailored solution, there are several places to explore for formats that meet your needs.

1. Online Invoice Generators

Many online platforms offer customizable billing solutions that allow you to create professional documents quickly. These tools often provide both free and premium options with various templates and customization features. Some popular platforms include:

- Zoho Invoice: A robust tool offering both free and paid options with automated features and easy customization.

- Invoice Generator: A simple, free online tool where you can create documents instantly, perfect for freelancers and small businesses.

- FreshBooks: A paid service that provides highly customizable documents, integrated with accounting and payment processing features.

2. Template Libraries and Marketplaces

If you prefer downloading a ready-made format and customizing it on your own, there are numerous template libraries available. These platforms offer a wide range of high-quality designs for various business types. Some popular options are:

- Template.net: A large collection of customizable formats for different industries, available for free or with a paid subscription.

- Envato Elements: A premium marketplace offering professional designs with extensive customization options for businesses of all sizes.

- Microsoft Office Templates: Free templates available directly within programs like Word and Excel, allowing quick customization and editing.

3. Accounting Software

Many accounting software solutions offer built-in formats as part of their service. These options are often fully integrated with invoicing and accounting tools, saving you time and effort. A few examples include:

- QuickBooks: Popular accounting software with templates that can be customized and directly linked to your financial records.

- Wave Accounting: A free accounting platform that provides high-quality billing formats along with integrated financial management tools.

4. Freelance Platforms and Designers

If you need something unique or tailored to your specific business, hiring a freelance designer might be the best option. Websites like Fiverr and Upwork allow you to find professionals who can design a custom format that meets your exact needs, from layout to functionality.

In conclusion, there are numerous resources available for finding high-quality billing document formats. Whether you opt for free, ready-made solutions or decide to invest in a paid service with advanced fea

How to Edit and Use a Billing Document Format

Once you’ve chosen a suitable format for your payment requests, the next step is learning how to personalize and use it effectively. Customizing your document to fit the specific details of each transaction is essential for ensuring clarity and accuracy. Whether you’re working with a pre-designed format or creating one from scratch, editing the document to meet your needs is a straightforward process that can be done with a few simple steps.

1. Personalizing the Document for Your Business

The first thing you’ll want to do is customize the format to reflect your business’s unique details. This includes adding your company name, contact information, logo, and any specific terms relevant to your services. Key sections to modify include:

- Business and Client Information: Update the fields with your company’s details and the recipient’s contact information.

- Logo and Branding: Insert your business logo and use your brand’s colors and fonts to create a professional appearance.

- Payment Terms: Make sure the due date, payment methods, and late fees (if any) are clearly stated.

2. Editing the Content for Each Transaction

Once the basic format is set up, you’ll need to adjust the content for each specific transaction. This involves inputting the details of the products or services you provided and any related charges. Follow these steps to ensure accuracy:

- Itemization: List each product or service, along with its description, quantity, and unit price. Ensure all numbers are correct and match your records.

- Tax Information: If applicable, calculate and include the relevant taxes for each item and provide a clear breakdown.

- Total Amount: Ensure that the total due is accurately calculated, taking into account discounts, taxes, and any additional charges.

3. Using the Document for Payment Requests

Once the document is edited and finalized, you can use it to request payment from your clients. Depending on the format you’ve chosen, you may have the option to email the document directly or print and mail it. Here are some tips for using the format efficiently:

- Digital Formats: Save the document as a PDF or another universally accessible format before emailing it to clients.

- Paper Formats: If you need to print the document, make sure it’s formatted correctly for clear, professional presentation.

- Record-Keeping: Keep a copy of each document for your own records, whether digitally or in hard copy, for future refe

Benefits of Using a Format for Billing

Utilizing a pre-designed format for your payment requests can significantly streamline the process of managing financial transactions. Whether you’re a freelancer, a small business owner, or running a large company, having a standardized approach to billing can save you time, reduce errors, and enhance professionalism. By adopting a consistent format, you can create documents quickly and ensure they contain all the necessary details to avoid misunderstandings and facilitate smooth payments.

1. Saves Time and Effort

One of the main advantages of using a pre-made billing structure is the time it saves. With a format in place, you don’t need to create a new document from scratch for each transaction. Instead, you can simply fill in the necessary details, such as product descriptions, quantities, and pricing. This streamlined process leads to:

- Consistency: Using the same format every time ensures that all your documents are uniform, which helps avoid errors.

- Speed: Pre-built structures allow for quick completion, so you can send out requests faster and focus on other aspects of your business.

- Automation: Some formats can be integrated with accounting software, making data entry even quicker and more accurate.

2. Professional and Clear Presentation

With a structured layout, your billing documents appear more polished and professional. A well-organized format ensures that all necessary information is clearly visible, making it easier for your clients to understand and process the payment. Benefits include:

- Clarity: Pre-designed formats typically include sections for all essential details like business contact info, due dates, and breakdowns of charges.

- Trust: A professionally formatted request for payment reflects positively on your business, helping to build trust with your clients.

- Branding: Many formats allow you to incorporate your logo, colors, and fonts, reinforcing your brand identity with every document.

3. Accuracy and Reduced Errors

When you use a set structure, the likelihood of omitting important details or making mistakes decreases. These formats are designed to ensure that every essential element is included, which reduces the risk of human error. The main benefits are:

- Comprehensive Layout: Every field in a good structure is designed to capture critical information, ensuring nothing is overlooked.

- Automatic Calculations: Some formats include features that calculate totals and taxes automatically, further minimizing the chance of errors.

- Easy to Review:

Billing Document Formats for Different Industries

Each industry has unique requirements when it comes to payment requests, and using a specialized document format can ensure that all necessary details are included. Whether you’re in consulting, construction, retail, or another sector, having the right format for your billing needs is essential for maintaining clarity, professionalism, and accuracy. In this section, we’ll explore how different industries can benefit from tailored formats designed to meet their specific demands.

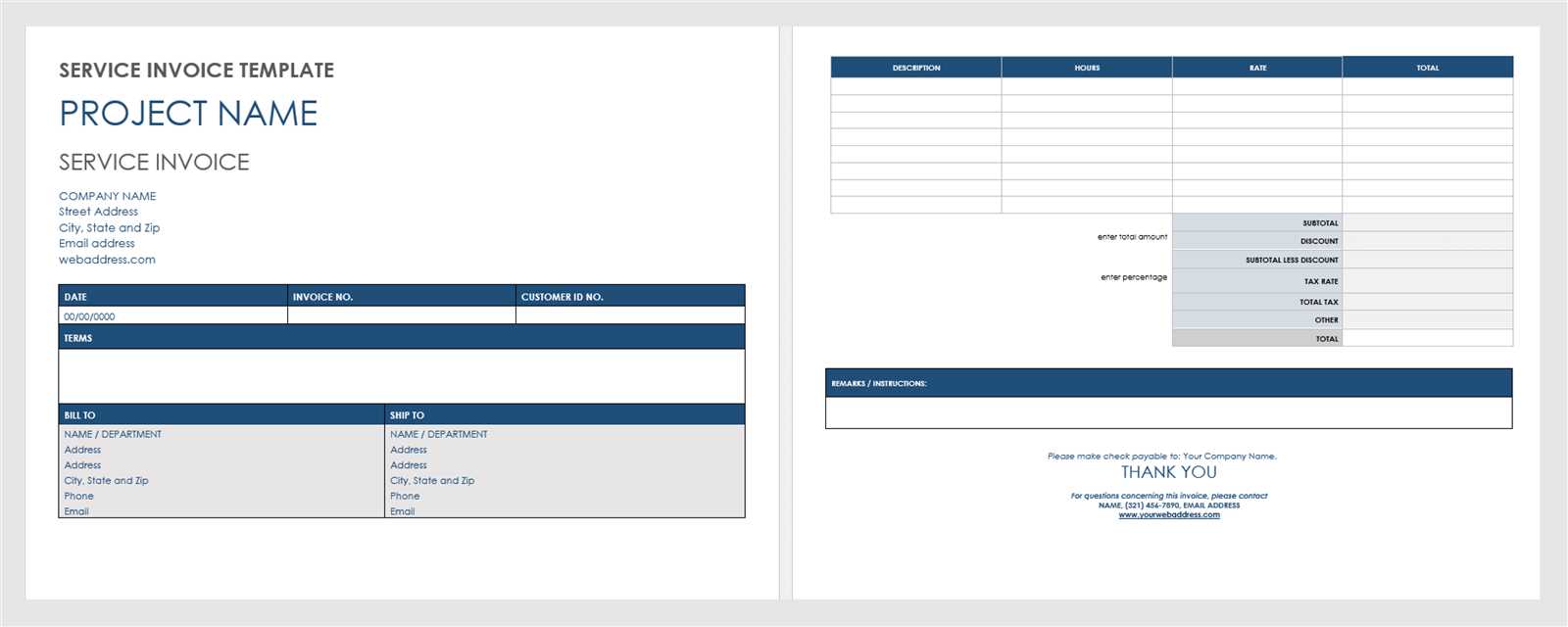

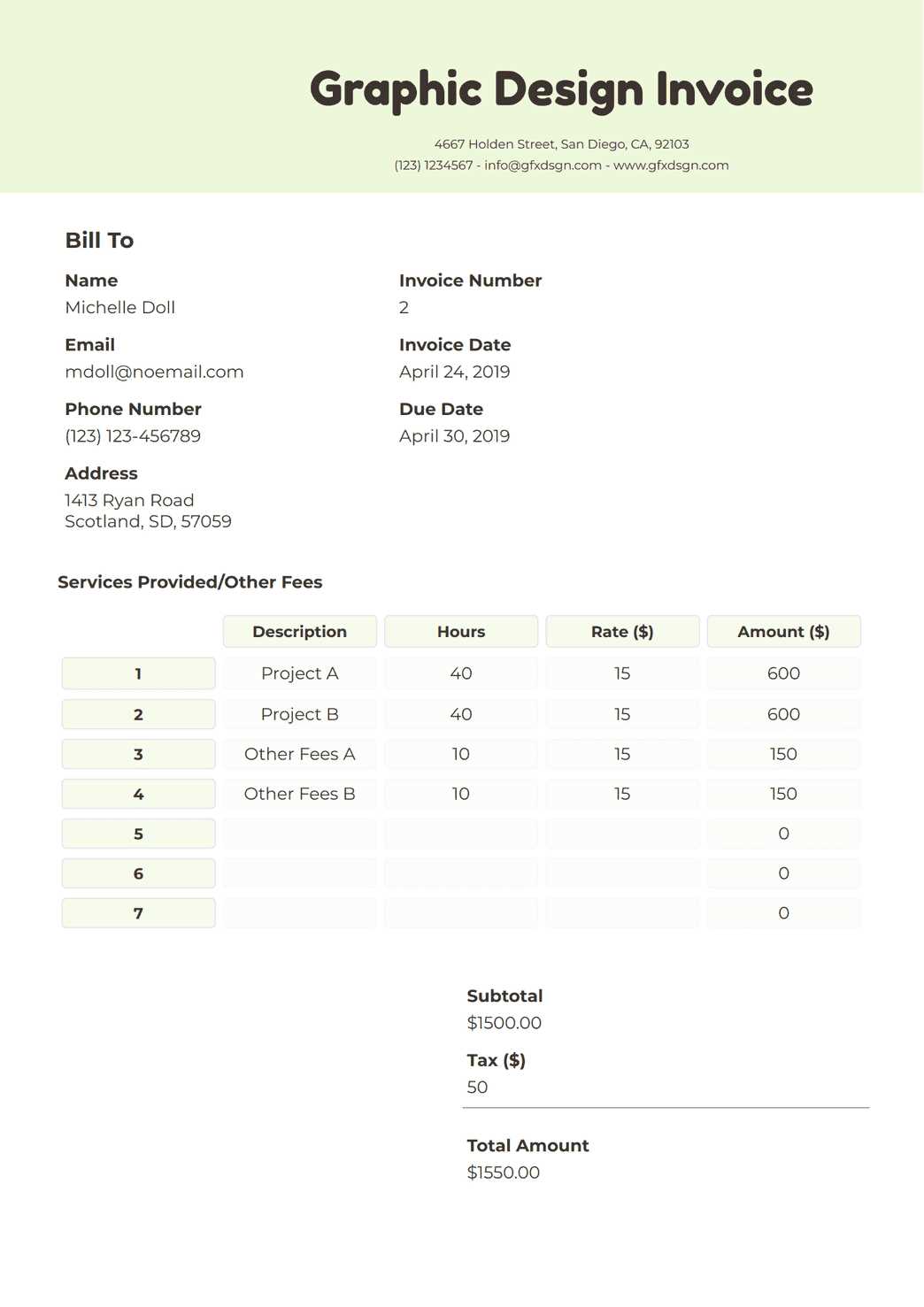

1. Service-Based Industries

For businesses offering services–such as consulting, marketing, or legal services–billing formats need to clearly outline the nature of the service, hours worked, rates, and any applicable taxes or fees. The primary features of these documents include:

- Detailed Descriptions: Clear breakdowns of services rendered, with hours, rates, and the specific tasks completed.

- Hourly Rates or Project Fees: The format should allow for easy input of hourly rates or flat project fees, depending on the type of service offered.

- Payment Terms: Clear terms regarding payment due dates, any deposit requirements, or installment plans.

For example, a consultant might need a format that allows them to list each hour worked, along with a description of the task and the agreed hourly rate. This transparency helps build trust and ensures clients are clear about what they are being charged for.

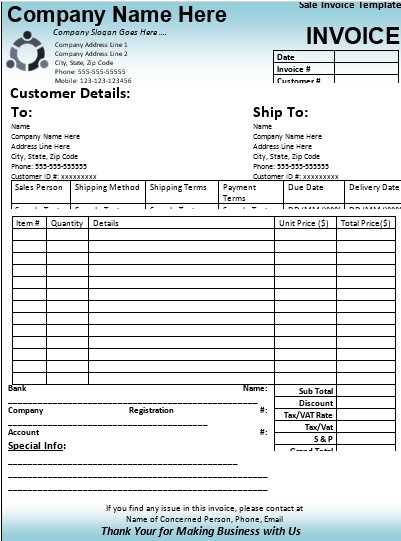

2. Product-Based Industries

In retail or product-based businesses, billing documents must be able to itemize physical goods, quantities, prices, and discounts. The format should make it easy to display product names, SKU numbers, unit prices, and totals. Key features of these documents include:

- Itemized Lists: Products or goods should be clearly listed with quantity, description, unit price, and total cost.

- Tax Calculations: Most product-based businesses need to account for sales tax, which should be clearly shown in the document.

- Shipping and Handling: A section for additional costs like shipping or handling fees may also be necessary.

Retail businesses, for example, will need a format that lets them list each product sold, the quantity ordered, and the total cost. This helps customers understand exactly what they are paying for and makes it easier for businesses to track inventory and revenue.

3. Construction and Trades

In the construction and trades industry, billing documents must often include complex job descriptions, materials used, labor costs, and project milestones. These industries require a format that is adaptable and can accommodate detailed project information, such as:

- Material Costs: Clear breakdowns of materials purchased, including item descriptions and quantities.

- Labor Charges: Detailed labor costs, often broken down by worker, hours worked, and the corresponding rate.

- Project Milestones: If the work is project-based, including a section for project phases and due payments based on milestones is crucial.

For example, a contractor may use a format that includes separate sections for materials, labor, and project milestones, ensuring both they and the client can track the project’s progress and payments accurately.

4. Creative Industries (Design, Photography, etc.)

In creative fields, billing documents need to reflect the nature of the services provided, whether it’s design, photography, or writing. These industries often require formats that focus on time-based billing, royalties, or flat project fees. Features typically include:

- Project Descriptions: Clear descriptions of creative work, such as designs, photoshoots, or written content.

- Licensing Fees or Royalties: If applicable, these formats should include a section for licensing fees or royalty-based payments.

- Revisions and Additional Costs: Sections for additional charges, such as revisions or rush fees, should be included.

A photographer, for example, may need a format that includes the number of hours for the shoot, the type of images delivered, and any additional charges fo

Making Your Billing Document Look Professional

Creating a polished and professional document for payment requests is essential for building trust with your clients. A well-organized and aesthetically pleasing document not only ensures clarity but also reinforces your business’s credibility. From the layout to the content, every element should be carefully considered to leave a lasting impression on your clients. In this section, we’ll explore the key aspects that contribute to making your billing document look professional and effective.

1. Clean and Organized Layout

The layout of your document plays a significant role in how easy it is for clients to read and understand. A cluttered or disorganized design can create confusion, which may delay payments or lead to disputes. To ensure a professional look:

- Use clear headings: Sections such as client information, services or products provided, payment terms, and total amounts should be distinct and easy to locate.

- Align text properly: Ensure text is aligned in a way that makes the document easy to scan. Important details like dates, amounts, and contact information should be clearly visible.

- Whitespace: Don’t overcrowd the document; use adequate spacing between sections and lines to create a clean, breathable look.

2. Consistent Branding

Branding is an essential part of a professional billing document. It reflects your company’s identity and creates a cohesive experience for your clients. To integrate branding effectively:

- Logo: Include your company logo at the top of the document, ideally in the header section, to make the document immediately recognizable.

- Color Scheme: Use your business’s primary color palette to highlight key sections or headings. This adds a cohesive touch that ties the document to your brand identity.

- Fonts: Use professional, easy-to-read fonts. Avoid overly decorative or hard-to-read text styles, as clarity is the priority.

3. Clear and Accurate Information

Professionalism comes down to the accuracy and clarity of the information provided. Be sure to include all the essential details in a way that leaves no room for confusion:

- Correct Client Information: Double-check that the client’s name, address, and contact details are correct to avoid misunderstandings.

- Itemized List: Provide a clear breakdown of the products or services offered, including quantities, unit prices, and any applicable taxes.

- Clear Payment Terms: Be explicit about payment due dates, acceptable payment methods, and any late fees or discounts for early payments.Best Practices for Document Numbering

Properly numbering your payment request documents is essential for maintaining an organized and efficient system. It ensures that both you and your clients can easily reference and track transactions, preventing confusion and potential errors. A clear, consistent numbering system also contributes to a professional image and facilitates smooth accounting processes. In this section, we will discuss the best practices for numbering your billing documents to help keep your records in order.

1. Use a Sequential Numbering System

One of the most fundamental best practices is using a sequential numbering system for your payment requests. This ensures that each document has a unique identifier, making it easier to track transactions. The benefits include:

- Simple Organization: By numbering documents in a continuous sequence, you can quickly locate and reference past transactions.

- Prevents Duplication: Sequential numbers reduce the risk of accidentally generating duplicate documents.

- Audit Trail: A clear, chronological record of documents helps when reconciling accounts or preparing for audits.

For example, starting with #001 and progressing upwards allows you to keep track of each transaction as it occurs, ensuring that no document is skipped or duplicated.

2. Include a Prefix or Suffix for Organization

To further streamline your system, consider adding a prefix or suffix to the numbering system. This can help differentiate between different types of transactions or separate billing periods. Some common approaches include:

- Yearly Prefix: Include the year at the start of the number, such as 2024-001 for the first document of the year. This helps quickly identify documents from a specific period.

- Client Identifier: Adding a unique code or identifier for each client can help track transactions more easily, such as 001-ABC for the first document for client ABC.

- Invoice Type: Some businesses use a suffix to denote the type of service, like INV-001 for standard services and RET-001 for returns or refunds.

This added detail makes it easier to organize documents for different clients or types of transactions, improving both organization and clarity.

3. Avoid Reusing Numbers

Reusing document numbers, even after a transaction has been completed, can lead to confusion and errors. Each document should have a unique number that has never been used before. The risks of reusing numbers include:

- Client Confusion: If clients receive multiple requests with the same number, it can create misunderstandings and delays in payment.

- Accounting Issues: Reused numbers can complicate record-keeping,

How to Keep Billing Documents Organized

Proper organization of payment request documents is essential for smooth financial operations. An efficient filing system ensures that records are easy to access, track, and manage, which ultimately helps with timely payments and better business management. Whether you’re handling a few or hundreds of transactions, establishing an effective method to organize these records can save valuable time and reduce errors. In this section, we’ll explore strategies to help you keep your payment requests orderly and accessible.

1. Implement a Consistent Naming Convention

One of the most effective ways to maintain organization is by using a clear and consistent naming system for your billing documents. A structured naming convention makes it easy to identify, sort, and retrieve specific records. Consider the following guidelines:

- Include key information: A well-organized name might include the client’s name, document number, and date. For example, “ClientName_Invoice_2024_001” ensures you can quickly identify the document’s content.

- Use standardized formats: Consistency is key. Decide on a format and stick to it. For example, always use “YYYY-MM-DD” for dates to keep sorting clear.

- Separate categories: If you handle multiple types of transactions (e.g., services, products, or refunds), make sure to label them accordingly, such as “Service_Invoice_001” or “Refund_2024_005”.

2. Digital Filing and Cloud Storage

Storing your documents digitally offers numerous advantages, such as quick access, remote retrieval, and backup security. By using cloud storage platforms, you can access your records from anywhere and avoid the risks associated with physical files. Here are some tips for organizing digital payment requests:

- Create dedicated folders: Organize your files by client, date, or project. For example, you can create a separate folder for each client and store all documents related to that client within it.

- Use cloud-based software: Cloud storage platforms like Google Drive, Dropbox, or OneDrive allow you to organize, share, and access files securely. Many of these tools also offer version control and collaboration features.

- Maintain backups: It’s essential to back up all digital files to avoid data loss. Most cloud storage solutions automatically sync and back up your files, providing an additional layer of security.

3. Utilize Accounting Software for Automation

For businesses with a high volume of transactions, utilizing accounting or billing software can streamline the process of tracking and organizing documents. Many platforms integrate billing functions that automatically generate, send, and store payment requests. This reduces the chance of human error and keeps your records well-organized. Some features to look for include:

- Automatic numbering: Most accounting software automatically generates a unique number for each document, which helps prevent duplicate or missing records.

- Client management: Accounting software often lets you track client information, making it easier to link each request to a specific client or project.

- Digital storage: These platforms usually offer cloud storage, ensuring your documents are stored securely and can be easily retrieved whenever necessary.

4. Keep Physical Copies (When Necessary)

Although digital systems are widely used, keeping physical copies of important payment requests may still be necessary for some businesses, especially for legal or tax purposes. If you need to maint

How to Add Payment Terms Effectively

Including clear payment terms in your billing documents is essential for maintaining transparency with your clients and ensuring timely payments. By specifying how and when payments should be made, you create a mutual understanding and minimize the risk of delays or confusion. In this section, we will discuss how to effectively incorporate payment terms into your documents and why it’s important to get them right.

1. Clearly Define the Payment Due Date

One of the most critical elements of your payment terms is the due date. Clearly stating when payment is expected helps manage both your cash flow and your client’s expectations. Here are a few guidelines for setting clear due dates:

- Specific Date: Always provide a precise due date (e.g., “Due by July 15, 2024”). This eliminates any ambiguity about when the payment should be made.

- Use Net Terms: Many businesses use net payment terms, such as “Net 30” or “Net 60”, which means payment is due 30 or 60 days after the billing date. Make sure these terms are clearly stated to avoid confusion.

- Include Grace Periods: If applicable, indicate whether there is a grace period (e.g., “Payment due within 30 days, with a 5-day grace period”). This gives clients a little flexibility without compromising your terms.

2. Specify Accepted Payment Methods

To avoid confusion about how payments should be made, it’s important to specify the accepted methods of payment. Make it clear whether clients can pay via bank transfer, credit card, online payment platforms, or checks. Providing multiple options can streamline the payment process and reduce delays. Here are some tips:

- List all options: Include all possible payment methods (e.g., “Bank transfer, credit card, PayPal”).

- Provide clear instructions: For bank transfers or online payments, make sure you include all necessary details such as account numbers, payment links, or other relevant information.

- Highlight preferred methods: If certain payment methods are preferred or help you process payments faster, specify them as such (e.g., “Paying via bank transfer is preferred for quicker processing”).

3. Include Late Payment Fees

To encourage timely payments, it’s important to state the consequences of missing the due date. Including late payment fees can help incentivize clients to pay on time. Here’s how to effectively communicate these terms:

- Set a clear fee structure: State the amount or percentage that will be charged for late payments (e.g., “A late fee of 1.5% will be applied to overdue balances every 30 days”).

- Be transparent: Clearly explain how the late fees will

Tips for Ensuring Quick Payments

Getting paid on time is essential for maintaining healthy cash flow and running a smooth business. However, delays in receiving payments are common, and without the right strategies, they can disrupt your operations. By implementing effective practices and communicating expectations clearly, you can encourage clients to settle their accounts quickly. In this section, we will explore several strategies to help you expedite the payment process and reduce the chances of overdue balances.

1. Provide Clear and Concise Payment Terms

One of the most effective ways to ensure prompt payment is by clearly stating your payment terms from the outset. When clients know exactly when and how to pay, it reduces the chances of confusion or hesitation. Here are some best practices:

- Specify due dates: Include a clear due date or number of days (e.g., “Due within 30 days of receipt”). This helps your clients understand when the payment is expected.

- Clarify accepted payment methods: List all available payment options, such as credit cards, bank transfers, or online payment systems, making it easier for clients to pay quickly.

- Outline late fees: Let clients know about the consequences of overdue payments, such as late fees or interest charges. This can encourage timely payment and minimize delays.

2. Send Invoices Promptly and Consistently

Timely delivery of your payment request documents can have a significant impact on how quickly you receive payments. When you send your documents as soon as possible, you give clients ample time to process the payment before the due date. Here’s how to make the most of this strategy:

- Send as soon as services/products are delivered: Issue a payment request immediately after completing the work or delivering goods, ensuring that there are no delays in the process.

- Follow up on overdue payments: If a payment is missed, send a polite reminder right away. Regular follow-ups will show that you’re proactive and serious about receiving payment.

- Use automation tools: Consider using billing software that sends automatic reminders, reducing the time spent managing accounts receivable.

3. Offer Multiple Payment Methods

To make it as easy as possible for clients to pay, offer a range of payment options. The more convenient the payment process is, the more likely clients are to pay quickly. Consider these approaches:

- Accept digital payments: Platforms like PayPal, Stripe, or bank transfer make it quick and easy for clients to settle their bills online. Ensure your clients are aware of these options.

- Offer credit card payments: Some clients prefer to use credit cards for ease and rewards. Enable this option if possible, especially for larger transactions.

- Provide clear instructions: If you accept checks or bank transfers, include all the necessary details (e.g., account number, routing code) in your payment request document to avoid delays.

4. Set Up Incentives for Early Payment

Offering a discount or incentive for early p