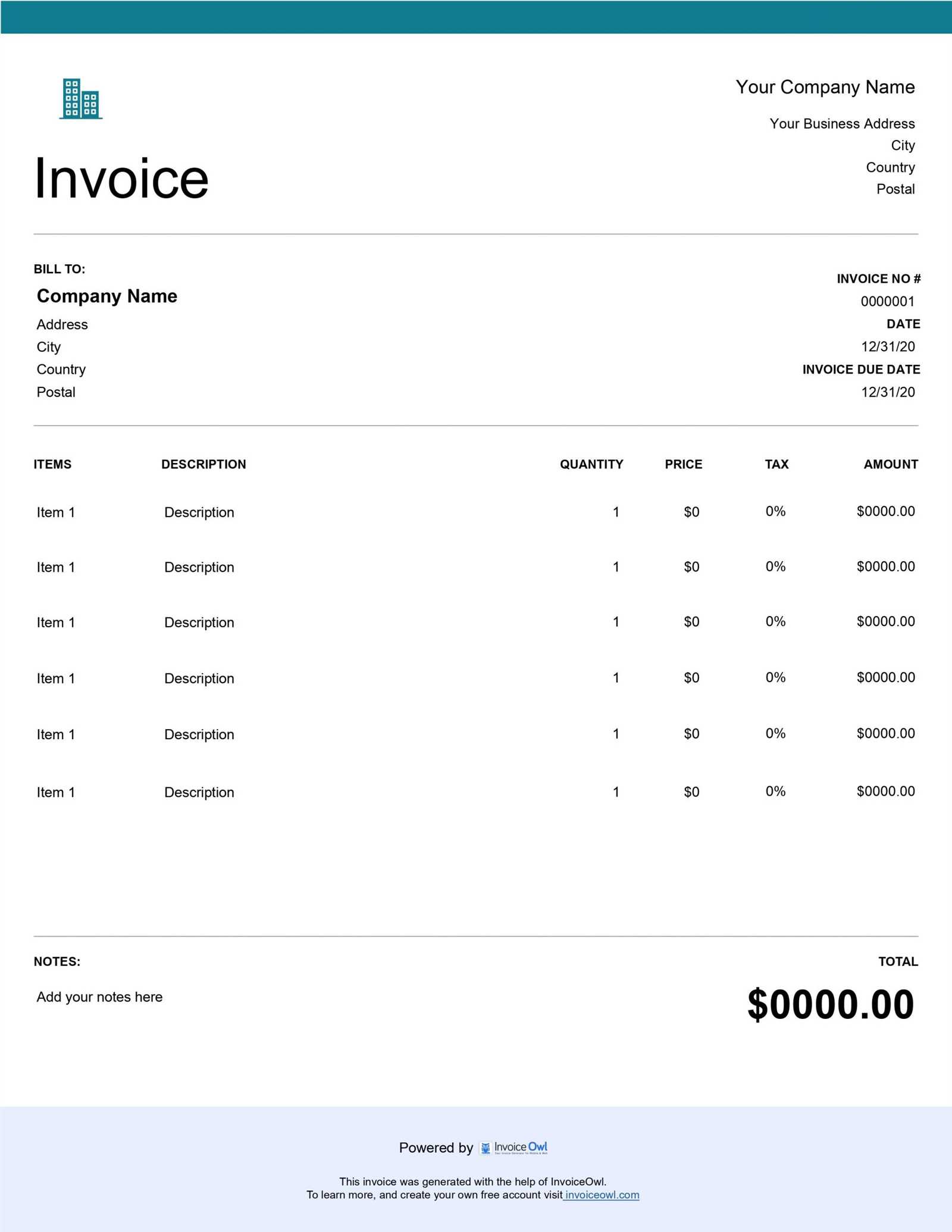

Customizable Generic Invoice Template for Word

Managing financial transactions efficiently is essential for any business. Whether you’re an entrepreneur, freelancer, or a small business owner, having a reliable tool to produce clear and professional billing documents can save time and avoid costly errors. A well-organized statement helps ensure that both you and your clients stay on the same page regarding payments and services rendered.

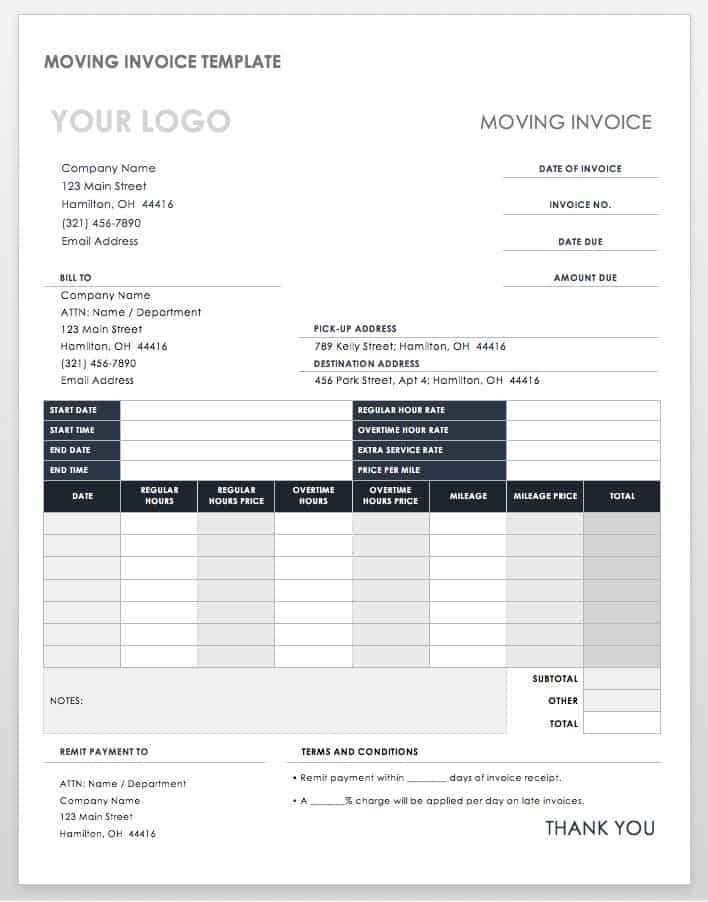

Customizable formats offer the flexibility needed to meet the unique requirements of different industries. They can be easily modified to reflect specific details such as service descriptions, payment terms, and tax calculations, making them an ideal solution for both personal and professional use.

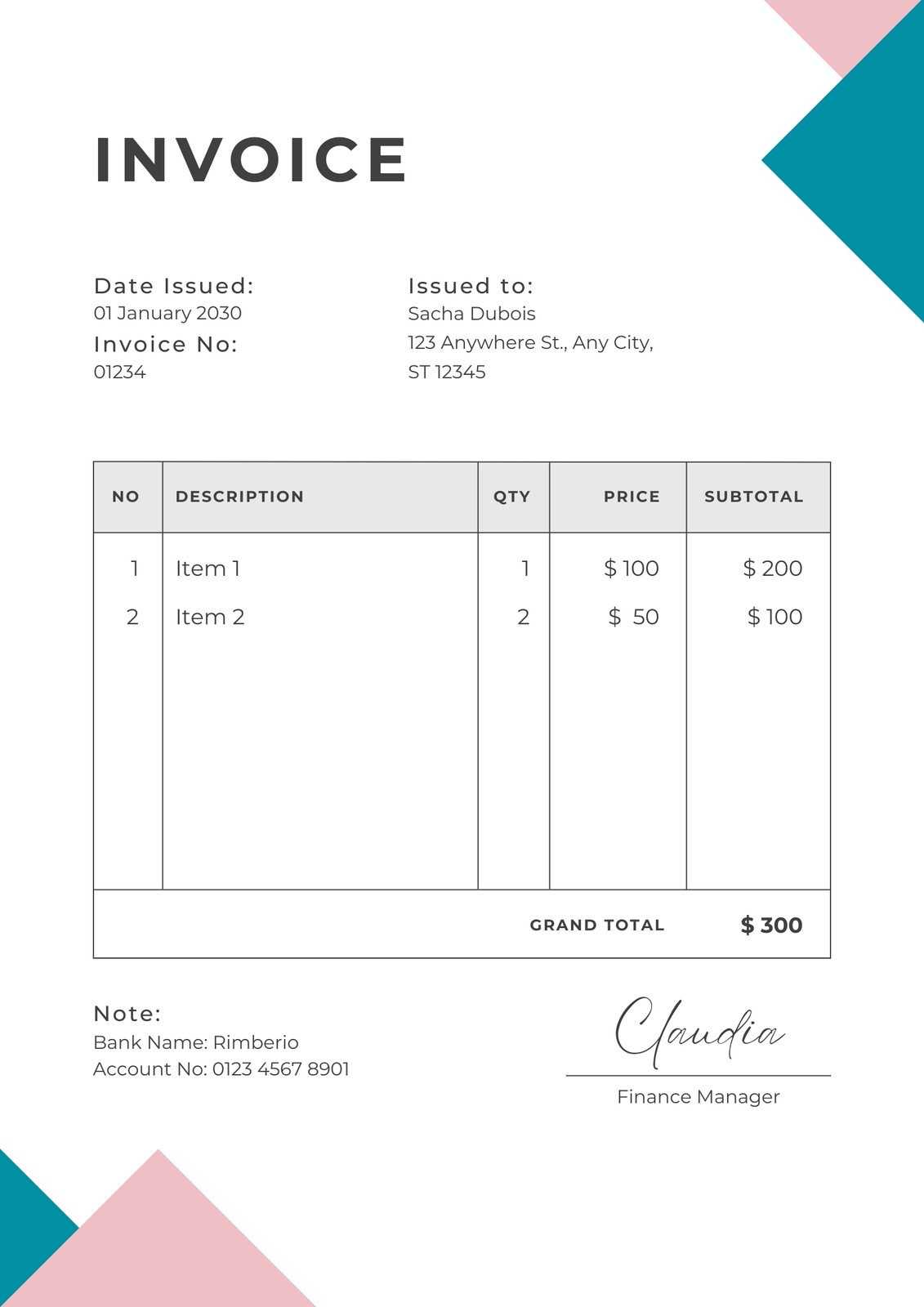

With the right structure, these documents can also enhance your brand’s credibility and foster trust with your clients. By focusing on clarity, accuracy, and visual appeal, you can create documents that not only convey essential information but also leave a positive, lasting impression.

Why Use a Standardized Billing Document

Creating consistent and professional billing records is crucial for any business or freelancer. Having a structured, easy-to-use document saves valuable time, reduces errors, and ensures that all necessary details are included. With a ready-made format, you can focus on delivering your services rather than worrying about formatting and layout.

Key Benefits of a Pre-designed Format

- Time-saving: Quickly generate accurate records without starting from scratch every time.

- Consistency: Ensure your billing process is standardized across all transactions.

- Customization: Easily adjust the document to fit specific business needs or personal preferences.

Why It’s Ideal for Small Businesses

Small businesses and independent contractors often face time constraints and limited resources. Using a pre-arranged format simplifies the creation of professional records, allowing business owners to maintain focus on growing their company. Additionally, these ready-made documents can be easily shared and stored, providing a streamlined approach to managing finances.

Benefits of Using Word for Billing Records

Choosing the right software for creating financial documents can greatly improve both efficiency and professionalism. A widely available tool like Microsoft Word offers a variety of benefits for generating detailed billing records. Its ease of use, flexibility, and wide compatibility make it an ideal choice for business owners and freelancers alike.

| Benefit | Description |

|---|---|

| Accessibility | Almost everyone has access to Microsoft Word, making it easy to create and edit documents without needing special software. |

| Flexibility | Word allows you to fully customize your document layout and content to suit your business needs. |

| Ease of Use | With an intuitive interface, creating and editing professional documents is quick and straightforward. |

| Formatting Options | Word offers a wide range of formatting tools to enhance the appearance of your documents, from fonts to tables and colors. |

| Compatibility | Documents created in Word can easily be shared, printed, or converted to different formats such as PDF for easy distribution. |

By using Word, you gain a flexible and reliable tool that helps maintain professionalism in all your financial records. Whether you are creating a single document or managing a collection of transactions, Word’s features can assist in making the process smoother and more efficient.

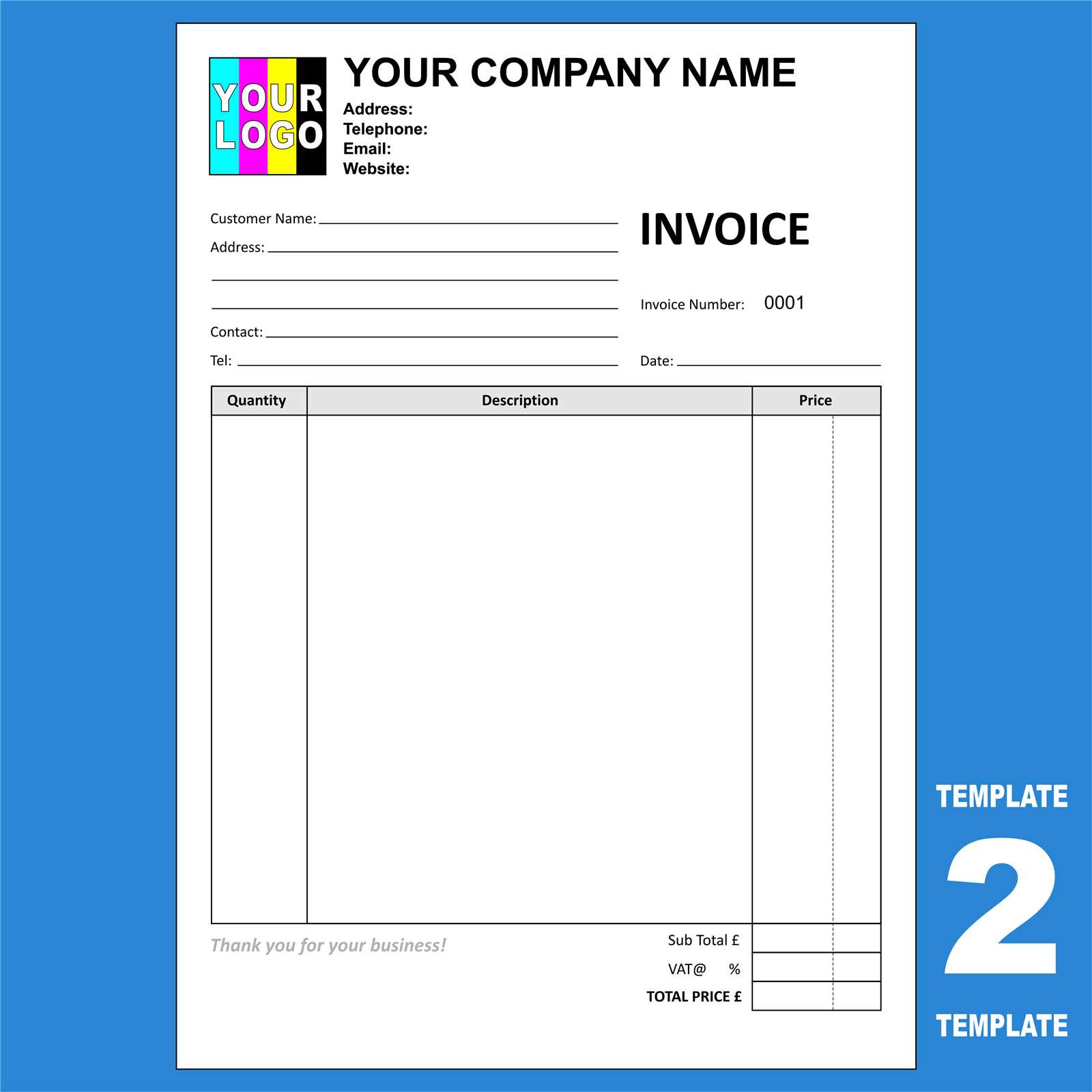

How to Customize Your Billing Document

Tailoring your financial documents to reflect your brand and business needs is a simple yet impactful way to enhance your professionalism. Customization not only ensures your records are visually appealing but also allows you to include all necessary details that suit your specific transactions. By adjusting key sections, such as your company logo or payment terms, you can make these documents uniquely yours.

Editing Key Sections

- Company Information: Add your company name, address, phone number, and email for easy contact.

- Payment Terms: Include clear terms regarding payment deadlines, penalties for late payments, and accepted methods.

- Service or Product Descriptions: Provide detailed descriptions of the services rendered or products delivered.

- Logo and Branding: Incorporate your business’s logo and use your company’s brand colors for consistency.

Adjusting Formatting and Layout

Word processors offer a variety of formatting tools that let you adjust the layout of your document. You can modify fonts, text alignment, and tables to ensure readability and clarity. By keeping the design simple and organized, you can create a document that is both functional and visually appealing.

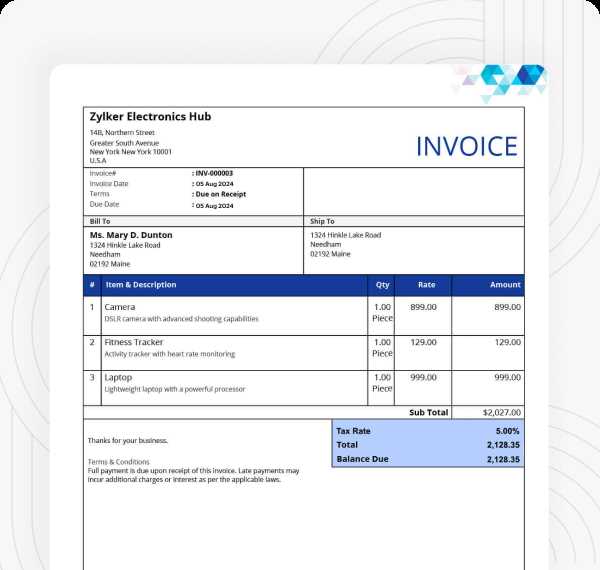

Top Features of Word Billing Documents

When it comes to creating professional financial records, certain features in document editing software make the process more efficient and streamlined. With the right set of tools, you can ensure that your billing documents are not only functional but also visually appealing and easy to understand. These features allow for quick customization, accuracy, and consistency across all your transactions.

Key Functionalities for Accuracy and Clarity

- Automatic Numbering: Automatically generate sequential numbers to track transactions easily.

- Preformatted Sections: Structured fields for service descriptions, payment terms, and total amounts ensure consistency in every document.

- Customizable Fields: Personalize your document with spaces for tax calculations, discounts, or additional charges as needed.

- Table Support: Insert organized tables for itemized services or product lists, helping clients quickly understand the charges.

Design and Layout Features

- Text Styling Options: Adjust fonts, colors, and sizes to match your branding and make important details stand out.

- Logo Insertion: Easily add your company’s logo to reinforce your brand identity on every document.

- Responsive Layout: Create well-balanced documents that look great on both printed copies and digital formats.

With these features, document creation becomes a seamless process that not only saves time but also helps maintain a high standard of professionalism in all your transactions.

Creating Professional Billing Documents in Minutes

In today’s fast-paced business environment, time is a valuable resource. By using a well-structured document layout, you can quickly create professional financial records without sacrificing quality. With a few simple adjustments, these documents can be tailored to your business needs and ready for delivery to your clients in no time.

Steps to Quickly Generate Professional Records

- Select a Pre-designed Layout: Start with a pre-made format that includes all necessary fields for your transaction details.

- Fill in Your Business Information: Add your company’s name, logo, and contact details to personalize the document.

- Enter Service or Product Details: List the services provided or items sold, along with the corresponding costs.

- Double-check Payment Terms: Ensure the payment deadline, methods, and any additional terms are clearly stated.

Time-saving Tips for Efficient Creation

- Use Keyboard Shortcuts: Speed up your editing process with commonly used shortcuts for text formatting and navigation.

- Save as a Template: Save a blank version of your document to reuse, reducing the time needed for future records.

- Automate Repetitive Tasks: For regular clients, set up automatic fields to populate common information like billing addresses or tax rates.

By following these steps and utilizing available tools, you can streamline the process of creating professional billing records, allowing you to focus on what matters most–your business.

Where to Find Free Billing Documents

If you’re looking to create professional financial records without spending money on software or services, there are many reliable resources offering free, customizable formats. These tools make it easy to generate accurate and clean documents for any type of transaction, whether you’re a freelancer, small business owner, or entrepreneur. Finding the right platform can save time and help ensure consistency in all your financial dealings.

Top Sources for Free Documents

- Microsoft Office Online: Offers a wide range of free document formats that are easy to customize and edit.

- Google Docs: Provides a simple, cloud-based solution with free document templates that can be customized and stored online.

- Template Websites: Websites like Template.net or HubSpot feature a variety of free formats, from basic to more detailed layouts.

- Freelance Platforms: Many freelance websites offer free downloadable documents for clients and service providers to use.

Other Helpful Resources

- OpenOffice and LibreOffice: Free software that comes with pre-built documents, which can be easily customized for any business.

- Online Communities: Platforms like Reddit or forums often share free resources and templates created by other users.

- Business Blogs: Many business-related blogs and websites offer downloadable documents as part of their content, including practical tools for managing finances.

By exploring these free resources, you can quickly find a format that fits your business needs, helping you stay organized and professional without spending extra money.

Common Mistakes to Avoid in Billing Documents

While creating financial records may seem straightforward, small errors can cause confusion, delays, or even damage your business’s reputation. Whether it’s missing details or unclear payment terms, such mistakes can lead to misunderstandings with clients and complicate your accounting processes. It’s important to be aware of the most common mistakes and how to avoid them when preparing billing documents.

Frequent Errors to Watch Out For

- Missing Contact Information: Failing to include your business’s contact details or the client’s information can create unnecessary communication issues.

- Incorrect Payment Terms: If payment deadlines, methods, or penalties aren’t clearly stated, it can lead to delays or disputes.

- Calculation Errors: Simple math mistakes can result in incorrect amounts, which could cause confusion and trust issues with clients.

- Ambiguous Descriptions: Not providing enough detail about the services rendered or products delivered can lead to questions or misunderstandings.

- Not Using a Unique Reference Number: Every document should have a distinct number for easy tracking and organization. Without one, tracking payments can become a hassle.

How to Prevent These Mistakes

- Double-Check Calculations: Always verify the math to ensure accuracy and prevent costly errors.

- Use Clear and Specific Language: Be as descriptive as possible when outlining services or products to avoid confusion.

- Review All Details: Before sending any document, ensure that all necessary fields are filled in, from business contact info to payment terms.

- Save and Reuse Successful Formats: Using a consistent layout and structure can reduce the chances of forgetting essential information.

By paying attention to these common mistakes and implementing best practices, you can create more effective, accurate, and professional financial records that leave a positive impression on your clients.

How to Add Company Branding to Billing Documents

Incorporating your company’s branding into financial records not only makes them look more professional but also reinforces your brand identity with every transaction. Customizing your documents with your logo, color scheme, and fonts creates a cohesive look that communicates consistency and trustworthiness to your clients. By adding these personal touches, your documents become more than just functional–they represent your business’s values and style.

Key Elements to Include

- Logo: Adding your business’s logo at the top of the document gives it an instantly recognizable professional look. This establishes a connection with your brand right from the first glance.

- Brand Colors: Use your company’s primary color palette for headings, borders, or section highlights. This helps reinforce your brand identity visually.

- Fonts and Typography: Choose fonts that align with your company’s visual identity. Stick to one or two complementary fonts to maintain a clean, professional appearance.

- Tagline or Slogan: If applicable, include a brief tagline or slogan to further personalize your documents and remind clients of your business mission.

Where to Place Branding Elements

- Header Section: Place your logo and company name at the top of the page to immediately establish your brand identity.

- Footer: The footer is an ideal location for additional branding elements such as your contact information, business registration details, or website link.

- Table Highlights: Use your brand colors for headers or borders around tables to make the document visually appealing while maintaining professionalism.

By consistently applying your branding to every document, you enhance your business’s image and create a unified experience for your clients, further building trust and recognition over time.

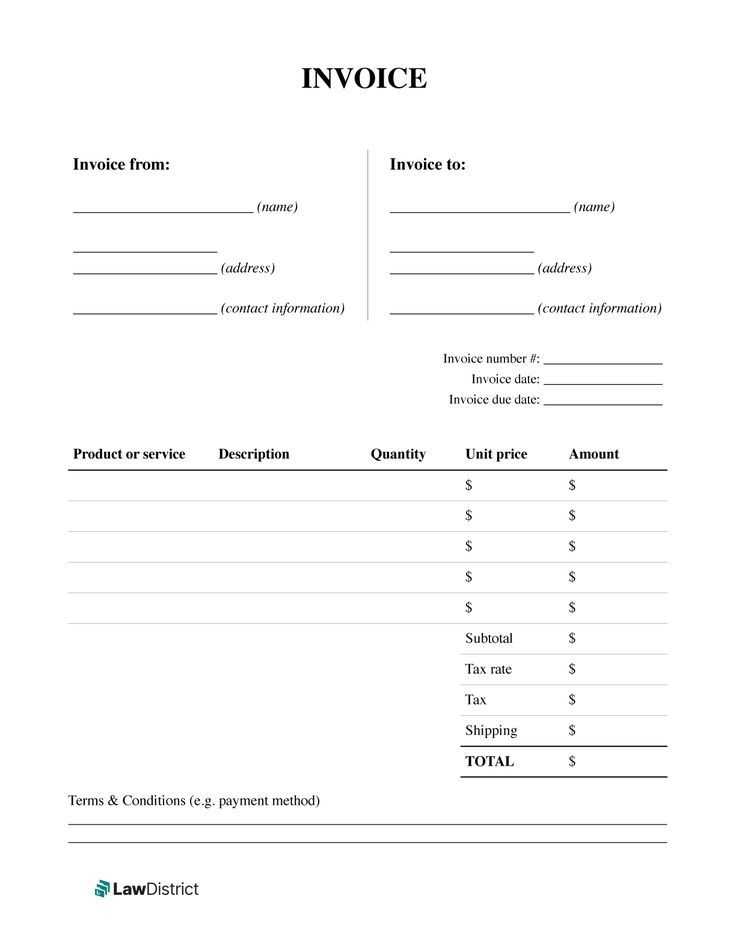

Essential Fields for Every Billing Document

When creating financial records, there are certain key pieces of information that should always be included. These essential fields ensure that the document is complete, accurate, and provides all necessary details for both parties. Including the right information helps prevent confusion, facilitates smooth transactions, and ensures that both you and your clients are on the same page regarding payment terms and expectations.

Core Information to Include

- Business Details: Your company name, address, phone number, email, and website should be clearly visible at the top of the document.

- Client Information: Include the client’s name, business name (if applicable), address, and contact information to ensure clarity in communication.

- Document Number: A unique reference number is essential for tracking the document and maintaining organized records.

- Issue Date and Due Date: Clearly state when the document was created and when payment is due to avoid confusion over deadlines.

- Detailed List of Products/Services: A breakdown of what was provided, including descriptions, quantities, unit prices, and any relevant item codes.

- Total Amount: The final amount due should be prominently displayed and calculated correctly, including taxes or discounts if applicable.

- Payment Instructions: Specify how payments should be made, such as bank transfer details, accepted payment methods, or online payment links.

Additional Helpful Information

- Tax Information: Include any applicable tax rates or tax identification numbers, ensuring compliance with local regulations.

- Terms and Conditions: Outline any terms regarding refunds, late fees, or other important conditions related to the transaction.

- Notes or Messages: Space for any additional comments or instructions for the client, such as “Thank you for your business” or specific delivery instructions.

By ensuring that all of these key fields are included, you create a document that is clear, professional, and legally compliant, helping you build trust with your clients and facilitating smooth business transactions.

Tips for Organizing Your Billing Data

Properly organizing your financial records is key to running an efficient business. By creating a clear and consistent system for managing these documents, you can easily track payments, manage cash flow, and stay on top of overdue accounts. With a few simple practices, you can keep your billing data well-ordered and easily accessible whenever you need it.

Effective Organization Strategies

- Use Folders and Subfolders: Create digital folders for each client or project. Within each folder, include subfolders for specific transactions, such as paid and outstanding records.

- Maintain a Spreadsheet: Track all billing documents in a spreadsheet, including payment dates, amounts, and status (paid, pending, overdue). This allows you to quickly assess your financial situation at any time.

- Label Files Clearly: Name your documents with clear identifiers, such as client name, date, or document number, to make searching easier.

- Back-Up Your Data: Regularly back up your records to a secure cloud service or external drive to ensure they are protected from loss or damage.

Best Practices for Tracking Payments

- Update Regularly: Consistently update the status of each transaction as payments are made. This will help you avoid confusion and ensure accurate records.

- Automate Reminders: Use automated reminders for overdue payments to help you stay on top of collections without spending too much time on follow-ups.

- Use Tags or Categories: Tag transactions based on their status (e.g., “paid,” “pending,” “disputed”) to quickly filter and prioritize your records.

By implementing these organization strategies, you can reduce the time spent searching for records, avoid errors, and ensure that your financial documents are always up to date and ready when you need them.

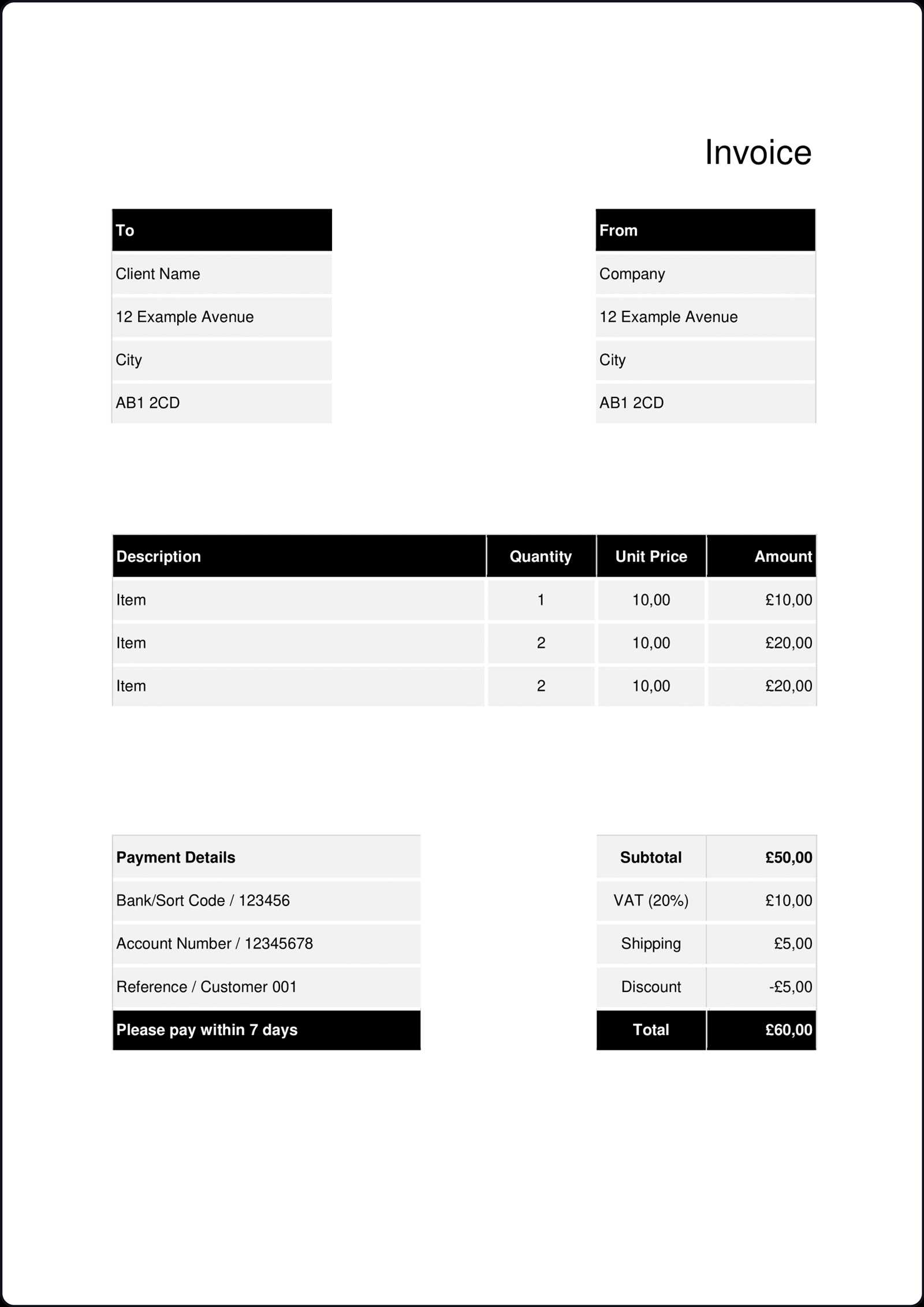

Managing Payment Terms on Your Billing Document

Clearly outlining payment terms is crucial for ensuring timely and smooth transactions. By specifying the expectations around payment deadlines, methods, and penalties for late payments, you reduce the risk of misunderstandings and disputes. A well-structured payment section in your billing documents not only reflects professionalism but also helps in maintaining a healthy cash flow for your business.

Key Elements of Payment Terms

- Due Date: Always specify a clear due date, such as “30 days from the date of issue” or a fixed calendar date.

- Accepted Payment Methods: Indicate the payment options available, including bank transfer, credit card, or online payment portals.

- Late Payment Fees: Include a penalty for overdue payments, such as a percentage added to the total amount after the due date.

- Early Payment Discounts: Offer incentives for early payment, such as a discount if paid within a certain period (e.g., a 2% discount for payments made within 10 days).

Example of Payment Terms

| Payment Term | Description |

|---|---|

| Due Date | Payment is due 30 days after the date of issue. |

| Late Payment Fee | A 5% fee will be added for payments made 15 days after the due date. |

| Early Payment Discount | A 2% discount will be applied if payment is made within 10 days of issue. |

| Accepted Payment Methods | Bank transfer, credit card, or PayPal. |

By clearly setting out these payment conditions, you help ensure that clients understand their obligations and are more likely to pay on time, reducing the need for follow-up and improving your financial efficiency.

How to Include Taxes on Billing Documents

Including taxes accurately on your financial documents is essential for compliance and clarity. Whether you’re adding sales tax, VAT, or another form of tax, it’s important to show these charges transparently. This not only helps you adhere to legal requirements but also prevents confusion for your clients regarding the total amount due.

Steps to Include Taxes Correctly

- Determine Applicable Tax Rates: Before adding tax to the document, ensure you know the correct tax rate based on your location and the nature of the goods or services provided.

- Clearly Label Tax Amounts: Specify the type of tax being charged (e.g., “Sales Tax” or “VAT”) and include the percentage or flat amount applied to the total.

- Show Subtotals: Break down the subtotal before tax, the tax amount, and the final total, so the client can easily understand the calculations.

- Specify Tax Registration Number: If required by law, include your business’s tax identification or VAT number on the document.

Example of Tax Breakdown

| Description | Amount |

|---|---|

| Subtotal | $500.00 |

| Sales Tax (10%) | $50.00 |

| Total Due | $550.00 |

By following these steps and providing a clear tax breakdown, you ensure both accuracy and transparency, helping to foster trust with your clients while staying compliant with tax laws.

Saving and Sharing Your Billing Documents Easily

Once your financial document is ready, it’s important to know how to save and share it efficiently. Having a reliable system for storing your files makes future access quick and easy. Furthermore, providing clients with a straightforward way to receive the document enhances your professional image and streamlines the payment process.

Ways to Save Your Billing Records

- Save in Multiple Formats: Save your document in popular formats like PDF, which is universally accessible and preserves formatting, ensuring your document appears professional on all devices.

- Organize with Folders: Create specific folders for each client or project, and store related documents in these categories to maintain easy access and organization.

- Cloud Storage: Utilize cloud-based services like Google Drive, Dropbox, or OneDrive to store your files. Cloud storage allows for easy access from any device and ensures your documents are backed up and secure.

- File Naming Convention: Use a consistent naming system for your files that includes the client name, document number, and date (e.g., “ClientName_Invoice_2024-10-15”) to quickly identify and search for specific documents.

Sharing Billing Documents with Clients

- Email Attachments: Attach the saved document directly to an email and send it to your client. Ensure the subject line clearly indicates the purpose of the email (e.g., “Your October 2024 Payment Request”).

- Online Payment Portals: If you use an online payment service, upload the document to your client’s account or payment portal, allowing them to view and pay directly from the platform.

- Secure File Sharing Services: Use secure file-sharing platforms like Dropbox or Google Drive if you prefer sending a link instead of attaching the document. This can be especially useful for larger files.

- Physical Mail: In certain situations, you may choose to send a printed copy via postal mail, especially for clients who prefer physical records.

By saving and sharing your documents in a structured way, you not only make the process efficient but also enhance the professionalism of your business communication, making it easier for clients to access and settle their payments.

How to Track Billing Document Payments

Tracking payments for your financial documents is essential for maintaining cash flow and ensuring all transactions are accounted for. Without an organized system, it can be easy to lose track of outstanding payments or miss overdue amounts. Establishing a clear process to monitor which payments have been made and which are still pending is key to managing your business’s finances effectively.

Steps to Track Payments Efficiently

- Maintain a Payment Log: Create a log or a spreadsheet to record the details of each transaction, including the date of payment, amount received, and payment method.

- Update Status Regularly: As soon as a payment is received, update the status of the document to “Paid” or “Completed” to avoid confusion later on.

- Track Overdue Payments: Mark documents as “Overdue” or “Pending” if payment has not been received by the due date, and follow up with clients accordingly.

- Use Automated Reminders: Set up automated reminders or alerts for upcoming or overdue payments to prompt clients for action and reduce manual tracking.

Example of Payment Tracking Table

| Document Number | Client Name | Amount Due | Payment Date | Status |

|---|---|---|---|---|

| 001 | ABC Corp. | $500.00 | 2024-10-15 | Paid |

| 002 | XYZ Ltd. | $300.00 | 2024-10-18 | Pending |

| 003 | Global Tech | $700.00 | 2024-10-20 | Overdue |

By tracking payments systematically, you can easily identify outstanding balances, reduce errors, and keep your financial records up to date. This will not only help you stay on top of your finances but also build stronger, more transparent relationships with your clients.

Why Consistency Matters in Billing

Maintaining consistency across your financial documents is crucial for both professionalism and efficiency. When you follow a consistent format and structure, it not only enhances your brand identity but also ensures that both you and your clients can easily understand the terms, totals, and other important details of each transaction. This reliability helps to prevent confusion, errors, and delays, ultimately strengthening your business relationships.

Benefits of Consistency in Billing

- Improves Professional Image: Consistent formatting across all your billing records portrays a well-organized and professional image to your clients, which can enhance trust and credibility.

- Streamlines Processing: Having a standard way to present charges, due dates, and payment terms makes it easier for clients to process payments quickly, reducing the likelihood of delays or misunderstandings.

- Avoids Errors: A consistent approach helps ensure that no important details are overlooked, which minimizes the risk of mistakes, such as miscalculating totals or forgetting tax rates.

- Improves Client Experience: When clients are familiar with your document style, they can easily locate relevant information, such as the total amount due or the payment terms, leading to a smoother and quicker transaction process.

How to Ensure Consistency

- Use a Standardized Format: Stick to a consistent layout for all your documents. This includes using the same font, font size, headings, and text alignment to create a unified appearance.

- Automate Where Possible: If you use software to generate your documents, choose one that allows you to set templates and automate the process to ensure uniformity across all billing records.

- Use Consistent Language: Keep the language consistent for clarity. Always refer to the same terminology for payment terms, taxes, and other standard sections.

By prioritizing consistency in your financial documentation, you make it easier for clients to navigate and understand their obligations, while also improving your workflow and reducing potential errors in the billing process.