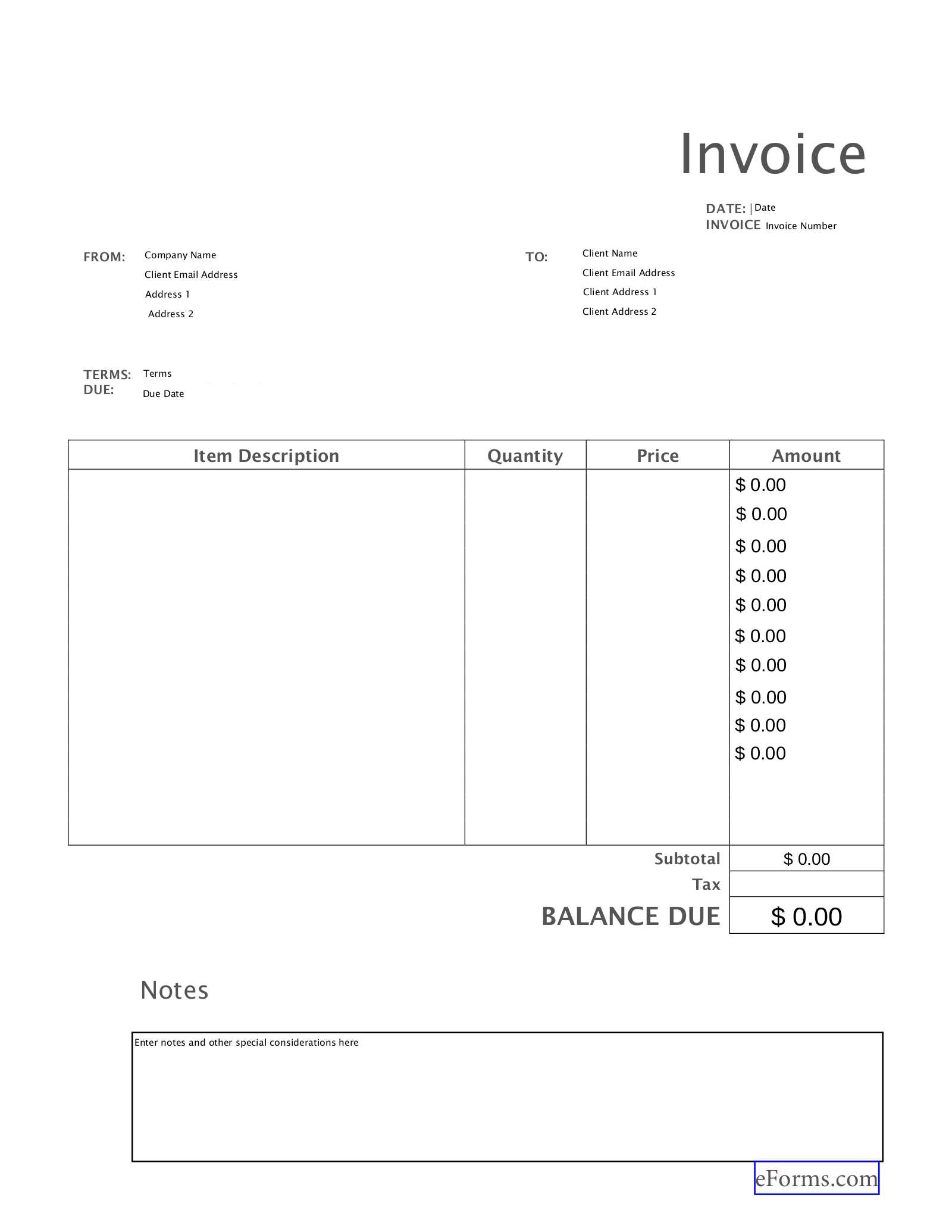

Download and Customize General Invoice Template

When managing business transactions, having a clear and structured document for requesting payments is essential. A well-organized form helps ensure that both the service provider and the client understand the details of the exchange. This document can be easily customized to suit various types of services or goods, making it a versatile tool for any business.

By using a customizable format, you can streamline the billing process and reduce the chances of errors. Customizing this form to reflect your brand and the specifics of each transaction ensures professionalism and clarity. With the right layout, you can communicate payment terms, dates, and amounts efficiently.

Whether you are a freelancer, a small business owner, or part of a larger enterprise, this tool will save you time and increase productivity. Understanding how to tailor it to your needs is key to maintaining smooth operations and fostering trust with your clients.

Understanding the Basics of Billing Documents

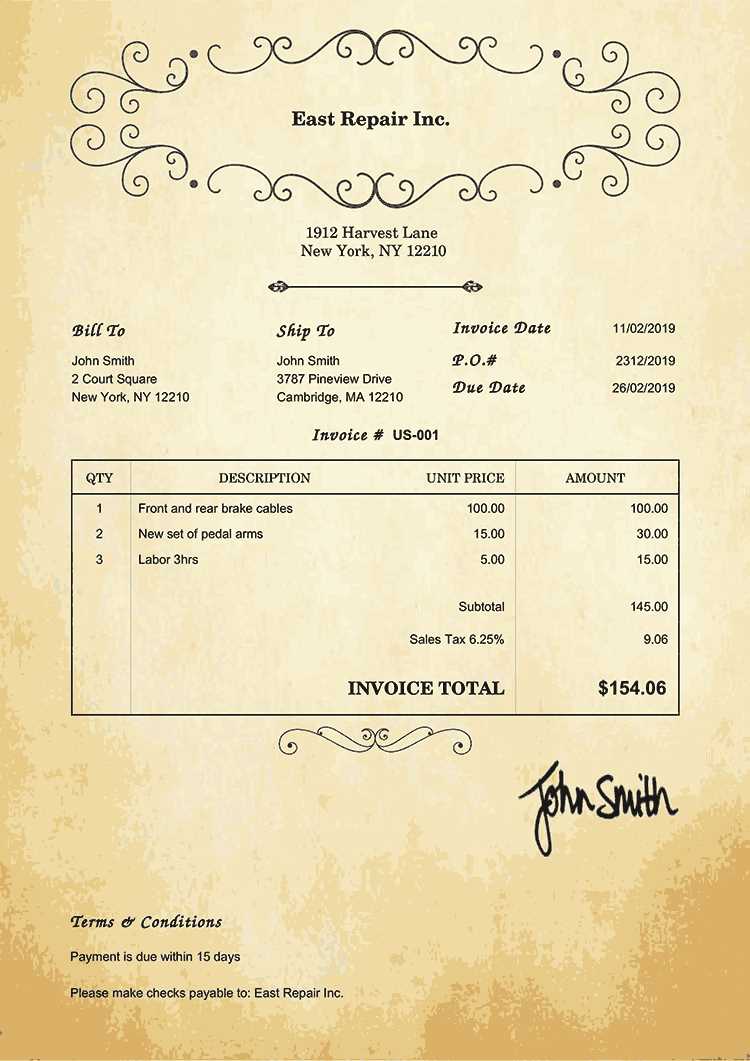

At its core, a billing document is a formal request for payment after goods or services have been provided. It outlines key details about the transaction, such as the amount due, the payer’s information, and payment terms. Knowing how to structure this form correctly is crucial for clear communication and efficient transactions.

These documents serve not only as a record of the transaction but also as a professional tool that helps businesses manage their finances. A well-designed document can prevent misunderstandings and provide a clear outline of what the client owes.

Here are some key elements that should be included in a well-structured document:

- Business Information: Include the name, address, and contact details of the seller.

- Client Information: Ensure the buyer’s details are correctly listed.

- Description of Goods or Services: Provide a clear breakdown of what is being billed.

- Amount Due: Specify the exact payment required.

- Payment Terms: Define when the payment is due and any penalties for late payments.

- Unique Identification Number: Assign a reference number to each document for easy tracking.

By incorporating these elements, businesses can ensure that their billing documents are both informative and professional. This helps reduce errors and improves the efficiency of the payment process.

Why Use a Standardized Billing Form

Having a standardized billing document offers numerous advantages for businesses of all sizes. It helps maintain consistency and accuracy across financial transactions, reducing the likelihood of errors and misunderstandings. Instead of creating a new document from scratch for each transaction, using a pre-designed form simplifies the process and ensures all necessary information is included every time.

Here are some key reasons why businesses opt for a standardized billing form:

| Benefit | Description |

|---|---|

| Efficiency | Using a pre-designed structure saves time, allowing you to generate bills quickly without reinventing the wheel. |

| Consistency | Every document follows the same format, ensuring important details are never overlooked. |

| Professional Appearance | A well-structured form helps create a polished, professional image for your business, building trust with clients. |

| Legal Compliance | Using a consistent format ensures that all necessary information is included for legal or tax purposes. |

By using a pre-structured billing form, businesses can simplify their accounting processes, reduce administrative workload, and enhance client relationships. The time saved and the reduction in errors ultimately leads to a smoother and more efficient payment process.

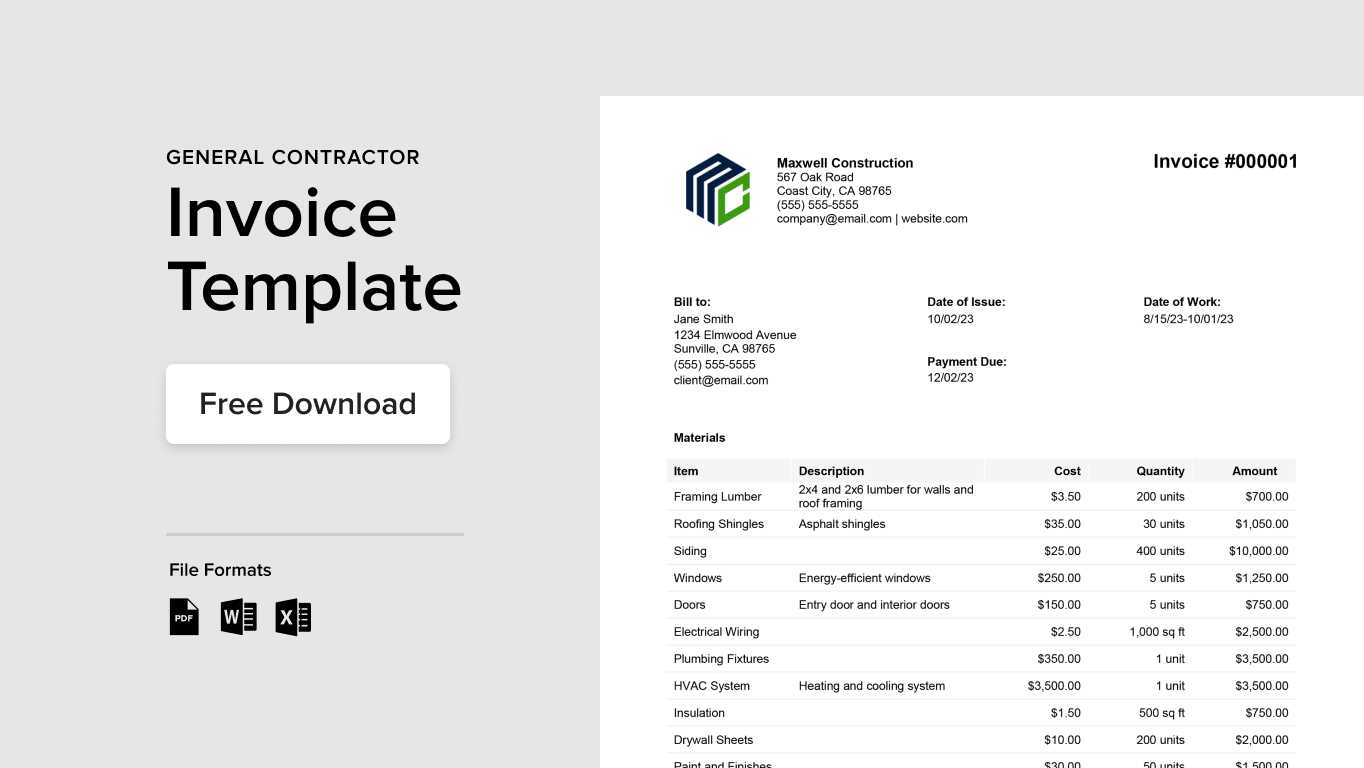

Essential Components of a Billing Document

For a billing document to be effective, it must contain several key elements that provide clarity and ensure all necessary information is communicated. Each section serves a specific purpose, from identifying the parties involved to detailing the transaction and specifying payment terms. Without these components, the document may lack essential details, leading to confusion or delays in payment.

Here are the most important elements to include in a well-structured billing document:

- Business Information: This includes the name, address, and contact details of the entity issuing the bill. It ensures that the recipient knows where to direct payment or inquiries.

- Client Details: Similar to the business information, the client’s full name, address, and contact information should be included to avoid any confusion about who is responsible for payment.

- Itemized List of Products or Services: A detailed breakdown of what is being billed is crucial. This could include quantities, descriptions, rates, and any applicable discounts.

- Amount Due: Clearly state the total amount the client owes, ensuring that all calculations are accurate and transparent.

- Payment Terms: Specify when payment is due and any late fees or discounts that may apply for early or late payments.

- Unique Document Number: Each billing document should have a unique identifier for tracking and record-keeping purposes.

- Payment Methods: Indicate the acceptable methods of payment (e.g., bank transfer, credit card, check), along with the relevant account or payment details.

By including these essential components, businesses can ensure that their billing documents are clear, professional, and complete, minimizing the chances of disputes or confusion and facilitating smooth financial transactions.

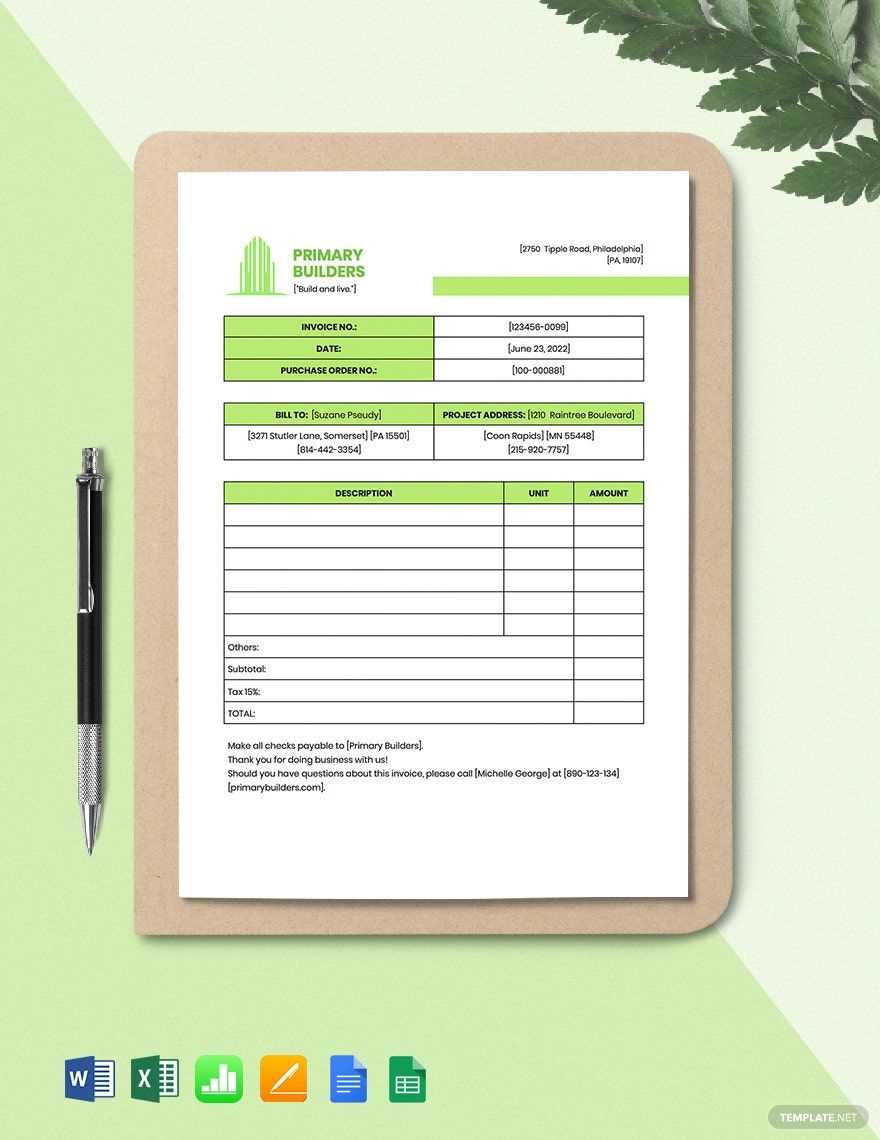

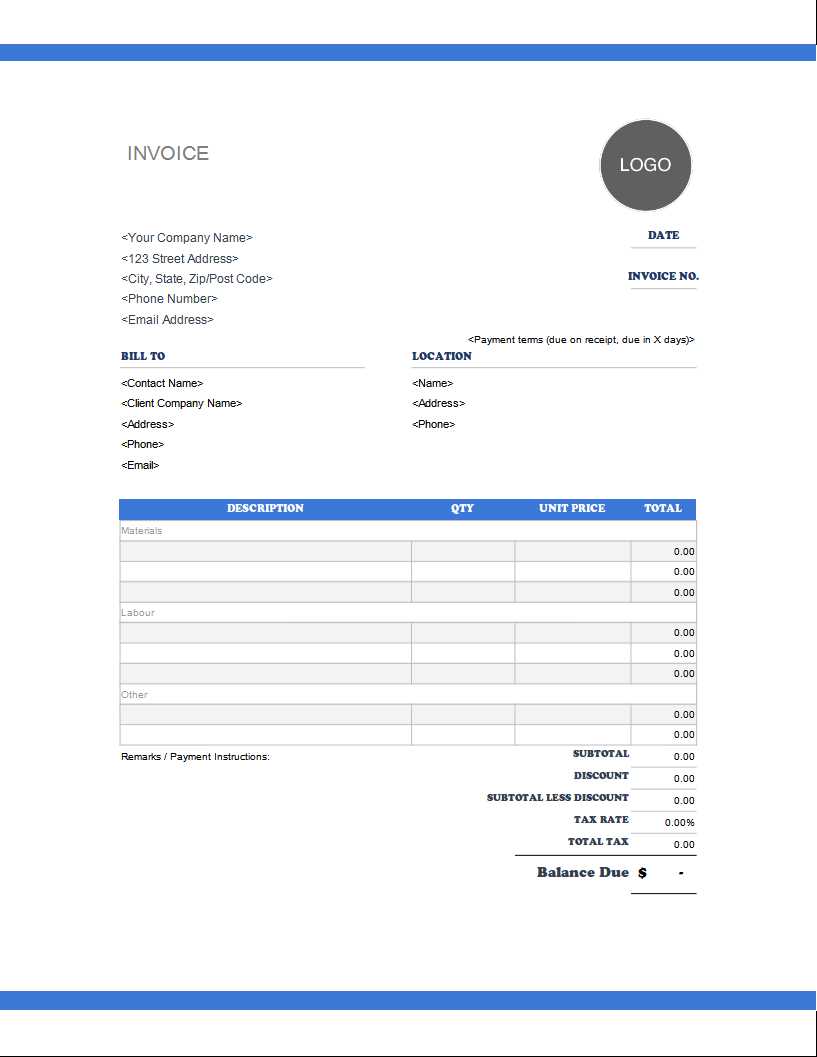

How to Customize Your Billing Document

Customizing a billing document allows you to tailor it to your business’s specific needs and branding. This ensures that each document reflects your company’s identity and communicates the necessary details to clients clearly. Personalizing your form can also improve professionalism and make your documents more recognizable to recipients.

To start customizing, you can modify various sections of the document, including:

- Logo and Branding: Add your company’s logo and use brand colors to make the document visually aligned with your corporate identity.

- Business Information: Ensure that your contact details, including address, phone number, and email, are accurate and prominently displayed.

- Payment Instructions: Customize payment terms and methods based on your preferred methods of receiving payments, such as bank transfer, credit card, or online payments.

- Product or Service Descriptions: Tailor the list of items or services to reflect your offerings, including pricing, quantities, and any special offers or discounts.

- Terms and Conditions: Adjust payment terms and late fee policies to fit your business’s requirements.

By making these adjustments, you ensure that the document is not only functional but also professionally aligned with your business. Customizing your forms also saves time, as you don’t need to create a new layout from scratch for every transaction, allowing you to quickly generate consistent, branded documents.

Free vs Paid Billing Forms

When choosing a billing document format, businesses often face the decision between free and paid options. While both have their advantages, each offers different levels of features, customization, and support. Understanding the key differences can help you select the option that best suits your business needs.

Here’s a comparison of the benefits of free and paid billing forms:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited options for design and layout customization. | Wide range of customization options, including branding and advanced formatting. |

| Templates and Features | Basic templates with essential information. | Advanced templates with additional features like recurring billing, tax calculations, and multiple payment options. |

| Support | Minimal or no customer support. | Dedicated customer support and regular updates to the software. |

| Security | Limited security features and may require manual tracking of sensitive information. | Enhanced security measures, including encryption and secure storage for sensitive data. |

Free billing forms can be an excellent starting point for small businesses or individuals who need a simple solution. However, paid options provide greater flexibility, professional features, and the support necessary for larger operations. When choosing between the two, consider the scale of your business, the complexity of your transactions, and the level of customization you need.

Top Features to Look for in Billing Forms

When selecting a billing form, it’s important to consider the features that will make the document both functional and professional. The right features can streamline your billing process, reduce errors, and improve the overall client experience. Whether you’re just starting a business or looking to upgrade your current system, these essential attributes can significantly enhance your billing efficiency.

Here are some key features to look for when choosing a billing form:

- Customizable Layout: The ability to tailor the design to reflect your business’s branding and needs is essential for creating a professional appearance.

- Itemized Details: A clear breakdown of products or services provided, including quantities, unit prices, and total amounts, ensures transparency and accuracy.

- Payment Terms: Clear indication of payment deadlines, late fees, and available payment methods helps prevent misunderstandings and delays.

- Tax Calculations: Automatic tax calculation features help ensure that your forms comply with local tax laws and simplify the billing process.

- Unique Identifiers: Each document should have a reference number or code for easy tracking and record-keeping.

- Multi-Currency and Language Support: For international businesses, the ability to handle multiple currencies and languages makes transactions smoother and more accessible for clients worldwide.

- Integration with Accounting Software: The ability to easily integrate with accounting platforms allows for automatic syncing of payments, reducing manual data entry and errors.

Choosing a billing form with these features will not only improve your operational efficiency but also ensure your transactions are clear, consistent, and professional. Investing in the right tools can save time, reduce mistakes, and enhance your business’s credibility with clients.

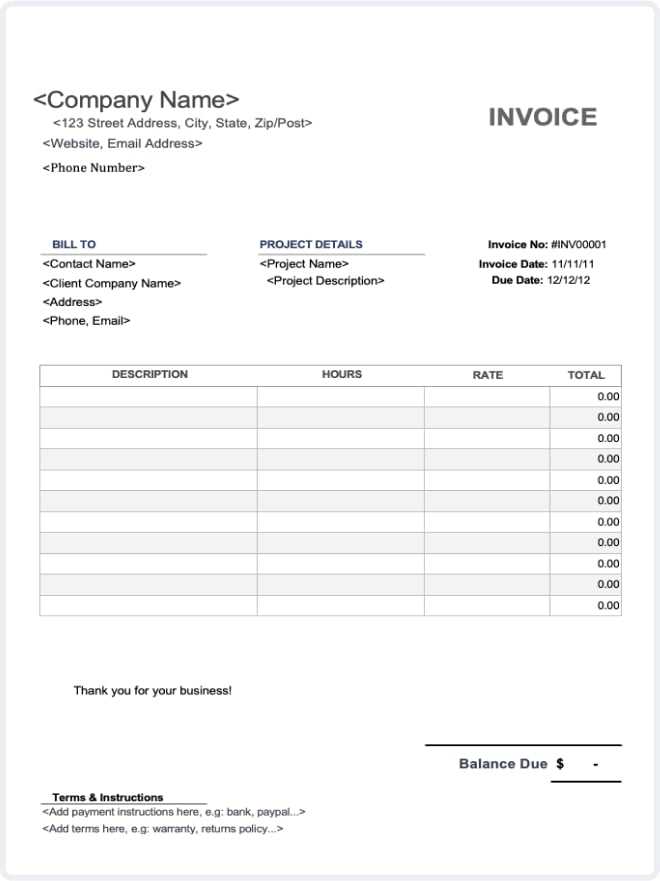

Creating a Professional Billing Document from Scratch

Creating a professional billing document from scratch requires careful attention to detail and a structured approach. It’s important to ensure that the document is clear, comprehensive, and visually appealing. A well-designed form not only communicates the necessary payment information but also enhances your business’s professionalism and credibility.

Here’s a step-by-step guide to help you create a polished billing document:

- Start with Business Information: Include your company name, address, contact details, and logo to establish your identity. This ensures clients know who to contact for inquiries.

- Add Client Details: Make sure to include the full name, address, and contact information of the recipient to avoid any confusion about who is being billed.

- Provide a Unique Document Number: Assign a unique identifier to each document. This helps with tracking and organizing your records.

- List Items or Services: Clearly describe the goods or services provided, including quantities, unit prices, and total amounts. This section should be detailed and easy to understand.

- Specify Payment Terms: Include clear information about when payment is due, any late fees, and the acceptable payment methods.

- Calculate the Total Amount: Double-check the calculations to ensure the total amount due is accurate, including taxes and discounts where applicable.

- Review and Finalize: Before sending the document, review all the details for accuracy and make sure the layout is neat and professional.

By following these steps, you can create a customized, professional billing document that accurately reflects your services and ensures timely payments from your clients.

How to Add Your Business Information

Including your business details in every billing document is crucial for ensuring that clients know exactly who they are working with and how to contact you. The information should be clear, accurate, and consistent across all forms. It not only provides transparency but also adds a professional touch to your documents.

Key Details to Include

- Business Name: Always list the official name of your company, as it appears in your legal documents or branding materials.

- Address: Include your physical address, or if you are operating remotely, provide your mailing address or a P.O. box.

- Phone Number: Ensure that clients can easily reach you by phone. Include a business line or customer service number.

- Email Address: Provide a dedicated business email address for inquiries or payment-related communication.

- Website (Optional): If applicable, include a link to your company’s website for further information or customer resources.

Formatting Your Business Information

- Positioning: Place your business details at the top of the document, ideally in the header, so they are immediately visible.

- Consistency: Make sure the business name, contact info, and branding are consistent with other communication materials for brand recognition.

- Clarity: Use clear, legible fonts and make sure the text size is appropriate for easy reading.

By ensuring your business information is clear and easy to find, you create a more organized and professional appearance for your billing forms. This practice helps to build trust and makes it easier for clients to contact you or resolve any potential issues with payments.

Including Tax Information on Billing Documents

Including accurate tax information on your billing documents is essential for ensuring transparency and compliance with local regulations. Whether you are charging sales tax, value-added tax (VAT), or any other form of tax, providing these details clearly can help prevent misunderstandings and make it easier for clients to process payments.

Key Tax Information to Include

- Tax Identification Number (TIN): Include your business’s tax ID number to identify your company for tax purposes.

- Tax Rate: Clearly state the applicable tax rate for the products or services being billed.

- Tax Amount: Calculate and display the exact tax amount applied to the total cost of the goods or services provided.

- Tax Breakdown: For transparency, break down the tax calculations if multiple rates apply to different items or services on the document.

- Exemption Details (if applicable): If your business or the transaction is exempt from certain taxes, include a note explaining the exemption.

Formatting and Presentation

Presenting tax information clearly is essential for both legal purposes and customer understanding. Here is a sample structure for including tax information:

| Description | Amount |

|---|---|

| Subtotal | $500.00 |

| Sales Tax (8%) | $40.00 |

| Total | $540.00 |

By providing clear and accurate tax information, you ensure compliance with tax laws and help clients understand the final amount due. This practice also enhances the professionalism and credibility of your billing documents.

Different Billing Formats and Styles

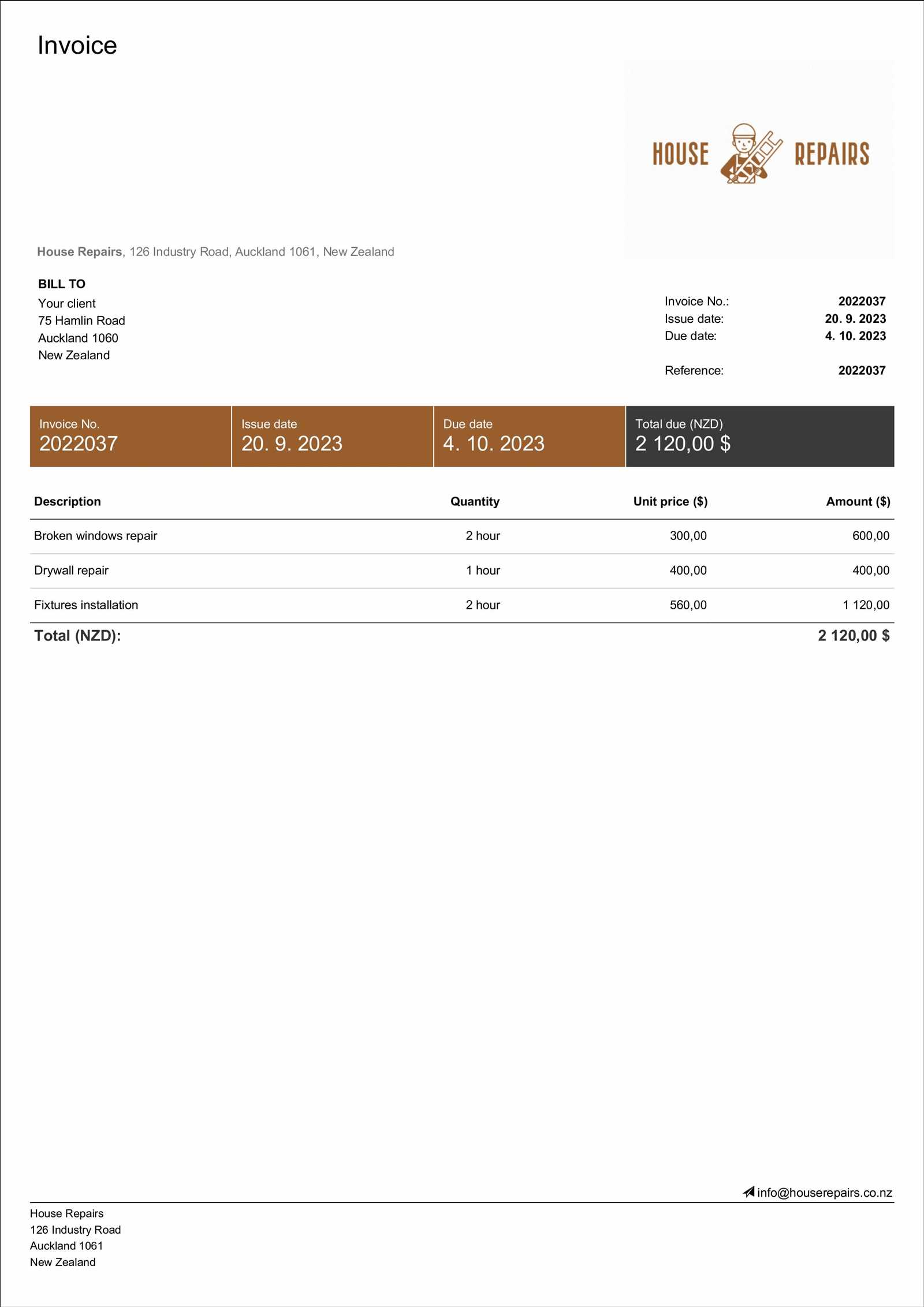

There are various formats and styles to choose from when creating a billing document, each tailored to different business needs and preferences. Selecting the right style ensures that the document is not only functional but also reflects your brand identity and meets legal or industry standards. Whether you’re looking for a simple layout or something more detailed, understanding the different formats can help you make an informed decision.

Popular Billing Formats

- Basic Format: A straightforward layout with essential details such as the business name, client information, services/products, and total amount due. This format is easy to use for small businesses or freelancers.

- Itemized Format: Includes a detailed breakdown of each item or service provided, with quantities, rates, and individual amounts listed separately. Ideal for businesses offering multiple products or services.

- Summary Format: Provides an overall summary of the goods or services delivered, often with subtotals, discounts, taxes, and final totals. This is perfect for clients who prefer a concise yet comprehensive overview.

- Proforma Format: A preliminary bill given before the actual transaction, often used in international trade or for quotation purposes.

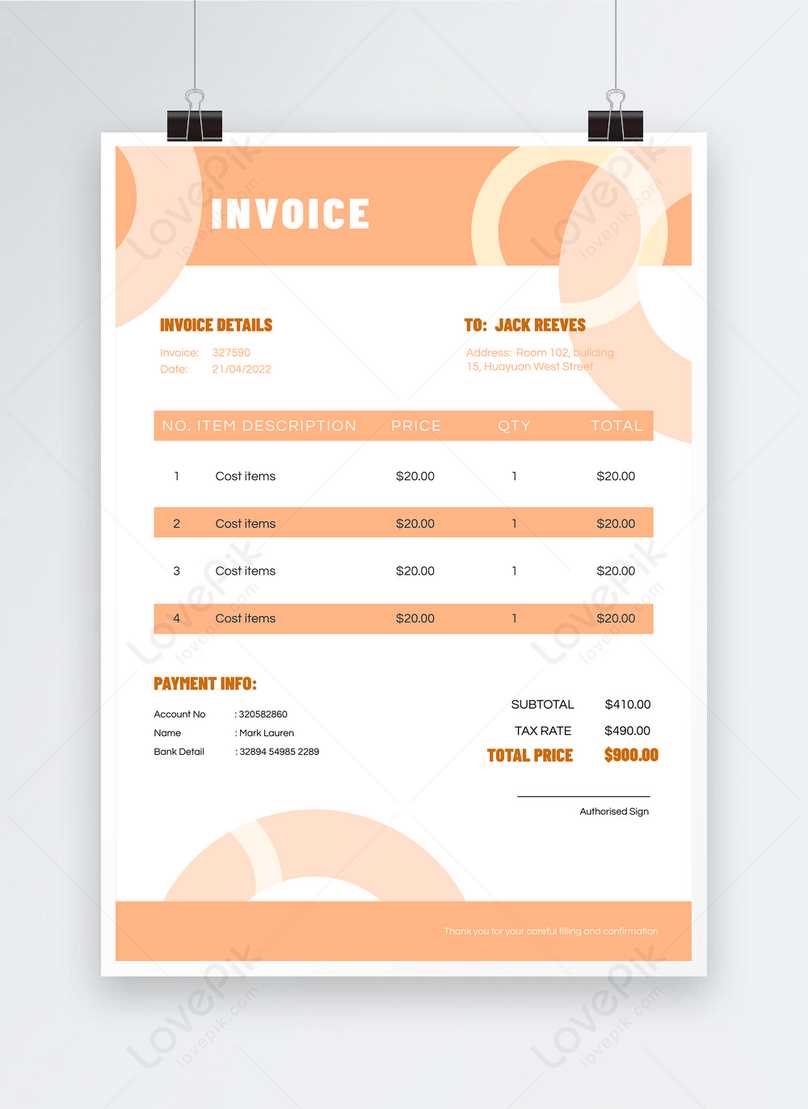

Design Styles to Consider

- Minimalist Style: A clean and simple design with basic text and essential information. This style works well for businesses that want a no-frills, professional look.

- Branded Style: Incorporates your business’s logo, color scheme, and fonts. This style helps reinforce brand identity and adds a polished touch to the document.

- Creative Style: Uses creative elements like unique fonts, icons, or graphics to make the document stand out. This is best suited for businesses in design, fashion, or entertainment industries.

- Formal Style: A traditional, professional design with a focus on clarity and legal compliance. Commonly used in industries like law, consulting, or corporate businesses.

Choosing the right format and style will depend on your business type, client preferences, and the level of detail you want to include. By aligning your billing documents with the right format and aesthetic, you ensure they are both functional and aligned with your brand image.

How to Automate Billing Document Generation

Automating the creation of billing documents can save time, reduce errors, and ensure consistency across all transactions. By implementing automation tools, businesses can streamline the process of generating and sending professional payment requests. This approach not only improves efficiency but also allows for more accurate and timely invoicing, benefiting both the business and the client.

To set up automation for your billing process, follow these steps:

- Choose an Automation Tool: There are numerous software options available for automating billing, including cloud-based platforms and accounting software. Select a tool that integrates seamlessly with your existing systems and offers customization options.

- Set Up Client Information: Ensure that all client details, such as contact information and billing preferences, are entered correctly into the system. This will allow the automation software to generate accurate documents for each client.

- Define Billing Cycles: Set up recurring billing cycles if your services or products are subscription-based. Specify how often the documents should be generated–whether weekly, monthly, or quarterly.

- Include Tax and Payment Terms: Predefine any tax rates and payment terms (such as due dates or late fees) to ensure they are automatically included in each document without having to be entered manually.

- Automate Delivery: Once the document is generated, automate its delivery by setting up email reminders or integrations with your CRM to send the billing documents directly to clients on the specified date.

By automating the process, you not only save time but also reduce human error and create a more professional and reliable billing experience. The ability to generate and send accurate payment requests on time can improve cash flow, enhance client relationships, and free up valuable time for other business tasks.

Benefits of Using Digital Billing Documents

Adopting digital billing documents offers a wide range of advantages for businesses looking to streamline their financial processes. Moving away from paper-based systems not only enhances efficiency but also provides a more professional and eco-friendly approach to managing transactions. The ability to create, store, and send billing documents electronically can save time and resources while also ensuring accuracy.

Some of the key benefits of using digital billing formats include:

- Increased Efficiency: Automating the creation and delivery of digital billing documents speeds up the entire process. There is no need to manually fill out or print each document, reducing administrative time.

- Cost Savings: Digital formats eliminate the need for paper, ink, and postage, helping businesses cut down on operational costs. Additionally, the storage of electronic documents is far more affordable than maintaining physical files.

- Improved Accuracy: Digital tools minimize the chances of human error, ensuring that the details, calculations, and tax information on your documents are correct. Automated systems can also highlight any discrepancies before sending, further enhancing accuracy.

- Faster Payment Processing: By sending billing documents electronically, clients can receive them instantly and make payments faster. Many digital platforms also offer built-in payment options, further speeding up the transaction process.

- Better Organization: Storing digital documents allows for easy access and better organization. Instead of having to search through stacks of paper, you can quickly retrieve previous records, track payments, and maintain a more streamlined filing system.

- Environmental Benefits: By reducing the need for paper, ink, and physical storage, digital formats contribute to a more sustainable business model, helping you reduce your carbon footprint.

Incorporating digital billing documents into your business processes not only makes daily operations more efficient but also offers long-term savings, improved client relationships, and enhanced compliance with modern business practices. The convenience and benefits of going digital are undeniable, making it an essential tool for businesses of all sizes.

Billing Document Software for Small Businesses

For small businesses, managing financial transactions effectively is crucial for maintaining cash flow and ensuring smooth operations. One of the most important tools in this process is using software that automates the creation of professional payment requests. Billing software tailored to small businesses can simplify the entire process, from designing customized documents to tracking payments and generating reports.

These solutions help businesses save time, reduce human error, and enhance the professionalism of their communication with clients. Most software options offer features that allow easy customization, integration with accounting systems, and even recurring billing options, making it a valuable asset for small business owners.

Key Features of Billing Software

When choosing billing document software, there are several essential features that small business owners should look for to ensure they are getting the most out of the tool:

| Feature | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customization Options | Ability to tailor documents with company logos, specific terms, and client information. | ||||||||||||

| Automated Calculations | Automated tax and total calculations to reduce errors and ensure accurate billing. | ||||||||||||

| Recurring Billing | Option to set up subscriptions or regular payments, eliminating the need for manual entry each time. | ||||||||||||

| Payment Integration | Built-in options for clien

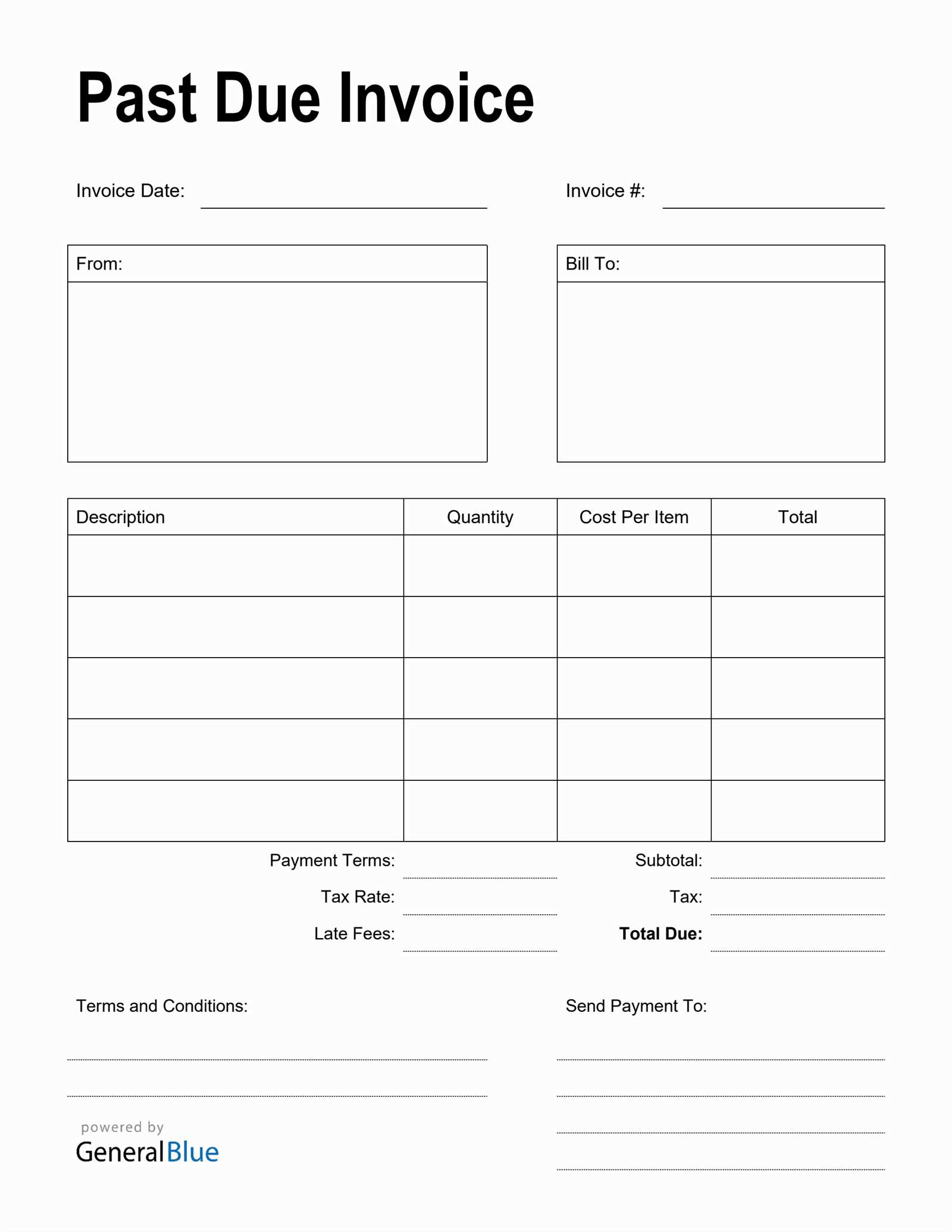

Understanding Payment Terms on Billing DocumentsWhen creating billing documents, it is essential to clearly outline the payment terms to ensure both parties are on the same page regarding when and how the payment is due. Payment terms set expectations and help maintain smooth transactions by defining deadlines, late fees, and accepted payment methods. This transparency is vital for preventing misunderstandings and ensuring timely payments from clients. By specifying the conditions in which payments are expected, you can avoid confusion and help ensure that payments are made on time. Common payment terms include the due date, the time frame for payment, and any discounts or penalties for early or late payments. Common Payment Terms ExplainedThere are various types of payment terms that businesses can use depending on their industry, client relationships, and preferred payment structures. Below are some of the most commonly used payment terms:

Why Payment Terms Are ImportantHaving clear payment terms in place helps businesses manage their cash flow and ensures that payments are received in a timely manner. These terms not only protect the business from late payments but also establish a professional relationship with clients. Clear payment guidelines can also improve customer trust and satisfaction by making the billing process straightforward and predictable. Incorporating payment terms into your billing documents helps avoid disputes and allows both the business and the client to have a clear understanding of expectations. Whether it’s a strict due date, installment plans, or discounts for early payments, the right terms can strengthen financial relationships and support smooth operations. Tracking and Managing Billing PaymentsEfficiently tracking and managing payments is crucial for maintaining financial stability in any business. Without a proper system in place, it can become difficult to monitor outstanding balances, late payments, and discrepancies. A streamlined process ensures that you can quickly identify which clients have paid, which invoices are overdue, and what actions need to be taken to avoid payment delays. By using clear records and automated tools, businesses can simplify their payment management processes, reducing the risk of errors and maintaining consistent cash flow. It is also essential to follow up on overdue payments in a professional manner to maintain healthy relationships with clients while ensuring financial operations run smoothly. Methods for Tracking Payments

There are several methods to effectively track payments, each with its own advantages depending on the size of the business and volume of transactions. Below are some common approaches:

Best Practices for Managing PaymentsTo maintain a smooth and professional payment collection process, businesses should implement the following practices:

By effectively tracking and managing payments, businesses can minimize late fees, prevent cash flow problems, and ensure a seamless financial operation. Consistent monitoring and professional communication can help maintain strong client relationships while ensuring that payments are collected promptly. Common Mistakes to Avoid with Billing StatementsWhen preparing billing documents, even small errors can lead to confusion, delayed payments, and strained business relationships. Ensuring accuracy and clarity in every transaction is essential to maintain trust and avoid misunderstandings. By understanding the common pitfalls and how to prevent them, businesses can streamline their financial processes and ensure smoother transactions with clients. Below are some frequent mistakes that occur in billing and tips on how to avoid them: 1. Missing or Incorrect Contact InformationFailing to include accurate details about your business or your client’s contact information can delay payments or create confusion. Ensure that the correct addresses, phone numbers, and email addresses are listed.

2. Not Including a Clear Due DateOne of the most common mistakes is neglecting to clearly state the payment due date. Without a clear deadline, clients may delay payment or not know when to pay.

3. Using Vague Descriptions for ServicesProviding unclear or overly broad descriptions of the products or services provided can lead to confusion. Clients should be able to easily understand what they are paying for.

4. Not Including Proper Tax InformationOmitting tax information or failing to provide the correct tax rates can lead to issues, especially for businesses that must comply with local tax regulations.

5. Forgetting to Add Payment InstructionsIf clients are unsure how to submit payment, they may delay the process. It’s important to make payment instructions clear and simple.

6. Not Double-Checking for ErrorsEven a small typo or arithmetic mistak How to Send Billing Statements ProfessionallySending billing statements in a professional manner is essential for maintaining strong business relationships and ensuring timely payments. A well-organized, polite, and clear approach can help enhance your credibility and encourage prompt responses from clients. Whether you’re sending physical or digital copies, there are several best practices to follow to ensure a professional experience for your clients. 1. Choose the Right Delivery MethodThe way you send a billing statement can significantly affect its reception. Whether via email or physical mail, it’s important to select a method that aligns with your client’s preferences and business practices.

2. Craft a Clear and Polite Message

When sending the statement, include a concise and polite message that explains the content and any actions required. A friendly yet professional tone is key to ensuring that your communication is well-received.

For example, you could write: Dear [Client’s Name], Please find attached the billing statement for [service/product] provided on [date]. We kindly request payment by [due date]. If you have any questions or need assistance, please don’t hesitate to reach out. Thank you for your business! 3. Attach a Professional DocumentEnsure that the billing document is clearly labeled with the appropriate details and follows a consistent, professional format. Attachments should always be in a non-editable format, such as a PDF, to avoid alterations.

4. Follow Up ProfessionallyIf payment is not received by the due date, send a polite reminder. Following up promptly and courteously ensures that your client knows that payment is expected without coming across as pushy.

|