General Blue Invoice Template for Professional Billing

When it comes to managing finances, having a well-organized billing system is crucial for maintaining a professional image and ensuring timely payments. An effective document layout can streamline the invoicing process, saving you valuable time and reducing errors. With the right design, businesses can create consistent and easily readable records for clients.

Customizable formats allow for greater flexibility, giving users the ability to adjust details according to specific business needs. Whether you’re a freelancer or part of a larger organization, choosing a layout that reflects your brand can enhance the overall client experience. By incorporating key elements such as payment terms, itemized services, and due dates, these documents help ensure clarity and accuracy in every transaction.

In this guide, we’ll explore how to create professional and visually appealing documents that improve both functionality and aesthetics. From simple edits to advanced customizations, you’ll find helpful tips for making your billing process more efficient and client-friendly.

General Blue Invoice Template Overview

In the world of business, the need for clear, professional billing documents is essential. These documents not only serve as a record of services rendered or products delivered but also reflect a company’s level of professionalism. A well-structured design can help businesses communicate more effectively with clients, making it easier for them to understand the payment terms and details. A modern approach to billing includes various customizable options, allowing businesses to align their documents with their branding and specific needs.

Why Choose a Customizable Format?

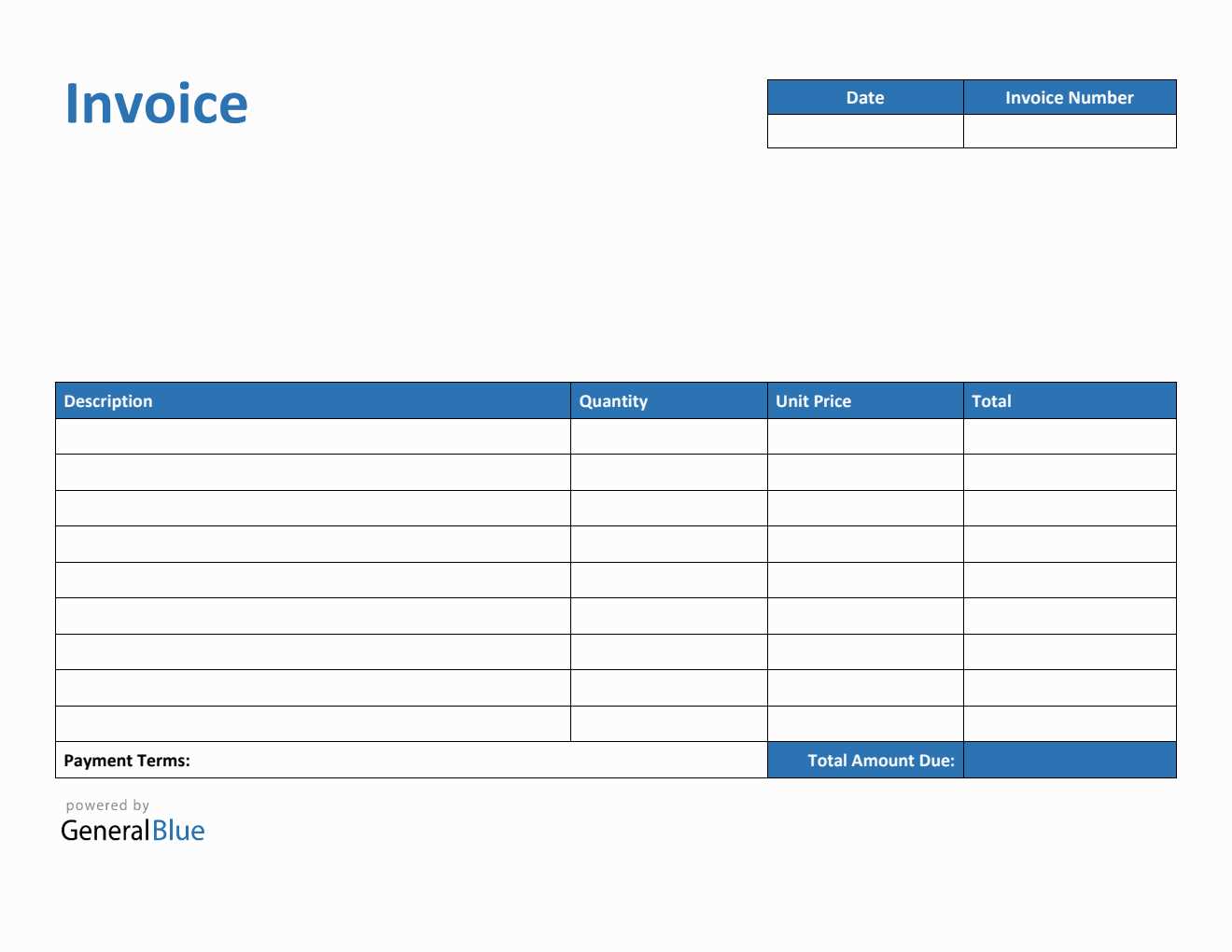

Customizable formats offer flexibility and simplicity, making it easier to adapt the design to different types of transactions. Businesses can modify key fields such as payment terms, item descriptions, and contact information to suit their unique requirements. This not only saves time but also ensures consistency across all issued records. By having a standardized layout, companies can streamline their financial processes, reducing errors and increasing overall efficiency.

Key Features of an Effective Billing Design

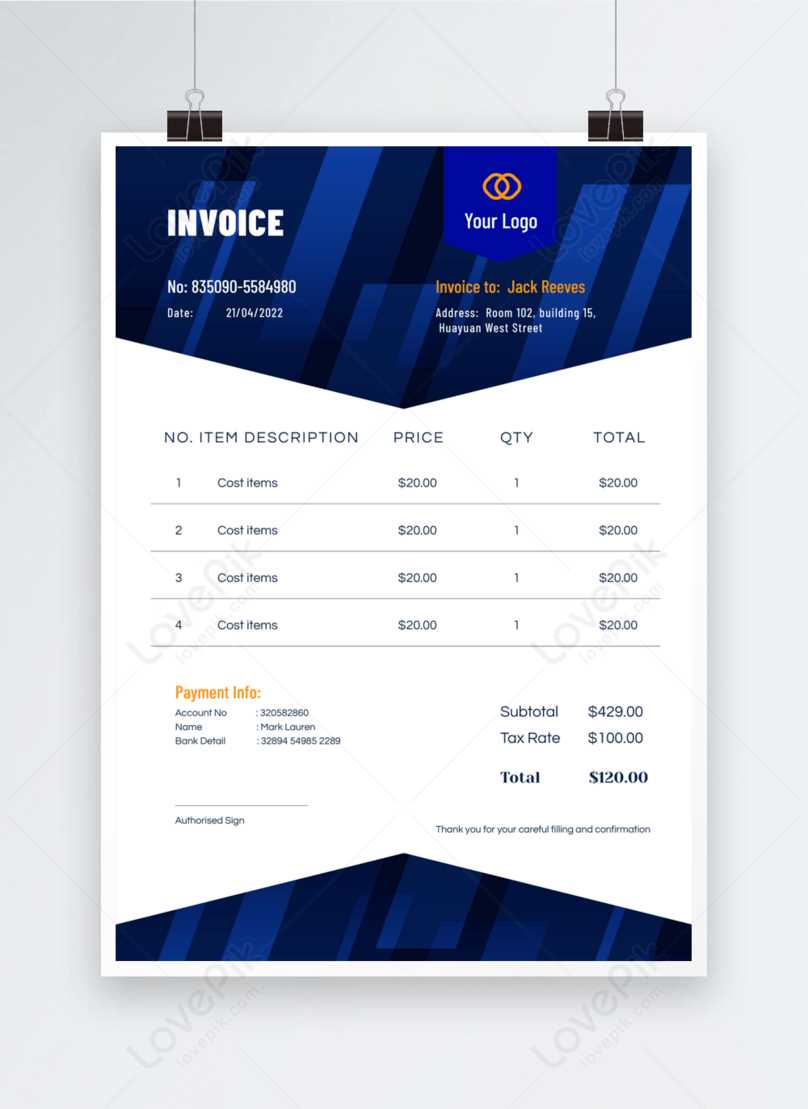

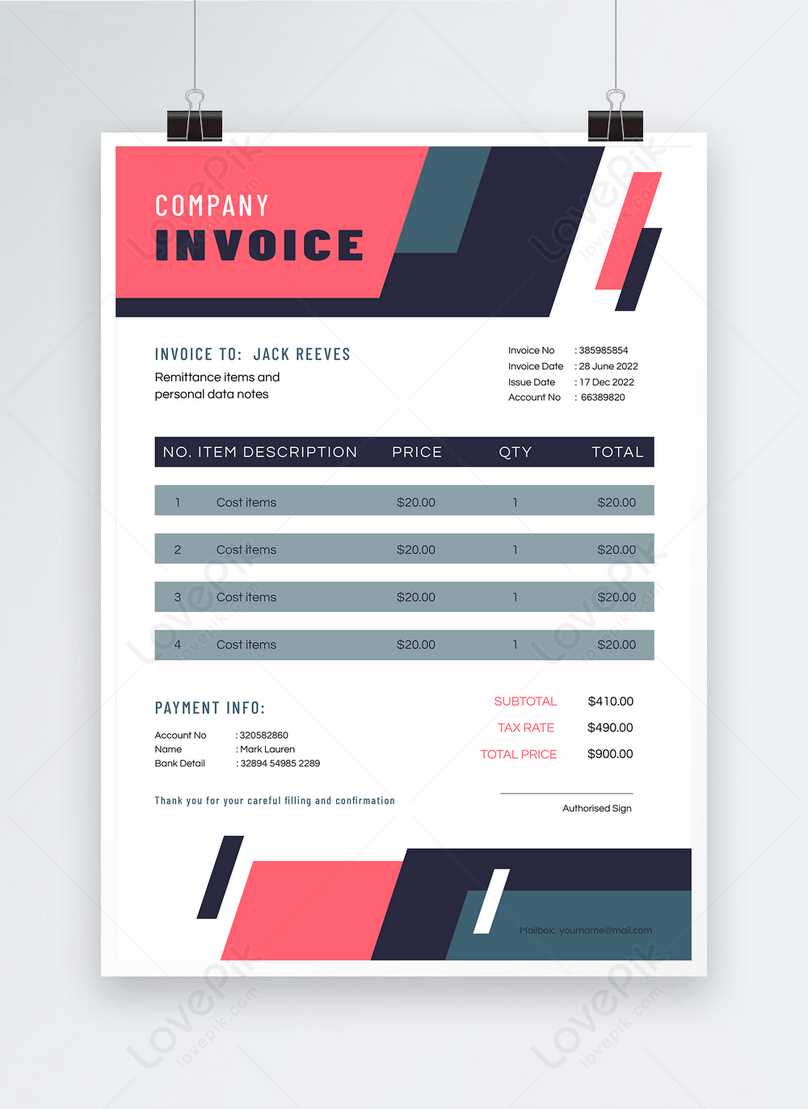

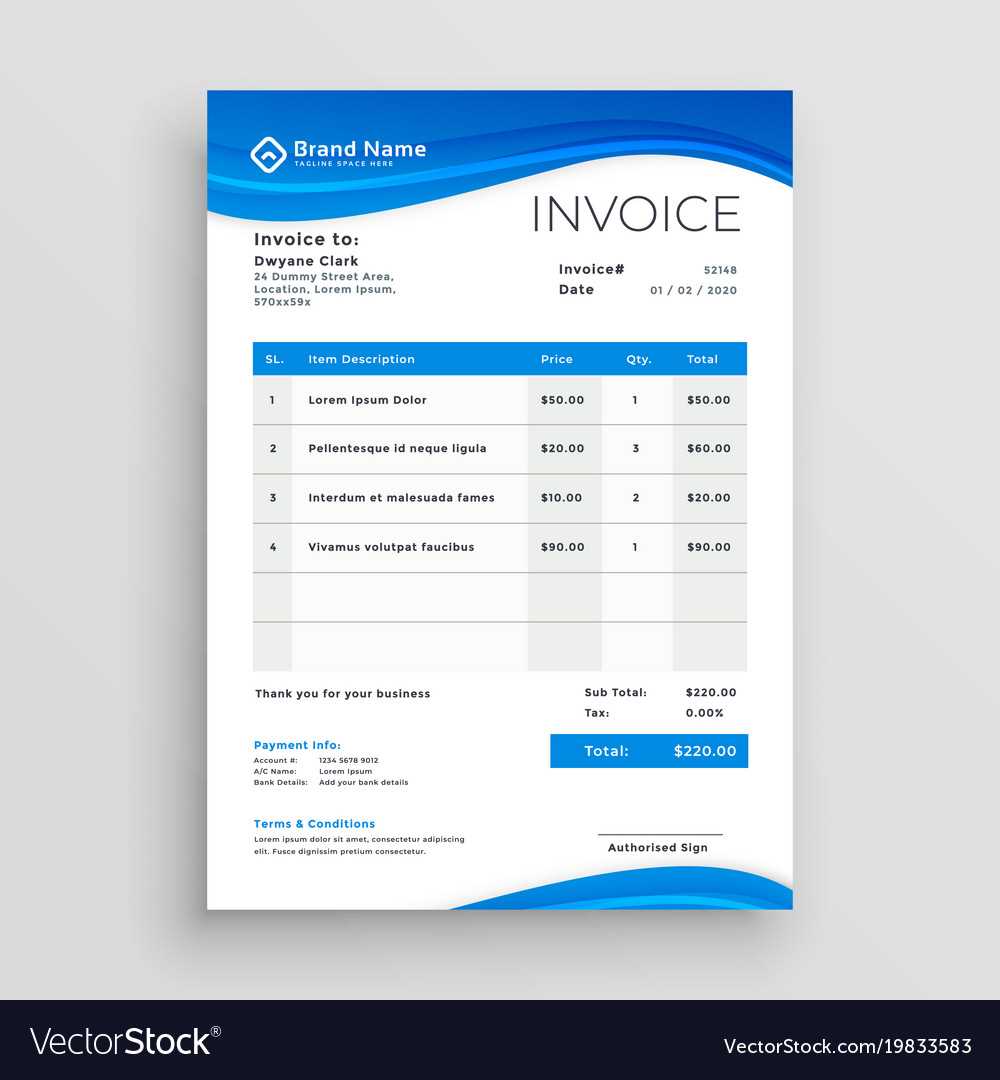

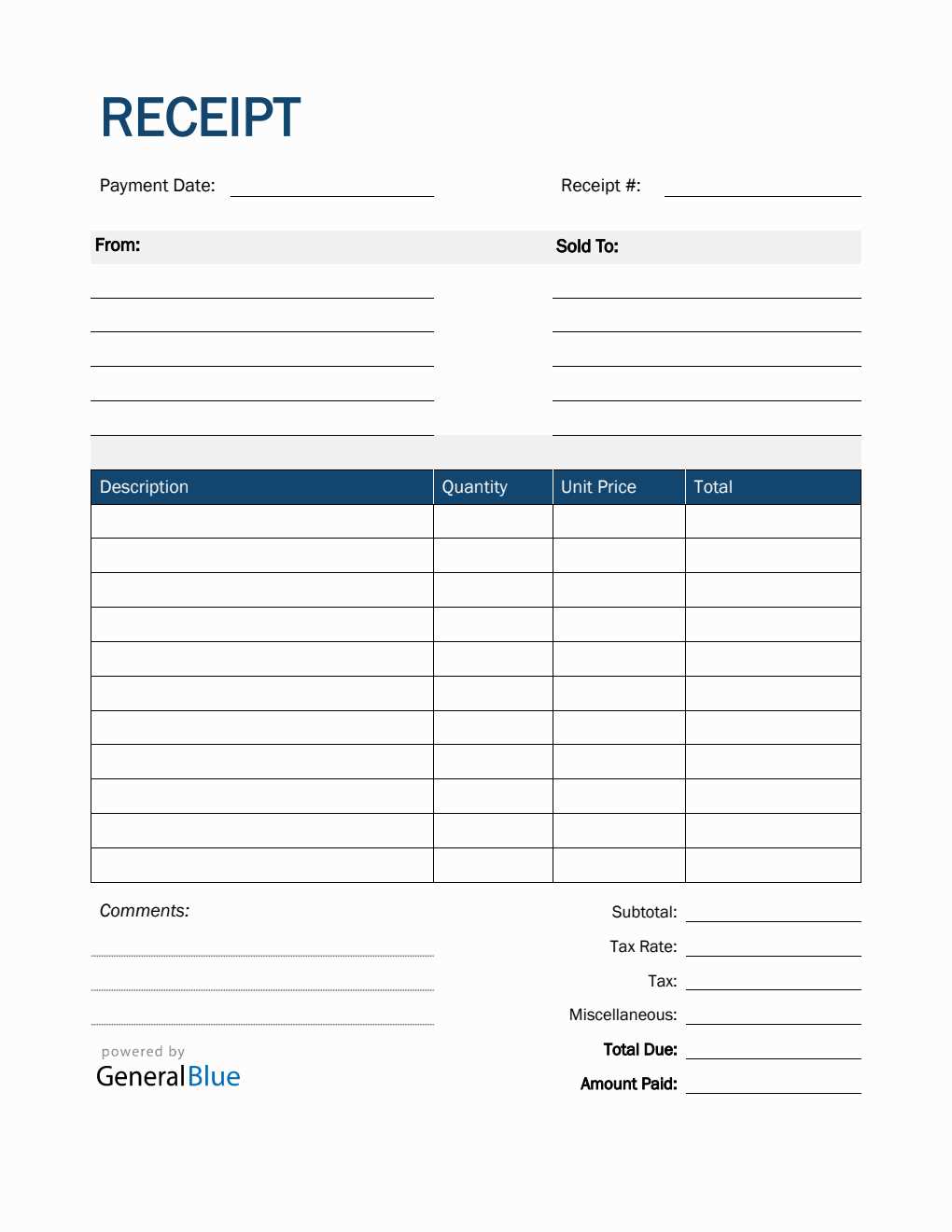

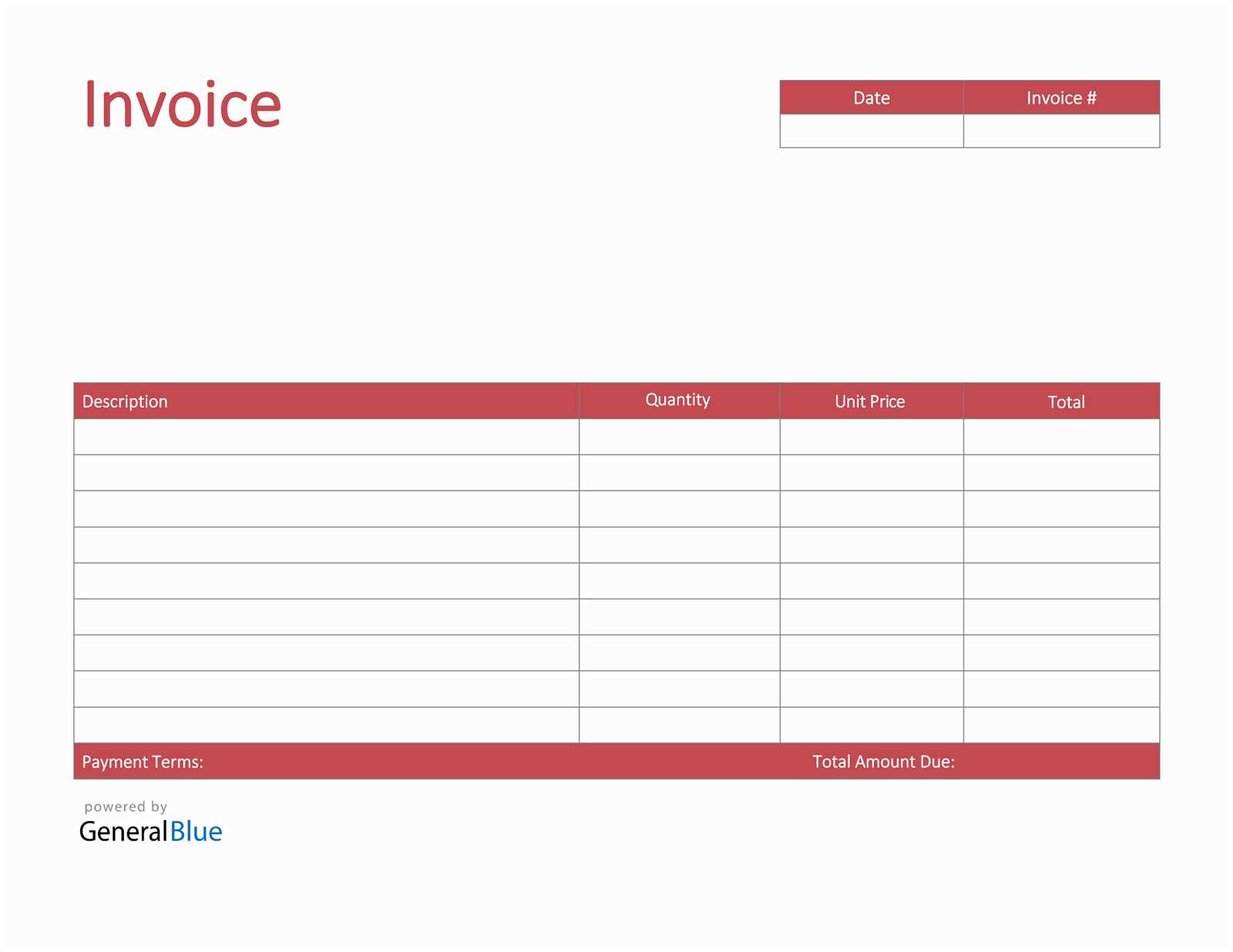

An effective billing document should include clear headings, well-defined sections, and ample space for necessary details. Basic elements typically include the recipient’s contact information, a breakdown of services or products, payment instructions, and due dates. A professional design should ensure that all of these sections are easily identifiable and that the document looks polished. Customizing fonts, colors, and logos also helps reinforce brand identity, adding an extra layer of professionalism to the entire process.

Why Choose a Blue Invoice Template

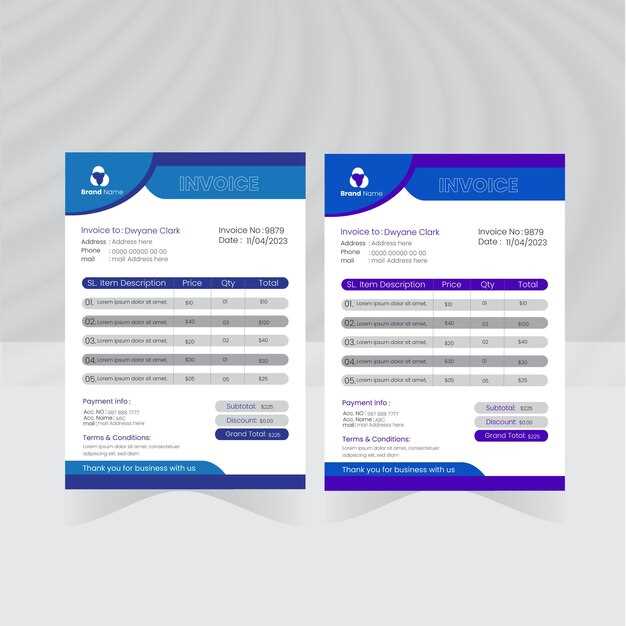

When selecting a design for your billing documents, color and layout play a significant role in how clients perceive your professionalism. The choice of color can evoke different emotions and responses, and the right color palette can help make your documents stand out while still maintaining a polished and professional look. One of the most popular color schemes for these records is a calm, professional hue that balances readability and visual appeal.

A specific color choice, such as a soft shade of blue, has been shown to convey trust, reliability, and stability–qualities that are important when dealing with financial transactions. This particular design offers a perfect combination of aesthetics and functionality, making it a favored option for businesses aiming for a modern yet professional appearance.

Advantages of a Colorful Layout

Adding color to your documents isn’t just about making them look appealing; it can also improve clarity. A thoughtfully chosen color palette can help differentiate between various sections, making it easier for recipients to find the information they need. For instance, using a contrasting shade for headings, payment details, and total amounts can guide the reader’s eye, ensuring they don’t miss any crucial information.

Key Features of Colorful Document Designs

| Feature | Benefit |

|---|---|

| Enhanced Readability | Clear distinction between sections improves information flow |

| Professional Appearance | Subtle use of color reinforces your brand’s image |

| Improved Client Trust | Colors like blue evoke feelings of security and dependability |

| Brand Consistency | Customizable design ensures your documents align with company identity |

Benefits of Using a Customizable Template

Having the flexibility to modify your billing documents according to your specific needs brings numerous advantages. Customizable formats provide businesses with the ability to adjust layouts, fields, and designs, making it easy to tailor documents for various clients or industries. This level of adaptability not only saves time but also enhances the overall client experience by offering a more personalized approach to billing.

One of the key benefits of using a flexible design is the ability to incorporate your company’s branding. You can easily add logos, choose fonts, and select colors that align with your corporate identity, ensuring a consistent and professional appearance across all communications. A personalized touch on your records can help reinforce your brand and create a lasting impression.

Customization also makes it easier to streamline your accounting process. You can set up specific fields for services, products, taxes, discounts, and payment terms, minimizing errors and ensuring accuracy in every transaction. Additionally, by adapting the document to fit your business’s unique requirements, you can reduce the need for manual changes or corrections, leading to more efficient operations.

Another benefit is that these adaptable documents allow for better organization. For example, fields can be arranged in a way that makes sense for your workflow, making it simpler for both you and your clients to follow the structure of the document. This is particularly helpful for businesses dealing with complex services or multiple product categories.

How to Edit a General Blue Invoice

Editing your billing document allows you to personalize it to match the specifics of each transaction or client. Whether you’re updating payment terms, changing item descriptions, or modifying the layout, the process should be simple and efficient. With the right software or tool, you can easily make adjustments to create a customized and professional document every time.

Step-by-Step Guide to Editing

The process typically involves several key steps, starting with opening the document in your preferred editor. From there, you can make changes to any section, including the header, footer, and line items. Here’s a basic overview of what to do:

| Step | Action | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Open the document in your editing software (e.g., Word, Excel, or PDF editor). | ||||||||||||||||||||||||||||||

| 2 | Update company and client information (name, address, contact details). | ||||||||||||||||||||||||||||||

| 3 | Modify item descriptions, quantities, prices, and taxes if needed. | ||||||||||||||||||||||||||||||

| 4 | Adjust payment terms and due dates based on the agreement with the client. | ||||||||||||||||||||||||||||||

| 5 | Review the layout and make sure all information is clearly presented and accurate. | ||||||||||||||||||||||||||||||

| Element | Best Practice |

|---|---|

| Header | Include the company logo and contact details at the top for easy recognition and communication. |

| Details Section | Ensure a clear breakdown of services or products, with itemized lists, quantities, and prices. Use rows and columns for neatness. |

| Legal Terms | Clearly display payment terms, due dates, and any applicable taxes. Use bold or italic fonts to highlight important dates and values. |

| Footer | Provide space for additional contact information, terms and conditions, or thank you notes in the footer. Keep it concise. |

Incorporating these practices ensures that the document is not only functional but also reflects professionalism and attention to detail, fostering positive client relationships and smoother financial processes.

How to Add Your Company Logo

Incorporating your company logo into any formal document not only strengthens brand identity but also adds a professional touch. A logo serves as a visual representation of your business, helping clients easily recognize your company and creating a lasting impression. Below are some practical steps to effectively include your business logo in any billing document.

Step-by-Step Process

To properly add your logo, it’s essential to choose the right placement and size. Most commonly, logos are positioned in the top-left or top-center of the page, where they are immediately visible. The size should be large enough to be recognizable but not overpowering, ensuring the document remains clear and easy to read. Here are the key considerations:

| Step | Description |

|---|---|

| 1. Prepare the Logo File | Ensure the logo is in a high-quality format (such as PNG or SVG) to maintain clarity when resized. It should have a transparent background for easy integration. |

| 2. Choose the Placement | Decide on a location that makes sense for your layout, typically in the header section for maximum visibility. |

| 3. Insert the Logo | Upload the image file to your document editor. Resize it proportionally to maintain the aspect ratio, and place it within the chosen location. |

| 4. Test for Visibility | Ensure the logo contrasts well with the background and doesn’t interfere with other important text or details on the document. |

Best Practices

While adding a logo is important, it’s equally essential to ensure it enhances the document’s overall readability. Avoid using overly large logos or intricate designs that could distract from the essential information. Always check that the logo’s colors and design align with your brand’s overall aesthetic and the document’s tone.

Understanding Invoice Numbering System

A clear and consistent numbering system is essential for any business that issues formal billing documents. A well-structured numbering system not only helps with organization but also aids in tracking payments and ensuring accurate record-keeping. By assigning unique identifiers to each document, you can easily reference past transactions, avoid duplication, and maintain order within your financial records.

When creating a numbering scheme, consider the following factors:

- Uniqueness: Every document should have a distinct number to prevent confusion. Sequential numbering is the most common approach, where each new bill gets a number that follows the last issued.

- Format: The format of the numbering system can vary, but it should be consistent. Common formats include numbers alone (e.g., 001, 002) or a combination of numbers and letters (e.g., INV001, INV002), sometimes with dates (e.g., 2024-001).

- Progression: The numbers should follow a clear progression to indicate the order in which documents were issued. This makes it easier to track pending payments and prevent overlaps.

Here are some common ways to structure your numbering system:

- Simple Sequential Numbering: Start with 001 and continue increasing by one for each new document. This method is straightforward and effective for small businesses.

- Date-Based Numbering: Incorporate the year or month into the number (e.g., 2024-001 for the first document issued in 2024). This is useful for keeping track of documents by time period.

Including Payment Terms on Invoices

Clear communication regarding payment expectations is essential in any business transaction. By specifying the terms of payment, you set the foundation for a smooth financial exchange and reduce misunderstandings. These terms not only inform the client about the due date but also outline any penalties, discounts, or specific payment methods, ensuring both parties are aligned on expectations.

When adding payment terms to your documents, consider including the following details:

- Due Date: Clearly specify when the payment is expected. A typical format is “Due within 30 days” or “Payment due by [date].” This helps avoid confusion and establishes a firm deadline.

- Late Fees: Outline any penalties for late payments. For example, “A late fee of 2% will be applied after [date].” This encourages timely payments and protects your cash flow.

- Early Payment Discounts: If you offer a discount for early payments, make sure to include this incentive. For instance, “A 5% discount applies if paid within 10 days.”

- Accepted Payment Methods: Specify the ways in which the payment can be made (e.g., bank transfer, credit card, online payment). This ensures the client knows their options and helps avoid any delays due to payment method confusion.

Including these essential details ensures transparency and reduces the likelihood of delayed or missed payments. By being clear about your expectations, you encourage professionalism and maintain healthy business relationships.

Customizing Invoice Layout for Your Needs

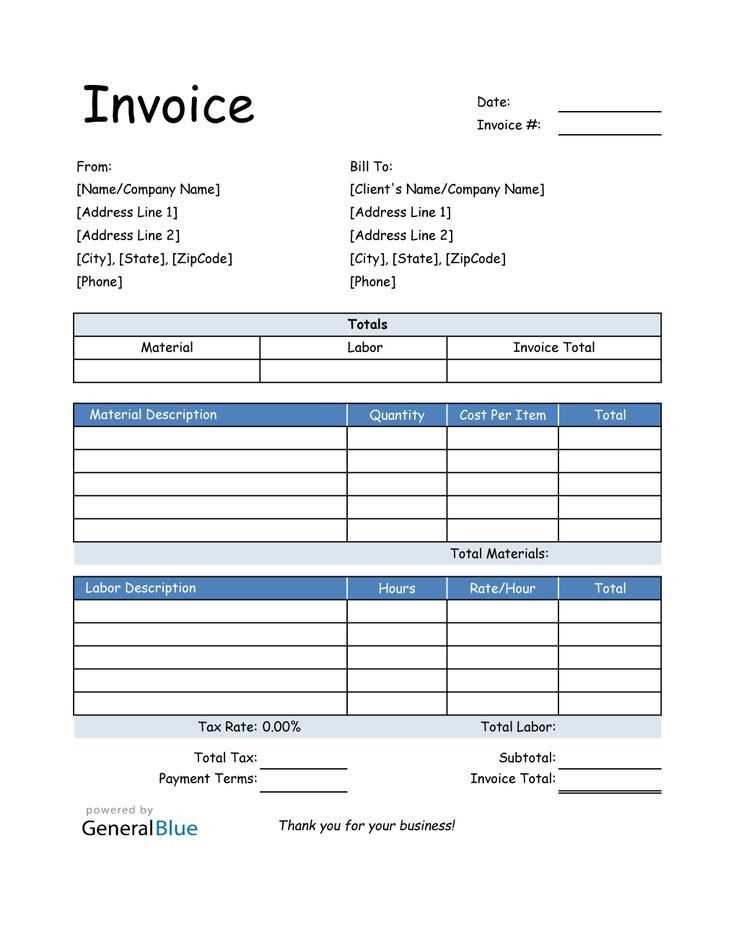

The design and structure of a billing document play a significant role in how your business is perceived by clients. Tailoring the layout to reflect your brand, highlight key details, and improve readability can make a substantial difference. Customizing the arrangement of information allows you to create a document that not only meets your functional requirements but also aligns with your business style and client expectations.

When adjusting the layout for your specific needs, consider the following aspects:

- Header Section: Place essential information, such as your company logo, name, address, and contact details, in the header. This ensures your business is immediately identifiable and provides clients with the means to reach you easily.

- Client Information: Position the client’s details clearly, typically on the left-hand side, so that it is easy to locate. Include the client’s name, address, contact information, and any relevant reference numbers.

- Itemized Breakdown: Ensure the items or services being billed are clearly listed. Use rows and columns to organize the description, quantity, rate, and total for each product or service. This enhances clarity and allows clients to review charges easily.

- Payment Instructions: Provide detailed instructions for making the payment, including due dates, accepted methods, and any additional terms. Make sure these are prominent, possibly in a separate section or a footer, so clients can easily reference them.

- Branding: Integrate colors, fonts, and styles that align with your business identity. A customized design that reflects your branding can reinforce your company’s professionalism and make the document more memorable.

By adjusting these elements, you can ensure that your billing document is not only functional but also visually appealing and aligned with your business goals. Customizing the layout improves the client experience and ensures all necessary information is clear and easy to follow.

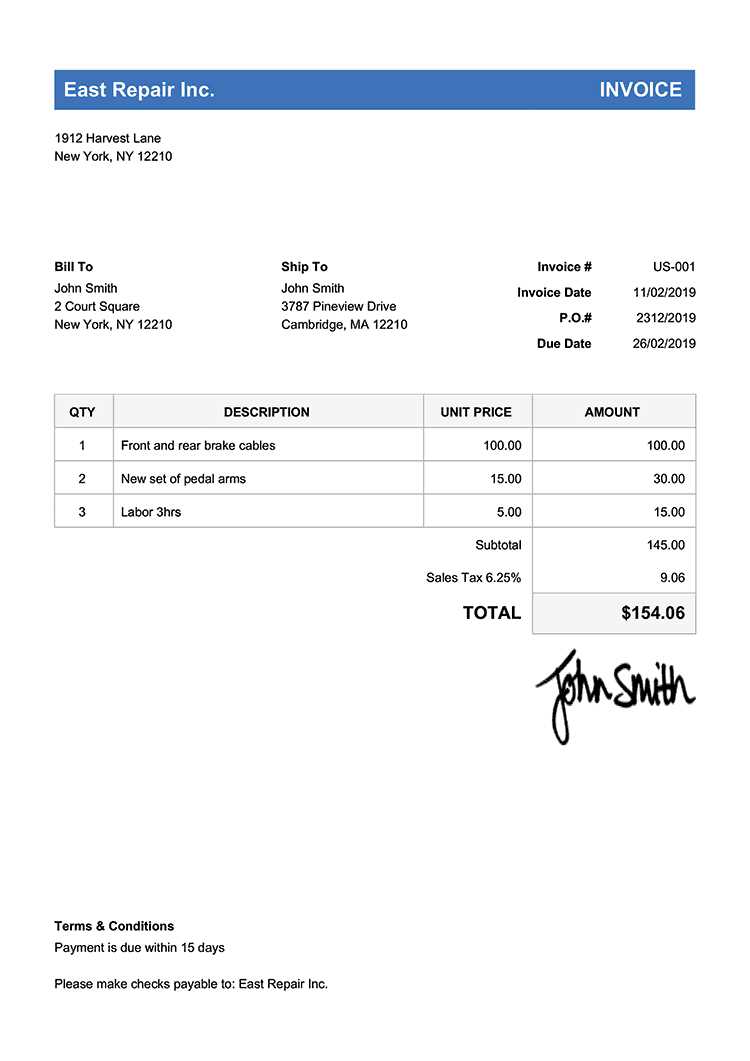

Essential Information to Include in Invoices

For any formal billing document, it is important to include all the necessary details that ensure clarity and accuracy. The right set of information not only helps in maintaining transparency between businesses and clients but also ensures timely payments and reduces the likelihood of misunderstandings. A well-organized record of the transaction makes the entire process smooth for both parties involved.

Key Details to Include

The following pieces of information are essential to ensure a professional and comprehensive document:

- Document Title: Make it clear that the document is a bill or statement. This is typically indicated by the word “Invoice” at the top of the page.

- Unique Identifier: Assign a unique reference number to each billing document to help track payments and avoid confusion.

- Issue Date: Clearly state the date the document is issued to establish when the transaction occurred.

- Due Date: Include a specific due date to avoid any ambiguity regarding when payment is expected.

- Seller’s Information: List your business’s name, address, phone number, and email, ensuring that clients can contact you if necessary.

- Buyer’s Information: Include the client’s name, address, and any relevant reference numbers or account details to ensure the payment can be properly attributed.

Financial Breakdown

Providing a clear breakdown of the charges is crucial for transparency:

- Description of Goods or Services: List the items or serv

How to Ensure Invoice Accuracy

Accuracy is key when creating any formal billing document, as even small mistakes can lead to confusion, delayed payments, or strained business relationships. Ensuring that all the information is correct helps to maintain professionalism and ensures a smooth transaction process. To avoid errors and discrepancies, it’s important to follow a few essential steps during the creation and review process.

Here are some best practices to help ensure your billing documents are accurate:

- Double-Check Client Information: Ensure that the client’s name, address, and contact details are correct. Mistakes in this section can cause confusion and delays in payment.

- Verify Item Descriptions and Pricing: Carefully review the list of goods or services provided, along with their corresponding prices. Confirm that quantities, rates, and any discounts are correctly applied before finalizing the document.

- Confirm Payment Terms: Review the payment due date and any additional terms or conditions to ensure they are accurate. This includes verifying any agreed-upon discounts or late fees.

- Cross-Check Calculations: Double-check all math, including item totals, taxes, and overall amounts due. Small errors in calculations can lead to larger issues down the line.

- Ensure Consistency with Previous Records: Compare the current document with previous ones to make sure the numbering system and formats are consistent. This avoids confusion when referencing past transactions.

Implementing a thorough review process is critical for minimizing errors. Many businesses also use software or digital tools that can automatically calculate totals and ensure consistency, reducing the chances of human error. Taking these steps will help maintain accuracy, improve client trust, and ensure timely payments.

Setting Up Discount and Tax Fields

Including clear and accurate discount and tax fields in your billing document is crucial for transparency and maintaining accurate financial records. These fields help break down the final amount due by showing how any applicable discounts or taxes are applied to the original price. Properly setting up these sections ensures that both your business and the client are on the same page when it comes to payment expectations.

To ensure that discounts and taxes are properly accounted for, consider the following steps:

Step Action 1. Identify Applicable Discounts Determine whether any discounts apply to the transaction, such as early payment discounts or volume-based price reductions. Clearly specify the percentage or flat amount discount and its application method. 2. Calculate Tax Amounts Determine the appropriate tax rate based on your location or industry regulations. Apply the correct rate to the subtotal and display the tax amount separately for clarity. 3. Add Discount and Tax Fields Ensure that you have distinct fields for both discounts and taxes in your layout. Clearly label these sections to avoid any confusion. 4. Show Subtotal After applying any discounts, show the subtotal before taxes are added. This provides a clear breakdown of the pricing structure. 5. Display Total Amount After taxes and discounts have been accounted for, calculate and display the total amount due. This should be clearly highlighted for easy reference. By sett

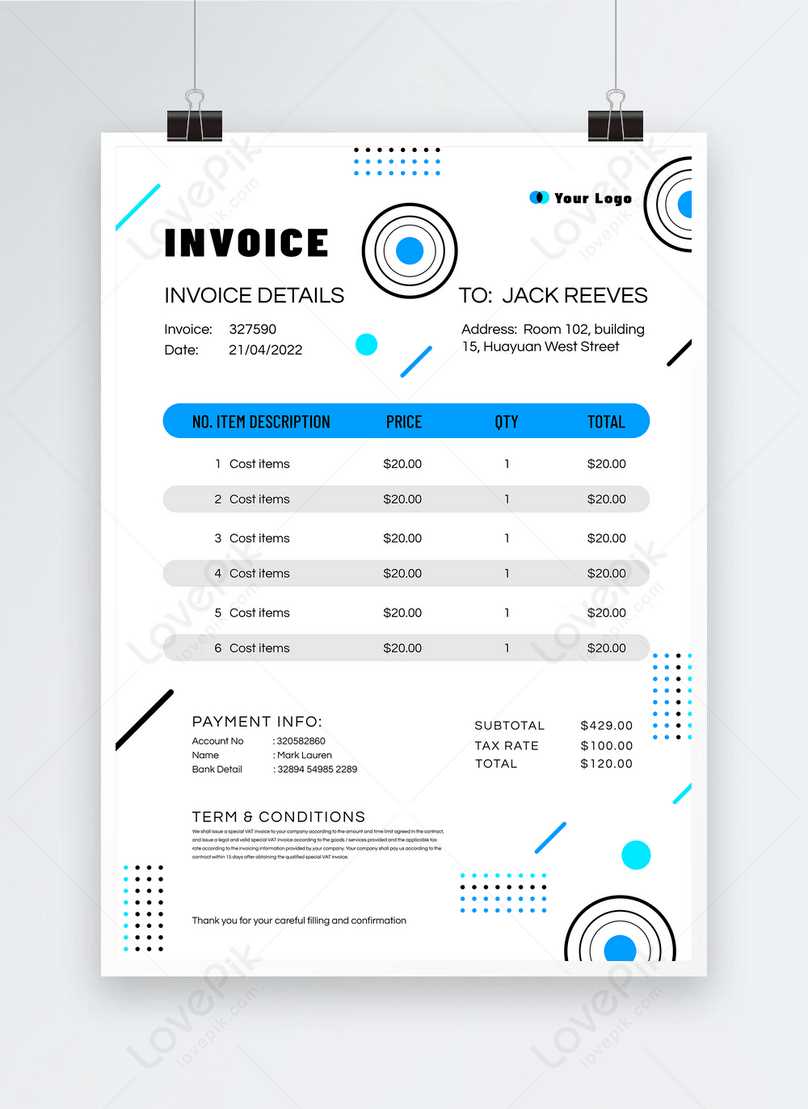

Using Blue Invoices for Branding

A well-designed billing document can serve as a powerful marketing tool by reinforcing your company’s identity. The use of colors, fonts, and layout styles all contribute to a cohesive brand image. Specifically, incorporating a consistent color scheme can help strengthen brand recognition and create a lasting impression. Using a calming or professional tone, such as incorporating shades of blue, can subtly communicate trustworthiness and stability to your clients.

Here are some ways to leverage the use of color in your billing documents to enhance branding:

- Color Psychology: Blue is often associated with trust, professionalism, and reliability. By incorporating this color into your documents, you subtly communicate these qualities to your clients.

- Consistent Brand Identity: Use the same shades of blue (or any color from your brand palette) across all your official documents, from billing to marketing materials, to create a unified and recognizable brand presence.

- Design Elements: Integrate your brand’s logo, fonts, and other graphical elements in a way that complements the color scheme. This creates a visually appealing and consistent design that reflects your company’s identity.

To ensure your branding remains strong and professional, it’s important to strike the right balance between design and functionality. A clean layout with strategically placed colors will help clients focus on the critical information without overwhelming them. Here are some tips:

- Maintain Simplicity: Keep the color usage subtle. Too many contrasting colors can create visual clutter. Use blue sparingly for emphasis on key details like totals, headers, or borders.

- Readable Text: Make sure that the text remains easily legible against the background color. If using a darker shade of blue, opt for white or light-colored text for clarity.

- Use of Borders or Highlights: Highligh

How to Save and Share Your Invoice

Once you’ve created a billing document, the next step is to ensure it is saved in a way that preserves its details and is easy to distribute. Proper storage and sharing methods allow you to maintain professionalism and prevent potential issues when dealing with payments. This section will guide you through how to keep your file safe and how to send it to clients or colleagues efficiently.

Saving Your Document Securely

First, choose a file format that is widely accepted and ensures the integrity of your information. PDF is often the preferred choice, as it maintains the layout and prevents unauthorized editing. Save the file in a designated folder on your computer or cloud storage service for easy access. Consider naming the file with a clear, recognizable format that includes relevant details, such as the client’s name and the date.

Sharing Your Document with Clients

When it comes to sharing, email is the most common method. Attach your saved file and provide a brief, polite message explaining the contents. If you prefer more secure methods, you may use a file-sharing service that requires a password for access. Always ensure that the recipient has received the document and can open it without issues, confirming any potential questions about payment or details promptly.

Integrating Templates with Accounting Software

Integrating billing documents with accounting software streamlines your financial workflow, automating many of the tedious tasks involved in tracking payments and generating reports. By linking your prepared files with a digital platform, you can ensure accuracy and efficiency while saving time. This integration eliminates the need for manual entry, reduces errors, and provides a centralized system for managing finances.

Benefits of Integration

- Automated Data Entry: Automatically import details from the document into your accounting system, saving time and preventing human error.

- Real-Time Tracking: Monitor payments and outstanding amounts instantly, ensuring that your records are always up-to-date.

- Enhanced Reporting: Generate financial reports directly from the software, offering clear insights into income, expenses, and cash flow.

- Improved Accuracy: Reduce the risk of discrepancies between your records and the actual amounts received or owed.

Steps to Integrate

- Choose the Right Software: Select an accounting platform that supports integration with the types of documents you’re using. Popular options include QuickBooks, Xero, and FreshBooks.

- Set Up Integration: Follow the software’s instructions to link it to your billing tools. This might involve uploading files directly or using an API for automatic syncing.

- Customize Fields: Ensure that the relevant fields from your document (e.g., client name, amount due, date) match with the accounting software’s format.

- Test the Integration: Before using it for regular transactions, test the system to confirm that the data transfers correctly and seamlessly.

- Start Using the System: Once everything is set up, begin importing your billing details into the software for tracking and analysis.

Common Mistakes to Avoid in Invoicing

When preparing billing documents, small errors can lead to confusion, delayed payments, and strained client relationships. Ensuring accuracy and clarity is crucial for maintaining professionalism and promoting timely transactions. This section will highlight the most common mistakes that can occur during the billing process and how to avoid them.

Incorrect or Missing Details

One of the most frequent mistakes is failing to include important information. Omitting essential details such as the client’s name, description of services, or the payment due date can lead to misunderstandings. Double-check that all fields are correctly filled out before sending any document. Common oversights include:

- Missing client contact details

- Incorrect or unclear descriptions of the products or services provided

- Failure to include payment terms or deadlines

Inconsistent Payment Terms

Establishing clear and consistent payment terms is essential. Confusion over when payment is due, what methods are accepted, or what late fees apply can cause delays. Always ensure that payment terms are the same across all documents and are communicated clearly to the client. Some common pitfalls include:

- Not specifying if the payment is due immediately or within a set number of days

- Failure to clarify late fees or interest charges for overdue payments

- Offering multiple payment methods without indicating preferences or instructions

How Blue Invoices Improve Professionalism

Using well-designed billing documents can significantly enhance the professional image of your business. When clients receive clear, organized, and visually appealing records, it demonstrates attention to detail and a commitment to quality. A thoughtfully crafted layout not only reflects your business standards but also establishes trust and credibility with customers.

Incorporating visually distinct elements, such as a cohesive color scheme or elegant design, can make the document stand out, while also maintaining readability. This professionalism helps ensure that your clients feel confident in the accuracy and integrity of the charges. Furthermore, a polished format encourages timely payments and strengthens your business reputation in competitive industries.

Where to Find Free Blue Invoice Templates

If you’re looking to create professional billing documents without spending money on software or design services, there are several resources available online that offer free templates. These can be downloaded, customized to fit your business needs, and used for sending payments or tracking expenses. Whether you need a simple or more intricate design, the right platform can provide exactly what you need.

Popular Websites Offering Free Templates

- Canva: Offers a wide variety of customizable billing document designs, including those with color themes that give a clean and polished look.

- Microsoft Office: Provides free downloadable files through Word and Excel, which include multiple options for crafting professional documents.

- Google Docs: Has free templates available through Google Drive, which you can edit online and share with clients instantly.

- Template.net: Offers a range of free designs suitable for businesses of all sizes, which can be tailored and downloaded in various formats.

Benefits of Using Free Resources

- Cost-Effective: Free templates eliminate the need for additional software purchases or professional design fees.

- Time-Saving: Ready-to-use designs allow you to quickly create and send billing documents without starting from scratch.

- Customization: Many free resources offer customization options, allowing you to adjust colors, fonts, and fields to match your branding.