Gardening Services Invoice Template for Quick and Professional Billing

Running a business requires efficient systems to manage tasks, and invoicing is one of the most crucial aspects of maintaining a smooth operation. Whether you’re a freelancer or part of a larger team, having a structured and professional approach to billing ensures clarity and builds trust with your clients.

Using a well-designed billing document allows you to quickly and accurately detail the work completed, the costs involved, and the payment terms. With the right tools, this task becomes faster, more consistent, and error-free. The ability to create clear, understandable records not only improves your financial organization but also enhances your business’s professionalism.

In this article, we’ll explore how to effectively manage your billing process with simple, customizable forms that suit your business needs. You’ll discover practical advice for creating documents that reflect the quality of your work while ensuring clients are informed and payments are processed promptly.

Gardening Services Invoice Template Overview

Effective billing is a cornerstone of any successful business, ensuring that clients understand the costs of completed tasks and helping professionals stay organized. A structured billing document can simplify the process, reduce errors, and make communication between parties more efficient. It also provides a record of transactions that can be useful for both financial tracking and legal purposes.

For businesses involved in outdoor work, having a customizable document to outline completed tasks, charges, and payment details is essential. It can help clarify expectations, prevent misunderstandings, and ensure timely payments. A well-designed form captures the necessary information in a straightforward manner while presenting a professional image to clients.

Key Elements to Include

When creating a billing document, it’s crucial to include all relevant information. This typically includes contact details, a clear breakdown of work performed, costs, taxes, and payment terms. Ensuring that the document is easy to read and professional in appearance can positively impact client relationships.

Benefits of Using a Structured Document

Using a structured billing form brings many advantages. It saves time by streamlining the creation process, reduces the likelihood of errors, and allows for easy updates if necessary. Additionally, it helps businesses maintain consistency and track income over time, ensuring smooth operations.

Why Use an Invoice Template

Having a predefined structure for documenting completed work and payment details offers significant advantages for any business. It allows for quick and efficient creation of documents without starting from scratch each time. This approach minimizes the risk of overlooking important information, ensuring that all relevant details are included consistently across each transaction.

Utilizing a ready-made form also streamlines the billing process, saving valuable time and reducing the potential for errors. By using a standardized format, professionals can focus on providing quality work instead of worrying about how to organize payment requests. It also helps maintain a professional image, as clients receive clear and organized documents that reflect attention to detail.

Key Features of Gardening Invoices

A well-structured document for billing purposes should include essential details that clearly communicate the nature of the work, the costs, and payment terms. These features not only help clients understand their obligations but also ensure that businesses maintain organized records of completed tasks and payments. Having these key components in place minimizes confusion and enhances the professionalism of your transactions.

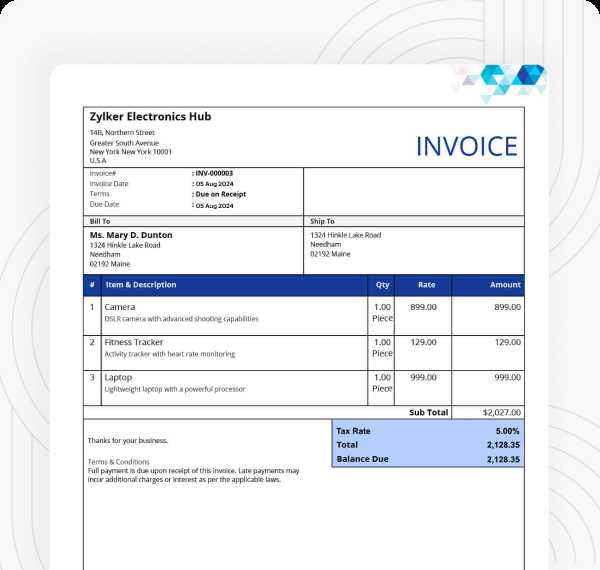

Clear Breakdown of Charges

One of the most important aspects of any billing document is a transparent breakdown of all charges. This includes a detailed description of the tasks performed, time spent, and materials used, as well as any applicable taxes or fees. Clients appreciate knowing exactly what they are paying for, which reduces the likelihood of disputes and promotes trust.

Payment Terms and Due Dates

Including clear payment terms and due dates is crucial for ensuring timely payments. This section should outline when the payment is expected, any late fees that may apply, and the preferred payment methods. Clear terms help set expectations and provide both parties with a reference point in case of any payment-related issues.

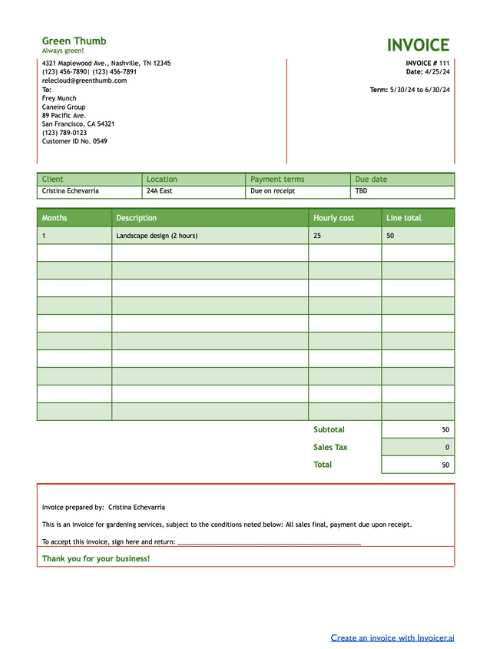

How to Customize Your Invoice

Tailoring a billing document to fit your specific needs allows you to create a professional and clear record that aligns with your business’s branding and requirements. Customization is important to ensure that all relevant information is included, and that the format matches the way you prefer to present your work. Adjusting certain elements of the document can also make the billing process more efficient and organized.

Steps to Personalize Your Billing Document

Follow these steps to make your document work for you:

- Include Your Business Information: Start by adding your company name, logo, contact details, and any other branding elements that represent your business.

- Adjust the Layout: Choose a clean and easy-to-read format. You can arrange the fields and sections according to your preferences, ensuring that important information is highlighted.

- Customize the Descriptions: Tailor the task descriptions to be specific and clear, so your client knows exactly what they are being billed for.

- Set Payment Terms: Specify the payment methods you accept, as well as the deadlines and any penalties for late payments.

Additional Customization Tips

- Branding: Include your logo or colors to give the document a professional, branded look.

- Payment Reminders: Add a friendly note or reminder about payment deadlines to encourage timely settlement.

- Optional Notes: If necessary, include a section for additional comments or special instructions for the client.

Essential Details in Gardening Invoices

To ensure that a billing document serves its purpose effectively, it must include specific pieces of information that are critical for both clarity and accuracy. These details not only help the client understand what they are paying for but also help the provider maintain proper financial records. Including the right components ensures smooth transactions and minimizes confusion.

Key Information to Include

There are several vital elements that must be present in any billing document:

- Contact Details: Clearly display the names, addresses, and phone numbers of both the client and the service provider. This makes it easy for either party to get in touch if needed.

- Work Description: Provide a concise yet detailed summary of the tasks performed. It’s important to list each job separately, indicating the time spent and any materials used.

- Pricing Breakdown: Include the cost for each task or item separately, along with the total amount due. This transparency builds trust and prevents misunderstandings.

- Payment Terms: Specify when the payment is due, acceptable methods of payment, and any penalties for late payments.

Additional Considerations

In addition to the basic details, consider including the following:

- Invoice Number: Use a unique number for each document to help with tracking and record-keeping.

- Tax Information: Clearly show any applicable taxes, such as sales tax or VAT, with a breakdown of the amounts.

- Discounts or Offers: If applicable, include any discounts or special rates that apply to the bill. This can encourage prompt payment and build customer loyalty.

Benefits of Digital Invoice Templates

Using electronic billing documents has become increasingly popular due to the convenience and efficiency they offer. These digital solutions not only save time but also provide several advantages over traditional paper-based methods. By adopting digital formats, businesses can streamline their financial processes and enhance overall productivity.

Key Advantages of Using Digital Documents

Digital billing tools offer a wide range of benefits that can simplify your work and improve client relationships:

- Time-Saving: Digital formats can be created quickly and reused, eliminating the need to manually draft new documents for each transaction.

- Accuracy: Automated calculations reduce the chances of errors in pricing,

Free vs Paid Gardening Invoice Templates

When it comes to creating billing documents, there are two main options: free and paid solutions. Both have their pros and cons, and the best choice depends on the specific needs of your business. Free options can be a great starting point for small operations or those on a tight budget, while paid options often offer more features and customization for businesses looking to scale.

Advantages of Free Solutions

Free billing documents are easy to access and require no financial investment, making them an attractive choice for many small business owners. However, these solutions typically offer limited features and customization, which can be restrictive in the long run.

- Cost-Effective: No upfront costs or ongoing fees.

- Easy to Use: Simple templates that require little customization.

- Good for Small Businesses: Ideal for those just starting out or with minimal transactions.

Benefits of Paid Solutions

Paid billing documents usually come with more robust features, offering advanced customization, integrations, and professional layouts. These tools often include automatic calculations, customizable branding, and options for managing recurring payments, which can be invaluable for growing businesses.

- Customization: Greater flexibility in design and layout.

- Advanced Features: Options for integrating with accounting software or automating payment reminders.

- Professional Appearance: More polished and sophisticated document designs.

Comparison Table

Feature Free Solutions Paid Solutions Customization Options Limited Extensive Ease of Use Simple Varies, but generally user-friendly Advanced Features None or minimal Includes calculations, reminders, and integration with other tools Cost Free Subscription or one-time fee Professional Design Basic Highly polished, with options for branding Common Mistakes in Invoice Creation

Creating billing documents might seem straightforward, but there are several common errors that can lead to confusion, delayed payments, and lost revenue. Whether it’s overlooking critical details or failing to format the document properly, these mistakes can have a lasting impact on both your business and your client relationships. It’s important to be aware of these pitfalls and take steps to avoid them.

Below are some of the most frequent errors that occur when drafting payment requests:

- Missing Contact Information: Failing to include essential details such as the business name, client’s name, or contact numbers can delay communication and payment. Always ensure both parties’ contact information is clearly listed.

- Incorrect or Incomplete Descriptions: Vague or incomplete descriptions of the work completed can lead to misunderstandings. Make sure each task or item is described in sufficient detail so the client knows exactly what they are paying for.

- Failure to Include Payment Terms: Without clear payment terms, clients might not understand when payments are due or what the penalties for late payments are. Always specify due dates, payment methods, and any late fees.

- Errors in Calculations: Mathematical mistakes in pricing or taxes can result in overcharging or undercharging. Double-check all amounts before finalizing the document to avoid discrepancies that could harm your reputation.

- Not Including an Invoice Number: An invoice number helps track and organize billing records. Omitting this number can make it harder to reference specific transactions, especially in case of disputes or future audits.

- Not Providing Clear Payment Instructions: If the payment process isn’t clear, it can create delays or confusion. Provide easy-to-follow instructions, including the preferred payment methods and links, if applicable.

Avoiding these common mistakes ensures smoother transactions and builds trust with your clients. The more professional and accurate your billing documents are, the more likely you are to maintain good relationships and receive timely payments.

How to Calculate Gardening Service Charges

Accurately determining the cost of a job is an essential part of running a successful business. Properly calculating charges ensures that you are compensated fairly for your time, effort, and materials. There are several factors to consider when establishing the price for a completed task, and it’s important to take a structured approach to ensure you don’t overlook any details.

Factors to Consider When Setting Prices

When calculating the cost of a job, you need to consider several key elements:

- Labor Costs: Determine how much time you’ve spent on the job and your hourly or daily rate. Multiply your time spent by your rate to calculate labor costs.

- Materials and Supplies: If the job requires materials, such as plants, tools, or other supplies, include the cost of these items in the total calculation.

- Overhead Costs: Factor in any business-related expenses, such as transportation, equipment maintenance, or advertising, that contribute to the overall cost of the work.

- Profit Margin: Add a reasonable profit margin to cover your business’s growth and sustainability. Typically, this is a percentage of the total cost.

Step-by-Step Guide to Calculating Charges

Follow these steps to calculate the total charges for a task:

- Estimate Time: Determine the amount of time needed to complete the work. Multiply this by your hourly or daily rate.

- Account for Materials: Add the cost of any materials used, including delivery or transportation costs if applicable.

- Include Overhead: Calculate a proportionate share of your overhead costs based on the task’s size and complexity.

- Add Profit Margin: Decide on an appropriate profit percentage (usually between 10% and 30%) and apply it to the subtotal.

- Total Cost: Add all the above factors together to determine the final amount due.

By following these steps, you can ensure that your pricing is fair, transparent, and sustainable, while also remaining competitive within the market.

How to Track Payments and Due Dates

Keeping track of payments and their due dates is essential for maintaining healthy cash flow and ensuring that your business stays on top of its finances. Properly monitoring when payments are expected and when they’ve been made helps you avoid overdue bills, late fees, and misunderstandings with clients. A clear system for managing this information will also help you stay organized and professional in your approach to billing.

Methods for Tracking Payments

There are several effective ways to track payments and their deadlines:

- Manual Record-Keeping: For smaller businesses, manually recording payment dates and amounts in a notebook or spreadsheet may suffice. Be sure to regularly update your records and double-check for any missed payments.

- Accounting Software: Software solutions can automatically track payments, due dates, and outstanding balances. Many tools can generate reports and send payment reminders to clients.

- Online Payment Platforms: If you use digital payment methods, many platforms (like PayPal or Stripe) offer built-in tracking of when payments are made and when they are due.

Tracking Due Dates and Late Payments

To ensure you never miss a payment deadline, consider the following tips:

- Set Clear Deadlines: Specify the due date on each document, and ensure it’s visible to the client. Include the payment terms and any late fee clauses.

- Use Reminders: Set up automatic reminders via email or through your accounting system to notify clients about approaching due dates. This proactive approach can reduce the likelihood of late payments.

- Monitor Outstanding Payments: Regularly review your records to identify any overdue balances. Follow up with clients promptly to resolve any issues.

- Implement Late Fees: If you consistently experience delays in payments, consider implementing a late fee policy. This can motivate clients to pay on time and help cover any additional administrative costs.

By maintaining an organized system for tracking payments and due dates, you ensure that your business runs smoothly and that you’re compensated promptly for your work.

Organizing Client Information in Invoices

Properly organizing client details in billing documents is crucial for ensuring clear communication, accurate record-keeping, and smooth transactions. Well-structured client information helps avoid confusion and ensures that both parties can easily access essential details for reference. It also contributes to a professional and trustworthy image for your business.

When setting up your billing document, it’s important to categorize client information in a consistent and easy-to-understand manner. This can include both basic contact details and any specific preferences or instructions that may relate to the payment process.

Key Client Information to Include

Here are the key details that should be organized within each document:

Client Information Details to Include Client Name Full name of the person or company receiving the work. Contact Details Phone number, email address, and mailing address for correspondence. Job Description A brief summary of the work performed, including any special instructions from the client. Payment Terms Clear terms specifying the amount due, payment methods accepted, and due date. Discounts or Special Offers Any applicable discounts or promotions that were agreed upon with the client. Client Notes Any additional notes related to the client’s preferences or specific requirements for the billing process. By systematically organizing client information in a billing document, you make it easier to manage payments, reduce the chances of errors, and create a professional experience for your clients.

Integrating Invoices with Accounting Software

Integrating billing documents with accounting software is a powerful way to streamline your financial processes. This integration allows for automated tracking, efficient record-keeping, and simplified reporting. By syncing your billing and financial systems, you can reduce manual data entry, minimize errors, and ensure that all transactions are properly recorded and updated in real time.

Benefits of Integration

Integrating your payment documents with accounting tools offers several key advantages:

- Time-Saving: Automatically transfer payment details to your accounting system, saving time on manual data entry and reducing the risk of errors.

- Real-Time Updates: As soon as a payment is made, your system can update financial records, making it easier to track cash flow and outstanding balances.

- Accurate Reporting: Integration allows for comprehensive financial reports that include payment histories, outstanding amounts, and profit margins, helping you make better business decisions.

- Improved Organization: All financial data is stored in one central location, making it easier to access, review, and manage your records.

- Fewer Errors: Automation minimizes the chances of human error that can occur during manual data entry, ensuring that everything is properly recorded and categorized.

How to Integrate Payment Documents with Accounting Software

To integrate your documents with an accounting system, follow these steps:

- Choose the Right Software: Select an accounting platform that supports integration with your payment document solution. Popular options include QuickBooks, Xero, and FreshBooks.

- Link Your Accounts: Connect your billing platform with your accounting system through API integrations or software add-ons. Many platforms offer direct integrations with popular tools.

- Set Up Automation: Configure your software to automatically sync payment details, due dates, and amounts from your documents to your accounting system.

- Verify Data Accuracy: After integration, ensure that your data is syncing correctly by checking both the billing document and accounting records for consistency.

- Maintain Regular Updates: Regularly update your accounting software and billing system to ensure that the integration remains functional and up to date with the latest features and security patches.

By integrating your billing and financial systems, you can enhance accuracy, save time, and focus more on growing your business rather than dealing with administrative tasks.

Legal Considerations for Service Invoices

When creating billing documents for work performed, it’s crucial to consider the legal requirements that govern financial transactions. Ensuring that your documents comply with local laws can prevent potential disputes and protect your business interests. From taxes to payment terms, understanding the legal framework is essential for maintaining transparency and professionalism in your transactions.

Key Legal Elements to Include

Several key components must be included in your billing documents to comply with legal standards:

- Accurate Client Information: Always ensure that the client’s name, address, and contact details are correctly listed. Mistakes here can lead to confusion or disputes over payments.

- Clear Payment Terms: It’s vital to specify when payments are due, acceptable methods of payment, and any penalties for late payments. This helps avoid misunderstandings and protects your rights.

- Tax Information: Depending on your location, you may be required to include sales tax or other applicable fees. Clearly itemize tax amounts to comply with local tax laws.

- Legal Notices or Disclaimers: Some businesses may be required to add legal disclaimers, such as warranty exclusions or terms of liability. Always consult legal advice to ensure your documents are fully compliant with industry standards.

Consequences of Non-Compliance

Failure to follow legal requirements when issuing billing documents can result in financial penalties, legal disputes, or damage to your reputation. Ensuring your documents include all necessary information not only ensures compliance but also builds trust with clients. Some potential consequences include:

- Late Payments: Without clear payment terms or reminders, clients may delay payment or dispute charges.

- Legal Penalties: Inaccurate tax reporting or missing required details could lead to fines from tax authorities or other regulatory bodies.

- Business Disputes: Unclear terms or incomplete information could lead to disagreements or even lawsuits, which could harm your business’s credibility.

By paying close attention to these legal considerations, you help ensure that your transaction

How to Create a Professional Invoice

Creating a well-designed and professional billing document is key to ensuring that your business transactions are smooth and efficient. A polished document not only helps you get paid on time but also builds trust and credibility with your clients. By following a clear and structured approach, you can create a document that reflects your professionalism and provides all the necessary information in a concise, easy-to-understand format.

Here are the key steps to creating a professional and effective billing document:

- Use a Clean and Clear Layout: Ensure that your document is easy to read and well-organized. Use clear headings, consistent fonts, and adequate spacing to make the document visually appealing and straightforward for clients to understand.

- Include Complete Contact Information: Clearly list your business name, address, phone number, and email address at the top. Include the client’s details as well, so they can easily reference the document if needed.

- Specify Work or Products Provided: Describe the work performed or items delivered in detail. Be specific about what was done, and include dates or timeframes to avoid confusion. This helps clients understand exactly what they are paying for.

- Clearly State Payment Terms: Make sure to include the total amount due, due date, and acceptable payment methods. Consider adding late fees or early payment discounts if applicable to encourage timely payments.

- Use Professional Language: Always maintain a polite and professional tone in the document. Use formal language to convey seriousness and reliability, which can positively influence the client’s perception of your business.

- Ensure Legal Compliance: Make sure that your document complies with any local tax or business regulations. Include required information such as tax rates or business registration numbers if necessary.

By paying attention to these details, you ensure that your billing documents are not only effective in securing payments but also reinforce your business’s reputation as professional and trustworthy.

How Often Should You Send Invoices

Determining the right frequency for sending billing documents is essential for maintaining steady cash flow and managing client relationships. Sending invoices at the appropriate intervals ensures that payments are received in a timely manner and helps you stay organized in your financial management. The frequency with which you bill clients can depend on the nature of your work, client agreements, and the type of payment structure you have in place.

Factors to Consider When Deciding Billing Frequency

There are several key factors that will influence how often you should issue payment requests:

- Type of Work: If you are working on long-term projects, you may want to send periodic billing documents (e.g., monthly or after specific milestones). For shorter, one-time jobs, a single document upon completion may be sufficient.

- Client Agreement: Some clients prefer to receive regular billing documents, while others may prefer one-time payments. Discuss and agree on the frequency before starting the project to avoid confusion.

- Payment Terms: Clear payment terms are crucial in determining when to send a document. If clients have 30-day payment terms, you may want to send the billing documents at the start of the month, with a due date at the end of the month.

- Business Cycle: For businesses with recurring work, like subscriptions or ongoing engagements, monthly or weekly billing may make sense. For other projects, invoices can be issued after each task is completed.

Recommended Billing Intervals

Depending on the nature of the work and agreements with clients, here are some common billing intervals:

- Weekly: Ideal for projects or contracts with short timelines or recurring tasks that require regular updates.

- Monthly: Common for ongoing projects or retainers, where work is performed over the course of a month.

- Upon Completion: Suitable for one-time jobs or projects where payment is requested after the completion of the work.

- Milestone-Based: In cases where a project is broken down into phases, invoices can be issued after each completed phase or milestone.

Establishing the right frequency for sending billing documents is a balance between client needs, project timelines, and ensuring your cash flow remains stable. Consistent communication and clarity in terms will help prevent late payments and ensure smooth transactions.

Best Practices for Invoice Management

Efficient management of billing documents is key to maintaining a smooth and professional financial process in your business. Proper management ensures that you stay organized, get paid on time, and minimize any potential errors or disputes with clients. By adopting best practices for handling your billing paperwork, you can streamline the entire process, from creation to payment collection, while keeping track of important financial data.

Here are some essential practices to follow for effective billing management:

- Maintain a Consistent Format: Use a standardized format for all your billing documents. This consistency not only makes your documents look professional but also ensures that both you and your clients can easily understand the details of each transaction.

- Organize by Date: Keeping your billing documents in chronological order helps you track which ones have been paid and which are still outstanding. Regularly updating and reviewing these records will prevent confusion and missed payments.

- Track Payments and Due Dates: Use an automated system or a simple spreadsheet to track which payments have been made and which are still pending. This helps you avoid overdue accounts and makes it easier to follow up with clients if necessary.

- Keep Backup Copies: Always store copies of your billing documents, both electronically and in hard copy (if necessary). These records are important for future reference, tax purposes, and in case of any disputes that might arise.

- Send Timely Reminders: If a payment is overdue, send friendly reminders to clients promptly. Timely follow-ups demonstrate professionalism and can help encourage clients to settle their outstanding balances.

- Use Secure Payment Methods: Ensure that the payment methods you offer are safe and convenient for your clients. Using secure platforms reduces the risk of fraud and builds trust with your customers.

By adhering to these best practices, you can maintain control over your financial processes, improve client relationships, and ensure that your business continues to run smoothly.