Garage Repair Invoice Template for Streamlined Billing

For any service-based business, clear and precise financial documentation is essential to maintaining smooth operations. When it comes to billing clients, having a well-structured document not only helps in tracking payments but also enhances professionalism. A properly designed record ensures that both the service provider and the client are on the same page regarding costs, services rendered, and payment expectations.

In this guide, we will explore how to craft an effective billing statement that accurately reflects your work. Whether you’re a technician or a contractor, organizing this paperwork correctly can significantly improve cash flow and reduce misunderstandings with customers. By adopting a streamlined approach, you can ensure prompt payments and boost your business’s reputation.

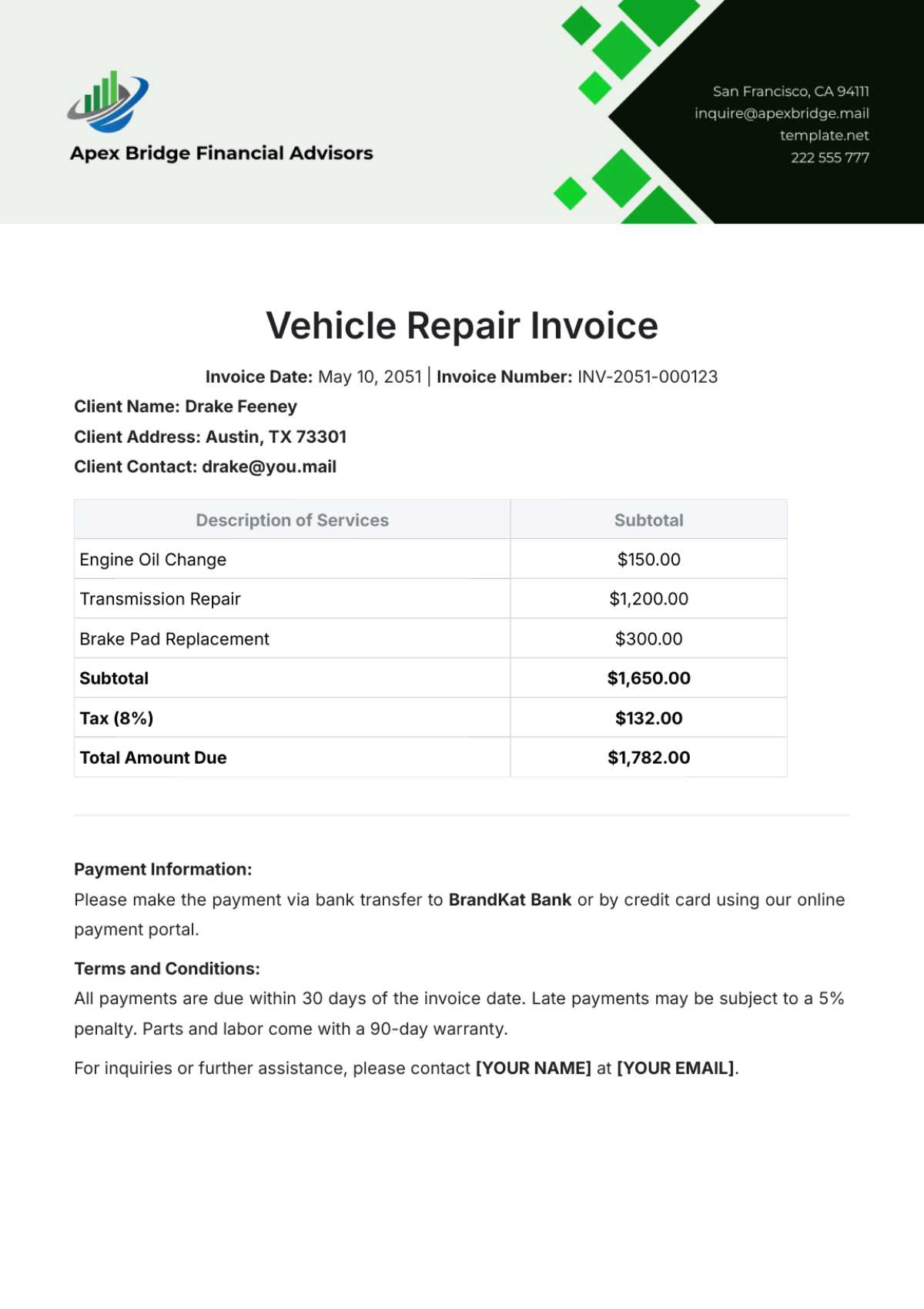

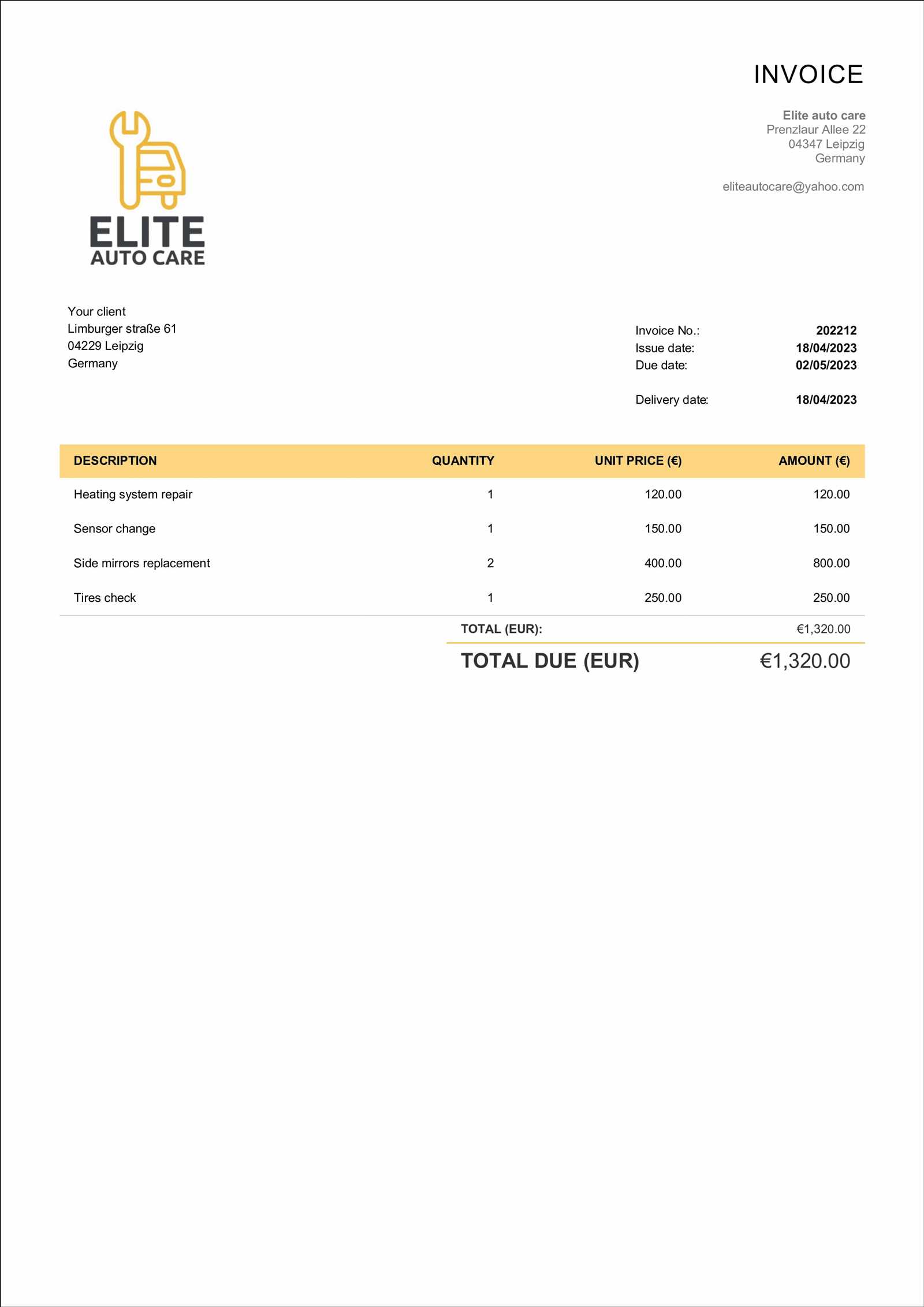

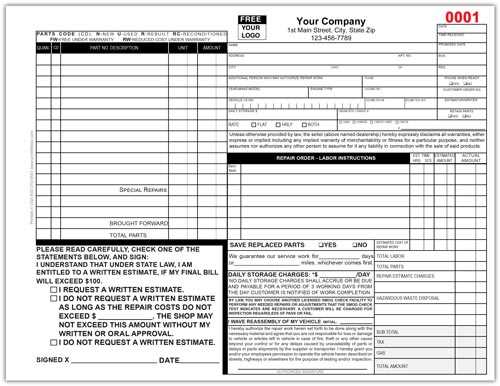

Key elements like including detailed service descriptions, labor rates, and itemized costs will be covered to help you create a transparent document. We will also discuss options for customization, as every business has unique needs, and how you can tailor your documentation to match your brand’s identity.

Getting the paperwork right from the start is essential for long-term success and customer satisfaction.

Garage Repair Invoice Template Guide

Creating a well-organized document for billing is crucial for any business that provides hands-on services. A clear and professional document not only ensures clients understand the charges but also protects your business by setting expectations up front. This guide will walk you through the essential elements of designing a billing statement that reflects the work completed, the cost breakdown, and the payment terms.

Key Elements to Include

To ensure clarity and transparency, it’s important to include the following sections in your billing document:

- Business Information: Include your business name, address, contact details, and any necessary registration numbers.

- Client Details: Clearly state the client’s name, address, and contact information for easy reference.

- Work Description: List all the services provided with specific details to avoid confusion. Be as precise as possible.

- Cost Breakdown: Itemize the costs for labor, materials, and any additional charges. This helps justify the total amount due.

- Payment Terms: Specify when payment is due, acceptable payment methods, and any late fees or interest charges.

- Additional Notes: You may include warranties, service guarantees, or disclaimers to further clarify any terms of the agreement.

Customization Tips

Personalizing your document will give it a professional touch and enhance your brand’s identity. Here are a few ways to tailor the document to your business:

- Branding: Add your logo and use your company’s color scheme to make the document instantly recognizable.

- Format: Choose a clean and easy-to-read format, with consistent fonts and clear headings for each section.

- Special Offers: If applicable, include any discounts, packages, or promotional pricing to incentivize future business.

By following these guidelines, you can create a professional and efficient document that not only helps with organization but also builds trust with your clients.

Why Use a Garage Repair Invoice

Having a structured document for billing services is essential for any business that provides hands-on work. It not only helps establish transparency between the provider and the client but also ensures that all charges are accounted for and agreed upon. Such a document is more than just a receipt; it serves as a formal record of the transaction, offering both protection and clarity for both parties involved.

Using a well-crafted billing statement can prevent misunderstandings, reduce disputes, and create a professional image for your business. It ensures that all aspects of the service provided–such as labor, materials, and additional charges–are clearly listed and understood by the client. This organized approach can help speed up payment processing and build trust with your customers.

Moreover, this document acts as a legal reference in case of any disagreements or questions regarding the charges. It provides a clear outline of the work performed, ensuring that both the service provider and the client are aligned in their expectations and agreements. By making billing transparent and easy to understand, you establish a reliable foundation for customer satisfaction and business success.

Key Features of an Invoice Template

For any service-oriented business, a well-structured billing document is a vital tool for both organization and professionalism. The most effective documents include key elements that not only help clarify charges but also ensure a smooth transaction process. Understanding these key features can assist you in creating a billing record that is clear, detailed, and easy to follow.

Below is a breakdown of the essential features that should be included in any well-designed billing record:

| Feature | Description |

|---|---|

| Business Information | Include your company name, address, and contact details so clients can easily reach you for questions or future services. |

| Client Details | Provide the customer’s name, address, and phone number to ensure the document is personalized and traceable. |

| Work Description | Clearly outline the tasks completed, making sure to break down the work into specific, understandable descriptions. |

| Cost Breakdown | List all costs involved, including labor, materials, and any other additional charges. This helps avoid confusion about pricing. |

| Payment Terms | Define when payment is due, acceptable payment methods, and any late payment penalties or discounts for early settlement. |

| Dates | Specify the date of service completion and the date by which payment should be made. |

| Unique Invoice Number | Assign a unique identifier to each document for easy tracking and record-keeping. |

Including these key elements in your billing document ensures that it is comprehensive, clear, and professional, making it easier for both you and your clients to manage financial transactions smoothly.

How to Customize Your Invoice

Customizing your billing document is an important step in creating a professional and unique experience for your clients. Tailoring your document allows you to reflect your brand’s identity, while also meeting the specific needs of your business. A personalized billing statement can also help improve client trust and make the payment process more efficient.

Step 1: Incorporate Your Branding

To ensure that your document aligns with your business’s image, start by adding your company logo and contact information in the header. You can also customize the fonts and color scheme to match your brand. This small but effective personalization helps create a cohesive and professional appearance, making it easier for clients to recognize and remember your business.

Step 2: Adjust the Layout and Content

Tailor the structure of the document to suit your specific requirements. For example, if your services involve multiple categories of work, consider including separate sections for each. You can also adjust the itemization of costs, grouping charges according to labor, materials, or additional services. This makes the statement easier to understand and provides clear transparency for your clients.

Additional Tips:

- Payment Terms: If your business offers discounts for early payments or late fees for overdue balances, make sure to highlight these conditions clearly.

- Service Descriptions: Be as detailed as possible in describing the work done, especially if different tasks or parts were involved. The more clarity you provide, the less chance there is for confusion.

- Custom Fields: Depending on the nature of your business, you might want to add custom fields, such as tracking numbers, warranties, or future service reminders.

By making these adjustments, your billing document not only becomes a functional tool but also enhances your professional image and improves communication with clients.

Essential Information for Garage Invoices

To ensure smooth financial transactions and avoid confusion, it is important to include certain key details in any billing document. The accuracy and clarity of the information provided not only helps in faster payment processing but also protects both parties in case of disputes. This section will highlight the most critical elements that should be included to create an effective and professional billing statement.

1. Business and Client Information: Clearly listing the service provider’s and client’s names, addresses, and contact details is essential for easy communication. This ensures both parties are identified properly, and any follow-up or clarification can be easily carried out.

2. Service Details: A clear description of the tasks performed should be provided, specifying what was done, how long it took, and any materials or parts used. This transparency helps clients understand what they are paying for and reduces the risk of misunderstandings.

3. Cost Breakdown: It is crucial to provide an itemized list of all charges. This should include not only labor costs but also the price of materials, parts, or any additional services provided. This gives the client a detailed overview of the overall charges and justifies the total amount due.

4. Payment Terms: Clearly outline the due date for payment, accepted methods of payment, and any applicable penalties for late payments. Establishing these terms upfront helps set clear expectations and encourages timely payment.

5. Unique Identifier: Every document should have a unique reference number. This makes it easier for both the service provider and the client to track the document for future reference, ensuring proper record-keeping and preventing any confusion about the transaction.

6. Date of Service: Always include the date when the service was provided, as well as the date when the payment is due. This helps both parties maintain an accurate timeline for the work completed and ensures the document is up to date.

By ensuring these details are included and properly formatted, you can create a professional document that facilitates smoother business operations and strengthens client relationships.

Common Mistakes to Avoid in Invoices

When creating a billing document, it’s essential to be thorough and accurate to avoid potential confusion or disputes with clients. Even small errors can cause delays in payment or damage your professional reputation. In this section, we’ll look at some common mistakes businesses make and how to prevent them when preparing a billing statement.

1. Missing or Incorrect Contact Information

Failing to include the correct details for both your business and your client can lead to miscommunication and delays. Always double-check the names, addresses, and contact numbers to ensure they are accurate and up-to-date.

2. Lack of Clear Service Descriptions

Vague or overly general descriptions of the work performed can confuse clients and make it difficult for them to understand what they are being charged for. Make sure you clearly outline the tasks, parts used, and any additional services provided.

3. Errors in Pricing or Totals

One of the most critical errors to avoid is miscalculating costs. Whether it’s forgetting to add taxes, mispricing parts, or incorrectly totaling the charges, errors like these can erode trust. Always double-check the pricing and ensure the final amount reflects all the agreed-upon charges.

| Mistake | How to Avoid It |

|---|---|

| Missing Due Date | Always specify when the payment is due to avoid delays and confusion. |

| Unclear Payment Terms | Be specific about accepted payment methods, penalties for late payments, and any discounts. |

| Omitting Unique Reference Number | Assign a unique identifier to each document for easy tracking and future reference. |

| Inconsistent Formatting | Ensure that all text, headers, and sections are clearly formatted and easy to follow. |

4. Not Including Terms and Conditions

Some businesses fail to include payment terms, such as late fees or discounts for early payments. These terms should be clearly stated on the document to ensure both parties understand the expectations and avoid future disagreements.

5. Failing to Follow Up

After sending the billing document, it’s crucial to follow up if the payment has not been received within the agreed timeframe. Many businesses make the mistake of assuming the client will pay on time without prompting. A polite reminder can help ensure timely payment and maintain a good client relationship.

By avoiding these common mistakes, you can ensure your billing documents are accurate, professional, and clear, leading to smoother transactions and better client satisfaction.

Benefits of Professional Invoice Design

A well-designed billing document is more than just a record of transactions; it is a reflection of your business’s professionalism and attention to detail. The design of these documents plays a significant role in ensuring that your clients understand the charges and feel confident in the services you’ve provided. A polished and clear layout not only facilitates smoother financial processes but also strengthens your brand’s image.

1. Enhances Professionalism

A clean, well-organized document instantly conveys a sense of reliability and professionalism. Clients are more likely to take your business seriously when they receive neatly formatted records that are easy to read and understand. This can lead to better customer relations and a stronger reputation in the market.

2. Builds Trust and Credibility

A professional design helps establish trust with your clients. When a document is easy to navigate and free from errors or confusion, clients are more likely to feel confident in your services. Trust can be built through clarity in terms of services rendered, pricing, and payment conditions, all of which are important to your clients.

3. Streamlines Payment Processing

One of the main advantages of a well-structured document is that it accelerates payment processing. When the document is clear and contains all necessary details–such as payment terms, due dates, and itemized costs–clients can quickly process payments without the need for back-and-forth communication. This reduces delays and helps maintain cash flow.

4. Improves Brand Recognition

Designing a document that reflects your brand identity can help increase visibility and brand recognition. By using your company logo, color scheme, and fonts consistently, you reinforce your brand in the client’s mind. A professional design makes your document instantly recognizable and gives it a polished, cohesive look.

Key Benefits

- Clarity: Clear breakdowns and descriptions of services and costs prevent confusion.

- Consistency: Customizing your design ensures uniformity across all documents, enhancing brand identity.

- Efficiency: A well-designed layout helps speed up the payment process by making details easy to understand.

- Client Satisfaction: A professional presentation helps ensure your clients feel valued and respected.

Investing time and effort into designing professional billing documents pays off in the long run. It improves your relationships with clients, streamlines administrative processes, and enhances your business’s overall credibility and reputation.

Choosing the Right Invoice Software

Selecting the appropriate software for managing billing documents is crucial for streamlining your business operations. The right solution can save you time, reduce errors, and ensure that your financial processes run smoothly. With so many options available, it’s important to choose a tool that fits your specific needs and helps you stay organized while maintaining a professional image.

1. Consider Your Business Size

The size of your business plays a significant role in determining which software will work best for you. Smaller businesses may benefit from simpler, more cost-effective tools, while larger companies might require more robust systems with additional features for managing a higher volume of transactions.

2. Look for Customization Options

Customization is an important feature to consider when selecting software. A good solution will allow you to personalize your documents with your company logo, colors, and preferred formatting. This will help maintain consistency in your branding and make your billing records stand out to clients.

3. Key Features to Prioritize

- Ease of Use: Look for software that is intuitive and simple to navigate, even if you’re not tech-savvy.

- Automation: Software that offers automated reminders for overdue payments or recurring billing can save you time and improve cash flow.

- Integration: Ensure the software can integrate with other tools you use, such as accounting software, CRM systems, or payment gateways.

- Security: Make sure the software offers secure storage of financial data and complies with necessary regulations to protect your business and clients.

4. Price vs. Features

When evaluating different software options, weigh the cost against the features offered. While some tools may be free or inexpensive, they might lack advanced features or customer support. On the other hand, more expensive options may offer a wider range of features than you need. Choose a software that provides good value for your business without overpaying for unnecessary features.

5. Customer Support

Strong customer support is essential when using any software. Look for tools that offer multiple ways to get help, such as live chat, email, or phone support. Good customer service can be a lifesaver when you’re troubleshooting or need assistance with a technical issue.

By carefully considering your business’s needs, the software’s features, and the level of support, you can select the right tool to help streamline your billing process, improve effic

How to Calculate Labor Costs Accurately

Accurately calculating labor costs is essential for ensuring that your business remains profitable while offering fair pricing to your clients. It’s not just about tracking the hours worked; you must also factor in overhead, wages, and any additional expenses related to the task. Properly calculating labor costs can prevent undercharging and help you avoid unexpected losses.

1. Determine Hourly Rates

To begin with, you need to set an hourly rate for your employees or contractors. This rate should take into account various factors such as:

- Employee Wage: The base salary or hourly wage of the worker performing the service.

- Overhead Costs: Indirect costs like insurance, benefits, and other operational expenses that must be covered by the hourly rate.

- Profit Margin: You should also include a margin that ensures your business remains profitable after covering labor and overhead costs.

2. Track and Account for Time

Accurate time tracking is crucial when calculating labor costs. This includes:

- Time Spent on the Job: Track the exact hours spent on each task or service. Use time tracking software or manual logs to ensure precision.

- Additional Time: Account for any extra time required for preparation, travel, or delays that might occur during the job.

- Breaks and Downtime: Depending on your business, consider whether employee breaks and downtime need to be factored into the cost or excluded.

Once you have the hourly rate and the total time spent on the task, simply multiply the hours worked by the rate to get the total labor cost for that particular job.

3. Add Overhead and Additional Costs

In addition to the wages and time, don’t forget to include other associated expenses, such as:

- Transportation Costs: If employees are required to travel to different job sites, those costs should be factored into the total price.

- Equipment and Materials: While materials are often itemized separately, make sure to include any specific tools or equipment that are necessary for the labor.

- Administrative Costs: Consider the time and resources spent on scheduling, invoicing, and other administrative tasks involved in completing the job.

By thoroughly accounting for all these factors, you can ensure that your labor costs are accurate and reflective of the true expenses involved in delivering a quality service.

Adding Parts and Materials to Invoices

Including the cost of materials and parts in your billing document is essential for providing clarity and transparency to your clients. It ensures that all the necessary components used in completing a job are accounted for, and the client can easily see the breakdown of charges. Properly documenting these costs also helps to maintain accurate records for your business.

1. Itemize Each Component

When listing parts or materials, it’s important to be as specific as possible. Each item should be clearly identified, including:

- Part/Material Name: Provide a detailed description of the item, including brand, model, or type.

- Quantity: Indicate the amount of each item used in the job.

- Unit Price: List the price per unit for each item.

- Total Price: Multiply the unit price by the quantity to provide the total cost for each item.

This level of detail ensures your clients understand exactly what they are paying for and helps to avoid any confusion or disputes later on.

2. Consider Markups and Discounts

If you apply a markup to parts or offer discounts on materials, it’s important to clearly indicate this on the document. For example:

- Markup: If you mark up the cost of parts for profit, specify the markup percentage and the adjusted price.

- Discounts: If you offer any discounts on materials or parts, be sure to show the original price, the discount applied, and the final price.

This ensures that both the original cost and the adjusted amount are transparent to your client.

3. Group Similar Items Together

For clarity, it’s often helpful to group similar parts or materials together in your billing document. For instance, if multiple items fall under the same category (e.g., plumbing parts or electrical components), list them together, making it easier for the client to understand the total cost of materials at a glance.

4. Add Total Costs

At the end of the materials and parts section, always include the total cost of all items used. This total should be clearly separated from labor charges, making it easy for your client to see the breakdown of each expense.

By including these elements in your billing statement, you can ensure your clients receive a complete, accurate, and transparent record of all costs associated with the work performed.

Understanding Payment Terms in Invoices

Payment terms are a critical component of any billing document, as they define the expectations for when and how payments should be made. Clear payment terms help prevent misunderstandings and ensure timely compensation for the services provided. By clearly outlining these terms, businesses can protect themselves financially and foster a transparent relationship with clients.

1. Common Payment Terms

There are several common types of payment terms that businesses use, depending on the nature of the work and the agreement with the client. Here are a few of the most widely used:

- Net 30: This means the payment is due 30 days after the billing date. It’s one of the most common payment terms used in many industries.

- Due Upon Receipt: This means payment is due as soon as the client receives the document. It’s typically used for smaller projects or services.

- 50% Upfront: This requires the client to pay half of the total amount before work begins, with the remaining balance due upon completion.

- Late Fees: Some businesses include a clause that charges interest or a flat fee if the payment is not made within the agreed timeframe.

2. Key Factors to Include

To avoid confusion, it’s important to include specific details when stating payment terms on a billing document. These might include:

- Payment Due Date: Clearly specify the exact date by which the payment must be made to avoid any ambiguity.

- Accepted Payment Methods: List the types of payment methods you accept, such as bank transfers, credit cards, or checks.

- Late Payment Penalties: If applicable, outline any penalties for overdue payments, such as interest rates or additional charges.

- Discounts for Early Payment: If you offer discounts for early payments, make sure to include the details so clients can benefit from them.

Including these specifics ensures that both parties are on the same page and helps prevent potential issues down the line.

3. The Importance of Clarity

To avoid delays or disputes, clarity in payment terms is essential. Both businesses and clients should have a mutual understanding of the expectations for payments. By stating payment terms upfront and making sure they are easy to read, you can create a smoother, more efficient process for collecting payments and maintaining a positive client relationship.

How to Track Invoice Payments

Keeping track of payments is an essential part of managing your finances. Without an organized system, it can be difficult to know which clients have paid and which still owe money. Efficiently monitoring payments ensures that your cash flow remains steady and that you can follow up with clients who are overdue. By tracking payments properly, you also minimize the risk of losing track of outstanding debts.

1. Organize Payment Records

The first step in tracking payments is to keep an organized record of each transaction. Make sure you have a system in place to document:

- Payment Date: Record the date when payment is received to ensure timely follow-ups.

- Amount Paid: Clearly note the amount that was paid, especially if a partial payment was made.

- Payment Method: Track the method of payment, such as bank transfer, credit card, check, or cash.

- Reference Number: If applicable, include a payment reference number for easy identification.

These details will help you keep an accurate record of transactions and assist in resolving any discrepancies that may arise.

2. Use Payment Tracking Tools

Investing in payment tracking software or tools can make the process easier. These tools allow you to automatically update records and generate reports. Popular options include:

- Accounting Software: Tools like QuickBooks, Xero, or FreshBooks allow you to track payments, generate reminders for overdue accounts, and easily categorize expenses.

- Spreadsheets: If you’re not ready to invest in software, a simple spreadsheet (Google Sheets, Excel) can be a cost-effective solution for tracking payments manually.

- Dedicated Payment Platforms: Services like PayPal, Stripe, or Square often have built-in payment tracking features that let you view transaction histories and outstanding balances.

These tools help streamline the payment tracking process, reducing the risk of errors and ensuring that you never miss a payment.

3. Send Regular Payment Reminders

To ensure timely payments, it’s important to remind clients of upcoming or overdue payments. Set up automated reminders or manually send follow-ups via email. Be sure to include:

- Invoice Details: Reference the original document and the amount due.

- Payment Due Date: Clearly state when the payment is expected.

- Late Fees (if applicable): Mention any penalties or interest charges for overdue payments.

By staying on top of reminders, you can encourage clients to settle their debts promptly and avoid cash flow disruptions.

4. Reconcile Payments with Bank Statements

Periodically reconcile your payment records with your bank statements to ensure accuracy. Cross-check the payments you’ve logged against your bank account to confirm that all transactions have been recorded correctly. This step helps you identify any missing payments or discrepancies early on and ensures your financial records are up to date.

Tracking payments efficiently is an essential skill for managing your finances and maintaining healthy cash flow. By keeping detailed records, using the right tools, sending timely reminders, and regularly reconciling your payments, you can stay on top of your finances and reduce the risk of payment-related issues.

Tips for Quick Invoice Processing

Efficient billing management can significantly improve your cash flow and reduce administrative burdens. The faster you process your payment requests, the sooner you can receive compensation for your work. By streamlining your workflow, automating tasks, and staying organized, you can accelerate the processing of financial documents and ensure timely payments.

1. Automate the Process

Automation tools can save you time and eliminate the risk of human error. Here are a few ways to automate your billing process:

- Use Accounting Software: Tools like QuickBooks, FreshBooks, or Xero allow you to automate the creation, sending, and tracking of financial documents.

- Set Up Recurring Billing: For clients with regular payments, set up recurring billing so invoices are generated and sent automatically at regular intervals.

- Enable Online Payments: Use platforms like PayPal, Stripe, or Square to allow clients to pay directly from the document with a few clicks.

By automating key tasks, you can save time, reduce errors, and speed up your invoicing process.

2. Standardize Your Process

Consistency is key to processing requests quickly. Create a standardized workflow for all steps, from preparing the documents to sending them and tracking payments:

- Use a Template: Design a professional and consistent format for your documents, ensuring they include all the necessary details, such as payment terms, service descriptions, and due dates.

- Define Clear Payment Terms: Set standardized payment terms for your clients, such as net 30 or due upon receipt, to avoid confusion and ensure quick payment.

- Implement a Follow-Up System: Set reminders for yourself to follow up with clients if a payment is overdue, reducing the need for manual tracking.

Standardizing your process ensures that every step is clear and manageable, enabling you to process documents more efficiently.

3. Reduce Administrative Delays

Administrative delays can slow down the payment process. To minimize these delays, keep the following in mind:

- Accurate Data Entry: Double-check client information, service details, and pricing before sending out documents. Mistakes can lead to delays or confusion.

- Set Payment Reminders: Send reminders well in advance of the due date to give clients ample time to process their payments.

- Offer Multiple Payment Options: The more options clients have to pay, the quicker they can make a transaction. Accept credit cards, bank transfers, and online payment systems to make the process more convenient.

By reducing administrative hold-ups and provi

Legal Requirements for Billing Documents

Understanding the legal requirements for financial documentation is crucial for any business. Properly structured billing documents not only help maintain transparent transactions but also ensure that you comply with tax laws and contractual obligations. Failing to include necessary details or adhering to local regulations can result in penalties or disputes. It is essential to be aware of the key elements that should be included to stay legally compliant.

1. Mandatory Information

In most jurisdictions, there are certain pieces of information that must appear on all billing documents. These details help ensure the transaction is clear and enforceable. Some of the key elements include:

- Business Details: Include the full name, address, and contact information of your business, as well as your tax identification number (TIN) or business registration number if required.

- Client Information: Clearly list the name and contact details of the client receiving the services or goods.

- Itemized List of Services or Products: Provide a detailed breakdown of the services rendered or products supplied, including descriptions, quantities, and prices.

- Payment Terms: State the agreed-upon payment terms, such as the due date, accepted payment methods, and any late fees for overdue payments.

- Unique Identification Number: Assign a unique reference number to each document for tracking and record-keeping purposes.

These details are critical not only for clarity but also for ensuring the document is legally binding and compliant with taxation and regulatory standards.

2. Tax Compliance and Reporting

Tax compliance is a key aspect of legal billing requirements. Depending on your region, you may need to include specific tax-related details on each billing document:

- Sales Tax: If applicable, you must include the sales tax rate, the amount charged, and the total including tax.

- Tax Identification Number: Both your business’s and your client’s tax numbers may need to be included for certain types of transactions, especially for cross-border services.

- Currency: Clearly specify the currency in which the payment is due, particularly if you are working with international clients.

Being diligent about tax requirements ensures you avoid issues with local authorities and helps you maintain proper records for future audits.

3. Regional Differences

Legal requirements can vary significantly from one region to another, so it’s important to familiarize yourself with the specific regulations in your location. Some areas may have stricter rules for invoicing, such as requirements for electronic submissions or digital signatures, while others might mandate additional documentation or forms to be included with your billing documents. Make sure to check with a local accountant or legal professional to ensure you are fully compliant with all relevant regulations.

By adhering to these legal requirements, you can reduce the risk of non-compliance, disputes, and delays in payments, while maintaining a professional and lawful approach to your financial transactions.

Incorporating Your Business Branding

Incorporating your brand identity into all aspects of your business communication, including financial documents, is essential for creating a professional and cohesive image. When clients receive a document that reflects your brand, it reinforces trust and credibility. By including elements such as your logo, colors, and fonts, you can ensure that your business stands out and is easily recognizable, even in day-to-day administrative tasks.

1. Consistent Visual Identity

Your brand’s visual elements should be consistent across all documents. This consistency helps to establish a strong, unified presence in the minds of your clients. Key components to include in your financial documents are:

- Logo: Feature your logo prominently at the top of the document to immediately establish your brand identity.

- Color Scheme: Use your brand’s primary colors for headings, accents, and borders to create a visually cohesive design.

- Font Choices: Choose fonts that align with your brand’s style guide. Make sure the fonts are legible and professional, particularly for essential details like payment terms and service descriptions.

By using these elements, you create a polished look that ensures your document is not just functional, but also an effective representation of your brand’s values and professionalism.

2. Personalized Touches

Adding personalized elements to your documents can enhance the overall client experience. For example, you can include:

- Customizable Header/Footer: Customize the header with a tagline or a brief description of your business, and include your contact details in the footer for easy reference.

- Custom Messages: Include a friendly, professional message or a thank-you note to reinforce customer relations and showcase your business’s personality.

- Branded Watermark: A subtle watermark featuring your logo or company name can be added to the background of the document to further emphasize your brand while maintaining a clean look.

These small touches not only improve the aesthetics but also help clients remember your business long after the document has been filed away.

Incorporating your branding into financial documents isn’t just about aesthetics; it’s about building a consistent and professional image that fosters trust and enhances your reputation. Whether it’s through your visual identity or personalized elements, a branded document reinforces your business’s credibility and sets you apart from the competition.

Managing Billing Disputes Effectively

Disputes over financial documents can arise for various reasons, from misunderstandings about the charges to discrepancies in the services provided. Handling these issues promptly and professionally is crucial to maintaining positive client relationships and ensuring timely payments. Effectively managing billing disputes can prevent escalation, safeguard your business reputation, and ensure that issues are resolved in a fair and transparent manner.

1. Stay Calm and Professional

When a client raises a concern or dispute, it’s important to remain calm and avoid becoming defensive. Approaching the situation professionally will help maintain trust and respect. Here are a few steps to keep in mind:

- Listen Carefully: Understand the client’s perspective and the specific reasons for the dispute before responding. Take note of all the details to ensure you address the issue accurately.

- Respond Promptly: A timely response shows that you take the issue seriously and are committed to resolving it efficiently.

- Stay Neutral: Focus on the facts and avoid making assumptions. Neutrality helps keep the conversation constructive and professional.

By handling disputes calmly, you show your clients that you value their business and are willing to resolve any issues amicably.

2. Review the Details Thoroughly

Before engaging in a conversation with your client, thoroughly review the billing document in question. Ensure that all charges are accurate and that the details align with the services rendered or products delivered. If any mistakes are found on your end, be prepared to acknowledge and correct them. A clear and transparent approach to resolving discrepancies will go a long way in maintaining customer trust.

- Check the Terms: Review the payment terms and conditions that were agreed upon at the outset. Ensure both parties are on the same page about the expectations for payment and deadlines.

- Verify the Charges: Cross-check the services or goods provided with what is listed on the financial document. Ensure the quantities, rates, and calculations are correct.

- Provide Supporting Evidence: If necessary, provide documentation such as work orders, emails, or contracts to clarify the charges and resolve the issue quickly.

Reviewing the details before discussing the matter ensures that you can address any issues accurately and demonstrate professionalism in your response.

3. Offer Flexible Solutions

In some cases, disputes may arise from genuine misunderstandings or financial challenges. Offering flexible solutions can help preserve the relationship and ensure the dispute is resolved satisfactorily for both parties:

- Offer Payment Plans: If a client is struggling with a large payment, consider offering a payment plan that suits their financial situation while ensuring you still receive compensation.

- Negotiate a Discount: In certain situations, offering a partial discount or credit may be a good way to resolve a dispute while maintaining goodwill

How to Send and Follow Up on Billing Documents

Successfully managing financial documents goes beyond creating and sending them. It’s crucial to follow up appropriately to ensure timely payment and maintain good client relationships. The process involves sending the document efficiently and keeping track of any outstanding balances, all while maintaining professionalism and courtesy. A well-planned follow-up strategy can minimize delays and reduce the chances of disputes.

1. Sending Your Billing Documents

When sending financial documents, clarity and professionalism are essential. Follow these steps to ensure that your client receives the document without any issues:

- Choose the Right Method: Depending on your client’s preference, send the document via email, physical mail, or through an online platform. Email is the quickest and most cost-effective method for many businesses, but some clients may prefer hard copies.

- Confirm Receipt: If sending electronically, ask for a read receipt or request confirmation that the document has been received. This ensures there are no misunderstandings regarding delivery.

- Provide Clear Instructions: Make sure the document includes clear payment instructions, such as the payment methods accepted and the due date. If relevant, include a link or a payment portal for online transactions.

By sending documents in a clear and professional manner, you ensure that your clients understand the expectations and details of the transaction.

2. Following Up on Payments

If the payment is not made by the due date, a follow-up becomes necessary. Proper follow-up is key to maintaining professionalism while ensuring payment is collected. Here’s how to handle it effectively:

- Send a Reminder: Start with a polite reminder shortly after the due date. It’s important to remain courteous and express understanding, as sometimes payments can be delayed due to various reasons.

- Provide Payment Details Again: When following up, include all relevant details, including the original amount, payment methods, and a link or instructions on how to make the payment.

- Set Clear Deadlines: In your follow-up, specify a clear deadline for the payment and let the client know the consequences of non-payment, such as late fees or suspension of services.

- Offer Assistance: If there’s any issue with the payment process, offer assistance. Sometimes technical difficulties or confusion can delay payments, and a helpful approach can resolve issues swiftly.

By keeping follow-ups polite and professional, you remind clients of their financial obligations without damaging the business relationship.

3. Escalating Payment Requests

If repeated follow-ups don’t result in payment, escalation may be necessary. However, it’s important to approach this step carefully and professionally:

- Send a Final Notice: After several reminders, send a final notice that clearly states the payment is overdue and outline any penalties or consequences for non-payment.

- Consider Payment Plans: If the client is experiencing financial difficulties, offer a structured payment plan that makes it easier for them to settle the balance.

- Legal Action (Last Resort): As a final step, if the payment remains unpaid, you may need to consult with a legal professional to explore further actions such as collections or small claims court.

Escalating the situation should always be a last resort. Throughout the process, maintaining professionalism and fairness is essential for protecting your reputation and your business relationships.

By following these steps for sending and following up on financial documents, you can streamline your payment process, reduce delays, and maintain strong client relationships, all while ensuring timely compensation for