Free Garage Invoice Template PDF for Easy Professional Billing

In any service-based industry, clear and accurate billing is essential for maintaining strong relationships with clients and ensuring timely payments. Having a standardized document to outline services rendered, amounts due, and payment terms can streamline your accounting processes and boost professionalism. Whether you operate a repair shop, a consultancy, or a personal service, using an efficient format for your payment requests can make all the difference.

By adopting a consistent format for your billing, you not only reduce the chances of errors but also enhance the overall customer experience. Clients appreciate when transactions are easy to understand and visually organized. Moreover, leveraging tools that allow easy creation, customization, and sharing of these documents ensures that you’re always prepared for any transaction, whether it’s for small jobs or larger projects.

Choosing the right format for your payment documentation can save time and improve efficiency. The ability to customize each document with your business details, pricing structure, and specific services is crucial for transparency. Moreover, the option to convert these documents into a universally accessible format makes sharing and storing them more convenient.

Whether you’re handling one-time projects or ongoing contracts, having a streamlined billing solution is a key aspect of business operations. Understanding how to best create and manage these documents will support both your workflow and financial organization.

Garage Invoice Template PDF Overview

For businesses offering repair or maintenance services, having a professional document to outline charges and services is crucial for clarity and record-keeping. A well-structured billing form not only helps in tracking payments but also enhances customer trust by providing transparent and organized details of the work done. The document format plays a significant role in how efficiently these transactions are processed and stored.

Why Standardized Forms Matter

Using a standardized format for payment requests ensures that all the essential information is included and presented consistently. This includes details like service descriptions, labor costs, materials used, and payment terms. A consistent approach simplifies communication between the service provider and the client, reducing misunderstandings and errors. Additionally, with the right setup, the process becomes much quicker and more efficient, saving both time and resources.

Key Features of an Effective Document

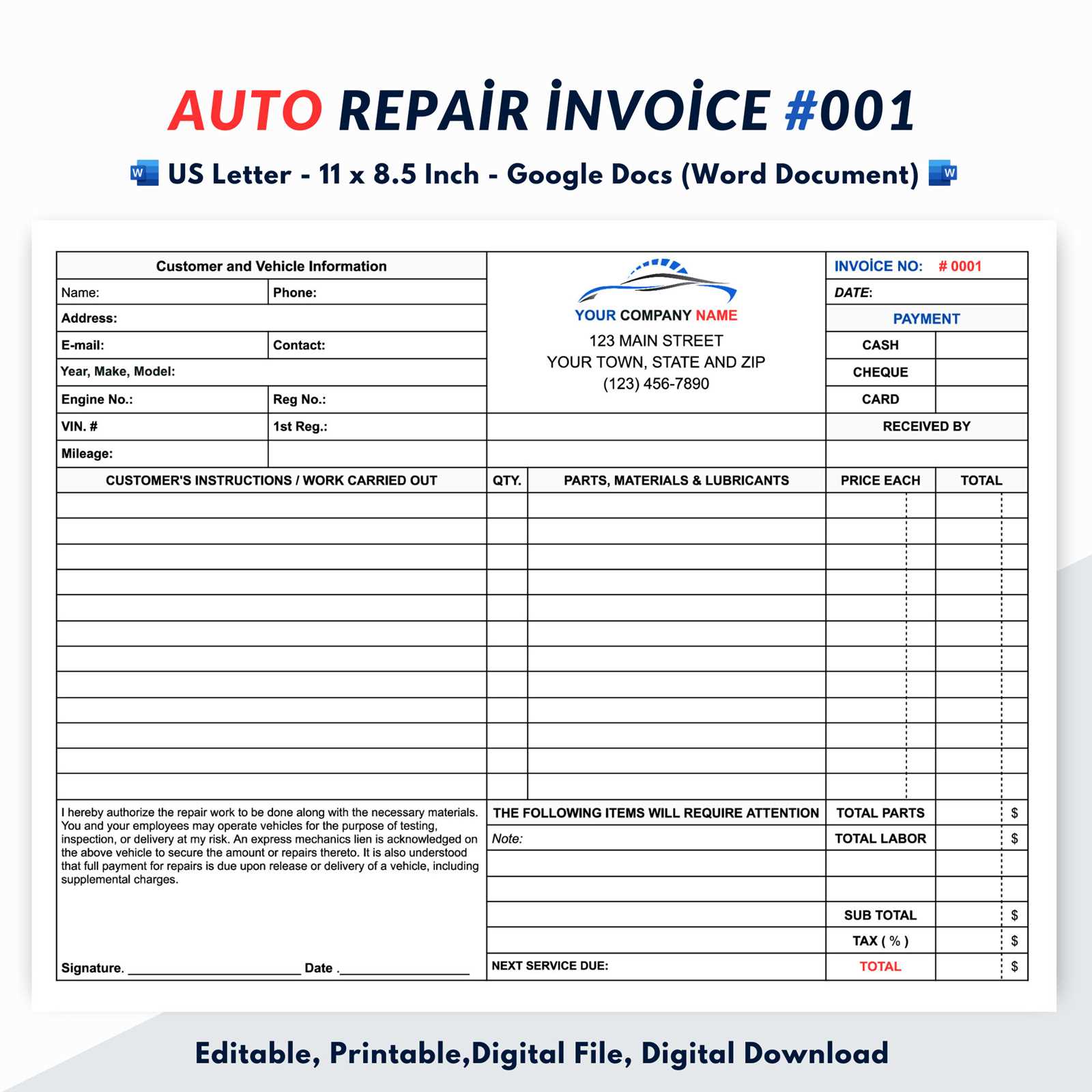

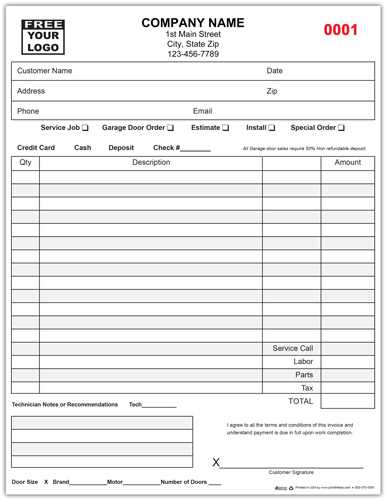

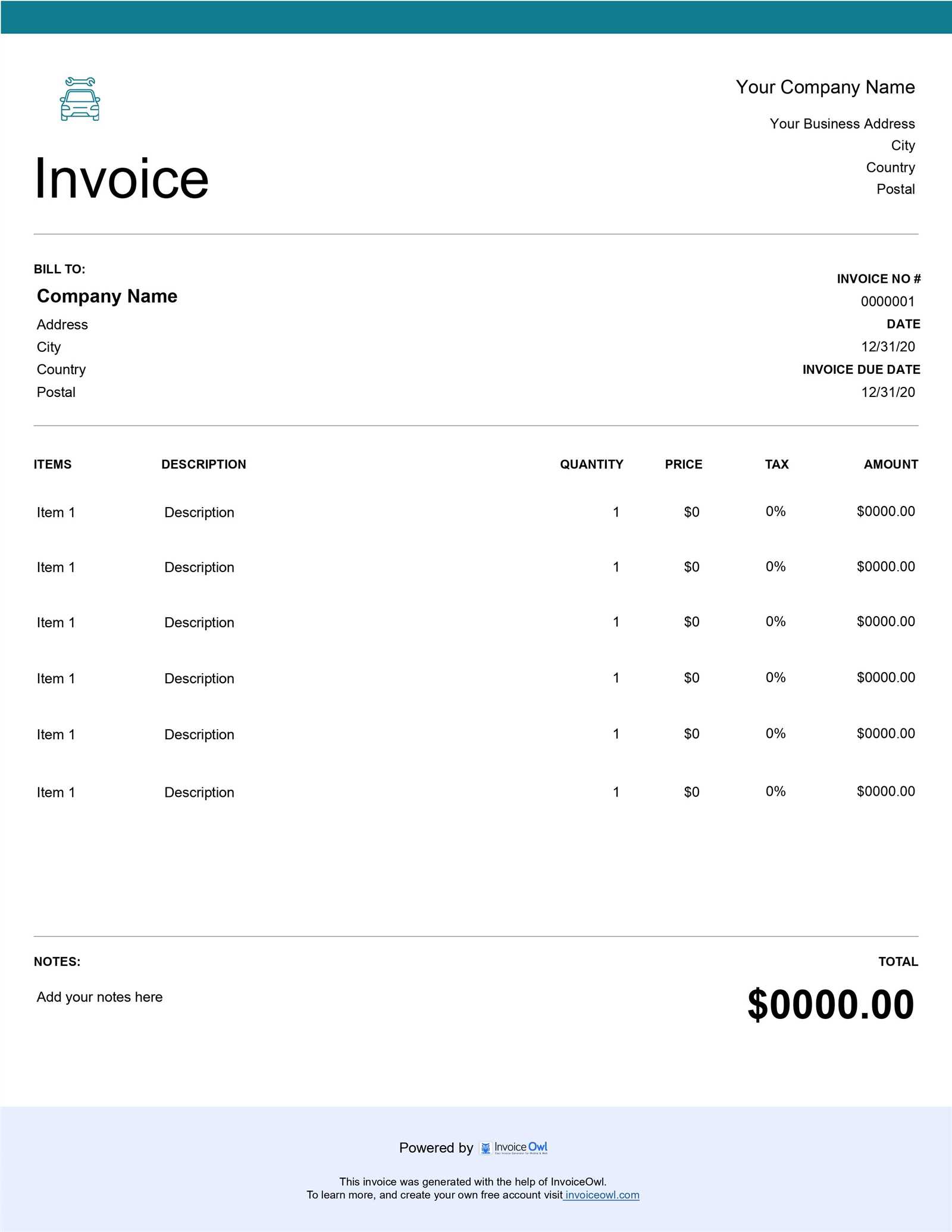

When selecting a document format, it is important to choose one that is easy to customize and adapt to various service types. An ideal format should allow you to include the name of your business, contact information, the specific services provided, pricing, and the total amount due. Moreover, it should offer clear sections for payment deadlines, discounts, taxes, and any other relevant terms. Flexibility and ease of editing are essential for quickly tailoring the form to individual client needs.

In addition to clarity, accessibility is another important consideration. The ability to save and share the form electronically ensures clients receive the documents instantly and can keep digital copies for future reference. This level of professionalism fosters a positive client relationship and contributes to smoother financial transactions.

Benefits of Using a Billing Document

Having a professional document to outline the costs and services rendered is essential for any business providing repair or maintenance work. Not only does it help with tracking payments and services, but it also contributes to building trust and transparency with clients. A well-organized billing record ensures that both the service provider and the client have a clear understanding of the transaction, reducing the chances of misunderstandings or disputes.

Improved Accuracy and Clarity

Using a formalized billing structure helps eliminate confusion and ensures that all necessary details are included. Each section can clearly describe the work done, materials used, labor charges, and any applicable taxes or discounts. This reduces errors and ensures both parties have the same information. With all the charges clearly outlined, clients can easily verify the costs, leading to fewer questions and smoother transactions.

Streamlined Financial Management

For businesses, having a consistent way to document payments aids in financial planning and tracking. It makes it easier to keep records for accounting and tax purposes, as all charges are documented in a structured way. Moreover, when a payment request is issued promptly after services are provided, it helps to maintain a steady cash flow and avoid delayed payments. A professional billing form also improves the overall efficiency of your workflow, saving time and reducing administrative effort.

Increased Professionalism is another significant benefit. When clients receive a neatly organized payment document, it reflects well on the business and helps establish a trustworthy image. A professional format can instill confidence in clients, showing them that the business is organized and reliable.

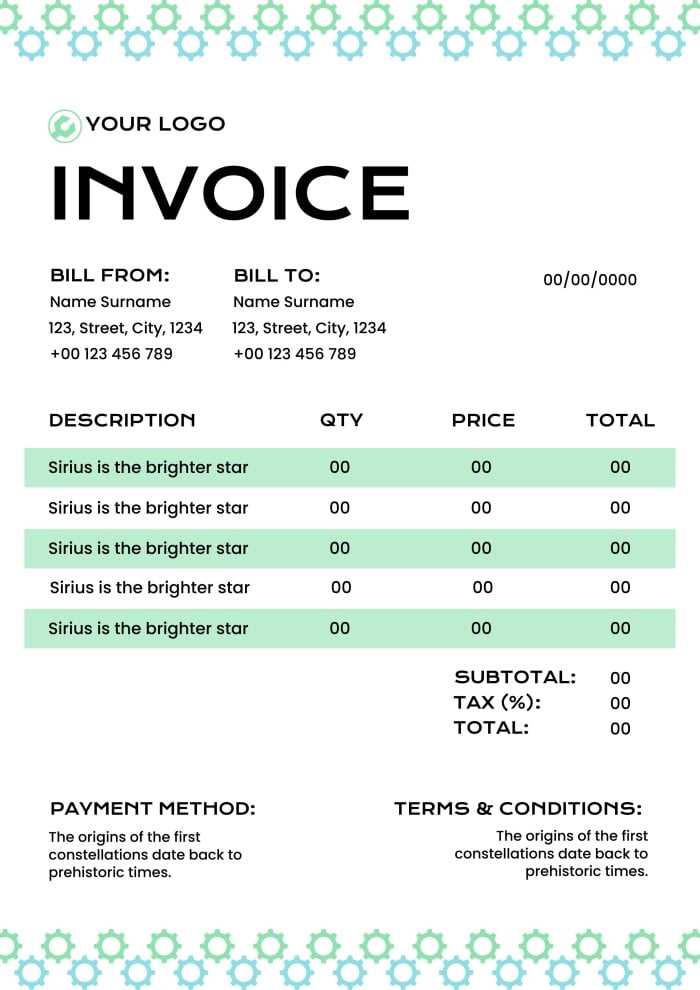

How to Customize Your Billing Document

Customizing your payment request form allows you to tailor it to your specific business needs, ensuring that it reflects your brand identity while clearly communicating essential details to clients. A personalized document not only enhances professionalism but also provides flexibility in how you present your services, pricing, and payment terms. Customizing a billing form is a straightforward process that can greatly improve your business’s efficiency and client relationships.

Adding Your Business Information

The first step in customizing your document is to include your business’s contact details. This should feature your company name, address, phone number, and email, making it easy for clients to reach out if they have questions or need further information. Including your logo adds a personal touch and reinforces your brand image. Clear identification helps establish trust and professionalism, which is essential for client satisfaction.

Modifying Service and Pricing Sections

Next, tailor the service descriptions and pricing sections to accurately reflect the work you perform. Each service provided should be clearly listed, with a brief description of what was done. You can also specify labor hours, materials used, and individual costs. Providing detailed breakdowns allows clients to understand exactly what they are being charged for. It is also helpful to offer flexible payment terms, such as installment options or discounts for early payment, based on your business policies.

By making these adjustments, you ensure that your documents are aligned with your business operations, improving both clarity and professionalism in every transaction.

Why Choose PDF Format for Billing Documents

When creating and sharing payment documents, choosing the right format is essential for efficiency and accessibility. A widely used option for digital documents is the format that ensures consistency across devices and operating systems. This particular format allows businesses to send clear, professional-looking payment forms that retain their layout and design, no matter where or how they are opened. It provides numerous advantages for both service providers and clients, making it a top choice for financial transactions.

Key Advantages of Using This Format

- Universal Compatibility: Documents in this format can be opened on almost any device, whether it’s a computer, smartphone, or tablet, without losing formatting or quality.

- Security: The format allows you to add password protection and restrict editing, ensuring that sensitive financial details are kept safe from unauthorized changes.

- Professional Appearance: This format preserves the design and layout of your document, ensuring that it always looks polished and well-organized, which helps maintain a professional image.

- Easy Storage and Archiving: Files are compact and easy to store digitally, making it simple to organize and retrieve documents when needed for accounting or future reference.

- Print-Ready: These files can be printed without any distortion, preserving the exact format and ensuring that physical copies are clear and easy to read.

How This Format Enhances Workflow

Using this particular format streamlines communication and eliminates the need for time-consuming troubleshooting that can occur with other document types. With customizable features like digital signatures and automatic calculation tools, businesses can speed up the process of generating and sending payment forms. Additionally, the ease with which these files can be shared via email or cloud storage further enhances their practicality, allowing for quick distribution and better management of financial records.

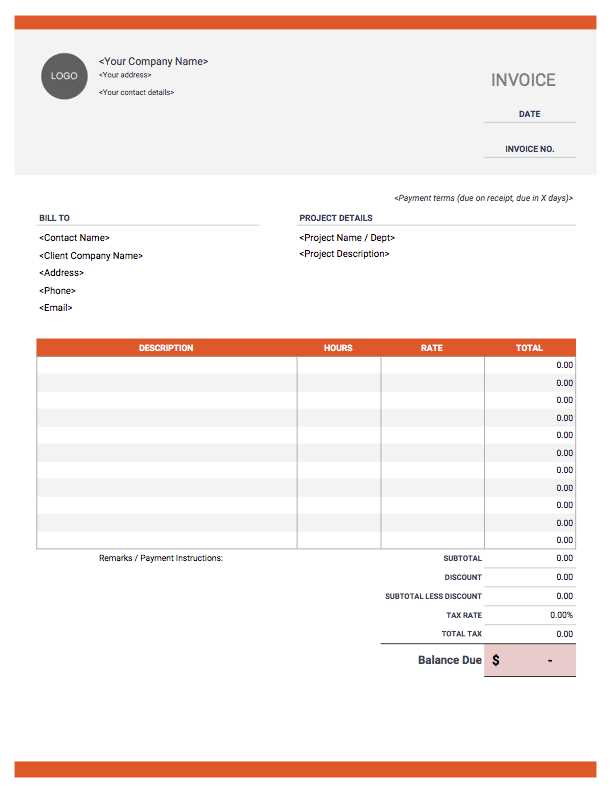

Essential Information to Include in a Billing Document

To ensure clarity and avoid confusion, it is important that every payment request form contains all necessary details about the services provided, the charges, and the terms of payment. An incomplete or unclear document can lead to misunderstandings or delays in payment. Including the right information not only helps your clients understand the charges but also makes the process smoother for both parties.

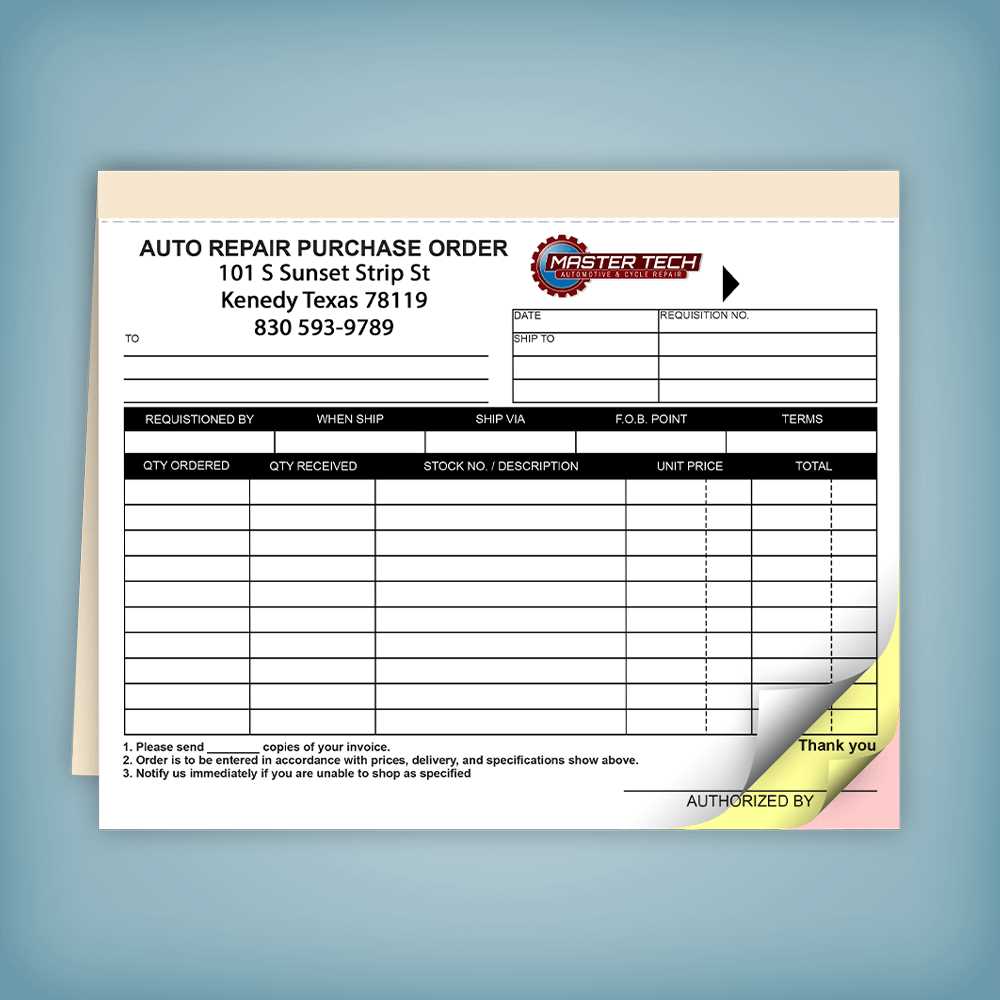

Client and Service Provider Information

At the top of the document, clearly state both your business’s and the client’s contact information. This should include your company name, address, phone number, and email address, as well as the client’s name, address, and contact details. Having these readily available helps avoid confusion and ensures easy follow-up if needed.

Details of Services Rendered and Costs

Provide a detailed breakdown of the work completed. This should include a description of each service, the quantity (if applicable), and the cost for each item or task. Clearly list any labor charges, materials used, and applicable taxes. If the service involves multiple steps or products, include a subtotal for each section. This transparency helps clients understand exactly what they are being charged for and ensures that no information is overlooked.

Additionally, include the total amount due, payment terms (such as due date or late fees), and any relevant discounts or special offers. A well-organized document will allow clients to quickly verify the charges and reduce the chance of disputes later.

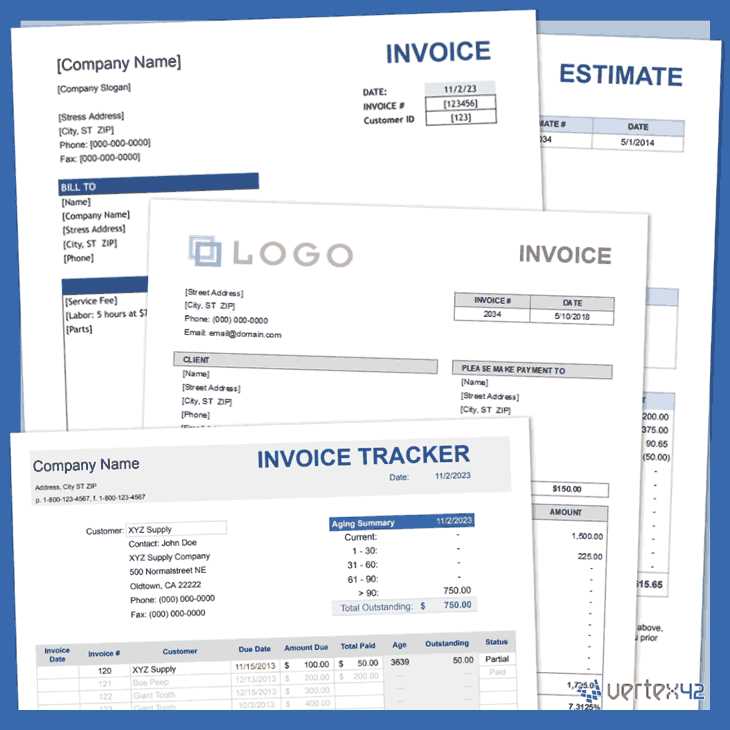

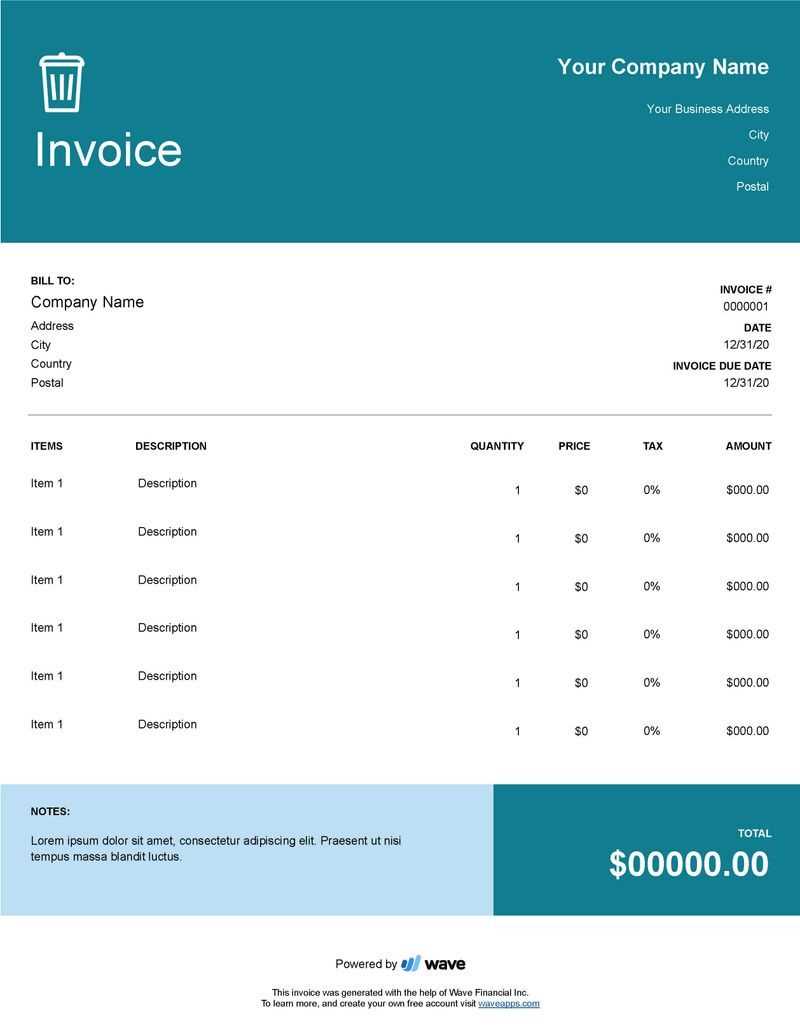

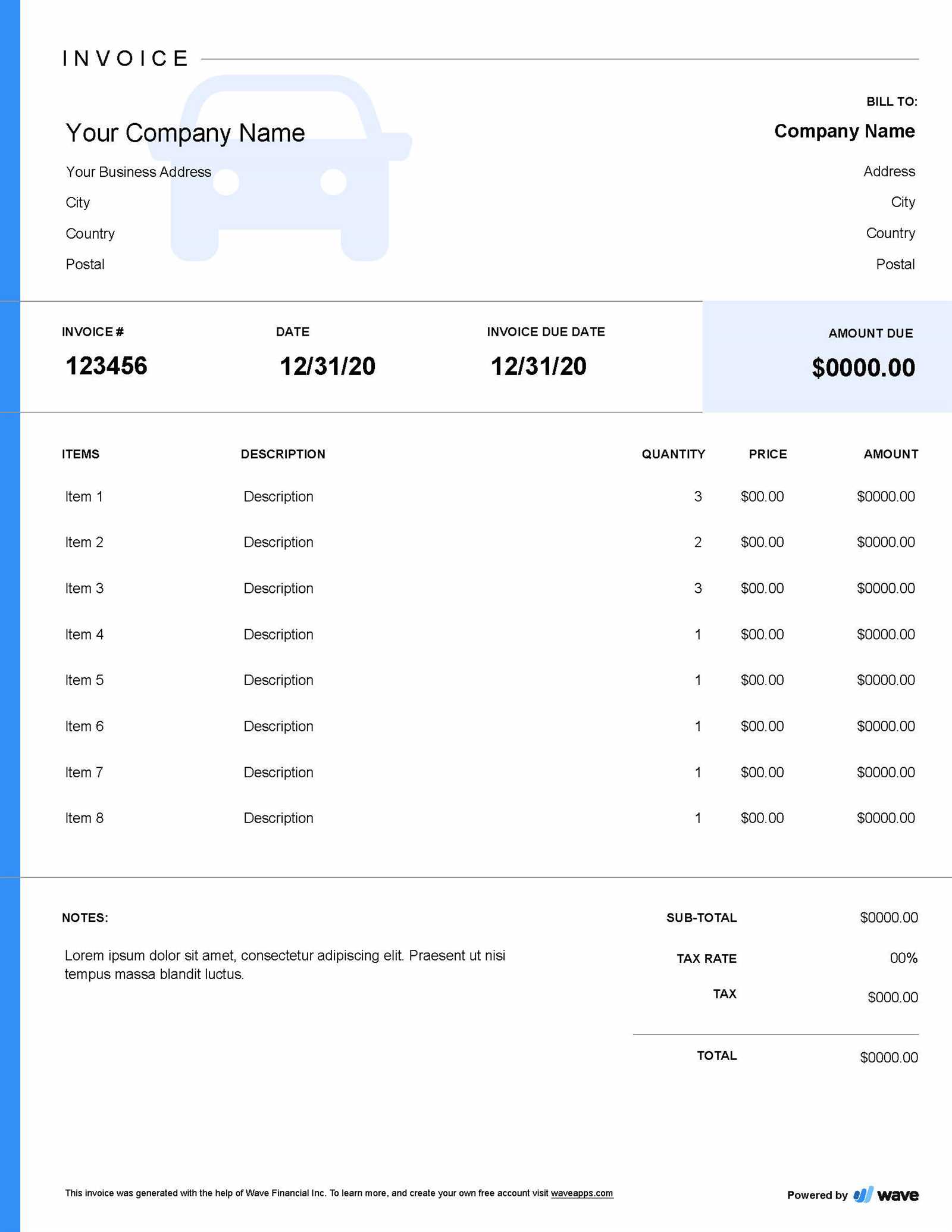

Free Downloadable Billing Forms

For businesses that want to simplify their payment request process, using a ready-made document can save both time and effort. Free downloadable options offer a convenient solution for creating professional, accurate payment forms without the need for specialized software or design skills. These forms can be easily accessed, customized, and used to suit the specific needs of your business, allowing for quick and efficient billing.

Many websites offer a variety of formats to choose from, ranging from basic to more detailed documents that can accommodate various service types. These free resources allow you to download a form that can be filled in with your business information, services rendered, pricing, and payment terms. Whether you’re looking for a simple layout or something more intricate, there’s likely a downloadable option that fits your needs.

Using a pre-designed form also ensures consistency across all your transactions, maintaining a professional appearance while reducing the risk of errors. Simply customize the details for each client and job, and you’re ready to send it out for payment. Best of all, these resources are free, making them a cost-effective choice for businesses of all sizes.

Common Mistakes in Billing Documents

Even the most experienced service providers can make errors when preparing payment forms, which can lead to delays in payments and misunderstandings with clients. Common mistakes often involve missing details, incorrect calculations, or unclear terms, all of which can create confusion. By recognizing and avoiding these pitfalls, you can ensure that your billing process is smooth and professional.

Frequent Errors to Avoid

- Missing Contact Information: Failing to include complete contact details for both the service provider and the client can lead to communication issues and confusion.

- Inaccurate Pricing or Totals: Mistakes in pricing, such as incorrect service fees or missing charges, can lead to disputes. Always double-check your numbers before sending out the document.

- Omitting Service Descriptions: Not clearly outlining the services provided can cause misunderstandings. Each task should be described in detail so the client knows exactly what they are paying for.

- Unclear Payment Terms: Lack of clarity about payment due dates, late fees, or available payment methods can delay payments and cause confusion. Ensure these are clearly stated.

- Not Including Tax Information: Failing to include tax rates or calculations can result in clients questioning the total amount due. Be sure to show tax rates if applicable.

How to Prevent These Mistakes

To avoid these common errors, take the time to carefully review each document before sending it out. Use a structured, easy-to-follow format that includes all the necessary information. Additionally, consider using an automated system or pre-designed document that calculates totals and applies tax rates for you. This can significantly reduce human error and save you time.

How to Convert Your Billing Document to a Digital Format

Once you’ve created a payment request document, converting it into a widely accepted, universally accessible format can make sharing and storing the file much easier. The digital format ensures that your document maintains its structure and appearance across different devices and operating systems. Whether you need to email the document to a client or save it for your records, converting it into a reliable format streamlines the process.

Steps to Convert Your Document

- Use Built-In Options in Word Processors: Most word processing software, such as Microsoft Word or Google Docs, offers an easy “Save as” or “Export” feature that allows you to convert your document into a standard digital format.

- Online Conversion Tools: If you’re working with a different format, online conversion tools can help. Simply upload your document to one of the many free websites that offer file conversion, and you’ll receive a link to download the file in your preferred format.

- Printing to Digital: Many operating systems now allow you to “print” any document to a digital file. By selecting the “Print” option and choosing a digital format as your printer, you can create a file without needing any specialized software.

Tips for a Smooth Conversion

- Check Formatting: After converting your document, ensure that all text, images, and tables remain properly aligned and legible.

- Optimize File Size: If your document contains high-resolution images or large files, consider compressing the digital file to make it easier to share and store.

- Double-Check Accessibility: Make sure that the digital version can be easily opened on various devices, ensuring that clients can access the document without issues.

By following these simple steps, you can easily convert your payment documents into a digital format, ensuring greater accessibility, security, and professionalism in your business communications.

Best Practices for Billing Documents

Creating clear and effective payment requests is essential for maintaining professionalism and ensuring smooth transactions with clients. By following best practices when preparing your financial documents, you can avoid common mistakes, improve client satisfaction, and expedite payment processing. Implementing these strategies helps your business maintain consistency, organization, and transparency in all billing interactions.

Key Practices to Follow

- Use Clear and Concise Descriptions: Provide detailed descriptions of the work completed, including the time spent and any materials used. This transparency helps clients understand the charges and minimizes misunderstandings.

- Organize Information Logically: Structure the document in a way that makes it easy to read. Start with your contact information, followed by the client’s details, a clear list of services, costs, taxes, and payment terms. A clean, logical format makes the document professional and easy to follow.

- Double-Check for Accuracy: Ensure that all prices, quantities, and totals are correct. Mistakes in calculations or missed items can lead to confusion and delay payments.

- Be Clear About Payment Terms: Always include clear payment terms, such as the due date, acceptable payment methods, and any late fees or discounts for early payment. This helps avoid ambiguity and sets expectations from the start.

- Maintain Consistency in Format: Whether you’re creating a document manually or using a pre-designed format, consistency is key. Stick to the same layout and design across all your billing forms to present a unified and professional image.

- Ensure Legal Compliance: Include any necessary legal disclaimers or compliance-related information. This might include tax details or industry-specific regulations that are required by law.

Additional Tips for Streamlining the Process

- Automate Calculations: Using tools or software that automatically calculate totals and taxes can help reduce human error and save time.

- Use Digital Formats for Easy Distribution: Sending your documents electronica

Automating Your Billing Process

Automating your payment documentation process can save valuable time, reduce errors, and improve overall efficiency in your business operations. With the right tools, you can streamline the creation, sending, and tracking of payment requests. This not only speeds up the process but also ensures consistency and accuracy across all transactions, making it easier for both you and your clients.

Benefits of Automation

Automation offers several advantages, particularly for businesses that handle a high volume of transactions. Here are some key benefits:

- Time Savings: Automatically generating payment documents reduces the time spent on manual data entry and formatting, allowing you to focus on other aspects of your business.

- Improved Accuracy: With automated systems, the risk of errors in pricing, calculations, or service descriptions is minimized.

- Faster Payment Processing: When payment requests are created and sent quickly, it can lead to faster payments and better cash flow management.

- Better Record-Keeping: Automated systems typically track all payment requests and their statuses, making it easier to organize and retrieve financial documents for future reference or accounting purposes.

How Automation Works

Automation tools allow you to pre-set your service details, pricing, and client information. Once a job is completed, the system can automatically generate a payment document with all the required details and send it to the client via email. Below is a simple example of how the process can work:

Step Action Outcome 1 Enter Client Information Client details are saved in the system for easy access in future transactions. 2 Define Service and Pricing Details of the service and the pricing structure are pre-set and available for quick use. 3 Generate Document The system automatically generates the payment form with all necessary details. 4 Send to Client The document is sent to the client via email with payment instructions and terms. By integrating such systems, you can automate your entire billing cycle, from creating and sending forms to tracking payment statuses. This approach makes your business more efficient and your financial management smoother.

Billing Form for Small Businesses

For small businesses, creating accurate and professional payment request documents is crucial for maintaining cash flow and client trust. A well-structured financial form ensures that all essential details are communicated clearly, making it easier for clients to understand the charges and pay promptly. Small business owners can benefit from using a customizable billing document that suits their specific needs, allowing for a more streamlined billing process.

Key Features for Small Business Billing Forms

A well-designed payment request form for small businesses should include several key elements to ensure clarity and efficiency:

- Business and Client Information: Clearly list both the business’s and the client’s contact information. This makes it easier for clients to reach out for questions or concerns.

- Service Descriptions: Provide detailed descriptions of the work performed. This helps clients understand exactly what they are paying for, reducing confusion or disputes.

- Clear Pricing Breakdown: Include an itemized list of charges, including labor, materials, and any applicable taxes. A transparent pricing structure builds trust with clients.

- Payment Terms: Clearly state the due date, payment methods accepted, and any penalties for late payments. Setting clear expectations helps avoid payment delays.

Why Small Businesses Should Use Customizable Forms

Using customizable forms allows small businesses to adjust the document to their unique needs. Whether you need to add extra fields for discounts, include a logo for branding, or adjust the layout to fit specific industry requirements, customization ensures your form fits your business model. With easy-to-use tools, you can create professional-looking documents in minutes, ensuring consistency in all your financial transactions.

By adopting a structured, professional billing form, small businesses can save time, reduce errors, and improve their financial processes. Customizing your payment requests helps set your business apart and keeps your financial operations organized.

Legal Considerations for Billing Documents

When preparing payment request documents, it’s essential to consider the legal aspects involved in ensuring that the document is enforceable and complies with relevant regulations. Proper documentation not only ensures timely payments but also helps protect your business in the event of disputes. Understanding the legal requirements and including the necessary information can help safeguard your business and avoid potential legal complications.

Key Legal Elements to Include

- Business Information: Ensure that your company name, address, and registration details are included. This helps establish the legitimacy of your business and provides clarity in case of legal issues.

- Client Information: Include the client’s full name and contact details. This ensures that both parties are clearly identified and can be contacted if needed.

- Clear Payment Terms: Clearly state the payment terms, including the due date, any late fees, and the acceptable methods of payment. These terms must be agreed upon by both parties to avoid future conflicts.

- Tax Information: Depending on your location, certain taxes may need to be included. Be sure to include the applicable tax rates and calculations as required by law.

- Legal Disclaimers: Include any necessary legal disclaimers, such as your right to take legal action in case of non-payment. This can serve as a safeguard for your business and ensure clients are aware of your legal recourse.

Best Practices for Compliance

- Familiarize Yourself with Local Laws: Different regions may have specific legal requirements for payment documentation. Ensure you’re aware of any regulations that apply to your business.

- Maintain Accurate Records: Keep a copy of all documents, including payment requests, receipts, and correspondence. These records will be essential if any legal disputes arise.

- Seek Legal Advice: If you’re unsure about the legal requirements or need help with terms and conditions, it’s always a good idea to consult with a legal professional to ensure your documents are compliant.

By adhering to these legal considerations, you ensure that your payment request forms not only serve their purpose in collecting payments but also protect your business and prevent potential legal issues.

Creating Professional-Looking Billing Documents Easily

Producing a professional and polished payment document is essential for any business looking to maintain credibility and foster trust with clients. Thankfully, creating such documents doesn’t require advanced design skills or expensive software. With the right tools and a structured approach, you can easily craft well-organized, clear, and professional-looking financial statements that reflect positively on your business.

Steps to Achieve a Professional Look

- Use Clean and Simple Layouts: A clutter-free design is the key to readability. Stick to basic, well-structured layouts that prioritize clarity. Avoid using too many fonts, colors, or complex graphics.

- Incorporate Your Branding: Including your logo, business name, and brand colors gives your payment documents a personalized touch. This not only adds to your business identity but also helps your documents look cohesive and professional.

- Use Clear Headings and Sections: Break down the document into clearly marked sections (e.g., “Services Provided,” “Total Amount Due”) to make it easy for the client to navigate. This improves the overall user experience and ensures that important information stands out.

- Ensure Legibility: Make sure the font size is readable and that there’s enough contrast between the text and the background. Avoid using overly decorative fonts that could make the text hard to read.

- Maintain Consistency: Consistency across all of your payment documents is crucial. Use the same fonts, formatting, and layout style for all your documents to reinforce your professional image.

Helpful Tools for Creating Professional Documents

- Online Generators: There are many online platforms available that allow you to generate professional payment documents quickly. These tools often offer pre-designed templates that you can easily customize with your information.

- Spreadsheet Software: Programs like Microsoft Excel or Google Sheets provide customizable templates with automatic calculations for easy creation and accurate totals.

- Word Processing Software: If you’re looking for more design flexibility, word processors like Microsoft Word offer easy-to-use templates and formatting options that can help you create polished documents without much effort.

By following these simple steps and utilizing the right tools, creating professional payment forms becomes an easy and efficient process. With a little attention to detail, you can ensure that your documents are both functional and visually appealing, enhancing your business’s credibility and client satisfaction.

How to Manage and Track Billing Documents

Managing and tracking payment requests efficiently is essential for maintaining a smooth workflow and ensuring timely payments. By staying organized and using the right tools, businesses can avoid missed deadlines, reduce the risk of errors, and improve their overall cash flow. Whether you’re a small business owner or managing a larger operation, setting up a proper system to keep track of all financial documents is crucial.

Steps to Effectively Manage Billing Documents

- Establish a Consistent Naming System: Give each document a unique reference number or a naming convention that includes the client’s name or job number. This will help you easily locate specific documents and avoid confusion.

- Create a Centralized Record System: Whether you use digital software or a physical filing system, keeping all payment requests in one place ensures you have quick access to all your records. This can help streamline your accounting process and make audits easier.

- Track Payment Status: Keep a log of payment statuses for each document. Use categories like “Paid,” “Pending,” or “Overdue” to easily monitor the progress of each transaction and avoid forgetting follow-ups.

- Set Payment Reminders: Set automatic reminders for due dates or overdue payments. This will prompt you to follow up with clients in a timely manner and avoid delays in cash flow.

- Store Documents Securely: Ensure that your records are stored in a secure manner, particularly if they contain sensitive client information. Use cloud-based storage with backup options or encrypted files for maximum security.

Tools for Tracking Payment Documents

- Accounting Software: Tools like QuickBooks, FreshBooks, and Xero allow you to manage, track, and automate the entire billing process, including sending reminders, generating reports, and monitoring payment statuses.

- Spreadsheet Tools: Programs like Microsoft Excel or Google Sheets can be set up with custom tracking systems. These are cost-effective solutions that provide flexibility and control over your billing documents.

- Cloud Storage Services: Using services like Google Drive or Dropbox can help store and share documents safely, allowing you to access your financial records from anywhere and keep them organized by folders or tags.

By following these steps and utilizing the right tools, you can efficiently manage and track your payment documents. This will help ensure that no payment is overlooked, clients are billed on time, and your financial records remain accurate and up to date.

Protecting Your Billing Document Information

Safeguarding the sensitive details within your payment documents is crucial for protecting both your business and your clients. Whether it’s personal information, payment details, or service descriptions, keeping this data secure prevents fraud, unauthorized access, and data breaches. Implementing proper security measures ensures that your financial records remain private and compliant with relevant regulations.

Methods for Securing Payment Information

- Encryption: Encrypting your financial documents ensures that only authorized users can access or read the information. This is especially important when sending sensitive documents via email or online platforms.

- Strong Password Protection: Use strong, unique passwords for any software or online storage where payment records are kept. This adds an additional layer of security to prevent unauthorized access.

- Limit Access: Ensure that only authorized personnel have access to payment documents. Restricting access to sensitive information reduces the risk of accidental leaks or malicious attacks.

- Regular Backups: Regularly back up your payment records to secure locations. This can prevent data loss in the event of a system failure or cyberattack.

- Secure Storage Solutions: Store payment documents in secure, encrypted cloud storage or password-protected systems. Avoid storing sensitive information on unprotected devices or in unsecured physical files.

Best Practices for Compliance and Risk Management

- Comply with Data Protection Regulations: Make sure you are following the necessary local and international regulations, such as GDPR or HIPAA, depending on your region. This ensures that you are legally compliant and helps protect your customers’ information.

- Monitor for Fraudulent Activity: Regularly monitor your financial records for any unusual or unauthorized transactions. Early detection can help you prevent further issues and mitigate risks.

- Educate Your Team: Ensure that everyone involved in handling financial documents understands the importance of security. Provide training on how to properly store, share, and dispose of sensitive records.

By taking these precautions, you can ensure that your payment records remain safe and secure, fostering trust with your clients and avoiding potential legal or financial issues.

Using Billing Documents for Tax Purposes

When it comes to managing taxes, having accurate and organized financial records is essential. Properly formatted billing documents serve as an important tool for tax reporting, ensuring that all transactions are clearly documented and can be easily referenced when filing your taxes. These records not only help maintain compliance but also simplify the process of claiming deductions, reporting income, and managing business expenses.

Why Billing Documents Are Crucial for Tax Filing

- Income Verification: Well-documented payment requests show exactly how much your business has earned, making it easier to verify income when filing your taxes. Clear records help avoid discrepancies with the tax authorities.

- Tax Deductions: Detailed billing forms allow you to itemize business expenses, which may qualify for tax deductions. Accurate documentation of services, parts, and labor costs can reduce your taxable income.

- Proof of Transactions: Organized payment records serve as proof of sales, protecting your business in case of an audit. Proper documentation provides clear evidence of the transactions that occurred, making it easier to substantiate your claims.

- VAT and Sales Tax Compliance: In many regions, businesses must collect sales tax on certain goods or services. A detailed document should clearly show the amount of tax collected, helping you comply with tax laws and report it accurately.

How to Organize Your Billing Documents for Tax Purposes

- Store Documents Electronically: Digital records are easier to organize, search, and back up. Use cloud-based storage or accounting software to store your billing documents in a secure, accessible location.

- Maintain Detailed Records: Include all necessary information such as client details, services rendered, payment terms, and taxes applied. The more comprehensive your documents, the easier it will be to prepare your tax returns.

- Track Payment Status: Monitor whether payments have been made, overdue, or partially paid. This will help you account for all income correctly and reduce the chances of missing payments during tax reporting.

- Review Regularly: Regularly reviewing your payment records will ensure that everything is accurate and up-to-date. Make it a habit to organize and verify documents at least once a month to avoid last-minute issues when tax season arrives.

Using properly structured billing documents for tax purposes can save you time and money while ensuring compliance with tax laws. By keeping these records organized and accessible, you’ll streamline your tax preparation and reduce the risk of errors during your filing process.