Furniture Invoice Template for Streamlined Billing

Efficiently managing billing processes is essential for any business. Using well-structured documents that capture all the necessary details ensures smooth transactions and clear communication with clients. A well-crafted bill can reflect professionalism and boost customer confidence.

Customizable billing forms offer flexibility, allowing businesses to easily adjust their documents based on specific needs. Whether for regular sales, custom orders, or services, having a consistent format helps maintain clarity and organization. These tools allow quick updates and precise tracking of payments, making them invaluable for both small and large enterprises.

In this guide, we will explore the key aspects of creating accurate and professional documents that fulfill legal and business requirements. Understanding the essential elements to include and how to tailor them for your specific needs is crucial for efficient financial management.

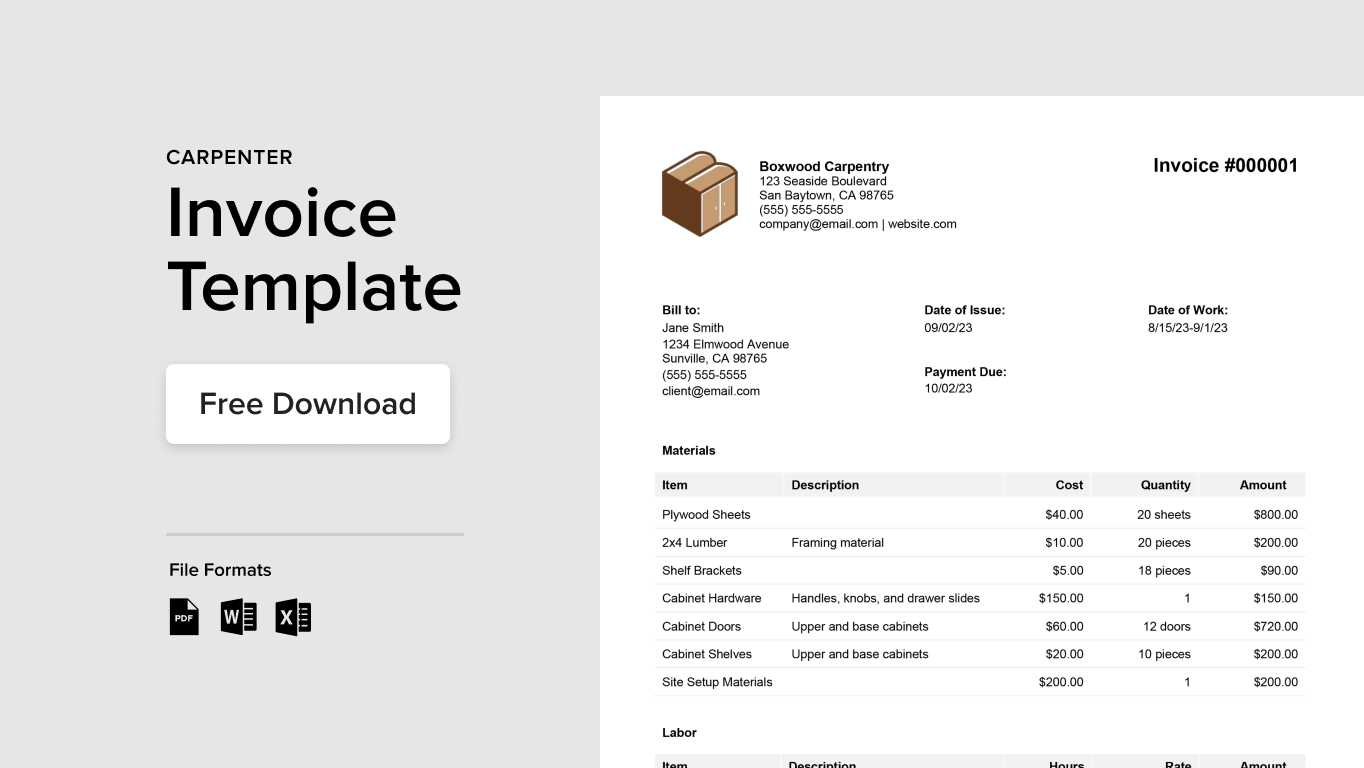

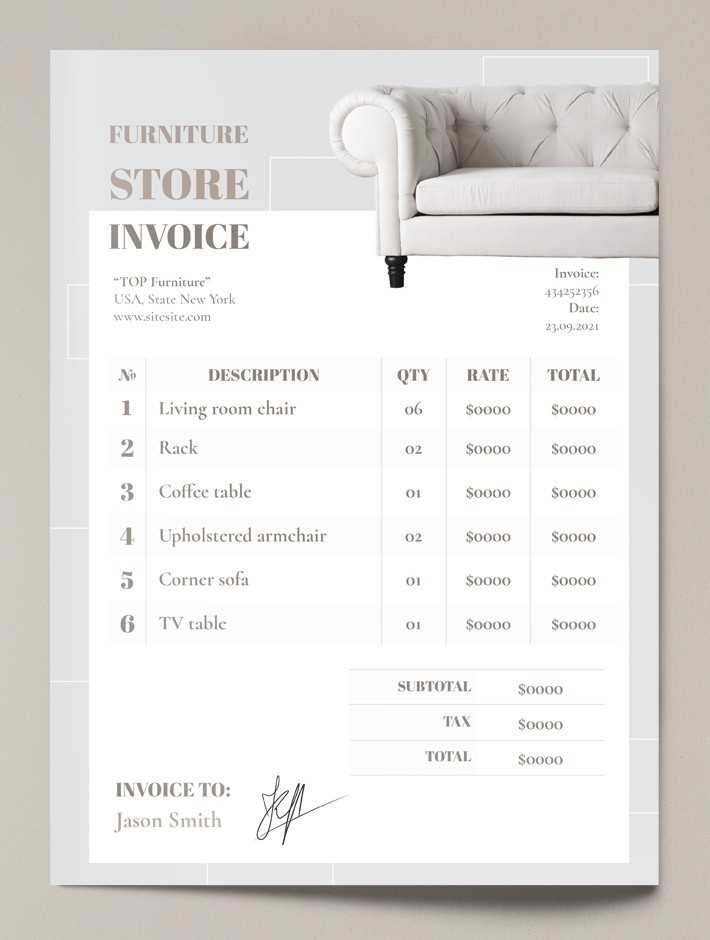

Furniture Invoice Template Overview

When running a business, having a reliable and standardized method for documenting financial transactions is crucial. Whether you’re dealing with sales, repairs, or custom-made items, ensuring that all necessary information is recorded correctly is essential for maintaining professionalism and clarity. A well-organized document is not only a proof of the transaction but also serves as a valuable tool for tracking payments and managing finances.

A well-structured billing document includes key elements that help businesses remain efficient and avoid confusion. These documents can be customized to meet the specific needs of any business, ensuring that they capture all the essential information without unnecessary complexity.

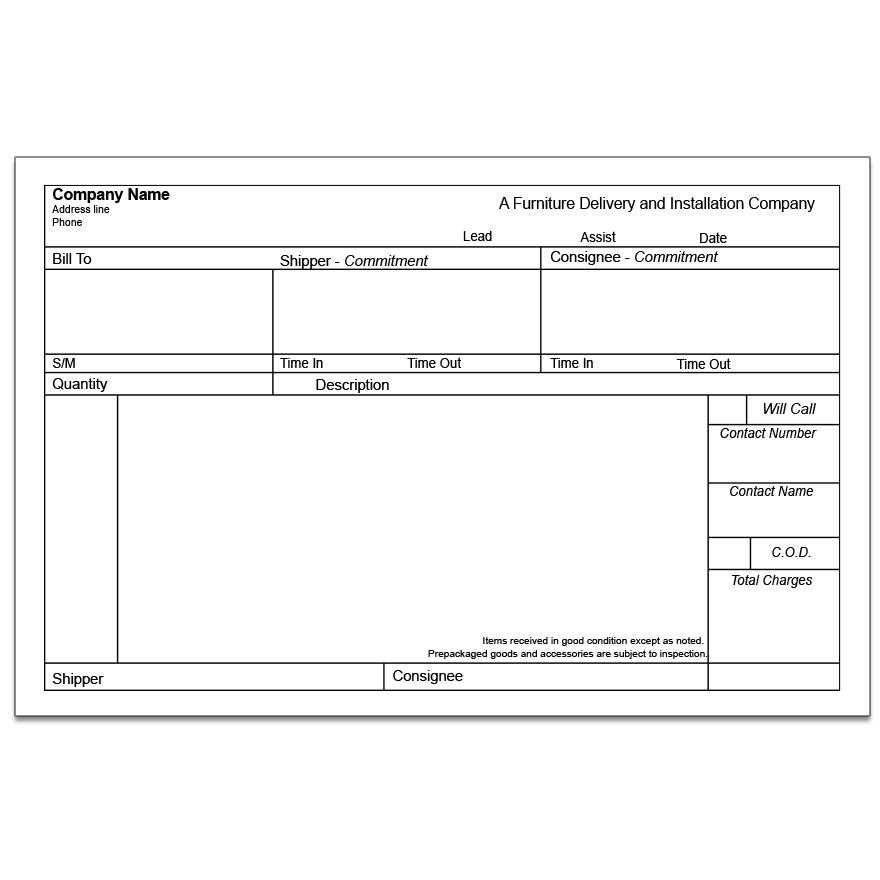

- Client information: Name, address, and contact details.

- Transaction details: Description of goods or services provided, including quantities and unit prices.

- Payment terms: Clear instructions regarding the amount due, payment methods, and deadlines.

- Legal disclaimers: Any relevant terms and conditions that apply to the transaction.

With the right format and all the required information included, these documents ensure smooth interactions between businesses and their clients. This structure allows businesses to maintain a professional image and helps avoid payment delays or disputes.

Why Use a Furniture Invoice Template

Having a standardized document for recording sales or services is essential for any business. A pre-designed structure helps streamline the process, ensuring that all important details are captured correctly and consistently. By using a ready-made format, companies save time and reduce the risk of errors, providing a professional and organized appearance to clients.

Efficiency and Consistency

Utilizing a structured format enables businesses to issue bills more efficiently. A consistent approach eliminates confusion and ensures that all necessary information is included every time. This also allows for quicker processing, whether it’s for customer transactions, order fulfillment, or service completion.

Improved Financial Management

Well-structured documents are crucial for tracking payments and maintaining clear financial records. By using a consistent format, businesses can easily monitor outstanding amounts, due dates, and payment methods, reducing the likelihood of mistakes and disputes. This simplicity also makes it easier to file and reference past transactions for accounting purposes.

| Benefit | Explanation |

|---|---|

| Time-saving | Pre-built structure reduces the time spent creating documents from scratch. |

| Accuracy | Clear layout ensures all necessary details are included without omissions. |

| Professionalism | A polished format creates a professional image and builds customer trust. |

Overall, using a pre-designed document enhances both the efficiency and the reliability of your business processes, contributing to better organization and smoother client interactions.

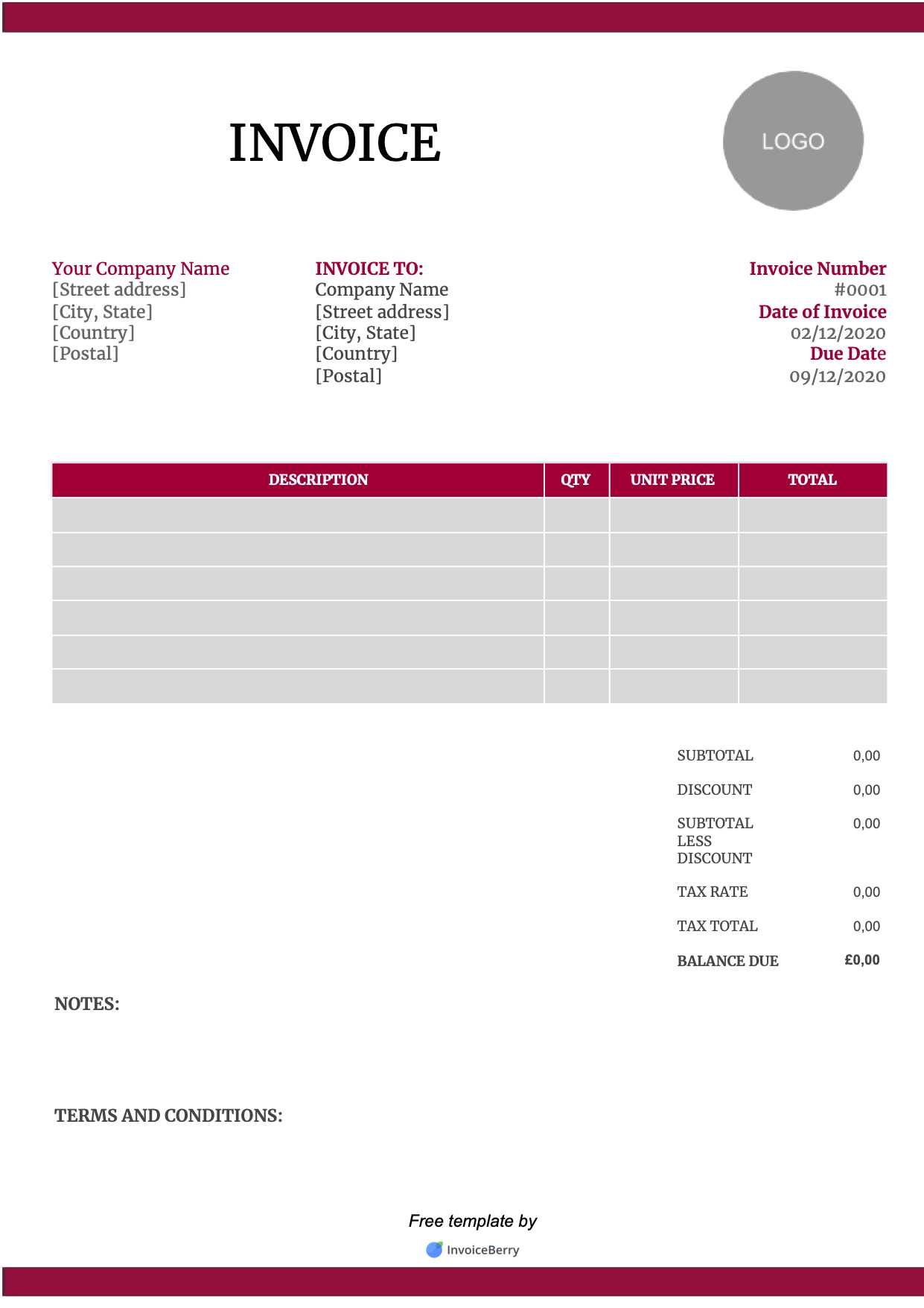

Key Features of an Invoice Template

When creating a billing document, it’s important to ensure that it includes all the essential elements for clarity, professionalism, and accuracy. A well-designed document structure helps both businesses and clients keep track of transactions and ensures that all necessary details are clearly outlined. Below are the key features that should be included to make sure the document is effective and comprehensive.

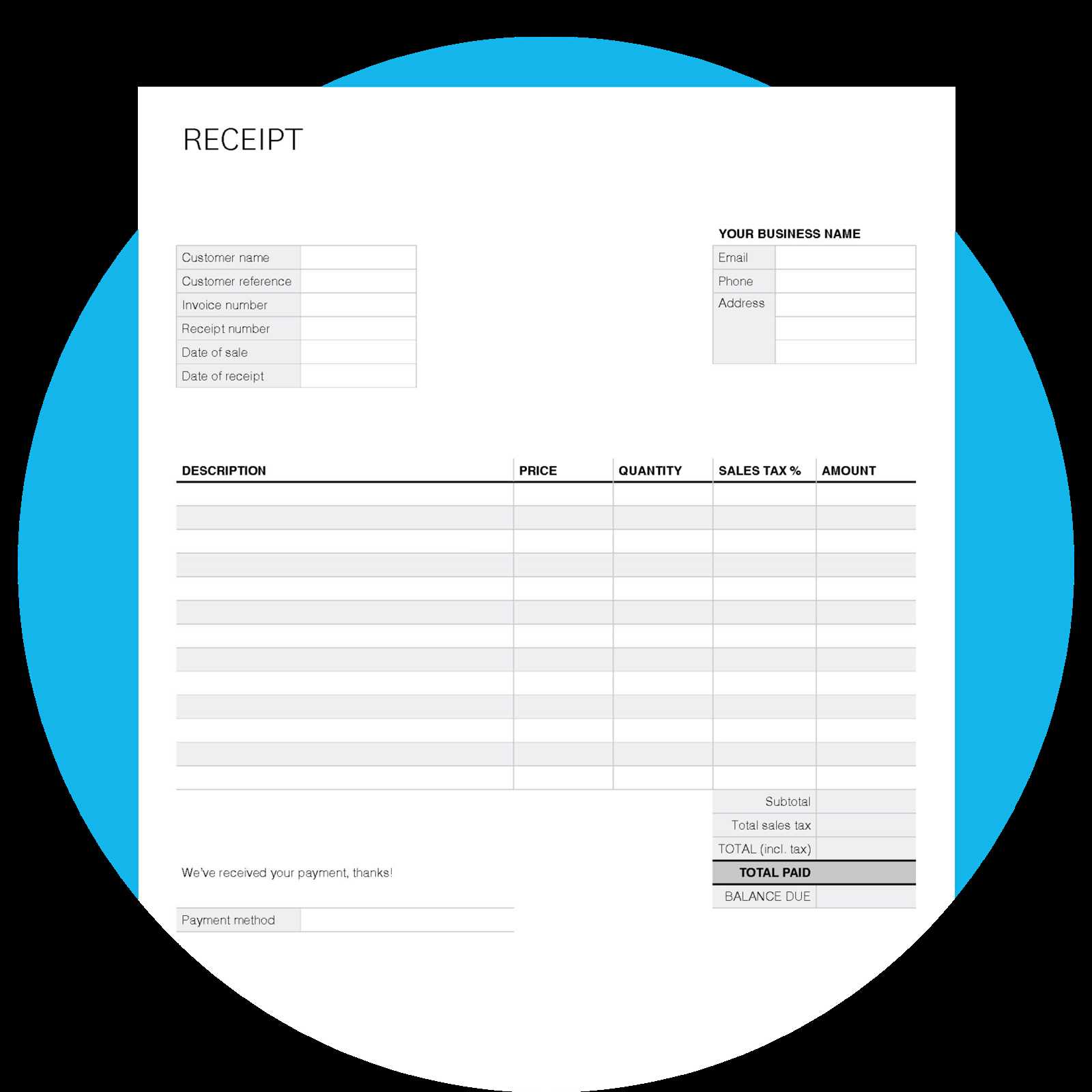

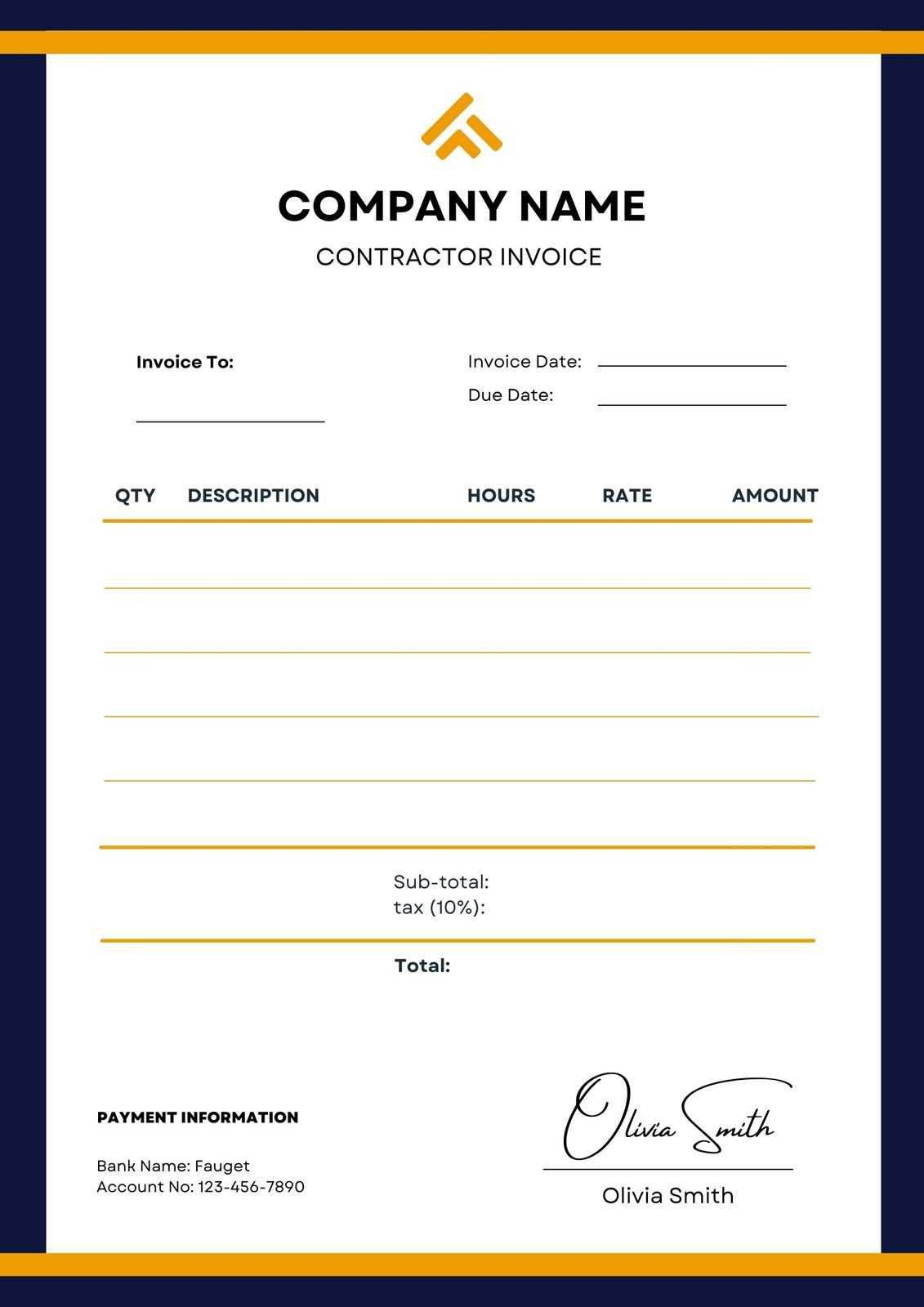

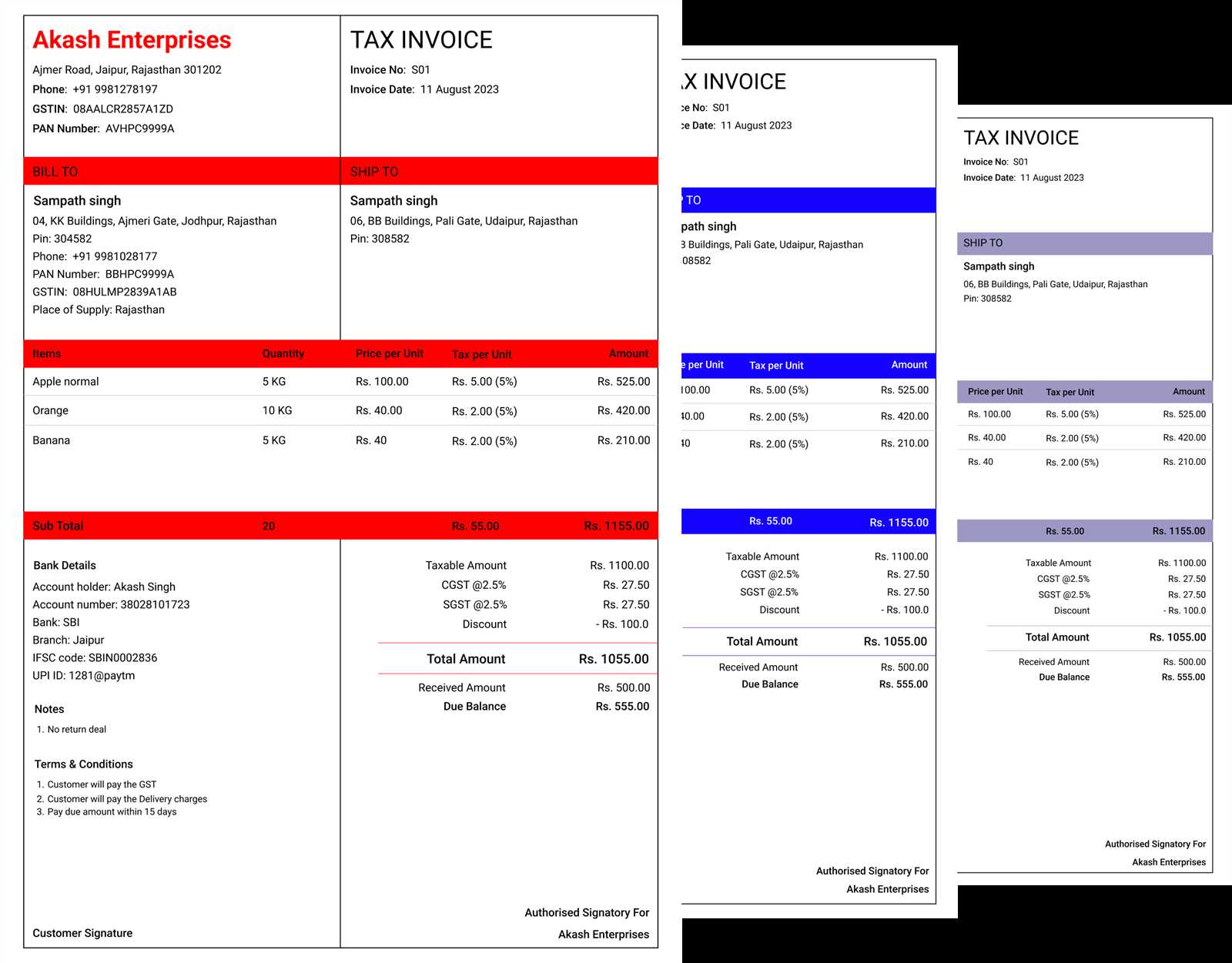

- Business Details: Include the name, address, phone number, and email of the company issuing the document.

- Client Information: Make sure to add the client’s full name, address, and contact details to ensure proper identification.

- Unique Identification Number: Each document should have a unique reference number for easy tracking and referencing.

- Product or Service Descriptions: Clearly describe the items sold or services provided, including quantity, unit price, and any applicable discounts.

- Payment Terms: Include payment deadlines, methods accepted, and any penalties for late payments.

- Tax Information: Clearly indicate the applicable taxes, whether as a separate line item or integrated into the total amount.

- Total Amount Due: The final amount to be paid should be easy to identify, including all charges and taxes.

These features ensure that the document is easy to understand, legally compliant, and helpful for both businesses and clients when tracking payments or resolving issues. By including these key details, businesses can present a professional and organized appearance, which is crucial for building long-term customer relationships.

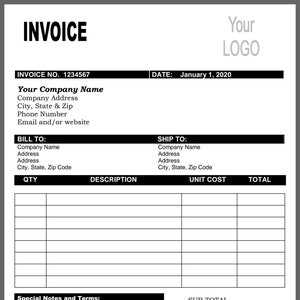

How to Customize Your Template

Customizing a billing document is essential for ensuring that it fits the specific needs of your business and presents the information in a professional manner. By adjusting various elements, you can tailor the structure to reflect your brand, make the document easier to read, and ensure all relevant details are included. Here’s how to customize your document to suit your unique requirements.

Step 1: Modify Business and Client Information

The first step in customizing your document is updating the header with your company details. This includes your business name, logo, contact information, and any legal disclaimers. Additionally, ensure that the client’s name, address, and contact details are correctly listed for accurate delivery and follow-ups.

- Update your company name and logo at the top of the page.

- Ensure your business address, phone number, and email are clearly visible.

- Check the accuracy of the client’s information, including their shipping address.

Step 2: Tailor the Product or Service Section

Next, modify the section that details the goods or services provided. This is where you describe each item, its quantity, unit price, and any additional discounts or fees. Be sure to adjust the format according to the complexity of the order or service provided.

- Describe each item or service clearly and in detail.

- Include quantity, price per unit, and total cost for each line item.

- Add any applicable discounts or special offers as separate line items.

Step 3: Adjust Payment Terms and Totals

Ensure that the payment terms are clear and customized to your business practices. This includes setting deadlines for payment, specifying acceptable payment methods, and adding any late fees or interest charges if necessary. The final amount due should be clearly highlighted.

- Specify the payment due date and acceptable payment methods.

- Include any penalties for late payments or missed deadlines.

- Ensure the total amount due is prominently displayed at the end of the document.

By following these steps and customizing each section, you can create a personalized and professional document that meets the specific needs of your business and clients. Customization allows you to maintain consistency, streamline your workflow, and improve overall customer experience.

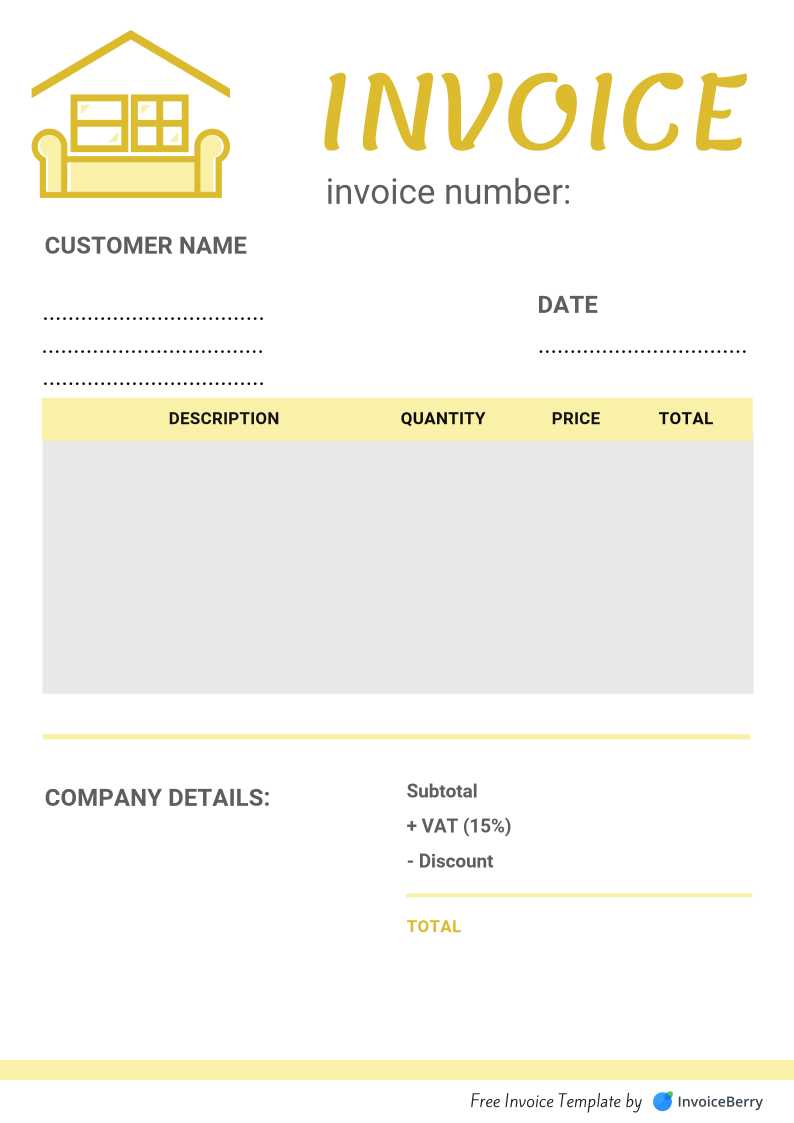

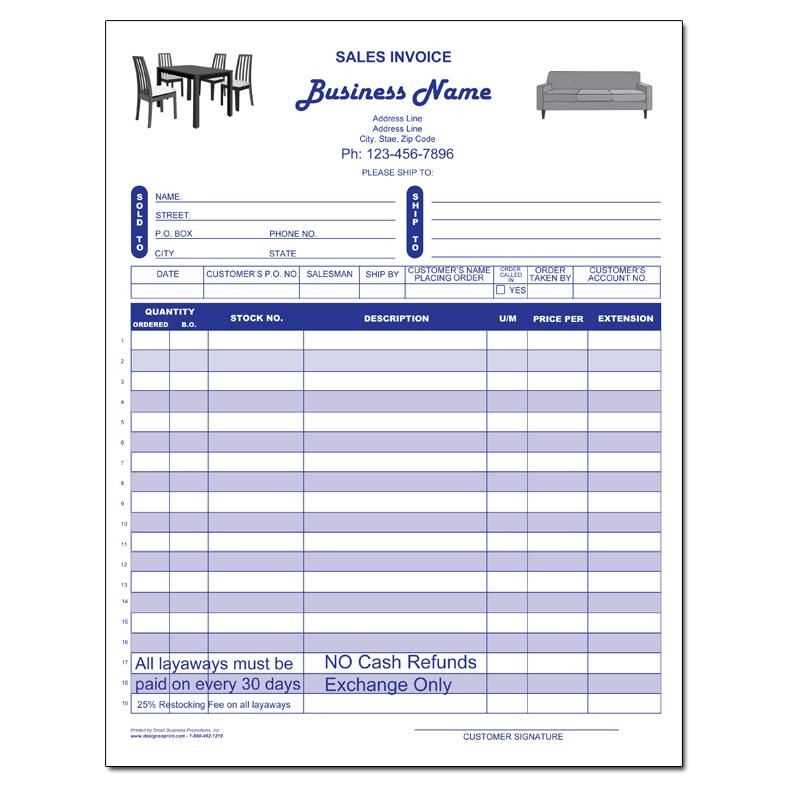

Best Formats for Furniture Invoices

Choosing the right format for your billing documents is crucial for ensuring clarity and efficiency. The format you select impacts how easily clients can understand the charges and how well the document integrates with your accounting system. Different formats offer various advantages depending on your business needs and the nature of the transaction.

Digital vs. Paper Formats

One of the first decisions to make is whether to use a digital or paper format. Digital formats are typically easier to manage, share, and store, while paper formats may still be necessary for clients who prefer physical copies or for legal purposes.

- Digital Formats: Easily customizable, shareable via email, and suitable for quick payments.

- Paper Formats: Best for in-person transactions or clients who prefer traditional documentation.

Popular Document Types

There are several formats you can use for your billing documents, each with its own benefits. The most commonly used formats are Word documents, PDF files, and spreadsheet formats. Each has its advantages depending on how you want to handle and distribute the documents.

| Format | Advantages |

|---|---|

| Word Document | Easy to edit, flexible formatting, can include logos and text customization. |

| Universal compatibility, fixed layout, secure for sending via email. | |

| Spreadsheet | Ideal for detailed calculations, easy to track payments, and automatic updates. |

Each format serves a specific purpose. Depending on the complexity of your business and the volume of transactions, you may prefer one format over the other. Digital formats, such as PDFs, are particularly useful for businesses looking to streamline their processes, while Word documents provide flexibility for more customized billing forms.

Step-by-Step Guide to Filling Out an Invoice

Filling out a billing document correctly is essential for ensuring smooth transactions and maintaining clear communication with clients. By following a structured approach, businesses can ensure all necessary details are included and that the document is both professional and accurate. Here’s a step-by-step guide to help you complete the document effectively.

Start by including all essential business and client information. This will ensure that both parties are clearly identified, and any correspondence can be easily referenced.

- Business Details: Include your business name, address, contact number, and email address.

- Client Information: Add the client’s full name, address, and contact details.

Next, provide a unique reference number for the document. This will make it easier to track and refer to the document in future communications or accounting records.

- Reference Number: Assign a unique ID to each document for easy identification and record-keeping.

Then, move on to listing the items or services provided. Be specific about the quantities, unit prices, and descriptions to avoid any misunderstandings.

- Description: Clearly describe each product or service, including size, model, or any distinguishing features.

- Quantity: Specify the number of units sold or hours worked.

- Price: List the price per unit or service, followed by the total cost for each item or service provided.

After that, include the payment terms. This section outlines how and when the payment is due, including accepted payment methods and any late fees or interest charges.

- Payment Terms: Specify the due date, acceptable payment methods, and any late payment penalties.

Finally, calculate the total amount due, ensuring that taxes or discounts are

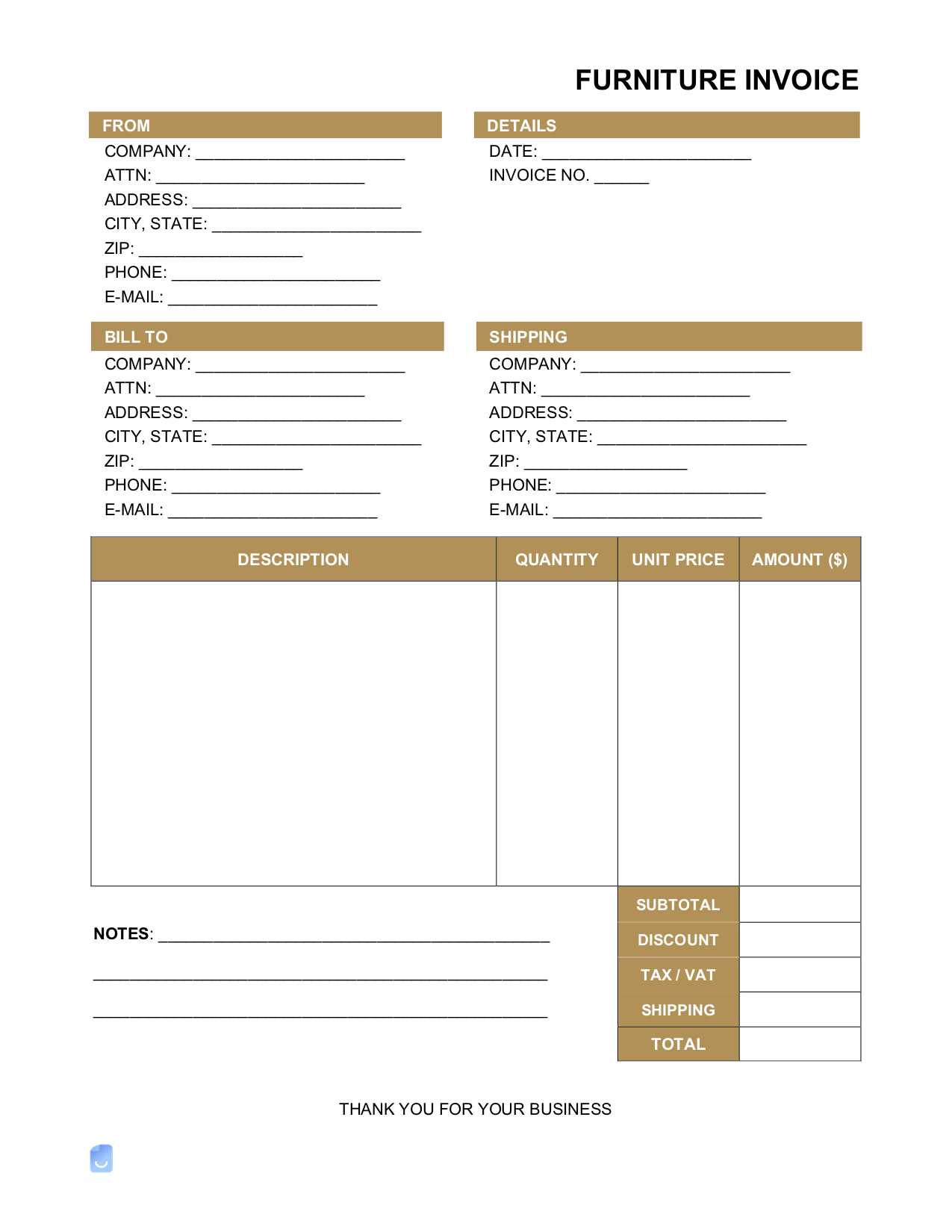

Essential Information to Include in Invoices

When creating a billing document, it is vital to include all necessary information to ensure both clarity and proper record-keeping. This helps prevent misunderstandings and facilitates smooth transactions between businesses and clients. Below is a list of key details that should always be present in every document.

Basic Business and Client Details

The foundation of any billing document is clear identification. Make sure both your business and the client’s details are prominently displayed for easy reference and future communications.

- Business Information: Include the full name of your business, address, phone number, email, and business registration details if applicable.

- Client Information: List the client’s name, company (if relevant), address, and contact information.

Transaction Details

Be specific about what is being provided to ensure that both parties understand the nature of the transaction. This includes a breakdown of the items or services rendered, pricing, and any applicable taxes or discounts.

- Unique Reference Number: Assign a unique number to the document for easy tracking and future reference.

- Item or Service Descriptions: Clearly describe each product or service provided, including quantity and unit price.

- Subtotal: List the cost for each item or service before applying taxes, discounts, or additional fees.

- Tax Information: Include the applicable tax rate and amount, ensuring it is transparent for the client.

- Discounts or Additional Fees: Mention any applicable discounts or fees that apply to the transaction.

Payment Information

Clear payment terms help prevent misunderstandings and ensure timely payment. This section should provide all the necessary details for the client to process the payment efficiently.

- Payment Due Date: Clearly state the deadline by which the payment should be made.

- Accepted Payment Methods: Specify the methods of payment you accept, such as bank transfer, credit card, or PayPal.

- Late Fees or Penalties: If applicable, state any late fees or penalties for overdue payments.

By ensuring all of these essential details are included in your billing documents, you not only present a professional appearance but also make the payment process clear and easy for your clients. This transparency fosters trust and helps avoid future disputes.

Common Mistakes in Furniture Invoices

Creating billing documents that are accurate and clear is essential for smooth business transactions. However, mistakes in these documents can lead to confusion, delays, or disputes. Below are some of the most common errors that businesses make when preparing their billing documents, along with tips on how to avoid them.

- Missing Client Information: One of the most common mistakes is failing to include all relevant client details, such as the full name, address, and contact information. This can result in communication issues and delays in payment.

- Incorrect Product or Service Descriptions: Another frequent mistake is listing unclear or incomplete descriptions of the products or services provided. It’s crucial to provide clear details, including model numbers, sizes, or specifications, to avoid misunderstandings.

- Inaccurate Pricing: Incorrect pricing is a significant issue, whether it’s a typo or miscalculation. Always double-check the unit price and total cost to ensure they match the agreed-upon terms with the client.

- Missing or Incorrect Payment Terms: Not specifying the due date, payment methods, or late fees can create confusion and payment delays. Always make sure that your payment terms are clear and precise.

- Failure to Include Taxes: Some businesses overlook adding applicable taxes, while others miscalculate them. Make sure to include the correct tax rate and amount to avoid undercharging or overcharging the client.

- Lack of Reference Number: Omitting a reference number or making it unclear can make tracking the document difficult for both parties. Always use a unique reference number for easy identification.

- Overcomplicated Format: Using an overly complex format with too much information or difficult-to-read fonts can confuse clients. Keep your document clean, simple, and easy to read.

By paying attention to these common errors and ensuring that your billing documents are thorough, clear, and accurate, you can avoid unnecessary complications and maintain a professional relationship with your clients.

How to Send Your Invoice to Clients

Sending a billing document to clients should be done in a professional manner to ensure that the client receives all necessary information and can process the payment efficiently. There are various methods for sending these documents, each with its advantages depending on the client’s preferences and your business needs. Below are some of the most common and effective ways to send a billing statement.

Emailing the Document

Sending the billing document via email is the most common and efficient method. It allows for quick delivery and ensures the document can be easily saved and referenced by the client.

- Attach the Document: Attach the document in a universally accessible format like PDF to avoid compatibility issues.

- Clear Subject Line: Ensure the subject line is clear, such as “Billing Statement for [Client Name] – [Date/Reference Number].”

- Include a Brief Message: Include a polite and professional message in the body of the email, briefly explaining the contents of the document and payment terms.

- Request Confirmation: Ask the client to confirm receipt of the document, ensuring it has been successfully delivered to the correct person.

Using Online Payment Systems

If you use an online payment platform or invoicing software, you can send the billing document directly through the platform. This method also facilitates immediate payment and easy tracking.

- Generate a Link: Many platforms allow you to create a link to the billing document, which clients can access directly.

- Automatic Reminders: Set up automatic reminders through the platform for upcoming or overdue payments.

- Secure Payments: Online systems often include secure payment processing, which ensures that transactions are completed smoothly and safely.

Whichever method you choose, it’s important to maintain professionalism and clarity in your communication. Sending a well-organized and timely document is a crucial part of maintaining good business relationships and ensuring prompt payments.

Benefits of Digital vs. Paper Invoices

When it comes to sending billing documents, businesses often face the decision between using digital or traditional paper formats. Both options have their advantages, but in today’s fast-paced world, many businesses are transitioning to digital methods. Below, we explore the key benefits of digital and paper formats to help you make an informed decision for your business.

Advantages of Digital Documents

Digital billing documents offer several benefits that can streamline processes and enhance efficiency for both businesses and clients. Here are some key reasons to choose a digital method:

- Faster Delivery: Digital documents can be sent instantly to clients, reducing the time it takes for them to receive and review the information.

- Cost-Effective: Digital methods eliminate the need for printing, postage, and storage, saving businesses money in the long run.

- Easy Record Keeping: Digital files can be stored and organized in cloud-based systems, making it easier to manage and retrieve documents when needed.

- Environmental Impact: Using digital documents reduces paper consumption, making it a more environmentally friendly option.

- Security: Digital formats can be encrypted and password-protected, adding an extra layer of security to sensitive business information.

Advantages of Paper Documents

Although digital documents are increasingly popular, paper billing remains relevant for some businesses. Here are a few advantages of using traditional paper formats:

- Client Preference: Some clients may prefer paper documents, especially those who are less familiar with digital tools or prefer physical records.

- No Technology Requirements: Paper billing doesn’t require internet access or special software, making it accessible to anyone.

- Physical Documentation: Having a physical copy can be useful for record-keeping in some industries where hard copies are needed for audits or legal reasons.

Comparing the Two Formats

To help you make the right choice, here’s a quick comparison of digital vs. paper billing:

| Factor | Digital | Paper |

|---|---|---|

| Speed of Delivery | Instant | Days or Weeks |

| Cost | Low (No Printing/Shipping) | High (Printing/Shipping Costs) |

| Storage | Easy Digital Storage | Requires Physical Space |

| Environmental Impact | Eco-friendly | Less Eco-friendly |

| Security | Can Be Encrypted | Easy to Lose or Damage |

Both digital and paper formats have their place depending on the needs of your business and your clients. However, as businesses continue to embrace technological advancements, digital billing is becoming the preferred method due to its convenience, security, and cost-effectiveness.

Using Templates for Consistent Branding

Maintaining a consistent brand image across all communications is crucial for building trust and recognition with clients. One of the simplest ways to achieve this is by using standardized formats for your business documents. By utilizing pre-designed structures, you ensure that each document sent carries the same professional look and feel, reinforcing your brand’s identity every time you interact with clients.

Enhancing Brand Recognition

Consistency in your business materials creates a recognizable identity that clients can instantly connect with. When you use a uniform design for all your documents, it reinforces your branding elements, such as your logo, color scheme, and typography. This familiarity makes your communications stand out and ensures that your business remains memorable.

- Visual Identity: A consistent layout featuring your brand colors and logo establishes a clear visual identity.

- Professional Appearance: A well-designed document conveys professionalism, which strengthens client confidence in your business.

- Client Trust: Consistent communication builds trust, making clients more likely to engage with your business repeatedly.

Simplifying the Process

Using predefined formats also simplifies the process of creating new documents. Rather than starting from scratch each time, you can quickly input the necessary details, saving time and effort while ensuring all required information is included. This not only streamlines your workflow but also reduces the chance of errors or omissions.

- Time-Efficiency: Pre-designed documents save time, allowing you to focus on other aspects of your business.

- Accuracy: Templates help ensure that all necessary elements are included, minimizing the risk of missing important information.

- Scalability: Templates make it easy to handle high volumes of documents without sacrificing quality or consistency.

Ultimately, using a structured design for your documents ensures that every communication, whether it’s a bill or a quote, aligns with your business’s values and image, contributing to a stronger, more professional presence in the market.

Invoicing for Custom Furniture Orders

When handling bespoke orders, it’s essential to create clear and detailed billing documents to ensure both the business and the client are aligned on the agreed-upon costs and terms. Custom pieces often involve unique specifications, materials, and timelines, which should all be accurately reflected in the final transaction statement. Proper documentation is vital to avoid misunderstandings and maintain professional communication throughout the entire process.

Detailing the Order Specifications

For custom-made items, the billing statement must include comprehensive information about the order. This ensures the client is fully aware of what they are being charged for and the specific details related to their request.

- Itemized Breakdown: Each custom element of the order, including materials, labor, and any special features, should be listed individually with corresponding costs.

- Design Specifications: Include a brief description of the design elements or customizations to make the transaction transparent.

- Timeline and Deadlines: It is important to outline the expected completion date, any milestones, and the delivery schedule to set proper expectations for the client.

Clear Payment Terms and Conditions

In custom orders, the payment structure often varies from standard transactions. It’s crucial to clearly outline any upfront payments, milestones, or final balances to avoid confusion later on. Clear terms help prevent payment disputes and ensure both parties are on the same page.

- Deposits: Specify if a deposit is required before work begins, and outline any non-refundable portions.

- Payment Schedule: If the payment is to be made in installments, include a clear breakdown of amounts and due dates.

- Additional Charges: Highlight any potential extra charges, such as for premium materials or expedited shipping, to ensure transparency.

By clearly outlining the specific details and payment terms for custom orders, businesses can provide better service and reduce the potential for misunderstandings or disputes. This careful documentation strengthens the relationship between the company and the client, ensuring a smoother transaction from start to finish.

Setting Payment Terms in Furniture Invoices

Establishing clear payment terms is essential for ensuring smooth transactions and avoiding misunderstandings between businesses and clients. Payment terms outline when and how the client is expected to pay for the products or services provided. These terms should be straightforward, transparent, and agreed upon before any work begins or goods are delivered, providing both parties with clarity on their financial obligations.

Common Payment Structures

There are several common ways to structure payment terms, depending on the nature of the transaction and the client relationship. It’s important to choose the one that best suits the business model and client needs while maintaining fairness and financial security.

| Payment Term | Description |

|---|---|

| Full Payment Upfront | The client pays the entire amount before any goods are delivered or work begins. |

| Deposit + Balance | The client pays a deposit before work begins, with the balance due upon completion or delivery. |

| Installments | Payments are divided into equal parts, due at specific intervals (e.g., monthly or per milestone). |

| Net Terms | Payment is due a certain number of days after the delivery of goods or services (e.g., Net 30 or Net 60). |

Considerations When Setting Payment Terms

When setting payment terms, it’s important to consider both the business’s cash flow and the client’s preferences. Clear expectations help prevent delays in payment and can build trust between the business and the client. Here are a few key considerations:

- Late Fees: Clearly outline the consequences of delayed payments, such as interest or penalties, to encourage timely payment.

- Payment Methods: Offer various payment methods (e.g., credit cards, bank transfers, checks) to accommodate different client preferences.

- Discounts for Early Payment: Offer incentives for clients who pay before the due date, which can help improve cash flow.

Setting clear and fair payment terms ensures both parties understand their obligations and helps maintain a positive working relationship throughout the course of the transaction.

Tracking Payments and Outstanding Invoices

Effectively managing and monitoring payments is crucial to maintaining healthy cash flow and ensuring that all transactions are properly settled. Keeping track of paid and unpaid balances helps businesses stay organized and avoid late payments, which can have a negative impact on operations. A systematic approach to managing these financial records not only improves efficiency but also fosters transparency and trust with clients.

Methods of Tracking Payments

There are several ways to keep track of payments, depending on the scale of the business and available tools. Using the right method ensures that no payments are overlooked, and any outstanding balances are easily identified.

- Manual Record Keeping: Some small businesses still prefer to use physical books or spreadsheets to track payments and balances. While this method can be effective for smaller operations, it can become cumbersome as the number of transactions increases.

- Accounting Software: Many businesses use specialized software to track payments automatically. This software can generate reports, send reminders for overdue payments, and integrate with other financial tools to streamline the process.

- Cloud-Based Solutions: Cloud platforms allow businesses to track payments from anywhere. These tools also allow for easy collaboration and sharing of financial data with team members or accountants.

Handling Outstanding Balances

Outstanding balances should be promptly addressed to maintain financial stability. A business must have clear procedures in place for managing overdue accounts to minimize the risk of non-payment.

- Follow-Up Reminders: Sending regular reminders, especially as due dates approach, can encourage clients to pay promptly. These can be automated through email or notification systems.

- Late Fees: Implementing late fees for overdue payments can help incentivize clients to pay on time. Ensure that these fees are clearly outlined in the payment terms and communicated upfront.

- Payment Plans: In some cases, clients may experience financial difficulties. Offering flexible payment plans can help both parties reach an agreement without damaging the business relationship.

By staying on top of payments and outstanding balances, businesses can improve their cash flow and reduce the stress of dealing with overdue accounts. Regular tracking and proactive follow-ups ensure that financial obligations are met in a timely manner, supporting the overall health and success of the business.

How to Handle Late Payments

Late payments can pose a significant challenge for businesses, affecting cash flow and overall financial health. Effectively managing overdue balances requires a mix of clear communication, consistent follow-ups, and, when necessary, implementing stricter payment policies. Addressing late payments in a timely and professional manner helps maintain a positive relationship with clients while ensuring that the business remains financially stable.

Steps to Take When Payments Are Delayed

When a payment is overdue, it is crucial to approach the situation methodically to avoid unnecessary conflict while also protecting your business interests.

- Initial Reminder: As soon as a payment deadline is missed, send a polite reminder to the client. This can be a simple email or phone call, confirming whether there was an issue or delay on their end.

- Second Reminder: If there is still no response, send a more formal reminder. Include the original terms of payment and clearly state that the amount is now overdue, specifying any late fees or consequences that may apply.

- Offer a Payment Plan: If the client is facing financial difficulties, consider offering a flexible payment plan. This allows them to settle their balance in manageable installments while maintaining a positive relationship.

Enforcing Payment Terms

When informal reminders are ineffective, it’s important to start enforcing the terms outlined in the agreement to protect your interests. This may include additional actions, such as:

- Late Fees: Implementing late fees, as per the payment terms, can encourage quicker payment. Ensure the fees are reasonable and clearly communicated upfront.

- Suspension of Services: If the payment remains unpaid for an extended period, consider temporarily suspending any ongoing services or shipments until the outstanding balance is paid.

- Legal Action: In extreme cases, when all other methods fail, pursuing legal action or involving a collections agency might be necessary. This should always be a last resort and done in accordance with the law.

By being proactive and consistent in handling overdue payments, businesses can reduce the risk of cash flow disruptions while maintaining positive client relationships. Clear communication and setting expectations from the start are key to preventing late payments and managing them effectively when they arise.

Legal Considerations for Furniture Invoices

When it comes to financial documents, there are several legal factors to consider to ensure compliance with applicable laws. Proper documentation is essential not only for tracking transactions but also for protecting both the seller and the buyer in case of disputes. Understanding the legal obligations related to these documents can help avoid costly errors and potential legal issues down the line.

First and foremost, it is crucial to ensure that all relevant terms and conditions are clearly outlined in the documentation. This includes payment terms, applicable taxes, and any penalties for late payments. Accurate and transparent information will make it easier to resolve conflicts, should they arise, and ensure that the business remains legally protected in case of disputes.

Additionally, businesses must be mindful of privacy laws and data protection when handling sensitive customer information. Personal details, such as names, addresses, and payment methods, must be stored securely and in compliance with data protection regulations, such as the GDPR in the European Union or similar privacy laws in other regions.

Another important consideration is the adherence to consumer protection laws. Depending on the location and type of product or service provided, there may be specific regulations regarding refunds, returns, and cancellations. Familiarizing yourself with these laws will help ensure that your business stays compliant and avoids any legal complications.

Finally, it’s essential to know when to seek legal advice. If a transaction involves unusual terms or if there are concerns about non-payment or fraud, consulting with a legal professional can provide clarity and help you navigate complex situations. Legal expertise ensures that your business is not at risk, especially in matters that involve contracts, warranties, or disputes.

How to Save and Organize Your Invoices

Properly managing financial documents is crucial for both operational efficiency and legal compliance. Keeping track of transactions not only ensures smooth business operations but also helps in filing taxes and handling audits. With a few best practices, you can streamline the process of storing and organizing these important records.

The first step in organizing financial documents is choosing the right storage method. Digital storage is often preferred due to its ease of access and reduced physical space requirements. Cloud-based systems are particularly useful, allowing you to store and retrieve records from anywhere while keeping your files secure. On the other hand, if you prefer paper records, it’s important to have a well-organized filing system that categorizes documents by date or client for easy retrieval.

To enhance organization, create a clear and consistent naming system for digital files. For instance, using the client name and date of transaction in the file name can make it easier to find specific documents later. This method reduces the chances of misplacing important records and ensures you can quickly access them when needed.

For businesses that handle a large volume of documents, investing in document management software can make a significant difference. Such systems help automate the organization process by tagging and categorizing files based on custom criteria. This reduces the time spent manually organizing documents and minimizes human error.

It’s also essential to have a backup plan. Regularly back up digital files to an external hard drive or another secure location to protect against data loss. If you’re using paper records, consider scanning and storing them digitally as an additional safeguard.

Lastly, set a routine for reviewing and archiving records. Regularly go through your documents to ensure that outdated or unnecessary records are safely discarded or archived. Keeping only the essential documents not only saves storage space but also makes the process of finding important records more efficient.

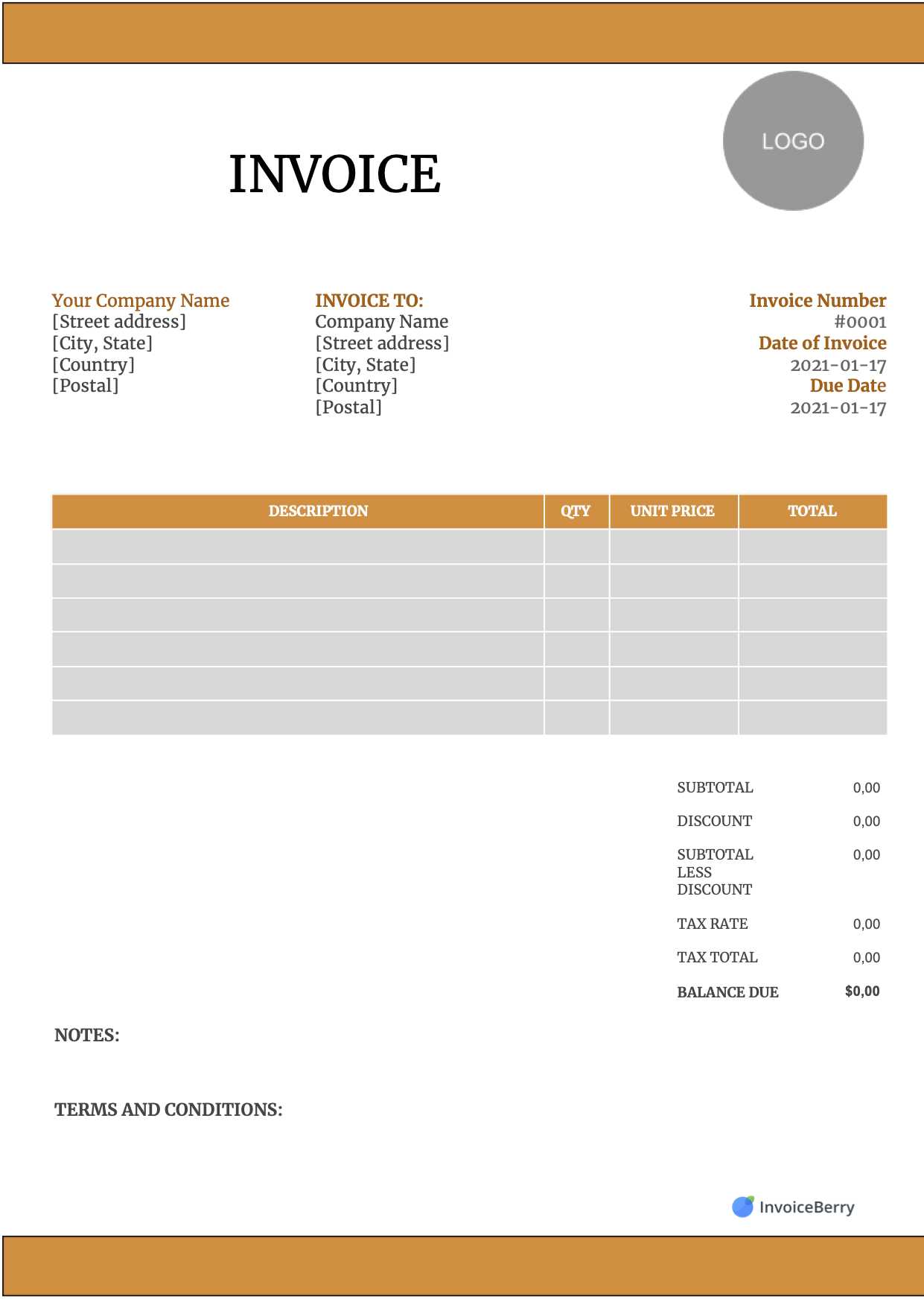

Free vs. Paid Invoice Templates

When it comes to managing business transactions, choosing the right document format is essential. Both free and paid options are available, each with its own advantages and drawbacks. Understanding the key differences between these two can help you determine which solution best fits your business needs.

Free Invoice Options

Free templates are widely accessible and can be a great starting point for small businesses or freelancers just beginning to manage their financial documents. These options often come with basic features, allowing users to quickly create and send documents without significant upfront investment. However, there are certain limitations that might make them less suitable as your business grows.

- Simple, easy-to-use design

- Accessible on multiple platforms

- Basic customization options

- Limited support for advanced features

Paid Invoice Options

Paid templates or premium software solutions offer a more robust set of features and customization options. These solutions are designed to provide greater control over your documents, allowing for more advanced functionalities such as automatic calculations, brand customization, and integration with accounting systems.

- Advanced design and customization options

- Integration with accounting and CRM systems

- Customer support and updates

- Better security features

| Feature | Free Templates | Paid Templates |

|---|---|---|

| Customization | Limited | Extensive |

| Support | No dedicated support | 24/7 customer support |

| Security | Basic | Enhanced encryption and security |

| Features | Basic | Advanced (automated calculations, branding) |

Ultimately, the decision between free and paid options depends on your business’s needs and budget. If you only need a simple way to generate documents, a free option might be sufficient. However, if your business requires more advanced capabilities or greater customization, investing in a paid solution could provide the added functionality needed to streamline your workflow.