How to Create and Use a Funeral Invoice Template

Handling the financial aspects of end-of-life services can be an overwhelming task, especially during a difficult time. Having a clear and structured way to manage payments and related details is crucial for both service providers and families. A well-organized document can help ensure transparency, prevent misunderstandings, and keep the process as smooth as possible for everyone involved.

In this guide, we’ll explore how to create a professional and comprehensive document that outlines the costs associated with burial or memorial services. Whether you’re providing these services or managing payments on behalf of a loved one, understanding the essential elements and how to customize such records is essential for accurate billing and financial management.

By following a set format, you can simplify the process of tracking services rendered, items purchased, and any additional charges. This approach not only saves time but also ensures all necessary details are included, reducing the likelihood of errors or disputes down the line. Let’s dive into the key steps to create an efficient financial record for these important services.

Funeral Invoice Template Overview

When it comes to organizing and documenting the costs of end-of-life services, having a clear and structured approach is essential. A well-organized document helps both service providers and families keep track of payments, services rendered, and any additional fees. The purpose of such a document is to provide clarity, ensuring all charges are transparently outlined and easily understood.

This guide offers an overview of the key components and benefits of using a standardized format for recording costs related to burial and memorial services. By following a consistent structure, you can ensure that all necessary information is captured accurately, making the financial aspect of this process much easier to manage for both parties.

Below is a typical breakdown of the sections commonly included in this kind of financial record:

| Section | Description |

|---|---|

| Service Provider Information | Details of the company or individual providing the services, including name, contact information, and address. |

| Client Information | Information about the individual or family receiving the services, including name and address. |

| List of Services | A detailed list of the services provided, such as cremation, burial preparation, memorial services, etc. |

| Itemized Costs | A breakdown of costs for each service or item, such as caskets, urns, or transportation. |

| Payment Terms | Details on payment methods, deadlines, and any applicable payment plans or discounts. |

| Total Amount Due | The final amount to be paid, including taxes or other additional charges. |

By including these sections, you create a comprehensive financial record that minimizes confusion and ensures all necessary information is readily available. This format helps avoid mistakes and makes the process smoother for both clients and service providers alike.

What Is a Funeral Invoice?

A financial document used to record the costs associated with burial or memorial services is essential for both service providers and families. This document serves as an official record of all charges related to the services provided, outlining the amounts owed and the specific items or services rendered. It ensures transparency and helps both parties keep track of payments, avoiding any confusion or misunderstandings.

Purpose of the Document

The primary purpose of this document is to provide a clear and organized summary of all fees related to the end-of-life services. It includes details on the services performed, items purchased, and any other associated costs, allowing the client to review and settle payments in a timely manner. It may also serve as a reference for future transactions or legal purposes.

Key Elements Included

A typical financial statement for these services includes a list of services provided, such as embalming, transportation, or memorial preparations. It also includes an itemized list of any materials or goods used, such as caskets, urns, or flowers. Payment terms are also clearly outlined, specifying when payments are due, the acceptable methods of payment, and any applicable discounts or late fees.

By ensuring all charges are clearly listed and agreed upon, this document helps both the service provider and the client avoid disputes and keep track of their financial obligations during a sensitive time.

Why Use a Funeral Invoice Template?

Utilizing a standardized document for billing end-of-life services offers several significant advantages for both service providers and clients. By following a consistent format, all charges can be clearly outlined, ensuring that all necessary information is included and easy to understand. This not only helps prevent misunderstandings but also streamlines the process of managing payments during an emotionally charged time.

Benefits of Using a Standardized Billing Document

- Clarity and Transparency: A well-organized document eliminates confusion by listing all services and associated costs in a clear, structured manner.

- Efficiency: Using a pre-designed document reduces the time spent creating billing records from scratch, allowing for quicker processing and fewer errors.

- Consistency: A standardized format ensures that all necessary details are always included, minimizing the risk of omissions or mistakes.

- Professionalism: Providing a clear and polished financial document enhances the credibility and trustworthiness of the service provider.

- Legal Protection: Having an accurate and complete record can help prevent disputes or complications if legal issues arise later.

How It Simplifies Payment Management

By using a set structure, service providers can easily manage multiple transactions and track payment status. Clients also benefit by receiving a clear breakdown of charges, which makes it easier to understand their financial obligations and meet deadlines. This organized approach to billing ensures that no important information is overlooked, fostering trust and facilitating smooth financial transactions.

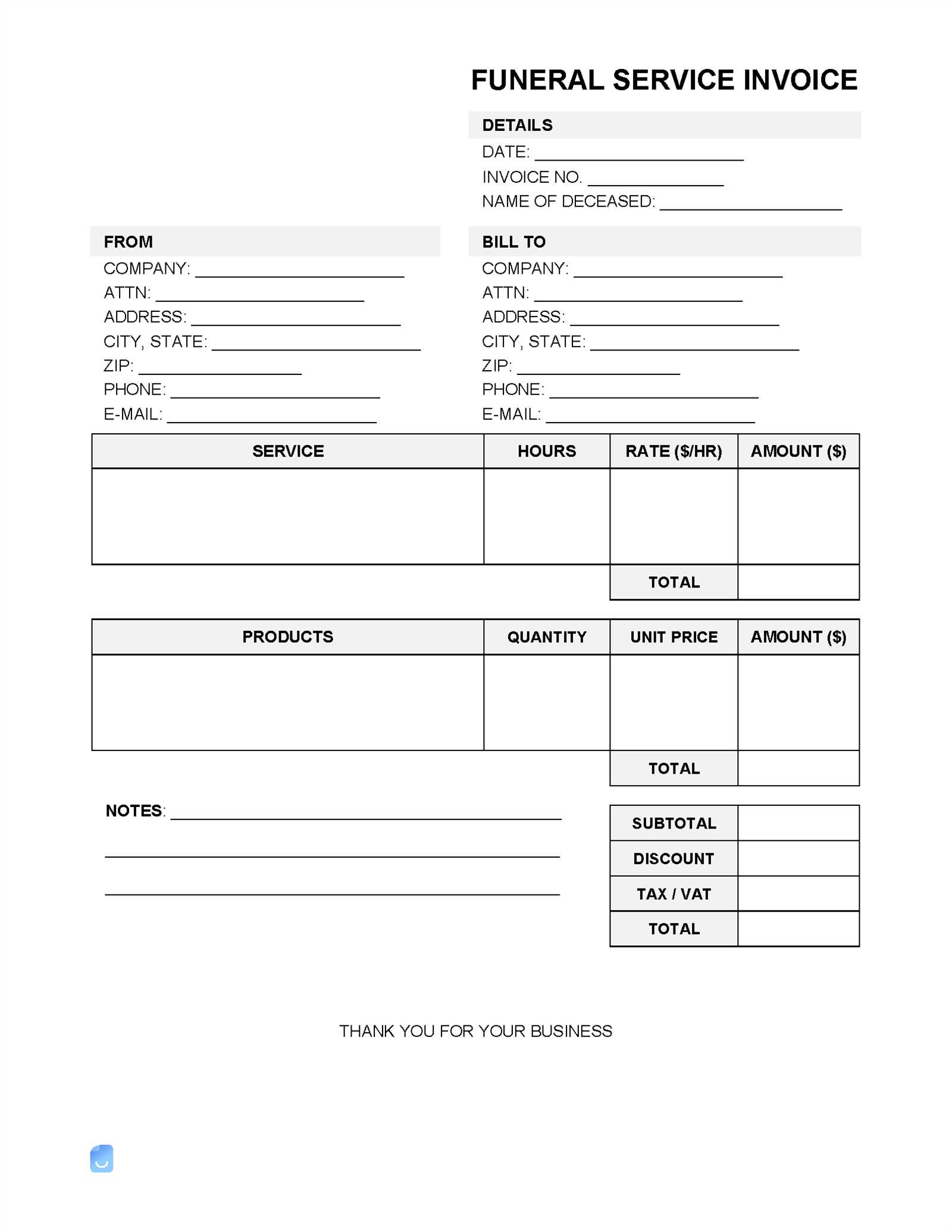

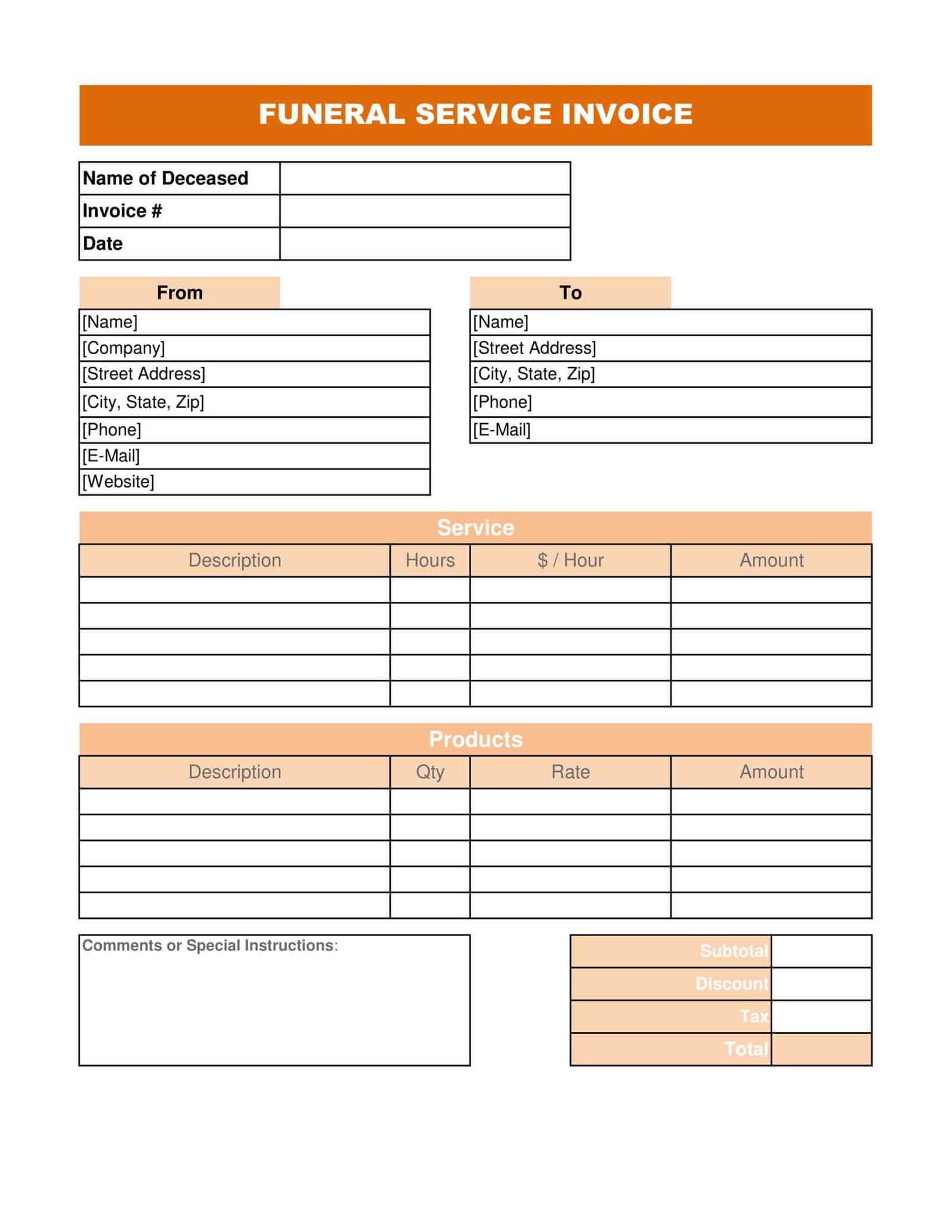

Key Components of a Funeral Invoice

A comprehensive financial document for end-of-life services includes several key elements that help organize and clarify the details of the charges. These components ensure that both the service provider and the client have a clear understanding of the services rendered, the costs involved, and any applicable payment terms. Knowing what to include in this document is essential for both accuracy and transparency.

Essential Sections to Include

- Service Provider Information: This section should contain the name, address, phone number, and email of the company or individual providing the services.

- Client Information: Includes the name, address, and contact details of the individual or family receiving the services.

- List of Services: A detailed description of each service provided, such as embalming, burial, or transportation.

- Itemized Costs: A breakdown of all items purchased, such as caskets, urns, flowers, or any other products associated with the services.

- Payment Terms: Information on the payment due date, accepted payment methods, and any applicable late fees or discounts.

- Total Amount Due: The final amount, including taxes, service fees, and any additional charges.

Additional Considerations

- Special Instructions: Any specific terms or instructions related to the payment or services provided.

- Reference Number: A unique reference or transaction number that can help both parties track the document and associated payments.

- Legal Disclaimers: Any necessary legal disclaimers regarding refunds, responsibilities, or payment timelines.

By including these key sections in the financial document, you create a comprehensive and clear record that is easy to understand and follow, helping to avoid misunderstandings and ensure smooth transactions.

How to Customize a Funeral Invoice

Customizing a billing document for end-of-life services allows service providers to tailor the details to their specific offerings while ensuring all necessary information is clearly presented. Personalizing the layout, adding specific terms, and adjusting the breakdown of charges are essential steps in making the document both functional and professional. This customization also helps address the unique needs of each client and service provided.

To make this document fit your business or personal needs, follow these steps:

| Step | Description |

|---|---|

| 1. Add Your Branding | Include your logo, business name, and contact information at the top of the document for a professional appearance. |

| 2. Personalize Client Information | Ensure the client’s name, address, and other details are correct. Customize the layout to reflect the client’s specific needs. |

| 3. Detail the Services Provided | List each service or product offered with clear descriptions, ensuring no ambiguity about what is being charged. |

| 4. Adjust Payment Terms | Customize the payment conditions, such as the due date, payment methods, and any applicable discounts or penalties. |

| 5. Add Optional Charges | Include any additional fees or optional services, such as transportation or extra memorial items, ensuring they are clearly marked as extras. |

| 6. Set a Clear Total | Summarize the costs by providing a clear total that includes all items, services, taxes, and any other charges. |

Once these sections are customized, review the document for accuracy. A well-structured, personalized billing record ensures that all terms are clear to the client, leading to a smoother financial process and minimizing confusion.

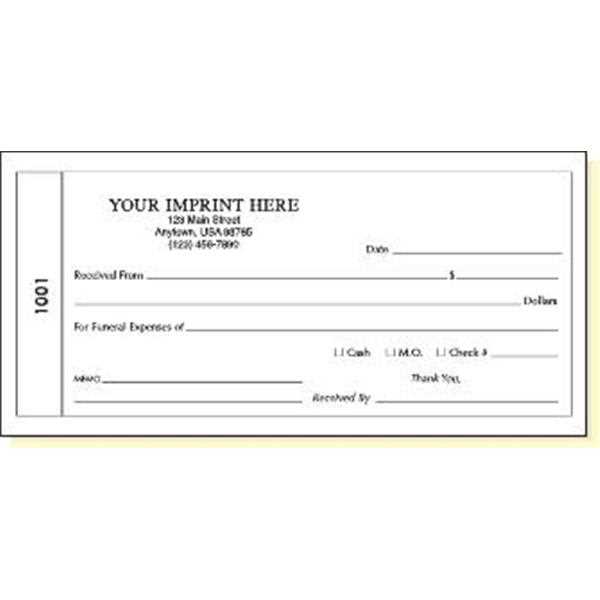

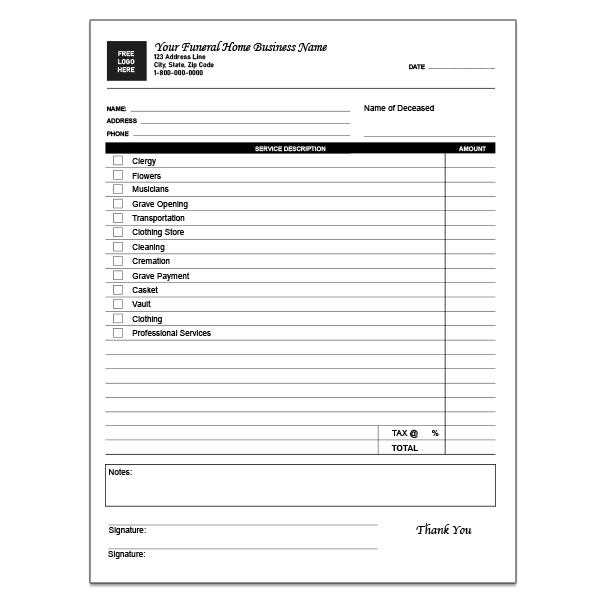

Free Funeral Invoice Templates to Download

Accessing ready-to-use financial documents can save time and effort when managing end-of-life service billing. Whether you’re a service provider or handling the financial aspect on behalf of a loved one, downloading pre-designed billing formats is a convenient option. These customizable files allow you to quickly input the relevant details and ensure that all necessary components are included without starting from scratch.

Many websites offer free downloadable options that cater to different needs and preferences. These files are often available in various formats, such as Word, Excel, or PDF, allowing you to choose the one that best fits your needs. With these pre-made documents, you can easily fill in service details, adjust costs, and finalize the billing record in a fraction of the time.

Advantages of Using Free Downloadable Documents:

- Convenience: No need to design a document from the ground up; simply fill in the necessary fields.

- Customization: Most options allow you to modify the content to fit specific services, charges, and payment terms.

- Time-Saving: Ready-to-use formats speed up the process of creating an accurate financial record.

- Free Access: Many sites offer these resources at no cost, allowing you to use them without financial commitment.

By downloading one of these free resources, you can ensure that all the required details are included in a structured and clear format, minimizing the chance of errors while making the process of handling payments more efficient.

Best Practices for Funeral Billing

Managing the financial aspects of end-of-life services requires careful attention to detail and clear communication. By following best practices for creating billing records, service providers can ensure that all costs are accurately documented and clients are fully informed about the charges. This reduces the potential for misunderstandings and helps streamline the payment process for both parties.

Key Considerations for Accurate Billing

- Detail Every Service and Item: Be sure to list each service provided, along with any additional items purchased, such as caskets, flowers, or transportation. An itemized list helps clients understand exactly what they are being charged for.

- Use Clear and Simple Language: Avoid jargon or overly complicated terms. The billing document should be easily understood by anyone, regardless of their familiarity with the services.

- Provide a Breakdown of Costs: Ensure that each service or item is accompanied by its individual cost. This promotes transparency and makes it easier to address any questions from clients.

- Include Payment Terms: Clearly outline the payment due date, acceptable payment methods, and any applicable penalties for late payments or discounts for early settlement.

- Keep Records Organized: Maintain an organized record of all transactions and communications related to each service. This will help resolve any disputes and provide a reference for future transactions.

Additional Tips for a Smooth Billing Process

- Provide Clear Instructions: Include detailed payment instructions, especially if clients have multiple payment options. Make it easy for them to fulfill their financial obligations.

- Stay Consistent: Use the same format for every billing document to create a consistent experience for clients. This helps build trust and reduces confusion.

- Follow-Up on Unpaid Balances: If payments are overdue, make sure to follow up promptly and professionally. Offering payment plans or reminders can encourage timely payments.

- Offer Assistance: Provide a contact number or email for clients to reach out with questions regarding the charges. Being available for support enhances client satisfaction.

By implementing these best practices, service providers can create clear, accurate billing documents that foster trust, minimize errors, and help ensure a smoother financial process for everyone involved.

Common Mistakes in Funeral Invoices

When preparing financial records for end-of-life services, it’s important to avoid common errors that could lead to confusion, disputes, or delays in payment. Small mistakes can cause unnecessary complications and even damage the relationship between service providers and their clients. By being aware of these potential pitfalls, you can ensure that your billing documents are accurate, clear, and professional.

Frequent Errors to Avoid

- Incomplete Service Descriptions: Failing to list all services provided in detail can lead to misunderstandings. Each service or product should be clearly described, including any optional services like memorial items or transportation.

- Omitting Important Costs: It’s essential to include every cost, including taxes, service fees, and additional charges. Omitting these can result in clients being surprised by a higher final total than expected.

- Incorrect Client Information: Mistakes in the client’s name, address, or contact details can create confusion and delay communication, making it harder to process payments or resolve issues.

- Vague Payment Terms: Ambiguity around payment methods, due dates, and late fees can lead to missed payments or disputes. Clearly state when payments are due, how they can be made, and any penalties for delays.

- Failure to Include Reference Numbers: Not including a unique reference number or transaction ID makes it difficult to track payments, especially if multiple transactions are involved or the service is spread out over time.

How to Avoid These Mistakes

- Double-Check All Entries: Always review your billing document for accuracy, especially when filling in client and service details. A second set of eyes can help catch errors.

- Be Thorough: Include every charge and provide clear descriptions of services. Don’t assume anything is obvious–clients appreciate clarity.

- Stay Consistent: Use the same format and structure for every financial record to minimize errors. Familiarity with the layout helps ensure consistency.

- Clarify Terms Upfront: Make payment terms as clear as possible. Consider highlighting key points, such as due dates and payment options, so they’re easy to find.

By avoiding these common mistakes, you can ensure that your billing documents are accurate, professional, and easy for your clients to understand, leading to smoother transactions and greater trust.

Benefits of Using a Template

Utilizing a pre-designed billing format offers several advantages that can simplify the process of managing financial records for end-of-life services. By relying on a set structure, service providers can ensure consistency, reduce errors, and save time. This approach not only makes the process more efficient but also helps maintain professionalism and clarity in all financial documents.

Advantages of Using a Pre-Designed Document

- Time Efficiency: A pre-made structure eliminates the need to start from scratch, allowing you to fill in the necessary details quickly and easily.

- Consistency: Using the same format for every financial record ensures that all necessary information is included and reduces the risk of omitting important details.

- Accuracy: Templates often come with predefined sections that ensure all critical information, such as services rendered, charges, and payment terms, are accounted for correctly.

- Professional Appearance: A well-designed document enhances the professionalism of your services, building trust with clients and demonstrating attention to detail.

- Customization: Many pre-designed documents allow for easy customization, enabling you to adjust the content to reflect your unique offerings and client needs.

How Templates Improve Client Communication

- Clear Information: A standardized structure makes it easier for clients to understand the breakdown of services and costs, minimizing the chance of confusion or disputes.

- Transparency: By clearly listing all charges, payment terms, and services provided, templates help establish a transparent relationship between the service provider and the client.

- Easy Tracking: Templates often include fields for reference numbers or transaction IDs, making it easier to track payments and resolve any issues that may arise.

By using a pre-designed document, you can ensure that your financial records are both efficient and professional, fostering smoother transactions and stronger client relationships.

Legal Considerations in Funeral Billing

When preparing financial records for end-of-life services, it is crucial to understand the legal implications involved in billing practices. Ensuring that all terms are clearly defined and that all charges comply with local laws can protect both service providers and clients. Legal considerations help prevent disputes, ensure fairness, and maintain transparency throughout the entire billing process.

Key Legal Aspects to Keep in Mind

- Clear Communication of Costs: Always provide a detailed and itemized list of services and products with corresponding costs. Ambiguity in pricing can lead to legal disputes or confusion.

- Compliance with Consumer Protection Laws: In many regions, there are laws that protect consumers from unfair billing practices. Ensure your billing complies with these regulations, which may include disclosing all fees and providing the right to cancel certain services.

- Payment Terms and Deadlines: Clearly outline the payment due date, accepted payment methods, and any penalties for late payments. Contracts or billing documents should specify the consequences of non-payment to avoid misunderstandings.

- Refund and Cancellation Policies: Legal requirements often include outlining refund policies for canceled services. Make sure to provide clients with a clear explanation of when and how refunds can be issued, if applicable.

- Tax Compliance: Ensure that all applicable taxes, such as sales tax or service tax, are accurately included in the billing document. Incorrect tax calculation can lead to legal consequences for both parties.

Protecting Your Business and Clients

- Written Agreements: Where possible, have written agreements that include all the terms of service and payment. Verbal agreements can be difficult to enforce in case of a dispute.

- Privacy and Confidentiality: Make sure any personal or financial information is handled securely and in compliance with privacy laws, such as GDPR or HIPAA, where applicable.

- Accurate Record-Keeping: Retaining accurate and detailed financial records is essential not only for tax purposes but also for resolving any legal disputes that may arise in the future.

By addressing these legal aspects, you can ensure that your financial documentation is both compliant with the law and transparent for clients. This builds trust and helps maintain smooth, dispute-free transactions.

How to Handle Funeral Service Payments

Managing payments for end-of-life services requires careful attention to detail, as these transactions often involve sensitive circumstances. It’s important to ensure that all payment processes are clearly defined, easy to follow, and transparent for the clients. Clear communication about payment options, deadlines, and any potential issues helps ensure that the financial aspects of the service are handled smoothly and professionally.

Steps to Effectively Manage Payments

- Define Payment Options: Offer multiple payment methods to accommodate different preferences. This could include credit or debit cards, bank transfers, checks, or even payment plans, depending on the client’s needs and the services provided.

- Provide Clear Payment Deadlines: Clearly state the due date for the full payment and any payment terms. If the payment is to be made in installments, outline the schedule and amounts due for each payment.

- Offer Payment Plans: Many clients may prefer to spread out their payments. If possible, provide flexible payment options, such as installments, to reduce the immediate financial burden.

- Include All Fees: Ensure that all potential fees are included in the total payment, such as late fees, additional service charges, or taxes. Transparent pricing will prevent confusion later on.

- Communicate Payment Methods Clearly: List the accepted forms of payment on the billing document, and provide clients with instructions on how to make a payment, including any relevant account details or payment portals.

Best Practices for Payment Collection

- Send Timely Reminders: If payments are due on a certain date, send reminders in advance to avoid delays. Follow-up reminders can be helpful, but should be polite and professional.

- Be Transparent About Late Fees: If you charge late fees, be clear about the terms and when these fees apply. This helps to avoid any confusion or frustration on the client’s part.

- Maintain Detailed Records: Keep thorough records of all payments received, including partial payments and payment methods, to ensure you have a complete history in case of disputes or for tax purposes.

- Provide Receipts: After a payment is made, issue a receipt to confirm that the transaction has been completed. This serves as both proof of payment and a record for the client.

By following these guidelines, service providers can ensure that the payment process is handled smoothly, reducing the chance of errors and maintaining a positive relationship wit

Designing a Clear Billing Document

Creating a billing document that is both clear and professional is essential for ensuring that clients understand the charges and can easily process their payments. A well-structured financial record provides transparency and fosters trust between the service provider and the client. By organizing the document logically and presenting information in an easy-to-read format, you can avoid confusion and reduce the risk of disputes.

Key Elements of a Clear Billing Record

- Client Information: Include the full name, address, and contact details of the client to ensure that the billing document is correctly addressed and easy to reference.

- Service Breakdown: Clearly list all the services or products provided, with a detailed description and corresponding costs. An itemized breakdown helps clients see exactly what they are paying for.

- Total Amount Due: Display the total sum at the bottom of the document, making it easy for clients to see the full amount owed, including taxes and additional charges.

- Payment Terms: Include information about the due date, acceptable payment methods, and any penalties for late payments. Clear payment terms ensure that both parties understand the expectations and avoid misunderstandings.

- Contact Information: Provide a phone number, email address, or other means of communication in case the client has any questions or concerns about the billing details.

Design Tips for Better Clarity

- Simplicity: Avoid cluttering the document with unnecessary details or complicated jargon. The simpler and more straightforward the design, the easier it is for clients to understand.

- Readable Fonts: Use a legible font size and style. Ensure that the font is clear and professional to enhance readability.

- Logical Layout: Organize the information in a logical flow, starting with client details, followed by services provided, and ending with the total amount and payment instructions.

- Use of Headings: Use bold headings or separators to distinguish between sections and make the document easier to navigate.

By following these design principles, you can create a billing document that is not only clear and easy to understand but also professional and trustworthy, enhancing client satisfaction and ensuring smooth financial transactions.

Billing Documents for Funeral Directors

For directors managing end-of-life services, having a well-structured and professional financial document is essential for maintaining transparency with clients. These records ensure that all services rendered, products provided, and associated costs are clearly communicated. Using a predefined format can streamline the billing process, allowing directors to focus on the services they provide while ensuring the financial side is handled efficiently and accurately.

Why Use a Structured Billing Format?

- Efficiency: A predefined format reduces the time spent creating each document from scratch, helping directors focus on their core responsibilities.

- Consistency: Using the same layout for every financial record ensures consistency in presentation and helps maintain a professional image.

- Transparency: Clearly defined sections and itemized costs make it easier for clients to understand the charges, which builds trust and reduces confusion.

- Customization: Structured billing formats can be easily customized to meet the specific needs of each client, ensuring that no important details are missed.

Key Features to Include in Billing Records

- Client and Service Provider Information: Both parties should be clearly identified, with full names, addresses, and contact details.

- Detailed Breakdown of Services: List all services provided, such as embalming, transportation, and documentation preparation, along with the associated costs for each.

- Payment Information: Clearly state the total amount due, including any taxes, fees, or other charges, and outline payment terms, including due dates and acceptable payment methods.

- Legal Disclaimers: Include any necessary terms and conditions, such as cancellation policies, refund guidelines, or late payment penalties, to ensure clients are fully informed.

Benefits of Using Predefined Billing Formats

- Time-Saving: Predefined formats allow for quick and easy generation of billing documents, eliminating the need for directors to design each one manually.

- Professional Appearance: A well-organized billing document enhances the professional image of the director’s business, contributing to customer confidence and satisfaction.

- Clear Communication: With a structured layout, important information like costs, payment terms, and contact details are easy to find, which minimizes the chances of disputes or misunderstandings.

- Compliance and Accu

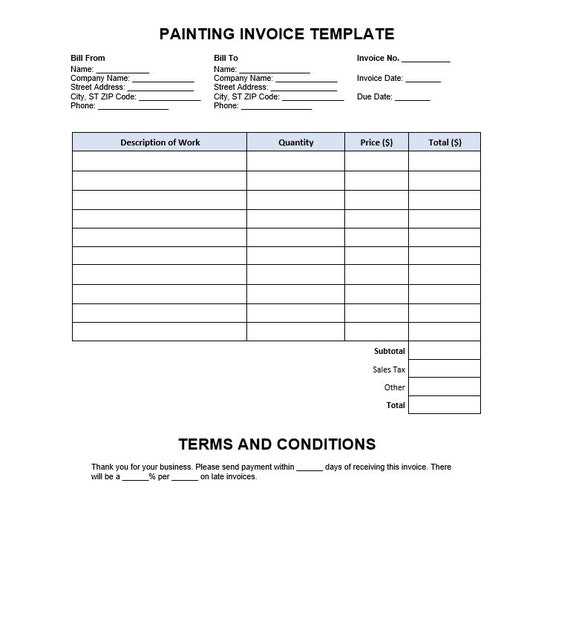

Choosing the Right Format for Your Needs

Selecting the right format for your billing and documentation needs is crucial for ensuring efficiency, professionalism, and clarity. The correct structure should meet the specific requirements of your business, provide flexibility, and help facilitate smooth transactions with clients. By choosing an appropriate format, you can streamline your process, maintain consistency, and create transparent financial records that benefit both you and your clients.

Key Considerations When Choosing a Format

- Business Type: Consider the nature of your services. Some businesses may require more complex documentation, while others may benefit from a simpler layout. Ensure the structure reflects the scale and scope of your offerings.

- Clarity and Simplicity: A format should be easy to read and understand. Avoid overly complex designs that might confuse clients. A straightforward approach with clear headings and sections will help in maintaining transparency.

- Customization Options: Choose a format that can be tailored to your needs. Flexibility in adding or removing sections, adjusting fonts, and incorporating your branding will ensure the document suits your business identity.

- Legal Compliance: The format should include all legally required information, such as terms of service, payment policies, and tax details. This helps avoid disputes and ensures that your documents are compliant with local laws.

Benefits of a Well-Suited Structure

- Efficiency: A properly structured document reduces the time spent on administrative tasks. Pre-designed formats allow for quick generation of professional records, saving time for both the provider and the client.

- Professional Image: A clean, consistent format enhances your credibility. When your records are organized and easy to navigate, clients are more likely to trust your services.

- Transparency: A well-organized layout helps ensure that all charges are clearly communicated, reducing the likelihood of misunderstandings or disputes over payment.

- Consistency: Using a consistent structure across all your financial documents promotes organization and makes it easier to track past transactions.

Ultimately, choosing the right format involves balancing functionality with aesthetics to create a document that meets your business needs and delivers clarity to your clients. Consider all aspects before making a decision to ensure that the format you choose helps streamline your processes and supports your professionalism.

How to Track Payments for Services

Effectively tracking payments for services provided is essential to maintaining a smooth and organized business operation. Having a reliable system in place ensures that all transactions are recorded accurately, outstanding balances are identified, and payment histories are easily accessible. Whether payments are made in full, in installments, or through various methods, clear tracking prevents confusion and helps maintain good relationships with clients.

Steps to Track Payments Effectively

- Use a Payment Log: Maintain a detailed record of all payments received, including the payment date, amount, method, and any relevant transaction identifiers. This log will provide a quick reference and ensure that no payments are missed.

- Update Accounts Regularly: Each time a payment is received, update the client’s account immediately. This ensures that balances are always current and accurate, a

Creating Digital Billing Documents

In the modern age, transitioning to digital billing records offers numerous advantages for businesses, including efficiency, accessibility, and eco-friendliness. By creating digital records, you can easily store, share, and retrieve financial documents, while reducing paperwork and minimizing the risk of errors. Digital formats also allow for greater customization and automation, making it simpler to manage multiple clients and transactions.

Steps to Create Digital Billing Records

- Choose the Right Software: Select a digital tool or software that suits your business needs. There are various platforms available, from simple spreadsheet programs to advanced accounting systems that automatically generate and track billing documents.

- Use Professional Formatting: Ensure that the digital document is formatted in a clear, professional manner. Consistency in design and organization helps make the document easy to read and ensures it reflects your business’s professionalism.

- Include All Necessary Information: Just like physical records, digital billing documents should contain all relevant details, such as client information, services rendered, costs, taxes, and payment terms. Ensure these elements are clearly laid out to avoid confusion.

- Incorporate Automated Features: Many digital tools allow you to automate certain processes, such as generating recurring billing records, adding taxes, or applying discounts. Automation can save time and reduce errors.

- Save in Accessible Formats: When saving your documents, choose formats that are widely accessible, such as PDF or Excel. These formats ensure that clients can easily view and print the records, regardless of the software they use.

Benefits of Digital Billing Documents

- Time-Saving: Digital records can be created and sent instantly, eliminating the need for manual paperwork and postal delays. Automation tools further speed up the process.

- Easy Sharing: You can easily email or share billing records with clients, making the payment process quicker and more convenient for both parties.

- Improved Organization: Digital files can be easily stored, categorized, and searched, making it simpler to keep track of past transactions and manage your financial records.

- Security: Digital records can be encrypted and password-protected, reducing the risk of loss or unauthorized access compared to paper-based documents.

- Environmentally Friendly: Moving to digital records reduces the need for paper, helping your business contribute to environmental sustainability.

Creating digital billing records is a smart and efficient choice for businesses looking to streamline their operations. By a