How to Use a Fuel Invoice Template for Efficient Billing

Managing accurate billing records is essential for any business that provides goods or services, especially those involving regular transactions like fuel supply. Proper documentation ensures clarity, prevents errors, and helps maintain smooth financial operations. An organized billing system can save time, minimize misunderstandings, and improve overall customer satisfaction.

One of the best ways to streamline this process is by using a structured document design that can be easily customized for different needs. Such a format allows businesses to quickly generate clear and professional statements that meet both legal requirements and customer expectations. The right approach can greatly reduce the risk of costly mistakes, making it easier to focus on other aspects of running a business.

In this article, we will explore how to create and utilize an effective billing format that suits various industries, offering a reliable solution for anyone looking to enhance their invoicing process. Whether you’re a small enterprise or a larger organization, having a straightforward, reusable document model is a key step toward efficient financial management.

Fuel Invoice Template Overview

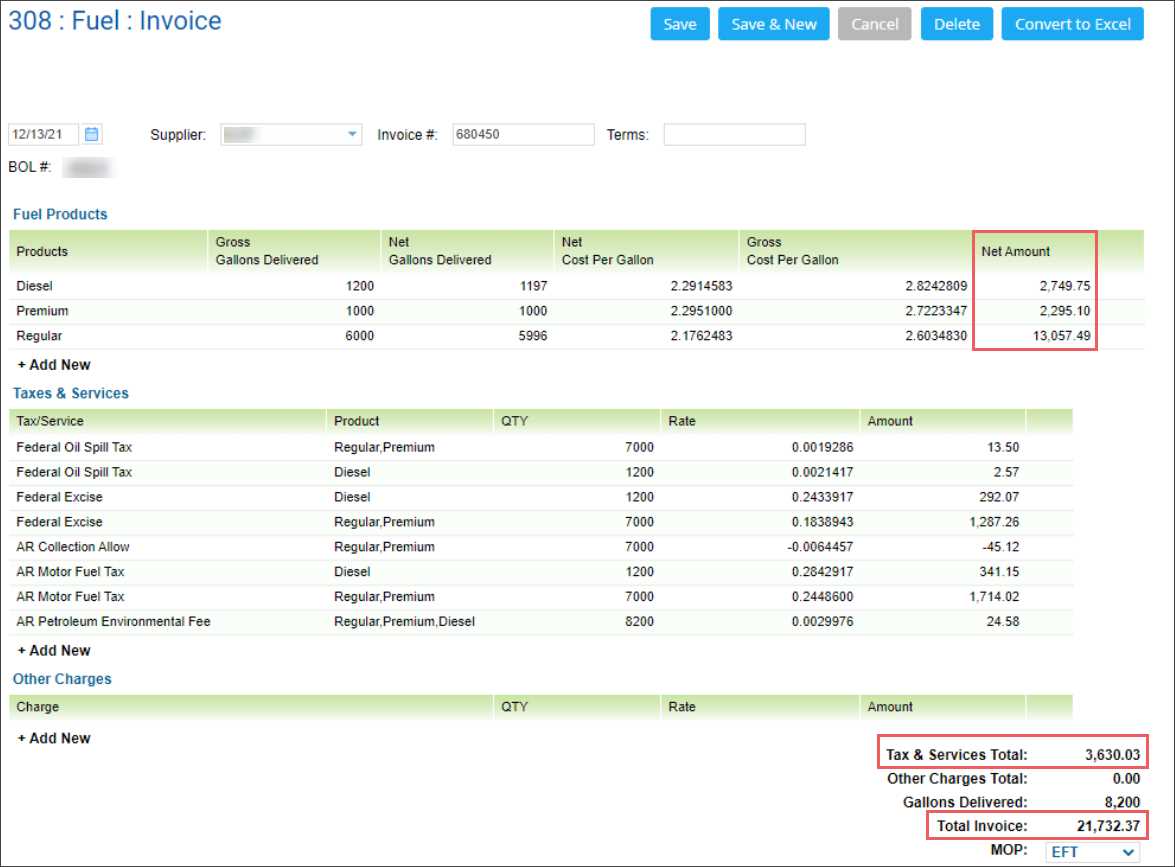

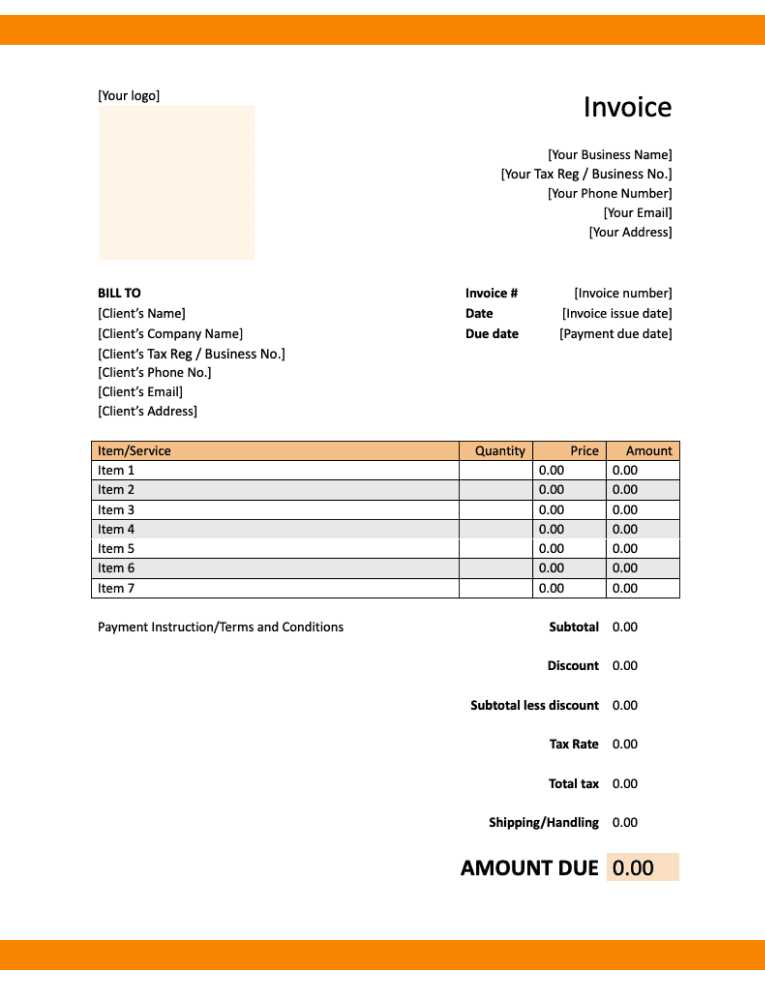

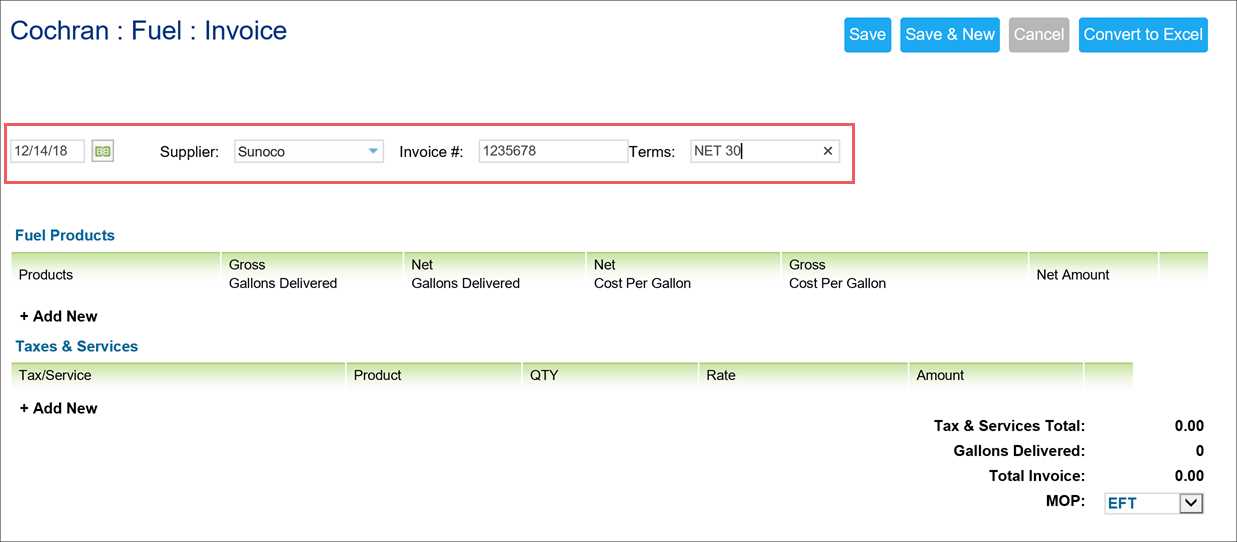

Having a well-structured billing document is crucial for any business involved in the delivery of consumable products like gasoline or other energy sources. This type of document serves as a formal record of the transaction between the supplier and the customer, outlining key details such as the quantity delivered, cost, and terms of payment. A standardized format can simplify the process of generating these records while ensuring consistency and accuracy across all transactions.

By utilizing a pre-designed layout, businesses can reduce errors and save time that would otherwise be spent on creating a new document from scratch for each transaction. Additionally, it helps maintain professionalism, contributing to clearer communication with clients and smoother financial operations. The key is to focus on all necessary information while keeping the structure simple and easy to understand.

The following table outlines the main components that should typically be included in a well-crafted billing document for energy-related transactions:

| Section | Description | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Seller Information | Details about the supplier, such as company name, contact info, and business address. | |||||||||||||||||||||||||

| Customer Information | Information about the buyer, including name, address, and billing contact. | |||||||||||||||||||||||||

| Transaction Date | The exact date when the product was delivered or the service was provided. | |||||||||||||||||||||||||

| Product/Service Description | A brief summary of the product or service provided, including unit prices and quantity delivered. | |||||||||||||||||||||||||

| Total Amount | The final amount due, often broken down into subtotal, taxes, and any additional charges. | |||||||||||||||||||||||||

| Payment Terms | Details on how and when the payment should be made, including payment methods and deadlines. | |||||||||||||||||||||||||

| Notes | Any additional relevant details, such as

Why Fuel Invoices Are ImportantProper documentation of transactions plays a crucial role in ensuring transparency and trust between businesses and their customers. When it comes to services involving the delivery of consumable products, having an organized record is essential for both parties. These records not only help track payments but also serve as a legal safeguard, should any disputes arise. Without such documents, businesses may struggle to maintain accurate financial records and risk facing complications in tax reporting or payment collection. Moreover, a standardized record provides a clear summary of the transaction, helping businesses and clients stay aligned on the agreed terms. It also simplifies accounting processes, making it easier to manage payments and monitor cash flow. Without this structured approach, businesses might find it difficult to assess the accuracy of their income or identify discrepancies in what has been paid versus what is owed. Legal and Financial BenefitsIn addition to streamlining internal processes, well-organized documentation plays a key role in legal and financial matters. It can be used as evidence in case of disputes or discrepancies and ensures both parties fulfill their obligations. Moreover, it helps businesses maintain compliance with tax laws by providing the necessary details for reporting purposes. Impact on Customer RelationsClear and professional documents contribute to building trust with clients. By offering accurate and timely records, businesses demonstrate their reliability and attention to detail. This not only helps in securing long-term contracts but also ensures that customers feel confident in their transactions, ultimately leading to better customer satisfaction and retention. The following table summarizes the key reasons why these documents are so essential:

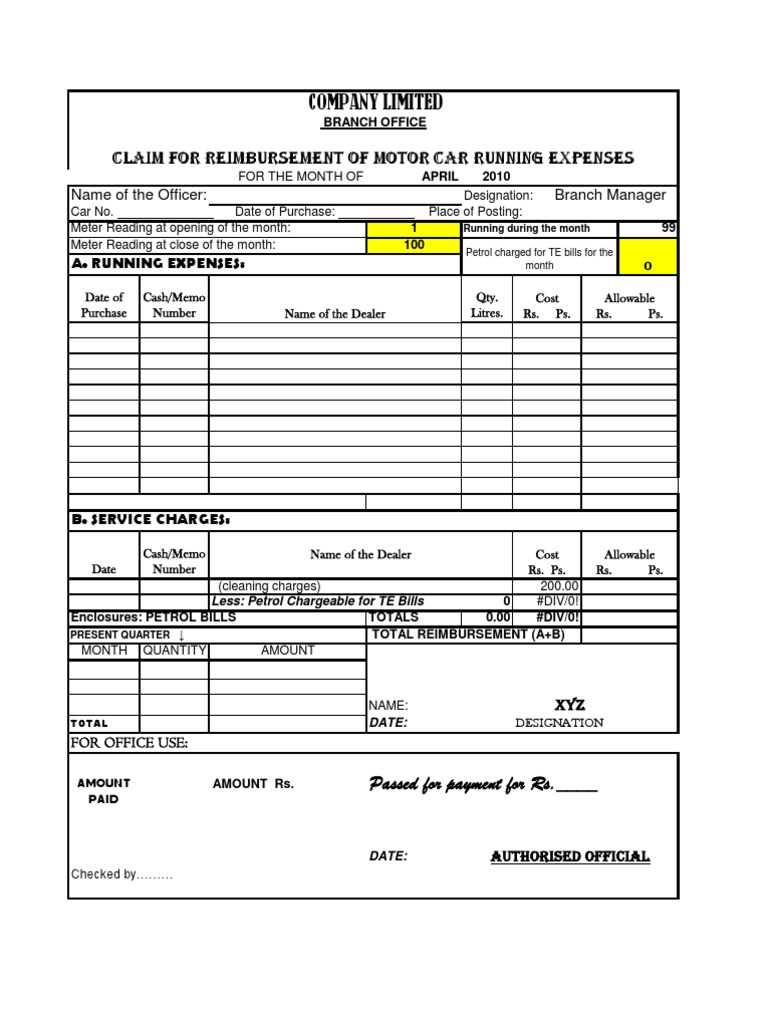

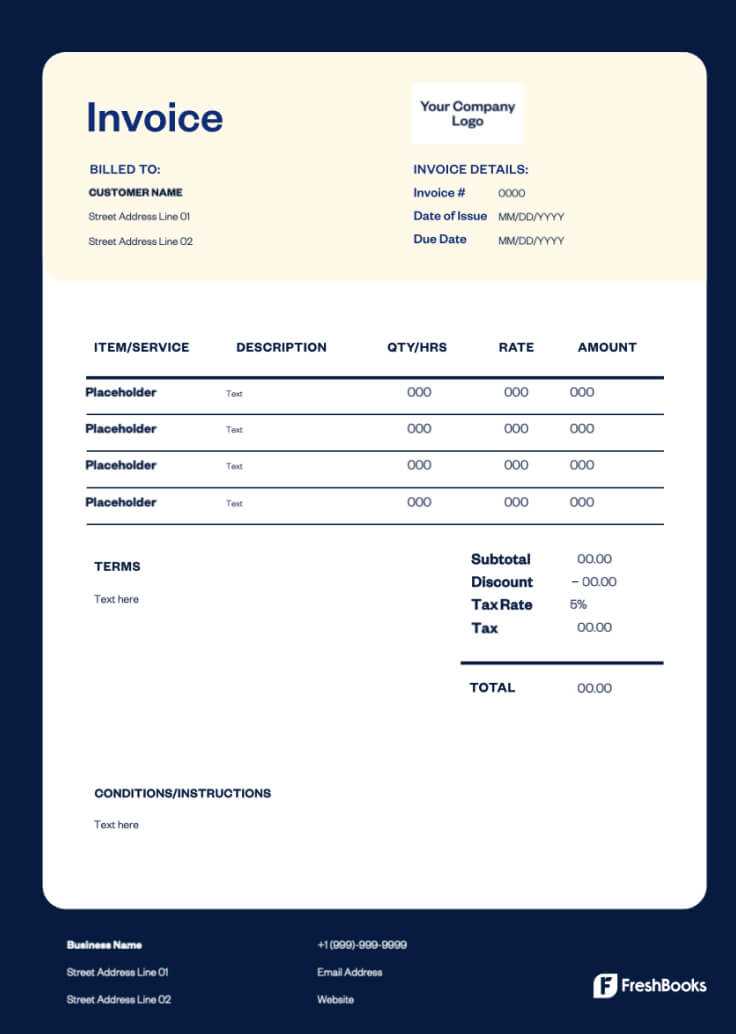

Overall, the use of a well-structured format How to Customize a Fuel InvoicePersonalizing your billing documents allows you to better align them with your business needs and branding. Customization helps you include specific details relevant to your industry, making each record more accurate and tailored to both you and your clients. It also ensures that every document maintains a professional appearance while reflecting the unique nature of your service or product. Here’s a step-by-step guide on how to adjust your document to suit your business requirements: 1. Adjust Layout and Design

2. Include Relevant Sections

3. Personalize with Additional Features

Once you’ve made these adjustments, your document will not only look more professional, but it will also reflect the uniqueness of your business while being more functional for both you and your customers. Customizing a billing document ensures that all relevant details are captured and presented clearly, making the process smoother for everyone involved. Common Mistakes in Fuel InvoicesWhile preparing billing documents, businesses can often overlook key details or make mistakes that can lead to confusion, payment delays, or even disputes. It’s important to be vigilant and ensure that all necessary elements are correctly included, as even small errors can have significant consequences. Understanding common mistakes can help businesses avoid them and ensure smooth transactions. 1. Missing or Incorrect Information

One of the most frequent mistakes is failing to include accurate or complete details, which can result in confusion or missed payments. Some common issues include:

2. Lack of Clear Payment TermsFailure to clearly specify payment terms can create confusion regarding when payment is due and what methods are accepted. Common issues include:

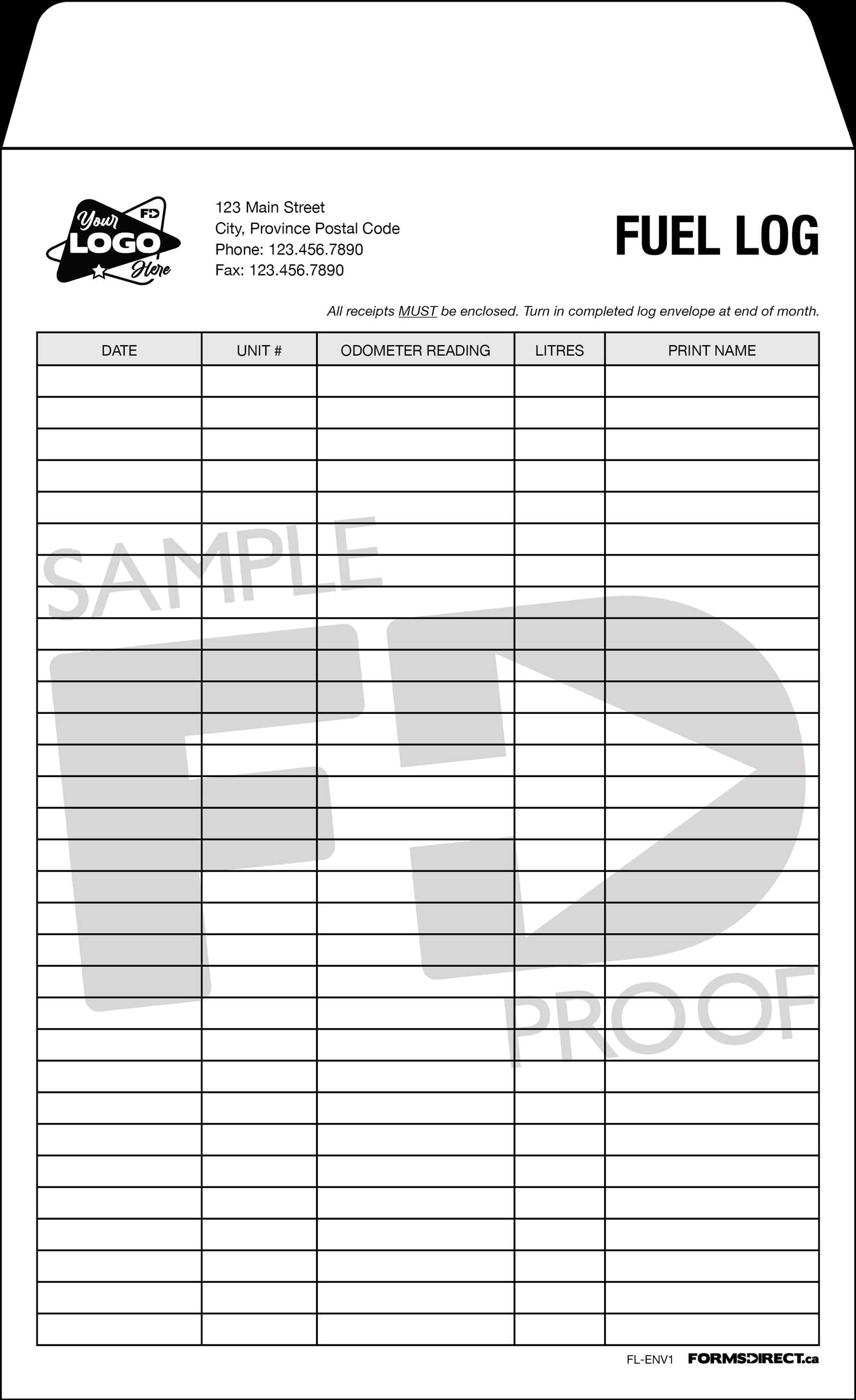

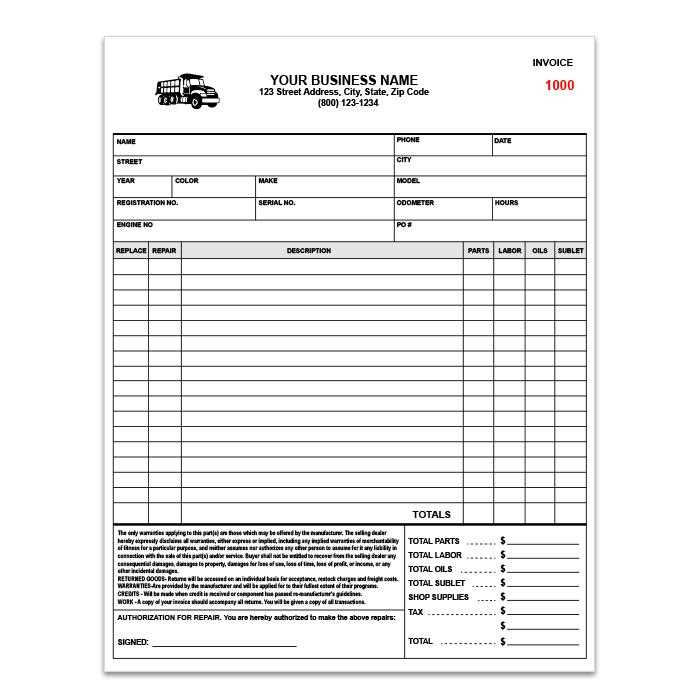

By being mindful of these common errors, businesses can create clear, professional, and accurate billing records that help facilitate smooth and timely transactions. Creating a Professional Invoice LayoutA well-organized and visually appealing layout is essential for any billing document. A professional appearance not only enhances the credibility of your business but also makes it easier for both parties to review and understand the details of the transaction. By designing a clear and structured layout, you can ensure that the most important information stands out and that the document is easy to navigate. 1. Organize Information LogicallyEnsure that your document follows a logical flow, with each section clearly defined and easy to find. A typical layout includes sections such as supplier and customer information, transaction details, payment terms, and any additional notes. Grouping related elements together helps the reader focus on the relevant details without confusion.

2. Prioritize Readability and ClarityWhen designing your document, keep readability in mind. Use clear fonts and adequate spacing between sections to ensure the content is easy to read. Avoid cluttering the page with too much information or using overly complicated language. Simplicity and clarity are key to making the document effective.

|