How to Create a Friendly Invoice Reminder Template for Better Payment Follow-up

Maintaining a smooth cash flow is crucial for any business, but one of the most challenging aspects is ensuring timely payments from clients. Sending reminders about overdue balances is an essential task, but the way these reminders are worded can make a significant difference in how clients perceive your communication. A well-crafted message can prompt prompt action while preserving positive relationships.

Rather than resorting to harsh or impersonal notices, adopting a polite, professional tone can improve the chances of a quick response. Crafting messages that are clear yet considerate not only encourages prompt payment but also strengthens your reputation as a reliable and approachable business partner. The right approach can turn a potentially awkward situation into a simple administrative task.

In this article, we will explore the best practices for creating an effective follow-up message. By focusing on tone, clarity, and timing, you can develop a system that helps manage your receivables efficiently while maintaining strong customer relations. Whether you’re reaching out by email or using other forms of communication, these guidelines will help ensure your requests are met with a positive outcome.

Friendly Payment Follow-Up Message Guide

Reaching out to clients for overdue payments can be a delicate task. The key to success lies in crafting messages that are clear, concise, and respectful. The right balance ensures that clients understand the urgency of the situation while maintaining a positive relationship. A well-structured communication approach can help you collect payments on time without damaging rapport.

When creating a follow-up message, it’s important to consider the tone. Being polite and professional while clearly stating the outstanding amount and due date helps convey the necessary information without being too forceful. Additionally, it’s essential to provide clients with easy options for settling the balance, such as offering payment methods or including payment instructions.

In this section, we’ll outline a simple yet effective structure for a follow-up communication that encourages clients to act swiftly and professionally. By following these guidelines, you can ensure that your payment requests are not only effective but also maintain a positive relationship with your clients.

Why Polite Payment Follow-Ups Improve Payment Rates

When clients receive payment requests that are clear, courteous, and professional, they are more likely to respond promptly. A respectful tone helps maintain a positive relationship, even when discussing overdue balances. A thoughtful approach to communication not only enhances the chance of timely payments but also ensures long-term customer loyalty.

The Importance of Tone in Client Relationships

Clients are more inclined to settle accounts when the tone of the message is polite and understanding. When reminders are firm but respectful, they communicate professionalism without causing frustration. A message that acknowledges the client’s busy schedule and gently urges them to take action shows empathy while still emphasizing the need for timely payment.

Reducing Negative Reactions Through Courteous Communication

Harsh or impersonal language can lead to negative emotions and may even strain business relationships. On the other hand, polite follow-ups reduce the risk of clients feeling pressured or resentful, creating a cooperative atmosphere. This approach not only improves the likelihood of payment but also fosters trust and goodwill.

Key Elements of a Polite Payment Follow-Up

When requesting payments from clients, certain elements are essential to ensure the message is both clear and considerate. A well-crafted communication includes vital details like the outstanding amount, payment methods, and a gentle tone. These components work together to convey professionalism and respect, helping clients feel at ease while addressing the overdue balance.

Important Aspects to Include in Your Message

To create an effective payment request, make sure to include the following elements:

| Element | Description |

|---|---|

| Clear Amount | Ensure the outstanding balance is clearly stated to avoid confusion. |

| Due Date | Remind the client of the original due date or state a new deadline for payment. |

| Payment Instructions | Include simple and clear instructions for how the payment can be made. |

| Polite Tone | Use courteous and professional language to maintain a positive relationship. |

| Contact Information | Provide your contact details in case the client has any questions or needs assistance. |

Building Trust with Clear Communication

By incorporating these key elements, you can create a message that encourages timely payment while maintaining positive rapport with your clients. Providing clear instructions and a friendly tone helps prevent misunderstandings and shows your commitment to a professional and trustworthy relationship.

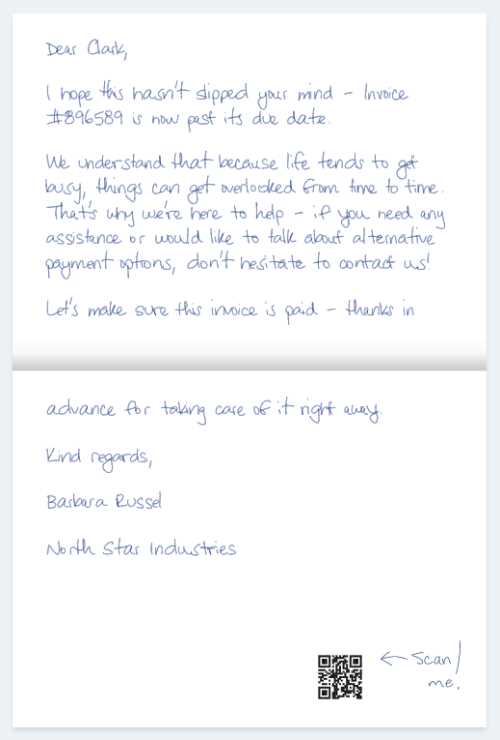

How to Personalize Your Payment Request Message

Personalization plays a significant role in making payment follow-ups more effective and less likely to be ignored. Tailoring your communication to each client shows that you value their business and strengthens your professional relationship. By incorporating personal touches into your messages, you can increase the likelihood of a prompt response and payment.

Key Strategies for Customizing Your Message

Here are some strategies to personalize your payment follow-up effectively:

- Use the Client’s Name: Always address the recipient by their first or full name to make the message feel more personal and direct.

- Reference Previous Communication: If you’ve spoken with the client before about the payment, mention this briefly to show you are attentive to their account.

- Adjust the Tone Based on Relationship: Customize the tone of the message depending on how well you know the client. For long-term clients, a more casual approach may work, while new clients may appreciate a more formal tone.

- Offer Solutions: If the client is facing financial difficulties, consider offering flexible payment options or negotiating terms to ease the process.

Examples of Personalized Payment Requests

Here are a few examples of how to personalize a message:

- Dear [Client’s Name], we hope you’re doing well. We wanted to follow up on your recent purchase from [Company Name] on [Date]. The outstanding balance of [Amount] was due on [Due Date]. Please let us know if there’s anything we can assist you with regarding the payment.

- Hello [Client’s Name], we truly appreciate your business with us. We noticed that your payment of [Amount] for [Service/Product] hasn’t been received yet. We would be grateful if you could let us know if there’s any issue with the payment process.

By adding these personal touches, you demonstrate attentiveness and professionalism, which can help build trust and encourage faster payment.

Choosing the Right Tone for Clients

Effective communication with clients is essential in maintaining positive relationships, especially when it comes to handling outstanding payments. The tone you use can significantly impact how your message is received and, ultimately, the outcome of the situation. Striking the right balance between professionalism and approachability is key to ensuring that clients are not only reminded of their obligations but are also left with a favorable impression of your business practices.

Factors to Consider When Setting the Tone

The tone of your message should vary depending on the nature of your relationship with the client and the specifics of the situation. Key factors include the client’s history with your company, the frequency of past interactions, and the urgency of the payment request. A respectful and courteous approach will often yield better results, even in cases where payments are overdue.

| Situation | Recommended Tone | Key Elements |

|---|---|---|

| First-time reminder | Polite and helpful | Gentle approach, expressing understanding |

| Repeated delays | Firm but respectful | Clear request, setting expectations |

| Ongoing relationship | Friendly yet professional | Maintain rapport, offer solutions if needed |

Striking the Right Balance

It’s important to remember that a strong yet courteous tone can encourage prompt payment without damaging the client relationship. Tailoring your message according to the situation and the client’s personality will help convey professionalism and maintain mutual respect. An overly stern tone can lead to negative feelings, while being too casual might undermine the importance of the matter. Finding the middle ground is essential for preserving both the client’s trust and your business’s financial health.

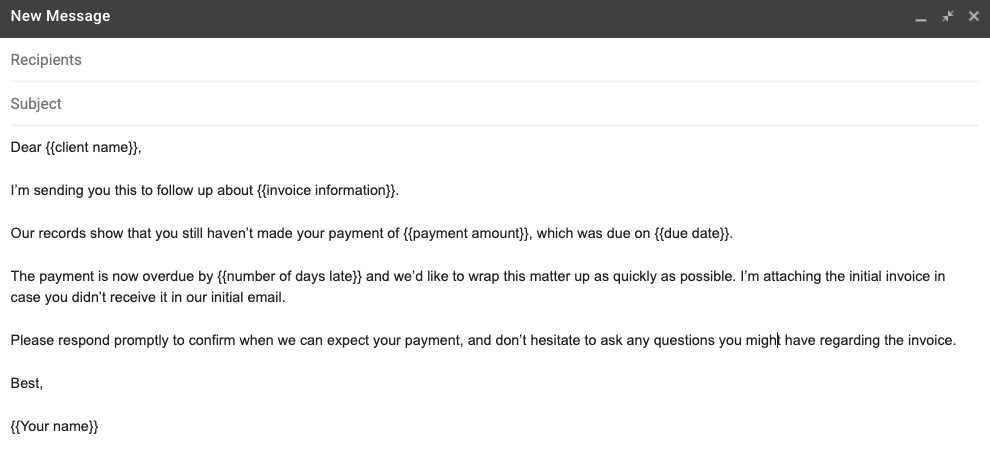

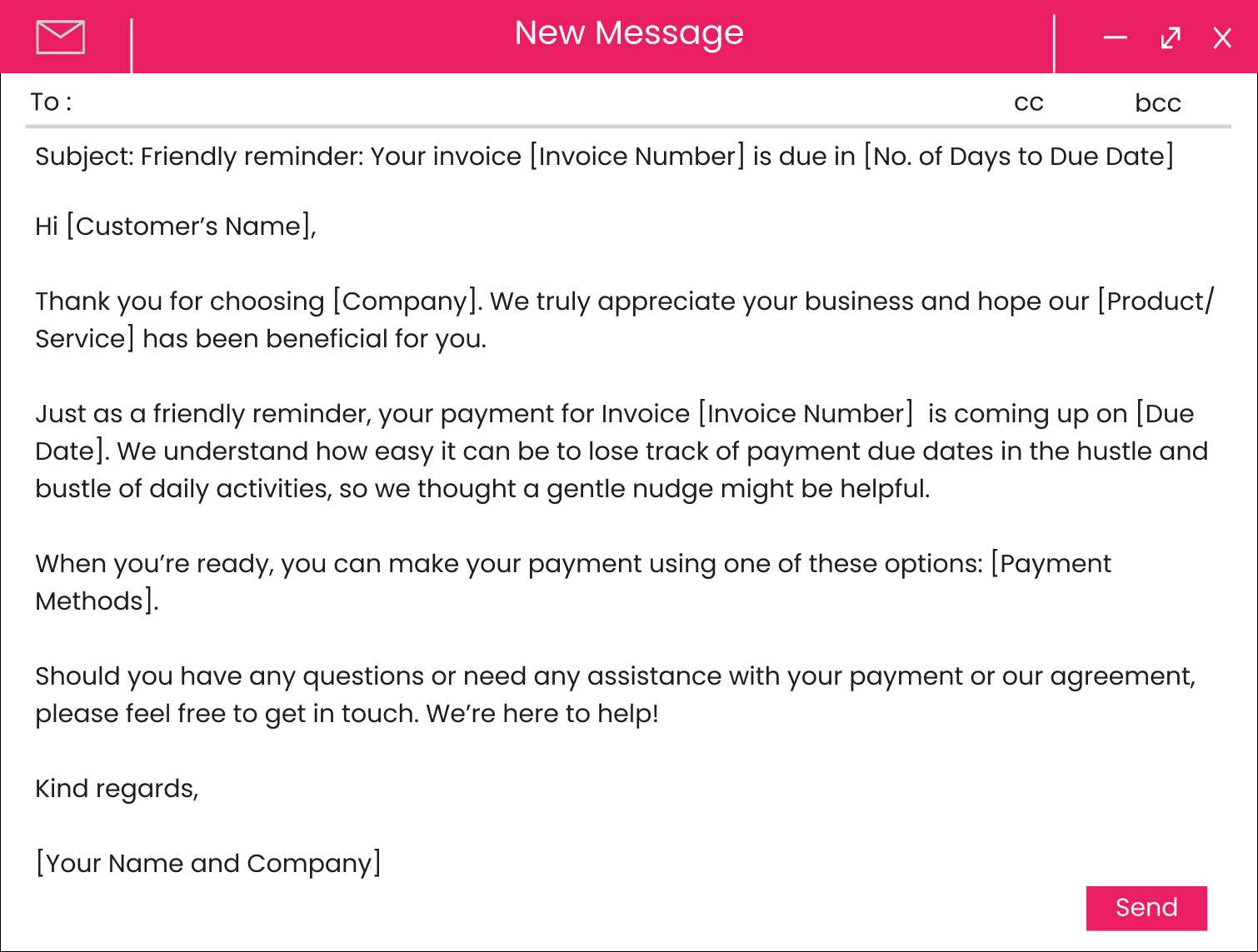

Best Practices for Email Invoice Reminders

Sending reminders via email is one of the most effective ways to ensure that clients fulfill their payment obligations in a timely manner. However, crafting a message that strikes the right tone, provides all necessary details, and encourages prompt action requires careful attention. Implementing a few key strategies can enhance the chances of a successful follow-up and maintain a positive relationship with your clients.

Key Elements to Include

To ensure clarity and professionalism in your email, it’s important to incorporate the following elements:

- Clear Subject Line: Make sure the subject is direct yet polite, so it’s immediately clear what the email pertains to.

- Polite Greeting: Begin with a respectful and professional salutation, tailored to the client’s preferred form of address.

- Specific Details: Provide clear information about the outstanding amount, due date, and any necessary payment instructions.

- Reminder of Terms: Mention any agreed-upon payment terms and highlight the benefits of timely settlement, such as avoiding late fees or maintaining good standing with your business.

- Call to Action: Encourage action by providing clear instructions on how to proceed with the payment.

- Polite Closing: End the email on a positive note, thanking the client for their attention and offering assistance if needed.

Timing and Frequency

Sending the follow-up at the right time is crucial for a successful outcome. Too early, and it might come off as unnecessary; too late, and the client may have already forgotten about the pending payment. Here are some guidelines for when to send your emails:

- First Notice: Send an email as soon as the payment is due, providing the client with enough time to process the payment.

- Second Notice: If the payment has not been made after a few days, follow up with a polite email reminding them of the outstanding balance.

- Final Notice: If payments remain overdue, send a more urgent email, reiterating the importance of timely payment and mentioning any applicable late fees or other consequences.

By following these best practices, you can help ensure that your clients are reminded of their obligations without feeling pressured, and keep your cash flow running smoothly while preserving a positive working relationship.

Setting the Right Reminder Frequency

Finding the ideal frequency for sending follow-up messages about unpaid balances is crucial for maintaining a good client relationship while ensuring timely payments. Too frequent reminders can come across as pushy, while infrequent ones might lead to delays or missed payments. Striking the right balance is essential for effective communication and a steady cash flow.

Factors to Consider

When determining how often to send a follow-up, consider the following factors:

- Client’s Payment History: If the client has a consistent record of paying on time, you might not need to follow up as frequently.

- Amount Due: Larger amounts may warrant more frequent follow-ups to ensure timely settlement, while smaller amounts could afford a longer grace period.

- Relationship with Client: For long-standing clients with whom you have a strong rapport, you can often be more lenient with follow-up frequency.

- Urgency: If there are any time-sensitive elements (e.g., project deadlines or contracts), it’s important to remind the client sooner to ensure there are no delays.

Recommended Follow-Up Schedule

Establishing a clear timeline for follow-ups helps set expectations and ensures you’re being respectful of your client’s time. A typical approach could look like this:

- First Follow-Up: Send the first message the day after the due date has passed. This provides a gentle reminder without being overbearing.

- Second Follow-Up: If payment is still outstanding after 7–10 days, send another email, this time with a slightly firmer tone but still polite and respectful.

- Final Follow-Up: After 15–20 days, consider sending a more urgent email, clearly stating the importance of settling the balance and any potential consequences of further delays.

By adjusting the timing of your follow-ups based on these factors, you can maintain a professional and considerate approach that encourages prompt action without alienating your clients.

How to Design a Simple Reminder Template

Creating a straightforward follow-up message that is both professional and easy to understand is essential for ensuring your clients know exactly what is expected of them. A well-designed message should be concise, clear, and visually appealing, making it easy for the recipient to process the information and take the necessary action. By focusing on the key elements and structure, you can design an effective communication piece that enhances your chances of timely payments.

Key Elements to Include

When designing a simple follow-up message, certain components are essential to convey the information clearly and professionally. Here are the most important elements to consider:

- Clear Subject Line: Choose a direct and polite subject line that immediately conveys the purpose of the message.

- Client Information: Include the client’s name or company name to personalize the communication and establish relevance.

- Outstanding Amount: Clearly mention the amount due and the due date to avoid confusion.

- Payment Details: Provide all necessary details regarding how the payment can be made, including bank account details, links, or payment methods.

- Contact Information: Make sure to include a contact option in case the client needs assistance or clarification regarding the payment.

- Polite Tone: Use a respectful and professional tone throughout the message to maintain a positive relationship with the client.

Design Tips for Clarity and Impact

In addition to the content, the design of your follow-up message can play a big role in its effectiveness. A few tips to keep in mind when structuring the email:

- Use a Clean Layout: Avoid clutter by keeping the design simple. Utilize short paragraphs and bullet points for easy reading.

- Highlight Key Information: Use bold text to emphasize important details such as the outstanding amount and the due date.

- Choose Professional Fonts: Opt for clear, legible fonts like Arial or Helvetica that make the message easy to read on any device.

- Keep the Message Concise: Avoid long-winded explanations. Focus on the essential details and keep the tone courteous but to the point.

By following these guidelines, you can create an effective and straightforward follow-up message that encourages timely action while maintaining a professional and positive relationship w

Timing Your Reminder for Maximum Impact

Sending a follow-up message at the right moment can greatly influence how quickly your clients act. The timing of your communication is crucial not only to get the best results but also to preserve a positive relationship. A well-timed request shows professionalism and respect for the client’s schedule, which can encourage prompt responses and payments.

When to Send Your Follow-Up

Choosing the best time to send a payment follow-up depends on several factors, such as the client’s payment history and the urgency of the outstanding amount. Here are key timeframes to consider:

- Immediately After the Due Date: Sending a polite follow-up on the day the payment is due sets a clear expectation without sounding too harsh. It helps clients stay on track and reminds them of their obligations.

- Three to Five Days After the Due Date: If payment hasn’t been made, waiting a few days before sending another message is ideal. This gives clients time to process payments while still addressing the issue promptly.

- Ten to Fifteen Days After the Due Date: If the payment remains unsettled, this is the point at which you can begin to apply more urgency. At this stage, it’s important to stress the importance of clearing the balance to avoid further complications.

Factors That Affect Timing

Several factors can influence when to send a follow-up, including:

- Client Relationship: For clients you have a long-standing relationship with, you may give them a bit more flexibility in terms of timing, but be sure to remain consistent.

- Amount Due: Larger outstanding balances should generally prompt quicker follow-ups, as they may take more time to process. For smaller amounts, you can afford to wait a little longer before sending a message.

- Payment Cycle: Consider the client’s usual payment schedule. If they typically take longer to pay, it’s important to adjust your follow-up timing accordingly without seeming too demanding.

Timing your follow-up communication wisely can significantly improve your chances of receiving prompt payments while maintaining a positive rapport with your clients.

Common Mistakes to Avoid in Reminders

When following up on unpaid balances, the way you communicate can significantly affect the outcome. Mistakes in your approach may lead to unnecessary tension or even delayed payments. By being mindful of certain pitfalls, you can craft messages that are professional, clear, and effective while maintaining a positive client relationship.

| Mistake | Impact | How to Avoid |

|---|---|---|

| Using an Aggressive Tone | Can damage the relationship and cause the client to feel defensive or resentful. | Maintain a polite, professional, and understanding tone, even if the payment is overdue. |

| Overloading the Message with Information | Can overwhelm the client and obscure the key points, making it harder for them to act. | Be concise and focus only on the necessary details, such as the amount due and payment instructions. |

| Sending Too Many Follow-Ups | Can be perceived as pestering, potentially irritating the client and damaging trust. | Set a clear follow-up schedule, ensuring reminders are sent at appropriate intervals. |

| Being Too Lenient with Deadlines | Can create ambiguity, making it unclear when the payment is actually expected. | Set clear and firm deadlines while remaining courteous and respectful in your communication. |

| Failing to Personalize the Message | Can make the client feel as though the communication is impersonal, reducing engagement. | Use the client’s name and reference specific details, such as the service provided or agreed-upon terms. |

By avoiding these common mistakes, you can ensure your follow-up messages are more effective, leading to better results and preserving your professional relationships.

How to Automate Your Reminder Process

Automating your follow-up process can save you time, reduce errors, and ensure that no payment goes overlooked. With the right tools and systems in place, you can set up automatic notifications to be sent to clients at predefined intervals, helping you maintain a consistent approach to payment collection while minimizing manual effort. This streamlined approach also allows you to focus on more strategic aspects of your business.

Steps to Automate Follow-Ups

To effectively automate your follow-up process, you need to implement the right tools and strategies. Here are the key steps:

- Choose the Right Software: There are numerous tools available that can automate the sending of payment reminders, such as accounting software or dedicated invoicing platforms. Look for options that integrate with your existing systems to minimize additional work.

- Set Up Customizable Triggers: Many automation tools allow you to set triggers based on specific actions, such as when a payment is due or when it becomes overdue. Customize these triggers to align with your business’s payment terms and schedule.

- Personalize the Messages: Even though the process is automated, it’s essential to personalize the content. Use the client’s name, include specific details about the transaction, and ensure the tone remains respectful and professional.

- Define the Frequency and Timing: Decide how frequently the system should send follow-ups and at what times. Ensure that the messages are spaced appropriately to avoid overwhelming the client, while still keeping the payment request top of mind.

Benefits of Automation

By automating your follow-up process, you gain several advantages:

- Consistency: Automation ensures that reminders are sent on time, every time, without fail.

- Time Savings: Automated follow-ups eliminate the need for manual intervention, freeing up your time to focus on other tasks.

- Reduced Errors: Automation reduces the likelihood of human errors, such as forgetting to send a follow-up or sending it too late.

- Improved Cash Flow: Consistent reminders can help improve the speed of payments, contributing to a healthier cash flow for your business.

Automating the follow-up process is an efficient way to ensure payments are collected on time, while maintaining professionalism and saving valuable resources.

Using Friendly Reminders for Better Client Relationships

Maintaining positive relationships with your clients is essential for long-term business success, especially when it comes to managing payment processes. A well-crafted follow-up can serve not only as a gentle nudge for outstanding balances but also as an opportunity to reinforce goodwill and show respect for the client’s time and business. By using polite, considerate messages, you can ensure timely payments while preserving the trust and rapport you’ve built with your clients.

Why the Tone Matters

The tone of your follow-up communication is crucial in shaping how clients perceive your business. Here are a few reasons why using a courteous and approachable tone is so important:

- Builds Trust: A respectful approach fosters mutual trust, showing that you value the client’s business and are committed to maintaining a professional relationship.

- Encourages Timely Payments: A kind and understanding tone is more likely to prompt clients to settle their balances quickly, as they won’t feel pressured or offended.

- Reduces Tension: Overly harsh or aggressive messages can create tension and conflict, whereas a friendly tone helps maintain a positive atmosphere even when discussing overdue payments.

How to Use Polite Follow-Ups Effectively

To use follow-ups effectively in your client interactions, consider the following practices:

- Personalize the Message: Tailor your follow-up to the individual client, using their name and referencing previous interactions or the specific services you provided. This shows that you care about their unique situation and aren’t sending generic messages.

- Express Understanding: Acknowledge that oversights happen and that you understand how busy clients can be. This reduces any potential defensiveness and helps maintain a positive rapport.

- Offer Flexibility: If appropriate, offer alternative payment options or solutions if the client is facing financial difficulties. This shows empathy and can lead to quicker resolutions.

- Set Clear Expectations: While being friendly, ensure your follow-up is clear about the due date or payment terms. This helps avoid confusion and sets clear expectations for the client.

Examples of Polite and Effective Messaging

Here are some tips on how to str

Building Trust Through Professional Communication

Effective communication is a cornerstone of any successful business relationship. When clients feel respected, informed, and valued, they are more likely to maintain trust in your business and be responsive to requests. Professional communication, especially when addressing outstanding matters, plays a key role in strengthening these bonds. It not only ensures clarity and transparency but also helps to create a sense of reliability and mutual respect.

The Importance of Tone and Clarity

How you convey information can make a significant difference in how your message is received. By maintaining a professional tone and ensuring your message is clear, you foster an environment of respect and trust. Here are a few ways in which tone and clarity influence your client relationships:

- Establishes Reliability: Clear and respectful communication demonstrates that you are organized and dependable, making clients more likely to trust you with future business.

- Minimizes Misunderstandings: By expressing your points in an easy-to-understand manner, you reduce the risk of confusion and ensure that both parties are on the same page.

- Builds Respect: Consistently professional communication shows that you value the client’s time and business, leading to increased respect from both sides.

Best Practices for Building Trust

To ensure your communication builds trust rather than undermines it, follow these best practices:

- Be Transparent: Always provide accurate information and be upfront about any expectations or timelines. Transparency demonstrates integrity and fosters a sense of honesty in your relationship.

- Stay Consistent: Consistency in your communication ensures clients know what to expect and can rely on you to follow through on promises.

- Maintain Professionalism: No matter the situation, maintaining a courteous and respectful tone is essential. This professionalism helps to manage even difficult situations effectively.

- Follow Up Timely: Responding to inquiries or sending follow-up messages in a timely manner shows that you are attentive and value the client’s needs.

How Professional Communication Strengthens Client Relationships

By consistently applying these principles, you enhance your business’s credibility and create a foundation of trust with clients. Whether it’s a routine follow-up or addressing a delayed payment, each interaction is an opportunity to reinforce your professionalism and ensure that your clients feel confident in working with you.

Ultimately, building trust through professional communication not only supports the smooth operation of your business but also helps to foster long-lasting relationships that

How to Handle Late Payments with Courtesy

When clients miss payment deadlines, it’s important to approach the situation with tact and professionalism. Maintaining positive relationships while addressing overdue balances ensures continued trust and cooperation. A considerate yet firm approach can encourage timely settlement without causing unnecessary tension.

Understanding the Importance of Diplomacy

Effective communication is key in resolving payment delays without straining professional ties. The goal is to express the need for payment while acknowledging the possibility of unforeseen circumstances that could have caused the delay. Being patient and accommodating can often lead to quicker resolutions.

Steps to Take When Addressing Late Balances

Here are several steps to approach overdue payments respectfully:

| Action | Description |

|---|---|

| Initial Gentle Follow-Up | Start with a soft message asking if there were any issues with processing the payment, offering assistance if needed. |

| Provide Clear Payment Details | Ensure your client has all the necessary information to make payment quickly and easily. |

| Set a New Deadline | Offer a reasonable extension for payment, ensuring they know when the payment is now due. |

| Express Appreciation | Thank them for their attention to the matter and express gratitude for their continued business. |

How to Handle Late Payments with Courtesy

When clients miss payment deadlines, it’s important to approach the situation with tact and professionalism. Maintaining positive relationships while addressing overdue balances ensures continued trust and cooperation. A considerate yet firm approach can encourage timely settlement without causing unnecessary tension.

Understanding the Importance of Diplomacy

Effective communication is key in resolving payment delays without straining professional ties. The goal is to express the need for payment while acknowledging the possibility of unforeseen circumstances that could have caused the delay. Being patient and accommodating can often lead to quicker resolutions.

Steps to Take When Addressing Late Balances

Here are several steps to approach overdue payments respectfully:

| Action | Description |

|---|---|

| Initial Gentle Follow-Up | Start with a soft message asking if there were any issues with processing the payment, offering assistance if needed. |

| Provide Clear Payment Details | Ensure your client has all the necessary information to make payment quickly and easily. |

| Set a New Deadline | Offer a reasonable extension for payment, ensuring they know when the payment is now due. |

| Express Appreciation | Thank them for their attention to the matter and express gratitude for their continued business. |

How to Handle Late Payments with Courtesy

When clients miss payment deadlines, it’s important to approach the situation with tact and professionalism. Maintaining positive relationships while addressing overdue balances ensures continued trust and cooperation. A considerate yet firm approach can encourage timely settlement without causing unnecessary tension.

Understanding the Importance of Diplomacy

Effective communication is key in resolving payment delays without straining professional ties. The goal is to express the need for payment while acknowledging the possibility of unforeseen circumstances that could have caused the delay. Being patient and accommodating can often lead to quicker resolutions.

Steps to Take When Addressing Late Balances

Here are several steps to approach overdue payments respectfully:

| Action | Description |

|---|---|

| Initial Gentle Follow-Up | Start with a soft message asking if there were any issues with processing the payment, offering assistance if needed. |

| Provide Clear Payment Details | Ensure your client has all the necessary information to make payment quickly and easily. |

| Set a New Deadline | Offer a reasonable extension for payment, ensuring they know when the payment is now due. |

| Express Appreciation | Thank them for their attention to the matter and express gratitude for their continued business. |

How to Handle Late Payments with Courtesy

When clients miss payment deadlines, it’s important to approach the situation with tact and professionalism. Maintaining positive relationships while addressing overdue balances ensures continued trust and cooperation. A considerate yet firm approach can encourage timely settlement without causing unnecessary tension.

Understanding the Importance of Diplomacy

Effective communication is key in resolving payment delays without straining professional ties. The goal is to express the need for payment while acknowledging the possibility of unforeseen circumstances that could have caused the delay. Being patient and accommodating can often lead to quicker resolutions.

Steps to Take When Addressing Late Balances

Here are several steps to approach overdue payments respectfully:

| Action | Description |

|---|---|

| Initial Gentle Follow-Up | Start with a soft message asking if there were any issues with processing the payment, offering assistance if needed. |

| Provide Clear Payment Details | Ensure your client has all the necessary information to make payment quickly and easily. |

| Set a New Deadline | Offer a reasonable extension for payment, ensuring they know when the payment is now due. |

| Express Appreciation | Thank them for their attention to the matter and express gratitude for their continued business. |

How to Handle Late Payments with Courtesy

When clients miss payment deadlines, it’s important to approach the situation with tact and professionalism. Maintaining positive relationships while addressing overdue balances ensures continued trust and cooperation. A considerate yet firm approach can encourage timely settlement without causing unnecessary tension.

Understanding the Importance of Diplomacy

Effective communication is key in resolving payment delays without straining professional ties. The goal is to express the need for payment while acknowledging the possibility of unforeseen circumstances that could have caused the delay. Being patient and accommodating can often lead to quicker resolutions.

Steps to Take When Addressing Late Balances

Here are several steps to approach overdue payments respectfully:

| Action | Description |

|---|---|

| Initial Gentle Follow-Up | Start with a soft message asking if there were any issues with processing the payment, offering assistance if needed. |

| Provide Clear Payment Details | Ensure your client has all the necessary information to make payment quickly and easily. |

| Set a New Deadline | Offer a reasonable extension for payment, ensuring they know when the payment is now due. |

| Express Appreciation | Thank them for their attention to the matter and express gratitude for their continued business. |