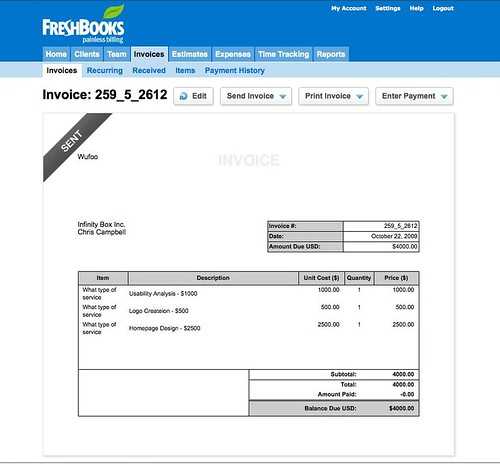

How to Create a Freshbooks Invoice Template for Efficient Billing

In the world of business, having a streamlined system for generating payment requests is essential. Whether you’re an entrepreneur, freelancer, or small business owner, the ability to create polished, clear, and accurate billing records is vital to maintaining a professional image and ensuring timely payments.

Modern tools offer an efficient way to design and send customized payment requests that match your brand and business needs. These solutions not only simplify the process but also save time, allowing you to focus on what matters most–growing your business. By leveraging customizable document layouts, you can ensure that every detail, from itemized charges to payment instructions, is professionally presented.

Through the use of customizable options, it’s possible to tailor each document to specific client needs, ensuring clarity and ease of understanding. Whether you’re looking to automate reminders or incorporate different payment methods, having the right system in place can significantly enhance your workflow and reduce administrative burdens.

Understanding Freshbooks Invoice Template Features

When it comes to creating professional billing documents, having access to versatile features can greatly enhance both the process and the outcome. Customizable solutions allow businesses to tailor each document to specific needs, ensuring consistency, accuracy, and a polished presentation. These features make it easier to generate personalized payment requests while maintaining a professional appearance that aligns with your brand identity.

Customizable Layouts and Design

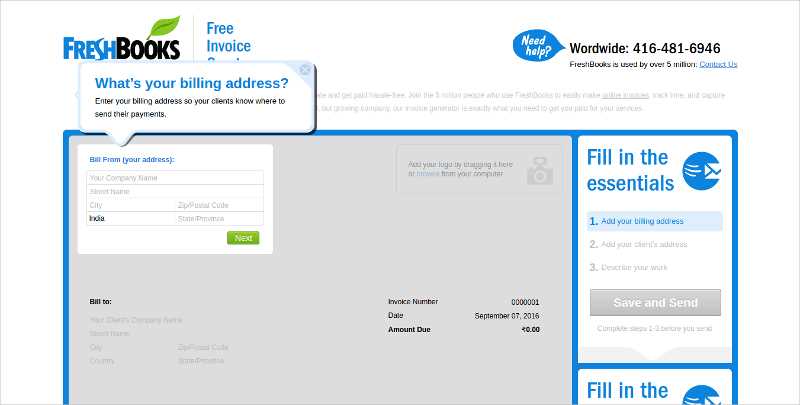

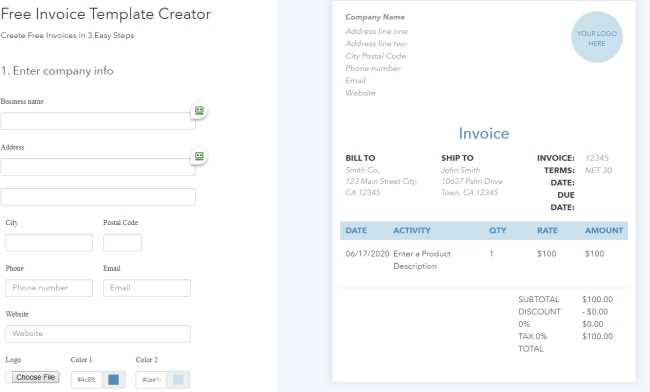

One of the most powerful aspects of these billing tools is the ability to adjust the layout and design. Users can personalize the appearance, from the color scheme to the font style, ensuring that the final product is aligned with their business’s branding. Whether it’s adding a logo, adjusting text alignment, or choosing the most suitable format, this flexibility ensures that every document feels unique and professional.

Incorporating Essential Payment Details

Effective payment requests include not just the charges for services rendered, but also important details such as payment terms, due dates, and client information. With customizable features, you can easily add and modify sections for taxes, discounts, or late fees. This ensures that all the necessary details are present, which helps clients understand their obligations clearly and pay on time.

Why Choose Freshbooks for Invoicing

When it comes to managing billing processes, selecting the right tool can make all the difference. An efficient and intuitive solution can save time, reduce errors, and enhance the overall experience for both business owners and clients. Many platforms offer similar features, but some stand out for their ease of use, customization options, and additional business management capabilities.

Here are some reasons why this platform is ideal for handling payment requests:

- User-Friendly Interface – Simple, easy-to-navigate design that allows you to create professional documents in minutes without the need for technical expertise.

- Customization Options – Flexibility to adjust layouts, logos, colors, and content to match your unique branding and business needs.

- Automated Reminders – Automatically send payment reminders to clients, reducing the need for manual follow-ups and helping ensure timely payments.

- Seamless Payment Integration – Direct integration with popular payment processors, making it easy for clients to pay directly through the billing document.

- Time-Saving Features – Save time with features such as recurring billing, expense tracking, and multi-client management all within the same platform.

By choosing this solution, businesses can streamline their entire payment process, allowing them to focus on growth and customer satisfaction while minimizing administrative work.

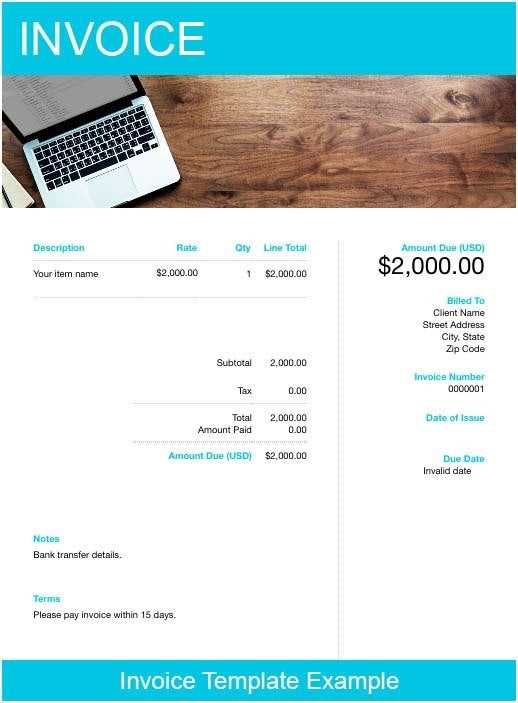

How to Customize Your Invoice Template

Creating a personalized billing document allows you to reflect your business’s identity and professionalism. By customizing the appearance and details of your payment requests, you ensure consistency across all communication with clients. Customization options make it easy to adjust your documents to suit various business needs, whether you’re adding your logo or modifying content sections. This flexibility helps you stand out while keeping the process simple and efficient.

Adjusting Layout and Design

One of the first steps in personalizing your payment requests is selecting a layout that suits your business style. Most platforms allow you to modify the structure, such as the arrangement of the company’s details, itemized charges, and client information. You can choose from a variety of predefined layouts or create your own by adjusting the size of fields, changing text alignment, or adding colors and logos. This ensures that every document reflects your brand.

Adding and Editing Key Information

Customizing the content is equally important. Ensure that essential sections, such as payment terms, due dates, and item descriptions, are clearly outlined. You can easily add custom fields for things like taxes, discounts, or notes for clients. With this flexibility, you can tailor each request to suit specific client needs, ensuring accuracy and clarity in every transaction. Don’t forget to check the payment options, ensuring the payment methods you accept are clearly presented.

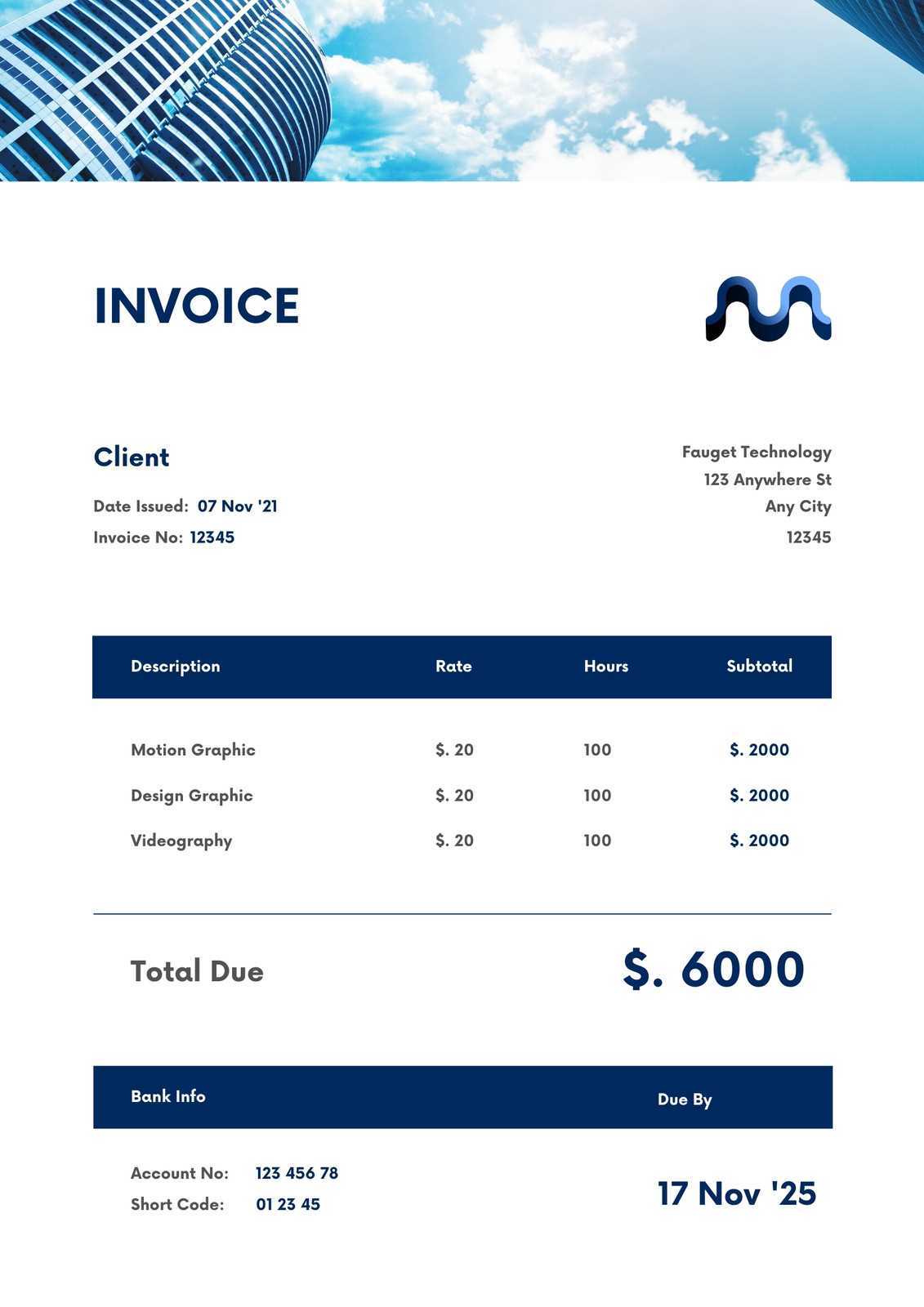

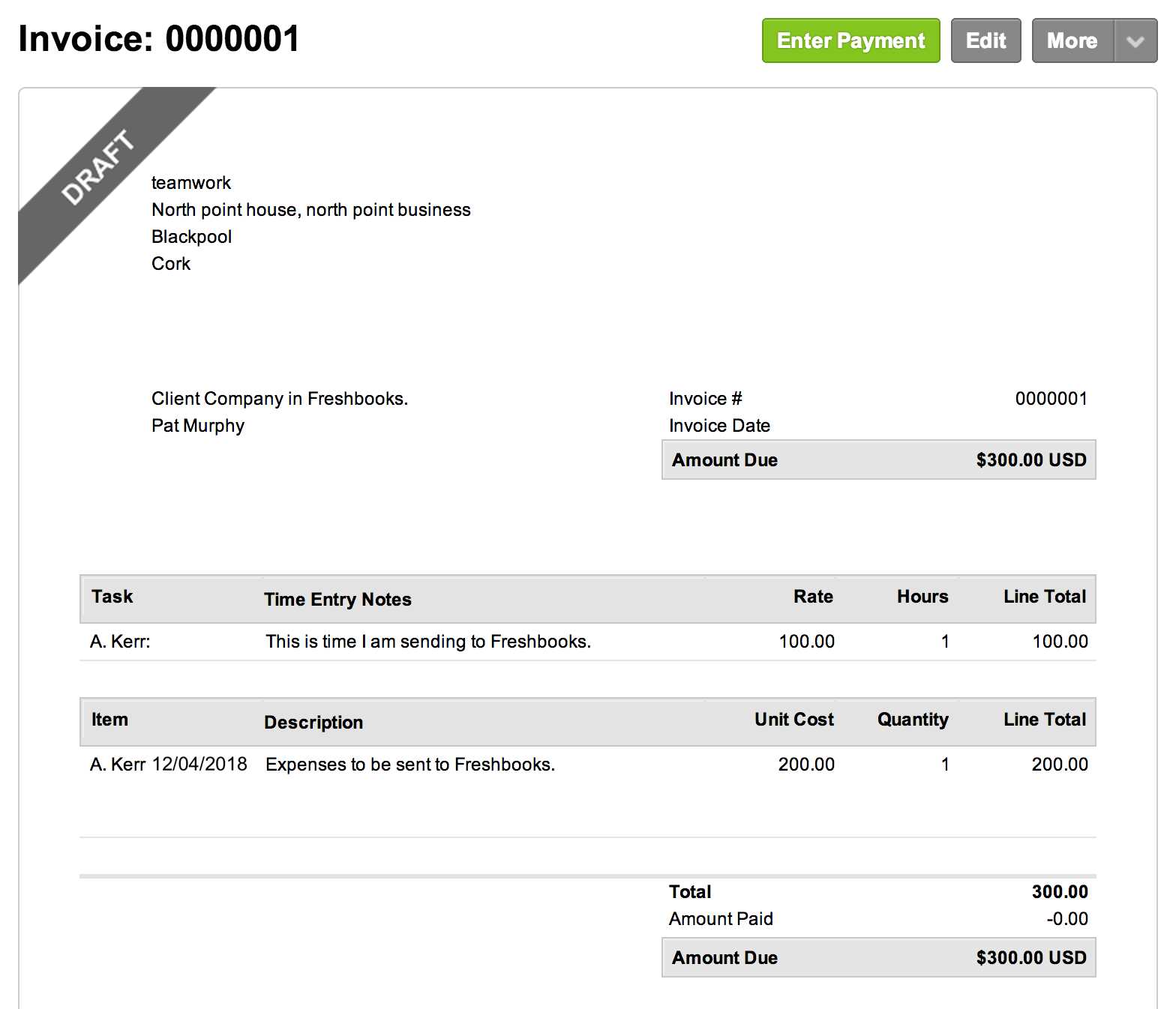

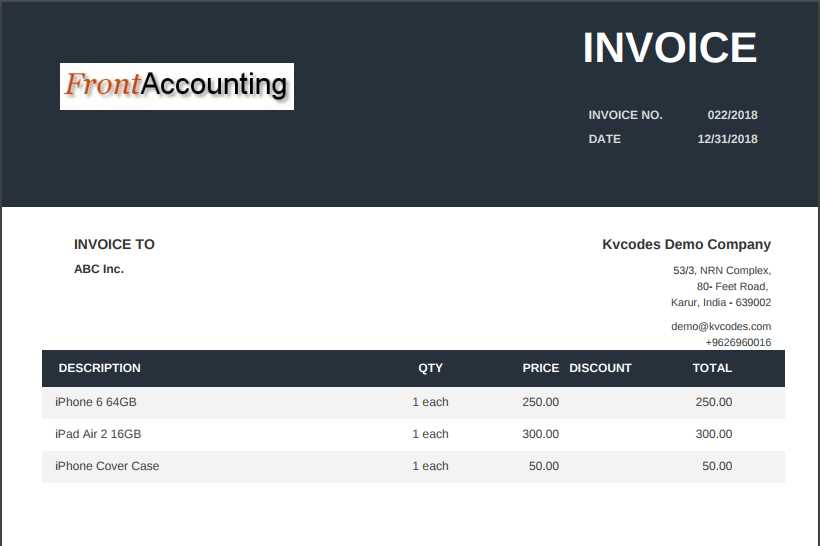

Key Elements of a Professional Invoice

To ensure that your billing documents are clear, comprehensive, and professional, it’s essential to include certain key elements. A well-structured payment request not only helps clients understand the charges but also streamlines your business processes. By including the right information in an organized manner, you create a positive impression and reduce the risk of confusion or delayed payments.

Essential Details to Include

Every payment request should contain specific information that makes it easy for clients to process the payment. These include your business details, the recipient’s information, and a breakdown of the services or products provided. Additionally, it’s important to include the payment terms and due dates to ensure clarity and timely settlement.

Formatting the Breakdown of Charges

Clearly listing charges for goods or services helps avoid misunderstandings. An organized layout with itemized entries is key to ensuring your clients understand exactly what they’re being billed for. Below is an example of how this can be structured in a professional manner:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation Services | 5 hours | $100 | $500 |

| Website Design | 1 | $1,500 | $1,500 |

| Total | $2,000 |

By clearly organizing your charges and providing detailed descriptions, clients will have a clear understanding of the costs, reducing any potential confusion.

Setting Up Payment Options in Freshbooks

Offering a variety of payment methods helps make the transaction process seamless for both you and your clients. Setting up flexible payment options within your billing system ensures that clients can pay in the way that’s most convenient for them, while also helping you manage cash flow more effectively. Whether you’re accepting credit cards, bank transfers, or online payment systems, configuring these choices correctly is essential for smooth business operations.

Types of Payment Methods to Consider

There are several payment methods you can integrate into your billing documents. Offering multiple options can increase the likelihood of prompt payments. Here are some common payment methods that can be set up:

- Credit and Debit Cards – Allow clients to pay quickly and securely through popular card networks like Visa, MasterCard, or American Express.

- Bank Transfers – Provide clients with the option to pay directly from their bank accounts using ACH or wire transfers.

- Online Payment Systems – Integrate platforms such as PayPal, Stripe, or Square to accept payments through their secure networks.

- Checks – While less common in the digital age, some clients may prefer to pay by check, especially for larger amounts.

How to Set Up Payment Options

To streamline payment collection, you should configure your preferred methods within your account settings. This usually involves linking your business bank account, connecting to third-party payment processors, and specifying the types of payments you accept. Follow these steps to set up payment options:

- Go to the payment settings section in your platform’s dashboard.

- Choose the payment gateways or methods you’d like to integrate.

- Enter any required information, such as your bank account details or API keys for third-party payment providers.

- Test the payment options to ensure everything is working smoothly before sending out any documents.

- Enable automatic payment reminders to encourage timely payments from clients.

By configuring these payment methods, you create a more convenient experience for clients while ensuring a reliable and consistent cash flow for your business.

Using Freshbooks for Recurring Invoices

For businesses that provide ongoing services or subscriptions, setting up automatic billing is essential for maintaining a steady cash flow. Recurring payment requests save time and reduce the risk of missed payments, allowing businesses to focus on delivering value to clients. By automating the process, you ensure that clients are consistently charged on time, and you minimize the need for manual administrative work.

Setting Up Recurring Billing

Setting up automatic billing involves creating a system that generates and sends payment requests at regular intervals–whether it’s weekly, monthly, or annually. This is ideal for subscription-based businesses or services with regular maintenance fees. Most platforms allow you to specify the frequency of billing, set start and end dates, and automatically apply the same charges each time.

Benefits of Automating Recurring Charges

Automating your recurring payment requests offers several advantages:

- Consistency – Ensure that payments are processed on time without the need for manual intervention.

- Time Savings – Reduce administrative tasks by eliminating the need to create and send individual requests each time.

- Improved Cash Flow – By automating the billing process, you maintain a predictable and steady stream of income.

- Client Convenience – Clients benefit from the ease of automatic payments without needing to remember to make a payment each time.

Once you set up recurring payment requests, they will automatically be generated and sent based on the agreed-upon schedule. This feature is an excellent way to streamline your billing process while enhancing customer satisfaction and ensuring reliable income.

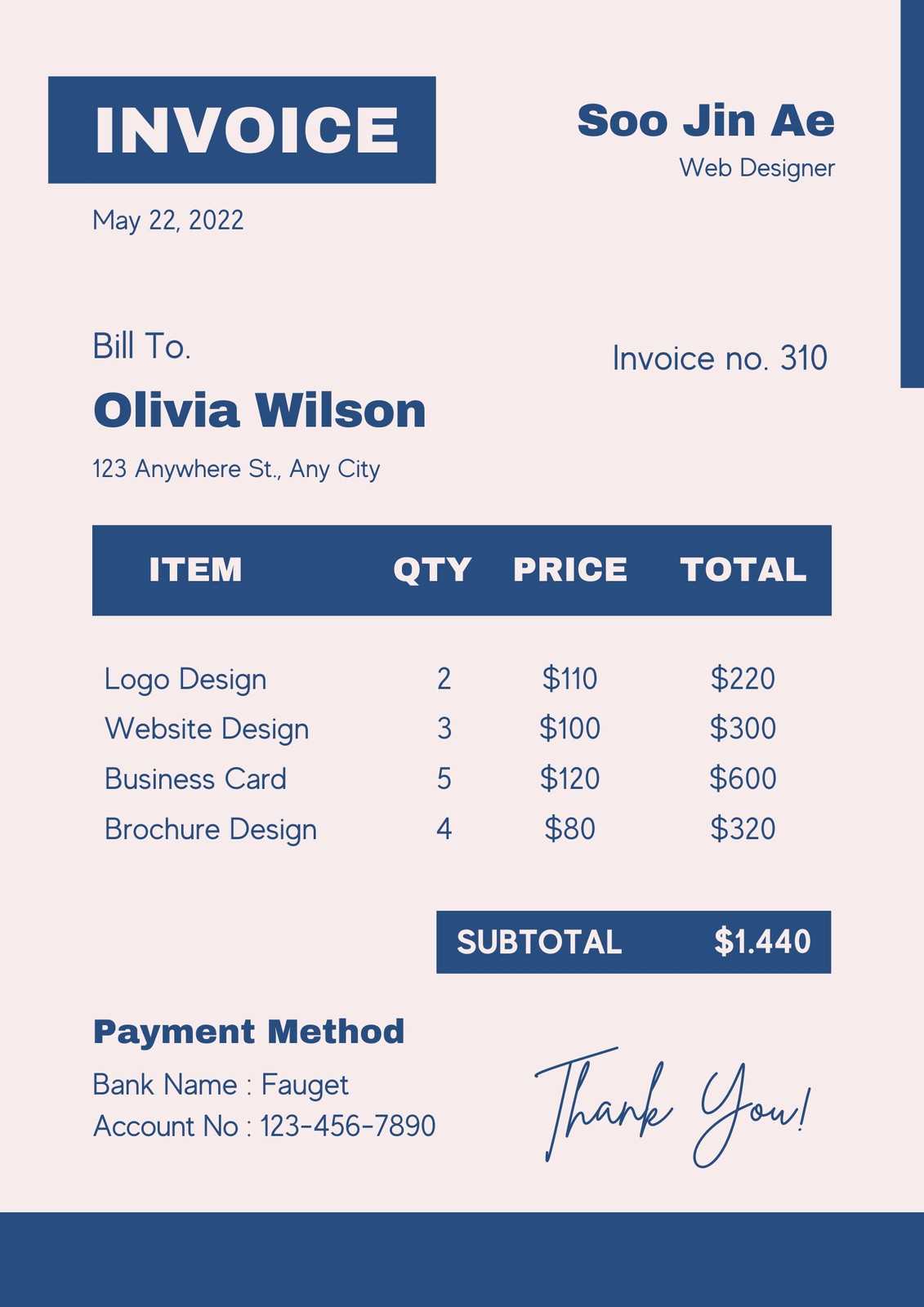

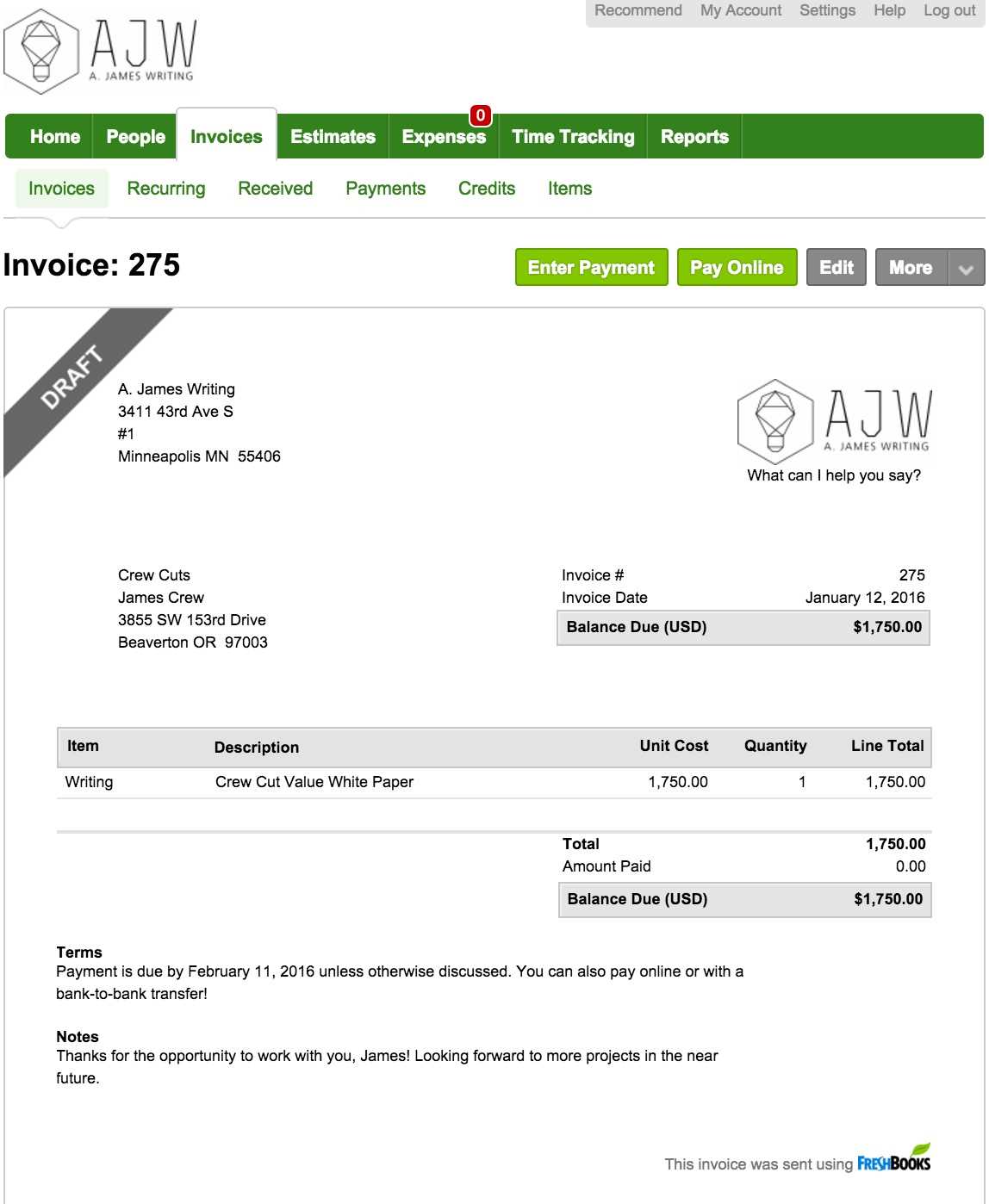

How to Add Your Logo to Freshbooks Invoices

Branding is an essential aspect of maintaining a professional image, and adding your logo to your billing documents is an effective way to reinforce your brand identity. Customizing your payment requests with your company logo not only makes them look more professional but also helps clients easily recognize your business. Most billing platforms allow you to upload and position your logo on the document, making the process quick and straightforward.

Steps to Upload Your Logo

To ensure your branding is prominently displayed, follow these simple steps to add your logo to your billing documents:

- Access the Customization Settings – Log in to your account and go to the settings section where you manage document appearances.

- Select the Logo Option – Look for an option specifically for uploading or adding a logo to your documents. This is usually found in the “Appearance” or “Design” settings.

- Upload the Image File – Choose the logo file from your computer. Make sure the image is in a high-quality format, such as PNG or JPEG, for the best appearance.

- Position Your Logo – Once uploaded, you can adjust the placement of your logo within the document. Most platforms allow you to move it to the top center, top left, or top right of the page.

- Save Your Changes – After positioning the logo, save your changes to apply it to all future payment documents.

Tips for Logo Design and Placement

Here are a few best practices for ensuring your logo looks great on your billing documents:

- Use High-Resolution Images – A clear, high-resolution logo enhances professionalism and avoids pixelation when printed or viewed on screen.

- Maintain Consistency – Ensure that your logo matches the overall color scheme and style of your business documents for a cohesive brand identity.

- Keep It Simple – Your logo should be easily recognizable without overwhelming the document. Avoid overly complicated designs or excessive use of colors.

By adding your logo to your payment requests, you create a consistent and professional appearance that enhances your business image and builds trust with your clients.

Creating Tax Breakdown on Your Invoice

When generating billing documents for your clients, it’s essential to provide a clear and transparent breakdown of all charges, including applicable taxes. This ensures that your clients fully understand what they are being charged for and helps you maintain compliance with tax regulations. A well-structured tax breakdown not only enhances professionalism but also fosters trust with your clients by showing them the exact amount of tax they are being asked to pay.

How to Include Tax Information

Including tax information in your payment requests is relatively simple. Depending on your business needs, you can apply a standard sales tax rate or specific tax rates based on the type of service or product provided. Most systems allow you to specify tax rates and automatically calculate the total tax amount. Here are a few key elements to include:

- Tax Type – Clearly indicate which tax is being applied (e.g., sales tax, VAT, service tax, etc.).

- Tax Rate – Specify the percentage rate being charged (e.g., 10%, 15%, etc.).

- Amount of Tax – Show the exact tax amount being applied to the subtotal.

- Total Due – Make sure to display the total amount due, including both the cost of services or products and the tax.

Sample Tax Breakdown

Here’s an example of how the tax breakdown might appear in your billing document:

| Item Description | Amount |

|---|---|

| Consulting Services | $500.00 |

| Sales Tax (10%) | $50.00 |

| Total Due | $550.00 |

In this example, the total charge includes both the original amount for the service and the calculated tax. This clear breakdown ensures clients can easily verify and understand the costs associated with the service or product they are paying for.

How to Automate Invoice Reminders

Managing payment reminders manually can be time-consuming and prone to human error. Automating payment reminders allows you to streamline the process and ensure that clients receive timely notifications about upcoming or overdue payments. This not only saves time but also improves cash flow by reducing delays in payments. Setting up automated reminders means you can stay on top of your accounts receivable without the need for constant manual follow-ups.

Setting Up Automated Payment Reminders

Most billing platforms offer features to automate reminders for clients at various stages of the payment cycle. These reminders can be scheduled to be sent before the payment due date, as well as after the due date if the payment has not yet been made. To set up automatic reminders, follow these steps:

- Access Reminder Settings – Go to the settings or notification section of your billing system where you can customize reminder options.

- Select Reminder Timing – Choose when the reminders will be sent, such as a few days before the due date or immediately after a missed payment.

- Customize Reminder Content – Personalize the message to include important details like the amount due, due date, and payment instructions.

- Set Frequency – Determine how many reminders will be sent, and whether they should be sent daily, weekly, or after a certain number of days past the due date.

- Activate Automation – Turn on the automation feature so that reminders are sent out without manual intervention.

Example Reminder Schedule

Here’s an example of how your automated reminder schedule might look:

| Reminder Type | Timing | Content |

|---|---|---|

| First Reminder | 3 days before due date | Friendly reminder about the upcoming due date and payment instructions. |

| Second Reminder | 1 day after due date | Notice of missed payment with a polite request for immediate action. |

| Final Reminder | 7 days after due date | Last notice with potential late fee details and a stronger call for payment. |

By automating these reminders, you ensure that clients are informed at the right times, minimizing delays and improving your chances of receiving payment promptly. Automated reminders also help maintain professional relationships, as they are sent consistently and on time.

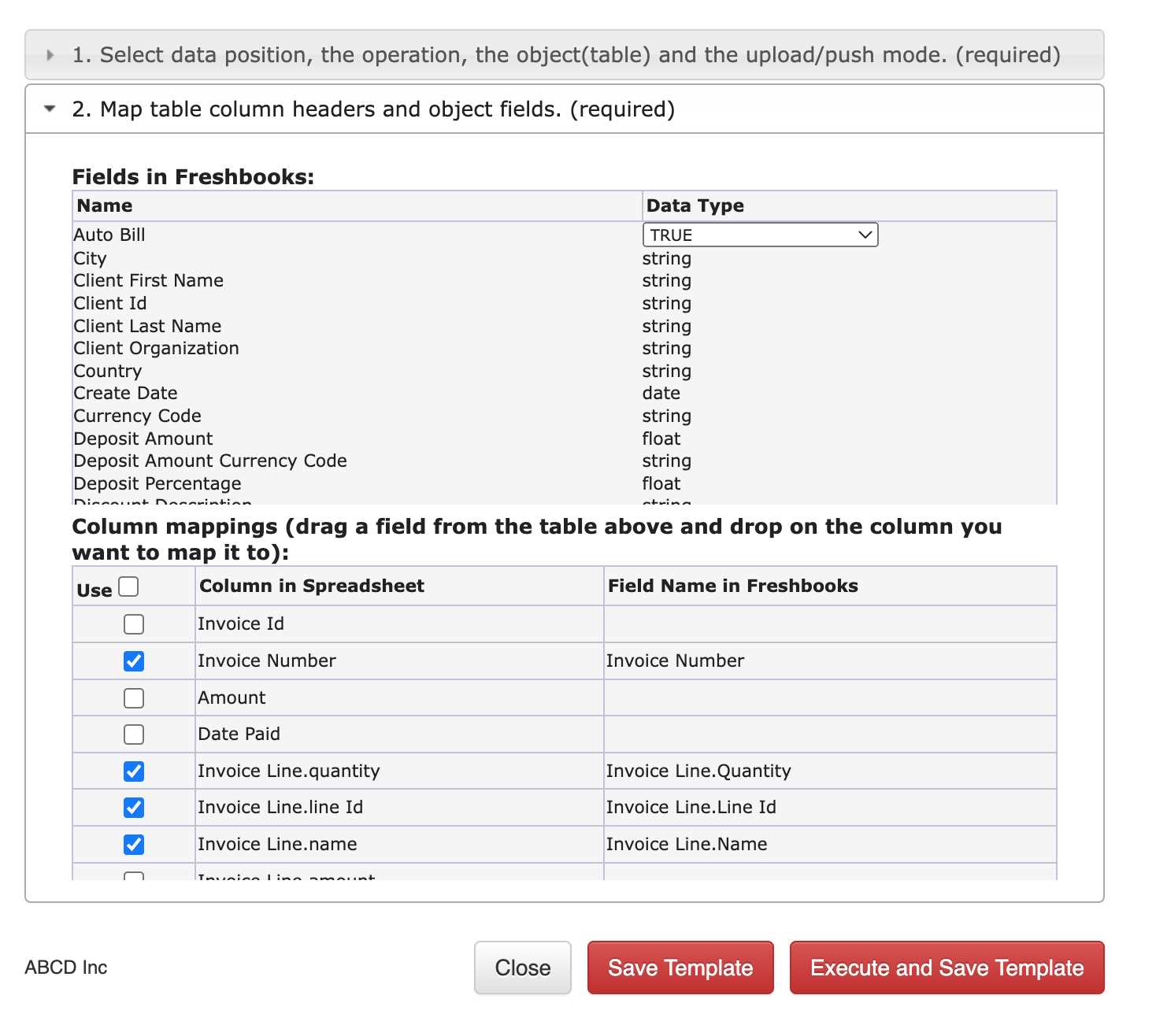

Managing Multiple Clients with Freshbooks Templates

For businesses with a large client base, staying organized is key to managing multiple accounts efficiently. Using customized billing documents for each client helps you keep track of individual transactions and maintain a professional appearance. The ability to tailor each document to the specific needs of each client ensures that you deliver a personalized experience while streamlining your overall workflow.

Organizing Client Accounts

Managing several clients can become complex without a clear organizational system. Most platforms offer tools that allow you to create and save client profiles, making it easy to generate and track payment requests for each individual client. You can store important client details such as contact information, payment terms, and any custom preferences, so that each document is ready to go when needed.

- Client Profile Creation – Store essential details such as name, address, and payment terms for each client.

- Custom Payment Terms – Set specific payment terms for each client, including due dates, discounts, or late fees.

- Multiple Document Templates – Customize documents for different clients, ensuring that each one receives a tailored payment request.

Tracking Payments and Managing Accounts

With multiple clients, it’s important to monitor the status of each payment. Most systems offer the ability to track payments, send reminders, and view a history of transactions for each client. This enables you to follow up on overdue accounts, offer discounts to loyal clients, and adjust terms as necessary.

- Payment Status Tracking – Easily check the status of payments, from unpaid to paid in full, for each client.

- Automated Reminders – Set up automatic reminders for clients with overdue payments, helping ensure timely settlements without manual follow-ups.

- Reports and Analytics – Generate detailed reports to track revenue, outstanding balances, and financial trends across multiple clients.

By using these tools, you can efficiently manage multiple clients, reduce administrative workload, and maintain a high level of professionalism in all your transactions.

Saving and Exporting Billing Documents

Efficient management of your billing documents involves not only creating them but also saving and exporting them for future reference or sharing with clients. The ability to store documents in a secure system ensures that you can access past transactions whenever needed, while exporting them allows you to send them to clients or integrate them with accounting tools. Knowing how to save and export your payment requests is an essential part of keeping your financial records organized.

Saving Your Documents

Once you’ve generated your billing documents, it’s important to store them in a way that makes them easy to find when needed. Many platforms offer the option to save documents directly within the system, ensuring that you don’t lose track of any past transactions. Here’s how you can save your payment requests:

- Automatic Saving – Many platforms automatically save documents as you create them, so you don’t have to worry about losing any data.

- Manual Saving – You can also manually save your documents by naming them clearly (e.g., client name, date, and document number) to easily locate them later.

- Organize by Client – Create folders or tags for each client, making it simple to search and retrieve documents when needed.

Exporting Documents for Client or Accounting Use

Exporting your billing documents is equally important when you need to share them with clients or your accounting team. Most platforms allow you to export payment requests in a variety of formats, such as PDF or CSV, which can be easily sent via email or imported into other financial tools. Below is a simple guide for exporting your documents:

- Select the Document – Choose the document you wish to export from your saved list.

- Choose the Export Format – Decide whether you need a PDF for client sharing or a CSV for accounting purposes.

- Download or Share – Download the document to your computer or share it directly via email or through cloud storage.

Example Export Table

Here’s an example of how you might organize and export documents:

| Client Name | Document Number | Export Format | Date Exported |

|---|---|---|---|

| John Doe | #12345 | 2024-11-01 | |

| Jane Smith | #12346 | CSV | 2024-11-02 |

By effectively saving and exporting your documents, you can maintain a well-organized financial record, making it easy to access, share, and integrate your billing data with other systems.

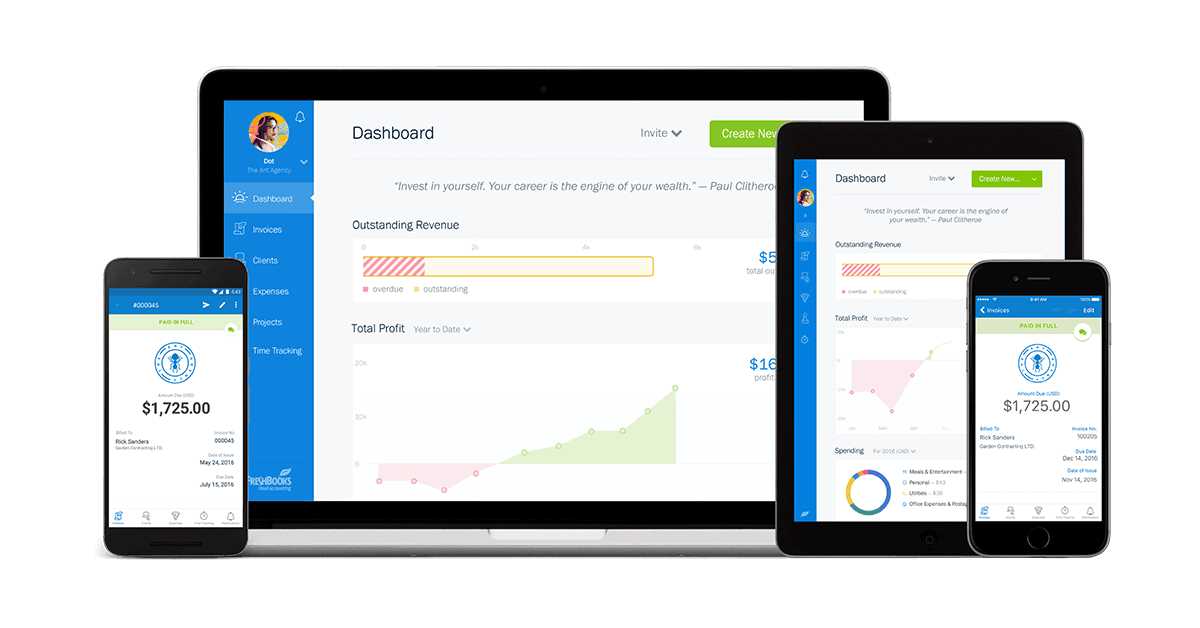

Mobile App: Accessing Your Billing Documents Anywhere

In today’s fast-paced business environment, having the ability to manage your financial documents on the go is essential. A mobile app allows you to access, view, and manage your billing records from anywhere, whether you’re in the office, at home, or traveling. With a mobile app, you can stay on top of client payments, send reminders, and generate documents, all from the convenience of your smartphone or tablet.

How to Access Your Billing Records on the Go

Using a mobile app to access your payment documents is simple and efficient. Whether you need to send a payment request, check the status of a transaction, or view past documents, everything can be done directly from your device. Here’s how you can make the most of the app:

- Login and Sync – Log in to your mobile app using your account credentials. The app will sync with your account, allowing you to access all of your saved documents in real-time.

- View Documents – Quickly browse through your documents, whether it’s a current payment request or a past transaction. You can easily search for specific clients or documents using filters.

- Send or Share Documents – If needed, you can send documents directly to clients via email or messaging apps, right from your mobile device.

Benefits of Mobile Access

Having the ability to manage your documents remotely comes with several key advantages:

- Increased Flexibility – Access your documents whenever and wherever you need them, making it easier to respond to client needs and update your records in real-time.

- Time Efficiency – No need to wait until you’re at your desk to review or send documents. Handle everything from your mobile device while you’re on the move.

- Client Communication – Stay connected with clients by quickly addressing questions, sending reminders, or providing payment confirmations, all directly from your phone.

Example of Mobile App Features

Here’s a quick look at some of the key features available in the mobile app:

| Feature | Description |

|---|---|

| Real-Time Sync | Access up-to-date documents synced across all devices, ensuring you’re always working with the latest information. |

| Instant Sharing | Easily share documents with clients via email or text directly from the app. |

| Client Communication | Send automated reminders or messages to clients about overdue payments or upcoming due dates. |

By using the mobile app, you can keep your billing process efficient and flexible, ensuring that you’re always in control of your business finances, no matter where you are.

How to Apply Discounts on Billing Documents

Offering discounts is a common practice in business to incentivize prompt payment or reward loyal customers. The ability to apply discounts directly to your payment requests ensures that your clients receive accurate pricing while maintaining your business’s profitability. Whether you’re providing a percentage off the total amount or a fixed amount, knowing how to apply these adjustments correctly helps streamline your billing process and keeps your transactions clear and transparent.

Steps to Apply Discounts

Applying discounts to a billing request is straightforward and can typically be done during the document creation or editing process. Follow these steps to ensure the discount is applied properly:

- Open Your Billing Document – Start by opening the specific document where you wish to apply the discount. This could be a draft or an already existing request.

- Select Discount Type – Choose whether you want to apply a percentage discount (e.g., 10%) or a fixed amount (e.g., $50). The discount options will typically be available in the itemization section.

- Enter Discount Details – Enter the appropriate percentage or fixed amount that you wish to discount from the total price. Be sure to specify the reason for the discount if required (e.g., promotional offer, early payment discount, etc.).

- Review Changes – After applying the discount, check that the total amount due has been adjusted accordingly. Ensure that the tax and other charges reflect the discount as well.

- Save and Send – Once the discount is applied and reviewed, save the updated document and send it to your client.

Discount Options to Consider

There are various types of discounts you can apply to your billing requests, depending on the nature of your business and customer relationships. Here are a few common discount strategies:

- Percentage Discount – A discount based on a percentage of the total amount. For example, offering a 15% discount on a service charge of $200 would result in a $30 discount, making the total due $170.

- Fixed Amount Discount – A fixed amount discount, where a specific sum is subtracted from the total. For example, if a product costs $100, a $20 discount would bring the total down to $80.

- Early Payment Discount – An incentive for clients to pay their bills early. For instance, a 5% discount might be offered if payment is made within 7 days.

- Loyalty Discount – A reward for returning customers, often used in subscription-based businesses or for long-term clients. This could be a fixed amount or percentage off for each subsequent billing cycle.

Example Discount Application

Here’s an example of how a discount might appear on your billing document:

| Description | Amount | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Cons

Billing Documents for FreelancersAs a freelancer, having a professional and organized way to request payments is essential for maintaining a positive relationship with clients and ensuring timely compensation for your work. Using customized billing forms can simplify the process, making it clear and easy for your clients to understand the services rendered and the amounts due. Whether you’re providing one-time services or ongoing projects, having a consistent approach to invoicing ensures accuracy and saves time. Why Freelancers Need Customized Billing DocumentsFreelancers often work on multiple projects for different clients, making it important to have a clear, detailed record of work completed and the corresponding fees. A well-organized billing system helps you track payments, manage due dates, and provide your clients with the information they need to process payments quickly. Here are some key reasons why customized billing documents are crucial for freelancers:

Key Elements of a Freelancer Billing FormFreelancers should ensure that their billing documents include several essential elements to make the process smooth for both themselves and their clients. These elements ensure that everything is clearly communicated and easily understood. Here are the key components that should be included:

Including these key elements ensures your clients have all the necessary information to make payments efficiently and without confusion, allowing you to maintain good business relationships and improve cash flow. Handling Currency Conversion in Billing Documents

When working with international clients or engaging in cross-border transactions, it’s essential to manage currency conversion effectively. Handling multiple currencies can be complex, but with the right tools, you can easily convert amounts to match your client’s preferred currency, ensuring accurate and timely payments. Understanding how to manage and display currency conversions helps maintain transparency and professionalism in your billing process. How Currency Conversion Works in Billing SystemsCurrency conversion involves converting the amount due from one currency into another based on the current exchange rate. Many modern billing platforms automatically update exchange rates, making it easier to apply the correct rates without manual calculations. To manage currency conversions effectively, you’ll need to follow these steps:

Benefits of Managing Currency ConversionManaging currency conversion offers several key advantages, especially for businesses that deal with clients globally:

Integrating Billing Systems with Payment GatewaysIn today’s digital age, simplifying the payment process is crucial for businesses to receive timely payments. By integrating your billing platform with popular payment gateways, you can offer clients seamless and secure payment options directly from their billing documents. This integration reduces manual steps, accelerates payment collection, and enhances the overall client experience, ensuring that you are paid faster and more efficiently. How Payment Gateway Integration WorksIntegrating a payment gateway with your billing system allows clients to pay directly from the billing request, eliminating the need for them to manually enter payment details on a separate website. Here’s how the integration typically works:

Benefits of Payment Gateway IntegrationIntegrating a payment gateway with your billing system offers several advantages that streamline both the client’s experience and your internal financial management:

Popular Payment Gateways to Integrate

There are numerous payment processors you can integrate with your billing system, depending on your location and client preferences. Some of the most widely used gateways include:

|